We are proud to present the November edition of Portfolio magazine.

While the 2024 calendar year is nearing its close, there is still plenty happening at RWC, with our biannual auction showcase kicking off this month. With more than 50 properties going under the hammer, RWC will be rounding out the year with a bang… of the gavel.

From 13 November - 13 December, our agents around the country will be running auctions across all asset classes. Check out our selection of stock here

In this month’s edition of Portfolio, RWC Head of Research Vanessa Rader will discuss the latest results for the RLB crane count, and what they mean for our nation’s residential and commercial development landscapes. Vanessa also shares an insight into whether owner occupiers are fuelling the commercial market, particularly in the sub-$20 million category which is showing resilience.

RWC Commercial Property Management Performance Specialist Leteicha Wilson shares valuable insight into how property investors can future-proof their commercial assets, sharing three vital tips for staying ahead of market trends.

We also recap the October edition of RWC’s Between the Lines webinar, in which Vanessa interview RWC Bayside principal Nathan Moore and RWC Glen Waverley principal Ryan Trickey about the small investment market, and what trends they were seeing across industrial, retail, and office.

James Linacre Head of Commercial RWC Australia and New Zealand

VANESSA RADER

Ray White Head of Research

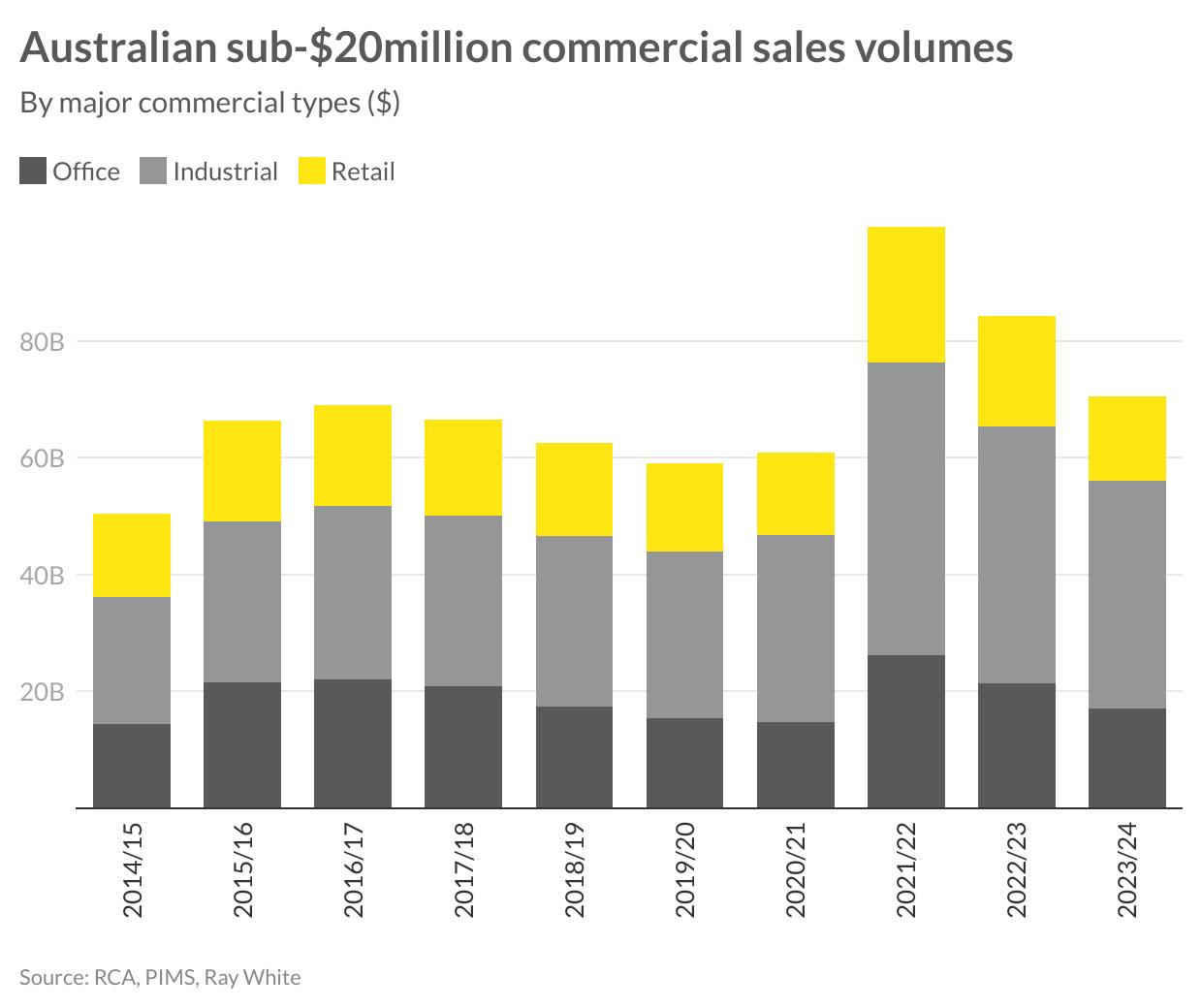

The commercial property market is experiencing an intriguing shift, particularly in the sub-$20 million sector, which continues to demonstrate resilience in the face of challenging market conditions. Despite the increased cost of financing, this segment of the market is performing remarkably well, with transaction volumes surpassing both historical averages and pre-pandemic levels. This stands in stark contrast to the broader commercial market, which has seen declines of up to 70 per cent year-on-year in some areas.

While the sub-$20 million market has cooled from the peak activity seen in 2021/22, when volumes approached $100 billion, the current trend still indicates robust demand for smaller commercial assets. The annual decrease of approximately 15 per cent from those record highs underscores the enduring appeal of this market segment to both investors and owner-occupiers.

Investors remain active players in this space, drawn to the prospect of higher yields, opportunities presented by distressed sales, and the potential for land banking with an eye toward future development. However, a notable trend has emerged in the form of increased activity from owner-occupiers, who have become a significant and competitive buying group in this market. These owner-occupiers are motivated by a desire to secure their business premises and shield themselves from the uncertainties associated with leasing commercial space. By purchasing properties within their business structure or through self-managed superannuation funds (SMSFs), they aim to bring long-term stability and certainty to their operations. This strategy not only protects them from potential rental fluctuations but also allows them to build equity in a real estate asset.

The current financial year has seen $70.5 billion change hands for traditional commercial assets in the sub-$20 million price range. Industrial properties have dominated this activity, accounting for a substantial 55.3 per cent of all sales. This dominance of the industrial sector is not a new phenomenon, as its share of investment has been steadily growing year-on-year over the past decade, reflecting changing attitudes towards this asset type as well as required business needs and broader market dynamics.

Geographically, the distribution of investment shows some clear patterns. NSW continues to lead in terms of investment volume, followed closely by Victoria. However, the Queensland market is showing rapid growth, with Western Australia a small but growing location also, indicating an expansion of commercial property interest beyond the traditional powerhouse states.

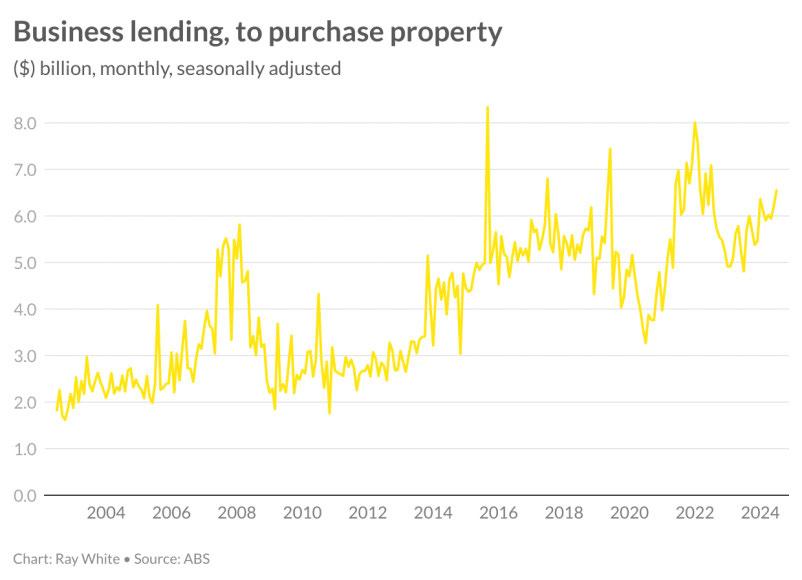

The uptick in owner-occupier activity is further evidenced by the growth in business lending for property purchases. While this data shows some month-to-month volatility, the overall trend has maintained an upward trajectory. During the 2022/23 financial year, a total of $69.6 billion was lent to businesses for property purchases. This represents a 4.3 per cent increase from the previous year, although it’s down 14.6 per cent from the exceptionally busy 2021/22 period when volumes reached record highs.

To put this into perspective, prior to the recent surge, the 10-year average for annual business lending for property purchases stood at $54.1 billion. The current figures significantly exceed this long-term average, highlighting the growing trend of businesses opting to own their commercial properties. This shift towards owner-occupation in the commercial property market reflects a broader strategic move by businesses to secure their operational spaces and invest in their long-term stability. As this trend continues to unfold, it may have lasting implications for the commercial property market and the way businesses approach their real estate needs.

LETEICHA WILSON RWC Property Management Specialist

As a commercial property investor, staying ahead of market trends and tenant demands is crucial for maintaining and growing your asset’s value. Future-proofing your investment ensures its long-term profitability, and a skilled property manager can be your key partner in making this happen. Here are three critical ways to future-proof your property.

With rising demand for eco-friendly spaces, sustainability is no longer a choice but a necessity. Tenants seek energy-efficient buildings to reduce costs and align with corporate values. A property manager can oversee energy-saving upgrades like efficient lighting or smart HVAC systems and help secure green certifications (such as NABERS), which can boost the property’s appeal and value. Additionally, property managers stay on top of environmental regulations, ensuring your asset is compliant and futureready.

Technological change is reshaping the commercial real estate landscape. From smart building tech to flexible workspace designs, tenants expect properties that support modern business needs. A property manager can facilitate tech upgrades—like enhanced digital infrastructure and automated systems—and advise on flexible leasing options to attract tech-driven tenants. They can also track tenant feedback, ensuring your asset evolves with market demands.

Long-term asset health depends on proactive maintenance. A property manager can develop a preventative maintenance plan that addresses small issues before they become costly problems. They’ll also manage capital expenditure for major upgrades and ensure tenants meet their maintenance obligations, protecting your investment and keeping the property in peak condition.

Future-proofing your commercial property is essential for long-term success. By focusing on sustainability, adapting to new technologies, and implementing preventative maintenance, you can safeguard your asset’s value. Partnering with an experienced property manager will help you navigate these areas with confidence, ensuring your property thrives in the years to come.

VANESSA RADER

Ray White Head of Research

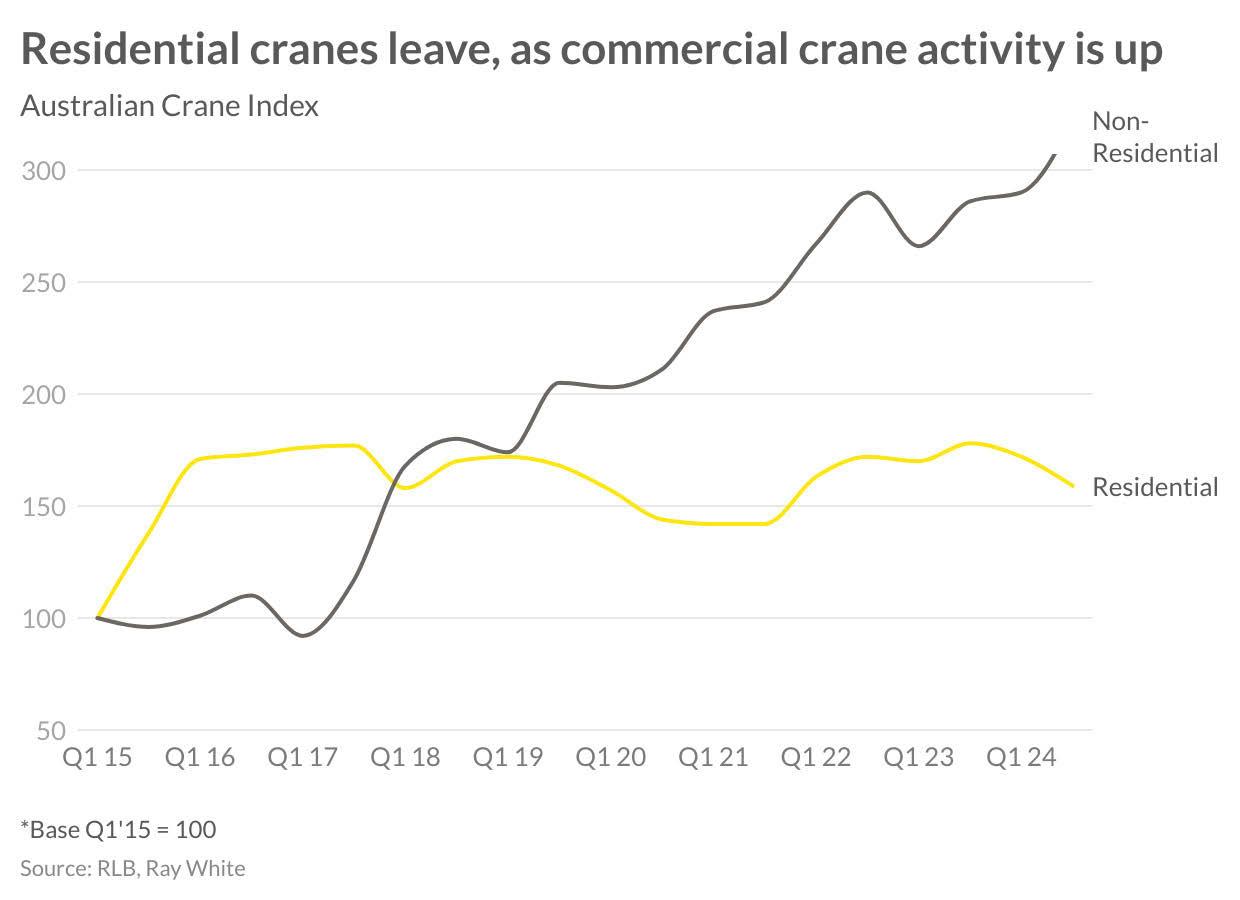

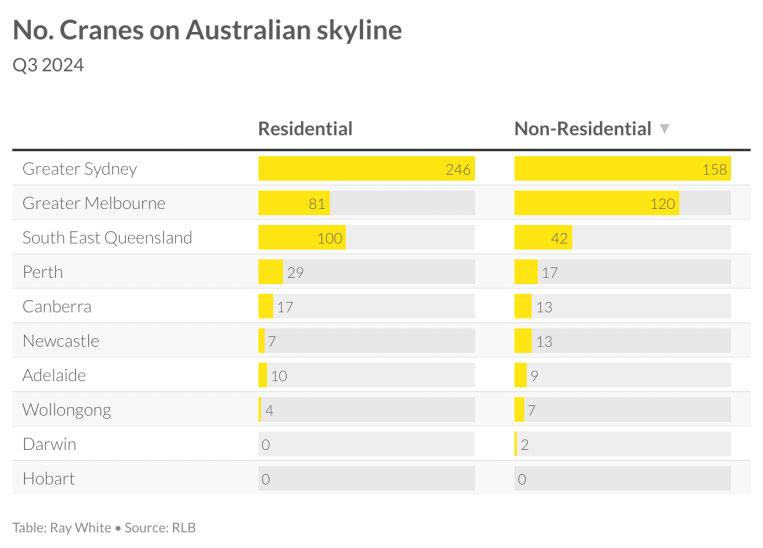

The RLB bi-annual crane count for Q3 provides an insight into construction activity across Australia, revealing significant shifts in development patterns. At the national level, a notable trend has emerged: a decline in residential development activity contrasted with growth in non-residential sectors. The number of residential cranes dotting the skylines across the country has decreased from 535 to 493 over the past six months, resulting in a substantial fall in the index result.

Conversely, the non-residential sector has demonstrated robust growth, with an increase of 34 cranes over the same period, bringing the total to 370. This surge has propelled the index to its highest rate on record since its inception in 2015, indicating a strong focus on commercial development and changing urban development priorities.

Looking regionally, south east Queensland has recorded net losses in crane numbers, most notably as 34 residential projects reach completion, replaced by only 30 new ones. This trend is particularly evident in Brisbane and the Sunshine Coast, which have both seen reductions in crane numbers. However, the Gold Coast bucks this trend, continuing to see an uplift in crane numbers. Despite the overall decline, residential projects still dominate the south east Queensland skyline, accounting for 100 cranes (albeit down from 104), while non-residential cranes maintain a significant presence.

Sydney retains its position as the epicentre of construction activity in Australia. Sydney’s western region has shown the most significant growth, now home to 108 cranes, up from 95 six months ago. Greater Sydney hosts an impressive 246 cranes for residential projects, though it’s worth noting that this represents a negative net movement. This decline highlights that project completions are outpacing new construction starts, however, non-residential cranes have seen positive net movements across various sectors, including mixed-use, education, civic, civil, and even commercial.

Melbourne has experienced some of the most dramatic changes over the past six months. The number of residential cranes has plummeted from 107 to 81, in contrast, non-residential projects have become the key area of construction activity for this market. There’s a strong focus on infrastructure, with cranes for civil, civic, and data centre projects all continuing to grow.

Other major cities, including Perth, Adelaide, and Canberra, have seen limited changes in their crane counts. However, there have been slight improvements across both residential and nonresidential construction sectors, indicating steady growth in these markets.

The overall national trend shows a decline in residential crane counts, while the non-residential sector has seen an uptick. Mixed-use developments continue to be the second most active sector after residential. This trend is fueled by the ongoing need for residential dwellings and the growing popularity of mixed-use projects that cater to both residential and commercial needs, often combining residential spaces with retail, office, or hotel facilities.

Interestingly, the sector that has seen the greatest increase in cranes over the last six months is civil construction, up by 11 cranes. This growth reflects strong investment in infrastructure across the country, notably in Brisbane (the future Olympic city), followed by Melbourne and Sydney. The increase in civil projects suggests a focus on improving urban infrastructure given our positive population story.

Other sectors showing growth in crane numbers include civic, commercial, and data centres, highlighting the changing face of projects across Australia. However, some sectors have shown limited growth despite apparent demand. The development sectors of aged care and education have seen minimal positive change in crane numbers, which is somewhat discouraging given Australia’s ageing and growing population. This trend may suggest a need for increased focus on these vital social infrastructure sectors in the future.

Two commercial asset classes that have grown in investment popularity in recent times are retail and hotel. Interestingly, there appears to be limited new supply projects for these sectors, which is likely to continue fueling their demand. This scarcity of new developments in retail and hospitality could present opportunities for investors and developers in the coming years.

Hundreds of people tuned into the October edition of RWC Between the Lines webinar, where the panel of experts discussed the market for small investor stock.

Ray White head of research Vanessa Rader was joined by RWC Bayside principal Nathan Moore and RWC Glen Waverley principal Ryan Trickey.

Ms Rader said while commercial transaction volumes had declined, the smaller investor market, for transactions sub $10 million and especially sub $5 million, was still seeing a lot of activity. She asked Mr Moore and Mr Trickey what trends they were seeing across industrial, retail, and office.

“Interest in the smaller industrial market is largely price point driven, we see a lot of strata products which transact close to $1 million. That’s a relatively affordable price point now for a lot of small businesses,” Mr Moore said.

“When you factor in the ability to leverage a self-managed super fund (SMSF), we’re seeing self occupation as a really big driver in that space.”

Contrary to that, Mr Trickey said as a result of regulation around SMSF he has seen a different partner.

“As a result of the cost and regulation involved at that price point, it really compresses the dollars that you get out of it, even for an owner occupier,” Mr Trickey said.

“We’re also seeing a divestment away from those residential assets at circa $1 million with people saying ‘hey what can we buy in the commercial space?’.

“Granted we have a bigger deposit threshold, however that deposit is often being generated by increased equity in their home or residential investment.

“So rolling it off into a simplified tilt slab low maintenance commercial asset has proven to generate that momentum that we’re seeing in the $1 million to $1.5 million space.

“So the two main things are that it’s too expensive to run a SMSF, but we are seeing money coming out of the residential market here in Victoria.”

With much of the industrial market experiencing high rents and low vacancies, Ms Rader asked if this was driving owner occupier demand.

“In Brisbane we were seeing market rents lift at 10 per cent per year which is a very significant increase. I think it put some fear in people and the only way to cap that moving forward is to buy the asset and control the occupancy costs.

“The second thing is the cost of a fit out now. If you can get trades, south east Queensland is under immense pressure with all the infrastructure projects going on, it’s expensive to do a fit out. So people are thinking if they have to spend $50,000-$200,000 on a fit out, they might as well do it in something that they own.”

Mr Trickey said investors were still active in the Melbourne market.

“I think Victoria remains an opportunistic state, especially with some of the pressure we’ve had from state government and interesting taxation challenges,” Mr Trickey said.

“We are still seeing interstate buyers. They see the market as something that has bottomed out, or is close to it, and are saying ‘that’s an opportunity’ and if you’ve got the money there is money to be made.”

Ms Rader said retail was still showing some strength in the post-covid environment.

She asked Mr Moore and Mr Trickey what trends they had seen in the smaller retail space, such as strip shops.

“A lot of strip shops are quasi-professional spaces as well, which has added some depth to that market,” Mr Moore said.

“There’s only so much main road frontage that’s available, so you’re not seeing massive expansion of that kind of product which is putting a cushion under values and putting a cushion under rents.

“Some of the really discretionary retail uses that popped up just after covid are under pressure at the moment, like takeaway food providers.

“A lot of the activity in that space is investor driven and, provided tenant demand can be demonstrated, they’re still transacting on a pretty good yield.”

Mr Trickey said the Glen Waverley area had a really strong retail market.

“It took a pounding for a period there, but we were fairly optimistic about the bounce back. The reinstatement of really good rents and good performing tenants happened really quickly,” he said.

“We break that category up into primary, secondary and tertiary. And when we look at our primary strips, their vacancy rates are lower than what we’ve seen in a long time.

“Our secondary retail like bike shops, gelato, Auspost, those strips are doing really well too, they’re assets in the $500,000 to $2 million range.

“Then you get into our tertiary retail and they’re our strips with maybe 5-8 shops with no anchor tenant, and they’re struggling. That’s due to the increased cost of living and goods.

“The quasi businesses who were doing okay because they were only paying $25,000 a year are now struggling because their rents have crept up and the costs of goods have crept up, but they haven’t got the foot traffic.”

The office market in south east Queensland has fared a lot better than the market in Melbourne over the last few years.

“We’ve had no discernable issue, our core market is 30 minutes out of the Brisbane CBD so it probably got stronger during the course of covid. When people were forced out of the CBD offices but they didn’t want to work at home, they looked for an intermediate facility,” Mr Moore said.

“There is a two-tier market appearing and a lot of that is surrounding disability compliance and availability of car parking on site. If those boxes can be ticked then the product is walking out the door.

“A lot of our product is ground level or two-storey so it has dual purpose, there could be retail on the ground floor and professional services above.”

Mr Trickey said the office market was a strange space in Melbourne at the moment.

“A lot of the smaller 100-250sqm spaces are on four or five year leases and they’re all just starting to come up now off the back of that challenging time,” he said.

“We’re now doing a lot more reviewing of those rents and trying to instil in owners that holding those tenants at a capped rent of a similar rent and to go into a rebuilding process.

“Because once you start talking about agent costs, marketing costs, legal costs, all of a sudden to go and see a 10-15 percent reduction in the face rent you’re getting, but you’ve enjoyed those increases over the last five years, it’s far more expensive to lose your tenant to get a low rent. It’s a real education piece at the moment.”

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

Ormiston Plaza is a vibrant shopping centre anchored by Red Rooster. With a high traffic flow, this bustling hub offers a diverse range of amenities including a medical centre, beauty and health services, fast food and a thriving office environment.

WEST END, QLD

16,823sqm* riverfront property that has been partially demolished to accommodate a potential redevelopment to incorporate over 101,000sqm2* of saleable residential space across 8 towers. This appointment is focussed on assisting the receivers of this asset in managing the commercial occupiers in the remaining buildings onsite until such time redevelopment occurs.

This secured and fully gated warehouse and display yard area covers more than 2,000sqm* in the heart of Toowoomba’s industrial precinct. The block offers access from both Taylor Street and Eyers Street.

RWC CANBERRA

TUGGERANONG, ACT

Purpose built on a parcel of land approx 2600sqm* for a leading national childcare provider. A 20 year lease in place and 100% of the outgoings paid by the tenant.

242*sqm of NLA on Volumetric Title

Rental rates exceeding $1,000*psqm - $1,200*psqm

12* Exclusive use car parks. Large covered alfresco area

Rare opportunity to acquire as vacant possession Excellent location only a stones throw Burleigh Beach

Pre-established business. Fitout and equipment included

Suited to Retail, Restaurant, Medical & Office (^STCA)

Periodic lease agreement in place

6* Car spaces (5* uncovered and 1* covered space)

Opportunity to invest now and occupy later Trophy location within minutes of M1 Motorway

Council approved for office use (MCU/2017/640)

207/1-25 Parnell Boulevard,

35*sqm fitted out Café + 53*sqm of Alfresco area

2 Exclusive use storage areas (circa 35*sqm total space)

2 Allocated, secure carparks under the building

Grease trap connectivity, plumbing and electrical in place

178* Residential units located in the same building

Covered alfresco area with weatherproof blinds

Prominent corner position with excellent exposure

100% leased with a net income of $523,000* per annum

Positioned between McDonalds and Woolworths

Large land holding of 2,910*sqm

Net lettable area of 858*sqm plus 52 car spaces

Currently 10 tenancies including Dominos and Coronis

Surrounded by dense population, providing stable

Strong annual increases up to 4% per annum

Flexible "Local business & industry" zoning

Development approval in place Only 1.2km* to the Warrego Highway

Strong complementary surrounding mix

409-419 McDougall St & 676-706 Boundary St,

Remaining stages 4-7 of Park Hill Estate

DA for 84 residential lots ranging 390m2* - 695m2*

Includes 3.912Ha* central parkland dedication

Application submitted for 136 place childcare centre Expressions Of Interest

Low Density Residential-General Precinct & Open Space

Closing Wed 4 Dec 2024 4pm (AEST)

Matthew Fritzsche 0410 435 891

Mark Creevey 0408 992 222

Tony Williams 0411 822 544

Land Area: 9.467Ha* over two (2) titles RW Special Projects Queensland

Close to major local shopping and educational facilities

raywhitecommercial.com

1/4 Tombo Street, Capalaba, 4157

•202m2* strata titled unit

•185m2* high bay warehouse and 17m2* office/showroom

•23m2* of additional mezzanine storage area

•Self-contained amenity, kitchenette and 2 car parks

•Strategic location in the heart of Capalaba's thriving trade precinct

•Offered for sale with vacant possession

70-72 Greenbank Road, Aeroglen, 4870

It is an ideal investment for businesses looking to expand or take over an existing storage business. The property boasts a fully operational storage facility, plus a high-set Queenslander on-site that provides accommodation and office facilities.

Site and property benefits:

•Land area of 3,035 sqm | Building area of 1,000* sqm

•95 varying size storage sheds | 6 carport storage bays

•1 workshop facility | 1 high-set Queenslander home/office

Business Benefits:

•Fully operational storage facility self-operated by the family for many years with low overheads

•Current storage charges achieving a medium return with excellent scope for improvement

•Close proximity to the Cairns Airport

River Frontage - 30 metres* 15 storey Building Height (STCA^)

Zoned High Density Residential (HDR2) Northerly Aspect - Exceptional Views Irreplaceable Position

136-140 Russell Street, Toowoomba City, 4350

•Large land parcel - 3,166sqm* (Freehold Sale)

•Great location on busy corner of West & Russell Streets

•Diversely tenanted with substantial income

•35 on-site car parks

•Walking distance to Toowoomba CBD

•Each building is air-conditioned with a variety of recent improvements

•Potential to value-add to the property

2/9-11

Ben Sands 0432 547 164 ben.sands@raywhite.com

AJ Calvet 0488 113 270 aj.calvet@raywhite.com

Gateway raywhitecommercial.com

Josh Jones 0499 773 788 josh.jones@raywhite.com

Marc Zietsman 0412 047 026 marc.zietsman@raywhite.com

Jared

jared.doyle@raywhite.com

13/54-66 Perrin Drive, Underwood, 4119

•90m2 to 390m2

Lease From $31,000 PA Net + GST + Outgoings

office 348sqm

• Grand reception area

• Large corporate boardroom/training room

• Several executive offices

• Multiple open plan work areas

• Large kitchen

• Disabled bathrooms and shower facilities

• Access to multiple male and female amenities

• Ducted air-conditioning throughout

• Basement and street parking available

• On site cafe

• Just minutes from major arterial roads

• Walking distance to bus terminal and two popular shopping centres

• Offices with partial fit-out in place

• 23 Car parks assigned (Including 10 Basement)

• Fully secure building with swipe card access after hours

• Ducted air-conditioning throughout

• Monitored security system

• Lift access to all floors

• Walking distance to cafes

• Just minutes from M1/Gateway and major arterial roads

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

Jett Bevacqua 0450 005 810 jett@rwcs.com.au

RWC Springwood raywhitecommercial.com

Land area: 982sqm*

Offered for the first time in 70 years

Zoned R2 - Low Density Residential

Height Limit: 9.5m Auction Wednesday, 13 November 2024 at 10:30am (AEDT) Ray White Corporate Office, Level 7, 44 Martin Place, Sydney

Located opposite the Oval Lane entrance to UNSW

SC Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com Henry Robertson 0420 414 580 henry.robertson@raywhite.com

Currently configured as 4 separate rental opportunities raywhitecommercial.com

400m* from UNSW High Street Light Rail Station

Tuesday, 26th November 2024 at 10:30am (AEDT) AuctionWORKS, 50 Margaret Street, Sydney

Building area - 1,000sqm*

Site area - 5,644sqm*

Net income $468,000 p.a.* with 4% annual increases

Imminent rent increase to $486,720 p.a.* (March 2025)

Tenant pays all outgoings (including land tax)

Fully secure site with fencing, parking and truck access

Multitude of development options^

Ward 0433 702 903

SC

Site area - 553sqm*

Building area - 1,900sqm*

Diverse income streams across multiple tenancies

Lift access to all levels and ducted air conditioning Auction Tuesday, 26 November 2024 at 10:30am (AEDT) AuctionWORKS, 50 Margaret Street, Sydney

Zoned E2 - Commercial Centre New solar panels installed

Dual street access with ample on street parking

Stephen Townsend 0427 631 957 stephen.townsend@raywhite.com

SC Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

'Ginninderra Falls' Parkwood Road, Wallaroo, 2618

Expressions Of Interest

Closing Thursday, 28 November 2024

'Ginninderra Falls', freehold NSW land 25 mins* from Australia's Parliament House

•One of Australia's natural wonders and eco landmark of great national significance

•55.73ha*^ of land 30 mins* to Canberra International Airport and 8 mins* to Kippax town centre

•A mystical sanctuary with numerous waterfalls and picturesque walking tracks, 1km* Murrumbidgee River frontage and 1.8km* Ginninderra Creek frontage

•Lucrative R1 residential zoning, prized SP1 resort, retail & tourism zoning and esteemed E2 zoning

•Jewel in the crown of the approved 11,500 home Ginninderry masterplan

•An Australian Capital landmark in an ideal position to capitalise on global wellness sector growth

Samuel Hadgelias 0480 010 341

shadgelias@raywhite.com

George Southwell 0429 838 345

george.southwell@raywhite.com

RWC SC

raywhitecommercial.com

651 George Street, Haymarket, 2000

Rare 100% freehold property

Dual street frontages to George and Sussex Streets

191sqm* site, 1,432.5 sqm* GFA potential

Planning controls: 7.5:1 FSR, 50m height limit

D.A for 42 room boutique hotel + commercial retail

Opportunity with flexible value-add potential

Adjacent to Light Rail Station, high pedestrian traffic

Auction Wednesday 13 November 2024

Ray White Corporate Level 7, 44 Martin Place Sydney NSW 2000

Phillip Elmowy 0425 285 444

John Skufris 0414 969 221

Steve Kremisis - Ray White Dulwich Hill 0414 818 317

RWC South Sydney

raywhitecommercial.com

Established in 1990, this is the first time the property and the business are available for sale. Existing clients and long term income stream available to purchase. Opportunity to take on an existing business, holding income and the chance to modernize and increase operating efficiencies.

•4,032m2 (approx.) E4 Industrial Land

•1,853m2 (approx.) Improvements

•153 self storage units

•Substantial existing income

•Low maintenance business

•High occupancy rate with constant income from long term occupants

•Dual Access from Pavitt Crescent & Lucca Road

brad.rogers@raywhite.com

Baraiolo 0497 100 967 ernie@versace.vbs.com.au

Central Coast Brad Rogers 0459 921 122

raywhitecommercial.com

Renovated 3BR and 2B private residence 105sqm* A flexible opportunity to either owner occupy or invest Potential uplift under NSW TOD STCA^ Ground floor commercial 207sqm* Estimated net income (fully leased) - $100,000* pa

Level 6, 9 Barrack Street, Sydney, 2000

9 Barrack Street is a heritage office building prominently positioned on the corner of York Street. The building is in close proximity to Martin place, Wynyard Station and the Queen Victoria Building. The lifts and foyer have been recently upgraded.

•Boutique whole floor with natural light on 2 sides

•As new fully fitted floor with room for over 36 desks

•Fully upgraded floor feat. reception, 2 meeting rooms

•Includes large boardroom and full kitchen

•New bathrooms and shower in tenancy

•New direct lease, vacant from Q4 2024

2-14 Elsie Street, Burwood, 2134

Discover a versatile selection of strata office suites, available for sale, ranging from 60 to 860 sqm to suit businesses of all sizes.

With unrivalled proximity to the CBD and connected by a multitude of transport options, Elsie Suites is situated in the heart of Burwood, a proven business destination central to all amenities.

Elsie Suites, with DA approval and a builder appointed, is on track for completion by July 2025.

Frank Giorgi 0403 839 822

frank.giorgi@raywhite.com

Piette Roberts 0484 947 693

piette.roberts@raywhite.com

Frank Giorgi 0403 839 822 frank.giorgi@raywhite.com

Piette Roberts 0484 947 693 piette.roberts@raywhite.com

37 Cochranes Road, Moorabbin, 3189

•Building area | 810m2*

•Land area | 1,074m2*

•Internal clearance | 4.7m*

•High exposure location with over 20m* of frontage

•Next door to Morris Moor

•Vacant Possession

•Zoning | Industrial 1 Zone (IN1Z)

260-280 Governor Road, Braeside, 3195

•Construction Commencing Early 2025

•Dual Street Access Governor & Canterbury Roads

•Governor Road showrooms from 457m2

•8m* spring height

•Three phase power supply

•Painted internal walls

•Sealed & polished concrete flooring

•Kitchenette with stone benchtops, matte black tapware, timber veneer cabinetry

•Fully enclosed mezzanine offices with viewing window

•Reverse-cycle heating & cooling to mezzanine offices

•Allocated car parking on title for staff & visitors

•3 phase power & remote-controlled roller doors

•Floor to ceiling tiles to all bathrooms

Sale

RWC Oakleigh raywhitecommercial.com

53 Taunton Drive, Cheltenham, 3192

Theo Karkanis 0431 391 035

George Ganavas 0478 634 562

Ryan Amler 0401 971 622

George Kelepouris 0425 798 677

•Total land area | 988m2

•Warehouse / Office area | 355m2

•Includes small air conditioned office | 17m2

•Further storage / hardstand area accessible from the rear roller shutter | 130m2

•2 x Roller shutters accessing the front and rear of the property

•Amenities include male and Female toilets plus kichenette

•Zone | Industrial 1 Zone (IN1Z)

•Excellent exposure to Taunton Drive

•Future development or add value upside (STCA)

•Visitor car parking directly at front

•Outstanding Bayside location, close to a host of amenity including cafes, transport and more

•Terms | 10% deposit, 30/60/90 day settlement

Auction Wednesday November 20 2024 at 11:30 am

On-site and Online

RWC Oakleigh

George Kelepouris 0425 798 677

george.kelepouris@raywhite.com

Jonathan On 0479 003 122 jonathan.on@raywhite.com

*Approx

Established Business: Successfully operating since 2018.

Upcoming NET Income

Secure Lease: Lease to 2028 with two 5-year options. Net Income: $324,782.22 p.a.* + GST and Outgoings Auction

$334,525.68 p.a.* (as at February 2025)

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422 883 011 will.jonas@raywhite.com

8-10 James Court, Tottenham, 3012 Fitted with 3-phase power for heavy equipment. Equipped with three large roller shutter doors.

12

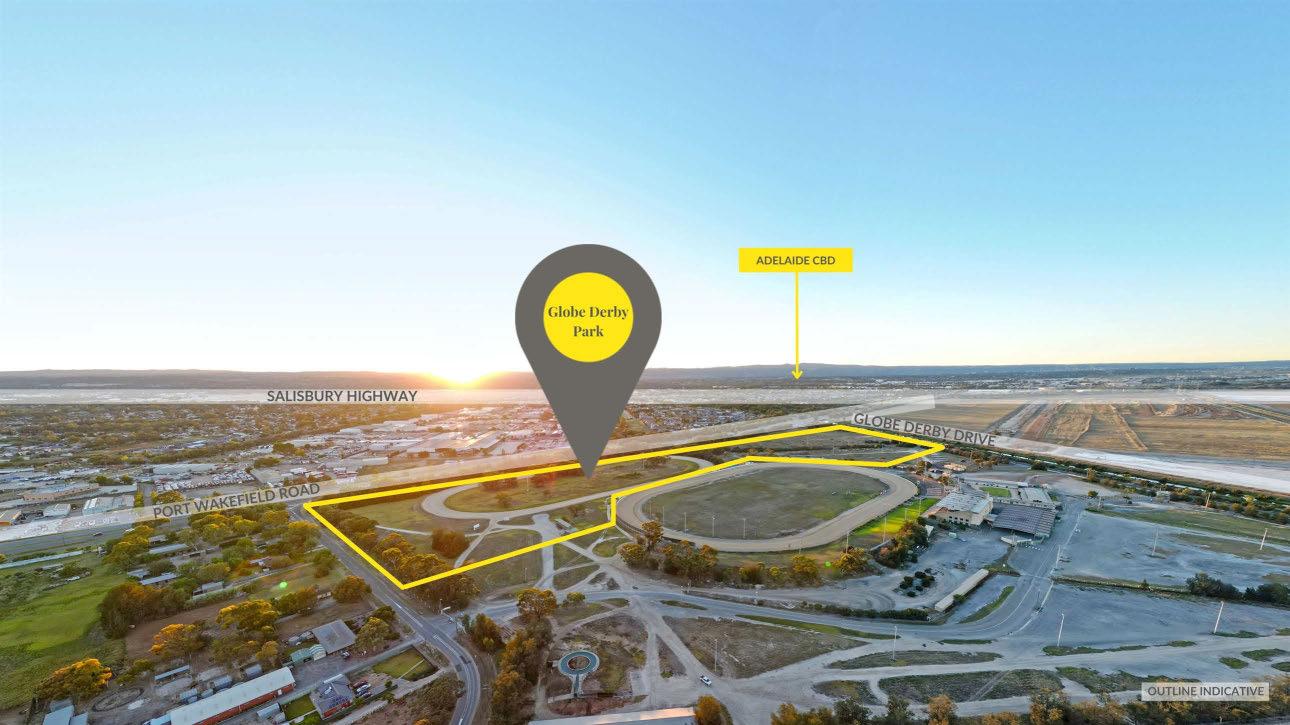

21-77 Globe Derby Drive, Globe Derby Park, 5110

Expressions Of Interest

Closing Wednesday 20 November at 4pm (ACDT)

Allotments ranging from 2,450sqm to 9,252sqm

B Double access via Port Wakefield Road

High exposure and visibility with 480m+ of frontage

Strategically located only 16kms from the CBD*

Strong connectivity from heavy vehicle access routes

Fully serviced, level & compacted serviceable allotments

Flexible Employment zoning within City of Salisbury

Oliver Totani 0412 808 743

Jack Dyson 0448 685 593

Martin James 0413 450 415

Kym Hutchins 0438 836 817

RWC Adelaide

raywhitecommercial.com