AIRLINE SOCIAL MEDIA OUTLOOK 2017

Every year since 2010, SimpliFlying has surveyed airline professionals globally to get their perspectives on the present and the future of social media in aviation. We publish our findings based on this survey in the annual Social Media Outlook Report.

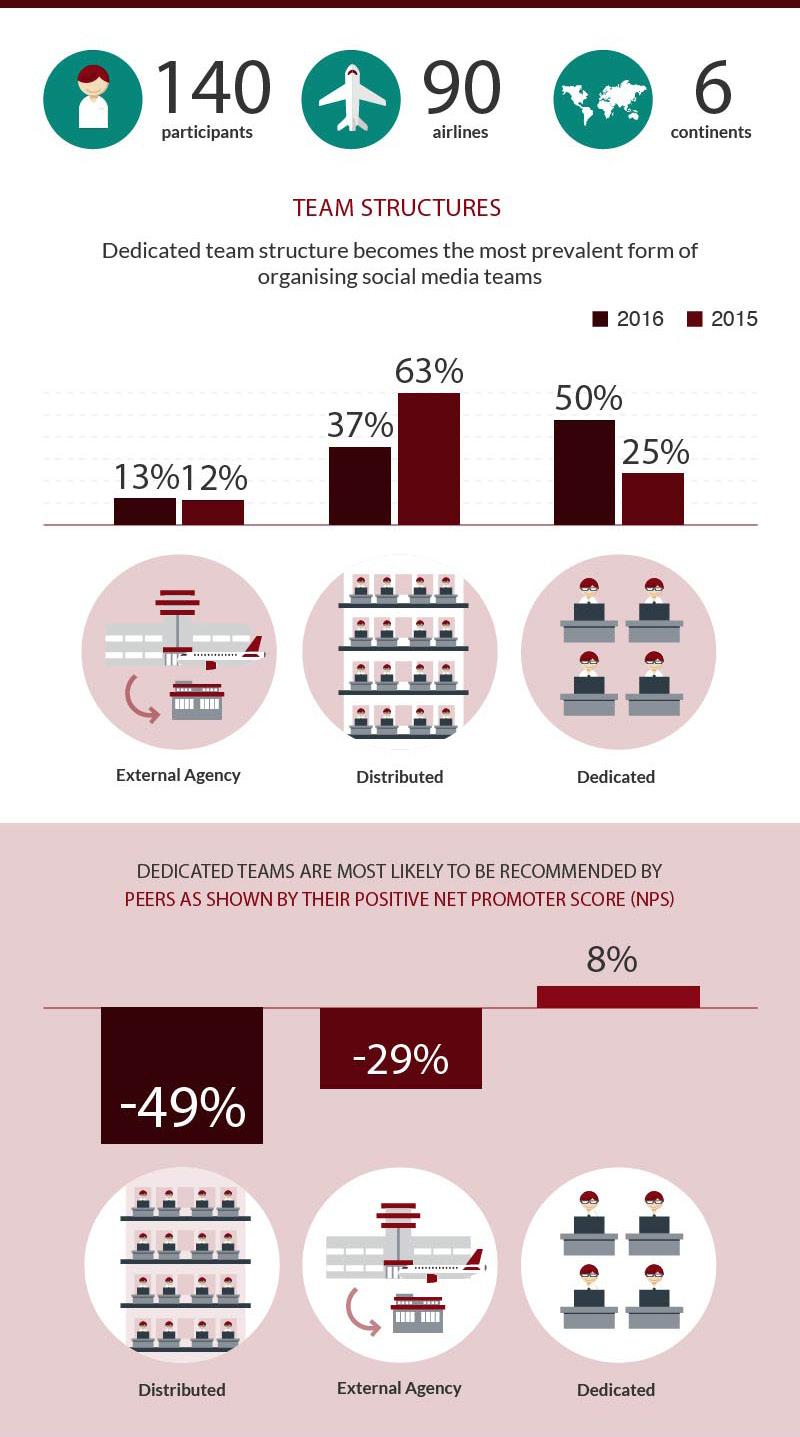

This year, 142 professionals from 90 airlines across the world participated in our survey, making it the most widely taken Outlook Survey ever. The Airline Social Media Outlook Report 2016/17 draws insights from these responses.

The objective of this report is to help airlines stay abreast of the latest trends, benchmark against competition and adapt for the future. We enable this by presenting findings, trends and actionable insights derived from the survey data in an easy to understand format. Additionally, we add to this our specialised insights that help airline professionals derive concrete actionable insights.

Dedicated team structure has become the most prevalent form of organising social media teams. Our research shows clear current and future preference for this. Dedicated teams, however, face greater operational challenges than any other form of organisation.

Social customer service has emerged as the top priority for airlines across the world. This increases the need for resources – both monetary and human.

Senior management have updated their social media goals and priorities. They have developed well informed organisational priorities for social media. This is an encouraging change. Their main focus now is to integrate social media with operations using latest technology and institute better team structures.

Budgets are all set to go up. 58% of airline professionals expect an increase in social media budget, up 50% from the past year. While the airlines want to focus this increase on advertisements, aviation professionals prefer to focus primarily on improving operations and direct it towards better social media training and technology.

Data and analytics remains a top focus for airlines. Its most common application is found in customer segmentation and customer service. However, airlines across the world are limited by the lack of dedicated data professionals to make sense of the data they have.

– 50% of all airlines use a dedicated team structure for social media

– Dedicated teams are most likely to be recommended by current users

– Dedicated teams face significant operational challenges

Last year, despite the widespread prevalence of distributed teams, our survey identified a growing preference for a dedicated team structures. It appeared that most airlines were stuck with distributed team structures even though they found them to be undesirable. This was primarily because distributed teams are easy to assemble and cheaper to operate. This year we have seen a reversal of this trend.

Social media teams are maturing across the world. Consequently, the dedicated team structure has now become the norm. As Chart 1 shows, currently, 50% of all teams are organised as dedicated teams -- twice the number last year. In keeping with the trend, the number of distributed teams has also halved. The increased importance of social media in everyday airline operations has likely caused the increased need for dedicated teams. No more is social a vertical for a few forward-looking airlines, but an operational necessity for all.

Currently, only 50% of all teams are organised as dedicated teams, but 80% of the surveyed professionals reported a clear preference for a dedicated social media team structure. On the other hand, distributed team structure is preferred only by 18% of airline professionals and external agencies only by 2% (Chart 2).

We asked social media teams across the world how likely they were to recommend their current team structure to a fellow airline marketer. They had to rate it on a scale of 1 to 10 -- 10 being the highest likelihood of recommendation. This was done to calculate the Net Promoter Score (NPS) for each team structure. The NPS calculated is based on the responses of the participants reinforced the effectiveness of dedicated teams.

(NPS is an index that measures the willingness of customers to recommend a company’s products or services to others. It is used for gauging the customer’s overall satisfaction with a company’s product or service and the customer’s loyalty to the brand. Scores of eight and above qualify as recommendations whereas 5 and below are counted as negative impressions. NPS is calculated as the percentage of people recommending minus the percentage of people who have a negative impression.)

The NPS of a Dedicated team is a healthy 7.5%, whereas both distributed and external teams recorded a negative NPS scoring -48.98% and -29.41% respectively. The higher satisfaction rate of dedicated teams has resulted in them being the most satisfied with their current performance and the most optimistic about their future. Despite all the advantages, however, having dedicated teams comes with its own set of challenges and opportunities.

Despite being extremely efficient, dedicated teams come with their own set of challenges. Quite often, they are set up without enough planning and foresight in terms of support structures such as budgeting and training. As a result, they tend to suffer most from operational challenges such as inflexible team structure (Chart 4.1 ), lack of training (Chart 4.2) , lack of tools and software (Chart 4.3).

Chart 4.2 : Percentage of respondents, by team structure, who rated lack of training as a top challenge

Chart 4.3 : Percentage of respondents, by team structure, who rated lack of tools or software as a top challenge

Having an internal dedicated team for social media must therefore be preceded by complete buy-in from the senior management. This will ensure that dedicated teams get regular training and updated tools to deal with the specialised roles they have to fulfill.

Owing to greater need for technology, training and people, dedicated teams are also most likely to take up a bigger portion of the company’s marketing budget than a distributed team (Chart 5).

Therefore, opting for a dedicated team should be a carefully considered decision. To help you decide if you are ready for a dedicated team, we recommend referring to this checklist.

Does your team perform multiple organisational functions like marketing and customer service?

Does your company understand the full potential of social media?

Do you have the full backing of the senior management?

Is your company ready to make continuous investments in training and technology in the future?

Does the volume of enquiries and feedback coming from social media make up 20% or more of total enquiries that your airline receives (e.g. from website contact form, emails, calls)?

If the answer to each of the questions above is a yes, a dedicated team structure is recommended. If you have very limited resources, a distributed team structure may be preferred. If the challenge is backing from the senior management, then having external teams, with clear deliverables is the way to go.

SimpliFlying has been working with LATAM (formerly LAN) for over five years, helping it understand and use social media and digital communications. LATAM has a complex structure dictated by its size, with separate teams in many countries that manage local communications and have a main communication team based in Santiago.

For this airline, the dilemma between using a dedicated or integrated team was an especially complex one as it involved not only the airline’s own departments but also its local teams. Following the LAN-TAM merger, the marketing team was brought under a new leadership that reorganised and restructured it.

The new structure had an innovative feature: a content creation team. The team manages all the customer facing content of the airline, from its website and social media to IFE and in-flight magazines. It also supervises the work of local teams for whom it provides strategy coordination and support. In this structure, social media is managed with a partially distributed model where local teams have a degree of freedom but receive strategic oversight from the airline’s HQ. The customer service function is also kept separate and operated under the airline’s customer care department.

The creation of a content management team signals a new stage of maturity for the airline, one where social media is no longer a separate, somewhat alien, element of the company. It shows that the airline understands the need to create a coherent message across channels and, in a way, argues in favour of a distributed model.

This distributed model, however, is not a situation where each department acts independently on social media, rather one where the regular coordination and functions of each department are extended to the social media sphere. It’s a good model and one we expect to see adopted by many airlines in the future, but it is not free of its challenges.

MARCO SERUSI Senior Consultant, SimpliFlying“The primary challenge is coordination. The speed at which events unfold on social media is very different from that of traditional media, and departments will need to match this speed to avoid dangerous situations for their brands. Listening will also pose a challenge since it is a key social media function that needs to be accessible to all teams but is often not present, or limited to customer service issues. Therefore, airlines need to be well aware of the costs and benefits of different team structures, and adapt to their own unique challenges.”

– Social customer service is the single most important priority of airlines across the world.

– Social customer service puts increased pressure on human, technological and financial resources

– Social customer service departments are most likely to push for better integration with operations.

Last year, 32% of the respondents named customer service as their top goal. This year the number has gone up to 40%. The priorities have shifted from branding and marketing to more fundamental business functions like customer service and driving ancillary revenues, both of which have experienced a rise in preference in 2016 compared to 2015. This indicates that social media is becoming a mainstream part of an airline’s business priorities.

Encouragingly, we are seeing customer service as the top business priority not just in select regions of the world, but globally1

Customer service is resource intensive in terms of technology, finances and human resources.

Despite the advancement in chatbots and sentiment analysis technology, customer service remains a human domain. This requires hiring and training human beings for delivering customer service. Therefore, it is no surprise that the highest demand for a bigger team size comes from the customer service department.

Everyday, social customer service channels are bombarded with questions and queries by thousands of passengers. Listening, prioritising and resolving such a large number of problems requires modern software, capable of tracking customer queries across platforms and helping operators to solve them. The lack of investment in such technologies has been a source of frustration for many customer service professionals. This is apparent in Chart 8 where 20% of customer service teams rated getting better technology tools as their top priority -- the highest among all the other departments handling social. This might be a direct result of the increasing need for coordination between the operation and social media teams.

The demand for more technological and human resources has increased the bugetary needs of customer service. However, due to a lack of planning, these resources were often not budgeted for (see our checklist at the end of the chapter). As a result, 52% of social customer service teams currently suffers from a lack of financial resources (Chart 9).

Thanks in part to its increasing integration with operations departments, and the overall growth in messaging services, social customer service is bound to become bigger than traditional customer service2.

This is especially true for organisations where customer service teams handle social media, since these tend to focus more on the integration of social media with operations (see Chart 10). This is also in line with the aims and objectives of the senior management.

The SimpliFlying social care checklist offers a quick assessment of your airline’s readiness to start a full fledged social customer service effort:

We have decided on the channel(s) to use for social customer service

We have decided on the brand personality/tone for our social customer service

We have decided on the team structure for our social customer service team

We have decided the number of full-time people allocated to handle social customer care.

We have decided on the tools and software for our social media team

We have a knowledge bank of responses to common queries.

We have a prioritisation list i.e. which customers / queries to respond to first

We have well thought out plans for handling various contingencies

We have internal service level agreements on the level of responsiveness to meet – i.e., number of mentions to respond to; the average response time.

We have a Quality Control Process: Collecting data on queries and responses, setting quality benchmarks; establishing a quality improvement process.

If you score 6/10 or above, we think that you are ready to launch social customer service successfully.

Implementing full-fledged customer service on social media can be a big operational challenge for a lot of airlines. Our work with one of Southeast Asia’s largest low-cost airlines in 2015 showed how such challenges can be overcome to bring about positive transformations for airlines.

Rapid growth over the past decade had led to certain pains for the airline. Operational outages were growing in frequency and the customer service ecosystem was fragmented due to the internal structure. There was a clear division of labour for agents responding via call centre, emails, website forms that had resulted in a lack of shared purpose and coordination. At the same time, an increasing number of passengers were taking their requests to Facebook and Twitter. The task was clear - transform existing customer service processes and usher them into the digital age where responses are expected in real-time.

1. Senior management buy-in: There was very strong support from the airline C-level executives to prioritise and transform the customer service delivery. SimpliFlying acted as a catalyst and the airline consequently re-organised its internal structure into one single unified customer care department.

2. Dedicated well-trained staff: 20 social customer care agents, from former teams are now specialised in responding on the airline’s Facebook and Twitter. In the workshops with SimpliFlying, these agents studied other airlines closely and adapted best practices of those similar to their airline’s brand tone and culture.

3. Clear roadmap of other departments’ role: Alignment with corporate communications and operations departments are crucial. During the workshops, both departments were involved in a series of crisis simulations with the social customer care agents. The customer care department has also been set-up in close proximity to where operations department sits, to facilitate gathering of information whenever needed.

“All airlines are different in how they are organised. It takes a highly-experienced consultant to identify the gaps that exist within the organisation, before he or she can recommend the best way forward.

For long-term success in delivering social customer service, airlines must be clear about the KPIs (i.e. response rate and resolution), as well as conduct regular reviews on the quality of the agents’ responses.”

– 52% of senior management rate customer service as their top priority.

– 29% of senior management rate aligning social media and operations as their top priority.

– Senior management must focus more on providing better training to social media employees.

In the past, senior management was often blamed for having an outdated vision. However, with the rise of social media as a key organisational function senior management have developed their own unique vision about social media.

52% of senior management executives have named customer service as their top goal, considerably higher than the middle and junior level professionals ( Chart 11).

This is a giant leap from last year when just 32% listed customer service as their top goal, making it one of the top trends for 2015/16. This is particularly encouraging for the first time senior, middle and junior level management are aligned about their top priorities.3

Chart 12 : Top priorities of senior management - 2015 vs 2016

Senior management have recognised that they need to invest in new technology if they want to realise the potential of social media. In terms of priority for budget allocation, the acquisition of new tools is the single biggest priority going into 2016-17 -- for 40% of senior management executives.

Better technology is also critical for aligning social media with operations - a top priority for 29% of senior management, as illustrated in Chart 13. Another top priority among senior management (19%) is the acquisition of new tools. These two outline the vision of senior management to turn social media into one of the core functions of airline operations.

Though the increased importance of social media is a welcome change, our findings indicate that senior management needs to focus more on employee training. We believe better training is especially important for the junior level management who depend on incremental training to be up to date. Our position is validated by the fact that 53% of junior level management demand better training for their social media teams whereas just 25% of senior management recognised that as their top priority. More

are available in the next section.

As the Director of Social Media Communications at American Airlines, few people would be better place to answer this question than Jonathan Pierce. Jonathan leads a team of 21 individuals in charge of American’s online Customer Engagement efforts. Having worked at American for over a decade, Jonathan took up this freshly-minted position in March 2011. Under his leadership, American is now a leader on social media, with strong presences and high-level customer engagement activities occurring across most major platforms.

1. Hire resourceful people - As Jonathan Pierce shares - “When you are asked questions about every part of our business, you have to know a lot, and if you don’t know the answer, you need to be resourceful to know where to go to get the answer.”

2. Train for success - Technology is no substitute for training. Jonathan explains how his team is trained regularly and kept updated of what happens in the company. He says - “Every new hire goes through up to 6 weeks of initial training, with a mix of classroom work and mentor assistance. Recurrent training keeps the team apprised of what’s happening across the business. Every team member gives feedback to improve the training program for the next class, and we update it with real situations, both what we did well and what we could’ve done better.”

3. Focus on qualitative metrics - There are many data providers in social media and it is easy to get carried away by KPIs. But as Jonathan puts it “ We look at data to guide us and keep on track, but there are so many variables in social that KPIs are not an obsession. Qualitative measures of culture, consistency and tone are as important as quantitative metrics of response time and productivity. Everyone on the team has objectives and targets, but priority goes to accurate, diligent and sensitive assistance, over churning the tweets to keep hard metrics down.”

SHASHANK NIGAM CEO SimpliFlying

“Customer service departments at airlines deal with large volumes of queries and have a tendency to focus on efficiency and KPIs over quality and tone of voice. Jonathan’s last point marks a clear difference in AA’s approach and highlights one of the things that make its social team stand out.

Having said that airlines often wonder how to achieve both efficiency and quality of service. The answer is surprisingly simple: look inside and train well. Recruit experienced people from your customer service team, who know the airline inside out, and train them to work on your most visible platform: social media.”

– Though airlines have focused budgets on increased advertising in 2016/17, employees want to focus on training.

– Alignment between senior and junior level management needs to be increased.

Despite the increased use of dedicated team structures, social media continues to have a very small portion of the marketing budget. Currently in 70% of all teams, only 0-10% of marketing budget has been allocated to social media.

However there are substantial regional differences. Middle-Eastern airlines are the best funded, with 70% of them receiving >10% of the marketing budget for social; just 30% of APAC and EU airlines get >10% of the marketing budget4.

However, the good news is that budgets for social media are expected to rise in 2016/17 according to 58.33% of the surveyed airline professionals this year, up from 40% in 2015/16.

It appears airlines are going to deploy most of the budgetary increase into increased advertising. Though understandable, this is incongruous with business goals, especially since customer service has been named as the top priority across the board, including among senior management.

Team Expansion and Training

Increased Advertising Spending

Aquisition of New Tools

Other (Pls specify)

Furthermore, the preferences of the employees with regards to usage of budgetary increase were quite different from the airlines’ decision. 39% rate training of senior and junior level management as a top priority. This was followed by acquisition of new tools with 24% listing it as the top budgetary priority for the future. These choices show that junior and middle level management are more concerned about operational challenges and want investments there rather than towards advertising.

Where employess want budget to go

Team Expansion

Increased Advertising Spending

Aquisition of New Tools

Better Training

Whilst the senior management has prioritised customer service it has not aligned its budgetary goals with that objective. Even before technology steps in, customer service requires rigorous training of customer service representatives and for senior management to understand the challenges and potential of this new field. Without the solid foundation of training, no customer service can be built, no matter what technology is at their disposal.

SimpliFlying worked with Saudi Arabia’s national airline, Saudia, to dramatically upgrade customer service and make it relevant for the age of the connected traveller. This was made possible by a clear-sighted buy-in from senior management that social customer service is the future. This stemmed from a belief that customer service in today’s social and digital age involves upgrading the mindsets of both customers and agents.

While many customers were already very tech-savvy in Saudi Arabia and outspoken on social media channels, Saudia needed to urgently upgrade its team and processes to match the needs of these connected customers, many of them young, urban and travel-savvy. Mr Hazim Sombol, VP of Direct Sales says: “We didn’t have the know-how and experience in dealing with customers on social media. So we brought on SimpliFlying.”

In order to ensure that all tiers of management and execution were on the same page, SimpliFlying conducted comprehensive training for Saudia’s customer service executives, as well as executive briefings for senior management. Theory and best-practices were combined with real airline case-studies into exerciseand simulation-based coursework.

The rigorous training sessions, held twice in six months in Jeddah, proved essential in instilling belief as well as excitement in the customer service executives. The trainings were designed for hands-on practice. Dr Mustafa Binsiddiq, GM Customer Relations says: SimpliFlying helped us adopt best practices and enhance our content with their expertise and training.

Mr Sombol concludes: “After the training, our customer service team now feels much more empowered and comfortable in dealing with customer queries on social media. We are now handling all queries within five minutes on Twitter and Facebook.”

“Often, airlines conclude that the latest, cutting-edge social customer service tools will help them achieve critical KPIs and stay ahead of competition. The reality is that a well-trained social care staff is a much more mission-critical requirement to accomplish these tasks. While tools-training is certainly a key component of such trainings, a holistic training plan involves essential aspects such as simulated exercises in tackling real-world situations; best practices from airlines across the world; content strategy for social care; brand voice guidance; crisis communications plans, and more. Ultimately, the comfort and confidence of your agents in handling queries on multiple social channels will determine a successful social care outcome. Without continued investment in training, excellent results are unlikely.”

7. Data analytics is a top priority but suffers from lack of dedicated professionals.

– Data analytics is one of the top priorities for airline professionals across the board.

– 43% of airlines suffer from the lack of good data professionals.

In today’s age, data is all important. Thankfully, there is across the board agreement about how important data is. Over 85% of airline professionals rated data as important or very important.

Chart 18 : How important is data to you?

Somewhat Important Very Important Not Important

Not only is the importance of data widely recognised but data is also being used for multiple operational purposes. These include customer segmentation, customer support and new product strategies. However, this varies from the level to level and region to region. For senior management, customer service improvement is the primary use of social media data. On the other hand, middle and junior level management are more focused on getting customer insights from social media data.5 Similarly, North American carriers are focused on using data for customer service and support whereas the Middle Eastern carriers are focused on getting product insights from social6

Chart 19 : What is your primary usage of social media data?

Customer insight or segmentation

Customer service/support

New product strategies

Internal performance management

Budgeting

5Appendix 1.5

6Appendix 1.6

Though a lot of senior management focus seems to be on procuring tools and technology for data, the real need seems to be getting talent that can help make sense of the data captured. Over 43% of all surveyed aviation professionals rated data specialists as their top requirement (Chart 20).

More Monetary Investment

Data Specialist Team member/members

Better Software/ Tools

Better Training

Others (Please Specify)

This is a particularly important challenge. For example, when asked what the three most important trends are for the future, better integration with operations and customer sentiment analysis were among the top choices. Both these goals require someone with deep understanding about data and software. It is therefore in the interest of airlines to hire a data specialist within their dedicated social media teams.

Customer insights or segmentation

Customer Service/ Support New Product strategies

Budgeting

Internal Performance management

We don’t use it for anything

Customer insights or segmentation

Customer Service/ Support

New Product strategies

Budgeting

Internal Performance management

We don’t use it for anything

List of participating

Download the hi-res infographic from bit.ly/AirlineSM2017