Management Committee Meeting

Philippine Rice Research Institute, Maligaya, Muñoz, Nueva Ecija

November 22-26, 2021

Prefatory Statement

The Department of Agriculture submitted to Congress a total proposed budget of Php 231.8-Billion for FY 2022 comprising of Php 77,438,582-Billion (tier1) and Php 154,325,262-Billion under tier2. Our FY 2021 GAA budget was Php 90.1-Billion, thus, there is an increment of Php 141.7 Billion which is 157.43% higher than the 2021 GAA. Net of corporations, the total proposed budget is Php 204.9-Billion. Likewise, the FY2022 budget proposal for attached corporations also increased by 40.76%. The proposed budget amounts to Php 26.8-Billion.

However, only 70.93% of such proposal was reflected in the National Expenditure Program (NEP) translating into Php 18,993,446 million. Note, in FY 2020, the approved budget for attached corporations amounted to Php 19-Billion. As for the NEP for FY 2022, the Department has Php 91,007,940 million or 1.05% higher than 2021 GAA translating this increment to Php 945.M. The breakdown is as follows: Personnel Services, Php 6.3-Billion (6.95%); Capital Outlay, Php 27.5-Billion (30.22%); and MOOE, Php 57.2-Billion (62.83%).

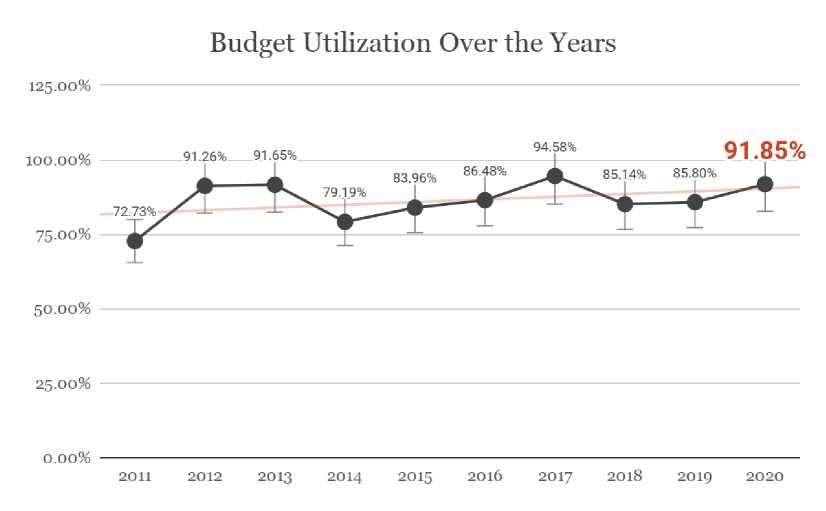

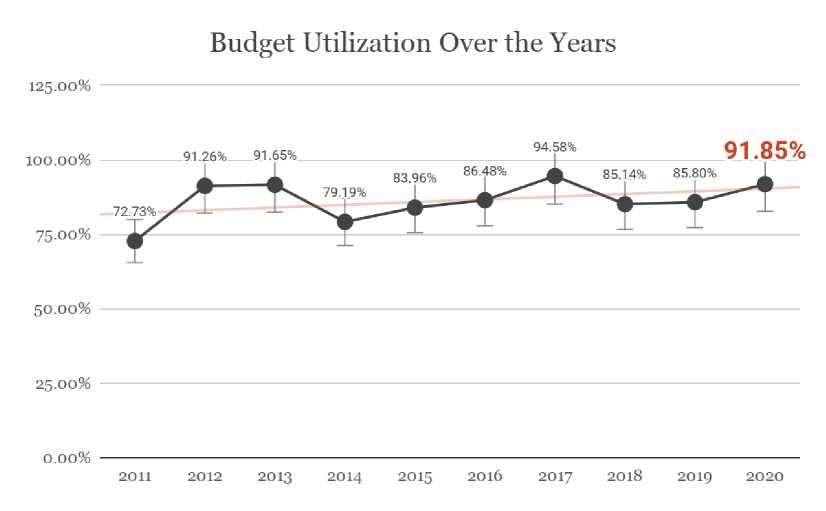

It is worthy to mention that the Administration of Secretary William D. Dar breached the high score of 91.85% performance if we were to base on the obligational rate for FY 2020. As a recap of previous annual utilization reports (net of corporations) from Fiscal Years 2009 to 2020, the year 2009 has 87.75%; 2010, 81.85%; 2011, 72.73%; 2012, 91.26%; 2013, 91.65%; 2014, 79.19%; 2015, 83.96%; 2017, 94.58%; 2018, 85.14%; 2019,85.80%; 2020; 91.85%. The immediately preceding year was defined by uncertainties due to the pandemic. However, special funds (Bayanihan 1 and Bayanihan 2) and the programmed funds under the 2020 GAA, has to be examined in the light of disbursement performance of the Department.

This fiscal report presents the highlights of performance, using some innovations of the Office of the Undersecretary of Administration and Finance in drilling down financial details and the applicable use of digital technology in the graphical illustrations. It has to be noted finally that this report does not necessarily provide a prognosis of the health of our agency’s finances. It elicits its humble analysis on the overarching goals of the Duterte Administration, especially with the issuance of Executive Order (EO) 91, s. 2019 on September 9, 2019, mandating the adoption of cash-based budgeting system beginning fiscal year (FY) 2019, and for other purposes.

The shift from obligation-based budgeting to cash-based budgeting is meant to improve fiscal planning of government agencies and in turn, speed up the implementation of programs and promptly deliver goods and services to the Filipinos. As such, it has implications on government operations, particularly on budget as the new scheme prioritizes the most implementation-ready programs, activities, and projects of government agencies/units, as emphasized by Manasan (2002).

Analysis

1 1

USEC. ROLDAN G. GORGONIO Undersecretary for Administration and Finance

of the President’s Budget Book Series by Rosario Manasan, Philippine Institute of Development Studies

Financial Performance Report as of September 30, 2021

Republic of the Philippines Department of Agriculture

Elliptical Road, Quezon City

Office of Usec. Roldan G. Gorgonio

Undersecretary for Administration and Finance

2021 FINANCIAL PERFORMANCE REPORT as of September 30, 2021

TOTAL ALLOTMENTS - Php 68,153,253,000

Total Obligations Incurred - Php 46,335,646,000

Budget Utilization Rate - 67.99%

Lapsed NCA - Php 1,719,929,467.24

Total Receipts (NCA) - Php 49,950,693,757.00

Total Disbursements - Php 47,015,214,744.53

NCA Utilization Rate - 94.12 %

| 1

2021 Fiscal Report as of September 30, 2021

As gleaned from the above table, out of the Php 68.153 billion allotment received by the Department of Agriculture (DA)1, the obligations incurred amounted to Php 46.335 billion, constituting 67.99 percent. The Office of the Secretary (OSEC)2 received Php 50.095 billion allotment from the current and continuing funds. The obligations incurred by the OSEC amounted to Php 33.486 billion, and the unobligated balance is Php 16.609 billion. On the other hand, the Attached Agencies3 received Php 18.057 billion allotment from the current and continuing funds. The obligations incurred by the Attached Agencies amounted to Php 12.849 billion, and the unobligated balance is Php 5.208 billion. Therefore, as of September 30, 2021, the total unobligated allotments by the DA is amounted to Php 21.817 billion.

In its entirety, the DA obligated almost seven tenth (7/10) of the allotment it has received amounting to Php 46.356 billion. However, included in this allotment is the amount of Php 2.833 billion from Bayanihan II4 funds which was extended up to June 30, 20215. The remaining unobligated allotment for Bayanihan II funds amounting to Php 331.042 million has to be reverted to the National Treasury in compliance with the Republic Act No. 11519.

1DA-OSEC and Attached Agencies

2DA-Central Office (DA-CO), Regional Field Offices (RFOs), Agricultural Training Institute (ATI), Bureau of Agricultural Research (BAR), Bureau of Agricultural and Fisheries Engineering (BAFE), Bureau of Agriculture and Fisheries Standards (BAFS), Bureau of Animal Industry (BAI), Bureau of Plant and Industry (BPI), and Bureau of Soils and Water Management.

3Agricultural Credit Policy Council (ACPC), Bureau of Fisheries and Aquatic Resources (BFAR), Fertilizer and Pesticide Authority (FPA), National Fisheries Research and Development Institute (NFRDI), National Meat Inspection Service (NMIS), Philippine Carabao Center (PCC), Philippine Center for Postharvest Development and Mechanization (PhilMech), Philippine Council for Agriculture and Fisheries (PCAF), and Philippine Fiber Industry Development Authority (PFDA).

4 Republic Act 11494 Bayanihan to Recover as One Act

5 Republic Act No. 11519, An Act Extending the Availability of Appropriations under RA 11494.

2021 Fiscal Report as of September 30, 2021 | 2 BUDGET UTILIZATION AS OF SEPTEMBER 30, 2021

1

Table

As

Allotment Received (‘000) Obligations Incurred (‘000) BALANCES (‘000) % Total 68,153,253 46,335,646 21,817,606 67.99% UTILIZATION Current Funds 61,578,820 42,058,162 19,520,658 68.30% Office of the Secretary 44,668,242 30,016,478 14,651,764 67.20% Attached Agencies 16,910,577 12,041,684 4,868,893 71.21% Continuing Funds 6,574,433 4,277,484 2,296,949 65.06% Office of the Secretary 5,427,214 3,469,974 1,957,240 63.94% Attached Agencies 1,147,218 807,510 339,709 70.39%

of September 30, 2021

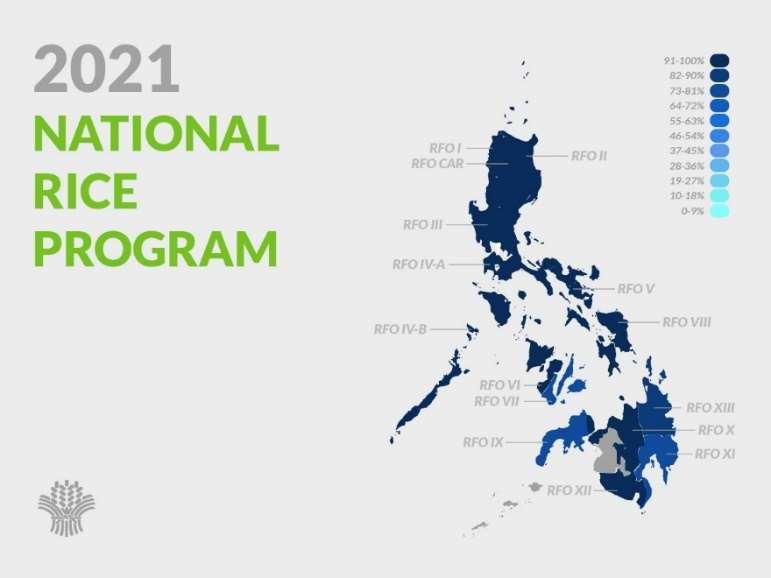

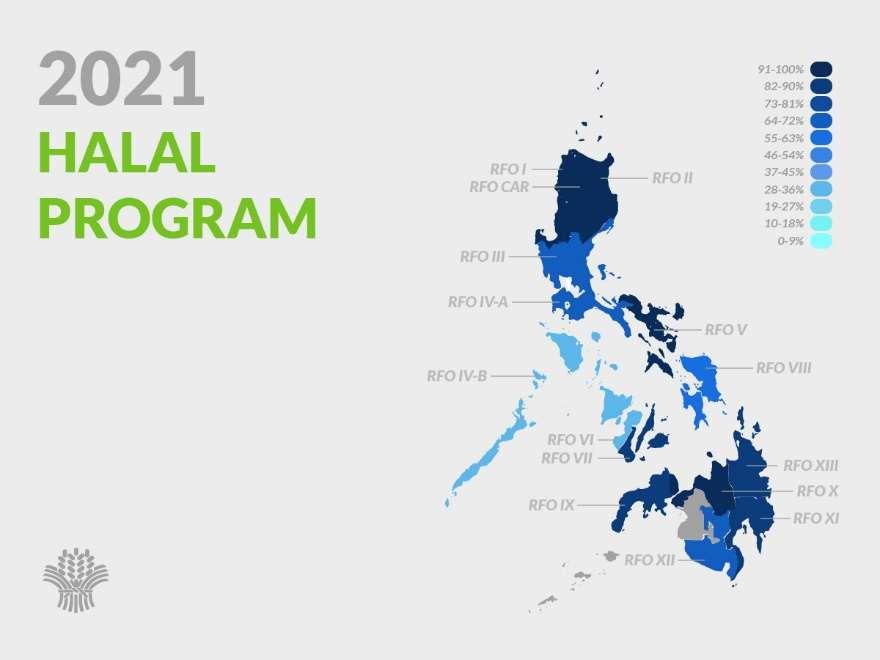

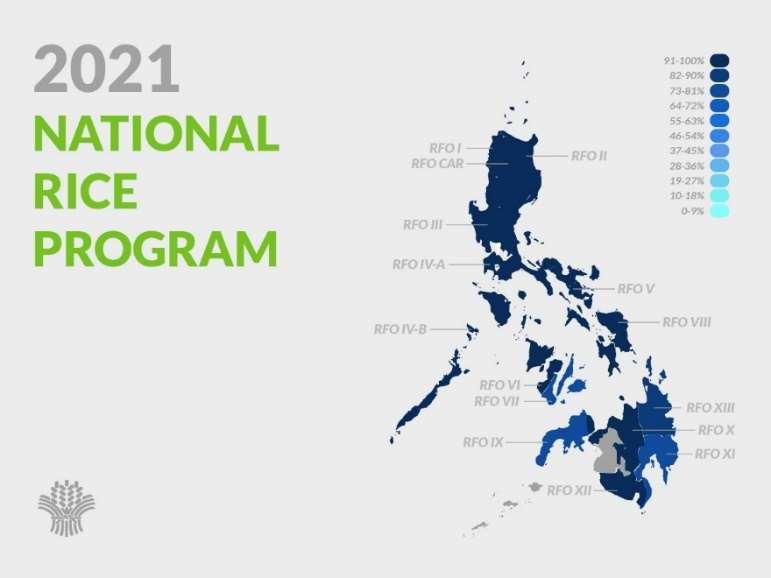

Likewise, Table 2 illustrates that among the banner programs of the DA, the National Rice Program has the highest incurred obligations in relation to its corresponding allotment it has received at 94.60 percent rate of utilization. The other programs which consist of the National Corn Program, National High Value Crops Program, National Livestock Program, National Organic Agriculture Program, National Fisheries Program, and Halal Food Industry Development Program has a total of 86.49 percent rate of utilization.

2021 Fiscal Report as of September 30, 2021 | 3

BANNER PROGRAMS Allotment Received Obligations Incurred Rate of Utilization National Rice Program 15,591,276 14,748,638 94.60% National Corn Program 1,549,985 1,299,346 83.83% National High Value Crops Program 1,956,679 1,431,211 73.14% National Livestock Program 1,305,698 918,870 70.37% National Organic Agriculture Program 793,928 661,931 83.37% National Fisheries Program 3,889,254 2,643,314 67.96% Halal Food Industry Development Program 23,843 15,281 64.09% TOTAL 25,110,663 21,718,589 86.49 %

Table 2

NATIONAL RICE PROGRAM FINANCIAL PERFORMANCE

The National Rice program performed well in the utilization of their allotted budget with 94.60 percent expenditure as of September 30, 2021. However, upon assessment of the performance for its operating unit, it shows that the Central Office got the lowest utilization rate at 15.50 percent. Far second is the Bureau of Soils and Water Management (BSWM) AT 49.96 percent. While the rest got higher marks from 71.81 percent to 99.54 percent.

2021 Fiscal Report as of September 30, 2021 | 4

BY OPERATING UNITS Allotment Received Obligations Incurred Unexpended Balances % Central Office 105,556 16,360 89,196 15.50% Region I - Ilocos Region 1,809,162 1,707,382 101,780 94.37% Cordillera Administrative Region 347,149 315,896 31,253 91.00% Region II - Cagayan Valley 2,833,945 2,801,967 31,978 98.87% Region III - Central Luzon 2,920,065 2,901,075 18,990 99.35% Region IVA - CALABARZON 301,541 288,741 12,800 95.76% Region IVB - MIMAROPA 1,411,193 1,332,147 79,046 94.40% Region V - Bicol Region 1,121,377 1,116,179 5,198 99.54% Region VI - Western Visayas 956,892 876,334 80,558 91.58% Region VII - Central Visayas 242,743 177,127 65,616 72.97% Region VIII - Eastern Visayas 662,856 623,449 39,407 94.05% Region IX - Zamboanga Peninsula 223,267 191,073 32,194 85.58% Region X - Northern Mindanao 592,517 570,374 22,144 96.26% Region XI - Davao Region 101,133 76,355 24,778 75.50% Region XII - SOCCKSKSARGEN 1,211,944 1,158,731 53,213 95.61 Region XIII - CARAGA 165,608 140,577 25,031 84.89

GRAND TOTAL (IN THOUSAND PESOS)

NATIONAL CORN PROGRAM FINANCIAL PERFORMANCE

The National Corn Program performed well also with an average of 83.83 percent utilization rate while the Central Office still emerged with the lowest percentage of utilization at 13.36 percent.

GRAND TOTAL (IN THOUSAND PESOS)

2021 Fiscal Report as of September 30, 2021 | 5

BY OPERATING UNITS Allotment Received Obligations Incurred Unexpended Balances % Central Office 38,992 5,211 33,781 13.36% Region I - Ilocos Region 92,215 76,634 15,581 83.10% Cordillera Administrative Region 81,194 76,536 4,658 94.26% Region II - Cagayan Valley 145,250 139,152 6,098 95.80% Region III - Central Luzon 97,085 90,943 6,142 93.67% Region IVA - CALABARZON 93,783 89,858 3,925 95.81% Region IVB - MIMAROPA 82,464 59,030 23,434 71.58% Region V - Bicol Region 100,797 95,137 5,660 94.38% Region VI - Western Visayas 61,711 49,974 11,737 80.98% Region VII - Central Visayas 75,903 55,113 20,791 72.61% Region VIII - Eastern Visayas 69,634 56,366 13,268 80.95% Region IX - Zamboanga Peninsula 64,089 52,438 11,650 81.82% Region X - Northern Mindanao 103,855 94,166 9,689 90.67% Region XI - Davao Region 76,138 58,361 17,777 76.65% Region XII - SOCCKSKSARGEN 127,475 105,300 22,176 82.60 Region XIII - CARAGA 76,512 66,415 10,097 86.60

NATIONAL LIVESTOCK PROGRAM FINANCIAL PERFORMANCE

The National Livestock Program performed also within the average level at 70.37 percent. Though some units garnered higher efficiency level at 94.22%, 98.34% and 95.45 %.

2021 Fiscal Report as of September 30, 2021 | 6

PARTICULARS GRAND TOTAL (IN THOUSAND PESOS) BY OPERATING UNITS Allotment Received Obligations Incurred Unexpended Balances % Central Office 20,000 - 20,000 0.00% Region I - Ilocos Region 69,377 55,890 13,487 80.56% Cordillera Administrative Region 75,000 70,664 4,336 94.22% Region II - Cagayan Valley 78,403 77,104 1,299 98.34% Region III - Central Luzon 58,035 51,740 6,295 89.15% Region IVA - CALABARZON 55,174 46,043 9,131 83.45% Region IVB - MIMAROPA 48,093 36,397 11,695 75.68% Region V - Bicol Region 69,737 66,756 2,981 95.73% Region VI - Western Visayas 49,888 37,065 12,822 74.30% Region VII - Central Visayas 55,720 48,662 7,057 87.33% Region VIII - Eastern Visayas 51,325 44,470 6,855 86.64% Region IX - Zamboanga Peninsula 54,270 51,802 2,468 95.45% Region X - Northern Mindanao 68,295 52,400 15,895 76.73% Region XI - Davao Region 57,837 39,793 18,044 68.80% Region XII - SOCCKSKSARGEN 54,252 39,368 14,884 72.57% Region XIII - CARAGA 56,148 47,092 9,056 83.87%

NATIONAL HIGH VALUE CROP DEVELOPMENT PROGRAM FINANCIAL PERFORMANCE

2021 Fiscal Report as of September 30, 2021 | 7

PARTICULARS GRAND TOTAL (IN THOUSAND PESOS) BY OPERATING UNITS Allotment Received Obligations Incurred Unexpended Balances % Central Office 32,214 1,391 30,283 4.32% Region I - Ilocos Region 133,293 102,042 31,251 76.55% Cordillera Administrative Region 105,078 102,133 2,945 97.20% Region II - Cagayan Valley 104,331 103,779 552 99.47% Region III - Central Luzon 117,171 111,051 6,120 94.78% Region IVA - CALABARZON 113,830 92,752 21,078 81.48% Region IVB - MIMAROPA 102,860 73,241 29,619 71.20% Region V - Bicol Region 107,903 103,718 4,185 96.12% Region VI - Western Visayas 79,199 55,785 23,415 70.44% Region VII - Central Visayas 75,013 54,378 20,636 72.49% Region VIII - Eastern Visayas 101,237 80,823 20,414 79.84% Region IX - Zamboanga Peninsula 88,479 73,611 15,137 82.94% Region X - Northern Mindanao 112,809 71,174 41,635 63.09% Region XI - Davao Region 94,973 46,613 48,360 49.08% Region XII - SOCCKSKSARGEN 70,568 54,933 15,636 77.84% Region XIII - CARAGA 88,707 58,831 29,875 66.32%

NATIONAL ORGANIC AGRICULTURE PROGRAM FINANCIAL PERFORMANCE

2021 Fiscal Report as of September 30, 2021 | 8

PARTICULARS GRAND TOTAL (IN THOUSAND PESOS) BY OPERATING UNITS Allotment Received Obligations Incurred Unexpended Balances % Central Office 8,319 - 8,319 0.00% Region I - Ilocos Region 29,268 21,886 7,382 74.78% Cordillera Administrative Region 15,844 15,227 617 96.11% Region II - Cagayan Valley 20,723 19,993 730 96.48% Region III - Central Luzon 23,991 21,313 2,678 88.84% Region IVA - CALABARZON 19,164 12,197 6,967 63.64% Region IVB - MIMAROPA 17,778 12,887 4,891 72.49% Region V - Bicol Region 24,146 22,660 1,486 93.85% Region VI - Western Visayas 11,159 8,683 2,477 77.81% Region VII - Central Visayas 10,317 9,746 571 94.47% Region VIII - Eastern Visayas 27,435 21,506 5,928 78.39% Region IX - Zamboanga Peninsula 10,698 9,287 1,410 86.82% Region X - Northern Mindanao 12,817 9,213 3,604 71.88% Region XI - Davao Region 9,959 7,832 2,128 78.64% Region XII - SOCCKSKSARGEN 12,783 9,415 3,367 73.66%

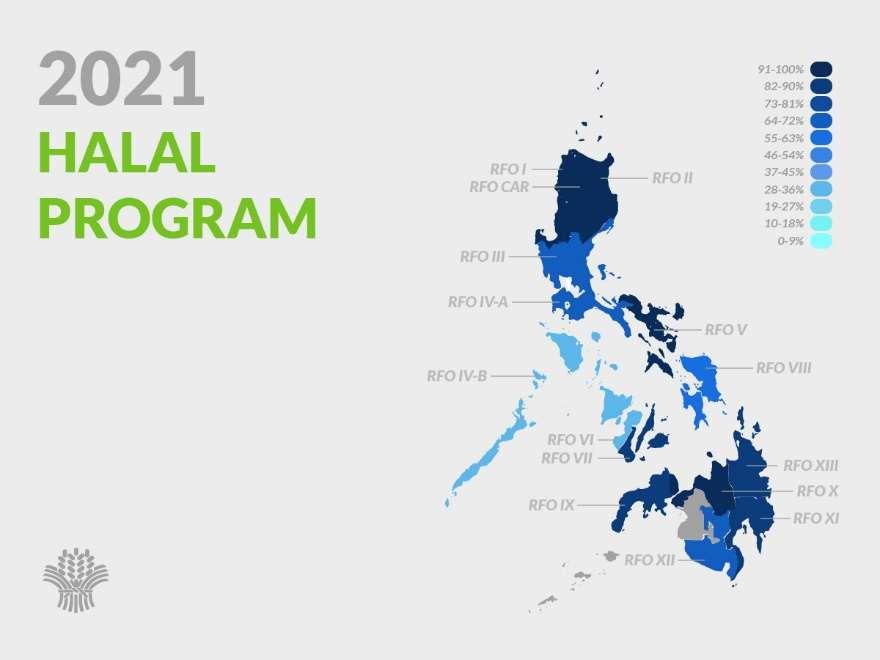

HALAL PROGRAM FINANCIAL PERFORMANCE

DISBURSEMENT RATE AS OF OF SEPTEMBER 30, 2021

The DA’s disbursement rate is at 94.84 percent. From January to September 30, 2021, the DA credited Php 49.950 billion in the individual Operating Units Modified Disbursement System (MDS). The total Notice of Cash Allocation (NCA) disbursement amounted to Php 47.015 billion.

2021 Fiscal Report as of September 30, 2021 | 9

PARTICULARS GRAND TOTAL (IN THOUSAND PESOS) BY OPERATING UNITS Allotment Received Obligations Incurred Unexpended Balances % Central Office 8,478 4,205 8,563 64.09% Region I - Ilocos Region 680 678 2 99.75% Cordillera Administrative Region 1,000 995 5 99.54% Region II - Cagayan Valley 250 228 22 91.10% Region III - Central Luzon 415 263 152 63.33% Region IVA - CALABARZON 1,024 667 358 65.07% Region IVB - MIMAROPA 1,000 326 674 32.60% Region V - Bicol Region 250 250 - 100.00% Region VI - Western Visayas 505 180 325 35.70% Region VII - Central Visayas 1,281 1,080 201 84.32% Region VIII - Eastern Visayas 500 304 196 60.77% Region IX - Zamboanga Peninsula 2,014 1,806 208 89.67% Region X - Northern Mindanao 1,200 1,121 79 93.39% Region XI - Davao Region 1,201 1,001 200 83.35% Region XII - SOCCKSKSARGEN 2,441 1,539 901 63.08% Region XIII - CARAGA 413 360 53 87.23

2021 Fiscal Report as of September 30, 2021 | 10 Table

AGENCY Disbursement Performance (MDS) Cash Receipts Disbursements MDS Adjustments Lapsed NCA Adjusted Balances % Disb/Receipts CO 6,768,787,407.67 6,001,703,161.68 5,973.74 763,892,184.04 3,198,035.69 88.67% CARFO 1,163,598,241.00 1,163,534,508.15 -63,732.85 0.00 0.00 99.99% RFO 1 2,629,189,773.00 2,629,189,773.00 0.00 0.00 0.00 100.00% RFO 2 3,258,185,068.00 3,258,184,789.32 0.00 278.68 0.00 100.00% RFO 3 2,794,021,155.26 2,792,648,893.26 0.00 1,372,262.00 0.00 99.95% RFO 4A 1,511,926,914.15 1,487,884,164.98 0.00 24,042,749.17 0.00 98.41% RFO 4B 1,509,157,968.00 1,506,728,332.65 0.00 2,429,635.35 0.00 99.84% RFO 5 2,783,059,272.00 2,783,016,529.73 0.00 42,742.27 0.00 100.00% RFO 6 1,692,668,549.99 1,647,825,282.38 0.00 22,033,913.64 22,809,353.97 97.35% RFO 7 923,622,879.00 783,202,895.40 2,299.06 140,422,282.66 0.00 84.80% RFO 8 1,159,021,206.00 1,158,051,217.76 -124,500.00 845,488.24 0.00 99.92% RFO 9 886,732,642.00 886,732,247.54 0.00 394.46 0.00 100.00% RFO 10 977,043,695.00 968,590,843.72 0.00 8,452,851.28 0.00 99.13% RFO 11 1,215,228,602.93 1,050,348,696.93 0.00 157,702,946.08 7,176,959.92 86.43% RFO 12 1,963,761,694.00 1,963,761,337.97 0.00 356.03 0.00 100.00% RFO 13 784,026,939.00 784,020,199.89 0.00 6,739.11 0.00 100.00% ATI 1,023,318,505.00 1,004,292,001.72 0.00 19,026,503.28 0.00 98.14% BAI 833,535,166.00 619,636,821.91 0.00 211,646,922.68 2,251,421.41 74.34% BAR 1,338,548,479.00 1,338,546,214.94 0.00 2,264.06 0.00 100.00% BPI 964,650,148.00 887,352,228.55 0.00 77,297,919.45 0.00 91.99% BSWM 955,752,158.00 820,532,791.60 0.00 135,219,366.40 0.00 85.85% PRRI 17,076,808.00 17,001,446.37 -73,731.61 1,630.02 0.00 99.56% BAFE 79,302,574.00 79,301,940.03 0.00 633.97 0.00 100.00% Sub-Total, CO, RFOs, SBs, 37,232,215,845.00 35,632,086,319.48 -253,691.66 1,564,440,062.87 35,435,770.99 95.70% ACPC 2,308,371,000.00 2,308,369,543.67 0.00 1,456.33 0.00 100.00% BFAR 3,496,075,118.00 3,490,498,536.44 -2,348,520.23 1,159,938.57 2,068,122.76 99.84% PhilFIDA (FIDA/CODA) 323,952,000.00 323,909,613.42 0.00 27,632.14 14,754.44 99.99% FPA 107,891,000.00 104,286,534.63 0.00 9,328.17 3,595,137.20 96.66% PCAF (NAFC/LDC) 161,284,162.00 147,680,605.59 0.00 13,603,556.41 0.00 91.57% NMIS 498,193,808.00 379,958,168.71 0.00 118,235,639.29 0.00 76.27% PCC 490,189,033.00 490,189,033.00 0.00 0.00 0.00 100.00% PhilMech 5,090,698,469.00 3,896,413,067.98 950,475.00 22,451,853.07 1,172,784,022.95 76.54% NFRDI 241,823,322.00 241,823,321.61 0.00 0.39 0.00 100.00% Sub-Total, Attached 12,718,477,912.00 11,383,128,425.05 -1,398,045.23 155,489,404.37 1,178,462,037.35 89.50% Totals 49,950,693,757.00 47,015,214,744.53 -1,651,736.89 1,719,929,467.24 1,213,897,808.34 94.12%

3

NCA

2021 Fiscal Report as of September 30, 2021 | 11

the Secretary

NCA Receipts - Php 37,232 billion Disbursements - Php 35,632 billion Lapsed NCAs - Php 1,564 billion Adjusted Balance - Php 35 million Utilization Rate - 95.70 % Attached Agencies: NCA Receipts - Php 12,718 billion Disbursements - Php 11,383 billion Lapsed NCAs - Php 155 million Available Balance - Php 1,178 billion Utilization Rate - 89.50 %

UTILIZATION Office of

(OSEC):

The Notice of Cash Allocation (NCA) utilization rate of the Department of Agriculture – Office of the Secretary (OSEC) is at 93.05 percent while its attached agencies are at 86.71 percent. This equates to a 92.10 percent utilization rate of the Department of Agriculture from January to September 30, 2021, corresponding to Php 45.998 billion out of Php 49.946 billion in NCAs released for the period. Operating Units of the DA may still request for the issuance of another NCA in lieu of the lapsed NCAs subject to the evaluation of the Department of Budget and Management. Cumulative

As stated in the above-mentioned monthly figures, the month of September showed the highest rate of utilization at 94.12 percent. An increase of NCAs utilization for the month of February and March, 2021, respectively, was due to the influx of NCA requests representing Prior Year’s Obligations covered by additional funds received under Bayanihan I and II Projects.

ACTUAL DISBURSEMENT VS MONTHLY DISBURSEMENT PLAN

Every year, all agencies prepare their Budget Execution Plans through the Budget Execution Documents (BEDs) 1, 2 and 3 for their proposed budgetary requirements and usually based on the National Expenditure Program (NEP). All of these BEDs must be prepared and linked with each other. Operational wise, the end result of the BED 1 and BED 2 is the BED 3 or the Monthly Disbursement Program (MDP). This MDP will then be used by the Department of Budget and Management (DBM) as the basis on the release of Notice of Cash Allocations (NCAs) for the current Budget Year. In addition, thereto, NCAs may also be released through separate NCA requests particularly for Prior Year Obligations. The NCA shall only be release by the DBM once the agency provides sufficient

2021 Fiscal Report as of September 30, 2021 | 12

Utilization Month Receipts (‘000) Disbursements (‘000) Unused (‘000) Percent January 6,091 805,414 5,285 13.22 % February 14,006 7,993 6,013 57.07 % March 21,512 16,962 4,550 78.85 % April 24,671 19,263 5,408 78.08 % May 29,937 23,139 6,798 77.29 % June 35,958 32,156 3,802 89.43 % July 41,885 35,013 6,871 83.59% August 45,349 38,400 6,949 84.68% September 49,951 47,015 2,935 94.12%

NCA

information that the requested NCAs will be utilized immediately since they will be requiring a List of Due and Demandable Obligations-Advice to Debit Account (LDDAP-ADA).

2021 Fiscal Report as of September 30, 2021 | 13

FIRST QUARTER GRAPHICAL PERFORMANCE 0 50,000 100,000 150,000 200,000 250,000 Actual Disbursement vs Monthly Disbursement Plan -(In Thousand Pesos)1st Quarter January Actual January Plan February Actual February Plan March Actual March Plan CA RF O RF O I RF O II RF O III RF O IVA RF O IVB RF O V RF O VI RF O VII RF O VIII RF O IX RF O X RF O XI RF O XII RF O XIII ATI BA FE BAI BA R BPI BS W M January Variance -65-40-40-33-63-51-43-39-40-31-53-56-66-47-37-44-60-61-96-57-60 February Variance -460-1420.00.5-2830.-32-38-6.-10-33-53-14-30-37-329.315.-15 March Variance -59-53-27-4.40.20.-2444.-12-18-210.9169-62-5.-18-8.-67-1.45.-19 -150.00% -100.00% -50.00% 0.00% 50.00% 100.00% 150.00% 200.00% Actual Disbursement vs Monthly Disbursement Plan -(In Thousand Pesos) 1st Quarter

We have come up with a table of analysis regarding the actual disbursement vis-a-vis’ the Monthly Disbursement Plan in the Office of the Secretary. As shown in the matrix, the Central office has the highest percentage variance of -95.85%, -86.24%, -98.75% percent, respectively, for the 1st quarter of 2021 or and an average of -93.61% percent. This means that the Central Office has disbursed an average of 06.39% percent of the submitted Bed 3 or the Monthly Disbursement Plan to the DBM. There were also operating units that have shown negative variance in the 1st two (2) months of the year and recover positively in the 3rd month of the 1st quarter to wit; RFO IVA – 40.93%, RFO IVB – 20.39%, RFO VI – 44.23%, RFO XI – 169.23%, BPI – 45.30%, BSWM – 19.03% AND PRRI – 9.45% (as attached, “Annex A”).

2021 Fiscal Report as of September 30, 2021 | 14

(Graphical Illustration) 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 Actual Disbursement vs Monthly Disbursement Plan -(In Thousand Pesos)2nd Quarter April Actual April Plan May Actual May Plan June Actual June Plan

SECOND QUARTER PERFORMANCE

Disbursement vs Monthly Disbursement Plan -(In Thousand Pesos) 2nd Quarter

In the 2nd quarter of 2021, the Central Office still has garnered the highest percentage of variance in the implementation of the Monthly Disbursement Plan. With an average of -93.76% percent, the office has just disbursed 06.34% of the Monthly Disbursement Plan. The following units have improved their actual disbursement performances while others had surpassed the 100% ceiling as stated in their Disbursement Plans. RFO III has shown 556.97% percent disbursement performance of 351,562 million against their MDP of Php 53.512 million for the month of June, 2021. The other positive performers were RFO V – 116.11%, RFO XII – 50.49%, RFO XIII – 64.46%, ATI – 92.66%, BAFE – 10.58%, BAI – 43.37% and PRRI – 29.86%. Ideally, the positive result of variances will result to a positive outcome and good performance of the unit. However, in the same manner those results may just send a wrong signal that we failed to overcome bottlenecks when submitting a Disbursement Plan to the Department of Budget and Management (as attached, “Annex B”).

2021 Fiscal Report as of September 30, 2021 | 15

CA RF O RF O I RF O II RF O III RF O IVA RF O IVB RF O V RF O VI RF O VII RF O VIII RF O IX RF O X RF O XI RF O XII RF O XIII ATI BA FE BAI BA R BPI BS W M AprilVariance -67-64-41-87-38-74-471.6-52-45-30-16-56-90-52-51-54-42-11-54-62 May Variance -410051.45.-28-23-16-35-36-8.-4351.-90-59-21-3.-50-242.9-61 June Variance -28-7.-14556-8.-25116-48-62-52-51-67-4250.64.92.10.-43-18-15-55 -200.00% -100.00% 0.00% 100.00% 200.00% 300.00% 400.00% 500.00% 600.00% Actual

THIRD QUARTER PERFORMANCE (Graphical Illustration)

2021 Fiscal Report as of September 30, 2021 | 16

0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 Actual Disbursement vs Monthly Disbursement Plan -(In Thousand Pesos)3rd Quarter July Actual July Plan August Actual August Plan September Actual September Plan

Actual Disbursement vs Monthly Disbursement Plan -(In Thousand Pesos) 3rd Quarter

We are now in the 3rd Quarter of the year, but the Central Office still garnered the highest percentage variance with an average of -66.88% of their Disbursement Plan. This means that only 33.12% was paid out of the Total Disbursement Plan. This is an improvement of the First and Second Quarter performance of 06.39 and 06.34 percent, respectively. The operating units with positive results are the following; RFO II – 111.79%, RFO III – 71.05%, RFO IVA – 11.66%, RFO IVB – 38.72%, RFO V – 148.83%, RFO VI – 19.26%, RFO VII – 65.68%, RFO IX – 9.26%, RFO XI – 21.37%, BSWM –58.14%

In the ordinary course of business, these positive performances of some of the units may lead to greater realization of profits. But as a National Government Agency with the mandate responsible for the promotion of agricultural development by providing the policy framework, public investments, and support services needed for domestic and export oriented business enterprise. We should focus on delivering interventions, services or public investment in a timely manner and in accordance with a strategic plan that the over-all aims and interest is to achieve an almost perfect performance in the implementation of deliverables (as attached, “Annex C”).

2021 Fiscal Report as of September 30, 2021 | 17

CA RF O RF O I RF O II RF O III RF O IVA RF O IVB RF O V RF O VI RF O VII RF O VIII RF O IX RF O X RF O XI RF O XII RF O XIII ATI BA FE BAI BA R BPI BS W M July Variance -26-91-68-53-0.-72-90-11-76-61-9.-83-64-77-55-70-15-22-47-4.-59 August Variance -13-79153212-69-3196.-60-66-32-4539.0.9-17-69-15-8.-1221.-22-55 September Variance -1317325053.10521944052.-540.127.41.12733.139124-1228.-19-8.289 -200.00% -100.00% 0.00% 100.00% 200.00% 300.00% 400.00% 500.00%

THIRD QUARTER OF 2021 AGRICULTURE PERFORMANCE OF THE ECONOMY

According to the Joint Statement of the Duterte Administration’s Economic Managers on the Philippine Economic Performance for the 3rd Quarter of 2021 states that, on the production side, the industry sector expanded by 7.9 percent, while the services sector grew by 8.2 percent. In contrast, agriculture slightly declined by 1.7 percent. The increase in palay production, which was aided by the continued implementation of the Rice Competitiveness Enhancement Fund, was more than the value to offset damages caused by typhoons and other calamities to other agricultural crops and by the African Swine Fever to livestocks.

PROSPECTS AND RECOMMENDATIONS

These recommendations aim to provide the Management a better understanding on the importance of the proper preparation of Budget Execution Documents. As per the Department of Budget and Management (DBM) Circular Letter No. 2021 – 11 dated October 28, 2021.

The preparation of the BEDs, the following, among others, shall be strictly observed for the timely implementation of programs/projects such as but not limited to:

1. Ensure that their plans contain the projected budget requirements of programs, activities and projects that can be obligated and implemented within the period January to December of FY 2022.

2. Coordination/synchronization of activities among planning, operations, budget and accounting offices in the program/project implementation.

3. Accounting for timelines for procurement-related procedures; and Considering historical performance (absorptive capacity), seasonality (e.g., peak/slack periods) of activities and other factors that influence programming.

Moreover, facilitation of the program/project implementation including the conduct of pre-procurement activities short of award and the prompt completion of procurement timelines, all concerned Operating Units are reminded to ensure the consistency of the information reflected in the BEDs with the procurement schedules/specifications.

2021 Fiscal Report as of September 30, 2021 | 18

2020 Annual Fiscal Report

2020 Annual Fiscal Report

Republic of the Philippines

Department of Agriculture

Elliptical Road, Quezon City

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

2020 ANNUAL FISCAL REPORT

“Continuing the Journey to a More Peaceful and Progressive Philippines”

January 2021

Introduction

“The FY 2020 Budget is another opportunity for the Filipino people to come closer to our collective dream of a more peaceful and progressive Philippines. ” - President

Rodrigo Roa Duterte

On January 6, 2020, President Rodrigo Roa Duterte signed into law Republic Act No. 11465, the Fiscal Year (FY) 2020 General Appropriations Act (GAA), underscoring the importance of peace and progress in the process looking forward to 2020 with high hopes.

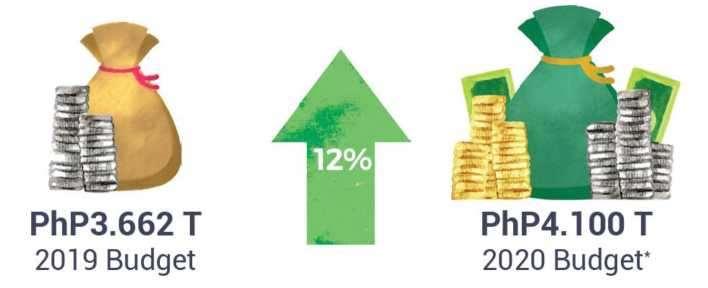

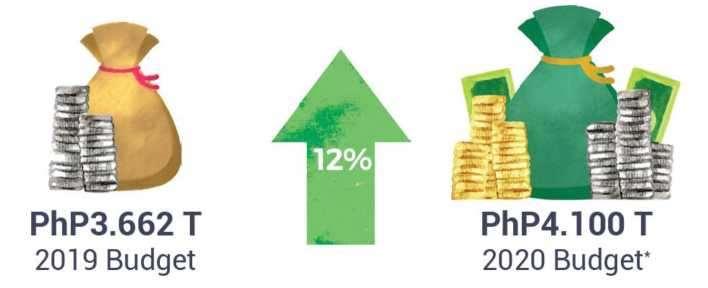

Budget Comparison (2019 vs 2020)

As the financial program that marks the second half of the Duterte Administration, the PhP4.1 trillion National Budget for Fiscal Year 2020 aimed to continue the path to a more peaceful and progressive Philippines. This is twelve percent (12%) higher than the FY 2019 National Budget.

Budget Dimensions by Expense Class

MOOE - Maintenance and Other OPERATING Expenses

PS = 5,312,830,000; MOOE = 30,460,396,000; FINEX = 1,365,000; CO=28,901,814,000. inclusive of automatic appropriations

2020 Annual Fiscal Report | 2

The Department of Agriculture ranked 8th in the Highest Agency-Specific Budget Allocations.

Notable Events in 2020

To better respond to the Coronavirus Disease 2019 (COVID-19) crisis, the Congress, through Republic Act No. 11469 or otherwise known as the “Bayanihan to Heal as One Act”, granted President Rodrigo Roa Duterte the power to adopt emergency measures such as: providing subsidies to the most vulnerable and most affected families; ensuring the protection of public health workers; fast and efficient procurement of goods e.g., personal protective equipment; and the reallocation and realignment from savings to other items in the 2020 Budget.

The National Budget Circular No. 580, issued on April 22, 2020, provided for the adoption of economy measures in the government, citing Section 4 (v) of the “Bayanihan To Heal as One Act” which directed the discontinuance of appropriated programs, activities, and projects (PAPs) of any agency of the Executive Department, in the FYs 2019 and 2020 GAAs, whether released or unreleased, including unobligated allotments of covered entities as of March 31, 2020, to augment the allocation for any item directly related to support operations and response measures

As of June 9, 2020, cash allocations amounting to PhP 354.46 billion were released. These were sourced from discontinued PAPs under the 2020 and 2019 Budgets. The excess revenue from actual dividend collections of the Bureau of the Treasury has also been tapped for the COVID-19 response.

PhP 8.5 billion was released to the Department of Agriculture to cover the funding requirements of the Rice Resiliency Project (RRP) under the Ahon Lahat, Pagkaing Sapat (ALPAS) Kontra COVID19 Program. The RRP aimed to ensure the availability of rice supply through increased local rice production during the 2020 wet season. Around 3 million rice farmers nationwide were expected to benefit from this program.

2020 GAA PhP 64.7 B 2019 GAA PhP 49.7 B

Department of Agriculture

2020 Annual Fiscal Report | 3

PhP 8.5 Billion

COVID-RELATED RELEASES

*Cash allocations, net of withholding tax, as of June 9, 2020

“We Recover As One”

In the pursuit of providing response and recovery interventions and providing mechanisms to accelerate the recovery and bolster the resiliency of the Philippine Economy, the congress enacted Republic Act No. 11494 or the “Bayanihan To Recover As One Act” (Bayanihan Act II) on September 11, 2020.

As of December 19, 2020, the Department of Budget and Management (DBM), pursuant to Republic Act No. 11494 or the “Bayanihan to Recover as One Act”, has released a total of PhP 107.96 billion to various government agencies for their respective COVID-19 related response programs. With this, PhP 103.24 billion out of the PhP 140.0 billion allocation and an additional PhP 4.7 billion charged from regular funds were released to the different departments and agencies.

The Department of Agriculture received PhP 23.29 billion for the Agriculture Stimulus Package to support agri-fishery enterprises, farmers and fisherfolk registered under RSBSA and agricultural cooperatives through cash or loan interest rate subsidies and the Plant, Plant, Plant Program, among others.

PhP

23,293,650,000.00

COVID-RELATED RELEASES

As of December 2020

Towards the end of the year, President Rodrigo R. Duterte authorized the grant of a one-time Service Recognition Incentive (SRI) for Fiscal Year (FY) 2020 at a uniform amount not exceeding PhP 10,000 for each qualified government employee. Budget Circular No. 2020-6 was issued on December 22, 2020 containing the guidelines for the grant of the SRI for government employees for FY 2020. The SRI was granted to recognize and further encourage the unwavering commitment and dedication of civil servants to providing efficient and effective public service. It was also meant to reward them for their collective and unceasing participation and invaluable contribution to the government's continuing efforts towards the establishment of streamlined government processes, especially amid the COVID-19 pandemic.

2020 Annual Fiscal Report | 4

Contract of service (COS) and Job Order (JO) government employees also received up to PhP 3,000 in gratuity pay in recognition of their invaluable service, especially those part of the emergency COVID-19 response efforts. On December 28, 2020, President Duterte signed Administrative Order No. 38 allowing one-time gratuity pay for workers who have rendered at least four months of satisfactory performance of services as of December 15, and whose contracts are still effective as of the same date. The gratuity pay was sourced from the operating budget of the government offices concerned.

Budget1 Utilization UTILIZATION AS OF DECEMBER 31, 2020

This table shows the budget utilization of the Department as of December 31, 2020., net of corporation. It shows that 91.85% or 77.7 Billion has been utilized.

For Current Appropriations, the Department received 82.4 Billion which includes the Regular Agency Budget, Bayanihan 1 and Bayanihan 2.

For the Continuing Appropriations, only 80.22% of the Office of the Secretary's Fund was utilized, part of the reason may be due to the disapproval for the request for augmentation for the priority projects of Secretary like CHARMP.

PARTICULAR Amount in Thousand Pesos ALLOTMENT RECEIVED OBLIGATIONS INCURRED BALANCES % -1 -2 -3 (4) = (2-3) (5) = (3/2) CURRENT FUNDS 82,447,635 75,970,552 6,477,083 92.14% Office of the Secretary 58,776,228 54,623,638 4,152,590 92.93% Attached Agencies 23,671,407 21,346,914 2,324,493 90.18% CONTINUING FUNDS 2,201,318 1,783,595 417,723 81.02% Office of the Secretary 2,027,201 1,626,130 401,071 80.22% Attached Agencies 174,117 157,465 16,652 90.44% TOTAL 84,648,953 77,754,147 6,894,806 91.85%

2020 Annual Fiscal Report | 5

1 DA Funds are composed mainly of Current and Continuing Appropriations released and available for use to DA-OSEC Offices and the Attached Agencies. DA-OSEC consists of the Central Office, the Regional Field Units and Staff Bureaus, e.g. ATI, BAI, BAR, BPI, BSWM, BAFE, PRRI. BAFS is a Staff Bureau but its financial resources are managed by the Central Office. Attached Agencies on the other hand, consist of the ACPC, BFAR, NFRDI, PCC, PCAF, PhilMech, NMIS, PhilFIDA, and FPA.

Out of the PhP 84.649 billion allotment to the Department of Agriculture, the Office of the Secretary received PhP 60.803 billion, constituting 72 percent, of the total allotment. The obligations incurred by the office amounted to 92.51 percent or PhP 56.250 billion. On the other hand, its attached agencies received 28 percent of the allotment with PhP 23.846 billion. Of this, PhP 21.504 billion was obligated.

Office Allotment Received Obligations Incurred Unexpended Balances Utilization Rate Office of the Secretary 60,803,429.00 56,249,768.00 4,553,661.00 92.51% Central Office 20,581,322.00 19,630,451.00 950,871.00 95.38% Bureaus 6,651,878.00 6,065,582.00 586,296.00 91.19% Regional Field Office 33,570,229.00 30,553,735.00 3,016,494.00 91.01% Agricultural Credit Policy Council 5,118,199.00 5,115,790.00 2,409.00 99.95% Bureau of Fisheries and Aquatic Resources 5,913,648.00 5,580,002.00 333,646.00 94.36% Fertilizer and Pesticide Authority 160,388.00 156,638.00 3,750.00 97.66% National Fisheries Research and Development Institute 275,502.00 275,496.00 6.00 100.00% National Meat Inspection Service 769,781.00 655,778.00 114,003.00 85.19% Philippine Carabao Center 457,545.00 451,416.00 6,129.00 98.66% Philippine Center for Postharvest Development and Mechanization 10,578,089.00 8,729,405.00 1,848,684.00 82.52% Philippine Council for Agriculture and Fisheries 155,758.00 148,603.00 7,155.00 95.41% Philippine Fiber Industry Development Authority 416,614.00 391,252.00 25,362.00 93.91% TOTAL 84,648,953.00 77,754,148.00 6,894,805.00 91.85%

(IN THOUSAND PESOS)

2020 Annual Fiscal Report | 6

# Office of the Secretary

# Agricultural Credit Policy Council

# Bureau of Fisheries and Aquatic Resources

# Fertilizer and Pesticide Authority

# National Fisheries Research and Development Institute

# National Meat Inspection Service

# Philippine Carabao Center

# Philippine Center for Post-Harvest Development and Mechanization

4 Philippine Council for Agriculture and Fisheries

# Philippine Fiber Industry Development Authority

Significant increases in the allotment received since September are due to the releases for the implementation of the “Bayanihan to Recover as One Act”. This allotment included PhP 17.8 Billion which was released by the Department of Budget and Management (DBM) in parts of PhP 12 Billion in October and PhP 5.8 Billion in November of the same fiscal year. Included in the balances for the prior year budget are the amount requested from the DBM for the modification of the allotment intended for the following projects: expansion of the agricultural livelihood program in support of the province of Quirino; rice program for the province of Quezon; Bantay-ASF sa Barangay; and scaling-up of the second cordillera highlands agricultural resource management project.

For the month of December, the department received an additional allotment of PhP 321 million allocated for sustainable agriculture and improved farming systems in upland communities for indigenous people, the Kabuhayan at Kaunlaran ng Kababayang Katutubo (4Ks) Program, the Bayanihan II, and mainstreaming of climate resilient agriculture in regional programs/projects. Thus, the unreleased appropriations of the department totaled to PhP 3.8 billion as of December 10, 2020.

The major OSEC programs consist of the Rice Program, Livestock Program, Corn Program, HVCC Program, Organic Agri Program, SAAD Program, Halal Program, PRDP- Original Loan, PRDPExpansion Loan, Quick Response Fund, Calamity Fund, and ALPaS Program. Out of these programs, the Rice Program incurred the most obligations in relation to its corresponding allotment, at 90.48 percent.

Five funds compose the current budget for 2020: the Regular Agency Fund (which includes New Appropriation, Automatic Appropriations, and Special Purpose Fund net of Bayanihan I), the Agricultural Competitiveness Enhancement Fund, the Rice Competitiveness Enhancement Fund, and the Bayanihan I and II.

2020 Annual Fiscal Report | 7

The operating units committed to obligate PhP 16 billion at the end of the year at a projected 94.49 percent utilization rate. In actuality, the Department of Agriculture was able to obligate 91.85 percent of the allotment received, amounting to PhP 77.75 billion. Despite falling short by almost three percent, this marks the second highest utilization of the department's budget in the past ten years.

2020 Annual Fiscal Report | 8

Disbursement

From January to December 2020, the Office of the Secretary disbursed PhP 37.75 billion while the 9 attached agencies of the Department of Agriculture disbursed PhP 12.63 billion. The rate of disbursements over the obligations of the Department is 64.89 percent

The Philippine Center for Postharvest Development and Mechanization (PhilMech) has paid only 12.65 percent of its obligations. The Agricultural Credit Policy Council (ACPC), Fertilizer and Pesticide Authority (FPA), and National Fisheries Research and Development Institute (NFRDI) exhibited aggressive spending activities at more than 95 percent to 100 percent of their corresponding obligated allotments.

Higher disbursements of ACPC against its obligations were due to a cash advance refund and a stale check of a prior year (2019) obligation that was obligated and charged to FY 2020, resulting in an overpayment. A Notice of Obligation Request and Status Adjustment (NORSA) was issued to cancel the obligation after the payment covering the replacement check was made.

2020 Annual Fiscal Report | 9

NCA Utilization

NCA Receipts

The Notice of Cash Allocation (NCA) utilization rate of the Department of Agriculture - Office of the Secretary (OSEC) is at 89.24 percent while its attached agencies are at 68.22 percent. This equates to an 83.35 percent utilization rate of the Department of Agriculture from January to December 2020, corresponding to PhP 58.087 billion out of PhP 69.693 billion in NCAs released for the period.

Quarterly NCA Utilization

Looking at the quarterly figures, the first quarter showed the highest rate of utilization at 98.39 percent. The low NCA utilization in the second quarter is mainly due to the unused cash allocation of PhP 8.5 Billion for the Rice Resiliency Project (RRP) under the

30,000,000.00 25,841,506.00

2020 Annual Fiscal Report | 10

Ahon Lahat, Pagkaing Sapat (ALPAS) Kontra COVID-19 Program. Since then, PhP 5.25 billion (61.77 percent) was disbursed to cover the program; the balance of PhP 3.249 billion has lapsed.

For Quarter 4, NCAs allocated for PhilMech's Mechanization Program under RCEF contributed a large chunk of the PhP 4.893 billion unused NCAs. This amount excludes the Quarter 3 allocation of PhP 1.193 billion carried forward until the end of 2020.

Cumulative NCA Utilization

Steep increases in NCA levels in April, July, and October of PhP 18.08 billion, PhP 11.55 billion, and PhP 21.20 billion, respectively, are the results of the frontloading policy of the government. For Q2, about PhP 12.1 billion cash allocations for May (PhP 5.7 billion) and June (PhP 6.3 billion) were credited to the accounts of Operating Units (OU) in April by their respective Authorized Government Depository Banks (AGDBs) per instruction of DBM. In Q3, about PhP 6.8 billion cash allocations for August (PhP 3.7 billion) and September (PhP 3.1 billion) were credited to OU accounts in July by their respective AGDBs. For Q4, about PhP 16.47 billion cash allocations for November (PhP 11.28 billion) and December (PhP 5.18 billion) were credited to OU accounts in October by their respective AGDBs, inclusive of the NCA dated October 28-29, 2020 covering the Bayanihan II cash requirements amounting to PhP 8.3 billion (PhP 7.16 billion for November and PhP 1.14 Billion for December).

Disbursements

• Receipts £

Unused

2020 Annual Fiscal Report | 11

NCA Utilization of Attached Agencies

Among the Department of Agriculture's attached agencies, all were able to utilize at least 95 percent to 100 percent of NCAs received, except for three: the Philippine Center for Postharvest Development and Mechanization (PhilMech), the National Meat Inspection Service (NMIS) and the Fertilizer and Pesticide Authority (FPA), which utilized 15.90 percent, 68.23 percent and 84.71 percent, respectively.

The performance of the Department of Agriculture is slightly below the average NCA utilization rate of all government agencies of 95 percent.

Status of Special NCA Releases (Cash)

Status of Special NCA Releases

All the unused NCAs have lapsed. Thus, none of the releases are available for the next period. Total disbursements related to the Rice Resiliency Project amounted to PhP 4.9 Billion. The allocation for Q1 for the cash requirement of the Rice Farmer Financial

Disbursements

B

B Unused

12,500,000.00 | Unused | Disbursements -9,930,877.0010,000,000.00 7,500,000.00 5,000,000.00 2,500,000.00 0.00 802,491.00 8,500,000.00

2020 Annual Fiscal Report | 12

Assistance (RFFA) project in 2019 was PhP 2.4 billion, which was also obligated in the same year

The Financial Subsidy for Rice Farmers (FSRF) in 2020 amounting to PhP 43.7 million was not successfully transferred due to outstanding unliquidated fund transfers of the Land Bank of the Philippines (LBP) and subsequently lapsed. Total disbursements related to the Quick Response Fund (QRF) amounted to PhP 592 million (85 percent) while PhP 361 million and PhP 368 million lapsed in Q2 and Q3, respectively. The lapsed amount for the Agricultural Competitiveness Enhancement Fund (ACEF) and Trade Remedies: PhP 51.8 million (Q1), PhP 65.3 million (Q2), and PhP 63.8 million (Q4) can be attributed to the delayed perfection of the Memorandum of Agreement (MOA) between DA and CHED and various SUCs. A huge chunk of the Php 5.8 billion unused NCAs under the Rice Competitiveness Enhancement Fund (RCEF) can be attributed to PhilMech's Mechanization Program.

For Bayanihan II, the total receipts were allocated as follows: PhP 2.5 billion NCAs for Agricultural Credit and Financing Programs (ACPC), PhP 299 million for the National Meat Inspection Service (NMIS), PhP 5.5 billion for the Office of the Secretary (OSEC), and the rest for other agencies. These NCAs were dated October 28-29, 2020. The lapsed amount of PhP 802.49 million is attributed largely to the PhP 600 million erroneous NCA releases by DBM to BPI instead of BAR and the PhP 200 million NMIS- led projects. Out of the PhP 9.93 billion NCAs for Bayanihan II, 82 percent, or PhP 8.16 billion were utilized for obligations directly related to the purpose of the NCA releases.

Bayanihan II

Bayanihan II

2020 Annual Fiscal Report | 13

Fiscal Outlook

The outlook for the Philippine economy, as well as the rest of the world, has been drastically changed by the COVID-19 pandemic. As the country progresses towards the post-pandemic period, it acknowledges that it is foremost a public health crisis - there can be no true economic recovery unless the health crisis is resolved or contained and business confidence returns.

The recovery will be sustained by the government's response measures, supported by the “Bayanihan to Recover as One Act”, the BSP's accommodative monetary policy stance, and the passage of the remaining economic reform agenda. On the supply side, the effective implementation of the government's Plant, Plant, Plant Program could support greater productivity in agriculture to bolster food security.

The passage of the FY 2021 Budget in Congress aims to strengthen its strategies and programs for health, social protection, and economic recovery to better move towards a pandemic-free period.

Releases relevant to RA 11494 were made on a per project basis starting as early as October 28, 2020 towards the end of the fiscal year 2020 knowing that these funds will be reverted back to the national government after D ecember 31, 2020. Since these funds were released only in the latter portion of the 4th quarter, the timing of obligations and payments followed through.

So for DA-OSEC, despite the situation and the challenges it imposes on mobility, we still managed to pay 67.12% of the total obligations made as of December 31, 2020.

Current Appropriations for FY 2020, as described under General Provision No. 60, was enacted to be implemented following the Cash Budgeting System, while the Continuing Appropriations as a GAA for FY 2019, made no mention in its General Provisions that the appropriation is CashBased.

Under a cash-based budgeting system, appropriations and allotments are available only for release and obligations within the fiscal year while completion of cons truction/delivery of goods and services, inspections, acceptance and payments will be made within the extended payment period of three (3) months.

However, for FY 2020 GAA, the extended payment period for Capital Outlay (Infrastructure) for another twelve (12) months, while other Capital Outlays and MOOEs is extended for another six (6) months.

Funds provided under Bayanihan Act I, as component of General Appropriations Act of 2020, were extended for obligations and disbursements until December 31, 2021 as per Republic Act No. 11520 while funds provided under Bayanihan Act II were extended for obligations and disbursements until June 30, 2021 as per Republic Act No. 11519.

Almost half of the P11 Billion additional disbursements is contributed by Central Office

2020 Annual Fiscal Report | 14

alone, thanks to the P5 Billion Farm-to-Market Connectivity Project under the Bayanihan II, which, its disbursements have materialized in early February catapulting the disbursement to obligations rate to almost 100% from its 73% performance as of December 31, 2020.

Regional Offices contributed the other half of the increased disbursements but remains to perform at the average of below 90% while Staff Bureaus, which by historical data always perform better on the Obligations to allotment and disbursement to obligations categories, were not expected at this very low average, performing only at 72% and 88% average disbursement to obligation utilization rate for the cut off dates December 31, 2020 and March 31, 2021, respectively.

Attached agencies have a very low improvement in disbursements within the period of three months. Large chunk of the low disbursement rating as of December 31, 2020 up to this date though is due to the high amount of unpaid obligations under the Mechanization component of RCEF lodged under the PhilMech.

Consistent with the Cash- Based Budgeting System and the existing policy of the DBM as a government resource management agency, I would to like emphasize that when DA will be evaluated by DBM based on this performance ratings, subject of course to several conditions and exclusions, these percentages represent DA's absorptive capacity in implementing its funds and would only mean decreasing the resources to be poured to the agriculture sector.

2020 Annual Fiscal Report | 15

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

Summary Report generated on at

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents.

an analysis of accounts and adjustments of errors/omissions

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

CAR

To ensure that data and other supporting documents are carefully analyzed for proper recognition and reconciliation of accounts.

Accounting Section 01/08/2021 31/12/2021 Partially Implemented On-going retrieval of relevant supporting documents for any adjustments and for proper reclassification to appropriate accounts.

A total of 34 million was adjusted out of P 62.303 million

Accounting errors, and P 26.304 million are awaiting documents under deficiencies, some items have no adjustment to their nature.

Out of P457.096 million, a total of P9.390 million was adjusted as of July 31, 2021 and P447.705 million is awaiting for documents. Concerned offices are currently reviewing and harmonizing their procedures to include the proper submission of documents for timely recognition of appropriate accounts in our books.

Audit Observation/s Audit Recommendation/s Implementation Status No.

5:19:21 PM

19 Nov 2021

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

1 CAAR 2020 p. 5 -13 DA-CO Management

Accounting Division 01/07/2021 31/12/2021 Partially Implemented Due to numerous items

will conduct

and documentations needed for an account to be adjusted and recorded

2 CAAR 2020 p. 5-13

1 Page

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

1.

Unadjusted

accounting

errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

Summary Report generated on at

19

Nov 2021 5:19:21 PM

Management made a 100% or P 34.410 million adjustments on the omissions/errors to correct the reported balances of the affected accounts in the Financial Statements through various Journal Entry Vouchers (JEV) with details attached as Annex “A” in our AOM response dated June 2, 2021.

Implemented Management already recorded 100% or P 22.243 million adjustments for errors/omissions, and 100% or P 10.317 million for deficiencies.

Audit Observation/s Audit Recommendation/s Implementation Status No.

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

3 CAAR 2020 p. 5-13 RFO I Accounting Section 01/05/2021 31/12/2021 Fully Implemented

4 CAAR 2020 p. 5-13 RFO II Accounting Section 01/11/2020 31/12/2020 Fully

2 Page

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

6 CAAR 2020 p.

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

Summary Report generated on at

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

and effect the necessary adjustments on the cited

Implemented Management made adjusting entries with a total of P1.404 million out of P 48.382 million for the Due from NGAs, Due from Operating Units, Guaranty /Security Deposits Payable, Due from NGAs, LGUs, NGOs/POs.

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

RFO V

Management will thoroughly examine and verify the accounts to determine necessary adjustments

Accounting Section 01/01/2021 31/12/2021 Partially Implemented Management made P 182.416 million adjustments for errors/omissions as of July 31, 2021 and P 16.885 million for deficiencies and to support the necessary adjustments an investigation is being done.

Audit Observation/s Audit Recommendation/s Implementation Status No.

19 Nov 2021 5:19:21 PM

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

5 CAAR 2020 p. 5-13 RFO III To conduct reconciliation

AOMs Accounting Section 01/04/2021 31/12/2021 Partially

5-13

3 Page

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

Summary Report generated on at

19 Nov 2021 5:19:21 PM

8 CAAR 2020 p. 5-13

1. Unadjusted accounting errors/omissions

and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

To reconcile the negative balances to correct the deficiencies noted.

Due to the difficulty of retrieving the source documents for basis of reconciliation

A total of P 3.135 million are still awaiting for documents under accounting deficiencies, and an ongoing retrieval of documents is being done by management.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

RFO IX

To effect the adjusting entries in the books

Accounting Section 01/04/2021 Fully Implemented Management made 100% or P 94.388 million adjustments on its error/omissions.

Audit Observation/s Audit Recommendation/s Implementation Status No.

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

7 CAAR 2020 p. 5-13 RFO VII

Accounting Unit 01/01/2021 31/12/2021

Partially Implemented

4 Page

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

Summary Report generated on at

19 Nov 2021 5:19:21 PM

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

RFO X To adhere to the recommendation provided by the finding, by continuing

Accounting Section 01/03/2021 Partially Implemented Management made adjustments of P 104.187 million for errors/omissions and P 1.537 billion are awaiting documents for deficiencies. Demand letters have also been coursed through each Province's Supervising Auditors.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

RFO XI Partially Implemented Management already recorded adjustments of P28,706,272.39

Audit Observation/s Audit Recommendation/s Implementation Status No.

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

2020 p. 5-13

9 CAAR

10 CAAR 2020

5-13

p.

5 Page

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

12

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

Summary Report generated on at

19 Nov 2021 5:19:21 PM

2020 p.

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents

1. Unadjusted accounting errors/omissions and uncorrected accounting deficiencies

A qualified opinion was rendered on the Financial Statements due to various accounting errors/omissions amounting to ₱2,087.408 million, which exceeded the materiality level of ₱ 360.581 million and accounting deficiencies such as absence of subsidiary ledgers and lack of complete accounting records on 379 accounts with an aggregate amount of ₱32,362.002 million which prevented alternative audit procedures to be undertaken to obtain sufficient and appropriate evidence relating to various assertions on the accounts.

Management made 100% or 3,143.122 million adjustments for deficiencies, and P 1.186 million for errors/omissions.

6 Page

Audit Observation/s Audit Recommendation/s Implementation Status No.

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

11 CAAR 2020 p. 5-13 RFO XII Accounting Section 01/01/2021 30/04/2021

Fully Implemented

CAAR

We recommended and Management agreed to require the Chief Accountant to effect the necessary adjustments on the errors/omissions and corrections on the deficiencies observed with the corresponding supporting documents 5-13

BAR For immediate compliance Accounting Unit 31/12/2021 Ongoing Implementation The Accounting Unit has already partially made the necessary adjustments of P 1.250 million on the errors/omissions to correct the balances of the affected accounts , and P 1.725 million for deficiencies. This shall be a continuous effort and such corrections shall be forwarded to the Audit Team.

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

Overall, the agency’s fund utilization/ obligation of ₱ 56,249.768 million is 92.51 percent compared to its allotment of ₱60,803.430 million with unobligated amount of ₱4,553.662 million due to the delays in the procurement process and discontinuance of implemented projects to address the emergency situation brought by COVID-19 pandemic, among others. Moreover, it registered a utilization rate of 97.86 percent for Provision of Agricultural Equipment and Facilities under Rice Program wherein low utilization of funds was observed in RFO V.

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

Summary Report generated on at

19 Nov 2021 5:19:21 PM

A. Ensure that appropriated funds are fully utilized the soonest possible time for the agency’s programs, projects and activities to hasten socioeconomic development and benefits to intended stakeholders/ beneficiaries; (ii) provide a catch up plan to maximize the available allotment to avoid reversion of the unutilized amount to the Unappropriated Surplus of the General Fund; and (iii) abide by the target timelines for future projects to provide the timely developmental benefits of the projects;

Consistent monitoring of procurement activities and coordination with the LGUs with ongoing sub-projects

01/07/2021 31/12/2021 On-going Implementation Due to numerous activities and the priority in the approval and effectivity of Second Additional Financing

Management will ensure that appropriated funds will be fully utilized by closely monitoring the Procurement activities in the NPCO, PSO, RPCO and LGUs and provide assistance so as not to delay the awarding of contracts for goods and services. Monitoring of sub projects will be given more attention to ensure sub project completion by providing solutions to the challenges in the implementation

BAFE

14 CAAR 2020 p. 14-18

2. Fund Utilization/Obligation

Overall, the agency’s fund utilization/ obligation of ₱ 56,249.768 million is 92.51 percent compared to its allotment of ₱60,803.430 million with unobligated amount of ₱4,553.662 million due to the delays in the procurement process and discontinuance of implemented projects to address the emergency situation brought by COVID-19 pandemic, among others. Moreover, it registered a utilization rate of 97.86 percent for Provision of Agricultural Equipment and Facilities under Rice Program wherein low utilization of funds was observed in RFO V.

B. Ensure that funds allocated to the agency are utilized based on plans and targets to maximize utilization of funds;

The management will conduct a quarterly assessment on the actual accomplishment versus targets based on Budget Execution Documents to ensure that what's committed was executed and any deviation will be addressed accordingly.

All Division 01/01/2021 31/12/2021 On-going Implementation Due to COVID 19 quarantine restrictions cause delay in the conduct of activities.

Management conducted the 1st quarter assessment for FY 2021 allotment and a catch-up plan was laid down for programs that were not implemented per planned for the quarter.

Audit Observation/s Audit Recommendation/s Implementation Status No.

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

2. Fund Utilization/Obligation

13 CAAR 2020 p. 14-18 PRDP

PRDP

7 Page

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

2. Fund Utilization/Obligation

Overall, the agency’s fund utilization/ obligation of ₱ 56,249.768 million is 92.51 percent compared to its allotment of ₱60,803.430 million with unobligated amount of ₱4,553.662 million due to the delays in the procurement process and discontinuance of implemented projects to address the emergency situation brought by COVID-19 pandemic, among others. Moreover, it registered a utilization rate of 97.86 percent for Provision of Agricultural Equipment and Facilities under Rice Program wherein low utilization of funds was observed in RFO V.

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

Summary Report generated on at

19 Nov 2021 5:19:21 PM

RFO V

B. Ensure that funds allocated to the agency are utilized based on plans and targets to maximize utilization of funds;

The management will direct the responsible offices to fast track implementation of the projects.

Rice Program, RAED, Accounting Section, and Budget Section

01/01/2021 30/06/2021 Partial Implementation Due to deducted retentions. Management disbursed a total of 34,462,513.20 or 98.96% out of P34,825,000.00 and 362,486.80 were undisbursed as of June 30, 2021. Due to deducted retention and shall only be released 1 year after the acceptance of the project.

2. Fund Utilization/Obligation

Overall, the agency’s fund utilization/ obligation of ₱ 56,249.768 million is 92.51 percent compared to its allotment of ₱60,803.430 million with unobligated amount of ₱4,553.662 million due to the delays in the procurement process and discontinuance of implemented projects to address the emergency situation brought by COVID-19 pandemic, among others. Moreover, it registered a utilization rate of 97.86 percent for Provision of Agricultural Equipment and Facilities under Rice Program wherein low utilization of funds was observed in RFO V.

C. Continue the monitoring phase of the Program and conduct periodic inspection/ validation on the operational status of cooperatives/associations/ beneficiaries including implementing agencies to determine whether the support services and farm equipment extended are used for purpose of ensuring the maximum utilization of extension services/ facilities for the attainment of the identified project objective;

31/12/2021 On-going Implementation Management will continue the monitoring of various programs and projects by conducting periodic inspection and validation to ensure the purpose and objective of the programs and projects are attained.

Audit Observation/s Audit Recommendation/s Implementation Status No.

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

15 CAAR 2020 p. 14-18

01/01/2021

16 CAAR 2020 p. 14-18 RFO III Banner Programs, PMED

8 Page

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

17

AGENCY ACTION PLAN AND STATUS OF IMPLEMENTATION

Summary Report generated on at

19 Nov 2021 5:19:21 PM

2. Fund Utilization/Obligation

Overall, the agency’s fund utilization/ obligation of ₱ 56,249.768 million is 92.51 percent compared to its allotment of ₱60,803.430 million with unobligated amount of ₱4,553.662 million due to the delays in the procurement process and discontinuance of implemented projects to address the emergency situation brought by COVID-19 pandemic, among others. Moreover, it registered a utilization rate of 97.86 percent for Provision of Agricultural Equipment and Facilities under Rice Program wherein low utilization of funds was observed in RFO V.

18 CAAR 2020 p. 14-18

2.

Fund Utilization/Obligation

Overall, the agency’s fund utilization/ obligation of ₱ 56,249.768 million is 92.51 percent compared to its allotment of ₱60,803.430 million with unobligated amount of ₱4,553.662 million due to the delays in the procurement process and discontinuance of implemented projects to address the emergency situation brought by COVID -19 pandemic, among others. Moreover, it registered a utilization rate of 97.86 percent for Provision of Agricultural Equipment and Facilities under Rice Program wherein low utilization of funds was observed in RFO V.

RFO VII

The management will require the full time delivery unit to strictly monitor the physical and financial targets of all implementing units.

FDU and all implementing units

01/01/2021 31/12/2021 Due COVID 19 restrictions, implemented by LGU, Project implementation was greatly affected

Management direct implementing units to fast track the timely implementation of the projects

E. As much as practicable, (i) fast track the implementation and completion of programs, projects and activities already funded; and (ii) identify, prioritize and formulate a comprehensive plan/program that would improve and normalize as quickly as possible the situation and living conditions of the Filipino people affected by the COVID-19 pandemic; and

RFO XI Programs/Marie Ann Constantino Not yet Implemented Management will adapt to this recommendation

9 Page

Audit Observation/s Audit Recommendation/s Implementation Status No.

Ref.No. Date Observations and Recommendations Action Plan AGENCY ACTION PLAN Responsible Office Target Implementation From To Reason of Partial/ Delay/NonImplementation Action Taken Management Comments Remarks

D. To strategize the procurement process and ensure that all procurement activities are within the time frame to implement the programs and activities; CAAR 2020 p. 14-18

Office of Usec. Roldan G. Gorgonio, Undersecretary for Administration and Finance

2. Fund Utilization/Obligation