LPS (Valuation) assess the Net Annual Values (NAV), produce and maintain the Valuation List.

Department of Finance (DoF) responsible for policy, rate reliefs and Regional Rate poundage.

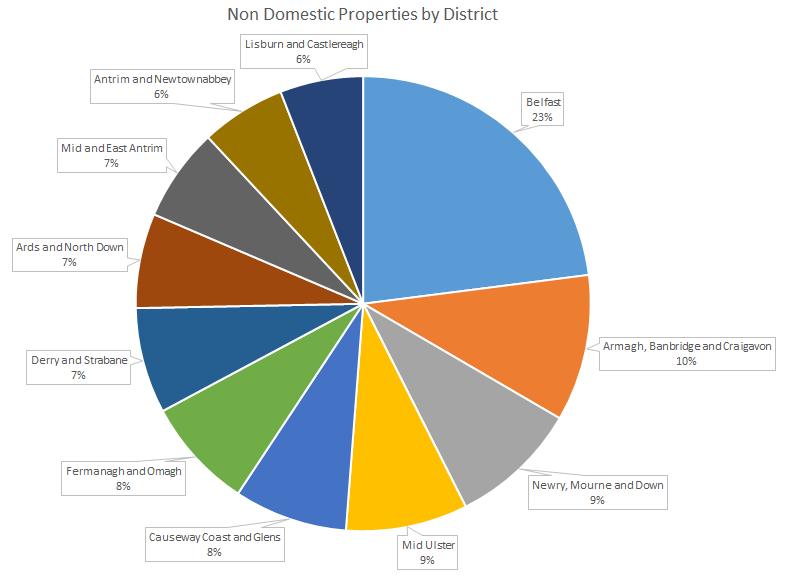

11 District Councils set their own Non Domestic District Rate poundage.

LPS (Revenues & Benefits) calculate rate bills using the NAV and rate poundages, apply reliefs, collect rates and then redistribute monies.

Rating – is “ad valorem”

The basis of value for non domestic property is the rental value at the statutory valuation date.

The occupier is liable

Or persons entitled to occupation (if vacant)

Businesses have called for regular revaluations

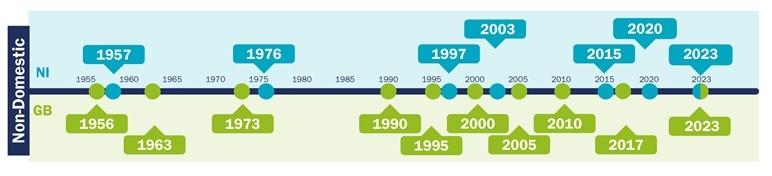

Reval 2023 puts us on a 3 year revaluation cycle

Regular revaluations are essential to maintain fairness & equality between ratepayers

A revaluation does not increase or decrease the total NI Rates revenue.

Revaluations are about redistributing the rate burden , by rebalancing business rates.

Revaluations ensures business rates stay up-to date and reflect local economic change.

Revaluations reflect relative changes between properties that occur over time

1 October 2021: Statutory valuation date. The valuations represent an estimated rental value of the property at this date.

1 January 2023: LPS published a draft schedule of values online where businesses can check their valuation and compare it with similar property types. There is an opportunity to request and informal review.

1 April 2023: The new Non Domestic Valuation List comes into force.

District

Antrim and Newtownabbey

£131,982,787 £129,603,974 -£2,378,813 -1.8%

Ards and North Down £101,357,194 £100,279,635 -£1,077,559 -1.1%

Armagh City, Banbridge and Craigavon £147,180,015 £143,443,542 -£3,736,473 -2.5%

Belfast £524,832,608 £524,927,591 £94,983 0.0%

Causeway Coast and Glens £96,891,400 £99,970,075 £3,078,675 3.2%

Derry City and Strabane £129,027,906 £125,772,352 -£3,255,554 -2.5%

Fermanagh and Omagh £103,642,323 £102,018,816 -£1,623,507 -1.6%

Lisburn and Castlereagh £131,190,972 £133,966,370 £2,775,398 2.1%

Mid and East Antrim £100,242,542 £98,385,598 -£1,856,944 -1.9%

Mid Ulster £105,732,676 £109,761,859 £4,029,183 3.8%

Newry, Mourne and Down £120,936,189 £114,671,056 -£6,265,133 -5.2%

Northern Ireland £1,693,016,612 £1,682,800,868 -£10,215,744 -0.6%

Total NAV Change per district between lists (6 Dec)

Count H Total NAV 2023 List Change in Total NAV % change NAV Antrim and Newtownabbey 4,486 £129,524,024 -£2,976,903 -0.02 Ards and North Down 5,043 £100,416,640 -£985,022 -0.01

District

Armagh 7,765 £142,741,722 -£4,301,783 -0.03 Belfast 16,909 £522,238,926 -£1,964,502 0.00 Causeway Coast and Glens 6,077 £99,481,075 £2,565,175 0.03 Derry City and Strabane 5,621 £125,809,752 -£3,269,204 -0.03 Fermanagh and Omagh 5,927 £101,931,896 -£1,869,957 -0.02 Lisburn and Castlereagh 4,438 £133,813,580 £2,624,498 0.02 Mid and East Antrim 4,938 £98,795,547 -£1,921,205 -0.02 Mid Ulster 6,530 £108,490,312 £2,001,466 0.02 Newry, Mourne and Down 6,865 £114,723,656 -£6,012,083 -0.05 Northern Ireland 74,599 £1,677,967,130 -£16,109,520 -0.01

DISTRICT

Retail

Count 8th List Total NAV 9th List Total NAV Diff Multiplier

Antrim and Newtownabbey 1,022 £29,169,540 £28,516,440 -£653,100 0.98

Ards and North Down 1,521 £28,905,520 £28,807,230 -£98,290 1.00

Armagh City, Banbridge and Craigavon 2,116 £40,190,050 £38,244,575 -£1,945,475 0.95 Belfast 4,375 £103,771,750 £95,126,795 -£8,644,955 0.92

Causeway Coast and Glens 1,498 £20,577,280 £20,609,370 £32,090 1.00

Derry City and Strabane 1,451 £29,658,765 £27,604,597 -£2,054,168 0.93

Fermanagh and Omagh 1,233 £21,618,790 £19,788,180 -£1,830,610 0.92

Lisburn and Castlereagh 1,044 £31,936,360 £31,394,920 -£541,440 0.98

Mid and East Antrim 1,398 £21,422,340 £20,969,840 -£452,500 0.98

Mid Ulster 1,428 £19,212,250 £18,635,330 -£576,920 0.97

Newry, Mourne and Down 1,856 £30,297,990 £28,646,800 -£1,651,190 0.95

Grand Total 18,942 £376,760,635 £358,344,077 -£18,416,558 0.95

• 3 districts – more than 90% of retail will see NC or a decrease

• Some neighbourhood shops will see increases – circa 10%

• NI wide 86.5% of retail will see NC or decrease

• Belfast 84% no change or decrease

• Derry & Strabane 93% no change or decrease

• Shopping centres in general are down

75% of non domestic properties are entitled to some form of rates relief.

This amounts to £243 million of relief

Reliefs include small business rates relief (29,511)