The global content industry is experiencing a very crude shifting era, and that's no news. In the middle of that landscape, the production business moves its models and strategies to

supply an evolving demand from clients without hurting quality and trying to keep the audience's eyeballs.

Muge Akar, Head of Sales at ATV, describes the local performance, main features, and global potential of the new drama that the Turkish company will launch at Mipcom.

Claire Runham, Head of Acquisitions, and Tatiana Grinkevich, Head of Sales, describe how the company has adapted to changing viewer habits and market trends.

Elif Tatoğlu, Distribution Strategy and Sales Director at Kanal D International, explains the company's growth path while highlighting the potential of each global region.

2

7

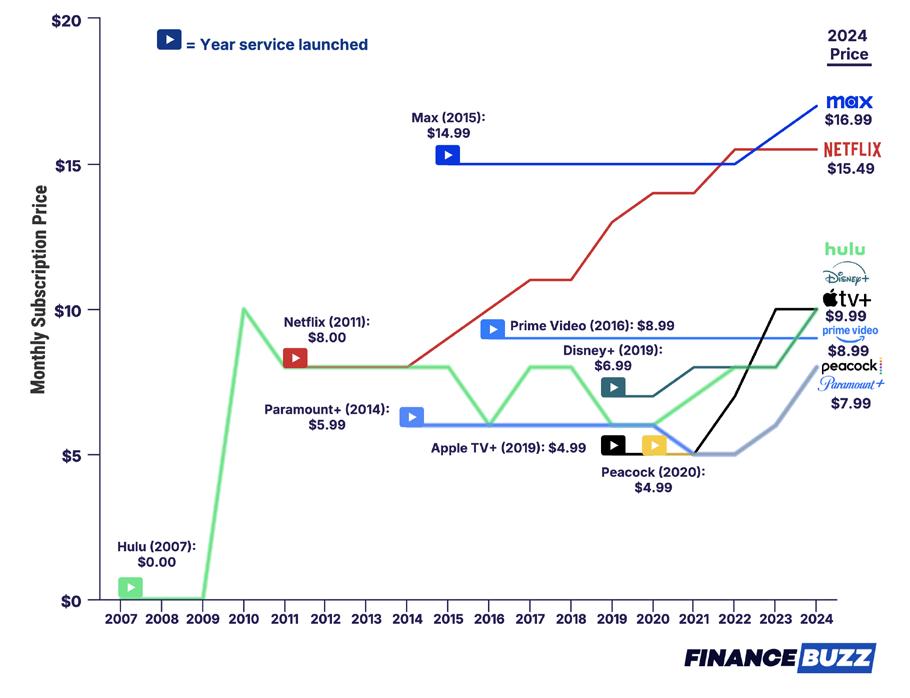

SINCE 2011, NETFLIX HAS INCREASED PRICES SEVEN TIMES, WHICH HAS ULTIMATELY RESULTED IN A 94% INCREASE IN THE COST FOR A STANDARD MONTHLY SUBSCRIPTION.

$15.49

NETFLIX INCREASED ITS COST MORE OFTEN THAN ANY OTHER STREAMER ($8 IN 2011 - $15.49 IN 2024).

2nd

NETFLIX’S $15.49 COST IS THE SECOND-HIGHEST OF ANY PLATFORM, BEHIND MAX’S $16.99.

Streaming services have decreased prices since launching. Paramount+ prices dropped from $5.99 to $4.99 between 2020 and 2021 before returning to $5.99 in 2023. Hulu dropped the price for its standard subscription multiple times, from $9.99 to $7.99 in 2010 and 2011, dropping it a further $2 to $5.99 in 2016, and from $7.99 to $5.99 in 2019 following a 2017 price increase.

BBC iPlayer has recorded remarkable year-on-year growth and is outstripping all its competitors across all audiences. The British service is up over 20% this year so far. BBC iPlayer’s viewing growth is twice that of Netflix, three times ITVX and four times that of Channel 4. The streamer recorded high levels of people coming to the platform this summer, which has grown 10% on

the same time last year. Live events during summer generated over 350 million requests. •

A+E Networks EMEA has rebranded to Hearst Networks EMEA. The international broadcaster, which operates across the UK, Europe, Middle East, and Africa, is fully owned by Hearst and will now operate under the new name of Hearst Networks EMEA. Hearst Networks EMEA will continue to be comprised of four unique companies: Hearst Networks UK, Hearst Networks Germany, Hearst Networks Italia. •

Dori Media International, Mexico City-based Atenea Media, and veteran production executive Joshua Mintz, have signed a production partnership, expanding their established relationship in Latin America. The deal was announced by Nadav Palti, CEO & President of Dori Media Group, Atenea Media President Ana Celia Urquidi and Mintz. Mintz, who will continue serving as Dori Media International’s Chief Content Officer, will oversee the partnership and also become a partner in Atenea Media. Dori Media will also be a partner in the venture. •

ITV Studios and Tokyo Broadcasting System Television are partnering to create the world’s first-ever “Ninja Warrior” FAST channel dedicated to programming worldwide. The deal is a first, both in terms of ITV Studios’ first FAST channel creation for third-party IP and Tokyo Broadcasting’s first foray into FAST. Brokered by Bellon Entertainment on behalf of TBS, ITV Studios will initially create, operate, market, and distribute the “Ninja Warrior” channel in the UK and Canada, with Australia and several other major territories to follow in the coming months. •

BBC Studios Productions has hired Channel 4’s former Head of Youth and Digital Karl Warner to establish and lead a new creative unit within its recently formed Global Entertainment business that will target premium longform and digital formats for the UK and international markets. Taking up his new role in November as Executive Vice President of UK Entertainment and Digital Development, Warner’s new team will be tasked with creating new IP and formats for the BBC as well as other UK and global platforms. His unit will also partner with BBC Studios Global Entertainment teams around the world. •

Canal+ Group Supervisory Board appointed Amandine Ferré a member of Group’s Management Board. Ferré joined Maxime Saada, Chairman and CEO, Anna Marsh, Deputy CEO of Canal+ Group and CEO of Studiocanal, and Jacques du Puy, Deputy CEO of Canal+ Group in charge of International and President of Canal+ International. Amandine Ferré was also appointed Chief Financial Officer of Canal+ Group. She will be in charge of Canal+ Group’s Finance and CSR, succeeding Grégoire Castaing, who joined the Lagardère Group as Assistant Managing Director in charge of Finance. •

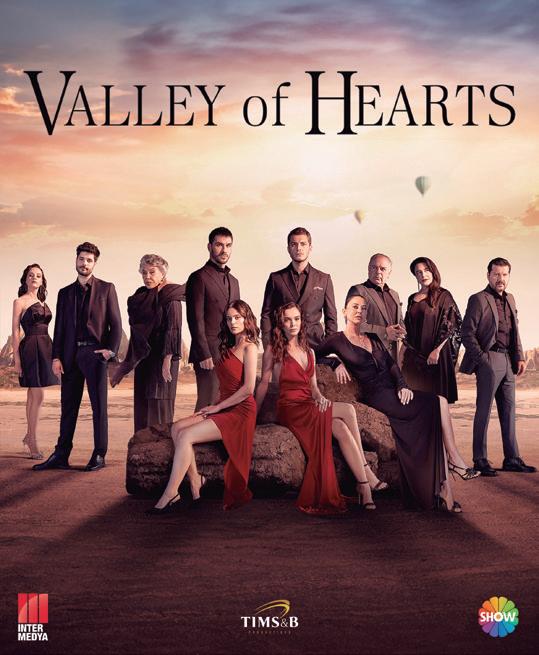

Tims&B Productions has teamed up with Inter Medya for the global distribution of their latest hit TV dramas, “Valley of Hearts” and “Loveberry.” These two series from will make their international debut at Mipcom under the representation of Inter Medya. “Valley of Hearts,” currently airing on Show TV in Türkiye, explores the dark secrets and fierce power struggles within the powerful Şansalan family. On the other hand, “Loveberry,” airing on ATV in Türkiye, follows the journey of Zuhal, a successful personal development expert whose seemingly perfect life takes a drastic turn when she falls in love with someone she shouldn’t. •

Ted Sarandos, Netflix's coCEO, has a new demand: he wants the streaming industry to be more transparent about its viewership data. At first glance, this sounds like an altruistic move, a push for a fairer playing field. But here's the truth: Sarandos isn't doing this to make the industry more accountable; he's doing it because Netflix knows it would win. A big win.

Netflix just released "What We Watched: The Engagement Report" for the first half of 2024, with audiences consuming over 94 billion hours of content from January to June. Titles like "Damsel" (144 million views) and "Lift" (129 million views) dominated, while the Spanish hit "Berlin" pulled in a massive 318 million hours of consumption. Sarandos knows that Netflix's dominance is clearer than ever, and by pushing for transparency, he's asking rivals like Disney+ and Max to reveal just how far behind they are.

Let's not pretend this is a move for industry-wide equality. Netflix's numbers are impressive because of its vast library and global reach. If other platforms had comparable data, they'd be flaunting it already. Sarandos is playing a smart game by calling for transparency, knowing Netflix's rivals will either have to reveal weaker numbers or stay silent and look defensive.

But here's the problem: hours watched is a slippery metric. Sure,

"Berlin" logged 318 million hours, but that doesn't mean it had the highest number of viewers. A long-running series can easily accumulate hours, even if fewer people are watching, compared to shorter, high-impact films like "Damsel." That emphasis on hours might look good in reports, but it only sometimes captures authentic audience engagement.

Here is Sarandos' endgame: pressure. By pushing for transparency, Netflix is making life harder for its competitors. Disney+, Prime Video, and Max have built reputations on their exclusive titles, but do they really want to open their books and reveal how many (or how few) are watching? Unlikely. It's a classic power move: either you share the data and expose your weakness or stay quiet and look reticent.

Anyway, let's not get too excited about transparency. Netflix's data-driven approach can have a chilling effect on creativity. If a show doesn't pull in "Damsel"-level engagement, does it get sidelined in favor of content that racks up hours? Netflix has already been willing to cancel fan-favorite shows that don't hit targets fast enough. More transparency could put even more pressure on the industry to prioritize high-viewing content at the expense of riskier, more creative shows.

So, where does that leave us? Sarandos isn't pushing for transparency for the sake of fairness. He's asking for a victory lap, knowing Netflix is miles ahead. Sure, it might lead to more honesty in the industry, but let's not pretend it will benefit everyone equally. For smaller players, transparency could highlight how far behind they are. It's just another move for Netflix to cement its place at the top.

We come to Mipcom this year amidst a continually worsening tempest in the media industry.

Paramount is selling itself off the discount rack, FOX is re-enacting “Succession” in a Nevada court, Warner Bros Discovery can truly only be described as beleaguered. The traditional Media Industrial Complex is a melting ice cube left out in the sun, making less entertainment content than prior to the major American strikes. Public Service Media is shedding viewers to big tech streamers and social video. Most producers are finding it harder each year to sell the shows and movies that were flying off shelves just a few years ago.

Those who make and sell content continually ask me when we will reach “the new normal.” Unfortunately, for those who got addicted to the high-flying days of Peak TV, when everything was sold at high margins and when streaming services bought movies and series at ridiculous prices, in a desperate quest to “scale,” I have some bad news: THIS is the new normal. Welcome. Scale has been replaced by free cash flow as the holy grail of the Media Industrial Complex. Budgets for scripted entertainment have been stolen to buy sports. Even when you can sell to entertainment gatekeepers, they will offer you far less than they used to. What’s more: consolidation will only exacerbate these trends. If your business model is predicated on selling to the big gatekeepers at better than cost plus rates, then your model is broken. And, in my studied opinion, it will not unbreak. Peak TV was a bubble. That bubble has burst.

those communities, without relying SOLELY on those gatekeepers for greenlights and profits. Then teach yourselves to monetize it. If this sounds impossible, understand that Ryan Kaji learned to do this when he was just four years old. He and his family now run one of the most successful kids content studios on earth. Sports goofballs Dude Perfect have perfected this art form. This year they raised $100 million of investment capital. Dax Shepard took this leap. He just signed an $80 million deal with Amazon.

The Creator Economy is already a quarter of a trilliondollar business. By 2040, it will be a trillion-dollar industry. It is NOT JUST about influencers. If you don’t believe this, if you refuse to take the time or make the effort to understand it, you will be left behind by what’s coming next. Community is the new audience. Lean in or get out.

HOW ELSE? Jump into the retail media business. Don’t just develop shows about cooking or fashion or home improvement or travel, develop them to sell the products you feature in them.

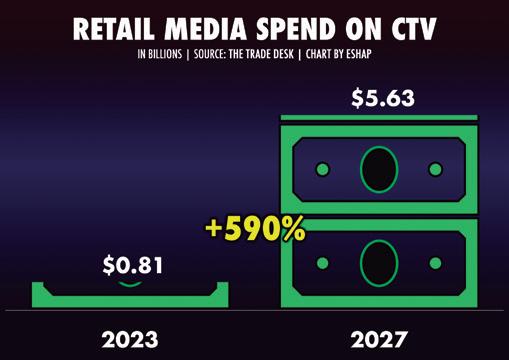

If you want funding for what you want to make, start to explore relationships not just with brands, but with the platforms who sell them. There’s a reason Walmart is buying Vizio, and it’s NOT bc they love the smell of new TVs. Amazon’s $45 billion ad business isn’t about commercials, it’s about commerce. Retail Media on TV is already a billion-dollar business in the US alone. By the end of this decade, connected TV retail media will generate $6 billion, per year in America.

This is new money to the entertainment ecosystem. You can grab your share of this pie, or someone else will eat your lunch.

So, then, now what’s a studio or producer to do? Give up and sell real estate? Not necessarily. There are solutions to your problems. There are ways to do more than just survive - and thrive - in this new era of media. However, to do so, you must be willing to retrain yourself and your company to meet the moment, the same way horse buggy manufacturers had to learn how to make automobiles or go out of business.

HOW? Learn how to operate in the creator economy. Redesign your studio to make content for specific communities and then develop internal competencies to distribute that content directly to

The corporate media industrial complex will continue to contract. As it does, the Creatorled ecosystem will fill that void, taking over those audiences and those revenues. The traditional TV ad business is being replaced by an outcome-based marketplace, where the smartest creators and best environments win.

Imagine for a second you made radio when TV was invented, or a silent film producer when talkies arrived…. Would you have rejected that new technology? Or embraced it?

That is the crossroads where we find ourselves at this Mipcom. Choose your path wisely.

By Evan Shapiro

ACCORDING TO OMDIA DATA, THESE MARKETS WERE WORTH $188 MILLION IN 2023 AND ARE EXPECTED TO GROW TO $328 MILLION IN 2025.

Latin America & the Caribbean is now the thirdlargest regional market for FAST ad revenues, after North America and EMEA, according to recent data from Omdia. The leading players to propel this growth have been Samsung and LG, which have maintained their regional presence over the past year. "At the time of writing, there is no confirmation of when Samsung TV Plus will expand beyond Brazil and Mexico. Paramount-owned Pluto TV maintains its leadership because it is the first FAST platform to launch in the region," Juan Villegas, Research Analyst, Media & Entertainment at Omdia, explained. At a country level, Brazil and Mexico maintain their dominance thanks to the size of the main players and the presence of additional other services such as Fox Corporation's Tubi, TelevisaUnivision's ViX, and Roku Channel. Roku has grown enormously in the region, claiming Mexico to be its largest market outside the United States. In addition, these two territories and Spain are among the top ten markets in the FAST business outside the United States. "FAST's share of the Latin American and Spain premium ad-supported video market is expected to reach an all-time high of

Latin America & Caribbean and Spain FAST Ad revenue and regional FAST share of premium ad-supported online video revenue, 2019-25, $m, %

27% in 2024," Villegas described. Latin America and the Caribbean has the highest FAST share of premium video advertising globally, mostly thanks to CTV platform operators and Pluto TV, as well as a continued appetite for linear content.

Pluto TV launched in March 2014 as an independent streaming platform. Over time, it secured licensing deals with different providers, such as Lionsgate, MGM, and Warner Bros. Discovery. In 2017, it added premium content to the platform's channels and an on-demand library. Omdia's FAST Channel Distribution database tracks the number of channels per FAST service. In Q3 2024, it registered an average of 170 FAST channels on its platform. Omdia expects Pluto TV to reach U$D 35.9 million annual average monthly users in Latin America and Spain, with a considerable footprint in these territories. This combination shows an excellent prospect for advertisers. Pluto TV distribution has been quite even across Latin America and Spain. It offers well over 100 channels in each country where it is present, showing its growth and increasing relevance. A large part of its channels are provided by its parent company. These include channels with Paramount premium content from networks like Nickelodeon and MTV. Pluto TV is also used as a marketing tool for its SVOD sibling, Paramount+. "As other platforms grow, Pluto TV is expected to maintain prominence among the top three players over the next few years," Villegas concluded.

By Omdia

WITH SEVERAL EXTERNAL FACTORS TO CONSIDER, THE PRODUCTION BUSINESS IS ADAPTING TO NEW DEMANDS, BUDGET LIMITS, AND AUDIENCE BEHAVIORS. THE HEART OF THE CONTENT INDUSTRY IS RESHAPING ITS FOCUS.

The global content industry is experiencing a very crude shifting era, and that's no news. In the middle of that landscape, the production business moves its models and strategies to supply an evolving demand from clients without hurting quality and trying to keep the audience's eyeballs. Recent data from ProdPro reported a 22% increase in the number of projects actively filming in Q2 2024 compared to the same period last year. The U.S. experienced a 30% year-over-year increase in Q2. However, ProdPro noted that this comparison is against the beginning of the 2023 WGA strike, a period characterized by unusually low production activity. Over the past six months, the total number of productions filming globally in 2024 is still 16% lower than in 2022 and 37% lower in the U.S. That decline, though anticipated, is challenging for an industry that expanded to meet the demands of the peak T.V. era regarding crew and suppliers. Comparing the number of productions that started principal photography in Q2 2024 to those in 2022, the U.S. saw a decrease of approximately 40%, while globally, there was a 20% decrease.

ProdPro reported 344 scripted productions that started principal photography worldwide in Q2 2024. That encompassed 130 TV series and 214 feature films. Feature films decreased 18% compared to the same period last year. As with the Q1 drop-in feature starts, this can partially be attributed to the risk of another strike in 2024, which has made it more difficult for indie film producers to get bonded for production. T.V. series experienced an increase of 20% year-over-year, primarily driven by major studios making up for lost time and ensuring their fall slates are delivered.

GLOBAL SCRIPTED TV AND FILM PRODUCTIONS, Q2 2023 vs Q2 2024

Q2-2023

Continuing the trend from Q1 of delayed productions driving an increase in committed spending, ProdPro measured a 39% increase in committed spending in Q2 2023. The biggest increase was with projects in the $40M-$100M range, continuing the trend from Q1 2024 of returning episodic projects and mid-budget studio films driving the increase. Notably, this number is 20% less than committed spend during Q2 2022. On the episodic side, the U.S. and Canada experienced notable increases in the number of series beginning production compared to the prior year. While the U.K. lagged in series starts, they were the only region to experience an increase on the features side.

GLOBAL SCRIPTED TV AND FILM PRODUCTIONS BY BUDGET TIER, Q2 2024

GLOBAL PRODUCTIONS, EPISODICS AND FEATURES, Q2 2023 vs Q2 2024 Q2-2023

Furthermore, according to research by Vitrina, global film and T.V. production volumes increased by 9% last July, continuing the slow and steady recovery from the rock-bottom levels of the second half of 2023. The APAC and EMEA regions saw significant growth, with 48% and 19% increases, respectively. In contrast, the

Americas experienced a 31% decline in production volumes. However, during this same month, I.P. and Development activity experienced a 16% decline compared to June. This turnaround highlighted a renewed focus on bringing new projects to life, even as intellectual property and development volumes cooled. Drama remained the top genre, experiencing a 33% increase compared to June, with Comedy trailing closely behind. Scripted content made up 77% of June productions. English productions represented 38% of the June projects, marking a 12% decrease from June.

According to Vitrina, Prime Video and Netflix have kept their stronghold in commissioning, with The German Federal Film Board, Disney+ (including Star+) following closely behind. Production transactions from OTT providers contributed 21% of the total deals (a 4% increase over June), with Netflix and Prime Video leading the commissioning. Vitrina revealed that EMEA emerged as the leading market bloc for July, with the United Kingdom securing the highest volume of production transactions. The top buyers and commissioners comprised a diverse mix of broadcasters, OTT providers, and production houses, led by Prime Video, Mediaset, Netflix, and Rok Studios (part of Vivendi and Canal Group). The share of

APAC increased from 17% in June to 27% in July, with production volumes from India rising by 77%, driven by companies such as Sony Yay!, Zee5 & Jio Studios. According to Ampere Analysis, Netflix commissioned its highest number of new titles since Q3 2021 in 2024, and Amazon set a new record for its quarterly commissions. This resurgence in original orders coincides with falling commissions from costconscious rival streamers, which meant the two streaming giants accounted for more than half (53%) of all SVoD commissions globally in Q1.

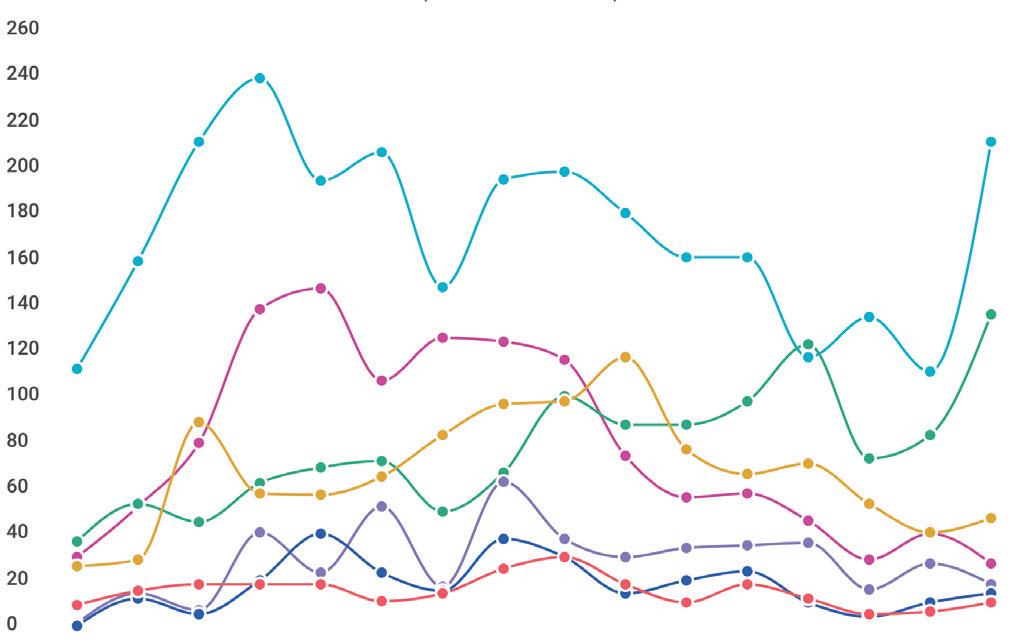

# of SVoD commissions ordered globally by major US-based parent commissioners, (Q2 2020 - Q1 2024)

This growth is spurred by increased investment in international territories, with Netflix and Amazon ordering most of their titles outside the United States. Over the past few years, spending outside the United States by the two commissioners has increased steadily. Ampere predicts it will continue to rise as the players attempt to combat domestic subscriber stagnation by chasing expansion internationally. In Q1 2024, Netflix's Western European commissions almost achieved parity with North American titles for the first time. Asia Pacific titles also saw a notable uptick. Netflix is seizing the opportunity for international growth, focusing on proven market providers of portable content, such as Spain, India, and South Korea. The UK, Spain, and Germany led Netflix's Western European commissions. Cost-effective unscripted content featured heavily in the platform's Western European commissions, with documentaries accounting for 30% of regional orders, up from 23% in Q1 last year. The U.K. contributed 43% of the region's documentaries, a notable drop from the same period last year when it was 78%.

Share of non-US originated commissions (%, Q2 2021 - Q1 2024)

Source: Ampere Commissioning. (excluding theatrical movies, Amazon Freevee and miniTV)

According to Ampere Analysis, Thailand experienced the most significant individual increase in Asia Pacific, with nine titles ordered in Q1 2024. Crime & thriller content was a focus in India, which is predicted to become Netflix's largest subscriber hub in the region as it seeks to compete more closely with Amazon in the country. Netflix increasingly relies on pay-one agreements with theatrical studios to supply new, exclusive U.S. films and has decreased its domestic commissioning of original movies. By contrast, it has upped its international movie orders in territories like the Nordics, Asia Pacific, and Sub-Saharan Africa. In comparison, in Q1 2024, Amazon's Asia Pacific commissions were dominated by Indian productions with a record slate of 37 titles. That is more than the previous six quarters combined and an increase on Amazon's previous primary Indian slate in Q2 2022 of 32%. Global streamers, including Amazon, have previously struggled to compete with local players that offer strong regional content. However, this total signals Amazon's intention to take on the incumbent platforms, cementing India as the cornerstone of its international strategy. The streamer also announced its largest slate of Indian original movies to date and is actively pursuing pay-one and co-financing deals with local theatrical distributors. Enabled by its takeover of studio MGM, Amazon has upped its global orders of original movies in the past two years, commissioning more films than Netflix for the first time in Q2 2023.

YouTube's content spend, consisting of its distinct revenue-sharing arrangement with content creators, will rank as the second largest non-sports content spend globally in 2024, behind Disney, according to the latest report from Ampere Analysis. While YouTube's content investment differs from traditional studios, its total expenditure will be the third largest worldwide this year for the fourth consecutive year when considering sports rights spending. That places it behind Disney and Comcast, with both forecasted to spend just over $9 billion on sports rights in 2024, yet YouTube's total spend is ahead of any VOD-first player and some of the major studios.

CONTENT SPEND BY COMPANY GROUP FOR TOP 5 GLOBAL

Content spend by company group for top 5 global spenders, 2024 (f) ($bn, by spend type)

Original and Acquired

Sports Rights

Unlike SVOD platforms, YouTube's primary source of revenue is advertising, not subscription fees. YouTube's advertising revenue alone, forecasted at $35 billion in 2024, exceeds Disney+ and Amazon Prime Video's total earnings and falls just shy of Netflix's total revenue. YouTube is the number one platform for online video viewing globally, and its advertising revenue is driven by its large user base. Despite having few opportunities to re-license content on other platforms, YouTube has affirmed its focus on funding content creators. While it has experimented with more traditional-style commissioning in the past, this was never a primary way to incentivize production, and YouTube has since significantly reduced commissioning activities. The shift in power from box office and cable/broadcast to streaming continues to reshape the landscape, prompting a mid-term correction with less appetite for high-budget projects and a stronger focus on mid and smaller-budget productions. Players gravitate towards lower-risk strategies, favoring smaller budgets, timetested stories, I.P. adaptations from other media/

TOP 3 MARKETS BY COMPANY GROUP, GLOBAL

markets, and strategic partnerships. Cross-border collaborations in co-productions are becoming essential. Production financing decision-makers need to be convinced of the strength of I.P., development, and pilot projects, as skepticism and longer decision cycles risk delaying projects. Additionally, renewed and fierce competition between rival governments and film commissions is intensifying. Amidst these challenges, the industry must navigate a rapidly changing supply chain influenced by new tech players across every value chain dimension.

By Diego Alfagemez

UNIFRANCE RENDEZ-VOUS CELEBRATED ITS 30TH ANNIVERSARY AND MOVED ITS EVENT TO LE HAVRE, WHERE 56 FRENCH DISTRIBUTORS SHOWCASED KEY SHOWS TO 180 INTERNATIONAL BUYERS.

Unifrance Rendez-Vous 2024 was a special edition. The market, focused on French and French-speaking content, celebrated its 30 th anniversary, and was held in a new location, Le Havre, on the Normandy coast. "Our main objective was to maintain the efficiency of the event while moving," Sarah Hemar, Director of Audiovisual at Unifrance, said. "Unifrance Rendez-Vous is the last all-inclusive event with a screening room where people can truly focus on spending time together, either in formal meetings or informally, like during lunches and dinners. It was essential to keep it as efficient and successful as it has been for 29 years," she added.

Despite being away from Paris, Le Havre attracted 180 international buyers from 40 countries, including HITN,

V-me (United States), Gusto TV (Canada), Antena 3, Movistar, Mediaset España (Telecinco), OneGate Media (Germany), ORF (Austria), Warner Bros. Discovery – HBO Europe, LRT (Lithuania), TV Nova (Czech Republic), FTV Prima (Czech Republic), and Markíza Group (Slovakia). Regarding genres, 29% of the buyers were looking for animated programs, 55% for fiction, and 64% for documentaries.

In the market, 56 French distribution companies offered more than 700 shows from all genres in a screening room set up specially for the occasion. Among the most viewed were the fictions "The Eclipse" (About Premium Content), "Tom and Lola" (Mediawan Rights), and "Ça, c'est Paris" (Federation Studios). The documentaries "The Army of

Romantics" (ARTE Distribution), "From the Plate to the Ocean" (Only Distrib), and "An American Pastoral" (Mediawan Rights) also gained global attention. Lastly, in animation, the most viewed titles were "Lana Longuebarbe" (APC Kids), "Les Minus" (MIAM! Distribution), and "Samuel" (Folivari International).

The Centre National du Cinéma et l'Image Animée (CNC) and Unifrance released their annual report on the export of French audiovisual programs. In 2023, sales of French audiovisual programs remained high, reaching €203.4 million (-5.3% compared to 2022). That was the third time in 30 years that French content exceeded the €200 million threshold (previously

in 2017 with €205.2 million and in 2022, a record year with €214.8 million). The strong performance of French exports reflects the quality and diversity of audiovisual works across all genres, which continue to appeal to the international market despite a challenging environment characterized by lower acquisition budgets, a contraction of the North American market, and longer negotiations between partners.

The success of French drama was confirmed in 2023, with sales of €74.5 million, making it the genre's second-best year after 2022 (-7.7%) and well above the average for the last ten years (€54.9 million). It remained the leading export genre for the second year, accounting for 36.6% of total sales. Ambitious and creative series with strong

intellectual properties, such as "HIP," "Marie Antoinette," "Bardot," and "BRI," as well as French expertise in procedural series like "Deadly Tropics" and "Bright Minds," contributed to the success of French dramatic fiction on the international scene.

Documentaries continued their excellent international sales momentum, reaching €47.2 million (-3.0% compared to 2022, a record year). 2023 was marked by the success of programs echoing current events and hybrid works combining several genres, such as science and history. Animation sales declined again, to €51.2 million in 2023 (-11.2% compared to 2022). While French animation programs with high visibility continued to circulate globally, the genre was affected by a reduction in buyers' investments, particularly

“ IN 2023, SALES OF FRENCH AUDIOVISUAL PROGRAMS REMAINED HIGH, REACHING €203.4 MILLION (-5.3% COMPARED TO 2022). THAT WAS THE THIRD TIME IN 30 YEARS THAT FRENCH CONTENT EXCEEDED THE €200 MILLION THRESHOLD"

in North America (-69.7%, to €4.3 million), and a decrease in worldwide rights to €12.9 million (-6.6%). However, animation remained the #2 export genre, with a 25.2% market share.

Unifrance Rendez-Vous Le Havre was the perfect setting for the launch of new key projects. ARTE Distribution hosted the screening of The Legends of Paris: A Tale of the 19 th Century Artistic Scene (4x52'), a 2D animation series that recounts the story of literary and artistic Paris between 1824 and 1870. "It's an amazing show that took six years of writing and two years of animation," said Josephine Letang, Head of Sales at ARTE Distribution. "It changes how we tell stories, and I think it will reshape how we present history to the audience. It’s captivating," she added. Judith Nora, producer

of the series, mentioned that an international team of 90 people worked on the project, creating 30 characters and 2,000 Parisian settings. "It’s the equivalent of two feature films in animation’s own art history. It’s an ambitious project," she said.

Federation Studios screened the first episode of Ça, c’est Paris (6x60'), a drama series produced by Federation Studios and Mon Voisin Productions ("Call My Agent!") that tells the story of Gaspard Berthille (Alex Lutz), the manager of Le Tout-Paris, a renowned cabaret perpetuating the myth of wild Parisian nights. The title has been sold in 190 countries, with remakes produced in 12 countries.

Mediawan Rights hosted the screening of Tom and Lola (12x52'), a procedural crime series starring Dounia Coesens and Pierre-Yves Bon as two best friends since high school who, as cops, must work and live together. Randall

Broman, Head of International Sales Scripted at Mediawan Rights, described it as following in the footsteps of the successful procedural Tandem with a dynamic duo who must navigate both their professional and personal lives, including co-parenting in the same apartment.

France tv distribution closed Unifrance Rendez-Vous with the screening of Zorro and a thematic party. The 8x40 minute series, coproduced by Paramount+, France Télévisions, and other international partners, features Jean Dujardin as Don Diego, who returns as Zorro to fight for justice while trying to win back his wife's heart, unaware she’s fallen for his alter ego. "It’s a modern, action-packed, and romantic take on this global classic," said Julia Schulte, SVP International Sales at France tv distribution.

By Romina Rodriguez

EXPERTS FROM ITV, FREMANTLE , BANIJAY, AND BBC STUDIOS EXPLAIN THE MOST EFFECTIVE STRATEGIES FOR A BUSINESS MODEL THAT GAINS MORE VALUE FOR GLOBAL PRODUCERS AND DISTRIBUTORS.

Audiences, producers, broadcasters, platforms, and advertisers have adapted to new scenarios and needs as the audiovisual industry continues to evolve. Branded content has emerged as a robust, long-term solution in that context.

Carlotta Rossi Spencer, Head of Branded Entertainment Business Development at Banijay

"People are starting to respect the concept of branded content,"

Carlotta Rossi Spencer, Head of Branded Entertainment Business Development at Banijay, asserted. "For years, the attitude was that if it's branded, it doesn't meet the standards of a good production. Now, we're in a situation where we, along with other players in

the United States and Europe, are making great shows. I always say we're talking about entertainment made for and with brands, so the keyword is still entertainment," she explained.

Devina Seth, Brand Partnerships Director at BBC Studios Digital Brands

The industry's economic challenges are forcing producers to create premium content on tighter budgets, which can feel like performing magic. "When there is limited investment available for content, the power of research and insights (which we analyze using various methodologies) helps bring to life content that truly contributes to culture and transcends generations," Devina Seth, Brand Partnerships Director at BBC Studios Digital Brands, said. "High-quality brand partnerships that result in custom assets tailored to each platform help

generate the best user experience, creating impactful and evergreen relationships between a brand and its audience. That safeguards the brand image, which is of utmost value and supersedes its association with a single product or service that usually has a limited shelf life," she added.

Devina Seth also explained that with any campaign, it is essential to identify that there are two potential sets of audiences to explore across both partner portfolios: the core groups (loyalists of the brands) and the broad groups (potential loyalists) that can be identified through interest, behaviors, attitudes, and demographics. "It's important to ingest the data and approach it as a common source to avoid anomalies. Once the campaign is actioned, the expectation is that the existing loyalists will engage with the content because the content is of genuine value to them. In the broad audience category, based on interaction with the content, we can confirm a new audience base and refine the broad targeting so there is minimum wastage from a distribution POV, and we are only exposing audiences who are truly interested in what we have created," she stated.

Roberta Zamboni, Global Head of Branded Content & Sponsorship at Fremantle

"The dynamic of interconnected brand budgets and production budgets, particularly in more ambitious projects, is becoming more common, both in scripted and unscripted content," Roberta Zamboni, Global Head of Branded Content & Sponsorship at Fremantle, commented. She highlighted the importance of maintaining creative freedom for the production team while ensuring the brand also benefits from authentic integration. "Brands benefit from being authentically integrated into content that

resonates with audiences, offering a more engaging and impactful form of advertising than traditional spots," she noted. Zamboni also explained that the mentioned integration creates opportunities for innovative storytelling, as brands often provide unique resources, locations, or expertise that can enhance the narrative. "Ultimately, branded content not only fills the financial gap but also adds strategic value, ensuring that high-quality productions continue to thrive in a competitive media landscape," she added.

Bhavit

Chandrani,

Director of BE Studio at ITV

Bhavit Chandrani, Director of BE Studio at ITV, mentioned they are still making significant investments in commissioning programming. "Branded content, or ad-funded

entertainment, can really help us add value to this investment. We can work with advertisers to develop shows that support their marketing ambitions and objectives while also delivering compelling entertainment for our audiences," he explained.

Brand-funded content allows broadcasters and digital streamers to reach new audiences innovatively. "Investment in engaging and impactful content creates credibility for the brand and helps foster deeper connections with existing and new audiences," Seth said. She also explained that this model encourages brands to listen to their audience, cater to their interests, and build a sense of community and loyalty around the brand. Zamboni agreed, stating that branded content offers a more organic approach to reaching new audiences by embedding the brand message within storytelling that resonates with active viewers. "Instead of relying on traditional advertising, which many audiences, especially younger generations, tend to skip or ignore, branded content integrates the brand into the narrative in a more seamless and engaging way," she described. Chandrani also emphasized that ITV, through the launch of ITVX, has been able to take creative risks in its approach, allowing it to commission shows they wouldn't have pursued traditionally.

Last year, Beyond Productions, a Banijay company, presented a documentary titled "Mind Games – The Experiment," commissioned by the international sportswear

“ THE DYNAMIC OF INTERCONNECTED BRAND BUDGETS AND PRODUCTION BUDGETS, PARTICULARLY IN MORE AMBITIOUS PROJECTS, IS BECOMING MORE COMMON, BOTH IN SCRIPTED AND UNSCRIPTED CONTENT"

brand ASICS. The production was an editorially driven, impartial, and unbranded film, and Rossi Spencer pointed out that it's hard to realize a brand commissioned it. The company also developed a branded solution for "The Secret Life of 4-Year-Olds", a UK show that was highly successful on Channel 4 Linear. Alongside Channel 4's digital commissioning team, Banijay produced digital content pieces for different platforms. "It allows Channel 4 to bring back something that was already successful for them, and it gives a CMO the ability to say, 'I recognize this title, and I know I can bring my values back with it,'" Rossi described. In Portugal, the company launched "Mistura Beirão," a talent show for cocktail makers in partnership with the premium Portuguese liqueur Licor Beirão and broadcaster TVI. Additionally, in Italy, Banijay is producing the second season of "Maître Chocolatier – Talenti in Sfida" in collaboration with Lindt & Sprüngli Spa for Sky Italia's freeto-air channel TV8.

BBC Studios Digital Brands has developed the commercial YouTube channel of TopGear, where audiences can find the

best clips from their favorite episodes, such as "Ad Feature: How Audi Won The Iconic Dakar Rally." Cupra UK and BBC TopGear have also collaborated on a series of advertisement features on the TopGear website, with their latest feature showcasing the new limited edition Cupra Formentor VZN. BBC Studios Digital Brands also produced the BBC's new documentary series "Arts in Motion" in partnership with Rolex, which profiles South Korean opera star SeokJong Baek, one of the world's top young tenors.

ITV's "Sessions," in partnership with O2, is another excellent example of branded content. "Live music is a bit of a departure for ITV, so we were delighted to work with O2 to bring this show to life," Chandrani noted. Other notable examples include "Dress the Nation" with Marks & Spencer, a hunt for Britain's best amateur fashion designer, and "Champions: Full Gallop" with Paddy Power, a high-octane documentary following a season of British horse racing.

The most recent collaboration involving Fremantle is the film "Maria" by Pablo Larraín, produced by Fabula, The Apartment

(a Fremantle company), and Komplizen Film. "We integrated a brand that the protagonist genuinely loved, Fernet Branca, into the storytelling in a way that felt authentic and natural," Zamboni explained. According to legend, Maria Callas drank the Italian liqueur before performing on stage to soothe her voice, making her one of the first endorsers of massconsumption brands. "In the film, this story within the story is told subtly and delicately, as only a great director would," she added.

By Romina Rodriguez

MUGE AKAR , HEAD OF SALES AT ATV, DESCRIBES THE LOCAL PERFORMANCE, MAIN FEATURES, AND GLOBAL POTENTIAL OF THE

The ongoing global expansion of Turkish drama can be attributed to a combination of strong storytelling, high production quality, and the ability to evoke universal emotions that transcend cultural barriers. In that context, ATV is launching “The Nightfall” at Mipcom. Señal News spoke with Muge Akar, Head of Sales at ATV, to understand the global potential of the show.

What is the global potential of "The Nightfall," the series ATV is launching at Mipcom?

"'The Nightfall' has already solidified its position as a breakout hit in Turkey, becoming the ratings leader in its slot and captivating local audiences. This early success points to its strong global potential, as Turkish series continue to thrive internationally due to their unique blend of emotional storytelling and high production values. The show has attracted great interest from international buyers, clearly indicating its wide-reaching appeal. The universal themes of love, betrayal, and the quest for justice, along with its cinematic visuals and complex character dynamics, ensure that 'The Nightfall' will resonate with diverse audiences worldwide. As Turkish dramas consistently perform well

“’THE NIGHTFALL' STANDS OUT DUE TO ITS GRIPPING STORYLINE”

in regions like the Middle East, Latin America, Eastern Europe, and Asia, 'The

Nightfall' is poised to follow in the footsteps of previous Turkish successes, expanding ATV's footprint in these key markets and beyond."

How would you describe the main features of the show? How would it appeal to global audiences?

"'The Nightfall' stands out due to its gripping storyline, a perfect blend of classic drama elements and fresh, unpredictable twists. The show has high-stakes tension, emotional depth, and intricate character relationships. 'The Nightfall' has high production values, stunning cinematography, and carefully crafted set designs that elevate it to an international standard. Additionally, it incorporates all the elements of drama, giving it a fairytalelike narrative that feels fresh while remaining deeply rooted in universal themes of fate, justice, loyalty, and love. The title's ability to marry local authenticity with global storytelling conventions ensures it will have broad international appeal, attracting a wide range of viewers across different cultural contexts."

How important is having a wellknown cast to expand the show's global footprint?

"Casting globally recognized actors like Burak Deniz and Su Burcu Yazgı Coskun adds considerable weight

to 'The Nightfall' international appeal. With his established presence in international markets, Burak Deniz serves as a major draw for viewers already familiar with his previous work. Moreover, Su Burcu Yazgı Coskun is quickly emerging as one of Turkey's brightest stars, and her role in 'For My Family' has garnered her a substantial international following. A well-known and charismatic cast is pivotal in driving international sales, as it offers buyers a familiar entry point to the TV series while ensuring higher engagement from existing fanbases across multiple territories."

How important is the show's high ratings in Turkey to reinforce its brand?

"Achieving top ratings in the Turkish market is a strong indicator of a show's quality and appeal, particularly given the highly competitive nature of the Turkish TV landscape. 'The Nightfall' leading its prime time slot is a measure of its domestic success and a crucial selling point for international buyers. A series that performs exceptionally well in a competitive market like Turkey demonstrates its capacity to engage and sustain viewer interest over time, a crucial consideration for buyers. 'The Nightfall' strong performance in Turkey enhances its brand identity. Ratings success also means that they have already been tested with a highly demanding audience, thereby reducing the risk for international networks and platforms when acquiring the rights."

By Diego Alfagemez

CLAIRE RUNHAM, HEAD OF ACQUISITIONS, AND TATIANA GRINKEVICH, HEAD OF SALES, DESCRIBE HOW THE COMPANY HAS ADAPTED TO CHANGING VIEWER HABITS AND MARKET TRENDS WHILE STAYING FOCUSED ON DELIVERING CONTENT THAT RESONATES INTERNATIONALLY.

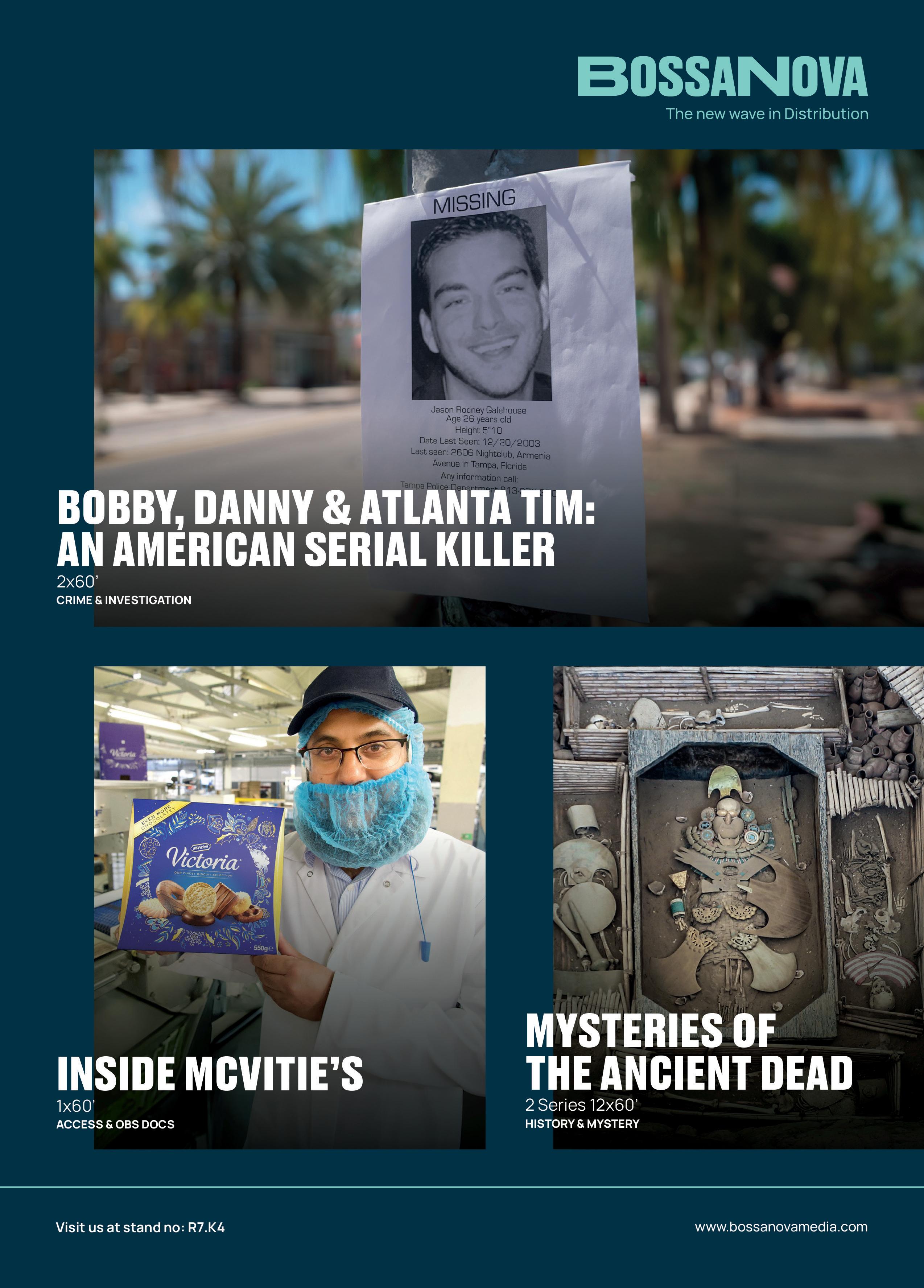

BossaNova Media has carved out a unique strategy in both acquisitions and sales as the media landscape continues to evolve. Claire Runham, Head of Acquisitions, and Tatiana Grinkevich, Head of Sales, spoke with Señal News about how the company has adapted to shifting viewer habits and market trends, focusing clearly on delivering content that resonates internationally.

BossaNova, a boutique company with a tight-knit team of ten employees, has grown increasingly selective about the content it chooses to acquire. Claire Runham explained the company's approach: "We're more selective than ever with the content we acquire. As a boutique company, any project we pick up crosses the desk of every single person in the business, so the

acquisitions need to be worth the resource. That process ensures that each title aligns with internal priorities and market appetite," she said.

When it comes to content diversification, the company's focus is clear: internationally appealing content. "Rather than focusing specifically on

local content, our focus is more on internationally appealing content," Runham shared, emphasizing the importance of historical productions like "Tsunami: The Day the Wave Hit" and "Greatest Escapes of World War 2," which draw global attention. Runham also highlighted the balance between maintaining a robust catalog and pursuing new acquisitions. "Much of the content we're currently representing is selling internationally. We're not averse to taking risks, so considering diversification is something we continue to explore," she added. That careful balance keeps

their catalog fresh while catering to broad audience demands.

On the sales front, Tatiana Grinkevich stressed the importance of listening to buyer demands and staying agile. "Listening to what buyers want is essential.

We work closely with producers and buyers to keep up with their ever-evolving strategies. That approach helps Bossanova adapt to the fast-paced and competitive nature of the media industry," she stated.

According to the executive, a significant challenge in sales is staying ahead of evolving trends: "The industry is quite fast-paced, so keeping up with all the trends is essential, and this is probably the main challenge," Grinkevich said. To navigate that landscape, she closely monitors market trends and regularly checks in with buyers to ensure that BossaNova's content matches their evolving needs.

The company's strategy extends beyond traditional content offerings. As Grinkevich explained, buyers are becoming more creative with channel strategies, experimenting with formats, genres, and scheduling models. "Buyers have been as creative as possible in the past few years. Audiences have been spoilt with such a variety of content on offer," she described. BossaNova doesn't just rely on gut instinct and relationships in the sales process. Technology and data analytics play a pivotal role. "I often rely on data analytics when working on deals, including pitching and negotiations," she said. This data-driven approach ensures that BossaNova is well-informed when making critical decisions, helping the company stay ahead in an increasingly tech-driven market.

By being selective about acquisitions, focusing on internationally appealing content, and adapting to the fast-changing market, Bossanova is positioned to continue its growth. With a blend of traditional methods and forward-thinking strategies, BossaNova remains committed to producing and distributing high-quality, globally resonant content. "The model that we use at BossaNova still works. It's about continuing that while also making plans for the future," Runham noted.

By Federico Martinez

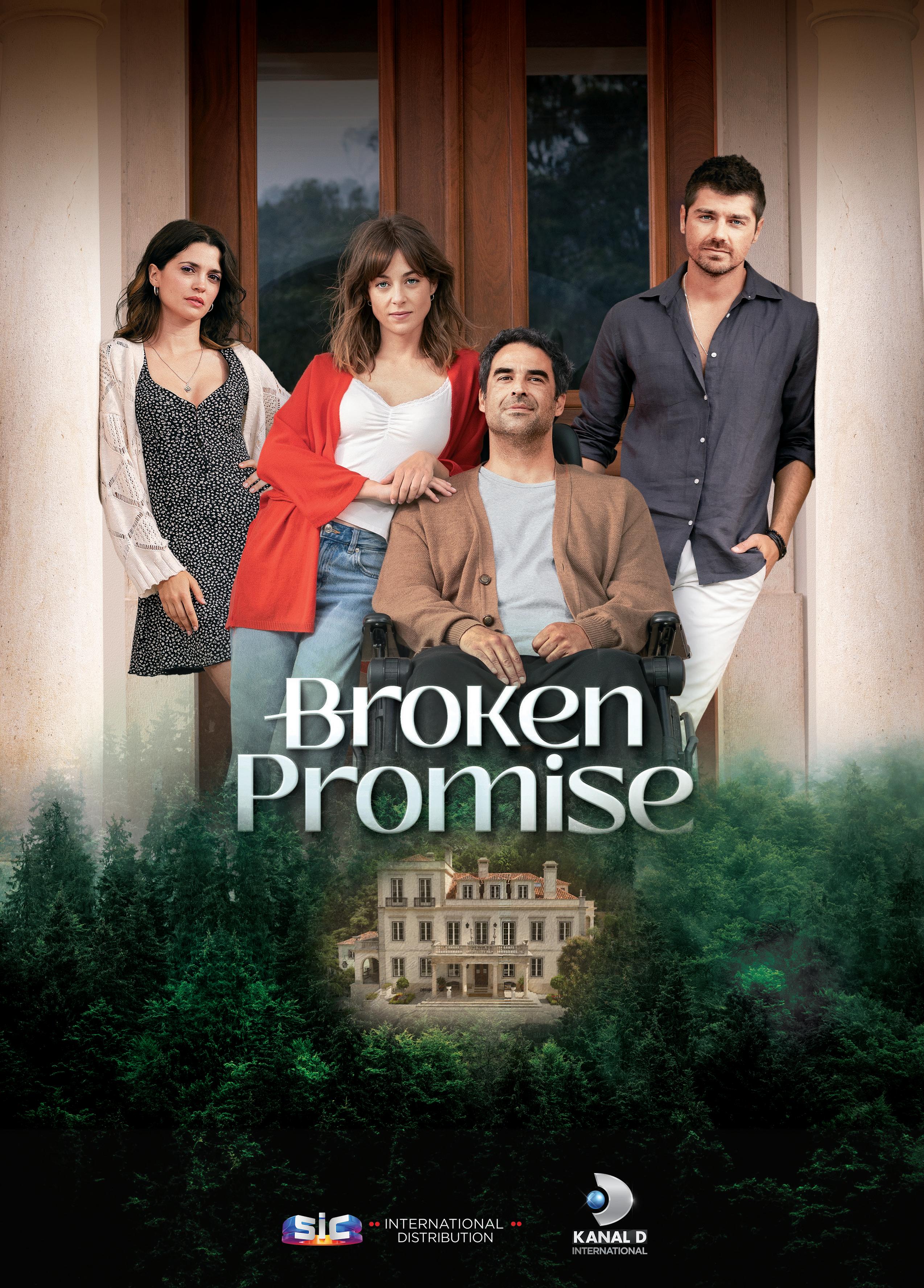

K“THE

anal D International will launch 'My Mother's Tale,' 'The Family Burden,' and the new season of 'Secret of Pearls' at Mipcom, enhancing the global need for Turkish drama. Señal News talked to Elif Tatoğlu, the company's Distribution Strategy and Sales Director, to describe its strategy to expand its global footprint.

How would you describe Kanal D's global expansion strategy?

"Kanal D International's global expansion strategy focuses on increasing the footprint of our Turkish dramas across multiple regions by partnering with key broadcasters and digital platforms. We aim to leverage the growing interest in Turkish content, tailoring our approach to the specific needs of each market and client. That includes a mix of strategic partnerships, format adaptations, and ensuring our content is accessible through multiple distribution channels such as free TV, pay TV, and digital platforms."

Where are the growth opportunities for Kanal D's shows internationally in terms of business models?

"The key growth opportunities lie in diversifying our business models, including AVOD, SVOD, and partnerships with global streaming platforms. In addition, there is a significant opportunity to syndicate

our content to relatively new regions, such as Africa, Asia, and Europe, where Turkish dramas are gaining popularity. Licensing and format adaptations also offer the potential for expanding our footprint."

Kanal D will feature new launches at Mipcom; what are the expectations around those titles?

"We are very excited about our new titles launching at Mipcom: 'My Mother's Tale,' 'The Family Burden,' and the new season of 'Secret of Pearls.' These series blend fresh storytelling, high production values, and universal themes that resonate across cultures. Our expectations are high, particularly given the ongoing demand for quality Turkish drama. We're confident these new launches will perform well in key territories, further solidifying our position as a leading distributor of Turkish content globally."

How do you analyze the neverending growth of Turkish drama worldwide?

"The growth of Turkish drama worldwide is driven by its unique ability to blend traditional values with contemporary themes, making it relatable to diverse audiences. Turkish series are known for their emotional depth, strong character development, and high production quality. As viewers seek fresh,

emotionally compelling content, Turkish dramas continue to meet this demand, ensuring sustained growth in global markets."

Kanal D recently closed deals in Vietnam, Bangladesh, and Thailand. How important is the Asian business in Kanal D's global strategy?

"Asia offers immense potential with its diverse and rapidly expanding audience base. We focus on revitalizing interest in Turkish dramas across the region. Our recent deals in Vietnam, Bangladesh, and Thailand underscore our commitment to deepening our Asian presence. That market is a strategic priority for us due to its scale, and we are continuously exploring innovative approaches to expand our footprint, tailoring our strategies to meet each market's unique preferences and dynamics."

What is the growth potential around the European market?

"The European market continues to be a strong growth area for Kanal D, with a deep appreciation for Turkish dramas in regions like the Balkans and Central and Eastern Europe. As streaming platforms grow and evolve, there's an increasing opportunity to reach new audiences across the broader region through digital platforms. Additionally, we are actively expanding the market with format sales, as the Kanal D catalog is unmatched in terms of the quality and richness of its stories, all of which have proven successful locally and globally."

By Diego Alfagemez

EXECUTIVES FROM AMC NETWORKS, FLIXXO, OUTTV, QALBOX , AND KOCOWA+ UNVEIL THEIR SECRETS FOR KEEPING THEIR PLATFORMS ALIVE AND GAINING GLOBAL SUBSCRIBERS EVERY YEAR.

Consumer appetite for subscription streaming services has transformed the industry over the past decade, but new data from Omdia has found a notable shift in the SVOD "stacking" behavior. Omdia's latest report found that there has been a significant change in the way consumers are subscribing to multiple streaming services: previously, they would often stack multiple subscriptions to gain access to a wider range of content, but they are now becoming more selective in their choices and opting for a more focused approach to their streaming subscriptions. In this landscape, how can niche platforms such as Flixxo, OUTtv, Qalbox, Acorn TV, and Kocowa survive and stand out from streaming giants like Netflix or Disney+?

AMC Networks’ streaming strategy has always been focused on offering specialized and targeted services that appeal to fans of specific genres or types of content. “Our AMC+ service, for example, is built around the kind of high-quality scripted dramas that have defined the AMC brand for years, going back to shows like ‘Mad Men,’ ‘Breaking Bad,’ and ‘The Walking Dead.’ But we also have Shudder, which is the best and most comprehensive streaming service for horror fans in the world; Acorn TV, for fans of international dramas and mysteries; and HIDIVE, for those looking for the best in anime. We really drill down into these various content categories and offer fans exactly what they are looking for, with a level of depth and authority that can’t be matched by larger services that need to offer something for everyone. We want each of our services to do one thing better than anyone else, and fans have responded,” Courtney Thomasma, Executive Vice President of Linear and Streaming products for AMC Networks, stated.

Qalbox offers global Muslim lifestyle content that is anchored on the Islamic faith. "We offer niche content that resonates with diverse Muslim

cultures, including films, series, documentaries, and educational content in multiple languages. In addition, we also include Quranic recitations, lectures, and teachings from respected global scholars to cater to spiritual needs," Junaidah Said Khan, Head of Content at Qalbox, stated.

"Flixxo stands out by offering a decentralized, community-driven streaming experience that goes beyond the algorithms of traditional platforms. Our content is short-form, independent, and comes from creators worldwide, providing a fresh and diverse range of stories often overlooked by mainstream services," Adrián Garelik, CEO at Flixxo, said. "Flixxo also empowers users through its tokenized economy. Creators and viewers can earn Flixx tokens, turning content interaction into a rewarding experience," he added.

There are a few notable differences between Kocowa+ and the major streaming platforms. "We are a specialized channel focused solely on the best Korean content that caters to a specific audience

segment," KunHee Park, CEO at Kocowa, explained. "As a tech-entertainment platform, we have set ourselves apart by strategically curating over 40,000 hours of the best Korean entertainment from K-Dramas, K-Variety Shows, and K-Pop, and we are constantly adding more," he added. Another key differentiator is Kocowa+ unique content scheduling method. "We don't release entire series at once. Instead, we localize premieres in real-time and release episodes as they roll out in Korea," he explained.

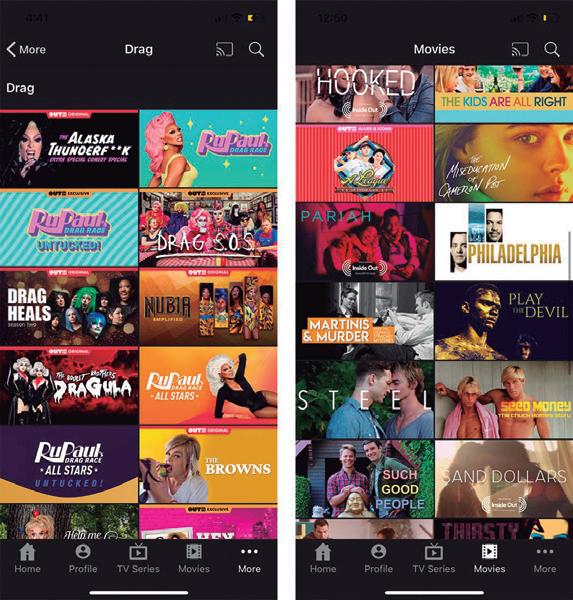

Focusing on LGBTQ+ content, OUTtv is the world's leading premium service provider for that community. "What makes OUTtv unique is our audience and how we produce content. While other platforms offer some LGBTQ+ content as part of their slate, we exclusively focus on this community and make deliberate choices for what best serves it specifically," Brad Danks, CEO of OUTtv, commented. "Our original and acquired programming is not just about the LGBTQ+ people and perspectives; it is also written, produced, and starred in LGBTQ+ creators both on and behind the camera, telling their stories authentically," he completed.

Retaining the platforms' subscribers and getting new ones is a big challenge for niche streaming services. Flixxo does that by focusing on its niche: independent, short-form content that resonates with younger audiences who value community and discovery over commercialized media. "Our upcoming 'Ticket 3.0' model, using NFTs for exclusive access, adds an innovative edge that appeals to users interested in owning a piece of the content experience. Partnerships

with telecom carriers and integrations with Web3 platforms will further enhance user reach, making Flixxo accessible, engaging, and rewarding in ways that major streaming services do not offer," Garelik explained.

Junaidah Said Khan mentioned that Qalbox encourages its users to share their stories, experiences, and content, fostering a sense of community. "With our interactive features such as livestream, we are also inviting our users to engage with the scholars or influencers," he said.

AMC Networks’ focused approach to each of its services allows them to break through with authority and credibility in a crowded marketplace. “Shudder, for example, released its top five movies of all time in the last year, and these were also some of the biggest films in the entire horror genre for the year. Acorn TV, HIDIVE, and Sundance Now also brought new shows and films to subscribers that rank among the most popular ever for each of those platforms. Because we are doing one thing and doing it in a better and more comprehensive way than anyone else, we are able to build community around each specific genre or content category. That is a rare and powerful thing fans understand and appreciate, even in a noisy and competitive environment,” Thomasma stated.

Kocowa is pursuing the 'Kocowa Everywhere' strategy as a specialized K-Wave content brand. "K-Content " has become a widely consumed genre with mainstream audiences across many countries. Accordingly, while maintaining the neutrality of our service, we communicate the message that KOCOWA is 'the K-Content brand' through both B2C and B2B partner platforms," Park declared.

Brad Danks mentioned that the key to all platforms is creating great content that keeps audiences returning. "We have seen users that leave OUTtv often coming back

and resubscribing for a new season of their favorite show. We're continually working to understand what our viewers are looking for and creating as many projects as possible that will engage and surprise them," he expressed. Regarding retaining existing subscribers, Danks revealed that the platform continues that relationship via social media and email marketing, as well as programming shoulder seasons of shows so that they continuously have interesting content at their fingertips.

Flixxo's approach to content acquisition and production is decentralized and creator-focused. "Unlike major streaming services that often gatekeep content through high-budget productions and exclusive contracts, Flixxo embraces a more inclusive model. We empower creators with blockchain-based monetization tools, allowing them to maintain control over their work while earning directly from their audience," Garelik commented. "Additionally, our emphasis on tokenized access offers creators unique ways to engage fans and generate revenue without relying on traditional subscription fees, making Flixxo a more sustainable platform for diverse and independent voices," he completed.

"Our approach to content acquisition and revenue distribution is quite different," Kocowa's Park commented. "Instead of focusing solely on original content, we have adopted a business model that shares revenue with IP holders, ensuring a win-win scenario where both parties split the earnings for each piece of content. To support that strategy, a transparent settlement process is essential, and the data collected for these settlements and the content consumption on our platform in various market segments is processed and analyzed to provide valuable insights to our Program and Content Providers to assist in curated content production," he added.

OUTTv offers a mix of original programming with popular acquisitions, but they're unique in super-serving

queer content to LGBTQ+ audiences and aiming to do so both through programming and also by nurturing LGBTQ+ talent. "Since we are a targeted service, our audience

expects us to deliver content that is truly original and authentically queer. Therefore, both of these criteria drive our production and acquisition decisions. We actively seek out programming you could only find on OUTtv, whether because it's outrageous, telling previously untold stories, or amplifying new and upcoming voices. While acquisitions are an important element of our programming, it's still hard to find authentically queer content that has already been made, so commissions are vital. Another point of difference compared to other, larger streaming services is that we challenge producers to hire and cast LGBTQ+ talent, making our programming authentic and honestly portrayed," he expressed.

Courtney Thomasma explained that AMC Networks takes a very careful content curation, at the heart of all of its streaming services. “The way we focus on specific categories allows us to make and acquire shows and films that appeal to superfans of the genres we focus on, in a way the bigger and broader services can’t. They just have too much ground to cover in trying to deliver something to every member of a household as opposed to focusing on passionate fans of some specific thing. We sometimes say we’re not trying to offer something for everyone, we’d rather our services represent everything to someone, and that mindset drives everything we do around our streaming products and why we’ve been growing, successful and distinct in a crowded environment,” she explained.

Qalbox focuses on global Muslim lifestyle content acquisition and production, differentiating it from larger streaming services. "We prioritize understanding the specific needs and preferences of diverse Muslim communities globally by conducting surveys and engaging with community leaders to gather insights. And with that, we tailor our content to reflect the cultural nuances of different regions, ensuring representation from various backgrounds," Khan explained. "We also collaborate with local and international scholars, Muslim filmmakers, writers, and influencers who can provide us with authentic perspectives. That not only enhances credibility but also fosters community trust. The stories we highlight are from different sects, ethnicities, and cultures within the Muslim world to ensure a broad representation," she finished.

By Romina Rodriguez

CHRIS OTTINGER , HEAD OF WORLDWIDE DISTRIBUTION AT AMAZON MGM STUDIOS, DESCRIBES THE DIVISION'S FIRST YEAR, WHICH AIMS TO STRATEGICALLY WINDOW CONTENT TO EXTEND ITS LIFECYCLE.

Amazon MGM Studios Distribution has marked its first year. The division, which functions as the in-house studio for Amazon's streaming platforms, has successfully balanced content supply to these services while licensing shows and films to third-party outlets globally. Chris Ottinger, Head of Worldwide Distribution, Amazon MGM Studios, spoke with Señal News and explained that the division's core mission is clear: "Generating license fees, which

help finance production. We also help strategically window content to extend its lifecycle."

This new approach has allowed the studio to broaden its content's global reach, benefiting not only customers but also creators and talent. Ottinger emphasizes the importance of extending the content lifecycle through licensing. "The longer lifecycle benefits the customer, series creators, talent, and our business by giving it a broader reach. We have been working on this project for nearly two years now, and we needed to overcome many operational challenges," he stated.

One of the main hurdles was organizing key materials like music cue sheets, unit stills, and metadata, assets required by thirdparty licensees. "Our teams worked hard to build new work processes and organize the information so that it would be ready to give to our licensees when the time came," Ottinger acknowledged.

Amazon MGM Studios sees a great opportunity in licensing local original titles to global markets. Ottinger highlighted the success of several series that originated in the UK but have found new audiences worldwide. "Clarkson's Farm" and "The Grand Tour" are standout examples, licensed in territories ranging from France to Israel. Ottinger also mentioned licensing other notable shows, such as "Sebastian Fitzek's Die Therapy" and "Un Asunto Privado,"

showing the division's commitment to expanding its footprint in the international market. "In the next year, we are working to grow this business area significantly," Ottinger noted.

As the division matures, Ottinger envisions it playing a pivotal role in content greenlighting decisions, particularly regarding international appeal and long-term viability. "I see licensing becoming a part of the conversation, ideally in the greenlight process," Ottinger said. This evolution could make the division a key selling point for talent and creators looking for a long shelf life for their work.

Looking ahead, Amazon MGM Studios Distribution is attending Mipcom with the launch of several highly anticipated titles. Leading the pack is "Earth Abides," a limited series adaptation of George R. Stewart's sci-fi novel starring Alexander Ludwig and Jessica Frances Dukes. The division will also offer films like "Mercy," starring Chris Pratt and Rebecca Ferguson, and "Crime 101," featuring Chris Hemsworth and Barry Keoghan. Rounding out the lineup is "The GOAT," a competition reality show where 14 reality superstars compete for the title of "Greatest Of All Time."

By Federico Martínez

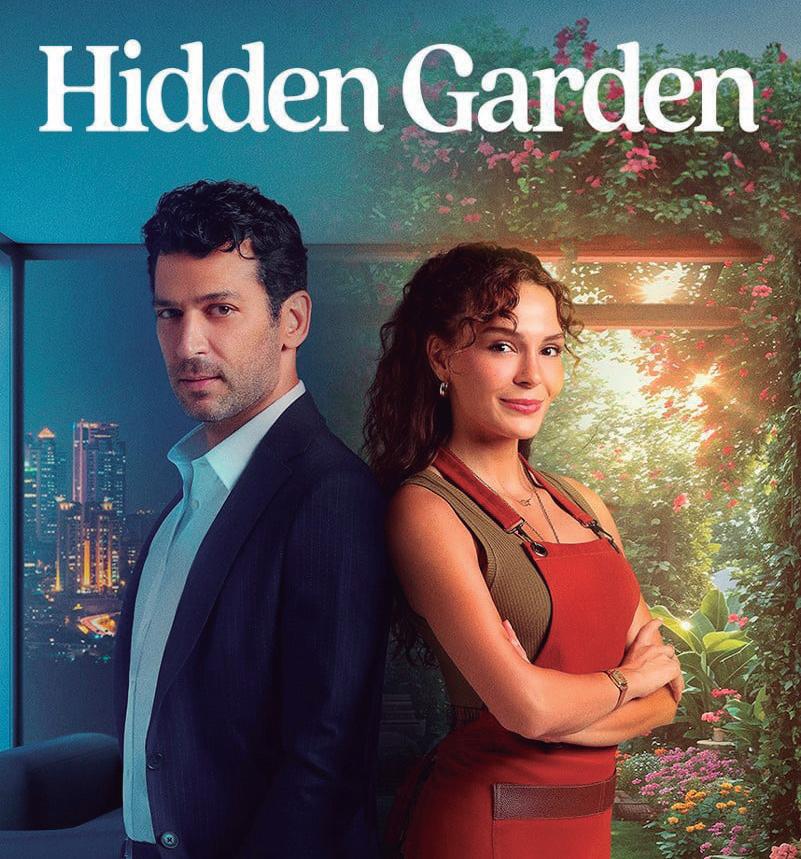

FIRAT GULGEN, FOUNDER AND CEO OF CALINOS ENTERTAINMENT, HIGHLIGHTS THE GLOBAL APPEAL OF "HIDDEN GARDEN," THE COMPANY'S NEW DRAMA, WHICH IT IS LAUNCHING AT MIPCOM.

Calinos Entertainment is launching "Hidden Garden" at Mipcom, a premium drama produced by TMC Film and starring Ebru Sahin and Murat Yildirim. As the company's headliner for the market, it features a story of extraordinary love, loss, and buried secrets. Señal News spoke with Firat Gulgen, Founder and CEO of Calinos Entertainment, to understand the show's global potential and describe the company's growth strategy.

How would "Hidden Garden" appeal to global audiences?

"With its internationally recognized cast and engaging storyline, "Hidden Garden" has all the elements needed for international success. The compelling storyline delves into complex relationships and emotional journeys, drawing audiences into the characters' lives and struggles. It showcases diverse personalities, allowing viewers from different cultures to find relatable characters. Its exploration of universal themes resonates across cultural boundaries, fostering a deep emotional connection with the audience. Moreover, the high

“WE ARE STRENGTHENING OUR GROWTH THROUGH COPRODUCTIONS”

production quality, featuring stunning visuals and meticulous attention to detail, enhances the viewing experience. Overall, "Hidden Garden" combines universally relatable themes with cultural nuances, making it accessible to diverse audiences and ensuring it captivates viewers with its drama, romance, and intrigue blend."

How do you analyze the neverending growth of Turkish drama?

"The growth of Turkish drama worldwide can be attributed to several key factors. First, the storytelling is rich and multifaceted, incorporating universal themes like love, family, and social issues that resonate with diverse audiences. High production quality, characterized by stunning visuals and well-crafted narratives, also plays a significant role. The rise of streaming platforms has made these dramas more accessible to international viewers, while the popularity of Turkish actors has helped expand their reach."

How would you define Calinos' global expansion strategy?

"International audiences have specific expectations, often seeking compelling themes such as love, loss, and family secrets. Strong female lead

characters and engaging storylines involving children are also crucial. Additionally, a wellknown cast significantly boosts a series' appeal. As we acquire distribution rights, we prioritize these elements to ensure our selections resonate with viewers and maximize their potential for success across various markets. We are also expanding our catalog by incorporating award-winning, highly-rated non-Turkish series. This strategic move highlights our commitment to offering diverse, high-quality content that connects with global audiences. By adding these acclaimed titles, we aim to enrich our offerings and enhance our competitive position in the international market. Moreover, we are strengthening our growth through co-productions with several global companies and distributing local adaptations of our Turkish series."

What business models offer the best global growth opportunities?

"We are working on a Spanish remake of a Turkish series from our catalog. Additionally, we have started working on a script for an epic drama series for a platform in the United States. We have also started working on a film based on a book inspired by a true story after obtaining the rights of a famous author whose books are best sellers in Europe. We are planning co-production projects by developing stories in Turkey, Europe, and the United States. Having our stories made abroad and distributing them will bring us new global growth."

By Diego Alfagemez

Last September, Abacus Media Rights was acquired by Sphere Media following the conclusion of Amcomri Entertainment's sale of the company, resulting in the creation of Sphere Abacus. Jonathan Ford, Sphere Abacus' Managing Director, and Bruno Dubé, Sphere Media's CEO, spoke with Señal News about what this merger means and the future of the Sphere Media group.

The executives explained that Sphere Abacus's goal is to continue operating exactly as it did before. "We will keep working with a wide range of independent producers and continue to license a wide range of scripted and non-scripted content to buyers across all platforms and broadcasters. Now, through the ownership of Sphere Media, we can extend our relationships with Canadian production partners and

JONATHAN FORD, MANAGING DIRECTOR OF

ABACUS,

REASON AND STRATEGY BEHIND THE RECENTLY MERGED COMPANY.

broadcasters both within Sphere Media and externally," Ford and Dubé stated.

Talking about the company's new role as Sphere Media's distribution arms, they added: "Even before the transaction, we were working closely with Sphere Media and selling a number of their titles (scripted and non-scripted), and this is how the two parties got to know one another. So now, as Sphere Abacus, we will develop broader co-production opportunities with international buyers across multiple genres and languages."

Looking ahead, Ford and Dubé agreed that investments in productions from independent producers remain a key and significant source of programming: "We will continue to work on

co-production models, putting forward distribution advances and securing pre-sales. Several new investments will be announced in the run-up to Mipcom."

Another key is content diversification in order to appeal to different audiences and markets. In this case, the executives depicted the process behind that strategy: "We carefully assess every title that we acquire, checking that sales opportunities match the investment being made. That is why we look for a broad range of programming across many different genres, ensuring we cover a significant portion of the international market and audiences," they explained. In that broad range of content, both highlighted an increased importance of locally relevant programming, as the market goes back to being locally-led as opposed to streamer-led: "Our focus has moved to funding programming that is relevant for numerous territories, making certain it has as broad an appeal as possible."

During Mipcom, the company will launch three new dramas, including "Scrublands: Silver," the sequel to "Scrublands," which has proved to be a huge success. It will also launch a range of documentaries and non-scripted series, including "Gunpowder Seige," "The Last Musician of Auschwitz," "Breaking Bird: The Rise and Fall of Twitter," "Billy and Dom Eat the World," and "The Titan Disaster" (w/t).

By Federico Martinez

NEM DUBROVNIK WAS THE EPICENTER OF DISCUSSION ON THE MAIN BUSINESS MODELS OF AN EVOLVING REGION. LEADERS OF THE CONTENT INDUSTRY EXPLAIN THE POTENTIAL AND CHALLENGES FOR THE SHORT AND LONG TERM.

NEM Dubrovnik celebrated a new edition in June, gathering representatives from more than 260 global companies, including more than 150 buyers and a record number of exhibitors. The prevalence of linear TV in the CEE region was a hot topic during the event. The stillgrowing number of TV households with old habits of viewers and localization creates opportunities for channel owners to expand their reach and tap additional revenues via linear offers. Nicolas Eglau, Managing Director EMEA, APAC & Global Distribution of Moonbug, explained that the company's strategy reversed the traditional model by expanding from YouTube to premium streaming services like

from YouTube, making our linear channels top performers globally. We are now focusing on expanding into Central Eastern Europe, a region with strong traditional TV viewership, to continue growing our linear channel presence," he stated.

Robert Šveb, General Director at Croatian Radiotelevision (HRT), asserted that the media landscape in Croatia and Eastern Europe is evolving, but traditional Netflix, Amazon, and Hulu, eventually to local streamers and linear TV channels. "This approach capitalized on brand recognition

like sports. "Despite the growing popularity of streaming, linear channels continue to attract significant audiences. This trend highlights the significance of timing and content selection in linear viewing habits," he said.

Kenechi Belusevic Warner Bros. Discovery

Kenechi Belusevic, VP of Business Development and Distribution at Warner Bros. Discovery, commented that linear TV remains strong in many regions due to its established presence and familiarity with older demographics. "However, streaming services present new opportunities and challenges as they grow. If the popularity of linear TV declines, exploring and investing in streaming services becomes essential. Market dynamics vary geographically, and successful adaptation hinges on understanding these nuances," she recommended.

Robert Šveb

Croatian Radiotelevision

TV, particularly free-to-air channels, remains strong. "In Croatia, linear channels are still popular, especially in sports and entertainment, maintaining high ratings," he said. Furthermore, Adrian Ježina, President of the Management Board at Telemach Croatia, affirmed that linear TV remains a dominant viewing format in the country, especially for flagship programs and events

"Linear channels help to establish franchises and brands, as we did with 'Paw Patrol' or 'Sponge Bob,'" affirmed Bernhard Schwab, Senior Vice President, Content Licensing at Paramount Global Content Distribution. "The strength of content drives both linear and digital viewing habits, and successful franchises are essential for maintaining and growing audience engagement," he said.

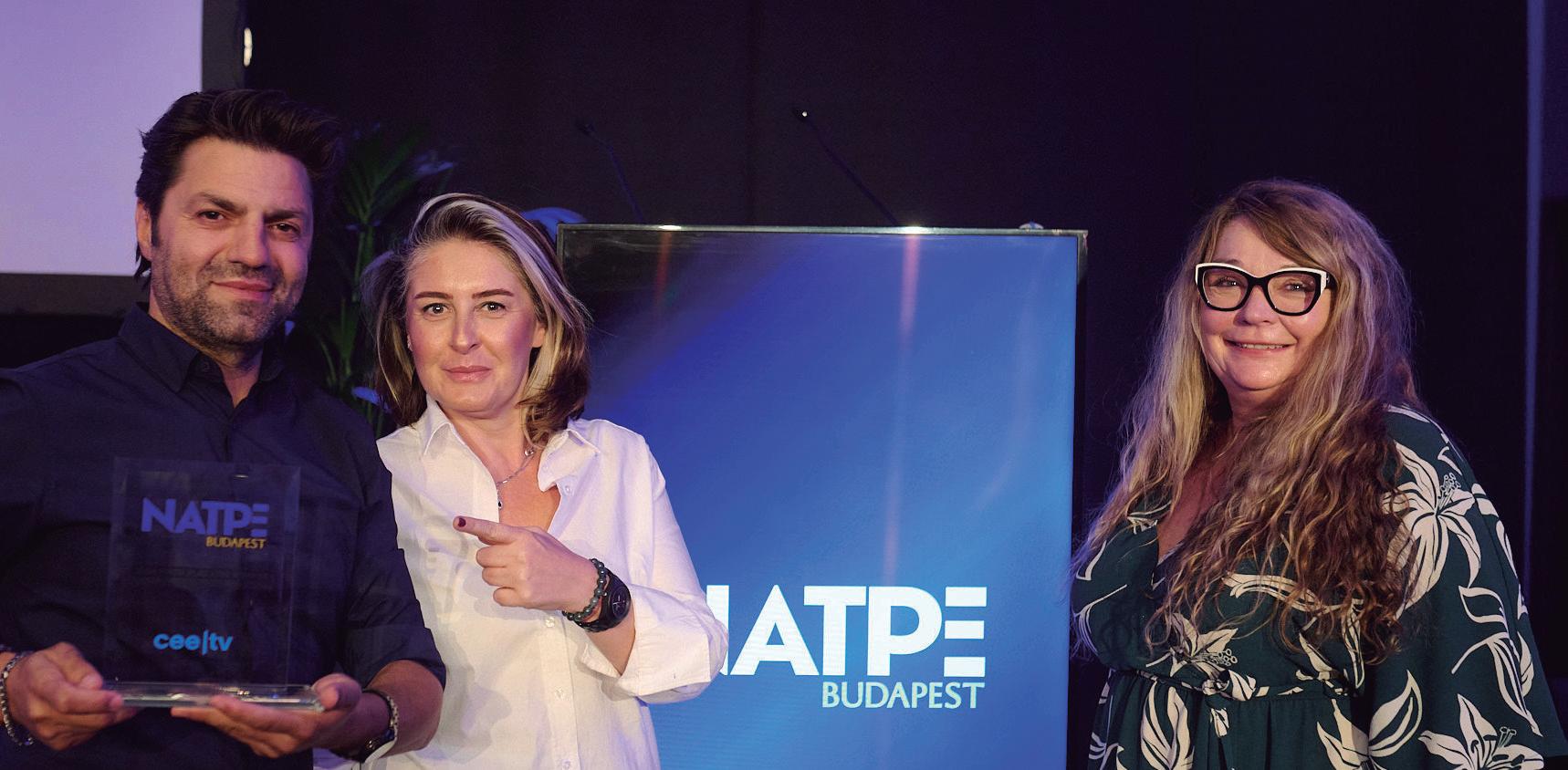

Müge Akar ATV

Moreover, Müge Akar, Head of Global Sales at ATV, offered an overview of Turkey's market and affirmed that it is still predominantly linear, but there's a noticeable shift towards digital consumption. Turkey's primary product for distribution is longrunning TV series, which are very

popular in regions like Central and Eastern Europe, where linear TV is still dominant. "This demand aligns well with Turkey's production strengths. Audiences on digital platforms often seek different types of content compared to linear TV, such as historical series with higher budgets, shorter series, or unique formats," she explained. The trend indicates that digital consumption will continue to rise. "Preparing for this shift involves creating and curating content that appeals to digital viewers while maintaining a strong presence in linear TV," she affirmed.

Complementing FAST Channels with the existing TV business was another critical point in better understanding the CEE region's current landscape. "Different models are working or being experimented with, which can also be applied to the CEE region. It's about what works for your business model and market and how we

streamers are joining forces and offering their launches through new business models and streaming partnerships.

Maria Rua

can participate," asserted Victoria Davies, Managing Partner of Davies, Stoychev & Partners. "FAST channels are just additional great content that telco operators can add to their offerings, and they can do it for free," added Iza Piotrowska, Director of Affiliate Sales and Business Development of Mega Max Media. "Telcos have to integrate FAST channels to their EPGs naturally, where people watch that content anytime," said Karina Rompa, Business Development and Partnerships at Rakuten TV. Something unthinkable in the past years has happened: