Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Page 2 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

CREDITS 4 INTRODUCTION ............................................................................. 5 CHAPTER 1 Background 6 CHAPTER 2 Demographic and Economic Trends 7 CHAPTER 3 Hutcheson Building Renovation Options 15 CHAPTER 4 Additional Site Development Options 23 CHAPTER 5 Multi-Family Mixed-Use Residential Development 24 CHAPTER 6 Single Family Residential Development 30 CONCLUSION 34

Page 3 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

TABLE OF CONTENTS

Credits

PRINCIPAL INVESTIGATORS, CARL VINSON INSTUTE OF GOVERNMENT

Alexandra Hill, UGA, CVIOG, Fiscal and Economic Analyst

Tommie Shepherd, UGA, CVIOG, Economist and Public Service Associate

CATOOSA COUNTY

Larry Black, Catoosa County Commission Chairman; Public Facilities Authority Board Member

Jeff Long, Catoosa County Commissioner, District 1; Public Facilities Authority Vice Chairman

Chuck Harris, Catoosa County Commissioner, District 2; Public Facilities Authority Chairman

Vanita Hullander, Catoosa County Commissioner, District 3

Charlie Stephens, Catoosa County Commissioner, District 4

Ronnie Davis, Catoosa County Public Facilities Authority Board Member

Derek Rogers, Catoosa County Public Facilities Authority Board Member

Dan Wright, Catoosa County Manager

Meghan Trusley, Executive Administrative Assistant to the County Manager

Rachel Clark, Catoosa County Chief Financial Officer

Chad Young, Catoosa County Attorney

THE LYNDHURST FOUNDATION

Macon C. Toledano, Associate Director

THE UNIVERSITY OF GEORGIA CARL VINSON INSTITUTE OF GOVERNMENT

Danny Bivins, Senior Public Service Associate

Alexandra Hill, Fiscal and Economic Analyst

Tommie Shepherd, Economist and Public Service Associate

Greg Wilson, Assistant Director

Eleonora Machado, Creative Designer

Karen DeVivo, Editor

CATOOSA COUNTY MANAGER’S OFFICE

Special thanks to Dan Wright and Meghan Trusley.

Partners

SPECIAL THANKS: This project was made possible by the generous support of the Lyndhurst Foundation. We extend our deep appreciation and gratitude to the Lyndhurst Foundation for its commitment to improving communities across the metropolitan Chattanooga region.

Page 4 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

INTRODUCTION

“The primary goal is to return the parcel to private ownership in an alternative use that suits the community. Renovating and preserving the existing facility is the preferred outcome”

The Carl Vinson Institute of Government at the University of Georgia was commissioned by the Lyndhurst Foundation to aid the Catoosa County Public Facilities Authority (PFA) in evaluating alternative options for redeveloping the Hutcheson Building site. PFA’s primary goal is to return the parcel to private ownership and select an alternative use that suits the community. Institute researchers collected data on demographics, economic trends, and long-term sustainability to aid PFA in determining the feasibility of various uses for the property. PFA prefers to renovate and preserve the existing facilities. This report presents the projected renovation costs of the facilities and estimates of the direct, indirect, and induced economic impact of the two PFA-selected alternative uses. This report will aid PFA in selecting a private developer to achieve its vision and redevelop the site in a way that offers long-term stability and fosters additional economic opportunities.

Partners

Carl Vinson Institute of Government Lyndhurst Foundation Catoosa County Public Facilities Authority

Carl Vinson Institute of Government Lyndhurst Foundation Catoosa County Public Facilities Authority

Page 5

CHAPTER 1

BACKGROUND

The Hutcheson Building site is a 30-acre parcel containing just under 300,000 square feet of facilities.1 The site originally opened as the Tri-County Hospital in 1953, later renamed the Hutcheson Medical Center. The grounds also encompass the historic Post Hospital, which was erected in 1904 as part of the US Army’s Sixth Cavalry headquarters, located in what is known today as the city of Fort Oglethorpe. As of 2021, the site and facilities were valued at approximately $9.7 million.

In 2021, Catoosa County acquired the site from Enots LLC. The Catoosa County PFA’s acquisition of the site will allow the community to have input on an alternative use that complements the local economy and aligns with the Fort Oglethorpe downtown redevelopment plan. In their initial meeting with Institute researchers, PFA members expressed an interest in preserving and repurposing the existing Hutcheson Building complex. Their stated goal was to work with a redevelopment partner whose vision aligns with that of the community and to see the property serve a new purpose that enhances economic development and further strengthens community relationships.

The Institute of Government worked with the Catoosa County PFA to develop a list of criteria for alternative uses of the Hutcheson Building site. The goal was to identify potential alternative uses that are…

• Consistent with PFA input

• Compatible with local vision

• Complementary to each other (if multiple uses are selected)

• Sustainable long-term

• Supportive of additional economic opportunity

In February 2023, Institute researchers presented the Catoosa County PFA with eight possible alternative uses for the site. These possible uses were chosen based on the size of the parcel and the existing facilities, though the team acknowledged that it may ultimately be more feasible to demolish existing buildings and build one or more new structures. Institute researchers presented demographic information and evaluated the pros and cons of residential, hotel, office space, industrial, education, aging care, retail, and mixed uses. The PFA was most interested in further exploring two primary options for redevelopment of the site: aging care and mixed-use residential.

In May 2023, Institute researchers presented the PFA with economic and fiscal impact estimates for senior living and mixed-use residential housing. Estimates for senior living were modeled with and without aging care. Estimates for residential housing were modeled for a single-family development as well as higher- and lower-end multifamily developments. This report details the background research conducted for evaluating the renovation, economic, and fiscal impact estimates.

“County ownership allows us to work with a redevelopment partner whose vision aligns with that of the community” — Catoosa County Public Facilities Authority

The grounds encompass the historic Post Hospital, which was erected in 1904 as part of the US Army’s Sixth Cavalry headquarters

Page 6 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

1 Catoosa County Tax Assessor’s website: www.qpublic.net/ga/catoosa/

DEMOGRAPHIC AND ECONOMIC TRENDS

DEMOGRAPHICS

The demographics of an area have a significant impact on the industry makeup, real estate market, and tax base of the local economy. For this report, Institute researchers examined the demographic trends in Catoosa County and the larger Chattanooga MSA. Demographic trends are one of the key predictors of economic sustainability when evaluating a large-scale redevelopment project. Demographics analyzed in this report include population growth and age, along with population projections.

Population Growth

From 2010 to 2019, Catoosa County saw slower population growth than the Chattanooga MSA. In July 2019, an estimated 67,580 people lived in the county. Population in Catoosa County grew by 5.5%

from 2010 to 2019, for an annualized growth rate of 0.6%. The Chattanooga MSA saw population growth of 9.4% over the same time period, for an annualized growth rate of 1%.

Net in-migration (people moving in from other areas minus people moving out to other areas) made up the majority of population growth in the Chattanooga MSA since 2016. From 2010 to 2015, net in-migration accounted for 74% of population growth. Net natural change (resident births minus resident deaths) made up the remaining 26% of the population growth. The effect of net in-migration increased from 2015 to 2020, accounting for 95% of population growth in the Chattanooga MSA. Net in-migration is forecasted to account for nearly all population growth in the MSA from 2020 to 2025 due to a declining birth rate and an aging population.

Most Population Growth in the Chattanooga HMA will come from Migration

Net in-migration is forecasted to account for nearly all population growth in the MSA from 2020 to 2025.

2

CHAPTER

Page 7 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Source: 2021 Comprehensive Housing Market Analysis Chattanooga, Tennessee-Georgia. US Department of Housing and Urban Development, Office of Policy Development and Research

AGE

Catoosa County has a higher median age than the state as a whole: 39.9 years versus 37.5 years.

Compared to other counties in the Chattanooga MSA, however, Catoosa has the second-lowest median age. Sequatchie County in Tennessee has the highest median age at 43.3 years, whereas Hamilton County in Tennessee (home to the city of Chattanooga) has the lowest median age at 39.6 years.

Individuals aged 60 years and older represent an increasing share of the population in the Chattanooga metropolitan area. This age cohort represented 21% of the population in 2010 and accounted for 25% of the total population in 2019.2 In Catoosa County, 16.8% of the population is 65 or older, while in Georgia, 14.7% of the population is 65 or older.

Compared to other counties in the Chattanooga MSA, however, Catoosa County has the lowest

Catoosa’s Population Is Aging

proportion of residents 65 or older. Sequatchie County, Tennessee, has the highest proportion at 19.5%, followed by Marion County, Tennessee (19.1%), Dade and Walker counties (18.1%). Hamilton County, Tennessee, has the second-lowest proportion of residents aged 65 or older.

Although Catoosa’s population is younger than other counties in the Chattanooga MSA, the population is expected to age significantly over the next 20 years. Population projections from the Georgia Governor’s Office of Planning and Budget indicate that the number of Catoosa residents aged 65 and older will increase by 36% over the next 20 years—from a baseline of 13,511 residents in 2023 to 18,408 residents in 2043. As a proportion of the county’s population, seniors (65+) will grow from 19% in 2023 to 24% in 2043.

Based on population projections from the Georgia Governor’s Office of Planning and Budget, the number of Catoosa residents aged 65 and older is forecasted to increase by 36% from 2023 to 2043.

ECONOMIC TRENDS

The economic trends in an area are key indicators of the feasibility of large economic development projects, whether they be construction of new facilities or renovation of existing properties. Institute researchers summarized the economic

trends in Catoosa County and the larger Chattanooga MSA. Economic trends synthesized in this report include primary industries, commuting flows, median household income, affordability/cost of living, and housing market trends.

Source: Governor’s Office of Planning and Budget 2021 Series Interim Long-Term Population Projections 0 2000 4000 6000 8000 10000 12000 14000 16000 18000 Under 20 20-29 30-39 40-49 50-59 60-69 70 or Older Population Projections 2023 2043 2 American Community Survey, one-year data. Page 8 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Primary Industries

Catoosa County has a relatively diverse economy with several primary industries, including manufacturing, health care, retail, and hospitality. Catoosa County is home to several manufacturing firms that produce a wide range of products, including textiles, automotive parts, and chemicals. Health care dominates the county, with several hospitals, clinics, and other medical facilities located within its borders. Catoosa County also has a strong retail sector. The county’s location near Chattanooga, Tennessee, makes it an attractive destination for tourists, and the hospitality industry plays a significant role in the local economy.

To better understand the local economy, the research team began by narrowing industries in the county to the four-digit NAICS level.3 Catoosa County’s top five industry groups by number of jobs are as follows: Food service and drinking places dominate the economy with 2,106 jobs as of September 2022. General merchandise retailers are the second-largest industry with 1,040 jobs in the county. Ambulatory health care services, textile mills, and food and beverage retailers round out the final three largest industry groups in Catoosa, with 846, 843, and 809 jobs, respectively.

Just as raw job numbers provide a rough idea of the size of various industries, the employment location quotient (ELQ) is a useful measure of employment concentration. The ELQ is a geographic index

that measures the relative concentration of an industry in a subarea compared to a larger area. In this case, the subarea is Catoosa County and the larger area is the US. By this measure, the most concentrated industry groups in Catoosa County are textile mills, ambulatory health care services, museums and historical sites, textile product mills, and general merchandise retailers. Textile mills are the most concentrated, with Catoosa County having nearly 83 times more jobs than the US on average. Ambulatory health care employment is 13 times more concentrated, followed by museums with an ELQ of 12.2.

While the size and concentration of employment in each primary industry are useful measurements of the current economic situation in Catoosa County, job growth helps forecast the trajectory of the local economy over the next few years. The top five industries for job growth in Catoosa County are retail trade, manufacturing, construction, real estate and rental leasing, and other services. In this case, manufacturing is considered the “anchor industry” since it is the true job creator and draws employees from surrounding areas. Retail, construction, and real estate can be thought of as satellite industries that supply the manufacturing employees and their families with goods and services. The growth of the satellite industries would not exist without the anchor industry.

Manufacturing Is One of the Top Industries for Job Growth

Retail, construction, and real estate can be thought of as satellite industries that supply manufacturing employees and their families with goods and services. The growth of the satellite industries would not exist without the anchor industry.

As the Manufacturing Industry grows, workers buy more housing, goods, and services:

• Retail Trade

• Construction

• Real Estate & Rental Leasing

• Other Services

Source: Lightcast 2023 Q1 Data, Catoosa County, Georgia | Lightcast 2020 Data, Catoosa County, Georgia

3 The North American Industry Classification System (NAICS) is the standard used by federal agencies to classify business establishments. NAICS uses a six-digit hierarchical coding system to classify all economic activity into 20 industry sectors.

Page 9 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

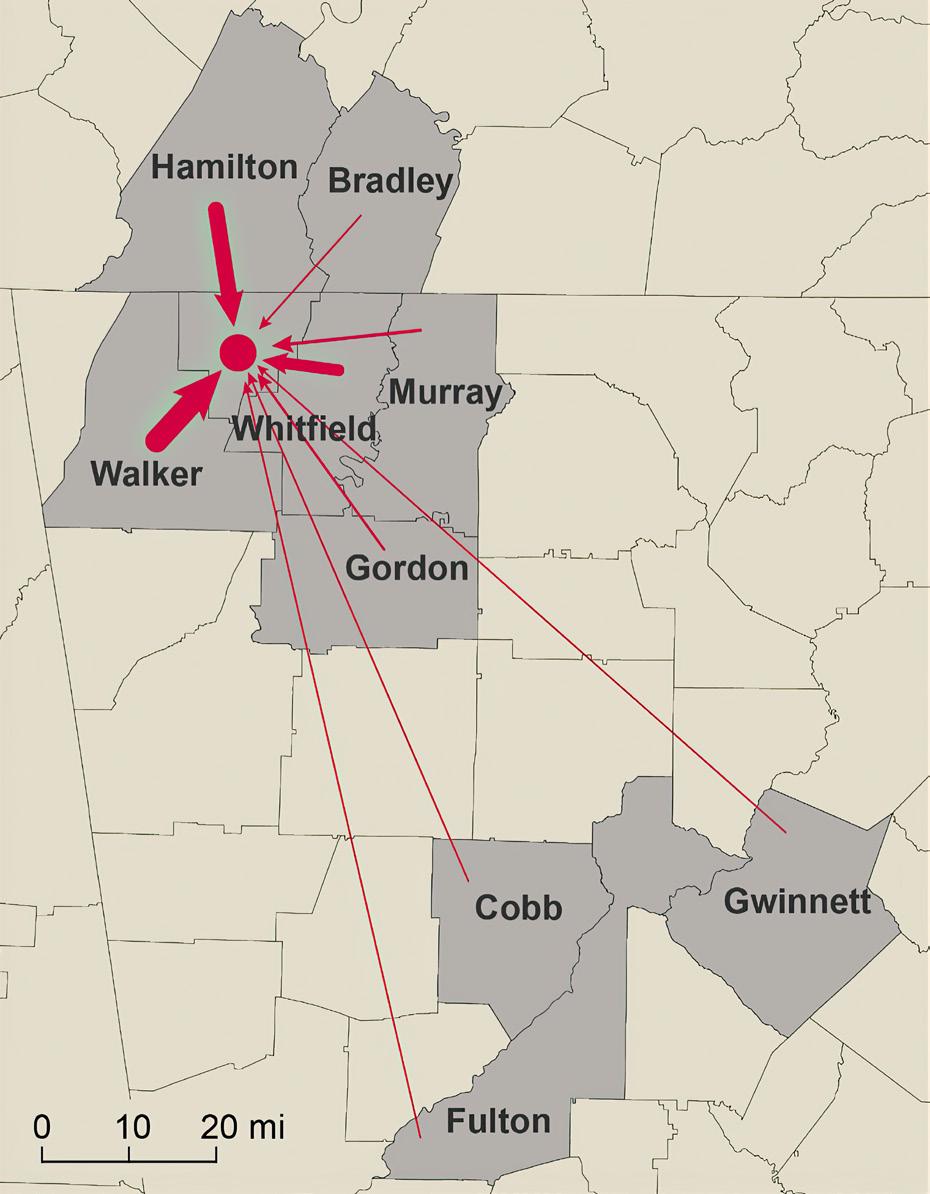

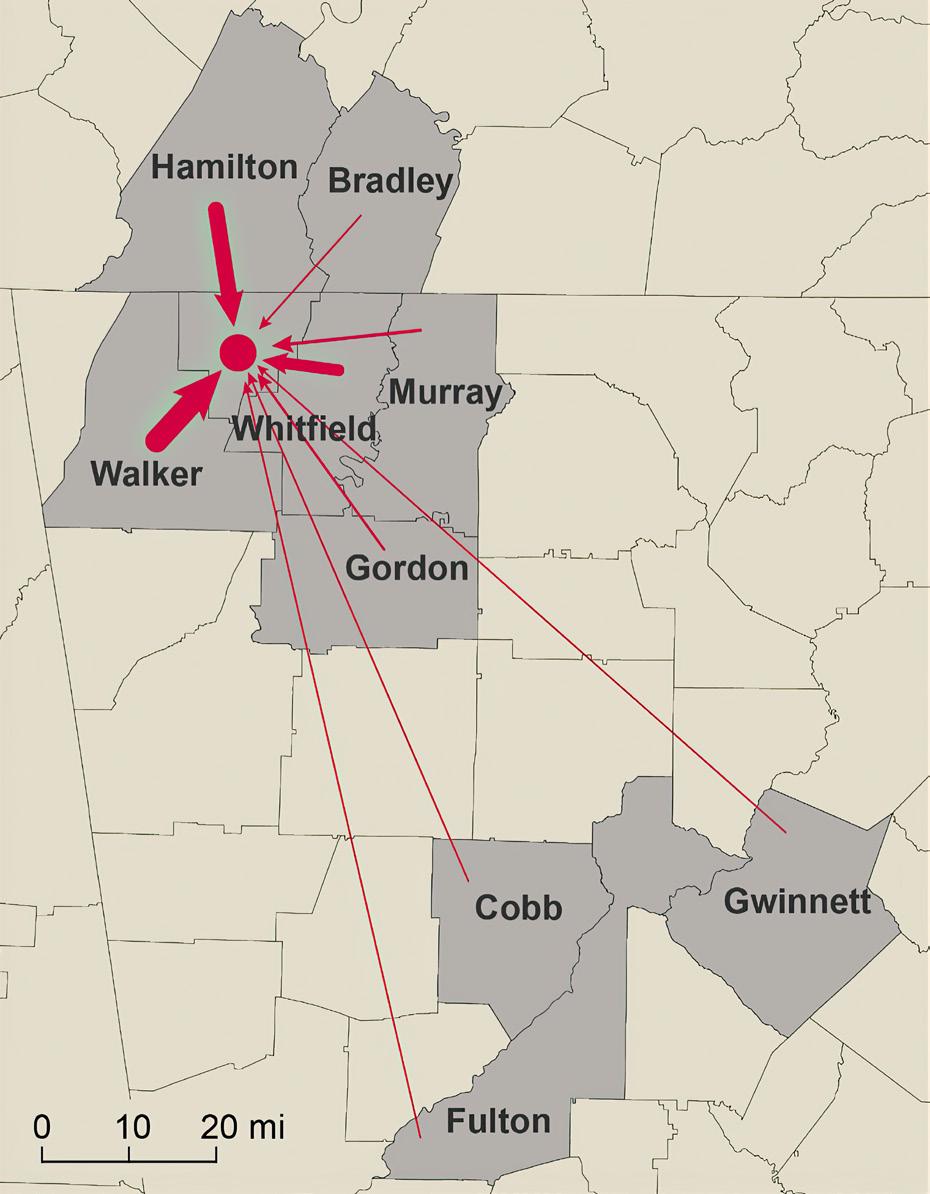

Commuting Flows

Commuting flows can be useful indicators of the health of a local economy. An imbalance in the proportion of people who commute to and from the county for work — versus those who both live and work in the community — can indicate issues with the supply of housing and/or jobs in the county. As of the latest available data from the US Census Bureau (2019), approximately 22,778 workers were living in Catoosa County. Of those workers, only 15% (3,397) also worked in Catoosa County, while the remaining 85% (19,381) of Catoosa County residents commuted to jobs outside of the county.

For those who commuted outside of the county for work, the most common destinations were Hamilton County, Tennessee (which includes Chattanooga) and Whitfield County, Georgia. In total, 10,286 people, or 45% of residents, commuted to Hamilton County for work, while 2,583 people, or 11% of residents, commuted to Whitfield County. Conversely, approximately 7,922 people worked in Catoosa County but lived elsewhere. Nearby Walker and Whitfield counties in Georgia and Hamilton County, Tennessee, were the top three counties

from which Catoosa County workers commuted. Surprisingly, just over 500 Catoosa workers (6.3%) commuted all the way from Cobb, Fulton, and Gwinnett counties. Note that these commuting flows may have changed significantly since 2019 due to a variety of factors, such as the COVID-19 pandemic, changes in employment opportunities, and shifts in population demographics.

Commuters from distant counties suggest that Catoosa County may not have enough available housing to meet the needs of the people who work there. Conversely, the fact that 85% of Catoosa residents commute to other counties for work indicates that the industry makeup may be imbalanced, skewed too heavily toward bluecollar jobs, forcing residents seeking white-collar employment to commute into Chattanooga. The primary factor impacting these commuting flows, though, is the fact that Fort Oglethorpe—and Catoosa County by extension—serves as a bedroom community for Chattanooga, Tennessee, meaning that there will likely always be more residents commuting out of the area than workers commuting in.

2 American Community Survey, one-year data.

Page 10 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

85% of Catoosa Residents Commute to Another County for Work

30% of Catoosa Workers Live in the County

The high percentage of workers in Catoosa who live outside the county is a strong indicator of local housing needs. Where

85% of Catoosa Residents Commute to Another County for Work

Catoosa is home to many workers employed in Hamilton County, Tennessee.

Commute To…

Catoosa County, GA 3,397 30.0% Walker County, GA 2,068 18.3% Hamilton County, TN 1,477 13.0% Whitfield County, GA 1,069 9.4% Murray County, GA 295 2.6% Gordon County, GA 214 1.9% Cobb County, GA 178 1.6% Fulton County, GA 178 1.6% Bradley County, TN 173 1.5% Gwinnett County, GA 145 1.3% All Other Locations 2,125 18.8%

Commute From… Count Share

Count Share Hamilton County, TN 10,286 45.2% Catoosa County, GA 3,397 14.9% Whitfield County, GA 2,583 11.3% Walker County, GA 1,157 5.1% Fulton County, GA 568 2.5% Gordon County, GA 370 1.6% Cobb County, GA 323 1.4% Gwinnett County, GA 301 1.3% Bradley County, TN 295 1.3% DeKalb County, GA 203 0.9% All Other Locations 3,295 14.5%

Live Where Catoosa County Residents Work

Workers in Catoosa County

Page 11 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Source: US Census Bureau, OnTheMap Application and LEHD Origin-Destination Employment Statistics (Beginning of Quarter Employment, 2nd Quarter of 2019).

Income

In statistics, the median is a better measure of central tendency than the mean for datasets that have high or low outliers. In the case of income, a small number of high earners tend to skew up the average. Thus, median household income is a better indicator of the economic conditions of an area than mean income. Median household income in Catoosa County was $62,669 in 2021, the highest in the

Chattanooga MSA, followed by Hamilton County, Tennessee, at $61,050. Marion County, Tennessee, has the third-highest median household income in the Chattanooga MSA at $53,148, followed by Walker County, Georgia, ($48,633) and Sequatchie County, Tennessee ($47,835). Dade County, Georgia, has the lowest median household income in the Chattanooga MSA at $47,675.

Affordability/Cost of Living

Fort Oglethorpe, Georgia, is slightly more affordable than Chattanooga, Tennessee, making it an attractive bedroom community for those employed in Chattanooga. The Best Places cost of living calculator gives Chattanooga an overall score of 86.5, 3 points higher than Fort Oglethorpe, which received a score of 83.9.4 Food, groceries, and housing contributed to Fort Oglethorpe’s affordability. Owned housing is 17.7% more affordable in Fort Oglethorpe compared to Chattanooga. The median home cost is $49,100 lower in Fort Oglethorpe (median home cost of $169,600) compared to Chattanooga (median home cost of $218,700).

Some aspects of Fort Oglethorpe’s cost of living are less affordable than in Chattanooga, including utilities, transportation, and health care. Utilities are 4.9% less affordable in Fort Oglethorpe compared to Chattanooga; transportation is 6.1% less affordable; and health care is 7.1% less affordable. Transportation is likely less affordable in Fort Oglethorpe due to lower availability of public transportation. Health care may become more affordable after the new CHI Memorial Hospital is opened, somewhat alleviating supply constraints, with fewer residents being redirected to the Chattanooga location.

4 https://www.bestplaces.net/

Median Household Income $62,669 $61,050 $53,148 $48,633 $47,835 $47,675 $$10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000

Catoosa Has the Highest Median Household Income in the Chattanooga MSA

Catoosa Hamilton

Marion

M e d i a n H o u s e h o l d I n c o m e Page 12 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Walker Sequatchie Dade

Fort Oglethorpe, Georgia Is More Affordable than Chattanooga, Tennessee Fort Oglethorpe is slightly more affordable than Chattanooga, making it an attractive bedroom community for those employed in Chattanooga.

Source: Best Places 2023 Cost of Living Calculator https://www.bestplaces.net/cost-of-living/chattanooga-tn/fort-oglethorpe-ga/75518

Housing Market

The homeownership rate in the Chattanooga MSA has steadily declined from 70% in 2000 to 67.8% in 2010 to a low of 64.5% in 2021.5 The home sales and rental markets in the Chattanooga MSA are currently balanced. Vacancies are low at 1.4% for the sales market and 7.9% for the rental market. The average sales price of a new home was $348,900 as of June 2021, up 4% from June 2020. The average sales price of an existing home was $249,000 as of June 2021, up 16% from June 2020. New singlefamily home building permits were up by 26% from June 2020 to June 2021.

In the rental market, 38% of renter households in the Chattanooga MSA live in single-family homes, 18% live in buildings with two to four units, 36% live in multifamily buildings with five or more units, and the remaining 8% live in other housing types, including mobile homes.6 The average rent for apartments in the Chattanooga MSA was $901 as of June 2021, up by 3% from the previous year. By bedroom size, average rents in the area were $664 for a studio, $795 for a one-bedroom, $979 for a two-bedroom, and $1,177 for a three-bedroom unit. Three-bedroom units saw the greatest year-over-year increase

in rent at 5%, followed by two-bedroom units at 4%. One-bedroom units saw the smallest increase in rent at 2% over the previous year. Multifamily construction activity has fluctuated between 200 and 800 units since 2015, down significantly from the peak of 1,125 units in 2014.

So far, both sales and rental building permits have kept pace with forecasted demand through 2024. As of May 2021, the US Department of Housing and Urban Development (HUD) forecasted that the Chattanooga MSA would demand 5,125 singlefamily homes through May 2024. As of April 2023, 5,263 single-family homes have been permitted. HUD also forecasted demand for 1,975 rental units over this three-year period. As of April 2023, 2,477 units have been permitted.

Though permits have kept pace with demand for new housing over the 2021–2023 period, in-migration will continue to increase demand for sales and rentals of new and existing homes and apartments. The rise in home sales prices has slowed somewhat in recent months due to higher interest rates, but rent prices show no signs of slowing. The primary way to make housing more affordable is to increase the supply.

6

Census Bureau 2019 ACS 1-year estimates

5 Chattanooga Tennessee-Georgia Housing Market Profile, US Department of Housing and Urban Development

US

Chattanooga TN Fort Oglethorpe GA % Difference Overall 86.5 83.9 3.0% Lower Food & Groceries 97 94.8 2.3% Lower Housing (owned) 64.9 53.4 17.7% Lower Median Home Cost 218,700 169,600 $49,100 (22.5% Lower) Utilities 95 99.7 4.9% Higher Transportation 80.9 85.8 6.1% Higher Health 100.1 107.2 7.1% Higher $ $ Page 13 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Two potential renovation options for the Hutcheson Building were discussed in an initial meeting with the Catoosa County Public Facilities Authority: senior living apartments for 55+ adults and a continuous care retirement community (CCRC). Institute researchers were tasked with evaluating the likely feasibility of each option.

Page 14 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

CHAPTER 3

HUTCHESON BUILDING RENOVATION OPTIONS

SENIOR LIVING VERSUS CONTINUOUS CARE RETIREMENT COMMUNITY

BACKGROUND

“Active Adult” Communities

An active adult community is a type of housing designed for older adults (55 years of age or older) who are looking to maintain an active, social lifestyle. These communities differentiate themselves from traditional nursing homes in that they seek to maintain the independence of their residents when possible. Active adult communities offer a range of amenities and activities designed to help residents stay physically active, socially engaged, and independent. Amenities often include fitness centers, swimming pools, clubhouses, golf courses, and walking trails. Activities such as exercise classes, social events, educational opportunities, and group outings enhance seniors’ quality of life.

Active adult communities offer a range of living accommodations, from detached homes available for purchase to rented apartments. Many communities offer maintenance services such as housekeeping, landscaping, and exterior repairs to assist residents who wish to maintain their independence but want a reduced burden of maintaining a traditional home. Active adult communities also tend to offer security features such as gated entrances, security patrols, and emergency response systems to provide residents with peace of mind.

Continuous Care Retirement Communities

A continuous care retirement community (CCRC), also known as a life plan community, is a type of senior living facility that offers a continuum of care services to residents as they age. CCRCs are designed to provide a comprehensive and seamless living arrangement, accommodating the changing needs of seniors throughout their retirement years.

Page 15 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

CCRCs include several types of living arrangements based on mobility and care needs. CCRCs generally require an entry fee and monthly fees that cover the cost of services and amenities. Specific offerings and contract terms can vary widely between CCRCs.

CCRCs usually include independent living residences, such as apartments, cottages, or villas, where residents can live independently and maintain an active lifestyle. These accommodations often include various amenities like dining options, fitness centers, social spaces, and recreational facilities. As residents’ care needs change, CCRCs offer assisted living services. These services aid in daily activities such as bathing, dressing, medication management, and meal preparation. Assisted living residences in CCRCs typically offer a supportive environment while still promoting residents’ independence. Some CCRCs have dedicated memory care units or neighborhoods that cater to individuals with Alzheimer’s disease, dementia, or other memoryrelated conditions. These areas are designed to provide a secure and stimulating environment with specialized care and programming tailored to the unique needs of residents with memory impairments.

In terms of health care and wellness, CCRCs often include on-site skilled nursing facilities or have partnerships with nearby health care providers. Skilled nursing care is available for residents who require more intensive medical attention, postsurgery rehabilitation, or long-term care. This level of care is provided by licensed nurses and trained staff. Many CCRCs offer rehabilitative services such as physical therapy, occupational therapy, and speech therapy. These services are designed to help residents regain or improve their functional abilities after an injury, surgery, or illness.

CCRCs focus on promoting a vibrant and engaged lifestyle for residents. They often provide a wide range of wellness programs, social activities, educational classes, cultural events, and recreational opportunities. These activities aim to enhance residents’ physical, mental, and social well-being. CCRCs typically offer multiple dining venues and meal

plans. Residents can enjoy restaurant-style dining, cafés, bistros, or even private dining options. Nutritious and chef-prepared meals are often provided, and special dietary needs can be accommodated.

CCRCs also offer transportation, maintenance, housekeeping, and security to their residents. Many CCRCs provide transportation services for residents, ensuring they can access medical appointments, shopping centers, and other local amenities conveniently. CCRCs often handle maintenance and housekeeping services, relieving residents of the burden of home repairs, yard work, and housekeeping chores. CCRCs prioritize the safety and security of their residents. They may have security staff, controlled access points, emergency call systems, and other safety measures in place.

PROS AND CONS

Primary factors supporting redevelopment of the Hutcheson Building into a senior living facility include compatibility with the existing building design and location, growing demand for senior living from an aging population, and increased federal support for the industry. Converting the Hutcheson Building into a senior living facility preserves the building’s historical significance and makes use of the existing architecture and design, creating a unique and distinctive living experience for residents. The building lends itself well to conversion into a senior living facility, as the building is already divided into many patient rooms. The building has many features designed to accommodate mobility limitations, including wide hallways, zero-step entries, and elevators.

Most senior living facilities are also designed with a connection to nature and the outdoors in mind. The former Hutcheson Building hospital complex comes pre-equipped with multiple enclosed courtyards and plenty of space to expand green areas in the surrounding complex. The site is also located in an urban, downtown area, making it an ideal location for a senior living facility, as it provides residents with easy

Page 16 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

access to shops, restaurants, medical facilities, and other essential businesses. Currently, senior living options in the Fort Oglethorpe area are limited, which creates an opportunity for developers to meet the growing demand spurred by demographic changes.

A few primary factors work as headwinds against senior living for the Hutcheson Building redevelopment, including staffing challenges, high renovation costs, supply chain issues, and currently high interest rates. Staffing challenges are the primary obstacle to senior living with aging care or memory care services. The nursing shortage is affecting the entire US. Approximately 100,000 nurses have left the profession since 2020, and another 600,000 plan to leave by 2027. Georgia has the second-lowest (after Utah) number of nurses per capita at 7.3 nurses per 1,000 residents, compared to the US as a whole, which has 9.2 nurses per 1,000 residents. These staffing shortages drive up the cost of attaining staff and limit the number of patients that can be treated in aging care and memory care based on state and federal regulations.

High renovation costs are another obstacle for conversion to senior living, especially for aging care or memory care. Aging care facilities must be constructed at or near hospital-grade standards. This adds significant expense, even when remodeling a previous hospital, since health care technology is constantly changing and improving. The current high interest rate environment makes financing any large capital investment project more expensive and less economically feasible. Supply chain issues can add to the cost of renovation or delay the timeline of certain projects significantly. High interest rates and supply chain issues are headwinds against any use case and must be considered by the county, city, and prospective developers to ensure that the project will remain profitable.

In conclusion, converting a former hospital building into a senior living facility has its pros and cons. Demand for senior living space in Fort Oglethorpe and across the country is growing. Developers have an opportunity to meet this demand by renovating a

facility that is already well-suited to this use. However, challenges abound, including the shortage of nursing staff, high renovation costs of medical-grade facilities needed for aging care, and macro-economic trends such as high interest rates and supply chain issues.

EVALUATING THE OPTIONS

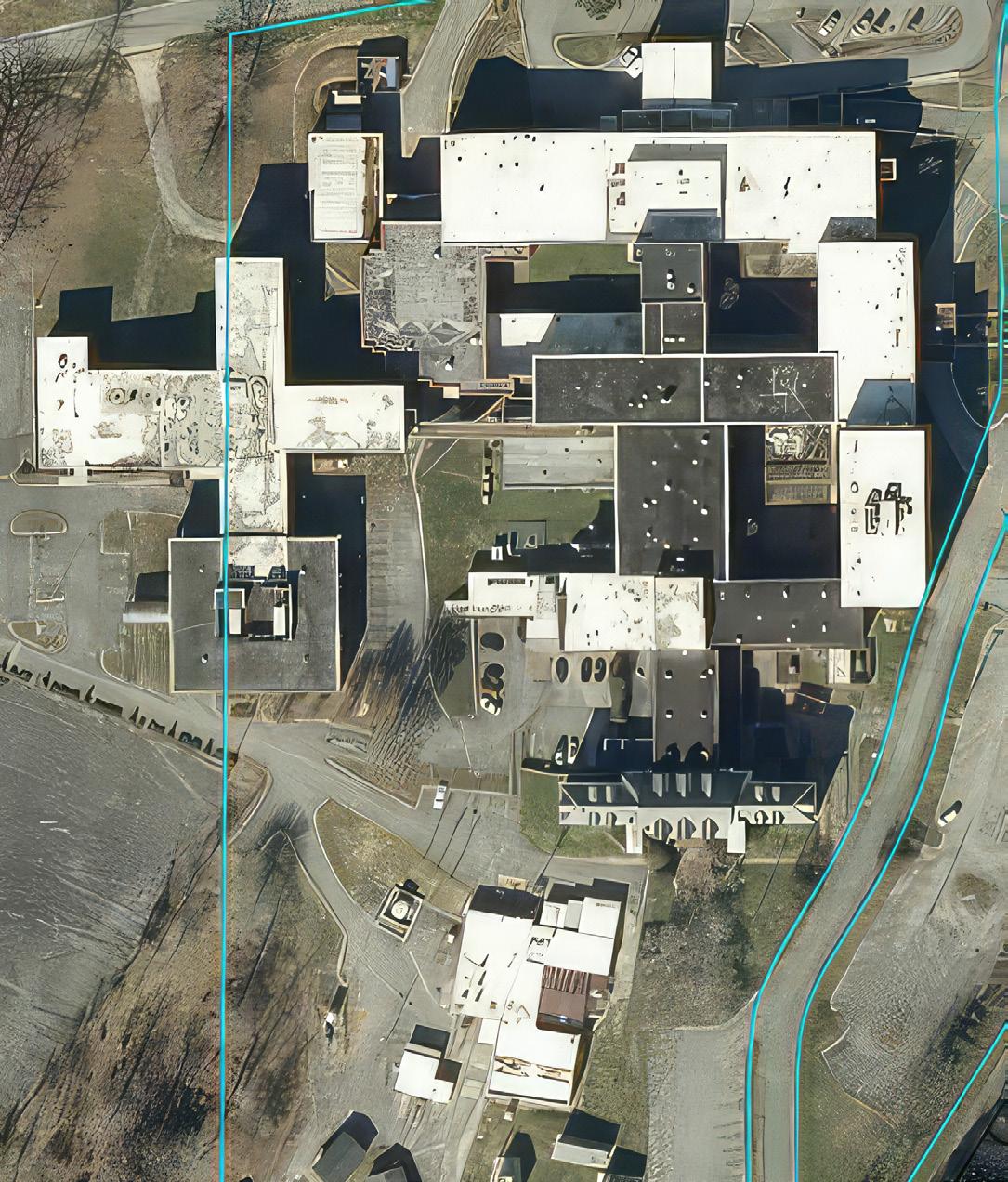

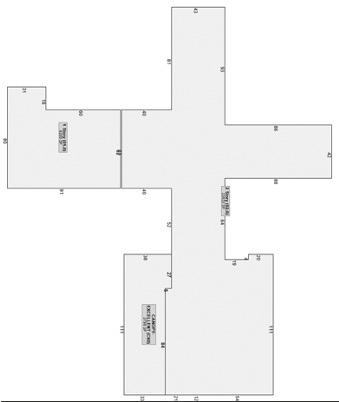

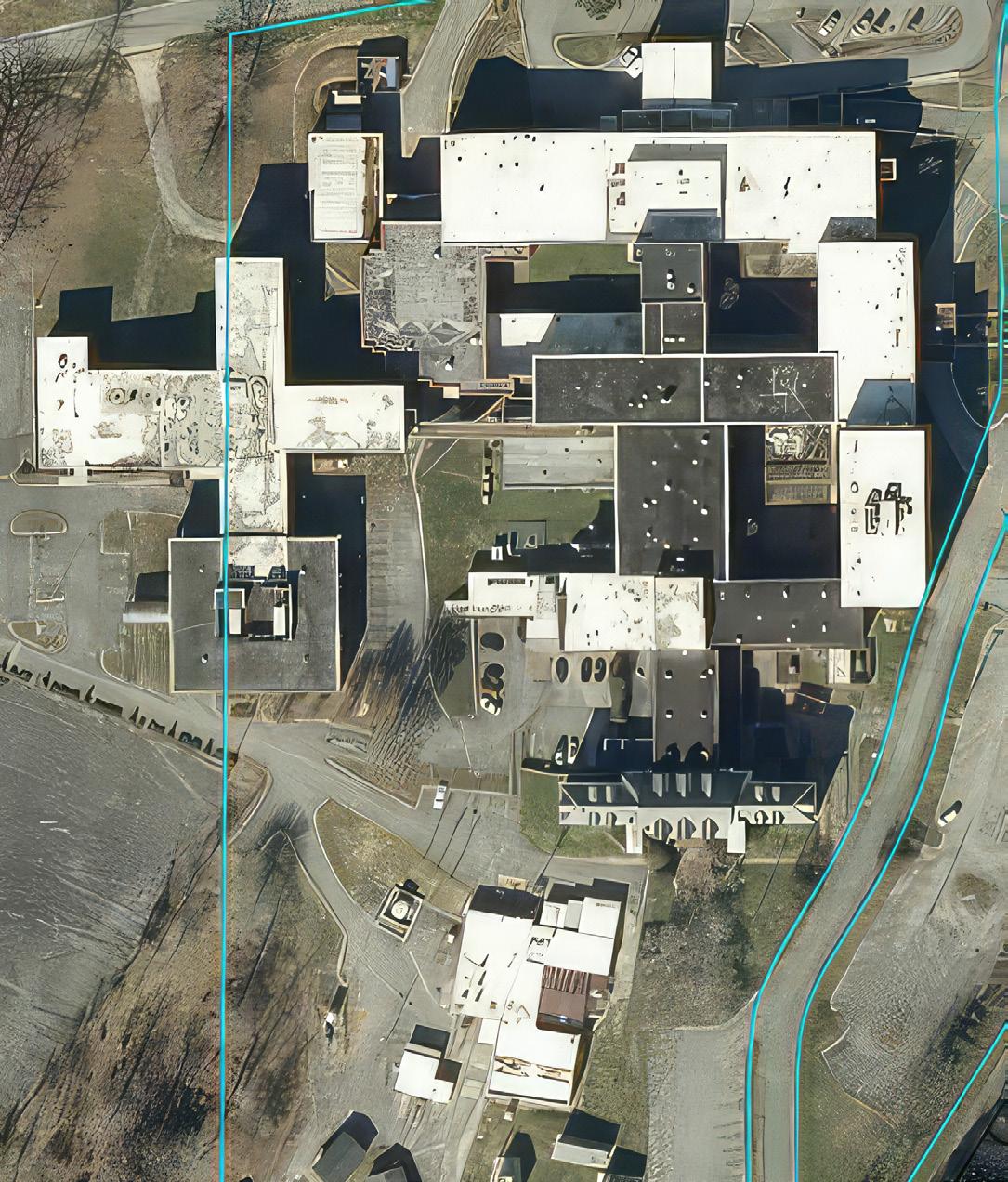

Aerial view of the site pieced together from the Catoosa and Walker county tax assessors’ websites with Catoosa portions shaded in green

Page 17 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

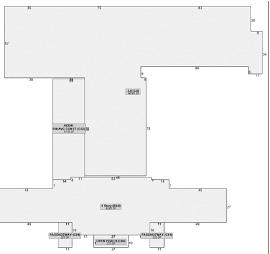

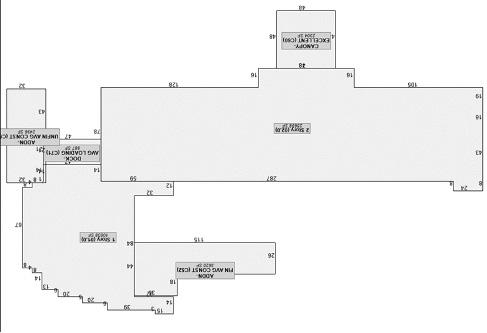

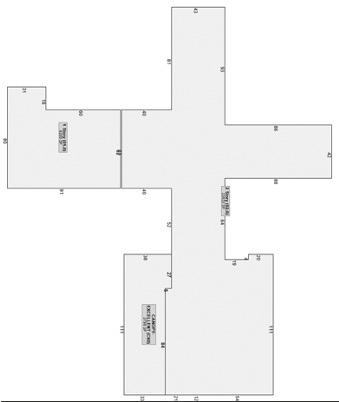

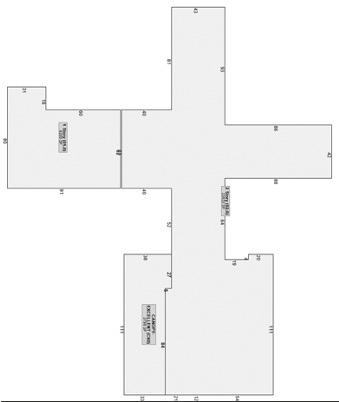

THE HUTCHESON BUILDING IS COMPOSED OF EIGHT CONNECTED BUILDINGS SITTING ON APPROXIMATELY 30 ACRES THAT STRADDLE THE CATOOSA-WALKER COUNTY LINE.

Methodology

To compare the projected feasibility of repurposing the Hutcheson Building as a 55+ senior living community and a CCRC, Institute researchers estimated the cost to completely renovate the building for each option, as well as the costs and revenues associated with operating the renovated facility under each scenario. R.S. Means construction cost estimation software was used to estimate the cost of renovating the building for each use. Numerous examples of each type of facility were examined to determine the most common amenities offered. The research team then scaled a typical set of amenities to fit the existing floor plan of the Hutcheson Building. Based on measured drawings available from the Catoosa County Tax Assessor’s Office, a representation of these typical uses was developed and assigned to individual buildings for illustrative purposes for each use.

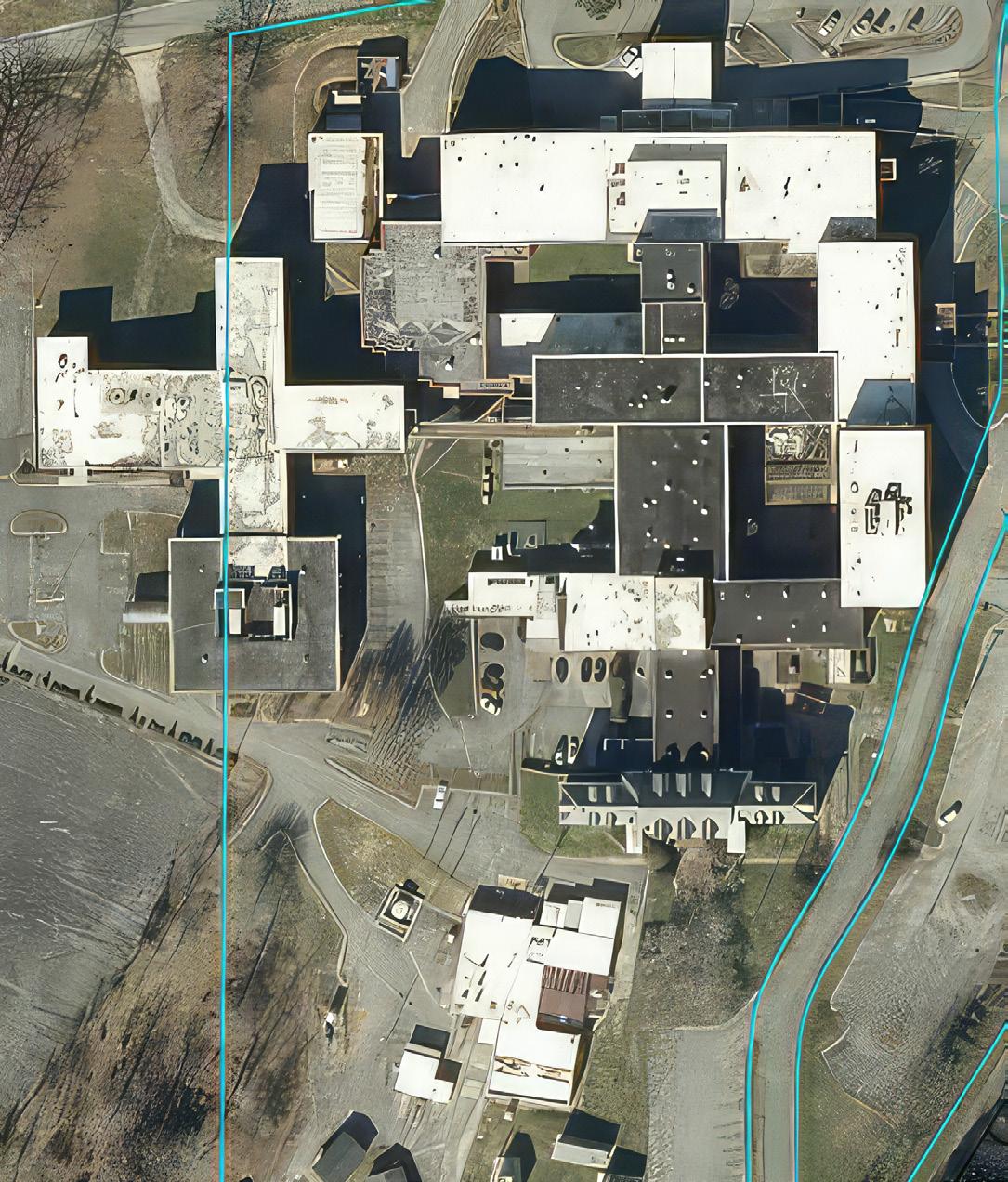

Estimating Renovation Costs With Aging Care

Estimated renovation costs for the CCRC option with an aging care wing

$114 SQUARE FOOT

$11,016,577

Building #3 $6,008,783

Building #4,5,8 $10,742,256

Building #6 Demolish

Building #7 $210,814

Total Renovation $33,225,957

Figures based on tax assessor data, data may be incorrect or outdated. All square footage and acreage figures subject to surveys and engineering studies.

Source: RS Means Construction Software

Building # Projected Renovation Costs

#1

Building

$5,247,527 Building #2

Page 18 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

The primary difference in the CCRC and senior living–only options is that Building 2, designated for aging and memory care under the CCRC option, is renovated to hospital-level standards, whereas it is renovated to apartment building standards under the senior living option. Other uses remain

the same between the two options. The difference in renovation costs between the two options is approximately $6.2 million due to the additional cost of building out the aging and memory care unit of the CCRC option to hospital-level standards.

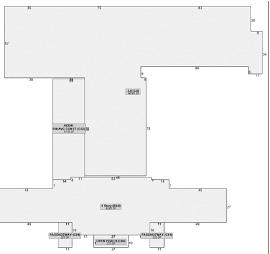

Estimating Renovation Costs Without Aging Care

Estimated renovation costs for a 55+ senior living facility without a CCRC wing

The financial feasibility of any project is heavily dependent on sufficient cash flow to meet debt obligations. In the case of the Hutcheson Building, revenues less expenses for either the CCRC or senior living options must be sufficient to cover the cost of acquisition and renovation. Projecting cash flows for any new business is difficult at best, and projecting them for a renovated Hutcheson Building is further complicated by the fact that the renovations will likely take place several years in the future. Nevertheless, financial projections are useful for comparing the feasibility of competing, alternative uses.

Financial projections for CCRC and senior living options were compiled by Institute researchers from a variety of sources, including publicly available tax returns, published financial statements, management consultants’ websites, and interviews with industry professionals. These projections represent a compilation of weighted averages of actual businesses and, as such, are intended to represent revenues and expenses for a “typical” CCRC or senior living facility and do not replicate the financial situation of any individual entity.

Figures based on tax assessor data, data may be incorrect or outdated. All square footage and acreage figures subject to surveys and engineering studies.

Source: RS Means Construction Software

$93

Figures based on tax assessor data, data may be incorrect or outdated. All square footage and acreage figures subject to surveys and engineering studies.

Source: RS Means Construction Software

$93

Building # Projected Renovation Costs Building #1 $5,247,527 Building #2 $4,838,576 Building #3 $6,008,783 Building #4,5,8 $10,742,256 Building #6 Demolish Building #7 $210,814 Total Renovation $27,047,956 Page 19 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

SQUARE FOOT

Results

The research team compared revenues less operating expenses (i.e., cash available for debt service) with the payment that would be necessary to amortize a loan equal to renovation costs. The key point from this comparison is that the CCRC option fails to generate sufficient cash flow to amortize the renovation loan at prevailing interest rates, while the senior living option does. This result is due to two factors. First, the CCRC option requires a costlier remodel of the existing facility because a portion of the building must be equipped to hospital-grade standards. Second, operating expenses are higher for the CCRC option because of the need to employ trained and certified health care staff compared to the staff of a senior living–only facility, whose wages are more likely to be similar to those of hotel staff.

Estimating revenue and expenses with Aging Care

The CCRC option is projected to fall short of generating cash flow sufficient to meet debt obligations.

Annual Revenue $9,672,000 Annual Operating Expenses

Salaries & Benefits $3,872,693

Marketing $483,600

Admin $29,280

Operations $195,197

Other $98,772

Housekeeping $677,040 Medical Supplies $701,342

Food $1,472,819

Annual Operating Expenses $7,530,743 Revenue Less Operating Expenses $2,141,257 Loan Amortization $2,995,386 Cash Flow -$854,129

Revenues and expenses estimated using tax returns of Aging Care facilities.

Page 20 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Estimating revenue and expenses without Aging Care

The Senior Living ONLY option is projected to generate cash flow sufficient to meet debt obligations.

Based on these projections, the senior living option is more economically feasible than the CCRC option. As previously noted, this comparison is made at the prevailing prime interest rate of 8.25% in mid-2023. Calculations around the sensitivity of cash flows to changes in interest rates reveals that the CCRC option begins to become feasible as interest rates near 5%.

The Institute of Government research team estimated the fiscal impacts of renovating the Hutcheson Building based on the estimated value of the complex when complete. The fully-renovated Hutcheson Building is projected to appraise at $55.4

million. This figure was calculated by using R S Means construction estimation software to estimate the cost of constructing a new building of the same size and to the same quality level as a renovated Hutcheson Building plus associated land value. The fiscal impact was calculated at 40% of the sum of the estimated construction cost plus land value, using current Catoosa County and Fort Oglethorpe millage rates. The renovation would generate a total annual fiscal impact of $639K. Annual county tax collections were estimated at $163K. Annual school tax collections were estimated at $335K. Annual city tax collections were estimated at $142K.

Revenues and expenses estimated using tax returns of Aging Care facilities. Annual Revenue $7,488,000 Annual Operating Expenses Salaries & Benefits $2,249,414 Marketing $374,400 Admin $22,668 Operations $151,120 Other $76,468 Housekeeping $524,160 Medical Supplies $0 Food $1,140,247 Annual Operating Expenses $4,538,478 Revenue Less Operating Expenses $2,949,522 Loan Amortization $2,438,427 Cash Flow $511,095 Page 21 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Approximately half of the Hutcheson Building’s property has the potential for being developed for other uses.

Page 22 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

CHAPTER 4

ADDITIONAL SITE DEVELOPMENT OPTIONS

While roughly half of the approximately 30-acre property is occupied by the Hutcheson Building, the remaining half, currently covered by parking lots, green space, storage, and hospital outbuildings, could be utilized for other compatible types of development. The Catoosa PFA tasked Institute researchers with evaluating the feasibility of a mixed-use, multifamily/retail development and a single-family home development.

1. Multifamily Residential Mixed Use

2. Single-Family Development

1. Multifamily Residential Mixed Use

2. Single-Family Development

Page 23 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

TWO OPTIONS:

CHAPTER 5

MULTIFAMILY MIXED-USE RESIDENTIAL DEVELOPMENT

A mixed-use multifamily and retail real estate development is a project that combines residential and commercial components within the same property. It aims to create a vibrant and selfcontained community where people can live, work, and shop in close proximity, fostering convenience and a sense of community.

The residential aspect of this type of development typically includes multiple housing units such as apartments, condominiums, or townhouses. These units may vary in size, layout, and amenities to accommodate a diverse range of residents. The design of the residential spaces often focuses on creating comfortable living environments with modern features, communal areas, and, occasionally, recreational facilities.

The retail component of the development includes commercial spaces such as shops, restaurants, cafés, or service-oriented businesses. These retail spaces are usually located on the ground floor or at street level to maximize visibility and accessibility. They are designed to cater to the needs and preferences of the residents as well as the surrounding community, providing a range of goods and services conveniently accessible to residents and visitors alike.

A mixed-use multifamily and retail development often incorporates common areas and amenities that foster community engagement and social interaction. These may include parks, plazas, green spaces, fitness centers, community rooms, or shared recreational facilities. The goal is to create an environment that encourages residents and visitors to interact, build relationships, and establish a sense of belonging.

From a design perspective, these developments often emphasize walkability and connectivity, with well-designed pedestrian-friendly streetscapes, sidewalks, and cycling infrastructure. They may also incorporate sustainable features like green roofs, energy-efficient systems, and alternative transportation options to minimize environmental impact. A mixed-use development on the subject

property would easily connect with Fort Oglethorpe’s existing downtown area, walking paths, and the historic Chickamauga Battlefield.

The economic benefits of such developments can be significant, as they attract residents, shoppers, and businesses to a concentrated area, leading to increased foot traffic, economic activity, and job opportunities. The combination of residential and commercial spaces in close proximity allows for a diverse and dynamic community, enhancing the overall quality of life for the residents.

Overall, a mixed-use multifamily and retail real estate development offers a comprehensive and integrated living experience, providing residents with the convenience of nearby amenities, access to goods and services, and a vibrant community atmosphere.

PROS AND CONS

Several factors contribute to the appeal of multifamily, mixed-use residential for the redevelopment of the Hutcheson Building site. These factors include a growing population, a relatively low cost of living compared to Chattanooga, consistency with surrounding residential areas, walkability, and prospects for additional economic opportunity. Catoosa’s population has been steadily increasing in recent years, primarily through in-migration, making it an attractive location for developers looking to invest in rental housing. Prospective residents will find Fort Oglethorpe’s relatively higher affordability attractive when compared to Chattanooga.

The area around the Hutcheson Building site is primarily residential, though the surrounding area is largely made up of single-family or townhouse-style units. Still, a multifamily residential development would fit relatively well with the character of the surroundings. Another factor in favor of residential development is the walkability to downtown Fort Oglethorpe, including the newly renovated farmer’s market, as well as the Chickamauga Battlefield. Catoosa County and the city of Fort Oglethorpe

Page 24 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

could easily cooperate to establish a walking path that directly links the Hutcheson Building site to the battlefield.

Finally, incorporating retail, event, or restaurant space into the redevelopment of the site would allow for additional economic opportunity, increasing the long-term economic sustainability of the project and reducing the risk to developers via multiple streams of income. Though retailers at the site could face competition from the multitude of stores and restaurants on Battlefield Parkway, some smaller boutique shops and restaurants could likely be sustained solely by residents in the development, along with local residents visiting on foot from surrounding residential areas, downtown Fort Oglethorpe, and the Chickamauga Battlefield, especially if developers work with the local government to enhance walkability.

A few factors work as headwinds against residential mixed use for the Hutcheson Building redevelopment. These factors include an increased burden on local schools, supply chain issues, and the current high interest rate environment. Unlike some more rural areas in Georgia, Catoosa County is seeing increasing enrollment in its school system. A new multifamily residential development is likely to increase the burden on the school system.

The final two factors working against redevelopment of the Hutcheson Buildings site to residential mixed use are supply chain issues and the current high interest rate environment. Supply chain issues alone do not make or break a new residential development, but decreased availability or higher prices of certain materials can certainly slow the pace of the project and add cost. Luckily, it seems that supply chain issues are not as acute as they were one or two years ago, but some materials are still recovering in terms of availability and price due to shocks from the pandemic. High interest rates make securing financing costlier for developers. As of June 2023, the Fed prime rate is 8.25%, the highest it has been since 2006.

In conclusion, constructing mixed-use residential and retail space on the Hutcheson Building site is certainly feasible, but comes with pros and cons.

Developers must carefully consider the costs of financing and site development, but with the area’s growing population, prospects for additional economic opportunity, and consistency with the character of the surrounding area, there is potential for success in mixed-use residential development as an alternative use of the site.

ECONOMIC IMPACT Methodology

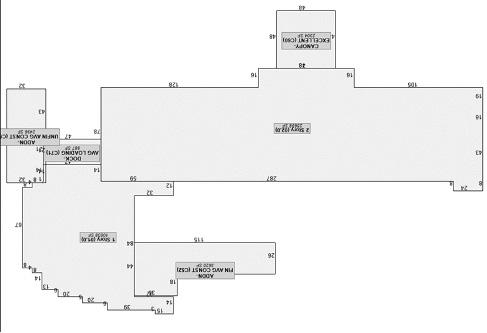

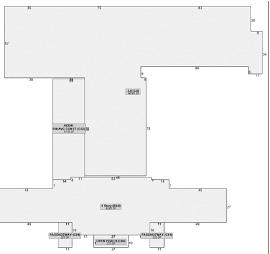

To estimate the potential scale of a multifamily development in the Hutcheson Building site, the research team hypothesized a street running east to west between Gross Crescent Circle and Park City Road.

A street of this length would accommodate approximately 10 mixed-use residential/retail buildings the size of the historic Old Post Hospital. Georgia has several similar developments, including the one pictured in Madison. The design and façade of the Madison buildings are intended to mimic the design of many of historic Madison’s old downtown structures.

Page 25 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

A street running from Gross Crescent Circle to Park City Road would accommodate approximately 10 mixed-use buildings the size of the historic Post Hospital building.

Modern downtown Madison, Georgia buildings constructed to evoke the look and feel of old historic structures

Page 26 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

James Madison Inn

In particular, the James Madison Inn is similar in size to the Old Post Hospital. A building of this size would contain about 25,000 total square feet of floor space across three floors, amounting to 18 units of 1,000 square feet each after accounting for hallways, stairwells, and other communal areas. Each unit would be roughly the equivalent of a two-bedroom apartment, with the possibility

of combining multiple street-level units to achieve the desired square footage for event space or retail space such as restaurants, pubs, or shops. R.S. Means construction estimation software was used to estimate the construction cost for a high-end, steel and reinforced concrete structure with brick veneer similar to that shown in the example photo.

Higher-End Mixed-Use Multifamily Development

Similar Aesthetic to Old Post Hospital

Approximately 25,000 sq. ft. building

18 units of 1,000 sq. ft. each (2BR)

Each building $5.3 million to construct

Requires monthly rent of $2,200

Based on housing budget rule of thumb (30%), target demographic of households earning $90K annually

Average rent in the area is $1,347

Median income in the Chattanooga MSA is $72K

Construction of a higher-end multifamily building would cost an estimated $5.3 million, which would require monthly rent of $2,200 per 1,000 square foot unit to amortize a 30-year construction loan at prevailing interest rates. Average rent for a two-bedroom apartment in the Chattanooga MSA was $1,347 in mid-2023 according to a survey of apartment rental rates, implying that the required

rental rate would need to be roughly 63% higher than the area average to meet debt obligations. Based on a commonly used mortgage industry rule of thumb that no more than 30% of household income should be spent on housing, such a development would target households earning approximately $90K annually. Thus, this development would be targeting households earning 25% more than the

Page 27 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

An example of high-end construction designed similar in scale to the historic Post Hospital

median household income in the Chattanooga MSA of $72K. These figures suggest that a high-end mixed-use development may be too expensive for the local rental market.

The previous example may be viewed as an upper bound on the price level of a mixed-use structure that could be constructed on the property. It is also

informative to examine how a more modest level of construction would affect feasibility and affordability. A building of the same size constructed with wood framing, fiber cement siding, and a lower trim level would cost approximately $4.7 million to construct and would require monthly rental income of $1,960 for a 1,000 square foot unit to amortize a 30-year construction loan.

Lower-End Mixed-Use Multifamily Development

Approximately 25,000 sq. ft. building

18 units of 1,000 sq. ft. each

Each building $4.7 million to construct

Requires monthly rent of $1,960

Based on housing budget rule of thumb (30%), target demographic of households earning $80K annually

Average rent in the area is $1,347

Median income in the Chattanooga MSA is $72K

Page 28 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

An example of more modestly priced construction similar in scale to the historic Post Hospital

This rent would be 45% higher than the area average and target households earning $80K annually, only 11% higher than the median income of $72K. This lower level of construction aligns more closely with the average rent and median household income of the area than the higher-end development and

suggests that a mixed-use development may be feasible at a more modest level of construction. While this analysis is for a single structure, these results would extend to multiple identical, or similar, structures within the same development.

Results

The economic impact of a mixed-use multifamily development differs somewhat depending on the quality of construction materials. A higher-end brick multifamily development would cost $53.2 million to construct (10 x 25K square foot buildings at $5.3 million each), generating a direct output of $53.2 million for the project. This project would also generate an indirect output of $2.7 million and an induced impact of $757K for a total economic impact of $56.5 million. Construction of a less expensive, wood-framed, multifamily development would generate a direct output of $47 million (10 x 25K square foot buildings at $4.7 million each). This project would generate an indirect output of $2.4 million and an induced impact of $391K for a total economic impact of $49.8 million.

The fiscal impact of a mixed-use development was estimated by applying current Catoosa County and

Fort Oglethorpe millage rates to 40% of a projected appraisal value equal to construction cost plus associated land values for a 10-unit development. A higher-end multifamily development made up of 10 buildings of 25,000 square feet each with 18 units of approximately 1,000 square feet each would have an estimated annual fiscal impact of $614K. Annual county tax collections, school taxes, and city taxes would be an estimated $156K, $321K, and $136K, respectively. A lower-end multifamily development made up of 10 buildings at 25,000 square feet each with 18 units of approximately 1,000 square feet each would have a total estimated annual fiscal impact of a $541K. Annual county tax collections, school taxes, and city taxes would be an estimated $138K, $283K, and $120K, respectively. It should be noted that, depending on the orientation of the development, a portion of taxes generated would accrue to neighboring Walker County.

Mixed-Use Multifamily Development Higher-end Lower-end Construction Cost $53.2 million $47 million Direct Output $53.2 million $47 million Indirect Output $2.7 million $2.4 million Induced Impact $757K $391K Total Economic Impact $56.5 million $49.8 million Estimated Annual Fiscal Impact $614K $541K County Tax Collections $156K $138K School Taxes $321K $283K City Taxes $136K $120K Page 29 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

SINGLE-FAMILY RESIDENTIAL DEVELOPMENT

BACKGROUND

The final development option considered was singlefamily housing. As discussed in previous sections, in-migration and commuting flows within Catoosa County and the Chattanooga MSA indicate that there may be greater demand for housing than the current supply. Catoosa’s relatively low cost of living compared to Chattanooga, consistency with surrounding residential areas, and potential walkability are the primary factors in favor of developing single-family housing on the site.

The area around the Hutcheson Building site is primarily residential, including the historic homes on Barnhardt Circle, brick homes originally built as housing for doctors on North Thomas Road, and a newer development on 6th Street. Another singlefamily residential development would fit seamlessly with the character of the surroundings. Walkability to downtown Fort Oglethorpe, including the newly renovated farmer’s market and a potential path to Chickamauga Battlefield, would be a desirable amenity for residents.

Primary factors working against a single-family development include increased burden on local schools, the cost of utility installation, supply chain issues, and the current high interest rate environment. As discussed in the multifamily section, Catoosa County is seeing year-over-year increasing enrollment in its school system, unlike some areas in the state. A new residential development is likely to increase pressure on the school system, though this burden would be partially defrayed by increased tax collections from the residents. Another option would be to designate the single-family development as 55+, which would largely eliminate the risk of burdening the school system.

Another factor to consider when planning a new single-family residential development is the cost of utility installation, particularly water and sewer lines. Increased tax collections from new singlefamily dwellings typically only cover about 80%

of the cost to local governments of developing new sewer and water lines. Though increased land premiums charged to developers for each parcel can help defray the cost of building these utilities, a new residential development can take decades to switch from a budget liability to an asset for the local government due to the initial cost of utility installation.

The final two factors working against redevelopment of the Hutcheson Buildings site to single-family residential are supply chain issues and the current high interest rate environment. High interest rates make securing financing costlier for both developers and prospective residents. As of June 2023, the Fed prime rate was 8.25% and the average 30year mortgage rate was hovering at approximately 7%, a 20-year high. There is hope that the Fed will pause rate hikes in the near future as inflation and corporate debt are reined in.

In conclusion, a single-family residential development within the Hutcheson Building site is certainly feasible but comes with pros and cons. A mid- to highdensity single-family housing development would appear to be a natural fit with both the surrounding communities and a renovated Hutcheson Building repurposed as a senior living facility. Development of single-family homes could be accomplished in tandem with construction of a multifamily residential mixed-use facility if desired. Designating these homes as a 55+ development would place a far smaller burden on local schools.

CHAPTER 6 Page 30 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

ECONOMIC IMPACT

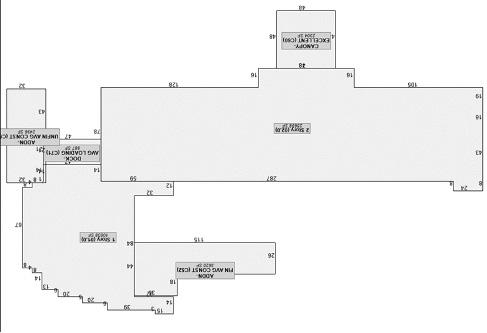

Methodology

Researchers estimated that approximately 200 high-density single-family homes could be constructed in the area south of the Hutcheson Building currently covered by a parking lot and storage buildings associated with the hospital.

Option 2B: Single-Family Development

A hypothetical high-density housing development based on an example located in Barrow County, Georgia

About half of these homes would lie in Catoosa County and the other half in neighboring Walker County. Based on similar developments in other areas of the state, homes would average 1,600 square feet and cost about $264K to construct, exclusive of land costs. Each home would occupy

a half-acre lot valued at approximately $40K (land premium), for a total estimated cost to develop of $304K. The homes would appraise for $320K based on mid-2023 assessed values for similar properties. Total expenditure for the 200-home development, exclusive of utilities, would be about $60.8 million.

Page 31 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Single-Family Development –Homebuyer Side Development

Based on a sales price of $320K, a sample monthly payment for a home in this development would be $2,260, targeting households earning $90K annually based on the previously noted mortgage industry rule of thumb. These estimates align closely with the

Homes appraise for about $320K with a monthly mortgage payment of ~$2,260

Target demographic of households earning $90K annually

Average new home sales price in Chattanooga MSA is $350K with a mortgage payment of ~$2,450

Median income in the Chattanooga MSA is $72K

average new home sales price of $350K and average mortgage payment of $2,450 for the Chattanooga MSA, suggesting that such a development would be in line with typical home prices, affordable for an average homebuyer in the surrounding area.

Page 32 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

A typical home in an urban high-density housing development

Results

Though the total expenditure for a 200-home development on the site was estimated at $60.8 million, the land premiums are not included in economic impact estimates. Land changing hands does not generate economic value like construction, goods, and services. Thus, the direct economic impact of the single-family development would be $52.8 million ($60.8 million minus land premiums). This project would also generate an indirect output of $11.9 million and an induced output of $8.7 million, for a total economic impact of $73.4 million.

The fiscal impact of a single-family housing development was projected based on Catoosa

County’s and Fort Oglethorpe’s current millage rates assessed on 40% of an average estimated value of $320K per unit. The total annual fiscal impact of a single-family development made up of 200 homes at 1,600 square feet and appraised/sold at $320K is estimated to be $662K. County tax collections would total an estimated $184K annually, with an additional $318K in annual school tax collections. Annual city tax collections are estimated at $160K. Depending on lot configurations, approximately half of these homes would generate tax revenues in Walker County rather than Catoosa and would be subject to somewhat different millage rates.

Estimated costs, economic impact, and fiscal impact

Total Expenditure $60.8 million Land Premiums Not included in economic impact estimates

economic impact of the single-family development Direct Economic Impact (Total Expenditure minus Land Premiums) $52.8 million Indirect Output $11.9 million Induced Output: $8.7 million Total Economic Impact $73.4 million Fiscal impact of the single-family housing development Estimated Annual Fiscal Impact $662K County Tax Collections $184K annually School Tax Collections $318K annually City Tax Collections $160K annually

Single-family development expenditure

Direct

homes at 1,600 sq. ft and appraised/sold at $320K Page 33 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

200

CONCLUSION

Paired with aging demographics in Catoosa County and the surrounding Chattanooga MSA, the argument for repurposing the facility as a CCRC is strong. However, the current macroeconomic climate puts the financials of a renovation project of this size and scope on shaky ground. At current interest rates, the economic feasibility of any large economic development project is reduced somewhat. The cost for renovating even a small part of the complex to hospital-grade standards for aging care is significant. Consider the increased cost of staffing and medical supplies, and the projected cashflow turns negative.

Senior living without aging care would be a more economically feasible alternative use for the Hutcheson Building complex at current interest rates, though the sensitivity analysis shows that

a 1% increase in the prime rate would largely eliminate the profit margin of that use case as well. Luckily, it seems that any redevelopment plan for the facilities is likely on hold for the foreseeable future as the new CHI Memorial Hospital has yet to break ground. As the Federal Reserve slows rate hikes or, better yet, cuts rates, the economic feasibility of both options would improve.

Though renovation of the Hutcheson Building facility is likely on hold for several years, the parcel includes approximately 15 additional acres that are currently home to parking lots, outbuildings, and greenspace. The Catoosa County PFA could choose to split the parcel or rezone certain areas of the site to residential. Options for residential development include a series of multifamily mixed-use buildings or a moderate-

Partners Page 34 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

The Hutcheson Building facility, as a hospital complex, lends itself well to use as an aging-care facility.

to-high-density single-family development. Institute of Government researchers utilized RS Means construction software to estimate the cost of building a multifamily development with a higherend brick façade as well as a lower-end cement board exterior. Based on the projected cost of construction, the lower-end multifamily development would most closely match the area’s affordability needs.

Two-hundred single-family homes of approximately 1,600 square feet each could be constructed on the lower half of the parcel, provided that the parking lot south of Clinic Drive were removed and the outbuildings surrounding Building 6 demolished. Institute researchers estimated that homes would appraise for approximately $320K each, making them affordable for households earning approximately $90K annually, 25% higher than the median household income in the Chattanooga MSA.

Economic impact figures can be useful when determining the local effect of dollars invested in large-scale economic development projects. However, economic impact figures are largely driven by the direct output—or capital investment—of a project, inflating the total impact of more expensive projects. Constructing new facilities is approximately twice as expensive as renovating existing facilities, depending on the building specs. With this in mind, it follows that the site use options requiring new construction have the highest total economic output. Ranking the site use options by total economic output, the single-family development has the largest economic impact at $73.4 million, followed by the higher-end multifamily development at $56.7 million, then the lower-end multifamily development at $49.7 million. A CCRC that includes aging care has a higher total output ($44.3 million) than a senior living facility, with the lowest total output of $36 million. The estimated fiscal impacts of alternative site uses follow a similar pattern, though in this case the projected tax collections from multifamily developments rank lowest. A 200-home singlefamily development has the greatest projected fiscal impact, generating an estimated $662K in county, school, and city taxes annually. The renovated

Hutcheson Building complex for senior living has the second-highest estimated annual fiscal impact at $639K with or without aging care. The higherend multifamily development would generate approximately $614K in taxes annually, followed by the lower-end multifamily development with the lowest estimated fiscal impact of $541K per year.

The Hutcheson Building site is large enough to host a combination of alternative uses. Using the market analysis, paired with economic and fiscal impact estimates generated by the Institute of Government, the Catoosa County PFA can make data-informed decisions about contracting with one or more developers to redevelop the Hutcheson Building site. Aided by this analysis, the PFA can pursue one or more site uses that would complement each other, would be sustainable long term, and would foster additional economic opportunity to enhance downtown Fort Oglethorpe and the community as a whole.

Page 35 Hutcheson Property Market Study and Financial Feasibility Redevelopment Report

Embrace the power of innovation and envision a future where the old becomes new, where aging care facilities are transformed into vibrant spaces that uplift our community and foster economic growth.

Partners

Carl Vinson Institute of Government Lyndhurst Foundation Catoosa County Public Facilities Authority

Carl Vinson Institute of Government Lyndhurst Foundation Catoosa County Public Facilities Authority

1. Multifamily Residential Mixed Use

2. Single-Family Development

1. Multifamily Residential Mixed Use

2. Single-Family Development