27 minute read

Easter Treats

Easter Eggstravaganza

Easter means a huge surge in confectionery sales, with Irish shoppers spending €44m on Easter eggs last year.

IT’S well known that Irish people have a sweet tooth, particularly when it comes to chocolate. In fact, Irish consumers spent a total of €44m on Easter eggs leading up to Easter Sunday in 2019, according to figures from Kantar for the 12 weeks to April 21, 2019.

Retailers across the country set about promoting Easter eggs early last year, with sweet toothed consumers stocking up on these seasonal treats long before Easter Sunday itself: two weeks before Easter weekend in 2019, more than half of Irish households had stocked up on Easter Eggs, many as part of multi-buy promotions.

Cadbury Cadbury has unveiled its Easter offering for 2020, with plenty of returning favourites, as well as some new products that will be sure to get shoppers eggcited for the Easter Bunny to arrive this year. The traditional Cadbury The 409g Cadbury Creme Egg tin contains eight Cadbury Creme Eggs and one Cadbury Mini Creme Egg Bag.

Creme Eggs and Cadbury Mini Eggs are making a comeback; however, this year, Cadbury is introducing something egg-stra special. These egg-shaped treats are available in gifting tins, perfect for sharing with family and friends. The 409g Cadbury Creme Egg tin contains eight Cadbury Creme Eggs and one Cadbury Mini Creme Egg Bag (RRP

mature taste in chocolate!

Also new for 2020 is a giant Cadbury Dairy Milk Choca-Latte Inventor egg. Voted by the public, this egg is based on the winning Dairy Milk Bar designed by Irish teenager Callum Clogher. Callum, from Roscommon, won the Cadbury Inventor competition, which saw 220,000 chocolate lovers in Ireland and the UK try to create a new Cadbury’s chocolate bar.

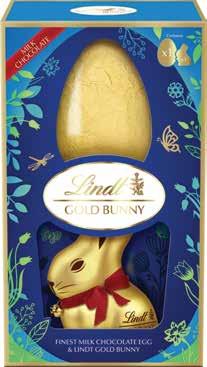

Lindt The Lindt Easter Egg range continues to be a key sales driver for retailers at springtime. Lindt Easter Eggs have been growing six times faster than the category since 2016 (Source: Nielsen Scantrack to April 21, 2019, MAT - Easter Period = 17 weeks to April 21, 2019,

versus 14 Weeks to April 1, 2018) and are once again proving a must stock item for retailers as consumers look to trade up and give a premium Easter gift.

This Easter, Cadbury are introducing the brand new Cadbury Darkmilk chocolate egg with three Cadbury Darkmilk bars.

€10) and The 319g Mini Egg gifting tin contains 10 Cadbury Mini Eggs treat size bags (RRP €10). 2019 saw the introduction of Cadbury Darkmilk, the richest, creamiest chocolate Cadbury has ever made: a brand new type of chocolate made with 40% cocoa solids and smooth and creamy milk. This Easter, Cadbury are introducing the brand new, Cadbury Darkmilk chocolate egg with three Cadbury Darkmilk bars (RRP €13). The perfect gift for someone with a more

New for 2020 comes the Lindor Easter Egg 140g range, certain to delight shoppers this Easter. The Lindt Gold Bunny is hopping back into stores nationwide this spring.

This year, Lindt is bringing more exciting new news to the category. From the relaunch of the magical and endearing Gold Bunny Easter Egg Range to the introduction of the new Lindor Easter Egg 140g range, Lindt continues to delight shoppers with an exquisite array of Easter egg creations to choose from.

The Lindt Gold Bunny is hopping back into stores nationwide this spring. Delivering over €800k in sales, the Lindt Gold Bunny is the clear market leader in Easter hollow figures in Ireland (Source: Nielsen Scantrack to April 21, 2019, MAT - Easter Period = 17 weeks to April 21, 2019, versus 14 Weeks to April 1, 2018). Made by the Lindt Master Chocolatiers from the finest Lindt chocolate, wrapped in exquisite gold foil packaging and finished with the iconic red ribbon and ringing bell, the Lindt Gold Bunny is guaranteed to bring a smile to the face of your shoppers and their loved ones.

This Easter, retailers can expect to see a heavyweight support plan behind the Gold Bunny brand. This year the Make Yours Personal campaign allows customers to choose from four different ribbon messages in-store for their Gold Bunny or go even further and completely personalise their Gold Bunny at various pop-up shop locations across the country in the run-up to Easter. The Lindt Gold Bunny is available in a variety of sizes and formats and is available in all good retailers nationwide.

The Lindt Gold Bunny Easter Egg, sure to prove popular with Irish chocolate lovers.

Lindt Lindor has strengthened its position as the number one boxed chocolate brand in the Irish market. €1 in every €6 spent on a box of chocolates in Ireland is spent on a Lindor box (Source: Nielsen, Total Scantrack ROI + Discounters Data to December 29, 2019), proving that Lindt Lindor continues to be a must stock for retailers in 2020.

With a wide range of exciting and delectable flavours as well as formats, Lindt Lindor is the perfect chocolate gift for any occasion. From the classic Lindor Milk recipe to the new Mint Edition, the Lindor Cornet range is sure to excite and engage your customers.

Supported by a strong national campaign, Lindt Lindor TV advertising will return to screens this spring with increased support and activity both in and out of store.

Nestlé Confectionery Nestlé Confectionery’s Easter 2020 range will focus on offering consumers its big brands such as KitKat, Aero, Quality Street and Smarties in bestselling formats, and features mini eggs, large eggs, giant eggs and premium eggs. What’s more, all of the Easter range from Nestlé Confectionery contains no artificial colours, flavours or preservatives.

In 2020, the Easter season will be shorter than in 2019, and therefore retailers need an early start to capitalise on mini eggs sales, which are popular throughout the full season and attract New KitKat Bunnies are hopping into stores this Easter.

with friends and family and at an accessible price point. Making a welcome return this year are Nestlé's range of Incredible eggs, each containing a chocolate egg with something special included in the shell. From flagship brand KitKat is the KitKat Chunky Salted Caramel Fudge Incredible egg, which contains a caramel flavour chocolate egg with soft salted caramel fudge pieces in the shell, as well as three full-size bars of KitKat Chunky Salted Caramel Fudge. The Yorkie Raisin and Biscuit Incredible egg is a milk chocolate egg with crunchy biscuit and juicy raisin pieces in the shell, plus three full-size bars of Yorkie Raisin and Biscuit. The Smarties Mini Eggs Incredible egg is a milk chocolate egg with crunchy mini Smarties in the shell plus a Smarties mini eggs sharing bag.

repeat purchases right up until Easter Sunday. 2020 will see family favourites Smarties mini eggs and Milkybar mini eggs once again at the heart of the range, and new for 2020, combining the ultimate chocolate indulgence with the lightness of Aero, there is the newly launched bag of Aero milk chocolate mini eggs.

Other new additions hopping into the range are the KitKat Bunnies. With an original take on the classic KitKat flavours, the bunnies have a rich chocolatey centre filled with crispy wafer pieces, all encased in a smooth milk chocolate shell. They are vegetarian and gluten free, and come in a variety of different formats, including singles, a mini bunny sharing bag, multipacks and large and giant eggs.

Smarties also launches a new range of cute milk chocolate bunnies, each filled with mini Smarties inside and these colourful additions to the range come in many different sizes and formats, from singles right through to multipack and gift box solutions.

Big, well-known brands are also key when it comes to stocking large eggs as shoppers are looking for the recipient’s favourite. Nestlé’s extended large egg range for 2020 gives shoppers a greater choice of trusted, quality brands in a popular size format, ideal for sharing

Premium eggs also feature more indulgent offerings such as the After Eight premium egg, which features a large mint flavoured dark chocolate egg, complete with a 300g box of everyone’s favourite after dinner mints.

The wider Nestlé range includes a giant egg range with offerings from Smarties, Aero, KitKat, Yorkie and Quality Street, and kids’ added value packs from Smarties and Milkybar. Egg hunts continue to be a growing trend and both the Smarties and Milkybar Egg Hunt packs will also prove popular with shoppers again this year. The Quality Street giant egg is sure to prove hugely popular this Easter. larger Kinder Surprise 220g eggs will receive a Marvel Avengers update. The Kinder Maxi Surprise 150g, the number three kids seasonal Easter egg in Ireland (Source: Nielsen Scantrack, Seasonal Confectionery, Sales, 13 weeks to Easter 2019, 21.04.19), will also receive an update, with the addition of two new licences - Frozen 2 and Spiderman.

Thorntons will also be adding two new products to its range. Sitting alongside its bunny Easter egg designs, the new Dinosaur and Unicorn eggs (151g) will feature fun and eye-catching designs to bring the popular creatures to life.

In adult eggs, Thorntons will also be revamping the design of three of its smaller Easter eggs, featuring an updated packaging design that reflects Thorntons’ established heritage in premium chocolate craftsmanship. A new Mint egg (197g) will now sit alongside the returning Classic (207g) and Toffee, Fudge & Caramel (203g) eggs.

Thorntons is also expanding its range of premium gift eggs, perfect for shoppers to give as a treat to someone special. With an improved luxury look and feel to boost appeal in store, the

Ferrero Ferrero is launching new seasonal lines to complement its strong core range. “We expect to see shoppers planning in advance and being more considered in their purchasing decisions for Mother’s Day and Easter,” explains Levi Boorer, Customer Development Director at Ferrero. “We would, therefore, encourage retailers to stock up early to make sure they meet the demand for those shoppers looking to purchase in advance.”

Eggs remain a firm nostalgic favourite. “This year we’ll be bolstering our eggs range with an array of products to appeal to shoppers throughout the Easter period,” Boorer continues.

When it comes to kids’ eggs, the Kinder range will be strengthened with the launch of two new Kinder Surprise eggs that include bigger toys and relevant licenses. The new Kinder Surprise 100g will see Justice League and Trolls toys featured, while the The Kinder Maxi Surprise 150g egg sees the addition of two new licences - Frozen 2 and Spiderman.

existing Classic Premium Egg (264g) and Continental Premium Egg (256g) will be joined by a new Continental Dark Premium Egg (256g).

Ferrero will also introduce a new premium adult option with Thorntons new Dinosaur egg features fun and eye-catching designs to bring the popular creatures to life.

the Ferrero Collection Egg (240g). Featuring a milk chocolate shell, the egg is complimented with six Ferrero Collection chocolates (Ferrero Rocher, Ferrero Rondnoir and Raffaello).

The Ferrero Collection Egg has a milk chocolate shell and six Ferrero Collection chocolates (Ferrero Rocher, Ferrero Rondnoir and Raffaello).

The Kinder Joy Easter range will undergo a revamp in 2020, which will see 16 different toys launched in what will be the range’s largest selection.

The Kinder Joy Easter range will undergo a revamp in 2020, which will see 16 different toys launched in what will be the range’s largest selection. Kinder Joy is valued at €160k, up 18% vs Easter 2018, making it one of the top three selftreat brands in Ireland (Source: Nielsen IE Total Scantrack 12 weeks to Easter 2019 vs 12 weeks to Easter 2018), and the updated range will encourage early seasonal sales.

The Kinder novelties range will also expand with the launch of a new Kinder Chocolate Fluffy Leopard toy (73g), that joins the bunny and sheep novelties. Thorntons is also expanding its footprint in the self-treat impulse sector with the introduction of a Thorntons Bunny (29g) and Thorntons Chocolate Caramel Egg (36g).

“We’d always recommend that retailers focus on the core all-year range first and foremost, as shoppers trust and recognise the well-known brands for their quality,” Boorer continues, highlighting Ferrero’s boxed chocolate range.

It’s no surprise that shoppers spend more to show their affection towards loved ones in the lead-up to the spring occasions. 57% of early Easter season (the first 5 weeks) sales come from self treat and seasonal sharing in Ireland. (Source: [Nielsen IE Total Scantrack 12 weeks to Easter 2019 vs 12 weeks to Easter 2018).

Marks & Spencer The M&S Easter range is guaranteed to egg-cite. With eggs starting from only €1.50, loveable new characters including Seth the Sloth, and M&S’ iconic Percy and Colin taking centre-stage, there’s a chocolatey sweet treat for everyone.

Highlights include the brand-new Easter Sundae eggs – two milk chocolate eggs overflowing with yummy treats and finished with a chocolate “straw”. The Jumbo Chocolate Button from their Christmas collection has had an Easter makeover, topped with mini speckled eggs, and customer favourite, the

M&S’ Colin the Caterpillar Milk Chocolate Hollow Egg includes a whole bag of Colin the Caterpillar fruit gums!

Extremely Chocolatey Biscuit has been transformed into the new extra-thick Extremely Chocolatey Egg!

Available in-store from January 28, the full-size Easter Eggs are joined by a host of treat bags and minis, including new Bunny Tin filled with foiled milk chocolate farmyard characters, Fried Egg Chocolate Whips and limited-edition Percy Pig Meets the Easter Bunny sweets.

Jus de Vine wins off-licence award

Jus de Vine in Portmarnock, Co. Dublin, was named National OffLicence of the Year at the NOffLA Off-Licence of the Year Awards 2020, where NOffLA called on the next Government to prioritise Minimum Unit Pricing.

JUS de Vine in Portmarnock, Co. Dublin was named National Off-Licence of the Year 2020 at the annual Off-Licence of the Year Awards 2020, which took place at the Honorable Society of King’s Inns recently.

At the event, the National Off-Licence Association (NOffLA) called on all political parties to make a commitment to commence Minimum Unit Pricing as a matter of priority following the General Election.

Now in their 24th year, the Awards recognise and showcase excellence in the independent off-licence sector, which represents 315 specialist businesses throughout the country.

“The annual NOffLA Awards highlight the expertise of the independent off-licence sector, showcasing the benchmark of personal service in our industry, as well as the top-quality products offered by our highly trained, specialist members,” said NOffLA Chairman, Gary O’Donovan.

Minimum Unit Pricing NOffLA members have expressed concerns regarding the scale of deep discounting by supermarkets during the Christmas period, as well the delays in commencing Minimum Unit Pricing more than 14 months since the Public Health (Alcohol) Act became law.

“As socially conscious independent retailers, NOffLA welcomed the Public Health (Alcohol) Act in 2018. Despite the passage of more than a year, however, we have seen little action to address the critical issue of deep discounting by supermarkets,” O’Donovan noted. “Our members are concerned by the failure of this Government to commence Minimum Unit Pricing, and the serious health risk this poses to consumers.

“In light of this fact, we are calling on all political parties to make a clear commitment in their manifestos to immediately commence Minimum Unit Pricing and honour the spirit of the Public Health (Alcohol) Act by ending reckless alcohol retailing”.

The winners The awards, which included 37 finalists, saw Jus de Vine awarded National Off-Licence of the Year 2020; O’Donovans Off-Licence Group win Responsible Retailer of the Year 2020; and Derren Green of Molloys Liquor Store, Ballyfermot, win RTC Online Trainee of the Year 2020.

All 37 finalists were awarded certificates of either Merit or Excellence and a Customer Service Award based on their performance. Other awards on the night included: NOffLA Chairman Gary O’Donovan pictured (left) presenting Tommy Cullen, Paul McKenna and Julie Cullen from Jus de Vine, Portmarnock, with National Off-Licence of the Year 2020 Award.

• The NOffLA Best First Time Entrant 2020 – Carry Out OffLicence “The Reeks”, Killarney • The Peroni Food Retailer Off-Licence of the Year 2020 – Shiel’s Londis Off-Licence • The El Coto Customer Service Award of the Year 2020: Gibneys Off-Licence • The Redbreast Spirit Specialist of the Year 2020: Deveney’s of Dundrum • The Guinness Beer Specialist of the Year 2020: McHugh’s Malahide Road • The Dona Paula Wine Specialist of the Year 2020: Mitchell & Son CHQ • The Hennessy Munster Off-Licence of the Year 2020: Galvins Carry Out Carrigaline • The Drumshanbo Gunpowder Irish Gin Connacht/Ulster Off-Licence of the Year 2020: Dalys Drinks, Boyle, Co. Roscommon • The Vina Los Boldos & Finca Flichman Leinster OffLicence of the Year 2020: The Wine Centre, Kilkenny • The Bombay Sapphire Dublin Off-Licence of the Year 2020: James Redmond & Sons • The NOffLA RTC Online Trainee of the Year 2020: Derren Green, Molloys Liquor Store Ballyfermot • The NOffLA Responsible Retailer of the Year 2020: O’Donovans Off-Licence Group • The NOffLA National Off-Licence of the Year 2020: Jus de Vine

Taking a bite of the foodservice market

THE Irish foodservice market continues to grow, with Bord Bia revealing that Irish consumers spent €8.55 billion on out-of-home food & beverage in 2019, up 4.5% on the previous year; €6.32 billion was spent in the Republic of Ireland and €2.23 billion in Northern Ireland.

The Bord Bia Irish Foodservice Insights Report shows that everyday foodservice occasions continue to drive growth and are less likely to be affected by changes to consumer sentiment. Foodservice is closely tied to economic growth and tourism. Industry executives commented how the past several years has seen growth unlike any other time in

Irish consumers spent €8.55 billion on foodservice in 2019, with that figure set to rise again this year, according to the latest Bord Bia report.

recent past, and 2019 growth has been “good”, but not as robust as in previous years. Industry observers note that there are some cautionary tones starting to appear as we head into 2020. Many of these relate to Brexit -the uncertainty around sourcing and the impact on tourism, and some of the impact is already being felt on the numbers, as visitors both from the UK and other parts of the world are starting to taper off (and spend fewer nights in the country). The restoration of the special 9% Hospitality VAT back to 13.5% in ROI has also created an additional challenge to an industry that is striving to remain competitive.

The report also states that the industry should expect some maturity and deceleration over the next three years through to 2022, with overall island of Ireland growth forecasted to be 4.2% per year (4.5% in the Republic of Ireland and 3.4% in Northern Ireland).

It is important for food and beverage suppliers to the industry to stay close to the needs of today’s consumers and think about how their product can be part of a final solution that meets those needs. Bord Bia’s 2019 report includes detailed feedback from a range of individuals that shared first

solutions away from the home. These ‘context-driven’ functional foodservice occasions appear resilient to changes in consumer confidence, as consumers display fixed behaviours and rely on foodservice for the fulfilment of basic daily needs.

hand insights into what is important to them when eating out and where they feel the industry could be doing better. Ireland’s foodservice industry is heavily oriented toward the commercial sectors; 91% of all consumer spending is found in venues such as quick service restaurants, hotels, coffee shops and cafés, full service restaurants and pubs. The non-commercial (or institutional sector) represents the other 9% and consists of business sectors such as business feeders, education and healthcare, among others.

There remains three tiers of success within foodservice. Overall, Dublin is seen as a market unto itself, with continued strong growth as employers and tourists flock to the city. Secondary urban markets also appear generally healthy, but perhaps not as robust, and these areas are still seeing positive growth in foodservice. Rural areas remain more challenged, and restaurants and pubs in outlying areas are not sharing in the same strong growth as other parts of the country.

Northern Ireland’s growth remains slower, but has seen strong urban performance (particularly in Belfast, which continues to see benefits from investment and tourism growth). 35% of consumer spend in the commercial channel is found in Limited Service Restaurants (LSRs), with 12% attributed to Full Service Restaurants (FSRs). Pubs account for

2. Consumers articulate a different decision-making process and value equation for pleasure-related occasions Consumers tend to be less price sensitive in pleasure-related occasions outside the routine of everyday life. In contexts like ‘date night’, carefree spending becomes a part of how consumers differentiate these experiences to take a break from ‘real life’. Consumers cite a tendency to stick to the same operators for indulgent occasions as they tend to be more reliable and pose less of a risk when it comes to ‘return on investment’.

17% of commercial foodservice spend (excluding alcohol). The fastest growing segment in the commercial space is Coffee Shops (up 5.9% in ROI and 5.3% in Northern Ireland). While overall growth is still relatively strong, these figures show a deceleration compared to growth rates from previous years.

Macro Consumer Findings 1. Lifestyle-based needs drive a growing consumer reliance on functional foodservice occasions In consumer bulletin boards and ethnographies alike, consumers demonstrated how the logistics of everyday life can determine and undermine meal planning, resulting in an increased need for reliable, convenient meal 3. Consumers are accustomed to using technology to discover foodservice options and place orders online and inside the restaurant Consumers are amenable to the idea of more technology in the front of the house and back of house as long as it doesn’t detract from the experience. At the same time, whether at the office canteen, fine dining or a sandwich bar, consumers note that positive human

14 14

interaction provides value as part of dining out.

4. Customer service is a differentiator Service was cited again and again as a differentiating factor. Instances where consumers were most loyal were service-driven operators, where hospitality included reciprocity and respect. Achieving a human connection with the customer can lead to greater loyalty than any item can generate.

5. Little effort to prepare for uncertain times ahead While Brexit was top of mind for all consumers contacted for the Bord Bia report, few were actively making preparations on how it would affect their daily lives, citing a three-year build up with little action. The sentiment among some consumers is that a recession may be coming, but that it was unlikely to be as extreme as the last and they felt unlikely to impact their lifestyle. Others accepted that saving up for a downturn would be the responsible thing to do, but the realities and expenses of daily life make it difficult to act with this type of intentionality.

Unmet Consumer Needs So what more can the foodservice sector do to meet consumer needs?

Foodservice Product Trends

1. Margin pressure remains a challenge for operators of all types Food costs tend to make up about one third of the cost of a menu item, and while the costs continue to see increases, particularly items sourced from outside Ireland, other costs such as labour and rent are rising faster than the operators’ ability to raise prices. Coupled with the ROI VAT increase at the beginning of 2018, operator profitability continues to be under pressure.

2. Vegan/vegetarian options growing in importance Operators of all types continue to see the need for offering vegan options. While many acknowledge that strict veganism still only accounts for a small percentage of consumers, it is important to cater to those consumers looking for wider choices when eating out.

3. Beverages remain a driver for growth Beverages, especially hot beverages, remain a solid strategy for growth, and operators continue to invest in high quality coffee and tea programmes.

4. Alternatives to sourcing from UK being sought Uncertainty remains regarding Brexit and our future trading relationship with the UK, but operators and distributors both acknowledge that they’ve been actively working to identify alternatives to sourcing products from the UK, including Irish, European and even North American goods

5. Chilled foods remain on trend The continued demand toward fresh by consumers has meant that chilled items continue to exceed overall industry growth, and chilled items now represent 59% of total purchases made. Frozen space remains limited back-of-house and operators have switched over to chilled wherever possible. Grocery/ambient products are growing slower than average.

1. Healthy options for all ages Respondents across all life stages indicated an increased awareness and desire to eat healthier foods. For some, this amounts to following a restrictive diet that excludes certain ingredients or calorie thresholds. For others, health relates to good tasting, correctly portioned kids’ meals that are easily consumed. There are also those that think of health in terms of moderation. These consumers want their food to be fresh, and while they will indulge in the occasional fried food or routine treat (e.g. specialty coffee), the norm is to find betterfor-you options for day-to-day occasions. While there are concepts in the marketplace that satisfy this need, the availability of ‘good tasting’ and ‘good for you’ options at an everyday affordable price remains a consumer pain point.

2.

3. Customisation Consumers cite a desire for increased customisation in their foodservice options. The ability to prepare a meal the way they want it represents a level of control that consumers associate with at-home meals, and remains a white-space for foodservice offerings.

a desire to explore global flavours, including newer, more ethnically authentic cuisines, as well as flavours that have been largely normalised to the Irish consumer palette. 4. Perceived goodwill from operators Consumers expressed a desire to visit operators that they feel good about. This good feeling can be the result of elevated hospitality, transparent practices or mutual respect; the most common response to why consumers are brand loyal was ‘because of the service’. 5. Reliable and competitive delivery services While first and third party home delivery services have grown rapidly in popularity and reach, delivery remains a challenge for many who cite issues related to address, pricing and wait times. Despite these challenges, consumers tend to use third party websites as a tool for brand discovery, exploring options in the area before ordering first party for take-away. This highlights the importance for operators to develop a presence on third party platforms. Food-to-Go The Food-to-Go segment includes convenience stores, supermarkets, and petrol stations with forecourt convenience stores. Traditionally, the food offer in this channel have been prepackaged, but the focus over the past several years is to bring a renewed focus on freshly prepared items. • Forecourt convenience continues to position itself as a destination for both breakfast and lunch occasions. • Motorways are a big focus area for key players. • Supermarket prepared foods are still a small part of this segment, but continue to grow at above average rates. • Coffee and other beverages are a huge driver for “grab-n-go” and represent a large share of overall visits. • High levels of competition are reported in most markets, with saturation in city centres and many players looking for new avenues for growth. Coffee remains an extremely popular and growth-oriented beverage. Some operators have been experimenting with delivery services such as Deliveroo. Sustainability initiatives are front and centre as single-use disposables, especially coffee cups, fall out of favour. Planning for the future The Irish foodservice industry has been growing at robust levels for several years, but warning signs are on the horizon and industry participants should be examining options and alternative strategic plans in the event of a possible slowdown. The following are imperatives for companies involved in the foodservice industry: 1. Keep the consumer front and centre The consumer is the ultimate driver for the foodservice industry; as conditions evolve in Ireland, there may be some shifts in how consumers utilise foodservice. The focus in the food-to-go sector over the past several years is to bring a renewed focus on freshly prepared items.

2.

3.

4.

5. Broadly, occasions can be separated into “entertainment” and “convenience” driven usage, and while convenience will always drive large parts of foodservice, it is the “entertainment” portion that is more discretionary and may be more at risk.

Contingency planning is key While our future trading relationship with the UK is still an unresolved issue, many companies have created contingency plans for alternative sourcing and cost control. More broadly, having an understanding of cost drivers and strategic alternatives should be a priority for all companies involved in the industry.

Identify solutions for the labour crisis Every segment in foodservice is facing labour issues; shortages in qualified help, up to and including culinary and management personnel. New technologies exist and value-added products in the back-of-house that help operators create ‘speed scratch’ menu items are becoming more critical.

Keep an eye out for major disruptors Delivery remains one of the fastestgrowing service areas, and third party service providers are often seen as disruptive to the current situation. At the same time, the consumer is the ultimate driver and this disruption will continue to grow in importance. Companies must address disruptors and ensure that their strategies adapt to the industry as it evolves.

Don’t become complacent Years of growth have made growth seem inevitable, but becoming complacent and not investing in innovation/ differentiation comes at a price.

ONLINE copies of the 2019 Irish Foodservice Market Insights Report, the 2019 Irish Foodservice Directory and speaker presentations from the annual Bord Bia foodservice seminar are available to download at www.bordbia.ie/foodservice2019

1 T OUGH DECISION. FLAVOURS. 2 NEW

BLUEBERRY MIXED BERRIES

UPGRADE TO COMPACT.

MORE FLAVOURS MORE CHOICE

NEW

NEW

BLUEBERRY 6/12 mg

MIXED BERRIES 6/12 mg

CHAI 6/12 mg

MENTHOL MELON STRAWBERRY 6/12 mg 6/12 mg 6/12 mg

BERRY MINT TOBACCO RED CHERRY TOASTED TOBACCO 6/12/18 mg 6/12/18 mg 12/18 mg 12/18 mg

ALL YOUR CUSTOMERS’ FAVOURITE FLAVOURS NOW AVAILABLE IN COMPACT. ALL YOUR CUSTOMERS’ FAVOURITE FLAVOURS NOW AVAILABLE IN COMPACT.

logicvapes_ie