GAME

&

& RAB

BOARD OF DIRECTORS

AFFAIRS

STATEMENT

DIRECTORS

DIRECTORS

DIRECTORS

STATE DIRECTORS

November 2022

Sunday Monday Tuesday Wednesday Thursday Friday Saturday

8:30 AM Remodelers Council Exec. 11:30 AM Executive Committee 3:30 PM Builders Exchange Board of Trustees

7:30 AM Commercial Builders Council Exec. 12:00 PM Showcase Committee

11:30 AM Program Committee 6:00 PM Past President’s Dinner

12:00 PM Government Affairs Committee

3:00 PM Board Meeting

7:30 AM Green Building Committee

4:30 PM 40 Below Friendsgiving

11:30 AM Fashion Show Committee

12:00 PM Remodelers Council

12:00 PM Ambassadors Committee 4:30 PM 40 Below Exec Committee

3:00 PM Development Services Advisory Committee

Happy THANKS Giving

11:30 AM Home Show Committee

NOW BEING HELD IN PERSON UNLESS NOTIFIED DIFFERENTLY

JOHN

Rochester

2022 Calendar of Events

2023 CALENDAR OF EVENTS

WELCOME OCTOBER 2022 NEW MEMBERS

ONE TO FOUR YEARS

Sorenson’s Appliance & TV, Inc. 2021

Supporting Strategies | Rochester, MN 2021 Kitchen Refresh by Value Add Services, LLC........................ 2021

Terracon Consultants

Heartland Gun Club & Range

2021

2020

Premiere Artisan Design & Build 2020

Continuum Financial Group 2019

FIVE TO NINE YEARS

Kramer Contracting, LLC 2017

Southeastern MN Multi-County HRA

Destination Medical Center EDA

2016

2017 City of Lanesboro

2016

RSBS Management, Inc. 2015

St. Charles EDA 2015

Kimley-Horn & Associates, Inc. 2015

Heartland Security Services, LLC 2014

10 YEARS TO 14 YEARS

Nuss Truck & Equipment 2010

15 YEARS TO 19 YEARS

Advanced Builders & Remodeling 2007

Eckert Construction, Inc.

Penz Custom Homes, Inc.

The Home Depot

Mike Allen Homes, LLC

Jim Whiting Nursery & Garden Center, Inc.

20 YEARS TO 24 YEARS

David Reiland Building Contractor, LLC

Communications, LLC

Goodin Company

United Rentals - 432

Werner Electric

25 YEARS OR MORE

Leyendecker Homebuilders, LLC

Ryan Windows & Siding, Inc.

Accord Electric, Inc.

Ims Contracting, LLC

Carpet One of Rochester

Robert Gill Builder, Inc.

Are there young professionals in your organization who aren’t involved with 40 Below yet? Let us know so we can invite them to the next event and introduce them to this great group!

Coming up: 11.10.22 Friendsgiving at Workshop Food Hall & Bar

Contact Rebekah for more information.

FREE

P O S T I N G

FORMS

FROM THE PRESIDENT

Warners’ Stellian showroom (AKA old Haley Comfort Showroom). I personally can’t wait to see what they have done with the place. Remember the challenge that was given to us by the Membership Committee to bring a friend, peer or even competitor and earn your points. It is always a great opportunity to introduce yourself to new people. Don’t forget the food and drinks too.

host a student for the morning. This will be held on October 27th.

Did you know that the RAB website will post Job Openings and Apprenticeships for FREE??? Talk with Elizabeth if you have something you would like to post.

Enjoy your cooler weather.

BECKY HOLMEN President

Rochester Area Builders, Inc

The chill is in the air and the frost is on my flowers. It’s time for cuddling in front of your fireplaces and snuggling on the sofa with your loved ones. I can’t believe it is only 10 weeks until the old man in red comes down that chimney. But before that we have the all-important duty as a citizen of the United States to cast our votes. Every vote counts. Remind your college students and family that will be out of town to send in their mail in ballets.

I want to thank the members of 40 Below who did an amazing job with some community service with Seasonal Yard Clean-Up for our community. Every way we can get our message out that we are an organization that not only is a great source for quality labor, but we love our community and want to take care of the people in it.

The next networking opportunity is Tuesday, October 25th at the new

2023 Home Show Booths are available and going fast. Make sure to talk to Shelly about getting your booth reserved. A variety of activities are being planned throughout the weekend. Continue reading the newsletters for more information.

Mark your calendars for the RAB Holiday Party. This year’s theme is Game Night! Friday, December 2nd at the downtown Hilton. Better get a hotel room too just in case there is a blizzard like last year. The Program Committee has been working hard to put together another fun filled event. We are bringing back some of the oldies to teach all the young kids how we had fun in the “OLD Days”. One of my favorite games is Builder Feud. Sponsorship opportunities and ticket information can be found in this month’s newsletter.

Studs, Struts and Stilettos is moving back to April! We need fashion designers and sponsors to make this event a great success. The 2023 theme is “Broadway”. There are so many options for costume designs. What is your favorite Broadway show? Cats, Lion King, Showboat, Sound of Music – This list goes on and on.

We are excited to offer Job Shadowing to the carpentry students of Kasson Mantorville again. Please contact Rebekah if you would like to

Becky Holmen Haley Lighting 2022 RAB President

Consider your marketing investments now to get the best bang for your buck.

If you did not receive information about your marketing opportunities contact Shelly

Thank you to our 40 Below members who volunteered doing seasonal yard work at homes affiliated with Family Service Rochester. This group has been incredible when it comes to giving back to the community. The homeowner’s were very appreciative of the work they did!

VOLUNTEERS

FORTY

Matt Aldrich

RSBS Management, Inc. Jeremy Wohlfiel Merit Contracting, Inc. Adam Giannini Knutson Construction Services Katie Olson Kimley-Horn & Associates, Inc. Marc Kluge Kimley-Horn & Associates, Inc. Tyler Lenzner Knutson Construction Services Adam Pleschourt Widseth Mike Salerno Minnesota 97.5 FM - KNXR

Friendsgiving

Thursday, November 10th 4:30 PM - 6:30 PM Workshop Food Hall & Bar 1232 3rd Ave SE Join us at the Workshop Food Hall & Bar for 40 Below’s Friendsgiving. Then stick around to test your knowledge at Trivia Night! We look forward to seeing you there!

T

F

Media Contacts

Geno Palazzari Jenna Bowman

Destination Medical Center City of Rochester Communications Manager Strategic Communications & Engagement Director genopalazzari@dmceda.org jbowman@rochestermn.gov 307 696 9088 507 328 2391

Amanda Leightner, PhD Collider Executive Director amanda@collider.mn 507 722 0306

FOR IMMEDIATE RELEASE

Women, People of Color and Veterans Interested in Starting a Business Invited to a Co-Stars® Get Started Workshop

October 14, 2022 ROCHESTER, MINN. The City of Rochester and Destination Medical Center are sponsoring a CO.Starters Get Started three hour workshop to help entrepreneur minded individuals explore their business ideas. Collider will host the workshop on November 15 from 5:30 - 8:30 p.m. at the new Rochester Economic Development, Inc. (RAEDI) Center (Minnesota BioBusiness Center at 221 1st Avenue SW). Women, people of color and veterans working in construction related careers are encouraged to attend. Pre registration is required for the CO.Starters Get Started workshop on Eventbrite. The fee to attend is $25 per person.

CO.Starters Get Started will equip entrepreneurs with the best tools and resources needed to support starters of all kinds. Following the workshop, the Small Business Development Center will provide entrepreneurs with technical assistance.

Targeted Businesses are companies that are certified as owned and operated by women, people of color or veterans or are located in an economically disadvantaged areas, including Fillmore County. “We have seen the number of locally owned certified Targeted Businesses grow from four (4) in 2019 to twelve (12) in 2022 and hope to see that trend continue,” comments Jorrie Johnson, City of Rochester project manager of Targeted Business and workforce compliance. “We are inviting women, people of color working in construction to attend this productive workshop.”

Destination Medical Center professional services and construction projects have Targeted Business contracting goals. In 2023 City of Rochester capital improvement plan projects valued at $1 million or greater have Targeted Business contracting goals. The number of projects with the Targeted Business contracting goals (4% for heavy civil and 7% for commercial construction) will increase even more over the next couple of years as the project valued threshold decreases.

For more information about City of Rochester Targeted Business contracting goals and certification visit City of Rochester Equity in Development webpage https://www.rochestermn.gov/government/departments/administration/wmbe-wf-goals

Are you a female in the construction industry? Looking to join a fun, supportive group?

Why Join NAWIC?

Women in construction join NAWIC for many reasons.

• To be part of a network of like-minded women

• Learn more about technical or leadership skills

A NAWIC membership offers educational opportunities, local networking events, regional conferences and our annual national meeting. Also a shared camaraderie of other women in construction at various points in their careers.

Visit nawicsemn.org for a list of current members. Email info@nawicsemn.org for more information.

SINGLE-FAMILY PERMITS DECLINE IN AUGUST 2022

BY DANUSHKA NANAYAKKARA-SKILLINGTON on OCTOBER 17, 2022Over the first eight months of 2022, the total number of single-family permits issued year-to-date (YTD) nationwide reached 728,866. On a year-over-year (YoY) basis, this is 6.0% below the August 2021 level of 775,772.

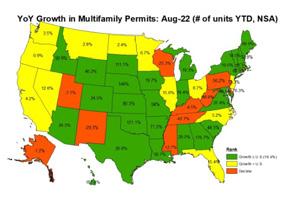

while 11 states recorded a decline in multifamily permits. Hawaii led the way with a sharp rise (187.8%) in multifamily permits from 320 to 921 while Delaware had the largest decline of 76.3% from 928 to 220. The ten states issuing the highest number of multifamily permits combined accounted for 63.6% of the multifamily permits issued.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

Year-to-date ending in August, single-family permits declined in all four regions. The South posted a modest decline of 3.9%, while the Midwest region reported the steepest decline of 10.6%. The Northeast declined by 9.8% and the Western region reported an 8.0% decline in single-family permits during this time. On the other hand, multifamily permits posted increased in all four regions. Permits were 24.4% higher in the Midwest, 22.5% higher in the South, 9.6% higher in the West, and 3.8% higher in the Northeast.

Between August 2021 YTD and August 2022 YTD, eight states saw growth in single-family permits issued. New Mexico recorded the highest growth rate during this time at 37.1% going from 3,961 permits to 5,431. Forty-two states and the District of Columbia reported a decline in single-family permits during this time with the District of Columbia posting the steepest decline of 25.4% declining from 268 permits to 200. The ten states issuing the highest number of single-family permits combined accounted for 63.9% of the total single-family permits issued.

Year-to-date, ending in August, the total number of multifamily permits issued nationwide reached 456,244. This is 16.4% ahead of the August 2021 level of 392,067.

Between August 2021 YTD and August 2022 YTD, 39 states and the District of Columbia recorded growth,

Metropolitan Statistical Area

Single-Family Permits: Aug-22 (Units #YTD, NSA)

Houston-The Woodlands-Sugar Land, TX 35,973

Dallas-Fort Worth-Arlington, TX 33,435

Phoenix-Mesa-Scottsdale, AZ 21,886

Atlanta-Sandy Springs-Roswell, GA 19,551

Austin-Round Rock, TX 16,927

Charlotte-Concord-Gastonia, NC-SC 14,218

Orlando-Kissimmee-Sanford, FL 12,094

Tampa-St. Petersburg-Clearwater, FL 11,566

Nashville-Davidson–Murfreesboro–Franklin, TN 11,564 Jacksonville, FL 10,353

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

Metropolitan Statistical Area

Multifamily Permits: Aug-22 (Units #YTD, NSA)

New York-Newark-Jersey City, NY-NJ-PA 36,009

Dallas-Fort Worth-Arlington, TX 22,495

Houston-The Woodlands-Sugar Land, TX 18,025

Austin-Round Rock, TX 16,979

Seattle-Tacoma-Bellevue, WA 13,901

Los Angeles-Long Beach-Anaheim, CA 13,407

Atlanta-Sandy Springs-Roswell, GA 13,090

Washington-Arlington-Alexandria, DC-VA-MD-WV 12,651

Phoenix-Mesa-Scottsdale, AZ 12,154

Minneapolis-St. Paul-Bloomington, MN-WI 11,232

New Flat Discount

Goodin Company carries a full complement of products for the markets we serve.

Are you in need of products for plumbing, HVAC, industrial, or pump and well applications?

HVAC

PUMP & WELL

are your Source of Supply, serving the industry since 1937.

INFLATION REMAINS STUBBORNLY HIGH DESPITE FED RATE HIKES

BY FAN-YU KUO on OCTOBER 13, 2022Consumer prices eased in September for the thirdstraight month as declines in energy prices partly offset increases in food and shelter indexes. Despite this slight improvement, inflation remains above an 8% year-overyear rate for the seven straight month. The food and shelter indexes continued to rise at an accelerated pace, with the owners’ equivalent rent index seeing the largest monthly increase since June 1990. Though it is likely that both core PCE and CPI measures of inflation have peaked, the Fed is expected to remain aggressive with respect to tightening monetary policy. It is also worth noting that higher interest rates will have limited effects on rising rent (a function of a lack of attainable housing) or the ongoing labor shortage.

The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose by 0.4% in September on a seasonally adjusted basis, following an increase of 0.1% in August. The price index for a broad set of energy sources fell by 2.1% in September as a decline in gasoline (-4.9%) partly offset an increase in electricity (+0.4%) and natural gas index (+2.9%). Excluding the volatile food and energy components, the “core” CPI increased by 0.6% in September, as it did in August. Meanwhile, the food index increased by 0.8% in September, the same increase as August.

The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.6% in September, following an identical increase in August. The indexes for owners’ equivalent rent (OER) and rent of primary residence (RPR) both increased by 0.8% over the month. Monthly increases in OER have averaged 0.7% over the last three months. More cost increases are coming from this category, which will add to inflationary forces in the months ahead. These higher costs are driven by lack of supply and higher development costs. Higher interest rates will not slow these costs, which means the Fed’s tools are limited in addressing shelter inflation.

During the past twelve months, on a not seasonally adjusted basis, the CPI rose by 8.2% in September, following an 8.3% increase in August. The “core” CPI increased by 6.6% over the past twelve months, following an 6.3% increase in August. The food index rose by 11.2% and the energy index climbed by 19.8% over the past twelve months.

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster (slower) than overall inflation, the real rent index rises (declines). The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

The Real Rent Index rose by 0.3% in September. Over the first nine months of 2022, the monthly change of the Real Rent Index increased by 0.1%, on average.

Most component indexes continued to increase in September. The indexes for shelter (+0.7%), medical care (+0.8%), motor vehicle insurance (+1.6%), household furnishings and operations (+0.5%) as well as education (+0.4%) showed sizeable monthly increases in September. Meanwhile, the indexes for used cars and trucks (-1.1%), apparel (-0.3%) and communication (-0.1%) declined in September.

GET UP TO $5,400 TO GET THE JOB DONE

USING THE PRIVATE OFFERS1 FOR NAHB MEMBERS IS EASY:

1. Get your NAHB proof of membership.

2. Visit your local Chevrolet, Buick or GMC dealer and mention this Private Offer.

3. Select an eligible vehicle(s) to purchase or lease and present your NAHB proof of membership.

For even more value, combine this offer with the National Fleet Purchase Program and Business Choice Offers. For full details on the Private Offer, NAHB members should visit nahb.org/gm

Example offer for NAHB members who are business owners purchasing a 2021 Chevrolet Silverado 2500 HD Crew Cab 1LT 4WD.

1Private offer amount varies by model; up to $500 offer for retail delivery and up to $1,000 offer for fleet deliveries. Valid toward the purchase or lease of eligible new 2020, 2021 and 2022 model year vehicles. Customer must take delivery by 1/3/2022. Not compatible with some other offers. Not valid on prior purchases. Excludes all Cadillac vehicles; 2020 Buick Cascada, LaCrosse, Regal and Verano; Chevrolet Colorado 2SA, Sonic, Trax, Volt and GMC Canyon 2SA; 2020-2021 Encore 1SV; Chevrolet Blazer, Camaro, Corvette, Equinox 1SM, Malibu 1VL, Traverse 1L0; GMC Acadia 1SV and Terrain 2SA. Additional GM models may be excluded at GM’s sole discretion. See dealer for details. 2Offer available to qualified fleet customers through 1/3/2022. Not compatible with some other offers. Take delivery 1/3/2022. See dealer for details. 3To qualify, vehicle must be used in the day-to-day operations of your business and not solely for personal/ non-business-related transportation purposes. Must provide proof of business ownership. For complete program requirements, including information regarding offers, vehicles, equipment, options, warranties and ordering, consult your dealer or visit gmbusinesschoice.com. 4Eligible purchases must be equal to or greater than the amount of the cash allowance. Accessory Cash Allowance requires purchase of the eligible accessories from your dealer.

Reach

Qualified Customers Advertise on the RAB Website!

More than 3,000 people visit the RAB website each month, many of them looking for a contractor. Advertise on our site and reach them when they’re primed to buy! Banner ads are available in a variety of locations on the RAB site, from job posts to the contractor directory. Higher tiers come with priority placement in directory search results too. Contact us today to learn how you can start advertising, starting at $299.

Contact Elizabeth Elizabeth@RochesterAreaBuilders.com or 507-282-7698

FOUNDATIONS NEWSLETTER ADVERTISING

Rochester Area Builders Newsletter is an unbeatable opportunity to advertise to members and individuals associated with RAB. It is a source of valuable association and industry information, and is published and emailed monthly. Foundations is sent to over 1600 connected industry professionals. Ad sizes are listed under Display Ad Dimensions, and prices are located above. Ads may be changed from month to month. Our prices are for full color ads. We will gladly work with you to design your ad. Please send digital files for all ad copy, logos, and artwork. We use PC format. We accept Illustrator and Photoshop files. Convert all fonts to outlines. We also accept the following high resolution file types: .tif, .eps and .pdf (with all graphics and fonts embedded). If you have any other formats please contact us.

RETURN TO:

ROCHESTER AREA BUILDERS

Shelly Bahlmann

Shelly@RochesterAreaBuilders.com 108 Elton Hills Ln NW Rochester, MN 55901 507-282-7698

Newsletter Advertising Rates Per Issue 12 Issues New Member

Issues

Full color 1/2 Horizontal c $70.00 c $650.00 c $490.00 Full color Full Page c $90.00 c $900.00 c $675.00 Full Color Full Page Press Release c $25.00

Newsletter Display Ad Dimensions 1/2 Horizontal 8-1/2 x 5-1/2 Full 8-1/2 x 11

Send artwork to Shelly@RochesterAreaBuilders.com by the 15th of the month to be included in the upcoming Foundation Newsletter.

REMODELING MARKET SENTIMENT SOFTENED IN THIRD QUARTER, BUT REMAINS POSITIVE

BY ERIC LYNCH on OCTOBER 13, 2022The NAHB/Westlake Royal Remodeling Market Index (RMI) for the third quarter of 2022 posted a reading of 77, declining 10 points from the third quarter of 2021.

The RMI is based on a survey that asks remodelers to rate various aspects of the residential remodeling market “good,” “fair” or “poor.” Responses from each question are converted to an index that lies on a scale from 0 to 100, where an index number above 50 indicates that a higher share view conditions as good than poor.

The RMI is an average of two major component indices: the Current Conditions Index and the Future Indicators Index. The Current Conditions

Index is an average of three subcomponents: the current market for large remodeling projects ($50,000 or more), moderately-sized projects ($20,000 to $49,999), and small projects (under $20,000).

In the third quarter of 2022, the Current Conditions component index was 82, dropping 8 points compared to the third quarter of 2021. Year-over-year, the subcomponent measuring large remodeling projects experienced fell 6 points to 80, moderately-sized remodeling projects dropped 8 points to 83, and the subcomponent measuring small remodeling projects declined by 6 points to 85.

The Future Indicators Index is an average of two subcomponents: the current rate at which leads and inquiries are coming in and the current

backlog of remodeling projects. In the third quarter of 2022, the Future Indicators Index was 71, which fell 13 points from the third quarter of 2021. Year-overyear, the subcomponent measuring the current rate at which leads and inquiries are coming in dropped 17

points to 66, which was the largest decline among all subcomponents. The subcomponent measuring the backlog of remodeling jobs decreased 8 points to 77.

The NAHB/ Westlake Royal RMI was redesigned in 2020 to ease respondent burden and improve its ability to interpret and track industry trends. As a result, readings cannot be compared quarter to quarter until enough data are collected to seasonally adjust the series. To track quarterly trends, the redesigned RMI survey asks remodelers to compare market conditions to three months earlier, using a “better,” “about the same,” “worse” scale. In the third quarter of 2022, 10 percent of respondents said the remodeling market is “better” compared to 23 percent of respondents who indicated “worse”; those who stated “about the same” was 67 percent.

An overall RMI of 77 showcases positive remodeler sentiment due to increases in home equity over the last two years, ongoing demand for work at home, and an aging housing stock. However, the year-over-year decline indicates weakness in the market even though the rise in interest rates has more of a negative effect on new construction than remodeling. NAHB expects a small increase for remodeling activity in 2023, while the rate of new construction will continue to decline.

For the full set of RMI tables, including regional indices and a complete history for each RMI component, please visit NAHB’s RMI web page.

STANDARD LISTING UPGRADED LISTING ENHANCED LISTING

LISTING