Strategic Marketing africa

Can we solve Africa’s nonconsumption challenge?

Plenty of people – not enough spending power

FROM THE PRESIDENT OF THE AFRICAN MARKETING CONFEDERATION

Can we solve Africa’s nonconsumption challenge?

Plenty of people – not enough spending power

GOOD DAY AFRICAN marketers! It’s been a whirlwind finish to 2024 and an exciting start to 2025!

The AMC signed collaborative agreements with the European Marketing Confederation (see our article in Issue 4 2024) and with the UK-based Chartered Institute of Marketing – better known as the CIM (see pg 40 of this issue).

We were also privileged to be invited to Madrid, Spain to participate in a UN Tourism Brainstorming session for their Brand Africa project. We were well received, with the participants eager to find out how the AMC can help them to better understand ‘destination marketing’ for their respective countries,

as well as the continent. We are now planning an AMC Tourism Chapter to support this – more info soon.

Read about the UN Tourism Brand Africa project on pg 20. Also see our related articles on the work of Africa No Filter (pg 24) and marketing’s role in developing African aviation (pg 28).

We’re now planning a Tourism Chapter within the AMC ›

Marketing is central to all tourism development, and we hope to welcome a few tourism marketers to participate in our second Chartered Marketer

DON’T FORGET!

2025 AMC Conference in Ghana: 20-22 August! Save the date!

(Africa) programme, starting soon. Look for details on the AMC website and social media platforms.

In March, I attended the IMM Institute’s Annual Excellence Awards in Johannesburg (pg 50), which had me thinking about our AMC Awards 2025, which will be part of the fourth AMC Annual Conference in Accra, Ghana on 20-22 August 2025. We’ll soon be calling for award nominations and, of course, please save the date.

Until next time!

Helen McIntee BA MBA (Wits) CM (SA) Co-founder and President: African Marketing Confederation

BONJOUR À TOUS LES SPÉCIALISTES DU marketing africains ! L’année 2024 s’est terminée en trombe et l’année 2025 a commencé de manière passionnante !

L’AMC a signé des accords de collaboration avec la Confédération européenne du marketing (voir notre article dans le numéro 4 de 2024) et avec le Chartered Institute of Marketing basé au Royaume-Uni – plus connu sous le nom de CIM (voir page 42 de ce numéro).

Nous avons également eu le privilège d’être invités à Madrid, en Espagne, pour participer à une session de brainstorming sur le tourisme des Nations Unies pour leur projet Brand Africa. Nous avons été bien accueillis, les participants étant impatients de découvrir comment l’AMC peut les aider à mieux comprendre le « marketing de destination » pour leurs pays respectifs, ainsi que pour le continent. Nous prévoyons désormais de créer un chapitre AMC Tourisme pour soutenir cette initiative – plus d’informations prochainement.

Pour en savoir plus sur le projet de marque touristique des Nations Unies pour l’Afrique, consultez la page 20. Voir également nos articles connexes sur le travail d’Africa No Filter (p. 24) et le rôle du marketing dans le développement de l’aviation africaine (p. 28).

Le marketing est au cœur de tout développement touristique, et nous espérons accueillir quelques spécialistes du marketing touristique pour participer à notre 2e programme Chartered Marketer (Afrique), qui débutera bientôt. Recherchez les détails sur le site Web d’AMC et sur les plateformes de médias sociaux. En mars, j’ai assisté aux Annual Excellence Awards de l’IMM Institute à Johannesburg (pg 50), ce qui m’a fait réfléchir à nos AMC Awards 2025, qui feront partie de la 4th conférence annuelle de l’AMC à Accra, au Ghana, du 20 au 22 août 2025. Nous lancerons bientôt un appel à candidatures pour les prix et, bien sûr, veuillez réserver la date.

À la prochaine !

Hélène McIntee BA MBA (Wits) CM (SA) Co-fondatrice et Présidente : Confédération africaine du marketing

SAUDAÇÕES PARA OS PROMOTORES DE vendas africanos! Foi um final de 2024 agitado e um começo de 2025 emocionante!

A AMC assinou acordos de colaboração com a Confederação Europeia de Marketing (veja o nosso artigo na edição 4 de 2024) e com o Chartered Institute of Marketing, sediado no Reino Unido – mais conhecido como CIM (veja a pág. 41 desta edição).

Tivemos também o privilégio de sermos convidados a ir a Madrid, Espanha, para participar numa sessão de troca de ideias sobre o Turismo das Nações Unidas para o seu projecto Brand Africa. Fomos bem recebidos, com os participantes ansiosos para descobrir como a AMC pode ajudá-los a entender melhor o “marketing de destino” para os seus respectivos países, bem como para o continente. Estamos agora a planificar um Capítulo de Turismo da AMC para apoiar esta iniciativa - mais informações em breve.

Leia sobre o projecto Brand Africa do Turismo da ONU na pág. 20. Veja também os nossos artigos relacionados com o trabalho da Africa No Filter (pág. 24) e o papel do marketing no desenvolvimento da aviação africana (pág. 28).

O marketing é fundamental para todo o desenvolvimento turístico e esperamos receber alguns profissionais de marketing turístico para participarem no nosso 2º programa Chartered Marketer (África), que terá início em breve. Para mais informações, consulte o website da AMC e as plataformas das redes sociais.

Em Março, participei nos Prémios Anuais de Excelência do Instituto IMM em Joanesburgo (pág. 50), o que me levou a pensar nos nossos Prémios AMC 2025, que farão parte da 4ª Conferência Anual AMC em Acra, no Gana, de 20 a 22 de Agosto de 2025. Em breve, estaremos a convidar à apresentação de candidaturas a prémios e, como é óbvio, não se esqueçam da data.

Até à próxima!

Helen McIntee

BA MBA (Wits) CM (SA) Cofondateur et président : Confédération africaine du marketing

PUBLISHER

African Marketing Confederation

https://africanmarketingconfederation.org info@africanmarketingconfederation.org

PUBLISHING COMMITTEE

Kwabena Agyekum (Chair)

Helen McIntee

Nigel Tattersall

Mike Simpson

A.M.C. PRESIDENT

Helen McIntee

A.M.C. SECRETARY GENERAL

David Balikuddembe

EDITORIAL

Simpson Media

Editor: Mike Simpson mike@media-simpson.com

ADVERTISING SALES & COORDINATION

Avenue Advertising

Managing Director: Barbara Spence

Landline: +27 11 463 7940

Mobile: +27 82 881 3454

barbara@avenue.co.za

DESIGN & LAYOUT

Tamlin Lockhart Design tamlin@tamlinlockhart.co.za

PRODUCTION

Reproduction: Tamlin Lockhart Design Digital magazine: Belgium Campus Print magazine: Business Print

IN ASSOCIATION WITH

Angola Marketing Network

Chartered Institute of Marketing, Ghana

Ethiopian Marketing Professionals’ Association

Institute of Marketing in Malawi

Institute of Marketing & Management, Mauritius Institute of Marketing Management, South Africa

L’Association Marocaine de Marketing et de la Communication

L’association Tunisienne des Professionnels de Marketing et de la Communication

Marketing Association of Botswana

Marketers Association of Zimbabwe

Marketing Society of Kenya

Mozambique Marketing Association

National Institute of Marketing of Nigeria

Tanzania Marketing Science Association

Uganda Marketers Society

Zambia Institute of Marketing

DON’T FORGET!

2025 AMC Conference in Ghana: 20-22 Augus t! Save the date!

HELLO! WELCOME TO another issue of the magazine for deep-thinking African marketing professionals.

In a world where a recent (credible) survey found that 63% of respondents worry that it’s becoming harder to tell if news was produced by a respectable source or originated from some form of attempted deception, we promise that we will always strive to be the former.

We often find ourselves delving into the finer detail of marketing activities and strategies. In this issue, however, several of our articles take in the bigger picture; the macro-environment in which African marketers and brands must operate.

Our cover story (pg 10) is a case in point. It focuses on Consumption or, more specifically, Non-Consumption in the African context. Which may, at first glance, seem to be a finance or an investment story. But, as I sat late last year reading reports from an investment gathering taking place in Lagos, I realised that the conference hot topic of Non-Consumption by African consumers is very much a macro-marketing topic too. Multinationals, transnationals, foreign investors – and even local African companies looking to spread their wings elsewhere on the continent – have succumbed to the siren call of numbers of people (supposed consumers) theoretically equating to shiny numbers on a sales report and

positive numbers on a balance sheet.

For the marketing teams on the ground, charged by the board with tapping into this supposedly vast consumer market, the going has been tough. The marketers have marketed, the merchandisers have merchandised, the supply chain teams have supplied, the salespeople have sold (or tried to). But the consumers haven’t consumed. Cue the tears and a perplexed withdrawal from the market.

The article makes for thought-provoking reading and grounds us in reality. It needn’t be all doom-and-gloom though. Businesses – foreign and home-grown – do succeed in Africa, as our article points out. We also have vast natural resources, land, people, optimism and some of the fastest-growing economies in the world. Against a backdrop of ageing, troubled, low-growth, highly restrictive first-world economies.

Oh, and we Africans are also a go-ahead bunch, working hard to turn the continent’s fortunes around – as many of our articles point out.

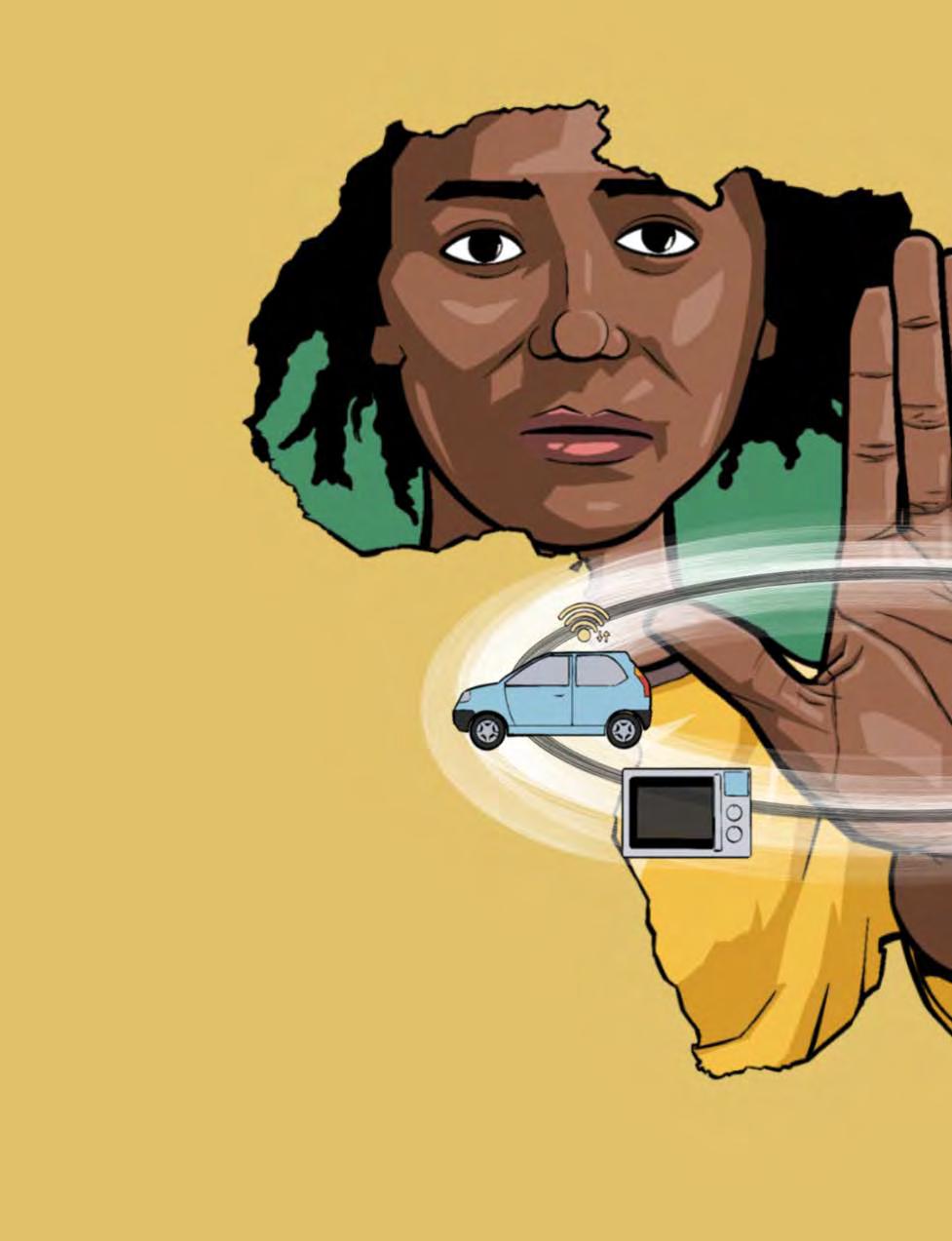

Each issue, we work hard to come up with an interesting cover design. This issue’s illustration depicts Africa and its growing population powered by young people – a population that, as yet, largely lacks the economic muscle to meaningfully consume goods and services. Did this cover hit the mark? Let us know.

Be bold! Be optimistic! See you soon.

Mike Simpson Editor

Lagos event hears insights on how Nigerian brands can stand out in a highly competitive market

Africa is not consuming goods and services at a rate considered essential for

An envisaged Brand Africa tourism strategy aims to encourage positive storytelling and shift the narrative

REPOSITIONING AFRICA

Africa has long had an image problem. It’s time to change perceptions that are entrenched and self-perpetuating 28 AFRICAN AVIATION

As African aviation grows, Marketing 5.0 has a role to play in enhancing efficiencies and customer service

Angola will soon be the 14th member of the SADC Free Trade Area, gaining expanded access to new markets.

Morocco’s Tanger Med port complex is growing in global importance and is to undergo expansion

The Chartered Institute of Marketing and African Marketing Confederation announce a new partnership

Why attention is the ultimate currency in a distracted world – and how to make it work for your brand

Meet a Ugandan designer of marketing campaigns who thought of becoming a fashion designer

Uganda Marketers Society announces several exciting new developments, including a renewed partnership

50 A.M.C. MEMBER NEWS

Top marketers and supply chain professionals are honoured at the IMM Institute awards in Johannesburg

54 SOCIAL MEDIA

New legislation in Zambia is helping to establish a more supportive environment for social media content creators

56 TEA EXPORTS

Kenya is working to add value and further diversify the export base of its growing tea industry

58 ECONOMIC DEVELOPMENT

French-based Géant retail brand has opened a second hypermarket in Benghazi as Libya’s economy grows

60 INFORMAL ECONOMY

Informal workers comprise 80% of Ghana’s workforce, but contribute only 27.4% to the national GDP

6 INTRODUCING THE A.M.C.

The African Marketing Confederation is spearheading the development of the highest standards of marketing

To develop Marketers into positions of influence.

Promoting professional development of Marketers in Malawi.

Setting best marketing practice standards. Offering professional marketing training courses.

Networking opportunities for Marketers. Organising marketing events. Providing guidance to marketing students.

We have individual and corporate membership categories.

Membership runs from 1st April 2023 to 31st March 2024.

To become a member contact Vidah Mmadi on +265 991 00 83 88.

Confederation is the groundbreaking pan-African body of marketing professionals spearheading the ongoing development of the highest possible standards of marketing across Africa. Founded in 2011, the AMC is a collaboration between the various national marketing bodies and

The AMMC (English name: Moroccan Association of Marketing and Communications) was created in 2013 as a platform for the country’s marketing and communication communities. Its aim is to promote the professions, develop the skills and knowledge of members, and promote the economy of Morocco.

Visit Facebook page

The Marketing Association of Botswana (MAB) is dedicated to empowering marketing professionals, fostering industry growth, and shaping marketing’s future in Botswana. It exists to unite marketing leaders, strategists and creatives under one dynamic network. It also aims to elevate standards through knowledgesharing, mentorship and learning, as well as advocate for marketing’s strategic role in driving growth. Visit LinkedIn page.

More information coming soon!

associations to exchange expertise and information, as well as to promote the marketing profession as a whole. By unifying the bodies in the various countries, the AMC exchanges expertise and information, provides intellectual capital, and ensures that the continent has a platform for like-minded marketing professionals.

Established in 2012, the aim of the ATPMC (English name: Tunisian Association of Marketing and Communications Professionals) is to offer the country’s marketing and communications professionals privileged access to a network of colleagues and high-level industry experts. It also promotes the image of marketing and communications in Tunisia. Visit website

NIMN was established by Act of the National Assembly no. 25 of 2003 with a chartered status conferred on it, the responsibility to regulate and standardise marketing professional practice through the conduct of professional examinations and certifications, training, retraining and consultancy services geared towards ensuring that members adopt a professional approach to marketing.

Visit Website

The Chartered Institute of Marketing, Ghana was founded in July 1981 with the vision to be the voice of marketing practice in Ghana. The Chartered Institute of Marketing, Ghana (CIMG) ultimately aims to see organisations (both private and public) embrace the marketing concept, and be marketingoriented in their operations.

Visit Website

The Institute of Marketing Management South Africa (IMM) has for decades been the pre-eminent marketing institute in Southern Africa, bringing together likeminded individuals and organisations to share thoughts and experiences within the rapidly changing marketing environment. The IMM Institute offers a range of activities and services for industry professionals.

Visit Website

Uganda Marketers Society is the premier organisation for marketers in the country, dedicated to promoting excellence in the field. UMS provides a range of resources and opportunities for skill-building, so members can stay up-to-date with the latest trends and best practices in marketing. We help members become the best marketer they can be.

Visit Website

MSK is the national umbrella body for all marketers in Kenya. Its key mandate is to empower and regulate the marketing industry by creating policy that governs the Marketing Industry (self-regulated), education and training of professionals, corporates and entrepreneurs, marketing and business mentorship, and arbitration through the Advertising Standards Board.

Visit Website

The Tanzania Marketing Science Association is a one-voice platform which harmonises the knowledge and practice of marketing in Tanzania. TMSA’s aim is to achieve a strong marketing professional ecosystem in Tanzania by driving collaboration between industry and marketing experts. Its services include professional training programmes, ranging from certified to professional marketer.

Visit website

The Marketers Association of Zimbabwe was launched in 2007 with a vision to be a leading body of marketing professionals promoting professionalism of the highest standards, and establishing channels of career development for the benefit of organisations and the Zimbabwean economy at large. Visit Website

The Ethiopian Marketing Professionals’ Association is a beacon of marketing excellence, officially recognised and licensed by the Ministry of Justice under Proclamation No. 621/2009. The EMPA’s goal is ambitious but tangible: To emerge as Africa’s leading marketing association and catalyse engagement, education, inspiration, and the training of exceptional marketing professionals.

Visit Website

The Zambia Institute of Marketing is a professional marketing institution that was established by an Act of Parliament No. 2 of 2022 to regulate, promote, uphold and improve the standards of training, practice and professional competence of persons and organisations engaged in marketing and advertising in Zambia.

Visit Website

The Mozambique Marketing Association (MMA) was established in 2024 and is dedicated to the development and promotion of marketing practices in Mozambique. MMA’s mission is to promote excellence in marketing and contribute to the development of the sector, providing assistance, training and resources to professionals, and serving as a platform for networking and knowledge exchange.

Established in 1991, the Institute of Marketing & Management is the leading professional marketing education and training institution of Mauritius.

No Website

IMM Malawi is a locally recognised and registered marketing body, whose agenda is to promote, enhance, and regulate the marketing profession in Malawi, with the aim of developing marketers into positions of influence. IMM Malawi started in January 2021, transitioning from the Chartered Institute of Marketing (CIM) Malawi.

Visit Website

will raise the bar in marketing once again: Stay

2

Last year we learned from high-calibre experts like Cynthia Oforia-Dwumfuo (Marketing Group Head, Hollard Ghana), Nyimpini Mabunda (CEO, GE Southern Africa), and Professor Jimmy Wong (Singapore University of Social Sciences), who explored the latest innovations in brand resilience and digital transformation.

With last year's conference setting a new benchmark for thought leadership, this year's speaker lineup will provide fresh perspectives from those leading Africa's marketing evolution. 1 3 4 5

From AI and digital transformation to shifting consumer behaviours, expect future-focused discussions that will shape the future of marketing in Africa.

Join a community of influential marketing professionals and expand your network across Africa and beyond.

Walk away with practical strategies and fresh ideas to implement in your business right away.

Despite a growing population – one in four people will likely be African by 2050 – we are not consuming goods and services at a rate considered essential for economic growth. By Cara Bouwer

economies like South Korea, Japan, the EU and the United States facing the reality of rapidly aging populations, Africa – with its young and growing population – has all the hallmarks of an emerging consumer paradise.

On paper, that is. In practice, African consumers as a whole are not spending at the rate required to not merely keep the continent’s economic wheels ticking over, but to help economies grow, attract more investment, encourage industrial development and local manufacturing, incentivise entrepreneurial activity, and build the confidence necessary to create stable and reasonably paid employment.

As Nigeria’s Tobi Lawson, a social sciences and economic commentator, wrote on the ‘1914 Reader’ Substack blog he shares with author and commentator Feyi Fawehinmi: “Yes, there are 200-million Nigerians in the country but the vast majority of them are unable to afford anything that is not food (and even that is a big struggle).”

In a post titled ‘Wither Nonconsumption. Why betting on the patience of big firms is not a development strategy’, he noted that “Nigeria is now in a decade of practically zero growth which really means that Nigerians are getting poorer when you factor in population growth”.

Non-consumption refers to an individual’s inability to access goods and services, which effectively keeps them from playing an active role in a country’s economy.

This is the case across many parts of Africa. As Efosa Ojomo, a Nigerian author and Director of the Global Prosperity research group at the Clayton Christensen Institute for Disruptive Innovation, told Strategic Marketing for Africa: “Today, as we know, the only thing growing in Africa is the population and the number of people living in poverty. Almost everything else is declining.”

This does not paint an enticing picture for investors, such as those who

gathered in Lagos, Nigeria for ‘The Africa Prosperity Summit’ in November 2024.

It was at this summit that Kola Aina, Founding Partner of Ventures Platform, noted with concern the 67% drop in African venture capital investments since Covid-19. “By 2050, the one-billion Africans born will face a future of chronic non-consumption unless we act now,” Aina said in his keynote address.

Globally, however, venture capital flows are down by 70%. So perhaps our 67% offers a glimmer of positivity for Africa.

In 2023, foreign direct investment flows into Africa sat at US$48-billion –about 3.5% of global FDI flows and substantially below the continent’s requirements if Africa is to claw back its existing infrastructure deficit and develop conditions conducive to growing a strong, consumer-focused middle class.

Nobody comes out well in a deeper look at why Africa isn’t lifting its citizens out of poverty with the same focus that China displayed since the late 1970s. It was an approach that saw the Asian giant reduce inequality and shift some 800-million people out of extreme poverty.

Multinationals aren’t ‘drivers’

African governments, noted Lawson, need a serious and competent approach to developing their own countries and creating an enabling business environment.

“Multinational corporations can be very useful partners in development – but they are certainly not drivers,” emphasised Lawson. “It is time to stop making excuses for incompetent governance. It is time to take the politics of delivering economic transformation very seriously.”

This view has been echoed by Cristina Duarte, Under-SecretaryGeneral and United Nations Special Adviser on Africa, in an article published in the UN Chronicle

“In line with the ‘Africa Rising’ narrative and to maximise the potential of Africa’s growing middle class – a portion of which remains vulnerable to external shocks, including those living on US$2 to US$4 per day – the continent needs to build a broad-based producer economy, raising purchasing power and facilitating the demand for efficiencies in both the public and private sectors,” she observed.

When it came to the consumer challenge, Duarte noted: “While increasing consumption power is a good start, in the long term, African

countries should transform their economies, aiming to produce for domestic and export markets.”

A strong and growing middle class across all African nations would prove a formidable asset and unlock an enviable consumer market, was Duarte’s message.

However, getting there would also require the companies looking to benefit from this market in the long term to come to the party. Depending on how these organisations approached their interactions with the continent, this

approach could either be an expensive problem or a golden opportunity.

With Nestlé and Unilever scaling back African operations, the likes of Shell and HSBC exiting the South African market, and Kimberly Clark calling it quits in Nigeria, the focus in 2025 is once again on the challenges associated with doing business in Africa.

As Kuseni Dlamini, a former chairman of Walmart Inc.’s African unit who now heads the American Chamber of Commerce in South Africa, told news agency Bloomberg in a 2024 article outlining currency woes, bureaucracy and electricity challenges: “It doesn’t justify the effort.”

Ojomo believes that big business only

has itself to blame by entering unknown and complex African markets without adjusting and adapting existing business models to suit a region in which the average government spend is around US$500 per person per year, compared with the United States’ annual spend of approximately US$30,000 per person.

“If you are a brand, you need to know this is the Africa we are talking about. And if you are looking to sell a product or service this is where you are playing. It’s easily Googleable,” says Ojomo, who urges brands coming into Africa to redesign their business models to serve the average African, rather than global consumers with access to greater resources.

That’s not all a business can and should be doing. Brands must also engage in market-creation innovations, believes Ojomo.

“You have to make the product or service simple and affordable. And you need to make investments that brands in Norway or the United States don’t have to. You’ll have to invest in staff, in educating customers, and you’ll have to ensure good government relations. You’ll also need an exchange rate policy. So, you’ll have to sit down and slowly consider these things if you are a business serious about doing business in Africa.”

Ojomo firmly believes that astute businesses with a future-focused approach can still win on the African continent. Unfortunately, the world as a whole appears to have lost patience – and the appetite – for investments in regions that take more time and effort.

“We are often not patient enough to wait for these investments to yield fruit,” he says, citing the case of the mobile phone in Africa.

“If you go back 25 years ago and say I want to invest millions of dollars in African telecoms, people would have said – and did say – you are crazy. However, today we don’t think twice when we see a

farmer with a mobile phone. These guys came in and invested into the underlying infrastructure and government relationships. This has created a market that is worth a quarter of a trillion dollars. These things are possible, but it is not a quick fix,” notes Ojomo.

Nor is this degree of success achieved by having a ‘one foot in and one foot out’ approach to business.

“As far as I know, Africa has never lied to anyone about what it takes to do business in Africa,” he says. “Yet, somehow, we keep thinking Africa is something it is not – not yet. Excuses about the business environment are lazy excuses.”

To illustrate his point, Gregory Rockson’s primary healthcare company mPharma was launched in Ghana in 2013 and now spans 10 African countries.

Rockson’s understanding of how Africans use healthcare and the role of the pharmacy in this value chain –

where pharmacists often act like doctors – saw mPharma install primary care doctors within pharmacies and building the services from there.

“They also create data-on-demand services and, in 10 to 20 years’ time when mPharma opens a hospital it will be anchored in data received from the pharmacies. That is the kind of thinking that is necessary [to do business in Africa],” explains Ojomo.

A prime example from Nigeria is diversified consumer goods company Tolaram Group, which is headquartered in Singapore. The subject of a Harvard Business School case study by Ojomo and general management lecturer Derek van Bever, Tolaram’s first exposure to the Nigerian market came in the 1970s when Haresh and Sajesh Aswani began selling textiles in the country.

They spotted an opportunity to import Indomie instant noodles in 1988 and defied the naysayers by investing in manufacturing and distribution capabilities. Today, Tolaram runs 11

› Singapore-based Tolaram invested in manufacturing and distribution capabilities in Nigeria, creating the successful Indomie instant noodles brand

manufacturing plants across Nigeria and a vast logistics company.

Tolaram’s MD for Africa, Haresh Aswani, told the London-based Financial Times in 2019 that navigating infrastructure challenges was frustrating, especially working with government to expand road access to Lagos’s main port.

“I will never deal with government again,” Aswani told the newspaper. “Give me the permits and just let me run the business.”

Despite the challenges, when a company like Tolaram makes multimillion-dollar investments in a country, it’s harder to pack up and go, even when the government ‘messes up’, emphasises Ojomo.

“In making those investments you are embedded in the social value of a country. It’s not about selling here and there. These guys cannot leave,” he says.

For those that stay and help to build Africa’s middle class and wider consumer market there is a potential pot of gold at the end of the rainbow … maybe. After all, in Africa nothing is certain and anything is possible.

However, as Business Day Nigeria newspaper wrote in a 2024 opinion piece, those that don’t invest today might not be well-positioned to benefit in the future.

“Here’s the truth: Africa is not a land of quick wins; it is a marathon, not a sprint,” wrote the editorial team. “Success hinges on a long-term commitment and a willingness to roll up

Is consumption – another name for consumer spending – really essential for economic growth?

“Consumer spending accounts for more than half (60%) of global GDP. When consumers spend, the economy grows; and when they don’t, it shrinks,” states Jon Copestake, Global Lead Retail Analyst for consulting firm EY Insights.

“Governments and companies rely on consumer spending as a foundational building block of the global economy and society,” he explains in a blog post.

“It’s become an accepted principle that progress is measured through growth and growth is driven by consumption. Companies are measured by how much they can grow revenues and margins; national economies are measured by how much they can grow GDP.”

your sleeves and build alongside the continent… Companies that succeed here will be those willing to invest in the future, not just exploit the present. They’ll be the ones who see the challenges as opportunities to cocreate a thriving marketplace alongside Africa, not skirt around them in search of a shortcut.”

Does this, therefore, make Africa’s non-consumption issue a problem or an opportunity?

Ojomo is holding out for the latter. “I’m optimistic because I have not yet found a valuable reason to be pessimistic,” he says.

Cara Bouwer is an experienced writer, independent researcher, journalist and editor. Her words appear in media articles around the world, in business case studies, white papers, insight reports and corporate copywriting.

› Africa has a big and growing population, but too many are non-consumers

The country will be the 14th member of the SADC Free Trade Area, providing Angolan businesses with expanded access to new markets.

IN WHAT WILL BE THE most significant milestone in the past decade for the Southern African Development Community (SADC) Free Trade Area, Angola is set to become the 14th member of the regional market.

Full ratification and implementation of Angola’s membership is expected to take place in May or June 2025, according to a statement released by the SADC Secretariat.

“This milestone is not only a victory for Angola but also a significant achievement for the region, reinforcing SADC’s commitment to deepening economic integration, fostering intra-regional trade, and

enhancing economic resilience,” the Secretariat states.

“With Angola’s inclusion, the SADC Free Trade Area takes a bold step forward, unlocking new avenues for industrial development, investment and cross-border trade. This achievement underscores the region’s collective vision for a more interconnected, economically vibrant Southern Africa.”

The SADC Free Trade Area (known as an FTA) was officially launched in 2008, with the primary goal of promoting intra-regional trade through the elimination of tariffs and non-tariff barriers among participating countries.

The FTA is presently being implement

by 13 of the SADC’s 16 member states, creating a market of over 280-million people and facilitating duty free trade on approximately 85% of goods.

Current FTA members are Botswana, Eswatini, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, United Republic of Tanzania, Zambia and Zimbabwe. The Democratic Republic of Congo (DRC) and Comoros are yet to join the SADC Free Trade Area.

“By joining the SADC FTA, Angola stands to benefit immensely from reduced trade costs, improved market access and greater regional cooperation, which are crucial for stimulating local industries, diversifying exports and attracting foreign investment,” comments the Southern African Research and Documentation Centre, which monitors regional developments.

“With Angola’s vast resources, growing industrial base and strategic location along the Atlantic coast, its integration into the SADC trade network is expected to bolster regional value chains, strengthen economic resilience and enhance Africa’s global trade competitiveness.

“This milestone, therefore, marks not just an economic transition for Angola but a significant step forward for Southern Africa’s broader trade ambitions, bringing the region closer to a fully integrated and competitive African market.”

Angola has traditionally relied on its oil exports, which comprise more than 90% of its foreign exchange earnings. However, diversification efforts have gained momentum in recent years, with agriculture, fisheries and manufacturing emerging as important sectors of the economy.

O país será o 14º membro da Área de Livre Comércio da SADC, proporcionando às empresas angolanas maior acesso a novos mercados.

de tarifas e barreiras não tarifárias entre os países participantes.

A FTA está actualmente a ser implementada por 13 dos 16 estadosmembros da SADC, criando um mercado de mais de 280 milhões de pessoas e facilitando o comércio livre de impostos em aproximadamente 85% dos produtos.

Os actuais membros da FTA são o Botswana, Eswatini, Lesoto, Madagáscar, Malawi, Maurícias, Moçambique, Namíbia, Seicheles, África do Sul, República Unida da Tanzânia, Zâmbia e Zimbabwe. A República Democrática do Congo (RDC) e Comores ainda não aderiram à Área de Livre Comércio da SADC.

NO QUE SERÁ O MARCO

mais significativo da última

década para a Área de Livre Comércio da Comunidade de Desenvolvimento da África Austral (SADC), Angola está prestes a tornar-se o 14 º membro do mercado regional.

A ratificação e implementação completa da adesão de Angola deverá ocorrer em Maio ou Junho de 2025, de acordo com um comunicado divulgado pelo Secretariadoda SADC.

“Este marco não é apenas uma vitória para Angola, mas também uma conquista significativa para a região, reforçando o compromisso da SADC em aprofundar a integração económica,

› Luanda, Angola

promover o comércio intrarregional e aumentar a resiliência económica”, afirma o Secretariado.

“Com a inclusão de Angola, a Área de Livre Comércio da SADC dá um passo ousado à frente, desbloqueando novos caminhos para o desenvolvimento industrial, investimento e comércio transfronteiriço. Esta conquista ressalta a visão colectiva da região para uma África Austral mais interconectada e economicamente vibrante.”

A Área de Livre Comércio da SADC (conhecida como FTA) foi lançada oficialmente em 2008, com o objectivo principal de promover o comércio intrarregional por meio da eliminação

MELHOR ACESSO AO MERCADO “Ao aderir à FTA da SADC, Angola pode beneficiar imensamente da redução dos custos comerciais, do melhor acesso ao mercado e de uma maior cooperação regional, que são cruciais para estimular as indústrias locais, diversificar as exportações e atrair investimento estrangeiro”, comenta o Centro de Documentação e Pesquisa da África Austral, que monitora os desenvolvimentos regionais.

“Este marco, portanto, marca não apenas uma transição económica para Angola, mas um passo significativo em direcção às ambições comerciais mais amplas da África Austral, aproximando a região de um mercado africano totalmente integrado e competitivo.”

Angola tradicionalmente depende das suas exportações de petróleo, que representam mais de 90% de suas receitas cambiais. No entanto, os esforços de diversificação ganharam força nos últimos anos, com a agricultura, a pesca e a produção emergindo como sectores importantes da economia.

Be Future Ready Be Globally Recognised Be Africa-Focused

Benefit from Over 60 Years of Education Excellence

Access the Latest, Industry-Relevant Curricula

Receive Academic and Professional Support

Graduate as a Highly Sought-After Job Candidate

Access International Markets through Global Expertise and Career-Ready Skills with Industry-Recognised Accreditation from:

Initiative aims to encourage positive storytelling and shift the narrative around the continent as a safe and desirable tourism destination.

Marketing Confederation is collaborating with UN Tourism, a specialised agency more formally known as the United Nations World Tourism Organization (UNWTO), on its Brand Africa initiative to create a responsible, sustainable and attractive pan-African tourism brand.

As part of this process to promote positive storytelling and shift the narrative around the continent as a safe and desirable tourism destination, the AMC was a guest at UN Tourism’s think-tank held in Zambia in July 2024, and again at a follow-up brainstorming session held at UN Tourism’s headquarters in Madrid, Spain in early 2025.

The latter attracted representatives of 20-plus African countries, with the AMC – through its President, Helen McIntee – being a special guest, along with technology conglomerate Meta (formerly known as Facebook Inc.).

Elcia Grandcourt, Regional Director for Africa at UN Tourism, emphasised to attendees that the growing number of international tourists travelling to Africa is proof of the expanded visibility and attractiveness that the continent has been able to achieve.

Figures from the World Tourism Barometer showed that African tourism has fully recovered from Covid, she said. During 2024, the continent even exceeded pre-pandemic levels by

registering 12% more arrivals than in 2023, and 7% more arrivals than pre-pandemic levels.

“This demonstrates the resilience of Africa’s tourism and the flexibility of the sector to adapt to an evolving international context which is still exposed to ongoing geopolitical and economic challenges,” Grandcourt stated.

Tourism sector is both flexible and resilient

In her presentation, Sandra Carvão, Director of the Market Intelligence, Policies and Competitiveness Department at UN Tourism, noted the importance of changing and reshaping global perceptions in positioning Africa as a premier tourism destination.

There is a strong interconnection between Brand Africa and the various national brands, she explained.

“The way people perceive Africa as a whole directly influences their views on individual countries, and vice versa. A strong national brand contributes to enhancing Africa’s overall image, just as a well-positioned continental brand can elevate individual destinations.

“To achieve this, we must work on two levels: national and continental. Strengthening Africa’s global brand will reinforce individual country identities, while solid national brands will collectively shape and consolidate Africa’s positioning on the world tourism map.”

Carvão listed the common challenges identified by delegates attending last year’s Brand Africa Think-Tank in Livingstone, Zambia:

● Narrative Ownership: Africa’s story is often shaped by external voices rather than by those within the continent.

● Media Influence: National media play a crucial role in shaping narratives that international media outlets, which may

The African Marketing Confederation is collaborating with, and supporting, the Brand Africa initiative in the following ways:

● Helping to strengthen individual national destination brands so that they can ultimately reinforce the concept of Brand Africa.

● Collaborating with learning institutions and researchers to access relevant data and insights that can be shared with Ministries of Tourism and national tourism organisations (NTOs) to strengthen and expand the capacities of African tourism professionals in strategic communication, branding and marketing.

● Providing data analytic tools which would help countries understand the audience they are targeting, to adjust and tailor their communication and messages accordingly.

● Establishing a Tourism Chapter within the AMC to facilitate appropriate knowledge-sharing and education.

In recent years, gastronomy tourism (also sometimes called ‘culinary tourism’ or ‘food tourism’) has emerged as a significant motivator for people to travel, offering authentic experiences that resonate with the growing interest in food among travellers.

At the same time, it is attractive to the growing number of tourists who are looking for a more profound connection with local communities during their trips.

“Africa’s gastronomic heritage is rich and diverse, yet often overlooked by tourists,” comments UN Tourism.

“Its flavours tell stories of cultural traditions, from ancient recipes to modern innovations. African cuisine reflects a fusion of influences, merging ancestral recipes with the creativity of chefs, who sublimate local specialties and ingredients, inviting the world to experience the richness of African gastronomy.”

With this in mind, the organisation arranged the first UN Tourism Regional Forum on Gastronomy Tourism for Africa in July 2024, which was held at Victoria Falls in Zimbabwe.

The forum brought together around 200 delegates from 33 countries, including 11 Ministers and Deputy Ministers, the African Union, the Southern African Development Community (SADC) and the Food

and Agriculture Organization of the United Nations (FAO).

Discussions at the forum emphasised the transformative power of gastronomy tourism in enhancing local communities and economies throughout Africa. Participants explored the role of gastronomy in elevating Africa’s presence on the global tourism stage, as well as strategies for integrating gastronomy into national tourism policies.

There was a strong focus on showcasing Africa’s rich culinary heritage to the world, emphasising the importance of collaboration among chefs, policymakers and other stakeholders.

Participants discussed the need for effective funding and the significance of combining tradition, innovation and quality to create unique food tourism experiences.

The forum also highlighted the importance of changing mindsets to value local gastronomy and instil pride in Africa’s diverse culinary traditions. This includes working with the African diaspora in promoting African cuisine globally, as well as stepping up education and vocational training.

UN Tourism hosts its Second Regional Forum on Gastronomy Tourism for Africa in Arusha, Tanzania on 23-25 April 2025.

not have a direct presence on the ground in African countries, will echo and amplify.

● Brand Creation and Management: How can destinations take control of their own storytelling, ensuring Africa is at the forefront of global tourism discourse? There remains immense untapped potential and countless unexplored stories about Africa.

● Structural and Policy Barriers: Issues such as connectivity, investment in infrastructure, visa policies, and workforce development constitute pressing issues to be tackled for Africa’s tourism development and growth.

Following on from the above, the participants in the Madrid brainstorming session listed several core conclusions and deliberations requiring further action:

● Branding and Communication: A targeted approach is essential to effectively reach and engage audiences.

● Data-driven Decisions and Strategies: More market research is needed to understand perception challenges through data, intelligence, consumer insights and statistical analysis. In this sense, it is also paramount to maximise the use of technology, modernise data and research (with a particular focus on big data) to analyse and gain a better understanding of consumers’ habits and behaviours.

● Building an African Travel Website (in the long term) as a platform to populate and showcase positive narratives and impactful stories from the continent.

● Creating the Brand Africa Community and Network by agreeing on an adaptive and easy-to-work-with model.

● Diversifying Tourism Products by prioritising cultural heritage, events, sports, gastronomy and MICE (Meetings, Incentives, Conferences and Exhibitions).

● Human Capital Development: Creating specialised training programmes focused on branding, marketing, social media and digital technology, while also developing strategies to attract talent to the tourism sector.

● Connectivity and Aviation: Reinforce the connection between tourism and aviation at the highest level through meaningful platforms such as the upcoming conference on Tourism and Air Transport in Africa taking place in Angola in July 2025.

Meta is providing technical support to government stakeholders to help

them fine-tune their marketing strategies across Meta’s platforms, apps and tools. Africa No Filter, whose primary mission is to shift stereotypical narratives about Africa, has also expressed interest in collaborating with the Brand Africa initiative.

Editor’s Note: The following two articles in this issue – outlining some of the philosophies of Africa No Filter and the potential role of Marketing 5.0 in growing excellence in the African commercial aviation sector – both tie in with the aims and objectives of the Brand Africa tourism initiative.

AFRICA HAS LONG HAD an image problem. We get top marks for great scenery and wildlife. But we’re viewed less positively on stability, development and economic growth.

The problem is that many of these perceptions are entrenched and self-perpetuating. Blinkered views

expressed by early foreign visitors about the ‘dark continent’ and ‘darkest Africa’ have somehow carried through to the 21st century and blended with narratives about wars, coups, dictators, disasters and famines.

That, in many instances, has now become the standard default African story line. International aid agencies

There’s a default and entrenched narrative around Africa that perpetuates negative stereotypes and ignores our positive stories. Can it be changed?

By Cara Bouwer + Mike Simpson.

trot it out in an effort to motivate (or “shame”) international donors into action. Developed-world news agencies and media outlets constantly refer to it in their content – which is often created in newsrooms on the other side of the world by journalists and editors who have never been to Africa.

Foreign leaders, investors, company

boards and business executives digest the narrative and allow it to influence and direct their African investment decisions as they sit in offices in the far-flung capitals of the world.

It’s a narrative that must be changed. A story that needs to be retold. A brand that has to be repositioned. Africa has warts and a past. But it also has glowing health and a future.

Prominent among those working to adjust the African narrative is Africa No Filter, a non-profit organisation

dedicated to challenging harmful stereotypes about the continent.

Speaking at the African Marketing Confederation’s annual forum in Mombasa, Kenya last year, its Executive Director, Moky Makura, addressed these perceptions head on, challenging the dilution of the real African story of art and creativity, opportunity and ideas, by lazy reporting about the continent.

These narratives, built on longstanding and stereotypical ideas of how Africa looks and acts, feed a particular bias about the “poverty, poor leadership, corruption and disease” across Africa, said Makura.

“There are three narratives through which the world is viewing Africa. The narrative that Africa is broken because somehow everybody’s trying to fix us, the narrative that we are dependent on outside donors … and the third one that bothers me the most is that we, as Africans, lack the agency to create the change that we need.”

Not only do these one-dimensional narratives impact beliefs about the continent, but they also affect how individuals, governments and businesses act – and hurt the bottom line for every African nation, argued Makura.

“There’s a thing called the African risk, really, where African countries pay more for debt, because there’s a perceived risk. Perceived risk, often not based on any data. So, it’s actually costing us,” she explained.

Africa No Filter’s 2024 report, The Cost of Media Stereotypes to Africa, puts the cost of this one-dimensional media narrative about Africa at US$4.2-billion in lost opportunities

Addressing the AMC forum delegates, Makura noted that content about Africa on the popular Wikipedia platform accounted for less than 2% of all subjects explored – less than the reportage on the city of Paris. Furthermore, when Africa did get a look in on news platforms, the angle was invariably negative.

This was particularly true during election cycles, when words such

as “rigging”, “rigged”, “corruption” and “corrupt” were frequently used when covering African elections –but far less so when covering elections on other continents.

Armed with these facts and figures, Makura presented at the World Economic Forum’s Davos gathering in January 2025, with a clear call for more coverage and better representation of Africa by global media outlets.

“There can be no true global development without Africa. Our significance goes beyond our population numbers – we are intrinsic to the world’s progress because of our vast resources, our critical role in addressing climate change, and the immense opportunities that exist,” Makura said.

“We are calling for equal partnerships that recognise and leverage the unique value this continent brings to the table.”

Africa No Filter issued a challenge to world leaders in Davos:

● In concer t with African governments, help break the chains of donor dependency and support Africa’s financial independence.

● Close the rhetoric-reality gap by matching words with bold policies.

● Embrace Africa’s potential as a leader in trade, innovation and sustainability.

“With Africa projected to be home to two billion people by 2040 and driving the largest free trade area in the world, the stakes are higher than ever. ANF calls on leaders at Davos to seize the moment, confront outdated narratives, and foster an equal global stage where Africa’s voice is heard and respected,” the non-profit said in a press release titled ‘Africa No Filter Challenges World Leaders at Davos: Align Rhetoric with Reality’.

‘ THE ECONOMIST’ COVER STORY

January 2025 proved to be a busy month for Africa No Filter, which leapt into the fray when The Economist, the prominent London-based business newspaper, published a cover story titled ‘The capitalist revolution Africa needs’.

“As the rest of the world ages, Africa will become a crucial source of labour: more than half the young people entering the global workforce in 2030 will be African,” The Economist reported.

“This is a great opportunity for the poorest continent. But if its 54 countries are to seize it, they will have to do something exceptional: break with their own past and with the dismal statist orthodoxy that now grips much of the world. Africa’s leaders will have to embrace business, growth and free markets. They will need to unleash a capitalist revolution,” the publication added.

Mokura, however, felt that The Economist had fallen into the trap of stereotyped reporting on Africa from afar and penned a sarcasm-fuelled response to the publication’s editor on LinkedIn. “It’s comforting to know that, from London, your team has been able to craft such a transformative theory of

change for a continent of 54 sovereign nations. Your observations about African leaders not being ‘serious about growth’ are particularly helpful. I’m sure they’ll find this advice to ‘get serious about growth’ to be both timely and inspiring,” she wrote.

In the subsequent debate on LinkedIn there were supporters and opponents of her viewpoint.

Dr Deanne De Vries – a professor, author and Africa advisor – commented: “Disappointing that The Economist (and others) seem unable to learn from history – their own history – of misdiagnosing what the continent of Africa represents, is, or allegedly needs.

“I think it is a way to continue deflecting from the woes of the UK (and other allegedly ‘first world’ countries).”

Writing in the Daily Maverick, veteran South African journalist Tim Cohen had an opposing view, “I hate to say this, but this time I think The Economist has absolutely nailed it. The most recent cover calls for the ‘capitalist revolution Africa needs’ and points out that Africa is slipping behind.”

Latching onto The Economist’s observation that “Africa must think big”, African branding authority, author and marketer, Thebe Ikalafeng, argues that African leaders do ‘think big’.

In fact, they’ve been dreaming about a shared vision for the continent, a common market and shared industrialisation since 1963 – and they reaffirmed this goal in 2013. However, dreaming big will only get you so far, he tells Strategic Marketing for Africa. With 54 countries at differing levels of development and sophistication, pulling all the strands together is a tough ask and one that requires a more nuanced and systemic approach to growth than simply pushing the capitalist button. After all, notes Ikalafeng, a united Africa must always consider “shared values of humanity, resilience, hospitality and resourcefulness” while walking a tightrope of “languages, cultures, sizes

and colonial-era borders”.

He agrees that Africa must industrialise, but it also needs to be smart about how. A big step was reached in 2018, when the African Continental Free Trade Area (AfCFTA) was finally ratified.

But, frustratingly, seven years on, the potential is still ‘on pause’ although the vision remains one of boosting intraAfrican trade from 15% to 50% by 2030 – creating a continent-wide economy of US$3.5-trillion in the process.

To reinforce the AfCFTA’s potential and drive much needed action, Ikalafeng believes an African Uniondriven pan-African ‘Buy Africa Act’ is the way to go.

Instead of perpetuating the production of goods it does not consume, while consuming what it does not produce (as Kenyan-born academic Ali Mazrui put it in his book ‘Africa, The Next Thirty Years’), Ikalafeng’s vision of Africa of 2050 is a place in which 50% of the most-admired brands that Africans buy will be made in Africa. That’s quite a number when you consider Africa’s population projection hits 2.5 billion by 2050, but that’s what thinking big will get you.

Is The Economist article a case in point when it comes to a skewed international media narrative around Africa. Or are we being too sensitive? As is so often the case, the reality may lie somewhere in between. And perhaps, if Africa thinks and acts big enough, the narrative will change of its own accord.

› ‘Thebe Ikalafeng

In a brave new world of expanding African aviation, Marketing 5.0 has a vital role to play in enhancing operational efficiencies and customer service. By Mahlet Debebe.

THE AVIATION SECTOR in Africa is experiencing dynamic growth and rapid transformation, resulting in various challenges and opportunities alongside an evolving technological landscape.

According to the African Airlines Association (AFRAA), passenger traffic for African airlines increased by 15% in 2024 compared to 2023. In December 2024, there was a 12.4% increase in traffic, driven by a 10.6% growth in international demand and a 5.5% increase in domestic traffic.

Similarly, the International Air Transport Association (IATA) reported in January 2025 that African airlines’ annual traffic rose 13.2% in 2024 versus the prior year. Full year 2024 capacity was up 9.5% and load factor

climbed 2.5 percentage points to 74.5% – the lowest among regions but a record high for Africa. December 2024 traffic for African airlines rose 12.4% over December 2023.

These statistics reveal a clear upward trend in travel demand, underscoring the necessity for the continent’s airlines to enhance customer service, operational efficiency and value-added services. Effective marketing strategies will be crucial, as each initiative enhancing operational efficiency serves as a compelling selling point for airlines.

Marketing 5.0 emphasises the integration of innovative technologies – such as artificial intelligence (AI), big data, and augmented reality (AR) – into marketing strategies. This approach is increasingly influencing various

industries, including aviation.

Notably, Marketing 5.0 recognises the generational diversity within society, accommodating five distinct generations simultaneously. In Africa, where aviation plays a growing role in economic and infrastructural development, adopting Marketing 5.0 can revolutionise how airlines engage with customers, optimise operations and create unique travel experiences. At its essence, Marketing 5.0 seeks to harmonise technology with human interaction, aiming to enhance customer experiences through technological innovation. It leverages data analytics, AI-driven insights, automation and immersive digital experiences to reshape the connections between airlines, airports and passengers.

› Airlines may use predictive analytics to gain insights into customer preferences such as seat selection and in-flight entertainment

Recognising the importance of generational dynamics is essential. In a competitive landscape, failing to acknowledge these differences can impede organisational effectiveness. The arrival of younger professionals in management roles signifies a generational shift, highlighting the need for customised communication strategies within the digital realm. Understanding these generational characteristics can help navigate potential communication challenges in the aviation industry:

● Baby Boomers: The Ageing Economic Powerhouse (1946-1964).

● Generation X: The Middle-Child Leaders (1965-1980), often overlooked.

● Generation Y: Millennials (born 19811996).

● Generation Z: The First Digital Natives (born 1997-2009).

● Generation Alpha: Children of Millennials (born 2010-2025).

The coexistence of these generations presents anticipated challenges in communication, particularly in the aviation industry, where integrated communication and aligned processes are vital for operational efficiency.

Marketing strategies – ranging from destination identification and customer segment analysis to pricing decisions, aircraft selection, seat design and service promotion – require careful communication planning.

Nonetheless, despite comprehensive strategies, challenges may arise among generations. These include budget constraints, resistance to new ideas, or opposition to marketing options proposed by Gen Y, Z or Alpha – and vice versa. These dynamics can significantly impact customer experiences, underscoring the importance of effective intergenerational communication within the industry.

The aviation sector in Africa is undergoing a significant transformation driven by Marketing 5.0, particularly in enhancing the passenger experience. As travellers increasingly seek personalised services, technology plays a pivotal role in this evolution. For instance, AI-powered chatbots are being utilised to assist travellers with flight bookings, itinerary management and real-time inquiries. This technology not only makes travel easier but also boosts passenger satisfaction, which is vital for fostering brand loyalty in a competitive airline market.

Marketing 5.0 plays a role as travellers seek personalised offerings ›

› Marketing 5.0 has a vital role to play in enhancing operational efficiencies and customer service in African commercial aviation

› Generational dynamics can impact customer experiences, underscoring the importance of effective inter-generational communication within the African aviation industry

Airlines are also employing predictive analytics to gain insights into customer preferences. This allows them to tailor services such as seat selection, in-flight entertainment and meal options to meet individual needs.

Research from McKinsey highlights this trend, revealing that 44% of global consumers engage in ‘web rooming’ browsing online and purchasing instore, while 23% prefer ‘show rooming’ – experiencing products in-store before buying online. Such varying behaviours underline the requirement for personalised and flexible customer experiences across sectors, including aviation. (Sourced from the book Marketing 5.0: Technology for Humanity by Philip Kotler, Hermawan Kartajaya and Iwan Setiawan).

Innovative technologies like virtual reality (VR) and augmented reality (AR) are enhancing passenger experiences both in airports and during flights. For example, VR systems provide immersive entertainment for travellers, while AR applications streamline navigation through check-in, security and boarding procedures.

These advancements help reduce stress and improve overall efficiency – crucial factors in today’s fast-paced travel environment.

In his book Marketing 5.0: Technology for Humanity, the celebrated marketing thinker, Philip Kotler, and his co-authors Hermawan Kartajaya and Iwan Setiawan, explain how marketers can use technology to address customers’ needs.

In a new age when marketers are struggling with the digital transformation of business and the changing behaviour of customers, this book – published in 2021, provides marketers with a way to integrate technological and business model evolution with the dramatic shifts in consumer behaviour that have happened in the last decade.

To stay profitable and sustainable, African airlines must embrace technology as a catalyst for innovation. Data analytics can optimise operations by improving flight scheduling and fuel efficiency.

Through big data and AI algorithms, airlines can forecast demand, enhance flight route planning and adjust ticket pricing dynamically based on real-time market conditions.

This is especially relevant in Africa due to significant fuel price fluctuations and seasonal travel demand.

Furthermore, the rapid expansion of mobile technology offers airlines an opportunity to amplify their marketing strategies through mobile platforms. With over 80% of Africans utilising mobile phones for payments and services, airlines can effectively engage with passengers through mobile apps. These applications provide real-time updates, personalised promotions and streamlined customer support, thereby enriching the travel experience.

Mobile booking services mark a significant advancement, enabling passengers to purchase tickets, manage itineraries, and check in without the need for physical tickets or direct interaction with airline staff. This convenience is particularly important in African nations where traditional distribution channels may be limited.

By integrating technological advances with a customer-centric approach, the aviation sector in Africa not only improves the passenger experience but also enhances operational efficiency and business sustainability.

The implementation of Marketing 5.0 within the African aviation sector

presents several notable challenges, despite its promising potential.

A significant obstacle is the limited connectivity to the internet, particularly in rural and remote areas. This lack of access hinders passengers from utilising mobile applications or digital platforms effectively. Nonetheless, as the mobile network infrastructure continues to develop across the continent, this barrier is progressively being mitigated.

Furthermore, issues related to data privacy and security pose considerable concerns. The extensive collection of customer data necessitates that airlines adhere strictly to global data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe. It is imperative that airlines ensure the secure handling and processing of passengers’ personal information throughout Africa.

Additionally, there exists a pronounced skills gap within the industry. Although the adoption of advanced technologies such as artificial intelligence (AI) and big data presents significant opportunities, there remains a critical need for qualified professionals capable of managing and operating these systems effectively.

Consequently, training and development initiatives within the African aviation sector will be essential to fully capitalise on the technological integration with humans.

As the aviation sector in Africa continues to progress, the integration of advanced technologies will play a crucial role in determining its success. The ability to personalise the travel experience, enhance operational efficiencies, and innovate in passenger engagement will afford airlines a competitive advantage in a rapidly growing market.

In the coming years, it is projected that African airlines will experience an annual growth rate of approximately

› Passengers now expect a range of booking and ticketing options, without the need for physical tickets or direct interaction with airline staff

5%, driven by the emergence of an expanding middle class and rising tourism, as reported by the International Air Transport Association (IATA) and cited by Aviapro, an aviation consulting firm operating from various international locations, including Africa.

This data highlights the importance of collaboration among governments, airlines and technology providers to ensure that infrastructure, regulatory frameworks and skill development are aligned with the increasing demand for digital transformation, customer

In a LinkedIn post published in late January 2025, Aviapro, an international aviation consulting firm, notes that since the pandemic the African aviation market has rebounded with impressive momentum.

“Despite rising operational costs and regulatory hurdles, the African airline market’s fundamentals remain strong, with air travel demand set to reach new heights over the coming decade,” Aviapro states.

“Passenger demand has surged across the continent, projected to reach 400-million by 2035, a sharp increase from the 80-million passengers recorded in 2019. Key hubs such as Johannesburg, Nairobi and Lagos have experienced significant upticks in passenger traffic, supported by the rise in both business and leisure travel. Additionally, airlines have launched new routes to meet demand.”

service excellence and value-added services for passengers.

In summary, the focus of African aviation going forward should encompass the integration of human skill development alongside the principles of Marketing 5.0, technological adoption, and innovation.

Mahlet Debebe is a strategic marketing advisor at the African Network for Innovation, an Addis Ababa-based organisation that works to foster innovation across Africa. She has extensive experience in marketing, research and development, and innovation. Mahlet holds a Master of Science in International Business from Addis Ababa University and a Bachelor of Arts in Marketing Management from Admass University.

‘Retail Trends to Watch in Africa in 2025’ event hears insights on how Nigerian brands can stand out in a highly competitive market.

are not unfamiliar with inflation and high food and fuel prices. But the current economic crisis has led to increased concern.

Research by NielsenIQ, for example, indicates that 75% of Nigerians were financially worse off in 2024 than in 2023 as food inflation reached its highest level in 25 years. In addition, the value of the naira currency dropped by two-thirds to hit an all-time low in February 2024.

Although the currency has since stabilised and inflation has eased slightly, uncertainty remains.

Understandably, this is a worry for management and marketing teams who are trying to sell retail products in a stagnant yet highly competitive market.

It was against this backdrop that media buying and planning agency

MediaReach OMD held a hybrid conference in early 2025 – in collaboration with the Lagos Business School, Pan-Atlantic University, and the National Institute of Marketing of Nigeria (NIMN) – to understand why some brands succeed while others fail.

The event examined what brands can do to capture the attention of fickle, often critical, ‘Naija’ consumers.

Most Nigerian businesses failed to grow in 2024, and conference keynote speaker Akbar Ali Shah – Managing Director for household, health and personal care company Reckitt

A privileged location to feed Asian

Benckiser’s SSA cluster – emphasised that new strategies are needed to change the status quo. With disruption the ‘new normal’, business leaders must be agile and companies need to relook their business models.

Although Nigerians are hopeful, this hope must be grounded in reality, attendees were told by Uchenna Uzo, Professor of Marketing and Academic Director of the Africa Retail Academy at Lagos Business School. He noted that few business innovations succeed, largely because the implementing businesses fail to understand what Nigerian consumers need.

Uzo stressed the importance of closely observing consumer needs and aspirations, but noted that Naija shoppers are notoriously difficult to reach, both literally and figuratively.

Logistical challenges aside, marketers need to understand that young, increasingly urbanised Nigerians are sophisticated bargain-hunters who put price concerns ahead of brand loyalty. According to NielsenIQ (NIQ) research, 70% of local consumers switched brands over the past year due to price increases.

Naija consumers are also known to be ‘mega-hustlers’ who wear many different hats and have different needs according to which ‘hustle hat’ they wear on a given day.

Uzo said successful companies understand the necessity of

communicating with customers and managing prices as best they can. Some examples of brands that are getting this right include Uber, which implements a dynamic pricing model that adjusts in real time based on inflation rates, and Nescafé, which has adopted sachet pricing to expand its market reach and customer base, especially in price-sensitive regions.

The bottom line? If you want to reach customers, you need to care most about their top three concerns: price, convenience and proximity.

Brand loyalty is a tough nut to crack, Uzo emphasised.

A recent brand recall survey indicated that only 56% of respondents could identify which positioning statements were linked to specific brands. For example, only 20% could recall the positioning statement of FirstBank, an institution that has been around since 1894. In addition, 80% of respondents ascribed positioning statements to a brand’s competitors.

Uzo emphasised that a brand’s purpose and positioning must resonate with customers.

Hypo Homecare, which manufactures homecare products, is one of those that has enjoyed success due to its affordable products and highly visible hygiene campaigns. For example, the brand has organised walks to raise awareness of the health risks of open defecation and using unsafe toilets in schools and public centres.

Consequently, Hypo Homecare is viewed as a change agent that has a positive impact in communities. This has led to portfolio growth of 72% over the past three years. “Brands that cautiously innovate their unique selling point to tackle customer pain points will thrive,” Uzo noted.

By contrast, fintech start-up Thepeer, which raised US$2.1-million in seed funding in 2022, closed its doors last year after failing to scale. Although it

boasted an impressive core concept and technological innovation, there has been slow uptake in accepting digital wallets as a viable payment option in Nigeria.

Ricardo Lopes, Regional Director for SSA at research company GeoPoll, pointed out that Naija consumers are socially and environmentally aware, and this also influences their purchasing decisions.

Around 86% of young people think it’s important or very important for brands to engage with social causes, according to a 2024 study conducted by the United Nations Development Programme and the University of Oxford. The study also noted that 82% of Nigerians base their life decisions –where to live and work and what to buy – on the effects of climate change.

This provides brands with an opportunity to use storytelling, sponsored content and educational campaigns to their advantage, amplifying more conscious narratives.

Lopes suggested that marketers integrate sustainability into their core messaging and operations, especially as young Nigerians are willing to look beyond price if products are ethically sourced and use eco-friendly

packaging. Partnerships with conscious brands can further raise awareness.

Consumers are content-led, but they gravitate towards platforms that offer convenience and flexibility, Emmanuel Charis Adediran, Business Unit Director and Head of Strategy at Nigerian media agency Plus Acuity, told the attendees.

Traditional channels need to plan for cross-platform distribution of content and explore new pricing models, said Adediran, noting that consumers tend to opt for free on-demand content that employs a more subtle, creative approach than a ‘hard sell’. However, it’s important to note that consumers still believe legacy media has an edge over digital platforms when it comes to factual information, so brands with a presence on a variety of platforms should strive to remain trustworthy and credible.

Another notable insight is that consumers gravitate towards brands that create ‘cultural moments’ and speak to Gen Z consumers in a way they can relate to, since they prefer a moment of connection to a product push. “[Competitors] can copy a product

● Brands that cautiously innovate their USP to tackle customer pain points will thrive.

● Creativity in price management and communication will grow brand loyalty.

● Supermarkets will outperform other sales channels.

● Social commerce will continue to dominate.

● Nigerian consumers are becoming more environmentally and socially aware, and this is influencing their purchasing decisions.

● Gaming is not just entertainment, but a sleeping-giant industry with a growing influence on marketing and consumer engagement.

● Going local: Nigerian consumers are increasingly favouring local brands over international ones.

● The ‘humanisation’ of brands will help to build cultural equity and growth this year.

● Leapfrog in AI adoption in marketing via content creation and personalisation.

● Nigerian consumers will remain content-led but coalesce around platforms that offer convenience and flexibility.

Source: ‘Retail Trends to Watch in Africa in 2025’ conference.

formula, but not a brand,” Adediran pointed out.

Brands that understand this are collaborating with ‘culture shapers’, whose stories inspire and motivate. A good example is Viva Plus Detergent’s partnership with popular fashion designer and stylist Veekee James, using the slogan ‘Designed by Veekee James, maintained by Viva’. This reinforces the brand’s aim to serve and inspire while meeting Nigerians’ everyday needs.

Another noteworthy example is the collaboration between Samsung and AI innovator Jadrolita, who has been named as Samsung’s ‘physical AI robot’. She originally created TikTok content as ‘Jarvis’, an AI character from the Iron Man movie franchise, and collaborated with other TikTok personalities.

Importantly, Nigerian consumers are increasingly favouring local brands over international ones, which means that brands that showcase Nigerian stories and culture will be far more relatable and palatable. “Localising international executions is not good enough,” Lopes said.

Brands have learnt that Nigerian gamers are a force to be reckoned with. Africa’s gaming industry is booming, with around 46.5-million gamers in Nigeria alone, according to the 2023 Africa Games Industry Report

More than half of these gamers value cultural relevance, Lopes stated, and a mobile-first gaming strategy will pay off for media buyers and brands, since 92% of these gamers play on their phones, with 65% making a purchase after seeing an in-game ad.

If these ads reinforce national or regional identity, so much the better – and international companies can win by partnering with complementary Nigerian brands, thus solidifying their own brand positioning.

Social commerce – buying and selling products directly on social media – is also growing, with 69% penetration in Nigeria. Around 65% of shoppers can

In its ‘Nigeria: Economic forecast for consumer demand through 2025’, Trendtype, the emerging markets consultancy, says the general trend for Nigerian consumers for the next few years will be downtrading and downsizing.