HUNTER’S HINTS

Withhholding Tax

By Hunter Boucher, Director of Operations, LandlordBC

Over the past few months there has been significant media coverage of something called withholding tax and how it can affect residential tenancies. But what is withholding tax?

Withholding tax is a Canada Revenue Agency’s (CRA) requirement whereby a payer must deduct tax from payments made to a recipient. This tax is withheld at the source of income, such as salaries, wages, interest, dividends, or royalties, and, in the case of residential tenancies, payments of rent and/or fees before the recipient receives the funds. In residential tenancies, withholding tax is set to 25 per cent and is intended to ensure tax compliance, aid in collecting tax revenue, and prevent tax evasion by non-residents or businesses that do not otherwise have a taxable presence in Canada.

The media coverage we have seen over the past few months has focused on whether tenants are responsible for withholding this amount and remitting it to CRA and furthermore, what consequences exist if this does not happen. And while the short answer is that tenants are not expected to withhold this tax, it is much more complicated than that.

The primary point of confusion is that by law and quite pointedly on the official CRA site it states, “If you receive rental income from real or immovable property in Canada, the payer (such as the

...THERE WAS A RECENT CASE WHERE A MONTREAL-BASED TENANT WAS ORDERED TO PAY SIX YEARS OF THIS TAX WITH INTEREST ON BEHALF OF A NON-RESIDENT LANDLORD WHOM

CRA WAS UNABLE TO COLLECT FROM.

tenant) or agent (such as the property manager) must withhold non-resident tax of 25 per cent on the gross rental income paid or credited to you.” To compound this issue, there was a recent case where a Montreal-based tenant was ordered to pay six years of this tax with interest on behalf of a non-resident landlord whom CRA was unable to collect from.

It is clear that requiring residential tenants to withhold taxes for non-resident landlords would complicate rental arrangements and introduce challenges for both parties involved. It would put an administrative burden on tenants and potentially mean every landlord would need to prove residency within Canada.

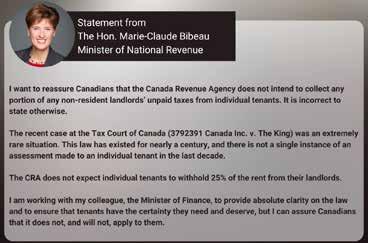

So, what is protecting tenants from needing to withhold and remit this tax? A history of non-enforcement on the part of CRA and Canada’s Minister of National Revenue Marie-Claude Bibeau. In a statement made on X (formally Twitter) Minister Bebeau stated that the recent case “was an extremely rare situation” and that “there is not a single instance of an assessment made to an individual tenant in the last decade”. Minister Bibeau went on to say, “I am working with my colleague, the Minister of Finance, to provide absolute clarity on the law”.

While tenants are not expected to withhold and remit this tax, that same leniency is not afforded to property managers or agents of non-resident landlords. Requirements and procedures for dealing with the withholding tax should be built into management agreements. A property manager’s job is to withhold 25 per cent of the gross income and submit it to the CRA. In most cases this 25 per cent is higher than the real tax liability of the non-resident landlord. The 25 per cent can, by application to CRA, be reduced from Gross to 25 per cent of net income after expenses when the non-resident and their property manager co-sign a NR6 form.

In conclusion, the recent spotlight on withholding tax and its impacts for residential tenancies underscores the complexity and potential challenges inherent in its application. While the law mandates a 25 per cent withholding tax on rental income for non-resident landlords, the responsibility for withholding and remitting this tax is not placed on tenants, but rather on property managers or agents. However, the recent case of a Montreal tenant ordered to pay six years of tax on behalf of a non-resident landlord has raised concerns and highlighted the need for clarity and consistent enforcement from the Canada Revenue Agency (CRA).

Minister Marie-Claude Bibeau’s assurance of addressing these issues and providing clarity on the law is crucial in ensuring fair and effective implementation. Moving forward, it is imperative for property managers, tenants, and landlords to understand their respective roles and obligations regarding withholding tax, and for proper procedures to be established to mitigate confusion.

ACCESS CONTROL KEY FOB

Vandelta Communication Systems Ltd.(VDC)

Christopher Rae (604) 732-8686

vandelta.com

ACCOUNTING

D&H Group LLP

Arthur Azana (604) 731-5881

dhgroup.ca

Smythe LLP

Daniel La (604) 687-1231

smythecpa.com

ADVERTISING - VACANCIES

Yardi Breeze Premier

Jasmin Rodas (800) 866-1124

yardibreeze.ca

ADVERTISING & PROMOTION

Places4Students.com

Laurie Snure (866) 766-0767

Places4Students.com

AIR CONDITIONING

Reliance Home Comfort

Dan Harvey (416) 707-5964

reliancehomecomfort.com

APPLIANCE - RENTALS

Coinamatic Canada Inc.

Lyle Silverstein (604) 270-8441 coinamatic.com

Penguin Appliances Sales & Services Inc.

Harb Sangha (604) 451-4411

penguinappliances.com

APPLIANCE - SALES & SERVICE

Coinamatic Canada Inc.

Lyle Silverstein (604) 270-8441 coinamatic.com

Penguin Appliances Sales & Services Inc.

Harb Sangha (604) 451-4411

penguinappliances.com

Trail Appliances

Catherine Maxwell (604) 838-3385 trailappliances.com

APPRAISAL - INSURANCE

Normac Nicole Daniels (604) 221-8258 normac.ca

ASBESTOS REMOVAL

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

BUILDING ENVELOPE

ATRIA Building Solutions

Wojtek Ulasewicz (604) 837-8813 atriaconstruction.ca

Lambert Plumbing and Heating Ltd

Youhann Semov (604) 734-0890 lambertplumbing.ca

BUILDING MANAGEMENT

Greater Vancouver Home Services Ltd.

Shawn Stevens (778) 727-2888

greatvancouverhomeservices.com

CLEANING - JANITORIAL

SERVICES

Greater Vancouver Home Services Ltd.

Shawn Stevens (778) 727-2888

greatvancouverhomeservices.com

CONCRETE WORK

Garpy Concrete & Restoration Ltd.

Claudio Pineda (604) 375-3017 garpyconcrete.com

Seal-Crete Restoration Ltd.

Claudio Pineda (604) 375-2017 seal-crete.ca

CONTRACTORS

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

Lambert Plumbing and Heating Ltd.

Youhann Semov (604) 734-0890

lambertplumbing.ca

KS Maintenance LTD

Teresa Cheung (604) 339-8223

ks-propertyservices.com

CREDIT REPORTS

RentCheck Credit Bureau

Brenda Maxwell (800) 661-7312

rentcheckcorp.com

DEBTOR LOCATOR

RentCheck Credit Bureau

Brenda Maxwell (800) 661-7312

rentcheckcorp.com

DECKS AND BALCONIES

Lambert Plumbing and Heating Ltd.

Youhann Semov (604) 734-0890 lambertplumbing.ca

DRAINAGE & SEWER

Lambert Plumbing and Heating Ltd.

Youhann Semov (604) 734-0890 lambertplumbing.ca

DRAPERIES AND BLINDS - SALES

Westport Manufacturing

Mary Mckinley (604) 261-9326 west-port.com

DUCT CLEANING

Air-Vac Services Canada Ltd.

Brent Selby (604) 882-9290 airvacservices.com

ELECTRICIANS

Control Tech Electrical

Greg Mitsiadis (604) 779-7176 contoltechelectric.com

Evanson Electric Ltd.

David Evanson (604) 657-7957 evansonelectric.com

ELEVATOR

Metro Atta Elevator Ltd.

Preet Binning (604) 569-2977

metroelevator.ca

ENERGY EFFICIENCY & CONSERVATION

BC Hydro To learn more about energy savings opportunities go to bchydro.com

FortisBC Energy Inc.

Mel Tugade (888) 224-2710

fortisbc.com

FRESCo Building Efficiency

Jordan Fisher (778) 783-0315 frescoltd.com

Yardi Breeze Premier

Jasmin Rodas (800) 866-1124 yardibreeze.ca

ENGINEERS

FRESCo Building Efficiency

Jordan Fisher (778) 783-0315

frescoltd.com

Read Jones Christoffersen Ltd.

Jason Guldin (250) 213-2520

rjc.ca

ESTATE & SUCCESSION PLANNING

Monarch Financial/ Manulife Securities Inc.

Richard Laurencelle (604) 681-2699

EV CHARGING STATIONS

Sparkle Solutions

Connie Goldman (866) 769-0680 sparklesolutions.ca

EVICTION SERVICES

Canadian Tenant Inspection Services Ltd.

Anna Garnett (778) 846-9125 ctiservices.ca

EXTERIOR/ SIDING REPLACEMENT

Lambert Plumbing and Heating Ltd.

Youhann Semov (604) 734-0890 lambertplumbing.ca

FIRE PROTECTION & MONITORING

Telus Communications Inc.

Sarah Ballantyne (250) 310-3343 telus.com

FIRE PROTECTION, MONITORING & EQUIPMENT

Community Fire Prevention Ltd.

Jordan Kennedy (604) 944-9242 comfire.ca

Vancouver Fire and Radius Security

Angela Nottingham (604) 232-3473 vanfire.com

FLOORING AND CARPETING

Lambert Plumbing and Heating Ltd

Youhann Semov (604) 734-0890 lambertplumbing.ca

Mira Floors Limited

Kevin Bergstresser (604) 856-4799 mirafloors.com

FOOD WASTE DISPOSER

Super Save Group of Companies

Danielle Johannes (604) 533-4423 supersave.ca

GAS SERVICE

Absolute Energy

Kirby Morrow (604) 315-2058 absolute-energy.ca

GUTTERS, SOFFITS & RAILING INSTALLATION

Cambie Roofing Contractors

Paul Skujins (604) 261-1111 cambieroofing.com

HEATING FUELS

Columbia Fuels

Nathan Dorie (877) 500-4328 columbiafuels.com

INSPECTIONS-TENANCY

COMPLIANCE

Canadian Tenant Inspection Services Ltd.

Anna Garnett (778) 846-9125 ctiservices.ca

INSURANCE

AC&D Insurance Services Ltd.

Robert ten Vaanholt (604) 985-0581 acdinsurance.com

BFL Canada Risk and Insurance Services Inc.

Stacey Wilson (778) 374-4125 bflcanada.ca/real-estate

Capri CMW Insurance Services Ltd.

Danielle Russel (604) 294-3301 capricmw.ca

Megson FitzPatrick Insurance

Mike Nichol (250) 519-2300 megsonfitzpatrick.com

INTERCOM REPAIRS & INSTALLATION

Vandelta Communication Systems Ltd.(VDC)

Christopher Rae (604) 732-8686 vandelta.com

INTERNET LISTING SERVICES

Yardi Breeze Premier Jasmin Rodas (800) 866-1124 yardibreeze.ca

INVESTMENT & RETIREMENT PLANNING

Monarch Financial/ Manulife Securities Inc.

Richard Laurencelle (604) 681-2699

LANDSCAPING - LAWN & GARDEN MAINTENANCE

BUR-HAN Garden & Lawn Care

Robert Hannah (604) 983-2687 bur-han.ca

LAUNDRY EQUIPMENT

LEASING AND SALES

Sparkle Solutions

Connie Goldman (866) 769-0680 sparklesolutions.ca

LEGAL SERVICES

Haddock & Company

Jessica McNeal (604) 983-6670 haddock-co.ca

Lesperance Mendes

Alex Chang (604) 685-3567 lmlaw.ca

Refresh Law

Oscar Miklos (604) 800-8096 refreshlaw.ca

LIGHTING

Control Tech Electrical

Greg Mitsiadis (604) 779-7176 contoltechelectric.com

MEDIA

MediaEdge Communications

Dan Gnocato (604) 549-4521 mediaedge.ca

MORTGAGE FINANCING

Citifund Capital Corporation

Derek Townsend (604) 683-2518 citifund.com

CMHC

Eric Bond (604) 737-4161 cmhc.ca

ONLINE PAYMENT SERVICE

Yardi Breeze Premier Jasmin Rodas (800) 866-1124 yardibreeze.ca

PAINT SALES

Cloverdale Paint

Dave Picariello (604) 551-8083 cloverdalepaint.com

PAINTING SERVICE

Garpy Concrete & Restoration Ltd. Claudio Pineda (604) 375-3017 garpyconcrete.com

Lambert Plumbing and Heating Ltd. Youhann Semov (604) 734-0890 lambertplumbing.ca

Remdal Painting & Restoration Inc. Paul Maryschak (604) 882-5155 remdal.com

PEST CONTROL

Assured Environmental Solutions

Brett Johnston (604) 463-0007

assuredenvironmental.ca

Solutions Pest Control Ltd. Jason Page (604) 815-0093 PestSolutions.ca

PIPE LINING/ RE-PIPING

CuraFlo of Canada Ltd. Randy Christie (604) 298-7278 curaflo.com

PLUMBING/HEATING/ BOILERS

Allied Plumbing, Heating & Air Conditioning

Lance Clarke (604) 731-1000

allied-plumbing.ca

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

Cambridge Plumbing Systems Ltd.

John Jurinak (604) 872-2561 cambridgeplumbing.com

CuraFlo of Canada Ltd.

Randy Christie (604) 298-7278

curaflo.com

Lambert Plumbing and Heating Ltd.

Youhann Semov (604) 734-0890 lambertplumbing.ca

Manna Plumbing Ltd.

Chris Kobilke (604) 710-3908 mannaplumbing.com

Montalbano Plumbing Services Ltd.

Andrea Giovanni (604) 444-0222 montalbano.ca

Reliance Home Comfort

Dan Harvey (416) 707-5964 reliancehomecomfort.com

Xpert Mechanical & JK Lillie Ltd.

Kerry West (604) 294-4540 xpertmechanical.com

PRINTING

Citywide Printing Ltd.

Gordon Li (604) 254-7187

citywideprint.com

PROPANE

Columbia Fuels

Nathan Dorie (877) 500-4328 columbiafuels.com

PROPERTY MANAGEMENT

Bayswater Projects Ltd.

Nicholas Wadsley (604) 720-0603 bayswater-projects.com

GWL Realty Advisors

Residential Inc.

Michele Caley (587) 412-5583 gwlraresidential.com

Holywell Properties

Adam Major (604) 885-3460 holywell.ca

88West Realty Ltd.

Shirin Saleh 88westrealty.com

A A Property Management Ltd.

Aaron Leung (604) 207-2002 aaproperty.ca

Advent Real Estate Services Ltd.

Michelle Farina (604) 736-6478 rentwithadvent.com

Aedis Realty

Azi Hosseini (778) 881-4414 azihomes.com

Ambiance Property Management Inc.

Deepak Kumar (604) 366-4959 ambianceproperty.ca

Ami Dixon Property Manager

Ami Dixon (604) 833-4144

Appelt Management Inc.

Ryan Gray (250) 980-3577 risemanagement.ca

Associa British Columbia, Inc.- RHOME

Katie Khoo (604) 591-6060 rhomepm.ca

Associated Property Management (2001) Ltd.

Rob Zivkovic (250) 712-0025 apmkelowna.com

Atrium Pacific Properties Inc.

Accounts Payable (250) 477-5353 atriumpropertymanagement.ca

Barbican Property Management

Dragana Lazic (604) 943-2203 Barbicanpm.ca

Bayside Property Services Ltd.

Lynda Creamer (604) 432-7774 baysideproperty.com

BentallGreenOak (Canada)

Limited Partnership

Candace Le Roux (604) 646-2814 bentallgreenoak.com

Birds Nest Properties

Alvin Cheung (604) 260-9955 birdsnestproperties.ca

Bodewell Realty Inc.

Myra Rajan (604) 633-5511 bodewell.ca

Bolld Real Estate Management

Leo Chrenko (855) 266-8588 bolldpm.com

Brightside Homes

Ronald Singh (604) 684-3515 brightsidehomes.ca

Casa Rental Management

Tammy Diego-Mott (604) 273-6801

Cecilia Court

Armida Cumberbirch

Century 21 Energy Realty Ltd.

Mike Buburuz (250) 785-0021 c21energymanagement.ca

Century 21 In Town Realty

Michael La Prairie (604) 685-5951 century21vancouver.com

CLV Group

Michael Forani (613) 728-2000 clvgroup.com

Cogir Real Estate

Kevin Anderson (905) 434-2243 cogir.net

Copper Ridge Court

Vera Lloyd (250) 372-0829

Coronet Realty Ltd.

Aaron Best (604) 298-3235

coronetrealtyltd.com

Custom Realty Ltd.

Jolene Foreman (604) 916-6345 custom-realty.ca

Deecorp Properties

Patricia Dee (604) 683-0002

Delta King Place Housing Society

Lucy Borges (250) 632-6535 deltakingplace.ca

Devon Properties Ltd.

David Craig (250) 595-7000

devonproperties.com

Devonshire Properties

Paola Lopez (604) 879-7368 devonshire-inc.com

Dexter Realty/Dexter PM Gurm Pandher (604) 869-8226 dexterrealty.com

Dorset Realty Group Canada Ltd.

Damien Roussin (604) 270-1711 ext.111 dorsetrealty.com

DPM Rental Management Ltd.

Phillip Paull (604) 982-7051

DPMonline.ca

Eagleson Properties Ltd.

Katherine Eagleson (604) 879-1070

eaglesonproperties.com

EasyRent Real Estate Services Ltd.

Reception EasyRent (604) 662-3279

easyrent.ca

Fireside Property Group Ltd.

Keith McMullen (403) 228-4303 firesidepropertygroup.com

FirstService Residential

Jaclyn Jeffrey (604) 683-8900 fsresidential.com

GMC Projects Inc.

David Milne (604) 717-4477 gmcprojects.com

Greater Vancouver Tenant & Property Management Ltd.

Keaton Bessey (604) 398-4047 gvantpm.com

Green Door Property Management

Jayde Cooke (250) 345-2133

Gulf Pacific Property Management Ltd.

Terry Roberts (604) 990-1500 gulfpacific.ca

Hathstauwk Holdings Ltd.

Terra Turton (604) 272-7626

Hathstauwk.com

Hewett Homes

Adrienne Hewett (604) 922-1934

hewetthomes.ca

HomeLife Benchmark

Realty Corp.

Rawad Najjar (604) 644-4491 homelifepropertyrentals.ca

Hope Street Management Corp.

Daria Vagner (604) 416-0042

hopestreet.ca

Hugh & McKinnon Realty Ltd.

Scott Higgins (604) 531-1909 hughmckinnon.com

Hume Investments Ltd.

Sally McIntosh (604) 980-9304

humeinvestments.com

Hunter McLeod Realty Corp.

Richard Anderson (604) 734-8860

hmrealty.bc.ca

JKS Realty & Property Management

Jason Kahl

jksrealty.ca

L Bennett Consultants

Lolly Bennett (604) 307-3080

Locarno

Riley Mari

Lougheed Enterprises Ltd.

Andrew Statham (604) 980-0067

Macdonald Commercial R.E.S. Ltd.

Tony Letvinchuk (604) 736-5611

macdonaldcommercial.com

MacPherson Real Estate Ltd.

Rob MacPherson (604) 605-2534 cbmre.ca

Maple Leaf Property Management Apartments

Melanie LeBar (604) 925-8215

Maxsave Real Estate Services

Linda Stacey (250) 640-3471 maxsave.bc.ca

Metro Vancouver Housing

Corporation

Farah Kassam (604) 432-6300 metrovancouver.org

Midwest Property Management

Tina Ding (604) 291-6878 rentmidwest.com

Minto Properties Inc.

Lynne Bedard minto.com

Mountain Town Properties Ltd.

Jodie Ouimet (250) 368-7166

Mr. Christopher E Hughes, CCIM

Christopher Hughes, CCIM (604) 833-7922

Multiple Realty Ltd.

Grace Cheng (778) 918-855

Murray Hill Developments Ltd.

Barry Wiedman (780) 488-0288

Oak West Realty

Yori Nakatani (604) 731-1400

Oakwyn Realty Ltd.

Arlene Chiang (604) 897-0458 oakwynpm.com

Peninsula Property Management

Doug Holmes (604) 536-0220 rentinfo.ca

Picket Fence Property Management Group

Cindy Hamel (604) 807-1105 picketfencepmg.com

Porte Realty Ltd.

Ryan Singleton (604) 732-7651

porte.ca

Prospero International Realty Inc.

Jeff Nightingale (604) 669-7733

Quality Property Management Real Estate Services Ltd.

Marianne Miller (778) 878-7304

bcpropertyspecialist.com

Raven Property Management Ltd.

George Holmes (250) 881-8866

RE/MAX City Realty Gibsons

Andrea Kerr (604) 682-3074

coastrentals.ca

RE/MAX Crest Realty

Tom Wang

RE/MAX Crest Realty

Aidin Ashkieh (604) 566-1010

RE/MAX Penticton Realty

Deborah Moore (250) 492-2266

yoursouthokanaganhome.com

Re/Max Sea to Sky Real Estate Ltd.

Shankar Raina (604) 935-9071 remaxseatoskypm.com

Real Property Management

Carla Browne (888) 272-2111

rpmcentral.ca

Real Property Management

Signature

Albert Langbid (877) 497-0848 rpmsignature.ca

Realstar

Steve Matish (416) 923-2950 realstar.ca

Red Door Management Corp.

Lisa Biggin (778) 827-0377 reddoorpm.ca

Reign Realty

Andi Pham (604) 404-4888 reignrealty.ca

REMAX City

Ken O’Donnell (604) 740-7652

Remax City Realty

Ken Zhou

Rent It Furnished Realty

Robson Souza (604) 628-3457

rentitfurnished.com

Rent Real Estate Services

Lucy Willcox PREC* (604) 737-8865

rentrealestateservices.ca

Reside Management

Ericko Toni residemanage.com

Rize Alliance Properties Ltd.

Rebecca Mumford (604) 630-1645 rize.ca

Roboson Holdings Ltd.

Sarah Hill (604) 682-2088

rennie.com

Royal LePage Rockies West

Realty

Cris Leonard (250) 409-5500

mountainviewproperties.ca

S.A.H. Properties Ltd.

Leslie Pomeroy

South Okanagan Property

Management

Ashley Lutke-Schipholt (250) 485-9935

southokanaganrentals.com

Southland Mortgage Ltd.

Erik Hyatt

Strand Development

Kris Loncar

Sunstar Realty Ltd.

David Mak (604) 436-1335

sunrealty.ca

Sutton West Coast Realty 120

Joseph T-Giorgis (604) 816-2928

Swift Realty Ltd.

Reza Khatami (604) 239-2144

swiftrent.ca

Townsend Management

Don Townsend (250) 448-0242

Transpacific Realty Advisors Accounting Department (604) 873-8591

transpacificrealty.com

Tribe Management Inc.

Scott Ullrich (604) 202-5500

Turner Meakin Management Company Ltd.

Brian Meakin (604) 736-7020

Unique Real Estate

Accommodations Inc.

Nina Ferentinos (604) 984-7368

VADA Asset Management Inc.

Michelle Farina (604) 416-3880 vadaam.com

ACCOUNTING

D&H Group LLP

Arthur Azana (604) 731-5881

dhgroup.ca

Smythe LLP

Daniel Lai (604) 687-1231 smythecpa.com

ADVERTISING - VACANCIES

Yardi Breeze Premier Jasmin Rodas (800) 866-1124 yardibreeze.ca

ADVERTISING & PROMOTION

Places4Students.com

Laurie Snure (866) 766-0767

Places4Students.com

APPLIANCE - RENTALS

Coinamatic Canada Inc.

Vancouver Property Management, VPM Group RE/MAX

Farid Entezari (877) 633-7910

VPMGroup.ca

Vancouver Rent It

Andy Yuen (604) 408-0008

Vancouver Rental Group

Seva Roberts (604) 537-4399

vancouverrentalgroup.ca

Ville Property Management Ltd.

Jade Yu

Virani Property Management

Anthony Fong virani.ca

Wealth Realty Inc.

Bill Mitsui billmitsui.com

Wesgroup Properties

Alysha Bacus (778) 957-7376 wesgroup.ca

West Kootenay Rentals

Paula Owen (250) 359-5021

Westwynd Real Estate Services Ltd.

Jeff Brown (604) 944-8917

Wynn Real Estate Ltd.

Juhan Lee (604) 762-4200 wynnrealty.ca

REAL ESTATE SALES

CBRE Ltd.

Lance Coulson (604) 662-5141 nationalapartmentgroupbc.ca

Goodman Commercial Inc.

Mark Goodman (604) 714-4790

Larry Berisoff RE/MAX Kelowna

Larry Berisoff (250) 878-7417 syberrealty.com

Macdonald Commercial

R.E.S. Ltd.

Tony Letvinchuk (604) 736-5611 macdonaldcommercial.com

APPLIANCE - SALES & SERVICE

Coinamatic Canada Inc.

Lyle Silverstein (604) 270-8441 coinamatic.com

Trail Appliances

Catherine Maxwell (604) 838-3385 trailappliances.com

APPRAISAL - INSURANCE

Normac

Nicole Daniels (604) 221-8258 normac.ca

ASBESTOS REMOVAL

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

Macdonald Commercial

R.E.S. Ltd.

Dan Schulz (778) 999-5758 bcapartmentinsider.com

McEvay Blair Multifamily Group

James Blair (604) 790-7089 mbmultifamily.com

Multifamily Real Estate Services

Seth Baker (778) 686-3330 multifamily.ca

Pospischil Realty Group

Adam Pospischil (604) 263-1000 pospischilrealty.com

REDEVELOPMENT

MANAGEMENT

IDS Group

David Adelberg (604) 245-9898 idsgroup.ca

RENOVATION & REPAIRS

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

KS Maintenance Ltd.

Teresa Cheung (604) 339-8223

ks-propertyservices.com

RE-PIPING

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

Cambridge Plumbing Systems Ltd.

John Jurinak (604) 872-2561

cambridgeplumbing.com

Manna Plumbing Ltd.

Chris Kobilke (604) 710-3908 mannaplumbing.com

RE-PIPING: RESTORATION

Lambert Plumbing and Heating Ltd.

Youhann Semov (604) 734-0890 lambertplumbing.ca

CLEANING - CARPET & UPHOLSTERY

Island Carpet & Upholstrey

Cleaning Inc.

Ron Gould (250) 590-5060 islandcarpetcleaning.ca

CONTRACTORS

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

CREDIT REPORTS

RentCheck Credit Bureau

Brenda Maxwell (800) 661-7312

rentcheckcorp.com

DEBTOR LOCATOR

RentCheck Credit Bureau

RESTORATION

FirstOnSite Restoration Ltd.

Amy Barilla (236) 335-0499 firstonsite.ca

Incredible Restorations

Mikael Gatfi (604) 639-0990 incrediblerestorations.com

ROOFING

Bond Roofing

Daniel Fajfar (604) 375-2100 bondroofing.ca

Cambie Roofing Contractors

Paul Skujins (604) 261-1111 cambieroofing.com

Read Jones Christoffersen Ltd.

Jason Guldin (250) 213-2520 rjc.ca

ROOFING MEMBRANES

Cambie Roofing Contractors

Paul Skujins (604) 261-1111 cambieroofing.com

SECURITY & INTERCOM SYSTEMS

Telus Communications Inc.

Sarah Ballantyne (250) 310-3343 telus.com

Vandelta Communication Systems Ltd.(VDC)

Christopher Rae (604) 732-8686 vandelta.com

SOFTWARE - PROPERTY MANAGEMENT

Pendo

Jodelene Weir (604) 398-4030 pen.do/partners/landlordbc

SUPPLIES - HARDWARE, BUILDING, MAINTENANCE

Rona

Nathalie Meloche 514-668-0051 rona.ca

Super Save Group of Companies

Danielle Johannes (604) 533-4423 supersave.ca

DRAINAGE & SEWER

Callaway Plumbing and Drains Ltd.

Brett Callaway (250) 216-7159 callawayplumbing.ca

Victoria Drains

Dave Lloyd (250) 818-1609 victoriadrains.com

ELECTRICIANS

Rushworth Electrical Services Inc.

Dustin Rushworth (250) 361-1231 rushworthelectric.ca

ENERGY EFFICIENCY & CONSERVATION

BC Hydro

The Home Depot Canada

Michael Lirangi (416) 571-8940

homedepot.ca/pro

TELECOMMUNICATIONS

Telus Communications Inc

Sarah Ballantyne (250) 310-3343 telus.com

UTILITIES/ NATURAL GAS

Absolute Energy

Kirby Morrow (604) 315-2058 absolute-energy.ca

UTILITY SUB-METERING

Enerpro Systems Corp.

Andrew Davidson (604) 982-9155 enerprosystems.com

WASTE/ RECYCLING

Super Save Group of Companies

Danielle Johannes (604) 533-4423

supersave.ca

Waste Connections of Canada Inc.

Tomas Hansen (604) 834-7578

WasteConnectionsCanada.com

WATERPROOFING

Cambie Roofing Contractors Paul Skujins (604) 261-1111 cambieroofing.com

WATERPROOFING

Read Jones Christoffersen Ltd.

Jason Guldin (250) 213-2520 rjc.ca

WINDOW - REPLACEMENT/ INSTALLATION/RENOVATION

A1 Windows Roque Datuin (604) 777-8000 a1windows.ca

Centra Windows

Andrew Anderson (888) 534-3333 centrawindows.com

Retro Teck Window Wilfred Prevot (604) 291-6751 retrowindow.com

FRESCo Building Efficiency

Jordan Fisher (778) 783-0315

frescoltd.com

Yardi Breeze Premier Jasmin Rodas (800) 866-1124 yardibreeze.ca

ENGINEERS

FRESCo Building Efficiency

Jordan Fisher (778) 783-0315 frescoltd.com

Read Jones Christoffersen Ltd.

Jason Guldin (250) 213-2520 rjc.ca

Anna Garnett (778) 846-9125 ctiservices.ca ASSOCIATE MEMBERS/CORPORATE SUPPLIERS - VANCOUVER ISLAND

Lyle Silverstein (604) 270-8441 coinamatic.com

Brenda Maxwell (800) 661-7312

rentcheckcorp.com

To learn more about energy savings opportunities go to bchydro.com

FortisBC Energy Inc.

Mel Tugade (888) 224-2710 fortisbc.com

EVICTION SERVICES

Canadian Tenant Inspection Services Ltd.

FIRE PROTECTION & MONITORING

Telus Communications Inc.

Sarah Ballantyne (250) 310-3343 telus.com

FIRE PROTECTION, MONITORING & EQUIPMENT

Rushworth Electrical Services Inc.

Dustin Rushworth (250) 361-1231

rushworthelectric.ca

Vancouver Fire and Radius Security

Angela Nottingham (604) 232-3473 vanfire.com

FOOD WASTE DISPOSER

Super Save Group of Companies

Danielle Johannes (604) 533-4423

supersave.ca

GAS SERVICE

Absolute Energy

Kirby Morrow (604) 315-2058

absolute-energy.ca

Callaway Plumbing and Drains Ltd.

Brett Callaway (250) 216-7159

callawayplumbing.ca

Heating Fuels

Columbia Fuels

Nathan Dorie (877) 500-4328 columbiafuels.com

INSPECTIONS-TENANCY COMPLIANCE

Canadian Tenant Inspection Services Ltd.

Anna Garnett (778) 846-9125

ctiservices.ca

INSURANCE

AC&D Insurance Services Ltd.

Robert ten Vaanholt (604) 985-0581

acdinsurance.com

BFL Canada Risk and Insurance Services Inc.

Stacey Wilson (778) 374-4125

bflcanada.ca/real-estate

Capri CMW Insurance Services Ltd.

Danielle Russell (604) 294-3301 capricmw.ca

Megson FitzPatrick Insurance

Mike Nichol (250) 519-2300

megsonfitzpatrick.com

INTERNET LISTING

SERVICES

Yardi Breeze Premier

Jasmin Rodas (800) 866-1124

yardibreeze.ca

LEGAL SERVICES

Haddock & Company

Jessica McNeal (604) 983-6670 haddock-co.ca

Lesperance Mendes

Alex Chang (604) 685-3567 lmlaw.ca

Refresh Law

Oscar Miklos (604) 800-8096 refreshlaw.ca

MEDIA

MediaEdge Communications

Dan Gnocato (604) 549-4521 mediaedge.ca

MORTGAGE FINANCING

Citifund Capital Corporation

Derek Townsend (604) 683-2518 citifund.com

CMHC

Eric Bond (604) 737-4161 cmhc.ca

ONLINE PAYMENT SERVICE

Yardi Breeze Premier

Jasmin Rodas (800) 866-1124 yardibreeze.ca

PAINT SALES

Cloverdale Paint

Dave Picariello (604) 551-8083 cloverdalepaint.com

PIPE LINING/ RE-PIPING

CuraFlo of Canada Ltd.

Randy Christie (604) 298-7278 curaflo.com

PLUMBING/HEATING/ BOILERS

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

Callaway Plumbing and Drains Ltd.

Brett Callaway (250) 216-7159 callawayplumbing.ca

Cambridge Plumbing Systems Ltd.

John Jurinak (604) 872-2561 cambridgeplumbing.com

CuraFlo of Canada Ltd.

Randy Christie (604) 298-7278 curaflo.com

PRINTING

Citywide Printing Ltd.

Gordon Li (604) 254-7187 citywideprint.com

PROPANE

Columbia Fuels

Nathan Dorie (877) 500-4328 columbiafuels.com

PROPERTY MANAGEMENT

460 Property Management Inc.

Carol Buck (250) 591-4603 460pm.com

Abingdon Moore Realty

Marilyn Koehle (778) 421-8797

Advanced Property Management Inc.

Lorri Fugle (250) 338-2472 advancedpm.ca

AQP Management

Andrew Bekes (778) 966-7277

BentallGreenOak (Canada)

Limited Partnership

Candace Le Roux (604) 646-2814 bentallgreenoak.com

Brown Bros Agencies Ltd.

Drew Storey (250) 385-8771 brownbros.com

Century 21 Queenswood

Chris Markham (250) 477-1100 century21queenswood.ca

Cherry Creek Property

Services Ltd.

Val Ketel (250) 427-7411 ccps.email

Clover Residential Ltd.

Alana Fitzpatrick (250) 532-2635 duttons.com

Colliers

Grant Evans (250) 414-8373 collierscanada.com

Colyvan Pacific Property Management

Jodi Levesque (250) 754-4001 colyvanpacific.com

Complete Residential

Property Management

Dennie Linkert (250) 370-7093 completeresidential.com

Cornerstone Properties Ltd.

Jason Middleton (250) 475-2005 cornerstoneproperties.bc.ca

Coronet Realty Ltd.

Aaron Best (604) 298-3235 coronetrealtyltd.com

Countrywide Village Realty Ltd.

Simranjeet Kaur (250) 749-6660

Devon Properties Ltd.

David Craig (250) 595-7000 devonproperties.com

DFH Real Estate Ltd.

Lisa Clark (250) 477-7291

Equitex Realty Ltd.

Joe Bellows (250) 386-6071 equitex.ca

Greenaway Realty Ltd.

Kirsten Greenaway (250) 216-3188 greenawayrealty.com

Hugh & McKinnon Realty Ltd.

Scott Higgins (604) 531-1909 hughmckinnon.com

Hume Investments Ltd.

Sally McIntosh (604) 980-9304 humeinvestments.com

Lannon Creek Holdings Ltd.

Dave McClimon (250) 744-0394

Oakwood Property Management

Carol Dobell (250) 704-4391 oakwoodproperties.ca

Pemberton Holmes

Property Management

Claire Flewelling-Wyatt (250) 478-9141 thepropertymanagers.ca

Proline Management Ltd.

Adam Taylor (250) 475-6440 prolinemanagement.com

Quality Property

Management Real Estate

Services Ltd.

Marianne Miller (778) 878-7304 bcpropertyspecialist.com

Richmond Property Group Ltd.

Jean McKay (250) 388-9920 richmondproperty.ca

Royal LePage Nanaimo Realty

Brenda Gilroy (250) 760-2234 royallepagenanaimo.ca

TPM Properties

Debbie Hunt (250) 383-7663

Tribe Management Inc.

Scott Ullrich (604) 202-5500

Widsten Property Management

Steve Widsten (250) 753-8200 islandrent.com

REAL ESTATE SALES

CBRE Limited

Lance Coulson (604) 662-5141 nationalapartmentgroupbc.ca

Colliers

Grant Evans (250) 414-8373 collierscanada.com

Goodman Commercial Inc.

Mark Goodman (604) 714-4790 goodmanreport.com

McEvay Blair Multifamily Group

James Blair (604) 790-7089 mbmultifamily.com

RENOVATION & REPAIRS

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

RE-PIPING

BMS Plumbing & Mechanical Systems Ltd.

Tamara Merchan (604) 253-9330 bmsmechanical.com

Callaway Plumbing and Drains Ltd.

Brett Callaway (250) 216-7159 callawayplumbing.ca

Cambridge Plumbing Systems Ltd.

John Jurinak (604) 872-2561 cambridgeplumbing.com

RESTORATION

FirstOnSite Restoration Ltd.

Amy Barilla (236) 335-0499 firstonsite.ca

ROOFING

Read Jones Christoffersen Ltd.

Jason Guldin (250) 213-2520 rjc.ca

SECURITY & INTERCOM SYSTEMS

Telus Communications Inc.

Sarah Ballantyne (250) 310-3343 telus.com

SOFTWARE - PROPERTY MANAGEMENT

Pendo

Jodelene Weir (604) 398-4030 pen.do/partners/landlordbc

SUPPLIES - HARDWARE, BUILDING, MAINTENANCE

Rona

Nathalie Meloche 514-668-0051 rona.ca

Super Save Group of Companies

Danielle Johannes (604) 533-4423 supersave.ca

The Home Depot Canada

Michael Lirangi (416) 571-8940 homedepot.ca/pro

TELECOMMUNICATIONS

Telus Communications Inc.

Sarah Ballantyne (250) 310-3343 telus.com

UTILITIES/ NATURAL GAS

Absolute Energy

Kirby Morrow (604) 315-2058

absolute-energy.ca

UTILITY SUB-METERING

Enerpro Systems Corp.

Andrew Davidson (604) 982-9155 enerprosystems.com

WASTE/ RECYCLING

Super Save Group of Companies

Danielle Johannes (604) 533-4423 supersave.ca

WATERPROOFING

Read Jones Christoffersen Ltd.

Jason Guldin (250) 213-2520 rjc.ca

WINDOWREPLACEMENT/ INSTALLATION/ RENOVATION

A1 Windows

Roque Datuin (604) 777-8000 a1windows.ca

Centra Windows

Andrew Anderson (888) 534-3333 centrawindows.com

Retro Teck Window

Wilfred Prevot (604) 291-6751 retrowindow.com

Colwood & Sechelt development sites Townhome, rental or condo projects

3 development sites with plans in place. Can be purchasesd separately.

Call for details

James Lodge

1116 West 12th Avenue, Vancouver

Vacant possession for 8 of the 11 units! 6,235 SF lot just 1.5 blocks from VGH.

List $5,700,000 (est. 4.7% cap)

Vancouver C-2 zoned warehouse 57 Lakewood Drive, Vancouver

C-2 zoned warehouse / development site. 24,142 SF corner lot. Build up to 3.0 FSR.

List $12,700,000

Yorkshire Apartments 2336 York Avenue, Vancouver

35-suite building – steps to Kits Beach. Attractive assumable CMHC financing. Ocean & water views.

List $19,800,000 (3.9% cap)

Gow Block 3589 Commercial Street, Vancouver

Mixed-use 6-unit heritage building in the Cedar Cottage neighbourhood. Completely rebuilt in 2010.

List $4,600,000 (3.8% cap)

Kits Point waterfront dev site 1000 Cypress Street, Vancouver

14,256 SF Kits Point DP-approved waterfront development site with direct beach access.

List $14,500,000

357 West 4th Street North Vancouver

12-suite apartment building in Lower Lonsdale neighbourhood. Residential Level 5 OCP.

List $6,900,000 (3.5% cap)

Georgian House 5450 Vine Street, Vancouver

12-storey concrete rental tower. 69 suites in the heart of Kerrisdale. Infill development potential.

List $42,000,000

Bayside Towers 1846 Nelson Street, Vancouver

43-suite 10-storey concrete rental tower in West End – west of Denman neighbourhood. Views. Sold $20,450,000

4790 mark@goodmanreport.com

Brackett Direct 604 714 4778 ian@goodmanreport.com