South East Asia

VOL 2 | ISSUE 6 | OCT-NOV 2022

EMPOWERING, INSIGHTFUL, ENGAGING W W W . S O L A R Q U A R T E R . C O M

How will corporate Power Purchase Agreements play a bigger role in Southeast Asia’s Solar Market? 04

Chung CEO, CME Solar 06 PUBLISHING Firstview Media Ventures Pvt Ltd EDITING Ashwini Chikkodi editorial@firstviewgroup com CONTENT Sadhana Shenvekar Rajarshi Sengupta publishing@firstviewgroup com DESIGNING Radha Buddhadev Neha Barangali design@firstviewgroup.com ADVERTISING Smriti Charan Sangeeta Sridhar advertise@firstviewgroup com ADVERTISE WITH US Contact: Smriti Charan e: smriti@firstviewgroup com CIRCULATION Sadhana Shenvekar SUBCRIPTION subscribe@firstviewgroup com CONTENT Opinion Interview Company Feature Product Launch Trina Solar GoodWe Trina Solar 08 12 10 Product Feature Trina Solar 09 Research Policy Insight Policy Debrief Technical Insight 13 14 16

Tuan

OCT-NOV ISSUE 2022 | PG 03 | SOUTH EAST ASIA

AUTHOR:

NIRANPAL SINGH Managing Director, BayWa r e Malaysia, BayWa r e Energy Solutions, APAC

The demand for energy in Southeast Asia is growing rapidly and according to the ASEAN Centre for Energy (ACE), the energy demand in the region is foreseen to triple by 2050. Most countries have adopted an approach to increase and adopt a future energy mix leaning towards renewable energy

This transition towards renewable energy generation is not only seen to be a rapid and quick enabler for capacity but the participation of private players in the market is further enabled by structures of the Power Purchase Agreements

Because of its financial and geographical feasibility, Power Purchase Agreements (PPAs) may become the primary entry point for companies to participate directly and introduce solar energy into their energy mix Companies and corporates have adopted targets and achieving them is no longer a matter of choice but for some a core commitment.

It is timely and critical for companies to make the transition

With every installation of the Conference of the Parties (COP), Southeast Asia will not be left out but are also racing towards adding more renewable energy into its energy mix, in a bid to reduce carbon emissions and limit global warming to 1 5 degree Celsius.

Governments are expected to establish stricter policies to achieve climate ambitions, while commercial & industrial (C&I) corporations take on greater responsibility in fighting for climate change in every way that they deem possible.

Reportedly, an 80% increase in renewable capacity among corporations in Asia Pacific is expected between 2022 to 2024 Part of this growth is attributed to more attractive corporate power purchase agreements (PPAs) and the respective business models of offering ZERO CAPEX sustainable solutions, making business decisions easy

THE CROSSROADS BETWEEN ECONOMIC HEADWINDS AND CLIMATE CHANGE

The solar market is well-positioned to provide PPA options that are ideal for companies to embrace renewable energy without sacrificing the capital that is needed for its core business Power prices have become more volatile and unpredictable, especially al tensions, supply chain outages, and with making their switch, to cleaner generation

As a consequence, this has made direct investments in renewable energy projects riskier for corporations without the know-how or experience

As such, corporate PPAs present an ideal strategy for solar market players to offer as the future standard solution

On one hand, PPAs encourage corporations to adopt carbonfree energy solutions while reducing energy costs On the other hand, PPAs help solar players balance costs, quality, and plant efficiency to tackle the rising costs of development and counter inflation.

With PPAs, risks associated with renewable energy investments can thus be minimized Corporations are able to get greater certainty over energy costs, while solar players secure steady future revenues from these assets.

This has also contributed to the region's heavy reliance on PPAs.

POWERING CORPORATIONS ACROSS BORDERS

PPAs are not bound by location, and this creates greater potential for solar players and corporations operating across Southeast Asian countries

In Europe, BayWa r e signed a 10-year PPA with Nestlé, the world’s largest food and beverage company The development of a solar park will see BayWa r.e. providing power to the conglomerates’ operations in Spain and Portugal

Generating 62GWh of sustainable energy per year, the energy produced from the solar plant is enough to power 25,000 households and save over 70,000 tons of carbon dioxide annually

Introducing renewable energy for cross-border operations has never been more convenient, and the multi-country benefits a single PPA can bring would be worth highlighting

LEVERAGING PPAS BENEFITS

The outlook for the role of PPAs in Southeast Asia remains optimistic with plenty of opportunities and growth and the solar market must be prepared for the accelerated growth of PPAs.

Solar players like BayWa r e will keep strengthening our PPA solutions towards the market needs.

From custom-tailored PPA options to offering virtual solar PPAs, these are implementations that would be necessary for the solar market to adapt to the growing need for PPAs in Southeast Asia’s energy transition.

OPINION

OCT-NOV ISSUE 2022 | PG 04 | SOUTH EAST ASIA

OCT-NOV ISSUE 2022 | PG 05 | SOUTH EAST ASIA

Tuan Chung

CEO, CME Solar

CONVERSATION HIGHLIGHTS

The price policy must be long-term and adjusted to the market so that investors can calculate the risks in advance

Other manufacturing sectors of Vietnam are also considering renewable energy from rooftop solar power systems as the most optimal solution in the plan to reduce greenhouse gas emissions towards the end of the year towards a green economy and sustainable socio-economic development

In the immediate future, it is proposed to apply a pilot Direct Power Purchase Agreement (DPPA) mechanism to facilitate users’ demand for green energy

Rooftop solar is still the most optimal solution for the factory to cut production costs, reduce greenhouse gas emissions and fight climate change."

The potential of the rooftop solar market is still a big room There are many reasons:

There Increasing rapid of industrial zones in Vietnam that lead to increasing demand for energy: The nation contains 520 industrial parks (IPs) with a total natural land size of 200, 900 hectares as of May 2022. There are 286 operating IPs (generating 3 78 million direct employment) with a 71 8 percent occupancy rate, down from 74% last year H1/2022 saw the establishment of 30 new industrial parks, 5 more than in H1/2021 Rooftop solar is still the most optimal solution for the factory to cut production costs, reduce greenhouse gas emissions and fight climate change

The global trend of combating climate change, Vietnam committed to net zero emissions by 2050: at the United Nations Conference on Climate Change - COP 26 To realize this goal, other manufacturing sectors of Vietnam are also considering renewable energy from rooftop solar power systems as the most optimal solution in the plan to reduce greenhouse gas emissions towards the end of the year towards a green economy and sustainable socio-economic development

In the northern region, there may be a shortage of peak capacity at some times, especially when the weather is hot and sunny The North's electricity consumption demand currently accounts for nearly 50% of the whole country and is forecast to grow higher than the national average With the actual situation of 2022, new power sources in the North are expected to be very low, and additional new power sources in the Central and Southern regions (mainly renewable energy) in recent years are also can only partially support the North because the transmission capacity through the 500 kV line is technically limited to the level to ensure the safety and stability of the system

There are also some issues for solar investors:

The installation conditions for solar power are still not clearly regulated. At present, the evaluation of standards and legitimacy is still unclear, and most of them are spontaneous and lead to a large appraisal cost

There is a lack of consistency and regulation throughout Some businesses are still confused because there are still no specific instructions This needs to be clear, the procedure to avoid a lot of trouble

The effects of solar PV on power quality (voltage, harmonics, voltage flicker) should be studied and remedial measures are taken."

OCT-NOV ISSUE 2022 | PG 06 | SOUTH EAST ASIA INTERVIEW

CAN YOU PLEASE GIVE US A BRIEF INSIGHT INTO VIETNAM’S ROOFTOP & C&I SOLAR MARKET OUTLOOK?

Regarding rooftop solar power (PV), currently, there is no national technical standard for rooftop solar power system equipment. There is no regulation on the supervision and control of solar PV systems, so the dispatching level cannot command and operate There is no consensus on guidelines for licensing including fire prevention and fighting, construction permits and environmental impact Especially, the purchase price mechanism for solar and wind power has expired, but there is no replacement and transitional new pricing mechanism

It is necessary to have a price bracket to buy electricity for solar and wind power projects as soon as possible because the FIT price expires too long Many businesses have completed building power sources without selling electricity and the power system is at risk of power shortage soon New businesses do not dare to invest The price policy must be longterm and adjusted to the market so that investors can calculate the risks in advance

In the immediate future, it is proposed to apply a pilot Direct Power Purchase Agreement (DPPA) mechanism to facilitate users’ demanding green power.

Continue to allow the development of rooftop solar power for the purpose of self-use, not generating (not selling electricity) to the national grid However, the Government and the Ministry

WHAT WOULD BE YOUR PREFERENCE BETWEEN N-TYPE AND P-TYPE LARGE FORMAT SOLAR MODULES FOR VIETNAM'S DISTRIBUTED SOLAR MARKET AND WHY?

It is dependent on the individual case, if the client’s size roof is small, Investors would like to use the N-type as it could optimize the energy that client could use because N-type provides high performance with a small size of PV. However, we also use the Ptype for our clients too, because the cost of PV is quite reasonable so we could offer a higher offer for DPPA services

INTERVIEW

The Government and the Ministry of Industry and Trade need to issue technical regulations for self-using rooftop solar power so as not to affect the grid when businesses and people install solar power for their own use."

WHAT IS YOUR OPINION ON ITS RECENTLY PROPOSED PDP-VIII LEGISLATION TO ACCELERATE VIETNAM'S ROOFTOP AND C&I INSTALLATION?

OCT-NOV ISSUE 2022 | PG 07 | SOUTH EAST ASIA

of Industry and Trade need to issue details and clear technical regulations for self-using rooftop solar power so as not to affect the grid when businesses and people install solar power for their own use

COMPANY

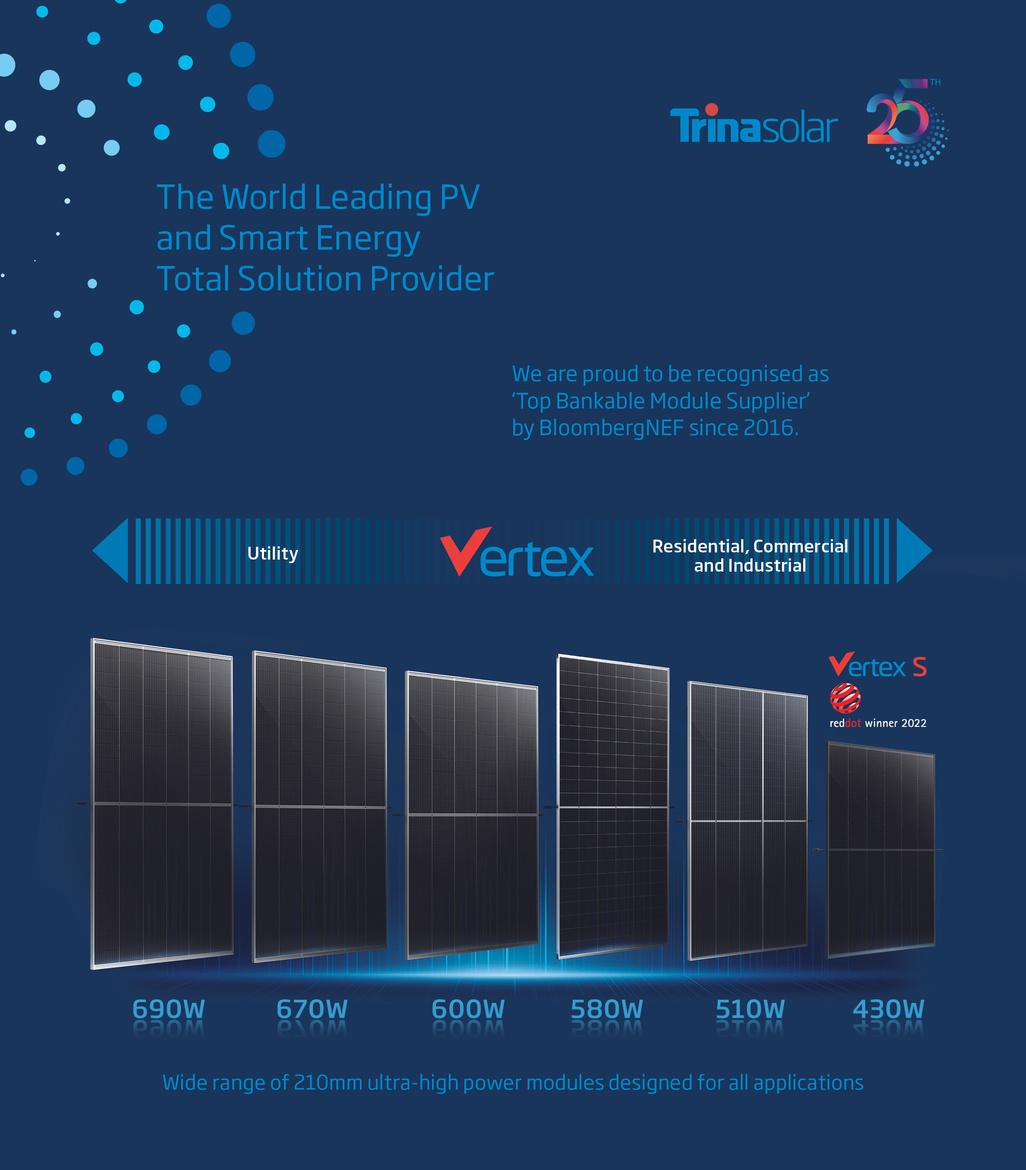

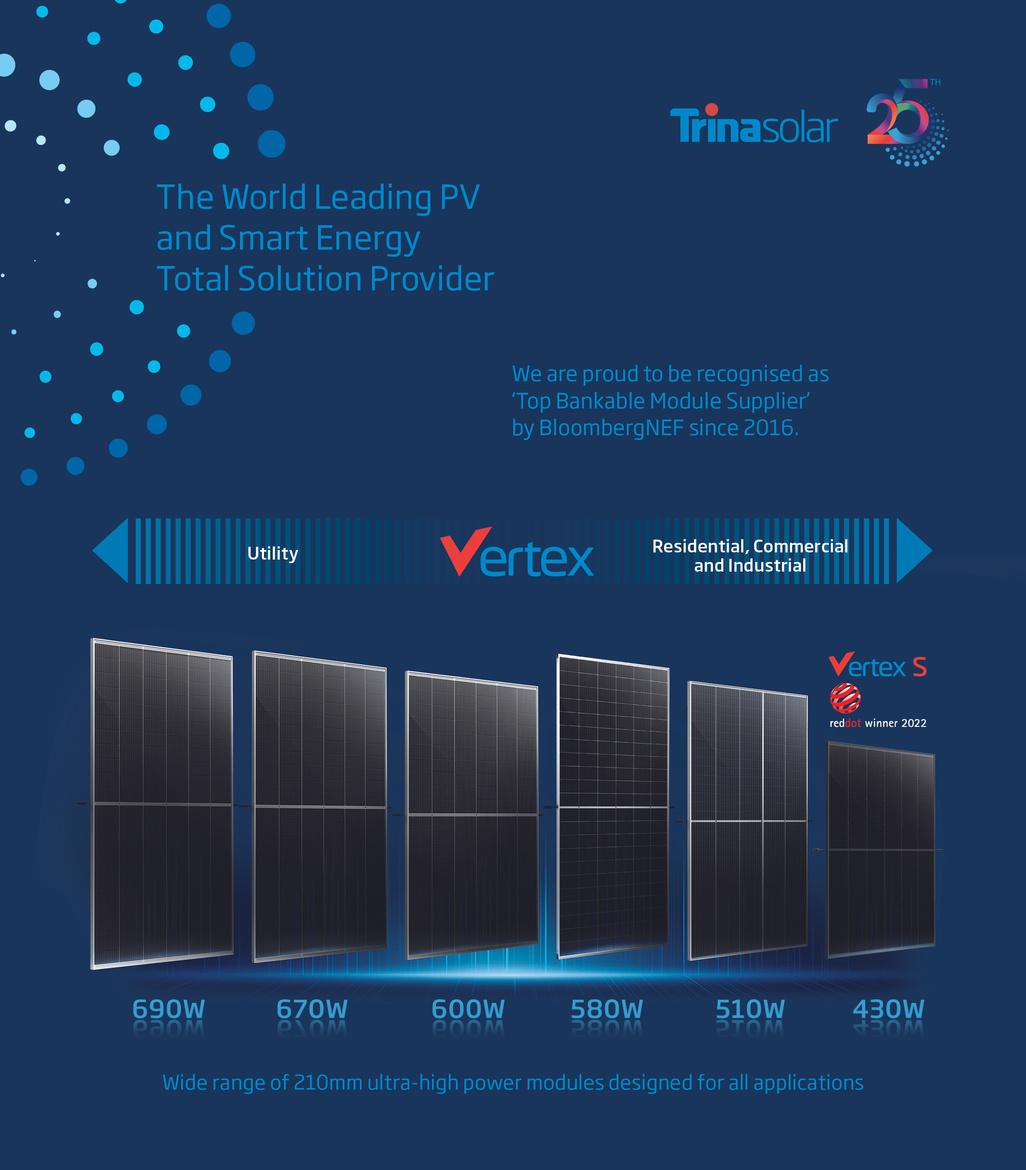

Trina Solar, a leading global PV and smart energy total solution provider, has stressed its clear commitment to leading the industry towards new levels of sustainability in every sense of the word In a session themed The Road to a Sustainable Future with a number of major renewable energy investment companies, hosted by BloombergNEF in London in middle October, Trina Solar outlined its vision for advancing the way to a net-zero future by providing smart solar energy solutions

The European Trina Solar team highlighted technological innovation, world-class quality standards, sound policies and knowledge sharing as key drivers for achieving a sustainable business and future-proofing Trina Solar’s leadership in the PV industry The company’s strategy actively supports all relevant global Sustainable Development Goals (SDG) shaped by the United Nations (UN) In addition, Trina Solar has joined the Science Based Targets initiative (SBTi), contributing to the common goal of limiting global warming to 1 5°C

Since the sustainable investment community demands supplier transparency as part of their own reporting standards, Trina Solar has been publishing annual CSR reports for many years. This year the company has been one of the first to adopt ESG (Environmental, Social and Governance) reporting standards As outlined during today’s event, as well as in Trina Solar’s latest ESG report, the company’s sustainable development path can be divided into the three broad categories of environment, society, and products & solutions

Trina Solar is aiming to achieve 100% renewable energy use in manufacturing and operations by 2030, aligned with the UN’s SDG 7 By 2025, the company will cut greenhouse gas emission intensity of solar PV products by 50%, while reducing its energy and water consumption in production by at least 40% and 20%, respectively Today, Trina Solar’s total carbon emissions during production, operation and R&D are remarkably less than total carbon emission offset by green electricity generation through Trina Solar PV stations, PV roof electricity generation, green electricity purchase and energy conservation.

Recently announced to the market, the new Vertex N module, featuring N-type TOPCon cells, has the best potential to make a positive impact on carbon emission reduction, as well as levelized cost of electricity. Trina Solar is currently ramping up new capacity of Vertex N based on the latest 210mm cell technology, which will be fully available and delivered in Q1/2023, with 10GW+ capacity to be released then

It goes without saying that Trina Solar’s long-lived practice of setting highest test and quality standards, backed by a comprehensive product warranty, are the best means to ensure longevity and reliability, as well as maximizing positive impact on the environment; resulting in world-class bankability ratings by BloombergNEF and other major players.

Driving transformation from the top

Fully aware of its social responsibility as a big global solar PV player, Trina Solar has introduced strict supply chain management systems, ensuring full compliance with industry standards and the regulations of each market The company integrates EHS (environment, health, and safety) and corporate social responsibility into all stages of the product life cycle

Moreover, Trina Solar is pursuing a stronger vertical integration in its new manufacturing bases such as the integrated N-type factory in Qinghai province, China The factory covers almost the entire PV manufacturing chain from polysilicon production to modules, thus inherently achieving maximum supply chain traceability

Products & Solutions

Trina Solar is converting its entire annual module manufacturing capacity of currently 65+ GW to 210mm Vertex modules The 210 Vertex family products (410–670W) have achieved an industry ssions assessment through ISO’s LCA (life arbon footprint qualification by renowned odies such as UL, EPD and Certisolis.

“The environmental challenges ahead of us require a major shift in mindset and leadership The UN has defined clear Sustainability Development Goals, driving transformation from the top Likewise, Trina Solar senior management has shaped a sustainable way of doing business from the beginnings of the company 25 years ago We are fully aligned with the UN’s defined goals, and are contributing actively to reaching them”, says Gonzalo de la Viña, Head of Europe at Trina Solar

De la Viña added, “As part of the PV industry, our responsibility and commitment is to drive technological innovation along the value chain to push for the transition into a carbon-free world. Our customers, especially renewable energy investors, have a high and increasing demand for ESG related information, not least because they are required to report on these topics to their own stakeholders At Trina Solar we are more than ready to provide maximum transparency and traceability, because our sustainable way of doing business is deeply engrained in our DNA ”

Click to download Trina Solar's 2021 ESG report: https://www.trinasolar.com/en-glb/our-company/sustainabilitydownloads

OCT-NOV ISSUE 2022 | PG 08 | SOUTH EAST ASIA

Trina Solar outlines key strategies for driving PV industry towards a Net Zero Future FEATURE

Environment Society

Trina Solar (688599 SH), a leading global PV and smart energy total solutions provider, reported its third quarter 2022 financial results on October 30, announcing revenue of about USD 8.8 billion (RMB 58 2 billion) in the first three quarters, up 82 56% yearover-year

Trina Solar said that by the end of the third quarter its module shipments for the year had totaled 28.79GW, tracker shipments totaled 2 8GW and energy storage shipments exceeded 300MWh Trina Solar ranks first in the industry worldwide in the number of 210mm cell modules shipped. According to the third-party TrendForce, the industry shipped 50GW of 210mm cell modules by the end of the third quarter this year, and the shipments of 210mm cell modules had totaled 76GW from the time they went into mass production

In mid-October Trina Solar launched its Vertex N 595W for rooftops and utility-scale projects globally, adhering to the LCOE-oriented principle, inheriting the Vertex family’s four key competencies of higher power, higher efficiency, higher energy yield and higher reliability, with 30W higher than conventional n-type modules in the market, delivering lower BOS and LCOE to projects

Trina Solar is committed to technical innovation and continues to lead the industry with n-type technology In August the company once again broke a world record by setting the aperture module efficiency of Vertex n-type module at 24 24%

The new generation of Vertex N modules will be in mass production by the end of this year, more than 10 GW of n-type modules capacity is expected to be released by the first quarter of next year, and 20GW to 30GW of capacity is expected to have been put on the market by the end of next year

The Vertex S Aesthetic Module, an upgraded product for residential market, defines the category of aesthetic black solar modules through all-around top and precise technology, including cells, bus bars, back sheets, frames, glass, modules,

“Trina Solar has always been committed to serve global customers with clean and lowcarbon products. We will continue to progress through technological innovation and provide customers with high performance and high value products, for a wider range of PV application all around the world.”

and packaging, delivery, unpacking, and installation in rooftop scenarios The high-standard design is aesthetically appealing in every detail, aiming to provide customers with an enjoyable experience of high technology and aesthetics that co-exist in harmony

Helena Li, Senior VP at Trina Solar said: “Trina Solar has always been committed to serve global customers with clean and lowcarbon products. We will continue to progress through technological innovation and provide customers with high performance and high value products, for a wider range of PV application all around the world ”

Thanks to Trina Solar’s excellent product performance, technological innovation and stable financial performance, it has won recognition in the financial market and from renowned institutes. Trina Solar was once again given the top AAA ranking in the latest Module Tech Bankability Ratings report by PV-Tech for the third quarter of 2022 In addition, Trina Solar has scored 100% in the BNEF Bankability Survey for six consecutive years, and Vertex modules have rated consistently highly in the Bankability Study For Trina Solar PV Modules by UL.

development of 210mm cell ules, including 600W+ ultra-high er modules, continues its strong worldwide, and TrendForce says industry has accelerated into the W+ era, with G12 cell (including R) +n-type cell technology ming the mainstream technology new generation of high-efficiency ules

rding to TrendForce, by the end of , the production capacity of large ules will account for 89% of modules dwide Of that, the capacity of mm cell modules is expected to h 466GW, accounting for 57% of all ules The dominance of 210mm cell ules will continue to grow from 2023 capacity of 210mm cell modules will unt for 66.04% by the end of 2025.

PRODUCT FEATURE

Trina Solar announces module shipments of 28.79GW as of third quarter, new-generation Vertex N modules redefine high-efficiency products

OCT-NOV ISSUE 2022 | PG 09 | SOUTH EAST ASIA

PRODUCT LAUNCH

Trina Solar defines the aesthetic black product by high tech, delivering new Vertex S modules globally

Trina Solar’s Vertex S Aesthetic Module, an upgraded product highly anticipated by global customers, has arrived in Europe, Australia, Japan and other markets recently It is the first solar PV module to win the Red Dot Award and is turning heads because of its efficient and reliable performance and an outstanding design and visual appearance, making it a favorite among distributed solar rooftops in global markets.

Vertex S Aesthetic Module, a ground-breaking innovation, defines the category of aesthetic black solar modules through all-around top and precise technology, including cells, bus bars, back sheets, frames, glass, modules, and packaging, delivery, unpacking, and installation in rooftop scenarios The high-standard design is aesthetically appealing in every detail, aiming to provide customers with an enjoyable experience of high technology and aesthetics that co-exist in harmony

Trina Solar, keenly aware of customer demand for products both technologically sophisticated and aesthetically appealing, has become one of the first leading companies in the industry to develop and launch an aesthetic black PV module

The Vertex S Aesthetic Module is equipped with selected cells strictly following the single, rigorous principle that all cells should be black and each of them should be almost equally black, offering both satisfactory cell efficiency and an ultimately aesthetic look

Trina Solar’s technical team is committed to innovatively upgrading film-forming technologies, improving the cell appearance graphic processing capabilities through the rigorous automated visual inspection system vision algorithm solutions In the production process the cells are subject to over three times automated visual selection, to achieve consistency in color and free of any flaw

Aesthetic black module

The Vertex S Aesthetic Module delivers a humanistic and aesthetic experience that is achieved through a combination of demanding processes and exacting standards over the black cells, frames, back sheets, labels, bus bars and glass, etc

Define Aesthetic Module by three dimensions

Aesthetic glass: Trina Solar has has innovatively developed and applied the double layer ARC (antireflection coating) glass technology that delivers a more consistent black effect to solar modules and reduces glass reflection. The LAB color mode has been introduced to measure and manage the aesthetic solar module to precisely control the chromatic values to appear more colorless, transparent and pure, thus greatly enhancing the aesthetic effect.

Uniformity: The Vertex S Aesthetic Module also features strict control over the uniformity of black chromaticity The black frame and back sheet make for a seamless and scratch-free appearance, thus ensuring high stability and consistency in hue, brightness and uniformity.

In October, Trina Solar, led by the China Photovoltaic Industry Association, developed a group standard in terms of coating chromaticity after deep discussion with third-party experts, leading the industry by establishing the color specifications and uniformity criteria for the aesthetic black solar modules.

Aesthetic

Multiple rows of aesthetic black modules, installed on the same plane, present a uniform and consistent almost-all-black effect, regardless of the roof type and angle of inclination, perfectly blend with the building and the surroundings

Black solar cell defines a rigorous aesthetic principle

OCT-NOV ISSUE 2022 | PG 10 | SOUTH EAST ASIA

black solar roof offers an all-round tech-savvy and aesthetic experience

To deliver an all-around black experience, Trina Solar has also adopted an outdoor installation scenario-specific evaluation method to inspect precisely

With the arrival of the upgraded Vertex S Aesthetic Module in Europe, Australia, Japan and elsewhere it has been used extensively in distributed solar PV projects Since the module was launched in 2020 it has been installed on countless rooftops worldwide The product, being highly efficient with a black and aesthetic look, has set a global trend in integrating solar power with a tech-savvy and aesthetic experience A quick uptake in global markets has, in turn, reinforced the Trina Solar’s positioning as the leader in truly aesthetic black modules

As defined by Trina Solar, an aesthetic black module should, following the single, rigorous principle, be as close to full black with zero color difference as possible, and deliver an allaround tech-savvy and aesthetic experience in various application scenarios To this end it needs to ensure high uniformity between all cells, between cells and frames and between modules, even under different installation angles. Only by doing so can the solar roofs finally produce a unified visual effect, which guarantees integrity, an essential element in building exterior design, and delivers to customers an almost-all-black aesthetic solar roof in a real sense.

An ingenious masterpiece of exquisite packaging

Solar’s aesthetic concepts are not only reflected in its products, but also applied in its exploration of packaging. Its newly upgraded pure black packaging design is consistent with the black appearance of the module

first scenario-based

use

Aesthetic

PRODUCT LAUNCH

OCT-NOV ISSUE 2022 | PG 11 | SOUTH EAST ASIA

Vertex S Aesthetic Module applied on the roof globally

Trina

With the industry’s

packaging solution, the Vertex S

Module provides customers with an all-around aesthetic experience that runs through pickup, unpacking and

By offering customers more aesthetic experiences as well as meeting their needs for green power, Trina Solar’s innovative Vertex S Aesthetic Module marks that solar rooftop products are transforming from green power to a gorgeous blend of ecofriendly technology, green aesthetics and harmonious experience

New milestone for GoodWe, new frontiers for Utility-scale PV

On November 16, a giant gift with a size of over 30 m³ appears in Guangdong Province, China

This is GoodWe’s first large-scale ground-mounted MV Station, which is ready to be delivered to the LSS4 project site in Malaysia GoodWe has dived deeply into achieving technology innovations and providing a turnkey solution for utility-scale projects

GoodWe MV Station mainly consists of high & low-voltage cabinets, a transformer and containerized enclosure The enclosure of the MV station is of high ingress protection level up to IP54, and the anticorrosion level reaches the C4H standard, which is suitable for longdistance ocean transportation The container has CSC safety certification, fully stackable during ocean transportation, which has greatly reduced freight costs

The high-voltage cabinets are equipped with an SF6 insulated ring main unit which has a voltage level of up to 35kV Compared with the air-insulated switchgear, it is of compact structure and smaller volume, which greatly reduces the space requirement inside the container, making the overall size of the cabinets smaller, and reducing the footprint of the MV station

In addition to the main Air Circuit Breaker and Molded Case Circuit Breaker, the low-voltage cabinets are also equipped with monitoring and control devices to transmit the MV Station operation data to the customer power plant control system in real-time It is also equipped with Auxiliary Transformer, UPS and sockets to facilitate maintenance and repair

The MV Station is equipped with a large-capacity oil-immersed threephase transformer, using low-loss high-quality silicon steel and wires, customized design, to make the transformer highly efficient low in noise and compact to fit into a 20 feet container

The transformer and MV / LV cabinets are pre-assembled and fully connected in the factory Once the MV Station is on the project site, clients just need to put it on the foundation, connecting HV and LV cables, then it can be put into operation through very simple commissioning, it will greatly reduce manpower and the overall commissioning cycle time to minimize human effort on site

In August 2022, the successful bidders of Malaysia LSS4 tender will have their power purchase agreements (PPAs) extended by four years, from 2021 to 2025 “The overall solution is of great significance to GoodWe, allowing it to qualitatively improve the comprehensive strength of ground power stations and rank at the forefront of the industry GoodWe is honored to support the Malaysia LSS4 projects and thanks to customers’ trust. In the future, GoodWe will also live up to expectations, and continue to bring more reliable smart energy solutions to customers with high-quality products and services ” said Jell Jiang, Business Director of GoodWe Southeast Asia and Central Asia

In recent years, GoodWe has built its corporate reputation by achieving sustainable growth in every market it operates With a longstanding strong presence in the solar market, GoodWe PV inverters have seen an accumulative installation of 35 GW in more than 100 countries. This time’s large-scale ground-mounted MV station delivery, not only makes a new milestone for GoodWe in the utility sector but also shows a step closer to the overall solution capability, re value and deeply empower the world.

COMPANY FEATURE

OCT-NOV ISSUE 2022 | PG 12 | SOUTH EAST ASIA

Proposed Mechanism Wind and Solar Projec

The Transitional Projects of Vietnam finished construction but have not ye projects also include those that have the power price has yet to be determ of Industry and Trade of Vietnam (MO to specifically address problems for so that remain unfinished ("Transition created under the Prime Minister’s D dated April 6, 2019, on the developm power plants (Decision 13), and Decision No 37/2011/QD -TTG, dated June 29, 2011, regarding the development of wind energy projects (Decision 37), and amended by Decision No 39/2018/QD -TTG dated September 10, 2018. (Decision 39).

Two options are offered by the MOIT :

Option 1: Developers for the Transitional Projects sign power purchase agreements with Vietnam Electricity (EVN) These agreements are subject to the price framework set by the MOIT according to the Law on Electricity and the Law on Prices and any subordinate guiding legislation

Or

Option 2: Prime Minister makes a new decision defining the procedure for bidding for the purchase of power from Transitional Projects It is estimated that this will be done within the MOIT price framework for a period of three years.

The Prime Minister will be asked to issue a directive in writing so that the MOIT may have the grounds to offer further guidance regarding the review and reconsideration of the signed PPA among EVN developers This would allow the MOIT to weigh the benefits and needs of the parties to the agreement, which includes buyers, sellers, and end-user customers

The MOIT proposes that future developers of wind and solar projects negotiate power prices and sign PPAs with EVN This is in accordance with the MOIT's price framework and guidance

The MOIT requests the Prime Minister to repeal these decisions for the following reasons Decision 13, Decision 37, and Decision 39 are still legally active

Provisions regarding the FIT no longer apply from January 1, 2020, for solar power; and from November 1, 2020, for wind energy

Many of the key provisions in these decisions have been deemed invalid These include the PPA term of twenty years, the adjustment of the FIT to the fluctuations of the USD and VND exchange rates, which is applied for a period of 20 years starting from the commercial operation date, and the responsibility of EVN to purchase all power generated by wind and solar projects After these decisions have been canceled, the MOIT will then amend its guiding circles, including Circular No Circular No 18/2020/TT BCT, dated August 31, 2019, on the development and implementation of solar and wind power plants, in order to align with the new

SOLARQUARTER RESEARCH OCT-NOV ISSUE 2022 | PG 13 | SOUTH EAST ASIA THE MECHANISM FOR TRANSITIONAL PROJECTS THE MECHANISM FOR FUTURE WIND AND SOLAR POWER PROJECTS THE MECHANISM FOR APPROVED/ACCEPTED PROJECTS PUT INTO COMMERCIAL OPERATION REPEAL OF DECISION 13, DECISION 37, AND DECISION 39 THE FOLLOWING RECOMMENDATIONS HAVE BEEN MADE BY MOIT TO THE PRIME MINISTER:

mechanism

INDONESIA’S NATIONAL GRAND ENERGY STRATEGY (GSEN)

The Ministry of Energy and Mineral Resources of Indonesia (ESDM), proposed that Indonesia have 100 percent renewable energy by 2060 This was through the National Grand Energy Strategy, (GSEN). It aims to achieve net-zero emissions in 2060 or earlier GSEN predicts that all capacity additions will come from renewables starting in 2030 The total installed capacity of renewables will then reach 587 GW by 2060 The state-owned utility PLN plans to retire coal plants that are not in use The GSEN proposal does not address fundamental issues like grid reliability and stability with 100% intermittent renewables penetration It also doesn't offer a solution for financial barriers to renewable development

INDONESIA: NEW MEMR REGULATION ON ROOFTOP SOLA

In line with its policies, the Government of Indonesia is pushing for rooftop solar PV development 49 of 2018 (" Reg 49") to promote Indonesia's solar PV industry and to support its international commitments to reduce greenhouse gas emissions

Recently, Reg 49 has been rescinded by the MEMR and replaced with MEMR Regulation No 26 of 2021 on Rooftop Power Plants Connected To the Electricity Grid For Public Interest License Holders (" Reg 26 ") Reg 26 was implemented on August 20, 2021

Key Changes:

Reg 26 also applies to consumers outside PLN's business areas

Net-metering discount on energy exported to the grid is now removed, Shorter period to obtain approval for construction, iv). Carbon Trading, Online licensing and reporting, SCADA or distribution smart grid system

THAILAND:

CARBON TAX MEASURES TO PROMOTE THE REDUCTION OF CARBON EMISSIONS

As part of the Net-Zero commitment and the Carbon Neutral commitment, Thailand recently via various government agencies, public organizations, and the Thailand Greenhouse Gas Management Organization Public Organization or TGO started to encourage the private and public sectors, as well as other government agencies, to better understand their carbon dioxide emissions and develop plans to reduce them

In order to achieve the goals Thailand has committed to, and to reflect international standards, the Excise Department has appointed a working committee to study the expansion of carbonbased taxes in the future to cover wider aspects in which carbon tax is defined internationally, including the tax imposed on the carbon emissions of manufacturing processes Initially, the Excise Department plans to introduce a carbon tax as a part of the excise tax, similar to the sugar tax that was successfully implemented in the past

SOLARQUARTER RESEARCH

OCT-NOV ISSUE 2022 | PG 14 | SOUTH EAST ASIA

THAILAND’S FIRST CLIMATE CHANGE BILL

Thailand has set NDCs to reduce carbon emissions by 20 to 25 percent from its business-as-usual levels by 2030. Thailand further pledged to aggressively tackle climate change by setting a goal for carbon neutrality by 2050 and net-zero emissions by 2065 Thailand has long-term environmentally friendly development strategies including drafting a climate change bill, adopting the bio-circular economy model, and setting a target for electric vehicle deployment, among others

The Bill will provide a framework for Thailand's response to climate change It will also stipulate policies and measures to reduce greenhouse gas ( GHG) emissions. This includes reducing emissions at source, increasing carbon sinks, and other initiatives to help lower GHG emissions from the atmosphere The Bill will establish a National Climate Change Policy Committee ( NCCPC) The NCCPC will be responsible for developing and integrating climate change strategies and policies. It will also plan and coordinate mitigation and adaptation efforts In collaboration with the Office of Natural Resources and Environmental Policy and Planning, the NCCPC will put plans into action through Cabinet and other state agencies

MALAYSIA’S RECENT VIRTUAL POWER PURCHASE AGREEMENT (VPPA) PROGRAM

After the teasers of the announcement made by the Prime Minister of Malaysia in August 2022, and the launch of the National Energy Policy 2022 – 2040 in September 2022 respectively, the Energy Commission of Malaysia finally launched the Corporate Green Power Programme ('' CGPP") on 7 November 2022. The CGPP is essentially a program that allows eligible corporate customers (" CC"), to enter into power purchasing agreements with solar power producers (" SPP") for the purchase of renewable energy virtually instead of direct delivery

MALAYSIA’S RECENT NATIONAL ENERGY POLICY 2022-2040

The National Energy Policy 2022 - 2040 ("NEP"), was launched by the Prime Minister of Malaysia on 19 September 2022

NEP Targets :

to increase the total installed capacity of renewable energy from 7,597MW to 18,431MW and to increase the percentage of renewable energy in the total primary energy supply from 7 2% to 17% (to consist primarily of 4% solar, 4% bioenergy, and 9% hydro);

to reduce the percentage of coal in installed capacity from 31.4% to 18.6%.

to increase the percentage of electric vehicle share in the country from less than 1% to 38%

to increase the percentage of residential energy efficiency savings and industrial and commercial energy efficiency savings from less than 1% to 10% and 11%, respectively

SOLARQUARTER RESEARCH

OCT-NOV ISSUE 2022 | PG 15 | SOUTH EAST ASIA

Vietnam’s Lack Of Critical Renewable Energy Transmission Capability & Way Forward

Vietnam has made impressive progress on its renewable energy transition, but the rapid expansion of solar and wind is straining the country’s electricity grid As per the recent draft Master Power Development Plan - VIII (PDP-VIII) coal would reduce to 9 5% share of the capacity by 2045 compared to 15 to 19% previously In addition, Vietnam is aiming for a 50% share of wind and solar power by 2045 compared to the previous target of around 40% As per the S&P report, for this target to be reached, Vietnam would need to have 42 7 GW of onshore wind capacity, 54 GW of offshore wind, and 54 8 GW of solar capacity by 2045 This will be a major challenge for the govt of Vietnam to integrate this potential variable energy into the limited electricity grid Vietnam where there was an ongoing Feed-in-Tariff (FiT) that was very attractive, and the industry rushed to add a whopping 11 GW rooftop PVs during the pandemic in 2020, according to data released by IRENA

More than 100,000 rooftop solar systems were connected to power grids in 2020 In 2021, there were at least 84 online wind power plants. Many of these projects are located in Ho Chi Minh City and in a few northern provinces This makes it difficult for the grid to integrate them Vietnam's National Load Dispatch Centre announced in 2022 that it would halt the development of new solar or wind projects Electricity Vietnam must invest in and plan better grids to continue progress towards Vietnam's renewable energy targets of 50% solar/wind by 2045

Viet Nam, like many countries in Asia developing, has historically under-invested in transmission Planners instead prioritize funding for power generation in order to meet the rapidly increasing demand Vietnam's 2021 transmission spendings were only about 25% of the total amount envisioned by the Power Development Plan This plan outlines Vietnam’s future vision for its power system through 2045

The existing north-south transmission lines may soon be at capacity A World Bank study found that the transmission system could handle up to 3.3GW of variable renewable energy. However, upgrades to transmission lines or transformers would be required to accommodate this additional power Recent solar and wind expansions have surpassed 20 GW in terms of power, which has significantly outpaced the grid's capacity to absorb this new power

TECHNICAL AND REGULATORY CONSTRAINTS WHICH ARE HOLDING BACK PROGRESS IN THE COUNTRY’S RE GRID INTEGRATION:

Vietnam is unable to forecast variable renewable energy production accurately, which hinders its ability to match demand and supply. Grid management would be easier if forecasts were based more on historical power plant operations and weather

Viet Nam has updated some grid regulations, but they don't provide enough flexibility to allow frequent changes in variable electricity and lack technical requirements.

Limited connections with its neighbor's transmission infrastructure Although Viet Nam has limited trade with neighboring countries China, Lao PDR, and Cambodia for electricity, it is growing Spot purchases of electricity from Cambodia or Lao PDR could be possible with increased interconnectivity This would optimize the power supply at the regional level

The government can take several steps to remove the transmission bottleneck. Prioritizing grid improvement funding is the first and easiest step Vietnam should rely solely on the private sector to generate power, but EVN will need to make short-term grid investments. These barriers can be removed or reduced by the international community through capacity building and financial assistance.

SOLARQUARTER RESEARCH

OCT-NOV ISSUE 2022 | PG 16 | SOUTH EAST ASIA

FEBRUARY24th PHILIPPINES SOLARWEEK2023 CONFERENCE & AWARDS PHYSICAL CONFERENCE WITH AWARDS NETWORKING KNOWLEDGE DON'T MISS OUT! For Speaking & Sponsorship Opportunities, contact: events@firstviewgroup.com INISGHTS INDUSTRY OPPORTUNITY SHARING LATEST TECH UPDATES ORGANISED BY