PUBLISHED BY: Shoppercentric

EDITOR: Rob Bates

DESIGN: Mike Higgs

e: mikehiggs@mac.com

We welcome ideas for future articles and reports. Guidelines on our preferred format and style are available from info@shoppercentric.com

All copyright is vested in Shoppercentric unless expressly stated otherwise. No permission is granted for reproduction, use or adaptation of the material, save as to provide for under Statute, and any such use must be accompanied by the appropriate accreditation.

This report is based on online interviews amongst a nationally representative sample of UK shoppers aged 18+.

Over 2,000 respondents were interviewed in December 2023. Qualitative interviews on the topic of social media took place in early January 2024.

Our quantitative Shoppercentric Stocktake measures in most cases go back to 2016 and allow further interpretation of pre and post COVID-19 trends. Some measures go back to 2009, the heart of the credit-crunch.

A big thank you goes out to the teams at Vitreous World for providing the quantitative sample and to Datatree for the survey scripting & data processing.

Jamie Rayner, Managing Director, Shoppercentric

Jamie Rayner, Managing Director, Shoppercentric

Welcome to our 53rd edition of WindowOn.

In the midst of a world that seems to be growing more complex right before our eyes, with greater levels of geopolitical conflict, this new AI ‘thing’ that we are not sure if we trust, that could take our job; it would be of little surprise that, if we mix a heavy dollop of interest rates and have some high inflation, we might notice a difference in consumer response and shopping behaviour. And that, we have.

For over a decade we have monitored shopper reaction to global financial crises or pandemics to self-induced Britain only events and on this occasion, this year we note the highest levels of ‘Strong Reactors’ (defined as those making significant financial changes) we have ever seen. This group represents 4 in 10 shoppers, with younger age groups being more profoundly affected.

But our shoppers (humans) do what they always do: they adapt and as a result there are some businesses that stay relevant and win and some that lose. Adaptations in shopper behaviour include more frequent, smaller shopping trips, increased reliance on loyalty cards and a focus on cost-saving measures. Trends such as the importance of own-label products, promotions, and minimising wastage are observed.

What about the environment though? Do these frugal behaviours subconsciously influence shoppers’ environmental choices? As interest rates stay in check (or go down) and inflation rebalances, the trend towards sustainable shopping actions may re-emerge as some of that cautious optimism, that all predict, appears towards the end of the year.

One thing is for sure, with the level of external challenge to businesses, for categories to grow: organisations will need to be more robust, aligned and connected than ever around their sales, marketing, revenue and category strategies. And don’t forget, the consumer and the shopper are the executors of these plans.

We explore all the above in this edition and much more. We thank you for taking the time to pause and read.

Presently, the UK is grappling with a cost-of-living crisis...

Tired of the same, routine meals...

Shaping an inclusive shopping experience for people with disabilities.

Does thriftiness trump sustainability?

The trials and tribulations of the ever-evolving world of social media.

Presently, the UK is grappling with a cost-of-living crisis, as evidenced by our nationally representative survey of 2,000 shoppers, many of whom are experiencing heightened levels of anxiety and distress. Intriguingly, these emotional states parallel the peaks observed during the Covid-19 lockdown. The predominant cause of concern among these individuals, surpassing environmental issues or geopolitical tensions like those in Israel/Palestine or Russia/Ukraine, is the substantial rise in rates and bills. It is worth noting that this worry about increasing expenses is particularly pronounced among individuals from C2DE backgrounds.

Following a relatively stable period in 2020, the proportion of ‘Strong Reactors’ has been on the rise. This group, facing the need for significant changes or struggling to meet their financial obligations, now constitutes 4 in 10 of our shoppers - a record high, surpassing even the levels seen during the credit crunch of 2009. Another third of individuals have had to implement minor adjustments to cope with

escalating costs, with only 16% reporting that they remain completely unaffected by the situation – only the credit crunch has seen a figure lower than this. As budgets tighten, our data indicates a notable increase in people resorting to full-time work to bridge the financial gap. This trend is significantly more pronounced than in 2022 and represents the highest percentage on our records.

2009* Credit Crunch (n=1015)

2017* Brexit (n=1108)

Wave 1 - May 2020 (n=1023)

Wave 2 - June 2020 (n=1002)

Wave 3 - December 2020 (n=1206)

Wave 4 - February 2022 (n=2011)

Wave 5 - December 2023 (n=2005)

18-24 (n=222)

25-34 (n=336)

35-44 (n=401)

45-54 (n=325)

55-64 (n=299)

65+ (n=422)

As explored in the 2021 WindowOn edition, the younger you are, the more likely it is that you are strongly affected by a tightening of finances with the ‘Unaffected’, being concentrated in the 65+ age group. These findings shed light on why younger generations exhibit heightened levels of anxiety and distress, extending beyond concerns about bills to encompass fears of potential job losses and unemployment. Among our ‘Strong Reactors,’ 55% express high levels of anxiety and distress about current life circumstances. While this group is likely to be younger, they also tend to have lower household incomes. Notably, our data reveals a widening gap between those navigating through these times unscathed and those grappling with major changes.

Numerous organisations are diligently working to assist those most affected by challenging circumstances. At Touchstone Shoppercentric, we recently connected with the team behind Witney Food Revolution 1, a local initiative responsible for a Community Fridge and Larder. The Community Fridge, located at the heart of town, operates three times a week, welcoming everyone without the need for referrals or means testing. Additionally, the Community Larder, open once a week, requires a £3.50 membership fee payable to SOFEA 2 SOFEA is an organisation that offers valuable work experience to young individuals, providing lifechanging support while simultaneously addressing local food poverty issues. The £3.50 subscription allows members to select 10 packaged goods items (excellent value!), along with as much fruit and vegetables as needed. During my visit, the supply seemed endless, featuring an abundance of brussels sprouts, parsnips, and potatoes, a result of Christmas leftovers!

This year, when running our monthly stats, most months I was saying sadly we’ve reached a new level that we never wanted to reach.3

Trussell Trust Organiser

The organisation takes in food from supermarkets, retailers and restaurants that is nearing the end of its shelf-life, as well as private donations and then makes it available for the community. It is a two-pronged approach that not only benefits vulnerable people in the area, but also focuses on sustainability by reducing food waste. To that end, SOFEA also partners with a local farm where anything leftover or that can’t be used is taken.

Like numerous food banks and larders across the nation, Witney Food Revolution has witnessed a substantial increase in the number of individuals seeking their services over the past year, some of whom are facing urgent needs. The Trussell Trust 3 revealed that over 2023 their network distributed 3 million emergency food parcelsa 37% surge compared to the same period in 2021/2022. At Witney Food Revolution, removing the need for a referral or means test has attracted more users, including those who might not have typically considered such services before. The stigma associated with reliance on a food bank remains strong. Interestingly, while the food assistance may not be an absolute necessity for all, we learnt from the organiser that it has evolved to meet other fundamental needs too. For some, especially older individuals, it has become an opportunity to connect and socialise. Regardless of the user’s situation, organisations like Witney Food Revolution are making a significant impact nationwide, providing a crucial source of material and spiritual sustenance for many facing genuine need.

At a broader level, we are observing several shifts in the behaviour of UK shoppers. There is a noticeable increase in shoppers opting for more, smaller shopping trips, diverging from the traditional pattern of a single substantial shopping session. For some, this may create a psychological perception of spending less. For others, they may be constrained by budget to shop this way. Furthermore, the change isn’t just in the frequency of shopping but also in the choice of stores. Discounters like Aldi and Lidl continue to experience robust growth year on year. Loyalty cards and retailer memberships have gained heightened importance, with twothirds of respondents expressing their influence in determining where they shop, a notable increase from 2022. The evolution of these programs has led to certain retailers requiring them to unlock the best prices. Notably, Tesco’s Clubcard (72%) and a Nectar Card (52%) are the most widely used in the UK. Interestingly, it’s the over 55-year-olds and those with higher household incomes who are maximising the benefits of these loyalty cards. This raises the question of whether an opportunity is being missed for encouraging younger and less affluent individuals to use these cards, given the cost saving potential they offer.

Figure 4

The rise in importance of cost saving measures.

They sell really good ‘own label’ products

Have good promotions

Have the cheapest prices

There

Regarding factors influencing retailer choices, we’ve observed significant increases in the claim around the importance of own-label products, promotions, having the most affordable prices, and ‘special buy’ areas. These elements play a crucial role in reducing the overall cost of household shopping. Taking own-label products as an illustration, data from May 2023, as reported by NIQ 4, indicates that sales of own-label products in UK supermarkets have grown at twice the rate of their branded counterparts (+14.1% vs. +7.1%).

The commitment to minimising wastage remains strong, with over 8 in 10 individuals expressing their diligence in this regard, seeking to optimise the use of everything they have. This tendency rises to around 9 in 10 among those aged over 55. Two-thirds of respondents indicate that they actively avoid places they perceive as expensive or upmarket, with half our sample also reporting an increase in using local retailers to save on petrol costs - an inclination notably more prevalent among individuals aged 18-34 years.

See Figure 5 – Cost of living behaviours.

When examining pricing and promotions, the stark reality sets in. In comparison to 2022, our surveyed shoppers are markedly more attuned to pricing dynamics. They are more likely to be cognisant of the typical prices of goods, knowing when items are more or less expensive elsewhere, opting for ‘own label’ products to manage costs and actively seeking the best prices even if it means going out of their way. In addition, they might split their shopping across various retailers or websites and consider purchasing smaller or larger packs to save money. Interestingly the younger demographic is particularly instrumental in driving these significant shifts; for instance, three-quarters of 18–24-year-olds claim they go ‘wherever the best deals are,’ compared with just half those aged 65 and above. While older shoppers appear more driven by store loyalty cards, younger shoppers are much more actively searching the market.

I’m more aware of pricing than I used to be I prefer promotions that save me money rather than giving me more of the same thing

I have a very good idea of prices, so I know when something costs more or less than elsewhere

I buy own label products when I can, mainly in order to keep costs down

It’s important that I get the best prices even if I have to go out of my way to get them

I buy larger packs to get more for my money

I go wherever the best deals are, even if it means I have to split my shopping across different shops/ websites

Many of our observations appear to be becoming enduring trends. Shoppers will persist in diversifying their choice of stores as they actively search for the best deals. Over the past year, our shoppers, on average, experimented with just under two new retailers for their grocery and household shopping (with a notably higher figure for those aged 18-44), with Aldi and ASDA being the primary beneficiaries. Looking forward, Aldi is poised to gain the most, as a third of our sample expresses an intention to shop there more in the future. This sentiment is particularly strong among younger shoppers, who expect they will face ongoing challenges for the foreseeable future.

Throughout the upheavals of the Covid era, we examined shocks and shifts as consumers were compelled to explore different brands, products, and lifestyles. We sought to identify which newfound behaviours would endure. Many of these behaviours have endured and grown to become habits. More people are turning to discounters, opting for own-label products, and adopting better meal planning practices to minimise waste. Even activities such as scratch cooking, home-baking, and creating ‘fakeaways,’ which clearly originated as lockdown pastimes, have remained robust, as, among other things, they continue to deliver a fiscal uptick.

I buy smaller packs to save money

Wave 3 - December 2020 (n=1206)

Wave 4 - February 2022 (n=2011)

Wave 5 - December 2023 (n=2005)

Regardless of how events unfold, here at Shoppercentric, we’ll be closely monitoring these changes and ready to help our clients navigate these challenges for their categories and brands.

References:

1 Livewell - livewell.oxfordshire.gov.uk/Services/4220

2 SOFEA - www.sofea.uk.com/about/our-story/

3. Trussel Trust - www.trusselltrust.org/news-and-blog/ latest-stats/end-year-stats/

4. REUTERS / NIQ - www.reuters.com/world/uk/uksupermarket-own-label-sales-growing-twice-fastbranded-goods-niq-2023-05-31/#:~:text=The%20 latest%20data%20showed%20value,%2C%20 versus%2062.1%25%20in%202022.

We’ll be speaking in conjunction with The LEGO Group in a session titled Inclusivity Unleashed: Building Retail Experiences for All Audiences at the Shopper Insights, Behaviours and Winning Category Management Conference 2024.

We’ll also have an exhibition stand so drop by and say “Hi!”

8th February 2024

Hallam Conference Centre 44 Hallam Street London W1W 6JJ

Find out more at: shopperinsightconference.com

Our very own Tim Baker appeared on Sky News during the summer to chat about the dip in retail sales through July.

Aldi’s Christmas advert, featuring Kevin the Carrot paying homage to Charlie and the Chocolate Factory, was voted the top Christmas advert of 2023 by our WindowOn sample.

Do you often get home from work and then have to work out what to eat? We all like to explore new and exciting culinary options, but when confronted with the need to choose and the effort this involves, do you often revert to one of your go-to favourites? If you do, you are not alone. Research conducted by McCain1 and Opinion Poll found that over half of UK shoppers (51%), wish they felt more inspired when it comes to cooking their meals during the week. A third also admitted to being bored with their mid-week meals – not surprising when some admit to eating the same recipe up to 4 times a week. Little surprise then that, despite a cost-of-living crisis, so many are resorting to takeaways, 2 in 3 of our UK sample state they have had a takeaway (delivered or to collect) within the last month.

But why this lack of creativity during the week? McCain’s1 research points to a lack of time (44%), the need for planning (39%), feeling too tired (44%) – or finding it too much effort to try out a new recipe mid-week (58%). For others, the convenience (56%), habit (38%), or because they are quick to make (41%) means they stick to the same meal multiple times a week. Of course, habits that have become ingrained, are always the most difficult to break.

Written by Marie Screene marie@shoppercentric.com

Firstly, let’s look at what we mean by “inspiration” Thrash and Elliot2 define inspiration as “A breathing in or infusion of some idea or purpose into the mind; the suggestion, awakening, or creation of a feeling or impulse, especially of an exalted kind.” Inspiration is all around us, it leads us to make choices about who we want to be, what we want to do and (of our particular interest) how we shop and what we consume. Retailers and manufacturers recognise the benefit of inspiring shoppers, and seek to achieve this. – Dr A.J Drenth2 states that inspiration is “among the more pleasurable and rewarding of human experiences. When inspiration hits, we feel alive and energized.” Therefore, creating positive experiences through food and meals, can be a sure way for retailers and manufacturers to excite consumers and shoppers.

So what options are out there to spice up your weekday meals?

A quick scroll on social media will provide shoppers with a dazzling range of recipes and easy to follow videos aimed at providing a quick inspiration hit. Celebrity chefs such as Gordon Ramsey and Jamie Oliver have their own accounts, which, when grouped with accounts such as OnlyScrans or Caught Snackin, provide a wide array of tips to the curious. Our latest WindowOn data reveals that 1 in 3 state they have sourced ideas for food/meals/cooking from social media: top of the list is YouTube (13%), followed closely by TikTok (11%) and Instagram (10%). This occurs more heavily among female shoppers and individuals with children, and it diminishes incrementally as respondents grow older, as one would expect.

Interestingly, despite all the options out there on social media, McCain’s research shows a third claim that despite watching numerous cooking videos on social media, they rarely actually try creating anything new themselves. Drenth2 states that “Inspiration can be fickle and fleeting, abandoning us just as quickly as it comes and leaving feelings of deflation and disappointment in its wake”. As excited as we may get about creating something new and different, when confronted with the effort required, our creative juices dry up. This could be because when using social media, we are simply copying what has already been created, rather than truly being innovative ourselves.

It’s not just recipes and food inspiration that our shoppers are using social media for: 15% claim to be using social media for shopping (both purchasing or inspiration), while 1 in 10 are keeping up to date with their favourite brands by following their social media accounts. 7% claim to be using social media for days out (again, both purchasing or inspiration).

Wave 4February 2022 (n=2011)

Wave 5December 2023 (n=2005)

I have had my shopping delivered to me by a Subsciption service eg. Hello Fresh, Riverford, Naked Wines, Themummyclub, Birchbox etc

Another source of possible inspiration are subscription services such as Hello Fresh. Our latest results show usage of these has grown significantly to 21% in the last 12 months. Users are significantly more likely to be male, ABC1, 18--34 and shoppers with kids. The services typically contain recipe cards to choose from, many not the norm or your typical weekly meal. Here in Witney, our local Sainsbury’s has had a radical makeover with the aim of providing more creativity and excitement to shopping. One change has been to offer Simply Cook boxes in-store, for recipes such as Chipotle Beef Chilli or Chicken Tinga Tacos, containing all the ingredients you need for a simple but different tasty meal. It’s the directness, simplicity and avoidance of the need for mindful effort that make options like this so appealing.

Sharing ideas with Family and Friends

Search engine

Eating out (Restaurants/Pubs etc)

Browsing websites

Social Media-YouTube

Experiencing new foods when socialising/ entertaining

Social Media-TikTok

Coupons/ discounts/ promotions (in newspapers etc)

Adverts on TV/radio/out and about (e.g.billboards)

Social Media-Instagram

Social Media-Facebook

Webstore/ online grocery retailer browsing

Webstore/ online grocery retailer recipe ideas

Our primary source of inspiration outside of stores remains friends and family, with a quarter citing them as a significant influence, closely followed by search engines like Google (19%). Since the advent of Covid-19, trends such as crafting homemade ‘fakeaways’ (readily accessible through a simple online search) have witnessed sustained growth.

According to research by Tesco3, UK shoppers are increasingly preparing international meals to economize and explore new flavours, with notable surges in Thai, Korean, and Japanese recipes (+15%), a significant uptick in Indian curries (+33%), and equally robust growth in Chinese meals (+32%).

‘Eating out’ is the third highest source of inspiration, at 19%. Demographically, younger people are much more likely to be seeking inspiration from beyond the confines of the store. Just 6% of individuals aged 18–24 claim they haven’t sought any inspiration outside the store, while this figure rises to 43% among those aged 65 and above. The older members of our sample seem firmly entrenched in their routines, seeing little reason for change.

So, how are retailers creating inspiration for shoppers in-store?

The primary strategy is leveraging price promotions, followed by on-pack messaging and counter displays. A local example is our revamped Sainsbury’s, where a notable emphasis on in-store communication is evident. Digital screens now showcase recipes and cooking ideas, while boards suggest complementary items and pairings. Communication via QR code communication is also offered, potentially directing shoppers to websites for recipe exploration and suggested combinations. However, it’s important to note that, presently, from our hours spent in-store observing and talking to shoppers there is limited evidence of shoppers actively engaging with QR codes in the UK. In addition, the unintentional Faraday cage effect in supermarkets, often constructed with metal frames, hinders mobile signals and consequently undermines the success of accessing links from scanned QR codes. QR codes in shopping is more common in countries such as US, Japan, India and China but a lot of this usage is around quick payment.

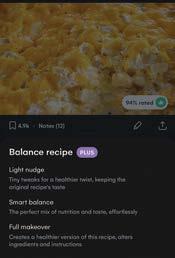

In previous inspiration articles we discussed Whisk, an app that had formed a partnership with Sainsbury’s, enabling users to save recipes and create smartphone lists. Utilizing AI, the app matched ingredients to available stock and facilitated online orders. Subsequently rebranded as Samsung Food4, Whisk introduced new innovations. During sign-up, users provide details about their diets, intolerances, and follow suggested food influencers.

The platform’s functionality is similar to its predecessor, allowing users to choose recipes and add them to their food planner. The selected ingredients are then seamlessly added to a basket, linking to Tesco, Sainsbury’s, Ocado, or Amazon Fresh for purchase in the UK. Recipes can be adjusted in scale based on the number of people being served. The Plus feature offers genuine creativity, permitting manual editing of existing recipes or utilising AI assistance with options like ‘Light nudge,’ ‘Smart balance,’ or ‘Full makeover’ based on desired adjustments. For instance, users can seek AI suggestions for transforming a meatbased dish into a vegan alternative or adapt a recipe based on available ingredients at home. Moreover, the app can be connected to a Samsung oven or fridge, allowing direct transmission of recipe cooking settings to the oven. This eliminates the need for manual oven preheating. Could this innovative solution be poised for widespread adoption, backed by the support of the Samsung brand? The capacity to modify and enhance existing recipes introduces a new – but importantly easy - dimension of creativity, potentially rejuvenating traditional mealtime routines. Maybe, just maybe, there’s a chance that the intelligent refrigerator tabled two decades ago [to supposedly end the need for going out to do grocery shopping by 2010] has finally found a context where it is relevant and aligns with consumers’ desire to enhance meals, injecting excitement into the routine of everyday dining.

As shoppers seek to infuse more excitement into their repetitive meals, we anticipate manufacturers will persist in fostering creativity to meet this demand. Building into existing habits, behaviours and desires, such as health will be key to facilitating inspiration. But, as always, helping the shopper manage time, money and cognitive load will help them incorporate new behaviours into existing routines and turbo charge the switch. Safe to say, we’ll be keeping a keen eye on this over the next 12 months.

References:

1 McCain Research - https://www.mirror.co.uk/ lifestyle/food-drink/food-cooking-dinner-mealsinspiration-31489994

2 Personality Junkie - https://personalityjunkie.com/08/ psychology-of-inspiration/

3 Tesco Adventurous Cooking - https://www.tescoplc. com/tesco-reveals-hot-new-trend-for-cookingadventurous-global-meals-at-home/

4 Samsung Food - https://samsungfood.com/

In our experience, most of our clients have excellent processes in place for the creation of brand, channel, Revenue Growth Management and customer strategies, which in turn, usually deliver great stand-alone functional strategies. Shopper strategies are now more frequently developed and meaningful corporate strategies against CSR and Environmental impacts are also increasingly evident.

The counterbalance to all this positivity though, is just how often we’re struck by the very individual functional nature of these strategies. Functional silos are still commonplace and company leadership teams often fail to connect their employees behind a consistently understood overall corporate strategy.

A major part of Quantic’s work is about creating this missing link and aligning clients’ functional strategies behind one vision for growth. We do this through the development of Category Growth Strategies. Quantic believe that these represent the best single opportunity to connect a total organisation behind a clear vision for growth that everybody owns. Ours have always connected consumer, shopper and customer agendas and increasingly, they connect to RGM, CSR and Environmental strategies too.

In this article, we will look to provide some practical advice on how to join the dots and connect functional strategies. We will provide some evidence statements against which you can judge how connected your plans currently are. They also will allow you a base to assess any agencies you might be looking at to source the insights and advice needed to assist in their creation and deployment across the full Category Growth Strategy journey, from insights to strategy to deployment.

Quantic’s core belief is that ‘connected organisations perform better’. But what does this actually mean? What does a connected company actually look and feel like?

We believe that connections start internally within a business, before it goes out to market and establishes strong customer connections. A connected organisation is one which can clearly

articulate where growth is predicted to come from and then one which aligns all its functional strategies behind delivering it. We believe that sustained, responsible profitable growth is an outcome and responsibility of all functions connecting behind a shared ambition and strategy. Let’s look at the implications and evidence statements across all functions typically involved in the creation and deployment of Category Growth Strategies:

Perhaps surprisingly in this Shopper-based magazine, we advocate that the best Category Growth Strategies always start with the Consumer. This is for the simple reason that shoppers only ever shop to fulfil the needs of consumers. All too often, corporate investment in Sustainability is under-valued and under-leveraged commercially. The most successful are those:

l Whose Marketing function understand and believe that it plays a crucial role against category development. Category is a multifunctional responsibility spanning pre and instore/points of decision, to include eCommerce

l Whose research draws upon the most contemporary understanding of behavioural science and its role in identifying the motivations of choice

l Who have the clearest understanding of all the consumer needs which are the very reason for the category’s existence

l Whose insights have created clearly differentiated consumer typologies based on attitude and not just simple demographics

Quantic’s multi-functional approach to activation along the entire customer shopper journey

Brand Building Consumer Mental Availability

Shopper Mental Availability

Shopper Conversion Physical Availability

Awareness

Consideration

Occasion & Mission Relevance Find & Engage

Select & Purchase

l Whose insights have helped create a framework of Category Growth Drivers which identify the behaviour changes required, against each typology. These Drivers are quantified and prioritised and calculated values are attributed to category product segments and channels

l Whose portfolio is assessed and allocated against each Category Growth Driver, meaning brands target different priorities and that the I&R process targets valuable, relevant gaps

l Whose brand plans can be clearly and consistently aligned to the most appropriate Driver and each respective targeted behaviour change

l Whose packaging designs have been proven to be the most effective for stand-out and conversion

l Whose Sustainability and Environmental policies are elevated beyond enabler status and sit alongside other Marketing-led Drivers of future growth

l Whose sustainable brand impact is authentically and actively expressed in consumer propositions, mixes and activations

I&R (product, brand, format)

Communication (focused on driving penetration)

Shopper Marketing (link to occasions/needs & missions)

Navigation (optimise range and merchandising)

Availability (optimise promos, layout, secondary sites, signage in context of all above)

In a connected company, targeted consumer behaviour-changing strategies are consistently front of mind and are activated through all of the category management, shopper marketing, RGM, NPD introduction and channel strategy work developed by this essential function.

The most successful are those:

l Who can translate Marketing’s targeted typologies into clear shopper targets

l Whose shopper research identifies how these shopper targets make decisions and how this differs across all relevant purchase environments

l Whose activation plans by channel are based on shopper mission understanding

l Whose shopper marketing campaigns are differentiated by channel depending on who the targeted shopper is, what their purchase expectations and motivations are by channel, how open or closed is their purchase decision and how they make decisions across different missions

l Whose NPD introduction work is always clearly contextualised by the Driver being activated

l Whose POP vision is one which maximises the key growth opportunities within the Category Strategy i.e.

range work is based on the predicted future segment growth, gained through the alignment of a quantified Drivers to channel and segments merchandising recommendations are designed to specifically maximise the priority Category Growth Drivers identified as priorities by channel

l Which uses the most effective Category Management software tools to help make the complex, simple and bring to life POP scenarios via convincing in-store environment visuals

l Whose portfolio promotional plans by product segment clearly align behind the behaviour change identified for the brands in the segments relating to each Driver

In organisations where there is a stand-alone RGM function, it often tends to report directly to a Finance, or at best, a Sales-Finance department. The very detailed analytical requirements of this role demand a forensic understanding of costs, margins and mix. Often though, RGM decisions are made in the absence of understanding a category strategy and can sometimes contradict it.

The most successful are those:

l Who use the category growth strategy, and the consumer/shopper insights that underpin it, to drive decisions on packs, formats, pricing and promotion strategies

l Where RGM decisions are made with the full backing of brand, channel and category managers, alongside Finance

l Who can demonstrate to customers a set of RGM recommendations that drive category value and grow the joint profit pool

It is imperative that customer-facing teams are fully immersed in the Category Growth Strategy so they can fully leverage the benefits it brings.

The most successful are those:

l Whose sales teams understand the category growth strategy and how it applies to the channels and customers they serve

l Who can prioritise which Drivers represent the biggest opportunity for their customers and are clear how to activate against them using shopper insights

l Who build medium-term joint value-creating business plans with their key customers, consistently using Drivers as the overall context

l Who develop Terms which reward progress against a jointly aligned growth strategy

l Who inspire customer commitment not just by demonstrating financial potentials, but by visualising in-store environments using the latest software packages

l Who consistently use the relevant Driver to contextualise business development conversations and NPD introductions

l Who can identify joint sustainability and environmental category initiatives that connect to both organisations’ priorities in an authentic way

Lots of implications and evidence statements!

How do you stack up against them? How’s your category strategy, supporting insights and category management deployment tools?

Quantic is an independent consultancy, based in the UK but working internationally across a mix of globally recognised brands and local jewels to find and deliver responsible, profitable growth.

Across our Strategy and Capability offers, we equip our clients to out-think, out-sell and outperform their competition.

For any follow up, please contact:

Karen Findlaykarenf@thequanticgroup.com

Duncan MacConnol

duncan@thequanticgroup.com

In the UK, the number of disabled individuals exceeds 16 million, with one in ten children facing disabilities1. These are undeniable statistics. It is quite likely that either we ourselves are disabled or have acquaintances who are. Despite living in a world that upholds the values of diversity and inclusion, it seems that disability concerns are just beginning to receive due consideration in decision-making processes. This goes beyond mere representation; it involves comprehensive engagement from both grassroots and leadership levels - actively seeking, listening, comprehending, incorporating, and responding to the frequently unheard voices.

Coping with a disability entails numerous challenges that extend beyond the disability itself. Our recent research reveals that individuals with disabilities have had to implement more financial adjustments to navigate economic pressures compared to those without disabilities. Moreover, the affected numbers are on the rise. Amongst disabled shoppers, 48% are ‘Strong reactors’ to financial pressures, making major changes to their household spending or struggling to pay their bills; this is an increase from 45% in 2022 and

The average extra spend for a household containing someone with a disability.

compares to just 35% with no disability. Add to this a reduction in employment levels. Only 49% of our disability sample are currently working, a significant drop from 56% in 2022. And then factor in Scope’s assessment that it costs disabled households an extra £975 extra a month (rising to £1,122 with inflation) to achieve the same standard of living as a non-disabled household. This has increased by a whopping £375 since 2022.2

Considering these financial strains, it is unsurprising that individuals with disabilities may experience heightened distress or anxiety regarding their current circumstances, in contrast to those without disabilities. Among shoppers with disabilities, 43% express feeling extremely or very anxious/distressed, while the corresponding figure for those without disabilities is 24%. But it is not financial pressures alone that creates anxiety. This sits in the wider context of perceived social exclusion - whether intended exclusion or a failure of society to work better to facilitate full inclusion. Scope report that 72% of disabled people experienced negative attitudes or behaviour in the last 5 years, with 87% of these saying it had a negative effect on their daily lives. Importantly, the key frustration, with one third of responses, was people making assumptions or judging their capabilities. A further quarter of the sample reported accusations of fakery with regards to their disability.2 This paints a bleak picture and a serious need to understand how social barriers can be broken down to make life more accessible - financially, socially, emotionally and physically.

If we drill down to the shopping experience, we can start by understanding the broader picture for disabled shoppers and understand how the current marketplace may be disadvantaging them. For example, as discussed in our earlier article, we know shoppers generally are visiting more stores to search out the best deals and promotions. Whilst a solution for many, this isn’t so easy if you have a disability or find shopping distressing.

Grocery shopping makes me anxious if the store is unfamiliar.

“Many disabled people and seniors can’t make multiple bargain-shopping trips,” writes Dorothy Ellen Palmer3. “We can’t travel to independent grocery stores. Grocery delivery isn’t an occasional luxury. It’s our only choice.” This sentiment is reflected in our data which shows disabled shoppers have a different shopping pattern.

l An increased focus on regular larger shops

This can limit range exploration (and social interaction). 39% of disabled shoppers sticking to large regular shopping trips vs 30% without a disability.

l Less ‘access’ to promotions, likely a result of this reduced market interaction.

61% of disabled shoppers say there aren’t as many promotions around anymore vs 51% of our sample without a disability. Unfortunately, those that need the promotions the most are not being able to make use of the deals that are out there in-store.

l Greater use of online shopping.

63% of disabled shoppers vs 51% of those without a disability shopped online and received their goods via delivery in the last month and 24% say almost all of the household’s shopping is done online (significantly higher than 17% in 2022).

l An increased importance of subscription services.

48% of disabled shoppers see this as significantly important shopping option, up from 35% in 2022, and compared to 37% with no disability this time around.

The question is, what can change to make shopping more accessible? When we ask disabled shoppers, they can easily shine a light on what makes a real difference to their whole experience. Inevitably these changes will benefit everyone, including commercial outcomes. Quickfire Digital, an e-commerce agency found that 55% of UK consumers have discarded a purchase due to accessibility issues (either online or in-store)4 Purple Tuesday state that 70% of disabled people will NOT return to a business after receiving poor customer service.1

So, what is important in-store to those with a disability? Ultimately, the same things that are important to all shoppers, but just more so, namely a straightforward, navigable and enjoyable shopper experience. Key significant differences include an increased desire for;

l wide aisles (76%)

l good customer service (72%)

l adequate toilet facilities (65%)

l reduced background noise (55%)

l choices of trolleys (54%)

l in-store quiet hours (35%)

The online journey isn’t necessarily any simpler. Challenges for disabled shoppers include; finding the design journey illogical/ confusing checkout process (17%), having troubles with the fonts, text and colours (16%) and a lack of audible information (9%).4 Ahead of this though is access to delivery slots. Our research reveals that just under a third of our disabled shoppers failed to successfully complete an online shop because there were either no slots available, or no slots that suited them. When we talk to disabled online shoppers, they often positively reference the priority slots issued during Covid-19 lockdowns and would love that option to return. Building on this, it is not just

the website accessibility, it’s the final touchpoint that can make the real difference. Helpful delivery drivers are crucial with 74% of disabled shoppers stating their importance. Ultimately, a better online shopping experience is about improving the simplicity of the user experience, at all points of the journey; a desire of all shoppers – but more important if you have a disability.

Change is happening and we can see a range of great, positive initiatives being introduced that address disability issues. At the beginning of 2024, Primark launched an adaptive lingerie collection designed with, and for, people with disabilities5 Most retailers and manufacturers now have disability forums that can report into the board. This is important for workers, but also essential in building understanding and ensuring the disabled voice is not just checked in with every now and

1 Purple Tuesday: purpletuesday.co

2 Scope: www.scope.org.uk/campaigns/extra-costs/ disability-price-tag-2023/ & www.scope.org.uk/media/ disability-facts-figures

3 Broadview: broadview.org/disability-tax-groceryshopping

4 Retail Insight Network / Quickfire Digital: www.retail-insight-network.com/news/disabledconsumers-accessibility-online-retailers

then, but is part of the whole conversation, all the time. Within these companies it means change can be led by the workforce, with support coming right from the top. These will benefit the customers as overall disability confidence grows.

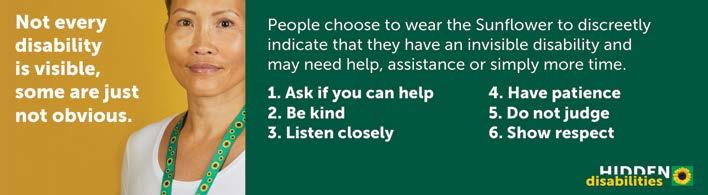

Certainly, there are numerous straightforward ways to enhance the shopping experience for both disabled individuals and all shoppers. It doesn’t necessarily require new technologies, store modifications, or additional features, although these can be beneficial if implemented correctly. The recurring priority emphasized is the pivotal role of staff and the overall customer service experience. According to the Hidden Disabilities organization, the key lies in providing time, care, patience, and understanding – essentially, being a compassionate human. Achieving this can significantly contribute to the removal of barriers.6

5 The Retail Bulletin / Primark: www.theretailbulletin. com/fashion/primark-launches-affordable-andinclusive-adaptive-collection-to-serve-disabledshoppers-21-01-2024

6 Hidden Disabilities: hdsunflower.com

Katy Talikowska CEO, The Valuable 500

Katy Talikowska CEO, The Valuable 500

Disability affects 1 in 5 people globally, yet the business world often falls too short when it comes to understanding, representing, and accommodating the disabled community. Bringing together more than 500 committed companies spanning various sectors, the Valuable 500 seeks to dismantle systemic barriers to disability and inclusion and pave the way for a future where every facet of society is more representative and inclusive of people with disabilities, starting with business.

Our approach is grounded in the concept of Synchronised Collective Action: we believe that a collective and coordinated effort is more likely to achieve positive outcomes than isolated or fragmented actions. That’s why we’re encouraging our companies and partners to work in harmony to tackle three systemic barriers to disability inclusion in the business landscape: leadership, reporting, and representation.

When it comes to representation, our recent survey of over 1000 disabled consumers paints a sobering picture, with over 50% of disabled people facing barriers to accessing products and content, and a mere 2% feeling accurately portrayed in media and marketing. This oversight not only limits access to products and services for disabled individuals, it also hinders businesses from tapping into the loyalty and purchasing power that an accurately represented and engaged disabled consumer base can bring to businesses.

In the consumer landscape, disabled people frequently face obstacles that impede their ability to make informed choices and fully participate in the market. Our white paper ‘Nothing About Us Without Us‘ makes the case for businesses to weave authentic and inclusive disability representation seamlessly throughout the consumer journey, from media and marketing to product design and retail spaces. No one of these components exists within a vacuum: we know that disabled consumers naturally gravitate towards brands that understand their needs and reflect their experiences, and campaigns highlighting accessibility through lived experiences hold disruptive power.

But change cannot happen without input from the disability community itself. Truly inclusive efforts centre the intersectionality of lived experience within the disability community. This not only means telling diverse stories, but also ensuring that disability representation is embedded into the fabric of an organisation. Crucially, workforces need to represent and reflect the consumer base, and disabled employees must be recruited, supported, and given opportunities to progress at all levels.

While boosting disability workforce representation is key, data remains scarce. The Valuable 500’s Self-ID Resource Guide provides recommendations for businesses to advance disability self-identification and answer the question that underpins one of the most integral KIPs for advancing disability inclusion: “What percentage of the company’s workforce identifies as disabled / living with a disability?” Developed in collaboration with our iconic partners Google and Deloitte, this resource makes the case for moving beyond a singular focus on disability inclusion as a DEI construct and towards operationalising disability inclusion as everyday practice.

By harnessing the power of the many and embracing the transformative potential of Synchronised Collective Action, our companies and partners are now beginning to unlock the myriad benefits of disability inclusion for businesses and consumers alike. The time to tap this potential and make disability inclusion ‘business as usual’ is now.

We are the global partnership of 500 companies working together to end disability exclusion. For more information, please visit our website: www.thevaluable500.com or contact - info@thevaluable500.com

In recent years, sustainability has been a siren call for consumers, retailers, and manufacturers. However, as the cost of living crisis has bitten deep, we observe its impact on the sustainable and ethical behaviours of consumers in the UK.

Pre-Covid-19 the world was a very different place from today. Each year witnessed a growth in sustainable shopping behaviours and ethical practices, including the preference for local or UK-produced goods and groceries. However, when the pandemic struck, survival modes took over as shoppers shifted their focus to securing the essential items. Ethical and environmental concerns – and, for some, common decency –were often set aside. It’s rumoured that some people still haven’t got through their stocks of toilet paper!

In our work within the leisure and charity sectors we often observe similar ‘set aside’ behaviour when we go on holiday. Moral and environmental considerations are left at the airport as we fly out to take rides on elephants, pet lion cubs and cuddle sloths.

Following the pandemic, we saw a gradual resurgence in shoppers’ ethical and environmental behaviours, until recently. Our nationally representative survey of over 2,000 UK shoppers, shows a notable decline in most sustainability measures compared with last year’s 2022 edition,

with some metrics even falling below the levels observed during the Covid lockdown. Purchasing imperfect or wonky fruits and vegetables, opting for products with minimal packaging, choosing items with recyclable packaging, and avoiding single-use plastic have all seen significant decreases over the last 12 months. Moreover, the act of buying local has dropped even below the levels observed during the Covid lockdown. This shift is significantly stronger among those most financially affected by inflation and the cost of living crisis: 18–44 year olds, and those with children.

Wave

This decline in sustainability actions creates cognitive dissonance for some: while overall our shoppers express a slightly higher level of contentment with the actions they take, (especially among those with children), on the other hand just over a quarter of our sample (rising to 35% among 18–24-year-olds) tell us they are extremely or very anxious about the environment. So, what is driving this apparent contradiction?

In simple terms, much like during the Covid lockdown, we’ve gone back to survival mode. The primary focus for shoppers, particularly those most financially impacted, has been getting the products we need at the lowest cost possible. Sustainable / ethical considerations are de-prioritised as more immediate concerns take precedence over those that will have future implications. The environment is now our 4th ranked worry/anxiety behind concerns about increasing rates/bills, rising unemployment, and the Israel/Palestine situation.

Rising rates/bills (e.g. energy)

I make food and drinks myself to avoid plastic (i.e. making my own coffee, smoothies or bread etc.)

The situation with Israel/Palestine

The environment (Global warming/extreme weather events)

The political situation here

The situation with Ukraine/Russia

Immigration

Kantar’s1 research revealed, for the first time in four years, a decline in “Eco-Actives” - shoppers who are highly concerned about the environment and are actively taking steps. For almost half their sample, acting sustainably has become more challenging due to social or financial constraints.

As we discuss in a previous article, a clear divide has emerged: younger respondents and those with families are facing greater financial challenges and consciously sustainable shopping has been affected, while older groups aged 55+ are less economically affected and continue as usual.

Where we do see an uptick in sustainable behaviours is when it coincides with practices that offer financial benefits. There has been a substantial increase in self-preparation of food and drinks, like smoothies or coffees, to reduce plastic usage. Buying dry products in bulk and utilising specific appliances, such as air fryers, have all witnessed significant growth compared to 2022, though likely not motivated solely by environmental concerns.

I use certain appliances/ services to be more sustainable (i.e. Sodastream, bread maker or air fryer etc.)

Our research suggests a cost-of-living crisis could trigger a surge in sustainable behaviour as these two aspects often go hand in hand. The opportunity to reduce expense by minimising waste (which has slightly increased over the last 3 years), making more conscious purchasing decisions, resisting temptations (higher than 2022 levels due to Covid), and getting creative with available resources to craft cost-effective meals can collectively have a positive environmental impact. Examples like the Witney Food Revolution showcase that food options exist which not only contribute to waste reduction but also offer affordable or sometimes even free solutions. In this light, it’s interesting to observe UK meat consumption is at its lowest level since records began in 1975, with a 14%2 decline since 2012 driven by cost-of-living crisis and lifestyle changes. Given what we know of the huge environmental impact of meat production, this often crisis driven behaviour is also an environmentally friendly one.

Exploring the theme of inspiration, we delved into the Samsung Food app. Beyond assisting consumers in preparing inventive meals, the app enables the creation of recipes based on existing stock and precise recipe upscaling - features designed to help consumers save money and foster sustainability by minimising wastage.

Whilst times have been financially strained, there has been a slight uptick in the emphasis on the government’s role and accountability for environmental protection and sustainability, especially among those in our sample aged below 35. When examining the concept of sustainable shopping behaviours, the under-35 age group is notably less inclined to view most measures as sustainable actions. Is there now a growing awareness within this group that, without intervention from both the government and manufacturers, individual efforts alone may not suffice?

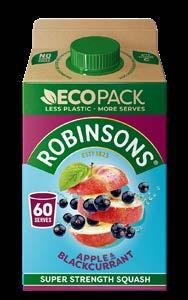

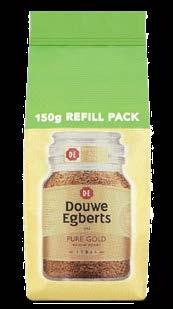

Certainly, a significant amount of behind-thescenes efforts by manufacturers may go unnoticed by shoppers. The responsibility has shifted to suppliers to enhance packaging without increasing costs for consumers. In our observations, we’ve noticed the introduction of smaller packs, not due to shrinkflation, in products like cereals and crisps. For instance, Walkers has transitioned to a

References:

1 Kantar - www.kantar.com/inspiration/sustainability /cost-of-living-crisis-dents-eco-shopping-habits

paper version for its Baked crisps multipacks. Refill options have expanded, including hand soaps, cleaning products, and coffee pouches.

Despite some consumer resistance to refills, often due to a perceived lack of value, assessing these products within a purchase context can be challenging, especially when other items are on promotion. Transitioning from mixed materials packaging requires substantial efforts from a manufacturing standpoint, as seen in Pringles’ recent release of their new ‘can,’ involving significant investment and planning to bring a product to the shelf. While there is considerable activity in this regard, shoppers may not necessarily be aware of the changes or realize that they are making environmentally conscious choices, given the product substitutions occurring.

Looking ahead, after the pandemic, there was a resurgence in proactive sustainable choices. It is probable that this trend will re-emerge as the cost-of-living crisis alleviates. The inclination to embrace sustainability and environmental friendliness we hypothesise is undiminished; it has merely been temporarily set aside as priorities shifted. Some shoppers may not realize they are already taking positive steps. Shoppers and consumers frugal behaviours, focused on moneysaving, might be subconsciously moulding their environmental choices.

2 Guardian - www.theguardian.com /environment/2023/oct/24/

Not only has the retail landscape nudged in a digital direction, but also the realm of market research has also undergone a substantial digital transformation. Behavioural Economics has long emphasised the significance of factors like question sequencing, phrasing, and length in influencing outcomes. It advises against making assumptions, stressing the importance of understanding, interpretation, and values. Famously introducing the dichotomy of System 1/ System 2 thinking, it discourages the use of direct questions.

Additionally, it has introduced challenging concepts like Framing, Priming, Choice Architecture, Heuristics, Change Blindness, and Context, further complicating the development of reliable research processes. While these concerns and complexities have been acknowledged, implementing solutions will be a time-consuming process. Clients have been dependent on specific data types within their organisations for an extended period, fostering confidence in commercial decision-making, whether founded or unfounded.

Our OptimEyesTM tool employs behavioural measures closely mirroring neurological responses. Neurological responses are involuntary, operating beyond an individual’s conscious control, and have been validated as reliable predictors of behaviour. It’s widely recognized that humans initiate actions before becoming consciously aware of their intentions; neuroactivity precedes conscious events or activities. When the body reacts to a stimulus, the conscious mind catches up, providing interpretation and meaning to the action. Traditional market research interventions have typically focused on conscious thought, overlooking the crucial moment when actions commence. With OptimEyesTM, we can precisely measure this initial neurological response, conveniently capturing it at the respondent’s discretion.

Primarily, within our context, neurological response manifests as fixations (when the eye pauses on an object/image for at least 60 milliseconds) and core micro-emotional responses (lasting less than 500 milliseconds). There are seven universal core emotions expressed in the same manner irrespective of nationality, ethnicity, or race. By instructing respondents to simply observe an idea, an image, a brand, a website, or anything displayable on a computer screen, we gauge these factors. This evaluation takes place conveniently in the respondent’s home or a central location.

64% of consumers try a new product because of the packaging but 60-80% of new products fail within their first year, packaging issues were a contributing factor in many of these failures.

From this data, we can provide you with insights such as:

l How they feel about what they are seeing (focusing on positive emotions)

l How engaged they are with it

l Areas/ parts of the creative that attract the most attention

l Which parts are the more / less engaging

l The order all elements are processed

Which, in turn, enables us to give insight and direction starting at a broad, multiple design level through to granular exploration of single designs and how they can be optimised:

l What works and doesn’t (elements, themes, colours, images etc.)

l Where to change things, and in what way

l Which routes are the best to take

l Relative potential performance levels

Additional questions can be tabled, chiefly to add context and insight to the results. We know, for example, that well-known brands can be accounted for in parafoveal vision: knowing that the brand might receive relatively few fixations is therefore not a big issue, but it can be reassuring to check brand recall (for example) more directly.

There is competition in this area from AI, last years ‘new thing’. AI has been around for years but is now firmly part of our industry’s armoury. In this context, AI absolutely has its place as a super-quick, cost-effective screening/sorting tool, but we are a long way from replacing the need for human subjects. While AI provides data, the human element remains pivotal in interpreting this data within the context of real-world business challenges. The capability to comprehend the intricacies of market dynamics and harmonise them with business objectives is a uniquely human skill.

Written by Jon Darby jon@shoppercentric.com

If you would like to find out more, please drop a note to optimeyes@shoppercentric.com

For years, there has been a desire to delve deeply into the realm of social media, and now, here we find ourselves. The landscape of social media networks has evolved significantly since the inception of the first recognisable site, Six Degrees, back in 1997. Over time, we’ve witnessed the ascent and descent of platforms like Myspace, bid farewell to Bebo, Friendster, Vine, Periscope, Friends Reunited, and more. We’ve observed the emergence of Instagram, TikTok, and Snapchat, and even experienced a complete rebranding when Elon Musk transformed Twitter into X. For many individuals throughout the country, checking their preferred social media platform is a daily ritual, but what is the true cost?

Before delving into the potential consequences, let’s review the current landscape of social media platforms and user preferences. This information is based on both a quantitative sample of those who have at least partial responsibility for shopping in the household and 15 qualitative interviews. At the forefront of the platforms is WhatsApp, with just under two-thirds of users engaging with Meta’s messaging powerhouse. Following closely are Facebook with 61%, YouTube with 54%, Instagram with 44%, and Facebook Messenger with 43%. The platforms used most often tend to track with overall usership.

longevity and the accumulation of memories and photos as users have grown with the platform are the only reasons for keeping it. However, Facebook’s strength appears to persist in a localised context, facilitating easy exploration of local events, and its Marketplace functionality has proven particularly popular.

While overall usage statistics provide valuable insights, a deeper understanding emerges when examining the demographic specifics of platform usage. Given WhatsApp’s nature, its resilience across age groups is expected, reaching its peak among 35-44-year-olds before gradually declining in older age groups. Facebook’s user base follows a similar trajectory, peaking among those aged 35-44 and 45-54. Instagram, TikTok, and Snapchat show robust usage among younger cohorts in our sample, with Snapchat experiencing a notable decline in user engagement after the age of 24.

It is evident that social media plays a crucial role in the lives of young adults, as all participants in the 18-24 age group from our WindowOn 2023 survey acknowledged using some form of social media. A significant portion of these individuals mentioned using multiple social media platforms, averaging just under six each. Although many rely on social media to nurture their social connections and cope with stress, loneliness, and anxiety, our data indicates that it is not devoid of adverse effects, particularly on mental well-being.

Focusing specifically on Facebook, although many users still maintain accounts, it no longer holds the same level of priority. In some instances, its

Figure 2 – Usership of social media platforms by age group.

Examining the primary platform used by age reveals distinct patterns. Facebook’s popularity increases with the age of the respondent, aligning with a longstanding trend where teenagers and the younger generation gravitate toward platforms like TikTok and Snapchat. Conversely, older generations embrace Facebook, potentially as late adopters or to stay connected with and monitor their children and grandchildren.

Figure 3 – Most often used social media platform by age.

According to our WindowOn data, individuals who heavily use social media are considerably more prone to experiencing extreme or very high levels of anxiety and distress about their current circumstances. Our findings indicate that anxiety levels related to loneliness and isolation are notably elevated among young adults, with 35% reporting feelings of loneliness. In a world where connectivity is more pervasive than ever, the question arises: Why is this the case?

Facebook Facebook Messenger

Snapchat

TikTok

Twitter/X

YouTube

When questioned about their motivation for using social media, nearly two-thirds of individuals aged 55 and above mention using it for communication and staying updated about friends or family, a percentage significantly higher than that of the 1834 age group. Female respondents are noticeably more inclined to use platforms for this purpose. Conversely, the primary reason for our younger respondents (44 and below) is entertainment and leisure. Additionally, the younger cohorts are significantly more active on social media, engaging in posting and sharing of images and videos, rather than merely consuming content.

Could the reliance on social media as a primary communication tool somehow hinder both the maintenance and establishment of relationships, ultimately contributing to heightened levels of isolation and loneliness?

An apparent ‘Internet Paradox’ 1 seems to be at play, where increased access to social media correlates with a decline in social well-being for many. The reason behind this phenomenon lies in our online communications, which often lack the meaningful and intricate aspects of face-toface interactions. This deficiency in fulfilling online interactions may be contributing to a heightened risk of loneliness among young adults.

I feel like you are not really connecting properly when doing it through a phone, you get a different feeling when talking to people face to face. Female, 17

Are face-to-face conversations being replaced by direct messages on Instagram or WhatsApp? It’s plausible that the lingering effects of Covid-19 lockdowns have played a role, with in-person meetups struggling to fully recover. Interestingly, during lockdowns, the positive aspects of social media use emerged, allowing the population to stay connected with friends and family, engage in activities, and socialise from the comfort of their homes.

A mental health crisis is evidently gripping the nation, with social media squarely under scrutiny. The prolonged exposure to others’ experiences of socialising with friends and family can trigger the dreaded “FOMO” (fear of missing out), heightening feelings of loneliness and, at times, jealousy. According to research by the New York Times, social media is undergoing a shift towards being less social.2 The once easily accessible posts about daily life from family and friends have become harder to find, now overshadowed by advertisements, branded content, influencer posts, and sensationalised or fake news. Insights from our interviews align with this trend, indicating that social media has become more passive, with only a dedicated few consistently posting.

Very little origination of content at all. 10 years ago, I was all over it, the life and soul etc – can’t be bothered nowadays.

Male, 50s

The era where the majority shared every aspect of their lives has dwindled, replaced by either infrequent postings or updates limited to significant milestones or holidays. Consequently, the focus has shifted to mindlessly scrolling through a plethora of content of little to no personal interest, contributing to a change in perspectives due to exposure to fake or sensationalised media.

TikTok or Instagram-watching some content for entertainment- dangerous before bed as I can spend hours watching the random stuff on there! Female, 24

What came through talking to real users was the addictiveness of these platforms. Some, while describing themselves as ‘low’ users, were still spending hours per day across social media. Social media is a wormhole – where hours can be lost, with nothing really taken in or enjoyed particularly. On a recent episode of the Diary of a CEO Podcast, Dr Aditi Nerurkar, a specialist in stress and resilience, shared that the average person checks their phone 2,617 times a day.3 There is a lack of boundaries for a lot of the population with regards to their phones - 62% reportedly check their phone within 15 minutes of waking up and 50% are also checking their phone during the night. Dr Nerurkar also talks about the concept of ‘Popcorn Brain’, an idea originally coined by David Levy.3 The theory states that our brains no longer get a moment to rest, slight breaks and time to think such as sitting on a train or standing in a queue have been replaced with a scroll through our phones. Everything now reverts to the phone with a quick hit of stimulation creating a “popping” affect in our brain’s circuitry because of information overload. This process explains the addictiveness and difficulty in disconnecting from our phones.

Life for young people is so much harder than it was for my generation. There is no escape. Kids are continuously bullied; they have no hiding place. Public humiliation is rife. They feel the need to conform to whatever they ‘consume’ – I believe this has had a huge impact on the mental health of a large proportion of young people! Male, 50s

Little surprise then that the social pressures that have built up, particularly for young people, because of social media being so hard to get away from – the pressures on how to look or act a certain way, to be seen to be popular are not going to go away without that disconnect.

So, what about brands and retailers?

Companies such as Aldi and Ryanair are notable examples of entertaining use of social media, they are always on-hand sharing and commenting on the latest trending topics with their own twist.

Aldi were even able to use the relatively negative situation of the Colin the Caterpillar copyright issue to build publicity, and show a sense of humour, in turn humanising the company. Our WindowOn data pointed to Tesco having the most memorable social presence, followed by Asda, M&S and Aldi.

Despite saying they (social media ads) are white noise, I have engaged with brands following an ad, made bookings with venues and purchased products and services where social media was my first awareness touchpoint. Female, 37

The latest insights from our WindowOn data highlights a clear connection between the extent of social media engagement and purchasing behaviour. When categorising our sample into non-users/ limited interaction, moderate social media users, and heavy users, we observe a consistent rise in various online shopping indicators as social media usage intensifies. Specifically, heavy social media users exhibit a notably higher likelihood of ordering household goods online for delivery or collection, subscribing to services, receiving direct brand deliveries, and utilising fast delivery options like Tesco Whoosh. Furthermore, this segment of heavy social media users is significantly more inclined to conduct a larger portion of their household shopping online. These findings emphasise the link between social media usage, shopping preferences across channels, and age, noting the increasing demand for seamlessly connected online and offline experiences - a trend that is likely to be crucial for catering to the preferences of the upcoming generation of shoppers - newbie ‘supermarket’ shoppers will demand it!

Ordered groceries / household products online for delivery

Ordered groceries / household products online for collection

Had shopping delivered by a Fast Grocery Delivery

Had shopping delivered by a Subscription service

Received a delivery direct from a brand/manufacturer

Low/ No social media usage (n=629)

Medium social media usage (n=929)

Heavy social media usage (n=447)

Amidst the prevalent negativity in the social media sphere, there lie opportunities for brands and retailers to spread joy, positivity, and inspiration, distinguishing themselves from the crowd. In this dynamic landscape, it is crucial to grasp the platforms on the rise and comprehend the demographics utilising each platform and their respective purposes.

But let us always remember that at times, it is okay to step away from social media. While listening to the Diary of a CEO podcast over the weekend, a line retold by Arthur C Brooks from his colleague, Harvard psychology professor Dr. Ellen Langer, resonated with us and therefore we’ll leave it with you: “Mindfulness is best practiced if you’re sitting on a train by putting down your phone, putting your hands on your lap and looking out the window.” 4

1 Kraut, R., Patterson, M., Lundmark, V., Kiesler, S., Mukophadhyay, T., & Scherlis, W. (1998). Internet paradox: A social technology that reduces social involvement and psychological well-being. American psychologist, 53(9), 1017.

2 The New York Times - www.nytimes.com/2023/04/19/ technology/personaltech/tiktok-twitter-facebook-social.html

3 Dairy of a CEO Podcast – Dr Aditi Nerurkarwww.youtube.com/watch?v=FN0_ow76hU8

4 Dairy of a CEO Podcast – Arthur Brooks/ Dr. Ellen Langer - www.youtube.com/watch?v=qRY-foz-ZAw

Real

I like to plan my meals ahead. It’s easier then after work, I know what I’m cooking each evening.

I can’t afford to be environmentally friendly like I used to. We don’t even do a ‘chippy’ tea now.

When you get older you like things calm and simple, you don’t want surprises.

I have a routine when I’m coming in to shop. I know exactly what I’m picking up. But now I stop and look, there is so much I’ve seen today that I’ve not seen before.

Once I’ve done my shopping the last thing I want to do is make myself some lunch.

Now we have kids, we just don’t eat or cook in the same way as before. It’s all a bit routine. I’m not sure I’d realised how much we’d changed.

You’ve got to be careful when buying for kids. And what’s worse, their tastes keep changing.

Going shopping (in-store) means I get out and have to walk. Which is good. But everyone else moves faster than me, and it’s tiring and stressful.

When you’re just putting stuff in your trolley, you think it’s not going to be that much, and then you get to the till. This is the decade for accessibility and inclusivity, much like the environmental agenda in the 90s.

I wish I liked the cheaper own brand ones, but I just don’t.

I do not do grocery shopping online as you get poor use by dates. Going to the store is much improved with scan and go.

I’d love my partner to be involved more because drafting the list of what I/we need can be very hectic sometimes.

Sometimes the replacements I’m given are not suitable replacements (ordered gluten-free food but the replacement has been something I am allergic to).

My dad cooks with love and it tastes better for it, but for me, cooking is a chore.

We love food, we don’t drink, don’t smoke so we want to enjoy our food and spend what we like.

What on earth does Natural Ingredient mean? How is that different from 100% natural? What am I meant to do with that information?

Sometimes you need a math’s degree to work out which is the best value.

Imagine if you could make up your own bag of crisps – like a pick n mix. Then you wouldn’t always have that one flavour left over.

I use Price Runner for my favourite brands then go and stock up - my wife calls the garage my tuck shop.

We thought we’d let our clients have the last word by telling you what they think of us...

One of the best creds decks I’ve ever seen.

Innovation Insight Manager – Restaurant Chain

I feel this is exactly the sort of insight we have needed for a long time - so really great stuff.

Brand Manager - Manufacturer

We were seeking an agile, in-context pack testing solution to help us move quickly and confidently to launch and found Shoppercentric. The pack testing service that they provide is always rapid, with great diagnostics enabling in market success.

NPD Director - Manufacturer

Thanks so much for the invitation, very insightful.

Brand Manager – Manufacturer

Thank you for sharing this amazing piece of work and lots of food for thoughts!

Brand Manager – Manufacturer

We think you’re an elite team!... there it’s been said. You have it in writing!

Insights Controller - Manufacturer

A huge thank you to the full team for carrying out these conversations (focus groups). I’ve heard a lot of enthusiasm from everyone who has had a chance to join live or watch recordings, so thank you already for giving us this opportunity to participate.

Market Researcher, Food & Drink Manufacturer