REAL ESTATE IN SK AGIT, ISL AND AND WHATCOM COUNTIES OPEN HOUSE , M AY 20TH, 11-1P M 2016 RE-Weekly FEATURED PR OPERT Y: 13136 B r i d g e v i e w way, M o u n t v e r n o n • $1,450,000 W W W. SK AGIT TR ADITIONREALT Y. COM 3780 E. COLLEGE WAY, MOUNT VERNON • PATRICIA BOX • ( 360 ) 941 - 9186 S EE PAGE 3 FOR MORE RealEstate weekly A supplement to the Sk agit Valley Herald and the Anacor tes American 363087-1 MAY 12, 2023 WHAT TO CONSIDER BEFORE PURCHASING A HISTORIC HOME P5 “DENIED A MORTGAGE? YOU’RE NOT ALONE” P7 CLASSIFIEDS P7 INSIDE This Issue

All

advertised in Real Estate

is subject to the Federal Fair Housing Act, which makes it illegal to advertise “any preference, limitation, or discrimination because of race, color, religion, sex, handicap, familial status, or national origin, or intention to make any such preference, limitation or discrimination.” We will not knowingly accept any advertising which is in violation of the law. All persons are

subject to prior changes without notice. Neither advertisers nor Skagit Publishing are responsible for any errors in the ad copy. Skagit Publishing reserves the right to refuse any advertising, which we deem unsuitable for our publication.

Unless otherwise noted, all photographs, artwork and ad designs printed are the sole property of Skagit Publishing and may not be duplicated or reprinted without express written permission.

Skagit Publishing is not responsible for typographical or production errors or the accuracy of information provided by advertisers.

2 May 12, 2023 RE-Weekly To advertise in RE-Weekly or other Skagit Publishing publications, Call: 360.416.2180 or Email: ads@skagitads.com ©2023 by Skagit Publishing | All rights reserved.

hereby

For further

1-800-669-9777.

real estate

Weekly

informed that all dwellings advertised are available on an equal opportunity basis.

information call HUD Toll Free at

All Houses

RE-Weekly What to consider before purchasing a historic home ....... P5 Q&A Ask Our Broker ....................... P6 “Denied A Mortgage? You’re Not Alone” .......................... P7 Classi eds .......................................... P7 TABLE OF CONTENTS 5 PAGE INSIDE own the local real estate market expand your reach when you combine the power of our digital audience and premium print ads in the re weekly ask your multimedia account executive for details. ContaCt: 360.424.3251 • ads@skagitads.Com TWIN BROOKS Division Street Village Condo Immaculate one level home on a tranquil lot bordering a greenbelt in the premier 55+ community of Twin Brooks! Gourmet kitchen w/quartz counters, upgraded baths, study, A/C, covered deck, fully landscaped, much more! 601 Timberland Loop Mount Vernon MLS 2066329 | $789,000.00 OPEN SAT & SUN 1-3 pm Small and efficient one-bedroom condo on the hill in Mount Vernon. All exterior maintenance covered, easy, convenient and affordable! 1521 E. Division Mount Vernon MLS 2065957 | $229,900.00 WINDERMERE REAL ESTATE/SKAGIT VALLEY Jim Glackin 360-428-2828 371366-1

Real Estate Stat

1.0%

The inventory of unsold existing homes rose 1.0% from the prior month to 980,000 at the end of March.

FEATURED PR OPERT Y:

Hist oric Ho using Wins 2023 Legisl ative Session Re cap

The 2023 Washington State Legislature adjourned Sine Die on April 23. Washington REALTORS® entered the session with a lengthy to -do list, asking the Legislature to update and correct several real estate brokerage issues, and to make this session the year of housing policy It is well known that Washington State ranks last in the number of housing units per family nationally, and the dream of homeownership has been moving farther out of reach for many families in our state. To urge the Legislature to address the housing crisis, Washington REALTORS® formed a partnership with Amazon and created the “Welcome Home” campaign, which prompted thousands of our members and consumers to reach out to Legislators, asking them to back REALTOR® prioritized bills.

Thanks to the constant advocacy of Washington REALTORS® Legislative Team during this session, bills have been passed that will benefit real estate business, future clients who are on the verge of becoming homeowners, and those in desperate need of affordable housing solutions

If you would like to read more about bills concerning real estate and brokerage services, please scan the QR code

- Source: Washington REALTORS®

OPEN HOUSE, MAY 20TH, 11-1PM

This 4 bed/ 3.5 bath, 3982 sq. ft. home is per fec tly situated on a shy acre offering exquisite one -level living in prime location with a spec tacular bay and mountain view. Away from the hustle and bustle yet so incredibly close to ever ything! Easy access to Hw y 20 for travel West to Anacor tes, Deception Pass, and beyond; or travel East to I-5 for commuting (Nor th and South) or continue Eastward to the beautiful Nor th Cascades. Recent upgrade of kitchen cabinets, decks on nor th, south, and west sides of the house, 3 car garage, expansive driveway parking, sauna, updated professional landscaping, sprinkler system, and garden space. Near to beach, park, and Padilla Bay trails; great area for walking, jogging, and biking.

MLS# 2047824

May 12, 2023 3 RE-Weekly STAT

Statement: The North Puget Sound Association of Realtors advocates for Realtors and their clients, and promotes the protection of property rights 517 E. F airh aven Ave, Burlin gton , WA 98233 (360) 416-4902

psar .realtor

Mission

www.n

367177-1

13136 B R i D g E vi E w wAY, M OU n T vER n O n $1,450,000 363093-1

Skagit Tradition Realty LLC 3780 E. College way Mount vernon, wA 360-424-0300

ww.skagittraditionrealty. com Patricia Box (360) 941-9186

w

Why advertising matters

No matter the size of your business, good and thoughtful promotion will always help you grow awareness about your brand, get in front of more serious prospective clients, and ultimately boost your revenue. Advertising has been shown to be worth the investment, and we’re taking a deeper dive into why it really matters and what you can do to spread the word about your business.

• It creates brand awareness.

• It provides credibility.

• It helps you reach potential clients.

• It drives lead generation.

• It produces more continuous business.

• It improves your digital presence.

• It encourages customer engagement.

• It keeps your consumers up to date.

• It leads to repeat business.

The bottom line? Advertising really works. It’s a key component to building your brand, growing your earnings, and maintaining a successful real estate business. Our marketing solutions can help you get lots more eyes on your business with targeted online advertising.

Let us help you meet your marketing goals by advertising your listings in Real Estate Weekly.

4 May 12, 2023 RE-Weekly RealEstate weekly

Call 360.424.3251 Today! In print and online goskagit.com ads@skagitads.com

What to consider before purchasing a historic home

by Erik J. Martin

ere is a big reason why antiques, artifacts and rare treasures go on the auction block for big money: Collectors want to own a piece of history and a coveted possession that’s one-ofa-kind. e same can be true of homes – specifically, historic homes, which are residences with a unique architectural design, age or historical significance that sets them apart from modern dwellings. Even though they were built long ago, historic homes come with a high price and high prestige.

“To qualify as a historic home, the property must be listed on a local or state historic register,” explains Shaun Martin, a business owner, real estate professional, land developer

and investment advisor in Denver. “Historic homes often have unique design elements like original stonework, detailed woodwork, stained glass windows, intricate ironwork and more. ey are typically older properties built before 1940, which allows them to retain their historical charm and craftsmanship that is rarely found in newer homes.”

Many of these abodes have been well-preserved and updated over the decades, allowing their owners to enjoy modern features and conveniences without compromising on their distinctive original details.

“Historic homes can also come with a sense of community pride in connection to the past that you don’t typically find in

more modern properties,” adds Martin.

Matt Tasgin, a real estate investor with Pegasus Home Buyers in Revere, Massachusetts, notes that historic homes come with several advantages.

“ ey offer aesthetic appeal and that they feature distinctive architecture and craftsmanship. ey can also provide tax benefits, as owners of historic homes may be eligible for tax incentives if they maintain and preserve the property according to local and federal guidelines.

In addition, owning a historic home allows individuals to contribute to the preservation of a community’s heritage,” he says.

Eric Bramlett, a Realtor in Austin, Texas, says one of the biggest reasons why buyers purchase historic homes is

their return on investment.

“In many cases, historic homes are located in established neighborhoods that have retained their charm over the years. is, combined with the distinctive character of the property itself can lead to increased value and potential appreciation over time,” says Bramlett. On the downside, purchasing and owning a historic home will involve serious upkeep and repairs. at’s because an older residence like this usually has materials and systems that need to be inspected, maintained and fixed if necessary. Also, owners could be subject to strict guidelines governing alterations and renovations. In other words, you probably won’t be allowed to thoroughly modernize a historic home

or substantially change its architectural style.

“For example, consider how historic homes may not be as energy efficient as newer constructions, given their older windows, insulation and heating systems. Upgrading these elements to improve efficiency can be challenging, especially when trying to maintain the home’s original character,” Bramlett cautions. Furthermore, it could be more costly to get a homeowners insurance policy for a historic home due to its unique qualities and higher value.

e cost of a historic home can vary significantly, depending on factors like its condition, location and historical significance.

“On average, historic homes are typically 10 to 15 percent more expensive than

comparable non-historic homes in similar locations – possibly much higher depending on the area and condition,” says Martin. Good candidates for acquiring a historic home are buyers who appreciate the distinctive charm and workmanship of older homes, have the resources and time to dedicate to maintenance and are willing to abide by local regulations and rules regarding the property.

“Historic homes are usually listed for sale like non-historic homes, appearing on multiple listing services and real estate websites,” says Tasgin. “But buyers interested in historic properties may also want to explore resources like preservation societies, local historical commissions and specialized real estate agents who focus on historic homes.”

May 12, 2023 5 RE-Weekly

Real Estate Questions and Advice

Question:

Home prices in our area have fallen a bit. Unfortunately, after the huge increases seen during the past few years, you still need a lot of cash for a down payment and closing costs. Instead of needing a lot of up-front cash, is it still possible to purchase with no money down?

Answer:

ere are several basic ways to buy with no-money-down, including VA and USDA mortgages as well as financing that includes a gift or grant.

In each case the borrower must meet special underwriting standards. For instance, borrowers must have qualifying-federal service to obtain VA financing. To get a USDA mortgage the property must be in an eligible rural area, and while a gift or grant can offset down payment costs not everyone has access to such funds.

While financing with nothing down is enticing, some caution is in order. Although a loan with no money down can substantially lower closing costs, it also means the mortgage debt is larger. As a result, there will be bigger monthly payments and – for some borrowers – less ability to qualify, especially if they have a debt-to-income ratio (DTI) that exceeds program limits.

Now, however, there is something new that may help many borrowers.

According to the Urban Institute, banks are offering Special Purpose Credit Programs (SPCPs), loans with nothing down. Such financing is available to those “who have suffered economic disadvantage and share common characteristics.” In effect, SPCPs are designed to help individuals hurt by discrimination on the basis of such factors as race and income.

“SPCPs,” said the Institute, “could offer homeownership supports such as down payment assistance, income restriction exceptions, home rehabilitation loans and streamlined refinance loans in addition to flexible underwriting standards and breaks on loan-level pricing.”

SPCP programs can be targeted by location to encourage development in areas which have been redlined; that is, communities where loans were historically withheld from qualified borrowers on the basis of race and other factors.

At this writing, a number of major banks offer SPCP programs.

e Community Affordable Loan Solution from Bank of America is a “Special Purpose Credit Program which uses credit guidelines based on factors such as timely rent, utility bill, phone and auto

ASK OUR BROKER

By Peter G. Miller

By Peter G. Miller

insurance payments. It requires no mortgage insurance or minimum credit score. Individual eligibility is based on income and home location. Anyone from any race or ethnicity is welcome to apply.”

Chase Home Lending, part of JPMorgan Chase, offers qualified buyers a $5,000 closing credit plus an additional $500 for those who take approved homeownership education programs. e “DreaMaker” mortgage is available in 6,700 communities nationwide.

TD Home Access Mortgage, from TD Bank, says it “provides prospective buyers with an affordable mortgage option, including a $5,000 lender credit which does not require repayment, that borrowers can use for closing costs or toward a down payment on a home purchase. It also offers more flexibility with a greater debt-to-income (DTI) ratio and expanded underwriting requirements, as well as credit parameters that increase accessibility.”

In effect, a $5,000 lender credit is similar to a grant in the sense that it does not have to be repaid and does not increase monthly mortgage costs.

To find out more, and to locate additional SPCP programs, speak with local real estate brokers and mortgage loan officers.

Email your real estate questions to Mr. Miller at peter@ctwfeatures.com.

6 May 12, 2023 RE-Weekly

Q&A Q&A

Marilyn Kennedy Melia

Applying for a mortgage is like taking a test you need to pass to graduate. Except instead of a diploma, the prize is a home of your own.

e “pass” rate on mortgage approval, though, is surprisingly low. Surveying 4,900 buyers, the Zillow Consumer Housing Trends Report 2022 finds that in 2022, 28 percent of applicants were denied a mortgage, down from 34 percent in 2021.

Often, denial comes as a surprise since the home buyer first received a nod in the form of a “pre-approval.” Before home shopping, real estate agents typically require buyers to have a pre-approval.

Staying Credit Worthy

A lender verifies applicants’ credit, income, savings for a down payment and current monthly debt load before issuing them a pre-approval for a certain size loan. If a borrower increases his debt, or otherwise alters his financial status after pre-approval, he could be rejected when he actually applies to buy a certain home, says Charles Chedester of Midwest Family Lending in Urbandale, IA.

Understanding Terms

Make sure a lender clearly outlines what financial changes can negate a

CLASSIFIEDS RE-Weekly

REAL ESTATE FOR SALE

Business for Sale

Apartments

pre-approval, Chedester says, adding that the drop in denials Zillow found in 2022 could be due to the fact that the mortgage business was unusually busy in 2021 and lenders didn’t take adequate time to verify pre-approval details or talk with borrowers.

Strengthening Your Position

Rejection can occur right away with a lender declining pre-approval. And, the Zillow survey finds that Millennials reported the higher rate of denials, at 39 percent. Moreover, 41 percent of borrowers of color reported being denied at least once.

“See a housing counselor from a HUD-approved agency [national listings at HUD.gov],” advises Mitria Spotser of the Center for Responsible Lending. “It’s free, and they can walk you through the lending process and let you know where you stand [financially].”

With advanced knowledge, borrowers have more insight into whether a rejection could be unfair, she adds.

Mortgage brokers, banks and financial institutions have different mortgage programs, and a borrower who’s rejected by one lender may find approval with another.

Local snack distribution business with 6 routes for sale!

Doing over 3 million sales per year. Contact jgsnacks@frontier.com

Accepting applications for 1, 2 & 3 Bedroom Apartments.

Rent is based on income. Income restrictions apply, call for details. 360-424-4051

Relay: 711 The U.S. Department of Agriculture (USDA) prohibits discrimination in all its programs and activities on the basis of race, color, national origin, gender, religion, age, disability, political beliefs, sexual orientation, and marital or familial status. EHO

RENTALS Apartments

“This institution is an equal opportunity provider and employer.”

“We accept comprehensive reusable tenant screening reports as defined in RCW 59.18.030”

Accepting applications for 1, 2, 3 & 4 Bedroom Apartments.

Rent is based on income. Income restrictions apply, call for details.360-424-4051

Relay: 711 Housing and Urban Development (HUD) prohibits discrimination in all its programs and activities on the basis of race, color, national origin, gender, religion, age, disability, political beliefs, sexual orientation, and marital or familial status.

EHO

“This institution is an equal opportunity provider and employer.”

“We accept comprehensive reusable tenant screening reports as defined in RCW 59.18.030.”

May 12, 2023 7 RE-Weekly

From:

“Denied A Mortgage? You’re Not Alone”

in

the Classifieds

Unfurnished

W TODA Y Skagit

NE

Village Apartments

Unfurnished

Olympic

NE W TODA Y

Apartments

RE-Weekly

Many buyers won’t leave a message. Give the best time to call!

Mondo is a well- established and well-loved family-style restaurant at the foot of the Cascade Mountain Range. Locals and travelers make this par t of their Hw y 20 and Nor th Cascade National Park trip. Major ar terial choice to Newhalem and continue on to Winthrop; or cross the Skagit River bridge and continue up to Cascade Pass and hiking to Stehekin. The restaurant is warm and inviting, with incredible fare Ver y spacious dining area. Some outside seating available Small gift shop area. The kitchen is beautifully remodeled New flooring and ex terior lighting MLS#2038466

ONLY $375,000

Many investment possibilities with this home & proper ty: Classic 4 bed/2.5 bath farmhouse style 2560 sq ft home with east-facing deck on 1.76 acres Home offers kitchen w/island & ceramic tile floors, office, bonus room, mud/ laundr y room, living room with propane fireplace, built-in bookshelves & beautiful laminate over hardwood floors Detached building per fec t for office or studio The proper ty features a 16,000+ sq ft pole building with its own water, power & septic Pole building includes a large, insulated shop area & expansive ex ternal parking area; RV hook-up at the east end, per fec t for guests. Potentially income -producing proper ty. Special Use permits were previously approved for home -based businesses (in 1995 & 2010).

MLS#2028784

Ver y private 5 acres just off Mountain View Road. Come check it out, a great neighborhood.

21136 LAfAyETTE RD, BURLiNgTON $450,000

7.5 acres of rich farmland with 200 fruit trees, ¾ acre blueberr y, 3 acres strawberries, ¾ acre blackberr y, ¾ acre raspberr y, 60x30 paver patio in place, incredible view, fully fenced with beautiful rolling gate, some farm implements and a trac tor included MLS#2050192

We are saddened by the passing of our dear friend and landscape artist, Martin Sandoval Mendoza. We offer prayers of peace to his family in their time of loss. Martin’s business, Green Yards Company, maintained our office grounds and landscape beautifully for 17 years. We look forward to many years of continued service with Green Yards Company. Rest in peace Martin.

for year round residenc y or weekend / vacation getaways Well shared with seller, power at street

Two ver y well maintained, level lots. Bring your camper, fifth wheel, RV or tiny home

Great location

Conveniently located corner building lot with available utilities. Build your dream home in this neighborhood that is close to schools Hillcrest Park, and the 18th Street Water Park. Easy access to I-5, shopping, and medical facilities.

8 May 12, 2023 RE-Weekly w w w.sk agittr aditionr ealt y.c om 3780 E. College Way, Mount Vernon 363081-1 360.424.0300 JoAnn Boudreau (360) 391-0746 Patricia Box Office Manager O: (360) 424-0300 C: (360) 941-9186 Juanita Bunch (360) 941-5530 Russ Lanker (360) 708-1117 Brett Tacker (360) 840-7931 Suzanne Jenkins (360) 941-2983 CRS/SRES Elva Hunter (360) 202-3086 CRS/SRES Carla Fischer (360) 982-0010 CRS/SRES Danya Wolf Designated Broker/Owner (360) 708-8294 CRS/CBA/GREEN 0 S ANDAL RD, MOUNT VERNON $149,000

potential, vacant land close to Mount Vernon and Big Lake. MLS#2057092 Elva Hunter (360) 202-3086 14903 RUSTic LANE, cONcRETE $23,500

Great

MLS#1951005 Patricia Box (360) 941-9186

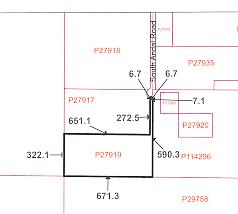

24017 TRiNiT y LANE, SEDRO-WOOLLE y $859,000

Danya Wolf (360) 708-8294

Danya Wolf (360) 708-8294

60102 STATE ROUTE 20, MARBLEMOUNT $675,000

OWNER FINANCING AVAIL ABLE! NHN S. 15TH STREET, MOUNT VERNON $199,000

Danya Wolf (360) 708-8294 BUSINESS

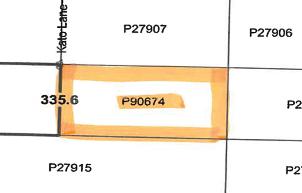

MLS#2029949 Suzanne Jenkins (360) 941-2983 Carla Fischer (360) 982-0010 KATO LANE, MOUNT VERNON $149,000

MLS#1880968 Elva Hunter (360) 202-3086