Inspired Customer Experiences

•we utilize the right blend of architectural technology to convey the branding and

•we provide compelling spaces that sell for institutions striving to accommodate a

•we help institutions leverage the retail

Customers are now adopting alternative delivery channels

29% cite ATMs/kiosks as 1st or 2nd channel of choice.

62% cite online banking as their banking method

Branches remain an important interaction point, playing an essential role in complex product sales and relationship building for both retail and small-business customers.

evolution of the branch

•redefine role of the branch

•examine services provided in the branch

•re-visit the square footage and staff counts required to provide an optimal brand experience

•provide spaces for higher return products - wealth management, insurance, financial planning services

•individual branches within a network need to cater to specific audience and their individual needs

features

•designed to deliver privacy, safety, and sense of security across all interactions

•digital marketing and signage facilitate branch navigation and makes offerings in new ways

•self-service channels emphasized for routine low-return transactions

•education tools displayed prominently

drivers

•customized branch designs to serve needs of diverse customer base

•consistency of branch design is important in order to provide customers with a reliable experience across branches and to enhance their self-service experience and reinforce the brand

today’s customer

•people are taking advantage of the ease of use of remote channels to access their accounts more frequently, while still valuing the opportunity to seek out personal interactions for trustworthy advice on managing their finances

•multiple surveys citing heavy digital users seeking out the branch for advice on financial products and services

Personalized Experience Upscale Model Branch

• Aims to create a comfortable and trusting environment where account holders are impressed with hands-on, white-glove type treatment from associates.

• Other than design, the key to achieving success with this branch experience weighs heavily on the caliber of staff who work there.

• This branch account base needs to meet a number of data points to make a Personalized Experience Upscale Model a success, including: a high enough income level, the right age range with accessibility to the branch.

• Unlike traditional branches where activities are separated by divisions of labor (teller activity, lobby interactions), this type of branch mostly requires universal bankers who handle the full-spectrum of the account holders experience.

Efficient Staffing Operating Model

conventional/traditional efficient/evolved

•staff are group in activity zones

•zones are arrayed around perimeter

•large inefficient central spce

•staff levels decline they become isolated

•isolation interferes with ability to adapt to traffic fluctuations

CSRs and tellers can’t adapt quickly

•can’t to multiple tasks in close proximity

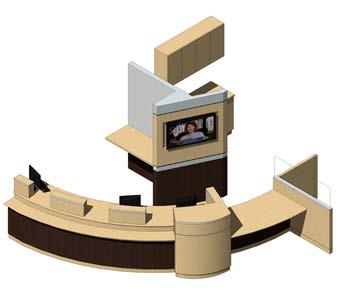

•activity hub

•maximizes teamwork by decreasing barriers

•increases communication between staff

•easily shift between tasks in response to traffic volume

•provide consistent, high quality, customer experiences at all times and level of activity

•branch can actually function with fewer FTEs

Ryan Bank Concepts

small branch concepts “more efficient by design”