FEBRUARY 2025

WHICH COMMERCIAL MARKETS ARE GAINING TRACTION?

WHERE COMMERCIAL PROPERTY DOLLARS LANDED IN 2024 A SELECTION OF STOCK FRESH TO MARKET

FEBRUARY 2025

WHICH COMMERCIAL MARKETS ARE GAINING TRACTION?

WHERE COMMERCIAL PROPERTY DOLLARS LANDED IN 2024 A SELECTION OF STOCK FRESH TO MARKET

We are proud to present to you our second edition of Portfolio magazine for 2025, it’s hard to believe we’re two months into the year already.

With market activity beginning to ramp up after the holiday period, we will reflect on the activity of 2024, and share some important insights for the year ahead.

In this edition, Ray White Group head of research Vanessa Rader looks back on where commercial investment landed in 2024, and which states and regions performed the best.

Vanessa also delves into her predictions for what the commercial property market will hold in 2025, and the trends in which each asset class could be set to see.

RWC property management performance specialist shares some valuable insight for investors about what they should expect from their commercial asset managers in 2025.

Here at RWC we are excited for the year ahead and what the next 12 months holds for the commercial property market. We look forward to working with you to provide the best service for all your real estate needs.

James Linacre Head of Commercial RWC Australia and New Zealand

VANESSA RADER

Ray White Head of Research

The conclusion of 2024 saw a flurry of investment activity across the larger end of the market, with portfolio sales, major data centres and office assets transacting, growing preliminary total commercial sales turnover for the year to $76.64 billion - a 19.2 per cent increase on 2023 results. While transaction numbers hit 11,694, this was well down on 2023’s results where over 18,000 deals were recorded. The average deal size in 2024 increased substantially to $6.38 million, compared to $3.42 million in 2023, reflecting stronger activity in the mid-market range, with private investors, syndicates and owner occupiers active in the sub-$20 million space.

NSW dominated investment activity, representing more than half of all transactions and recording a 59.8 per cent increase compared to 2023. This surge brought volumes back in line with 2022 levels, following a period where investors had sought higher-returning opportunities in Queensland and Western Australia. Major CBD office buildings, data centres and shopping centres drove activity, with nearly 100 transactions exceeding $100 million, many completing in the final quarter of the year. This concentration of major sales highlights renewed institutional and offshore confidence in core markets.

Victoria’s share of transaction activity declined to 20.6 per cent in 2024, down from 26.6 per cent in 2023 and 27.1 per cent in 2022. This reduction reflects growing investor concerns about legislative and taxation changes in the state. The dampening demand may continue to pressure yields upward, potentially creating improved opportunities in late 2025 as the market adjusts to these changes and investors seek value in this key market.

commercial sales volume

2024 by state

TOTAL TURNOVER $76.64 Bill

11.674 TRANSACTIONS

Source: Ray White, RCA, PIMS

$ million, by State

Queensland’s traditionally strong 18-19 per cent share of investment saw interesting movement throughout 2024. While representing approximately 25 per cent of turnover in the first half of the year, late major sales in NSW reduced Queensland’s final share to 14.8 per cent - a notable decline from previous years. Despite this, the state’s strong population growth and infrastructure investment continue to attract investor interest, particularly in the south east corridor.

South Australia emerged as a strong performer, being the only state to grow its investment activity, up 4.9 per cent to $3.37 billion - its highest total since 2021. This growth was primarily driven by the retail sector, where annual volumes nearly tripled 2023 results, indicating renewed confidence in this asset class and the state’s stable economy.

During the pandemic period, many investors speculated in smaller markets which saw growth in turnover and subsequent values in Western Australia, South Australia, Tasmania and Northern Territory. However, as market fundamentals reassert

themselves, there has been a more considered risk analysis of assets with a notable swing back to the key population nodes in Australia.

Looking ahead to 2025, this flight to quality and populationdriven markets is likely to continue. The return of institutional capital to major markets, particularly evident in the late-2024 surge in NSW activity, suggests growing confidence in core markets. Foreign investment could play an increasingly important role, with the Australian dollar trading at attractive levels making local assets appealing to offshore investors, particularly those from North America and Asia. While opportunities remain in emerging markets where strong population growth and infrastructure investment create compelling investment cases, the focus will likely remain on core markets where scale and liquidity attract international capital. The key to success will be thorough due diligence and realistic return expectations, particularly as interest rates and broader economic conditions continue to evolve.

LETEICHA WILSON RWC Property Management Specialist

As we move into 2025, the role of a commercial property manager continues to evolve, driven by the changing market landscape and heightened expectations from landlords. To maximise the value of your investment, here are four key things investors should expect from their property manager in the year ahead.

A great property manager is your eyes and ears in the market. In 2025, expect your property manager to go beyond the basics and provide tailored updates on market trends, vacancy rates, rental demand, and legislative changes. These insights help you stay informed and make strategic decisions about your assets, ensuring your property remains competitive and aligned with current conditions.

Gone are the days when property management was limited to an endof-month financial statement. In 2025, effective property management is about building trust and relationships. Your manager should prioritise meaningful communication, including regular phone calls or in-person meetings where possible. These conversations provide opportunities

to discuss performance, address concerns, and strengthen the landlordmanager partnership. Trust is earned through dialogue, not silence.

Your property manager should actively seek ways to increase revenue while controlling expenses. Whether it’s negotiating higher rents during lease renewals, securing quality tenants quickly, or negotiating service contracts, a proactive manager will always prioritise your bottom line. In a market that’s constantly shifting, having someone who monitors income and expenditure with a sharp eye is essential.

A forward thinking property manager doesn’t just maintain your portfolio—

they help you grow it. By collaborating with sales agents within their network and connecting you with experienced financial brokers or advisors, they can uncover opportunities to expand your investments. Education is key— whether it’s understanding financing options or identifying high-performing markets, your property manager should support your long-term vision.

As commercial property investors navigate the opportunities and challenges of 2025, having a skilled and forward thinking property manager is more critical than ever. By setting high expectations for your property management team, you can ensure that your investments are not just managed but actively nurtured for success.

VANESSA RADER

Ray White Head of Research

As we enter 2025, the commercial property market shows promising signs of recovery, though market conditions remain mixed across different sectors and locations. The anticipated easing of interest rates could provide the catalyst many investors have been waiting for, potentially narrowing the currently tight yield spreads that sit between 50-150 basis points above cash rates.

ransaction momentum is building, particularly evident in the sub-$20 million market where both investors and owneroccupiers remain active. While larger institutional transactions have started to improve we are expecting to see more activity this year and early signs suggest offshore capital is regaining its appetite for Australian assets. The Australian dollar trading below USD 0.70 creates an attractive entry point for international investors, effectively offering a significant discount on asset prices compared to other gateway cities globally. This currency advantage, coupled with attractive yields, is drawing particular interest in specialised industrial and retail sectors not to mention trophy office offerings.

The office sector continues its structural transformation with most CBD vacancies ranging above 10 per cent. However, this challenge is not just having staff back in the office, but driving innovation in the sector. Premium grade assets offering strong environmental credentials, smart building

technology, and enhanced amenities are attracting stronger tenant interest. Secondary assets face a crucial decision point between significant sustainability upgrades or exploring alternative uses, as corporate occupiers increasingly prioritise buildings that align with their ESG commitments. Despite this, affordability concerns will come into play for many occupiers particularly when incentive levels start to moderate.

A two-speed market is emerging in the industrial property sector. While headline vacancies remain low, growing incentives signal some cooling in traditional warehousing. However, specialised assets continue to outperform - cold storage facilities maintain tight yields, self-storage benefits from housing trends, and data centres (industrial’s great alternative) attract premium investment, particularly driven by AI and technology advancement.

The retail sector demonstrates unexpected resilience, particularly in prime locations. CBD retail cores are showing remarkable strength, with luxury retail expanding beyond traditional strongholds. Centres that successfully blend convenience-based retail, essential services, and entertainment offerings are outperforming, as consumers seek experiences alongside traditional shopping.

Traditional ‘alternative’ assets such as childcare centres, service stations and medical facilities will remain attractive to cash flow-focused investors, though success remains highly location-dependent. While these assets faced transaction headwinds in 2024 due to financing costs, improved lending conditions could reinvigorate activity, particularly given their accessible price points for private investors

Population growth continues to underpin market fundamentals, particularly evident in Queensland which maintains the bulk of regional investment activity. This demographic driver, combined with limited new supply across most sectors, should support occupancy levels through 2025.

While challenges remain, particularly around debt costs and yield spreads, several indicators suggest improving conditions for commercial property investment. Success will likely favour assets with strong fundamentals, clear valueadd potential, and alignment with demographic trends. The key will be identifying opportunities in this evolving market while maintaining realistic return expectations as we move through 2025.

corner allotment: 600m2* with dual frontage

Existing clinic: 130m2*

Property will be sold vacant possession

144 Olsen Avenue, Arundel, 4214 Ideal for office, specialist medical centre, dentist (STCA)*

Change in circumstances forces sale

Do not miss out

6 Jubilee Avenue, Broadbeach, 4218

East facing aspect with breathtaking ocean views

Development-Ready with recent underground cabling

607sqm block, site provides endless potential

Unmatched convenience with a short stroll to beaches

Golden opportunity to secure this exceptional site

Highly sought after investment industry

Lease expiry in 2028 with an additional 1x5 year option

well-recognised name with over 13 Gold Coast offices Tenant responsible for 100% of outgoings Established dental practice operating since 2010

58-60 & 62 Taylor Street, Bulimba, 4171

Expressions Of Interest

Closing 20 February, 2025 at 4pm AEST

KEY FEATURES:

•Land Area: 1,529 sqm total across three titles

•Zoning: Low Impact Industry

•58-60 Taylor Street: 400 sqm sawtooth warehouse divided into two tenancies

•62 Taylor Street: 394 sqm steel portal and clad shed

LOCATION HIGHLIGHTS:

•5 km from Brisbane CBD

•Easy access to Gateway Motorway and Port of Brisbane

•Adjacent to the Bulimba Barracks redevelopment, featuring 850+ new homes, retail, and parklands

•Ideal for industrial operations, redevelopment, or longterm investment

Paul Anderson 0438 661 266 p.anderson@raywhite.com

Andrew Doyle 0412 853 366 andrew.doyle@raywhite.com

raywhitecommercial.com RWC Queensland

2-4 & 6-8 Piper Street, Caboolture, 4510

4,975m2* of freehold land across two titles

1,705m2* of buildings across three tenancies

$336,596 of annual net income

20+ year government tenant history

Chris Massie 0412 490 840 chris.massie@raywhite.com

Troy Sturgess 0432 701 600 troy.sturgess@raywhite.com

Exclusive use car parking for all tenancies Auction In-room Thur 27 Feb, 11am

Tenanted investments in booming Northern Corridor

Suite 21/5 Innovation Parkway,

4575

10:00am Friday 7 March 2025

•Net Lettable Area: 260m2*

•Ground floor position with easy access

•Currently tenanted by IVF Sunshine Coast for the past 10 years

•New 3 + 3 year lease in place, commenced Dec 2024

•Rental return $139,579 per annum* + outgoings + GST

•Modern medical fitout

•Ducted air-conditioning throughout

•Seven exclusive use car parks on site

•Must sell at Auction

Pregnell 0481 218 481

Butler 0418 780 333

•Lot 511 leased by ASX-listed Viva Leisure with a new 10 year lease and options until 2046

•Current net income of $413,550* p.a. in lot 511 with further $112,500 to $180,000 of unrealised potential in lot 512

•Community Facilities zoning (CF5) allowing for diverse future uses such as childcare, education, or health services

•Both lots positioned on 6,296sqm block in highly sought after suburb Seven Hills, offering significant potential for future growth

•Both titles, 511 & 512 are available for sale either individually or as a package

•Together, both titles represent 60.9% of the body corporate

96 Bloomfield Street, Cleveland, 4163

The 1,183sqm* allotment has over 50m* of retail frontage to both Bloomfield Street and Bloomfield Street Park, currently improved by a 280sqm* building with timber floors and a glass shop front. Favourable zoning allows for a wide variety of commercial uses or mixeduse development up to 26m*.

The property is situated in the heart of the Cleveland CBD and is conveniently located near the Cleveland Central Shopping Centre, public transport and a wide variety of medical, retail and professional businesses.

1-3 Noel Street, Slacks Creek, 4127

•10 Tenancies within the building

• Total net area 720m2*

• Land area 589m2*

• Current gross income $172,559.35 PA*

• Current net income $139,826.03 PA*

• Outgoings approx. $32,733.32 PA

• Excellent exposure to Kingston Road

• Secure undercover basement parking

• Walking distance to cafes, restaurants and public transport

• Just minutes to the M1 and major arterial roads

Sale $2,200,000 (Going Concern)

RWC Springwood

raywhitecommercial.com

Aldo Bevacqua 0412 784 977

aldo.bevacqua@rwcs.com.au

2 Athena Grove, Springwood, 4127

•Total building area - 305m2 over 2 levels

• Total land area - 819m2

• Ready to occupy

• Recently renovated

• Medically approved - High standard full fit out with clinic and treatment rooms

• Ability for dual tenancy

• Opportunity for both tenancies to live onsite

• Reception area

• Consulting rooms

• 12 Exclusive onsite car parks

• Designated ambulance bay

• Centre zoned land allowing redevelopment options (STCA)

• Minutes to Pacific Motorway & major arterial roads

• Walking distance to bus terminal, local cafes, restaurants & local

Sale Contact Agent

RWC Springwood raywhitecommercial.com

Aldo Bevacqua 0412 784 977

aldo.bevacqua@rwcs.com.au

Zane Bevacqua 0400 270 666 zane.bevacqua@rwcs.com.au

83

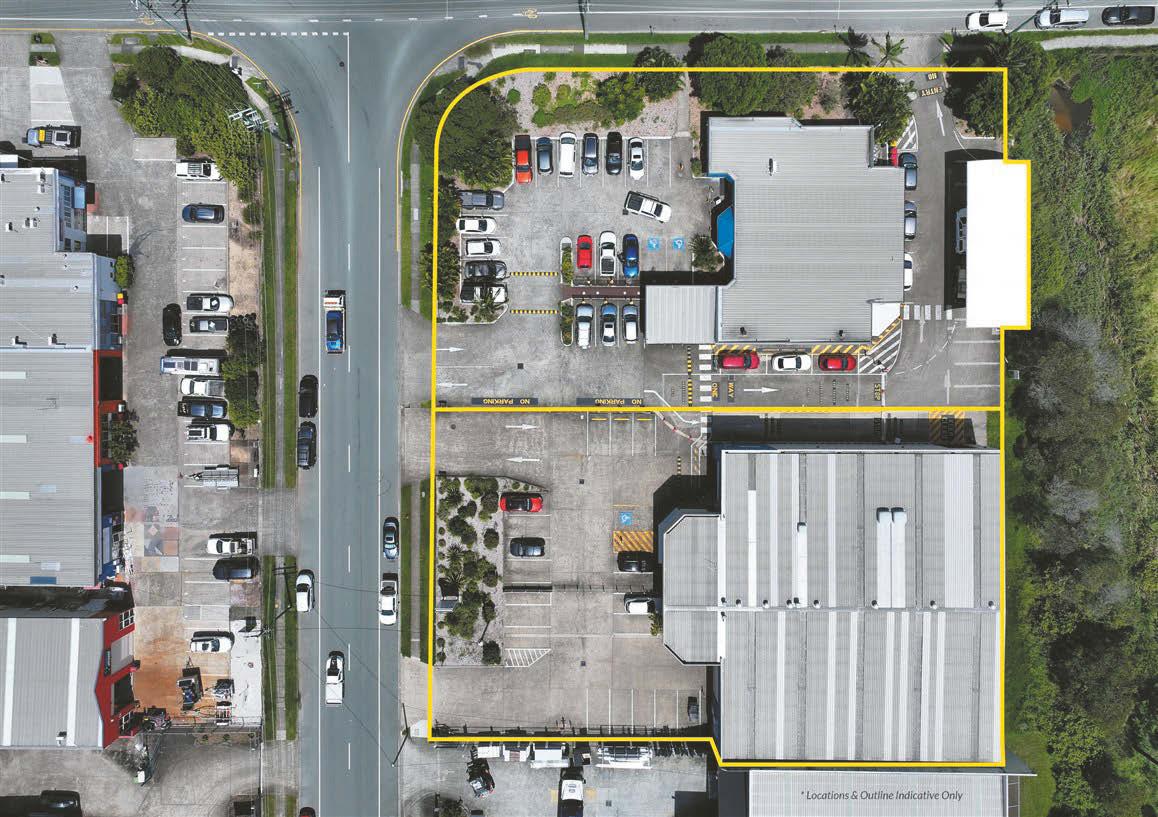

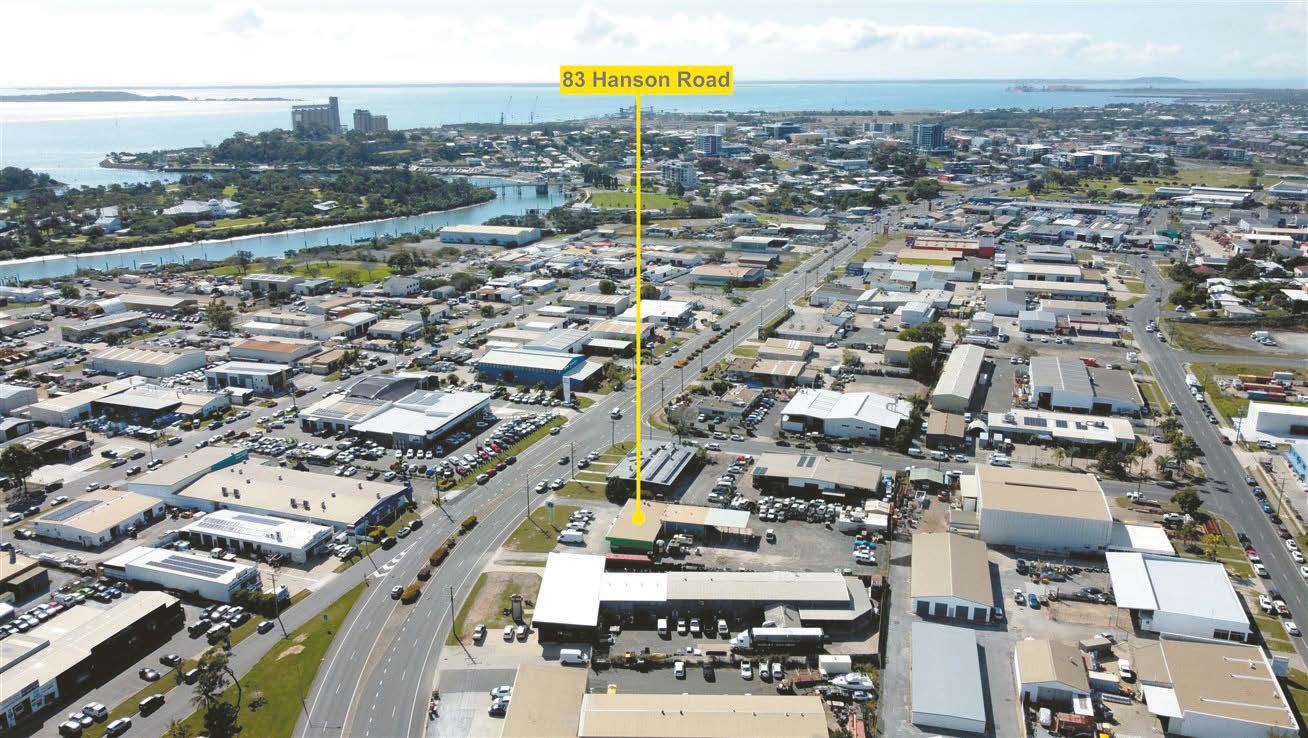

3,448m2* site area

Among the most high-profile positions in Gladstone, the rare chance to own a large property on Hanson Road is available now.

• Existing tenant providing holding income

• Vacant possession available

• 3,448m2* total site area

• 43m* frontage to Hanson Road

• 380m2* of showroom, office and workshop

• 100m2* awning

• Large yard for truck turnaround

The current owner has made other commitments and is seeking all offers for consideration.

Sale $2,500,000 (exc GST)

RWC Gladstone

raywhitecommercial.com

Andrew Allen 049723288 andrew.allen@raywhite.com

27 Scenery Street (Dawson Highway), West Gladstone, 4680

Positioned on a very high traffic intersection, the building offers the opportunity to invest or occupy.

Details

• 664 m2* floor area

• Combination retail, office and workshop tenancies

• 1,434m2* site area

• 16 onsite car parks

• Fully tenanted with vacant possession available Ideal for^:

• Amalgamate for single use

• Fast food/ drive-thru

• Medical/ allied health

Sale $1,400,000

Andrew Allen 049723288 andrew.allen@raywhite.com

580 Rode Road, Chermside, 4032

Units vary in size from 76sqm* to 120sqm*

Open storage mezzanines in each unit with sliding windows

Each unit comes standard with self-contained amenities

Opportunity to amalgamate for larger units

Over 70% sold

Sale/Lease Ideal for businesses with office/warehouse / storage requirements etc.

Jack Gwyn 0424 807 166 jack.gwyn@raywhite.com

Jared Doyle 0408 160 570 jared.doyle@raywhite.com

RWC Gateway

raywhitecommercial.com

1307 Kingsford Smith Drive, Pinkenba, 4008

Units from 123 - 429sqm*

Ultra-modern design by Sparc Architects

Air conditioned offices + amenities in each unit

Full height concrete tilt panel construction

Fenced & gated site + security cameras & patrols

90m* frontage to busy Kingsford Smith Drive Sale/Lease Price on Application Electric roller doors

Jack Gwyn 0424 807 166 jack.gwyn@raywhite.com

Jared Doyle 0408 160 570 jared.doyle@raywhite.com

2-14 Elsie Street, Burwood, 2134

Discover a versatile selection of strata office suites, available for sale, ranging from 60 to 860 sqm to suit businesses of all sizes.

Ideal for businesses seeking a lively community and modern amenities, Elsie Suites is perfect for hosting clients, events, or establishing your second home. Experience the convenience and vitality of working in one of the most sought after locations in the Inner West.

Elsie Suites, with DA approval and a builder appointed, is on track for completion by July 2025.

Excellent

Durable

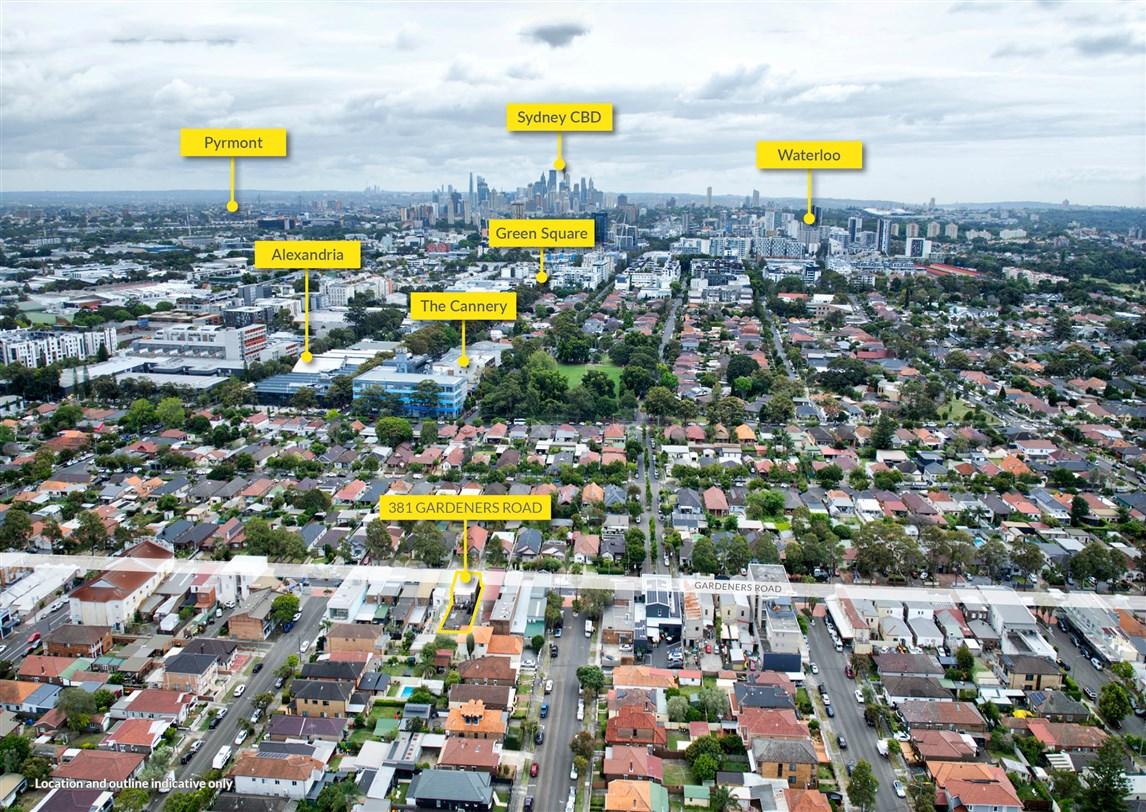

area 77sqm*

Covered exclusive use area 83sqm* plus parking/storage

DA approved as licensed cafe for 70 patrons

Equipped with grease trap, coolroom and exhaust

750 metres* from Green Square station

900 metres* from the new Waterloo Metro station

2 Triennium Road, Somersby, 2250

Hot off the completion of Stage 1, the highly anticipated Stage 2 ALVEARE is soon to be taking shape on the corner of Pile Rd & Triennium Road, Somersby. Set over 2 levels and boasting internal clearances of min 6 meters, ALVEARE is setting a new benchmark for industrial units on the Central Coast. Only a couple of minutes from the M1 motorway, the combination of units on offer in this development range from 75m2192m2.

With seamless access to Newcastle, Gosford, and Sydney, this development positions your business exactly where it needs to be for maximum convenience and connectivity. With construction and civil works commencing, the wheels are in motion to see this new development coming out of the ground early in 2025.

45a Marana Street, Bilambil Heights, 2486

Expressions Of Interest

Closing Thur 6 Mar 2025 4pm (AEST) Approved

Land area: 4.74* Hectares

DA approved for 30 residential lots

Lots ranging between 557m2* to 3,245m2*

Potential to increase yield through additional approvals^

Zoned R1 General Residential

15min* to Coolangatta, 25min* to Kingscliff

12min* to retail / commercial precinct in Tweed Heads

Matthew Fritzsche 0410 435 891

Tony Williams 0411 822 544

Mark Creevey 0408 992 222 *Approx

RW Special Projects Queensland

raywhitecommercial.com

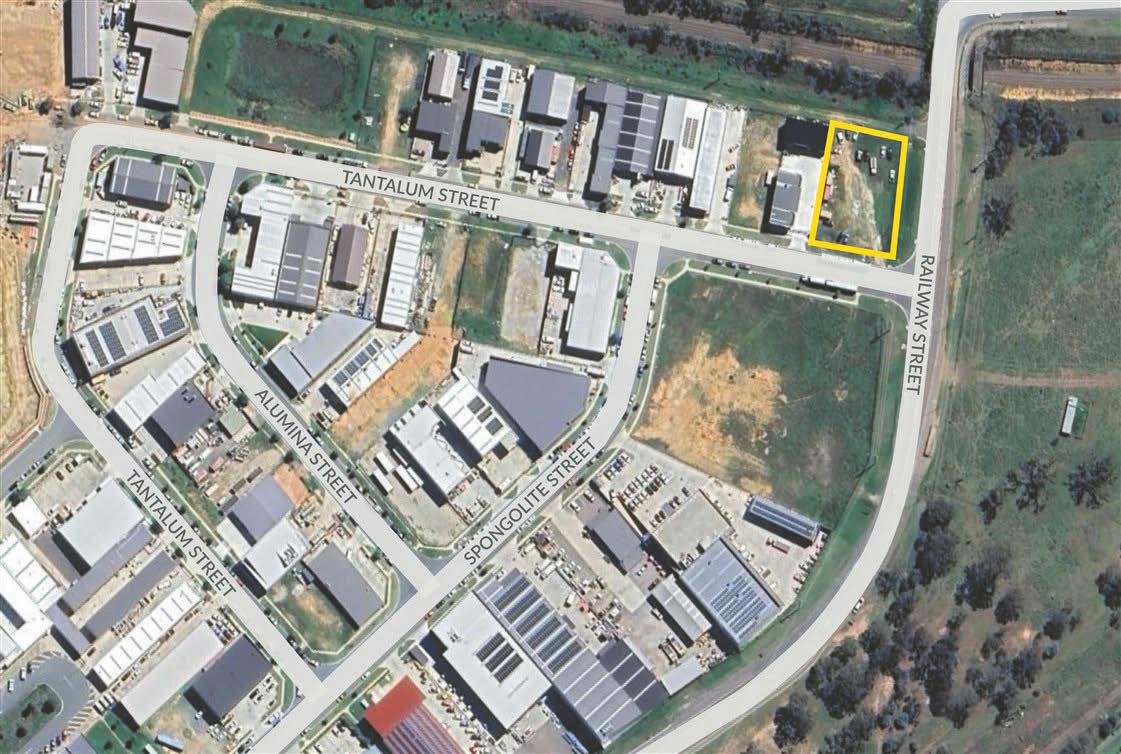

63 Tantalum Street, Beard, 2620

1599 sqm corner-block

$1,700,000 + GST

Block 26 | Section 2 | Jerrabomberra Beard (NUZ1)

1:1 Plot Ratio

$22,374.00 outgoings

Accessible to Oaks Estate Road and Canberra Avenue

Sale Stamp- duty free

Frank Giorgi 0403 839 822 frank.giorgi@raywhite.com

RWC Canberra

raywhitecommercial.com

Unit 4/38 Dacre Street, Mitchell, 2911

Property Features :

Site area of 355 sqm* with 2 bathrooms + 1 shower

175sqm* high quality clear span warehouse

High clearance auto-roller door

3-Phase power

High visibility with great signage potential

Sale 180sqm*- Air-conditioned office split over 2 levels

Frank Giorgi 0403 839 822 frank.giorgi@raywhite.com

32-36

Competitive lease terms on offer

Lease

'The State Cinema' 367-379 Elizabeth Street, 31 Strahan Street & 82 Federal Street, North Hobart, 7000

•Anchored by Reading International (NASDAQ: RDI): Highly successful international entertainment powerhouse with 57 movie theatres and 457 screens over three countries

•Long Ten (10) Year lease to 2029 plus options to 2039 to NASDAQ listed ‘Reading International’ trading as the ‘State Cinema’

•Global Theatre bouncing back with YTD box office revenue totalling $25 Billion in 2024.

•High profile, strategic 3,983sqm* corner site with a gross building area of 4,771sqm*.

•Key entertainment and dining precinct less than 2km from Hobart's CBD with huge value adding opportunities

•Estimated Income: $1,216,995pa* + GST

Expressions Of Interest closing Thursday 13th March 2025, (4pm AEDT)

Claude Alcorso 0417 586 756

claude.alcorso@raywhite.com

Matthew Wallace 0418 136 086

matthew.wallace@raywhite.com

RWC Tasmania

raywhitecommercial.com

15 & 17 Como Parade West, Mentone, 3194

Auction Thursday, 20 February at 12:30 PM (offered consecutively). On-site & Online Two retail freeholds - buy 1 or both

15 Como Parade West, Mentone:

•Total land area | 109m2

•Total building area | 146m2

•Three (3) Storey building

•Vacant possession

•Activity Centre Zone 2 (ACZ2)

17 Como Parade West, Mentone:

•Total land area | 108m2

•Total building area | 150m2

•Two (2) Storey building

•Vacant possession

•Quality fit out in place

•Activity Centre Zone 2 (ACZ2)

George Kelepouris 0425 798 677

george.kelepouris@raywhite.com

Jonathan On 0479 003 122 jonathan.on@raywhite.com

RWC Oakleigh

raywhitecommercial.com

278 Springvale Road, Glen Waverley, 3150

Available for Lease for the first time since 1998

Building: 130m2 / Land: 576m2

Currently configured as a medical and allied health practice

Two separate suites/offices, one large treatment room

Front reception area and kitchenette

Prominent street frontage

Five onsite car spaces at the rear

Lease

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Vincent Daniele 0428 272 887 vincent.daniele@raywhite.com

RWC Glen Waverley

raywhitecommercial.com

150 Rooks Road, Nunawading, 3131

Grounds for Success: Brew Up Profits with This Leased Café in Nunawading

120m2 of prime space in a highly sought-after retail strip

With four years of a five-year lease remaining plus options in place

Returning $52,050 annually with 4% increases

Tenants covering all outgoings

Well-loved café as your tenant - Little Hugh Cafe

Architecturally designed, with a modern fit out and aesthetic

Featured in the Australian Design Review and Habitus Living

Lease

RWC Glen Waverley

raywhitecommercial.com

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Vincent Daniele 0428 272 887 vincent.daniele@raywhite.com

*Approx

*Approx

30 Larkin Street, Kambalda East, 6442

7,130m2* freehold land footprint

800m2* spacious functional buildings

Broad recreational, civic, cultural uses (STCA)

Vacant possession - suit owner occupiers

Expressions Of Interest

Michael Milne 0403 466 603 michael.milne@raywhite.com

62-66 Paramount Drive, Wangara, 6065

4,030m2 general industrial land

2,067m2* office/warehouse over 2 titles

Tilt panel construction built circa 2000

5/516 Alexander Drive, Malaga, 6090

1,578m2* total building area

112m2* showroom

305m2* office and amenities

1,161m2* warehouse

Lease

$215,000 plus Outgoings and GST

Tom Jones 0478 771 117 tom.jones@raywhite.com

Lachlan Burrows 0499 552 296 lachlan.burrows@raywhite.com

Designer "Giorgi Group" building

181m2* office space on ground floor centre position

B1/118 Railway Street, West Perth, 6005 Potential medical consulting, or