thejournal.cii.co.uk

February – March 2023

TALENT TRAILBLAZER

Duty Bound Firms make strides to meet the Consumer Duty

Flexible future Can embedded insurance drive major growth in the sector?

Positive change How the profession is making progress towards net zero

Samantha Ridgewell is leading the charge to attract fresh talent into the insurance profession

Samantha Ridgewell is leading the charge to attract fresh talent into the insurance profession

Connections that matter

Learn from others or give back. With Connect the choice is yours.

In 2023 we’re growing the number of mentees AND mentors on Connect. Find your perfect match.

ii.co.uk

Start your journey at c

C O NTENTS

5 President’s opinion

Russell Higginbotham salutes CII members helping to build trust in the profession

6-13 News

UK and international news from the CII

23 Regulation

The latest regulatory updates from the UK

FEATURES

14-16 Regulation

The insurance profession prepares for the Consumer Duty this July

17-19 Ukraine

The impact of the war on insurance markets across the world

20-22 The Interview

Samantha Ridgewell on how the insurance profession can make strides to attract talent

24-25 Technology

Can embedded insurance trigger growth in the market?

26-28 ESG

Examining the sector’s progress towards net zero

30-31 Data

The big data ethics challenges for insurers in 2023

CONTACT US

32-33 Motor

The latest regulatory advances on autonomous vehicles

34-35 Advice process

Why curiosity is key for brokers and underwriters

42-43 Talent

Is insurance becoming a career of choice?

SECTOR SPECIAL

36-37 Claims

The latest focus of the claims community

38-39 Claims in 2023

How to be a better claims professional this year

40-41 Insurtech

What new tech disruptors can offer the claims sector

STUDY ROOM

29 Learning

Flexible ways to meet your CPD requirements

46-47 Education

Success stories of the CII partnering with universities

49 The Big Ten Test your knowledge

50 CII blog

Professional benefits of building confidence

The Chartered Insurance Institute 20 Fenchurch Street, London EC3M 3BY

The Chartered Insurance Institute 20 Fenchurch Street, London EC3M 3BY

Tel: (020) 8989 8464

Tel: (020) 8989 8464

The Journal is online at www.thejournal.cii.co.uk

The Journal is online at www.thejournal.cii.co.uk

The Journal is the official magazine of the Chartered Insurance Institute (CII). Views expressed by contributors or advertisers are not necessarily those of the CII or the editorial team. The CII will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication.

The Journal is the official magazine of the Chartered Insurance Institute (CII). Views expressed by contributors or advertisers are not necessarily those of the CII or the editorial team. The CII will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication.

The Journal is online at www.thejournal.cii.co.uk

Cover Image: Xxxxxxxxxx

Chief executive: Sian Fisher

CEO: Alan Vallance

EDITORIAL

Editor: Luke Holloway (020) 7417 4778 luke.holloway@cii.co.uk

Editor: Luke Holloway luke.holloway@cii.co.uk

Contributing editor: Liz Booth

Contributing editor: Liz Booth

DESIGN

Art editor: Yvey Bailey

Art editor: Yvey Bailey

Picture editor: Claire Echavarry

Picture editor: Claire Echavarry

Production: Jane Easterman

Printing: GD Web Offset

Cover Photo: Richard Lea-Hair

Production: Jane Easterman

Printing: The Manson Group

-

Redactive Publishing Ltd 9 Dallington Street, London EC1V 0LN

PUBLISHER

Redactive Publishing Ltd., 9 Dallington Street, London

EC1V 0LN

For sales and advertising please contact us on cii-sales@redactive.co.uk or 020 7880 7661

ISSN 0957 4883

For sales and advertising please contact us on cii-sales@redactive.co.uk or 020 7880 7661

© 2022 Chartered Insurance Institute Recycle your magazine’s plastic wrap – check your local LDPE facilities to find out how

ISSN 0957 4883

© 2022 Chartered Insurance Institute

FEBRUARY - MARCH 2023

3 thejournal.cii.co.uk / The Journal

/ February

March 2023

24 38 26 20 17

NEWS

Discover our new Product Simplification courses

Improving customer outcomes with product simplification

Following increased demand for simplified products from consumers and the FCA, the Chartered Insurance Institute has collaborated with Lloyd’s and the Lloyd’s Market Association to create two new introductory level Product Simplification courses. The courses introduce the use of Design Thinking as a framework to help improve customer outcomes within almost any role or function from product design and policy wording to marketing, customer service or distribution.

Product Simplification: Product Design looks at how to revise approaches to the design and development of products and product documentation.

Product Simplification: Sales and Distribution helps to revise approaches to the design and development of sales and distribution processes.

Key features

• 1 hour study time

• 1 hour of CPD accreditation

• Courses delivered via online module

• Completion certificate issued after successful course completion

For more information visit our webpages below:

Product Simplification: Product Design

www.cii.co.uk/learning/product-simplification-product-design

Product Simplification: Sales and Distribution

www.cii.co.uk/learning/product-simplification-sales-and-distribution

For business enquiries, email: business.enquiries@cii.co.uk

OUR PROMISE

CII president, Russell Higginbotham examines why trust is crucial to the insurance profession delivering for its customers

customers today and many years, often decades, into the future. Conduct regulation ensures that we deliver our products, services and solutions in a professional way and to the right standard. So, the next time you have a moan about regulation, try to keep this in mind.

BUILDING TRUST

We aspire, as professionals working in the insurance sector, to be held in a similarly high regard as doctors and teachers. So, how do we get there? As, very clearly, we are not there yet.

Insurance is an intangible. It’s a promise, usually to pay, or make right, when the unexpected or the worst happens. As such, to a large extent, it is based on trust. Trust that when something happens, we will be there to help, repair, resolve and provide comfort.

How is this trust built up? Past experiences, what you hear from friends, colleagues, what is said in the media and so on. But also, in the belief that insurers are financially strong, robust and well-run institutions. In this sense, it is having the strong belief that no matter what happens, your insurer and your adviser will be there to help when a claim comes. This ‘corporate resilience’ is a key part of the insurance landscape – how can we help provide societal resilience if we’re not resilient ourselves?

Regulation provides a key role in enabling this trust. While we might like to complain about increasing regulatory burdens, having strong regulation is an important part of providing this assurance to our customers. Prudential regulation ensures that we price, design products, monitor, reserve and control our business in an appropriate and consistent way, to enable us to meet the promises we make to our

It is all about building that trust. It is hard to do. It takes time. It takes good quality, consistently delivered. It takes good experiences for our customers when they are in difficulty. It takes strong regulation too. And the flipside is that while it takes a long time to build up, it can be destroyed or damaged quite easily.

The CII is here to play its part in all of this. Having well-qualified people working across the sector, who continuously invest in their knowledge and career, is one of the most fundamental aspects of building trust with our customers. Whether we meet them face to face, work to develop the products they buy, process their business or pay their claims, we are all representatives of the profession and all have a role to play in this trust-building.

If you’re reading this, you are clearly well on your way and already doing your bit. So, thank you! Spread the word, encourage your friends and colleagues to follow your example. It is a long journey and probably a bumpy road, but we’re all passionate about making the insurance sector the best it can be. ●

5 thejournal.cii.co.uk / The Journal / February - March 2023 PRESIDENT’S OPINION RUSSELL HIGGINBOTHAM

Russell Higginbotham is president of the CII

ILLUSTRATION: MATTHEW BRAZIER

WHILE WE MIGHT LIKE TO COMPLAIN ABOUT INCREASING REGULATORY BURDENS, HAVING STRONG REGULATION IS AN IMPORTANT PART OF PROVIDING THIS ASSURANCE TO OUR CUSTOMERS

@YutreeUW

@JamesHallamUK

@AstonLark

FROM THE CII TWITTERATI »

In her role as chair of the @brokingsociety, Yutree Director Laura Hancock joined @CIIGroup Radio to discuss how brokers and underwriters can benefit from the FCA’s Consumer Duty regulations

We are pleased to announce that our Chartered Insurance Broker status has successfully been renewed for another year by @CIIGroup

#ChooseChartered

Suzi Rackley, Client Director, features in The Journal from the @CIIGroup, sharing insights alongside fellow SIB Board members on how to support clients & staff during the cost-of-living crisis TALENT

CII LAUNCHES APPRENTICESHIP AWARDS

The CII is inviting nominations for its inaugural Apprenticeship Awards. These prestigious awards will celebrate the achievements of exceptional apprentices from across the UK in seven categories –including three from the general insurance profession – with winners receiving cash prizes of up to £1,000 funded by the CII’s Education and Training Trust.

The CII Apprenticeship Awards are open to all apprentices in England, Northern Ireland, Scotland and Wales that meet the awards criteria, which include achieving a CII qualification as part of successfully completing an apprenticeship standard or framework. Nominations are welcome from employers, training providers and apprentices themselves.

The general insurance categories are:

● Insurance Practitioner Apprentice of the Year – Level 3 (£500)

● Insurance Professional Apprentice of the Year – Level 4 (£800)

TALENT

● Senior insurance Professional Apprentice of the Year – Level 6 (£1000) Announcing the awards, CII president, Russell Higginbotham, said: “I am delighted to launch these new awards, which build on the great success of other programmes we already run to encourage young people to join the insurance and

CII NEW GEN GROUP PARLIAMENT VISIT

This year’s participants in the CII New Generation programme visited the Houses of Parliament in February. As part of the CII’s flagship talent programme, the 2022/2023 group heard from Craig Tracey MP, Flora Hamilton of the CBI and Lord David Hunt of the Wirral, who spoke to the young insurance professionals about campaigning, lobbying and how to engage with MPs.

personal finance professions, including our Next Gen initiative. I hope employers, training providers and apprentices themselves are excited to enter these awards and see them as a prestigious acknowledgment of the time, energy and hard work they invest in studying for their CII qualifications and broader apprenticeship.”

Winners will be presented with their awards at an event to be held later in the year.

Nominations are now open and will close on 12 May 2023.

→ To enter, visit: https://forms.office. com/e/Dawu1bV2Lk or scan the QR code to the right.

6 NEWS thejournal.cii.co.uk / The Journal / February - March 2023

Craig Tracey MP Lord David Hunt meets the New Gens

@ClaimsMedia

We’re thrilled to announce that Alan Vallance from the Chartered Insurance Institute is joining the British Claims Awards 2023 independent judging panel

@HineInsurance

Congratulations to Patrick McCahon at @MarshGlobalthis year’s winner of the @CIIGroup’’s David John Hine Memorial Prize

@LMAupdates

Andrew Oakley, Head of LMA Academy, recently spoke with Ian Simons, Customer Director at the @CIIGroup, to discuss the newly released Product Simplification courses designed by CII and LMA

20,230

Followers and counting...

CII company 88.9k followers

CII Group 50.2k members LEARNING

CII PILOTS NEW FORM OF FINANCIAL PLANNING ASSESSMENT

The CII is piloting a new form of assessment for the R06 Financial Planning Practice unit.

The Shaping the future together consultation gave members and other key stakeholders the opportunity to feedback on the CII’s proposed plans, as well as the services it delivers and how the professional body can best meet their needs and expectations in the future.

The format of the coursework assessments for R06 will be assignments based on client case studies.

Gill White, chief customer officer at the CII, said: “Our R06 unit currently uses on-screen written exams available four times per year. We are piloting a flexible, client-focused coursework assignment assessment, designed to fit in with contemporary working practice. This means learners with commitments that prevent attendance of exams on

the fixed dates will not face a barrier to completion of the Diploma in Regulated Financial Planning.

“The assessment is designed to meet the same syllabus learning outcomes and assessment criteria as the current R06 exam and meets the Level 4 qualification descriptors set out by education regulators. The assessment criteria include a requirement for analysis and justified recommendations, which are appropriate to assess in longer responses such as case study-based assignments.”

A review will be undertaken later this year once the pilot is completed and feedback from candidates has been received.

The CII will then decide during 2023 whether assessment for the R06 Financial Planning Practice unit will switch from written examinations to coursework, and the timetable for any changes.

CHARTERED INSURANCE INSTITUTE

JOHN BISSELL TO RETIRE FROM CII

John Bissell will be retiring from his role as chief operating officer and CII Board member in early April 2023, after more than six years with the organisation.

During this period, he has also been director of CII Hong Kong, CII Middle East, CII Enterprises and a trustee of the CII Prize Fund. After a short break, Bissell intends to extend his non-executive

director and trustee portfolio.

Alan Vallance, CII Group CEO, said: “I would like to thank John for supporting me during my first six months in post. He is a respected, long-standing servant of the CII and we wish him well for the future.”

Plans are currently being developed to cover Bissell’s responsibilities both in the short and longer-term.

7 thejournal.cii.co.uk / The Journal / February - March 2023

Twitter

@CIIGroup

NEWS

APPOINTMENTS

CII ANNOUNCES NEW CHAIRS FOR BROKING AND CLAIMS SOCIETIES

The CII has announced the appointment of new chairs for two of its specialist communities, the Society of Insurance Broking (SIB) and the Society of Claims Professionals (SOCP).

Laura Hancock, director of YuTree Insurance, replaces Kevin Hancock, also of YuTree, as chair of the SIB, while Ashton West OBE, non-executive director of Weightmans and director of Fidu Consultancy, succeeds Sue McCall of MS Amlin as chair of the SOCP. Chair appointments are made on a biennial basis and come following the natural completion of their predecessors’ cycles.

Hancock, who brings significant previous board experience, said: “It is an honour to have been given this opportunity and I will work tirelessly to ensure that I make a difference to the work that the wider CII does, as well as to the individuals in the broking

community that this board seeks to support.”

West brings broad experience from 15 years as chief executive of the Motor Insurer’s Bureau, as well as just over five years as a non-executive director of the Insurance Fraud Bureau, while he currently chairs the board of trustees for The Road Safety Trust charity.

West said: “Having served as a board member on the Society of Claims Professionals for the last two years, I was honoured to be nominated as the new chair by my fellow board members. It is an exciting time to be a part of the CII’s specialist claims community board. All of the board members bring a wealth of different experience and are

passionate about finding ways to add value to our members who work in the claims profession, and we look forward to sharing more on this shortly.”

Read the article from Ashton West in our special claims section on page 36 of The Journal

INSURANCE MUSEUM LAUNCHES SECOND GALLERY

‘Fuelled by Coffee’ is the second in a series of online galleries from the ‘Fire! Risk and Revelations’ exhibition by the Insurance Museum.

The first gallery, ‘Rising from the Ashes’ launched earlier this autumn and told the story of the birth of fire insurance back in 1667 following the historic Great Fire of London, which was instrumental in highlighting the need for fire insurance.

‘Fuelled by Coffee’, which is now live, will focus on the newly formed insurance companies that proliferated in the early 18th century, and is inspired by how important English coffee houses were to network, debate and conduct business,

including the renowned Lloyd’s Coffee House.

It will feature video interviews with industry experts, interesting facts and a focus on fascinating objects from archives and museums, to illustrate how fire insurance developed through the years.

The Insurance Museum aims to inform

and educate about the history of different areas of insurance through various exhibitions, with the first – ‘Fire! Risk and Revelations’ – focusing on fire insurance.

Through further support and funding from the industry, the plan is to produce further exhibitions, a popup museum with educational facilities and, ultimately, a permanent museum to be based in the heart of the City of London.

→ Visit the new museum here: www. insurance.museum/fuelled-by-coffee

→ To find out more about getting involved with the museum, visit: www.insurance.museum/membership

8 NEWS thejournal.cii.co.uk / The Journal / February - March 2023

HISTORY

Laura HancockAshton West

CII RADIO LAUNCHES SEASON 10

The CII’s podcast channel, CII Radio, has launched its 10th season.

The channel – hosted by The Journal website – invites industry experts to discuss a array of themes from across the insurance profession as well as give CII members and the wider insurance sector an insight into the work of the professional body.

This series features episodes including ‘The benefits of Apprenticeships’, ‘What the Consumer Duty means for brokers and underwriters’, ‘Meeting the CII President for 2023’ and ‘LGBT+ History Month’.

The podcasts are also available to Android users via SoundCloud, Stitcher Radio or via Apple.

To listen to the latest season and access a complete library of previous episodes, visit: thejournal.cii.co.uk/podcasts

FCA SUPPORTS FIRMS THROUGH TRANSITION TO IMPLEMENTING THE CONSUMER DUTY

As firms continue to get ready for the implementation of the Consumer Duty, the Financial Conduct Authority (FCA) is supporting firms through the transition with a programme of engagement, which includes setting out in letters the expectations of the Duty and arranging a series of regional in-person events for specific groups of small and medium-sized firms.

Sheldon Mills, executive director of consumers and competition at the FCA, said: “We want to thank firms for the hard work they’re putting into embedding the Duty. We were encouraged to see many examples of good practice in our review of implementation plans and found that many firms are embracing the shift that the Consumer Duty brings.

“Putting good outcomes for customers at the heart of firms’ strategies and business objectives will build trust and modernise how we regulate financial services.

“Leaders have a key role to play here. We have a world-leading financial services industry that serves its customers, colleagues and shareholders well through competition, innovation and leveraging talent. We want to see boards and senior management further embed the interests of customers into their firms’ culture and purpose.”

Read the article on the Consumer Duty on page 14 of The Journal

ALAN VALLANCE, CEO

ALAN VALLANCE, CEO

EXCITING FUTURE

The CII will launch its new five-year strategy later this month which will guide the long-term direction of our organisation. We have leveraged last year’s member consultation in its development, alongside expert input from colleagues, our volunteer network and the wider insurance and personal finance professions. The strategy will renew our vision and purpose, identify our key strategic goals and challenges and set out the initiatives we will deploy to further the Institute’s position as a global professional body, ensuring members’ interests are at the heart of everything we do.

I hope you will agree that an excellent example of that emphasis is our work to encourage more young people to join the insurance and personal finance professions – and then to help nurture them. Our New Generation programme has for many years been successful in helping those early in their careers to shine and I am delighted that we are now able to launch our new Apprenticeship Awards for those taking their first steps. If you’re a member with an apprentice, do please consider entering them for these prestigious awards.

Alongside these and other exciting developments, I know there is still much work for us to do to improve our overall member experience. Our focus during the remainder of 2023 will be to build the solid process and system foundations that will enable us to offer improved quality of service and products. A significant step in their construction will come later in March, with our transition to a new customer and member relationship management system that will mean we can provide more streamlined, tailored communications, alongside relevant continuing professional development (CPD) programmes and events.

And talking of events, one activity that the CII Group Board and Executive Leadership Team will doing in the next few months is getting out and about to visit our local insurance institutes and PFS councils. Our CII president, Russell Higginbotham, wrote in the last edition of The Journal about the importance we place on the work undertaken by volunteers to bring our communities together through CPD, lectures, learning and social activity. Having two professional membership bodies under one roof is a unique benefit to our group and gives us the potential to leverage a wide range of knowledge and expertise for the benefit of more members.

I hope to see you at one of those events soon.

9 NEWS thejournal.cii.co.uk / The Journal / February - March 2023

REGULATION

PODCASTS

ILLUSTRATION: MATTHEW BRAZIER

FIRST PROFESSIONALS COMPLETE LEAD PROGRAMME

In collaboration with the University of Hong Kong School of Professional and Continuing Education, the CII has launched the Learning Enhanced and Development (LEAD) programme in Hong Kong.

More than 250 insurance and financial professionals in four cohorts completed the programme and gained understanding of core knowledge of insurance and financial planning principles, while further developing their understanding of insurance contract law, insurance business and finance and risk management.

The accomplishment recognition ceremony for the first four cohorts took place in January 2023.

INTERNATIONAL AFFILIATED INSTITUTE FORUM

The CII hosted an International Affiliated Institute Forum in January. The forum discussed the importance of professional membership to support the sector and drive rising standards while working together to promote professionalism.

Representatives from the Asia Pacific region included the Indonesia Insurance Institute; Malaysian Insurance Institute; Insurance Institute for Asia and the Pacific; Philippines Singapore Insurance Institute; and Taiwan Insurance Institute.

10 INTERNATIONAL NEWS thejournal.cii.co.uk / The Journal / February - March 2023

ASIA PACIFIC

LEARNING

o

IONALS

CII HONG KONG WELCOMES PROFESSIONALS

Kenny Siu, regional director of Hong Kong & Asia Pacific and the CII team continue to support young talent in the insurance profession by meeting with young professionals at the CII Hong Kong office.

LEARNING

CONTINUE TO DELIVER CPD COURSES AND WEBINARS

The CII is continuing to deliver CPD courses and webinars in the first quarter of the year, with topics including: business ethics and the trusted professional, risk management, marine risks, and trade credit insurance.

The courses are on offer to members and business partners in the Asia Pacific region.

→ To find out more, visit: www.ciigroup.org/apac

HONG KONG

TALENT DEVELOPMENT TALK TO UNIVERSITY STUDENTS

Alpha Ho, corporate development manager of CII Hong Kong & Asia Pacific, delivered a presentation on talent development in insurance and how CII qualifications can support the professionalism in the

THE CII WISHES MEMBERS HAPPY CHINESE NEW YEAR

Kung Hei Fat Choi!

The Chartered Insurance Institute wishes a year of good health and good fortune to all those who celebrate Chinese New Year.

To keep in touch with CII Hong Kong via LinkedIn, visit: www.linkedin.com/company/ciihongkong

industry to students from Lingnan University, Hong Kong.

The CII continues to work with universities to support talent development and nuture young talent in the profession.

pment

11 INTERNATIONAL NEWS thejournal.cii.co.uk / The Journal / February - March 2023

KONG

HONG

SHUTTERSTOCK

MEMBERSHIP

COMMUNITY MONTH A SUCCESS IN LEEDS

The Insurance Institute of Leeds held its latest themed continuing professional development (CPD) focus event during February, with its Community Month series of activities.

The Institute introduced its innovative ‘Changing World’ fortnight during the pandemic in 2020, offering a series of digital events looking at changes to insurance and attracting talent. That was followed by its Festival Week technology-themed webinars in 2021, while this year Leeds chose ‘Community’ as the focus.

Insurance Network, the ISC Group, the LGBTQ+ Network (LINK), and the Group for Autism, Insurance, Investment and Neurodiversity (GAIN). It was hosted by Institute past president Melanie Jordan and provided attendees with key insight into the latest EDI developments.

The Institute ensured members could join Community Month via webinar, while the session ‘Confident Communication for Women in Business’ by Susan Heaton-Wright was very popular, with more than 130 bookings.

During the month, a combination of digital and face-to-face CPD sessions provided members with engaging and current topics to further their learning and development.

Among the highlights was the in-person session ‘Champion Teams: Leadership and the Community’, led by former Rugby League star Jamie Peacock MBE. He provided a motivational talk exploring teamwork,

mindset and professional standards, taking the audience through aspects of leadership and wellbeing that enable a team to fulfil their potential and for everyone to be the ‘Champion version of themselves’. Attendee feedback was very positive, reflecting the appetite for more holistic topics as additional CPD support.

An equality, diversity and inclusion (EDI) panel discussion followed, featuring contributions from the African and Caribbean

Institute president, Holly Copsey, said: “We were delighted to be able to continue our innovative approach to CPD support for members and it is pleasing to see how members have embraced it. It is an engaging and effective addition to our programme, and we will use the feedback to ensure our activities and delivery continue to meet members’ development needs. My thanks go to our tireless council volunteers whose incredible efforts make possible this level of member support.” NORTHEAST

INSTITUTES FOCUS ON WELLBEING

The insurance institutes of the northeast have joined forces to offer a series of events across April and May to support members’ wellbeing in the workplace and at home.

Nutritionist and workplace health coach Anna Reddy, from Leap Health, will host four webinars focusing on various aspects of wellbeing and workplace or workspace welfare:

● WFH&H… WFH&H: Working From Home & Hybrid… Without Forgetting Health & Happiness – Tuesday 18 April

● Food for Mood – Tuesday 2 May

● Breaking Burnout – Tuesday 16 May

● Rest, Recovery, Recharge… Ready for Productivity – Thursday 25 May

With the working-from-home phenomenon showing no sign of letting up, and the associated challenge of finding the balance wellbeing and optimal productivity, these sessions promise a fascinating insight in to how to achieve the best outcomes – for you and your role.

All events are one-hour sessions and will take place between 12:00pm and 2:00pm on the stated dates. More information and booking can be found across the eight northeast institutes websites: Bradford, Halifax, Hull, Leeds, Middlesbrough, Newcastle upon Tyne, Sheffield and York.

12 REGIONAL NEWS thejournal.cii.co.uk / The Journal / February - March 2023 EVENTS AN OVERVIEW OF MOTOR TRADE INSURANCE → 12:00pm – 1:00pm Institute of Cardiff cii.co.uk/cardiff 07 MARCH BEHAVIOURAL ECONOMICS → 2:00pm – 3:00pm Institute of Lincoln cii.co.uk/lincoln 08 MARCH EXCEPTIONAL COMMUNICATION –BECOME A VITAL COMMUNICATOR → 12:00pm – 1:00pm Institute of Cheltenham and Gloucester cii.co.uk/cheltenham-gloucester 09 MARCH

LEEDS

Jamie Peacock MBE

HOW TO MAKE PROPOSALS

→ 12:30pm – 1:30pm Institute of Newcastle upon Tyne cii.co.uk/newcastle

LOCAL INSTITUTES

HAWKINS WEBINAR: THE NEED FOR SPEED: ESTIMATING SPEED IN COLLISION INVESTIGATIONS

→ 09:30am – 10:15am Institute of Chelmsford and South Essex cii.co.uk/chelmsford

CYBER INSURANCE

→ 12:00pm – 1:00pm

Institute of Luton and Hertfordshire cii.co.uk/lutonhertfordshire

OBITUARY

INSTITUTE AGMS –AN OPPORTUNITY FOR YOU TO FIND OUT MORE

LOCAL

Your local institute annual general meeting (AGM) will take place between March and May. AGMs are a really useful introduction to what your institute is about, what its plans are for the year ahead and an opportunity to meet the volunteers who make up the council that provides your local support programme. Institutes will always welcome and encourage new faces and new ideas to council. It’s a great way to expand your professional network, use your skills and experiences to support members, as well as to learn new skills yourself.

Sophie Godbold is a council member for the Insurance Institute of Ipswich, Suffolk and North Essex: “Being a council member of the Ipswich, Suffolk and North Essex CII local institute for the past few years has been such a valuable experience. Getting involved in my local council has given me the opportunity to connect with likeminded people in the industry that I wouldn’t connect with otherwise.

THOMAS WAKELING

The Insurance Institute of Cambridge was saddened to learn of the recent passing of one its longstanding members, Thomas Wakeling.

Mr Wakeling was a supportive member of CII Cambridge, as well as the founder and director of Halstead Insurance Brokers, Mill Road, Cambridge.

@DACBclaims

“The council brings together underwriters, brokers, loss adjusters and PFS members from all different job roles, and we work collaboratively to put on events for CPD and social events, while also engaging with local firms and schools highlighting the profession, alongside planning large events such as our annual dinner,” she said.

“This is such a rewarding process, knowing that we are helping our local members connect and provide valuable resources and training that will benefit their career and inspire the future generation. Not only does this benefit our members, but volunteering leads to gained skills and experiences beyond what you may already have in your dayto-day job role, alongside networking and gained relationships. I cannot recommend enough reaching out to your local institute if you are thinking of getting involved. It’s a valuable experience that both you and local members will get a lot from.”

We had a fantastic time attending The Insurance Institute of Northern Ireland’s Annual Gala Dinner on Friday night! Thank you @CIIGroup #insurance

@YorksFSAwards

Holly Copsey, president of the Insurance Institute of Leeds, is the latest addition to the Yorkshire Financial Awards 2023 independent judging panel #YFAwards

@CIIReading

Announcing our Achiever Award 2023 to be awarded at our 90th Annual Dinner on Friday 24 March 2023! Open to anyone in the insurance market locally

13 REGIONAL NEWS

/ The Journal / February - March 2023

thejournal.cii.co.uk

15 MARCH

16 MARCH 22 MARCH

Council members, Insurance Institute of Ipswich, Suffolk and North Essex

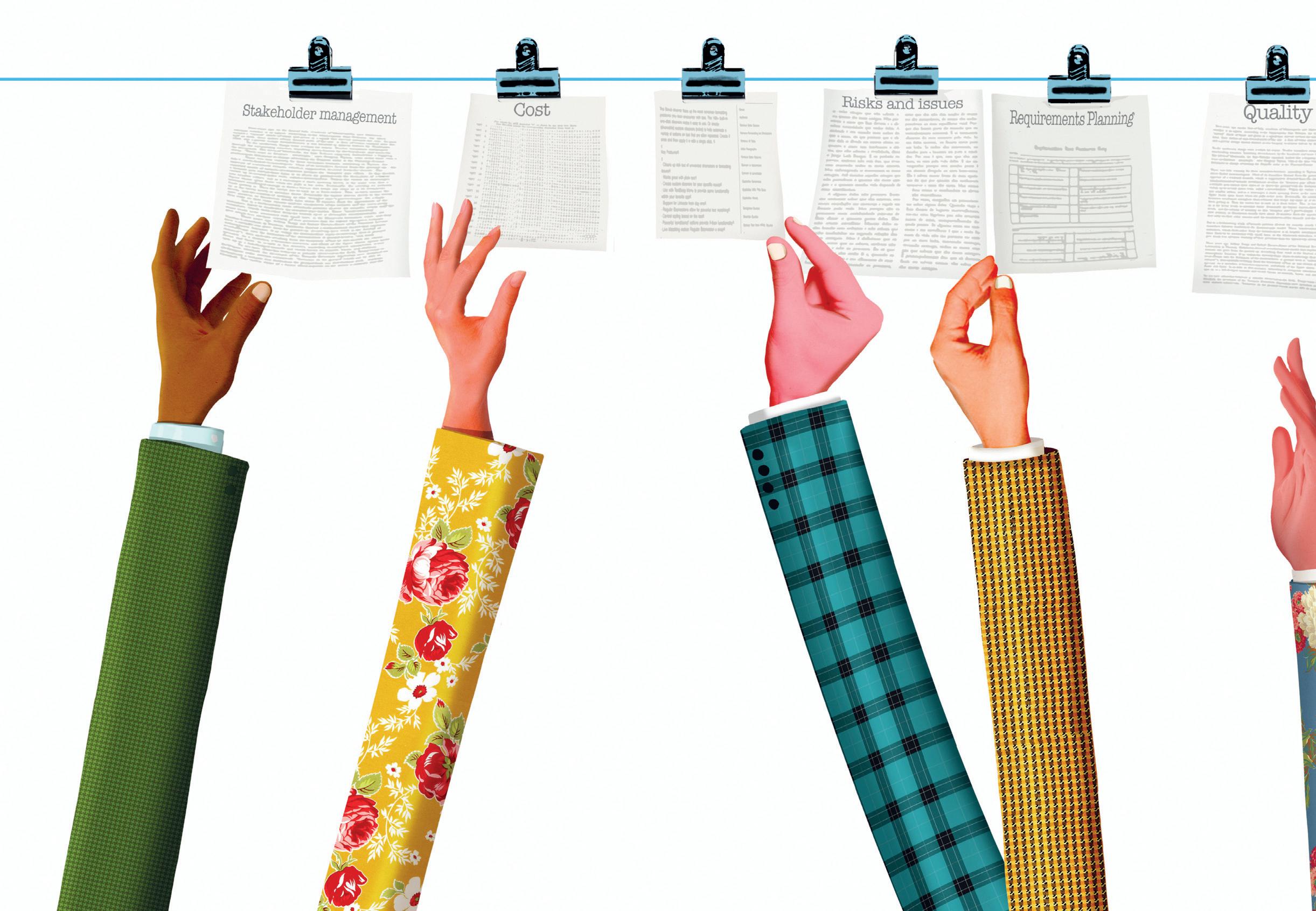

DUTY BOUND

With the profession now halfway to implementation of the Consumer Duty, Dr Matthew Connell provides an update

thejournal.cii.co.uk / The Journal / February - March 2023 REGULATION

14

CAMERON LAW IKON IMAGES

The UK Financial Conduct Authority’s (FCA) launch of the final Consumer Duty rules and guidance in July 2022 was greeted with a huge amount of interest. It was the first major piece of regulation to come out after the pandemic and significantly increased the scope of conduct regulation, especially in the areas of communication and service for consumers.

Although the launch of the Consumer Duty rules feels relatively recent, we are already halfway along the road to implementation for all products and services that are on sale or open for renewal. Firms must be fully compliant for these products and services by July 2023. By July 2024, the Duty will apply to all closed products and services.

At the end of January, the FCA published an overview of progress based on a range of financial services firms and at the beginning of February, it sent a letter to general insurance firms to talk specifically about implementation in this sector.

REGULATION

WHERE FIRMS SHOULD BE NOW

In July 2022, the FCA said it expected firms to have an implementation plan ready by the end of October. Although this plan did not have to be an exhaustive list of actions needed to comply with the Consumer Duty, it needed to address the four key consumer outcomes:

● Products and services.

● Price and value, whereby “firms should avoid designing products and services to include elements that exploit consumers’ lack of knowledge and behavioural biases to increase the price paid”.

● Consumer understanding.

● Consumer support – this requires firms to “enable consumers to get what they paid for… without unreasonable barriers”. As we move into the second half of the implementation period, it is important for firms to:

● Have evidence that they have considered what they need to do to meet the new standards.

● Have documented who is carrying out specific actions to meet those standards.

● Show how far along they are to completing those actions.

PRODUCTS AND SERVICES

For products and services, a useful place to start is the Product Intervention and Product Governance Sourcebook (PROD).

The FCA has said: “The existing PROD 4 rules, where implemented correctly, will mean firms in these sectors will already be meeting the requirements of the Duty’s products and services, and price and value, outcomes.”

As a result, a review of a firm’s existing compliance with PROD rules is an essential part of preparing for the Consumer Duty. The review could be based on this high-level steer from the FCA: “A key part of the Duty is that firms are able to define, monitor, evidence and stand

behind the outcomes their customers are experiencing… This monitoring must enable firms to identify where customers, or groups of customers, are experiencing poor outcomes and, where this is the case, firms must take appropriate action to rectify the situation.”

Where firms can show that they have considered their responsibilities under the PROD rules in the run-up to the consumer duty, and they have taken action to ensure that they are monitoring consumer outcomes and acting on what they see, they can be confident that they are in a strong position to comply with the products and services element of the Consumer Duty.

PRICE AND VALUE

The price and value element is likely to be a more demanding challenge for firms. The FCA has said: “We have seen some firms take a tickbox approach to fair-value assessments… We would expect fair-value assessments to include an analysis of data that results in considered commentary and a conclusion as to whether the product provides fair value. The mere restatement of data such as loss ratios, claims frequencies, specified target markets and distribution methods without analysis, context and a conclusion would not, in our view, be sufficient to deliver an adequate assessment that a product provides fair value.”

The key evidence that general insurance firms need to be ready to present for the price and value element of the Consumer Duty is:

● Price

● Loss ratios

● Services that add value – for example, a health insurer providing customers with a service to help them select a consultant.

● Instances where a firm has changed the price or features of a product, or taken it off the market altogether as a result of its analysis.

thejournal.cii.co.uk / The Journal / February - March 2023 15

ONE QUESTION FIRMS CAN ASK THEMSELVES IS WHETHER THEY ARE APPLYING THE SAME CONSUMER SUPPORT STANDARDS TO DELIVER GOOD CONSUMER OUTCOMES AS THEY ARE TO GENERATE SALES AND REVENUE

CONSUMER UNDERSTANDING

The consumer-understanding principle will also require thought and attention from firms. The FCA has made it clear that this does not mean firms must “verify that all individual consumers have in fact understood the information provided”. However, it does expect firms to “test, monitor and adapt communications to support understanding and good outcomes for customers”.

For GI firms, the FCA has also highlighted three specific expectations:

● Communications advising customers on how to cancel their policy or complain should be at least as clear as those used to sell the policy.

● Where firms conduct consumer testing of communications to maximise sales, they should use equivalent testing capabilities to assess the other aspects of consumer understanding to ensure good customer outcomes are achieved.

● Any cancellation fees, administration fees or other charges should be clearly signposted. This information should not be spread out across different webpages and policy documents, summaries and covering letters.

CUSTOMER SUPPORT

Finally, the customer support element is a key part of the Consumer Duty and arguably expands the scope of FCA regulation further than any other aspect of the principles and rules.

The FCA has highlighted some specific claims lessons from Covid-19 that it would like GI firms to consider, where firms had not always:

● Produced clear and robust conduct management information, which affected their ability to identify and address delays in the claims process.

● Kept records of policy wordings that were easily accessible for claims handlers, which resulted in delays for customers.

● Adequately identified vulnerable customers or took an inconsistent approach in dealing with the needs of vulnerable customers.

● Tailored customer communications to the recipient.

Given the importance of vulnerability in delivering good outcomes on consumer understanding, it is important that firms of any size ensure that they have access to diverse perspectives on consumers’ experience.

As Sheldon Mills, executive director of consumers and competition at the FCA, said recently: “Progress on making financial services, including the insurance industry, representative of the country and communities it serves remains at best uneven and, at worst, stagnant.

“Diversity and inclusion is a two-sided problem: first,

internal representation within our organisations; and second, externally, sufficient knowledge and understanding so that we can serve our diverse society well. That isn’t just about race or a gender debate, it’s also about social mobility, class or levelling up – ensuring that we serve all communities. And many of those things intersect with each other.”

The Consumer Duty covers every aspect of firms’ contact with clients, so preparing for compliance can be daunting. However, if firms think carefully about every aspect of the Consumer Duty and take steps to address the issues raised, they will be in a much stronger place to show that they have complied with its principles by July this year. ●

Dr Matthew Connell is director of policy and public affairs of the CII

thejournal.cii.co.uk / The Journal / February - March 2023 REGULATION

16 Source: FCA

27 July 2022: Final rules and guidance published 31 October 2022: Firms agree implementation plans 30 April 2023: Manufacturers complete reviews to meet the outcome rules 31 July 2023: Rules start for open products/ services 31 July 2024: Rules start for closed products/ services 12345

KEY MILESTONES

UKRAINE: ONE YEAR ON

Russia’s invasion of Ukraine has had far-reaching consequences for the world as a whole, including the insurance market, as Liz Booth reports

When Russia invaded Ukraine on 24 February 2022, it set off a chain reaction across the world, not least in the insurance markets.

Apart from insured damage to buildings from the war itself, there were ships trapped in ports now under Russian control, a sudden ceasing of trade (particularly for food crops such as wheat and sunflower oil), a dramatic impact on European energy supplies and sanctions against Russia that caused the insurance industry to withdraw cover. →

thejournal.cii.co.uk / The Journal / February - March 2023 17 UKRAINE

Sadly, one year on, the war continues and as the UN reports that currently more than 7.5 million people have fled Ukraine and nearly seven million Ukrainians are internally displaced, it is still unclear what the further long-term consequences will be.

At the start of the war, the insurance profession immediately braced itself for substantial losses – forecasts of about $20bn (£16.5bn) were widespread.

Many predicted that the worst losses would be suffered in the first quarter after the invasion, as the insurers adjusted to the new environment.

In the event, S&P reported that the global insurance industry disclosed roughly $1.3bn (£1bn) in collective losses and reserve charges related to the Russia-Ukraine war in the first quarter. It found insurers and reinsurers in Europe were hit particularly hard, with some signalling that losses may impact future earnings as well as incurred-butnot-reported reserve holdings as the situation escalates.

But what is the situation one year on?

According to a Verisk expert speaking last year, likely claims totals from the war in Ukraine may have risen to about $26bn (£21bn) from guesses possible early in the conflict.

The Organisation for Economic Cooperation and Development (OECD) has pegged overall losses a little lower, saying: “Initial losses for the insurance sector are materialising or expected to materialise mainly in specialty insurance lines, notably in aviation insurance, but some impacts have been felt in marine insurance and losses are expected to materialise in property, trade credit and political risk insurance.

“Losses in aviation and credit insurance stem from the imposition of sanctions and measures against Russia and related Russian responses.”

The OECD adds: “Damage to commercial property and infrastructure in Ukraine will generate losses, as many large companies will have purchased war or political violence coverage. The war is also increasing the level of cyber risk, with attacks already directed against Ukraine and Russia, along

with other countries, which may generate losses depending on the existence of coverage and the applicability of various types of exclusions.

“Recognising that the situation is uncertain, preliminary rough estimates suggest an overall industry loss of $20.6bn (£17bn) which, while large, is manageable for the sector, in line with the costs of a midsized natural catastrophe event.”

MYRIAD OF RISKS

Fitch Ratings’ Brian Schneider, senior director and global head of reinsurance, says: “The full extent of insurance and reinsurance losses stemming from the conflict between Russia and Ukraine remains a murky subject with many unknown factors,” but he remains confident that the war will prove to be a “contained risk” for the market.

Ratings agencies agree that the past year has given insurers time to add exclusions. For example, in January, Reuters reported that the commercial arm of French insurer AXA was reducing cover offered to aviation companies as it sought to protect the multibillion-euro business after heavy Ukraine-related losses.

Broker Howdens warns that the Ukraine crisis “presents a myriad of risks to the sector – direct underwriting losses, rapidly rising prices, slower economic growth, financial market volatility and the potential for asset shocks – that are not altogether different to what occurred during

Covid-19 and the financial crisis”.

It adds: “But with direct investment and underwriting exposures limited overall, and with second-order effects in financial markets currently manageable, the sector is strongly positioned to support clients through this period of uncertainty.”

As war broke out, the marine sector was one of those most immediately impacted, with travel immediately suspended. Added to that, about 84 vessels remain trapped in Russia-controlled areas. Those vessels (unless freed by 24 February 2023) become total losses. Although many of them are local, low-value vessels, the market is bracing itself for claims of somewhere between $800m (£660m) and $1bn (£830m).

Since last February, marine insurers have been scaling back cover and, in January 2023, Reuters reported that the protection and indemnity (P&I) clubs American, North, UK and West were no longer able to offer war-risk cover for some liabilities in the region. The clubs are among the biggest P&I insurers, covering about 90% of the world’s ocean-going ships.

Broker Marsh, meanwhile, provides a breakdown by class of the impact on insurers and availability of cover.

18 thejournal.cii.co.uk / The Journal / February - March 2023 UKRAINE

ISTOCK

THE UKRAINE CRISIS PRESENTS A MYRIAD OF RISKS TO THE SECTOR –DIRECT UNDERWRITING LOSSES, RAPIDLY RISING PRICES, SLOWER ECONOMIC GROWTH, FINANCIAL MARKET VOLATILITY AND THE POTENTIAL FOR ASSET SHOCKS

→

Aviation and space

Sanctions by the UK, EU and others prohibiting the supply of aircraft or parts to Russia as well as related financing or insurance, followed by a Russian expropriation of foreign-leased aircraft, have led to multiple aircraft stranded in Russia. This has resulted in significant aviation hull losses, which have already led to aviation hull war insurance rates spiking by approximately 200%, on average and underwriters re-examining coverage. The broader aviation insurance market may harden, further straining the aviation industry, which is struggling to recover from the impact of the pandemic. The aviation and space sanctions have also led to international insurance coverage for satellite launches and deployment being unavailable for Russian-built satellites and launch sites within Russia. Between 2017 and 2021, Russia accounted for about 16% of global launches.

$20.6bn

PRELIMINARY ESTIMATES SUGGEST OVERALL INSURANCE LOSSES OF $20.6BN

Source: OECD

Energy and power

The energy insurance market saw an immediate impact on its premium volume due to sanctions on Russian oil and EU attempts to reduce reliance on Russian energy. As of December 2021, Russia accounted for nearly 10% of world petroleum production. Germany and other EU members that previously bought Russian natural gas and oil are trying to line up alternative energy supplies, including possibly delaying original coal phase-out plans or revamping already shut-down coal power plants (when feasible). Meeting power demand may increase the need for new upstream energy investments and energy infrastructure outside of Russia.

Credit and political risk

Claims are beginning to emerge for Russian and Ukrainian trade credit, political risk, and structured credit policies issued before sanctions were imposed. More trade credit and structured credit claims for Russia were anticipated in the second half of 2022 and the first quarter of 2023. Political risk claims were expected from Russia in the fourth quarter of 2022 and through 2023.

Significant political risk claims for war and confiscation in Ukraine have emerged. Since late February, few –if any – new political risk or credit insurance policies have been available for Russia, Ukraine or Belarus.

Sanctions and supply chain

Sanctions and trade controls have significantly increased. While media reporting has focused on the aviation and marine industry, sanctions have impacted a large variety of goods and services being supplied to Russia.

D&O liability

The conflict has signalled a shift in corporate reactions to events that trigger moral/ethical decisions. More than 1,000 companies have announced they are leaving or voluntarily curtailing operations in Russia. ●

ISTOCK

thejournal.cii.co.uk / The Journal / February - March 2023 19 UKRAINE

Liz Booth is contributing editor of The Journal

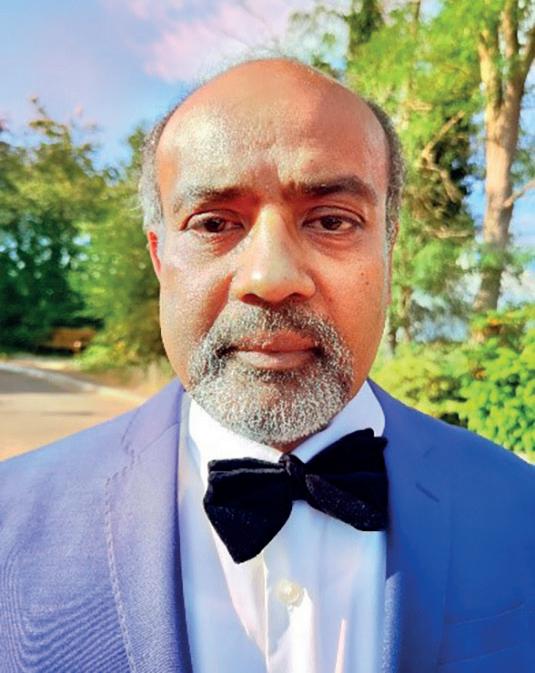

The insurance profession can win the war for talent – but it needs to be bold and embrace new ways of engaging with the wealth of untapped talent that is out there.

That is the view of Samantha Ridgewell, managing director of Empower Development, learning and training specialist, insurance TikTok titan and all-round talent trailblazer.

“I would like to see the insurance industry find a balance of working flexibly that has the progression of young talent at its heart,” Sam tells us.

“The challenge now with remote working is that the pace at which we are training people has severely slowed down and enrolments in professional qualifications that are so important to development have fallen.”

As well as attracting diverse talent, the insurance sector must also make significant efforts to retain it, says Sam. “Companies need to have an environment where people feel like they belong. They need to keep their culture alive and moving forward,” she says.

“Times have changed and how people learn and interact has changed with it. We must offer

them the chance to engage with us in new ways, so people are aware of insurance as a career and everyone feels included.

“There are reasons why we have the war for talent and insurance needs to keep evolving the way it connects to those who are curious about learning more.”

BUILDING KNOWLEDGE

Five years ago, Sam launched Empower Development, aimed at helping insurance professionals achieve their training and certification goals while offering a range of tools, resources and guidance to help support CII qualifications.

With a background in insurance human resources, she found that building her own knowledge by studying CII exams helped her collaborate with the brokers and underwriters she dealt with every day. This naturally progressed to offering informal training to colleagues, before her role evolved into recruiting graduates and apprentices.

“I realised there was a gap in the market for new ways of training. Young people kept saying that when they studied A-Levels they had lots of varied learning resources and accessible content – but there was far less of that once they moved into professional qualifications.

TALENT CHAMPION →

THE INTERVIEW: KEN NORGROVE THE INTERVIEW: RUSSELL HIGGINBOTHAM 20

Luke Holloway finds out how Samantha Ridgewell is leading the charge to attract new and diverse talent into insurance

thejournal.cii.co.uk / The Journal / February - March 2023 THE INTERVIEW: SAMANTHA RIDGEWELL

THE INTERVIEW: SAMANTHA RIDGEWELL

DEVELOPING TALENT

Samantha Ridgewell, ACII, is founder and managing director of Empower Development.

CII AWARD

Empower Development won the CII Public Trust Award for Talent Attraction Initiative of the Year in 2022.

FUTURE LEARNERS

Sam is a member of the CII Qualifications and Learning Committee and a Liverywoman at the Worshipful Company of Insurers.

thejournal.cii.co.uk / The Journal / February - March 2023

21

“We began building the resources that young people not only want but expect nowadays. Bitesized on-demand videos and audio, subtitled tutorials and, more recently, learning translated into Arabic for international modules.

“Anyone who wants to study CII qualifications can, regardless of their circumstances or what kind of learner they are.”

Sam sits on the CII’s Qualifications and Learning Committee and, with her HR experience and ACII qualification, she offers input from both the user and the business perspective.

“The committee reflects on what the CII’s plans are strategically around learning and we put forward our own suggestions,” she tells us.

“The experience of the committee is so broad – from across the whole of financial services and academia at all different levels – and we aim to have a positive input so that the CII can help more professionals with learning and development.”

THE POWER OF SOCIAL MEDIA

Insurers are regularly using LinkedIn to recruit new talent nowadays, with some also venturing onto Instagram, but can new social media phenomenon TikTok be a powerful tool for attracting talent into the sector?

“For me, if we had more people from insurance and financial services on these platforms it would go a long way to solving the talent problem,” says Sam.

“I got on TikTok during lockdown. I made one short video about graduates applying for jobs – that got half a million views and I gained 11,000 followers from that one video, which I made in my kitchen after I put my kids to bed!

“I suddenly had an audience. At first, my videos were focused on tips for CVs, interviews and cover letters,

but once they were interested, what they wanted to know was: where do I find jobs? The page then gradually transformed into ‘Insurance TikTok’.

“I talk about loads of subjects, from the fabulous historical buildings we insure and big underwriting risks, to Lloyd’s’ World Cup predictions – as well as the odd dance in front of the HMS Lutine bell at Lloyd’s – anything to spark people’s interest in insurance.

“At least 20 people that I know of are now working in insurance because they came via my TikTok,” says Sam. “I would love it if we could build up a whole trending feed of insurance professionals talking about their roles, their days, things they insure – it would really have an impact.”

DRIVING TALENT

Further projects Sam has launched take a slightly different tack to attracting talent.

Into Insurance – a scheme sponsored by the Worshipful Company of Insurers – is a free training course designed to help those entering the profession demonstrate the knowledge, skills and behaviour that organisations are looking for.

“The sessions look at things like understanding job descriptions, preparing for interviews, networking, building confidence and busting insurance jargon –so entrants get valuable practical support and something to put on their CV to illustrate their commitment and understanding,” she says. “There are already at least 70 people working in insurance that have come directly through that programme and we are running five more courses in 2023.”

The talent drives that Sam is central to are generating real-life results, as well as recognition from the across the profession. Empower Development won the Talent Attraction Initiative of the Year award at the recent CII Public Trust Awards, while the Women In Insurance awards recognised the Women with Presence programme with the Contribution to Gender Inclusion award in 2021, with Sam herself named Trailblazer of the Year.

“I am not a technical person,” says Sam. “I pride myself on understanding things and explaining them simply, then that openness and accessibility feeds into everything we do. The vision is to give everyone, no matter who they are, that extra support so they can thrive in a career in insurance.”

The talent is out there, now it is up to the insurance profession to go and get it.

Find Empower Development on TikTok @Empower.Development ●

Luke Holloway is editor of The Journal

THE INTERVIEW: KEN NORGROVE THE INTERVIEW: RUSSELL HIGGINBOTHAM 22 THE INTERVIEW: SAMANTHA RIDGEWELL

thejournal.cii.co.uk / The Journal / February - March 2023

ANYONE WHO WANTS TO STUDY CII QUALIFICATIONS CAN, REGARDLESS OF THEIR CIRCUMSTANCES OR WHAT KIND OF LEARNER THEY ARE

REGULATION UPDATE

Dr Matthew Connell examines the FCA’s paper on Finance for Positive Sustainable Change

The Financial Conduct Authority (FCA) published a discussion paper (DP) on Finance for Positive Sustainable Change on 10 February.

The paper looks at how issues around sustainability – including environmental, social and governance factors – can be addressed. It looks at three themes in particular:

● How sustainability is addressed through firms’ governance.

● How firms incentivise staff to promote sustainability.

● The competence of individuals within firms on sustainability issues.

The paper makes the point that sustainability is much wider than simply the drive to net zero for greenhouse gas emissions, and encompasses issues such as biodiversity, along with diversity and inclusion (D&I).

For example, the paper argues: “While many fi this area are currently focused on climate change, this DP seeks feedback on how fi with the breadth of sustainability topics, encompassing both environmental and social matters. A firm’s approach to D&I is one relevant area of focus. D&I can not only be a relevant social consideration, but also an enabler of good governance.”

The paper also suggests: “Consistent with the notion of a ‘social licence to operate’, our own Financial Lives Survey… found that as of May 2022, 79% of consumers thought businesses have a wider social responsibility than simply to make a profi

However, this does not mean the FCA has decided to impose more rules on fi sustainability. It says: “We will consider how we can better support the industry in this evolving field and whether there is a case for further

regulatory measures in the area of firm governance, incentives and competencies.”

One area where the FCA is supporting work by the profession is through the UK’s Green Finance Education Charter, of which the CII is a signatory. The CII is involved in this process and will be reporting back to members throughout 2023.

CUSTOMERS IN FINANCIAL DIFFICULTY

In January, the FCA published guidance for insurance businesses dealing with customers in financial difficulty. The FCA has proposed that the guidance should cover “both retail and commercial customers of non-investment insurance policies”. The primary trigger is when customers contact an insurance fi because they are in financial diffi

The proposed guidance suggests that firms should:

Reassess the risk profile of the customer, for example where a motor insurance customer may have reduced their vehicle use. Consider whether there are other products the firm can offer that would provide appropriate cover at a price the customer can afford.

Adjust cover to take account of the financial change in the customer’s circumstances

Work with customers to avoid the need to cancel cover that is important to them, including helping them to understand the potential consequences of cancelling cover that is important

Finally, where a customer’s policy is being adjusted or cancelled as a result of financial difficulties, the FCA’s draft guidance says that firms should consider whether it is appropriate to require the customer to pay all the contractual fees or charges associated with

e FCA expects to publish a final policy paper in the second quarter of 2023.

Read our article on ESG on page 27 of Th

REGULATION 23 1

2

is

CII al x ma re chan dth of s assing bo firm’s an n lso es A i to ue to the secondquarter o members ed nesses nancial osed that both mers e er is firm difficulties. ests that f customer, of 2023. n The Journal Read our article on E is di l the CII thejournal.cii.co.uk / The Journal / February - March 2023

director of policy and public affairs of the

Customisation and a seamless customer experience are two advantages of embedded insurance, which is the latest trend that is shaking up the profession.

Market expert Laura Mullaney has championed embedded insurance, which involves selling relevant and personalised insurance at scale where and when customers need it the most. Current examples are buying travel insurance when purchasing flights or opting in for insurance

FLEXIBLE FUTURE

thejournal.cii.co.uk / The Journal / February - March 2023 TECHNOLOGY 24

Aamina Zafar examines embedded insurance, which some experts believe can drive growth in the insurance profession

cover on your new mobile phone. It enables any third-party provider or developer to integrate innovative insurance products into its customers’ purchase journeys effortlessly and at a low cost.

Mullaney, managing director of distribution at BGL Insurance, says: “Customisation and a seamless customer experience are two huge benefits of embedded insurance and companies in various industries are seeing it as a real opportunity. Presenting customers with a technology-led approach and with propositions that are relevant, easy to purchase and good value can increase brand satisfaction and loyalty, which can ultimately aid retention. Companies need to be careful though, as not every insurance product can and should be embedded. The add-on has to feel authentic and appropriate to the company’s core offering, otherwise you risk alienating customers.”

DRIVING GROWTH

Embedded insurance is proving to be so popular that news articles have reported it as having an estimated $3.7trn (£3trn) market potential. Now, many industry experts have forecast that embedded insurance will drive growth and change in the profession.

Harry Croydon, president and chief executive officer at MIC Global, believes embedded insurance can power change by making the products more flexible: “Insurance needs to flex into customer requirements, [such as] flexible limits, periods and payments. Goodbye annual policies with large limits suited to big business and hello to hourly, daily, flexible insurance geared to micro businesses and the individual. Insurance that changes like people do. The growth in activity then is directly linked to growth of insurance.”

In particular, he praises embedded insurance for its ability to encourage more flexible arrangements for a policy’s term. He adds: “Embedded insurance can mean flexible arrangements for the term of the insurance – such as pay as you go.

Or reduced cost for better behaviours such as safer drivers or safer roads. Because we know more about the customer, we can target the insurance – using motor as an example – to make it cheaper when the car is locked in a garage and it can be tracked that it remains there, or for example, driving only in town versus long distance via motorways. Because of tracking, insurance can be linked to these changing conditions.”

DOWNSIDES

Croydon adds that although there are many benefits to embedded insurance, its success will depend on transparency. He says: “Insurance can be an opaque and complicated business. People need to know when they do buy insurance, it will pay out and quickly. If the goal is to trick people and build low-loss programmes or miss-sell, then embedded can be used to do this. Hiding insurance in the transaction as a profit centre is all too easy and this practice must never gain momentum – it should never be considered. Unscrupulous people can leverage this process.”

Another possible pitfall of embedded insurance is that it may inadvertently exclude some customers.

Croydon says: “Edge cases can exclude customers – for example, where the process or tech highlights high risk for the few, or as conditions change, potentially making high cost for the few and cheaper for the many. This can have undesirable effects, such as flood or wildfire predictions can mean property or areas of land become high risk areas and can only be met through traditional insurance.”

A warning is also issued by Andreas Schertzinger, from Swiss Re’s digital insurer iptiQ, who agrees that

embedded insurance has huge potential, but suggests there are five areas to consider where challenges can be turned into opportunities.

The first factor to consider is ecosystems. Schertzinger, regional market executive for EMEA at iptiQ, says: “Building a digital insurance ecosystem is highly complex. It requires specific capabilities for whitelabelling and managing partner business, such as businessto-business-to-consumer.

Incumbent insurers often face a channel conflict with their own sales force when they create partner-optimised products.” He adds that the second aspect to weigh up is how firms integrate data. He says it is not enough to have access to vast amounts of data and the key is to consider integrating data across the value chain to drive personalisation, automation and claims effectiveness.

The third element to consider is scalability. Schertzinger adds: “Embedded insurance needs to be built on highly scalable and performant platforms, otherwise it won’t be profitable in the long term. Enablers are modularity and reusability of products and platform across partners, countries and time.”

The fourth point to bear in mind is adopting an omnichannel approach. He explains: “Customers demand high levels of convenience and service quality – before, during and after sales of the insurance products. This requires a holistic hybrid approach, combining state-of-the-art technology with excellent human touch where customers benefit.”

Finally, the fifth aspect to consider is talent. Schertzinger says: “Implementing a successful embedded insurance offering needs highly specialised talents with different backgrounds in insurance, technology and behavioural economics.”●

thejournal.cii.co.uk / The Journal / February - March 2023 25 HARRY HAYSOM / IKON IMAGES

TECHNOLOGY

Aamina Zafar is a freelance journalist

IMPLEMENTING A SUCCESSFUL EMBEDDED INSURANCE OFFERING NEEDS HIGHLY SPECIALISED TALENTS WITH DIFFERENT BACKGROUNDS IN INSURANCE, TECHNOLOGY AND BEHAVIOURAL ECONOMICS

Climate change is a hot topic –quite literally – as the world’s temperatures continue to rise. However, the Covid-19 pandemic helped to highlight the impact even relatively small changes to our behaviour can make in terms of carbon emissions, something that is definitely not lost on the insurance profession.

The Association of British Insurers (ABI) released its Climate Change Roadmap 2022 in June last year as part of the insurance industry’s commitment to reaching net zero in its operations and activities, while insurers are starting to make

changes to policies that help their customers make changes too. Encouraging policyholders to change their behaviour by incentivising them with reduced premiums and other benefits will hopefully, little by little, make a wider difference.

The ABI’s Climate Change Roadmap 2022 states: “Alongside our role as investors in the transition from brown to green, the general insurance sector will also face the cost of climate change. These costs will affect a wide range of general insurance products. Examples of this could include physical impacts leading to property insurance claims

for flooding and other forms of weather, or motor insurance claims associated with impaired driving conditions; claims associated with disruption to supply chains (such as where goods have not been able to arrive on time or have been damaged in transit, as a result of disruption caused by extreme weather); and health insurance claims related to the physical and mental wellbeing impact of temperature rises.

“The climate change transition is not simple or short term. The changes that are envisaged in individual customers’ lives are significant and these changes will have significant

thejournal.cii.co.uk / The Journal / February - March 2023 ESG

SOME MOTOR INSURERS ARE ALREADY CHANGING THEIR POLICIES TO ENCOURAGE A MORE ENVIRONMENTALLY FRIENDLY APPROACH

26

CLIMATE OF CHANGE

Alison Steed examines the insurance profession’s progress on the journey to net zero

social consequences," says the roadmap. “As the government takes forward its Net Zero Strategy and its Heat and Buildings Strategy, and prepares for the 2030 deadline for phasing out non-electric vehicles, our sector wants to ensure it can support all of these initiatives.”

POLICY CHANGES

Given this push towards incorporating environmental, social and governance (ESG) aspects into insurance policies –but especially environmental – some motor insurers are already changing their policies to encourage a more environmentally friendly approach from customers. For example, Aviva Zero allows all policyholders to offset their carbon emissions from the driving and charging of their vehicle

for a year, which Aviva says helps them make more sustainable choices.

An Aviva spokesperson comments: “We believe this is an interesting proposition for customers who are conscious of their impact on the environment. Customers choose their insurance for different reasons and our aim is to offer choice and flexibility through our products and distribution channels.”

Aviva is not alone in offering an environmentally friendly option. Vitality does a similar thing, but in a different way.

Aviva takes the mileage you drive in a year and calculates your specific emissions based on the carbon footprint of your vehicle, then Aviva buys carbon credits to offset those emissions.

In contrast, Vitality’s policy prompts drivers to behave differently when they are behind the wheel, physically reducing their emissions as they drive, and encourages people to give up their car altogether with a cashback reward for car-free days each month. This has the additional benefit of helping them save money on fuel and wear and tear on their car.

A spokesperson for Vitality says: “Our car insurance proposition is open to everyone, incentivising and rewarding good driving behaviour that is safer and greener, with tangible financial benefits for the member. Since launching in June 2021, we have rapidly grown our customer base.

“This reinforces the fact that we are a different type of insurer and that our shared-value model of insurance

thejournal.cii.co.uk / The Journal / February - March 2023 27 NICK LOWNDES / IKON IMAGES ESG

really does work when incentivising behavioural change. We are also the only insurer that rewards you when you drive well or have car-free days.”

Drivers need at least 10 good driving days per month to get up to 25% cashback based on their premium, with the data logged through the Vitality UK app. This could save about £117 per year, presenting another saving during the cost-of-living crisis. Drivers can also get a weekly Caffè Nero reward and reduce their excess if they need to make a claim and offset their carbon emissions.

Vitality describes itself as a “purpose-driven organisation” which supports people to live more healthily and drive more safely.

“As experts in behavioural change, we know this model is more relevant than ever – particularly in the world of car insurance – as the connection between risk and behaviour grows clearer,” the insurer’s spokesperson adds. “We also know that society is expecting more from companies in terms of doing the right thing, and our car insurance is built on the fact that it helps to create safer roads and a greener planet for everyone. Our customers have had more than one million car-free days so far and we additionally offset carbon emissions when they drive well.”

However, what exactly does ‘good driving’ mean? Apparently, it is centred around five key driving behaviours:

● Acceleration

● Braking

● Cornering

● Distraction

● Speed.

That is all measured through technology that sits within the policyholder’s car and monitors these elements to determine whether their driving passes muster and qualifies for the rewards.

GROWING MARKET?

The wider question is whether these products are the beginning of a suite of ESG-based covers in other areas of insurance, including home insurance policies. For now, the jury is out.

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, says: “The increasing pressure to move towards net zero is likely to inspire creativity around policies to encourage people to reduce their carbon emissions. Concern around climate change may well mean there’s a growing market for these kinds of products.

“However, at the moment, the costof-living crisis is likely to mean that people’s budgets are under so much pressure that they are prioritising price. It means insurers need to offer a cost-

effective solution too.

“Structuring products to enable people to save money may encourage takeup. However, where they require behavioural change to secure a discount, it will limit the number of people who are prepared to take the challenge on. It remains to be seen whether this is a burgeoning market that grows in size and sophistication, or whether it’s an interesting sales technique with limited impact in the long run.”

Whether we see this approach take off or not, the insurance profession is keen to help customers become more climate conscious, including helping them to make different choices when it comes to claims and not necessarily replacing like for like. But this is also something insurers will have to independently support through the claims process.

The ABI’s Climate Change Roadmap 2022 states: “In the coming years, with rapid policy changes expected across these areas (from the rollout of electric vehicles and upgrading the energy efficiency of buildings, to reform of social care and increasingly flexible working patterns), the point at which someone makes an insurance claim will be a key moment when they could make a change to a more sustainable alternative.” ●

thejournal.cii.co.uk / The Journal / February - March 2023 ESG

28

Alison Steed is a freelance journalist

TAKING A BITE OUT OF CPD

The CII is aware that learning styles are always evolving and aims to provide flexibility within its continuing professional development (CPD) rules around bitesized learning. There are many different ways members can undertake CPD. Here, we explore those, along with common examples of how grouped activities can also count.

CPD SCHEME RULES

Our existing CPD scheme rules already provide flexibility for members. As a reminder, the scheme caters for all qualified members, irrespective of their specialism, discipline or geographical location. Your commitment is:

● Complete a minimum of 35 hours’ compulsory CPD each year, of which at least 21 hours must be structured CPD.

● 35 hours is the minimum required – in practice, the figure may exceed this as the actual requirement will be determined by an individual’s development needs in any 12-month period.

● For an activity to be eligible, it must be a minimum of 30 minutes in duration (a batch of different activities of less than 30 minutes each undertaken to meet a specific development need can be combined and recorded together).

GROUPED ACTIVITIES – COMMON EXAMPLES

The activities you may choose to group together as part of your learning and development will vary from person to person, but some common examples include:

● Undertaking 20 minutes of preparation for a meeting with a client on a new product or regulation, before taking 10 minutes after the meeting to check your understanding and follow up on any specific questions that you were not able to answer fully in the meeting.

● Reading an article on management skills, which took five minutes but highlighted a need for further knowledge and development. Then, meeting the development need by watching a 10-minute video on the topic and discussing the techniques you learned with your manager for 15 minutes, including how they

could be applied on the job, before spending 10 minutes reflecting on the outcome of what has been learned (perhaps including some commitments on implementing the knowledge in practice).

● Attending a conference where a topic was discussed as part of a 15-minute presentation and then testing your knowledge on the topic by taking a 20-minute online course with a multiple-choice test at the end.

EVIDENCING GROUP ACTIVITIES

For the grouped activities to be successfully claimed as structured CPD, your CPD record must clearly include:

● The development need.

● Details of the activity/activities undertaken to meet that development need.