202 5

202 5

In what has already been a big year for RWC, we are proud to present to you our March edition of Portfolio magazine.

The RWC network has seen extensive expansion over the last six months, with three new businesses opening their doors in the first two months of 2025 including RWC Tasmania, RWC MC, and RWC Collective. In this month’s edition of Portfolio we will introduce you to all the new offices that have opened across the country in the last six months, and the faces behind each one.

We hear from Ray White head of research Vanessa Rader who will discuss the surge of foreign investment being seen in Australia’s commercial property market.

RWC property management performance specialist Leteicha Wilson provides insights into how commercial property investors can navigate the evolving property market and unlock hidden value in their portfolios.

RWC’s monthly Between the Lines Live webinar was back in February, with host Vanessa Rader being joined by RWC Western Sydney managing director Peter Vines and Stamford Capital executive chairman Domenic Lo Surdo. We recap on the webinar in which the panel of experts discuss their outlook for the 2025 commercial property market.

James Linacre Head of Commercial RWC Australia and New Zealand

VANESSA RADER Ray White Head of Research

The Australian commercial property market saw a significant resurgence in foreign investment through 2024, particularly evident in the final quarter, helping drive total preliminary analysis of transaction volumes to $76.64 billion - a 19.2 percent increase on 2023 results. This renewed offshore interest, combined with steady domestic investment, signals growing confidence in Australian commercial real estate despite broader economic challenges.

The market demonstrated clear segmentation across price points, with domestic private investors dominating the sub-$50 million segment, accounting for approximately three-quarters of transactions. These acquisitions were predominantly focused on industrial assets across NSW and Victoria, with private investors particularly active in last-mile logistics facilities and smaller industrial units that offer strong tenant covenants.

The mid-market segment ($50-100 million) witnessed increased offshore buyer activity as international investors sought to capitalize on favorable currency conditions. This price point saw a balanced distribution across sectors, with retail leading transaction volumes, followed by similar levels of investment across office, industrial, and development sites. NSW remained the preferred investment destination, followed by Victoria and Queensland, reflecting the continued focus on core markets with strong population growth and infrastructure investment.

2024 commercial transaction buyers, by price range

Most notably, the institutional segment (over $100 million) experienced substantial momentum in the final quarter of 2024, reaching $30.43 billion in total transactions, with Sydney accounting for more than $22 billion. Foreign investors emerged as dominant players in this segment, representing over 60 percent of purchases while accounting for 51.2 percent of sales, resulting in significant net acquisitions by offshore capital.

The industrial sector, particularly data centres, attracted the strongest interest at this price point, though prime office and retail assets also recorded notable transactions. This surge in foreign investment reflects several key factors: Australia’s strong economic fundamentals, minimal currency hedging requirements in the current market, and the relative value proposition created by a favorable USD/AUD exchange rate, particularly for institutional-grade assets. The trend toward specialized industrial assets, including cold storage facilities and data centres, highlights the evolution of foreign investment strategies, with buyers increasingly focused on sectors benefiting from structural changes in the economy.

United States investors dominated acquisition activity in 2024, leveraging their currency advantage to diversify portfolios while seeking stable, transparent markets. Japanese capital continued to strengthen its presence in Australian property markets, followed by steady investment flows from Singapore, Hong Kong, and Canada. These

investors showed particular interest in the office sector, attracted by the correction in capitalisation rates and potential for value-add opportunities in prime assets, while also maintaining a strong appetite for industrial and retail investments that align with their long-term investment strategies.

Early 2025 has already witnessed an expanding pool of international capital, with notable diversification in both investor origins and target sectors. Korean institutional investors have emerged as significant new players, particularly attracted to build-to-rent and student accommodation developments in major metropolitan markets. This surge in residential development funding comes at a crucial time, with these purpose-built rental projects positioned to help address Australia’s housing supply challenges.

Looking ahead, this broadening of both capital sources and investment strategies suggests a maturing market that continues to attract global investment. While traditional commercial sectors remain important, the growth in alternative residential development funding highlights the evolution of Australia’s appeal to international investors. The combination of Australia’s transparent market conditions, robust regulatory framework, and strategic position in the Asia-Pacific region suggests sustained offshore interest through 2025, particularly as new investors seek to establish long-term positions in the market.

LETEICHA WILSON RWC Property Management Specialist

As commercial property investors navigate an evolving market, maximising returns requires more than just holding onto assets—it’s about unlocking their full potential. In 2025, investors who take a proactive approach to repurposing spaces, upgrading facilities, and identifying underutilised opportunities will be best positioned for strong, long-term performance. Here’s how to uncover the hidden value in your portfolio.

The way tenants use commercial real estate is shifting. Traditional office spaces are adapting to hybrid work, retail footprints are shrinking in favor of experiential offerings, and industrial demand is booming due to e-commerce growth. Assess your property for potential repositioning opportunities:

• Office conversions: Can underused office space be reconfigured into co-working areas or mixed-use developments?

• Retail repositioning: Is there demand for non-traditional tenants like medical or wellness services?

• Industrial optimisation: Can excess land be used for additional warehousing, truck parking, or last-mile logistics facilities?

By reimagining your asset’s use, you can attract a broader tenant base and increase revenue potential.

Investing in property improvements can enhance asset desirability, command higher rents, and improve tenant retention. However, not all upgrades deliver equal ROI. Consider:

• Sustainability enhancements: Green upgrades such as energy-efficient lighting, solar panels, and water-saving fixtures reduce operating costs and appeal to ESGconscious tenants.

• Technology investments: Smart building features, automated access controls, and tenant experience apps can differentiate your property in a competitive market.

• Aesthetic and functional upgrades: Modernising common areas, improving landscaping, and upgrading HVAC systems enhance tenant satisfaction and justify rental increases.

Strategic improvements not only boost rental yields but also increase your asset’s long-term valuation.

Many investors focus on physical upgrades but overlook revenue optimisation through better lease management. Consider:

• Reviewing leases for upside potential: Are your rental rates in line with the current market? Could renegotiating lease terms secure longer commitments or introduce CPI-linked increases?

• Exploring additional revenue streams: Could you introduce paid parking, signage income, or co-working memberships?

• Reassessing outgoings: Are there inefficiencies in your building operations that can be addressed to lower costs without sacrificing service quality?

A well-structured lease strategy ensures you’re maximising income without unnecessary capital expenditure.

The best investment decisions are backed by data. By regularly reviewing market trends and property performance metrics, you can make informed choices on asset repositioning, tenant demand, and competitive pricing. Work closely with your property management team to:

• Conduct market benchmarking to ensure your property is performing competitively.

• Analyse occupancy trends and lease expiry risks to proactively address vacancies.

• Monitor tenant feedback and operational efficiency to identify areas for improvement.

Unlocking hidden value in your commercial property portfolio requires a mix of strategic vision, proactive asset management, and a willingness to adapt to market changes. By rethinking how space is used, investing in high-impact upgrades, optimising leases, and leveraging data-driven decision-making, investors can uncover new opportunities for growth and profitability in 2025 and beyond.

Are you making the most of your portfolio? Now is the time to assess your assets and take action toward unlocking their true potential.

The outlook for the commercial property market the next 12 months was the focus of RWC’s first Between the Lines Live webinar for 2025.

Ray White head of research Vanessa Rader hosted the webinar, and was joined by RWC Western Sydney managing director Peter Vines and Stamford Capital executive chairman Domenic Lo Surdo.

The panel of experts started by reflecting on the year that was.

“2024 was a tough year for the commercial market, but we did see a flurry of activity towards the end of the year and a bit of confidence returning to the market,” Ms Rader said.

Mr Vines agreed that 2024 was a challenging year in commercial real estate.

“I think everyone was happy to see the back end of 2024,” he said.

“The cause of a lot of transactions at the end of the year was people sick of holding onto assets and deciding they just needed to dump it.

“There were pockets of light as there is in any market, but it was quite difficult overall.”

Mr Lo Surdo said 2024 was an interesting year for capital markets.

“We saw a number of new entrants and a lot of liquidity in the market which brought the cost of finance down,” he said.

“We were very active in a tough real estate market, and a lot of that was refinancing.

“But we’re looking forward to 2025 and seeing what this year has to offer.”

Mr Vines said there were some changes that needed to happen in order for the market to improve in 2025.

“What is required is valuations changing and resetting benchmarks,” he said

“Trying to do things below vals is very difficult. Once markets reset and values are there things become easier. That’s with investment.

“Development is still pretty tricky and that space will be interesting this year.”

Mr Lo Surdo said the development market had been difficult.

“Construction cost escalation was the material impact,” he said.

“We were expecting to see land values adjust downwards last year but we didnt. We did see a little bit of an uptick in forced sales.

“With feasibility you should see land prices adjust down. Whether those adjustments come this year or not remains to be seen, but it might as some of the owners of those sites become over extended.

“But it is really hard. Finding labour is hard as well.”

Mr Vines said the liquidity in the market is really what has stopped transactions from occurring.

“You can see where land values should have come down, but they’re simply not transacting,” he said.

“The price of units hasn’t really gone up. Serviceability is an issue, feasibility is an issue. Good real estate is really good and everything else is a bit more problematic.

“Where there is strength is for housing stock. Subdivision and townhouse stock are still really good and the build costs aren’t the same.

“But unfortunately we need more units so we can have more rental stock. The end value of the stock must go up, I don’t see any other answers.

“We need more investors in the market and government incentivisation.”

Ms Rader asked the panel whether they thought build-torent (BTR) had a place in the market, to which Mr Vines and Mr Lo Surdo agreed it did.

“BTR is certainly an institutional asset class. I think it has a place and has an important part in fixing the housing problem,” Mr Lo Surdo said.

“I think the government needs to mobilise the middle market. We think that is the real solution, not necessarily BTR.

“But there is a place for it and places it will work. It doesn’t stack up from a middle market stand point, but it can work for those institutions.”

Mr Vines said BTR had to be part of the Australian market in the future, as people owning their own homes became less common.

“I believe owning a home is not necessarily the Australian dream any more, and it’s now about lifestyle rather than a need to own real estate,” he said.

“So there has to be a place for BTR as it’s not sustainable for renters to have to move home every 12 months.

“There’s a lot of properties earmarked for it and I hope they get out of the ground.”

With allocated industrial land in short supply, Ms Rader asked if the demand for industrial property would continue in 2025, and whether this year would see more industrial development.

“There’s a real weight of institutional capital that loves to play in that field. Data centre space and warehouse space will only continue to grow,” Mr Vines said.

“However, stacking projects up when it comes to servicing land is difficult. Infill locations people will pay a higher price for because the services are there.

“The onslaught of demand we saw off the back of Covid has settled. But again good real estate is really good real estate, and the rest is a bit more difficult.” Mr Lo Surdo said industrial was still a great market with plenty of demand.

“The industrial sector has been very well supported through the debt and equity markets over the past few years,” he said.

“There has been some concern around capital marketers moving away from industrial, but I don’t share that view.

“In the industrial market 20 years ago no one wanted to do it, but there’s been a real shift and I think it’s permanent.”

RWC has grown its network to include 61 offices across the nation, with the addition of RWC Tasmania, RWC MC, RWC Industrial City South, RWC Asset Management and RWC Collective.

RWC TASMANIA

Tasmania’s top commercial real estate professionals have joined forces to open their own business, backed by Australasia’s largest real estate group.

RWC Tasmania is spearheaded by Tom Balcombe, Claude Alcorso, Trevor Fox, Heather Mason, Hayden Peck, and Matthew Wallace.

“We are a full-service commercial real estate agency, with sales, leasing and property management and have experts across all asset classes, specialising in industrial, retail, office, tourism and hospitality assets, with plans already mapped out to expand into a full line agency in the near future,” Claude said.

RWC MC

With over 15 years of experience working in Melbourne’s commercial property market, Ted brings a wealth of industry knowledge to his new venture, which aims to expand the reach of the RWC brand in Melbourne.

Ted is a Melbourne native who has spent his entire career in the city’s dynamic real estate market. With his late-father also working in real estate, Ted always knew he wanted to follow in his footsteps, and, after completing a property degree, Ted joined the commercial real estate industry.

Ted plans to expand his team in the coming months, focusing on serving clients across all asset types in Melbourne’s CBD and metro areas.

“In the next 12 months, my goal is to solidify the RWC brand’s presence in Melbourne and build a strong, dedicated team. I’m committed to delivering exceptional results for my clients and uncovering opportunities that align with their goals,” he said.

With over 28 years of combined experience between them in the commercial real estate industry, William Gathercole and Marcus Schraag have opened RWC Industrial City South. They are also joined by experienced young-gun agent Costa Fragias.

“I have been privileged to work with some of the leading International real estate firms throughout my career which has given me the very best experience, knowledge and know-how to facilitate, firsthand, several of the largest real estate transactions within the South Sydney market,” William said.

“My experience and knowledge enables me to deliver focused and accurate strategy, as well as all of the services that will derive the desired successful outcomes for all my clients.”

With more than 15 years of experience in the commercial property management industry, David Peterson has taken the next step in his real estate journey as the new head of RWC Asset Management (QLD).

David is joined by executive assistant Jenna Gustafson and sales executive John Dwyer.

David started his career working in the property management team at the Brisbane Markets, and has gained a range of experience since then. He joined RWC in 2022.

The team are passionate about property management and enjoy working closely with their clients to help provide them with the best outcomes for their assets.

Renowned real estate group Ray White Collective is expanding its offering with the opening of its commercial arm - RWC Collective. This addition to the business marks a significant milestone for the group as it diversifies its service offerings.

RWC Collective will be a collaboration between experienced commercial real estate professionals Isaac Sarra and Neal Orpin, and Ray White Collective business owners Haesley Cush and Matt Lancashire. The commercial team will be supported by real estate operations expert Patricia Valinho.

With a shared commitment to innovation and excellence, RWC Collective will provide clients with the elevated level of personalized service and cutting-edge market insights that Ray White Collective is known for.

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

Located on bustling Logan Road, this vibrant neighbourhood shopping centre provides a convenient, welcoming destination for dining, shopping, and essential services.

KILSYTH, VIC

Substantial office warehouse complex, situated on over 2 hectares of land, partially leased to multiple tenants, including international occupiers such as Cummins Filtration International Corp. RWC DISTON ASSET SERVICES CONTACT HERE

A rare opportunity exists to lease a highly visible 81sqm* retail/office space on Sylvania’s Princes Highway. This property offers a wide shopfront, prominent signage, and ample nearby parking, conveniently located near established businesses and transport options.

This group of modern office suites is located in the middle of the Toowoomba CBD, guaranteeing substantial pedestrian exposure. The anchor tenant is a major radiology provider, and all of the offices in the building are best suited to medical. The site includes on-site car parking, and is positioned opposite the Toowoomba Regional Council car park. RWC TOOWOOMBA RWC BAYSIDE

3 allocated basement carparks

Direct access to Bundall Road

8,068sqm* of flat land with 60*m road frontage

1-5 Phillip Street & 2 Clopton Street, East Toowoomba, 4350

•Situated at the intersection of Phillip, Clopton and Kitchener Streets for maximum accessibility

•4,509sqm* across six lots

•Mixed-Use zoning enables diverse development opportunities

•Three-storey building with an 860sqm* footprint and 50 car parks

•High-growth region exceeding $11 billion and sustained infrastructure investments

•Close to Wellcamp Airport and the Toowoomba Second Range Crossing

•Flexibility to begin development immediately or phase construction for long-term planning

•Positioned to align with Toowoomba's continued population growth, urbanisation and economic expansion

Expressions Of Interest closing March 7

Land Area: 4509 square metres*

Floor Area: 860 square metres*

Peter Marks

0400 111 952 peter.marks@raywhite.com

Brian Doyle 0434 551 628 brian.doyle@raywhite.com

RWC Toowoomba

raywhitecommercial.com

588 Bruce Highway, Woree, 4868

RWC Cairns is offering a two-level, fully leased office building at 588 Bruce Highway, Woree, Cairns.

Property Details:

Type: Professional Offices

Land Area: 809 sqm

Building Area: 492 sqm

Status: Fully tenanted

Key Features:

Modern, flexible office layout, High visibility on the Bruce Highway, Ample parking for staff and clients, Conveniently located near shops, restaurants, and public transport. This property is an excellent addition to any investment portfolio, offering security, flexibility, and profitability.

29 Acreage lots ranging from 3,951m²* to 7,007m²* (avg. 4,987m²*) under a CMS

Total land area 61.92Ha*

Lots 2 & 18 improved with residences

Situated 15min* west of Gympie and 1hr 5min* north west of the Sunshine Coast

822 544 tony.williams@raywhite.com

Czernik-Wojcicki 0413 481 971 chris.cw@raywhite.com

530sqm total building area

250sqm warehouse with high-bay lighting and sealed

280sqm office/mezz with air conditioning

3 full-height roller doors

Male and female toilets + shower

5 secure undercover plus 6 open-air bays

Prime main road position

66-98 High Street, Russell Island, 4184

This is your chance to secure a large commercially zoned property that has been held within the same family for 60 years.

Located just a short stroll from the ferry terminal and positioned along the main street, this expansive, predominantly level site boasts three street frontages.

Zoned as 'Local Centre,' the property is primed for a diverse range of business, service, and community developments to meet the growing needs of the island's residents.

As the largest single parcel of land available within this zoning*, the site opens the door to endless possibilities.

Of Interest

Closing 5 March 2025 4pm

Nathan Moore 0413 879 428 Hugh Fletcher 0429 583 765

Andrew Burke 0417 606 128

Bayside

raywhitecommercial.com

FEATURES:

•Modern architectural design

•320sqm* corporate offices over 2 floors

•Corporate grade bathroom and kitchen amenities

•1,286sqm* column free warehouse space

•Total GFA: 1,606 sqm* on 2,486sqm* land

•2 x container height roller shutters

•Superb marshalling apron

•Ample onsite carparking

•3 phase power

•Completion Q4 2025*

Sale/Lease

RWC Queensland

raywhitecommercial.com

Paul Anderson 0438 661 266 p.anderson@raywhite.com

Andrew Doyle 0412 853 366 andrew.doyle@raywhite.com

7 & 10 Athena Grove, Springwood, Qld, 4127

Mortgagee sale - 2,284 m2*

•Land area: 2,284m2* (two titles).

•DA approved for 60 units (10 levels).

•Zoning: Medium Density Residential.

•Centrally located to transport, health, shopping, schools and universities.

•Logan is one of the major population growth localities in South-East Queensland, with the projected population to exceed 500,000* by 2036.

Expressions Of Interest

Tom Barr 0405 144 352 tom.barr@raywhite.com

Matthew Fritzsche 0410 435 891 matthew.f@raywhite.com

Various hardstand sections both concrete & compacted gravel

404sqm* office/staff amenities

12,062sqm* warehouses/industrial infrastructure

Ample 3 Phase power

Multiple overhead cranes and jib cranes

Flammable goods store & Gas to site

Available circa October 2025

Lease Contact Agents

Jack Gwyn 0424 807 166 jack.gwyn@raywhite.com

Jared Doyle 0408 160 570 jared.doyle@raywhite.com

229 Leitchs Road, Brendale, 4500

2,556sqm*

895sqm* total building area

Dual tenancy with the opportunity to partially occupy immediately

Must sell at auction

Ben Sands 0432 547 164 ben.sands@raywhite.com

AJ Calvet 0488 113 270 aj.calvet@raywhite.com

1-3 Noel Street, Slacks Creek, 4127

•Total net lettable area - 720m2

•Land area - 589m2

•10 Tenancies within the building

•Shops 1 & 8 currently vacant

•Current gross income - $168,477.83

•Total projected net income - $165,893.04

•Annual outgoings - $40,584.79 PA Approximately

•Partial outgoings paid by select tenants

•Secure undercover basement parking

•Excellent exposure to Kingston Road

•Walking distance to cafes, restaurants, and public transport

•Just minutes to the M1 and major arterial roads

Sale $2,200,000 (Going Concern)

RWC Springwood

raywhitecommercial.com

Aldo Bevacqua 0412 784 977

aldo.bevacqua@rwcs.com.au

2 Athena Grove, Springwood, 4127

•Total building area - 305m2 over 2 levels

•Total land area - 819m2

•Ready to occupy

•Recently renovated

•Medically approved - High standard full fit out with clinic and treatment rooms

•Ability for dual tenancy

•Opportunity for both tenancies to live onsite

•Reception area

•Consulting rooms

•12 Exclusive onsite car parks

•Designated ambulance bay

•Centre zoned land allowing redevelopment options (STCA)

•Minutes to Pacific Motorway & major arterial roads

Auction

7th March 2025 at 11:00am onsite

RWC Springwood raywhitecommercial.com

Aldo Bevacqua 0412 784 977

aldo.bevacqua@rwcs.com.au

Zane Bevacqua 0400 270 666 zane.bevacqua@rwcs.com.au

area: 1,834 sqm*

area: 2,132 sqm*

Roof-top car parking for ~38 cars with ramp access

Permissible GFA: 5,424 sqm* (FSR 3:1), Past approvals for a fit-out and redevelopment Zoning: E3: Productivity Support

metre height limit

137 South Street,

Marsden Park, 2765 Auction Wednesday 5 March 2025 at 2:00pm

•Surplus land sale by Transport for NSW

•Expansive land area 19,515* sqm

•Within 1200m radius of proposed Marsden Park Town Centre

•Long term land banking opportunity in the fast growing North West Growth Precinct

•Currently zoned C2 Environmental Conservation and RU4 Primary Production Small Lots

•Proposed rezoning to C2 Environmental Conservation and RE1 Public Recreation^

•Marsden Park has benefited from up to 10,300 new homes and counting

•The neighbourhood is created over 3,000 new jobs, including 1,300 in the town center

raywhitecommercial.com

Roller door access with 4m clearance

Basement parking

Zoned: E4 - General Industrial Access to Warringah Freeway and Lane Cove Tunnel Land area: 515 sqm*

Of Interest

- Individually or in one line

Thursday 13th March 2025 at 4pm (AEST)

Purchase all four Lots or individually

Suites ranging from 66m2* to a total area of 331m2*

8 secure undercover car spaces plus 21m2* storage

Current passing net income $163,757.76

Currently occupied until September 2025

Zoned E2, caters to both commercial & retail businesses

Greater Sydney South

•Total building area | 440m2

• Total land area | 697m2

• 3x separate tenancies | $74,900 p/a net*

• Long leases with strong tenants in place

• Suits investors & future developers (6 levels S.T.C.A)

• Commercial 1 Zone (C1Z)

• Terms | 10% deposit, 60 - 120 days

Auction Wednesday, 20 March - 12:00pm On-site & Online

George Ganavas 0478 634 562

george.ganavas@raywhite.com

Anthony Anastopoulos 0488 095 057

anthony.anastopoulos@raywhite.com

RWC Oakleigh

raywhitecommercial.com

29

Occupy, invest or develop (STCA)

Land area | 5.19 acres*

Building area | 7,533 sqm*

Zoning | Industrial 1 Land

Partially leased to multipe tenants

Ideally situated within industrial precinct

Substantial hardstand and ideal truck access

17-25 Patrick Street, Hobart, 7000

RWC Tasmania is delighted to present 17 - 25 Patrick Street for sale. This exceptional city site boasts substantial existing improvements and is located a mere 650m from Hobart's central core.

Key property highlights include:

•Substantial land area of 1,630 sqm*

•Flexible Commercial Zoning

•Gross Building Area of 1,296 sqm*

•Spacious warehouse, office/showroom over two levels

•9 on-site car parks, rear storage yard

•Rare, mixed-use commercial offering For more information or to arrange an inspection please reach out to the undersigned.

238 East Derwent Highway, Lindisfarne, 7015

RWC Tasmania is proud to offer for sale 238 East Derwent Highway, Lindisfarne, a strategic, high profile corner development site, located on the Eastern Shore's busy East Derwent Highway.

Key Features:

•Exposure to over 20,000* vehicle movements daily

•Rare 24/7 council approval

•Situated in a tightly held commercial precinct

•Zoned: 'Local Business'

•High Profile, 1,637sqm* corner site, with dual access

•Substantial total frontage of over 80 metres*

•Capitalise on a high growth residential area For more information or to arrange an inspection please reach out to the undersigned.

claude.alcorso@raywhite.com

Trevor Fox 0419 355 917

trevor.fox@raywhite.com

raywhitecommercial.com RWC Tasmania Claude Alcorso 0417 586 756

RWC NT presents a rare opportunity to acquire 12 individual strata-titled warehouse units in the heart of Winnellie, just 7 km east of Darwin's CBD. Located within a well-maintained industrial complex, this property offers solid returns with high occupancy rates.

•12 strata industrial units for sale in one line

•Total building area: 2,749m2*

•Parcel area: 6,967m2*

•Zoned GI General Industry

•42 car parks & 2 loading bays

•Range of unit sizes: 206m2 to 298m2*

•Steel frame construction, concrete floors

•High demand, solid investment returns

An exceptional chance to invest in one of Darwin's top industrial areas.

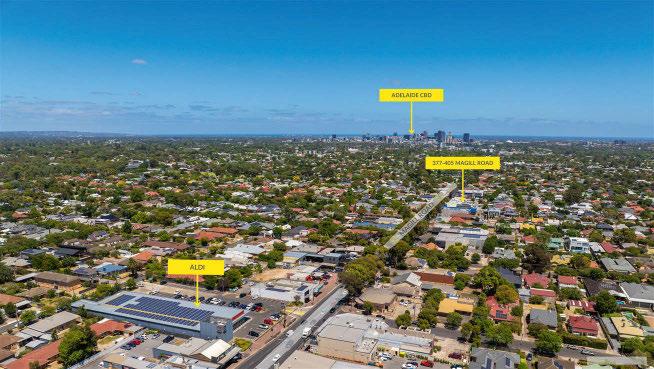

Expansive site area of 4,154sqm*

Total building area of 1,341sqm*

Zoned Suburban Main Street in the City of Norwood, Payneham and St Peters

Fully leased offering strong holding income

Total frontage in excess of 91m to Magill Road

Currently configured as 10 tenancies across 5 certificates of title

Expressions Of Interest

Closing Thursday 6th March at 4pm (ACDT)

RWC Adelaide raywhitecommercial.com

Harry Einarson 0421 747 442

Oliver Totani 0412 808 743

Jack Dyson 0448 685 593

70 Chief Street, Brompton, 5007

Absolute fringe location only 3.5km* from the Adelaide CBD

Regular shaped allotment of 911sqm* across two titles

Single level office/warehouse built form of 541sqm*

Housing Diversity Neighbourhood zoning allowing mixed-use outcomes

Offered with vacant possession

No stamp duty payable

Auction On Friday 14th March at 11am (USP)

Jack Dyson 0448 685 593

Oliver Totani 0412 808 743

Harry Einarson 0421 747 442

Strata lettable area: 651m2

lettable area: 703.2m2*

Income: $345,134.40 plus GST (effective as at 1 Nov 2024)

Tenancy: FTP Solutions - expiring 31 Oct 2028

Sustainability: 4.5 star NABERS Energy Rating (current to Oct 2024)

South facing over Swan River with an abundance of natural light

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

Luke Pavlos 0408 823 823 luke.pavlos@raywhite.com