10 minute read

Airport Experience News - Winter 2022

The Face Of The Average Traveler Has Changed; What Expectations Should Airports Anticipate?

BY SHAFER ROSS

Advertisement

For years now, even before the pandemic, experts and researchers were saying Millennials have been on their way to taking over from Baby Boomers as the primary traveling group. The oldest Millennials own homes, have established careers and are now entering middle age.

“A lot of times people think Millennials are 25 years old and their pants are falling off and they live in their mom’s basement. The truth is, the oldest Millennials are over the age of 40, which most people are shocked to hear. They’re the largest generation in the workforce,” says Jason Dorsey, president of the Center for Generational Kinetics (CGK), a generational research and advisory firm that works to demystify the differences between demographic groups.

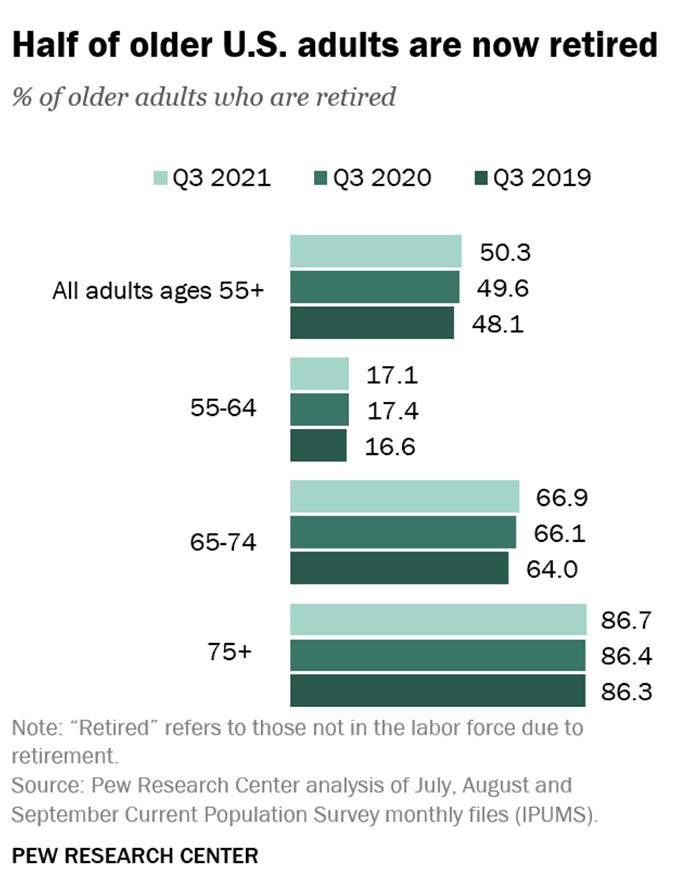

In fact, according to an analysis of the most recent official labor force data published by the Pew Research Center in early November of 2021, Baby Boomers are exiting the workforce at breakneck speed, especially as the pandemic begins to wane. Pew says just over half (50.3 percent) of adults aged 55 and over “said they were out of the labor force due to retirement. …In the third quarter of 2019, before the onset of the pandemic, 48.1 percent of those adults were retired.”

Jason Dorsey, president of the Center for Generational Kinetics, says Millennials are currently the largest generation in the workforce.

The analysis by Pew goes on to say that “between 2008 and 2019, the retired population ages 55 and older grew by about 1 million retirees per year. In the past two years, the ranks of retirees 55 and older have grown by 3.5 million.”

This exodus from the work force of “the only working age population since 2000 to increase their labor force participation” and

the resulting shift in traveler demographics has airports and their concessionaires searching for solutions to both attract and intrigue a new “typical traveler.”

Begging for Business Travel

“Not only are [Millennials] older than most people assume, they’re at places in their careers where they would be more likely to travel, as well,” Dorsey says. “Whether that’s traveling for meetings, for conferences, for client work, site visits and so forth, we do expect that they’re going to eventually really drive the business travel trends.

“It’s important that people shake off the old mystique of who Millennials were and

better embrace who they are now, or you’re going to be left behind by the market in five years,” he adds.

Welcome advice by many, considering business travel had been the backbone of the aviation industry for years before COVID-19 struck and halted the ability to travel for work. Leisure travel boomed in 2021, which has certainly helped elevate traffic levels to within a few percentage points of 2019 at times, but that market is so dependent on the whims of those doing the planning that it’s difficult for many airports to rely on as a sure sign of a comeback.

“We’ve seen a fairly strong recovery, although I will tell you most of that recovery has occurred in a leisure base, not in a business base. I think those of us in airport management are waiting to see more suitcoats and briefcases than flip flops and shorts,” said Scott Brockman, president and CEO of Memphis-Shelby County Airport Authority, in an episode of AXiNterviews that was released in September of last year. The authority manages Memphis International Airport (MEM), which relied quite heavily on business travel pre-pandemic, like many smaller hubs around the country.

The Global Business Travel Association (GBTA), a professional association focused on bettering and supporting business travel around the world, released the results of its business travel index BTI Outlook in November of last year, revealing that “in a poll of 40 CFOs across North America, Latin America, Asia-Pacific and Europe… about half (52 percent) of respondents reported they expect their company’s business travel spend to reach 2019 levels in 2022.” Hopefully this optimism holds, as follow-through on those plans could mean quicker rebounds in air traffic.

Suzanne Neufang, CEO of the Global Business Travel Association, says the organization expects full recovery of business travel by 2024.

Scott Brockman, president and CEO of Memphis-Shelby County Airport Authority, told AXN’s Carol Ward in an episode of AXiNterviews that his airport is still waiting for the stability business travel brings.

“Looking forward, business travel will continue to be significant for the air travel industry, not only in terms of travel volume but also revenue,” says Suzanne Neufang, CEO of the GBTA. “Although the road to business travel recovery may come with some bumps and adjustments, according to GBTA’s latest BTI forecast released in November, full recovery is expected in 2024, ending the year on pace with the 2019 pre-pandemic spend.”

Of course, the same Covid scares that can turn leisure travelers from hot to cold in the span of a single CDC guideline update can also affect the viability of business travel. As airports continue to try adapting to new strains and spikes of the virus, there are ways for them to be especially businesstraveler-friendly, Neufang says.

“Business travelers are savvy travelers but even for them, the fast pace of change is a challenge to follow,” she says, echoing a problem travelers and airport officials, employees and administration alike

share. “From one day to the next while planning or during a business trip, there may be changes to vaccination, testing, quarantine, documentation and other requirements – based on destination, not origin. So, an airport of origin needs to have all of those things in mind when even savvy business travelers show up without the right test, vax or other documentation required.”

Making options available, as well as continuing to innovate new ways to keep abreast of health concerns, will be key.

“As a significant part of the travel ecosystem, airports play a critical role in facilitating the mitigation of risk factors and the myriad pandemic requirements needed – such as testing, vaccinations, masking, and digital health certificates – to continue to ensure safe and responsible travel,” Neufang says.

The BTI Outlook states that four main factors will contribute to “full recovery in global business travel: the global vaccination effort; national travel policy;

business traveler sentiment; and corporate travel management policy. The recovery remains highly dependent on the vaccine rollout, employees’ return to the office, and a normalization of travel policies on both the national and corporate levels.”

Whatever the timeline, whether recovery of business travel should be looked at optimistically or not, as airports and concessionaires alike welcome back business travelers with open arms, they are going to be seeing new faces and, more importantly, facing new expectations.

New Brains To Pick

Because of the way air travel and its ubiquity have developed over the past few decades, as well as the recent onset of a pandemic which rapidly accelerated a transition already in motion, airport stakeholders are looking around for ways to appeal to a traveler whose needs they don’t really understand yet.

Erica Orange, executive vice president and chief operating officer of The Future Hunters, says Covid didn’t start new trends, rather it exacerbated existing ones.

“It’s very easy to think of progress in terms of step-by-step innovation,” says Erica Orange, executive vice president and chief operating officer of The Future Hunters, which focuses on tracking patterns as they make their way to the cultural and professional zeitgeist. “COVID is just hitting the gas on trends. It didn’t create new trends, it just sped up existing ones.”

CGK’s Dorsey suggests those trends were driven primarily from the bottom up, beginning with the youngest generation. “The pandemic has really accelerated what Gen Z was already looking for, and other generations have adopted it much faster,” he says. “Across generations, people are much more comfortable doing things through their mobile device than they were pre-pandemic. Whether that’s money, shopping, investing, you name it. As that’s happened, it’s definitely spilled over into the traveling public. The youngest generation is actually driving the trends up to the oldest generation, which has never happened.”

Businesses in 2019 were already seeing the effects of a savvier and more attuned consumer in the younger Gen-Z generation, which “are so well-versed, whether it’s on social media or whatever else, they’re actually dictating the spending habits of their parents and in some cases their grandparents.” agrees Orange, adding, “This is influencing not only household spending, but it is having an exorbitant influence on brand positioning.”

With the discerning eye of Gen Z rubbing off on other consumer groups, how a brand presents itself to customers is now a crucial part of its identity and, by extension, its success, says Orange. “So many people – particularly young people – are demanding transparency, authenticity, truthful messaging. The brands and retailers that don’t get it right are not winning eyeballs and dollars.

“There is a new set of standards that they have to abide by because [what the consumer wants and has access to] is entirely within the consumer’s control,” she adds.

Gen Z is a young group only just hitting the workforce and gaining the independence

of personal income in recent years. In contrast, Millennials have been working for a decade or more. The two groups are at totally different life stages, and yet many combine the groups as though they are practically identical. Dorsey advises against this.

“Frequently we see that people group Gen Z and Millennials together and it’s a significant mistake,” he says. “We’ve done more than 70 generational studies, worked with over 700 clients, and it’s very conclusive that Millennials and Gen Z are different.

“Gen Z is willing to spend their money, but they’re very pragmatic with their money,” Dorsey goes on. “They want to know that they’re getting a fair deal or good deal. Whatever that product or service is offering, Gen Z is really looking for value. Millennials might be looking for more luxury, a splurgepurchase at the airport, whereas when we look at Gen Z-ers they want to know that they’re getting a good value.”

Concessionaires have known for a while that Millennials are more likely to spend their money on activities instead of products, but Gen Z’s frugal nature means they’re more concerned with the tactile and tangible. “We do see travel as a priority, but we also see that Gen Z is really into buying physical goods, which is interesting because Millennials are really known for choosing experiences over stuff.”

Though, “We don’t know how they’ll carry that attitude into the future,” Dorsey adds.

Overall, though, says Dorsey, “customers of every generation want to have a good customer experience.” It’s not about disregarding the needs of the retiring demographics, rather focus should be placed on holistic approaches that cover all the bases.

“For older generations, a customer experience might mean being greeted with a friendly smile and a welcome, maybe even a little small-talk. For younger generations, oftentimes they just want to get in and out as fast as possible, which is something that we see business travelers want, as well.” Providing options to meet all these preferences, Dorsey says, will be the sweet spot for success.