Real'sJune2023 MarketReport

By Steve Curran

By Steve Curran

By Steve Curran

By Steve Curran

I hope that you have been enjoying the sunshine and the Mariner's season when they play the AAA Oakland A's! Brad Cahill and I have already made and broken 9 pacts that we are taking a break from the Mariners for a few days and it is only the end of May. It is going to be one of those up and down seasons.

Debt Ceiling! Fed! Inflation! These are headlines that are unavoidable these days I am of the belief that the debt ceiling will get "resolved" in time as it always does Washington DC political parties need to do the dance and play their games and then claim victory. Thank me, blame them, thank me, blame them! It's like kindergarten, but without the maturity or snack time. Once the debt ceiling is in the rearview mirror, the markets will get back to solely focusing on the Fed and inflation The question is: will they pause their rate hiking cycle at the next meeting? I am probably the only real estate broker in the country (or the only one foolish enough to put it in print) that hopes mortgage rates remain at their current elevated levels through spring of 2024.

But one might ask, “Aren't higher mortgage rates bad for the real estate market and your business?” Yes, but I'm a diehard Mariner and WSU fan, I know all about pain and suffering Short-term I believe it will take a toll on buyer demand if mortgage rates remain at 7%, but long-term I think it is needed to correct some of the excesses of recent years. Let me try to present my case through charts and explain my logic.

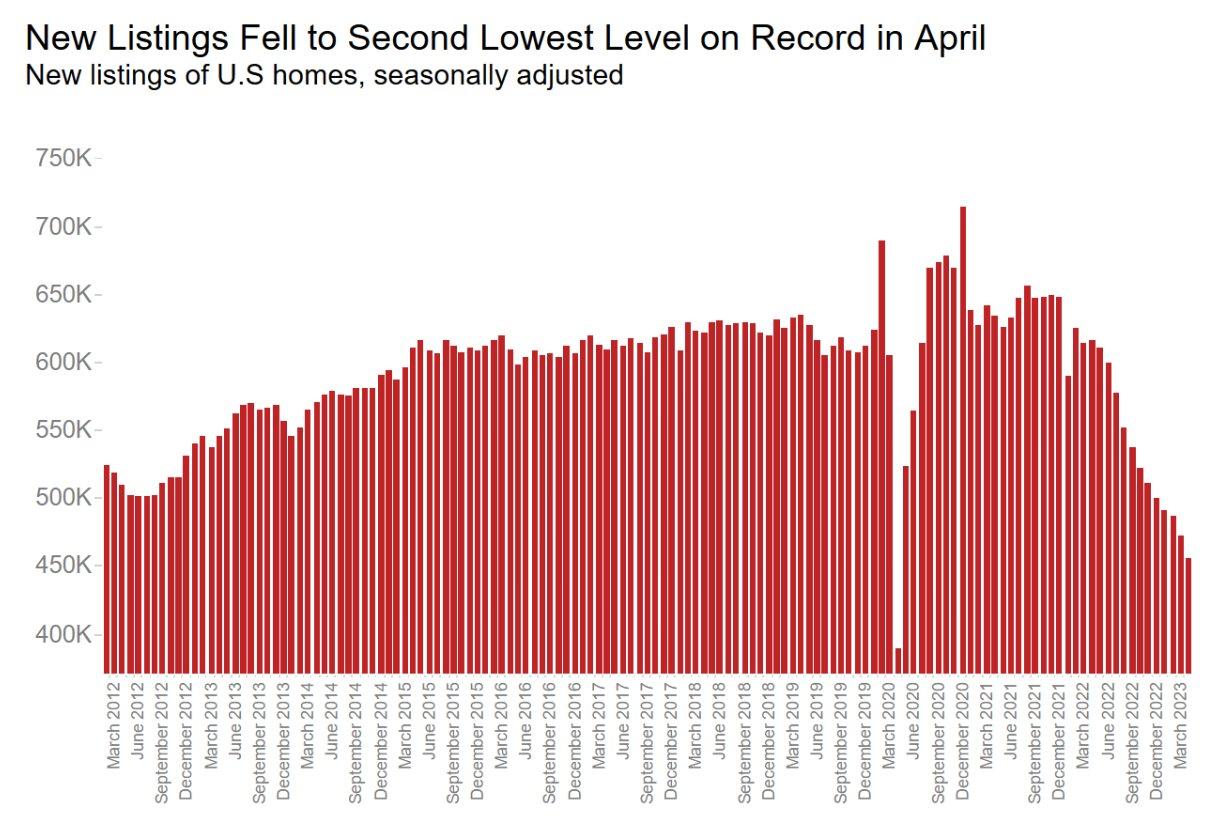

The rate of new listings, not existing listings, but fresh brand-new listings continues to fall to record low levels I'm taking the liberty of throwing out the new listing data from spring of 2020 and I think you can understand why Simply put, not enough homes are coming on the market to meet demand. The typical spring listing season did not materialize.

Let me paint the picture the best way I know how: through sports analogies and charts

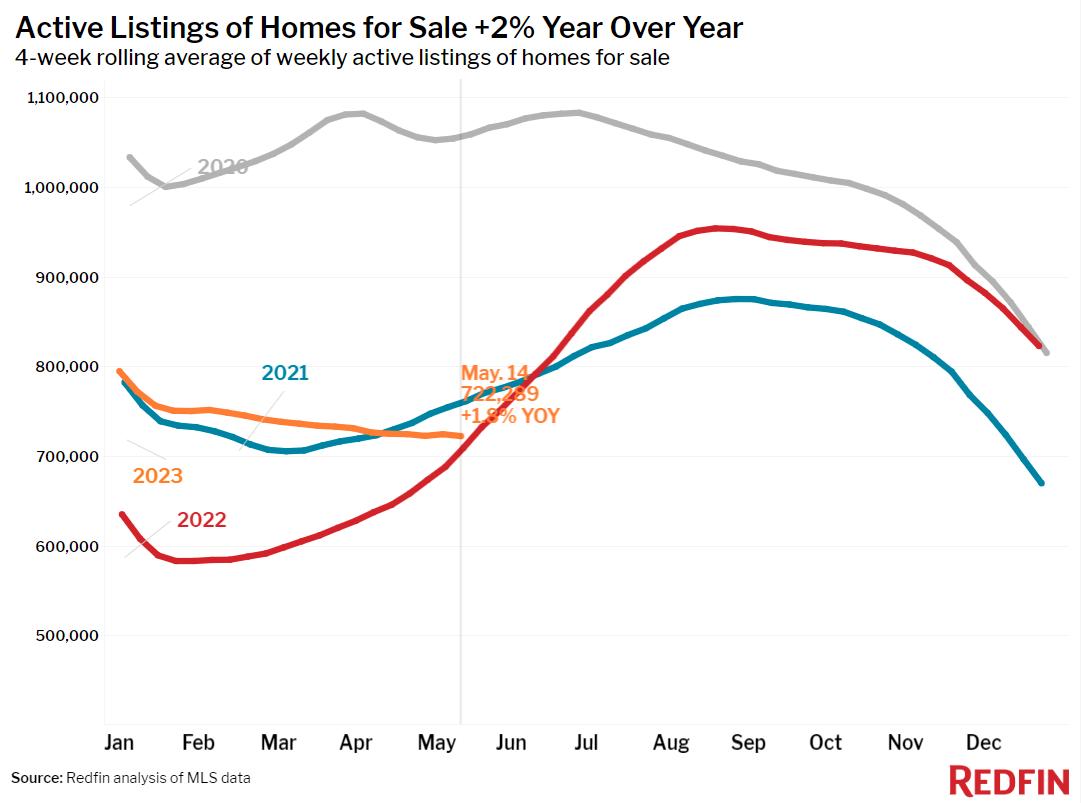

The total number of homes for sale nationwide is fast approaching a record low number of listings Many homeowners are asking themselves why would I trade a 3% mortgage rate for a 7% rate? I'll stay instead

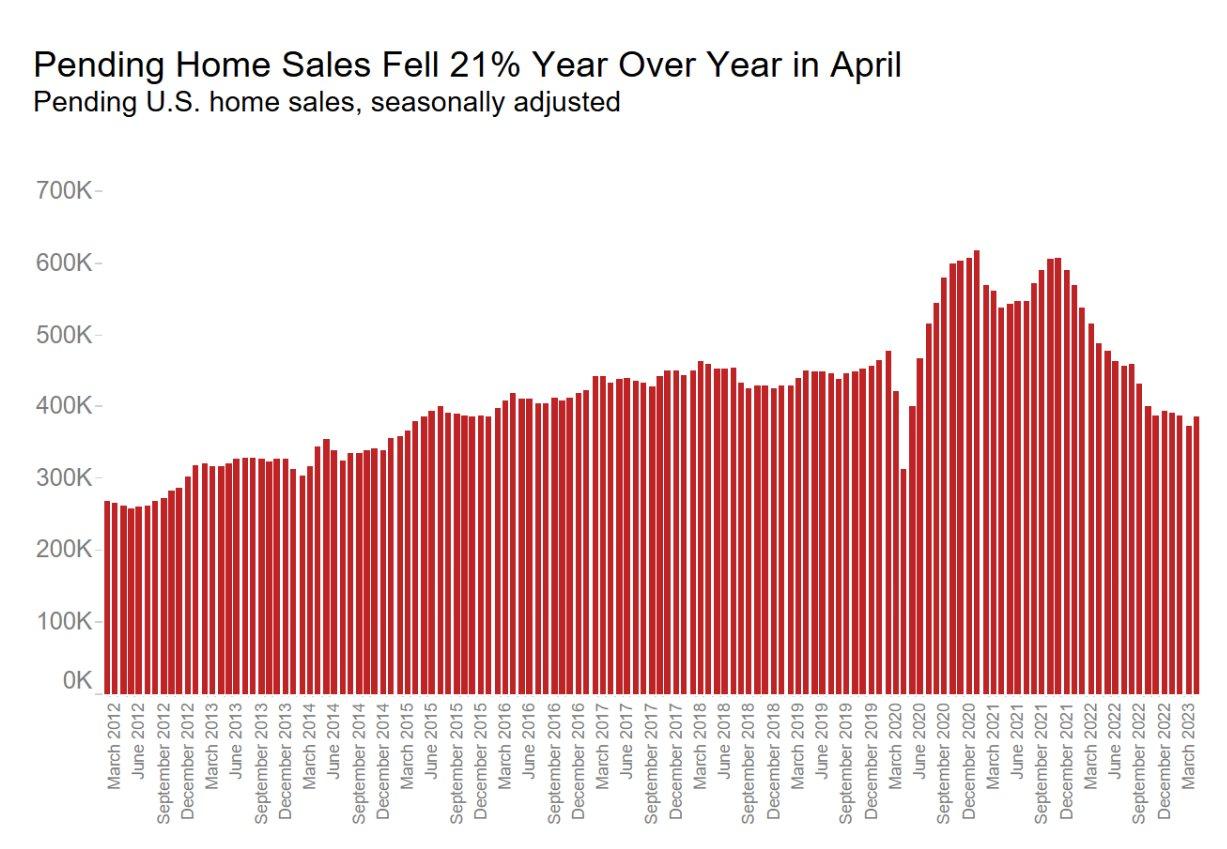

The number of homes going under contract (pendings) are holding up pretty darn well considering 7% rates and a lack of quality options for buyers to choose from Pendings going sideways while inventory is drastically declining is setting the stage for a doozy of a market in the spring of 2024.

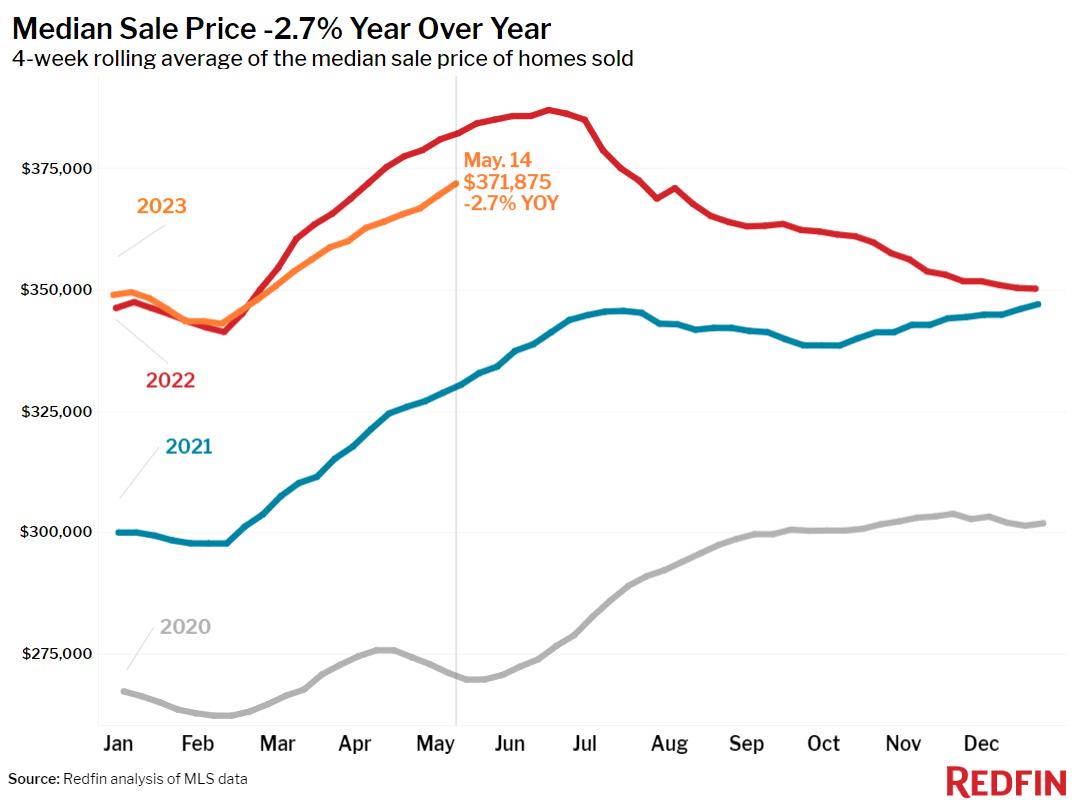

The national market is holding up extremely well price wise If you had said that mortgage rates would rise with record velocity from 300% to 700% and that prices would only fall 27% collectively, not many would have believed you

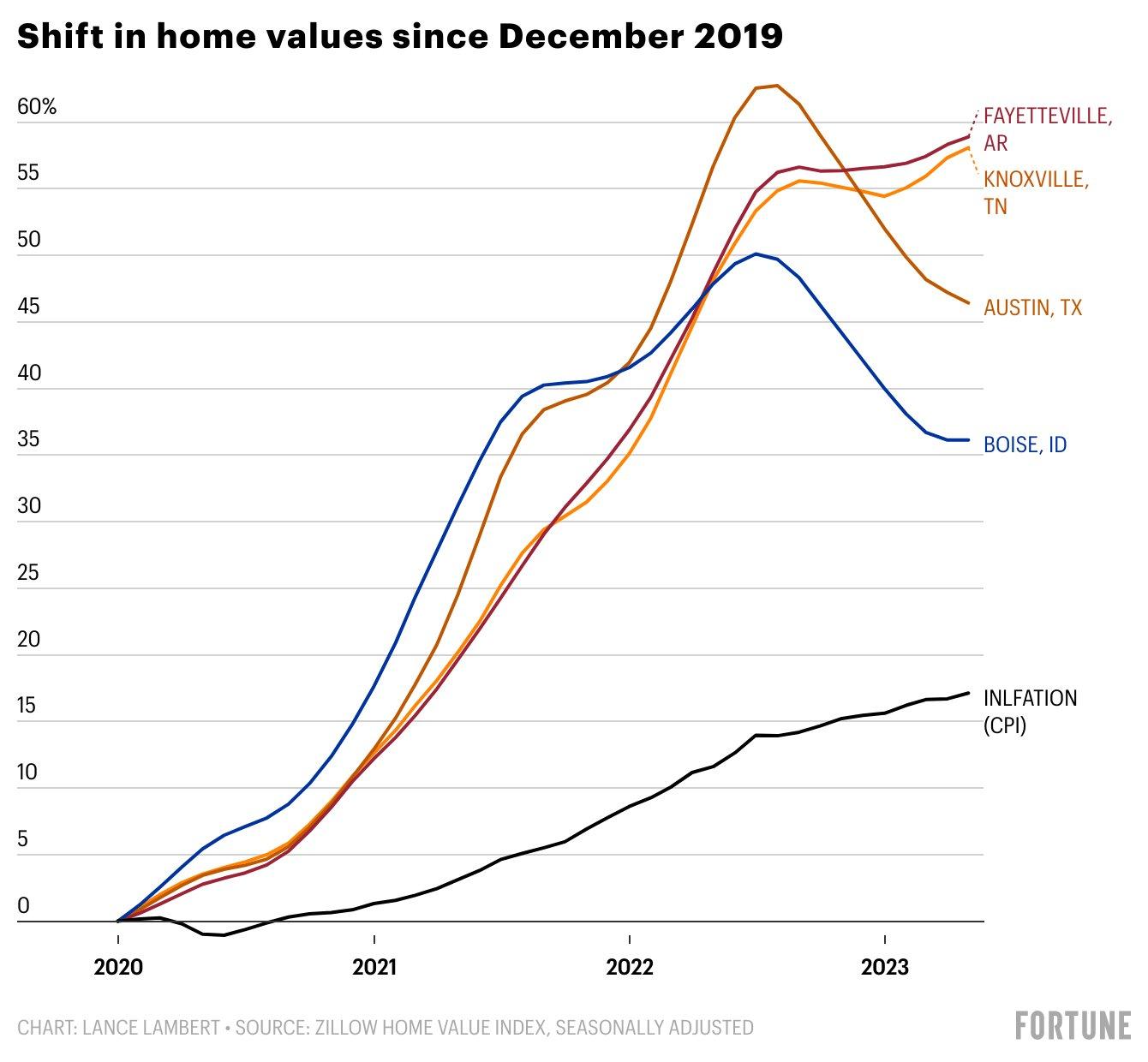

After multiple decades of outperformance, expensive coastal markets that rely on tech homebuyer demand, coupled with Covid superstar markets like Boise and Phoenix have seen prices decline by 12-16%. The midwest and southeast have continued higher with some markets rising by ANOTHER 10-12% after the market shifted last spring Raise your hand if you predicted in 2019 that Fayetteville, Arkansas would be one of the strongest markets in the country over the next four years Thank you for your honesty!

So what exactly is the dollar impact of the recent change in mortgage rates? One of my favorite Twitter follows just posted this graphic. Ironically, half of you are gasping at how large a $500,000 mortgage balance is, while the other half of you are rolling your eyes asking where can you buy in the Seattle area with a mortgage balance so small

Lance Lambert @NewsLambert

Lance Lambert @NewsLambert

Principal and interest payment on a $500k mortgage (30-year):

@ 311% it'd be $2,138 (ie Dec '21)

@ 737% it'd be $3,452 (ie Oct '22 high)

@ 599% it'd be $2,995 (ie Feb '22 low)

@ 701% it'd be $3,330 (ie today)

This leads us to one of the more sober charts making the rounds on Real Estate Twitter The gap between the monthly cost to own a home and the monthly cost to rent nationwide is at an alarming level This chart clearly illustrates just how historic the rate of change on mortgage rates was in the second half of 2022 Literally a straight line up

In conclusion, the market is still recovering from the excesses of the Covid real estate market frenzy The Great Migration, emotional factors coming out of the lockdown, the desire for more space, coupled with record low mortgage rates and record high financial markets (of all types) caused the real estate market to overheat This is why I am in the lonely camp of wanting mortgage rates to stay in the 650% range through this time next year Inventory levels are falling to such drastic low levels that if the Fed started to cut rates and mortgage rates fell back toward 550%, the national real estate market would take off again with the potential for double digit price growth

That is the last thing the country needs right now as the Fed attempts to put a lid on inflation If real estate prices were to soar again near term, my concern is the Fed would need to again raise rates, pushing mortgage rates over 8.00%, which would absolutely crush demand and the dreams of millions of first time and entry level homebuyers My dream is that the real estate market goes sideways for a couple of years as the market gets back in line with historic norms of supply and demand and real incomes begin to catch up to home prices Only time will tell if the market will begin to heal or remain historically under supplied

Wishing you all the best as summer finally arrives! Go M's!

Best, Steve Curran