CANADA $12.00 DECARBONIZATION DYNAMICS INVESTMENT PICKS OFFICE APPREHENSIVENESS SMART TECH UPTAKE OBSTACLES INSOLVENCY REMEDIES DATA CENTRE DEMAND Publication Agreement #40063056 FOR BUILDING OWNERS, ASSET AND PROPERTY MANAGERS VOL. 39 NO. 1 • SPRING 2024 PART OF THE PART OF THE Who’s Who 2024

All programs subject to bank approval and loan amounts are subject to creditworthiness. The CIBC logo is a trademark of CIBC. ARE YOU READY FOR THE NEXT STEP? LET’S EXPLORE YOUR GROWTH OPPORTUNITIES Our full suite of simple, predictable, all-inclusive financing solutions is tailored to the needs of the property management sector. We offer financing for: Ownership changes Acquisitions Real estate Contact the CIBC property management industry team today 905 273-3584 or mailbox.nationalindustryprograms@cibc.com

VOL. 39 NO. 1 SPRING 2024

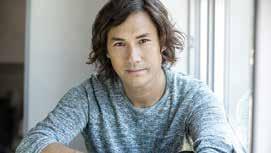

Editor-in-Chief Barbara Carss barbc@mediaedge.ca

Publisher Sean Foley seanf@mediaedge.ca

Art Director Annette Carlucci annettec@mediaedge.ca

Graphic Designer Thuy Huynh-Guinane

Contributing Writers Kim Bergeron, Gerald Ngan

Production Coordinator Ines Louis Inesl@mediaedge.ca

National Sales Jake Blanchard jakeb@mediaedge.ca Ron Guerra rong@mediaedge.ca Melissa Valentini melissav@mediaedge.ca

Digital Media Director Steven Chester stevenc@mediaedge.ca

Circulation circulation@mediaedge.ca

Alberta & B.C Sales Dan Gnocato dang@mediaedge.ca

editor’snote

AS BUSINESS BUZZWORDS GO, “nimble” had a short run in the commercial real estate industry and was perhaps never the best descriptor for activities focused on generating stable, long-term returns from illiquid assets built to last for generations. In contrast, “resilient” seems tailor-made for real estate’s purpose and attributes. It’s not about outrunning upheaval; it’s about stepping in, absorbing and redirecting the impact.

As we explore in this issue, real estate currently faces businessaltering challenges on diverse fronts: the sudden upending of norms in the office sector; and the mounting demand to cut greenhouse gas (GHG) emissions and manage the risk of an increasingly volatile and extreme climate. That would be difficult enough even without an additional swirl of economic uncertainties and social and geopolitical pressures.

As always, today’s real estate decision-makers place a priority on securing capital and generating income so that they can undertake the portfolio restructuring and redevelopment that needs to occur. But they’re also grappling with the well-being of the people they employ, the consumers they serve and the wider public they need to reach. Luckily, it’s a multidisciplinary industry.

President Kevin Brown kevinb@mediaedge.ca

Group Publisher Sean Foley seanf@mediaedge.ca

Accounting Michele Therien michelet@ mediaedgepublishing.com

TEL: (416) 512-8186

Published and printed four times yearly by MediaEdge Communications Inc. 2001 Sheppard Avenue East, Suite 500 Toronto, Ontario M2J 4Z8 (416) 512-8186 Fax: (416) 512-8344

e-mail: circulation@mediaedge.ca

Subscription Rates:

Canada: 1 year, $30*; 2 years, $55*

Single Copy Sales: Canada: $12*

Outside Canada:

US 1 year, $85 International $110 *Plus applicable taxes

Reprints:

Requests for permission to reprint any portion of this magazine should be sent to info@mediaedge.ca.

Copyright 2024

Canada Post Canadian Publications Mail

Sales Product Agreement No. 40063056

ISSN 0834-3357

Authors: Canadian Property Management Magazine accepts unsolicited query letters and article suggestions.

Manufacturers: Those wishing to have their products reviewed should contact the publisher or send information to the attention of the editor.

Sworn Statement of Circulation:

Available from the publisher upon written request. Although Canadian Property Management makes every effort to ensure the accuracy of the information published, we cannot be held liable for any errors or omissions, however caused. Printed in Canada

From an asset management and investment returns standpoint, commercial real estate is also an industry that can typically rely on a balance of ups and downs across a mix of property types. While 2023 results of the REALPAC/MSCI Canada Property Index show continued doldrums in the office sector, the news is not all bad. Industry insiders point to retail’s recovery momentum, the ongoing positive outlook for industrial and multi-residential assets and the relative strength of Canada’s market in the global context.

“When we’re immersed in it, we kind of see it as a glass-half-empty situation, but people looking from outside see Canada as a glass-half-full place,” Michael Brooks, REALPAC’s Chief Executive Officer, mused during the results presentation earlier this year. We report on those results and industry insiders’ views in this issue.

Turning to the other big challenge, we look at the industry’s burgeoning multidisciplinary strategy for achieving reductions in GHG emissions. That starts with charting a navigable roadmap to net-zero that identifies current obstacles and potential express routes, and assigns responsibilities for finance, management, engineering and operations.

Commercial real estate decision-makers are increasingly taking the stance that decarbonization efforts and expenditures will help weather the storm on other fronts. That’s something Joe Brown, Vice President, Building Technology and Decarbonization, with KingSett Capital, stressed in a recent webinar, as he outlined his firm’s pursuit of a 67% cut in emissions by 2035.

“We are a private equity company. We are not doing these things for the sake of doing them. We think there’s a business case to be made,” he affirmed.

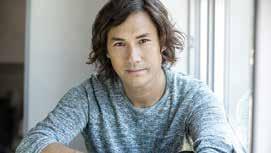

This issue also includes the 29th annual Who’s Who in Canadian Real Estate survey results. Thank you to this year’s participants, and to Kim Bergeron and Gerald Ngan for collecting and coordinating the data.

Barbara Carss barbc@mediaedge.ca

Canadian Property Management | Spring 2024 3

contents

Focus: Real Estate Trends & Context

6 Decarbonization Momentum: Roles assigned for finance, engineering, management and operations as commercial real estate takes an all-in approach to reducing GHG emissions.

12 Returns & Prospects: Investment outcomes were subdued in 2023, but Canada still looks like a preferred market.

16 Roster of Remedies: Commercial real estate lenders and borrowers grapple with insolvency.

21 Who’s Who in Canadian Real Estate: 29th annual survey of the industry’s players and portfolios in the office, industrial, retail and multifamily sectors.

34 Alternative Assets: Strong demand for data centres foreseen.

36 Smart Tech Attitudes: Survey of adopters and fence-sitters in the commercial and home markets finds generational differences in confidence and uptake.

Departments

3 Editor’s note

Validate your FM skills and mastery with the CFM®

Stand out as an industry leader with the Certified Facility Manager® (CFM®) credential, the gold standard of FM.

Showcase your mastery of the globally recognized FM body of knowledge

Gain credibility in your professional network

Empower your career

Did you know that no coursework is required to take the CFM? Because you're tested on your ability to apply FM knowledge, your eligibility is based on your experience and education.

Everything you need to prep for the exam is available through IFMA’s learning portal, fm.training:

Take a practice exam and experience the methodology

Brush up on a specific subject with our Core Competency Courses

Check your knowledge with our exam prep resource

Enroll in one of our exam prep workshops

• Offered virtually and in-person

Prepare, apply, pass and get recognized for your expertise. Learn more and prep:

ANSI-ACCREDITED PROGRAM Materials offered by IFMA to prepare for the CFM Exam, such as the CFM Exam Prep Workshop, the FM Learning System and CFM practice exams, are optional study resources and are not a requirement of eligibility, nor are they endorsed by the IFMA Certification Commission.

ALL-IN ON DECARBONIZATION

Roles Assigned for Finance, Engineering, Management and Operations

By Barbara Carss

DAUNTING TARGETS for the reduction of greenhouse gas (GHG) emissions in the buildings sector are spurring an all-in approach to decarbonization that assigns roles to finance, engineering, management and operations teams. Industry associations and a range of stakeholders within commercial real estate companies, their investor groups and service providers are likewise working together to develop resources and strengthen learning networks.

This winter brought the rollout of a series of free training courses from the

Canada Green Building Council (CAGBC), offered with the endorsement of the Building Owners and Managers Association (BOMA) of Canada, the Real Property Association of Canada (REALPAC), the Canadian Construction Association (CCA), the Climate Risk Institute (CRI) and the Royal Architectural Institute of Canada (RAIC). An overview of key low-carbon concepts was on offer through either online modules or in-person sessions focusing on: ESG; the integrated design process; operational carbon; embodied carbon; and zero carbon transition planning.

“Many of our member organizations have publicly announced their commitment to reach net zero or nearnet-zero. The challenge is how to make it happen,” Bala Gnanam, BOMA Canada’s Vice President, Sustainability, Advocacy and Stakeholder Relations, observed during a webinar to introduce the training courses and discuss decarbonization strategies. “We need to equip building operators and managers with the right set of skills to actively contribute to and support properties to enable this transition.”

6 Spring 2024 | Canadian Property Management

In that quest, Paolo Cordovado is helping to set the bar for informed and engaged frontline staff. As a senior building operator, he’s responsible for overseeing the functioning of a suite of equipment and systems that typically produce the largest share of GHG emissions, but are also central to optimizing performance, saving energy and curbing peak demand.

He joined the conversation to share a hands-on perspective on how operators can safeguard and facilitate emissions reductions. That includes: ensuring that equipment, controls and systems are

performing as intended; adjusting setpoints and run-times to find incremental energy savings and emissions reductions; and generating cost savings that can be redeployed to required capital projects.

“A minute a day, times a week, times a month, times a year, times the life of the building can be a lot of accumulated of savings,” Cordovado reflected. “If you can tweak a little bit, minute-by-minute, to get up to an overall 30 minutes a day of savings, that will be a full week over the course of a year that you’ve taken off.”

“We don’t want to forget that the cheapest unit of energy is the one we don’t use, or lose sight that efficiency is really the best solution to decarbonization,” concurred Daniel Gosselin, Senior Director of Professional Services with the facilities management and sustainability services firm, BGIS.

Pulling out to the big picture, he noted that the initial steps of a decarbonization strategy are generally sequential — committing to action, identifying major GHG sources within the portfolio,

LEED v5 PREMISED ON THREE FUNDAMENTALS

Decarbonization, quality of life and ecological conservation and restoration are the underpinning fundamentals of LEED version 5, which has just been released for a first round of public input. Developers at the U.S. Green Building Council (USGBC) expect the next iteration of the rating and certification system will be finalized by early 2025.

“Buildings offer immediate opportunities for addressing climate change, biodiversity loss, equity, health and so much more when they are designed, built, and operated with intent,” maintains Peter Templeton, the USGBC’s President and Chief Executive Officer. “This is the architecture behind LEED v5, which targets areas where accelerated progress is most needed while creating pathways that are accessible and applicable.”

The public is invited to submit comments until May 20 on the proposed updated prerequisites and credits for LEED for new construction, existing buildings and commercial interiors. These will still be organized around various categories of concern, such as energy and atmosphere (EA) and materials and resources (MT), but now they’ll all be tied to at least one of the three identified fundamentals, which a LEED v5 summary document calls “critical to facilitating the transformational changes required in the built environment”.

LEED v5’s decarbonization considerations will cover operational, embodied and transportation-related carbon. Quality of life considerations will encompass a range of “human-centric” strategies, including human and community well-being, and equity and inclusion. Ecological conservation and restoration considerations will address asset-level initiatives to limit environmental degradation and/or rehabilitate and restore ecosystems.

As well, LEED v5 will impose minimum decarbonization requirements for achieving LEED Platinum certification. For new construction and commercial interiors that will include 100% reliance on renewable energy and no on-site greenhouse gas emissions other than for emergency or backup needs.

Existing buildings must have low operational emissions, procure renewable energy or generate it on-site and have plans for further operational emissions reduction. All LEED Platinum buildings must be highly energy-efficient, with existing buildings achieving an Energy Star score of at least 80, and new construction and commercial interiors earning all 10 available credits for enhanced energy efficiency.

“Platinum is the highest level of certification available for LEED, and it denotes a level of leadership that is only attained by the most exceptional, high-performing buildings,” the summary document reiterates. “Because of the urgency of reducing carbon emissions, Platinum projects must show leadership in this area.”

For more information about the draft LEED version 5, see the website at www.usgbc.org/leed/v5

Canadian Property Management | Spring 2024 7

DECARBONIZATION

Operations

industrymomentum

“Especially on the engineering side, we often do not work closely enough with our operations teams. There’s a lot of work we could be doing.”

determining required mitigating measures and integrating them into the capital plan — but implementation is a more dynamic process with multiple simultaneous actions requiring many different types of skills.

IMPLEMENTATION REALITIES

While HVAC overhauls, building envelope upgrades and on-site renewable energy are likely to yield the most significant emissions reductions, it’s seldom economically feasible to undertake them collectively in one deep retrofit. More often, progress comes incrementally, project-by-project, as major systems reach end-of-life and need to be replaced.

That’s the case in QuadReal Property Group’s portfolio as the company pursues a 90% reduction in GHG emissions by 2050, with intentions to hit the 50% milestone by 2030.

“We’re looking at life spans of the units that are already in place in our existing buildings and getting a picture of what makes the most sense from our financial perspective,” said Nisha Agrawal, QuadReal’s Director of Sustainability. “We are a pension-backed organization so we have a fiduciary duty to do things very responsibly and think closely about how each sustainability piece aligns with the financial aspect.”

A focus on energy efficiency and operational performance is important, both before new low-carbon technology is in place and afterwards to ensure maximum return on the capital investment. As well, ongoing outreach to all QuadReal departments provides input for decision-making.

“There are a lot of experts out there across the organization so we’ve opened the door for it to be a very two-way communication process between us and the operations teams, the asset management team and anyone else who is affected [by the emissions reduction target],” Agrawal advised. “We have an ESG team so we work together to come up with strategies, programs and resources, and, at the end of

the day, it’s the property teams that are on-site delivering.”

Although low-carbon technologies will undoubtedly continue to evolve, Gosselin stresses that the basics for achieving netzero emissions in buildings have already been invented. From here, it’s a matter of refining the formulas to make it economically and practically feasible.

“Especially on the engineering side, we often do not work closely enough with our operations teams. There’s a lot of work we could be doing,” Gosselin acknowledged. “We’re pivoting toward operational excellence — defining operational excellence and then working with our operations teams to get there. We want to combine all these technologies that are available with really high-end sequences of operation so things are really working. Every minute of improvement counts.”

From operators’ perspective, Cordovado foresees that rising demand for skills combined with professional development opportunities, like the CAGBC lowcarbon training courses or the Building Operations Designation (BOD) program, could lead to further career satisfaction and advancement. That’s also happening as frontline staff emerge as the go-to source to help property managers field tenants’ demands for ESG information.

“I think that has opened up property managers’ eyes and changed the way they communicate with building operators,” Cordovado suggested. “I think it’s the perfect time for building operators to prove themselves.”

Gnanam reiterates that the rewards go both ways.

“We need to factor the value of training into our ROI calculations. We talk about the cost of the equipment; we talk about the returns in terms of energy savings or shielding from future cost of energy, but we’re not considering the potential costs in the absence of training,” he asserted. “We need to acknowledge that the building managers and operators are making the difference when it comes to actually delivering.”

FINANCIAL CONSIDERATIONS PUSH CLIMATE ACTION LEVERS

Sustainability proponents in the buildings sector acknowledge that there are abundant competing interests as they pursue decarbonization and climate resilience. Thus far, REALPAC reports that about one third of its membership of prominent Canadian real estate companies, institutional investors and investment managers have set targets to achieve netzero emissions.

Speaking in conjunction with release of the GRESB global ESG benchmark results for commercial real estate portfolios last fall, Darryl Neate, REALPAC’s Vice President, Sustainability, acknowledged the “tough” market conditions the industry faces, with “declining NOI evaluations, increased financing costs, less available capital”. However, he suggested that’s just one filter on the financial lens.

The number-crunchers are considering the annual escalating cost of carbon — in $15 increments to $170 per tonne by 2030 — versus the cost to reduce 1 tonne of carbon emissions on a per square foot basis. (As of April 2024, it’s now at $80 per tonne.)

“That’s an important metric. I think the CFOs are going to continue putting pressure on: What are the cost curves of net-zero carbon assets? What’s the return profile? How are we going to deploy our capital in the most efficient manner going forward to decarbonize our portfolios?” Neate maintained. “It’s about value and returns more than ever.”

Publicly listed companies are also watching for moves from Canadian Securities Administrators (CSA), which has indicated that rules are forthcoming to mandate disclosure of climate-related information, including a tally of Scope 1, 2 and 3 emissions. That may be more likely since the Securities and Exchange Commission (SEC) recently confirmed such rules in the United States.

Meanwhile, on the carrot side of climate action levers, a variety of federal and provincial/territorial incentives are on offer. Joining the GRESB results presentation as a representative of one of three benchmark participants to be highlighted as “examples of innovation and action”, Kit Milnes, Vice President, Sustainability and Resilience, with KingSett Capital, cited his company’s partnership agreement with Canada Infrastructure Bank to fund deep retrofits in its portfolio.

“Without external financing assistance, all this would be made much harder so I would highly recommend to any and all of you to understand what programs exist in your market so that you can get some assistance and help on executing these very complex strategies at the asset level,” he advised.

8 Spring 2024 | Canadian Property Management

industrymomentum

The BOD Program is creating a new standard for Building Operations professionals through current, relevant, engaging, and interactive training content with ongoing insights and information through continuing education, special events and direct access to industry subject matter experts. In tandem with the commercial real estate industry and over 325 recognized subject

Canadian Property Management | Spring 2024 9

Engage. Educate. Advance.

Proudly

If you and your staff are interested in registering for the BOD Program, please contact Chuck Nervick at: chuckn@mediedge.ca or 416-803-4653

Developed and Delivered by: The BOD Program is online, self-paced and includes a robust, ongoing continuing education component. For more information, please visit: BODProgram.com matter experts, we are proud to offer the BOD Program and its 22 certificates to all Building Operations professionals. Over 500 operations professionals have already registered and many have attained their Water Treatment Systems certificate.

CELEBRATING 10 YEARS OF FACILITIES MANAGEMENT

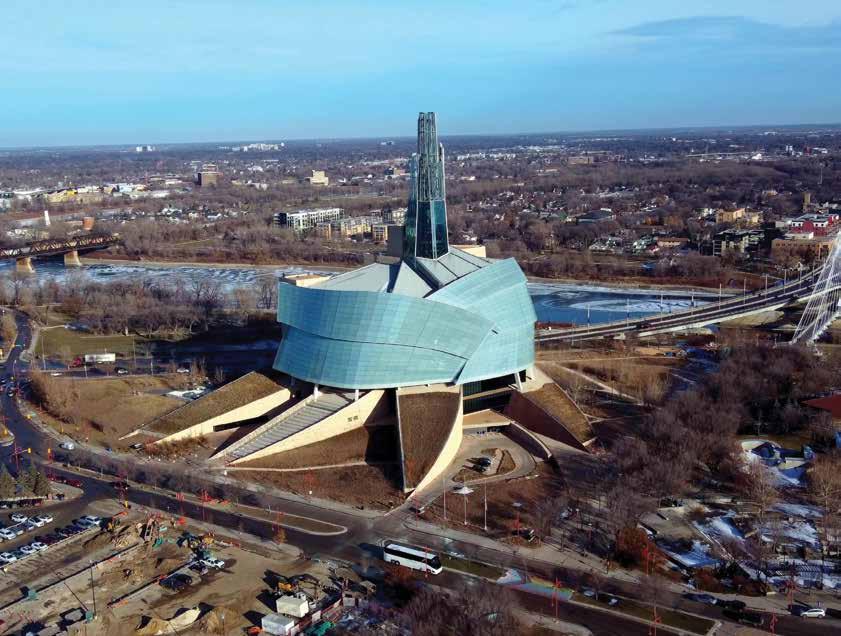

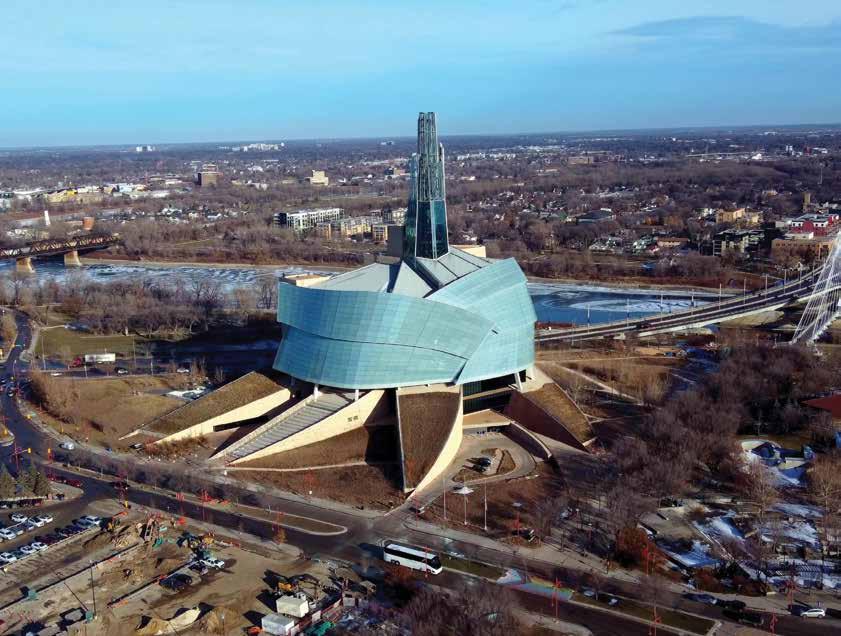

AT THE CANADIAN MUSEUM FOR HUMAN RIGHTS

Located in downtown Winnipeg, the Canadian Museum for Human Rights (CMHR) is an innovative structure of steel and glass, and a striking symbol for the quest to achieve equal rights for all global citizens. Black & McDonald’s facilities management team has been instrumental to operations since the award-winning museum opened for business over a decade ago.

“I find it a privilege to work at a facility that stands for

human rights, especially being a Red River Metis,” said Claude Plante, Contract Manager. “The building has many unique and exciting features, including the smoke evacuation system, our heating controls systems, and a unique grey water collection system. We also monitor our energy consumption and usage and are always looking for ways to improve. It’s been very fulfilling working here, problem-solving and finding solutions to complex issues.”

The Canadian Museum for Human Rights

SPONSORED CONTENT

A GREAT PARTNERSHIP

Over the course of the past decade, Black & McDonald has developed a great partnership with CMHR. Adam Rogalsky, Division Manager, Facility Management and Operations, Manitoba, says the relationship was built on transparency, confidence, and trust in the team’s ability to respond quickly and effectively to unforeseen issues.

“The contract is primarily in-house, labour-based, with a combination of hard and soft services,” he explained. “A portion of CMHR’s contracted services are also managed by Black & McDonald, and we play a supporting role with their capital projects and major improvements for the facility, as well as overseeing general site coordination and safety.”

AN EXTRAORDINARY BUILDING

From its award-winning design featuring curved lines and bold geometry, to its state-of-the-art systems and mechanical components, nothing about the CMHR

building is ordinary—and that can be said about broader operations, too.

The Museum is dedicated to human rights, which includes environmental responsibility. It calls attention to people’s rights to breathe clean air, access clean and safe drinking water, move freely and safely, and be part of something that’s overtly dedicated to the greater good.

For B&M, maintaining that responsibility means always looking for ways to improve efficiencies and cut costs so that any savings incurred at the operations level may be redirected toward areas that will deliver more important outcomes.

“Our great partnership has been built on understanding CMHR’s core business as well as bringing in numerous costreductions over time,” Rogalsky said. “I’m excited to see what the next chapter holds and am excited to have been a part of this great project!”

B&M OFFERS A FULL LINE OF FACILITIES MANAGEMENT SOLUTIONS AT CMHR, INCLUDING:

• BAS systems

• HVAC

• Plumbing

• Electrical

• Grass cutting and lawn care

• Tree and root preservation

For more information on Black & McDonald’s facility services, please visit www.blackandmcdonald.com

SPONSORED CONTENT

Canada Deemed a Preferred Place for Investment SUBDUED BUT STURDY

By Barbara Carss

CANADIAN INVESTMENT returns for 2023 show retail improvement, industrial deceleration and continuing office value decline. Analysts and industry insiders on-hand to digest release of annual results from the MSCI/REALPAC Canada Property Index also highlighted the steadier outlook for commercial real estate in Canada than in the United States or many other global markets, and shared their views on promising opportunities.

“If you’re going to invest, this is the country that you want to invest in because the others have a bunch of issues,” Mark Rose, Chief Executive Officer of Avison Young, told a gathering in Toronto earlier this winter. “In the U.S., they’re overbuilding; there’s far less discipline; there’s probably still a question around regional banks.

That’s not what we’re dealing with up here. It’s just a very different structure.”

“I’m quite positive with Canada and what we’re seeing in the country with the growth in population and everything that entails,” added Marie-Josee Turmel, General Manager, Real Estate Investments, with Canada Post Corporation Registered Pension Plan. “It’s going to help continue growth. We’ll have new development, new construction and it should help the overall sector.”

FLAT TOTAL RETURN

Last year saw a flat average total return on standing assets in the Canadian index — comprising 2,264 assets held in 52 portfolios collectively valued at CAD $165.7 billion — as a 4.7% drop in capital value cancelled out the 4.6% income return. Retail emerged as the best

performing asset type (for the first time since 2014) with a total return of 3.2%, while industrial posted a total return of 0.3% and slipped down after six years on top.

All asset types lost capital value, but the slippage was most muted for multifamily, with just a 0.5% negative trajectory. It recorded a 3% total return, retaining standing as the second-best performer for the seventh consecutive year. Office bottomed out the field with a -5% total return and a nearly 10% drop in capital value.

That rippled through to regional markets, where MSCI Executive Director Ken O’Brien linked negative total returns in Ottawa, Toronto and Montreal to their higher proportion of office assets. In contrast, he attributed Calgary’s revived showing — ranking as the second-best market with a

12 Spring 2024 | Canadian Property Management

total return of 4.6% — to a “strong component” of retail in the asset mix and the removal of some office inventory for conversion to multifamily housing.

Office is also fingered for flagging returns in other countries where MSCI has recently unveiled 2023 investment results. After a flat total return in 2022, Ireland charted a -8.5% total return in 2023, which O’Brien deems “an office story” given that it accounts for 60 to 65% the country’s index.

The slide was even steeper in the United States, falling from a 4.5% total return in 2022 to -8.4% in 2023. There, office represents about 21% of the index, but suffered a 20% decline in capital value (versus a 12% loss in Ireland).

“I think the numbers did come as a bit of a surprise to the constituents that are in our

“If you’re going to invest, this is the country that you want to invest in because the others have a bunch of issues.”

fund index,” O’Brien observed. “There were significant writedowns on the office sector in our U.S. portfolios.”

“Most office buildings other than Class A and AAA buildings are probably at 40 to 50%, and some are selling at 60 to 90% less than their value from a couple years ago,” Rose noted.

OUTBOUND AND INBOUND INVESTMENT

Yet, there’s little evidence Canadian investors are bargain shopping. Jim Costello, Chief Economist with MSCI Real Assets, tracked the pullback on foreign investment. Typically, about 50% of Canadian investment in commercial real estate is for acquisitions outside the country, but that contracted to about a third last year.

Investors were more active buyers at home across most asset types, with the exception of apartments and hotels. While office investment within Canada shrank by 52% relative to the pre-pandemic period, it practically evaporated in the U.S.

“Looking at Canadian capital flowing into the United States, in 2023 what’s missing from there is the office sector. People are still afraid of jumping into offices until we see where the bottom is,” Costello said. “Where they’re doing more globally than at home is apartments. In the United States the apartment market is just so large; it’s so liquid. If you want that exposure, it just provides that opportunity. So that’s the one thing that has been a constant for the Canadian investor.”

On the flipside, Phil Stone, Managing Director and head of Canadian research with BentallGreenOak, tallied foreign investment at 23% of transactions in Canada last year — a large shift from a historical average around 4%. “There were some pretty big names across multiple sectors, even in office,” he recounted.

“I think we’re going to see pension funds of non-domestic investors coming to

Canada,” Turmel reflected. “We have some very nice trends and the growth in population is one of them.”

Despite a 28% year-over-year drop in investment transaction value within Canada, 2023 activity was largely on par with the five years preceding 2020. “The sharp declines are really about the falls from the excess highs we had in 2021 and 2022 when interest rates were at record lows and investors were hungry for yield,” Costello advised.

What’s different from last decade is a shift in preferences. Excluding land purchases, about half of last year’s investment was in industrial assets — up from about 18% in the 2015-19 period.

“Industrial had been a $5-billion a year market and it’s up to now, on average, a $15-billion a year market,” Costello reported. “The office sector had been almost a $9-billion a year market, down to $4-billion.”

As in the U.S., Canada’s Class B and C office stock is hardest hit. In contrast, downtown office is again outperforming suburban, albeit as both sub-markets registered negative total returns last year.

POST-PANDEMIC ADJUSTMENTS

Super-regional malls show more marked improvement, boasting a total return of 4.7% in 2023 and surpassing community/ neighbourhood shopping centres for the first time since 2017. Retail was also the sole asset type to deliver positive total returns in all eight major regional markets represented in the index, ranging from 0.5% in Ottawa to 6% in Calgary.

“Admittedly, it’s a function of where retail has been,” O’Brien acknowledged. “This is a story everybody knows, how retail literally fell off a cliff.”

Drilling down to property categories, population growth, redevelopment and intensification potential and lack of new

Canadian Property Management | Spring 2024 13

investment

supply are all considered positive factors for enclosed shopping centres. Meanwhile, grocery-anchored plazas have consistently been tapped as a preferred asset in recent years and are expected to remain so.

“It is a little crowded in grocery-anchored retail, but we think it’s resilient from an income perspective,” Stone affirmed. “We just haven’t built enough of it to support the tremendous population growth that we’ve seen.”

Costello similarly projects that prospects should be sound for the many investors who have moved into industrial since 2020, given that e-commerce was already on course to steadily gain market share before the pandemic intervened to spike up demand. Activity has slipped from those heights, but is still about where it was plotted to be in the absence of the pandemic.

“It’s tapering down into what was the previous trend, but that previous trend was favourable for industrial. If you’re doing a little bit more activity every year in e-commerce sales, that generates a little bit more demand for logistics space. So it’s not like the fact that industrial is so crowded takes away from demand for it in the future,” Costello maintained. “It’s still on that nice steady growth path.”

Industrial assets delivered a total return of 0.3% to Canadian investors in the index last year, further breaking down to 3.8% income return and -3.3%. That follows outsized total returns of 17.5% in 2022, 31.6% in 2021 and 12.7% in 2020.

“For the last couple years, industrial rents and industrial values were going up 70, 80, 90, 100%. You’ve got to give that time to catch up. Then we started to build and build and build and build,” Rose remarked.

Still, he picks new industrial as a likely strong performer, along with multifamily, data centres, cold storage, outdoor storage and student housing.

FAVOURED ASSETS

Turmel foresees more value loss for various assets within the index, but with expectations of a turnaround relatively soon. Among best investment bets, she picks demographicsdriven categories such as multifamily and logistics, stating a preference for “new generation” assets, but conceding those are difficult to find in multifamily.

“There’s more writedowns to come, yes, because the numbers are still light in a few sectors. It should be done in ‘24 some time,” she said.

Stone similarly picked multifamily and

small-bay industrial as favoured assets and agreed with Turmel’s outlook on values. “I don’t know if anything looks cheap at this point. There still has to be some repricing,” he mused.

Prospective investors also await a catalyst to unlock the conundrum of purpose-built rental housing. Demand looks assured into the future, but current economic conditions are undermining the momentum that was brewing a few years ago.

“That’s a place where we should all be putting money, but it just doesn’t pencil out,” Rose said.

With a boost to clear the upfront hurdles to new construction, he suggests both public backers and private investors could be big winners — providing stability for key players in Canada’s labour force and tapping into a stable, lucrative tenant base that is increasingly being priced out of homeownership.

“Today, around the world, teachers, nurses, firefighters, police officers can’t afford their homes. Workforce housing is under siege right now,” Rose asserted. “The public sector needs to bring money to the private sector and we can get rolling. It is something that is really available to invest in and make a lot of money.”

14 Spring 2024 | Canadian Property Management investment A hassle-free way to get instant savings on lighting for your business No paperwork. No waiting. Just savings. Find a participating distributor today! Visit saveonenergy.ca/ instantdiscounts Choose from top-rated products that: Reduce energy use Enhance your space Boost your bottom line Subject to additional terms and conditions found at SaveOnEnergy.ca ™ Trademark of the Independent Electricity System Operator. Used under licence. IESO 138 03/2024 INSTANT DISCOUNTS PROGRAM JOB NO. / CLIENT / PROGRAM DATE PUBLICATION (VENDOR) / INSERT. DATE FILE NAME: IESO138_InstantDiscounts_CanPropertyMngmt_7-125x4-75_ID01

Real Estate Lenders and Borrowers Grapple with Insolvency A ROSTER OF REMEDIES

By Barbara Carss

AN UPSWING in defaulted real estate loans signals a continued downward trend in the market cycle. Developers with in-progress residential condominium projects are particularly struggling with insolvency, but legal specialists who advise both lenders and borrowers report a growing demand for remedies across all types of distressed properties.

“Most discussions I’ve had involve mezzanine lenders, private lenders and those who charge higher interest rates

and are more susceptible to these kinds of upsets in the market,” Norman Kahn, a Partner with Aird & Berlis LLP’s real estate group, reported during a recent webinar. “But, from calls I’ve had from some of my institutional clients, I know they’re also getting ready, expecting there will be mortgage defaults coming their way.”

Many creditors and debtors are now grappling with the fallout from a largely unexpected change in market conditions

over the course of their loan agreements. Kahn noted that his 42-year career has thus far encompassed two real estate recessions, but, tellingly, they occurred in the early 1980s and early 1990s. With a majority of today’s real estate players lacking familiarity with those times, he and other Aird & Berlis colleagues offered something of a crash course in the machinations of power of sale, foreclosure, judicial sale, receivership and workouts.

16 Spring 2024 | Canadian Property Management

PRECARIOUS CONDO ECONOMICS

Beginning with the most precarious market segment, Sam Billard, a Partner with Aird & Berlis’ financial services group, stressed that condo projects are most vulnerable to unexpected upheaval during the construction period when their financing has been fixed and they can’t generate income until completion.

Typically, developers look to presell about 70% of the units and use deposits from those buyers to secure the remainder of their financing. Prior to 2020, they could generally expect to retain 10 to 20% of total funds from unit sales once they had completed the project and paid off the construction loans, but delays and spiking costs have recently eroded those margins.

Statistics Canada has pegged construction cost inflation at about 80% between the second quarters of 2020 and 2022, which occurred alongside pandemic-related work slowdowns or outright stoppages and supply chain constraints. Even if developers had foreseen that trio of challenges coming, it’s unlikely they could have successfully accounted for it in unit presales.

“When you’re selling on day one, you couldn’t tell people: You have to pay double the [current] market rate to get your condo. Nobody could price that much price increase into a presale contract; you wouldn’t sell it,” Billard observed. “Also, they have been working on slower cycles and delays are rampant. If you start out at 15% recovery on the basis of an 18-month construction cycle and that becomes a 36-month construction cycle, that’s a problem.”

He concludes that most developers in southwestern Ontario are taking losses as they complete projects. For now, that’s primarily flowing through to subordinated debt holders when lenders are affected.

“It hasn’t got up to the senior secured level yet, but it may get there,” Billard mused.

Kahn sketched out the relative merits of power of sale versus foreclosure and scenarios in which each approach may work best for lenders or borrowers. Either action must begin with a series of required steps to give debtors notification and time to repay the loan, but power of sale is typically faster and less costly because it does not involve court proceedings.

Meanwhile, Sanjeev Mitra, a Partner in Aird & Berlis’ financial services group, explained that receivership, which involves a licensed third party to oversee all aspects of recovering funds owing, is typically more time-consuming and costly than either power of sale or foreclosure, but is often favoured for complicated insolvencies with multiple creditors.

LENDERS PLAN TO CURTAIL OFFICE EXPOSURE

Heading into 2024, CBRE Canada’s annual survey queried 34 lenders that collectively hold more than $200 billion in real estate loans and found them generally expecting to curtail office exposure while increasing overall allocations to Canadian real estate. Results, released in late 2023, showed survey respondents unanimously identifying “elevated interest rates” as a major challenge for the coming year. As well, 73% cited uncertainty around property valuations and 58% noted restrictions on capital as pressing issues.

In contrast to the fall of 2022, when all survey respondents predicted a recession, fewer than 40% ranked fear of recession as a major influence on underwriting. They were also largely confident in real estate market fundamentals, with only 30% flagging them as a concern.

Across all asset types, the majority of surveyed lenders indicated they were willing to offer recourse loans in the range of 61 to 75% loan-to-value (LTV) for top-tier assets and non-recourse loans at 51 to 65% LTV. A 25-basis-point (bps) premium typically applies on Class B assets and assets located in secondary markets.

Purpose-built rental housing and industrial emerge as favoured asset types, with half to three quarters of lenders aiming to increase budgets for those categories. On the flipside, twothirds planned to trim budgets for office. Office also stood out among 13 categories of assets in registering a complete absence of lenders willing to increase their office loan books.

“In reviewing the history of our surveys, this is the first time we have recorded that level of sentiment for any segment of real estate,” Carmin Di Fiore, Executive Vice President, Debt and Structured Finance, at CBRE Canada,

POWER OF SALE

Through power of sale — which is authorized under Ontario’s Mortgages Act (or equivalent statutes in other provinces) and is generally also contractually stated in mortgages — creditors take possession of and sell a property in order to recoup the debt. This option allows them to recover the defaulted loan amount only and makes them responsible for disbursing surplus earnings from the property sale to other creditors and/or back to the borrower.

reported during a webinar to explore the survey results. “Opinions have significantly reversed since 2021 when 70% of lenders were content with their office exposure.”

As borrowers seek renewals or refinancing, 94% of surveyed lenders were factoring elevated or significantly elevated credit risk for office assets. That tentativeness is linked to ongoing uncertainty about evolving workplace models and long-term demand for office. A slowdown in office transactions has also made it more difficult to corroborate values. However, Di Fiore maintains prospective deal-makers shouldn’t fear a liquidity crunch in Canada.

“That phenomenon may play out in U.S. markets where loose banking oversight now forces bank regulators to catch up and play hardball,” he noted.

Lenders in Canada are turning to a range options for maturing office loans. The majority of survey respondents indicated that they “occasionally” or “frequently” require equity paydowns as a condition of renewal, while 48% record frequent or occasional switchovers from interest-only to amortized loans. Just 15% report they frequently convey longterm renewals (52% do so occasionally), while 17% say they frequently request loan repayment. However, 86% confirm they are open to short-term loans extensions if necessary.

“The Canadian market is relationshiporiented and it generally works to everyone’s advantage,” Di Fiore said. “While tough discussions may be taking place at the time of renewal, at least there are rational and pragmatic solutions being offered.”

The Canadian Real Estate Lenders Report can be found at www.cbre.ca/ insights/reports/canadian-real-estatelenders-report-2023.

On the flipside, lenders have the right to pursue borrowers for the remaining loan amount if the property sale is insufficient to cover the debt. Since creditors don’t take ownership of the insolvent property, they avoid land transfer tax and many obligations that landlords incur, although there are special circumstances for power of sale of a residential complex.

“The other big liability you try to avoid is, of course, environmental issues. So

Canadian Property Management | Spring 2024 17

finance

RIPPLE EFFECTS FROM SHAKY U.S. OFFICE SECTOR

Financial institutions worldwide could see mounting losses from exposure to commercial real estate (CRE), and particularly the shaky office sector, in the United States. Recent commentary from the credit rating agency, Morningstar DBRS, concludes that Canada’s major banks are well insulated against the risk, but they are nevertheless experiencing a steep rise in gross impaired loans (GILs) tied to U.S. properties.

Analysts are watchful as roughly USD $1.2 trillion in CRE debt is set to mature over the next two years, including about USD $300 billion on office and retail properties secured through banks and commercial mortgage-backed security (CMBS). That’s occurring in the context of interest rate uncertainty, tightening lending standards and sliding property valuations.

“Refinancing certain transactions, particularly in the office space, will likely require additional equity and/or restructuring. We also expect an increasing number of borrowers unable or unwilling to pay,” the commentary states. “In our view, medium-sized banks and regional banks [in the U.S.] are more vulnerable to further market deterioration, given that they typically have a higher proportion of CRE within their loan portfolios.”

MSCI’s annual results for 2023 show a negative 8.4% total return across the U.S. property index, attributed in large part to slipping office performance. “There were significant writedowns on the office sector in our U.S. portfolios,” MSCI Executive Director, Ken O’Brien, told a CRE industry gathering in Toronto earlier this year. (See story, page 12)

Also speaking at that event, Mark Rose, Chief Executive Officer of Avison Young, noted that some Class B and C office properties in the U.S. are now in negative cash flow situations arising from a combination of high vacancies and “skyrocketing” credit and operations costs. Meanwhile, the U.S. Federal Reserve is advising against foreclosure.

“These banks do not want negative cash flowing buildings back,” Rose said. “The banks are holding onto them because, if they take it all in one year, we could have another systemic banking crisis. The Fed has told them: Just engage in workouts.”

For Canadian banks, gross impaired loans tied to U.S. CRE accounted for 22% of total business and government GILs as 2024 began, up from 7.6% at the end of 2022. U.S. CRE loans were also a growing portion of identified credit risk, representing 41.7% of provisions for credit losses (PCLs) versus 21% in Q4 2022.

Morningstar DBRS lists Royal Bank of Canada, Toronto Dominion Bank, Bank of Montreal and Canadian Imperial Bank of Commerce as large Canadian lenders experiencing this “credit quality deterioration”, and notes that office properties make up a larger share of their CRE loan books within the U.S. than in other regions. However, the risk is considered minimal.

“The total global office sector exposure at the large Canadian banks is generally well diversified and relatively small, comprising approximately 10% of total CRE loans and ranging from a very manageable 0.8% to 1.9% of total loans and acceptances,” the

For more information about Morningstar DBRS, see the website at https://dbrs.morningstar.com.

18 Spring 2024 | Canadian Property Management finance

Services we offer: Graffiti Removal Ever-Clean Program™ Sentinel Program Anti-Graffiti Coating Glass Restoration Power Washing Scratchiti™ & Etchiti™ Removal GraffWrap™

de graffiti Programme Ever-Clean™ Programme Sentinel Revêtement anti-graffiti Restauration de vitre Lavage à haute pression GraffWrap™

de Scratchiti™ et Etchiti™ Nos services offerts: www.goodbyegraffiti.com 1-877-684-4747

Enlèvement

Enlèvement

that’s the best way to keep yourself out of it,” Kahn said.

For their part, insolvent borrowers can legally challenge a power sale and require creditors to prove it is valid. Beyond adhering to statutory or contractual requirements for notifying borrowers and providing time to repay the debt, creditors must be able to prove the sale price reflects the property’s market value.

“The best practice would be to make sure that you’ve got at least two appropriate appraisals from appraisers who understand the market, and that you have listed the property with an appropriate real estate broker who markets the property appropriately, advertising it widely to the appropriate audience,” Kahn advised. “If you can establish you’ve done that and sold the property within the appraisal values, you are likely to be okay.”

FORECLOSURE AND JUDICIAL SALES

With foreclosure, creditors take ownership of the property in exchange for the debt. In doing so, they pay land transfer tax, relinquish the right to further pursue the borrower and are entitled to keep all profits from the eventual sale of the property. However, other legal mechanisms to protect borrowers makes this a relatively rare outcome.

Foreclosure is a legal proceeding, which begins when the creditor issues a statement of claim. At this point, the borrower can appeal to the court to convert the foreclosure to a judicial sale.

If granted, that will force the creditor to sell rather than hold the property and it will reestablish other creditors’ and the borrower’s entitlement to any surplus proceeds beyond the amount owing. Kahn likened judicial sales to the power of sale process, but with court oversight that eliminates the debtor’s ability to challenge its validity.

“If the lender wants to foreclose on the property and the borrower has good grounds to believe that the property is worth more than the amount of the debt, the bar is low to go to court, within a certain time limit, and request the court to turn that into a judicial sale,” he said. “The reason is, the borrower should have the right to redeem the mortgage to pay it off and get an accounting if there are excess proceeds.”

A straightforward foreclosure is most likely to occur in cases where the debt surpasses the value of property. In this, Kahn speculated there could eventually be a payoff if the new owners hold it until market conditions change.

“If you have patience and patient money, you may think: well this property

“It’s a lot less risky and more efficient to get a voluntary payout than going through the process of enforcement, but it requires a good level of trust and cooperation between the borrower and lender.”

may turn around in the future and I may take a windfall on it down the road with a redevelopment. Foreclosure, in those circumstances, may make some sense,” he said. “The reason the remedy is not used very often is because, in most instances, a borrower will require you to sell the property under judicial sale so you’re stuck with selling it anyway, especially if the property is worth more than the value of your mortgage.”

RECEIVERSHIP

Receivership unfolds similarly to a judicial sale, but with the third party receiver administering it. In some cases, a mortgage contract will include authority to appoint a receiver, but, more commonly, receivers are court appointed and act as legal officers of the court.

“Usually when you’ve got an insolvent situation, all the creditors are scrambling to try to get their money back. The receiver focuses first on monetizing the collateral and then taking steps to distribute to the creditors based on the statutory scheme of priorities — property taxes get paid out first; the first mortgagee gets paid out next; there may be CRA (Canada Revenue Agency) trust claims; there may be unsecured creditors; there may be new claimants,” Mitra said. “It’s complicated, but that’s one of the reasons that you have a court supervised process. It’s meant to get priorities and disputes resolved and moneys paid to the correct parties as transparently and efficiently as possible.”

Receivers also oversee any required emergency maintenance and repairs or ongoing property management, as well as the marketing and sales process. Much of the added costliness of the process is for covering the receiver’s professional services, which, along with property tax, take precedence over other claims.

“If you’re going down this route, you want to know that there’s probably enough equity to pay for this process,” Mitra said. “The

other reason you might be using a receiver is if there are some environmental concerns and the lender doesn’t want to even risk getting associated with the project — let the receiver and the court make the determination as to how the property should be wound down, decommissioned or sold.”

WORKOUTS

Alternatively, lenders and borrowers may choose to resolve a default collaboratively through a workout. Such a plan and schedule for remedying the debt could be enacted through amendments to the original loan agreement or a forbearance agreement, which is a new contract stating conditions the borrower must fulfill.

“It’s a lot less risky and more efficient to get a voluntary payout than going through the process of enforcement, but it requires a good level of trust and cooperation between the borrower and lender,” maintained Mistrale Lepage-Chouinard, a Partner with Aird & Berlis’ real estate group. “On the borrower’s side, it requires a solid plan to remedy the situation. On the lender’s side, it requires some financial and legal due diligence to determine the strength and weakness of the borrower and the lender’s security.”

Kahn cited a current example in Allied Properties REIT’s recent announcement that it is converting the mezzanine loans it holds on Westbank Corp. developments in Vancouver and Toronto into equity in the projects. The deal, which is expected to be completed in April 2024, will give Allied Properties respective ownership stakes of 90 and 95% — an increase from its previous 50% interest in the Toronto project.

“The transactions will reduce Westbank’s debt to Allied materially and afford Allied a large ownership position in two triple-A urban properties as they near successful completion and full lease-up,” the REIT’s announcement states.

“I assume they think they are better off having an ownership interest than having a debt that is in default,” Kahn submitted.

Canadian Property Management | Spring 2024 19 finance

Ensuring Preparedness: Make Remediation Response a Building Priority

Canada’s four distinct seasons make building maintenance a never-ending cycle of problems, often involving water. Building managers face difficult yearly challenges. Establishing a plan in response to maintenance threats ensures swifter remediation. The better prepared you are, the faster you can act.

THE IMPORTANCE OF FAST RESPONSE

“The first 24 hours after a disaster will influence how that project will be handled,” says Curtis Azevedo, Branch Manager for FIRST ONSITE Property Restoration, Edmonton, Alberta. “When we are called to the property as soon as possible, it can make a significant difference.”

Having an emergency restoration company on speed dial is an important part of stopping escalating damage, but to ensure the quickest response time possible, Azevedo recommends building managers install Internet of Things (IoT) water monitoring and leak technology devices.

alert you to a leak, allowing you to react to the situation promptly.”

If water issues are not treated quickly, mould spores can develop—this is especially true in hot and humid climates. Azevedo emphasizes the importance of always acting as fast as possible.

“Something very simple managers, owners, and boards can do, is install water sensors,” he suggests. “These are plugin devices that will send a notification or create an alarm to

“In ideal conditions, mould can develop as soon as 24 hours after the initial leak. If you leave things for a couple of days, it’s common that construction materials need to be completely replaced.”

PRIORITY RESPONSE EMERGENCY PLAN

Every building is individual and will have slightly different building materials and insulation levels, and each should have an individual emergency action plan.

First Onsite has developed a Priority Response Emergency Plan (PREP) partnership for commercial clients to help them fully prepare before disaster strikes. “We complete a full site inspection and walkthrough and take a full assessment of potential issues,” he explains. “We want to be aware of where all the building’s water, HVAC, plumbing, gas and electricity shut-offs are located, and understand how to shut them down in the event of an emergency.”

“We have an immense amount of experience with emergency preparedness plans,” says Azevedo. “This allows us to take quicker action when we arrive since we understand the building’s stabilization procedures.”

In addition, property managers with buildings in different provinces may be interested in securing a national contract with First Onsite. This allows property managers with buildings across more than one province to access competitive standardized pricing rates, a significant benefit for larger property management firms. “Knowing that you’re not going to see a difference in service costs (prior to taxes) between Alberta and Ontario provides peace of mind for some of our larger clients.”

Establishing a relationship with a mitigation and restoration team is becoming a standard practice for building management operators. Over the years, First Onsite has adapted their capabilities to the needs of the changing environment.

Having a thorough understanding of each property means shorter response times and quicker remediation. PREP clients receive preferred pricing rates with no stipulated contract period, zero program participation fees, and reduced losses and insurance claims since attendance by the First Onsite team is treated as a priority.

“We are a full-service company that can offer any type of disaster remediation or restoration,” he summarizes. “We provide the whole gambit.”

To learn more about First Onsite’s Priority Response Emergency Plan (PREP), contact them today at 1.877.778.6731

20 Spring 2024 | Canadian Property Management

SPONSORED CONTENT

WHO’S WHO 2024

PRESENTED BY:

SPONSORED BY:

AUTOMATION: DRIVING EFFICIENCY AND PRECISION IN COMMERCIAL REAL ESTATE

by Peter Altobelli, Vice President and General Manager, Yardi Canada Ltd.

2024 promises to be a pivotal year in Canadian real estate investment. CBRE Research, in its Canada Real Estate Market Outlook, highlights the positive shift in investor sentiment despite last year’s slowdown. Anticipated interest rate cuts later this year are expected to fuel a resurgence in investment activity, stimulated by the projected strong performance of GDP, employment and population growth.

While such conditions present fertile ground for investment opportunity, capitalizing on them effectively requires more than serendipity. Efficiency stands as a fundamental pillar of success in real estate asset and investment management, and advanced technology is the key to achieving it.

Automating Away the Chaos

The cornerstone of efficiency lies in replacing disparate operating systems, which are prone to data loss and inconsistencies, with a single, connected technology platform. In several areas of property management, including valuations, budget forecasting and deal management, technology has progressed to the point that processes are automated and performed within a company’s core property management and accounting platform. This approach eliminates the errors associated with redundant manual data entry and unreliable spreadsheets.

Gaining Deeper Financial Insights

Consider valuations, for instance. Today’s most advanced platforms facilitate the creation of valuations for all managed assets and model new acquisitions. This is achieved by unifying all portfolio information – including operating and forecast budgets, analyses, and up-to-date lease details – within a single, centralized database. This approach enhances accuracy and provides comprehensive insight into a property’s financial health.

The full integration of data systems brings financial, portfolio, performance, and revenue analytics, along with any number of key performance indicators, within easy reach. This empowers managers to analyze performance, generate valuations, prepare forecasts across any timeframe, and monitor the impact of changes in real-time at the dashboard and reporting levels.

Elevating Decision-Making

Integrating a valuation system with forecasting functionality adds even more value by creating valuations with current budget data, unit and lease assumptions, and debt information. Stakeholders can make informed decisions based on the latest financial projections and economic changes. Additionally, connecting valuation and forecasting systems with deal management illuminates the value impact of proposed deals. By projecting a real estate portfolio’s revenues and cash flow, asset valuation tools strengthen outreach to investors by providing reasonable estimates of their returns.

These platforms offer customized portfolio analysis across the entire asset lifecycle, from groundbreaking and construction all the way through project completion. They also deliver valuable quarter-by-quarter performance comparisons, solidifying their utility as powerful asset management tools.

Assessing Your Strategy

As the Canadian real estate market thrives in 2024 and beyond, embracing automation and AI solutions is no longer a choice, but a necessity. Property managers and investors have adopted software solutions that leverage automation and data centralization for more efficient performance, accurate and frequent valuations, and increased investor confidence. By using advanced technology to streamline workflows, enhance decision-making and boost overall efficiency, all stakeholders can navigate an evolving landscape with accuracy and confidence.

To unlock the full potential of technology, visit yardi.com.

22 Spring 2024 | Canadian Property Management

SPONSORED CONTENT

OWNED & MANAGED IN CANADIAN REAL ESTATE

Brookfield Asset Management 16.774 Manulife Investment Management 15.544 Allied Properties REIT 13.290 Oxford Properties Group 9.053 Morguard 7.826 Starlight Investments 7.741 BentallGreenOak (Canada) Limited Partnership 7.093 Crown Property Management Inc. 6.497 Dream 5.950 Slate O ce REIT 5.204 OFFICE OWN & MANAGE MILLIONS OF SQ. FT. Pure Industrial 41.0 BentallGreenOak (Canada) Limited Partnership 21.977 Choice Properties REIT 18.724 Prologis 11.0 Nexus Industrial REIT 10.654 Manulife Investment Management 10.017 Oxford Properties Group 9.989 Skyline Industrial REIT 9.984 Granite REIT 6.544 Concert Properties Ltd. 5.733 INDUSTRIAL OWN & MANAGE MILLIONS OF SQ. FT. Choice Properties REIT 42.284 SmartCentres REIT 32.310 RioCan 29.335 CT REIT 25.595 First Capital REIT 19.325 Crombie REIT 15.301 Morguard 8.198 Westcli 6.634 Oxford Properties Group 6.086 BentallGreenOak (Canada) Limited Partnership 5.807 RETAIL OWN & MANAGE MILLIONS OF SQ. FT. StorageVault Canada 11.422 NorthWest Healthcare Properties REIT 3.177 Oxford Properties Group 2.123 Centurion Asset Management Inc. 0.494 Concert Properties Ltd. 0.391 SmartCentres REIT 0.362 CT REIT 0.278 Gitalis Group Inc. 0.276 Northview Fund 0.180 Cogir Real Estate 0.164 OTHER OWN & MANAGE MILLIONS OF SQ. FT. Starlight Investments 48.080 Canadian Apartment Properties REIT 42.570 Boardwalk REIT 31.128 Homestead Land Holdings Limited 23.963 Hazelview Investments Inc. 21.789 Realstar Management 21.451 Skyline Apartment REIT 19.832 Killam Apartment REIT 16.952 Centurion Asset Management Inc. 15.678 Mainstreet Equity Corp. 14.119 APARTMENT OWN & MANAGE MILLIONS OF SQ. FT.

SPONSORED BY: WHO’S WHO 2024 * JUNE ISSUE

TEN TOP

OWNED IN CANADIAN REAL ESTATE

24 Spring 2024 | Canadian Property Management Healthcare of Ontario Pension Plan Inc. 7.037 H&R REIT 6.803 Crestpoint Real Estate Investments Ltd. 5.810 CPP Investments 5.017 Fiera Real Estate 3.60 Ivanhoé Cambridge 3.485 Hazelview Investments Inc. 3.395 Hines Canada 3.344 I.G. Investment Management, Ltd. 2.896 Artis REIT 1.952 OFFICE OWN ONLY MILLIONS OF SQ. FT. Crestpoint Real Estate Investments Ltd. 25.095 Dream 20.289 Fiera Real Estate 13.0 Healthcare of Ontario Pension Plan Inc. 11.546 H&R REIT 8.759 Ivanhoé Cambridge 8.303 I.G. Investment Management, Ltd. 7.226 Nicola Wealth 4.147 Artis REIT 2.570 Concert Properties Ltd. 1.717 INDUSTRIAL OWN ONLY MILLIONS OF SQ. FT. Ivanhoé Cambridge 10.552 North American Development Group 8.630 H&R REIT 5.711 Crestpoint Real Estate Investments Ltd. 4.451 Healthcare of Ontario Pension Plan Inc. 3.065 Automotive Properties REIT 2.80 Choice Properties REIT 2.410 SmartCentres REIT 2.218 Artis REIT 2.143 Fiera Real Estate 2.0 RETAIL OWN ONLY MILLIONS OF SQ. FT. Colliers 5.149 Ivanhoé Cambridge 1.782 Nicola Wealth 0.832 Centurion Asset Management Inc. 0.510 Morguard 0.311 Hazelview Investments Inc. 0.208 Jones Lang LaSalle Real Estate Services, Inc. (JLL) 0.160 Colonnade BridgePort 0.152 Shelter Canadian Properties Limited 0.127 Lanesborough Real Estate Investment Trust 0.088 OTHER OWN ONLY MILLIONS OF SQ. FT. H&R REIT 7.498 Globe Capital Management 7.280 Dream 1.939 Crestpoint Real Estate Investments Ltd. 1.747 Fiera Real Estate 1.461 Southwest Properties Ltd. 1.425 Westcli 1.215 Bedford Properties & Estates Ltd. 0.990 I.G. Investment Management, Ltd. 0.841 NexLiving Communities Inc. 0.780 APARTMENT OWN ONLY MILLIONS OF SQ. FT.

SPONSORED BY: P A R T O F T H E 10TH ANNUAL WHO’S WHO A ranking of the Canadian condo industry’s major players and portfolios * J u n e I s s u e

TEN TOP

TEN TOP

MANAGED IN CANADIAN REAL ESTATE

Canadian Property Management | Spring 2024 25 BGIS 104.405 CBRE Limited 41.871 Colliers 35.0 GWL Realty Advisors 18.376 Jones Lang LaSalle Real Estate Services, Inc. (JLL) 16.981 Canderel/Humford 11.192 BentallGreenOak (Canada) Limited Partnership 10.035 Epic Investment Services 7.556 Warrington PCI Management 7.109 Oxford Properties Group 6.235 BGIS 78.475 CBRE Limited 57.182 Jones Lang LaSalle Real Estate Services, Inc. (JLL) 16.097 Colliers 8.0 Epic Investment Services 6.835 Morguard 6.699 BentallGreenOak (Canada) Limited Partnership 5.608 Avison Young (Canada) Inc. 4.60 GWL Realty Advisors 4.099 Oxford Properties Group 4.087 MetCap Living Management Inc. 18.601 Cogir Real Estate 17.671 Sterling Karamar Property Management 17.187 Greenwin Corp. 17.062 The DMS Group 12.446 Briarlane Rental Property Management Inc. 10.361 Devon Properties Ltd 9.919 GWL Realty Advisors 7.992 Berkley Property Management Inc. 6.894 Tribe Management Inc. 5.545 OFFICE MANAGE ONLY MILLIONS OF SQ. FT. CBRE Limited 35.940 Dream 24.075 GWL Realty Advisors 17.470 Colliers 16.50 Jones Lang LaSalle Real Estate Services, Inc. (JLL) 16.298 One Property Management 15.80 BGIS 14.439 Realspace Management Group Inc. 9.517 Colonnade BridgePort 7.772 Avison Young (Canada) Inc. 7.30 INDUSTRIAL MANAGE ONLY MILLIONS OF SQ. FT. RETAIL MANAGE ONLY MILLIONS OF SQ. FT. BGIS 36.780 CBRE Limited 26.711 Avison Young (Canada) Inc. 2.70 Harvard Developments 2.543 Transpacific Realty Advisors 2.0 Stoneleigh Management Inc. Real Estate Brokerage 1.976 The DMS Group 1.581 Downing Street Property Management Inc. 0.870 One Property Management 0.560 Apollo Property Management Ltd. 0.464 OTHER MANAGE ONLY MILLIONS OF SQ. FT. FirstService Residential Management Canada 128.250 Crossbridge Condominium Services Ltd. 82.822 Del Property Management Inc. 78.30 Rancho Management Services 51.185 Wilson Blanchard Management Inc. 47.087 Pacific Quorum Properties Inc. 38.006 Tribe Management Inc. 36.354 ICC Property Management Ltd. 34.631 AWM-Alliance Real Estate Group Ltd. 29.508 Icon Property Management 29.250 CONDO MANAGE ONLY MILLIONS OF SQ. FT. APARTMENT MANAGE ONLY MILLIONS OF SQ. FT.

SPONSORED BY:

BGIS 234.099 104.405 14.439 78.475 36.780 CBRE Limited 161.703 41.871 35.940 57.182 26.711 FirstService Residential Management Canada 128.250 128.250 Crossbridge Condominium Services Ltd. 82.822 82.822 Del Property Management Inc. 78.30 78.30 Colliers 69.70 35.0 16.50 8.0 2.471 2.580 5.149 Choice Properties REIT 68.231 0.025 0.033 1.097 0.319 18.724 2.839 2.410 42.284 0.50 BentallGreenOak (Canada) Limited Partnership 63.180 10.035 7.093 6.737 21.977 5.608 5.807 1.843 4.079 Rancho Management Services 56.789 1.691 0.101 2.102 1.521 0.189 51.185 Starlight Investments 55.821 7.741 48.080 Dream 52.864 5.950 24.075 20.289 0.611 1.939 Jones Lang LaSalle Real Estate Services, Inc. (JLL) 50.256 16.981 16.298 16.097 0.720 0.160 GWL Realty Advisors 47.936 18.376 17.470 4.099 7.992 Wilson Blanchard Management Inc. 47.087 47.087 Oxford Properties Group 45.557 6.235 9.053 3.806 9.989 4.087 6.086 0.402 3.776 2.123 Canadian Apartment Properties REIT 42.570 42.570 Tribe Management Inc. 42.110 0.099 0.062 0.050 5.545 36.354 Morguard 41.574 4.785 7.826 5.305 1.066 6.699 8.198 0.063 7.323 0.311 Pure Industrial 41.0 41.0 Pacific Quorum Properties Inc. 40.478 0.374 0.053 0.20 0.075 1.769 38.006 Crestpoint Real Estate Investments Ltd. 37.103 5.810 25.095 4.451 1.747 SmartCentres REIT 35.956 0.391 0.126 2.218 32.310 0.549 0.362 ICC Property Management Ltd. 34.694 0.050 34.631 0.013 AWM-Alliance Real Estate Group Ltd. 34.547 1.246 0.670 1.686 1.436 29.508 RioCan 32.574 2.304 29.335 0.935 Boardwalk REIT 31.163 0.035 31.128 Manulife Investment Management 30.925 15.544 10.017 3.160 2.204 CT REIT 30.079 4.206 25.595 0.278 Icon Property Management 29.250 29.250 H&R REIT 28.771 6.803 8.759 5.711 7.498 Cogir Real Estate 27.945 1.383 0.383 4.709 17.671 3.634 0.164 Ivanhoé Cambridge 27.576 3.485 0.627 8.303 0.203 10.552 2.489 0.135 1.782 Hazelview Investments Inc. 27.551 3.395 0.111 1.242 0.436 0.371 21.789 0.208 Homestead Land Holdings Limited 23.963 23.963 Healthcare of Ontario Pension Plan Inc. 22.290 7.037 11.546 3.065 0.642 22.247 0.012 0.025 0.378 21.832 21.80 5.80 7.30 4.60 1.40 2.70

PROPERTY MANAGEMENT WHO’S WHO 2021 OFFICE INDUSTRIAL RETAIL APARTMENT CONDO OTHER TOTAL SQ. FT. (MILLIONS) MANAGE OWN BOTH MANAGE OWN BOTH MANAGE OWN BOTH MANAGE OWN BOTH MANAGE MANAGE OWN BOTH CANADIAN PROPERTY

WHO’S WHO 2024

CANADIAN

MANAGEMENT

Realstar Management 21.451 21.451 Epic Investment Services 20.989 7.556 5.459 6.835 1.140 Canderel/Humford 20.771 11.192 3.620 1.091 0.045 4.021 0.758 0.046 Sterling Karamar Property Management 20.601 1.135 1.174 1.105 17.187 Fiera Real Estate 20.061 3.60 13.0 2.0 1.461 Greenwin Corp. 19.885 0.160 0.123 0.096 0.164 0.413 17.062 1.867 Skyline Apartment REIT 19.832 19.832 First Capital REIT 19.325 19.325 Crombie REIT 19.211 0.962 2.434 15.301 0.514 MetCap Living Management Inc. 18.601 18.601 Centurion Asset Management Inc. 18.60 0.171 0.196 1.399 15.678 0.152 0.510 0.494 Warrington PCI Management 17.803 7.109 5.970 4.002 0.722 Equium Group 17.630 0.424 0.934 0.207 1.728 0.062 14.20 0.075 One Property Management 17.513 0.646 15.80 0.507 0.560 GPM Property Management Inc. 17.305 0.005 17.30 Killam Apartment REIT 16.952 16.952 Brookfield Asset Management 16.774 16.774 Goldview Property Management Ltd. 16.643 0.076 0.360 0.097 16.110 Apollo Property Management Ltd. 16.335 0.780 0.360 0.392 2.011 12.328 0.464 KDM Management Inc. 15.917 15.917 The DMS Group 15.767 0.163 1.032 0.544 12.446 1.581 Nadlan-Harris Property Management Inc. 14.876 0.020 14.850 0.006 Allied Properties REIT 14.636 13.290 1.346 Northview Fund 14.411 1.251 12.980 0.180 Mainstreet Equity Corp. 14.372 14.119 0.191 0.062 Concert Properties Ltd. 13.294 0.366 2.285 1.717 5.733 0.083 0.167 2.552 0.391 Briarlane Rental Property Management Inc. 12.674 0.178 1.762 0.373 10.361 Shelter Canadian Properties Limited 12.628 0.111 0.818 0.127 1.729 0.40 0.011 0.178 4.753 0.653 3.296 0.425 0.127 Colonnade BridgePort 12.532 2.937 7.772 1.040 0.631 0.152 InterRent REIT 12.516 1.036 11.480 Nexus Industrial REIT 12.516 0.323 0.203 0.413 10.654 0.811 0.111 I.G. Investment Management, Ltd. 12.167 2.896 7.226 1.204 0.841 Dorset Realty Group Canada Ltd 12.091 1.301 2.101 2.247 1.237 5.180 0.026 StorageVault Canada 11.422 11.422 Prologis 11.0 11.0 Westcliff 10.982 0.150 0.767 0.952 0.088 1.077 6.634 1.215 0.099 Berkley Property Management Inc. 10.864 0.250 0.050 0.040 6.894 0.030 3.60 OFFICE INDUSTRIAL RETAIL APARTMENT CONDO OTHER TOTAL SQ. FT. (MILLIONS) MANAGE OWN BOTH MANAGE OWN BOTH MANAGE OWN BOTH MANAGE OWN BOTH MANAGE MANAGE OWN BOTH CANADIAN PROPERTY MANAGEMENT WHO’S WHO 2024

Compass Commercial Realty LP 10.778 1.825 7.173 1.264 0.517 Downing Street Property Management Inc. 10.733 1.027 5.891 0.754 0.070 2.120 0.870 Realspace Management Group Inc. 10.702 0.610 9.517 0.574 Devon Properties Ltd 10.669 0.375 0.106 0.269 9.919 Drewlo Holdings Inc. 10.584 10.584 Crown Property Management Inc. 10.532 4.035 6.497 Transpacific Realty Advisors 10.50 1.50 5.0 1.0 1.0 2.0 Medallion Corporation 10.466 10.466 Park Property Management Inc. 10.418 0.069 0.042 0.185 10.121 Skyline Industrial REIT 9.984 9.984 GWL Residential 9.635 0.961 0.323 8.350 North American Development Group 9.264 0.634 8.630 Cominar REIT 8.862 4.609 4.253 Harvard Developments 8.720 1.916 0.775 1.126 2.361 2.543 Minto Properties Inc. 8.521 0.911 0.282 0.149 0.705 6.474 Hines Canada 8.498 2.491 3.344 1.517 0.027 0.756 0.363 Menkes Property Management Services Ltd. 8.126 2.811 1.089 0.855 3.210 0.161 Davpart Inc. 8.043 1.478 3.652 1.851 1.062 Anthem Properties Group Ltd. 8.011 0.760 1.220 5.346 0.610 0.075 Shindico Realty 7.969 0.191 0.128 0.665 0.877 0.719 0.521 3.125 0.854 0.877 0.010 Globe Capital Management 7.580 0.30 7.280 Nicola Wealth 7.225 1.517 4.147 0.283 0.445 0.832 Artis REIT 6.665 1.952 2.570 2.143 Granite REIT 6.544 6.544 CPP Investments 6.317 5.017 1.006 0.295 A.A Property Management & Associates 6.30 6.30 M&R Holdings 6.279 0.077 1.560 0.362 0.207 4.073 MF Property Management Ltd. 6.125 6.125 Lionheart Property Management Inc. 6.039 0.360 5.679 BTB REIT 6.033 2.819 1.822 1.392 Bayshore Property Management Inc. 5.865 0.950 4.915 Plaza Retail REIT 5.767 5.767 Prospero International Realty Inc. 5.524 0.278 0.363 1.359 3.525 Canreal Management Corporation 5.40 0.205 3.737 1.458 Slate Office REIT 5.332 5.204 0.063 0.064 Shape Property Management Corp. 5.323 0.267 0.090 1.760 2.832 0.374 Skyline Retail REIT 5.302 5.302 CANADIAN PROPERTY MANAGEMENT WHO’S WHO 2021 CANADIAN PROPERTY MANAGEMENT WHO’S WHO 2024 OFFICE INDUSTRIAL RETAIL APARTMENT CONDO OTHER TOTAL SQ. FT. (MILLIONS) MANAGE OWN BOTH MANAGE OWN BOTH MANAGE OWN BOTH MANAGE OWN BOTH MANAGE MANAGE OWN BOTH Simplify energy management Optimize spend, automate reporting & increase efficiency Learn more at Yardi.com/Pulse .,,. Verdi Pulse"

Osgoode Properties 5.298 0.136 0.058 5.104 Northam Realty Advisors 5.087 0.079 1.334 2.133 0.762 0.276 0.098 0.405 True North Commercial REIT 4.975 4.975 Taylor Co. Ltd. 4.50 2.50 2.0 Aspen Properties 4.30 4.30 Stoneleigh Management Inc. Real Estate Brokerage 3.899 1.797 0.029 0.068 0.029 1.976 Kelson Group 3.885 0.045 3.840 Williams and McDaniel Property Management 3.884 0.092 0.175 3.617 Dayhu Investments Ltd. 3.873 0.010 3.747 0.072 0.044 Real Estate 360 Property Advisory 3.830 0.356 0.295 0.207 0.473 2.498 HighPoint Property Management 3.689 3.689 Old Oak Properties Inc. 3.662 0.155 0.166 0.008 3.334 Blackwood Partners Corporation 3.651 1.265 1.602 0.733 0.052 Royal/Kente Property Management 3.609 0.006 0.002 0.451 3.150 Canadian Urban Limited 3.491 0.713 2.067 0.629 0.083 Melcor REIT 3.428 1.546 0.208 1.396 0.277 NorthWest Healthcare Properties REIT 3.177 3.177 Canlight Management Inc. 3.097 0.414 0.010 0.274 0.010 0.037 0.298 0.054 2.0 Lameer Management Inc. 3.095 0.140 0.010 0.210 0.035 2.189 0.511 Kevric Real Estate Corporation 3.050 2.921 0.129 Gulf Pacific Property Management Ltd. 3.042 0.908 0.131 1.666 0.338 Dove Square Property Management Inc. 3.039 0.040 0.086 0.095 2.816 0.003 Atlantis Realty Services, Inc. 2.990 0.179 1.469 0.298 1.045 KRP Properties 2.970 2.970 Richmond Property Group Ltd. 2.950 0.40 0.150 0.40 2.0 Realterm 2.891 2.687 0.204 Automotive Properties REIT 2.80 2.80 Lawrence Construction/Grant Management 2.651 0.055 0.173 0.091 0.588 0.034 0.125 0.646 0.939 Brown Group of Companies Inc., The 2.626 0.011 0.067 0.502 0.017 0.028 0.604 1.398 Melchior Management 777 Corporation 2.50 0.297 0.573 1.612 0.018 O'Shanter Development Company Ltd. 2.151 0.314 1.837 Armadale Property Management Inc. 2.151 0.103 0.185 0.249 0.011 0.031 0.071 1.162 0.339 Arnon Corporation 2.137 1.279 0.409 0.052 0.397 Provincial Property Management Limited 2.120 0.50 1.620 State Building Group 2.10 0.10 1.0 1.0 Brilliant Property Management Inc. 2.075 2.075 BlueStone Properties Inc. 2.034 0.238 0.649 1.148

PROPERTY MANAGEMENT WHO’S WHO 2024 OFFICE

RETAIL APARTMENT CONDO OTHER TOTAL SQ. FT. (MILLIONS) MANAGE OWN BOTH MANAGE OWN BOTH MANAGE OWN BOTH MANAGE OWN BOTH MANAGE MANAGE OWN BOTH

CANADIAN

INDUSTRIAL