PORTFOLIO

QUEENSLAND OFFICE MARKET S LEAD NATIO NAL P ER FO RMANCE

EX PE RTS DI SCUSS A SIAN INVESTME NT MARKET

RE TA IL V O FFICE VACANCIES, WH ICH CITY COMES OUT O N TOP?

QUEENSLAND OFFICE MARKET S LEAD NATIO NAL P ER FO RMANCE

EX PE RTS DI SCUSS A SIAN INVESTME NT MARKET

RE TA IL V O FFICE VACANCIES, WH ICH CITY COMES OUT O N TOP?

We’re proud to present the September issue of RWC’s Portfolio magazine.

August saw RWC hold its annual conference, where our network come together for two days of learning and development, with members hearing from a number of incredible speakers including Olympic gold medalist Grant Hackett. We also came together for RWC’s annual awards night where we celebrated the achievements of our network over the last financial year. RWC Western Sydney director Peter Vines was recognised as the top sales and leasing performer of the year, while Ray White Valuations was recognised as the top business.

In this month’s edition of Portfolio, Ray White head of research Vanessa Rader provides insight into the health of our nation’s CBDs, comparing retail vacancies and office vacancies in each capital city. She also took a deeper look at the country’s office markets, with Brisbane’s office market becoming the standout out when compared to other capitals.

We also recap August’s Between the Lines Live webinar which saw a panel of experts come together to discuss Australia’s Asian investment market. Vanessa Rader hosted the webinar, and was joined by RWC Western Sydney director of Asian investment services Victor Sheu, RWC Asian investment services agent Danny Shi, and Ray White Capital executive director David Mao.

James Linacre Head of Commercial RWC Australia and New Zealand

VANESSA RADER

Ray White Head of Research

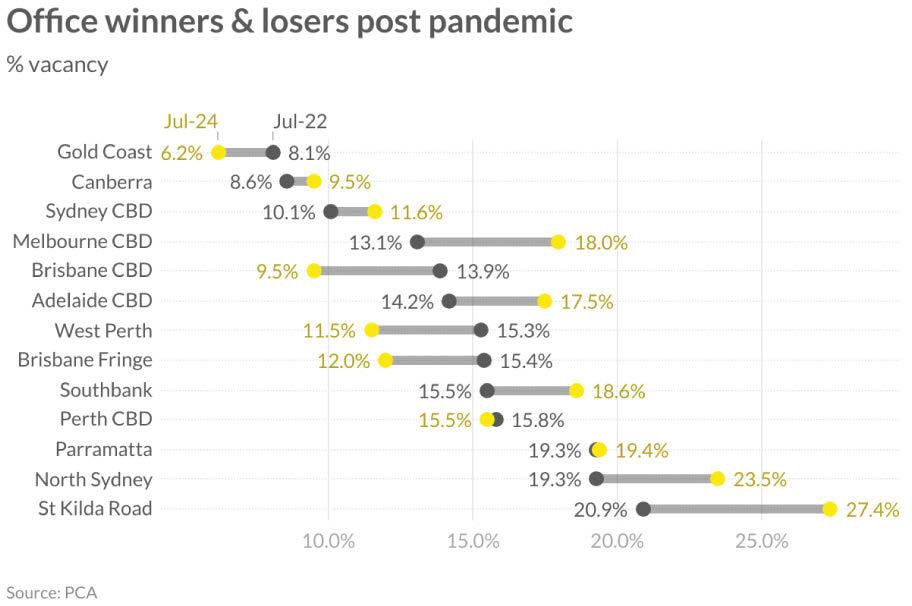

The Property Council of Australia’s latest bi-annual office market report reveals ongoing challenges in the sector, with vacancy rates continuing to rise across most markets. However, prime locations continue to outperform secondary markets. An analysis of changes in occupied stock highlights clear leaders among office markets in this post-pandemic era.

Adelaide CBD tops the list for net absorption this year, however, largely due to pre-commitments for new supply. The market’s vacancy rate decreased from 19.5 per cent to 17.5 per cent over the past six months. Post-covid, Adelaide has experienced significant volatility, impacted by continuous additions of new and refurbished stock.

Queensland emerges as the standout performer in the office sector, particularly the Brisbane fringe market. Brisbane CBD shows promising results with net absorption of 26,552sqm, while net supply decreased by 27,245 sqm, reducing vacancy to 9.5 per cent. The Brisbane fringe market continues its upward trajectory, recording its seventh consecutive period of positive take-up at 16,065 sqm in July 2024, bringing vacancies down to 12 per cent. Despite limited available stock, Gold Coast absorbed an additional 906sqm in the first half of 2024. These strong results across Queensland indicate ongoing business growth and a shift away from remote work trends.

Source: PCA

Perth’s office market also shows promise, with West Perth absorbing 2,553sqm and consolidating vacancies to 11.5 per cent. However, Perth CBD continues to face challenges, with vacancies rising to 15.5 per cent from 14.9 per cent in January 2024 despite the PCA’s boundary revision.

The office market’s recovery since the pandemic has been slow, with Queensland and Perth markets showing declining vacancy rates, indicating a return to “business as usual” compared to larger markets like Sydney and Melbourne. Melbourne CBD continues to struggle, with vacancy rates increasing for the ninth consecutive period to 18 per cent, now representing 943,775sqm of available stock.

Sydney CBD experienced some vacancy compression over the last six months, currently at 11.6 per cent, thanks to increased withdrawals despite negative take-up. Vacancies in Sydney CBD reached a low of 3.7 per cent in July 2019 but grew to 10.1 per cent by July 2022 before continuing to rise. Sydney’s non-CBD markets have seen greater vacancy growth postpandemic, with North Sydney, Crows Nest/St Leonards, and Chatswood all exceeding 20 per cent vacancy rates this period. Parramatta, while affected by a flight to quality, has maintained stable but high vacancies at 19.4 per cent due to stock withdrawals.

The Australian office market landscape presents a varied picture, with Queensland emerging as the clear front runner in performance. While challenges persist across all markets, particularly in Sydney and Melbourne, the resilience and growth seen in Queensland’s office markets - notably Brisbane CBD, Brisbane Fringe, and Gold Coast - highlight a shift towards regional strength and adaptability. Adelaide’s improvement and Perth’s mixed results further underscore the uneven nature of the postpandemic recovery. As businesses continue to navigate the evolving work environment, the disparity between prime and secondary markets remains evident, suggesting a continued flight to quality. Moving forward, the office sector’s recovery will likely remain gradual and geographically diverse as we manoeuvre business demands and working patterns.

VANESSA RADER Ray White Head of Research

A recent Ray White survey has shed light on the current state of retail and office markets across Australia’s major city centres. The study reveals a complex interplay between office occupancy, retail performance, and city vibrancy, influenced by factors such as public transport accessibility, night-time activities, and parking availability.

Prime retail core vacancy vs CBD office

Retail vacancy

Perth CBD

Brisbane CBD

Adelaide CBD

Melbourne CBD

Office vacancy

Sydney CBD

Source: Ray White, PCA

Sydney’s CBD emerges as the nation’s retail powerhouse, boasting a mere 5.4 per cent vacancy rate in its prime retail core. The city has become a luxury retail hub, with international brands occupying a quarter of core shopfronts. Despite this retail success, Sydney’s office market recovery has been sluggish post-pandemic, with vacancy rates at 11.6 per cent. However, this represents an improvement from the previous year’s 12.2 per cent. Sydney’s retail resilience is bolstered by robust tourism, efficient public transport, and competitive parking rates, especially during off-peak hours. Daily parking rates, while reduced, remain high at $78, but evening and weekend rates are more attractive.

Melbourne’s commercial landscape paints a picture of contrasts. The city’s retail sector, particularly the upscale “Paris End” of Collins Street, maintains its allure with a 10 per cent vacancy rate. This resilience is remarkable given the subdued CBD workforce presence. Melbourne faces the most significant challenges in office occupancy nationwide, with businesses struggling to entice employees back after prolonged pandemic lockdowns. Despite office sector woes, retail has shown signs of revival, buoyed by a

resurgence in tourism, a thriving student population, and increased evening activities. Improvements in transport and parking costs which have fallen over the past two years, have also contributed to reinvigorating the CBD.

Adelaide’s commercial property market presents a mixed outlook. The office sector grapples with long-standing challenges, exacerbated by new completions that have pushed vacancy rates to 17.5 per cent. In contrast, retail occupancy in prime areas remains strong. The central Rundle Mall boasts an impressive 6 per cent vacancy rate, offering a diverse mix of clothing & soft goods, and personal items that cater to weekend shoppers. However, student life remains busy on Hindley Street despite higher vacancies (13.7 per cent). Obstacles in its recovery are due to lower asset quality and a less diverse tenant mix dominated by food outlets, pubs and services.

Brisbane’s CBD stands out as the country’s strongest office market, boasting a low 9.5 per cent vacancy rate that has injected new life into the city centre. The retail landscape, while robust, shows some signs of uncertainty with a 13 per cent vacancy rate in prime areas. A shift in retail dynamics is evident, with luxury brands concentrating in the northern end of Queen Street Mall and Edward Street, while southern areas experience increased vacancies fuelled by Myer’s vacation last year. Weekend activity remains a challenge, but initiatives like discounted public transport aim to boost city visitation. Notably, Brisbane has become Australia’s most expensive city for CBD parking.

Perth’s commercial property scene has been quietly evolving. The office market, enhanced by high-quality new developments, shows a vacancy rate of 15.5 per cent. The retail sector keeps pace with a 14 per cent vacancy rate, with encouraging signs of expansion, particularly in the Murray Street Mall precinct crossing William Street. The completion of Raine Square has introduced premium tenancies to the market. While Murray Street maintains sub 10 per cent vacancies, Hay Street Mall faces ongoing challenges. The city’s retail landscape is influenced by the quality of assets, with newer or refurbished properties attracting both tenants and customers. Improving transport and affordable parking, aided by reinvigorated nighttime activity keeping retail more vibrant than ever before in the Perth core area.

Canberra’s unique government-centric economy presents distinct challenges for its commercial property market. Despite a low office vacancy rate of 9.6 per cent, actual occupancy is under pressure due to the prevalence of remote work in the public sector. This reduced weekday foot traffic severely impacts the retail sector, resulting in a high 15.5 per cent vacancy rate. Small businesses, particularly in food and beverage, struggle with limited weekday trade. The retail landscape is further complicated by strata-titled properties with minimal capital improvements, leading to a decline in the quality of retail offerings outside major shopping centres. The city’s town centre model also contributes to limited weekend visitation, casting uncertainty over the future of CBD retail.

Australia’s major CBDs present a diverse commercial property landscape in 2024. While some cities like Sydney and Brisbane show resilience in specific sectors, others face ongoing challenges in adapting to post-pandemic work patterns and changing consumer behaviours. The interplay between office occupancy, retail performance, and urban vibrancy continues to shape the commercial property dynamics across the nation’s urban centres.

Hundreds of people tuned in to watch RWC’s August Between the Lines Live webinar, where our panel of experts discussed the Asian investment market.

Ray White head of research Vanessa Rader hosted the webinar and was joined by RWC Western Sydney director of Asian investment services Victor Sheu, RWC Asian investment services agent Danny Shi, and RW Capital executive director David Mao.

While Mr Mao and the team at RW Capital were focused working with institutional and wholesale capital on credit and equity fund strategies, Mr Sheu and Mr Shi were focused on providing a full-service offering to private investors including brokerage, leasing, and property management.

The experts discussed how, in the last two decades, the way Asian investors were spending their money in Australia had changed.

“In 2010-2016 we saw a wave of money coming into Australia, particularly Sydney and Melbourne,” Mr Shi said.

“They saw a boom in Asia and made a lot of money in residential development, so they looked to Australia to do the same thing here.

“Here they are looking for 1000 units, but those kinds of developments are really hard to find here. In Asia one project could be 5000 units.”

Mr Shi said in 2016 - 2018 the large projects were harder to deliver and the presales were getting slower.

“Then they started focusing on smaller boutique projects. Then it was COVID and then we had a small boom in 2021.

“In the current market we still have a lot of interest looking for sites particularly in the upper and lower north shore and the eastern suburbs, but they now focus on small to medium size developments.”

Mr Mao said developers that were active were characterised by their ability to access funding.

“Developments are long-term but funding is typically short term in nature. The recent headlines from incoming investors have all been able to source long term stable funding from local or overseas financial institutions,” he said.

When you have long term stable funding, developers can weather the storm if there are delays in approvals, or construction, or pre-sales.

Mr Sheu said Asian investment into Australia continued to grow.

“We are seeing less people coming into the country but, if you look at the stats, Asian investment still represents over 15 per cent of investment into Australia. The amount of investment from these countries is continuing to grow.

“The Asian market is now a lot more educated and are very similar to our local investors as they have been through the boom and are familiar with all the processes.

“They are here to find a special vehicle to carry their wealth, it’s more about wealth preservation now than bigger returns.”

Mr Mao said it was a good thing that Asian investors had become more educated about the Australian market.

“You want people to think about what yields, schemes and designs will actually sell. We don’t want people to build for the sake of building,” he said.

“We wouldn’t call it a slow down but more a self-correcting mechanism. We want people to slow down and think about their projects rather than building a product which no one really desires.

“Having that self correction where you’re only producing products the market wants is a good thing.”

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

This quality grouping of office suites offers lots of natural light and great exposure to both West Street and Russell Street, air-conditioning throughout all units and plenty of car parking available on site.

Cannon Hill Urban Village is a conveniently located vibrant shopping centre that attracts a steady stream of both vehicle and foot traffic, and offers the local community an array of fast food choices, along with health and beauty services.

250 metres from Central Train Station and Sydney Light Rail, this light-filled corner office offers affordability and convenience at Elizabeth and Devonshire Street. Features include an open plan area with 2 private offices, air-conditioning and signage opportunities.

Kingsway Central offers prime multilevel retail spaces ideal for F&B businesses. Located in the heart of Glen Waverley, these modern tenancies boast natural light, private balconies, and flexible floor plans. Benefit from high visibility, ample parking, and proximity to public transport.

Griffin Deakin 0422 587 143

Blake Primrose 0421 203 677 Aaron Canavan 0447 744 948

at the entrance to the Sunshine Coast Hinterland, 1 Connection Rd, Glenview, is a rare offering that blends rural serenity with coastal proximity. With easy access to the Bruce Highway

Goldsworthy 0481 996 794 david.goldsworthy@raywhite.c om

Shadforth 0488 981 076

Troy Sturgess 0432 701 600 troy.sturgess@raywhite.com

Chris Massie 0412 490 840 chris.massie@raywhite.com

Lot 32 Else Road, Gladstone Central, 4680

•Situated within the Gladstone State Development Area.

•Surrounded by major regional infrastructure including HV power line corridors, QLD gas pipeline, Fisherman's Landing port facility.

•Located within close proximity to major industrial sites including Fortescue Future Industries, Rio Tinto, QER, Cement Australia and others.

•Rare privately owned freehold offering adjoining GSDA.

•15km* to Gladstone City.

868sqm* total building area

697sqm* warehouse area

82sqm* office over two levels

Clear-span warehouse, clearance of 5.5 to 7 metres

3-phase power

Large container-height roller door

Located in the heart of Rainbow Beach, these two properties are fully tenanted and available to purchase together or individually.

•NLA Lot 13: 167m2* + 14m2* car space

•NLA Lot 18: 90m2* + 14m2* car space

•Fully tenanted investments

•Diversified cashflow from four tenants

•Main street exposure with high foot traffic

•Two on site car parks

•Beachside location in the heart of Rainbow Beach

•Located beside Rainbow Beach Hotel and Post Office

Building 1, Freeway Office Park, 2728 Logan Road, Eight Mile Plains, 4113

•One of South East Queensland's most highly sought after commercial office locations.

•3.5 km* to Westfield Mt Gravatt and close to schools, universities, sporting facilities, and bush reserve.

•1,863m2* land area.

•1,429m2* NLA A-Grade office building.

•50 car parking bays (36 basement, 14 open on-grade).

•100% leased with a 5.5 year* WALE by income (as at 01/10/24).

•$912,883* p.a. net operating income (as at 01/10/24).

•Multi-tenanted building with eight strong covenant tenants, providing a diverse income stream and defensive cash flow.

•New fit outs and full disability compliant facilities.

•Landlord friendly net leases including bank guarantees, personal guarantees, CPI increases.

67 Ramsay Street, South Toowoomba, 4350

•Total Floor Space: 215sqm* on ground and first floors

•Ground floor tenanted; first floor ready for occupancy

•High exposure on Ramsay Street, a key thoroughfare

•The building is fully air-conditioned for year-round comfort

•Abundant natural light enhances the workspace ambiance

•Includes communal toilets and two showers for convenience

•Features a ramp for easy entry, ensuring accessibility

•Ten (10) on-site parking spaces plus one dedicated disabled parking spot

•Shared reception area provides a welcoming professional entry

•Close to shops and Toowoomba's largest high school, offering convenience and high foot traffic potential

Expressions Of Interest

Land area: 809 square metres*

215 square metres*

Peter Marks 0400 111 952

peter.marks@raywhite.com

Brian Doyle 0434 551 628 brian.doyle@raywhite.com

RWC Toowoomba

raywhitecommercial.com

Positioned in a prime business/retail precinct

1,131m2* site area with a wide 20* metre frontage

Situated on flat, fully-fenced block

Ample onsite and street parking

3 phase power to both buildings

Zoned Mixed use Fringe Business Precinct 128

Peter Laoudikos 0422 118 288

Ben Sands 0432 547 164

Lachlan Holliday 0455 553 813

Stephen Townsend 0427 631 957

119-121 &

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Stephen Townsend 0427 631 957 stephen.townsend@raywhite.com

Zoned E2: Commercial Centre Building area - 742sqm*

Net passing rent of $292,975.89 per annum (excluding GST)*

Stephen Townsend 0427 631 957 stephen.townsend@raywhite.com

196 Lords Place, Orange, 2800

Land area - 598sqm*

- 1,110sqm*

Zoned E2 - Commercial Core

Height Limit - 16m

Positioned in the heart of the Orange CBD

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Stephen Townsend 0427 631 957 stephen.townsend@raywhite.com

176-180 March Street, Orange, 2800

Zoned

5 x tenancies with flexible floor plans Site area - 5,294sqm*

Stephen Townsend 0427 631 957

903 Princes Highway, Engadine, 2233

RWC Greater Sydney South is pleased to exclusively offer for Sale 903 Princes Highway, Engadine to the market which has been the loving home of Engadine's top veterinary hospital for over 50 years.

•Secure 5 year lease till Sept 2028 plus 5 year option

•Blue chip corporate tenant

•Current net rent $113,573.90* (as at 1 Oct 24)

•Significant land holding 1,315m2*

Lot 4005 & 4006 16 Chapman Street, Werrington, 2747

•Two retail development sites

•Combined site area - 5,675m2*

•DA Approved for Neighborhood Shopping Village

•Located in thriving Lendlease Residential CommunityKings Central

•Zoned E4 General Industrial potential for alternative developments

•700m* from Werrington Railway Station & 2.7km* from future St Marys Metro Station

Expressions Of Interest

Wednesday 18 September 2024 at 3:00pm

Peter Vines 0449 857 100 Jai Sethi 0433 393 128 Minal Patel 0482833855

raywhitecommercial.com

19 Mildura Street, Fyshwick, 2609

Significant site area of 30,400sqm*

Current Net Income $1,169,349 + GST pa*

Existing building area of 6,382sqm*

Grossly underdeveloped with permitted GFA of 25,000sqm

Mildura Street frontage of 193 metres

Blue Chip tenant profile including ASX listed companies

Expressions Of Interest

Closing 12 September 2024

Frank Giorgi 0403 839 822 frank.giorgi@raywhite.com

Daniel McGrath 0411 140 523 daniel.mcgrath@raywhite.com

149-151 Canberra Avenue, 9 & 11 Nyrang Street, Fyshwick, 2609

To be sold separately or in one line

Total land area of 19,228sqm* with further development upside

Anchored by 7-Eleven and KFC

of $1,066,927 plus GST*

One of Canberra's busiest locations

Frank Giorgi 0403 839 822 frank.giorgi@raywhite.com Daniel McGrath 0411 140 523 daniel.mcgrath@raywhite.com

359 Centre Road, Bentleigh, 3204

•Total building area | 131m2*

•Flexible layout with high ceiling

•New 2 + 2 year lease

•Rear access with 1 car space

•Commercial 1 Zone (C1Z)

46 Wanda Street, Mulgrave, 3170

•Total building area | 178m2*

•Total land area | 203m2*

•Comprising of a shop front & 3 bedroom residence

•Long-term & established business since 2004

•Recently renewed 5 year lease with options

•Current Rent | $41,000 p/a plus GST and Outgoings

•Convenient rear access with onsite parking

•Commercial 1 Zoning (C1Z)

•Terms | 10% deposit, 30 - 90 days

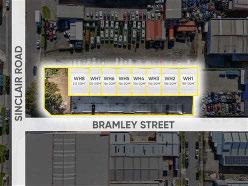

1-8/6 Bramley Street, Dandenong, 3175

Sale

5/1 Olive Grove, Keysborough, 3173

Sale Private Sale

•Choice of 8 Brand New Architectural Warehouses

• Building areas | 125m2* - 213m2*

• Container height electric roller door

• 3 phase power

• Kitchenette & bathroom facilities

• Multiple on-title car spaces

• Suitable for tradies, small business owners, man caves or personal storage

• Perfect entry level investment or S.M.S.F

• Flexible Industrial 1 Zone (IN1Z)

*Approx Boutique development of 8 brand new architectural

Theo Karkanis 0431 391 035 theo.karkanis@raywhite.com

George Ganavas 0478 634 562 george.ganavas@raywhite.com

RWC Oakleigh raywhitecommercial.com

•Total building area | 190m2*

• Includes first floor office | 36m 2*

• Warehouse clearance up to 8m*

• Designated container loading & unloading areas

• Vacant possession

• Amenities | kitchenette & disabled toilet

• Electric roller door, 2x split systems & 3 phase power

• Four (4) car spaces on-title

• Industrial 1 Zone (IN1Z)

• Terms | 10% deposit, 60 - 90 days

27/536 Clayton Road, Clayton South, 3169 RWC Oakleigh raywhitecommercial.com

Warehouse / office occupy / invest ($470,000$515,000)

•Total building area | 155m2*

• Including office area | 15m 2*

• Three (3) On-site parking spaces

• Amenities on-site

• 3-phase power

• Industrial 1 Zone (IN1Z)

• Vacant Possession

• Popular industrial pocket in Keysborough

• Conveniently located close to Eastlink, Cheltenham and Chandler Road

George Kelepouris 0425 798 677 george.kelepouris@raywhite.com

Jonathan On 0479 003 122 jonathan.on@raywhite.com

RWC Oakleigh raywhitecommercial.com

16/3 Audsley Street, Clayton South, 3169

George Ganavas 0478 634 562 george.ganavas@raywhite.com

Anthony Anastopoulos 0488 095 057 anthony.anastopoulos@raywhite.com

•Total building area | 166m2*

• Includes quality first floor office area | 64m 2*

• Clear span warehouse with clearance up to 6.9m*

• Corner unit with glass facade

• Disabled toilet & shower

• Two (2) split systems

• Electric roller door & 3 phase power

• Three (3) car spaces

• Industrial 1 Zone (IN1Z)

• Vacant Possession

Friday September 6, 2024 at 11:30 am On-site and Online *Approx

Auction ($480,000 - $525,000) Wednesday September 11, 2024 at 11:30 am On-site and Online

George Ganavas 0478 634 562 george.ganavas@raywhite.com

Anthony Anastopoulos 0488 095 057 anthony.anastopoulos@raywhite.com

RWC Oakleigh raywhitecommercial.com

year lease commencing 1 May 2023

8 Bowman Street, South Perth, 6151

Freehold title with 597m2* land area

187m2* spacious offices / consulting rooms

Ample parking front and rear and street

Zoned 'Centre' (R-AC0) - ultra high density permitted

Occupy or invest until redevelopment

Michael Milne 0403 466 603 michael.milne@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

83-85 Rokeby Road and 14-16 Rowland Street, Subiaco, 6008