5 minute read

5&Under

THE PILOT SQUEEZE

Small Airports Vulnerable As Pilots Leave Regionals For Mainline Carriers

Advertisement

BY CAROL WARD

Above: United Airlines’ new pilot training school will help to fill the carrier’s pilot needs in the future, and will also expand diversity in the field.

In September 2021, Envoy, a subsidiary of American Airlines, posted a plea for pilots that came with some pretty enticing perks. The regional carrier offered $175,000 in bonuses for incoming first officers meeting certain conditions, with an additional $7,500 to those experienced in flying certain aircraft. The company also touted first officer starting pay of more than $50 per hour.

Also last year, United Airlines opened a flight school in an effort to train 5,000 pilots by 2030, and said it plans to hire double that number in the same time frame.

The federal government also took action. The Federal Aviation Administration authorized a reduction in required hours of flight time for students at Metropolitan State University of Denver. The reduction to 500 hours from the federally required 1,500 hours of flight time for pilots in training means students can potentially graduate a year or two early.

These efforts and many others throughout North America are designed to help fill a pilot pipeline that has slowed to a trickle. With pandemic recovery well underway, the industry once again faces a crushing pilot shortage that will have negative impacts on the mainly small airports that rely on small regional jets for service.

How It Evolved

Many in the industry will remember a pilot shortage that cropped up during the recovery from the Great Recession and lasted throughout most of the 2010s. At that time, growing air travel demand prompted the need for more pilots, but a shrinking pipeline of pilots exiting the U.S. Air Force and high training costs and low wages for incoming civilian pilots made the situation untenable. Geoff Murray, a partner on Oliver Wyman’s global aerospace sector team, says signing bonuses from regional carriers were starting to become the norm in the late 2010s, easing the crisis.

Then the pandemic hit and, for a brief period, the shortage disappeared. Cashstrapped airlines offered early retirement incentives for older pilots but, because they wanted to take advantage of the federal government’s CARES Act, did not have any involuntary layoffs or furloughs.

“Lo and behold, the recovery starts taking hold and advances very quickly,” Murray says. “Unlike in previous downturns – like September 11 or the global financial crisis, when the airlines could just recall pilots who had been through initial training and could go back to the same seat that they left – all of a sudden post-Covid the airlines have to upgrade existing pilots into the seats of the pilots who took early retirement.

“At some airlines it was up to 15 percent of pilots, so they not only had to do the transitions with training, they had to hire new pilots,” Murray continues. “The mainline carriers invaded the regionals, the regionals started really feeling the pinch.”

Vacancies are now rampant at the regional level, and there aren’t enough pilots to fill the gap.

The Pipeline

Thus, the efforts by both universities and airlines to attract new prospective pilots.

“There is a pipeline but the pipeline isn’t sufficient to meet demand. It’s that simple,” says Murray. “The barriers to entry, particularly the costs, are still very high. There is a whole segment of our population that rules out being a pilot as a career because they’re not going to sign up for $70,000 or $80,000 in training.”

Scholarships and other incentives are starting to make a dent in those costs, and higher salaries, signing and retention bonuses and other efforts are ramping up.

Bill Swelbar, chief industry analyst for the Swelbar-Zhong Consultancy, says airlines “put skin in the game” beginning about 18 months ago, but “it takes about four years to fill the pipeline.”

Swelbar says there are positive signs for incoming pilots. “The wages have been increased significantly,” he says, noting that the $25,000 to $35,000 starting salaries prevalent at regional carriers a decade ago are long gone. In addition, “the bonuses for retention are huge, as are the bonuses to become a pilot and join an airline.”

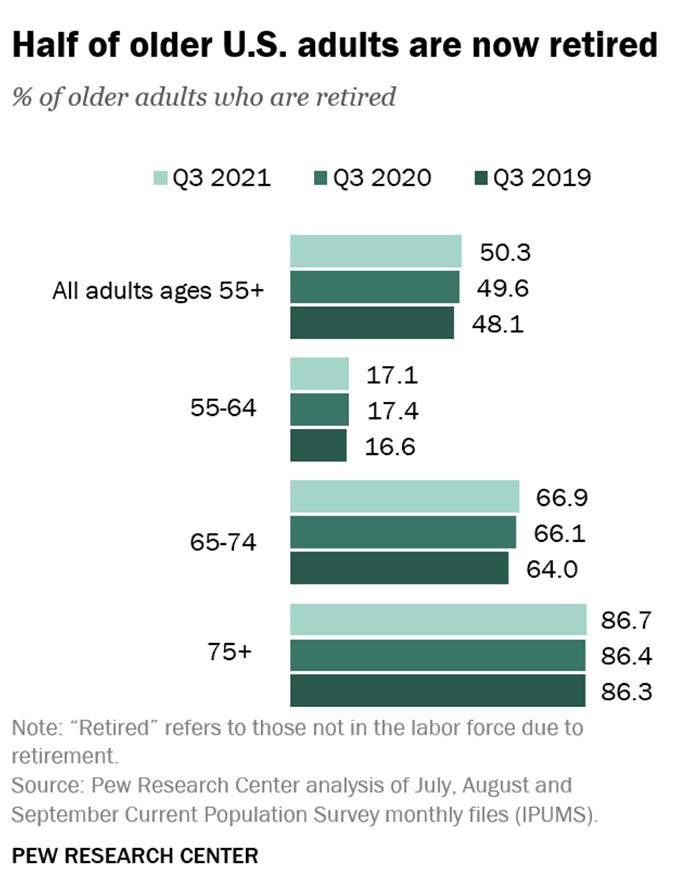

Global pilot demand versus supply

Number of pilots

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

60K Pilot shortage

50,000

0

2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029

Demand Supply Active

Pilot demand versus supply forecast

Magnitude of surplus/shortage

50,000

25,000

0

–25,000

Africa South/Latin America Europe Middle East North America Asia/Paci c

–50,000

2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029

Source: Oliver Wyman analysis

While focusing mainly on attracting any qualified candidates into training programs, some organizations are focusing on diversity as well. For example, United’s new Aviate Academy had its inaugural training class in December 2021 at its campus at Phoenix Goodyear Airport. United said it expects to train at least 500 students yearly, with plans for at least half those students being women or people of color.

The Impact

In both the short- and long-term, the “victims” in this shifting landscape will be mainly smaller airports.

Short term, the sheer lack of numbers means that airlines will be forced to curb flying. Select smaller markets are already seeing cuts and more will likely follow. “We expect fewer 50 [seat aircraft], and what that will mean is instead of three or four flights a day from a small airport to a large hub, it may be two, and maybe some other flights will go away,” Murray says.

Swelbar notes that those higher wages and bonuses are a positive for pilots but they may not translate into service at small airports. Even with eventual pilot availability, “2021 wages plus $80 oil equals less small community air service,” he says, noting that the economics in serving small communities just don’t work in some cases.

In fact, Swelbar suggests the airport landscape, and the mindset around the importance of airports, may need to shift.

“Should we maybe stop thinking that our community is only relevant if we have commercial air service?” he asks. “I appreciate that every community wants air service and every congressman wants air service for their community…but the economic cards are not going to play for everybody. For some it’s time to start thinking about repurposing the airport so it fits into new ways of doing business. I don’t believe you’re going to fall off a map because you lost your three-times-a-week, 50-seat service to a hub.

“We’ve got to start thinking about it because the market forces are working against these airports,” Swelbar continues. “Instead of being reactive why not start being proactive?”

Below: Pilots are in such high demand that some regional carriers are offering six-figure bonuses to attract new employees.