OF USERS OF PAID SVOD SERVICES IN THE CZECH REPUBLIC DO NOT PAY FOR THEM AND USE SHARED ACCOUNTS, ACCORDING TO DATA FROM THE ATMEDIA INDEX.

THE MOST POPULAR PLATFORMS IN THE CZECH MARKET ARE NETFLIX, VOYO, MAX, DISNEY+ AND PRIMA+. 2.8

MILLION CZECHS AGED 15-69 WATCH SVOD SERVICES SEVERAL TIMES A MONTH.

Two thirds of Czech Republic users pay for SVOD accesses directly to the service provider, while a 12% are paid for through one of the pay-TV operators that offer pay video services to their customers alongside dozens of TV stations.

RedBird IMI completed the acquisition of All3Media, the production and distribution company previously coowned by Warner Bros. Discovery and Liberty Global. The transaction, valued at £1.15 billion, marks RedBird IMI’s largest deal to date and has received regulatory approval from the United States, United Kingdom, and Germany. Jeff Zucker, CEO of RedBird IMI, became chairman of All3Media’s board. Jane Turton, CEO of All3Media, and COO Sara Geater, will continue to lead the company. •

United Media appointed Olga Slisarenko as Head of Reality and Entertainment Format Development. Slisarenko is an accomplished media professional with extensive experience in production and format development. From 2016 to 2023, she led the Entertainment Programs and Format Department at 1+1 Media in Kyiv, where she managed highprofile shows like “The Voice” and “Dancing with the Stars”. •

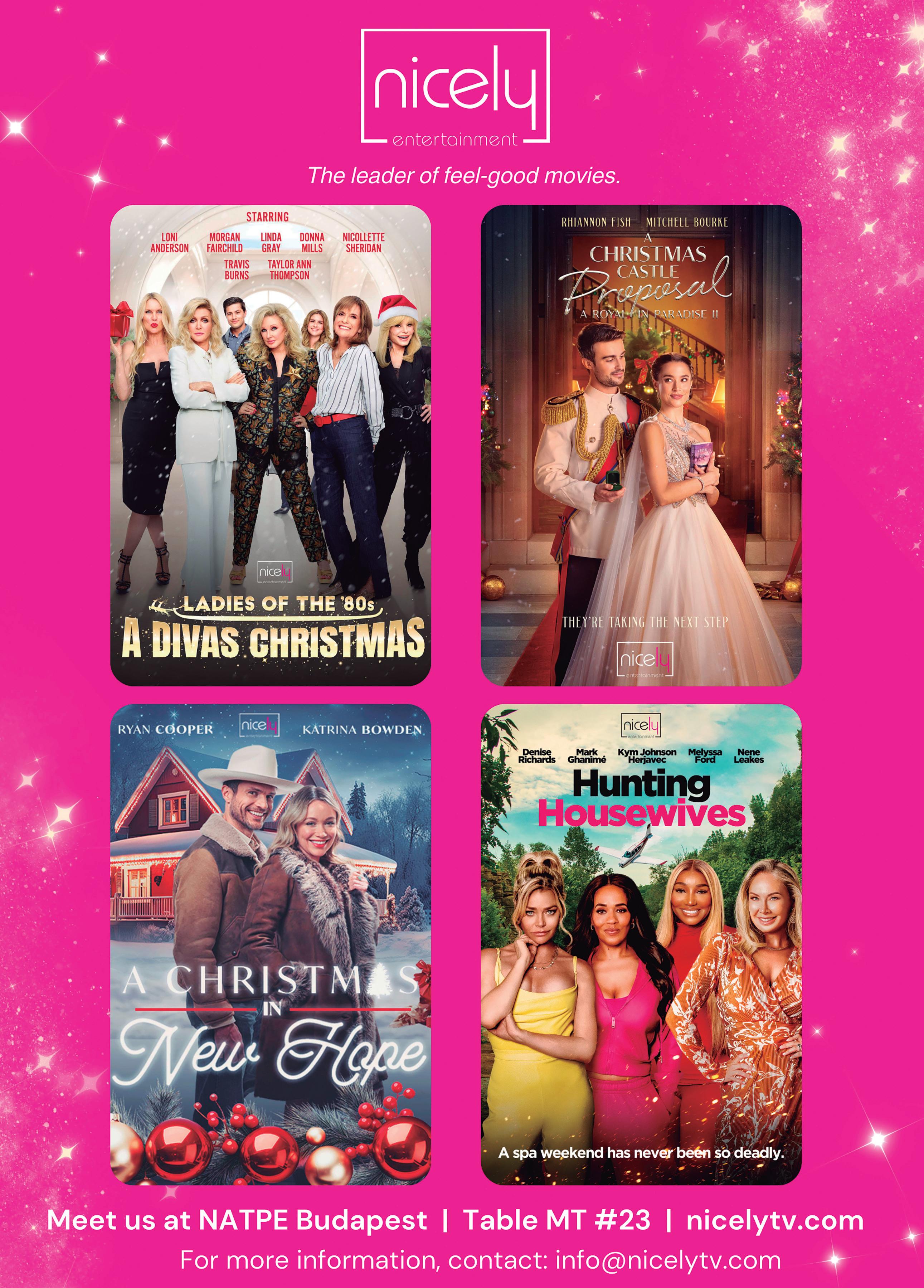

Spain’s Onza Distribution has sold several titles in key territories of Central and Eastern Europe. Onza’s telenovelas, “Forever” and “Unlimited love,” will travel to Serbia for the first time, and “Oro Verde” will renew its presence in Serbia. Additionally, “Cacao” will premiere in Lithuania. On the other hand, the dramas “Motel Valkirias,” “Parot,” “Little coincidences,” and “Flowers over the Inferno” will soon be seen in Romania. Onza’s “Cacao” has already been acquired in Spain, CIS territories, and the Balkans. Finally, “Forever,” “Payback,” and “Unlimited Love” were licensed to the Balkans, Latin America, and the United States. •

Turkey’s Calinos Entertainment has recently closed several deals. A package of series was sold to Bulgaria, including the popular Turkish adaptation of the “Cleaning Lady”, “Farah”, produced by O3 Medya, as well as Pastel Film’s “Ego”, the Canadian Award-winning crime drama “Alert Squad” by Pixcom and Telecom Serbia’s hit title the “The Clan”. “Ego” has also been licensed to the CIS region. In addition, Calinos Entertainment has inked sales in Africa for “In Love Again”, as well as a scripted format deal for “Second Chance” in Kenya. •

Mipcom 2024 will host Spain as the “Country of Honour” at the forthcoming 40 th edition of the International Co-Production & Entertainment Content Market in Cannes. The event will offfer a program highlighting the country’s significant growth in recent years as a major international production hub and provider of quality content to global audiences. The recognition comes with Spain seeing a marked rise in scripted and non-scripted productions in recent years by both domestic and global producers, and with Spanish content not only consistently ranking amongst the highest viewed worldwide but gaining wider recognition and awards internationally. •

Fremantle appointed Mark Reynolds as the new Global Head of Documentaries, reporting to Andrea Scrosati, Group COO and CEO Continental Europe. Reynolds joined the company as Interim Global Head of Documentaries in January 2024, in which time he has set the positioning strategy for our Global Documentaries unit. In his role Mark will continue to support the growth of the Fremantle Global Documentaries business, driving collaboration across production companies and labels around the world. Prior to his role at Fremantle, Reynolds was a consultant advising producers and platforms on programming, co-production and distribution strategies. •

Turkey’s distribution company Inter Medya closed new sales in Hungary, Romania, Albania, Slovakia and Macedonia for its series catalog. The company has licensed the series “Tuzak”, starring Akın Akınözü and Bensu Soral, to Hungary; and has also licensed both “Tuzak” and “Mrs. Fazilet and her Daughters” to Romania. Moreover, in recent additional deals, Inter Medya has licensed “Poison Ivy” and “Bitter Lands” to Albania, “Mrs. Fazilet and her Daughters” to Slovakia; and finally, it has sold “Tuzak” and “Destiny” to Macedonia. •

THE REGION FACES NEW BUSINESS TRENDS AND CONSUMER SHIFTS, WHERE THE LINEAR TV BUSINESS STILL HAS A PREDOMINANT ROLE AND SVOD SUBSCRIPTIONS TAKING A STRATEGIC ROLE.

Recent data from Omdia reveals that approximately 25% of all paid SVOD subscriptions in Central and Eastern Europe (CEE) now originate from pay TV and telco bundles. This shift highlights the growing importance of strategic partnerships in the region's streaming landscape. According to Omdia, indirect net additions, those through partnerships rather than direct-to-consumer channels, will dominate SVOD

PAID SUBSCRIPTIONS MARKET SHARE IN THE CEE REGION

SVOD SUBSCRIPTIONS IN THE CEE REGION BY 2029

net additions in the CEE region from now until 2028. By that time, indirect subscribers through partnerships are projected to constitute 29% of the total SVOD subscription base. Omdia's analysis includes data from Russia, where some SVOD services were withdrawn following the invasion of Ukraine in 2022. This period saw a peak in subscriber additions during the COVID-19 pandemic, followed by some market volatility and subscriber churn. Partnership deals implemented in 2022, such as HBO Max with Vodafone Hungary, Viaplay with Canal+ Polska, and Disney+ with Netia, have significantly influenced the market dynamics. The increasing significance of bundling in the CEE region makes indirect subscriptions more prominent to the total than in North America, although still trailing behind Latin

America, where bundling is crucial for SVOD. Eastern Europe will have 68 million SVOD subscriptions by 2029, up by 27 million on 2023, according to Digital TV Research’s latest report, which also notes that Russia will generate 12 million of the additional subscriptions, with Poland bringing in an extra 6 million. Digital TV highlights that the top platform by subscribers for the region will not be US-based, as it will be Kinopoisk, which is only available in Russia. Moreover, according to the report, Russia will account for 53% of the 2029 total SVOD subscriptions.

Still in the digital side of the video business, the CEE market is on track to reach US$ 42 million in FAST revenues by 2028, according to new research from Omdia. The CEE region joins a buoyant market currently dominated by the United States, with rapid expansion from the UK, Canada, and Australia expected over the next four years. Regarding players, Rakuten and Plex are the only FAST platforms available in CEE. A few local providers exist, such as Kabaret TV in Poland, but overall, the FAST market is nascent in the Central and Eastern European region. Due to CEE’s market size, the international FAST channel operators have not launched their channels in the region. ITV Studios cited cost of dubbing as the reason for not yet launching FAST in Italy or Spain, meaning CEE markets with multiple languages will lag even further behind.

Source: Omdia

Source: Ampere Analysis

The linear TV business still has a predominant role in the CEE region, as an essential component of the media distribution mix, generating more revenue for most content owners than ad-funded streaming, a key pillar of content brands alongside co-branded FAST channels and streaming services. According from data from Intelsat, these market dynamics are seen mainly in Central and Eastern Europe, where expanding economies and a still-growing number of TV households create opportunities for channel owners to reach new audiences and tap additional revenues. As pay TV operators and telcos in CEE shift to a super-aggregation model, offering popular linear TV channels is a crucial point of differentiation as they compete with standalone streaming competitors and smart TV devices. Channel owners have multiple technology choices for delivering their channels to operators, with satellite maximizing reach across pay TV platforms, fiber enabling robust delivery of localized channel versions, and internet feeds enabling rapid coverage of hard-to-reach operators. Operators have varying preferences for which delivery mechanism they prefer to use to receive channel feeds, with trade-offs between upfront cost, signal quality, operational complexity, security, and time-to-market. Channel owners can maximize the number of TV households they reach by adopting a hybrid distribution strategy, using each distribution mode flexibly to respond to the needs of each market and every individual satellite DTH, cable, and IPTV operator. This is enabled most efficiently and effectively by working with a distribution service provider that can support satellite, fiber, and internet models and demonstrate experience working with pay TV affiliates in multiple markets.

Within the CEE region, there are 30 million pay-TV households receiving satellite DTH, cable, and IPTV

Source: Ampere Analysis

services across the seven key markets (Bulgaria, Czech Republic, Hungary, Moldova, Poland, Romania, and Slovakia). The region has some of the highest average pay TV penetration in the world, according to data from Ampere Analysis. These are fast-growing economies, with per-capita GDP seeing a compound annual growth rate of 7% and 9% in most markets from 2017 to 2022, compared with less than 2% in many mature Western European countries. Further, six million pay TV customers can be found in Albania, Bosnia, Croatia, Montenegro, North Macedonia, Serbia, and Slovenia.

This combination of TV household growth and economic expansion provides a vast potential market for channel owners to reach a growing consumer base. This is attractive to advertisers, and households are increasingly willing to pay for premium content through TV channels and video-on-demand. While the number of pay TV households in Western Europe remains static, CEE markets have seen 1.9% compound annual growth in the number of homes receiving pay

TV services between 2017 and 2022. By 2027, Ampere Analysis forecast a gwoth of the 0.6%, with 30.8 million pay-TV households, with millions more receiving OTT TV services. The market is a vibrant mix of independently owned operators, with expanding regional groups like A1 Group, Canal+, Deutsche Telekom, Orange, Telekom Srbija, United Group, and Vodafone.

The number of digital pay TV subscribers in the CEE are expected to rise by 9 million by 2029, according to a research by Digital TV Research. However, the number of pay TV subscribers will decline by 8 million from 81 million in the peak year of 2018 to 74 million in 2029. However, 2018 included 17 million analog cable subscribers, which will drop to zero by 2027. Pay TV subscriber numbers will fall in 20 of the 22 countries analyzed by Digital TV Research from 2023 to 2029, with the total down by 2.4 million. There will be 4.6 million fewer analog cable subs. Pay satellite TV will fall by 2.6 million. However, IPTV will gain 2.8 million and digital cable 1.9 million. Russia will account for nearly half of the region’s pay TV subscribers in 2029, despite losing 2.6 million pay TV subscribers between 2023 and 2029.

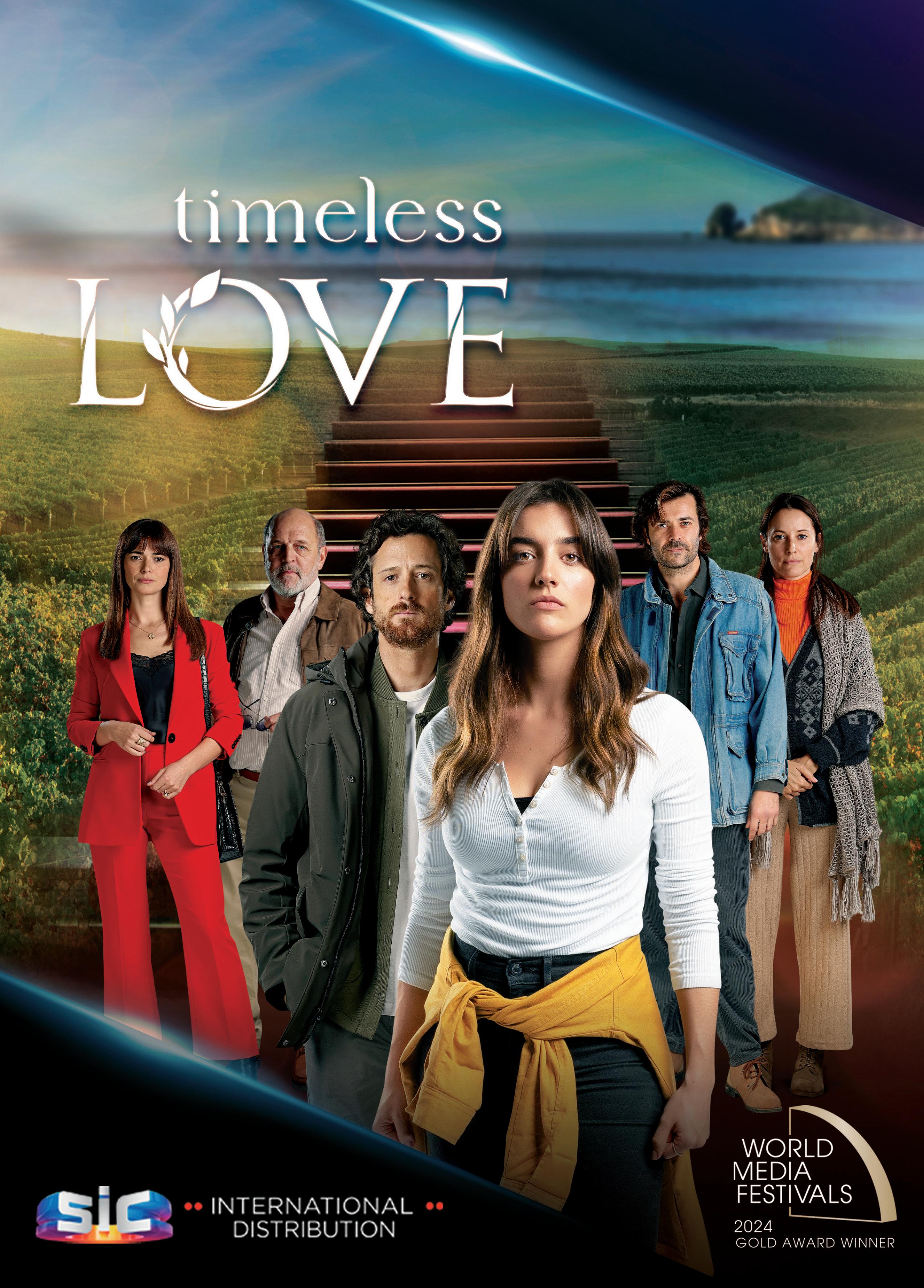

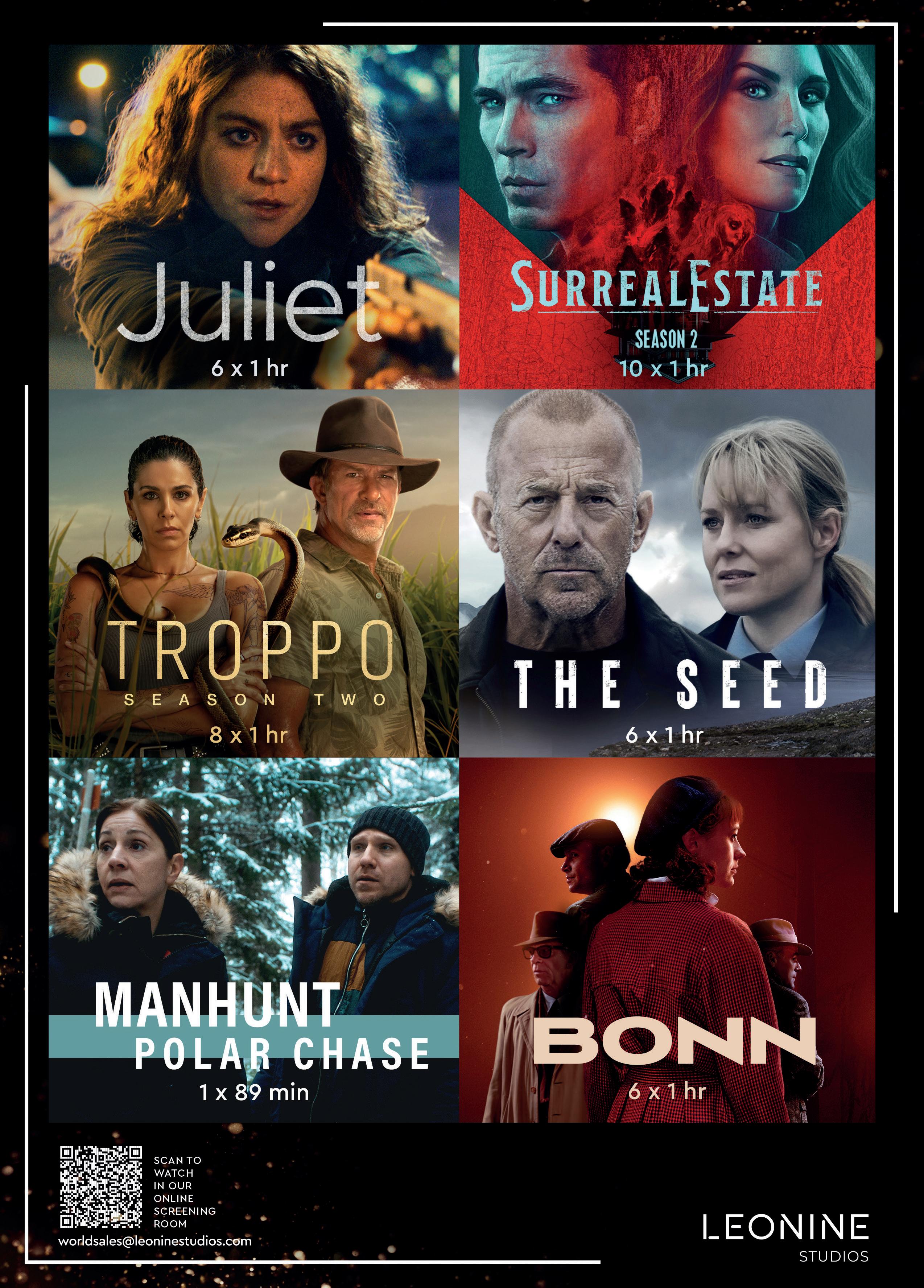

By Diego AlfagemezEXECUTIVES FROM A+E NETWORKS, INSIGHT TV, LEONINE STUDIOS, ATRESMEDIA, AND SIC DISCUSS THE RECENT CHANGES IN THE DISTRIBUTION INDUSTRY AND HIGHLIGHT THE MOST APPEALING BUSINESS MODELS.

Content sales have always been a crucial part of the media industry. In the past years, how content is commercialized has evolved as the audiovisual sector adopts new paradigms. Executives from A+E Networks, Insight TV, Leonine Studios, Atresmedia, and SIC discussed with Señal News the recent changes in content sales, what makes a show more successful, and what formats look appealing today.

MANAGER, INTL CONTENT DISTRIBUTION, A+E NETWORKS

SENIOR DIRECTOR OF INTL CONTENT SALES, EMEA, A+E NETWORKS

"There is a growing trend among buyers to integrate multi-platform strategies, combining linear TV, OTT, and digital platforms to maximize content reach and monetization. As a content provider, we must stay nimble to their needs. There isn't one single secret formula; however, at the heart, we focus on storytelling and compelling narratives. Formats that include localized reality, adapted to reflect local cultures and languages, are always relevant. The increasingly successful formats are the ones that combine global appeal with local relevance, making them more relatable and engaging for regional audiences."

GLOBAL VP OF CONTENT DISTRIBUTION AT INSIGHT TV

"There has been a noticeable decline in pre-buys, where buyers commit to content before completion. Instead, there is an upswing in first-window sales, where completed content is purchased for its initial release. This shift reflects buyers' need for greater certainty and confidence in the content's quality and timely delivery. This trend underscores the importance of uniqueness and reliability in content offerings. The relevance of content formats is continually shifting as audience preferences evolve. There is a growing interest in unscripted formats, especially those that offer unique, authentic experiences or deep dives into specific cultures and lifestyles. In factual content, a combination of appealing talent, engaging content types, and compelling locations can make a production

more attractive to buyers. While there may not be a one-sizefits-all secret formula, productions that innovate and provide a rich, engaging viewer experience tend to perform better in the market."

DIRECTOR INTERNATIONAL SALES, LEONINE STUDIOS

"Content sales has become more targeted, with buyers focusing on what they need and can afford without taking any risks or facing uncertainties. They're prioritizing content that fills a specific gap in their schedules. An emerging focus is on retaining and growing the young adult audience, seen as the core future viewer demographic. Additionally, there's a strong demand for local content, which is now capable of matching prime-time drama in quality. The latest trend across the industry points to lighter procedural crime series gaining traction. The content must resonate with the buyer's target audience.

A recognizable cast is often crucial; local talent can be as vital as established U.S./UK actors known for their roles in popular series and films. Additionally, a production helmed by directors, showrunners, and writers with strong track records assures buyers of its pedigree and potential for success."

SALES DIRECTOR FOR EUROPE, ATRESMEDIA

"A significant trend is the increasing diversity in series, both in genre and target audience. That means the series is developed to focus on various segments, especially young and female audiences, offering a great variety and diversity capable of attracting all types of viewers. There is also a general trend towards mini-series, which are more appealing to today's viewers, but regarding popular genres, true crimes and procedurals have proven to be successful. However, dramas, dramedies, universal comedies, and rom-coms are also in demand. Above all, creating series with universal and relevant stories that can travel internationally is crucial. Finally, the most remarkable growing trend we have identified is the featuring of female protagonists in leading roles, which has been well-received by audiences."

CARLOTA VIEIRA

CONTENT SALES DEPUTY DIRECTOR AT SIC

CARLOTA VIEIRA

CONTENT SALES DEPUTY DIRECTOR AT SIC

"Content sales keep on growing, thus following the audience consumption trend. High-quality production standards, combined with a solid narrative and a premise that allows the audience to connect with the story immediately, are key to success. Love keeps drawing much attention from buyers, although crime still plays the leading role. On the other hand, genres such as sci-fi and fantasy are taking a back seat. Also, series with more episodes are becoming increasingly popular, and long-running dramas, such as the classic

telenovelas, keep on being a genre transversal to many territories, not only in linear but now also winning digital models. About targets, streamers are reconsidering age as they now feel they have more percentage of mature audiences."

A+E has strengthened its ties with Polsat in Poland through a factual partnership for major franchises. In the Czech Republic, A+E expanded its deal with TV Nova, adding more episodes of "Pawn Stars" and "Storage Wars" to Nova Action. Prima Zoom now features top-tier documentary series like "Colosseum" and "History's Greatest Heists with Pierce Brosnan," along with "Ancient Aliens." Partnerships in Romania, Hungary, and the Baltic region also grew, with "Secrets of Playboy" and "Secrets of Miss America" sold to Tet's channels in Latvia.

Insight TV secured multiple deals for "Paradise Kitchen: Bali." Tastemade picked up US rights, while WBD launched it on AFN in Southeast Asia, Taiwan, and Hong Kong; ABC International covered it across Asia; Disney+ in Portugal and North Africa; and Insight TV's FAST channel, Intravel, premiered it in the UK. Upcoming productions include "Roads Unknown: India," "Resilience: The Els Visser Story," and "The Ride Life with Sung Kang."

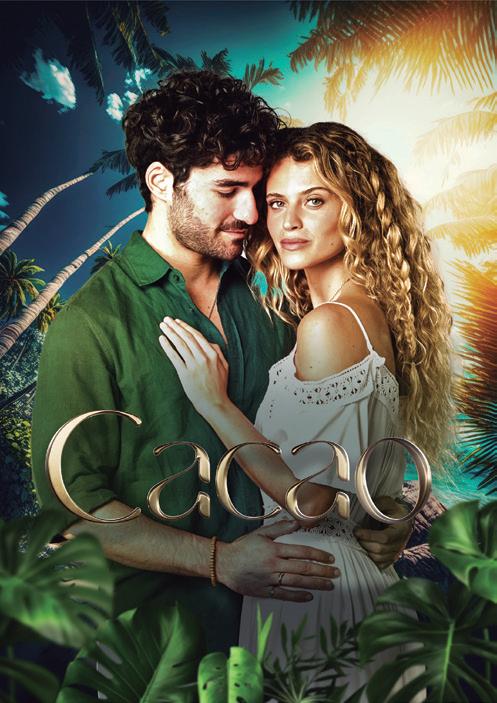

Leonine recently sold "Troppo" seasons 1 & 2 to Super Channel in Canada and season 2 to AMC in CEE and Freevee in the UK, Ireland, Germany, and Austria. "Name of the Rose" went to CosmosTV in Spain.

Atresmedia closed deals for "Heridas" and "Alba" in the CEE region and sold "Toy Boy" to Latvia. Negotiations are ongoing for "Sueños de Libertad."

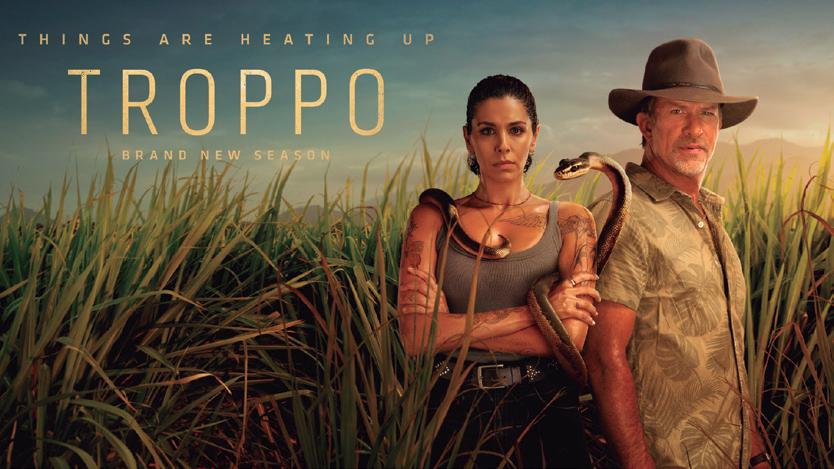

SIC sold "The List" to Prime Video and Multichoice, "The Good Girls Club" to Mongolia, Belgium, and Poland, and "The Delta Project" to CIS countries. "The Secret" debuted in French-speaking Africa, Canada, and Vietnam, while "Nazare" sold to Mozambique and Moldova. SIC also partnered with the Tribeca Film Festival for its inaugural event in Lisbon, featuring stars like Robert de Niro and Patty Jenkins.

By Federico Martínez

Turkish distributor OGM Universe returns to NATPE Budapest to showcase its diverse portfolio of Turkish content and strengthen its international presence. Señal News spoke with Ekin Koyuncu, Global Distribution & Partnership Director, to understand the company's growth strategy and long-term goals.

One of OGM's main titles is "Lost in Love," a story that follows Mete and Naz, who are bound together by a promise they made in their childhood. This promise stems from a tragic incident in which Naz's innocence is jeopardized, and his family unconditionally supports Mete. Koyuncu explained that the production and dubbing for the 77-episode series is complete, which sets the stage for the company to push it for sales worldwide heavily.

Moreover, Koyuncu shared details of "Dilemma," produced for Amazon Prime in Turkey, which has already been sold in Italy, France, Germany, Spain, Luxembourg, and the Middle East. "Amazon has the first option for Latin America and the United States, but we started to present the show to our free TV, pay TV, and other platforms in those territories," she explained. "Dilemma" features Neslihan Turhan, the TV show "One Truth" host. She touches people's lives, sheds light on the stories that remain in the dark and built her

“WE

AT OGM UNIVERSE, EXPLAINS THE TURKISH DISTRIBUTOR'S NEW HIGHLIGHTS AND EMPHASIZES THE VALUE OF FINDING THE RIGHT PARTNER FOR EACH TITLE.

career on the principles of justice. Her life is upturned by the death of Lal Kaleli, in which Can, her son, is implicated. Caught between motherhood and all the principles that she believes in, Neslihan faces the most challenging challenges. "We are proud of the product we have. It is a very different story to what we have in our library. It's a suspense crime series with eight strong episodes," Koyuncu added.

The executive also talked about "The Tailor," a series that will be available for pay TV and free TV clients in two years. Koyuncu explained that the company is designing a tailor-made windowing strategy for every title. "It depends on each deal. Some of our shows, like the Netflix titles, have already had a first window premiere. They were monetized on Netflix, so we have the pay TV and free TV windows. With 'Dilemma,' we have more flexibility. We aim to free TV and pay TV clients because it is a great show for the late prime time slot and also for the weekends. At the same time we will also prioritize the SVOD window," Koyuncu stated.

Koyuncu also shared that she has noticed more room from buyers to explore different genres, expanding their search from the classical drama series. "We had great feedback towards our short-running OTT series, and some clients are willing to open a new slot, late at night or during the weekend, for this kind of drama," she said.

However, she also noticed that not all series will work for all clients. "Every series has a buyer. You need to find the right screen for the right content. Not every content is for every channel, broadcaster, or platform, so we need to find the right window for each title."

According to Koyuncu, this new trend in content acquisition also opens a new opportunity for audiences to become more familiar with Turkish content. "American audiences are used to long-running dramas and expecting that type of show. So, this is new for them. However, since the stories are very different, the cast is very well known, and the production quality is very high, this could also lead them to get new audiences, maybe younger. I think it's a great introduction to Turkish talent and series to new generations and is a great opportunity for us and our clients."

By Diego Alfagemez and Federico Martinez

PARTNERSHIPS ARE OFFICIALLY MORE THAN A BUSINESS TREND; THEY AFFECT HOW CONTENT IS PRODUCED AND SOLD WORLDWIDE. EXECUTIVES FROM INTER MEDYA, FREMANTLE, PAPRIKA, ONZA, BANIJAY RIGHTS, AND GLOBO DESCRIBE THE VALUE OF ALLIANCES AND COLLABORATIONS.

In recent years, the number of partnerships in the content industry has increased due to the different benefits they bring for companies, including the opportunity to expand the content's reach and reduce production costs, among others. Executives from Inter Medya, Fremantle, Paprika, Banijay Rights, and Globo, all attending NATPE Budapest, spoke with Señal News about the impact of these partnerships in the industry.

CAN OKAN Founder and CEO of Inter Medya

CAN OKAN Founder and CEO of Inter Medya

For Can Okan, Founder and CEO of Inter Medya, partnering with companies from different regions offers added value: "By combining our strengths, we create content that resonates with diverse audiences and sets new standards in our industry." Looking for a new partner, Okan explained that the main focus is a common ground between companies: "Working with our partners towards a common goal, sharing the same ethical values, maintaining strong communication, building mutual trust, and, of course, enjoying the work we do together is incredibly important." Okan explained that their partners value Turkish content. "In the countries where we partnered with companies, Turkish content was already being broadcast and achieving great success. Our international production partners recognized Turkish content's success, were confident in its potential, and knew what they were offering, which led them to pursue Turkish co-productions."

Meanwhile, Anna Maslowska, Fremantle's Director of Distribution for Central and Eastern Europe, highlighted the value of international partnerships. "Partnerships

ANNA MASLOWSKA

Fremantle's Director of Distribution for Central and Eastern Europe

ANNA MASLOWSKA

Fremantle's Director of Distribution for Central and Eastern Europe

with other regions allow us to cater to our growing network of territories. These partnerships allow us to add international appeal to projects while catering to the interests of specific cultures, including the CEE region. Partnerships unlock new methods of producing content and help us identify new trends. Part of this involves sharing risks through finding partners with similar program needs. By working with partners with similar needs, we can get shows to market faster," Maslowska stated. She further explained that, when looking for a new partner, "we are platform agnostic, and work with all streamers: local, regional, and global, to cater to different audiences. For Fremantle, it's all about finding the right homes for the right shows and building long-term partnerships. We also partner with the best-in-class producers to bring our shows to life," Maslowska added.

ÁKOS ERDÖS

ÁKOS ERDÖS

Chief Executive Officer at Paprika Studios

For Ákos Erdős, Chief Executive Officer at Paprika Studios, partnerships can boost content's success. "Depending on the topic, you need creators with different backgrounds, and this is where a good partnership can give you an advantage. When selling your content, a partner with a network in regions or territories we don't know is definitely an accelerator." Erdős added that these partnerships can increase the content's profitability. "We can better utilize the available soft money opportunities in the respective countries and be eligible for EU funding for TV and film productions. The sales process is also much more straightforward with an international partner, who is usually more qualified and better prepared

to successfully sell content in their home country," he added. Paprika Studios is actively looking for international projects. "The more a project appeals to different target groups from different regions, the greater the chance of finding buyers and commissioners," Erdős said. While explaining how to look for new partners, the executive was clear: "Trust and passion. This business is about people, so the chemistry must be right for you to achieve your goals in a partnership," he said.

Gonzalo Sagardía, Founder and CEO of Onza, explained the added value of partnering with companies from different regions. "It helps to identify local trends and ensure that plots and dialogues incorporate local peculiarities. Some projects are clearly designed to be original, and it makes perfect sense for the production company to execute them that way. Others have a greater international potential and can operate in other models. Finding the right partner is 99% of the project's potential success. Perhaps every project has its ideal partner. For us, it is important to agree on the overall vision of the project and the way to tell the story. Producers have to be extremely flexible and anticipate market conditions."

GONZALO SAGARDÍA Founder and CEO of Onza

GONZALO SAGARDÍA Founder and CEO of Onza

Moreover, Claire Jago, EVP of Sales and Acquisitions, EMEA, at Banijay Rights, highlighted the importance of attending international markets to meet with potential partners. "Central and Eastern Europe is an important market for us, and we work hard to secure numerous formats and finished program sales across these territories. Over the years, we've built up significant momentum and worked closely with a broad spectrum of major broadcasters on both finished and format deals, launching new titles and continuing successful franchises," she stated.

CLAIRE

JAGOEVP of Sales and Acquisitions, EMEA, at Banijay Rights

Rodrigo Nascimento, Head of International Business for Europe, the Middle East, and Africa at Globo, believes that "collaboration and partnerships are fundamental,

Fremantle attends NATPE Budapest with scripted shows like the crime thriller "White Lies," the love story "Alice and Jack, the Cold War thriller "Herrhausen: The Banker and the Bomb," "Sullivan's Crossing," as well as new documentaries "Zuckerberg: King of the Metaverse for Sky," "A Brief History of the Future," Elizabeth Taylor: Rebel Superstar" and "Queen of Crypto".

Moreover, Paprika Studios is working on a feature film alongside an Italian production company. The company recently produced the unscripted series "The Bridge" for HBO in cooperation with a third-party production company. Finally, Globo will showcase "Codex 632" (co-production Globoplay, RTP, and SPi), "Rio Connection" (Globo, Floresta, and Sony), and "Theodosia" (Globoplay, Cottonwood Media, ZDF, ZDF Enterprise, and HBO Max).

Head of International Business for Europe, the Middle East, and Africa at Globo

thus bringing new ways of telling stories and doing business." He highlighted that it facilitates getting the resources needed for production and enriches the final product quality, combining diverse perspectives and possibly connecting with broader audiences. "Nowadays, producers are always looking for the next global hit, and the increasingly demanding public is getting used to consuming content from previously unthinkable places and regions," Nascimento said. He concluded that partnerships must make sense for all parties involved. "There must be a lot of synergy between the parties and a common perception of value," he stated.

By Federico MartínezTHE STRATEGY FOR FINDING AND DEVELOPING IP INVESTMENTS FOR FURTHER DISTRIBUTION.

MediaHub has maintained a steady growth in the international arena, with recent deals in the CIS and MENA regions, Europe, and Asia. Señal News spoke with Kerim Emrah Turna, Managing Director of MediaHub, to describe the company's next steps to keep the momentum and expand its global footprint.

What is MediaHub's positioning in the global production and distribution industry?

"MediaHub positions itself by highlighting the unique selling points of its content. We emphasize our portfolio's diversity, quality, and originality, setting it apart from the competition. Defining our target demographic is fundamental. We tailor our marketing and distribution strategies to cater specifically to the identified audiences of our clients".

What is the company's strategy for finding and developing IP investments for further distribution?

"Collaborating with other industry players, both domestic and international, provides us access to a wider range of intellectual properties. We are building alliances with industry leaders dedicated to developing

intellectual properties and ensuring a continuous stream of original content. These partners include writers, producers, and creative directors who generate and adapt new ideas. We will announce our alliance with a well-known business partner with a great track record by Q3 this year. That will help us to develop a premium IP stream in multiple international markets. We always seek new partnerships with global players to create a space for cultural, know-how, and skills exchange."

What was the value of sealing a partnership with Geophil to coproduce Turkish dramas?

"Today, we're gathering the fruits of this partnership through the completion and good reception of our first original 'Alaca' and our joint company Globalsphere. Geophil has proven to be a partner with strong business development skills that accelerate the learning curve for collaboration. Their ability to identify opportunities, forge strategic alliances, and drive growth significantly impacts the success and efficiency of joint initiatives. We are looking forward to executing more projects under the Globalsphere brand."

How would you describe the global feedback for Mediahub's first original "Alaca"?

"With its compelling storyline, great production values, and stellar cast performances, the

series seamlessly weaves together suspense, romance, and cultural richness, the show keeps viewers eagerly anticipating each episode. As a result of all those elements, we received great feedback from the buyers and have already closed more than ten presales deals.

'Alaca' is reaching screens in multiple territories".

How do you analyze the global appetite for Turkish content?

"Turkish productions have been recognized for their high production values, including cinematography, storytelling, and acting. This quality has helped them compete with content from other countries. Many Turkish dramas incorporate universal themes that transcend cultural boundaries. This cross-cultural appeal has helped Turkish content find acceptance among diverse audiences. This trend will increase in the upcoming years."

Mediahub also offers content from Malaysia, India, the Philippines, and South Korea. What is the value of providing a global drama slate?

"Asian content holds significant importance in the global entertainment industry as it reflects the rich tapestry of diverse cultures, traditions, and histories across the continent. This diversity contributes to a more inclusive representation in global media, offering audiences a wide array of stories and perspectives. We are a global player in the entertainment industry, and our content from Asia, MENA, CIS, and Latin America has a key role in our success."

By Diego Alfagemez

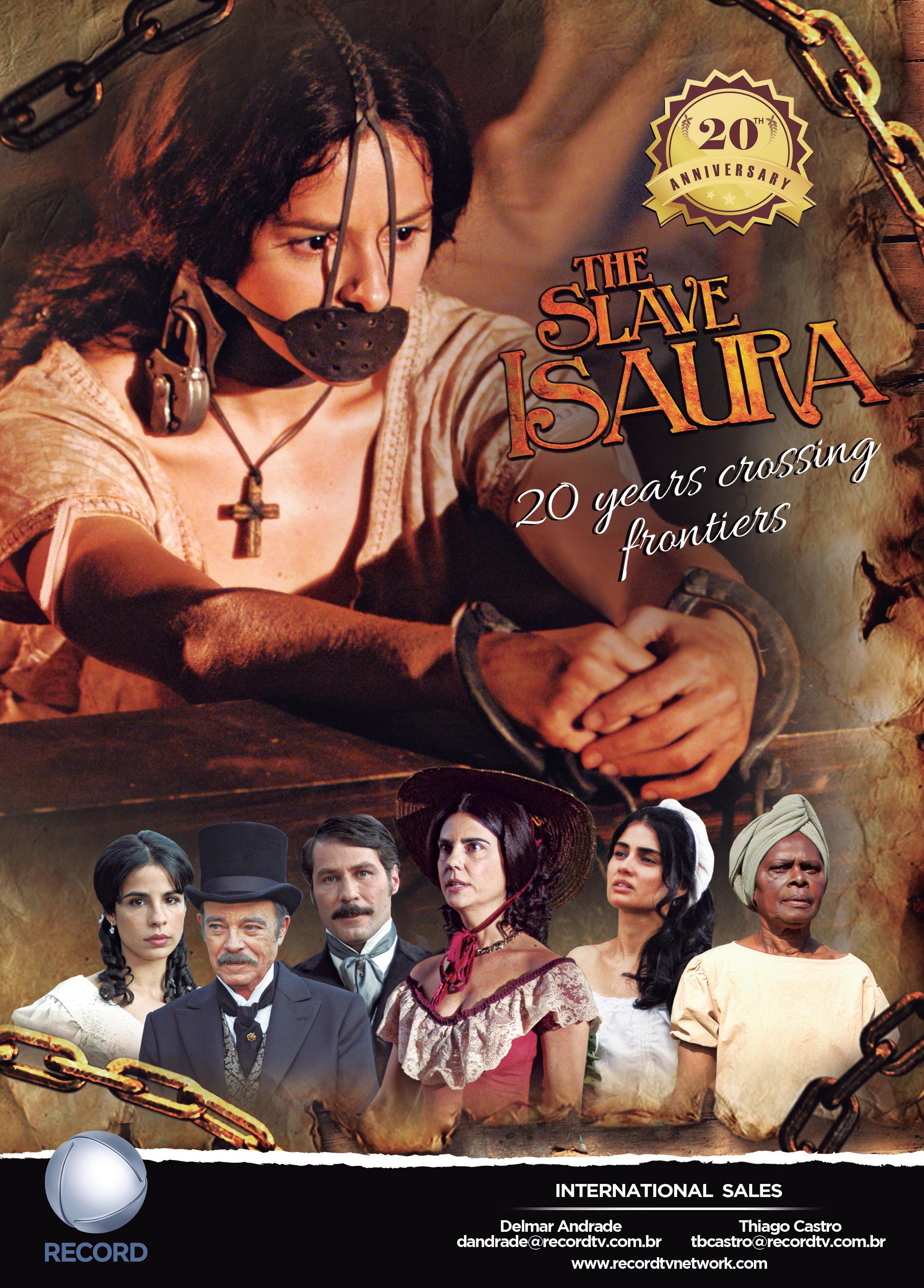

Zee Content Sales, the syndication division of Zee Entertainment, started the

year with a massive content development deal: the coproduction, together with VIP 2000 TV, of a modern Latin American telenovela for global audiences, championing autism awareness. This groundbreaking collaboration marks the inaugural coproduction of a telenovela between ZEE Entertainment and Latin America. The show is inspired by the acclaimed Indian soap opera "Aapki Antara," created in 2009 with immense popularity for its poignant portrayal of social issues, particularly autism.

This prime-time daily series, "Valentina, My Special Love," is a fresh take on the telenovela set in Guadalajara, Mexico. The show promises to captivate global audiences with a modern twist, weaving a poignant love story about a young woman with

MANJYOT SANDHU, HEAD OF GLOBAL SYNDICATION, DESCRIBES THE COMPANY’S NEW PROJECTS RELATED TO THE SPANISH LANGUAGE: THE LOCALIZATION OF “SER” AND THE COPRODUCTION OF A MODERN TELENOVELA WITH VIP 2000.

autism who is also a genius in the tech world. This dynamic partnership between VIP 2000 TV and ZEE transcends boundaries, fostering empathy, shattering misconceptions, and shining a light on the essence of inclusivity and acceptance while telling a powerful love story. Valentina will feature a diverse cast of talented Hispanic actors, stateof-the-art production values, and a compelling storyline that resonates with audiences of all ages and backgrounds. Production will start next month.

Señal News spoke with Manjyot Sandhu, the company's Head of Global Syndication, to describe a new milestone for Zee in the international arena.

How would you describe "Ser's" global appeal, and how has it performed in India and Asia?

"'Ser / El Secreto' experienced tremendous success in the MENA region, where it was the first series launched on Shaid, MENA's largest OTT, reaching the top 5 of most watched shows. It was later aired on MBC, the strongest Middle East channel, where it remained one of the top three shows until recently when it was moved to MBC4. While it competed directly with Turkish productions in these markets, 'Ser' obtained the highest audience ratings. The show also won the prestigious ASBU Broadcast PRO award as the best

adaptation of a foreign language drama series to Arabic."

Why did you decide to localize "Ser" into Spanish?

"'Ser' is not only a romantic story masterfully produced. It is full of suspense, intrigue, and high doses of beauty and glamour. That is the perfect combination for the Latin American and European markets."

What is the distribution potential of this show for Spanish-speaking territories?

"It is limitless since we are talking about a show that fits free TV, pay TV, and SVOD programming strategies."

Zee recently announced a coproduction deal with Vip 2000. What's the strategy behind this first business development with Latin America?

"It is no secret that the content made in Latin America or Spain has global relevance. Content made in Spanish is in high demand not only in the Americas but also in Europe and the MENA and APAC regions. This trend has been picking up in recent years, and Zee wants to ensure it is ready to bring audiences that highly appealing content. Zee is proud to coproduce 'Valentina, My Special Love,' a modern love story, in partnership with Vip 2000 TV."

By Diego Alfagemez

CGOQUEST MEDIA ATTENDS NATPE BUDAPEST WITH ITS FIRST TURKISH CO-PRODUCTION, "KUMA," AND EXCITING NEW TITLES. OFELYA TOVMASYAN, SALES EXECUTIVE FOR CEE, CIS, AND WESTERN EUROPE, EXPLAINS THE COMPANY'S FOCUS ON EASTERN AND CENTRAL EUROPE.

entral and Eastern Europe is a key territory for GoQuest Media, where the company takes a very strategic approach to sales and acquisition.

"We have established and nurtured relationships with key players in the region who are shaping content that is locally rich and attract platforms who want stories with deep roots and international impact," Ofelya Tovmasyan, GoQuest Media's Sales Executive for CEE, CIS, and Western Europe, told Señal News. "We had great success taking these titles across the world, including Australia, Japan, the United States, Brazil, Mexico, India, Africa, and Southeast Asia. Our partners trust us with their content, and we take their ambition forward to put their content on the global map," she added.

GoQuest has been doing business in the CEE region for over a decade and has worked with almost all the region's major players. "Viewership demands are quite diverse in the region, and the programming can vary from long-running melodramas to

short premium series," Tovmasyan stated. The GoQuest Media catalog is curated with this in mind, and it includes major productions from countries like Poland, Serbia, Estonia, Slovenia, and Lithuania. New content is a crucial highlight for GoQuest's expansion strategy. "We are excited to bring to the CEE one of the most demanded content of the region: our first Turkish coproduction, 'Kuma/The Other Wife,' which will make its European debut at NATPE Budapest," Tovmasyan anticipated. "Kuma" traces Ceylan's journey, which runs away from home to meet Karan, a wealthy young businessman. They fall in love and soon get married, but when Ceylan is framed for murder, Karan marries his brother's widow instead and forces Ceylan to become his kuma, a second wife to bear his children. Tovmasyan affirmed that they look forward to presenting "Kuma" at NATPE Budapest buyers. "We want to meet with our beloved partners to understand their programming plans and demands for the upcoming year," she said.

GoQuest will also bring a slate of new titles to the region, such as "South Wind" from Telekom Srbija. It's a story about a drug lord from Belgrade who conflicts with Red, the influential state curator of the Serbian criminal world. The company will also showcase "Absolute 100," where Sonja, an archer with Olympic dreams, protects her family from a

Ofelya Tovmasyan

Ofelya Tovmasyan

criminal's wrath, leading to a cycle of violence. "We also have a new series from Slovenia, 'Bridges of Us,' from Pro Plus, where Kristjan returns to Vipava Valley, sparking secrets and love entanglements, confronting family and the past, amid picturesque backdrops and modern dilemmas. Finally, we have the new and third season of the romantic drama 'Secrets of the Grapevine,' also from Telekom Srbija," she added.

Other GoQuest CEE dramas like "Ruby Ring" or "Traitor" have resonated in several territories. The first is led by two solid female actresses who tell a story of sibling rivalry turned into a revenge drama when a near-fatal accident causes the sisters' faces to be exchanged and their fates to be intertwined forever. "It is a human story that resonates with audiences worldwide, especially lovers of melodramas," Tovmasyan described. "Moreover, 'Traitor' slick production, its political angle, and strong characterization set it apart from other political espionage stories and appealed to international crime drama lovers keen to explore shows with new settings and contexts," she added.

By Romina Rodriguez

LORRAINE JOORE , SALES EXECUTIVE AT DUTCH CORE, DESCRIBES WHAT BUYERS IN THE CEE REGION NEED AND POINTS OUT THE GLOBAL APPEAL OF DUTCH AND FLEMISH PRODUCTIONS.

In recent years, Dutch Core has built strong collaborations with numerous Polish broadcasters and platforms, as well as buyers for the Czech Republic and the Baltics, and they're keen to get to know possible partners in other parts of the CEE region, too. "As the international sales representative of the Dutch NPO and public broadcasters, our main clients in the territory are foremost the public broadcasters. However, we also sell to commercial broadcasters, streaming platforms, educational parties, and inflight entertainment companies," Lorraine Joore, Sales Executive at Dutch Core, told Señal News. She also stated that the current interests of its clients are quite diverse. "The main part focuses on current affairs programs; stories that investigate, inform, and reflect on the world we live in, from geopolitical situations to technological developments," she described. Furthermore, Joore recognized that there's also room for more cinematic documentaries

within the genre of human interest. "We have sold some beautiful documentaries on intriguing life stories to the region, such as 'Mrs. Faber', 'Deaf Child,' and 'Etgar Keret: Based on a True Story.' Other genres of interest are true crime stories and forward-looking kids shows," she added.

Dutch Core's biweekly "Backlight" series focuses on remarkable shifts in society, geopolitics, economy, technology, and culture and their long-term consequences. It has already built a name within the region. "We currently have a new backlight on 'The Cost of AI,' which has already been sold to twenty-two countries," Joore said. Another highlight of the company's slate is the current affairs title "Hidden," a geopolitical detective series that takes the audience to the shadowy and frightening world of hybrid warfare. Regarding the humaninterest focus, Dutch Core has a new series called "The Butlers," which showcases the International Butler Academy in a Dutch village, where students of all ages from all over the world are taught the intricacies of the butler's profession in ten weeks.

Dutch Core's content slate offers a different angle, dealing with

controversial subjects. "The shows, films, and series we offer dive into current affairs topics for Dutch and Flemish regions. From reflecting on a shared past to the societal issues of today. And besides that, the universal stories that transcend current events," Joore affirmed.

According to the executive, Dutch and Flemish productions stand out because they don't shy away from breaking taboos and dealing with sensitive, controversial subjects. "The propensity of Dutch society to be straightforward can also be seen in their way of filmmaking. The strength lies in its approach, which can be critical yet always respectful and grounded. Dutch filmmakers are known for their thorough research and high-quality standards," she expressed.

Dutch Core is building a strong lineup of content that will be launched in the fall of this year at markets and festivals such as MIPCOM, Dubai International Content Market, Asia TV Forum, IDFA, Berlinale, and NATPE.

"We are proud of the films and series we represent, and we'd love for these stories to travel worldwide. Therefore, we are focusing on regions where we see opportunities to broaden our network, such as the CEE region," Joore announced. "Over the past few years, we've seen a substantial growth of interest in our programs, so we're excited to explore this further and get in touch with buyers there," she concluded.

By Romina Rodriguez

Gabriela Diaz Lozano (TVN PANAMA), Tania Porras (MEDCOM), Roxana Rotundo (VIP 2000)

Dario Turovelzky, Mercedes Feu (PARAMOUNT), Pablo Ghiglione (GLOBO), Samuel Duque, Juan Vicente, Guillermo Pendino (PARAMOUNT)

Elisa Aquino, Liliam Hernandez (UNIVERSAL CINERGIA), Ekin Koyuncu (OGM), Merve Doğan (ATV), Jorge Balleste (TELEVISAUNIVISION), Mikaela Perez (GOQUEST), Sibel Levendoğlu (KANAL D), Ivan Sanchez (GLOBAL AGENCY)

Mosca (CANAL 4), Barbora Suster (ECCHO RIGHTS), Javier Olivera (CANAL 4), Cida Goncalves (8 STAR)

Javier Mendez (THE MEDIAPRO STUDIO), Fernando Barbosa (DISNEY), Laura Fernandez Espeso (MEDIAPRO), Leonardo Aranguibel (DISNEY)