Our high performance fasteners support safe and reliable transportation.

The GE11 e-style clip is produced with an innovative manufacturing process which signi cantly reduces internal stress, improving the fatigue performance beyond that of the legacy e-Clip.Approved and used by Class I and transit customers, these American-made fasteners are available in both right-handed and left-handed versions.Innovative fastener solutions are just one more way we keep you rolling.

We keep you rolling.

Full disclosure:

As far as I know, this column (indeed, everything in this issue, or for that matter on our website), has not been written by artificial intelligence, or with AI assistance. That applies to stories about AI as deployed for the greater good of the railway industry. We guarantee that the close-knit cadre of human beings at Simmons-Boardman Publishing (editors, publishers, advertising sales reps, etc.) will not be replaced with lines of computer code.

Others, however, have not been so fortunate. Consider the case of the Columbus Dispatch, one of monstrous publishing conglomerate Gannett’s numerous small properties.

The Washington Post (like Railway Age, written by humans) recently reported that readers of the Dispatch’s high school sports section “might have encountered a new sportswriter with a prolific byline—and an odd way with words.”

This “writer” called a high school football game a “close encounter of the athletic kind.” Another story described a scoreboard “in hibernation in the fourth quarter.” A description of a late comeback in another game said the winning team “avoided the brakes and shifted into victory gear.”

Who—or what—wrote these silly synthetic sentences? It was Lede AI, an AI company that “uses game scores to generate automated sports recaps for newsrooms,” The Post reported. “Lede AI’s stories in the Dispatch, which generally provided the outcomes of high school games and the scoring after every period of play, were blasted on social media as having a stilted tone and using

SUBSCRIPTIONS: 847-559-7372

EDITORIAL AND EXECUTIVE OFFICES

bizarre turns of phrase ... Lede AI-generated articles in the Dispatch and other Gannettowned papers were appended with a notice that they’d been updated ‘to correct errors in coding, programming or style.’ In a statement, Gannett called the deployment of Lede AI an ‘experiment’ in automation to aid its journalists and add content for readers: ‘We have paused the high school sports Lede AI experiment and will continue to evaluate vendors as we refine processes to ensure all the news and information we provide meets the highest journalistic standards.’”

“Automation is part of the future of local newsrooms,” Lede AI told The Post. AI “allows reporters and editors to focus on journalism that drives impact in the communities they serve.” The company’s website says its service is “a powerful tool for newsrooms that can produce hundreds of accurate and compelling news stories in seconds to help newspapers capture web traffic and subscribers.”

“Accurate and compelling”? Yeah, OK. Add “on the cheap” to that description!

Let’s see ... If local news stories on grade crossing collisions were generated by AI, you might read something like this:

“The close encounter between the train and the truck resulted in tiny injuries to the train’s driver because he threw out the air before letting go of the steering wheel and ducking. But the truck driver was unable to absorb the impact of the much bigger engine, which weighed a lot and didn’t feel like stopping fast.” Would you like me to turn this column over to a robot?

I’m sorry, Dave. I’m afraid I can’t do that.

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

JENNIFER McLAWHORN Managing Editor, RT&S jmclawhorn@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Peter Diekmeyer, Alfred E. Fazio, Gary Fry, Michael Iden, Don Itzkoff, Bruce Kelly, Ron Lindsey, David Nahass, Jason Seidl, Ron Sucik, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Art Director: Nicole D’antona

Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors Kevin Smith ks@railjournal.co.uk

David Burroughs dburroughs@railjournal.co.uk

David Briginshaw db@railjournal.co.uk

address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA.

Robert Preston rp@railjournal.co.uk

rights:

permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the Circulation Director. Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not be responsible for safekeeping or return of such material.

Member of:

Simon Artymiuk sa@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 847-559-7372

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

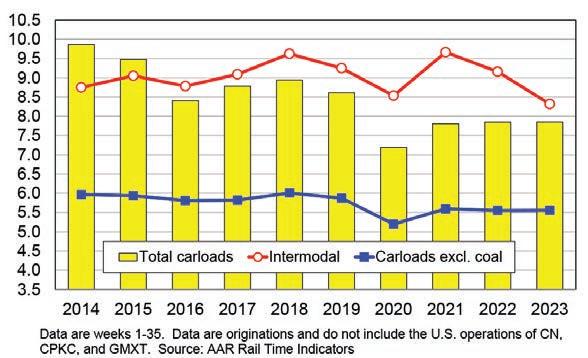

“It doesn’t bode well for total carloads when coal, chemicals and grain—typically the three highest-volume carload categories for U.S. railroads—all decline, but that’s what happened in August,” the AAR reported last month. “U.S. carloads of grain in August were down 22.9%. July and August 2023 were the two lowest-volume grain months for U.S. railroads since sometime prior to 1988, when our data begin. Blame weak grain exports. Chemicals fell 0.6% in August, their 11th decline in 12 months; year-to-date carloads were 1.09 million, down 3.3% but still the second most ever for the first eight months of a year. Year-to-date coal carloads were 2.30 million, virtually unchanged. Total U.S. electricity generation was down 4.0% in the first half of 2023, but generation from coal was down 27.3%. Excluding coal, U.S. carloads fell 1.7% in August and were up 0.1% year to date. On the plus side, carloads of motor vehicles and parts led the way for U.S. railroads in August: Carloads were up 13.6%, their 17th straight year-over-year increase. U.S. intermodal originations were down 6.3% in August 2023 from 2022, their 24th year-over-year decline in the past 25 months. However, originations averaged 247,858 units per week in 2023, the most in 10 months. Intermodal remains subpar for a number of reasons, including a continuing shift in consumer spending away from goods to services, a related sharp downturn in port activity, and tougher price competition from trucks.”

(% change from AUGUST 2022)

Transportation (train and engine)

52,102 (+6.85%)

Executives, Officials and Staff Assistants

8,232 (+4.20%)

Professional and Administrative

10,327 (+5.47%)

Maintenance-of-Way and Structures

28,994 (+1.96%)

Maintenance of Equipment and Stores

18,258 (+4.87%)

Transportation (other than train & engine)

4,879 (+3.46%)

Source: Surface Transportation Board

TOTAL North American CARLOADS, AUG. 2023 VS. AUG. 2022

1,657,9071,666,976

TOTAL U.S. Carloads and intermodal units, 2014-2023 (in millions, year-to-date through AUGUST 2023, SIX-WEEK MOVING AVERAGE)

BY UNANIMOUS VOTE, THE SURFACE TRANSPORTATION BOARD (STB) ON SEPT. 7 ISSUED A NOTICE OF PROPOSED RULEMAKING (NPRM) THAT IT SAID FOCUSED ON “PROVIDING RAIL CUSTOMERS WITH ACCESS TO RECIPROCAL SWITCHING AS A REMEDY FOR POOR SERVICE.” IT CALLED THE MOVE “AN IMPORTANT STEP IN ADDRESSING THE MANY FREIGHT RAIL SERVICE CONCERNS EXPRESSED BY STAKEHOLDERS SINCE 2016.” Comments were due by Oct. 23 (the AAR filed for a 90-day extension). STB said it anticipates “acting expeditiously” on the proposal.

“In the past several years, it has become clear that many rail customers nationwide have suffered from inadequate and deteriorating rail service,” STB Chairman Martin J. Oberman (above) said. “These problems were documented in detail in hearings conducted by the Board in April 2022 … The Board has continued to closely monitor the state of rail service.

“For this reason, the Board has determined to focus its efforts with respect to reciprocal switching on providing relief to rail customers suffering from poor service. With the issuance of today’s NPRM, the Board is proposing that one approach to improving rail service is to afford affected shippers the opportunity to obtain a reciprocal switch to a competing Class I carrier when service falls below a standard set in the proposed rule.

“The new rule contains a distinct advantage over both the existing regulations and the

proposal in the 2016 NPRM [Docket No. EP 711 (Sub-No. 1)]. The proposed new rule sets specific, objective and measurable criteria for when prescription of a reciprocal switching agreement will be warranted. This rule will bring predictability to shippers and will provide Class I carriers with notice of what is expected of them if they want to hold on to their customers who might otherwise be eligible to obtain a switching order. As a result, litigation costs to obtain a switch should be greatly reduced and petitions to obtain a switching order should be able to be litigated much more swiftly.”

The NPRM’s release closed Docket No. EP 711 (Sub-No. 1) and proposes, in a new Subdocket (Docket No. EP 711 [Sub-No. 2]), a new set of regulations that would provide “a streamlined path for the prescription of a reciprocal switching agreement when service to a terminal-area shipper fails to meet any of three performance standards.” The proposed standards, STB explained, “are intended to reflect a minimal level of rail service below which a shipper would be entitled to relief, and each standard would provide an independent path for a petitioner to obtain prescription of a reciprocal switching agreement.” STB said they are “intended to be unambiguous, uniform standards that employ Board-defined terms and are consistently applied across Class I rail carriers and their affiliated companies.” The three STB-proposed standards are:

1. Service Reliability. This is defined as the “measure of a Class I rail carrier’s success in delivering a shipment by the original estimated time of arrival (OETA) that the rail carrier

provided to the shipper.” The OETA “would be compared to when the car was delivered to the designated destination and would be based on all shipments over a given lane over 12 consecutive weeks.” One proposed approach “would be to set the success rate during the first year after the rule’s effective date at 60%, meaning that at least 60% of shipments arrive within 24 hours of the OETA, and increasing the success rate thereafter to 70%.” STB also seeks comment on other approaches, such as “maintaining the required success rate at 60% permanently or raising it to higher than 70% after the second year.” Phasing in a higher success rate over time would provide the Class I railroads “with time to increase their work forces and other resources, or to modify their operations, as necessary, in order to meet the required performance standard.”

2. Service Consistency. This is the “measure of a rail carrier’s success in maintaining, over time, the carrier’s efficiency in moving a shipment through the rail system.” The service consistency standard “is based on the transit time for a shipment, i.e., the time between a shipper’s tender of the bill of lading and the rail carrier’s actual or constructive placement of the shipment at the agreed-upon destination.” The NPRM proposes that, “for loaded cars, unit trains and empties, a petitioner would be eligible for relief if the average transit time for a shipment increased by a certain percentage— potentially 20% or 25%—as compared to the average transit time for the same 12-week period during the previous year.”

3. Inadequate Local Service. This is defined as the “measure of a rail carrier’s success in performing local deliveries (‘spots’) and pickups (‘pulls’) of loaded railcars and unloaded private or shipper-leased railcars within the applicable service window, often referred to as ‘industry spot and pull’ (ISP).” The NPRM proposes that a railroad would “fail the standard” if it had an ISP success rate of less than 80%, over a period of 12 consecutive weeks, in performing local deliveries and pick-ups within the applicable service window. “The ISP success rate would measure whether the carrier provides the service within its customary operating window for the affected shipper, which in no case can exceed 12 hours. This service metric provides rail customers with the longsought-after information on all important first mile/last mile service.”

L.B. FOSTER last month extended its partnership with lubricant manufacturer FUCHS LUBRICANTS CO. to rail markets in South America, Australia and China. The partnership, L.B. Foster says, combines its “expertise in the deployment of Total Friction Management® (TFM) solutions for the global rail industry with FUCHS’s manufacturing capabilities and world-class lubrication solutions for railway traffic. We offer rail customers trackside and on-board friction management solutions, and pioneered TFM for the rail freight, passenger and urban transit sectors. TFM is how we work with railroads around the world to deliver holistic, optimized friction management programs.” FUCHS is a global company that develops, produces, and distributes more than 10,000 lubricants and related services.

Siemens Mobility will supply six additional SC-42DM dual-mode (diesel-electric/third-rail) Charger locomotives to MTA MetroNorth Railroad, building on an initial 27-unit order placed in 2020. The Connecticut Department of Transportation (ConnDOT) is funding these six. M-N’s base order was for 19 units, expanded to 27 (all funded by the New York MTA) with exercise of a first option. This second option brings the total to 33. Options remain to purchase 32 additional units, along with 14 more for ConnDOT, 25 for the New York State Department of Transportation (NYSDOT) and 60 for MTA Long Island Rail Road (LIRR). The new power will replace GE P32AC-DMs, which have either reached or exceeded their projected 25-year lifespan. The original contract encompasses, with all options, up to 171 SC-42DMs for Metro-North, LIRR and NYSDOT, the latter for Amtrak Empire Corridor service. They will be built in Siemens’s Sacramento, Calif., facility to the current EPA Tier IV standards for operation in the Park Avenue Tunnel and on thirdrail territory across New York State.

THE GREENBRIER COMPANIES last month boosted its order book by 15,300 railcars in its fiscal fourth quarter ending Aug. 31, 2023. Customers operating in “various commercial sectors” are purchasing a “range of railcar types” with an aggregate value of $1.9 billion, the manufacturer reported. Greenbrier did not disclose the types of railcars or the customers. According to Greenbrier, “broad demand” across all railcar types led to its highest quarterly orders in nearly a decade, and the orders demonstrate its “lease origination capabilities balanced with its direct sale expertise.” Certain orders, the company added, are subject to “customary documentation and completion of terms.”

AMERGIN ASSET MANAGEMENT

(AAM) last month announced that its portfolio company AMERGIN RAIL has acquired PNC BANK’S operating railcar portfolio, including the purchase of more than 6,000 railcars under management, which are under lease to a variety of companies across the U.S. PNC will continue to provide traditional financing products and services to the rail and transportation industry. MACQUARIE CAPITAL acted

as exclusive financial advisor to AAM; EVERSHEDS SUTHERLAND (US) LLP acted as external M&A and rail leasing legal counsel to AAM and Amergin Rail; and WOMBLE BOND DICKENSON (US) LLP acted as external rail leasing legal counsel to Amergin Rail in connection with the acquisition.

STV has contracted with Arizona’s VALLEY METRO REGIONAL PUBLIC TRANSPORTATION AUTHORITY (VALLEY METRO), in partnership with the cities of Tempe and Mesa, to serve as lead planner and designer to expand the three-mile, 14-stop Tempe Streetcar system, which launched May 20, 2022. The Rio East-Dobson Extension project will evaluate adding approximately four miles of track from downtown Tempe into Mesa, Arizona’s third-largest city. STV is the lead designer for the project and PARTNERS IN ARCHITECTURE is the architect of record. STV will conduct an alternative analysis to consider and evaluate the line’s configuration and how it can best connect various regional activity centers, employment centers and residential areas.

Who, pray tell, is the vampire? Is it railroads, allegedly abusing their market power to drain from captive shippers monopoly pro ts? Or is it aggrieved shippers, urging the Surface Transportation Board (STB) to poach from railroads the fruits of enterprise essential to maintaining and renewing plant and equipment?

Don’t look to the law for answers. In partially deregulating railroads in 1980 (Staggers Rail Act), Congress created con icting objectives. Regulators were instructed to protect captive shippers from railroad market power abuse while simultaneously assisting railroads in earning their cost of capital (revenue adequacy).

Nor is the answer available from the STB, o scolded for delay and favoritism.

ere was no burnishing of the STB’s image last month when the ve-member Board unanimously voted—Reciprocal Switching for Inadequate Service, Docket No. EP 711 (Sub-No. 2)—to shi focus from increasing shippers’ competitive options to measuring service standards as a pre-condition for competitive enhancements.

If the STB’s assumption is that railroads are in business to sell shoddy service at in ated prices, it possesses authority to create e cient and e ective remedies— competition—without painting a new face on a rulemaking dating to 2011 and with roots to 1985.

e STB’s unused and rusting tools include capping rates for revenue adequate railroads; requiring reciprocal switching at sole-served shipper origins and destinations (the interchange of freight cars with a competitor at the nearest feasible junction); or requiring the sole-serving railroad to quote a rate to such a junction over the bottleneck (railroads now are required only to quote a rate from origin to destination no matter that they have an origin and/or destination monopoly).

Regulators ruled in 1985 (Coal Rate Guidelines) that once a railroad achieves revenue adequacy it be subject to a rate cap and “not consistently earn, over time, a return on investment above the cost of

capital.” Yet regulators dither over enforcement, notably ignoring tens of billions of dollars in stock buybacks by railroads, billions of dollars in asset value premiums paid to acquire competitors or o ered for them by hedge funds, and that no railroad has told investors it is revenue inadequate.

At sole-served shipper facilities, competition can be enhanced by requiring unbundling of service or rates. Long available in Canada with no railroad objection—in fact, o ered by Canadian Paci c and Kansas City Southern in their merger application and advocated by then-CP CEO Hunter Harrison when he sought to acquire Norfolk Southern—is a reciprocal switching remedy. It allows a captive shipper to demand its cars be interchanged at the soleserved origin or destination with a second railroad at a feasible junction, allowing for negotiation of a lower rate on the longer, more pro table (to the railroad) linehaul, and pressures the sole-serving railroad to improve service and o er a lower origindestination rate.

A second remedy at bottleneck origins and destinations is for the sole-serving railroad to quote a separate rate for the bottleneck segment (subject to challenge before the STB). Rate unbundling similarly allows shippers to negotiate a lower linehaul rate with a second carrier. Such competition mirrors what the Federal Communications Commission and Federal Energy Regulatory Commission mandate of telecommunications, wholesale electric power and natural gas carriers.

While shippers publicly praised the STB’s Sept. 7 ruling (who but Donald Trump speaks resentfully of magistrates holding one’s fate?), their con dential assessment is condemnatory, such as: “Despite shippers having for decades put together an exhaustive record on railroad market power abuse, the STB has proposed new rules based on service failures and no rules based on competition failures— not even a schedule or commitment with respect to competition rules.”

Why the STB terminated its focus on competitive remedies that railroads adamantly oppose is open to conjecture,

as the STB provided no explanation for its action. Undeniable is that the pivot betrayed the primary complaints of captive shippers—a lack of rate competition and prohibitive hurdles to bringing and pursuing rate complaints before the Board.

What the STB has done is once again kicked the can down the road.

(Frank N. Wilner’s new book, Railroads & Economic Regulation, is available from Simmons-Boardman Books at www.transalert.com, 800-228-9670.)

FRANK N. WILNER Contributing Editor

Why the STB terminated its focus on competitive remedies that railroads adamantly oppose is open TO conjecture, as the STB provided no explanation for its action.”

By David Nahass, Financial Editor

By David Nahass, Financial Editor

BY DAVID NAHASS, FINANCIAL EDITOR

BY DAVID NAHASS, FINANCIAL EDITOR

elcome to Railway Age ’s 2024 Railroad Financial Desk Book. Fall is upon North American rail. It is a time for the grain harvest and a time to begin reflection on what the year has delivered and an opportunity to look forward to the future. It is a time for closing the Southern border as South and Central American migrants decide that the roof of a covered hopper car is the new passenger ship to freedom and the American Dream and that Eagle Pass, Tex., is the new Ellis Island. After a four-day border closing by U.S. Customs and Border Protection, Union Pacific reported a 24-train backup in both directions equivalent to 32 miles.

Sociologists suggest that nostalgia tends to mute the more challenging

Waspects of our collective past in favor of a rosier, recollective narrative. (The memory of Hunter Harrison may disagree with the rosier look at one’s past.) In a recent article in the Los Angeles Times , a study from the American Enterprise Group was cited indicating that the 1980s and 1990s are replacing the 1950s as the era on which people reflect as “the good old days.”

Imagine that! The Eighties! Respectability! For industry veterans, let’s all go back to the pre-Staggers era. The article goes on to say that in the 1930s, people thought the good old days were the horse and buggy era. Human nature is a fallible thing.

When were the good old days of intermodal loadings? Was it the robust loadings of 2018? In 2023, intermodal loadings continue to languish down 8.7%

for the year (through Sept. 16, 2023, and after a better-than-expected August). At the most recent Intermodal Association of North America (IANA) Expo Conference in Long Beach, Calif., Journal of Commerce correspondent Ari Ashe noted in reporting about the state of the intermodal market, “While intermodal train speeds were up 3.8% and on-time performance was 12% higher year-over-year in the first week of September, shippers remember the subpar service that existed between 2020 and 2022.”

Intermodal loadings are the hangover that won’t go away. Remember when intermodal was going to be the great growth engine of rail for the 21st century? That’s so 2000s and 2010s and 2020s and … Except for the fracking boom, which gave intermodal a rail pass level moment of silence, intermodal (or Bruce Kelly

as Tony Hatch would call it, “The Great Experiment”) has been the unfulfilled promise that couldn’t or hasn’t.

Ashe continues in his article: “North American railroads are moving to reverse a multi-year loss in market share … by fixing … root causes … including unreliable service [and] uncompetitive pricing.” Focus on the latter point for the moment and realize that one reason that the railroads have been so blasé about intermodal service is that the operating ratio is generally higher on intermodal business than on other types of freight.

Heading into 2023’s fourth quarter, early year projections on a rebound are falling flat. The grip of a potential recession (and contrarily, the chances for sticking a soft landing) seems a little stronger. That does not bode well for recovery.

Some factors such as a change in how railroads handle the first and last mile for intermodal shipments that may improve the throughput of intermodal trains are fundamental supply chain changes that may be a generation in the making. As an industry, change is not something we do well, and there is no nostalgia for a time

when rail pivoted with great rapidity. Issues related to length of haul play a factor in intermodal’s future. After the West Coast pandemic-related container ship pileup, loads moved to the Southeast and the Northeast. The Panama Canal is having to place restrictions and penalty payments on certain types of shipments due to operating issues resulting from water supply. This could direct more traffic back to the West Coast (especially after the settling of labor-related issues at the Port of Long Beach). The Wall Street Journal has a video explaining the reason for Panama’s operational issues that is worth a viewing.

In previous musings, “Financial Edge” has highlighted how intermodal loadings have always bounced back from downturns with relative ease. Perhaps that is what the industry has to look forward to in 2024. Maybe it won’t be eye-popping, but as the cheap romance novelists like to say, “life isn’t always pretty but it is always beautiful.”

It was a really great time to be writing a lengthy article about railcars and finance. The Federal Reserve’s Sept. 20 decision to hold interest rates level while

projecting another increase between now and the end of 2023 was not unexpected. Pretty? Probably not. The Fed’s unanswerable question seems to be what the magic interest rate will be that will slow down unemployment and hold inflation at the targeted 2%. For years, that number (for the ten-year Treasury bond) seemed to be somewhere between 2% and 3%.

Interest rates are an impact factor in rail finance. Using some loose estimates, a 1% increase in interest rates can equate to an increase in lease rates on a railcar of $100 per car per month. (Sit down if you need to.) If you happened to be considering leasing a railcar in October 2021 (when the ten-year Treasury was about 1.5%), the cost adjustment (based on interest rates alone) could be equal to $300 per car per month for each month of your lease term. (The ten-year Treasury is just about at 4.5% after the Fed’s recent pronouncements.)

It’s just enough to have one wishing for the good old days of the 1980s and 1990s! Before going all in on purchasing a pair of vintage “Risky Business” Wayfarers (“Risky Business” was a popular movie in Bruce Kelly

With nearly 140 years of financial strength and stability, DJJ is also known for our creative transportation solutions. Contact us today to discuss private fleet or leasing options. RailGroup@djj.com www.djj.com

1984 that launched Tom Cruise’s lengthy movie career— yes, Tom Cruise is that old), check the facts. For those of you who were able to keep score at home in the early ’80s, the ten-year Treasury was 15% in 1981 and didn’t stabilize at today’s levels until the turn of the century. The only good things to buy in the early 1980s were municipal and Treasury bonds.

In addition, The Greenbrier Companies (whose fiscal year end is Aug. 31), announced earnings on Sept. 21 and announced what felt like the railcar industry equivalent of a quarterback dropping a dime in the fourth quarter of a close game. The revelation that Greenbrier had secured orders for 15,000 railcars in its fiscal fourth-quarter 2023 was material indeed. This is more surprising, considering that orders in the second quarter of calendar-year 2023 were 16,194 for all builders. The total value of Greenbrier orders: a cool $1.9 billion. But keep the facts straight: With Greenbrier’s fiscal year reporting including the calendar month of June 2023, there is some overlap between the eye-popping RSI American

Railway Car Institute Committee secondquarter 2023 order number and the equally eye-popping Greenbrier fiscal fourth-quarter order number.

Greenbrier did not provide much granular detail for the orders received. Clearly, some cars are for European orders (Greenbrier has European manufacturing facilities in Poland, Romania and Turkey) and they indicated that there were no multi-year orders. (This refers to a GATX-style multi-year.)

Certainly, no one expects Greenbrier to build only these 15,000 cars and not add to their prodigious backlog. In addition, at the recent 16th annual TD Cowen Global Transportation Conference, Greenbrier in its presentation (available on its website) noted that it expected new car production for the next three years to be around 40,000 cars annually. As of June 30, 2023, Greenbrier had 41% of the North American railcar manufacturing backlog of roughly 60,000 railcars. If these orders were all U.S. based, that would raise Greenbrier’s North American backlog to almost 40,000

railcars. Put all that together, and the 15,000 additional cars would suggest that Greenbrier’s deliveries are out until 2025. Knowing that at least a portion of the orders received by Greenbrier were European clearly matters, but concerns about scale are still warranted.

An industry contact marveled at this most precise example of the inelasticity of supply in the railcar market right now. It will be interesting to see where Trinity, FreightCar America and National Steel Car orders come in from the third quarter. Furthermore, it will be even more interesting to see how high the backlog and how long the delivery window will need to get until the OEMs decide to start building more than 40,000 cars annually.

Any continued strengthening of loadings will continue to require more equipment. Roughly 20% of the national eet of railcars is in storage. Most of those have been there for some time and many will never move again. With general freight loadings neutral for 2023 (thanks to all you automobile purchasers), any additional demand will continue to stress car supply.

It’s difficult to find balance between adequate supply and over supply. As an industry, railcar manufacturing has historically struggled to do this. The inelastic supply mentioned above is a new twist for railcars and railcar manufacturing. It will be interesting to see if it sticks, or maybe even more so to find out what throws it off kilter. A return to the good old days of railcar manufacturing and its boom/bust cycles shouldn’t really be on anyone’s agenda. Good luck closing out the year successfully.

Railcar users of all types are spending time in hindsight thinking about the rates they could have locked in for the long term when it felt like the siren song of low-cost lease rates and flexible terms would never come to an end. TD Cowen’s Matt Elkott has suggested that lease rates may have peaked in the most recent quarter. The question is, will today’s currents rates, even if

they plateau, remain at lofty levels?

Current car supply levels (Greenbrier orders notwithstanding), service levels and interest rates suggest that there is some grip to today’s economics. Lessors generally are pushing lease terms. Rates quoted here are five to seven years generally. Expect shorter-term leases to be more costly across all car types.

Here’s what’s going on in the market:

Coal Cars: Coal loadings have been flat for the year, but coal generation is down to 14% of overall energy generation in the U.S. Even with advances in carbon sequestration, the flame here continues to flicker. But with car supplies lower, demand continues, and rates remain elevated. For rapid discharge cars (if one can find them) expect lease rates in the high $300s full service (FS), with some uplift for terms of less than three years. For gondola railcars expect rates in high $200s to low $300s. Rates here continue to stay at elevated levels despite dropoffs in the cost of natural gas drifting well

below the $3.50 to $4.00 MMBTU price generally viewed as the cost threshold for moving and burning coal vs. burning natural gas. While car owners may be wishing for the good days of the 1990s, this is a better alternative than what was available in the 2019 timeframe. Expect rates to continue to hold at these levels.

Mill Gondolas: The high price of new cars really has an impact here. While scrap is holding at reasonable levels, loadings are up year-over-year (YOY) with service stressing car supply. Age matters more here than with other car types. Looking for 52-foot (Eastern scrap) gons? Expect lease rates in the mid-$500s. Need a car that works out West? Sixty-six-foot mill gondolas are in the mid- to high$600s. Do expect a slight autumnal drop in scrap prices (currently at $325 a ton for Chicago heavy melt #1) to be a high impact near-term factor.

Centerbeam Flat Cars: Oh wither the housing market! Wall Street seems bullish on builders even with mortgage

WorkSiteTrainingCourses:

Locomotive:

• TestingandTroubleshooting26-Type LocomotiveAirBrakeSystems

• LocomotivePeriodicInspectionand FRARulesCompliance

• LocomotiveElectricalMaintenanceand Troubleshooting

• LocomotiveAirBrakeMaintenanceand Troubleshooting

• DistributedPowerMaintenanceand Troubleshooting

• DistributedPowerOperations,Training,and OperatingRules

FreightCar:

• FreightCarInspectionandRepair

• SingleCarAirBrakeTest

• FRAPart232BrakeSystemSafetyStandards forfreightandothernon-passengertrains

• TrainYardSafety

Track:

• TrackSafetyStandards

rates up to a high 7%. (Miss the good old days? In 1982, the 30-year mortgage rate peaked at 18% and was nary below 7% until after 2000). The Association of American Railroads notes that a lack of sales of existing homes supports new builds. That suggest some strength in the loads here. Look for continued strength in this car class and rents in the low-$400s.

Tank Railcars: A bevy of cars moving in energy service continue to remain in demand: DOT 117Js are running north of $1,000 per car per month. DOT 117Rs are in the high $800’s/low $900s. Both of those are 29,000-gallon tank railcars; 25,500-gallon tank railcars cars are a little softer and more readily available. Want pressure cars? Expect the pressure here as rates are in the $1,000 range FS. The slide in natural gas has impacted this market, but a cold winter could shift these prices higher. Food grade tanks are not much better, with rates in the high$900s or low-$1,000s.

Covered Grain Hoppers: Ah, remember the good old days when lessees could lease jumbo cars for less than $400? Oh wait, that was early 2020. Back to the now, nothing says service matters like a market segment where loadings are down 13% YOY and rates continue to remain firm and at the highest levels in the past 20 years. Jumbo hoppers continue to command lease rates in the low $600s. If you’re able to use a smaller car, expect to pay in the low-$400s for the 4,750cf car, with possible sightings of numbers in the high-$300s.

Covered Cement and Sand Hoppers: A prodigious number of covered hoppers remain in storage. One would assume that a number of these are smaller cube. Despite what continues to seem like an oversupply issue, rate grip is a real thing here, with rates in the midto high-$200s. Attribute it to the costs of moving cars into service (repair shop and empty freight). As a result, cars are also transacting at higher sale prices.

Kawasaki Rail Car - Track Technologies

Kawasaki’s Maintenance Platform provides a customized suite of software that synthesizes data from multiple track maintenance sources.

Expect the older fleet to slowly continue transitioning to newer cars and for these lease rates to stay in place for some time to come.

Boxcars: A little softness here as the paper market has been seeing some price compression and weakness. There might be a little near-term softness as new cars being built (primarily for TTX) get absorbed into the fleet. The long-term perspective here is strong with the aging out of such a large percentage of the national fleet over the next eight years. It’s a commodity business, folks, so there will be ebbs and flows. Fifty-foot boxes have moved back into the mid-$500s, while 60-foot boxes are sitting in the mid-$600s. Those are low prices when compared to the cost of a new boxcar, so don’t expect those rates to remain. I have resisted the urge to talk about the good old days and grandfathered boxcars.

For all your rail leasing and financial needs Infinity

Infinity Transportation provides leasing and financing solutions for a broad range of clients in the rail and intermodal markets.

INFINITY DELIVERS:

• A large rail fleet with an extensive range of car types

• Exceptional customer service with flexibile lease terms

• A commitment to finding the transaction and equipment that meets each customer’s specific needs

• Extensive transportation experience within our Mechanical, Operations and Commercial Teams.

Kawasaki’s Track Monitoring provides locomotive mounted autonomous track inspection systems for geometry and components.

www.kawasaki-track.com

(251) 654-2166

infinitytransport.com

Bundy Group is a boutique investment bank that specializes in representing business owners and management teams in business sales, capital raises and acquisitions. e rm is a senior-driven organization with o ces in Charlotte, New York and Virginia. Bundy Group has been a recognized expert in the rail and transportation industry for more than a decade and has numerous successfully closed transactions in the segment. In representing a business and its shareholders in exploring a sale or recapitalization, Bundy Group is focused on managing a structured process and delivering premium value for its clients. For more information about Bundy Group’s work in the rail space, please contact Jim Mullens at jim@bundygroup. com or at 540-342-2151. For more information about Bundy Group visit www.bundygroup.com.

DJJ A NUCOR COMPANY

300 Pike Street, Cincinnati, Ohio 45202; Tel.: 513-419-6200; Fax: 513-419-6221; Trey W. Savage, Director Logistics; Luke Weatherhead, Manager, Private Fleet; Je Schmutte, Je Blake, and Eric Hausfeld, Regional Rail Sales; Steven R. Skeels, Mechanical Services Lead; and Ann Edwards, Retired Rail Assets (502-212-7365). DJJ’s Rail Group provides a broad range of transportation services throughout North America: single investor, leverage leases, freight cars, portfolio evaluation, remarketing eet management, purchases and sales of portfolios, and private eet management. Other services include freight car inspections and engineering services from design of new cars to complete ISL extended life, modi cations and analysis; in addition to railcar dismantling for scrapping and parts reclamation.

SEE OUR AD ON PAGE 13

RAILROAD FINANCIAL CORPORATION

676 N. Michigan Avenue, Suite 2800, Chicago, IL 60611; Tel.: 312-222-1383; Fax: 312-222-1470; David G. Nahass, President, Email: dnahass@ rail n.com; William J. Geiger, Senior Vice President, Email: wgeiger@rail n.com. RFC represents domestic and international clients in the following areas: debt and lease nancing of all railcar types including coal cars, tank cars and covered hopper cars for sand and plastics; railcar and locomotive eet acquisitions and sales; lease brokerage; mergers and acquisitions; equity and debt nancing of rail property acquisitions, eet and lease restructurings and/or re nancing. RFC also

provides continuing education for the industry.

RR MERGERS & ACQUISITIONS

11 e Pines Court, Suite B, St. Louis, Missouri 63141; Tel: 314 878-1414; Fax: 314-878-1414; Robert Fowler, President, 314 878-1414 x227 Email: robert@rrmergers.com. Jack Sickles, Vice President, 314 878-1414x221 Email: jack@rrmergers. com. RR Mergers & Acquisitions has specialized in the sale of rail-focused companies for more than 15 years. Trusted professionals with long-standing relationships in the rail sector, RR Mergers interfaces with strategic and nancial buyers nding the right buyer for a Company, to make the best deal happen. While maintaining con dentiality at all times, RR Mergers manages the total process of selling railroad industry suppliers, rail services companies and Short Line Railroads. RR Mergers provides advisory services to prepare the company for acquisition, developing a con dential information memorandum, negotiating term sheets, letters of intent and coordinating the due diligence process.

1700 Sansom St., Suite 500, Philadelphia, PA 19103; (215) 564-3122. Michael Sussman, President and CEO. SRF has served for 23 years as trusted advisor to Class I and short line railroads, rail shippers, public sector agencies, and industrial developers. e rm has brought capital, clarity, and velocity to infrastructure development projects in 45 states and Canadian provinces. SRF integrates capital from public programs and private sources with growth marketing strategies and management consulting to position executives toward shortterm objectives and long-term opportunities.

3201 Dallas Parkway, Suite 800, Frisco, TX 75034. Tom Forbes, Executive Vice President and Chief Sales O cer. (469) 777-5649 (o ce); (615) 290-3069 (mobile). Wintrust Commercial Finance (WCF) is Wintrust’s Texas-based, equipmentfocused nancing group o ering sophisticated loan and lease products to companies throughout the United States. Our team o ers exceptional customer service and expertise from years of experience providing customers in a variety of industries with innovative capital solutions. WCF funded in excess of $3 billion in equipmentsecured loans and leases since our founding in 2015 and has continued to grow into one of the largest equipment nancing companies in the country. WCF is led by an experienced management team with, on average, 25 years of experience. With

the team’s extensive knowledge, we’re prepared to consider all structures, including structured nancing and loans; nancing for new and used equipment acquisitions; re- nancings and estate planning; capital, operating, synthetic, and TRAC leases; sale/leaseback and lease discounting; capital expenditure nancing with xed and oating rates and acquisitions. For more information, visit http://www.wintrust.com/business-solutions/ mid-market/lending/commercial- nance.html.

AMERICAN INDUSTRIAL TRANSPORT INC. (AITX)

100 Clark Street, St. Charles, MO 63301-2075. Tel.: 636-940-6000; Fax: 636-940-6100.

Contacts: Sean Hankinson, Chief Commercial O cer, 814-242-6141. shankinson@aitx.com.

American Industrial Transport, Inc. is a leading solutions-provider of railcar services, dedicated to growing our eet and providing customers a range of options across leasing, eet management, and repair services. AITX has access to one of the industry’s most diverse eets of nearly 60,000 railcars across car-types and commodities-served. Due to their customer service, exible nancing options, and extensive knowledge of taxation, government regulations and railroad requirements, AITX has satis ed leasing customers across freight industries. AITX and its subsidiaries operate worldclass railcar repair services through its specialized network spanning across North America. O ering a range of programs from full to light repair, AITX’s maintenance capabilities include full-service repair facilities, tank car quali cations, a wide footprint of responsive mobile operations, and onsite customer dedicated partnerships. To learn more about AITX’s depth of services and customer commitment, visit aitx.com.

e Transamerica Pyramid, 600 Montgomery Street, San Francisco, CA 94111; Tel.: 415-6163486; Ken Fosina, Executive Vice President, Email: kfosina@atel.com. Since 1977, ATEL has leased rail assets to America’s largest railroads and shippers. ATEL specializes in the leasing of all types of rail assets, including railcars, locomotives and maintenance-of-way equipment. ATEL targets railcars and locomotives built prior to 2005, but prefers new maintenance-of-way assets. Leases can be full service, but net leases are preferred. ATEL executes lease transactions directly and through its Capital Markets desk. Each year, ATEL’s Portfolio

Management will sell rail assets from one of its Funds managing expiration.

CAI RAIL

Steuart Tower, One Market Plaza, 9th Floor, San Francisco, CA 94105. Tel: 415-788-0100; Fax: 415-788-3430. James H. Magee, President, email: jmagee@capps.com; Freddy Fernandez, Vice President-Operations, email: ernandez@capps.com.

CAI Rail is an operating lessor in the new and used railcar space. CAI performs full service, net, per diem and nance leases on all railcar types. We have complete maintenance, engineering, operations and eld marketing sta . In addition, CAI o ers a comprehensive rail car customization and refurbishing program to meet our clients’ specications. Our parent company, CAI International (NYSE: CAI) specializes in container leasing and sales as well as domestic and international intermodal logistics. So, let’s get moving!

CARMATH, INC.

25965 482nd Ave., Brandon, SD 57005; Walker Carmon, Vice President, Tel.: 605-582-8340; Email: wcarmon@mwrail.com; Website: www. carmathinc.com. At CarMath, we believe every business should have the opportunity to lease quality railcars at a reasonable price. We have the ability to lease both large and small groups of cars with a wide variety of leasing options and will customize a leasing program to best t your needs.

30 South Wacker Drive, Suite 2900, Chicago, IL 60606; Tel.: 312-906-5701. CIT’s Rail division

o ers a full suite of railcar leasing and equipment nancing solutions to rail shippers and carriers across North America. It manages one of the youngest and most diversi ed railcar and locomotive eets in the industry and leverages its deep experience to empower customers. Contact us to learn how our transportation solutions can power your business. Visit cit.com/rail, call 312-906-5701 or follow @CITgroup.

SEE OUR AD ON PAGE 15

C.K. INDUSTRIES, INC.

P.O. Box 1029, Lake Zurich, IL 60047-1029; Tel: 847-550-1853; Fax: 847-550-1854; email sales@ ckrail.net. Brian M. Harris. C.K. INDUSTRIES, a privately held corporation, began its U.S. leasing operations in 1980, and o ers its services to shippers, short line, regional and Class I railroads in North America. New investment opportunities up to $10MM of both new and used types of freight cars will be considered. Our existing lease eet

o ers a wide variety of car types to meet your lease requirements. We o er mid to long terms, either on a full service or triple net basis.

DJJ A NUCOR COMPANY

300 Pike Street, Cincinnati, Ohio 45202; Tel.: 513-419-6200; Fax: 513-419-6221; Trey W. Savage, Director Logistics; Luke Weatherhead, Manager, Private Fleet; Je Schmutte, Je Blake, and Eric Hausfeld, Regional Rail Sales; Steven R. Skeels, Mechanical Services Lead; and Ann Edwards, Retired Rail Assets (502-212-7365). DJJ’s Rail Group provides a broad range of transportation services throughout North America: single investor, leverage leases, freight cars, portfolio evaluation, remarketing eet management, purchases and sales of portfolios, and private eet management. Other services include freight car inspections and engineering services from design of new cars to complete ISL extended life, modi cations and analysis; in addition to railcar dismantling for scrapping and parts reclamation.

SEE OUR AD ON PAGE 13

125 South Wacker Drive, Suite 1500, Chicago IL. 60606. Phone 312-928-0850, Fax 312-928-0890. Email Fcasales@freightcar.net. Website: www. freightcaramerica.com. Matthew Tonn, Chief Commercial O cer. Since 1907, FreightCar America has been transforming metal into innovative solutions and lasting relationships. We are an industry leader in freight car design and manufacturing utilizing steel, stainless steel, aluminum, and hybrid steel-aluminum materials in freight cars that transport a wide variety of bulk commodities, containerized freight and other products shipped by rail. Our manufacturing facility, engineering expertise and experienced production team is purpose built, focused on delivering operation excellent while closely working with customers to create customized railcar solutions for all your needs.

SEE OUR AD ON PAGE 3

omas A. Ellman, President, Rail North America, GATX Corporation, 222 W. Adams Street, Chicago, IL 60606; Tel: 312-621-6200 Fax: 312-621-6546 GATX is a leader in the rail leasing industry with more than a century of experience, preeminent expertise in specialized railcars, and a growing international presence. GATX meets shipper and railroad needs with one of the largest lease eets of tank and freight cars and locomotives in the world. We provide our customers with a unique mix of nancial (global nancing,

valuation, structuring, leasebacks, joint ventures, partnerships) and mechanical (regulatory, maintenance, engineering, cleaning, inspection) services in North America. Contact via www.gatx.com or 1-800-428-8161.

One Centerpointe Drive, Suite 400, Lake Oswego, OR 97035; 800-343-7188; Fax: 503-968-4383; Email: Marketing.Info@GBRX.com; Website: www.GBRX.com. Tom Jackson, V.P., Marketing. Greenbrier, headquartered in Lake Oswego, Oregon, is a leading international supplier of equipment and services to global freight transportation markets. rough its wholly owned subsidiaries and joint ventures, Greenbrier designs, builds and markets freight railcars and marine barges in North America, Europe and Brazil. We are a leading provider of freight railcar wheel services, parts, repair, refurbishment and retrotting services in North America through our wheels, repair and parts business unit. Greenbrier manages 445,000 railcars and o ers railcar management, regulatory compliance services and leasing services to railroads and other railcars owners in North America. GBX Leasing (GBXL) is a special purpose subsidiary that owns and manages a portfolio of leased railcars that originate primarily from Greenbrier’s manufacturing operations. Together, GBXL and Greenbrier own a lease eet of 8,700 railcars. Learn more about Greenbrier at www.gbrx.com.

201 17th St., Suite 410, Atlanta, GA 30363; Website: www.in nitytransport.com. Brian Ottinger, Chief Commercial O cer: Tel: 312-731-2763; brian. ottinger@in nitytransport.com. Lee Martini, Sr. VP Sales & Marketing: Tel: 678-904-6315: lee.martini@ in nitytransport.com; Ken Johnson, VP Sales & Marketing: Tel: 859-640-0362: ken.johnson@ in nitytransport.com; James Weaver, VP Sales & Marketing: Tel.: 251-654-2166: james.weaver@ in nitytransport.com. In nity Transportation is a private lessor with a eet of more than 40,000 railcars of varying types. Lease options include net, fullservice and per diem with term variances ranging from short-term operating to long-term nance leases. In nity prides itself on exceptional customer service and exibility with regard to lease structures and railcar modi cations to nd the transaction and equipment to best serve our customers.

SEE OUR AD ON PAGE 17

THE INSTAR GROUP, LLC

2001 Route 46, Ste. 506, Parsippany, NJ 07054.

-

(636), 778-0611; (973) 355-6484. Umesh Choksi, CEO. UChoksi@instargrp.com. e InStar Group LLC is a full-service railcar leasing company established in 2016. We are owner operators and/or investors in the railcar business in North America and provide the highest quality railcars on either a full service or net lease to North American shippers and railroads. We invest and o er all railcar types across all industries we deem to be most e cient for the commodities carried with proven track record of consistent cash ow. We are exible in our approach to investing in railcars and have the ability to own outright, participate in lease in/lease out arrangements, sale-leasebacks, joint ventures or provide structured nancial products for our customers. e InStar Group management team is composed of seasoned industry professionals with manufacturing, leasing, railcar portfolio management, and nancing expertise. We maintain relationships with all major railcar manufacturers, other operating lessors, shippers, railroads, repair and maintenance facilities and nancial institutions within the industry. e InStar Group, LLC is now part of J.P. Morgan Global Alternatives’ Global Transportation Group, the alternative investment arm of J.P. Morgan Asset Management. More information: https://instargrp.com.

MITSUI RAIL CAPITAL, LLC

One South Wacker Drive, Suite 3110, Chicago IL 60606 - Phone: 312-803-8851: Dan Penovich, President; Chris Gerber, Vice President Sales and Marketing. Mitsui Rail Capital is a railcar operating lessor that o ers some of the youngest railcars in our industry. From tank cars to covered hoppers to a wide variety of other car types, we deploy assets in every industry, including oil, gas, plastics, agriculture and steel. Our proactive approach enables us to know your unique needs and railcar requirements, getting well-structured deals done, faster. MRC has been in business for 20 years and is a joint venture between Mitsui & Co. Ltd. and JA Mitsui Leasing of Tokyo.

PNW RAILCARS INC.

121 SW Morrison St., Suite 1525, Portland, OR 97204. 503-208-9295. sales@pnwrailcars.com. www.pnwrailcars.com. PNW Railcars, Inc. (formerly MUL Railcars) o ers a complete railcar leasing solution set with asset management, regulatory support, and specialized services designed to provide customers with the options they need. PNW Railcars has one of the newest and most comprehensive tank car and freight car eets in rail leasing, serving several industries including automotive, chemical, steel, agriculture, aggregates, construction, infrastructure and intermodal.

Mike MacMahon, Director of Railcar Leasing, mmacmahon@progressrail.com; Jay Hat eld, Director of Business Development, jhhat eld@ progressrail.com; Gary Lawrence, Manager, Locomotive Sales & Leasing, glawrence@progressrail. com. Jacob Creech, Manager, Locomotive Leasing, jcreech@progressrail.com. Progress Rail, a Caterpillar Company, o ers through its Freight Car Leasing Division o er a wide variety of freight cars and leasing options to meet our customers’ speci c transportation requirements: Full-Service, Net and Per-Diem leases, and Purchase-Leasebacks. Understanding your needs and supplying an optimal solution is what we do best. e Locomotive Leasing Division o ers Full-Service Leases: Net, Seasonal, Sell-Lease Back, Trade-Ins. All locomotives sold or leased go through an extensive inspection to ensure you are receiving equipment that is ready for service. Refurbishment or upgrades are available to ensure the locomotive ts your operation, with work completed in our own shops under our supervision, ensuring the highest level of quality. rough the acquisition of Electro-Motive Diesel, Progress Rail has access to locomotive information other providers cannot supply. Our locomotive inventory is constantly changing, as we strive to be your top supplier of quality and dependable used locomotives. C2

7695 Bond Street, Glenwillow, OH 44139; (440) 439-7088. John Roberts, CEO, Email: jroberts@ relaminc.com. As a full-service leasing company, we o er complete MOW equipment leasing services. Each of our team members is knowledgeable, professional, prompt and courteous, one reason why our clients stay with us. We understand the importance of making every business transaction easy on the customer. We handle all the paperwork and logistics for every lease, so you can spend your time on more important things. We are committed to providing our clients with the highest level of service while remaining competitive in today’s market. RELAM knows railroad operations and the equipment involved. C4

200 S. Wacker Drive, Suite 3100, Chicago, IL 60606; tel: 312-674-4742; fax: 312-421-2742; www. raltrac.com. RALTRAC (formerly RALCO) is a privately held, Illinois Limited Liability Company in the business of acquiring, managing and leasing railroad rolling stock on net or full services leases.

e Company has the intellectual and nancial resources necessary to compete in the small cap lease market where its size and structure provide it with a competitive advantage. RALCO also provides consulting and advisory services to its clients. Contact: Peter Urban, Principal, purban@ raltrac.com, 847-975-3568 (mobile); Richard Johannes, Principal; Jason Urban, Principal.

RELCO LOCOMOTIVES, INC.

One Relco Ave, Albia, Iowa 52531. Tel.: 641-932-3030; Website: www.relcolocomotives.com. RELCO, as one of North America’s leading locomotive rebuild, remanufacturing and leasing companies, can provide a full range of locomotive leasing and maintenance services. Since 1961, RELCO has developed a reputation for providing the nest motive power and custom maintenance packages to t any need:

• Full line of both switching and road power available.

• Speci cations ranging from quali ed to completely custom remanufactured.

• A ermarket systems upgrades available, including radio remote controls, microprocessor control systems, fuel management systems, etc.

• Nationwide full-maintenance programs available.

• Net, full-service, financial and sale/leaseback programs.

SMBC RAIL SERVICES LLC

300 South Riverside Plaza, Suite 1925, Chicago, IL 60606; Mike McCarthy, President & CEO (312) 559-4803; Tina Beckberger, Senior Vice President Leasing, (312) 559-4818. SMBC Rail Services is a full-service operating lessor, invested in all tank and freight car types, o ering a broad selection of equipment leasing and nancing products for the North American rail market. SMBC Rail can structure a solution for all your rail equipment needs, short and long term, full-service or net leases, sale/ leasebacks, or portfolio acquisitions. Contact us via www.smbcrail.com or sales@smbcrail.com.

1606 Rosebud Creek Road, Forsyth, MT 59327; Tel.: 406-347-5237; Fax: 406-347-5239; www.tealinc. com; webmail@tealinc.com; Julie Mink, President, 720-733-9922; julie@tealinc.com; Kristen Kempson, Director-Railcar Leasing & Sales; Tel. (708) 854-6307; kristen@tealinc.com; Shannon Rodgers, Director-Operations; Tel.: (814) 631-9277; shannon@tealinc.com. Tealinc, Ltd. is a boutique private freight railcar lessor, railcar eet manager and rail transportation consultant. Guided by our Customer-Centric philosophies, we partner with our customers by leasing, buying, and selling

railcars nationally and internationally. Our private railcar eet includes covered hoppers, atcars, gondolas, open top hoppers, etc. Custom-tailored railcar lease support packages include options such as daily tracing, cycle time reports, preventative maintenance planning, etc. Our rail transportation consulting services enable our customers to have a successful freight-by-rail experience. With a combined 80 years providing service and expertise in the freight rail industry, the Tealinc team is dedicated to being a rail partner to novice, intermediate, and expert freight railcar shippers.

14221 North Dallas Parkway, Ste. 1100, Dallas, TX 75254. 1-800-631-4420. TrintyRail® provides access to the rail transportation businesses of Trinity Industries, Inc. With an owned and managed eet of approximately 131,000 railcars, Trinity Industries Leasing Company (TILC) provides one of the largest railcar eets in North America. In addxition to comprehensive leasing and management services, our customers have access to extensive manufacturing and engineering resources, railcar maintenance, parts, asset management and advisory services, and on-site eld support for operational assistance and training. An overview of our platform of integrated rail products and services is available at www.trinityrail.com.

SEE OUR AD ON PAGE 27

175 W. Jackson Blvd., Suite 2100, Chicago, Illinois 60604; 312-431-3111; leasinginquiry@utlx.com; https://www.utlx.com. Union Tank Car Company (UTLX) supplies general purpose and pressure tank cars, in addition to plastics covered hopper cars, for bulk shippers. Along with Canadian a liate Procor Limited (PROX), our combined companies own the largest and most diverse tank car eet in North America, specializing in full-service tank car leasing. We also operate the largest railcar repair network on the continent, and with the acquisition of Transco Railway Products Inc. in 2019, our repair network now includes 26 full-service shops and more than 100 mini shop and mobile unit installations. UTLX is capable of servicing all eet management and maintenance needs for all car types. Our manufacturing operation, located in Alexandria, Louisiana, specializes in the fabrication of tank cars. Leveraging an integrated leasing-repair-manufacturing model with experience cultivated throughout our 130-year history, our talented team provides superior customer service and shapes the future of the highly regulated North American tank car

industry. Union Tank Car Company is a Marmon/ Berkshire Hathaway Company.

SEE OUR AD ON PAGE 11

VTG RAIL INC.

103 West Vandalia, Suite 200, Edwardsville, IL 62025. Bryan Vaughan, Regional Vice President Sales, 630-361-6745, Bryan.Vaughan@vtg.com. Lynn Hayungs, Regional Vice President, Sales, 956-630-2723 ext. 206, Lynn.Hayungs@vtg.com. VTG is a freight and tank railcar lessor o ering operating leases and customer structured solutions. VTG also provides eet management services for its customers and for other private railcar owners and operators. VTG is a customer service oriented leasing company that provides a best in class mix of service, operational and mechanical expertise at competitive lease terms. VTG invests in all freight car types.

WELLS FARGO RAIL

Wells Fargo Rail, 9377 W. Higgins Road, Suite 600, Rosemont, IL 60018; Telephone: 844-4599664; Fax: 847-318-7588; Web: www.wellsfargo. com/rail. Email: RailAccountServices@wellsfargo.com. Wells Fargo Rail is the largest, most diverse rail equipment operating lessor in North America. Whatever you’re transporting, we’ve got you covered with more than 175,000 railcars and 1,800 locomotives. Our team of experienced rail industry professionals is ready to listen to your needs and structure creative solutions to add value to your business.

RAILROAD APPRAISAL ASSOCIATES

Division of e Occor Company; Management Consultants providing a variety of consulting services to the railroad and urban transportation industries and the nancial institutions and leasing companies that serve them: Railcar and Locomotive Appraisal & Inspection Services for New and Used Equipment, Rail Equipment Portfolio Reviews and Valuation, Market Studies, General Consulting. We have more than 20 years of market experience and data. Patrick J. Mazzanti, President; Ronda Lemons, Assistant. Headquarters: 1914 Springdale Drive, Spring Grove, IL 60081, (815) 675-3300; E-mail: pat@railroadappraisals.com.

1401 Walnut Street, Suite 500, Boulder, CO 80302; (646) 258-5812. 2593 Wexford-Bayne Road, Suite 205, Sewickley, PA 15143; (724) 766-6699; Email:

mmahoney@railsolutions-llc.com, rblankemeyer@railsolutions-llc.com; Website: www. railsolutions-llc.com; Michael E Mahoney, President; Robert Blankemeyer, Senior Vice President. RailSolutions LLC provides a broad variety of railroad equipment-related consulting, technical and advisory services to nancial institutions, railroads, shippers and eet owners with a primary focus on equipment valuation and appraisal services. RailSolutions LLC o ers two publications on a subscription basis, e Investors’ Guide to Railroad Freight Cars and Locomotives and the RailSolutions Railroad Equipment Historical Database. Our rm draws on close to 50 years of railroad industry experience in railcar and locomotive equipment valuations supported by both a sound base of market data and advanced analytical techniques.

RR MERGERS & ACQUISITIONS

11 e Pines Court, Suite B, St. Louis, Missouri 63141; Tel: 314 878-1414; Fax: 314-878-1414; Robert Fowler, President, 314 878-1414 x227 Email: robert@rrmergers.com. Jack Sickles, Vice President, 314 878-1414x221 Email: jack@ rrmergers.com. RR Mergers & Acquisitions has specialized in the sale of rail-focused companies for more than 15 years. Trusted professionals with long-standing relationships in the rail sector, RR Mergers interfaces with strategic and nancial buyers nding the right buyer for a Company, to make the best deal happen. While maintaining con dentiality at all times, RR Mergers manages the total process of selling railroad industry suppliers, rail services companies and Short Line Railroads. RR Mergers provides advisory services to prepare the company for acquisition, developing a condential information memorandum, negotiating term sheets, letters of intent and coordinating the due diligence process.

STRATEGIC RAIL FINANCE

1700 Sansom St., Suite 500, Philadelphia, PA 19103; (215)564-3122. Michael Sussman, President and CEO. SRF has served for 23 years as trusted advisor to Class I and short line railroads, rail shippers, public sector agencies, and industrial developers. e rm has brought capital, clarity, and velocity to infrastructure development projects in 38 states and Canadian provinces. SRF integrates capital from public programs and private sources with growth marketing strategies and management consulting to position executives toward short-term objectives and long-term opportunities.

•Engineering for Operations

•Light Rail Engineering Standards

•Safety Certification

•Operations Planning and Modeling

•Battery and Hydrogen Fuel Cell Propulsion

•Signaling, Train Control and Street-Running Interfaces

•Leveraging Federal Funding

•PLUS Tour NJ Transit’s Hudson Bergen System

Speakers Include SUPPORTING ORGANIZATIONS

Keynote Speaker Kevin S. Corbett President & CEO NJ Transit

Anna Hooven, P.E. Program Mgr. –Bridges & Buildings SEPTA

Je rey A. Warsh Partner & VP MBI Former Exec. Dir., NJ Transit

Joe Costigan, Jr. Rapid Transit Program Sponsor (Dir.) Metrolinx

Giuseppe Mattoscio, P.E. Chief Safety Engineer Houston METRO

Fred Mills, P.E. Chief Signal Engineer Houston METRO

Rachel J. Burckardt, P.E. VP / Sr. Project Manager WSP USA Inc.

Ken Luebeck, P.E. Public Project Mgr. Benesch

John Mardente Civil Engineer – Passenger Rail Div. FRA

Keynote Speaker Kevin S. Corbett President & CEO NJ Transit

Anna Hooven, P.E. Program Mgr. –Bridges & Buildings SEPTA

Je rey A. Warsh Partner & VP MBI Former Exec. Dir., NJ Transit

Joe Costigan, Jr. Rapid Transit Program Sponsor (Dir.) Metrolinx

Giuseppe Mattoscio, P.E. Chief Safety Engineer Houston METRO

Fred Mills, P.E. Chief Signal Engineer Houston METRO

Rachel J. Burckardt, P.E. VP / Sr. Project Manager WSP USA Inc.

Ken Luebeck, P.E. Public Project Mgr. Benesch

John Mardente Civil Engineer – Passenger Rail Div. FRA

Change is not for the faint of heart. A new book, Change Questions, tells us how to implement it, and how to make it stick.

BY SONIA BOT, CONTRIBUTING EDITOR, WITH D. LYNN KELLEY

“Every methodology I have seen has a step-by-step process. However, no two changes are the same; every change is different.”

– D. Lynn Kelley

The pace of organizational change has been increasing. Unfortunately, most change activities fail to deliver anticipated results. ose that do o en fail to sustain such change. e recently released change management book, Change Questions, A Playbook for E ective and Lasting Organizational Change, by D. Lynn Kelley with John Shook, addresses these critical issues by providing a proven process with a strong record of sustainment that can be used by anyone responsible for implementing organizational change. e book includes a case study with examples and stories of transformation at Union Paci c when Kelly was Senior Vice President of Supply Chain and Continuous Improvement. e initiative resulted in a dramatic increase in operational performance and a 96% sustainment rate over hundreds of change initiatives.

Retired from UP, Kelley is working for Brown Brothers Harriman’s private equity group, advising on railroad investments and manufacturing. With a Ph.D in evaluation and research, she has guided large companies such as Textron and UP through change management. She has held leadership roles in supply chain manufacturing, engineering and continuous improvement across diverse industries at a global scale.

SONIA BOT: What do you see as the unique value that your book and change questions methodology o er?

LYNN KELLEY: Every methodology I have seen has a step-by-step process. However, no two changes are the same; every change is di erent. erefore, the methodology should be able to ebb and ow and adjust to your own speci c needs. e questions approach lets everyone review these questions and decide what’s appropriate for them and their change. ey end up with a customized approach.

SB: Railroads are an entrenched industry and there’s some beauty to the entrenchment, but they need to keep moving forward.

ere are new entrant competitors coming, but there’s also extensive union involvement and there’s a skill and an art in terms of how to deal e ectively with all di erent parts of a

railroad or that type of environment. You can also say the same about complexity when you factor into your change initiative any external parties or other legal entities that come into your change initiative such as, for example, external business partners, suppliers, regulators and customers. Too o en, 60% to 70% of change e orts fail, but it doesn’t have to be that way. You’ve also experienced sustainable change.

LK: So o en we implement change as if failure is not an option, or if we mention failure, it will jinx it, rather than proactively recognizing that there is a high probability that it will fail unless we systematically approach the change. When I le Textron, we were at a 90% sustainment rate for our changes across all industries—35,000 employees, 32 countries and hundreds of di erent initiatives a year. It proved to me that just taking time before we implement a major change really pays the dividends. We measured it the same way at UP When I le there, we had a 96% sustainment rate, where much of the work included union employees in the eld, and what they were doing to increase productivity and network velocity.

SB: Many organizations and change practitioners tend to get stuck in a method and apply it generically as a checklist while missing key things, or they take shortcuts and cut out important steps, or they simply tinker, ying by the seat of their pants. How do Change Questions help reduce this risk?

LK: When I developed Change Questions, I kept pulling in anything that was relevant. I wound up with 11 questions. It’s bigger than your normal model, but unless you have a super complex change, you probably won’t address every question. e result is that you don’t overproduce too complex of an implementation plan, or underproduce one that’s not complex enough. You end up with a plan that’s “just right.” at was my goal with Change Questions.

SB: You provide many vivid case studies of your experience at UP, where your mandate was based on Lean being the underlying methodology. Lean is a way of thinking about creating needed value with fewer resources

and less waste, a practice consisting of continuous experimentation. We need to recognize that Lean thinking and Lean practice occur together. ere are 11 Change Questions. Let’s spotlight two. First Change Question: What is your value driven purpose for the change?

LK: is is a powerful question on many fronts. It includes two elements: value and purpose. “Flavor of the month” can occur when many big organizational changes get rolled out, and we don’t o en de ne the value we expect to get from the change. With Change Questions, we do it as the rst question. Later on, we’ll be trying to measure the change to see if we really are getting the value we expect. A value-driven purpose statement starts to give us alignment and set us on a direction. For example, railroads live and die by velocity. ey want to keep things moving. Union Paci c, like most railroads, has two main groups that work on velocity: dispatchers, and the transportation folks in the eld. ere are pairs of dispatching and transportation managers who own the corridors. We found at UP that, though you may think they’re aligned on purpose because they both had velocity as a goal, sometimes transportation would suboptimize dispatch velocity by making their own velocity better, and vice versa. We started pairing them up on that shared goal with a shared purpose. Velocity immediately started to go up. We found that people in the eld felt sometimes the speed limits were too low. And over the course of 150 years, maybe a curve had been straightened or a bridge had been added, but nobody went back to dispatch in every single circumstance and changed the speed limit. An astute pair got out, looked at everything, and found that they could go through their corridor and increase speed dramatically. Everybody else did it, and velocity improved. It was fantastic because we were aligned on purpose.

SB: Second Change Question: How will you establish a supportive management system with the appropriate leadership behaviors?

LK: One of the top reasons that change initiatives fail is lack of top leadership support. ink of a management system as the infrastructure that might be working against your change, things like how we’re measured.

ink of the example I just gave you. Each of those folks on velocity were being measured through their own department, which was working against the overall goal. It could be how you’re measured, how you’re promoted, the organization chart, etc. We need to see if there’s anything that’s con icting with the change we want to initiate.

At UP, we found we needed to teach proactive problem solving, addressing problems before they become a crisis. A railroad experiences a crisis daily, and we love and reward the re ghters, the people who can get us out of emergencies. We don’t say very much about the people that avoid the res. We needed to nd a way to reward not only the re ghters, but the people who proactively eliminate those res from happening in the rst place.

The second part of that Change Question involves leadership behaviors. The research doesn’t just say that it fails if leadership doesn’t support it. It mostly refers to visible leadership behaviors where employees get more than lip service. Employees can see that leaders are supportive of change. At UP, we did something called catchball . We went to leaders and said, “This is the change we’re going to implement. How can you show your people you support this? What could you visibly do?” But it’s something we have to do delicately so that mentally and psychologically, leadership is engaged in visualizing themselves,

supporting the change. That’s a big step in terms of change behavior and internal buy-in.

SB: One of the techniques you describe is the “20-60-20 rule.” It’s very e ective.

LK: No matter what change it is, 20% of people will be open. ey’re the change agents, the early adopters. en, 60% will be neutral. ey’re just going to wait around, not take a strong stance. e remaining 20% will resist. And if you just roll something out without any preparation, the negative people will have a loud voice in trying to dissuade people from making the change.

Yet, I also found you could use that curve to your advantage. ose who resist change are going to pull neutrals over it in the wrong direction. You have to drive momentum in the positive direction. At Union Paci c, in almost every situation, we tried some type of a pilot, an experiment, a simulation. If you get a spark of success, you immediately glom onto it and have the CEO talk about it. Everybody is listening, and the neutrals are saying, “We want that.” I strongly recommend that for anybody implementing widescale organizational change.

I want to brie y describe a panel survey we did at Union Paci c. We had a lot of quick and easy ways to check if we were succeeding, but we thought we’d adopt an idea from the medical eld, which does longitudinal studies. We randomly selected 400 people for a strati ed sampled, which meant that the sample was representative of the demographic proportions of the population. We reached out and said, “We’re doing this new initiative over the next four years. Will you sign up so we can send you a survey every six months that takes 10 to 15 minutes? Your results will always be anonymous, and you can mail them in, go on a website—however you want to complete your survey.”

If we had done the whole population, we would’ve gotten maybe a 10% to 12% response rate. You can’t make inferences with that. We got an 85% response rate over four years, and we could see where the change was working, where it wasn’t working, where leaders supported it and where they didn’t. By year three, we were able to correlate that with our top-level key performance indicators (KPIs). We saw that the top service units who bought into our program were the top ve in terms