23 minute read

Report

Renewable Energy Integration is India's Next Big Challenge: IEEFA

According to a report from Institute for Energy Economics and Financial Analysis (IEEFA), India already has 93 GW of on-grid variable renewable energy (VRE) capacity as of January 2021. Now, one of the next big challenges for India’s electricity sector is battery storage, green hydrogen, and flexible coal-fired power generation into the electricity grid i.e. renewable energy integration over the next decade.

Advertisement

However, there are opportunities for cross-learnings as some of the renewable energy-rich Indian states such as Rajasthan, Gujarat, Maharashtra, Karnataka, and Tamil Nadu could have renewable generation increased to 50 percent by 2030, the reports suggested.

To do such a large-scale integration, India requires policy support for a time-of-day (ToD) pricing mechanism that incentivizes investment into a multitude of technology solutions for flexible, peaking power delivery.

“The transition to low-cost, variable renewable energy generation requires a flexible grid that can respond rapidly to changes in power demand dynamics,” says the report’s author IEEFA Research Analyst Kashish Shah.

The report stresses that the Central Electricity Authority’s (CEA) optimum generation mix report projects India’s solar and wind to form 420GW of capacity, 51 percent of the total installed capacity, by 2030. That will provide 31 percent of the total generation (biomass and small hydro will add another 30GW to the total installed capacity).

Also, in a recent India Energy Outlook 2021, the International Energy Agency (IEA) predicted that by 2040 India could add 900GW of renewable capacity with renewable energy becoming the dominant source of power supply in India’s electricity system.

The report focused on technology and enabling policies that incentivize investments into some of the key grid firming options such as battery storage, green hydrogen, and flexible coal-fired power generation.

Battery Storage: The report gives the numbers regarding the cost of standalone lithium-ion battery systems globally has fallen from USD 1,100/kWh in 2010 to USD 137/kWh in 2020. BloombergNEF (BNEF) proposes a further decline in the cost to USD 58/kWh by 2030.

IEA’s India Energy Outlook 2021 foretells that India could have 140-200GW of battery storage capacity by 2040, the largest of any country.

IEEFA concludes that despite the cost sensitivity of large parts of the Indian market in the face of current high battery costs, grid-scale batteries are not a distant dream for India, particularly for the commercial and industrial, and high-end consumer segments already paying an excessive cross-subsidy.

“Battery storage can provide a solution to help the grid manage massive amounts of intermittent wind and solar, provide dispatchable power during peak demand periods, and other essential grid services. And battery cost deflation is now making utility-scale battery storage projects possible for India," Kashish Shah added.

Green hydrogen: Electrolysis of water using electricity, one of the two most common methods of hydrogen production, which is now moving towards being competitive by the end of this decade, encouraged by the growing availability of ever-cheaper VRE.

According to The Energy and Resources Institute’s (TERI) recent analysis, the cost of alkaline electrolyzers is projected to drop 56 percent from around Rs6.3crore/MW today to around Rs2.8crore/MW by 2030.

Improving efficiencies of electrolyzers will play an important role in driving the costs of green hydrogen below Rs150/kg by 2030 versus Rs300-440/kg as of today.

The report suggests that India can look to green hydrogen as a lower cost, zero pollution domestic alternative to using imported LNG. Hydrogen gas peakers might prove another key tool to managing VRE integration but again, only when supported by ToD pricing.

Flexible coal-plant operation: Coal, which is likely to be the dominant source of Indian electricity generation for some time to come, is playing a vital balancing role in integrating large-scale variable renewables.

However, the best way to capture the value of more flexibility, coal-fired plants would require retrofitting, operational and regulatory amendments.

This report has discussed the findings of a couple of pilot studies on flexible coalfired plant operation in India, optimizing sunk investments to help the transition.

According to the report, under the current structure in India, plants with the lowest variable charges get dispatched first. In IEEFA’s view, this metric going forward should evolve to a highly flexible, dynamic ToD pricing to incorporate the flexibility parameters of coal-fired power plants in support of VRE integration.

“India’s strategy should be to plan in advance and be prepared to ride the energy storage wave when it arrives," Kashish Shah commented.

An analysis of spending by leading economies has found that only 18 percent of announced recovery spending can be considered ‘green.’

One year from the onset of the pandemic, recovery spending has fallen short of nations’ commitments to build back more sustainably. An analysis of spending by leading economies, led by Oxford’s Economic Recovery Project and the UN Environment Programme (UNEP), finds that only 18 percent of announced recovery spending can be considered ‘green.’

The report, ‘Are We Building Back Better? Evidence from 2020 and Pathways for Inclusive Green Recovery Spending’, calls for governments to invest more sustainably and tackle inequalities as they stimulate growth in the wake of the devastation wrought by the pandemic. The most comprehensive analysis of COVID-19related fiscal rescue and recovery efforts by 50 leading economies so far, the report reveals that only USD 368 billion of USD 14.6 trillion COVID-induced spending (rescue and recovery) in 2020 was green.

Brian O’Callaghan, lead researcher at the Oxford University Economic Recovery Project and the report’s author said that “despite positive steps towards a sustainable COVID-19 recovery from a few leading nations, the world has so far fallen short of matching aspirations to build back better. But opportunities to spend wisely on recovery are not yet over. Governments can use this moment to secure long-term economic, social, and environmental prosperity.”

The report emphasises that green recovery can bring stronger economic growth, while helping to meet global environmental targets and addressing structural inequality. To keep decades of progress against poverty from unwinding, low-income countries will require substantial concessional finance from international partners.

It raises five key questions for the road to sustainable recovery:

• What is at stake as countries commit unprecedented resources to recovery? • What spending pathways could enhance economic recovery and environmental

sustainability? • What is the role of recovery spending in addressing inequalities exacerbated by

COVID-19? • What kind of recovery investments countries are currently making to tackle climate change, nature loss, and pollution? • What more needs to be done to ensure a sustainable and equitable recovery?

On the whole, so far global green spending “has been incommensurate with the scale of ongoing environmental crises,” according to the report, including climate change, nature loss, and pollution, missing significant social and long-term economic benefits.

Key findings of the analysis in terms of recovery spending:

• USD 341 billion or 18 percent of spending was green, mostly accounted for by a small group of high-income countries. Global recovery spending has so far missed the opportunity for green investment. • USD 66.1 billion was invested in low carbon energy, largely thanks to Spanish and German subsidies for renewable energy projects and hydrogen and infrastructure investments. • USD 86.1 billion announced for green transport through electric vehicle transfers and subsidies, investments in

public transport, cycling and walking infrastructure. • USD 35.2 billion was announced for green building upgrades to increase energy efficiency, mostly through retrofits, notably in France and the UK. • USD 56.3 billion was announced for natural capital or nature based

Solutions (NbS)– ecosystem regeneration initiatives and reforestation. Two-fifths was directed towards public parks and counter pollution measures, notably in the US and China, improving quality of life and addressing environmental concerns. • USD 28.9 billion was announced in green R&D. Green R&D includes renewable energy technologies, technologies for decarbonising sectors such as aviation, plastics, and agriculture, and carbon sequestration.

Without progress in green R&D, meeting the Paris Agreement targets would require far-reaching pricing and lifestyle changes.

Professor of Environmental Economics at Oxford, Cameron Hepburn said “this report is a wake-up call. The data from the Global Recovery Observatory show that we are not building back better, at least not yet. We know a green recovery would be a win for the economy as well as the climate - now we need to get on with it.”

US Solar Industry Installed Record 19.2 GW Capacity in 2020: Report

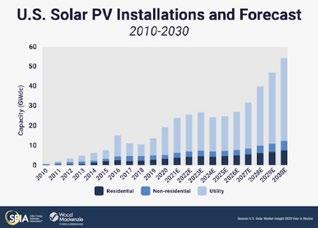

The US solar industry grew 43% and installed a record 19.2 GW of capacity in 2020, according to the US Solar Market Insight 2020 report

The US solar industry grew 43 percent and installed a record 19.2 gigawatts (GW dc) of capacity in 2020, according to the US Solar Market Insight 2020 Year-in-Review report, released by the Solar Energy Industries Association (SEIA) and Wood Mackenzie.

For the second year in a row, solar led all technologies in new electric-generating capacity added, accounting for 43 percent. According to Wood Mackenzie’s 10-year forecast, the US solar industry will install a cumulative 324 GWdc of new capacity to reach a total of 419 GWdc over the next decade.

“After a slowdown in Q2 due to the pandemic, the solar industry innovated and came roaring back to continue our trajectory as America’s leading source of new energy,” said SEIA president and CEO Abigail Ross Hopper. “The forecast shows that by 2030, the equivalent of one in eight American homes will have solar, but we still have a long way to go if we want to reach our goals in the Solar+ Decade. This report makes it clear that smart policies work. The action we take now will determine the pace of our growth and whether we use solar to fuel our economy and meet this climate moment.”

The report further highlighted that the 8 GWdc of new installations in Q4 2020 marks the largest quarter in US solar history. For perspective, the solar market in the country had added 7.5 GWdc of new capacity in all of 2015. New capacity additions in 2020 represent a 43 percent increase from 2019 and break the solar market’s previous record of 15.1 GWdc set in 2016. By 2030, Wood Mackenzie is forecasting that the total operating solar fleet will more than quadruple.

“The recent two-year extension of the investment tax credit (ITC) will drive greater solar adoption through 2025,” said Michelle Davis, senior analyst from Wood Mackenzie. “Compelling economics for distributed and utility-scale solar along with decarbonisation commitments from numerous stakeholders will result in a landmark installation rate of over 50 GWdc by the end of the decade.”

The report found that California, Texas and Florida are the top three states for annual solar capacity additions for the second straight year, and Virginia joins them as a fourth state installing over 1 GWdc of solar PV. In 2020, 27 states installed over 100 MWdc of new solar capacity, a new record.

Key Highlights: • Residential deployment was up 11 percent from 2019, reaching a record 3.1

GW. This was lower than the 18 percent annual growth in 2019, as residential installations were significantly impacted by the pandemic in the first half of 2020. • Non-residential installations declined 4 percent from 2019, with 2 GW installed.

The pandemic impacted this segment through delayed project interconnections and prolonged development timelines. • There was a historic 6.3 GWdc of utilityscale projects installed in Q4 2020, bringing the annual total just shy of 14

GWdc. • A total of 5 GWdc of new utility solar power purchase agreements were announced in Q4 2020, bringing the volume of project announcements in 2020 to 30.6 GWdc and the full utilityscale contracted pipeline to 69 GWdc. • The 2-year extension of the ITC in the final days of 2020 has led to a 17 percent increase in deployment in our 2021 – 2025 forecast.

6GW Offshore Wind Capacity Added Globally in 2020

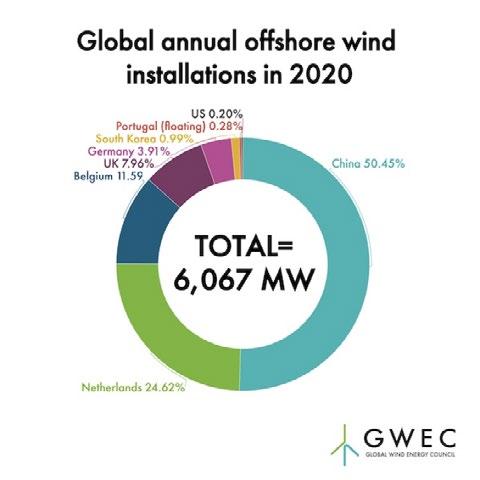

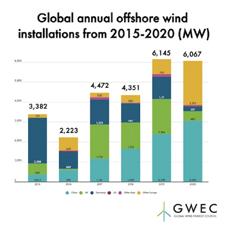

According to the latest data released by GWEC Market Intelligence, the global offshore wind industry had its second-best year ever in 2020 installing over 6 GW of new capacity, keeping growth on track despite the impacts of COVID-19 felt in other energy sectors. This growth was driven by a record year in China, which lead the world in new annual offshore wind capacity for the third year in a row, and installed over half of the new offshore wind capacity globally last year. The market report shows steady growth in Europe, which accounted for the majority of the remaining new capacity, led by the Netherlands which installed nearly 1.5 GW of new offshore wind in 2020, making it the second-largest market for new capacity in 2020 after China.

Other European offshore wind markets also experienced stable growth last year, with Belgium (706 MW), the UK (483 MW), and Germany (237 MW), all installing new capacity in 2020. The slowdown of growth in the UK is due to the gap between the Contracts for Difference (CfD) 1 and CfD 2. In Germany, the slowdown is primarily caused by unfavorable conditions and a weak short-term offshore wind project pipeline.

The report highlighted that outside of China and Europe, two other countries recorded new offshore wind capacity in 2020: South Korea (60 MW) and the US (12 MW).

Overall, global offshore wind capacity now exceeds 35 GW – a 106 percent increase over the past 5 years alone. China has now surpassed Germany in terms of cumulative installations, becoming the second-largest offshore wind market globally with the UK remaining in the top spot.

Feng Zhao, Head of Market Intelligence and Strategy at GWEC said “the continued growth of the offshore wind industry globally throughout the pandemic is a testament to the resilience of this booming industry. Although China was hit first by the COVID-19 crisis, the impacts on the offshore wind sector were minimal, resuming ‘business-as-usual’ as early as March 2020. China’s record-breaking growth is expected to continue in 2021, driven by an offshore wind installation rush to meet China’s Feed-in-Tariff deadline by the end of this year. “While Europe remains the largest offshore wind market globally, Asia Pacific will play an increasingly important role driving industry growth as major economies such as Japan and South Korea have recently established ambitious offshore wind targets. The US will also become an increasingly important market for offshore wind, as the new administration has made it clear they are working to accelerate the growth of this crucial industry.”

According to the Q4 2020 Wind Energy Auction Update by GWEC, nearly 30 GW of new wind power capacity was awarded globally through auctions in the second half (H2) of 2020, which is a slight increase compared to the 28 GW awarded during H2 2019. With the surge in new auctioned capacity being touted as the signal of the industry being back on track after COVID-19.

25% of Urban Population Lives in a City with RE Target, 18% in India: Report

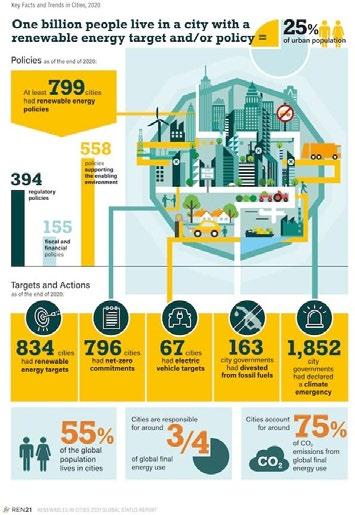

Anew report has found that 25% of the urban population lives in a city with a renewable energy (RE) target, lowering to 18% in India.

The latest Renewables in Cities 2021 Global Status Report shows that more than 1 billion people – about 25 percent of the urban population – live in a city with a renewable energy (RE) target and/ or policy. With the number lowering to 18 percent for Indians living in urban cities with a renewable energy target and/or policy.

The report by REN21 found that city governments around the world are increasingly using renewables to help fight energy poverty, reduce air pollution, tackle climate change, and improve public health and well-being. They have installed, purchased and contracted for renewable energy to meet the demand of their own buildings and vehicle fleets; adopted renewable energy targets and implemented policies to incentivise local renewable energy generation and consumption; and supported urban community energy projects; and facilitated co-operation among stakeholders.

And that urban commitments to directly support renewables are increasing. In 2020 alone, more than 260 cities either set a new renewable energy target or passed a new policy. As of the end of the year, over 830 cities in 72 countries had adopted renewable energy targets. More than 600 cities worldwide having targets for 100 percent renewable energy. Cities have also taken action away from fossil fuels: by 2020, over 10,500 cities had adopted targets to reduce their greenhouse gas emissions and around 800 had committed to net-zero emissions. That’s an eight-fold increase on such commitments from 2019.

Cities are home to 55 percent of the global population (and growing) and generate more than 80% of global GDP. Urban energy use has also grown significantly over the past decades. Today, cities are responsible for an estimated 3/4 of global carbon dioxide emissions. This makes cities a high-impact location for climate action, decarbonising the energy system and accelerating renewable energy investments, helping cities to achieve their own objectives as well as global goals.

“With their impact at scale, cities are our best bet to plan, develop and build a renewable future. But all too often their potential for transformation remains massively underused,” explains REN21’s Executive Director, Rana Adib.

The report goes on to add that although target-setting in cities has focused on the power sector (around 75 percent of the targets), city-level policies and investments go beyond power to include heating, cooling and transport. By the end of 2020, around 800 municipal governments had in place regulatory policies, fiscal and financial incentives, as well as indirect support policies which enable the uptake of renewables in buildings and transport citywide. In some cases, city targets and policies are more ambitious than those set by higher levels of government.

India

In Asia, the report found that much of the city-focused activity has occurred in India, where several “smart cities” have embraced renewables. In 2018, Diu Smart City became the country’s first city to operate on 100 percent renewable electricity, thanks in part to a 9 MW solar PV park and solar panels installed on 79 government buildings; several other smart cities issued tenders in 2019 and 2020 for local solar PV capacity atop buildings, canals and sewage treatment facilities.

In Delhi, solar PV installations on government and educational buildings totalled around 105 MW in 2019, with another 5 MW on residential buildings. By the end of 2019, the industrial city of Pune had more rooftop solar capacity (130 MW) than any other Indian city. Across India, the higher electricity rates, readier access to financing and larger rooftops for industrial versus residential users have encouraged the industrial adoption of solar PV.

The report also highlighted that in Asia, China and India account for most of the renewable energy investment. However, it also found that investment in renewable energy capacity in India fell 14 percent in 2019, to USD 9.3 billion.

Financing for renewables in Indian cities originates from three main sources: national and state-level schemes (such as the 100 Smart Cities Mission), which have increased in scale and number

over time; international financing agencies and development banks, with many of these projects being small and experimental; and local private capital, for which very little information is available. Although municipal bonds have been used to a limited extent for infrastructure projects in India, they have not been adopted for renewable energy projects to date.

Historically, Indian cities have not been at the forefront of financing renewables, in large part because energy governance in the country remains constitutionally with the central and state governments. In 2015, however, the government launched the 100 Smart Cities Mission, creating a new vision for the role of cities in renewable energy projects. Subsequently, around 100 cities in India created plans for investing in energy distribution and supply, including solar PV, waste-to-energy and wind energy (to a limited extent), as well as electric mobility.

Of the first 60 approved proposals, around 10 percent of the budget – a total of Rs 13,161 crore (USD 1.8 billion) – was for such energy projects, with the remainder directed towards other infrastructure projects such as water, buildings, transport and waste management.

As per the report, the cities allocating the most of their proposed budgets to solar PV were New Delhi (Rs 535 crore or USD 73 million), Mangalore (Rs 311.85 crore or USD 42.5 million) and Vishakapatnam (Rs 305.83 crore or USD 41.7 million), whereas the cities allocating the most to waste-to-energy were Jaipur (Rs 200 crore or USD 27.3 million), followed by Kalyan and Surat. The cities allocating the most to e-mobility were Chandigarh (Rs 163.15 crore or USD 22.3 million), followed by Pune and Dharamshala.

The report then goes on to add that the world is not on track to meet the Paris Agreement goals. While renewables have grown in the power sector, the shares of renewables in heating/cooling and transport remain low (around 10 percent and 3 percent respectively). Action is urgently needed – together, these sectors account for over 80 percent of global final energy demand. And cities are critical to decarbonise these sectors, and they’ve started to take up the challenge. Cities are leading by example, procuring renewables for their own operations, while scaling up renewable energy generation on public buildings and for municipal fleets. The 2021 edition shows that energy leaders’ perceptions of areas of risk, opportunity, and priorities for action have radically changed.

The World Energy Council has published its annual World Energy Issues Monitor. Now in its 12th year, the report provides a forward-looking assessment of the global energy agenda based on the views of more than 2,500 energy leaders from 108 countries. The 2021 edition shows that energy leaders’ perceptions of areas of risk, opportunity, and priorities for action have radically changed over the last 12 months.

While economic turbulence stemming from the ongoing reverberations of COVID-19 is the biggest area of uncertainty, with uncertainty around economic trends increasing by a third over the previous year, there is also a growing focus on the social agenda associated with a faster-paced energy transition.

The report details an increased awareness of the societal and human impact of both recovery and the wider energy transition and shows that the issue of energy affordability has rapidly risen up the industry’s priority list, with its impact and uncertainty perceived 20 percent larger than a year ago. Energy affordability affects society across all geographies ranging from city dwellers in developed countries to the rural poor in developing ones. Simultaneously the report details the emergence of a new generation of digital energy services and energy entrepreneurs. More agile, disruptive technologies have taken advantage of the social upheaval to gain market share at the expense of supplycentric energy solutions. There is a growing focus on customer-centric demand-driven solutions and fastchanging patterns of global and local demand. Dr. Angela Wilkinson, SecretaryGeneral of the World Energy Council, said “even before the onset of Covid-19, we had already begun to see the rise of the social energy agenda. A consequence of this health crisis is that it has put people at the centre of the conversation on global energy transition and given humanity a clearer voice in an otherwise polarised and fragmented debate.

“This edition of our World Energy Issues Monitor clearly shows a growing awareness among energy industry leaders of the unavoidable truth that we must humanise our energy systems and address new energy justice concerns to be successful.

“While there are still diverse views on recovery and different signals about the impact of recovery plans on the speed and direction of transition, the growing acceptance of a holistic view of energy to enable global human and sustainable development suggests we are moving in the right direction.”

The report findings also indicate that carbon abatement technologies have emerged as another major area of uncertainty, with 40 percent of respondents identifying the issue as highly or very highly uncertain. With large-scale carbon capture utilisation and storage (CCUS) deployment yet to take off, and a wide-ranging spectrum of national and corporate net-zero commitments, there is significant uncertainty about how to strike a balance between decarbonising the global economy while simultaneously ensuring that human needs are met during the recovery. Regional and country-level differences in both issues of critical uncertainty and action priorities reinforce the need for multiple energy transition pathways rather than a onesize-fits-all approach. Dr. Wilkinson, concluded, “the global imperative to secure more energy and climate neutrality is the key to enabling whole societies to recover and flourish. It is vital, that the connections between Planet and People are maintained and whole-energysystem change implications are thought through.

“There is no single ‘race to zero’, there are in fact multiple pathways being progressed with tremendous geographical and technological diversity. This 12th Issues Monitor once again shows that there is no ‘one size fits all’ approach to addressing energy challenges and progressing clean, affordable, reliable, socially inclusive and just energy transition.”

Humanising Energy Agenda Emerges From 12th Global Energy Leaders’ Survey

Renewables not Coal & Gas Should be Focus of Vietnam’s Latest PDP: IEEFA

Vietnam’s draft PDP8 has failed to acknowledge the need of developing a more flexible system that can accommodate a changing technology mix

Vietnam’s recently published draft power development plan for 2021-2030 (PDP8) has failed to acknowledge the importance of developing a more flexible system that can accommodate a changing technology mix, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA). “After a decade filled with disappointments from the fossil fuel industry, planners successfully tested the dynamism of renewable energy in Vietnam’s fast-growing market,” says report author IEEFA Director of Energy Finance Studies Asia, Melissa Brown. “Many conventional coal and gas-power projects failed to progress during the development process, only managing to meet half of the targeted capacity for 2016-2020.

“Solar power developers however overdelivered by five times, and they have done so in a fraction of the time. This evidence would surely inform the next stage of Vietnam’s power development,” Brown added. The authors of the report believe that unfortunately, planners have instead opted for generation-centric decisions in shaping the recently published draft PDP8. And thus, instead of acknowledging the importance of developing a more flexible system, baseload coal and gas-fired power will continue to dominate 57 percent of the pipeline to 2030 in the draft PDP8.

As the government reviews plans for PDP8, IEEFA’s new report outlines four issues that deserve attention if Vietnam hopes to diversify its generation mix, meet new demand for sustainable power, and control power tariffs, with renewables arguably playing a bigger role in PDP8, and not less. 1. Technology cost assumptions face high forecasting risk

PDP8’s usefulness as a roadmap will be limited due to the rapid pace of energy transition globally. 2. Baseload fossil fuel options come with risks that must be acknowledged and mitigated

Vietnam’s high reliance on coal power

projects, which are subject to frequent delays, has put Vietnam on the brink of serious power shortages on more than one occasion. 3. Failure to account for real costs of fossil fuel power will hurt ratepayers in the long-run

One of the most important take-aways from the rapid shift in global power markets is that power sector planners are increasingly vulnerable to fatal design errors if they fail to account for the real costs associated with different technology and fuel choices. 4. Underestimating the need for green power will threaten GDP growth

Over the past two years, Vietnam’s economic growth potential has diverged sharply from what IEEFA has observed elsewhere in Southeast Asia.

“Vietnam must take bolder steps to win the confidence of high-value foreign investors that are working hard to meet the needs of their global customers,” concluded Brown. “The market’s appetite for renewable energy investment is already there. Now it’s time to realize steady cost improvements.”