SHALE MAY/JUNE 2020

MAGAZINE

TEXAS RRC ESCHEWS STATEMANDATED PRODUCTION CUTS GLOBAL INVESTMENT SLOWDOWN SET TO HIKE OIL PRICES AND CAUSE UNDERSUPPLY OF 5 MILLION BPD IN 2025 PUBLIC POLICIES WEIGHED AS INDUSTRY NAVIGATES UNCHARTED WATERS A STRONG EMPLOYER BRAND AND VALUES ALIGNMENT ARE KEY TO ATTRACTING MILLENNIALS

STAY HEALTHY, AMERICA!

TOM PYLE AND IER:

PUNCHING ABOVE THEIR WEIGHT FOR ENERGY

MAY/JUNE 2020 SHALE MAGAZINE

1

THE ONLY OIL AND GAS SYNDICATED NATIONAL RADIO SHOW O I L & G A S P L AY E R S

|

BUSINESS

In the Oil Patch

|

TECHNOLOGY

|

POLICY

We have moved to a new bigger station in San Antonio! Sundays 2pm-3pm 930AM

San Antonio

Radio Show with Kym Bolado WHERE INDUSTRY COMES TO SPEAK

Saturdays 8am-9am KSIX 1230AM / 96.1FM / 95.1FM

Corpus Christi

Sundays 8pm-9pm KFXR 1190AM / simulcast on the iHeartRadio app Dallas Fort Worth Worldwide

Saturdays 1pm-2pm KWEL 1070AM / 107.1FM

Midland Odessa Permian Basin

Sundays 2pm-3pm The Answer 930AM

San Antonio New Braunfels San Marcos Austin

Sundays 8pm-9pm KTRH 740AM / simulcast on the iHeartRadio app Houston / Worldwide

MOST

listened to show on Sunday nights! Thank you

HOUSTON!

HOUSTON | MIDLAND | ODESSA | AUSTIN | DALLAS | SAN ANTONIO CORPUS CHRISTI | HOBBS, NM | LOUISIANA | MEXICO To listen to the show: Visit shalemag.com or download iHeart mobile app to listen live!

2

SHALE MAGAZINE MAY/JUNE 2020

MAY/JUNE 2020 SHALE MAGAZINE

1

2

SHALE MAGAZINE MAY/JUNE 2020

MOVING AMERICA’S ENERGY The Port of Corpus Christi puts its energy into what matters most - the needs of our customers. With our proximity and connections to Eagle Ford Shale, the Permian Basin, and beyond, we are built to meet the increasing production throughout Texas and the rising demand for energy across the globe.

connect with us: portofcc.com MAY/JUNE 2020 SHALE MAGAZINE

3

Call Us Today: (210) 471-1923 AutoPartsExpertsofTexas@Gmail.com

OilfieldExperts@gmail.com is the only place in Texas that carries everything you need in the oil patch!

From Fleet Products to MRO Products and everything in between, trust us for your next major auto parts or fleet parts purchase. - Bearings - Mounted Bearings - Hydraulic Motors - Hydraulic Hose and Fittings - Fluid Power Products - Industrial Hose and Fittings * PLUS MANY MORE! *Restrictions apply 4

SHALE MAGAZINE ď “ MAY/JUNE 2020

MAY/JUNE 2020 SHALE MAGAZINE

5

Katy Plantations HANDCRAFTED SHUTTERS

Hardwood Shutters • Shades • Blinds • Residential & Commercial

Beautiful Windows Made Easy

Manufactured in Katy • Made of North American Lumber Locally Owned • Competitive Pricing • Reduces Energy Costs

SHALE HOME IMPROVEMENT ICIAL ” SHA L E PA R T NER “OFF

HOUSTON

Direct from Manufacturer

281.402.1280 • 5346 E. 5th Street Suite D • www.katyplantations.com

6

SHALE MAGAZINE MAY/JUNE 2020

MAY/JUNE 2020

CONTENTS SHALE UPDATE

14

Shale Play Update

FEATURE

16

Texas RRC Eschews State-Mandated Production Cuts

COVER STORY

18

18

COVER IMAGE: SUSAN/STOCK.ADOBE.COM, TABLE OF CONTENTS IMAGE: ORHAN ÇAM/STOCK.ADOBE.COM

INDUSTRY 32 Prevent Screen Outs During Hydraulic Fracturing with Self-Destructing Balls for Large Bore Plugs

34 Global Investment Slowdown Set to Hike Oil Prices and Cause Undersupply of 5 million bpd in 2025 36 LWD vs. Wireline Logging: Which Should You Choose? 38 Coiled Tubing Drilling Offers Rising Opportunities for Oil

BUSINESS

56 Oil and Gas Has Been Hit Hard

INDUSTRY

58 The Economy After COVID-19

Pro – Or No – Rationing?

by COVID-19, But Consider All Your Options Before Layoffs

and Gas Recovery Worldwide

LIFESTYLE

POLICY

emotional resilience during a pandemic

42 Save America’s Oil and Gas Industry 44 The Texas Oil Industry Needs Some Long-Term Thinking 46 Is Prorationing Relevant Today? 48 Public Policies Weighed as Industry Navigates Uncharted Waters

52 To Fix Flaring, Railroad Commission Must Tackle the Incentive Problem

As an advocate for the energy industry, Tom Pyle, President of the Institute for Energy Research (IER), fights for free markets, sound science and sourceneutral energy policies. The IER is a not-for-profit organization that conducts intensive research and analysis on the functions, operations, and government regulation of global energy markets. IER maintains that freely-functioning energy markets provide the most efficient and effective solutions to today’s global energy and environmental challenges and, as such, are critical to the wellbeing of individuals and society.

62 Mental Health: How to build 64 A Time for Boosting Immune Health: Can Probiotics Help?

66 Tips to Staying Happy and Healthy in Uncertain Times 68 Three Telehealth Tips

Connected to COVID-19

30

POLICY

40

Be Wary of Government “Help”: We Cannot Let Negative Prices Lead to Negative Policies

BUSINESS

54

A Strong Employer Brand and Values Alignment Are Key To Attracting Millenials

MAY/JUNE 2020 SHALE MAGAZINE

7

17-0663 SHALE ad-3Q_FINAL.pdf

1

6/13/17

1:29 PM

VOLUME 7 ISSUE 3 • MAY/JUNE 2020

KYM BOLADO

PUBLISHER/CEO/EDITOR-IN-CHIEF CHIEF FINANCIAL OFFICER Deana Andrews EDITOR David Blackmon

Providing energy for the world while staying committed to our values. Finding and producing the oil and natural gas the world needs is what we do. And our commitment to our SPIRIT Values—Safety, People, Integrity, Responsibility, Innovation and Teamwork— is how we do it. That includes caring about the environment and the communities where we live and work – now and into the future. © ConocoPhillips Company. 2017. All rights reserved.

www.conocophillips.com

ASSOCIATE EDITOR David Porter DESIGN DIRECTOR Elisa G Creative COPY EDITORS Lauren Guerra, Melissa Nichols VICE PRESIDENT OF SALES & MARKETING Josie Cuellar ACCOUNT EXECUTIVES John Collins, Ashley Grimes, Doug Humphreys, Matt Reed VIDEO CONTENT EDITOR Daniel Tucker SOCIAL MEDIA DIRECTOR Courtney Boedeker CORRESPONDENT WESTERN REGION Raymond Bolado CONTRIBUTING WRITERS Scott Anderson, Jack Belcher, David Blackmon, Phil Bryant, Elizabeth Ames Coleman, Dr. Anne Docimo, Pamela Garber, Brent Greenfield, Lawrence Hoberman, M.D., Annette Idalski, Ikenna Idam, Karr Ingham, Bill Keffer, Colin Leyden, Aureen M. Monteiro, Anye Ndefru, David Porter, Brian Smith, Kenny Stein, Thomas Tunstall STAFF PHOTOGRAPHER Malcolm Perez EDITORIAL INTERN LeAnna Castro

www.shalemag.com For advertising information, please call 210.240.7188 or email kym@shalemag.com.

Find Quality Jobs. Find Skilled Employees. End your search on shalemag.com 8

SHALE MAGAZINE MAY/JUNE 2020

For editorial comments and suggestions, please email editor@shalemag.com. SHALE MAGAZINE OFFICE: 5150 Broadway St., Suite 493, San Antonio, Texas 78209 For general inquiries, call 210.240.7188. Copyright © 2020 Shale Magazine. All rights reserved. Reproduction without the expressed written permission of the publisher is prohibited.

MAY/JUNE 2020 SHALE MAGAZINE

9

PUBLISHER’S NOTE

IN THESE FAST-CHANGING AND UNCERTAIN TIMES, WE VIEW IT ESSENTIAL TO CONTINUE TO SHARE ENERGY INFORMATION YOU CAN TRUST. Our experts and contributors value the trust and support our SHALE readers give us to be your source for honest energy news. We know that while the world is at a seeming standstill, many energy professionals are working behind the scenes to protect the industry from over-reaching policy and insurmountable financial strain. SHALE would like to formally announce its support for the industry and its critical workers during these challenging times. We will continue to stand by you and the industry that powers our world and our economy. It is our hope that each of our readers are healthy, safe and optimistic, knowing our beloved industry is not dead nor defeated. Please continue to keep an eye on shalemag.com for updates and tune into In the Oil Patch radio show for continued coverage of the global, national and local energy markets.

KYM BOLADO

CEO/Publisher of SHALE Magazine/Editor-in-Chief kym@shalemag.com

10

SHALE MAGAZINE MAY/JUNE 2020

PHOTO BY MICHAEL GIORDANO

Stay healthy,

MAY/JUNE 2020 SHALE MAGAZINE

11

12

SHALE MAGAZINE MAY/JUNE 2020

MAY/JUNE 2020 SHALE MAGAZINE

13

SHALE UPDATE

SHALE PLAY UPDATE By: David Blackmon

Bakken Shale – North Dakota/Montana The May 15 Bakken rig count stood at 17, down from 52 in early March. During its May 11 earnings call, big Bakken pioneer Continental Resources told investors that it was cutting its May production levels by 70% due to depressed prices and low demand. Hess Corp. announced it was reducing its Bakken drilling program from six active rigs to one.

Denver/Julesburg (DJ) Basin - Colorado Just seven rigs were actively drilling in the DJ Basin as of May 15, a 75% reduction since March 1. Occidental Petroleum announced it was shutting in 9% of its DJ Basin wells and canceling its drilling program in the region for the remainder of 2020. Noble Energy announced it was significantly curtailing its production in the DJ and Permian Basins.

Permian Basin – Texas/New Mexico The Permian rig count, which regularly exceeded 400 during the most recent boom times, had fallen to just 195 as of May 15. The results of an aerial survey of the Permian region conducted by EDF and Harvard University found that the flaring and leaking of natural gas amounts to twice the officiallyreported volumes.

14

SHALE MAGAZINE MAY/JUNE 2020

Eagle Ford Shale – Texas The Eagle Ford rig count as of May 15 was 23, down 71% from March 1. Producers across the Eagle Ford continue to announce major production cuts. In response to the ongoing bust, Halliburton closed its Elmendorf facility in San Antonio, and laid off 384 workers located there. The company also announced it was reopening its Victoria location and would be relocating its surviving employees and staging its Eagle Ford operations from that facility.

Marcellus/Utica Shale – Pennsylvania/West Virginia/Ohio The May 15 rig count for the greater Marcellus/Utica region was 38. This gas-heavy region is faring better in this metric than the basins where oil is the main target. On May 4, Shell announced it was selling its upstream Marcellus assets for $541 million, in the process taking a loss of over $4 billion, given that it paid $4.7 billion to purchase the same assets from East Resources in 2010. Marcellus producer Chesapeake Energy warned investors in its May 11 earnings call that it is struggling to remain a going concern.

Haynesville/Bossier Play – Louisiana/East Texas The May 15 rig count for the Haynesville stood at a relatively healthy 32, thanks to the region’s natural gas-heavy production profile. During its earnings call on May 14, Comstock Resources told investors that it plans to sell at least 40 million shares of common stock to redeem preferred convertible stock and reduce debt. The offering would represent a 21% dilution to current investors, which would expand to 24% if underwriters exercise the full option to purchase an additional 6 million shares.

SCOOP/STACK Play – Oklahoma As of May 15, the Enverus Daily Rig Count for the SCOOP/STACK had dropped to 11, down by 73% from March 1. Oklahoma’s Corporation Commission, which regulates the state’s oil and gas industry, met on May 11 to consider proposals to limit oil production during this time of extremely depressed prices. Taking a cue from the Texas Railroad Commission, the regulators chose to do nothing.

Black Stone Minerals LP announced a deal with Aethon Energy for the development of its Shelby Trough Haynesville and Bossier shale acreage in Angelina County, Texas. The agreement includes minimum well commitments by Aethon in exchange for reduced royalty rates and exclusive access to Black Stone’s mineral and leasehold acreage in the area.

About the author: David Blackmon is the Editor of SHALE Oil & Gas Business Magazine. He previously spent 37 years in the oil and natural gas industry in a variety of roles — the last 22 years engaging in public policy issues at the state and national levels. Contact David Blackmon at editor@shalemag.com.

MAY/JUNE 2020 SHALE MAGAZINE

15

FEATURE

Texas RRC Eschews State-Mandated Production Cuts

T

he Texas Railroad Commission (RRC) met in open conference on Tuesday, May 5 and put the idea of prorating Texas crude oil production to bed for good. An order to implement proration prepared by Commissioner Ryan Sitton was withdrawn and never acted on, with Commissioner Sitton proclaiming, “proration is dead.” Chairman Wayne Christian then moved to dismiss the complaint by Pioneer Natural Resources and Parsley Energy to “determine reasonable market demand for oil in the state of Texas”, with a second on that motion by Commissioner Christi Craddick. The motion to dismiss the complaint passed on a 2-1 vote, with Commissioner Sitton voting against the motion because, he said, the assessment of market demand called for in the complaint was not conducted. Thus ends the month-long saga that was set in motion on March 30 with the filing of the complaint by Pioneer and Parsley. The potential for the implementation of production limits in Texas gained international attention and included a day-long public (virtual) hearing by the RRC on April 14 watched around the world in which over 50 companies and individuals submitted written and oral testimony. As the process played out, however, oil and gas companies in Texas were swiftly going about the painful business of reducing crude oil production. While the Texas Alliance of Energy Producers certainly has members who favored proration, the official position of the association as determined by the Board of Directors in a conference call on Tuesday, April 7 was that deep production cuts would take place as a result of market forces, and therefore proration would be unnecessary and ineffective at best and harmful at worst. Most of the rationale for the implementation of production cuts by order of the state of Texas had a worthy counterpoint. First and foremost, if the primary argument in favor of proration was to adjust Texas crude oil production downward in an attempt to align it with demand, which had collapsed under the weight of the COVID-19 pandemic, there was

16

SHALE MAGAZINE MAY/JUNE 2020

little doubt that production would fall, and do so in a hurry, in response to crashing demand, lower prices and pinched access to markets. A recurring theme among supporters of proration and Commissioner Sitton, in particular, is that action should be taken in response to unprecedented disruption in crude oil markets, leaving the impression that if the Railroad Commission doesn’t act to limit production then no “action” will be taken. That, as they say, is poppycock. Action is and will be taken, but by individual operators rather than the government, and, in fact, companies have and will act before the government can manage to get its act together. Under the most optimistic assessments, proration could not have begun before June 1, and even that would have been a tall order. Further, it is unclear what the “assessment of market demand” called for in the verified complaint by Parsley and Pioneer might look like, or how long it would take. Was a study to be undertaken within the Commission, or by a firm engaged by the Commission, either of which would take time? Or, was the assessment of current market demand simply to have been the best guess of three elected officials? The answer to that question appears to be ‘yes’, as the order indicates that by its adoption the Commission finds that production is occurring in excess of market demand, and that ‘waste’ is taking place as a result. However, no study or data is included to support that finding. Who is to say the 20% figure is correct? And actually the order makes no reference to that 20% or any other figure, so it may be that had it passed, the requested determination of market demand would have been carried out thereafter, but again, the clock would have been ticking. And all the while, operators will have already been going about the painful process of reducing crude oil production. Adding yet more time to the implementation of proration is the conditional nature of the proration order. Sitton did at least acknowledge that proration in Texas alone would have been insufficient to move the needle on crude

oil pricing, a point we made from the start, and our assessment was that to do so would have also put Texas at a competitive disadvantage with other states. Thus, according to the proposed proration order production cuts would not have been implemented absent “Complimentary Proration Measures” by other states and non-OPEC+ countries to the tune of at least four million barrels per day. Had the order passed, it would not have been implemented until some mishmash of other states and countries went through the same process — which most had not yet even begun to do — to come up with four million barrels per day. And what are other states to do? Had they moved to prorate, would that have been conditional as well? Why would other states implement proration with certainty while the Texas order is conditional? Proration turns into game theory at that point and it seems unlikely that the conditions required for actual implementation of the Texas order would be accomplished within six months, much less one month. And all the while, operators will have been going about the business of adjusting crude oil production to current market circumstances. Before COVID-19 turned the world upside down, Texas crude oil production comprised roughly 5% of global production. All Texas production would not have been subject to proration as smaller operators would have been excluded. Proration might have ultimately lowered Texas production by, say, 900,000 bpd — less than 1% of global production, and about 7% of U.S. national production. This is why unilateral action by Texas would be insufficient. There is no disagreement on the notion that crude oil production should fall in response to lower demand and falling prices. And guess what — IT IS. And in a hurry. While official reliable production data will not be available for months to come, anecdotal information suggests production is falling much faster in Texas and other U.S. states than most had expected. A 20% decline in Texas production from peak levels achieved in the first quarter 2020

ARTEGOROV3@GMAIL/STOCK.ADOBE.COM

By: Karr Ingham, Petroleum Economist and Executive Vice-President, Texas Alliance of Energy Producers

would amount to more than a million barrels per day, and astoundingly, it is at least possible that may occur by the end of the month of May or shortly thereafter. North Dakota is reporting production declines of nearly 30% in early May, while a Reuters study suggests production declines of as much as 10% have already occurred in the U.S. and Canada. In Texas, that would amount to production declines of well over 500,000 bpd in early May. The idea that production only declines in Texas and beyond as a result of a government order to do so is just silly, and the question must be asked: why is a 20% production decline mandated by the government somehow better or preferable to a market-imposed production decline of 20%? Yes, it may have been the case that the 20% upon order of the Texas Railroad Commission would have been “immediate” — but only upon implementation, which would be months away at best. The job will be done long before then. Perhaps supporters would argue that statemandated production restrictions keep operators from responding “too soon” to upward movements in the price of crude oil (the order would only have been lifted when global demand returned to at least 85 million barrels per day). What if that doesn’t take place for a year? Longer than a year? Struggling operators would be handcuffed, and prohibited from taking advantage of a somewhat higher price based on steady, but perhaps slow, improvements in demand. That alone could determine whether companies survive or not. The arguments for proration simply do not stand up under careful analysis and scrutiny. Even under the assumption proration could have been implemented in time to actually matter (which is to say before markets will have already done the job), governments do a poor job of managing markets, and there is little reason to suspect it would be different this time around. Finally, the concept of “economic waste” is a specious one and reveals the true motivation behind any attempt to prorate production in the state of Texas, which is to limit production in order to reduce supply relative to current demand. Even if the economic waste theory had any real basis in economics — which it does not — production during a transitional period of time in which supply is responding to the rapid onset of drastically changing market conditions cannot be considered waste. The market’s very purpose is to align production and consumption (supply and demand), and

the so-called “economic waste” is eliminated as a part of that process. In this context, waste can and should only be considered the loss of extracted crude oil to future use. Under no circumstances does that definition apply here. Each barrel extracted either moves into the marketplace or into storage and each barrel not extracted remains available for extraction in the future. If eliminating waste were truly the focus of the argument for proration rather than to simply substitute the Commission’s judgment for that of the market to restrict production to support prices, why was no such assessment of market demand undertaken by the RRC or requested by individual companies for natural gas in recent years? Natural gas is the poster child for actual waste — flaring to facilitate crude oil production, rendering it unavailable for future use — never mind the fact that natural gas production growth in Texas has occurred outside the natural gas market because it comes as a result of growth in crude oil production rather than supply and demand for the gas. Commissioner Sitton and most other supporters of proration in Texas (there are a few notable exceptions) clearly have the best interests of the industry at heart, and for that, they deserve respect and commendation. But all supporters of a healthy and viable Texas oil and gas industry should fear the ability by a future commission that is hostile to the continued development of oil and gas resources in the state to restrict production by a simple majority vote of three elected statewide officials.

THERE IS NO DISAGREEMENT ON THE NOTION THAT CRUDE OIL PRODUCTION SHOULD FALL IN RESPONSE TO LOWER DEMAND AND FALLING PRICES

About the author: Karr Ingham is an Amarillo, Texas economist, and is the owner and President of InghamEcon, LLC, an economic analysis and research firm specializing in statewide, regional, and metro area economics, and oil & gas/energy economics.

MAY/JUNE 2020 SHALE MAGAZINE

17

cover story

TOM PYLE AND IER: By: David Blackmon

18

SHALE MAGAZINE MAY/JUNE 2020

PHOTO COURTESY OF IER

PUNCHING ABOVE THEIR WEIGHT FOR ENERGY

W hen a person hears the term “think tank,” the mind naturally turns to politically-oriented entities like the Brookings Institute, the Cato Institute, Harvard University’s Kennedy Center and the Hoover Institute at Stanford. Those institutions and many others formulate policy positions from varying perspectives on the major issues of the day, with a goal of influencing the legislation and regulations emanating out of Washington, D.C. Another community of think tanks specializing in issues impacting major U.S. industries also exists. Where issues impacting energy are concerned, none has become more prominent and influential in the 21st century than the Institute for Energy Research (IER), led by its President, Tom Pyle. Founded in Houston in 1989, IER is now based in the nation’s capital where it has become the energy sector’s leading voice for energy policies based on principles of free markets, sound science and nonpreferential treatment between energy sources. IER advocates for a holistic approach that considers the welfare of energy consumers, energy producers and taxpayers concurrently in order to ensure the most efficient outcomes possible, and avoid the pitfalls inherent in subsidies and other policy choices in which elected officials or unelected regulators end up picking winners and losers in the marketplace. “I think we’ve made a pretty big difference in terms of these battles, these policy fights,” Pyle said when we sat down for an interview in early May. “I think we’ve established ourselves as a bedrock, a foundation of free market, promotion of free markets and less government intervention in energy. I’m really proud of the team that we’ve built, and we’ve got a lot of great alumni spread around, both at the Hill and in other places. One of our com-

MAY/JUNE 2020 SHALE MAGAZINE

19

munications directors is working for Texas Governor Greg Abbott, for example, another at the Department of Energy. Others have gone on to run other organizations. We’re just a little one issue shop, but I think we punch above our weight, and we’ve helped prevent some really bad policies from coming into fruition. We’ve been on the other side as well, where we’ve been providing some great solutions that this president has been able to achieve in the last three years.” That last point is undoubtedly true. There is no question that President Donald Trump, with his “American Energy Dominance” agenda, has been more focused on the promotion of expanding U.S. energy resources than any of his predecessors. The last three years have represented a 180° turnaround from the Obama Administration’s efforts to artificially pick winners and losers in the energy sector, and to actively work to restrict the production of so-called “fossil fuels” like coal, oil and natural gas. Pyle and the staff at IER recognized what was coming during the 2008 presidential campaign, as candidate Obama and his supporters in the environmental alarmist community made clear their intentions to promote a legislative and regulatory agenda that would aim to limit the use of those traditional sources of energy that have been the drivers of the U.S. and global economies for more than a century. “We saw the threat,” Pyle said. “To give the former president credit, he never hid what his intentions were with respect to the energy issues and the environmental issues. He made it absolutely clear he wanted to fundamentally transform this country. And he also made it clear in many a speech that he wanted to make ‘renewable’ or ‘clean’ energy become ‘profitable’ energy. That was code for using the government to make his pet energy sources more competitive with those that work better in the market.”

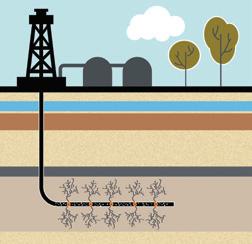

One of the main areas of focus throughout 2008 for candidate Obama and his activist supporters was the demonization of a long-used and safely-regulated process that the oil and gas industry refers to as hydraulic fracturing. It became obvious in early 2008 that the leftwing environmentalist lobby was mounting a coordinated effort to turn what they nicknamed “fracking” into a frightening public boogeyman. The campaign wasn’t limited to messaging produced by well-funded groups like the Sierra Club: Soon, Hollywood was producing entire movies and episodes of popular TV series like “CSI” in which evil “fracking” somehow managed to kill entire families and devastate vast swaths of landscape, things that simply do not — and physically cannot — actually happen in the real world. Pyle recalled those efforts during our interview. “Hydraulic fracturing was still an infant; well, not fracking itself, but the combination of fracking and horizontal drilling, was still an infant when Obama’s first term started,” he said. “The talking points they used were that we live in an era of scarcity, that we are running out of these resources, and that we are a consumer or a hog of them. And so, he was basing this whole agenda on this myth of scarcity, and we were having none of that. From the very beginning we intended to blow a hole in those theories. “One of the first projects we produced was an inventory of the natural resources that we have in this country. We found that we have more energy resources underneath our lands and shores than any other country in the world, by far. So, it was never an issue of scarcity. It was an issue of technology and price, and once those things came together, we began to produce the shale oil and gas. And hydraulic fracturing was a big part of that, which is why they did go all out to demonize that process. Just to plant in people’s minds this word that sounds a little bit scary. Right? ‘Fracking.’” One of the films produced in the midst of this campaign to turn fracking into a national boogeyman was one called “Gasland.” The movie was produced by a then-unknown filmmaker named Josh Fox. Many readers will remember that this was the film that pretended to show how fracking operations in Colorado were causing natural gas to leach thousands of feet upwards into underground

20

SHALE MAGAZINE MAY/JUNE 2020

PHOTO COURTESY OF IER

FIGHTING AGAINST THE WAR ON FRACKING

water tables, which is a geologic impossibility. Fox included one scene in which a nearby homeowner actually lit his tap water on fire. He conveniently left out the fact that local residents had been able to do that for hundreds of years since the water table in that area lay directly above a coal formation, and the natural gas leached naturally from the coal into the water. When I raised the fact that Fox has recently been attacking documentary producer Michael Moore on the grounds that his own new film, “Planet of the Humans,” which points out the dishonesty of many in the renewable industry, is filled with inaccuracies, Pyle laughed out loud at the irony. “Josh Fox! Yeah, he’s saying Moore’s movie should be taken down because it’s ‘riddled with inaccuracies.’ ‘Gasland,’ oh my gosh, are you kidding me? ‘Gasland’ is full of inaccuracies, outright lies, and they tried to use it to destroy the industry. And they were unable to do it.” Pyle points to the fact that the Obama regulatory agencies attempted to use the publicity derived from misleading efforts like ‘Gasland’ to justify the placement of onerous regulations on drilling and hydraulic fracturing. As Pyle points out, though, the activists ran into a big problem: Very little shale oil and gas lies beneath federally-owned lands. “They tried to use regulations to destroy the industry,” he said. “The Obama administration was successful in locking down the federal lands. They slowed up the permit process; they created layer upon layer of paperwork, and they basically just tried to bombard the industry with regulations. Well, it had an effect on the federal lands, but they couldn’t get at the state land or the private land. “Year after year the administration was successful in offering less land up for leasing. Federal leases were down year over year under Obama during his two terms. Unfortunately, there was a spill, the Deepwater Horizon, which had a big impact for offshore, but that was more of an impetus, or an excuse, to really lock it down.” One of the strategies the Obama administration used throughout its eight years was to use the leftwing activist organizations like the Sierra Club and NRDC as recruiting grounds for employees to staff federal agencies like the EPA and the Department of the Interior. Pyle talked about how this led to a very ideologically-motivated effort to shut the onshore industry down via regulation. “Onshore, what they tried to do was go after the private land activities and the state land activities with the Clean Water Act and the Waters of the US, or WOTUS as it’s called. The administration also tried to compel methane regulation as well, and use those tools of the regulatory stream to try to get after the private lands and the state land production, but the clock ran out on them.” Pyle points to a seemingly innocuous provision contained in an omnibus energy bill passed by congress during 2005 as one that prevented the Obama regulators from being able to achieve their goal of shutting down hydraulic fracturing operations nationwide. That language enshrined into federal law a principle that had already been in practice for many decades, which was that the

“WE FOUND THAT WE HAVE MORE ENERGY RESOURCES UNDERNEATH OUR LANDS AND SHORES THAN ANY OTHER COUNTRY IN THE WORLD, BY FAR.” various states had regulatory primacy over oil and gas operations conducted within their borders. “Thankfully, in 2005, although I would argue it was probably one of the worst energy bills except all the others,” he laughed, “there was a safeguarding giving the states primacy to regulate the technology and the process of fracking. And

MAY/JUNE 2020 SHALE MAGAZINE

21

PHOTO COURTESY OF IER

I think that saved the industry in part. Because if they had been able to regulate on a federal level, they would’ve been able to lock it down. They weren’t able to get those major regulations through.” Pyle went on to point to the fact that some of the onerous regulations the Obama administration did manage to set into place, like WOTUS and restrictions on fracking on federal lands, have been successfully repealed or modified by the Trump administration over the last three years. He is rightfully proud of that fact since he was actually asked to serve on the Trump Transition Team, where he played a major role in developing the Trump “American Energy Dominance” strategy. “I was fortunate to serve on President Trump’s transition team managing his Department of Energy work and some other issues within the transition team,” he said. “And that was great because we were able to give our ideas and our blueprint for how to make this country great again, and how to make American Energy great again.” When asked why he chose not to go into the administration, he laughed. “I love my job too much!” he said. “I wanted to go back and put my IER hat back on shortly after the transition — I took a couple days off and went right back at it. Now, we have the opposite; we’ve got the ability to do all the things we could only imagine about before. Quite honestly, I would argue that this president has done more than any other Republican in the modern era, with respect to free markets and his understanding of the importance of the oil and gas industry.” There is no question about that.

A LONG AND WINDING ROAD So, how does one end up being the president of a prominent think tank like IER? For Pyle, it was a long and winding road, one that is best told in his own words. We asked him to start at the beginning. “Well, it wasn’t the military, but we moved around a lot. Well, ‘us’ meaning my mom and the kids — my parents were divorced when I was little. I was born in Buffalo, New York, and we lived in a little town in Western New York near Buffalo, actually closer to Niagara Falls, and it was tiny. It was nice because we had a fairly large, extended family that all lived close by — in fact, most of us lived on the same street. So, we were able to play at each other’s houses, and to live that life, you know, a really small-town upbringing. “When I was a bit older my mom got a bug to move out west because my grandparents had moved out there for health reasons. We had some family in the Central Valley in California, so we moved there when I was in grade school, between 9th and 10th grade, and I finished out my high school years in a town called Lodi, California.” He chuckled recalling the lyrics to the old Creedence Clearwater Revival song, “Stuck in Lodi Again.” “Yep! Stuck in Lodi! It was quite a change for me. I was expecting surfboards and beaches, and we ended up in the heart of ag country in the Central Valley in California. At first, I was kind of annoyed, but man I’ll tell ya, it didn’t take too long for me to adjust and really enjoy living in California. “You’ve got to remember at the time it was a much different state. It was the late 80s, early 90s, and man, talk

22

SHALE MAGAZINE MAY/JUNE 2020

“THE POWER OF THE FREE MARKET IS THE SINGLE MOST IMPORTANT THING THAT HAS REDUCED CO2 IN THIS COUNTRY, AND THE MOST IMPORTANT PIECE OF THAT IS FRACKING.”

about night and day in terms of the make-up of the state compared to today. When I graduated from high school, I was accepted to the University of Southern California, and some other schools out west, but I ended up choosing USC. So, I moved down to Southern California and had a really great experience there. I took advantage of doing a lot of Southern California stuff.” “At the time there was also an environmental initiative on the ballot called the Big Green Initiative, Prop 128, I think it was. So, I was working on that as well, and that was my first foray into energy and environmental policy in politics. When I finished college, I had already been bitten by the D.C. bug, so I moved back out there. I didn’t have a job, but naturally I started putting out feelers, and stumbled into a staff position for then-freshman Congressman Richard Pombo, who was the youngest Republican ever elected at the time. I think he was 31, and I was 22 or 23, something like that. Anyway, he was my hometown congressman, and I couldn’t believe it. “Rich is just a great guy — a real go-getter. I really learned a lot from him, and we did a lot of good stuff together. When the Republicans took the House majority in the Contract for America election about a year later (1994), he was appointed to run a task force on reforming the Endangered Species Act. I had the fortune of being able to staff that for him, and we conducted field hearings all around the country; we were able to meet a whole lot of folks who were impacted by the law. Mr. Pombo quickly became the national voice for the Property Rights Movement, and for Western-related issues.” After two more years working for Congressman Pombo, another opportunity arose for Pyle, this time with another California congressman named George Radanovich. “Mr. Radanovich was from further south in the Central Valley near Fresno,” Pyle began. “I was his Legislative Director for about a year and a half, at a time when he was also the Vice Chairman of the Congressional Western Caucus. So, I was increasingly handling a lot of the responsibilities for the caucus. At the time it was more of an informal caucus, but we really worked to put some structure around it. “As a result, I became the first Executive Director of the Congressional Western Caucus. And that was also a great experience because it was beyond committee work; it was caucus work. In the U.S. House of Representatives there’s strength in numbers. If you can put a pretty strong coalition together, you can get a lot done. So, we spent a lot of time trying to advance the western property rights issues, Clean Water Act, endangered species, forest issues - a lot of the issues that we’re doing now quite honestly - and obviously energy issues as well. “So, that was a great experience, and during the course of it I got to know the House Majority Whip’s office really well, a gentleman named Tom DeLay. He had an opening for an Energy, Environment and AG Policy Director, and I was hired by Mr. DeLay to work in the Whip’s office. And that was really, just really interesting, I mean just really great, to be able to work in the capitol, to be able to work for such a go-getter, a hard charger, a really conservative member like Mr. DeLay. Doing that really helped to hone my skills even more, both on the policy side, but also the politics.” Pyle remained in his role in the Whip’s office until 2001, when America had just seen the most unusual and controversial end to a presidential campaign in its history. The election between Texas Governor George W. Bush and Vice President Al Gore, Jr. ended in such a photo finish that its

entire outcome hinged on a few hundred paper ballots in the state of Florida. It was the election that saw the birth of a new term, “hanging chads.” “So,” Pyle said with a laugh, “this campaign came around, this guy named George W. Bush, and he ran for president, and he ended up winning, but not quite winning; he went through the whole hanging chad thing. “So, I was deployed, or not ‘deployed’ per se, but I volunteered to help with the Florida debacle. I was one of those chad counters. If you remember the recounts and everything, I was down there for about five weeks. And Bush finally ended up being elected over Al Gore, and I think that overall, on balance was a pretty good, wise decision by the voters. “After that experience, with 10 years on the Hill, I decided that I wanted a change. I left the Hill, and I ended up working for a company called Koch Industries which at the time not a lot of people had heard of. More recently, the Koch brothers have become a bit of a household name, mainly because the political left and former Senate Majority Leader Harry Reid kind of demonized them for some of their politics. I was Koch’s energy lobbyist for about five years, and it was another amazing experience—- it was just another one of these things that made me a smarter, more well-rounded person. I learned at each job more and more. “From there, I actually decided to hang my own shingle, and I set up my own shop. I had a consulting business, a one-man shop, for a couple years. I had about five or six clients, including some non-profit organizations. And towards the end of that, I was approached by the founder of The Institute for Energy Research, a gentleman named Rob Bradley, who still lives in Houston. “Rob founded IER originally as a Texas think tank, and he was approached by some folks to see what they could do about getting IER more concentrated on the policy that was in Washington.

MAY/JUNE 2020 SHALE MAGAZINE

23

So, he hired me as a consultant to help put together a business plan and budget, and also a plan for ‘what are we going to do, and how are we going to bring talent to this organization?’ So, I worked closely with Rob and the board. I helped them to recruit talent, and they were looking for a CEO, because Rob didn’t want to move to Washington. They liked some of the candidates I forwarded them, but they never really settled in on anybody. “As that process was taking place, some of the board members kept asking if I was interested, but I kept saying no. But, the more that I thought about it, and the longer I worked on the project, the more I got into it. So, lo and behold, I ended up taking the gig. And that was about 12, going on 13 years ago. “We started small. Initially, we were about a $300,000 a year organization with two employees, and we slowly and steadily built up to where today IER is about a 15 person shop. Under normal circumstances, we are about a $3-5 million a year organization. We’re not a huge group, but as I said before, we punch above our weight. “In 2009, we added a 501 (c)(4) organization, The American Energy Alliance (AEA), because we wanted to have a place where all this great work that we do at IER could also be beneficial in the advocacy arena. “And I’ll tell you, I love this job. As you know, everything changes every election cycle, and we’ve seen just an amazing turnaround in just how the world views energy over that time. We fought lots of battles during the Obama years, and now we have lived close to one full term of what I would argue is the exact opposite in a president who sees the value of free markets, and choice in energy across the board and who understands the negative impacts of unnecessary and duplicative regulations on the industry. He paused before adding, “This job is the best job I’ve ever had because doing it has taken all the different skills that I've learned both on the Hill and in business in policy and politics. You have to know what a major corporation deals with, and also what a small company deals with, which I can do because I had one of my own. And the most important thing, the best thing, is that in a town where not making waves is usually what gets you ahead, I’ve been able to do and say what’s really on my mind while working in Washington D.C. It’s been very rewarding in that regard — It’s absolutely cathartic. He paused again, and then added, “I love this stuff.”

In a conversation we had had with Pyle a few weeks earlier, he had briefly talked about the “Green New Deal” introduced last year by New York Congresswoman Alexandria Ocasio Cortez, and which had been endorsed by every Democratic presidential candidate, including presumptive nominee Joe Biden. Speaking in the context of the current state of the U.S. economy, which is highly depressed at the moment due to the reaction to the COVID-19 pandemic, Pyle said what we see around us is pretty much what life under the Green New Deal would look like. We asked him to expand on that thought for this article, and he was happy to do so. “If you like your current situation, you’re going to love the Green New Deal. That’s what it comes down to,” he began. “We have seen folks in the Green movement cheer and celebrate; we’ve seen them make comments like ‘humans are the virus, and the coronavirus is the cure.’ These are things these people are actually saying. “The bottom line is this, this is what the Green New Deal is: stack people up, put them in public transportation, don’t drive, don’t fly. That’s what it comes down to, and we are living that. And we’re doing it because we were asked by our government to stay home, but this is really the way they want us to live permanently. “In order for the global Paris Agreement targets to be met, one of my guys crunched the numbers, and he thinks it would take five coronaviruses, that level of economic inactivity, to get to where they would like to be. “But of course, the Green New Deal isn’t about the environment, it’s about power and control. It’s about who decides: you, me, or them? It’s about who makes the choices about the cars they drive, the places they live, the electricity consumption that they use, even what type of energy is being used and how much they pay. And

24

SHALE MAGAZINE MAY/JUNE 2020

PHOTOS COURTESY OF IER

WE’RE LIVING IN THE GREEN NEW DEAL TODAY

it’s about who controls it — the government or us, the people, individuals, consumers, Americans? That is what the Green New Deal is, it’s about power and control, it’s not about the climate.” We pointed out the fact that carbon emissions levels have been the holy grail of the climate alarmist movement for 20 years now, and one outcome of the economic shutdown has been a significant reduction in such emissions globally. Pyle was ready for that one. “Yeah, sure, but here’s another interesting fact: In spite of all the humming and hollering by the Greens and the Obama administration and now the former Obama administration officials like (exEPA Administrator) Gina McCarthy who’s still at it at the NRDC, our emissions have gone down year over year since 2005. “In fact, the United States has crushed the world in emissions reductions. The numbers are stunning, and the countries that wag their fingers at the United States are not on track to meet their own emission targets. And of course, India and China — which basically received a free pass from the Paris Agreement — their emissions have gone up significantly in that time. “The power of the free market is the single most important thing that has reduced CO2 in this country, and the most important piece of that is fracking. Oh, they hate it when I bring that up! We’ve been able to use a lot more natu-

“QUITE HONESTLY, I WOULD ARGUE THAT THIS PRESIDENT HAS DONE MORE THAN ANY OTHER REPUBLICAN IN THE MODERN ERA, WITH RESPECT TO FREE MARKETS AND HIS UNDERSTANDING OF THE IMPORTANCE OF THE OIL AND GAS INDUSTRY.” MAY/JUNE 2020 SHALE MAGAZINE

25

ral gas because it burns cleaner than other sources, and it’s cheaper to build a gas plant than it is to build a coal or nuclear plant. Plus, it’s harder to build a coal plant anyway because the Greens have made it part of their mission to prevent any new coal plants from being built. “So, the key, the important part of IER is we put this information out there, and it’s not debatable. Our facts are not debatable because we source them all, they come mainly from government sources, and we put the facts out there in a way that basically tells the story. They say a picture is worth a thousand words; well, good charts are worth a thousand words as well. What we’re trying to do is to give consumers, Americans, policymakers, staff, and to the extent we’re able to — it’s not easy — the media the information and the tools to better understand, cut through the noise and get to the signal of these important issues of energy and environment.”

ON NOT KEEPING IT IN THE GROUND We raised the topic of a recent, specious court decision by an Obamaappointed federal judge in Nebraska that is now holding up the completion of the Northern leg of the Keystone XL Pipeline system for what seems like the 100th time over the past 10 years. Even worse, the decision is now also being used by the U.S. Army Corps of Engineers as a reason to suspend the permitting processes for several other crucial interstate pipeline

projects. We asked Pyle to discuss IER’s position on this key issue. “Yeah, well here’s the thing,” he began. “You’ll remember probably four or five years ago now the Greens organized around a philosophy of ‘keep it in the ground.’ That was their mantra: don’t let these hydrocarbons come out of the ground. Well, they were unsuccessful, thanks to the shale producers, in that keep it in the ground effort. So, now they’ve shifted their strategy. They’ve gone from ‘keep it in the ground’ to ‘keep it from moving around.’ That’s what this whole thing is with the pipeline. “The fight over Keystone XL was really the first prototype for this type of, what I call, environmental pressure tactics. They forum-shop, they look for friendly judges. Fortunately, the Trump administration is doing a darn good job of appointing conservative federal judges, and that’s going to have a long-term positive impact, I believe. “But what it does is it slows down the process for Alberta to get in the game here, to get their oil down to the refineries in the United States. Well, we’d much rather be filling our gulf refineries with Alberta crude than, say, Venezuelan crude. Seems like a much better partner, don’t you think? So, we’ve got to get this pipe in the ground. “The good news about Keystone is I understand that the Canadians are doubling down on getting it done and have done work at the border now. We also got past the Department of State permitting issue that the previous administration had bottled up. “Longer term, we’ve got to address a couple things with legislation or these judges are going to keep doing this, and keep slowing projects down, and keep preventing us from getting infrastructure built to meet up with the demand of the production that’s taken place over the last decade. “Honestly, it’s Congress’s fault. The national legislature has been an

DON’T EV ER WASTE A CHAN CE TO

WANDER.

26

SHALE MAGAZINE MAY/JUNE 2020

embarrassment for a very long time now. They refuse to tackle issues that matter; they punt everything over to the administration, and then they wonder why these administrations have more power. Well, it’s because they’re not inserting themselves into the conversations. They don’t have the wherewithal to reform these laws. “If the Greens don’t think they can achieve their goals with the Clean Air Act as it exists and want to go beyond it, then let them change the law. We free marketeers think these laws are woefully outdated and need to be reformed, so let’s have at it in Congress. “But you know how hard that is: You can’t even pass a stimulus bill without weeks and weeks of lag, because everyone’s holding out for their own, and they're all leveraged for their pet projects. I see this as a combination of a couple things. One, the Green influence on the Democratic party is outsized, and it needs to be reined in. Energy should not be a partisan issue the way that it has been, especially in this decade. “Two, we’ve got to get a handle on these regulations, and the Trump administration has done a good job of that. Hopefully, in a second term, he can finish the job and get some of these issues I’ve mentioned cleaned up as well.

“And lastly, we need a congress that actually functions again, and that has ramifications across all issues, but none as important or as critical as the energy stuff, because there’s just this chasm between the parties on these issues. “It’s not just oil and gas. It’s for everybody. It’s really more about freedom, free markets and rule of law than it is about energy.” Pyle appears to enjoy his job at IER so much that we felt the need to ask him if there aren’t some aspects of it that give him stress. “It’s not without its stress,” he said, “You know, we’ve got to raise money. That’s been a constant stress. “But overall it’s been great, I really enjoy what we’ve built, and hopefully when I’m in a rocking chair, and I’m thinking about the good ol’ days, I can still pull up IER on the interwebs and see that it’s still going strong, because I think it’s important. It’s a really important institution for the energy industry.” Indeed, the energy industry needs strong advocates willing to fight the good fight for free markets, sound science and source-neutral energy policies. Because without such advocates, the industry could have been essentially dead in the water a decade ago.

About the author: David Blackmon is the Editor of SHALE Oil & Gas Business Magazine. He previously spent 37 years in the oil and natural gas industry in a variety of roles — the last 22 years engaging in public policy issues at the state and national levels. Contact David Blackmon at editor@ shalemag.com.

Located in the lively downtown Marina District, Omni Corpus Christi Hotel offers luxurious guest rooms with spectacular views of the Corpus Christi Bay. Stay

SHALE HOTEL:

with Omni to enjoy personalized

ICIAL ” SHA L E PA R T NER “OFF

SAN ANTONIO

service and the most luxurious SHALE HOTEL:

accommodations by the sea during this ideal Texas coast getaway.

ICIAL ” SHA L E PA R T NER “OFF

HOUSTON

SHALE

OMNIHOTELS.COM/CORPUSCHRISTI

HOTEL: ICIAL ” SHA L E PA R T NER “OFF

CORPUS CHRISTI

MAY/JUNE 2020 SHALE MAGAZINE

27

28

SHALE MAGAZINE MAY/JUNE 2020

Support Texas energy with the nation's first and fastest-growing energy chamber! MEMBERSHIP BENEFITS Member Directory invite-Only Events Status as an Energy Advocate

www.txenergyadvocates.org MAY/JUNE 2020 ď “ SHALE MAGAZINE

29

INDUSTRY

Pro – Or No – Rationing? By: Bill Keffer

T

The suddenness and severity of the current collapse has many industry leaders frightened for their literal survival and has triggered a call by some for a return to proration has triggered a call by some for a return to proration (i.e., imposing limits on production through government regulation). In fact, the Texas Railroad Commission (RRC) convened a 10-hour hearing on April 14 to consider the respective arguments for and against cutting future production by government order. In Texas, it certainly has been done before. In the 1930s, in response to the collapse in crude oil prices caused by the flood of oil being produced by the enormous East Texas field, the RRC first imposed allowables, in an effort to restore equilibrium to supply and demand. For the next forty years, because Texas represented such a significant percentage of both U.S. and global production (and the RRC was recognized as being the most effective oil and gas regulatory agency in the world), proration did, in fact, keep crude oil prices stable. In the 1970s, however, with the advent of OPEC (continued on page 31)

30

SHALE MAGAZINE MAY/JUNE 2020

About the author: Bill Keffer is a contributing columnist to SHALE Oil & Gas Business Magazine. He teaches at the Texas Tech University School of Law and continues to consult. He also served in the Texas Legislature from 2003 to 2007.

ZHENGZAISHANCHU/STOCK.ADOBE.COM

here is really only one subject currently occupying the undivided attention of each and every person affected in any way by the oil and gas industry. To write about anything else would be about as nonsensical as trading favorite recipes during the final moments on the Titanic. This industry has undoubtedly weathered challenging conditions many times during its 160-year history, but the present ordeal seems like it must be the worst, mostly because it is happening to us now. A squabble between Russia and Saudi Arabia and other OPEC nations regarding production rates that led to flooding the global market with an excess supply of crude oil (with a substantial assist from the U.S. and our own continued record-setting production volumes), combined with a jaw-dropping collapse in demand caused by the COVID-19 pandemic, has delivered an unprecedented gut punch to the industry. Crude oil and natural gas prices are trading at levels not seen in decades. Companies have abruptly and drastically cut, if not completely eliminated, their drilling budgets and have laid off significant percentages of their personnel. As has always been the case in past downturns, companies will be filing for bankruptcy protection, and many will never come back. The deeper question being asked during the current collapse, unlike in any past downturn, is — will we return to past demand levels? Or, will the demand curve, and likewise the supply curve, now start to move in a different direction ... down? Of course, in the middle of any drama — or, in this case, more like trauma — it is easy to be drawn to hyperbole. When thinking with a cooler head, it is difficult to conceive of a world that will not still be heavily dependent on oil and natural gas to power its economic engine. In other words, it is likely still the case that the more apt adage for our present circumstance is “this, too, shall pass,” rather than “the end is near.” Nevertheless, the suddenness and severity of the current collapse has many industry leaders frightened for their literal survival and

on the world stage, Texas no longer held the same influence over global crude oil prices, so there was no longer a reason to limit production. Consequently, there has been no proration in Texas for almost 50 years. The April 16 RRC hearing could be viewed as, “desperate times call for desperate measures.” Those calling for a return to yesteryear and the RRC’s proration rules see no end in sight for the double-whammy of excess supply and collapse in demand. They believe that drastic curtailments in production in Texas, combined with cuts recently agreed to by Russia, Saudi Arabia, Mexico and others are the only way to keep the entire domestic industry from imploding. Not wanting to suffer separately by voluntarily cutting their own production rates, these companies want all producers to be subject to the same rules issued by the RRC. In an independent-minded state like Texas and an entrepreneurial industry like this one, it is a little confusing and counterintuitive to see these calls for affirmative government intervention. Not surprisingly, there are many others opposed to the idea of proration, and they also let their voices be heard during the RRC hearing. Some believe that there is no crisis grave enough to justify inviting more government regulation. Some wondered to what extent cutting production in Texas would do other than hurt Texas producers, unless every other producing state in the U.S. does likewise. Some predicted that, by the time the RRC can reach a decision on proration rules and actually implement them, the current crisis will have passed, so the opportunity for any potential benefit from such rules will have also passed. Along those same lines, some more specifically described how the market will likely react to the current circumstances, arguing that government intervention would be an unnecessary and potentially adverse step. They pointed out that, given the lack of storage capacity, the reduction in global demand, and the overall drop in global prices, production will necessarily have to be cut significantly anyway, as a practical matter — in other words, there is no need for government to artificially create a scenario that will eventually develop on its own. Some pointed out the obvious, yet important, point that the RRC hasn’t enforced allowables in 50 years; there is no longer any institutional knowledge or actual experience in the subject, so the learning curve now would likely be long and steep. So, what to do? As Twitter, Facebook and the media remind us daily, leaders are damned if they do and damned if they don’t. If you take significant action in a crisis, are you wise because you’re decisive or imprudent because you’re impulsive? If you fail to take action, are you cool, collected and able to withstand pressure — or are you paralyzed with fear? There are companies literally fighting for their very existence during this meltdown. Their position on prorationing is likely a function of what they believe will be most beneficial to their continued financial health. But what is the best overall policy for Texas? Before the current crisis, the problem in the industry that was receiving the most attention was excessive natural gas flaring. If the RRC were to impose limits on flaring, to what extent might a concomitant benefit be a reduction in crude oil production? In order to reduce the production of the associated gas being flared, companies would likely have to substantially reduce, or even shutin, the oil production creating the excess production in associated gas. Might a much more focused and limited rule from the RRC regarding flaring have the effect of accomplishing the benefits of proration without actually having to engage in proration?

ONLY TEXANS TEXANS

KNOW HOW TO FEED

Reaping the earth’s bounty is what we do best. That’s why you should plan your next offsite onsite by catering with Freebirds. From custom-rolled burritos to an entire burrito bar, your folks will attend this meeting and even look forward to the next. Place your order now.

Freebirds World Burrito San Antonio & South Texas Catering Sales Manager Josie Nieves P: 210-560-5002 F: 866-421-0876 jnieves@freebirds.com

MAY/JUNE 2020 SHALE MAGAZINE

31

INDUSTRY

Prevent Screen Outs During Hydraulic Fracturing with SelfDestructing Balls for Large Bore Plugs AEROSPACE TECHNOLOGY ADAPTED FOR HYDRAULIC FRACTURING IS IMPROVING PRODUCTION AND RELIABILITY Special to SHALE

after being exposed to sustained pressure greater than 1500 psi. Like other dissolvable balls on the market, any fragments quickly dissolve within the wellbore in a few days. This clears the blockage, resolves the screen out condition and allows stimulation to resume without further delay. The technology, developed with the assistance of an aerospace defense contractor responsible for explosive applica-

tions such as those used for emergency ejections of pilots on jet planes, can speed natural gas well completion and allow fracking operations to bring the product to market faster. “Screen out is just about the worst thing that can happen while you are pumping,” says Dave Hornak, an oil and gas industry consultant and previous Manager of Reservoir Stimulation at a firm that completed over 180 wells last year. According to Hornak, the previous fracking company he worked for had several crews working 24/7 and were installing an average of 30 plugs in each of the 180 wells. Given the volume, screen outs were “something to avoid if at all possible.” Screen outs often occur when the proppant (sand or other solids) in fracture fluid restricts flow within the wellbore or into the perforations. The restriction causes a rapid rise in pump pressure. (continued on page 33)

32

SHALE MAGAZINE MAY/JUNE 2020

PHOTOS COURTESY OF CERAMIC TECHNOLOGIES CORP.

D

uring hydraulic fracturing well stimulation, one of the costliest setbacks that can occur is a screen out, a condition in which pump pressure levels unexpectedly rise rapidly in excess of the safe-operating parameters of the wellbore or wellhead equipment. This condition, which occurs in up to 25% of well completions, requires immediate cessation of pumping to perform time-consuming drill-outs to clear any obstructions. Considering lost production time and added steps, a single screen out can cost as much as $150,000. Now, a self-destructing ball and large bore plug system is promising to resolve screen outs without operator intervention. The ball is designed to automatically self-destruct at a predetermined time (usually 3-4 hours)

Opening Doors in San Antonio Since 1974 To resolve the screen out, Hornak says his crew would have to rig down the wellhead and pull in a large coil tubing unit into the well under pressure and clear any obstruction, which could take a day or more. In order to improve his firm’s reservoir stimulation process, Hornak researched and then tested a self-destructing ball for large bore plugs, called DetBall. The product was patented by Ceramic Technologies Corp., a Houston-based company that provides advanced material solutions to a variety of industries including oil and gas. The self-destructing hollow ball (made of a Mg/Al alloy with a small amount of internal explosive), is designed to detonate at a preset time with a precisely controlled, minimal force sufficient to break the ball apart and not damage the plug or surrounding casing. The remaining fragments are water-soluble and will dissolve in 2-3 days. For safety and effectiveness in preventing screen out, the ball is designed to self-destruct after being exposed to a sustained pressure greater than 1500 psi. A timer counts down until the ball self-destructs at a pre-set interval 3-4 hours later. As an added safety mechanism, if the ball is ever brought to the surface after activation, the lack of pressure at the surface will ensure it does not detonate. To create the self-destructing ball, Ceramic Technologies Corp. partnered with Simsbury, Connecticut-based Ensign-Bickford Aerospace & Defense Company, a global leader of precision energetics systems and innovative explosive and non-explosive solutions. The company is responsible for developing solutions in aerospace, such as explosive charges used for automatic ejection of pilots in jet planes. “What is unique about the DetBall is the fact that you can time the detonation of the ball,” says Hornak. “All you have to do is wait a few hours for the ball to detonate. With the ball gone, the plug is open and you don’t need to bring in a coil tubing unit to correct your problem. In theory, everything below you in the wellbore is now open. So, you can pump into open perfs, flush the wellbore or put down another ball and plug and go about your business.” Hornak says he and his crew tested the self-detonating DetBalls in three fracking wells and no screen out condition occurred. He also tested the balls under simulated high-pressure conditions to ensure they performed as expected. When we tested the balls, we put them in place, increased the pressure and then waited for them to pop,” says Hornak. “When that happened, we saw the pressure drop immediately, which indicated the balls [self-destructed] as designed.” According to Hornak, this approach would have significantly improved his work crew’s completion efficiency if a screen out had actually occurred. “Since our pump time was two hours, if we had a failure after 90 minutes, all we would have had to do was wait for the ball to pop,” he concludes. “Then we would be able to pump down the wellbore and go on with our process. That is so much better than having to do a drill out.”

For more information: Call 281-556-8495; email: jepstein@ certechinc.com; visit www.certechinc.com; or write to Ceramic Technologies Corp. at 1015 Redcedar Lane, Houston, TX 77094.

KING REALTORS is dedicated to helping San Antonio and the oil industry with their real estate needs. If you are looking to buy or sell a property, call us and say you saw it in SHALE Magazine!

TABITHA KING 210.414.4255

5600 Broadway Avenue • San Antonio, TX 78209 KingRealtors.com tabitha@kingrealtors.com MAY/JUNE 2020 SHALE MAGAZINE

33

INDUSTRY

Global Investment Slowdown Set to Hike Oil Prices and Cause Undersupply of 5 million bpd in 2025 Special to SHALE

T

he COVID-19 pandemic will leave not only short-term, but also long-term, scars on the oil market. Even though the world is currently facing what is arguably the largest oil glut ever recorded, the tables will turn dramatically in coming years. The lack of activity and investments currently planned by cost-conscious E&P firms, combined with an inevitable rebound in global oil demand, is set to cause a supply deficit of around 5 million barrels per day (bpd) in 2025, Rystad Energy calculates, with prices seen topping $68 per barrel to balance the market. In our base case scenario, global demand for liquids in 2025 will reach around 105 million bpd. Before the COVID-19 pandemic, Rystad Energy expected supply to slightly exceed demand. However, due to the steep curtailment of investments and activity that the current crisis has brought this year, Rystad Energy now estimates that the downcycle in the upstream industry will remove about 6 million bpd from production forecasts for 2025. To fill this gap, Rystad Energy believes that some of the core OPEC countries, like Saudi Arabia, Iraq and UAE, will be able to ramp up production. In total, these countries might fill 3 to 4 million bpd of this gap. The remaining shortfall will most likely be filled with volumes from U.S. tight oil. To achieve this, prices may move above our current base case, which currently stands at an average price of $68 per barrel in 2025. “The current low oil price has tightened the medium-term supply and demand balance considerably. Despite high growth in tight oil, oil production outside the OPEC Middle East countries is expected to stay flat over the next five years. As demand is expected to recover, the core OPEC countries will need to increase their supply significantly or the market will face even higher prices than our base-case forecast,” says Rystad Energy Head of Upstream Research Espen Erlingsen.

The lack of activity and investments currently planned by cost-conscious E&P firms, combined with an inevitable rebound in global oil demand, is set to cause a supply deficit of around 5 million barrels per day (bpd) in 2025

Learn more at Rystad Energy’s UCube. Global E&P activity is poised to fall dramatically this year as upstream companies try to cope with the challenging market conditions, resulting in conventional project-sanctioning activity falling to a 40-year low and tight-oil investments dropping by almost 50% this year. The impact of the lower activity levels varies depending on the supply segment. For tight oil (including NGL) the impact on production is rather immediate, and we have reduced our 2020 forecast by close to 1.9 million bpd. The dramatic reduction in new tight-oil wells will also have a long-term impact, as fewer wells will be available for production. For 2025 our total tight-oil production forecast is revised to 18 million bpd, or 2.7 million bpd lower than our pre-crisis estimate. For more analysis, insights and reports, clients and non-clients can apply for access to Rystad Energy’s Free Solutions and get a taste of our data and analytics universe. About Rystad Energy Rystad Energy is an independent energy research and business intelligence company providing data, tools, analytics and consultancy services to the global energy industry. Our products and services cover energy fundamentals and the global and regional upstream, oilfield services and renewable energy industries, tailored to analysts, managers and executives alike. Rystad Energy’s headquarters are located in Oslo, Norway with offices in London, New York, Houston, Aberdeen, Stavanger, Moscow, Rio de Janeiro, Singapore, Bangalore, Tokyo, Sydney and Dubai.

34

SHALE MAGAZINE MAY/JUNE 2020

LET US STOP YOUR HIGH CREDIT CARD CHARGES AND MONTHLY PAYMENTS.

0% 0%

Credit card processing fee Transaction fee

No hidden fees $45 flat fee per month 210-240-7188 www.swypegreen.com

swype GREEN

.com MAY/JUNE 2020 SHALE MAGAZINE

35

INDUSTRY

LWD vs. Wireline Logging: Which Should You Choose? By: Anye Ndefru, SETC Senior & Employee Development and Engagement Manager, Schlumberger

I

n oilfield drilling operations, “logging” is the process that enables the operators to collect data about the formation through which they are drilling. The graphical representation of the geological data acquired in the process is called a log. Before drilling begins, operators must decide which type of data to acquire (drilling mechanics, resistivity, density, porosity, permeability, Gamma Ray, etc.), and determine how the geological data will be acquired: on wireline or while drilling. In wireline logging, an electrical cabling system is used to lower tools or measuring devices into a borehole, that then collect and transmit wellbore properties data. The wireline logging operations are carried out after the drilling operation has been completed. Alternatively, “logging while drilling (LWD)”

Data output shows comparable reliability between wireline logging and Logging While Drilling.

36

SHALE MAGAZINE MAY/JUNE 2020

technologies enable data collection in realtime or in a recorded mode as the drilling operations are in process. The LWD tools are made up to the Bottom Hole Assembly (BHA), along with MWD (measurement while drilling), RSS (rotary steerable system), and other “dumb” iron (non-smart equipment). Drilling operators generally agree that there are numerous benefits of running LWD technologies over wireline: • LWD tools are heavier, tougher and more robust • The tools acquire data continuously during the drilling operations without interruption (they are transparent to drilling) • Most LWD equipment has no directional logging limitations: the tools can be run in high dog-leg and high inclination angles

(continued on page 37)

About the author: Anye Ndefru is an Employee Development and Engagement Manager within the Drilling and Measurement (D&M) Technology Lifecycle Management sub-business unit of Schlumberger; the world’s largest oilfield services company. Mr. Ndefru, in his current role, manages engagement initiatives as well as the training and development planning of engineers and technicians of the Sub-Saharan Africa region, an area that spans across 37 countries. Prior to this role, he worked in field drilling operations, then in operations support, and finally, at Houston Formation Evaluation technology center; Schlumberger’s biggest worldwide technology center. During his assignment at the technology center, he was responsible for knowledge and process management, internal technical communications and global technical support to D&M business unit operations. While in this role, he also received the SETC recognition for his exceptional technical expertise and leadership with respect to matters relevant to business systems and processes development, organizational change management, quality and compliance management, continuous improvement and technology lifecycle management.

• Acquired LWD data serves real-time well placement and other decision-making purposes (imagine that you want to remain within, above, and below a specific reservoir while drilling; the only optimal solution is one that will enable your team to steer the well according to the position of the reservoir’s bed boundary) • LWD measurement is as accurate and repeatable as wireline logging • LWD eliminates the need for post-drilling logging, hence saving rig time and cost, and avoiding safety risks associated with operations and well integrity • There is no well trajectory or inclination restriction on running LWD tools: you can acquire data up to your end depth, and at times ahead of the bit in vertical, S-shape, and horizontal wells. With the emergence of LWD technologies, many people anticipated the death of wireline formation evaluation in drilling operations. However, multiple renowned oilfield service companies continue to invest in wireline technologies to offer both formation logging approaches. Why is wireline logging still viable? Despite the many benefits of LWD, the system still has drawbacks that must be weighed in any decision about which logging platform to use. Significantly, the data density in real-time for LWD is lower than wireline due to MWD data transmission rate (telemetry), which might be a deal-breaker for certain operators. Power could also be a problem for some, as LWD tools are either powered with batteries, by an MWD tool, or by a power section of the tool that generates its own power from a mud turbine. Finally, downlinking capabilities are somewhat limited with LWD. LWD services are often also priced higher than wireline. Nevertheless, complex well trajectories and deeper reservoir targets increase well integrity constraints and require a controlled rate of penetration (ROP). The controlled ROP favors the acquisition of good data density during the drilling process. Recent developments with wired drill pipes now enable very high telemetry rates, extend downlink capabilities and offer a whole new suite of bottom hole sensorial while drilling measurements. LWD technologies may not yet offer (or may be experimenting with) some wireline services such as sidewall coring, formation imaging, cement-bound logging and formation sampling. Yet, whenever the measurements are available on wireline and while drilling, I will strongly recommend using LWD services to maximize operational safety, improve the real-time drilling decision-making process, identify and mitigate well integrity challenges efficiently, optimize the well placement, and minimize the overall cost of well construction. In my experience, when I have a choice, I choose LWD.