THE RAILWAY INDUSTRY SINCE 1856 WWW.RAILWAYAGE.COM MAY 2023 CPKC, THE FINAL SPIKE A Grand Railroading Tradition RAILINC LOCOMOTIVE REPORT Rebuilding Ramps Up. New Units Still Rare

AILWAY G E SERVING

EXEMPLARY

Presenting Our 2023 Influential Leaders

Andy Muller CEO and Founder, Reading & Northern

EXECUTIVES

THE OKONITE COMPANY Okonite Cables...A higher Standard! 102 Hilltop Road, Ramsey, New Jersey 07446 201.825.0300 www.okonite.com OurPremierVitalCircuitSignalCablesare EscortedbySuperiorCustomerService OKONITE Ourformulatokeepyourbusinessontrackisourfleetof6 manufacturingplants,5servicecentersand23localsalesoffices. Ourmultipleplantcapabilityprovidesmanufacturingflexibilityaswe supportyourneedswithourdirectsalesforceandapplication engineeringstaff.Okonitehasbeensettingthestandardsince 1878...andalways100%builtintheU.S.A. We’re Here ForYou!

Railway Age, USPS 449-130, is published monthly by the Simmons-Boardman Publishing Corporation, 1809 Capitol Avenue, Omaha, NE 68102. Tel. (212) 620-7200. Vol. 224, No. 5. Subscriptions: Railway Age is sent without obligation to professionals working in the railroad industry in the United States, Canada, and Mexico. However, the publisher reserves the right to limit the number of copies. Subscriptions should be requested on company letterhead. Subscription pricing to others for Print and/or Digital versions: $100.00 per year/$151.00 for two years in the U.S., Canada, and Mexico; $139.00 per year/$197.00 for two years, foreign. Single Copies: $36.00 per copy in the U.S., Canada, and Mexico/$128.00 foreign All subscriptions payable in advance. COPYRIGHT© 2023 Simmons-Boardman Publishing Corporation. All rights reserved. Contents may not be reproduced without permission. For reprint information contact PARS International Corp., 102 W. 38th Street, 6th floor, New York, N.Y. 10018, Tel.: 212-221-9595; Fax: 212-221-9195. Periodicals postage paid at New York, N.Y., and additional mailing offices. Canada Post Cust.#7204564; Agreement #41094515. Bleuchip International, PO Box 25542, London, ON

May 2023 // Railway Age 1

railwayage.com

N6C 6B2. Address all subscriptions, change of address forms and correspondence concerning subscriptions to Subscription Dept., Railway Age, PO Box 239 Lincolnshire IL 60069-0239 USA; railwayage@omeda.com; or call +1 (402) 346-4740; FAX +1 (847) 291-4816. Printed at Cummings Printing, Hooksett, N.H. ISSN 0033-8826 (print); 2161-511X (digital). FEATURES 10 22 24 29 34 37 42 Exemplary Executives Our 2023 Influential Leaders CPKC: Driving the Final Spike A Definitive Day in Railroading Railinc Locomotive Review Rebuilding Ramps Up Tech Focus – M/W Rail Grinding, Milling, Welding Tech Focus – C&S/Mechanical Tell-All Tracking Through Telematics Timeout for Tech Understanding Wheel/Rail Contact MxV Rail R&D Asymmetric Hollow Worn Wheels COMMENTARY 2 8 48 From the Editor Financial Edge ASLRRA Perspective DEPARTMENTS 4 6 7 45 46 46 47 Industry Indicators Industry Outlook Market People Professional Directory Classifieds Advertising Index COVER PHOTO Andy Muller, CEO and Founder of Class II Reading & Northern. RBMN photo. May 2023 22 AILWAY GE Canadian Pacific Kansas City

Steel Wheels, Detroit Iron, Enhanced Competition

eith Creel hit the spike on the head when he said Canadian Pacific Kansas City (CPKC) will not only preserve competition (the STB’s litmus test), but also enhance it.

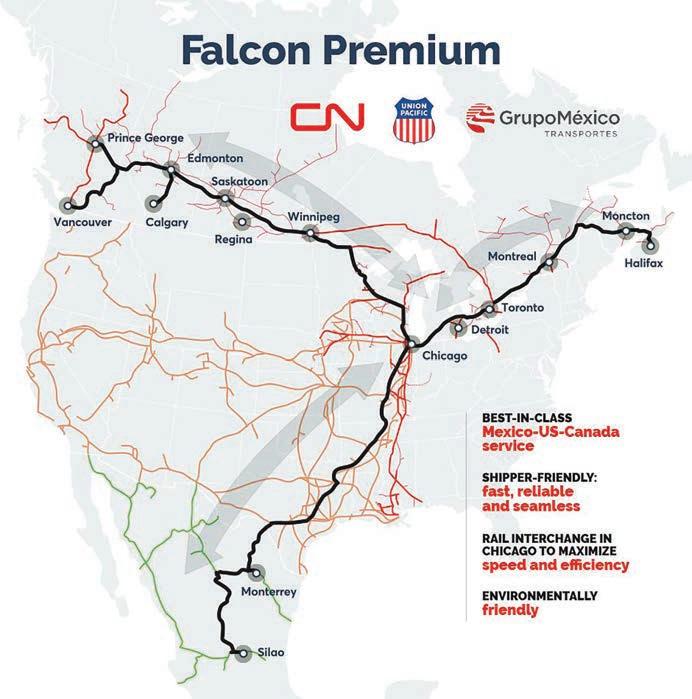

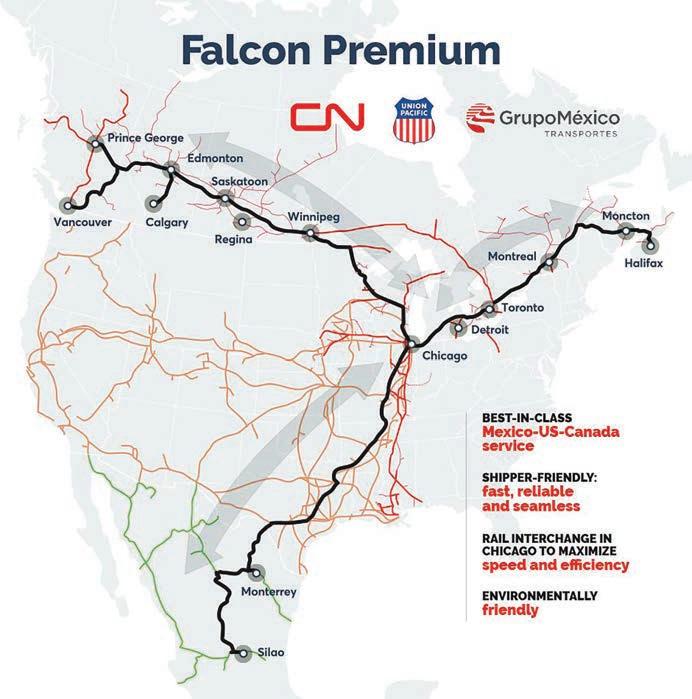

Not long after the metallic sound of a chromed spike maul hitting a ceremonial Final Spike (pp. 22-23) quieted, along came CN, Union Pacific and GMXT announcing their “Falcon Premium” interline intermodal product as competition to CPKC’s singleline service (p. 6). This is a very good thing, because healthy competition among friendly (hopefully?) railroad rivals should improve service, reduce costs passed on to customers, and grow market share.

Think back to the golden age of passenger rail, when the Pennsylvania Railroad’s premier train, the Broadway Limited, competed with its New York Central counterpart, the 20th Century Limited. Both left New York City (westbound) and Chicago (eastbound) daily at the same time. The PRR and NYC main lines ran parallel for six miles south of Chicago; on eastbound runs, the two trains would “race” each other (see Howard Fogg’s painting, The Race of the Century, below). On June 15, 1938, both railroads introduced 16-hour schedules and

Knew streamlined equipment. One of the most memorable examples of competition occurred at General Motors in the 1960s, during the “muscle car” era. In those days, GM’s divisions operated semi-independently, with their own teams of engineers and designers. Pontiac was first with the GTO in 1964. Its concept was simple: Take a largedisplacement, high-horsepower V8 from a full-size model, add some goodies like tripower carbs, a four-speed, dual exhaust and bucket seats, and offer them in a mid-sized Tempest LeMans. The idea wasn’t new (hotrodders had been doing it for years), but the “Goat” sold like crazy. Chevrolet, Oldsmobile and Buick soon followed, offering the Chevelle Malibu SS, Cutlass 442 and Skylark Gran Sport, respectively. Though these GM A Body cars shared some basic architecture (frames, suspensions, “greenhouses”), they were distinctive, with their own engines, and of course, styling. Ford, Chrysler and American Motors joined the competition (Torino GT, Charger, Roadrunner, Javelin, etc.). Glory days, for sure.

Badge engineering and cost-cuttingobsessed beancounters rather than people with a passion for cars running GM later led to some very dull products and huge market share losses. That’s a story for another day. Today, our industry seems to be developing a true competitive spirit. Falcon Premium and CPKC hotshot intermodal trains could be “racing” across the Mexican and Canadian borders. Who will win? Customers!

Let’s remember, though, that like GM’s divisions in the 1960s, we’re all on the same team, with identical service and safety goals.

AILWAY GE

SUBSCRIPTIONS: 1 (402) 346-4740

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

HEATHER ERVIN Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Peter Diekmeyer, Alfred E. Fazio, Michael Iden, Don Itzkoff, Bruce Kelly, Ron Lindsey, David Nahass, Jason Seidl, Ron Sucik, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Art Director: Nicole D’antona

Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES 46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors

Kevin Smith ks@railjournal.co.uk

David Burroughs dburroughs@railjournal.co.uk

David Briginshaw db@railjournal.co.uk

Robert Preston rp@railjournal.co.uk

(CCC)

photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the Circulation Director.

Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not be responsible for safekeeping or return of such material.

Member of:

Simon Artymiuk sa@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 1 (402) 346-4740

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

2 Railway Age // May 2023 railwayage.com

C.

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service. Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform. Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) +1 (402) 346-4740, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office

not

copies

provide extra

Send changes of

to:

Age, PO Box

Photocopy rights: Where necessary,

is

Center

FROM THE EDITOR WILLIAM

VANTUONO Editor-in-Chief

will

forward

unless you

postage. POSTMASTER:

address

Railway

239, Lincolnshire, IL 60069-0239, USA.

permission

granted by the copyright owner for the libraries and others registered with the Copyright Clearance

to

Industry Leading. Proven Expertise.

Advanced Rail Grinding Technology

With Loram’s Rail Pro ® Infinity, Loram’s best-in-class production rail grinders are now even more efficient and productive. Infinity allows for infinite grind patterns to achieve any transverse rail profile. New for 2023, Loram Virtual Rail helps our customers to quantify, visualize, and compare rail grinding benefits in a safe software environment before implementing their preferred strategies. Learn more at Loram.com

Rail Grinding | Ballast Maintenance | Material Handling | Quality Management © 2023 Loram Maintenance of Way , Inc

Clockwise from topRG400, RGS, L-Series, and RGT

Industry Indicators

VOLUMES NEGATIVELY INFLUENCED BY BROADER ECONOMIC TRENDS

“Rail volumes today are being negatively influenced by broader economic trends, including slowdowns in industrial output, high inventory levels at many retailers, lower port activity, and consumer spending that’s not as robust as it was during most of the past three years,” the Association of American Railroads commented last month. “Unfortunately, to date there are no clear indications that this uncertainty will dissipate in the near term. Total U.S. freight carloads were down 1.2% in March 2023 from March 2022, their fourth year-over-year decline in the past five months. Meanwhile, U.S. intermodal volume fell 13.3% in March 2023, its 13th straight year-over-year decline and 19th in the past 20 months. In the first quarter, volume was 3.024 million containers and trailers, down 10.3% from last year and the lowest first-quarter total for intermodal since 2012.”

Railroad employment, Class I linehaul carriers, MARCH 2023

TRAFFIC ORIGINATED CARLOADS

(+2.89%)

(+2.13%)

4 Railway

//

railwayage.com

Age

May 2023

Intermodal MAJOR U.S. RAILROADS BY COMMODITY MAR. ’23MAR. ’22% CHANGE Trailers 66,47595,652-30.5% Containers 1,093,181 1,242,559 -12.0% TOTAL UNITS 1,159,6561,338,211 -13.3% CANADIAN RAILROADS Trailers 0 0 Containers 298,752338,368-11.7% TOTAL UNITS 298,752338,368-11.7% COMBINED U.S./CANADA RR Trailers 66,47595,652-30.5% Containers 1,391,933 1,580,927 -12.0% TOTAL COMBINED UNITS 1,458,408 1,676,579 -13.0% FIVE WEEKS ENDING APRIL 1, 2023

Source: Rail Time Indicators, Association of American Railroads

Transportation

51,052

Professional

Administrative 10,071

Maintenance-of-Way

28,615

Maintenance

TOTAL EMPLOYEES:

(% change from march 2022)

(train and engine)

(+7.03%) Executives, Officials and Staff Assistants 8,147 (+7.79%)

and

and Structures

of Equipment and Stores 17,904 (+3.58%) Transportation (other than train & engine) 4,879 (+3.65%) Source: Surface Transportation Board

120,668 % CHANGE FROM MARCH 2022: +4.88%

U.S. RAILROADS BY COMMODITY MAR. ’23MAR. ’22% CHANGE Grain 99,956114,091-12.4% Farm Products excl. Grain 4,4394,1157.9% Grain Mill Products 48,97047,3603.4% Food Products 32,60633,460-2.6% Chemicals 165,866174,348-4.9% Petroleum & Petroleum Products49,86145,5819.4% Coal 339,616335,4701.2% Primary Forest Products 5,5215,3323.5% Lumber & Wood Products 15,57917,533-11.1% Pulp & Paper Products 26,39726,771-1.4% Metallic Ores 20,93720,6961.2% Coke 15,461 16,704 -7.4% Primary Metal Products 45,14843,4893.8% Iron & Steel Scrap 22,32121,2485.0% Motor Vehicles & Parts 74,72369,2477.9% Crushed Stone, Sand & Gravel 103,665101,2512.4% Nonmetallic Minerals 15,10417,740-14.9% Stone, Clay & Glass Products 35,09038,134-8.0% Waste & Nonferrous Scrap 17,80319,296 -7.7% All Other Carloads 24,98925,980-3.8% TOTAL U.S. CARLOADS 1,164,052 1,177,846 -1.2% CANADIAN RAILROADS TOTAL CANADIAN CARLOADS 406,955 379,6767.2% COMBINED U.S./CANADA RR 1,571,007 1,557,522 0.9%

MAJOR

FIVE

WEEKS ENDING APRIL 1, 2023

TOTAL U.S./Canadian CARLOADS, MARCH 2023 VS. MARCH 2022

1,571,0071,557,522

MARCH 2023 MARCH 2022

Short Line And Regional Traffic Index

TOTAL U.S. Carloads and intermodal units, 2014-2023 (in millions, year-to-date through MARCH 2023, SIX-WEEK MOVING AVERAGE)

May 2023 // Railway Age 5 railwayage.com

Copyright © 2023 All rights reserved.

CARLOADS BY COMMODITY ORIGINATED MARCH ’23 ORIGINATED MARCH ’22 % CHANGE Chemicals 58,323 49,93016.8% Coal 19,622 20,929-6.2% Crushed Stone, Sand & Gravel 30,363 24,553 23.7% Food & Kindred Products 12,663 12,709-0.4% Grain 27,249 31,211-12.7% Grain Mill Products 8,331 8,635-3.5% Lumber & Wood Products 9,487 11,098-14.5% Metallic Ores 2,740 3,159-13.3% Metals & Products 22,006 20,454 7.6% Motor Vehicles & Equipment 10,722 9,47113.2% Nonmetallic Minerals 2,386 2,807-15.0% Petroleum Products 2,372 2,144 10.6% Pulp, Paper & Allied Products 15,526 19,231-19.3% Stone, Clay & Glass Products 14,095 13,863 1.7% Trailers / Containers 40,727 49,030-16.9% Waste & Scrap Materials 12,086 12,106-0.2% All Other Carloads 74,760 75,395-0.8% We Bust The Pallet On Rail Produc ts Brake shoes Knuckle pins Wear plates Springs 888.700.4214 WE CARRY OVER 500 NEW & USED PARTS Need just a few? We’ve got you!

CN, UP, GMXT Launching Falcon Premium

THE CREATION OF CANADIAN PACIFIC KANSAS CITY (CPKC) APPEARS TO HAVE PROMPTED A COMPETITIVE RESPONSE. Union Pacific (UP), CN and GMXT (Grupo Mexico Transportes, comprising Ferromex, Ferrosur and IMEX) are introducing Mexico-U.S.Canada “Falcon Premium” interline intermodal service for automotive parts, food, FAK (freight all kinds), home appliances and temperature-controlled products.

Falcon Premium will connect all CN origin points within Canada, and at Detroit, to UP at two locations via CN’s former Elgin, Joliet & Eastern Chicago bypass, then to GMXT Mexican terminals at Monterrey and Silao, through UP’s border crossing at Eagle Pass, Tex. (Piedras Negras, Mexico).

CN’s connection to and from UP will occur at UP’s Yard Center Intermodal Terminal, Dolton, Ill., and at CN’s Chicago Intermodal Terminal in Harvey, Ill. CN terminals/ramps include Detroit, Brampton (Ont.), Montreal, Moncton (N.B.), Halifax, Winnipeg, Saskatoon, Regina, Edmonton,

Calgary, Prince George and Vancouver. CPKC (former KCSM) single-line-served locations in Mexico (Monterrey, Interpuerto and Mexico City) will all continue to be served and trucked in Chicago to/from CN and UP. All other Mexico, Canada and U.S. locations and service “will not be impacted.”

Equipment types eligible for Falcon Premium are privately owned 53-foot dry domestic containers, CN-owned 53-foot dry and reefer containers, and EMHU (EMP program) containers. EMP is a domestic interline service, consisting of more than 40,000 53-foot containers and chassis, offered by UP and Norfolk Southern, and including agent railroads such as CN and Florida East Coast Railway.

“The new service will start with Monterrey and Silao, but we will evaluate other locations in Mexico and the U.S.,” UP stated, adding that there are “no customs implications with the direct interchange vs. previous rubber tire connection; it is the same process for customs as used with the truck transfer in Chicago.”

The announcement on Falcon Premium came concurrently with CN’s first-quarter 2023 earnings report. Among the results:

• Revenues of C$4.313 billion, up C$605 million or 16% from first-quarter 2022’s C$3.708 billion. CN said this first-quarter record “was mainly due to higher fuel surcharge revenue as a result of higher fuel prices, higher export volumes of Canadian grain, freight rate increases, and the positive translation impact of a weaker Canadian dollar; partly offset by lower intermodal volumes.”

• Operating expenses of C$2.651 billion, up C$170 million or 7% from first-quarter 2022’s C$2.481 billion. This was “mainly due to the negative translation impact of a weaker Canadian dollar, increased purchased services and material expense, and higher labor and fringe benefits expense mainly driven by higher average headcount,” CN said.

• Operating income reached C$1.662 billion, a first-quarter record, according to CN. It was up C$435 million or 35% over first-quarter 2022 (or up 34% on an adjusted basis). This demonstrates the “strength and resiliency of the network,” CN noted.

• CN’s operating ratio was 61.5%, an improvement of 5.4 points (or an improvement of 5.1 points on an adjusted basis) over the year-earlier period.

• Diluted EPS of C$1.82, a 39% increase (or a 38% increase on an adjusted basis) over first-quarter 2022. CN said this was “driven by disciplined scheduled operations against Canadian winter conditions.”

The Falcon Premium announcement also came shortly before UP shared its April 21 weekly Surface Transportation Board (STB) metrics report with customers. “As we head into May, we’re seeing continued demand in some of our markets, and we’re working closely with Operating to make sure we are agile and have resources available in locations where we need them,” said Executive Vice President Marketing and Sales Kenny Rocker. “These metrics are compared to performance in mid-April 2022, and are based on the STB definitions for industry reporting. Car Velocity improved 14% to 202 miles per day. First Mile, Last Mile improved 2 points to 92%. Trip Plan Compliance (TPC) for Bulk (unit train) improved 17 points to 83%. TPC Manifest improved 10 points to 69%. TPC Intermodal improved 12 points to 85%.”

6 Railway Age // May 2023 railwayage.com Industry

Outlook

Union Pacific/CN/GMXT

Quebec: New Alstom LRVs

Quebec City has awarded Alstom an approximately C$1.34 billion contract to design, build and maintain for 30 years a fleet of 34 Citadis vehicles for its light rail project. Quebec City’s new 12-mile (19.3-kilometer) line is slated to open in 2028. More than 75% of it will be segregated from road traffic, but with the light rail vehicles (LRVs) having priority at road junctions. A 1.1-mile (1.8-kilometer) segment will operate in a tunnel under the city center. The electric low-floor LRVs will be adapted to the climatic and topographical conditions of Quebec City. Additionally, they will be developed by Alstom’s engineers in Saint-Bruno-de-Montarville—Alstom’s Americas’ headquarters on the south shore of Montreal—and assembled at the former Bombardier Transportation plant in La Pocatière, Quebec. Alstom’s contract includes an option for a maximum of five LRVs plus maintenance.

WORLDWIDE

The transport authorities of TOULOUSE, BREST and BESANÇON have awarded ALSTOM a contract for the manufacture of a new generation of LRVs for the three French cities. The framework agreement has a term of eight years and comprises a minimum order for 22 LRVs, which will be based on the lowfloor Citadis platform but will incorporate technology that will reduce energy consumption by at least 25%, compared with the current vehicles in service. The joint order will comprise nine vehicles for Toulouse, eight for Brest and five for Besançon, and includes an option for further vehicles to be ordered. The first deliveries are expected to arrive in Besançon in March 2025, with entry into service scheduled for September 2025.

NORTH AMERICA

ENSCO, INC. has entered an equity purchase agreement to acquire KLD LABS, a provider of automated wayside inspection technology and laser profiling solutions. ENSCO and KLD Labs will combine their inspection technologies, engineering and service teams to deliver railway inspection technology for track and rolling stock. KLD will become a wholly owned subsidiary of ENSCO. “The integration of KLD Labs and ENSCO uniquely positions us to inspect both rolling stock and track,” said ENSCO President Jeff Stevens. “Coupled with our vehicle/track interaction capabilities, the ENSCO and KLD Labs team will offer the first comprehensive condition assessment technology suite for railways, paving the way for unprecedented levels of safety and efficiency.” Based in Long Island, N.Y., KLD Labs designs and integrates artificial intelligence and machine learning solutions, laser technology, and machine vision systems for automated railway inspection applications. It is present in more than 35 countries and has deployed more than 500 solutions. “KLD Labs is renowned for its extensive history of providing reliable and innovative measurement technology and is pleased to join forces with ENSCO,

ensuring the preservation of its legacy,” said KLD Vice President Dan Magnus.

In a related development, the FEDERAL RAILROAD ADMINISTRATION (FRA) awarded ENSCO a new five-year contract to carry out its Automated Track Inspection Program (ATIP). ENSCO will provide operations, maintenance, information technology and engineering support for the FRA’s fleet of track inspection vehicles under this contract. FRA said its ATIP mission “is to provide objective information for FRA safety oversight and enforcement activities, audit railroad track safety compliance, and determine the State of Good Repair of the nation’s railroads. Since 1974, ENSCO has supported this mission by carrying out ATIP.” ENSCO noted it “has implemented new technologies and processes to improve ATIP’s ability to detect and report potentially hazardous track conditions during this time. ENSCO will continue to assist FRA in evolving ATIP to implement new inspection methods, assess compliance with additional areas of the Track Safety Standards, consider potential regulatory changes, and facilitate increased ATIP data utilization under this new award.”

May 2023 // Railway Age 7 railwayage.com

Alstom

MARKET

Financial Edge

What Do We Owe the Deceased?

Ch at bots and AI are all the rage these days. Whether it is BingAI, BardAI or openai. com, fantasies of Terminatoresque or chatbot romance abound. (See this article on an AI being asked to destroy humanity: www.vice.com/ en/article/93kw7p/someone-asked-anautonomous-ai-to-destroy-humanitythis-is-what-happened, or this one where a chatbot professes love for the author: www.nytimes.com/2023/02/16/technology/bing-chatbot-transcript.html.)

AI struggles with the veracity of its output. While a chatbot essay might be perfectly functional for someone too lazy to read a Wikipedia article, generally, under the auspice of improving technology, today’s AI carries forward the foibles of the humanity that have brought it into existence.

It would be perfectly wonderful, in a conveniently dismissive way, if AI were to blame for the dramatically focused, hyperbolic reporting on the aftermath of Norfolk Southern’s (NS) East Palestine derailment. Most notable in the literally postmortem reporting is the late E. Hunter Harrison. The exhumation of Mr. Harrison and his legacy for public flogging represents several in a series of nadirs sacrificing journalistic integrity that has gone into the reporting related to the East Palestine derailment.

In the January 2020 “Financial Edge,” the late Mr. Harrison was identified for the impact he was having on railroad CEOs across North America. It highlighted that the failure to align with the ideology of PSR was the equivalent of handing in one’s resignation.

So, having exhausted the topics of Alan Shaw and the NS, the drums have come to beat for Mr. Harrison. Having survived his rst turn as an industry and corporate savior and a second turn as overhanging legacy, Mr. Harrison is now the mastermind that implemented an era of neglect and unsafe train handling. His legacy has been called into question—his contributions to the industry connected to the East Palestine derailment as if he had been the ghost pushing the car o the tracks himself.

The Latin phrase mortuis nihil nisi bonum (never say ill of the dead) is attributed to Chillion of Sparta. We are now in an era where people in general do not worry about the spirits or about being haunted by them. Perhaps one can blame the existentialists for modernity’s focus on the appearance of existence over the appreciation of those who have passed. Nonetheless, respect for the dead is a quaint sentiment.

What do we owe the dead? Respect or at least honesty over a selective reinterpretation and allocation of blame. Modernity has shown that there is a cultivated and subjective process deciding whose sins and what sins do and don’t die. The reporting on Mr. Harrison sadly minimizes his role as a man who made progressive changes in how railroads perceive the operational dynamic. His role is then recontextualized as a person who had a leadership role in creating a culture of neglect and unsafe, derailment-inducing train handling. Talk about keeping one hand on the wheel.

Articles bashing Mr. Harrison read like something out of a chatbot. There’s some superficial biography, light facts and prodigious verbal summation. The package is backed by some juicy quotes— topic relevance indeterminate.

Gleaning from the chatbot set yields a few signi cant points and conclusions. Longer, heavier trains are harder to stop; a train light in the front and heavy in the back is more challenging to stop, especially

over Northeastern and Midwestern hilly terrain; and most attempts by industry parties (union, regulatory, advisory) to highlight longer train safety risks have gone unanswered. Biggest takeaway? It’s easy to hang an oppressor’s yolk on Mr. Harrison— demanding longer trains; wielding his Paul Bunyan axe cutting back on yards, employees and equipment; prioritizing pro t until safety standards collapse.

Derailments touch everything connected to rail—railroad, shipper, car owner, car manufacturer, component supplier, journalist. ey are a frequent “Financial Edge” topic (see “Who Will Protect the French Fries,” www.railwayage.com/regulatory/who-will-protectthe-french-fries/). Be clear: No one wants derailments—certainly not NS, especially a er the multi-million-dollar price tag of East Palestine.

The people of East Palestine (as well as those in communities in Atlanta, Ga.; Hyndman, Pa.; Princeton, Ind.; Mesler, Mo.; and Champlain, Utah to name a few) are the clear victims. No one feels that what happened to those people and communities is unimportant and is not life-threatening. It demands restitution and full reclamation.

One doesn’t see the same attribution of causality being thrust onto Mr. Harrison for Thomas Edison, Nicholaus Otto, James Bonsack or the Wright Brothers (inventors of the coal-fired generating station, modern internal combustion engine, cigarette rolling machine and modern airplane, respectively). Focus the blame on those who can defend their actions or accept accountability for them. Leave Mr. Harrison and the autoptic focus on his legacy where it belongs—in the dirt.

Got questions? Set them free at dnahass@ railfin.com.

DAVID NAHASS President Railroad Financial Corp.

8 Railway Age // May 2023 railwayage.com

The late E. Hunter Harrison

Congratulations

Muller Jr.

Team! Lehigh Anthracite congratulates Andy Muller and the team at Reading Blue Mountain & Northern Railroad for being awarded one of Railway Age 2023 Readers’ Influential Leaders.

Andy

and

EXEMPLARY EXECUTIVES 2023

READERS’ MOST INFLUENTIAL LEADERS

Railway Age’s fourth annual Readers’ Influential Leaders online poll garnered nominations for a large number of active (non-retired) people from all areas of the North American railway industry. We are pleased to present the top 10 nominees, plus two leaders receiving Honorable Mention.

Pam Arpin VP and Chief Information Officer, CPKC

Pam Arpin was named Canadian Pacific (CP) Vice President and Chief Information Officer (CIO) in July 2021 and assumed the role of CPKC Vice President and CIO

on April 14, 2023, when CP combined with Kansas City Southern (KCS). Arpin is responsible for technical integration activities related to the merger, as well as redefining CPKC’s digital strategy and information services (IS) road map, enabling CPKC’s strategic business goals with the right investments in technology. Arpin leads a diverse team focused on discovering and implementing new technologies that return competitive advantage. By fostering a culture of innovation, her role positions CPKC for sustainable growth through strategically connecting people, processes, systems, data and assets. Arpin has navigated an extensive and varied career and has more than 25 years of experience working in commercial, operations, finance, customer service and technology roles. Her leadership and industry influence have received North American recognition, including being named as the 2019 Railway Woman of the Year by the League of Railway Women (LRW) and one of Canada’s Most Powerful Women: Top 100 by the Women’s Executive Network that same year.

President-External Relations in December 2018. Bolin, who operates out of the railroad’s Washington, D.C., office, is responsible for UP’s advocacy programs regarding federal transportation and railroad issues, including economic and safety regulation, passenger rail and Amtrak, security, labor, and statespecific and other transportation projects. He serves as the primary liaison between elected officials, key Congressional Committees and Executive Branch agencies, including the U.S. Department of Transportation (USDOT) and the Surface Transportation Board (STB) to promote and defend UP’s interests. In 2022, a year of tumultuous labor negotiations between UP and its labor unions,

Printz Bolin VP-External Relations, Union Pacific Printz Bolin joined Union Pacific (UP) in 1991 and

Printz Bolin VP-External Relations, Union Pacific Printz Bolin joined Union Pacific (UP) in 1991 and

was appointed Vice

10 Railway Age // May 2023 railwayage.com 2023 Influential leaders

Railway Age ’s 2023 honorees—selected by our subscribers—approach their roles with an entrepreneurial spirit, and a commitment to service, safety and sustainability.

Pam Arpin VP and Chief Information Officer, CPKC

Printz Bolin VP-External Relations, Union Pacific

MATT IGOE lives BNSF’s values every day and we congratulate his recognition as one of Railway Age Magazine’s Most In uential Leaders.

bnsf.com

2023 Influential leaders

and is heavily involved in numerous organizations, including the National Railroad Construction & Maintenance Association (NRC), the League of Railway Women (LRW), the American Railway Engineering & Maintenance of Way Association’s (AREMA) Committee 24, and the Supplier and Young Professionals Committees with the American Short Line & Regional Railroad Association (ASLRRA).

Pete Claussen Chairman, Gulf & Ohio Railways

Bolin and his team obtained Congressional support and outreach to the White House encouraging the appointment of experienced, neutral arbitrators to the Presidential Emergency Board. Additionally, Bolin successfully lobbied Congress to prevent a work stoppage in December 2022 before UP had to begin shutdown procedures and issue embargoes by imposing the unratified Tentative Agreements with labor unions. Finally, he led the Public Affairs team in working with industry and coalition partners to defeat an amendment that would have altered the Tentative Agreements to include provisions unfavorable to UP business and cost the company millions of dollars per year.

Erika Bruhnke

VP of Training Services, RailPros

As Vice President of Training Services for RailPros, Erika Bruhnke leads the organization’s Training and Media Services divisions, which create and deliver vital rail safety programs to both contractor and railroad employees, as well as support the RailPros staff with their training needs. Prior to joining RailPros, Bruhnke held various operational and safety leadership positions at BNSF, establishing her understanding of railroad operations and the challenges rail employees face, which she later incorporated into the system-wide safety program, known then as Approaching Others. With her transition to RailPros, these same core principles established with BNSF are now being incorporated into industry-wide training programs, including several FRA-certified courses. Bruhnke is passionate about giving back

Pete Claussen established Gulf & Ohio Railways in 1985. Gulf & Ohio owns and operates four railroads in the southeastern U.S., which will handle 50,000 carloads when industrial development projects that have been announced are completed. Claussen is also the Chairman of Knoxville Locomotive Works, Inc., a green locomotive manufacturing company based in Knoxville, Tenn. Prior to establishing Gulf & Ohio, Claussen worked for the Tennessee Valley Authority where he held numerous roles, including Attorney, Assistant General Counsel and Division Director. In 1979, he joined the 1982 World’s Fair as Vice PresidentLegal Counsel, leaving that position in 1983 with the wrap-up of the Fair Corporation. Claussen is also the founder of the Seven Islands Foundation, which donated most of the land to help create Tennessee’s 56th state park, The Seven Islands State Birding Park. He has served as a member of the Smithsonian National Board, as Co-Chairman of the Alumni Board, and has been a member and past Chairman of the Smithsonian National

Museum of American History. Claussen presently serves on Boards, including the East Broad Top Foundation, Free Medical Clinic of America, Smithsonian Museum of American History Advisory Board, and Zoo Knoxville.

Paul Duncan

Executive VP and Chief Operating Officer, Norfolk Southern

Paul Duncan was appointed Norfolk Southern (NS) Chief Operating Officer (COO) in 2023 and is responsible for leading the teams that design and implement the company’s service schedules and operate the trains that safely move customer’s goods, as well as maintain and upgrade infrastructure and equipment. Departments reporting to him include Network Planning and Optimization, Network Operations, Engineering, Advanced Train Control (Mechanical and C&S), Safety and Environmental, Transportation, and the NS Police team. Duncan has more than 20 years of railroading experience. He joined NS in 2022 as Vice President Network Planning & Operations and was promoted to Senior Vice President Transportation & Network Operations. Previously, Duncan spent more than 19 years at BNSF, where began as a Hub Manager before holding several progressively responsible leadership positions in Intermodal Operations, Transportation, Network Operations, Capacity Planning, and Service Design. Most recently, he served as BNSF’s Vice President of Service Design and Performance. Duncan serves on the Boards of Directors of the Belt Railway of Chicago, Indiana Harbor Belt and Conrail.

12 Railway Age // May 2023 railwayage.com

Erika Bruhnke VP of Training Services, RailPros

Pete Claussen Chairman, Gulf & Ohio Railways

Paul Duncan Executive VP and Chief Operating Officer, Norfolk Southern

Andy

remarkable

career in railroading.

From his humble beginnings in 1983 operating over two small stateowned rail lines, Andy has through perseverance, skill and entrepreneurial risk grown Reading & Northern into a regional powerhouse. His focus on taking care of employees and customers is as much in our corporate DNA as his willingness to invest monies to ensure superior service to our customers. The fact that we are the most awarded railroad in Railway Age history is not an accident. Andy has pushed us all to grow the freight and passenger excursion business by focusing on providing excellent customer service. On-time scheduled deliveries, graffiti free RBMN-owned cars, reasonable fees and dedicated customer service staff keep our freight and passenger customers happy.

Thank you Andy for giving all of us an opportunity to grow this railroad that is crucial to the economic health of the region we call home. We look forward to years of exciting railroading under your leadership.

The Muller family and the 300+ employees of the Reading & Northern Railroad share in this celebration of

Contact Info: 610-562-2100 | rbmnrr.com

Muller’s

40-year

Matt Igoe Executive VP and Chief Operations Officer, BNSF Railway

Matt Igoe Executive VP and Chief Operations Officer, BNSF Railway

Matt Igoe was appointed BNSF’s Executive Vice President and COO in 2021 and leads the railroad’s entire Operations organization. Following his career as an officer in the U.S. Army, Igoe joined BNSF in 1998 as a management trainee. He later worked in a variety of positions

with increasing responsibility within the Marketing and Transportation organizations. Igoe served as General Manager for the Chicago Division between 2010 and 2012, and was later appointed to General Superintendent, Transportation. In 2013, he was promoted to serve as Regional Vice President for BNSF’s Central Region. In 2016, Matt was named Vice President, Service Design and Performance, and served in that role until being promoted to Vice President, Transportation in 2017.

Andrew Muller Jr.

Andrew Muller Jr. Founder and Chief Executive Officer, Reading & Northern

Andrew Muller Jr.

Andrew Muller Jr. Founder and Chief Executive Officer, Reading & Northern

Founder

and Chief Executive Officer, Reading & Northern

About 40 years ago, Andy Muller Jr. took a 13-mile, virtually abandoned branch line that the Commonwealth of Pennsylvania had purchased from Conrail, leased it as designated operator, and began to grow the business that would eventually become 400-mile Class II Reading & Northern (RBMN).

Railway Age’s four-time Regional of the Year (2002, 2011, 2015 and 2020). RBMN serves more than 70 customers in nine eastern Pennsylvania counties (Berks, Bradford, Carbon, Columbia, Lackawanna, Luzerne, Northumberland, Schuylkill and Wyoming). It has vastly expanded its operations over the past 40 years and now annually handles more than 34,000 carloads of

Nicely done, Printz.

Congratulations to Vice President–External Relations Printz Bolin for being named one of Railway Age’s 2023 “Most Influential Leaders.”

14 Railway Age // May 2023 railwayage.com 2023 Influential leaders

INNOVATIVE LEADERSHIP HAS THE POWER TO MOVE ANYTHING

Thank you, Paul Duncan, for laying the tracks for progress at Norfolk Southern. Having strong and innovative leaders like Paul Duncan as our Chief Operating Officer, a veteran railroader with over 20 years of industry experience, is what allows Norfolk Southern to power progress. Paul’s focus on enhancing our safety culture and driving operational excellence is helping us to advance our commitment to our employees, fostering a service-oriented approach to deliver for our customers, and always achieving progress.

©2023 Norfolk Southern Corporation

©2023 Norfolk Southern Corporation

2023 Influential leaders

freight and 250,000 steam- and dieselpowered excursion train riders. RBMN owns more than 1,700 freight cars and employs nearly 300. “The growth potential of this railroad, it just keeps going,” says Muller. “We didn’t miss a beat during the pandemic. We’re up 15%-20% in revenues every year. We’ve had record growth every year for the past 15 years. There’s so much potential. When the railroads started deteriorating in the ’70s, the people who lived in our area were still buying stuff. It just wasn’t coming on this railroad. It was coming into Philadelphia, being trucked out. It’s taken me 30 years to gradually get these commodities back, because it’s hard to break that chain when it’s moving.” RBMN’s success really flies in the face of the conventional wisdom that says, you give up traffic and it’ll never come back. It may take some time, but it can come back and grow. “It takes a lot of time and a lot of work,” adds Muller. “We chase new

CONGRATULATIONS

We’re thrilled that Erika Bruhnke, Vice President Training Services, has been named an Influential Industry Leader for 2023. She is passionate about sharing her insights and knowledge about safety training with clients and coworkers alike. Erika is always ready to talk safety and training with industry peers.

16 Railway Age // May 2023 railwayage.com

William

C. Vantuono

877-315-0513www.RAILPROS.comFollow Us ►

business all the time. Eventually, people say, ‘Wow. Andy and [RBMN President] Wayne Michel really have an interest in it.’ And then there’s our reputation for service. You can just about set your watch to our fast freight. It’s within five minutes every day. Our customers have a service window. There’s no, ‘Just when we get there.’ We ask when they want us there, and we get there. I don’t have any answering machines at this railroad until after five o’clock. You’ve got to answer the phone. If you call Reading & Northern, my people must answer the phone. They can’t look at the number and say, ‘Well, I don’t want to talk to them today.’ I think people can see my passion for the railroad business.”

John Orr Executive VP and Chief Transformation Officer, CPKC

In the new strategic position of Chief Transformation Officer, John Orr is responsible for network operations

Carl Walker

planning and design, procurement, labor relations and regulatory affairs. Previously, Orr served as Executive Vice President Operations for Kansas City Southern (KCS), overseeing the Transportation, Engineering, Mechanical, Network Operations, Health-SafetyEnvironmental and Labor Relations teams from 2021 to 2023. A fourthgeneration railroader, Orr began his career at CN in 1985, holding various leadership positions, including Senior Vice President and Chief Transportation Officer. Orr has also worked as an Executive Consultant since 2020, bringing more than 20 years of Precision Scheduled Railroading (PSR) experience to markets throughout Canada, the U.S., Mexico and Europe. Over the years, he has developed strong relationships within the industry, and with external stakeholders, including government and regulatory officials, customers, the community, and unions. Orr has co-authored “Entrepreneurial

Railroading and its Ecosystems: The Evolution of Precision Scheduled Railroading” (Bot & Orr, 2020; second edition 2021), as well as six articles and a white paper. He is also a speaker, podcast guest and board member within the industry, and Board Chair of the Diversity Committee at the University of Memphis.

Railway Age Most Influential Leaders

With over 20 years at CSX, Carl Walker has been an invaluable member of the Engineering Department, ensuring the safe and e cient operation of communications and signals across our far-reaching network.

Carl’s innovative work and e ective leadership have helped his team develop solutions that protect the safety of the people and communities we serve, and have helped him rise through the ranks to become the great leader he is today.

May 2023 // Railway Age 17 railwayage.com 2023 Influential leaders

Congratulations,

John Orr Executive VP and Chief Transformation Officer, CPKC

csx.com

CSXT-001709_RailwayAgeAd-CarlWalker-7x4.85_rsg.indd 1 4/25/23 1:51 PM

Ken Sherman is President of IntelliTrans, a leader in global multi-modal solutions for optimizing supply chain operations for bulk and break-bulk industries. Sherman leads the business unit, providing global direction for Information Technology, Product Management, and Account Management standards and practices. He supports the

primary line of business by providing leadership and establishing metrics and operational processes. Sherman adds value to existing customers through innovative solutions and training materials to meet changing and growing demands. Since he joined the company almost 20 years ago, IntelliTrans has more than tripled its customer base, added deeper functionality in rail, expanded into over-the-road and water modes, invested deeply in its products, and greatly expanded its transportation management services. Sherman is a multi-faceted executive who has the unique ability to bring together the technical and commercial sides of the business. Previously, he served as Vice President at IntelliTrans. Prior to that, he worked at GE Corporation, Plastics Division, as Supply Chain Manager and Master Black Belt, where he was responsible for procurement, production planning, distribution, transportation, and warehousing. “Technology can help solve issues in the rail industry by automating transportation operations,

GE

Supplier Spotlight

Carl

Carl

including visibility into transportation management and managed transportation services to augment the workforce,” Sherman says. IntelliTrans has more than 25 years of experience in the rail industry, providing managed rail transportation services to monitor, manage and automate freight rail services. For one customer, IntelliTrans was able to reduce the rail eet size by 5%; key customer inventory

18 Railway Age // May 2023 railwayage.com 2023

Influential leaders

Ken Sherman President, IntelliTrans

Ken Sherman President, IntelliTrans

Walker AVP C&S, PTC/Dispatch Systems, CSX

Find the right vendors for your business in the Railway Age Buyer's Guide. Search for products, research vendors, connect with suppliers and make confident purchasing decisions all in one place. RailwayResource.com AILWAY

Get listed in the Directory, visit RailwayResource.com/AddYourCompany Railway Age Buyer's Guide is powered by MediaBrains Inc. ©2023.

was reduced by 50%; and an issue where an average of 90 misrouted or lost railcars per month was resolved.

Carl Walker

AVP C&S, PTC/Dispatch Systems, CSX

As Assistant Vice President Communications and Signals, PTC and Dispatch Systems, Carl Walker plays a vital role in ensuring the e cient operation and safety of the CSX rail network. Since joining the CSX Engineering Department in 1999, Walker has ascended through leadership roles in the C&S department, including Assistant Chief Engineer of Signal Construction, Assistant Chief Engineer of Communications and Chief Engineer of C&S. He was promoted to his current role in May 2022. Walker’s leadership extends beyond CSX. He is member of the AREMA Board of Directors, as well as a Board Member at Meteorcomm, a rail communications technology company. He is the rst African American to serve in either of these roles.

May 2023 // Railway Age 19 railwayage.com 2023 Influential

leaders

CSX

HONORABLE MENTIONS

Kevin Corbett, President and CEO, NJ Transit: Kevin Corbett was appointed to lead NJ Transit in February 2018, and is responsible for the nation’s largest statewide public transportation system, and third largest overall. Before joining NJ Transit, Corbett served as Vice President at AECOM, leading important projects that included the rst phase of the Moynihan Station. Corbett is a Board Member on the APTA 2022-2023 Board of Directors; serves as the North American Representative to the Policy Board of UITP, the International Association of Public Transport; serves as Co-Chair on the Northeast Corridor Commission (NECC); and is also a Co-founder of the Commuter Rail Coalition (CRC).

Gary Wolf, Owner, Wolf Railway Consulting: Gary Wolf has more than 52 years of experience in the rail industry, including a 17-year span at Southern/Norfolk Southern Railway, 26 years as Consultant and Owner of Rail Sciences Inc., and the past nine years in private consulting practice. Wolf began his career in 1970 in the Mechanical Engineering department of the Southern Railway, but since 1975, he has focused on the analysis and prevention of derailments. In addition, Wolf also practices in the areas of train operations, train dynamics and train make-up, vehicle dynamics, wheel/rail interface, and track maintenance and assessment.

20 Railway Age // May 2023 railwayage.com 2023 Influential leaders

Kevin Corbett President and CEO, NJ Transit

Gary Wolf Owner, Wolf Railway Consulting

Congratulations to Pam Arpin and John Orr for being recognized among Railway Age’s 2023 Most In uential Industry Leaders. Connect to an exciting career at cpkcr.com. John Orr Executive Vice-President & Chief Transformation Of cer Pam Arpin Vice-President & Chief Information Of cer

April 14, 2023: Canadian Pacific Kansas City (CPKC) became the first single-line transnational railway connecting Canada, the U.S. and Mexico. A traditional ceremonial Final Spike driving at Knoche Yard in Kansas City, Mo., marked the historic day.

FINAL SPIKE DRIVING THE

Keith Creel places the Final Spike.

William C. Vantuono photo.

Keith Creel drives the Final Spike. CPKC photo.

Keith Creel places the Final Spike.

William C. Vantuono photo.

Keith Creel drives the Final Spike. CPKC photo.

KCS President and CEO Pat Ottensmeyer is now a special advisor to Keith Creel, focusing on Mexican affairs. William C. Vantuono photo.

CPKC President and CEO Keith Creel launches North America’s first and only single-line transnational railway. William C. Vantuono photo.

Coupler-to-coupler: CP and KCS locomotives represent the joining of two iconic railroads. William C. Vantuono photo.

KCS President and CEO Pat Ottensmeyer is now a special advisor to Keith Creel, focusing on Mexican affairs. William C. Vantuono photo.

CPKC President and CEO Keith Creel launches North America’s first and only single-line transnational railway. William C. Vantuono photo.

Coupler-to-coupler: CP and KCS locomotives represent the joining of two iconic railroads. William C. Vantuono photo.

REBUILDS RULE

BY DAVID HUMPHREY, PH.D., SENIOR DATA SCIENTIST, RAILINC

BY DAVID HUMPHREY, PH.D., SENIOR DATA SCIENTIST, RAILINC

Railinc’s analysis of the North American locomotive fleet reveals that the size of the total fleet decreased slightly in 2022. New for this year’s report, the age of locomotives is based on the rebuilt year in the Umler® equipment registry, if the data is present. Otherwise, it is based on the original built year. This better reflects the presence of rebuilt locomotives in the fleet.

Detailed analysis reveals the following trends:

At the end of 2022, the locomotive fleet totaled 37,704, down 284 units (–0.8%) from 2021. That is up from the approximately –1.0% year-over-year decline in 2021. Rebuilding programs continue, but new locomotives are still rare.

The average and median ages of locomotives in the North American fleet continue to increase. The average age increased 0.9 years in 2022, and the median age was up 0.8 years.

High-horsepower AC locomotives with six axles are driving changes in fleet

demographics. Most new additions to the fleet since the mid-1990s have been six-axle locomotives with a horsepower rating of 4,000 or higher. Locomotives with alternating current traction motors (AC units), which perform well at hauling

The long-term trend of new locomotives being added to the North American fleet paused in 2018, when the locomotive fleet decreased by three units and that decline continued in 2022. Last year, the locomotive fleet decreased by 284 units to 37,704 units, for a growth rate of –0.8%, up from the previous year’s growth rate of –1.0% (see Figure 1).

Most new locomotives in the report are recently rebuilt units rather than brandnew locomotives (see Figure 2).

heavy loads, account for most new additions to the fleet in the past decade.

Locomotives with the highest fuel capacity—more than 4,500 gallons— make up the largest percent of the fleet.

Historically, the average age of the fleet and the number of locomotives added to the fleet mirror the economic environment. When the economy is strong, as in the mid-1990s and mid-2000s—and there are more railcars in service—the average age is lower and the fleet tends to grow. During periods of recession, fewer new locomotives join the fleet. The decrease in 2022 reflects both the lasting economic impacts of the COVID19 pandemic and the excess supply of locomotives due to industry utilization improvements surrounding PSR (Precision Scheduled Railroading).

24 Railway Age // May 2023 railwayage.com

Carolina Worrell

High-horsepower AC locomotives with six axles are driving changes in fleet demographics.

As new locomotives join the fleet each year, larger railroads move older units to less-demanding roles, sell them to regional and short line railroads, or make them available to be rebuilt or refurbished.

A locomotive has a long service life and can be used in a variety of ways over that time. It can make long hauls during its first decades of service. Then, it can work on regional and short line railroads in middle age. Finally, it can perform lighter-duty service—such as moving railcars in a yard—at 60 or 70 years old.

DC HOLDS LARGEST SHARE AS AC GROWTH CONTINUES

DC locomotives make up 62% of the North American fleet. The share of AC locomotives has increased 10% since 2012 as more AC units join the fleet (see Figure 3).

Although DC locomotives continue to make up nearly two-thirds of the North American fleet, AC locomotives have dominated among additions in the past 10 years. Based on updated data referring to the rebuilt dates, only 35 DC units were added in the past two years. And, in the past six years, most new locomotives were AC units.

Locomotives with a horsepower rating of 4,000 or higher continue to make up most of the North American locomotive fleet. These locomotives comprised 56% of the fleet in 2022 (see Figure 4).

Locomotives between 2,000 and 3,999 horsepower comprised 32% in 2022, down from 38% in 2012.

Of the locomotives built or rebuilt in the past five years, virtually all have a horsepower rating of 4,000 or higher. The fleet does continue to add lowerhorsepower locomotives, though at generally decreasing rates. These lowerhorsepower additions to the fleet are made up of rebuilt locomotives and new units used as switcher locomotives.

Locomotives with a horsepower rating of 4,000 or higher dominate among AC locomotives, which tend to be newer. There are close to two-thirds more DC locomotives in the North American fleet than AC units. However, DC units are more evenly distributed by horsepower rating, with locomotives with

May 2023 // Railway Age 25 railwayage.com RAILINC LOC0MOTIVE REPORT

Figure 1: North American locomotive fleet count at the end of year (active locomotives in Umler)

Figure 2: North American locomotive fleet number of locomotives by age (active locomotives in Umler®)

Figure 3: North American locomotive fleet AC vs. DC power by year (active locomotives in Umler®)

horsepower ratings of less than 4,000 making up the largest share.

Six-axle locomotives make up 68% of the North American locomotive

fleet. Six-axle locomotives distribute the weight of a locomotive to the rails across more wheels and deliver tractive effort through more wheels and traction

HIGHER QUALITY WELDS FOR SAFER OPERATIONS

What’s the true cost of a bad weld?

50+ years of innovation mean that you can count on Holland to deliver the highest quality flash-butt weld every time.

Locomotives with a horsepower rating of 4,000 or higher dominate among AC locomotives, which tend to be newer. Pictured: Progress Rail/EMD 6,000-hp SD90MAC at MxV Rail, Pueblo, Colo.

motors. Most six-axle locomotives were built in the past 30 years.

Locomotives with fuel capacity of more than 4,500 gallons make up 57% of the

hollandco.com #HollandRail

26 Railway Age // May 2023 railwayage.com

William C. Vantuono

SIT AND LISTEN

Railway Age, Railway Track & Structures and International Railway Journal have teamed to offer our Rail Group On Air podcast series. The podcasts, available on Apple Music, Google Play and SoundCloud, tackle the latest issues and important projects in the rail industry. Listen to the railway leaders who make the news.

William C. Vantuono Railway Age

David C. Lester Railway Track & Structures

William C. Vantuono Railway Age

David C. Lester Railway Track & Structures

are available on Apple Music, Google Play and SoundCloud

Kevin Smith International Railway Journal

Podcasts

North American eet. is share has grown in recent years, while the share of locomotives with fuel capacity between 3,500 and

4,500 gallons continues to decrease (down 5% since 2012). is is consistent with the recent trend of the eet adding new

Iridium Certus Keeps You on Track

high-horsepower, six-axle locomotives, which have larger fuel tanks.

ROAD UNITS AND SWITCHERS

To distinguish locomotives used in road service from those used in switching service, Railinc has applied the following definitions:

• A road unit is a locomotive with six axles

28 Railway Age // May 2023 RAILINC LOCOMOTIVE REPORT

Figure 4: North American locomotive fleet horsepower by year (active locomotives in Umler®)

®

®

ASSETS MAXIMIZE YOUR

The newest milling, grinding andwelding technologies and services help to extend rail life, and reduce noise.

BY MARYBETH LUCZAK, EXECUTIVE EDITOR

BY MARYBETH LUCZAK, EXECUTIVE EDITOR

Steel rail is the industry’s foundation, making its maintenance a top priority for freight and passenger railroads alike.

Railway Age contacted leading suppliers and service providers to nd out about the latest rail milling, grinding and welding o erings that e ciently, cost e ectively and safely do the job as well as their market insights.

VOSSLOH NORTH AMERICA

“As the cost for raw materials and labor continues to increase, railways are looking at opportunities to extend the life of their assets, and, through novel approaches, to preventative maintenance,” Vossloh reports. “On top of that, every network operator strives to keep its network as e cient as possible.” Key to that is planning. “A preventive maintenance approach is the best chance to delay corrective,

time-consuming interventions,” the m/w machine manufacturer points out. “Instead of aggressively grinding and repro ling the rail when it needs to be, the rail would be ground more frequently, but with lower removals per cycle. e idea behind that is to remove rolling contact fatigue and corrugation at an early stage. is approach can be done at a signi cantly higher speed and lower cost to the customer, creating e ciencies and avoiding costly work blocks to get the job done.”

Vossloh says it’s incorporating more technology into its products to provide real-time feedback on the state of customer rail assets. “ is gives the customer an overall view of the health of their network and allows them to monitor how it changes over time,” the company explains. “Given the data and understanding the track’s condition, it is possible to change from a preventive to a predictive maintenance

approach, enabling the implementation of a long-term maintenance strategy.”

Vossloh tells Railway Age it is bringing its HSG-city rail grinding and measuring machines from Europe to North America.

eir mapl-e so ware provides data on the state of the rails minutes a er measuring has been conducted, the company says, allowing for signi cantly reduced lead times from measuring to evaluation to action.

HARSCO RAIL

“Overall, the rail grinding market is strong,” reports Dereck Bartz, Global Product Manager for the rail treatment portfolio. On the freight side, rail grinding is critical for pro ling and life extension, particularly through curves and switches, he says; on the transit side, it is driven predominantly by noise and vibration elimination and surface defect removal.

May 2023 // Railway Age 29 railwayage.com

TECH FOCUS – M/W

Plasser American

Plasser American ROMILL URBAN 3 E3 hybrid rail milling machine

TECH FOCUS – M/W

e company recently introduced a new model of its “Hercules” production grinder. Saudi Arabia Railway (SAR) will receive a 60-stone version and the India market will receive four 20-stone versions, the rst of which is due to ship in the next couple of months.

e new model includes an approximately 35-hp grinding motor, one of the most powerful in the industry, according to Bartz. It is liquid- rather than air-cooled, which he says extends motor life, and uses steel bearings instead of roller bearings.

Harsco is also delivering two TG-8s to BC Transit in Vancouver; they will run together as a 16-stone grinder controlled by one operator.

e company’s most popular transit/ switch grinder is the C model—used in North America by Los Angeles Metro and by RailWorks for freight work, Bartz tells Railway Age. e machine’s control system has been upgraded to make it more user-friendly, aiding in operations and in troubleshooting with self-diagnostics.

What’s new in R&D? Harsco’s e orts center around equipment exibility “to satisfy a customer’s needs from the time they lay out new rail and they need to grind the mill scale, throughout the life of that rail,” Bartz says. “ is includes di erent grinding techniques and scenarios, including measuring and planning equipment, to maintain the rail pro le and eliminate surface defects by removing the smallest amount of metal needed, so the customer gets the longest extension of rail life.”

HOLLAND LP

Holland LP is not only a ash-butt rail welding and track measurement provider with mobile, xed and portable plant o erings, but also a provider of crane rail, thermite, laser and electric welding for Class I, short line and transit rail customers. Additionally, it manufactures rail welding equipment as well as track testing and specialty vehicles.

“It’s been a busy year out of the gate,” EVP of Business Development Russ Gehl tells Railway Age. “ ere’s demand in the marketplace with railroads not having enough people to do the work, so there are a lot of additional requests for ash-butt welding.”

Holland is investing in improvements to boost welding speed and in process e ciencies, which are expected to help drive down costs, according to Gehl. e company is also re ning its short plug welding method that is said to provide railroads with higher-quality

and more cost-e ective defect remediation and repair. Traditionally, repair welding gangs have relied on a 20-foot-to-40-foot plug with three pieces of equipment as well as six to eight railroad employees and two Holland employees to do the job, according to the company. With Holland’s short plug ash-butt repair welding gang, ve-foot plugs are used with two pieces of equipment and a total of four (railroad and Holland) employees.

Among other projects, the company is building out its HAMR™ (Holland Automated Manganese Refurbishment) eet to help railroads extend frog and diamond-insert life, and is expanding weld program work internationally, which includes Tren Maya in Mexico.

Gehl tells Railway Age that Holland is wrapping up work for Brightline, which is extending its Miami-to-West Palm Beach intercity passenger rail line 170 miles north to Orlando, and “is anxiously awaiting Brightline West,” a planned 218-mile high-speed rail system connecting Las Vegas and Southern California.

LORAM MAINTENANCE OF WAY, INC.

“Customers are continuing to look for ways to maintain rail health,” reports Chris Lidberg, Product Manager-Rail at Loram, which o ers rail grinding, ballast cleaning, friction management, material handling, track inspection technologies, and structural monitoring services. And that’s dependent on data collection, he points out. Earlier this year, the company acquired Sentient Science’s rail business unit, which includes digital twins and economic model products used to extend rail life and realize savings from track maintenance practices. Loram is currently working to expand those models to include specialty assets, Lidberg tells Railway Age

In May, the company will roll out Loram VR (Virtual Rail), which Lidberg says will use a railroad’s inspection data to develop a properly designed grinding program.

With track occupancy at a premium, Loram continues to maximize the time spent grinding (for general repro ling work and to reduce noise) and milling (for heavy corrective work), Lidberg says. It is also working to improve grinding by developing new stone technologies.

Last September, the company announced a strategic alliance with Linsinger Maschinenbau Gmbh in which Loram will provide Linsinger technology to North American customers. It now owns the Linsinger MG11 Hydrogen, a zero-emission rail milling

machine, which will arrive in America this summer and enter service in late 2023, Lidberg says. According to the companies, the MG11 Hydrogen is said to remove a maximum of 1 mm of material on the rail surface/3 mm on the running edge in one pass, and it o ers lower heat emission than a combustible engine.

ORGO-THERMIT INC., A GOLDSCHMIDT COMPANY

Orgo- ermit manufactures and supplies ermit® rail welding materials and o ers OT grinding service. According to Michael Madden, President of North American Operations, rail grinding quote requests are up. What customers are looking for is a “solution provider, someone who is going to come in, with knowledge and experience, to help solve problems and maintain their key asset, not just perform grinding,” he tells Railway Age Orgo- ermit has an eddy current service, which allows it to perform measurements of up to three millimeters below the rail surface, to better understand rail condition. e data helps customers develop a customized grinding program. “ is is new technology to North America,” Madden reports. “ ere’s been a lot of interest, and we expect that to continue to grow.”

On the welding side, Madden says the company continues to gather customer feedback for improvements and is looking at ways to increase e ciency. With more federal funding on the table in the U.S., it expects to see transit agency/passenger railroad construction projects coming on line in the future, to which it can supply welding kits.

Orgo- ermit has a team in the U.S., Canada and Mexico providing technical sales and support services and training and quali cation for rail welding and contractor personnel. It was recently quali ed on a new American Welding Society standard for thermite welds. “We want to stay ahead to ensure that we can support our customers and make sure they perform quality welds in the eld,” Madden says.

PANDROL

“ e key to the welding market is to increase the speed of production while providing a more consistent and easier to install product,” says James Martin, Vice President Sales and Marketing for Pandrol, which o ers an array of railway welding tools and services. “ ermite welding is contingent on well-trained

30 Railway Age // May 2023 railwayage.com

New Contracting Services

Next Generation High Performance Milling Machine

Plasser American contracting services will provide the next level of rail maintenance through the innovative Romill Urban 3 E ³ milling machine to Transit Systems as well as Freight Railroads in North America. The innovative Romill Urban 3 E ³ high-performance milling machine incorporates the next generation of electric rail milling. The Hybrid drive system with high capacity batteries will provide hours of emission-free operations with the integrated diesel engine. This provides the ability to charge the batteries and operate the machine continuously. Featuring the revolutionary new cutter head design for longer tool life and extended operational capabilities along with state-of-theart measurement technology. This compact layout fi ts into the tightest subway tunnels and allows easy road transportation.

plasseramerican.com ”Plasser & Theurer“, ”Plasser“ and ”P&T“ are internationally registered trademarks HIGH CAPACITY I PRECISION I RELIABILITY

TECH FOCUS – M/W

personnel. Like most industries, we are struggling to keep up with demand for more crews.”

e company continues to evolve its product line to meet industry needs and is introducing a multi-use kit that Martin says, “should help with inventory levels for our customers and still provide a quality weld.”

PLASSER AMERICAN

In North America, rail milling is gaining market share as a complementary technology to rail grinding, according to Richard Stock, Global Head of Rail Solutions for Plasser American, which in fourth-quarter 2022 debuted what Stock calls the “ rst hybrid rail milling machine” in the U.S. e ROMILL URBAN 3 E3 “can operate on battery without any emissions for up to three hours,” Stock tells Railway Age. “ is provides a huge advantage in emission-sensitive environments like tunnels. In addition, working on battery signif icantly reduces the noise during milling opera tions, which is another bene t in urban areas.

e machine can be recharged externally— enabling it to operate ‘CO

electricity out of hydro, solar or wind power is available—or can be quick charged through the integrated tier 4 nal diesel generator.”

Stock notes that the “integrated measurement technology provides longitudinal and transversal pro le information as well as surface damage characterization through eddy current technology.” In regenerative or corrective application scenarios especially, he says, “rail milling can prevent premature rail exchange, thereby providing signi cant cost-saving opportunities.”

e ROMILL URBAN 3 E3 was rst used on a U.S. transit system, according to Stock, “where it focused on removing heavy rail defects like squats and shells in areas where rail grinding could not economically remove them.” is year, Plasser American has several planned milling campaigns with a similar focus on high-damage areas.

structure, which should continue to increase the need for more ash-butt and thermite welding as well as grinding and other services we provide, including geometry,” R.T. Swindall, Director of Sales, tells Railway Age

With year-over-year growth in ash-butt welding, RailWorks continues to grow its eet and its Canadian presence, according to Jacob Alexander, Director of Operations Flash-Butt Welding. e reason for the growth, he says, is “the failure rate is much lower” for this type of weld and more work can be performed safely in tighter track windows. “In the end you have a better product, and big picture, it raises track speeds and keeps revenue trains moving.”

Alexander reports that RailWorks continues to partner with rail suppliers “to make sure we’re providing the best program for the chemistry of the rail,” and with customers to improve equipment. It is now working to

e company is seeing increased grinding business, he says. Class IIs in particular are more o en asking for pre-grinding inspections

32 Railway Age // May 2023 railwayage.com

PHILADELPHIA 800.969.6200 | DENVER 800.713.2677 | DANELLA.COM/RENTALS R ENTA L SYSTEM S, INC.

TTX has begun installing Nexxiot GPS devices on its new-build TBOX high-capacity boxcar fleet. The company expects as many as 1,700 boxcars to be equipped in 2023, and will also be equipping several hundred multi-level autoracks (pictured).

TELEMATICS TELL-ALL TRACKING

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

The branch of information technology that deals with the long-distance transmission of computerized information, telematics is the focus of intense research and testing. e real-time, continuous tracking and health monitoring of railcars and locomotives, it’s considered essential to the industry’s longterm growth and safety. Are railroads and customers ready for telematics? How long to wide-scale adoption?

e global railway telematics market, according one research rm, is projected to exceed $13 billion by 2033, at a CAGR (compounded annual growth rate) of 7.1%. Key players in the North American market

include Nexxiot, the RailPulse™ consortium (TrinityRail, e Greenbrier Companies, GATX, Railinc, Genesee & Wyoming, Union Paci c/UP, Norfolk Southern, Watco, and Railroad Development Corp.), Wi-Tronix, Amsted Digital Solutions, and IntelliTrans. TrintyRail independently o ers its Trinsight™ technology. Globally, Siemens AG, Alstom SA, Knorr-Bremse AG, Robert Bosch GmbH, Hitachi Ltd., Intermodal Telematics, Intrex Telematics, ORBCOMM, Rail Nova and Savvy Telematics have a strong presence.

FUTURE MARKET INSIGHTS

“All the business sectors providing the solutions and services that go along with smart

technology in railway transportation are anticipated to expand rapidly in the near future,” says Future Market Insights, Inc. “Additionally, the ability to make quick decision-making for matters like asset deployment, use, and maintenance of railcars has increased the adoption of railway telematics across all countries. Moreover, new technologies have become a necessity to make the freight and logistics sector more e ective and superior. e adoption of railway telematics, including monitoring of refrigeration wagons and forecasted arrival times for every other railcar is the key factor driving the market in present times.

“The U.S. holds an 18.5% share of the global railway telematics market. Owing

34 Railway Age // May 2023 railwayage.com

Experts say the global rail market could exceed $13 billion in 10 years.

TTX

WHEN YOUR BUSINESS RELIES ON RAIL, RELY ON US.

TrinityRail ® is North America’s leading railcar equipment and services provider. With a comprehensive platform of leasing, manufacturing, maintenance and professional services, you can rely on TrinityRail to fully deliver trusted expertise, innovative solutions and supply chain optimization. Learn more at TrinityRail.com.

to the presence of many leading OEM industries, the overall revenue generated in the year 2023 is estimated to be around $1.2 billion.

“Germany constitutes the largest regional market for railway telematics in Europe and o ers plenty of room for further expansion. e country accounts for close to 4.7% of the money made by providing railway telematics services globally.

“ e U.K. comes in second a er Germany as the regional market for adoption of railway telematics for freight management. is country is projected to witness a growth rate of 3.3% annually.

“China is the leading market among the Asia Paci c countries in railway telematics components as well as services. China is projected to register a higher CAGR of 4.3% from 2023 to 2033.

“Japan is also a signi cant contributor to the Asia Paci c railway telematics market, with a 5.2% share of the global market. With advanced component manufacturers as well as excellent service providers, this country is estimated to generate revenue of $349 million in 2023.

“India is the world’s fastest-growing railway telematics market. rough 2033, the region is expected to grow at a 5.4% pace thanks to domestic railway infrastructure expansion projects and improved export capabilities.

“Australia has garnered enough traction in the global railway telematics business

recently, having a strong export potential for Southeast Asian countries and other nations. is nation, with a sizable rail transit system, is thought to account for around 2.3% of overall worldwide income.

“From 2023 to 2033, the sensor component segment is expected to grow at a higher rate than any other segment, acquiring a nearly 45.5% overall market share.”

RECENT APPLICATIONS

Following are just a few examples of recent telematics applications in the North American freight rail industry:

• According to TTX Director of Fleet Telematics Marketing John Woodcock, the company has begun installing Nexxiot GPS devices on its new-build TBOX high-capacity boxcar eet. TTX will also be retro tting existing TBOX boxcars as they cycle through the shop. e company expects as many as 1,700 boxcars to be equipped in 2023 and will also be equipping several hundred multi-level autorack railcars. TTX says installation of the GPS devices is straightforward and involves welding a bracket to the car and pairing the device to the car ID. e devices transmit location frequently via the cellular network on a set schedule, “resulting in greater visibility.” All telematics applications, TTX says, will comply with the Association of American Railroads’ (AAR) remote monitoring equipment installation standards.

• UP, through its involvement in

RailPulse, is accelerating use of GPS and other telematics technologies “to increase shipment visibility and enhance the customer experience, ultimately attracting more shippers.” During initial testing, RailPulse members like UP will analyze the data to help make improvements to the platform before its larger launch this year. Once launched, GPS and telematics data will be available on a dashboard and through Application Programming Interfaces (APIs), “making it easy for customers to view the data they care about most,” UP notes. “ e e ort is part of an industry focus to improve visibility down to the track level while generating e ciencies to improve rail competitiveness vs. truck. is year, 50 railcars equipped with a GPS device are being released onto our network, providing realtime information and visibility of the car’s location, condition and health to shippers, railcar owners and railroads. A er the pilot is complete, we will look to expand the RailPulse program to our entire eet.”