MINING INDABA 2025

Future-proofing communities

GROWING THREAT OF ILLEGAL MINING

Equipping South Africa’s workforce for a sustainable energy and water future

UNLOCKING ESG POTENTIAL IN AFRICAN OIL & GAS

AFRICA’S HYDROGEN POTENTIAL

MINING INDABA 2025

Future-proofing communities

Equipping South Africa’s workforce for a sustainable energy and water future

UNLOCKING ESG POTENTIAL IN AFRICAN OIL & GAS

AFRICA’S HYDROGEN POTENTIAL

Founded in 1964, BUTEC has evolved from a local engineering company into a regional corporation specializing in four areas of expertise: Engineering & Contracting, Electro-Mechanical Solutions, Facility Services, and Utility Services. Over the years, the company has expanded its reach, with its diverse capabilities spanning vital sectors such as Water & Environment, Power & Energy, Oil & Gas, Industrial Facilities, Infrastructure, and Buildings. Today, with a strong international presence in 21 countries across the Middle East and Africa, BUTEC is powered by a dedicated workforce of over 7,500 professionals, all committed to driving innovation and excellence across these dynamic industries.

SA Business Integrator

I’m truly honoured and excited to step into the role of Editor for South African Business Integrator. Following Tashne, whose leadership has been central to the success of this publication, feels both a privilege and a challenge. Her passion for highlighting South Africa’s dynamic business landscape has set a high bar, and I’m grateful for the opportunity to continue the great work she produced.

Tashne’s belief in me and the guidance she’s shared has been invaluable in preparing me for this role. I am committed to ensuring that the magazine remains a vital platform for empowering business owners, organisations, and industry leaders across South Africa.

In this Mining Edition, we explore the shifts taking place in the mining sector, from hydrogen-powered operations to the growing role of renewable energy in driving sustainability, and illegal mining. We feature Mpho Mookapele, CEO of the Energy and Water Sector Education and Training Authority (EWSETA), who spoke about the dual challenges of energy insecurity and water scarcity.

We also highlight the upcoming Mining Indaba, taking place from 3-6 February at the Cape Town International Convention Centre (CTICC), where key industry leaders will come together to discuss opportunities, challenges and the future of mining in South Africa and beyond.

Together, we will continue to champion South Africa’s business landscape and spark conversations that matter most.

Tarryn

Sign Up Now

Shaping the future of mining: the role of allyship in driving gender inclusion

Balancing environmental compliance and critical mineral extraction

Navigating the challenges of section 53

• South Africa Law Firm of the Year Chambers Africa Awards, 2021, 2022 & 2024

• ESG Initiative of the Year African Legal Awards, 2021, 2022 & 2023

• Tax Firm of the Year: South Africa International Tax Review EMEA Tax Awards, 2021, 2022 & 2023

• Innovation Award and Teams of the Year for Competition and Regulatory, Intellectual Property and Tax African Legal Awards, 2024

• Deal of the Year: M&A IFLR Africa Awards, 2024

in alliance with

PUBLISHER

Elroy van Heerden-Mays elroy@mediaxpose.co.za

EDITOR

Tarryn-Leigh Solomons editor@sabusinessintegrator.co.za

SUB-EDITOR

Charis Torrance charis@mediaxpose.co.za

CONTENT MANAGER

Wadoeda Adams artwork@mediaxpose.co.za

DESIGNERS

Anja Bramley | Shaun van Heerden-Mays | Tia Arendse

EDITORIAL CONTRIBUTORS

Anneline Sonpal

Dr David Khoza

Sisi Mahobe

Dominic Varrie

Mandy Hattingh

Erik de Jongh

6 Carlton Crescent, Parklands, 7441 Tel: 021 424 3625 Fax: 086 544 5217

E-mail: info@sabusinessintegrator.co.za Website: www.mediaxpose.co.za

Disclaimer: The views expressed in this publication are not necessarily those of the publisher or its agents. While every effort has been made to ensure the accuracy of the information published, the publisher does not accept responsibility for any error or omission contained herein. Consequently, no person connected with the publication of this journal will be liable for any

or

The publisher will give

Salit Anstey

Rob Morson

Margo-Ann Werner

ADVERTISING SALES MANAGER

Rashieda Wyngaardt rashieda@sabusinessintegrator.co.za

ADVERTISING SALES

Tarryn Napier tarryn@sabusinessintegrator.co.za

MEDIA PARTNERSHIPS | EDITORIAL ASSISTANT

Maurisha Niewenhuys maurisha@mediaxpose.co.za

DIGITAL MARKETING MANAGER

Juhi Rampersad juhi@mediaxpose.co.za

DIGITAL AND SOCIAL MEDIA

Kyla van Heerden social@mediaxpose.co.za

DISTRIBUTION & SUBSCRIPTIONS

Shihaam Gyer distribution@mediaxpose.co.za

CHIEF FINANCIAL OFFICER

Shaun van Heerden-Mays shaun@mediaxpose.co.za

HR MANAGER

Divan Lategan hr@mediaxpose.co.za

RECEPTIONIST

Kayley Townsend receptionist@mediaxpose.co.za

Equipping South Africa’s workforce for a sustainable energy and water future

Mpho Mookapele, CEO of the Energy and Water Sector Education and Training Authority (EWSETA), spoke with South African Business Integrator about driving a capable and skilled workforce for a sustainable and resilient energy and water sector.

MPHO MOOKAPELE | CEO OF THE ENERGY AND WATER SECTOR EDUCATION AND TRAINING AUTHORITY (EWSETA)

Under your leadership, what is your long-term vision for EWSETA’s role in shaping a resilient and skilled workforce, and how do you envision the authority contributing to South Africa’s broader socio-economic transformation?

Sector Education and Training Authorities in South Africa have been established to lead skills development to ensure capabilities in different sectors.

EWSETA’s long-term vision is to bring the transformation of energy, water and the people of South Africa through inclusive economic participation. Our vision acknowledges the critical role skills development plays in ensuring sustainable businesses by investing in the industry’s human capital and capacitating unemployed South Africans with the relevant skills to meaningfully participate in the energy and water industries.

Growing the South African economy is at the centre of transforming the country to address the burdening social challenges of unemployment, poverty and inequality. EWSETA’s approach is that, together with its local and international partners, we can provide skills development offerings in and outside the workplace, ignite innovation and catalyse economic growth, fully aligning with the National Development Plan’s objectives. Driving inclusivity drives workforce transformation by fostering adaptability and leadership in a changing economic landscape.

The Gert Sibande TVET Renewable Energy Programme empowers young women in Mpumalanga with skills for the renewable energy sector, contributing to a remarkable 71% youth participation rate in EWSETA initiatives. Through these efforts, we combat inequality. Renewable Energy companies can collaborate with EWSETA-trained youth to enhance their workforce while promoting innovation in transitioning regions like Mpumalanga.

As a leader navigating two of South Africa’s most critical sectors, how do you balance the immediate need for solutions with the longterm goals of sustainability and innovation? Balancing immediate challenges with long-term goals requires strategic foresight and action.

EWSETA recognises the current challenges of energy and water security for now and the sustainability agenda for a secure tomorrow.

Our learning programmes and skills development initiatives lay the foundation for a future that is both innovative and sustainable, as expressed in our strategic vision of creating a sustainable tomorrow, today through skills.

The Borehole Maintenance and Repair Programme, implemented in the rural communities in KwaZuluNatal that restored access to clean water for rural areas, addresses urgent water shortages while creating long-term livelihoods for artisans through the creation of SMME and job opportunities for our graduates. These efforts ensure today’s actions build a sustainable foundation for tomorrow.

South African businesses have an opportunity to partner with EWSETA on programmes to address immediate energy and water infrastructure needs that will contribute to the betterment of our communities through meaningful corporate social investment.

What strategic efforts are being made to address these challenges through skills development and capacity building, and what measurable impact has been achieved so far? EWSETA’s initiatives target critical energy and water sector challenges through practical training programmes. Major skills drivers in these sectors include the growing demand for renewable energy expertise and water resource management capabilities. Through demand-led planning, EWSETA delivers relevant learning programmes that equip educators to train future solar and wind energy technicians, addressing energy insecurity. Similarly, efforts like the recognition of prior learning for 984 individuals in plumbing and electrical trades ensure formal qualifications and broader employability, supporting the SETA’s commitment to workforce readiness.

When we invest in skills, we invest in a future where energy and water challenges can be met head-on. Businesses in the energy and water sectors can leverage EWSETA’s targeted training and upskilling initiatives to address skills shortages effectively.

Rural communities are often disproportionately affected by water shortages and unreliable energy supply. How are training initiatives tailored to address the

unique challenges and opportunities in these areas?

EWSETA collaborates with higher education, business and government to meet the unique needs of rural communities by focusing on capacitating TVET colleges, community education and training colleges. Programmes are specifically designed to serve areas with limited access to higher education institutions. Through partnerships, we support TVET colleges in delivering relevant programmes aligned with emerging economies that directly impact surrounding communities. For instance, the RE-Skilling Lab established at a TVET college equips TVET institutions with the tools and expertise needed to train learners in renewable energy technologies, ensuring that rural communities are not left behind in South Africa’s energy transition. Further, EWSETA achieved significant milestones in career guidance, hosting 24 urban and 42 rural career development services, training 320 career development practitioners, conducting 13 CPD workshops, and supporting two STEM initiatives. These achievements demonstrate EWSETA’s commitment to driving inclusive economic participation by taking knowledge and opportunities to those who have been previously excluded.

With the global push towards decarbonisation and the country’s commitment to a just energy transition, how are training initiatives preparing the workforce to meet the demands of renewable energy, energy efficiency, and sustainable water management solutions?

For South Africa to transition successfully and justly, we require a capable current workforce that will plan and drive a successful and impactful transition. EWSETA has led skills development initiatives to equip South Africa’s management with the skills needed to navigate this transformation. The EWSETA-led initiatives in partnership with Eskom, Duke University and Wits University to ready women managers at Eskom and TVET lecturer bears testament to the vision to drive inclusion for a just transition. These programmes target executive and middle management professionals from Eskom, SMMEs, and TVET colleges. Participants hone their leadership skills and prepare for an enriching global experience. They focused on personal leadership skills, strategic operations, sustainable economics, work-life balance, advocacy, and building supportive networks and the academic modules delved

into entrepreneurship, renewable energy trends, sustainable solutions, and policy.

Our focus on demand-led planning ensures that 39% of our discretionary grant budget in 2023/24 was allocated to high-level skills development, directly addressing the evolving requirements of the renewable energy and water sectors. EWSETA is working with global partners to advance the Just Energy Transition for youth, women, and rural communities, ensuring inclusive growth through tailored programmes and skills interventions. Renewable energy businesses can tap into EWSETA’s expertise and skilled professionals to effectively meet clean energy demands.

As South Africa continues to face environmental and economic pressures, what innovative approaches are being adopted to ensure the energy and water sectors remain resilient and future-ready?

EWSETA champions innovation to ensure sector resilience. Our partnerships have introduced advanced technologies in skills training, such as smart water monitoring systems under the PoVE Water Management Project, which also supports curriculum innovation. These approaches ensure the workforce is adaptable to industry needs. From solar to wind to wate technology these programmes ensure South Africa’s workforce is equipped with the skills to drive innovation in critical sectors.

EWSETA, in collaboration with CSIR and universities of technology, is driving innovation in South Africa’s energy sector. Key initiatives include the Energy Industry Support Programme, equipping 75 SMMEs with skills and resources, and hydrogen energy training for graduates through partnerships with the University of Pretoria and Bambili Energy. Collaborations like the Renewable Energy Studies School at Durban University of Technology further strengthen research and training in the energy and water sectors. These efforts showcase EWSETA’s commitment to skills development and fosters economic participation in the renewable energy space.

The rise of technologies such as AI in energy systems and advanced water treatment methods is reshaping the sector. How

does EWSETA integrate these technological advancements into its curriculum to futureproof South Africa’s workforce?

EWSETA integrates cutting-edge technologies into training programmes to future-proof South Africa’s workforce. The PoVE Water Management Project trains individuals in smart water monitoring and advanced treatment methods. In the energy sector, initiatives expose learners to AI-driven energy systems, aligning with EWSETA’s role in promoting modern, sustainable practices across sectors.

We encourage businesses that adopt AI and IoT technology to consider placement and access to new graduates to enable them to address emerging technologies.

The energy and water sectors have traditionally been male dominated. What targeted interventions is EWSETA implementing to foster greater gender diversity and empower women in leadership and technical roles?

The energy and water sectors in South Africa remain male-dominated, with women historically underrepresented in technical and leadership roles. Recognising this imbalance, EWSETA has placed a strategic focus on gender transformation to ensure that women are empowered to contribute meaningfully to

these critical industries. Initiatives such as the USAIDPower Africa Renewable Energy Programme and the Eskom Women Leading in Energy Programme provide women with the technical and leadership skills required to excel in renewable energy and water management. These efforts contributed to a 57% female participation rate in EWSETA’s programmes in 2023/24, highlighting progress towards a more inclusive workforce.

EWSETA looks forward to working with organisations that prioritise gender diversity and advancing the upliftment of women and bridging gaps in technical leadership roles.

What role do you believe policy reform plays in unlocking the full potential of South Africa’s energy and water sectors, and how do you collaborate with policymakers to drive change?

EWSETA collaborates with policymakers to align training initiatives with national frameworks like the Just Energy Transition Framework. Projects such as the Renewable Energy Manufacturing Programme ensure local skills development supports economic opportunities and addresses sector challenges effectively. These collaborations transform policies into actionable growth strategies, as reflected in EWSETA’s expanded stakeholder engagements and co-funded projects.

To drive impactful growth and scalability in South Africa’s key energy and water sectors, policymakers and industry leaders should work together with EWSETA. By supporting local skills development and production capacity, we create economic opportunities while addressing national challenges headon. That’s how we turn policy into progress.

www.ewseta.org.za

The Energy sector is in a dynamic transition that is constantly evolving, continuous learning is your key to sustainable growth and unrivaled success. Whether you’re already a qualified professional or aspiring to be one, keeping your skills up to date is non-negotiable.

Join the ranks of industry trailblazers by embracing the latest advancements, trends, and best practices that drive the energy and water sector forward.

IGNITE YOUR EXPERTISE, ELEVATE YOUR JOB PERFORMANCE, AND LEAD THE PACK!

WITHIN THE SECTOR WE SERVE, EWSETA

• Registers and establishes learning programmes

• Approve WSPs and ATRs

• Disburses mandatory and discretionary grants

• Monitors and quality assures education and training

• Promotes learnerships, internships, apprenticeships and other training programmes

To meet the pressing skills development needs of the energy and water sector requires co-operation and input from all sector role players. We encourage employers in the sector to be part of the solution.

22 Wellington Road Parktown, Johannesburg South Africa

011 274-4700

info@ewseta.org.za

The mining industry, historically regarded as a male-dominated sector, is undergoing a profound transformation. Traditionally defined by physical labour and a legacy of exclusion, the industry is now embracing a new narrative – one of collaboration, diversity and inclusion. Central to this shift is the role of male allies, who are stepping up as advocates for change.

By Sisi Mahobe, General Manager of Human Resources at Glencore

In South Africa, where mining plays a pivotal role in economic growth, this evolution has far-reaching implications. At Glencore, men are championing gender inclusion through deliberate action, challenging the

status quo, and fostering environments where women can thrive. These efforts signal a broader industry-wide recognition that true progress is achieved when men and women work together toward shared goals.

“Allyship requires vigilance. It’s about speaking up and ensuring inclusive practices become the norm.”

This growing allyship within mining is not merely symbolic but deeply intentional. Leaders like Sakhile Hlatshwayo, Astron Energy’s Area Manager for Logistics, view allyship as a commitment to partnership built on equality and respect. Drawing inspiration from Maya Angelou’s timeless wisdom, Sakhile advocates for creating workplaces where women feel valued and empowered. His approach underscores a critical aspect of allyship: ensuring women feel safe and supported in every sphere of their professional lives.

Similarly, Lakmal Korathota, Head of Projects for Africa Business at Lion Smelter, emphasises the importance of purposeful action. “It’s about engaging with existing frameworks and actively pushing for the changes we need,” he says. His perspective highlights the need for allyship to extend beyond compliance, driving systemic change that embeds inclusion into the fabric of organisational culture.

Awareness and accountability are equally vital. Paulo Barros, Financial Director at Glencore, underscores the responsibility men have to identify and address behaviours that undermine inclusion. “Allyship requires vigilance,” he explains. “It’s about speaking up and ensuring inclusive practices become the norm.” This level of commitment reinforces workplaces where diversity is celebrated, and every individual feels a sense of belonging.

Allyship also extends beyond the boardroom. For Ivo Rodrigues, Senior HR Business Partner at Eastern Chrome Mines, fostering inclusion begins at home. By living these values personally, men can create environments where respect and openness become second nature – helping to build a more inclusive society and workplace.

This collective effort from male allies is reshaping the mining industry, dismantling barriers, and creating pathways for women to excel. It is a testament to the power of collaboration, proving that inclusion is not a one-time initiative but a sustained commitment to progress.

As South Africa’s mining sector continues to evolve, the challenge lies in maintaining this momentum. For businesses across the industry, allyship must move beyond being a buzzword and become a cornerstone of organisational strategy. By embedding inclusion into their operations, companies can position themselves not only as ethical leaders but also as drivers of sustainable growth in a competitive global market.

The mining industry stands at a crossroads, with allyship paving the way toward a more equitable future. With deliberate action and shared responsibility, South Africa’s mining sector can lead the charge, demonstrating that inclusion is not just good for business –it’s essential for building a thriving economy and society.

Glencore is one of the world’s largest global diversified natural resource companies and a major producer and marketer of more than 60 responsibly sourced commodities that advance everyday life.

Through a network of assets, customers and suppliers that spans the globe, we produce, process, recycle, source, market and distribute the commodities that enable decarbonisation while meeting the energy needs of today.

With a strong footprint in over 35 countries in both established and emerging regions for natural resources, Glencore’s industrial activities are supported by a global network of more than 30 marketing offices. Glencore’s customers are industrial consumers, such as those in the automotive, steel, power generation, battery manufacturing and oil sectors.

We also provide financing, logistics and other services to producers and consumers of commodities. Glencore’s companies employ around 135 000 people, including contractors.

Glencore is proud to be a member of the Voluntary Principles on Security and Human Rights and the International Council on Mining and Metals. We are an active participant in the Extractive Industries Transparency Initiative.

Glencore recognises our responsibility to contribute to the global effort to achieve the goals of the Paris Agreement. Our ambition is to be a net-zero total emissions company by 2050. In August 2021, we increased our medium-term emission reduction target to a 50% reduction by 2035 and introduced a new short-term target of a 15% reduction by 2026.

The integration of artificial intelligence (AI) in geoscience is revolutionising the way we interpret and understand the Earth’s complex processes. What role do you think AI will play in shaping the future of the industry?

By Dr David Khoza, Technical Director, Integrated Geoscience Solutions

"There are, however, challenges with the application of AI."

The advent of sophisticated technologies, such as artificial intelligence (AI), has brought with them interesting applications across a wide range of sectors, not least in the mineral exploration and mining value chain. Geoscience data forms the backbone of mineral discovery and mining, and at the heart of it, the use of these data is primarily for risk reduction.

The context is therefore as follows:

(1) There is a fundamental global shortage of new mineral discoveries to support the energy transition. Without the raw materials derived from mining, there is simply no development of the technologies needed to respond to the energy and climate challenge. (2) The extraction of existing resources by mining is getting more challenging, as mineral deposits are getting deeper. (3) The current generation of data is beginning to outstrip our capacity to extract value from it.

The role of AI in mineral exploration

In mineral exploration, as an increasing large amount of data is collected at all scales (i.e., form surface to depths of tens of kilometres), AI has begun to contribute to locating new mineral discoveries through automation. There is now automated drilling, sampling, analysis, and interpretation of the data at a much faster pace. AI and its subsets (e.g., machine learning and deep learning) are now being used in the classification of geoscience data, such as drill-core data) in order to remove subjectivity from interpretation.

The exploration of new mineral deposits almost always involves the use of multiple datasets measuring different physical properties. These datasets must be integrated and interpreted to extract knowledge of resource quality, quantity, and geometry. The use of AI tools, such as machine learning in analysing these large datasets to identify and predict where new deposits could be located, is becoming more common. This, in turn, leads to derisking exploration projects and optimally allocating resources by reducing the exploration search space.

The most fundamental challenge in modern mining is safety, particularly as mines become deeper. AI-driven automated processes, such as rock-bolting, are now routinely employed in mining environments to virtually eliminate the risk of human presence in new mining areas with unstable ground.

Improvements in mining recoveries have also been enhanced by AI, including the optimisation of geometallurgy processes, the deployment of real-time

Addressing these fundamental challenges therefore requires new technologies, and this is where AI becomes a useful tool. AI is now routinely employed across the exploration and mining value chain, from finding deposits to mining and extraction, mineral processing, beneficiation, geometallurgy, and mine closure.

monitoring tools to provide up-to-date information on equipment performance, and the provision of advanced knowledge on equipment maintenance schedules. All of this is AI-driven to improve production.

Beyond the life of a mine, AI technologies are now used in environmental monitoring, including groundwater monitoring and surface land degradation around the mining site, using satellite-based information. This provides up-to-date information on whether the conservation measures employed during mine closure are optimal and allows for predictive capabilities to be invoked at any point in time.

There are, however, challenges with the application of AI. Firstly, AI is not a panacea to solving all the challenges we face. It is still a tool that depends heavily on data input. The old adage “garbage-in, garbage-out” applies here. If the AI model is fed incorrect information, the results will be incorrect. The risk is therefore in the mistaken belief that AI adoption will solve all problems. This is highly dependent on the quality of data being provided.

AI is also challenged where there is lack of data. Since most AI techniques rely on interpolation algorithms at their core, they will produce incorrect models when data scarce. In many instances, particularly in exploration, one generally has to work with sparse data.

WE’RE COMMITTED TO MAKING MINING SAFER, SMARTER AND GREENER WITH MARKET-LEADING TECHNOLOGY.

Probe IMT (Integrated Mining Technologies) provides exceptional productivity and safety solutions across Africa. For years, we’ve partnered with innovative global solution providers and industry leaders to address the unique challenges of mining environments.

Probe IMT (Integrated Mining Technologies) provides exceptional productivity and safety solutions across Africa. For years, we’ve partnered with innovative global solution providers and industry leaders to address the unique challenges of mining environments.

Leveraging the potential of Internet of Things (loT), big data and cloud computing, our comprehensive suite of Integrated Mining Solutions is designed to optimise performance across all aspects of mining operations. Discover how our forward-thinking solutions can transform your safety protocols, minimise downtime, and ensure regulatory compliance while maintaining operational excellence.

Leveraging the potential of Internet of Things (loT), big data and cloud computing, our comprehensive suite of Integrated Mining Solutions is designed to optimise performance across all aspects of mining operations. Discover how our forward-thinking solutions can transform your safety protocols, minimise downtime, and ensure regulatory compliance while maintaining operational excellence.

We are a proud Broad-Based Black Economic Empowerment (B-BBEE) Level 3 contributor and maintain our SANAS-approved ISO 9001 and ISO 45001 accreditations.

We are a proud Broad-Based Black Economic Empowerment (B-BBEE) Level 3 contributor and maintain our SANAS-approved ISO 9001 and ISO 45001 accreditations.

Partner with Probe IMT - your path to safer, smarter, and more sustainable mining.

For nearly 150 years, mining has been a cornerstone of South Africa’s economy, contributing approximately 7.5% to the GDP and around 60% of the country’s total exports. However, this vital sector now faces a formidable adversary: illegal mining.

By NSDV’s Dominic Varrie, Candidate Attorney and Mandy Hattingh, Legal Practitioner

The rise of illegal mining, driven by so-called Zama Zamas, has caused significant economic, environmental, and social disruptions. Operating outside the law, illegal miners have evolved into a complex challenge, eroding the stability of legal mining operations and jeopardising the livelihoods of affected communities.

In 2024, illegal mining was estimated to cost South Africa more than R70 billion annually in lost revenue, taxes, and royalties, particularly in the gold sector. This figure marks a sharp rise from previous estimates, underscoring the growing scale of the problem. The losses stem not only from the direct theft of minerals, but also from the damage to mining infrastructure, escalating security risks, and undermining investor confidence in the sector. This financial drain compromises both the integrity of legal mining and South Africa’s crucial revenue streams. As illegal mining intensifies, it is evident that regulatory measures alone will not suffice to protect the sector’s future.

For formal mining companies, illegal mining represents a significant threat. Many companies are forced to invest heavily in security, replace stolen equipment, or repair damage from sabotage. It is estimated that mining companies lose around R7 billion annually due to illegal mining. These financial burdens undermine profitability, hamper operations, and discourage investment.

Alarmingly, illegal mining incidents are on the rise. SibanyeStillwater, for example, reported a 241% increase in illegal mining incidents in the first quarter of 2024 compared to the previous year, with 581 cases and 247 arrests. These disruptions, along with escalating security costs, drive up operational expenses, reduce profitability, and make the sector less attractive to investors. This escalating instability limits activities such as exploration, development, and expansion, stunting sector growth.

The effects of illegal mining extend far beyond the mine shafts, deeply disrupting local communities. Affected areas often see a sharp increase in violence and criminal activities, fuelled by syndicates controlling these operations. The presence of illegal miners correlates with rising gang violence, human trafficking and prostitution, further destabilising already vulnerable regions. In some cases, syndicates form alliances with local officials and law enforcement, fostering a culture of dependency on the illicit economy. As a result, these communities become not only unsafe, but increasingly dependent on underground economies, fostering social decay.

Illegal miners face perilous working conditions, often driven by economic desperation. Operating in abandoned shafts with inadequate protective gear, many miners suffer frequent accidents and fatalities. In 2023, two incidents resulted in the deaths of 51 miners: one following a fire in an unused mine in Orkney, North West Province, and the other due to a gas explosion in an abandoned mine in Welkom, Free State Province. These miners, often migrants from neighbouring countries, work in exploitative conditions under the control of criminal syndicates.

The risks are further heightened by the use of hazardous chemicals, such as mercury and cyanide, to extract minerals, exposing miners to severe health hazards. Illegal mining strips these workers of their dignity and places their lives in constant jeopardy.

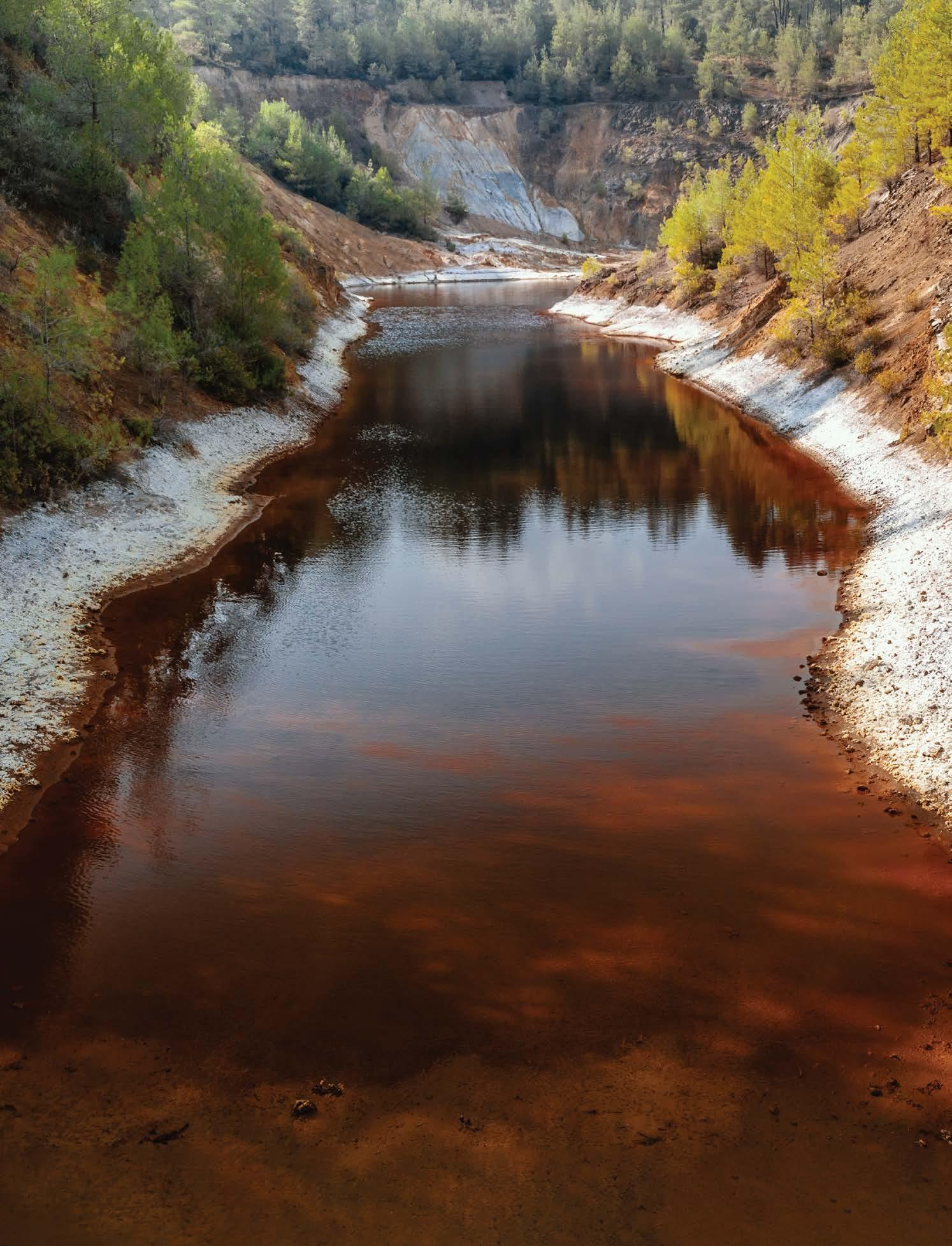

Illegal mining also takes a heavy toll on the environment, leaving long-lasting scars. Frequently disregarding environmental laws, illegal mining causes severe contamination of water sources and damage to ecosystems. The use of mercury and cyanide in gold extraction, for instance, poses substantial risks to both human health and the environment. Additionally, illegal mining contributes to soil erosion, deforestation, and the formation of sinkholes, while the lack of rehabilitation exacerbates the damage. This environmental degradation compromises the land’s potential for future use, such as agriculture.

Prevention mechanisms

• Deploying police and military forces

The South African government has deployed police and military forces in efforts to combat illegal mining. Operation Prosper, launched in October 2023, saw 3 300 SANDF personnel and SAPS officers tackle illegal mining hotspots like Van Ryan. While the operation temporarily removed 6 500 illegal miners from these sites, the return of illegal mining shortly after the military’s withdrawal in April 2024 highlighted the need for sustainable, long-term interventions.

Despite these setbacks, other operations like Vala Umgodi in Mpumalanga have yielded successes, with over 300 arrests and large quantities of illegal mining equipment confiscated since March 2024. However, these efforts must be complemented by more comprehensive and sustainable solutions, as criminal syndicates remain highly organised.

• Private sector prevention

Mining companies have significantly boosted investments in security and community engagement to combat illegal mining. Technologies like drones, thermal cameras, and radar systems are increasingly used to monitor and detect illegal activities. Some companies have also adopted AI-based solutions to track patterns and prevent unauthorized access over large areas.

In addition to security, many companies are implementing community-focused initiatives, collaborating with local authorities to address the underlying drivers of illegal mining. These initiatives provide alternative sources of income, educational opportunities, and employment to reduce the economic desperation that fuels illegal mining.

• Legislative and policy initiatives

Tackling illegal mining in South Africa demands a comprehensive overhaul of the regulatory framework, especially for Artisanal and Small-Scale Mining (ASM). High barriers to entry, such as complex licensing processes and steep costs, push many ASM operators into illegal activity. By formalising ASM operations, South Africa can provide a legal pathway for miners, fostering compliance with environmental and safety standards, while curbing illegal mining.

International examples, such as Ghana’s simplified licensing system and Tanzania’s support for ASM operations, provide valuable lessons. In both countries, formalising ASM brought miners into the formal economy, enhancing safety, and environmental protections.

For South Africa, a balanced approach that includes regulatory reforms, international best practices, and stricter enforcement is essential. Importantly, any formalisation efforts must ensure environmental sustainability and be inclusive of all stakeholders, including foreign nationals, to have a meaningful impact.

Although short-term successes like Operation Prosper show that progress is possible, the resurgence of illegal mining once military forces withdrew demonstrates the need for long-term solutions. A comprehensive strategy, focusing on the formalisation of ASM, enhanced regulatory oversight, and greater community involvement, is key to addressing the root causes of illegal mining. By learning from successful models across Africa, South Africa can mitigate the impacts of illegal mining, reduce environmental harm, and improve safety for miners and communities. Ultimately, a collaborative approach that integrates law enforcement, policy reform, and community engagement will be crucial for the future sustainability of South Africa’s mining sector.

In 2024, illegal mining was estimated to cost South Africa more than R70 billion annually in lost revenue, taxes, and royalties, particularly in the gold sector.”

REFERENCES:

1. https://www.gov.za/news/speeches/president-cyril-ramaphosainvesting-african-mining-indaba-05-feb-2024

2. https://www.gov.za/blog/illegal-mining

3. https://miningfocusafrica.com/2024/09/18/illegal-mining-threatenssouth-africas-economy/ https://www.miningmx.com/news/ gold/57919-south-africas-illegal-gold-mining-is-surging-again/

4. https://www.gov.za/blog/illegal-mining

5. https://www.aljazeera.com/news/2023/11/9/south-africa-turns-toarmy-in-nationwide-clampdown-on-illegal-mining

6. https://www.iol.co.za/news/politics/opinion/illegal-mining-canhave-devastating-impact-on-ecosystems-fea5978f-0559-4652a87f-a2b3a55948de#:~:text=Besides%20the%20risks%20to%20 human,for%20the%20leaching%20of%20gold.

7. https://www.citizen.co.za/lowvelder/news-headlines/localnews/2024/05/16/operation-vala-umgodi-sees-over-100-arrests-ofalleged-illegal-miners-in-mpumalanga/

As Group Director of Torque Africa Group, Nardus Bezuidenhout brings a wealth of experience, visionary leadership, and a deep commitment to innovation and sustainability in the drilling industry.

NARDUS BEZUIDENHOUT | DIRECTOR: TORQUE AFRICA GROUP

Hailing from Reivilo in the Northern Cape, his journey from learning the intricacies of resource management alongside his father to leading a dynamic organisation is both inspiring and insightful. In this Q&A, Bezuidenhout shares his perspectives on leadership, industry evolution, and the strategies driving Torque Africa Group’s success.

Can you share some key experiences from your career that have shaped your leadership style and contributed to your success at Torque Africa Group?

Growing up in a small town in the Northern Cape instilled in me a deep sense of community and resourcefulness. My early exposure to the water industry, learning alongside my father as a water diviner, gave me practical insights into the challenges of resource management. Later, my technical education and experience of living at boarding school instilled in me self-discipline and honed my problem-solving skills. These experiences have shaped my leadership style, emphasising adaptability, clear communication, and empowering my team.

How have you seen the drilling industry evolve over the past two decades, and what key trends do you anticipate will shape its future?

The drilling industry has transformed significantly in the past 20 years. Advancements in drilling technology, from more efficient rigs to real-time data collection tools, have improved precision and productivity. Safety standards have also become more stringent, reflecting a global shift towards worker welfare and operational excellence. Looking ahead, the industry will be shaped by trends such as automation, digital monitoring systems, and a greater emphasis on sustainable practices. Companies will need to embrace renewable energy solutions and explore alternative drilling techniques to remain competitive in a market increasingly driven by environmental considerations and regulatory compliance.

What role do you believe technological innovations will play in the drilling sector, and how is the company adapting to these changes? Traditional manual operations have evolved into highly mechanised and automated processes, improving efficiency and safety. The rise of data-driven decision-

making has also enhanced precision in exploration and drilling. I anticipate further integration of artificial intelligence (AI) and robotics, the development of renewable energy drilling technologies, and increased adoption of green practices. Additionally, the industry is likely to see a stronger focus on resource optimisation and circular economy principles to minimise waste and maximise value.

With the growing emphasis on sustainability, how is the company integrating environmentally friendly practices into its operations?

Sustainability is a key pillar of the company’s operational strategy. We have implemented eco-friendly practices, such as using biodegradable drilling fluids, reducing water waste, and adopting energy-efficient equipment. Additionally, we ensure that our projects include comprehensive site rehabilitation plans to minimise environmental impact. We are also actively engaging in renewable energy projects, which contribute to broader sustainability goals. Our focus on aligning with global environmental standards ensures that we meet the needs of clients while safeguarding the ecosystems where we operate, reflecting our commitment to responsible and forward-thinking business practices.

What are the biggest challenges currently facing the drilling industry in South Africa, and how can companies position themselves to overcome these challenges?

The South African drilling industry confronts numerous challenges, such as economic instability, regulatory obstacles, and infrastructural limitations. Furthermore, water scarcity and environmental considerations frequently complicate project implementation. To address these challenges, companies should adopt a proactive strategy by diversifying their services, investing in technology to improve efficiency, and cultivating strong relationships with stakeholders to effectively manage regulatory demands. Torque Africa Group has established itself as an industry leader by prioritising innovation, sustainability, and the development of a skilled workforce, thereby ensuring resilience and adaptability within this demanding market.

Given the skills shortage in technical fields, what strategies is the company incorporating to attract and retain top talent in the industry? The skills shortage is a significant challenge, but it

also presents an opportunity to innovate in workforce development. At Torque Africa Group, we focus on building talent pipelines through in-house training programmes and apprenticeships. We provide clear career progression paths recognising the importance of workplace culture, we foster inclusivity and ensure employees feel valued and motivated. Additionally, we leverage technology and digital platforms to upskill our teams, enabling them to adapt to evolving industry demands. Our people are our most valuable asset, and their growth directly contributes to our success.

How is Torque Africa Group embracing digital transformation, and what technologies do you believe will be game-changers for the drilling industry in South Africa?

We are implementing advanced, specialised programmes for project management, customised maintenance schedules, and data analytics to improve our operational efficiency. Cloud-based platforms facilitate seamless communication and data sharing, fostering enhanced collaboration among our teams and across various sites. I am confident that technologies such as AI-driven predictive tools and advanced geotechnical imaging systems will significantly benefit the South African drilling industry.

What is your vision for Torque Africa Group over the next five years, and how do you plan to navigate the drilling industry’s evolving landscape?

My vision for Torque Africa Group is to be the leading provider of sustainable, innovative drilling solutions in Africa. Over the next five years, we aim to expand our service offerings, explore new markets, and strengthen our position as an industry leader. This includes investing in cutting-edge technology, deepening our commitment to sustainability, and fostering strategic partnerships. Navigating the evolving landscape requires agility and a client-centric approach. By prioritising employee development, embracing innovation, and maintaining operational excellence, we are wellpositioned to achieve our goals and make a lasting impact in the industry.

www.torque-africa.co.za

Even as the global mining industry faces increasing pressure to adopt sustainable practices and meet zero-emissions targets by 2050, it has also been tasked with improving health and safety standards. Amidst these challenges, there is one key solution that is often overlooked: prefabrication.

By Erik de Jongh, Engineering Lead at TDS Projects Group

Notably, prefabrication involves the construction of key components in controlled environments, where quality control is stricter, and risks can be managed with greater precision. This reduces the need for extensive on-site construction work, while lowering the likelihood of accidents and project delays. This further means that mining companies, which often operate in unpredictable environments, can significantly streamline their processes, cut down on waste, and limit workers’ exposure to hazardous on-site conditions.

Likewise, by manufacturing components off-site in controlled environments, prefabrication minimises onsite construction risks, accelerates project timelines, and reduces material waste. So, while not a new concept, prefabrication and modular design practices have rapidly gained in popularity in recent years.

Efficiency, safety, and sustainability

Additionally, off-site workshops offer access to essential equipment like cranes and other tools that may not be

readily available on-site, particularly in mines. And, by fabricating off-site, prefabrication companies like TDS Projects effectively sidestep the challenges of piecing together complex structures in high-risk areas, minimising uncertainties and controlling variables. This circumvents enormous logistical difficulties, especially in underground operations where space is limited and extra modifications may be expected, while leaving little room for accidents to happen.

Furthermore, combining prefabrication practices with modular designs makes the transportation and assembly of components much easier, decreasing the time workers spend underground and minimising disruption to ongoing operations. This approach therefore supports higher safety standards while ensuring continuity and maximising productivity.

Moreover, pre-assembling components substantially reduces material waste, as offcuts and excess material can be managed more efficiently in a controlled factory

environment. As a result, this approach helps mining companies reduce both costs and their environmental footprint, directly impacting long-term profitability and bottom lines.

However, underground mining operations present some unique challenges, particularly when transporting large, prefabricated components. Where this task may not be much of an issue for above-surface operations, it becomes infinitely more complex when conducted deep beneath the Earth’s surface, as modules must fit through tunnels, shafts, and other narrow spaces which are typically no wider than six metres at most.

The key is designing prefabricated modules in a series of manageable sections, usually around three or four metres in length, that can be easily transported and assembled in confined spaces. For instance, TDS Projects often builds conveyor system components like stringer and gantry sections that can be utilised underground.

Another invaluable addition to restrictive underground mining operational areas is the use of modern prefabricated containerised motor control centres (MCCs) that play a critical role in managing and distributing power efficiently to operate electrical equipment on site. These MCCs are designed in compact, modular sections, which allows them to be easily transported through narrow underground shafts and tunnels. They can also be swiftly assembled and connected, reducing the need for extensive on-site work and ensuring minimal disruption to operations.

One such MCC option that TDS often recommends is the E-House Containerised IP65 enclosure with either top or bottom entry. With air-conditioning, pressurisation, and two-hour fire rating and suppression systems,

these containers are less vulnerable to dust, humidity, and water exposure. The containers are also easily configurable to meet specific requirements and have the added benefit of significantly reducing maintenance frequency and complexity.

Modular prefabrication further allows for meticulous planning of each stage of the production and installation process. Instead of attempting to work around site limitations or modifying parts in a hazardous environment, the controlled workshop environment offers greater flexibility and precision. Every detail of the components can be tested and verified before the parts are moved to their destination, ensuring seamless assembly on-site. This approach also cuts down on unexpected modifications, which are both timeconsuming and potentially dangerous in an underground setting.

But ensuring quality design and construction under such strict limitations is no easy task, which is why prefabrication solutions providers have become such essential partners to the mining sector in recent years. Their highly qualified and experienced engineers and tradespeople are helping mining companies achieve their environmental, health, and safety goals, while streamlining operations and improving profitability.

The benefits of prefabrication in mining

Health and safety:

Environmental sustainability:

Cost savings:

• Reduced on-site construction risks

• Less likelihood of accidents and project delays

• Limited worker exposure to hazardous conditions

• Reduced material waste through efficient off-site construction

• Minimised disruption to ongoing operations

• Smaller environmental footprint

• Streamlined processes through modular design

• Faster project timelines

• Improved productivity

• Reduced material waste and offcuts

• Lower maintenance frequency and complexity

• Higher long-term profitability

Additional advantages:

• Enhanced quality control in controlled environments

• Access to specialised equipment and tools

• Increased flexibility and precision in production and installation

South Africa’s economic growth hinges on mining sector reforms and infrastructure investment, says Minerals Council. With GDP growth projected at 1.8%, can the government’s plans for regulatory reforms, infrastructure development, and private sector participation unlock the sector’s full potential and drive job creation, investment, and export revenue?

As South Africa embarks on a new year, the Minerals Council South Africa reflects on the country’s economic outlook as it prepares for the upcoming Budget Speech. Projections suggest real GDP growth will average 1.8% between 2025 and 2027, surpassing the IMF’s forecast of 1.5%. This revised outlook is driven by improvements in power supply and a boost in business, consumer, and investor confidence under the Government of National Unity (GNU). However, the Minerals Council cautions that sustained growth over 2% is essential for long-term fiscal health, requiring critical structural reforms across multiple sectors, particularly mining.

Mining sector faces challenges amid positive outlook

While the Medium Term Budget Policy Statement (MTBPS) highlights positive developments in the mining sector, challenges remain. The poor performance of Transnet’s rail and port infrastructure,

coupled with regulatory bottlenecks and security issues, continues to limit mining production growth, which still lags behind pre-Covid-19 levels. While electricity supply improvements have provided some relief, these ongoing issues are preventing the sector from reaching its full potential.

One significant risk looming over the mining sector and broader economy is Eskom’s request for a 36% increase in electricity tariffs for 2025. National Treasury’s more conservative estimate of a 12.3% increase in the electricity CPI component offers some hope, but should Eskom’s tariff increase be approved, it could drive inflation higher and undermine growth.

The MTBPS also outlines important structural reforms that will shape the future of the mining sector. A key reform is the planned split of the Department of Mineral Resources and Energy (DMRE) into two separate departments by April 2025, which is expected to create a more focused Department of Mineral and Petroleum Resources. This is seen as a positive step toward addressing the mining sector’s unique challenges more effectively.

The MTBPS also emphasises the need for continued reforms in the logistics sector, particularly in Transnet. While the government remains opposed to further financial bailouts for Transnet, there is a clear call for the state-owned entity to improve its balance sheet, streamline operations, and explore alternative funding methods like joint ventures and project finance.

A highlight of the MTBPS is the government’s focus on increasing public infrastructure investment, which the Minerals Council sees as crucial for the mining sector. These investments will not only lower business costs for the mining industry but also stimulate demand for mining-related building materials, benefiting other sectors like agriculture and manufacturing. The government has committed to scaling up private sector participation in infrastructure projects and introducing innovative financing mechanisms such as infrastructure bonds.

“If these initiatives succeed, we could see a significant boost to growth, investment, and job creation, particularly in sectors like mining that rely heavily on infrastructure,” says Hugo Pienaar, chief economist at the Minerals Council.

As South Africa prepares for the 2025 Budget Speech, the MTBPS also highlights the country’s precarious fiscal situation. The country’s gross debt is projected to peak at 75.5% of GDP in 2025/26, higher than previous projections, largely due to lower-than-expected revenue and increased spending. Despite efforts to achieve primary budget surpluses, the debt ratio is expected to remain elevated over the medium term.

The government’s fiscal challenges underscore the importance of maintaining a balanced approach to spending, particularly as it prepares for the 2025 Budget Speech. This speech will likely provide more clarity on fiscal anchors, as well as potential adjustments to the South African Reserve Bank’s inflation targets. Treasury anticipates that headline CPI inflation will average 4.5% over the next three years, setting the stage for further fiscal decisions.

Looking ahead: mining’s role in South Africa’s economic future

The mining sector remains a critical pillar of South Africa’s economic recovery and growth. The MTBPS has laid out a roadmap for infrastructure and regulatory reforms that could help unlock the sector’s full potential, driving job creation, investment, and export revenue. However, achieving sustained growth in the mining sector will require continued focus on addressing structural challenges and securing necessary investments in infrastructure.

In conclusion, while South Africa faces significant fiscal and economic challenges, the government’s focus on infrastructure investment and mining sector reforms offers hope for a more robust economic outlook as the country prepares for the 2025 Budget Speech and the years ahead.

industry. Severely deteriorated sections have created unsafe driving conditions, characterized by corrugation, embedded stones, and loose material. These factors generate excessive dust emissions, reducing visibility and compromising road safety for those traveling to and from key mining areas.

This situation has not only heightened the risk of accidents but also imposed financial burdens on road users due to increased vehicle maintenance costs and fuel consumption. Additionally, delays caused by poor road conditions disrupt the free movement of both light vehicles and heavy delivery trucks, negatively affecting local economic activity. With the reliance on road transport for mineral logistics due to an unreliable railway network, the urgency of addressing this issue could not be overstated. measures to maintain a critical stretch of road until such time as a permanent solution could be implemented.

Following rigorous testing and approval processes, DASBio demonstrated superior performance, significantly improving road conditions and safety. DASBio, a premium emulsified bitumen-lignosulphonate-based binder was chosen to effectively bind and seal the road’s surface against wind and water erosion, as well as dust emissions caused by traffic

Dust-A-Side’s implementation strategy included systematic establishment and maintenance protocols each day on a predetermined stretch of road, involving defect correction, blade mixing, compaction, and sealing. Maintenance activities were scheduled on weekends, with adjustments made for weather conditions such as rainfall. The project team executed the project with minimal traffic disruptions, thanks to the presence of clear signage and well-trained traffic management personnel. The results have been transformative.

OPEN CAST MINING & QUARRIES

- Permanent Haul Roads

- Non-Permanent Haul Roads

- Community and Bypass roads

- Road monitoring and quantification

- Dust Monitoring

UNDERGROUND MINING

- Haul Roads

- Dust Suppression Systems

MINE PLANT & PROCESSING

- Dust Suppression Systems

- Fog Cannon Technology

- Stockpile Sealing

Dust-free roads have enhanced visibility, reduced commuting times, and improved morale among road users. Many commuters have reported safer journeys and significant time savings. Furthermore, the project’s success has underscored the importance of innovative approaches to road management in mining regions, setting a precedent for future initiatives.

This collaborative effort between the mine and Dust-A-Side Kalahari has not only addressed immediate safety concerns but also demonstrated a commitment to sustainable community development and environmental stewardship. The Northern Cape’s mining and transport sectors can look to this project as a benchmark for balancing operational efficiency with the well-being of local communities.

Indigenous people and mining communities at the heart of 2025

Mining Indaba

Mining Indaba, the premier platform for deal-making, investment and corporate networking for African mining for over 30 years, has announced its 2025 agenda, which will place the voices of Indigenous peoples and communities at the forefront of the conference. The focus of Investing in Mining Indaba 2025 underscores the event’s commitment to future-proofing African communities by prioritising the experiences of those directly impacted by mining.

Indigenous peoples and mining communities take centre stage

Taking place from 3 to 6 February 2025 at the Cape Town International Convention Centre (CTICC 1 & 2), the event continues to be the most comprehensive platform for mining investment, finance, and innovation in Africa.

“The meaningful integration and collaboration with mining communities and Indigenous people are essential to shaping the future of mining,” says Laura Nicholson, Head of Content & Strategic Partnerships for Mining Indaba.

“Those living closest to mining projects are vitally important stakeholders, and essential partners in building a sustainable, equitable mining industry,” adds Nicholson. “This year, for the first time at Mining Indaba, representatives of mining communities and indigenous groups will take part in key sessions right across the fourday event, providing their own perspectives on main event themes.”

While the interests of mining communities and indigenous groups intersect, the two groups have distinct characteristics. Indigenous peoples have historical and ancestral connections to the land they live on. They have an inherent, pre-existing tie to the land. In contrast, mining communities are formed as a result of mining activity and are made up of people who work and live on and around the mine, including migrant labourers and people who move to the area to find opportunities around the mine.

The meaningful integration and collaboration with mining communities and indigenous people are essential to shaping the future of mining.”

As an industry-leading event, Mining Indaba 2025 will foster meaningful community engagement between organisers, strategic stakeholders, and mining community representatives, facilitating constructive dialogue and problem-solving around communityrelated issues. “We look forward to direct engagement through Mining Indaba sessions and networking opportunities between mining communities, Indigenous peoples, industry, and government,” says Nicholson.

To build momentum ahead of the event, there will be a video competition in partnership with The Impact Facility, a social enterprise that actively supports artisanal mining communities in the East African gold sector and Congolese Copper-Cobalt belt. “Together, we are inviting mining community members, representatives of Indigenous peoples in mining areas, civil society organisations, activists, and visionaries to share their perspectives on building an equitable, inclusive and responsible mining sector that can transform mineral wealth into lasting, multi-generational prosperity,” says David Sturmes-Verbeek, co-founder and director of partnerships and innovation at The Impact Facility.

“We are inviting video submissions from mining community representatives and Indigenous people, outlining what it means to them to future-proof mining operations where they live,” Sturmes-Verbeek continues. “The competition is a tangible example of Mining Indaba’s commitment to inclusion, and will help stakeholders understand what needs to change to ensure mining communities thrive and co-exist with local mining operations.”

Videos entered in the competition will be featured at the Cape Town event, and the creators of the most compelling submissions will be offered free access to Mining Indaba. The producers of the best videos will also be considered for speaking engagements at the event.

The theme for the video competition is “What does Future-proofing African Mining mean for your community?”.

“We’re excited to be integrating Indigenous people and mining communities directly into the main programme of Mining Indaba 2025,” says Nicholson. “As major stakeholders, they have a massive role to play in shaping the mining ecosystem, its infrastructure and its relationships. They’re also key to future-proofing the sector as a whole.”

Investing in African Mining Indaba 2025 runs from 3 to 6 February 2025, at the Cape Town International Convention Centre (CTICC 1 & 2). The event remains the most comprehensive platform for mining investment, finance, and innovation in Africa.

The mining industry is undergoing a green revolution, with hydrogen emerging as a powerful solution to decarbonise operations and unlock new economic opportunities. As the industry embraces this clean fuel, key case studies, cost analyses, and next steps highlight the potential and challenges of adopting hydrogen in mining.

By Anneline Sonpal, Partner, Singular Group

Mining is a significant carbon emitter, but green hydrogen offers a game-changing solution. Replacing diesel with hydrogen can reduce emissions, as seen in Anglo American’s hydrogen-powered haul truck, which could cut diesel emissions by 80%.

Hydrogen refuelling is also faster than battery charging, making it operationally efficient. As global hydrogen demand is set to surge, mining can play a key role in adopting hydrogen technologies to decarbonise hard-to-abate sectors.

South Africa: The low-cost hydrogen leader

South Africa has a competitive edge in green hydrogen production due to its strong renewable energy resources and established infrastructure. Africa’s low-cost energy potential, driven by its high renewable energy endowments, offers a significant advantage.

South Africa can produce green hydrogen at $2-$2.4/kg, below the global average. The hydrogen economy is expected to contribute 3.6% to South Africa’s GDP and create over 370 000 jobs by 2050.

Key advantages for South Africa include:

• Proximity to renewable energy: Mines near solar and wind resources can produce hydrogen at low costs.

• Infrastructure readiness: Existing rail, road, and freight systems support hydrogen distribution locally and internationally.

• Export potential: Africa could export 20-40 Mt of hydrogen and its derivatives annually by 2050, meeting 22% of global crossborder trade demand.

Miners are uniquely positioned to adopt hydrogen due to their operational advantages:

• Mines are well-positioned for hydrogen production due to access to renewable energy and land.

• Hydrogen-powered mining haul trucks offer advantages, including centralised refuelling and faster refuelling times.

• Decarbonising mining with green hydrogen can significantly reduce emissions and ensure African minerals remain competitive.

• Developed the world’s largest hydrogen-powered haul truck at the Mogalakwena mine.

• Achieved an 80% reduction in diesel emissions with on-site hydrogen production powered by a 140-megawatt solar plant.

• Launched the $50 million Green Metal Project to produce 1 500 tonnes of green iron annually by 2025.

• Established a hydrogen refuelling station producing 530 kilograms daily to power 10 hydrogen-fuelled coaches.

• Faced delays in meeting its 2030 target for producing 15 million tonnes of hydrogen due to rising energy prices and geopolitical instability.

While the potential is enormous, miners face significant challenges:

• Achieving Africa’s green hydrogen ambitions requires significant investment, estimated at $450-900 billion by 2050. Approximately 70% of this investment would fund renewable energy and electrolyser capacity building, with foreign direct investment playing a crucial role.

• Reliable renewable energy infrastructure, electrolyser facilities, and hydrogen distribution networks, including pipelines and ports, are critical for scaling hydrogen in mining.

• While hydrogen is expected to reach cost parity with fossil fuels by 2030, miners must navigate current economic uncertainties.

To harness the full potential of hydrogen, miners must take a proactive approach:

• Analyse the costs and benefits of hydrogen projects to justify investments.

• Collaborate with partners in infrastructure, energy, and capital to create a supportive ecosystem.

• Explore opportunities for hydrogen exportation, oxygen sales (a by-product of hydrogen production), and domestic clean energy supply.

• Position operations to benefit from the emerging hydrogen economy by aligning with global decarbonisation efforts.

Unlocking Africa’s hydrogen potential

Africa holds immense promise for renewable hydrogen production. However, many regions lack reliable power supply, making renewable energy development crucial. With a strong infrastructure base, Africa could meet domestic clean energy needs and become a major green hydrogen exporter.

Southern Africa is poised to supply green hydrogen to Europe, Japan, and South Korea. Strategic planning, collaboration, and investment in infrastructure and renewable energy are critical to unlocking hydrogen’s economic and environmental benefits.

• Anglo American Hydrogen Initiatives Mining.com: Details on Anglo American’s hydrogen-powered haul truck at the Mogalakwena Platinum mine.

• Fortescue Metals Group’s Green Metal Project CarbonCredits.com: Fortescue’s Green Metal Project in Australia, its hydrogen refuelling infrastructure, and production targets.

• FuelCellsWorks.com: Updates on Fortescue’s project delays due to geopolitical and energy price challenges.

• Global Hydrogen Demand and African Potential AGHA-Green Hydrogen Potential Report: Data on Africa's renewable hydrogen potential, including economic impacts, export capabilities, and investment requirements.

• Hydrogen Pricing and Projections Hydrogen Valley Feasibility Study (South Africa): Cost competitiveness of South Africa’s hydrogen production compared to global averages.

• Economic Impact in South Africa Ministry of Science and Innovation, South Africa: GDP contributions and job creation projections for South Africa's hydrogen economy.

• Energy Cost Contribution Singular Research and Analysis: Insights into the role of energy costs in hydrogen production and Africa's comparative advantage.

• European Green Hydrogen Demand European Green Deal Hydrogen Strategy: Export markets, particularly Europe and Asia, for African hydrogen.

• Global Investment Requirements International Renewable Energy Agency (IRENA): Investment estimates for renewable hydrogen production in Africa by 2050.

Loesche has developed an AI-based mill control system (Mill Pro M) and machine surveillance (Dalog Machine Surveillance) software that allows maintenance managers, production managers, and process engineers to run equipment more efficiently. The system can be installed on existing equipment, regardless of the mill’s age, and is non vendor specific, making it adaptable to any mill.

The mill control system results in 6% lower energy consumption and up to 20% higher throughput, while the machine surveillance software provides a guaranteed six months’ notice for maintenance planning. However, the system has proven itself several times to exceed expectations, offering more than a year’s notification on parts that would fail and cause collateral damage. This visibility enables Loesche’s customers to order replacement parts when needed, reducing inventory costs.

Loesche aims to continue providing the best service and spares to the industries it serves, with a particular focus on digital solution offerings that enable a more direct and clearer interface with its clients.

Loesche South Africa has been supporting its clients for 50 years through various departments, staffed by specialists catering to every need throughout their production journey. The company's after-sales services have consistently added tangible value to all customers, prioritising sustainability and optimisation tailored to each individual's needs.

At a time of increasing environmental scrutiny, South Africa’s mining sector, a key contributor to the country’s economy, faces a pressing challenge: water management. While the industry contributed R202 billion to GDP last year and saw a production boost of nearly 5% in September, the environmental risks posed by mining effluent are mounting.

Although mining uses just 3% of the country’s water resources, its effluent creates some of the most severe water quality challenges that South Africa faces today.

According to Burt Rodrigues, CEO of Biodx, a South African biotech company specialising in sustainable water solutions, the problem is compounded by a lack of collaboration and foresight in addressing water contamination. “Effluent from mining operations often sits in holding ponds indefinitely, or worse, overflows into rivers, causing significant environmental and community damage,” he says. “This is no longer just a

mining problem but a national challenge that requires industry-wide collaboration.”

Once mines use water from rivers, dams, or boreholes, it becomes contaminated with pollutants such as heavy metals, sulphates, and other chemicals. In turn, this creates vast volumes of hazardous effluent. Mining companies are legally obligated to treat this water to meet the Department of Water and Sanitation standards before releasing it back into the environment. However, financial constraints and a lack of actionable strategies often result in non-compliance.

“There are mines that prioritise sustainable practices and invest in advanced water treatment systems,” says Rodrigues. “Worryingly, others choose to ignore the problem, leaving communities, farmland, and ecosystems to bear the brunt of their inaction. From dead fish to being unable to use their water, it has become a matter of accountability and collaboration.”

In one case, a mine near Bronkhorstspruit faced a legacy problem of 400 million litres of polluted water spread across three dams. Despite proposals from Biodx to implement a cost-effective filtration system capable of cleaning the water over two years, the mine declined to act, as operations had ceased. “They had made their profits and had not budgeted for water management following the mine’s closure,” Rodrigues explains. “Now the environment and nearby communities are left with the fallout.”

Contrast this with a new coal mine near Bethal, which has embraced innovative solutions. The mining house has worked with Ascent Project Consultants, Biodx, and other technology providers, including Siemens and DLM, to develop an automated water treatment system. This system is capable of blending effluent with treated water to meet compliance standards. It integrates hydraulic and mechanical systems, advanced measuring units, and Biodx’s Cronodx technology. This technology uses real-time data to monitor contamination levels and optimise treatment processes without human intervention.

“The Cronodx system was designed to provide realtime, actionable data to address one of the mining industry’s most critical challenges: water contamination,” says Prof Cloete, developer of the Cronodx technology for Biodx. “By integrating advanced sensors and AIdriven analytics, we can monitor water quality with precision and ensure compliance with environmental standards. This level of insight not only helps mining operations meet regulatory requirements but also fosters responsible water management practices that benefit surrounding ecosystems and communities.”

Another success story is the work done by a precious metal refinery in the East Rand. This mining house has invested heavily in state-of-the-art purification plants. “It treats all its effluent daily, ensuring that only clean water is discharged back into the environment,” says

Rodrigues. “It is a model for how mining operations can integrate sustainability into their core operations.”

Moreover, there are significant advantages to effective water treatment. In the study “South Africa’s options for mine-impacted water reuse,” it is noted that South Africa ranks among the top thirty driest countries globally. Alarmingly, it is anticipated that the country’s water demand will surpass its supply by next year. The South African government has identified that substantial amounts of water could be recovered through the recycling of treated water affected by mining activities.

At present, however, there is a substantial production of treated water from mining activities that is often only considered for discharge or disposal. This treated water could instead be utilised in sectors currently consuming high-quality water unnecessarily, such as agriculture, sanitation, or industrial processes. Repurposing this wastewater to meet ‘fitness-for-use’ standards for alternative uses could significantly lower the costs associated with treatment compared to producing potable water. The analysis suggests that the optimal use for repurposed mine-impacted water is in agriculture, specifically for irrigating crops, including food, forage, or energy crops, which currently consume the bulk of South Africa’s premium water resources.

Solving these challenges requires collaboration across the private and public sectors. “From engineering firms to biotech companies and regulatory bodies, everyone has a role to play,” says Rodrigues. This goes beyond a traditional supplier-customer relationship and centres on creating partnerships that bring together the best technologies and expertise. We need to stop seeing environmental management as a cost and start seeing it as an investment in the country’s future,” concludes Rodrigues.

With millions of litres of polluted water at stake daily, and the rainy season heightening the risk of overflow and contamination, the urgency is clear.

REFERENCES:

1. https://www.statista.com/statistics/1121214/mining-sectors-valueadded-to-gdp-in-south-africa/#:~:text=The%20mining%20sector%20 forms%20an,Gross%20Domestic%20Product%20(GDP)

2. https://tradingeconomics.com/south-africa/mining-production

3. https://www.africandecisions.com/resources/water-and-mining/

4. https://biodx.co/

In today’s industrial landscape, sustainability is a key driver for businesses looking to minimise their environmental footprint and enhance operational efficiency. Among various sustainability initiatives, efficient wastewater treatment plays a vital role. Industries, especially those with high water usage such as food processing, manufacturing, pharmaceuticals, and mining, must focus on efficient wastewater treatment to achieve long-term sustainability goals.

By Robert Erasmus, Managing Director of Sanitech