6 minute read

Even Though Less Than 1% of Venture Capital

Even Though Less Than 1% of Venture Capital Goes to Black Funders, Here's How I Raised $11 Million

By Joseph Heller

Advertisement

As an African American entrepreneur, I can tell you that you’ll face tremendous obstacles in building your vision. But there is nothing more personally liberating than seeing your dream come true—and right now, as an African American entrepreneur, your platform for change is growing exponentially as VCs are slowly starting to understand that they need to be more inclusive and that there are vast opportunities outside of their small network.

I encourage all African Americans to pursue their dreams of being an entrepreneur—and if your dream is to change the world, you should raise venture capital. There will always be diffi culties— yes, unique to you. My goal in this piece is to encourage you to keep moving in spite of them. So here’s my story on how I raised an $11M Series A.

It begins when my father came home one day and handed me a copy of Black Enterprise’s 1995 edition of the BE 100s. From that day forward, I decided that I would be an entrepreneur. I grew up in a mostly white neighborhood and went to a mostly white private school. On the weekends, I would work at my grandparents’ business in South Central Los Angeles, which was a historically black community in L.A. At a young age I was very aware that African Americans lived in relative poverty compared to most white people. That was compounded by overtly racist experiences I had throughout my childhood that made it clear that society viewed African Americans as inferior. But the individuals on the BE 100s my dad gave me told me there was hope.

I had a burning desire from an early age to prove to the world that I could do something great despite society’s perception of me. I always had this feeling that I would not be treated fairly in a large corporation—and the BE 100s were the perfect catalyst for my imagination to envision a reality where I would be totally liberated to create my own rules and vision for the world.

A few months after receiving that Black Enterprise magazine, I was inspired to start my own web design business in high school. In college, I raised angel investment to build a platform that would allow artisans to sell their products online. And after graduating from UC Berkeley, I went to China where I ended up starting an import/export business. Our customers were large companies that needed supply chain management consulting to

help them navigate the myriad process of working with Chinese factories.

Around the same time, I realized that there was a growing trend of small businesses that were being empowered by tools like Shopify and Instagram, where literally anyone could start their own business and sell products. But the backend manufacturing—how products actually got made—was still extremely complicated for these small businesses.

I wanted to create a technology company that

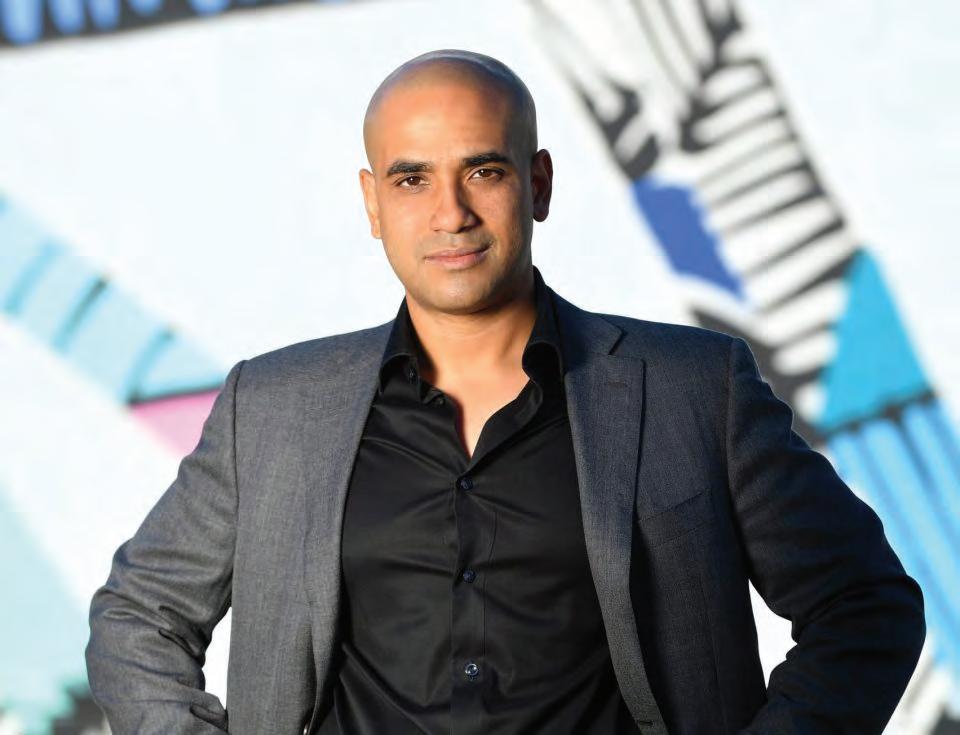

Joseph Heller

from page 75

would solve this problem, but I didn’t have the necessary connections in venture capital to raise money back then. So I decided to build TheStudio. com (www.thestudio.com) and later SuppliedShop. com (https://suppliedshop.com) with my own capital—slow but steady. Our vision was and is to democratize manufacturing for small businesses using software.

After having built the company to eight digits in revenue with over 100 employees in four countries, I decided that it was time to go back to the U.S. and raise venture capital—surely now the story was convincing—and with the numbers to prove it! I had seen companies raise a lot more money with no revenue and a less compelling vision for the future. I was confi dent that given the fact that we

had obtained a relative level of success completely bootstrapped and had a compelling vision and technology that actually worked that we would be able to easily raise money.

I soon found out that it would be much harder than I anticipated.

The big problem with the venture community is that it really operates like the stereotypical good old boys network. Forty percent of VCs went to Harvard or Stanford. It’s a pretty cynical testament to the insular nature of VCs that out of all the brilliant people they could hire in this country, 40% of them hail from just two schools. Seventy percent of VCs are white and only 3% are black; LatinX only represents 1%. Less than 1% of venture capital goes to Black founders.

I’ll be very clear: I think the vast majority of VCs are well-intentioned and are not overtly racist.

But because the VC model encourages fi rms to hire and invest in people that they have previous relationships with, the entire ecosystem ends up looking like a country club. Furthermore, there

are extreme but unconscious biases of what a successful entrepreneur should “look” like—and our natural human instinct of pattern recognition thinks a successful CEO looks like Mark Zuckerberg, Elon Musk, or Jeff Bezos. When I walked in a room, I didn’t look like a CEO to investors, and that perception hurt me when I was raising money.

Every African American knows that intangible feeling where you know you are unfairly judged by a room full of white people, just because of the color of your skin. I felt that.

I have the data to back up my feeling. I pitched roughly 150 VCs and about 80% of the partners that I pitched were white and 20% were non-white. I received zero term sheets from the white VCs and fi ve-term sheets (out of 30 pitches) from non-white VCs. The data is quite clear that although VCs don’t want to acknowledge biases, these biases do exist.

Raising VC money was the most agonizing thing that I have ever done in my life. I had spent years preparing the company to raise VC money, poured all of my savings into the company, and was literally being told on a daily basis that we weren’t good enough to raise money. It was really a heartbreaking experience. But through hard work and perseverance, we were able to raise an $11 million Series A.

To entrepreneurs in the stage I was a few years back, I say this: raising money is hard for everyone— including white males. But it will be more vastly more diffi cult if you are Black. If you’re in the middle of doing so, you must continue pushing hard to make your dreams come true. There’s no other way.

To VCs, I say: the entire venture capital community must take a hard look at themselves. Is your mandate to perpetuate inequality and do what is easy? Or is it to further equality and bring real value to your LPs by getting exposure to different types of businesses? If the venture community continues to be insular and ignore that things are changing, history will judge VCs as being part of the problem and maintaining inequality in our country—and being quite shortsighted in missing out on what was the best, most profi table outcome. Now is when the venture community can really step up and do the right thing both for society and for their investors.

The good news: there has never been a better time for black entrepreneurs. Because of the Black Lives Matter movement and other sources of pressure, the venture community is fi nally starting to pay attention to the problem. I encourage all Black entrepreneurs to take the leap now, not later—start solving complicated problems and light the path forward for others. www.blackenterprise.com/less-than-1-percent-vcgoes-to-black-founders-heres-how-i-raised-11-million Image credits: thestudio.com