As we enter the new financial year, we’re proud to present the July edition of Portfolio magazine.

We rounded out 23/24 with our June Auction Showcase, where more than 50 properties went under the hammer across the eastern seaboard, representing a preliminary clearance rate of 76 per cent. This success represents the confidence returning to the market going into the new financial year.

In this month’s edition of Portfolio, Ray White head of research Vanessa Rader talks about the growing popularity of data centres, noting Australia is currently the seventh most populous country for the asset, commanding interest from institutional and offshore groups.

RWC property management performance specialist Leteicha Wilson shares her insights on the importance of professional management for your commercial assets. She discusses the

risks associated with self-management, and the benefits of involving professionals to manage these assets.

We also recap on June’s Between the Lines Live webinar, where Vanessa hosted HTL Property’s Andrew Jolliffe and James Smithers to talk about Australia’s pub market. The group of experts discussed the opportunities in the pub market, and what the future might look like for the assets. This month’s Between the Lines Live webinar will be held on July 10, where Vanessa will head to Western Australia to chat to RWC WA’s Stephen Harrison and Brett Wilkins about the west coast market.

James Linacre Head of Commercial RWC Australia and New Zealand

VANESSA RADER Ray White Head of Research

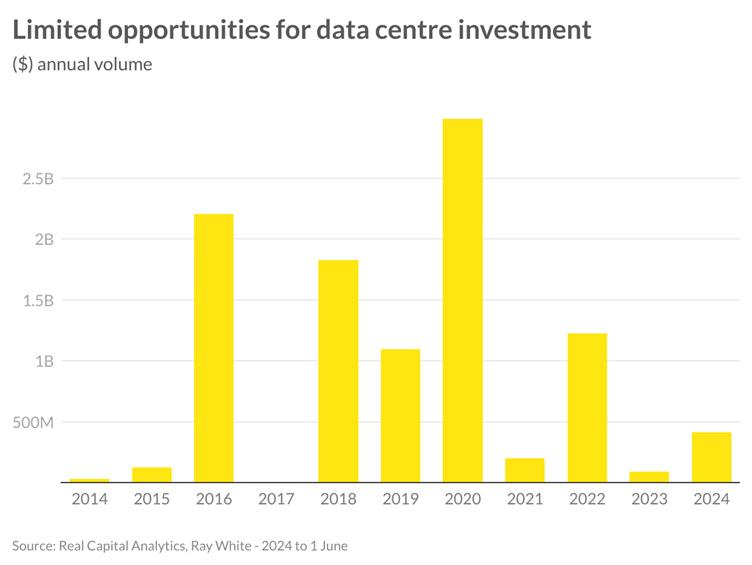

Over the past two decades, the number of data centres around the world has been steadily increasing, with Australia now ranking as the seventh most populous country for these facilities. The nation has witnessed significant investments, totaling more than $13.6 billion, directed towards the construction of new data centres. In the last year alone, completed projects added more than 150,000sqm of space. As the country’s population grows, it is anticipated that the demand for these facilities will also increase, resulting in assets being closely held and low annual sales volumes. In the past 10 years, transactions have been limited, reaching a peak of $3 billion in 2020, with an average investment of approximately $1.2 billion per year. During the first five months of 2024, a range of offerings have been transacted, amounting to $414.5 million.

Historically, the majority of investment activity has been concentrated in the NSW market, primarily in metropolitan areas, followed by Melbourne. Despite Queensland’s strong population growth, there have been limited transactions for data centres in this location, with existing assets being tightly held. On the other hand, opportunities in the ACT,, South Australia, and Western Australia have all made significant progress in terms of transaction volume.

($) annual volume

Source: Real Capital Analytics, Ray White - 2024 to 1 Junes

Data centres have proven to be an attractive investment opportunity for larger institutional and offshore investment groups, with the average investment size over the last ten years sitting at $94.5 million, unlike many other alternative asset classes. Historically, foreign investors have been the primary investor type, with the United States and Canada being the major buyers. However, prior to the pandemic, China, Singapore, and New Zealand groups also featured in the market. Although sales volumes have been limited in the last 18 months, there has been a shift in the seller profile, with some offshore groups divesting their assets and local groups now becoming the dominant buyer category. Despite this change, foreign funds continue to be the major players in the development of new data centre space. With more than 140,000sqm currently under construction, approximately 80 per cent is represented by offshore capital, including Microsoft’s Penrith facility, which is set to be completed in early 2025.

During 2023, the energy consumption of these facilities grew by 55 per cent internationally, highlighting the importance of focusing on renewable energy options moving forward. Developers and investors aiming to achieve their internal environmental, social, and governance (ESG) targets are placing a major emphasis on the ability to offset consumption costs, reduce carbon emissions, and maintain quality connectivity.

Moving forward, the development and investment of data centre assets will continue to prioritise these factors, along with efficient mechanical and plumbing systems, such as the use of recycled water. Assets that successfully incorporate these features will likely achieve the most favourable yields. Before the pandemic, yields for data centre assets ranged from 7 to 9.5 per cent. However, during the period of low interest rates, yields compressed to as low as 4.3 per cent. Recent sales have seen yields rumoured to be as low as 3.6 percent and as high as the upper 6 per cent range, varying based on factors such as size, location, and functionality.

As Australia’s population grows and its dependence on technology increases, the country’s demand for data is expected to rise. Consequently, data centres will attract greater attention as an investment class. While foreign investors have been active in this asset class for some time, Australia is emerging as one of the key global locations for new facilities, following countries like the United States, Germany, United Kingdom, and China. The growing demand from the listed sector is expected to put pressure on yields and drive the development of new supply.

MORE THAN 200

Ray White head of research Vanessa Rader hosted the webinar and was joined by HTL Property managing director Andrew Jolliffe and HTL Property national director for investment management James Smithers.

After the market peaked in 2022, with more than $2 billion in transactions in NSW alone, Mr Jolliffe said while the market had cooled slightly, pubs were still in hot demand.

“The calendar year of 2022 saw a peak in transaction volumes with more than 100 pubs sold for the state,” Mr Jolliffe said.

“Volumes in 2023 were lower, driven by the interest rate rises and with liquidity being less accessible, plus a change in the cadence of the investor.

“We’re in 2024 now and we believe it will be up on 2023, not where 2022 was, but certainly bouncing back.

“It’s been quite listing driven, but in a geographic sense regional/coastal activity is still really a feature. However, there has been a greater proportion of metro assets sold in 2024 compared to the previous years.

“Generational families or experienced private groups are still the majority of who are buying hotels. However, some domestic and offshore funds have also taken an interest, with some highlevel, sophisticated, transactions going on.”

Mr Smithers said pubs were able to provide a lot of value for investors.

“Pubs have been an asset class people have misunderstood, but you have five potential income streams across food, beverage, gaming, retail, and accommodation,” he said.

“The high-floor of the space is exceptional. The opportunity for sophisticated investors to optimise all five revenue streams rather than traditional operators that focus on just two or three.

“There’s a lot of conversation about discretionary spending, but people are still going out, but they’re

choosing venues with stronger offerings. So those venues with all five revenue streams are seeing increased footfall.”

Mr Jolliffe said yields had moved along with interest rates, but pubs were a “good bet”.

“They’re a good bet for a bank as they have prosperous cash flows, and you can influence revenue and profitability in a pub which makes them an attractive asset class for lenders,” he said.

“We have $100+ million dollar assets, so we’re an asset class with a bit of fire power now.

“There’s a bit of discussion around downward pressure on rates, it might be next year but I hope it’s this year.

“Let’s see post-July 1 with some stage three tax cuts, that will provide some relief for a lot of people so we might see more people wanting to go out for a night of entertainment.”

Mr Smithers said, as an asset class, pubs need to be able to move with the times in order to maintain their profitability.

“Pubs sit with an ability to utilise their square meterage more aggressively, but the air space above that is where the opportunity rises,” he said.

“With their location often on the high-streets, these assets are transitioning to precincts. Publicans are realising they need to be more universal in how they service consumer needs in changing demographics.

“I think we can be better in how we service consumers through the next phase, and how we approach development in the future is critical.

“The next 6-12 months will be an interesting time and I think assets will be keenly contested, and that development space will be important as investors look to diversify in a high-delivery sector.”

LETEICHA WILSON

Property Management Performance Specialist

In the world of commercial property investment, the allure of self-managing assets can be tempting for landlords seeking to maintain control and potentially save on management fees. However, the reality is that self-management often leads to significant challenges and pitfalls that can ultimately undermine the value and performance of the investment.

One of the most challenging aspects of self-managing commercial properties is dealing with tenant defaults on financial obligations. Landlords who have an emotional connection with their tenants often struggle to enforce strict lease terms. This reluctance to issue breach notices or charge interest on overdue payments can result in tenants falling significantly behind on rent and/or outgoings. The consequences are twofold; the landlord’s cash flow and financial commitments suffers, and the tenant’s financial situation deteriorates further, creating an unpleasant and potentially disastrous situation for both parties.

Professional property managers, on the other hand, maintain a professional distance and are well-versed in handling such situations. They ensure that lease terms are strictly enforced, breach notices are issued when necessary, and appropriate measures are taken to mitigate financial risks. This approach helps maintain a healthy financial relationship between landlord and tenant, preserving the integrity of the investment.

Another major pitfall for self-managing landlords is the challenge of keeping abreast of constantly evolving legislation, particularly the intricate laws governing commercial and retail leases. Retail lease laws, in particular, are incredibly complex and require a deep understanding to ensure compliance. Failure to adhere to these regulations can result in legal disputes, financial penalties, and reputational damage.

Professional property managers are experts in commercial and retail lease legislation. They stay updated on legislative changes and ensure that all lease agreements and property management practices comply with the latest regulations. This expertise protects landlords from legal pitfalls and ensures smooth, compliant operations.

Accurate asset valuation and market rent assessments are critical to maximising the returns on commercial property investments. Self-managing landlords, who may not be actively involved in the leasing market, often lack the necessary market knowledge to conduct accurate market reviews. As a result, they may undervalue their assets, missing out on potential rent increases and failing to optimise their investment returns.

Commercial property specialists have their fingers on the pulse of the market. They conduct thorough market analyses, ensuring that rent reviews and lease renewals reflect current market conditions. This expertise ensures that properties are competitively positioned, and landlords receive fair market value for their assets.

The pitfalls of self-managing commercial properties are clear: emotional connections with tenants, navigating complex legislation, and lack of market knowledge can all significantly impact the performance and value of the investment. Engaging a professional management specialist mitigates these risks and ensures that the property is managed with expertise, diligence, and a focus on maximising returns.

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

RWC TOOWOOMBA

This prime positioned professional office complex, located on the fringe of the CBD, is air conditioned throughout and fully tenanted

POTTS POINT, NSW

Mixed-use building in the heart of Kings Cross comprises a brothel, backpackers’ accommodation, and four retail spaces. Its prime location ensures high foot traffic and visibility, making it an attractive proposition for businesses.

RWC SOUTHWEST

SUMNER, QLD

1,235sqm* premium multi-tenanted asset with A-grade fit out located within the Sumner Industrial precinct on a 2,327sqm* prime site

RICHLANDS, QLD

4,231sqm* freestanding building in a high profile location. Leased by Advancell Isotopes Pty Ltd, a world leader in both research and development of Targeted Alpha Therapies for the treatment of various forms of cancer.

21 Reichert Drive, Molendinar, 4214

Of

Closing at 4:00pm (AEST) on Thursday, 18 July, 2024.

16,650m2* industrial land parcel

3,602m2* of building area (across 3 x buildings)

Total Income of $585,000 per annum + GST

Nearly 100 meters of street frontage For Sale for the first time in over 35 years

Strong existing tenants in place with 2-year WALE

5,723sqm* (2 tenants) Dual street access (Bridge St & Hawson St)

Precinct 3 zoning under Toowoomba Council

617-619 Ruthven Street, Toowoomba City, 4350

traffic exposure - next door to Toyota - entire office building

Land size 1,327sqm* (2 lots)

NLA 1,724sqm* (over 4 levels)

Current income $523,515p.a.* + GST (until 30/06/24)

Vacant possession

25* on site car parks

Dual street frontage (Ruthven St & Mann St)

Mixed Use Zoning under Toowoomba Council

j.ho@rwsp.net

Located within the award winning Parkridge Noosa, the restaurant portion of the property is one of the few commercial assets in Noosa with such a high capacity to cater for large dining groups and events. The whole building provides 694m2* of internal usable space.

•Restaurant 470m2* internal plus 123m2* outdoor exclusive use area

•Significant outdoor special rights area (utilise for up to 12 events per annum)

•Premium restaurant fitout and equipment includedready to trade immediately

•The building also includes a tenanted 202m2* gym and 22m2* office

•36 exclusive car parks on grade

Established in 1998, this seafood wholesaler/retailer not only services restaurants and cafes on the Sunshine Coast, but is also very popular with locals and visitors. The annual turnover is currently around $2.4M.*

All aspects of this business and premises are designed to cater for significant growth including:

•Large retail shop for peak trading periods like Christmas and Easter

•Spacious coolroom and processing area

•90 x pallet freezer

•Undercover loading/unloading of delivery vehicles allowing for all weather conditions

•65kW rooftop solar system to reduce electricity costs

If you are looking to buy an existing restaurant in Noosa, water views are a must. You don't get much closer to the water than this opportunity.

•Operating for over 15 years

•Multiple revenue streams: Dine in, takeaway, functions

•Turnover consistently over $2M per annum*

•Seats 80 a la carte, caters for 130 in a function

•Average spend approximately $125 plus per diner*

•Fully staffed, strong lease, well maintained equipment

•Currently over 20 weddings booked

1-11 West Terrace, Caloundra, 4551

penthouses, The Terraces provides a brand new medical hub with specialist medical suites ranging from 180m2* - 1,010m2*.

• 1,436m2* of new medical suites

• 67 dedicated on site car parks

• Zoning for Medical or Retail (STCA)

• Directly across from Caloundra Hospital

• •

Expressions Of Interest

RWC Noosa & Sunshine Coast

raywhitecommercial.com

Josh Harris 0452 604 478 josh.harris@raywhite.com

2/168 Noosa Parade, Noosaville, 4566

•Secured lease with long standing tenants Noosa Parade Dental Care who have traded for 20+ years

• • 97m2

• • Rental $48,693.45 per annum with all outgoings recoverable

• Three exclusive use allocated off-street car parks, one undercover

On site at 11am on Friday 12 July

David Brinkley 0448 594 361 david.brinkley@raywhite.com

Paul Forrest 0408 985 254 paul.forrest@raywhite.com

1,933*m2 of land

100*solar panels on the roof

$167,305*pa net income + GST + Outgoings

Expressions Of Interest

Closing Thursday 11 July 2024 at 4pm.

1,515 sqm Land with General Industry A zoning*

Existing Hall and Church Improvements

Opposite Bunnings Acacia Ridge

Exposure to 12,500 vehicles daily*

Strategic location with access to major transport routes

Corner of Learoyd Road and Bradman Street

Being sold with vacant possession

Paul Anderson 0438 661 266 Andrew Doyle 0412 853 366

Jason Hines 0418 721 744

RWC Queensland

586 Rode Road, Chermside, 4032

RWC Queensland & Castle Property Group are delighted to present 586 Rode Road Chermside to the market for sale or lease. Construction has now commenced on this next generation office and warehouse facility, with completion expected in Q4 2024.

•Building: 1,300m2*, Land: 2,228m2*

•Freestanding site, fenced and landscaped

•Secure tilt panel construction

•Column free warehouse space

•Springing height of 8 metres

•4 x motorised roller shutters

•3 phase power

•15 car parks (4 undercover)

•Flood free

•NBN and communication services available

Ample

106 Campbell Street, Toowoomba City, 4350 Lease Price on Application

Building Area: 499sqm* Floor Area: 195sqm*

•Prime corner position on Hume Street and Campbell Street

•Exceptional business exposure with outstanding signage opportunities

•195sqm* of modern office space on a 499sqm* lot

•Reception area and multiple meeting rooms and offices

•Well-appointed offices catering to various business needs

•Convenient on site parking for staff and clients

•Complete staff amenities for a comfortable working environment

•Strategic CBD fringe location in a vibrant business community

•Available to lease from August/September 2024

Brian Doyle 0434 551 628 brian.doyle@raywhite.com

RWC Toowoomba Peter Marks 0400 111 952 peter.marks@raywhite.com

raywhitecommercial.com

Lvl 1/36-38 Moffat Street, Cairns North, 4870

RWC Cairns proudly presents this modern designed professional office space situated at Level 1/36-38 Moffat Street, Cairns North. This tenancy offers a spacious layout of 218 sqm, making it an ideal space for your business to flourish. Located in Cairns North, it's an excellent location for any business associated with International airport business or travels.

The contemporary architecture and design of this office space will impress both clients and employees. You can create a comfortable and productive work environment with ample room for desks, chairs, and furniture. The large windows allow for plenty of natural light, creating a bright and welcoming atmosphere.

If you're looking to relocate your current office or start a new venture, this office space is the perfect opportunity. For more information and to schedule a viewing, please contact agent Grant Timmins or Susan Doubleday.

Lease

$65,400 pa Gross + GST

218 square metres

Available Now

raywhitecommercial.com

Grant Timmins 0422 534 044 grant.timmins@raywhite.com

Susan Doubleday 0408 038 380 susan.doubleday@raywhite.com

1/304-308 Mulgrave Road, Westcourt, 4870

Located in the heart of Cairns in Westcourt is a 162sqm retail shop on Mulgrave Road available for lease. The tenancy features excellent visibility with large windows and glass doors, allowing for ample natural light and highly visible retail displays. The building has a monitored security system, with 25 parking spaces available both on and off street in both Mulgrave Road and Lyons Street, catering to over 35,000 daily commuters.

The shop is situated on the corner of Mulgrave and Lyons Street opposite DFO, providing high exposure. With double entrance doors, the space is ideal for a retail showroom. The tenancy is available now, providing trading opportunities to various industries along busy Mulgrave Road for both staff and clientele.

Lease

$70,000 pa Gross + GST

Available Now

raywhitecommercial.com

Helen Crossley 0412 772 882 helen.crossley@raywhite.com

Grant Timmins 0422 534 044 grant.timmins@raywhite.com

860sqm* freehold exposure on busy State Road 57

198sqm* upgraded drive-thru convenience retail with on site parking Decade retail operator with 5 x QLD stores + 2024 openings

3 minutes from Maryborough town centre 204

Income $63,600pa + GST until 31/03/2029 with 2x5 year options

free site (Fraser Council)

Ben Sands 0432 547 164 ben.sands@raywhite.com

AJ Calvet 0488 113 270 teamsands@raywhite.com

Troy Sturgess 0432 701 600 troy.sturgess@raywhite.com

Chris Massie 0412 490 840 chris.massie@raywhite.com

Troy Sturgess 0432 701 600 troy.sturgess@raywhite.com

Aaron Canavan 0447 744 948 aaron.canavan@raywhite.com

497 Kingston Road, Kingston, 4114

•Total area -120sqm

• Land area - 809sqm

• Reception area

• Freshly painted

• Own private amenities

• Ducted air-conditioning

• 14 On site car parks

• Great position with direct exposure to Kingston Road

•Kingston is located within the Brisbane Region approximately 22 kilometres southeast of the CBD

$80,000 PA Gross + GST

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

2/3363 Pacific Highway, Slacks Creek, 4127

• Kingston is a predominantly residential suburb, with a low mix of industrial, commercial, and retail areas Lease

RWC Springwood raywhitecommercial.com

•Total area - 729sqm

• Warehouse - 421sqm

• GF Showroom - 154sqm

• First floor offices - 154sqm

• HIK Vision security system with face recognition and cloud recording

• Ducted air-conditioning

• 2 Toilets

• Kitchenette

• Ample onsite parking

• Easy access to major arterial roads

• Close to M1/Pacific Highway and Logan Motorway

• Accessible via public transport

• Located within close proximity to both bus and rail linkages

$148,000 PA Net + GST + Outgoings

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

RWC Springwood raywhitecommercial.com

3111 & 3112 / 2994-2996 Logan Road, Underwood, 4119

356-368 Forest Road, Bexley, 2207

This commercial property can be sold as two separate titles or sold as one title together. Offers submitted prior to EOI closing date will be considered.

•Total land area: 815sqm*

•Prime corner position with substantial land holding

•Zoned MU1 Mixed-Use

•Potential use for new development/boarding house^

•Title One: Comprises of 7 highly exposed commercial shops with 4 oversized residential units

•Title Two: Ground Floor shop & oversized 2 bedroom residence on level 1

•Ample street parking and Council car park nearby

•Multi-income asset

Suite 703/66 Clarence Street, Sydney, 2000

66 Clarence Street is an 11-level office tower on the corner of Erskine Street and Clarence Street. The building features end of trip facilities and parking in the basement. 4.5-star NABERS. The top 2 floors provide co-working spaces.

•All the hard work is done

•Just unpack in this new spec fitout

•Reception, 2x4pax meeting rooms, large boardroom

•2 focus rooms, 30 workstations, collab desk for 8 staff

•Large kitchen with breakout area and cafe seating

•Features exposed ceilings and polished concrete floors

356 Chisholm Road, Auburn, 2144

•3,763sqm Land Area*

•2,744sqm Total GFA*

•1,678sqm Warehouse*

•8-9m* high clearance warehousing split into two sections

•5 x On grade automatic roller shutters

•Exceptional truck access for pickup and deliveries

•Quality bi-level office fit out with lift access

•Basement parking for 25 car spaces

•Fully gated and secure complex with CCTV and alarm

•Strong covenant - leased to Copeland until 13/01/26 with 3 year option

•Passing income $449,743.60 per annum* Net ex GST

28 St Georges Terrace, Perth, 6000

Third level of ANZAC House

Whole floor tenancy

543.6m2*

High quality fit out (near new)

Stunning Swan River view

Available immediately

Lease Excellent natural light

Luke Pavlos 0408 823 823 luke.pavlos@raywhite.com

33 & 39 Prindiville Drive, Wangara, 6065

Wanneroo Markets and Spudshed Wanneroo

Strong established income stream and rental guarantees

Zoned ‘Special Use’ (SPU-5) multiple uses supported

Sites of 22,955m2* and 10,550m2* - combined 33,505m2* Ideal for retail, showrooms, hospitality or light industrial

Two adjoining dev sites - buy one or buy both Expressions Of

394-395

•Two properties on one title

•Potential Income (fully tenanted) | $85,500 p/a net*

•Total land area | 458m2*

•Combined building area | 247m2*

•Double frontage | 11m*

•Rear access with 7 car spaces

•Commercial 1 Zone (C1Z)

3/16

Drive, Croydon South, 3136 Auction On site & Online | Friday 12 July 2024 at 12:00pm

•Total building area | 128m2*

•Internal warehouse clearance up to 7m*

•Amenities | kitchenette & disabled toilet

•Located in a securely gated complex

•Three (3) on site car spaces

•Monthly Tenancy in place

•Electric roller door & x1 split system

•Easy access via Dorset Road, Canterbury Road & Eastlink (M3)

•Industrial 1 Zone (IN1Z)

•Terms | 10% deposit, payable in 30 - 90 days

634 562

Anastopoulos 0488 095 057

raywhitecommercial.com