BA (HONS) FASHION MARKETING YEAR 2

BA (HONS) FASHION MARKETING YEAR 2

STUDENT ID: 20008140

WORD COUNT: 4137

This consumer insight report outlines the purchase process of the 'Gen Z' customer segment's motives and behaviour using market research, consumer behaviour and primary research. The targeted customer niche is "Fashionistas on a Budget" in two global marketplaces - the United Kingdom and China - to explaindisparitiesinfluencedbysocioeconomicfactors.

The purpose of this consumer behaviour fashion insight report is to provide understanding into the 'Fashionistas on a Budget' consumer niche in the British and Chinese markets. While this segmentation might be of any age, the 18-25 demographic is the emphasis of this research. This age group is the report's major focus since they are more likely to budget non-essential purchases in order to fund their student lives or pay off their student debts. Budgeting for non-essential items, suchasclothing,isthehighestprioritywithinthiscategory.

Due to the fact that fashionistas on a budget change their wardrobe on a frequent basis to keep up with the newest trends, it is essential that this demographic in both countries set aside money for their fashion expenses while still having enough income to live. As a result, this market group is cautious about their spending, which is a frequent trait throughout both markets. However, based on primary research, Chinese customers are willing to spend more on fashion than British consumers,andmayevenpurchaseluxuryproducts.

Furthermore, this report highlights the desire of these consumers for sustainability that is unfortunately not accessible to them due to the high cost of sustainable fashion. Additionally, the report discusses the importance of technology in both the United Kingdom and China. Although social media has always been significant to this demographic, its significance has grown since the global pandemic began. Since COVID-19 and the ensuing lockdown, technology has become the primary meansofcontactbetweenfriendsandrelatives,aswellasallowingindividualstomakeonlinepurchaseswithease.Itgivesaplatformforfashionistasonabudgetto explorethecurrentfashiontrendsthatcanbeobservedthroughTikTok,Pinterest,TaoBao,etc.withconvenience.

Throughout this report, consumer behaviour and psychology theories are applied to secondary and primary research findings to analyse segments and markets to identifyconsumerswithinthissegmentandbothregions,aswellasfactorsthatinfluencetheirpurchasingdecisions,andtoevaluatetheirbehaviourandhabits. To corroborate secondary research findings and present reliable and accurate statistics within the two markets for Fashionistas on a Budget, primary research was conductedthroughin-depthinterviewsandwardrobeaudits.

1 defining the consumer segment introduction to the british market introduction to the chinese market detailed pen portraits: united kingdom & china demographics in the united kingdom demographics in china

KEY MARKET METRICS

2 psychographics in the united kingdom psychographics in china economic factors sociocultural factors: united kingdom sociocultural factors: china

3 shopper behaviour in the uk shopper behaviour in china motivators in retail experience

4 method of data collection & analysis interviews (united kingdom & china)

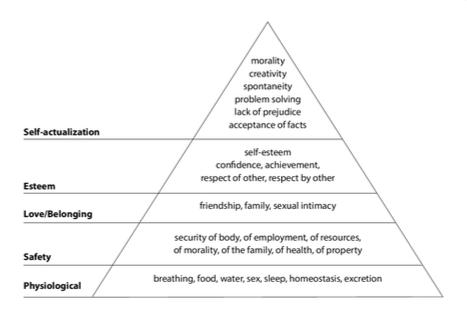

maslow's hierarchy needs

wardrobe audit: united kingdom wardrobe audit: china

5 conclusion recommendentations for future opportunities

6

7 APPENDICES & REFERENCES

Afashionistacanbedescribedassomeonewithadevotedinterestinfashionwhoispassionate aboutshowingtheirpersonalitythroughtheirclothing.Theyareawareofthecurrentfashiontrends andwhiletheywillfollowthem,theywilladdtheirownindividualityintheirstyle.Theycaregreatly abouthowtheypresenttootherpeopleandenjoyexperimentingwithfashiontomakethemselves standoutinacrowd.Undoubtedly,thestylizationoftheirgarmentisoneoftheirmainconcerns. However,recentlyanotherconcernattractedtheattentionoffashionistas:sustainability.Mostof themareawareofthemassivedisastrousimpactthefashionindustryhasontheenvironmentand therefore,therehasbeenariseindemandforcircularfashion-second-handclothing,rentof clothing,buying&reselling,etc.

Afashionistaonabudgetissomeonewhoappreciatesfashionwithintheirfinancialmeans.Theyusually searchforastylishgarmentofadequatequalityforalowprice.Theymightusecoupons,waittopurchase athigh-end/luxurybrandsonlywhensalesareavailableandmostimportantlysetabudgetforfashion. Theylimittheamountofitemstheypurchasebyconsuminglessand/orbygoingthroughaffordableways toconsume.Theyaspiretostaystylishandin-trendwhilenotbreakingthebank.Therefore,theyusually buyonlineonfast-fashionretailerswebsitesrentingclothingwebsites.Offline,theyusuallyshopatthrift storesorbrandssuchasH&M,ASOS,etc.

A garment’s style & quality even bought on fast fashion websites will be the main motivator for purchase.

There is a desire to show difference therefore affordable independent shops online or offline portraying a certain aesthetic attract fashionistas on a budget.

Price is the one of the most important factors influencing a fashionista on a budget’s buying decision. As they cannot afford every high-end/luxury piece they might want, instead of saving up they will also search for affordable options.

Fashionistas on a budget are environmentally conscious and would favour a sustainable brand. They also invest in new ways of consuming such as thrift shopping.

The British fashion’s consumption market is at an all time-high with an industry worth more than 61.2 billion British pounds (Statista, 2022). UK consumer spending on apparel has increasedbyalmost17billionBritishpoundsinlessthan10yearsdemonstratingthat the UK is a fast exponential market and its consumers are actively interested in fashion andengageinitsindustry.

77.9%

Percentage of the British population using social media (Bock, 2021)

68,455,451

Total British population (Worldometer, 2022) (in British pounds)

It is important to note that budgeting fashionistas are mainly Gen Z. As they are quite cautious with their finances and how they spend their money, they value a staple item at a reasonable price or purchase counterfeits. They usually mix high-street brands with designer goods in order to be trendy with their own identity while staying on top of their budget.

£61.2 billion

Net worth of the UK fashion market in 2021 (Statista, 2022)

With nearly 80% of the total UK population using social media, consumers are heavily influenced by social media platforms such as Instagram, YouTube, Pinterest, TikTok for trends and fashion news. Influencers, celebrities and other users are used to find fashion inspiration online and offline. As a very diverse generation, fashionistas on a budget explore inclusivity and garment originality as a way for them express themselvesespecially with the rise of multiple different trends due to TikTok (Bock, 2021), most fashionistas purchase from big online fashion retailers such as Shein, Zara as they make trendyitemsaccessible.

Most used social media platforms In the United Kingdom (from top to bottom: Instagram, TikTok Youtube) (Vogue, 2020)

China has one of the highest populations in the world with over 1.402 billion habitants. This undoubtedly creates a higher market with consumers with very different needs.

1,448,185,302

Total Chinese population (Worldometer 2022) (Heuritech, 2020)

18.4% of whole apparel market

Chinas passion for fashion is nothing new: many of the world's greatest high street businesses owe a significant portion of their earnings to Chinese customers, both abroad and at home. However, this association is more than just a matter of taste; it is a reflection of the countrys remarkable economic and social progress. Luxury brands were inaccessible to a big percentage of the population in the 1990s, but Chinese customers are now responsible for roughly 50 percent of all luxury retail sales worldwide. China is also the world's second-largest apparel market (Heuritech, 2020), accounting for 18.4 percent of the whole market with its fashion industry being worth more than $1.773 billion USD (approximately £871 million GBP).

Most of the consumers considered “fashionistas on a budget” are Gen Zers like in the United Kingdom. Younger Chinese customers are far more adventurous in their fashion choices than earlier generations, owing to the fact that they are a cohort that is highly educated, welltravelled, and financially stable. Fiinancial stability however does not equate to more purchasing power compared to previous generations but rather a more conscious approach to their spendings.

65% Percentage of the Chinese population using social media (Bock, 2021)

With over 65 percent of the population using the internet - social media use has exploded in China over the recent years. WeChat is the most popular platform being used for everything from messaging to shopping to video sharing, as well as Douyin (TikTok), TaoBao and Xiao Hong Shu are the most popular as it works on a word-to-mouth marketing basis where users’ share their customer experience and can have direct contact to brands which is preferred over advertising (DeGennaro, 2020).

Most used socia media patforms in Chna (from top to bottom: We Chat, TaoBao Xiao Hong Shu) (DeGennaro 2020)

A fashionista on a budget might be of any age, however 16-25 years old is the most common age group for this segmentation also known as Gen Zers. They are more likely to fund their social lives by staying financially conscious as they need to pay for essential student living

According to the ACORN consumer classification (CACI, 1978), this demographic fits into the “FinanciallyStretched”categoryandmorepreciselythe“StudentLife”group

Although this cohort is not the largest consumer group in the United Kingdom, they are also have the one with the lowest purchasing power, implying that once they achieve economic independence,theywillbecomethenextlargestconsumergroup

Education: With more than 2.4 million enrolled in higher education (Bolton, 2021), most in this segmentation are either in sixth form, university or have just recently graduated. They value career progression and have anxieties about their future they deem uncertain. They are focused on their education and work with 82% stating that it is a top priority in their lifestyle Gen Zers usually take part in apprenticeships or internships (Mintel, 2019)

Occupation: As full-time students,this demographic doesn’t have the time to take on a full-time job. They will have a part-time job to afford their rent groceries clothing but also to go out with their friends. It is most likely a job in retail as a sales assistant even though the industry varies.

Living situation: Gen Zers leave their hometown to study in bigger cities and therefore usually have to move out. Because of they are in full-time education or young graduates, they do not yet have a comfortable salary to afford rent. They use their student loans to pay for their rent and usually live

In student halls or accommodation (ACORN)

In a rented shared place with either friends or other students With their family

Sources of income:

This generation is not financially independent therefore they depend on third parties as sources of income. In the United Kingdom, the most common sources of income are:

Student loan

Family support

Part-time work

Student bank overdraft

Sources of income:

The "single child" is the most prevalent designation for China's new generation. They are raised in a comfortable environment with unconditional affection from their parents. The one-child policy has affected the generational characteristics of China's young as a key historical event. This policy, when combined with the country's strong economic growth has a significant impact on how financially dependent Gen Zers are on their family Therefore, their most common sources of income are

Part-time work

Student loan

Education: In 2020, China's public colleges and universities will have roughly 33 million undergraduate students enrolled in degree programmes (Statista, 2020). The number of Chinese students studying abroad continues to rise Around 703,500 Chinese students travelled in 2019 to pursue courses abroad. In comparison to the previous year, the number climbed by 625 percent (Statista, 2020), making China the worlds largest country of origin for overseas students. With their parents pushing them hard Chinese students are very competitive.

Occupation: In full-time education, most students get a part-time job in a state-owned enterprise to be able to sustain their lifestyles. Although they have a lot of financial support from their parents, they might work as to be able to buy luxury goods as they are the demographic spending the most on hard luxury in China (Jing, 2021)

Living situation: This demographic usually prefers living at home as it has been culturally traditional for children of previous generations to stay with their parents until they are in their 30s. Added to this, it saves them money to spend on rent. With around 60% of Gen Zers living in urban areas (Meyer, 2020), they usually don’t move out unless they’re studying abroad or want to study at a specific university in another province

Gen Zers being digital natives, there are 45 million active social media users in the United Kingdom (Statista, 2020). Individuals can express and convey how they want to be seen through the use of social networks, since their online persona is a crucial component in their lives (WGSN, 2019). However, this has resulted in concerns with mental health and self-confidence. Instagram, Snapchat, YouTube, Facebook, and Twitter are all popular social media platforms. According to Mintel research, consumers feel pressured to establish an online profile, which makes their opinions regarding digital enjoyment high, with 59 percent of the cohort believing they spend too much time online. Furthermore, as a result of the recent pandemic, social media usage is growing (WGSN, 2020), since it offers users a platform to stay connected with their relatives and friends, allowing them to maintain the human connection they require.

Fashionistas on a budget are homebodies - they enjoy spending their time at home, listening to music and browsing the Internet, watching movies/series, online shopping etc. Offline, they visit their friends and relatives, go to cafés, parks, museums and galleries. There is a rising interest in photography, mental well-being, yoga and plants. They also enjoy going to events, clubbing and shopping to take time off of their studies and relax.

This demographic is dependent on technology, consuming social media everyday. They use social media as a way to relax through digital activities but also to shop. In China, Accenture discovered that 31% of Gen Z customers use social media for product inspiration, with 58 percent saying they had expanded their use of social media for purchasing decision-making in the last year (WARC, 2017). Online word-to-mouth on websites such as TaoBao, is the most effective type of marketing for these individuals as they value consumer experience over third-party advertising.

Gen Zers had the most common interests and activities, which included watching movies, series, and variety shows, online shopping, and listening to music. They prioritise their health and fitness since beauty standards are very important in China, and having a specific body image is quite significant, thus exercising is a hobby for many people. They frequently spend time with their close friends and family, and they look to them for inspiration since they trust their viewpoint more than that of an influencer or celebrity.

The economy has continued to suffer as a result of Covid-19 and previous and current lockdowns in the United Kingdom. With the current state of uncertainty and the imposition of new limitations, brands will be wary of what the future contains, as the economy will remain impacted by the closure of businesses. Because people have nowhere to go and are losing their employment, spending activity has come to a halt (The World Bank, 2020), as they have less money to spend on non-essential products. The UK GDP is expected to decline by 11.2 percent in 2020, as per Financial Times (Smyth. J, 2020). Added to this, Brexit has had a major impact on the UK economy, causing consumer confidence to plummet as prices for goods and services rise, causing great economic instability (ONS, 2021). Brexit has resulted in a rise in freight shipping costs, which has a greater impact on many small firms.

China has been vastly impacted by the COVID-19, however managed to avoid a financial crisis with their drastic & effective lockdowns. Despite the fact that China's total economy grew during the pandemic, retail sales fell 3.9 percent in 2020. Consumer spending has remained slow since then, owing in part to travel restrictions that have stifled tourism. Overall retail sales increased by 12.5 percent in 2021, compared to the previous year's loss, and also surpassed 2019 levels (Cheng, 2021). In 2021, China's economy grew by 8.1 percent compared to the previous year (CNBC, 2021).

The United Kingdom has a PDI of 35, which is a rather low score. Individuals in the United Kingdom believe that inequality between individuals is minimised, as indicated by this score. They believe in equality, which meaning that everyone should be treated fairly.

The citizens of the United Kingdom with a score of 89, are highly private and self-reliant. Individuals are encouraged to think for themselves, to have their own beliefs, to have a purpose and endeavour to fulfil it in order to support the countrys economy and society. They believe that personal fulfilment is the key to happiness.

The United Kingdom is ranked 66, indicating that it is a masculine society. The desire to be highly successful while having a defined ambition drives its individuals.

Positioned at 36, individuals in this cohort are not frightened by spontaneous plans or out-of-theordinary approaches as long as they reach a clear and self-defined goal.

A dominating preference for British culture cannot be identified with an intermediate score of 51 in this factor.

A high score of 69 shows that British culture is considered to be indulgent. People in communities with a high Indulgence score are more likely to follow their instincts and wants when it comes to enjoying life and having fun.

China has a PDI of 80, indicating that it is a society that believes inequities among people are acceptable. The subordinate-superior relationship is polarised, and there is no safeguard against superiors abusing their power.

With a score of 20, China is a strongly collectivist culture in which people act in the group's best interests rather than their own.

At 66, China is a Masculine society, with a strong focus on success. The need to achieve success is reflected by the fact that many Chinese will put work ahead of family and pleasure.

China has a low Uncertainty Avoidance score of 30. Laws and rules could be modified to suit the circumstances, and pragmatism is a part of life. The Chinese are at ease in ambiguous situations, as they are adaptive and entrepreneurial.

China receives an 87 on this scale, indicating that it has a pragmatic culture. It demonstrates a willingness to adjust traditions to changing circumstances, a strong desire to save and invest, and tenacity in reaching goals.

China is a Restricted society, as evidenced by its low score of 24 in this dimension, indicating that people believe that their behaviours are constrained by social norms, and that indulging themselves is unethical.

Spending Habits: According to statistics, 53% of the younger cohort (Walker, 2019) claims to save money, reinforcing the concept that the younger generations are more "financially conservative" (Mintel, 2020). As a result, it's apparent that they're more careful of their spending habits and, as a result, they'll spend less money on stylish items. With this in mind, a budget-conscious fashionista may have to settle for far less expensive brands, such as quick fashion outlets, in order to maintain their sense of self-expression and keep up with the current trends.

Fashion attributes: With the influence of mass media and culture, UK fashionistas on a budget have a fluid identity and are willing to try out new styles and trends. They want to convey to others that they are distinctive and independent, and they want brands to help them do so. 74 percent of people believe that how they present themselves influences how others perceive and judge them (Mintel, 2019). According to Mintel data, roughly 50% of under 25s in the UK purchased luxury products in the previous 18 months. Fashionistas on a budget in this group tend to save up and buy luxury products, particularly accessories, which are a cheaper alternative to apparel.

Influences: With technology being one of the most important component in today's culture, especially in light of the worldwide pandemic, the usage of social media has become one of the key influences among the younger generation of fashionistas. With the continued growth of social media, it is clear that platforms such as Instagram have made it simpler to identify the current fashion trends, thereby having a significant impact on a consumer's purchasing behaviour and purchases (Wightman-Stone. D, 2019).

(Goldberg, 1981)

HighOpenness

HighExtraversion

Money-saving Individualism

Technological connectivity

HighAgreeableness

Spending Habits: This generation is the most likely to spend and the least likely to save of all the generations. Many members of this age also use credit cards to make purchases. Gen-Z is the most technologically advanced and the first to adopt new trends. Fashionistas on a budget in China have a habit of blowing through their budgets.

Fashion attributes: Fashionistas on a budget in China prioritise creativity and self-expression when deciding which firms best represent them. They prefer local names to international brands, and in order to save money, they frequently shop on websites like Alibaba, which provides them with an affordable option to obtain unique garments. In China, budget-conscious fashionistas have a wide range of styles, and there isn’t really a trend to follow; for the most part, individuality is most important.

Influences: According to a poll conducted by Accenture, their purchasing habits are impulsive and heavily influenced by social media. 70% of young people in China between the ages of 18 and 22 are eager to buy things directly through social media (WARC, 2017). They can be influenced by celebrities and influencers but prefer online word-to-mouth.

HighOpenness

HighConscientiousness

HighAgreeableness

Affordability on fast fashion websites like Pretty Little Thing, ASOS, boohoo

Saves time and effort therefore more convenient then having to look in a physical store

Same or next day delivery options

More choice and sizes

Promotional and student discount codes

Possibility of trying on outfits before purchase

In-store experience (décor, lighting, changing rooms, customer service, etc)

More variety in offline charity shops and thrift stores

Possibility to see the quality of an item

Social experience (going out shopping with friends)

SUMMARY

In line with Kahle's List of Values (1983), shopping is regarded as a pleasurable activity rather than a task. UK consumers prefer to buy in store because they can try on clothes before purchasing. Furthermore, because the British market places such a high value on second-hand clothing, online shopping does not provide as much variety. for them. Although, some consumers while shop online on fast fashion websites due to their affordability and convenience.

Easy access to international brands

Affordability on fast fashion websites like Alibaba, TaoBao

Variety of clothings for different styles

Convience of delivery options

Possibility to talk directly to the brands through social media

Trust in buying online for clothing recommend by others

Possibility of trying on the outfits before purchase

Value in-store experience

Social experience (going out with relatives or friends)

Quicker than having to return outfits online

SUMMARY

Customers may readily access shopping platforms anywhere and at any time, making e-commerce the preferred buying channel for Chinese consumers. Furthermore, Chinese customers appear to be getting more mindful of brands and quality. According to the research, ProsperChina Quarterly Poll largest China's online survey of consumers—around 36% of surveyed individuals prefer to shop from online platforms, with Tmall and Taobao being the most popular online sites.

In order to collect data for this insight report, primary research was conducted through personality and cultural profiling in the form of four interviews and four wardrobe Audits - two for each market. Consent was given by participants for their answers and images of their wardrobes to be shared for academic purposes only.

The interviews (Appendix 1 & 2) were all conducted via text through Instagram to be able to keep a proof of the interaction as well as to avoid any complications due to COVID-19 restrictions.

Two participants from each country (United Kingdom and China) between 18 and 21 were interrogated on their budget, lifestyle, shopping behaviour and motivations. Psychological theories were examined in order to justify the findings of the second study and to compare and contrast the differences and similarities between the two markets of Fashionista on a Budget.

Wardrobe audits were conducted on two individuals from each market to analyse their clothing in order to identify their fashion attitudes and consumption behaviours. These findings were essential to analyse the markets from an authentic point of view and were used throughout the entirety of the report as well as secondary research.

Price is the most decisive factor in making a purchase for both participants.

Male / 19 years old = £200 per month

Female / 21 years old = £80 per month

Price is the most decisive factor in making a purchase for both participants.

Male / 21 years old = £300 per month

Female / 20 years old = £100-300 per month

One of the participant always uses student discount or promo codes when shopping online. They both charity shop and second-hand shop even online on Vinted, Ebay.

None of the two participants stated having any particular shopping habits - they usually spontaneously buy what they like.

Both participants use social media for inspiration (TikTok, Instagram & Pinterest). One of the participants also takes influence from menswear magazines. They are more likely to purchase if advetised by influencer/ celebrity.

Both participants stated being heavily influenced by social media, close friends and family. They aren't particuraly more likely to buy an item advertised by an influencer or celebrity.

Although both participants would like to shop from a sustainable brand as they are environmentally aware. However, the price doesn't always allow them and it is therefore not their first priority.

Both participants are environmentally conscious and one of them wished there were more affordable sustainable brandsto buy from. One participant stated that it wasn't a key factor in their consumer decision making process.

Both participants prioritise individuality over trends. They wlll purchase trendy items but only if they give a sense of identity or personality. Being trendy is not much of a concern but they do believe that their sense of style follows current trends.

Both participants tend to be concerned by the trendiness of their clothes. They belive their individuality is more important. One of the participants shops from small local brands that offer a distinctive style.

The first motivator in the consumer decision making process for both participants is style, affordability, individuality and then sustainability.

Both participants believe individuality and quality is more important as they are willing to outspend their budget for a staple item if they deem it is worth it. However, affordability is also a key motivator.

Both participants prefer shopping in-store as they are into charity shopping and can browse, try on outfits. However, they also both shop online on fast fashion websites such as ASOS.

Both participants prefer shopping on-line as they find there is more diversity and variety of affordable clothes. Also the convinience of staying home is favourable for them as they usually spend more on next-day delivery options.

Both participants have never purchased counteirfeit, however one of them is open to the idea of purchasing designer counteirfeit as he particurarly enjoys high-end fashion that he cant afford as a student.

One interviewee has already purchased designer counteirfeit in the past to achieve their desired style within their means. The other interviewee is open to the idea but prefers the quality of products over their brands.

Both participants actively shop at charity shops however they also purchase from fast fashion brands such as COS, Zara, ASOS and EGO due to their affordability Other brands purchased are usually vintage such as Levi's.

Both interviewees purchase from the big e-commerce platform Alibaba - Taobao for more affordable items and Tmall for quality and branding of clothes.

Self-actualisation:

Acceptance of sacrifices for bigger goals such as budgeting for non-essential items

Creative in their individuality through fashion

Esteem:

Sense of gratification through purchasing

Confidence and high-self esteem with clothes they feel comfortable in

Safety:

Security of body through clothes as safe from weather conditions

Self-actualisation:

Cultural morality in investing in more local brands

Spontaneity of spending depending on desires

Creativity through distinctive styles

Esteem:

Sense of achievement through self-expression

Confidence and high-self esteem with clothes that conveys their identity

Safety:

Security of body through clothes as safe from weather conditions

Describes their style as: "Basic and eclectic"

Favourite piece of clothing: "Black leather trousers because they go with everything yet so flattering and stylish"

Considers themselves a fashionista on a budget: "Yes"

Describes their style as: "Quirky, elevated, eclectic"

Favourite piece of clothing: "Thrifted Alyx Chelsea boots, because they’re very versatile and compliment my style perfectly"

Considers themselves a fashionista on a budget: "Yes very much"

Describes their style as: "Minimal"

Favourite piece of clothing: "Dark Denim Jacket: very versatile piece of clothing that goes with everything or situation"

Considers themselves a fashionista on a budget: "Yes, although i like fashion I unfortunately have priorities at the moment in terms of money."

Describes their style as: "It's a mix of different styles but always all in black"

Favourite piece of clothing: "My Cleo Prada bag, it compliments every outfit so well"

Considers themselves a fashionista on a budget: "Yes, definitely, I mostly purchase counterfeit"

Fashionistas on a budget have grown up entirely in the digital era, thus they are familiar with the internet, social media and use it majorly as fashion inspiration and influence. Through their technological connectivity, fashionistas on a budget in both markets possess a similar digital behaviour. Both consumers use social media as fashion inspiration and influence. They are environmentally aware but these demographics can’t always afford to purchase from sustainable brands as they are, most importantly, price conscious. However, the United Kingdom differs in their shopping habits as they prefer an in-store retail experience compared to Chinese consumers who primarily shop online.

As a result, Gen Z resemble each other more than any other generation in terms of views, spending, values and outlook on the future. Fashionistas on a budget globally prioritise style, affordability and individuality in their consumer decision making process which is why there is a desire for fast fashion due to its affordability.

To balance offline and online sales, brands should promote in-store events, particularly high-street brands. This enables customers to share their positive experiences on social media and through word of mouth. Make promotional and student discount codes available on most online shops

As the British market favourises in-store shopping, the experience must be impeccable especially in fast fashion brands

To balance offline and online sales, brands should promote in-store events, particularly high-street brands. This enables customers to share their positive experiences on social media and through word of mouth. Make promotional and student discount codes available on most online shops

As the British market favourises in-store shopping, the experience must be impeccable especially in fast fashion brands

Proposition of affordable sustainable brands that could start by offering basic appareal at a low price

Fast fashion brands need to emphasize individuality in their style of garments as to increase sales

Advertising on social media used by fashionistas on a budget such as TikTok, Pinterest

Offer unique technological service to promote online purchase: an app where individuals can see the garment on their body through their phone in real time via 3D scan so they can try-on clothes. The app will also suggest their correct size to avoid the incovience of having to return outfits.

Environmentally conscious

Gen Z

Prefers shopping in-store at charity shops for their affordable price and vintage brands

18 - 25 years old

Finds inspiration on social media & is influenced by it

Students with a budget to respect

85% of consumers use social media

78% of consumers use social media

Heavily influenced by social media and online word-tomouth

Environmentally aware and would like to purchase sustainable brands

SELF-EXPRESSION INDIVIDUALITY AFFORDABILITY

FAMILY- ORIENTATED

Spontaneous buyers that usually outspend their budget

Students that have healthy lifestyles

Prefers shopping online on TaoBao for their affordable prices

Highest demographic indluging in luxury goods

In the form of a Google Form, four participants who consider themselves "Fashionistas on a Budget," two from the United Kingdom and two from China, were emailed a set of interview questions. Participants were asked to answer a series of questions as thoroughly as possible in order to gain a comprehensive understanding of the consumer category. The questions provided insight into the opinions of the participants concerning budgeting, trend following, sustainability, major motivators, and shopper behaviour.

Wardrobe audits were also carried out to obtain a better knowledge of the market's style.

Ethical considerations: All participants were to provide their consent for their responses and photos to be published for academic reasons only. Participants were also informed that they had the option to withdraw if they had changed their minds.

How old are you & whats your occupation(s)?

How much is your monthly budget for clothing?

Do you consider yourself to follow trends?

What platform do you use for fashion inspiration (social media, fashion runway shows, magazines, TV, friends & family, etc.) ?

Do you prefer shopping online or in-store?

Do you have any shopping habits (thrift-shopping, use of promotional codes & coupons, rental fashion, etc.) ?

What brands do you usually purchase apparel from and why?

Are you more interested in purchasing from sustainable fashion brands?

Have you or would you ever purchase designer counterfeit?

Are you more likely to purchase a piece of clothing that has been advertised online by influencers and/or celebrities?

Are you more likely to purchase a piece of clothing that is currently trendy?

Are you more likely to purchase a piece of clothing that is original and gives you a sense of individuality?

What do you consider to be the main motivator in purchasing a garment?

How would you describe your style?

What's your favourite piece of clothing and why?

Would you consider yourself to be a "fashionista on a budget"?

Interviewee Responses: United Kingdom (Appendix 1)

First participant: 21 year old / Female

21 I’m an undergrad fashion marketing student

It varies to be honest, but it’s usually around £80 per month

I don’t go out my to follow trends but usually my outfits are trendy

I use social media (TikTok, Pinterest) for fashion inspo

In-store because I usually charity shop and also to try-on outfits but sometimes online for some basics on ASOS

I always use student discounts when i can

I like ASOS because it’s trendy and affordable, sometimes COS & Zara

Yes i am but it’s very expensive

No, don’t think I will

Not really

It’s not my main priority I don’t really care if it’s trendy or not

Yes completely. I like unique clothes i want to feel different from others

Definitely the style, then the individuality and affordability factor, lastely sustainability.

Second participant: 19 year old / Male

19 & student, I work part-time in retail

£300/month

Not really

Menswear fashion magazine and social media

In-store

I only shop second hand vintage in charity shops, carboot sales, 2nd hand platforms (Depop, Vinted).

I really like vintage designer brands like Burberry

Yeah if they’re affordable No

Sometimes, depends who

Not at all

Yes 100% i think having distinctive clothes makes my style

Individuality, style, price, sustainability

First participant: 21 year old / Male

I’m 21 and I’m a university student. I also am a retail sales assistant.

It depends - usually around £300.

Yes sometimes.

Mostly social media platforms but also my very close friends.

Online because there’s more choice.

Just buy it if I like it.

There is no particular brand I purchase from.

Not really.

Maybe if it’s good quality but I don’t think brand matter that much to be honest.

Yes if it’s someone I like.

Yes.

Yes - I have a particular style.

Style, price, individuality, sustainability.

Second participant: 20 year old / Female

I’m 20, I study fashion and work part-time

Between £100-£200/month

Yes kind of not intentionally

I use social media & my family, friends too

I prefer shopping online because it’s more affordable

Not really

Taobao, Aliexpress

Yes I am but because i am a student i don’t have a high disposable income

Yes I already have

Yes maybe but depends on person

Maybe if I like yes

Yes I think i stand out a lot from the crowd because of my clothes which i like

Price, style, individuality, sustainability

Clow, KE. and James, KE. (2014). Essentials of marketing research : putting research into practice. Los Angeles: Sage

Patricia Mink Rath (2015). The why of the buy : Consumer behavior and fashion marketing. New York: Fairchild Books / Bloomsbury Publishing.

Powers, D. (2019). On trend the business of forecasting the future. Urbana University Of Illinois Press

Solomon, M.R, Askegaard, S and Hogg MK. (2019). Consumer behaviour a European perspective 7th ed. New York: Pearson.

Adegeest, D-A. (2020). Data reveals Brits are unknowingly spending 3.2 billion pounds on fake designer goods. [online] FashionUnited. Available at: https://fashionunited.uk/news/retail/data-reveals-brits-are-unknowinglyspending-3-2-billion-pounds-on-fake-designer-goods/2020082850602 [Accessed 3 Feb. 2022]

Bock, G. (2021). RETHINK Retail | Podcasts Publications Research. [online] RETHINK Retail. Available at https://www.rethink.industries/article/gen-zs-tiktok-is-setting-trends-and-influencing-fashion/ [Accessed 3 Feb. 2022]

Cheng E. (2022). China’s economy grew 8.1% in 2021 compared to a year ago. [online] CNBC. Available at https://wwwcnbccom/2022/01/17/china-economy-gdp-for-december-and-full-year-2021.html [Accessed 3 Feb. 2022].

Condé Nast (2021). The four fashion personas of China’s Gen Z. [online] Vogue Business. Available at https://www.voguebusiness.com/consumers/the-four-fashion-personas-of-chinas-gen-z [Accessed 3 Feb. 2022].

DeGennaro, T (2019) The 10 Most Popular Social Media Sites in China (2019) [online] Dragon Social Available at: https//wwwdragonsocialnet/blog/social-media-in-china/ [Accessed 3 Feb 2022]

Eastward Media (2021) Get to Know the Gen Z Power in the Chinese Consumer Market | Eastward Media [online] Eastward Media Available at: https//wwweastwardmediacom/2021/07/20/get-to-know-the-gen-z-power-in-thechinese-consumer-marketget-to-know-the-gen-z-power-in-the-chinese-consumer-market/ [Accessed 3 Feb 2022].

Fashion Network (2017) Chinese consumers prefer online shopping finds report. [online] Fashion Network Available at: https://wwfashionnetworkcom/news/Chinese-consumers-prefer-online-shopping-finds-report888182.html [Accessed 3 Feb. 2022].

Heuritech (2021). China’s Burgeoning Fashion market: Trends and Consumers. [online] Heuritech. Available at https://www.heuritech.com/fashion-market-china-consumer-trends/ [Accessed 3 Feb. 2022]

Hofstede Insights (2021). Country Comparison - Hofstede Insights. [online] Hofstede Insights Available at: https//www.hofstede-insights.com/country-comparison/china/ [Accessed 3 Feb 2022].

Jing Daily (2021). Gen Z is the New Target For Hard Luxury in China. [online] Jing Daily. Available at: https//jingdaily.com/gen-z-is-the-new-target-for-hard-luxury-in-china/ [Accessed 3 Feb. 2022]

Li, C (2020) Children of the reform and opening-up: China’s new generation and new era of development The Journal of Chinese Sociology 7(1)

Maguire, L (2020) Gen Z is reinventing social media marketing [online] Vogue Business Available at: https://wwwvoguebusinesscom/consumers/gen-z-reinventing-social-media-marketing-tiktok-youtube-instagram-louisvuitton [Accessed 3 Feb 2022]

Meyer, N. (2020). Comparing China’s Elderly to its Millennials & Gen-Z. [online] China Skinny. Available at: https://wwwchinaskinny.com/blog/compare-chinas-elderly-to-youth/ [Accessed 3 Feb. 2022].

Mintel (2020). UK Lifestyles of Generation Z Market Report 2020. [online] Mintel Store. Available at: https://store.mintel.com/report/uk-lifestyles-of-generation-z-market-report [Accessed 3 Feb. 2022].

Oxford Royale (2018) 7 Unique Characteristics of Generation Z. [online] Oxford Royale Academy Available at: https://www.oxford-royalecom/articles/7-unique-characteristics-generation-z/ [Accessed 3 Feb. 2022].

Sachitanand, R. (2020). Chinese Gen Z’s consumption trends distinct from previous generations Euromonitor reveals | Marketing. [online] Campaign Asia. Available at https://www.campaignasia.com/article/chinese-gen-zsconsumption-trends-distinct-from-previous-generations-euromonito/464232 [Accessed 3 Feb. 2022].

Shepherd, J. (2021). Social Media Marketing for Fashion Brands: A Strategy That Works…. [online] The Social Shepherd. Available at https://thesocialshepherd.com/blog/social-media-strategy-fashion-brands [Accessed 3 Feb. 2022]

Smith, J (2020) The Consumption Habits of Different Generations of Chinese Consumers | ADN Import Foods [online] ADN Imports Available at: https://adnimportscom/the-consumption-habits-of-different-generations-ofchinese-consumers/ [Accessed 3 Feb 2022].

Statista (2018a). China: number of students that study abroad 2018 | Statista. [online] Statista. Available at https://www.statistacom/statistics/227240/number-of-chinese-students-that-study-abroad/ [Accessed 3 Feb. 2022].

Statista (2018b). Clothing: consumer spending 2005-2018 | UK Statistic. [online] Statista Available at: https://www.statista.com/statistics/289999/consumer-spending-on-clothing-in-the-united-kingdom-uk/ [Accessed 3 Feb 2022].

Strategic Digitalab (2020). Unique Generation Z in China [online] Strategic DigitaLab. Available at: https://www.strategicdigitalab.com/unique-generation-z-in-china/ [Accessed 3 Feb. 2022]

Suger Coat It (2013). Budget Fashionista: What’s a Budget Fashionista {Part 1} • Suger Coat It. [online] Suger Coat It. Available at: https//sugercoatit.com/budget-fashionista-whats-a-budget-fashionista-part-1/ [Accessed 3 Feb. 2022].

Turner WT (2021) Your Top Budget Fashion Questions Answered [online] Trend Answers Available at https://wwwtrendanswerscom/your-top-budget-fashion-questions-answered/ [Accessed 3 Feb 2022]

Wasilak, S (2021) The Great Debate: Gen-Z Vs Millennial Street Style Which One Are You? [online] POPSUGAR Fashion UK Available at: https://www.popsugar.couk/fashion/gen-z-millennial-style-difference-48494288 [Accessed 3 Feb. 2022].

WORLDOMETER (2021). U.K Population (2019) - Worldometers. [online] Worldometers.info Available at: https//www.worldometers.info/world-population/uk-population/ [Accessed 3 Feb. 2022]

Zhou J. Poh, F, Zhang, C and Zipsier, D. (2020) China’s Gen Z are coming of age: Here’s what marketers need to know | McKinsey. [online] wwwmckinsey.com. Available at https://www.mckinsey.com/cn/our-insights/ourinsights/chinas-gen-z-are-coming-of-age-heres-what-marketers-need-to-know [Accessed 3 Feb 2022].

Figure 1: Rice Media (2019). Current Affairs Features Geylang Red Light District Gentle Into That Good Night Available at: https://www.ricemedia.co/current-affairs-features-geylang-red-light-district-gentle-into-that-good-night/ [Accessed 3 Feb. 2022]

Figure 2: Detailed Pen Portrait for UK consumer (Author 2022)

Figure 3: Detailed Pen Portrait for Chinese consumer (Author, 2022)

Figure 4: Consumption depending on generations in the United Kingdom (Author, 2022).

Figure 5: Luckhurst, P. (2018). High street fashion targets Gen Z customers with gender neutrality and inclusive sizing [online] www.standardco.uk. Available at: https//www.standard.couk/insider/fashion/high-street-fashiontargets-gen-z-customers-with-gender-neutrality-and-inclusive-sizing-a3948461.html [Accessed 3 Feb. 2022].

Figure 6: Consumption depending on generations in China (Author, 2022).

Figure 7: Kira (2019). The Best Street Style From Tokyo Fashion Week Spring 2020. TokyoFashion. Available at https://www.vogue.com/vogueworld/slideshow/tokyo-fashion-week-street-style-spring-2020 [Accessed 3 Feb 2022].

Figure 8: 画

(2019)

Ameblo Available at: https://ameblojp/smart-service/entry-12496968170html [Accessed 3 Feb 2022]

Figure 9: Stylist (2017) Scandinavia Stylist Available at: https//wwwstylistcouk/tag/scandinavia [Accessed 3 Feb 2022]

Figure 10 Agnew, K (2017). Gen Z Gives A Whole New Meaning To Dressing Extra Refinery29 Available at: https//www.refinery29.com/en-us/generation-z-teen-style-photos [Accessed 3 Feb. 2022].

Figure 11: Block, E. (2021). I Hate Skinny Jeans, so I’m Very Into These Gen Z Denim Trends. [online] Who What Wear UK. Available at: https://wwwwhowhatwear.couk/gen-z-denim-trends/slide6 [Accessed 3 Feb 2022].

Figure 12: Dazed (2021). Watch Audrey Nuna’s dreamy “That XX” music video for Acne Studios. [online] Dazed. Available at https://www.dazeddigitalcom/fashion/article/53651/1/watch-audrey-nunas-dreamy-that-xx-music-videofor-acne-studios [Accessed 3 Feb. 2022].

Figure 13: Minkim, G. (2021). Korean Men’s Fashion 2022 – Popular Korean Outfits for Men. Seoul Inspired. Available at: https://www.seoulinspired.com/korean-mens-fashion-trends/ [Accessed 3 Feb 2022].

Figure 14: Pinterest (2018). Poses Rinrinrin243 Available at: https//www.pinterestco.uk/rinrinrin243/poses/ [Accessed 3 Feb. 2022]

Figure 15: Prada (2019) Prada出

Sohu Available at https://wwwsohucom/a/358814430 656119 [Accessed 3 Feb 2022]

Figure 16: Pinterest (2015). Gods of the Mezzanine. Struck. Available at https://wwwpinterest.couk/strstrck/gods-of-the-mezzanine/ [Accessed 3 Feb. 2022]

Figure 17: McCabe, M. (2019). Your Body Doesn’t Care About Your Skinny Dreams Medium. Available at: https://medium.com/@megmccabe/your-body-doesnt-care-about-your-skinny-dreams-8f457e47ece4 [Accessed 3 Feb 2022]

Figure 18: 深地雅也 (2019). ファッションセンスが良ければ服が売れるのか?. Top Seller. Available at https://topsellerstyle/archives/11821 [Accessed 3 Feb. 2022]

Figure 19: Kelleher, B. (2016). Maslow’s Hierarchy of Needs for Employees. Dummies Available at: https://www.dummies.com/article/business-careers-money/business/human-resources/maslows-hierarchy-of-needs-foremployees-158091 [Accessed 3 Feb 2022].

Figure 20: Unsplash (2020) The Future of Circular Fashion The Conduit Available at: https://wwwtheconduitcom/past-events/the-future-of-circular-fashion/ [Accessed 3 Feb 2022]

Figure 21 Consumer Insight Report for UK (Author, 2022).

Figure 22 Consumer Insight Report for China (Author 2022).

Figure 23 Montemama (2020). SPONSORED INFLUENCER CONTENT: WHAT YOU NEED TO KNOW. MediaKix. Available at https://montemamanet/anmika-kugai/ [Accessed 3 Feb. 2022].