AFTER a seismic 2023, shows like COREbike at the start of 2024 were a good opportunity for shops to become familiar with which distributors were now handling which brands.

And we’re in a similar situation 12 months on. There are still notable absences in the market and it’s likely there are brands negotiating behind the scenes with potential distributors. Forums and closed Facebook chat groups are still chock full of posts along the lines of “so, who does x brand now?” and “how do I get hold of x now y has gone under…” Even heavy hitters like Cannondale have adjusted their approach to the UK and only recently (December) pinned down a new route to the British market, with Saddleback.

It’s probably no surprise it is taking so long for the dust to settle in the market. The strength of the headwinds the industry has endured has been huge. The overstocks, the holes left where Brexit slammed the brakes on some UK-to-Europe trading, investors pulling their backing for big retailers and brands… Clearly not all companies have endured, and the industry has lost talent and been thinned down. Against that backdrop, the rise of the eBike in the UK has been a big success story, but also undoubtedly a new set of challenges for the industry to absorb. Tying up more value on the shop floor, the misinformation challenge (page 44) and a new set of skills for mechanics to acquire, the advent of eBikes has been a big change.

But what an industry, eh? Cycling is hardly alone in experiencing a disrupted few years, but the sector has gone through some extreme highs and lows lately and has (largely) come out of the other side. Next year promises to be challenging for sure, but there’s a whiff of change and a touch more optimism now that we’ve “survived to 2025”. There’s also a good deal of built-up appetite to do more than just survive, so we look forward to 2025 with a keen interest. See you then.

Jonathon Harker

jon@cyclingindustr y.news

Publisher Jerr y Ramsdale jerr y@cyclingindustr y.news

Editor Jonathon Harker jon@cyclingindustr y.news

Sales Manager Lloyd Ramsdale Lloyd@cyclingindustr y.news

Head of Produc tion

Luke Wikner production@cyclingindustr y.news

Head of Marketing Shona Hayes shona@cyclingindustr y.news

Designers Dan Bennett Victoria Arellano

Bike prices continue to be a debating point for the industry, amidst a backdrop of very heavy discounting to clear through stubborn, excess stock. Last issue, we pulled together opinions on the topic from bike shops on whether cheaper bikes (including those related to proposed relaxed trade levies) actually benefit the industry and bring in more riders.

Ben Mowbray of retailer E-bikeshop, picks up the discussion…

When E-Bikeshop was set up (13 years ago now!) as an eBikeonly specialist, we set out with several very clear objectives. We would be a “crank drive” specialist. We would only stock bikes from the top European manufacturers. We would be entirely customer experience focused. We would work by appointment only for the showroom and in the workshop, exclusively on bikes we’ve sold to our own customers. We would also never stock far Eastern/ Chinese origin bikes.

Reading your article, I looked at it from three angles – origin, regulation and price.

Origin

We took the decision to not stock anything out of the Far East solely based on the long-term expectation (or lack of!) around service levels to the end consumer. The sub £1,500 price range is absolutely brimming with poor quality, often illegal (by way of having motors over the 250W nominal power rating, fitted with throttles, not meeting minimum EU safety standards for the electrical system, etc) bikes.

Sure, to a consumer unfamiliar with the intricacies of electric bikes, these initially look like a great deal. The truth is that we know from the dozens of phone calls we get each week from frustrated owners unable to get support from the company they purchased it from, that the bulk of them are being dumped on the market by Amazon/eBay sellers who are effectively just drop shippers. They’re not bike businesses. Most of them know little to noth-

ing about the products they’re selling. They’ve got some warehouse space, a shipping account and a label printer. Owing to them being very poor quality in comparison to top end brands, when something does inevitably go wrong, the level of support is next to or totally absent and this is the first point these consumers realise the biggest problem with cheap, imported bikes. No parts, no spares, no support.

We’re hearing more and more that IBDs are now refusing to work on these bikes because they clog up their workshops for weeks or months on end, not being able to get the parts to repair them. We’ve even heard of dealers refusing to have them in their building because they can’t get or afford the business insurance to touch them.

This mostly entirely absent level of aftersales support for these bikes is exactly why we’ll never stock them. Does it mean we miss out on a big chunk of

sales opportunities at the lower end of the market? Absolutely. But we’re not writing ourselves a post-dated cheque for a headache each time we sell one either. We don’t want our good name and reviews muddied by dozens of annoyed customers (rightly) taking their frustration out on us for selling them something we can never actually support and will ultimately end up in local authority recycling centres (or worse) long before any good quality bikes.

Reading CIN’s article was the first I’d heard of plans to relax the tariffs on importing Far Eastern origin bikes – I was honestly a bit baffled. It wasn’t that long ago the Government were making noises about much tighter restrictions on Far East origin eBikes from a safety standpoint, which of course we wholly support. You ask: “Is it going to benefit the trade”? I can’t see how it can.

“THE LEVEL OF COMPONENTRY AND TECHNOLOGY ON A GOOD QUALITY £2,500 HYBRID BIKE RIGHT NOW IS LIGHTYEARS AHEAD OF WHAT YOU WOULD HAVE GOT FOR THE SAME MONEY FIVE YEARS AGO. ”

Ben Mowbray E-bikeshop

Offering customers even more headaches surely can’t be the way forward?

Gavin from Butternut Bikes is absolutely right (Ask the Trade, issue #5 2024). At a time when the biggest thing separating dealers from each other over the last 18 months has been their overall service levels, diluting/damaging them with poor quality products which can’t be properly supported simply isn’t the answer. I think he’s also right about the route to market – most good quality independent bike shops are well versed in the headaches these bike cause and also don’t want to sell them – they’ll only bolster online-only sales and add to the load their customers are placing on the rest of us, who are not only unable to help, but are regularly given abuse down the phone or online for not being “willing enough” to help, like it’s our problem to fix...

This is something I covered at length in our shop blog a year ago. The truth is, eBikes have actually never been “cheaper”. Not just because of sale prices driving down consumer expectation on RRP but because of their overall value. No more so than right now than with brands like Cube who are really pushing the boundaries of the term “aggressive” when it comes to pricing strategy. The level of componentry and technology on a good quality £2,500 hybrid bike right now is lightyears ahead of what you would have got for the same money five years ago.

It’s true that the headline price hasn’t gone down, but specification lists are actually better than ever and that leads me neatly to what we should all, as an industry, be focusing on which is value, not price. If we all expect to still be in business in 10 years (or even two years!) time, we need to do better at increasing the value of what we’re selling to the consumer with each purchase rather than reducing prices. Flooding the market with shonky “Chinesium rolling housefires” (a fairly techy article I wrote on our shop blog with use of my background in lithium battery tech) of course, isn’t going to help that, either.

It’s interesting what Gemma & James from RedSky (Ask the Trade, issue #5 2024) say about how price-driven consumers are. It’s absolutely true that on the whole, the only stuff which has been selling in big numbers for us over the last 12-18 months is that which has a big

BECOMING A PANELLIST

If you are an independent retailer and would like to take part in future issues, e-mail: Jon@cyclingindustry.news

discount. Right now, with margin support from the manufacturers in some cases, we have £10k RRP bikes at £5k. Not only does this massively eat into the perceived value of the bike/brand, but it also sets the expectation for future sales.

Consumers, especially if you look at online forums, Facebook owners groups etc, all now think we’ve been, to echo one rider – “absolutely creaming it” for the last five years and that we’ve previously been “making £5k profit on a £10k bike” and that “it’s about time they stopped ripping people off”, which of course isn’t the case. In fact, most dealers are selling them at cost or less just to get them out of the door. This will (and already is) having a knock-on effect with brand new 2025 model year bikes, where some customers are expecting we have 40% “wiggle room”. We don’t. We never did.

It’s also true that we’ve seen just as many people snapping up the “wrong” bike because of the lure of a whopping discount from RRP. It’s akin to what we said during Covid, where people were buying pretty much anything they could get their hands on simply because it was available...

For the sake of the future of the industry, we need to begin adjusting these prices back toward RRP and resetting consumer expectations on price points in order to actually generate profit, while focusing on a service/experience led service in order to retain them throughout their ownership in the hope that they pop back again for the next bike.

More unvarnished truths from the bike retail frontline here, courtesy of CIN’s Market Data. We look at the trends that are driving customers into bike shops as well as how retailers are tackling online trading and - in some cases - treading a shrewd line on e-commerce...

IN TERMS OF ONLINE TRADING, WHICH APPLY TO YOUR BUSINESS?

Almost half of survey takers of CIN’s Market Data survey don’t trade online at all and have no plans to do so. That might seem something of an anomaly in this post-Covid retail trading period. In the UK, numbers from this year (via Statista) indicate that a quarter of internet sales in the UK (in value terms) are via the internet. It does seem something of an unstoppable rise –the percentage was 17% in 2018. A sizeable number of CIN survey respondents are considering investing in online trading (23%) and perhaps that indicates that there is a shift in the cycle trade too… But our inkling is that the percentage of non-internet traders will remain stubbornly high. Why? A big question maybe, but competing with cycling’s slick online retail players has been off-puttingly challenging for shops with fewer resources. There’s wisdom in focusing on your retailing strengths, like dealing face-to-face with customers in the local area, you might argue. There’s some nitty gritty detail here –those with full access to the CIN Market Data may be interested in cross checking with question 9 (2024 investment priorities) where it is revealed that the ‘online shop window’ of bike shops is an investment priority, with 54% of shops looking to spend more on this. Actual e-commerce is just one facet of the online retail eco-system but even those shunning taking money online

are mindful of their web presence, indicating not that bike shops are resistant to change in adopting online retail, but that many are perhaps shrewdly operating in an online retail middle ground. That’s one way to interpret the data.

A relatively small number (11%) use workshop software to manage online bookings. Can we expect that figure to rise? Digitalisation can surely make things easier and faster for workshop managers and here we would predict some uplift by the time we next gather market data. Hire business – which is a fraction of the workshop business seen by most UK bike shops – is used by a smaller number of retailers still, but likewise there are considerable opportunities for those offering such services to ease their workflow via software.

WHICH

Tubeless technology is still luring punters into bike shops, so if this is an area your shop has tended to avoid stocking then – judging by the number of years it has featured highly in this particular poll –surely here is a sound indication that it’s worth changing that. We’ve previously spent quite a bit of time talking about tubeless and how education on the sector is probably helping drive customers into shops (long may it continue), so – while we await another product genre that peaks customer curiosity and brings more footfall into shops – let’s dig into some of the other findings here.

Another trend featuring widely in bike shops is ‘women’s cycling engagement’. Whether you put that down to improved marketing, more visible women’s pro racing like Tour de France Femmes avec Zwift, or another factor/combination, that’s an encouraging finding. Breaking through to demographics previously underserved by the industry is obviously vital for its future and expansion, and to see bike shops reporting this to be the case when they have no vested interest in doing so (one of the benefits of our anonymised UK bike shop market data) proves that headway is being made. Doubtless there is some way to go, but it’s worth dwelling on the point that bricks and mortar shops are a key conduit for customers, particularly those making their first steps into a sport or market. Previously, industry thinking may have been that new customers tend to head into ‘less intimidating’ retail set ups like Halfords, so based on these results you could maybe make a case for this accepted thinking to be shifting, or swallow the premise

that Halfords and similar ilk are a stepping stone for customers heading into independent bike shops – part of the retail ‘journey’ if you like and food for thought.

A true bike shop stalwart shows up next: Group rides and clubs. While experiential retailing and similar may be buzzwords from the last decade of retail, the bike shop has long been an ‘experiential pioneer’ combining physical activities and engagement with customers that goes far beyond simply stocking product on shelves to retail. With selling more about relationships than just about any other factor, group rides continue to be a natural and maybe even vital area for the nation’s bike shops.

Next up we have utility cycling and – perhaps connected – cargo bike interest (for personal use) on CIN’s trend-o-metre. The cargo bike trend and the role that bike shops play has cropped up in some recent conversations CIN has had with shops and reps lately. As with eBikes, the UK has been slower to warm to cargo bikes than other European markets, but their floor space-hogging seems to becoming more of a fixture in Blighty.

With the rapid growth of the eBike industry, a wide range of players has emerged, offering solutions that vary greatly in terms of quality and approach. Among them, Ananda stands out by delivering accessible eDrive systems with a strong focus on quality, earning the trust of industry leaders such as Acell, Cycleeurope, Brompton and more. Now the firm is investing in more local service centres to boost dealer and brand support, and get its quality message across...

While Ananda is a well-established name among industry professionals and trusted by leading brands, it’s less familiar to the wider public. However, the company is actively working to bridge this gap, making significant investments and launching new initiatives to improve its visibility and strengthen its support for the broader market.

The Shanghai-headquartered manufacturer has been operating since 2011, producing open platform drive units for eBikes, eMotorcycles, eScooters and others over the decade-plus since then. Its product line-up includes gear drive hub motors, mid-motors, controllers, sensors and HMIs for comprehensive eDrive system.

Ananda has three separate production bases in China, a recently opened

factory unit in Vietnam, as well as a significant facility and service centre in Hungary. Closer to the UK, the company has been established in Arnhem, the Netherlands since 2013 and over the past two years has been bolstering its presence there with call centre staff and service personnel, alongside establishing service centres in Italy, France, Japan and the USA (with other locations to come).

The self-stated goal of the brand is to “provide riders with the best eRide experience possible and support our customers with their own identity and strengths. We research and develop new products and technologies, collaborate with brands to tailor solutions to their needs, and provide a full service.”

Ruben Brinkman, Marketing specialist Europe, tells CIN: “Ananda is not a

new player, but we’ve never really told our story before. It’s been low key! Most of the brands know us already, but there can be a stigma around Chinese companies, so it’s important that we share our story that we are professional and sizeable. That’s important for dealers and users to know.”

“At Ananda, our mission is to make eBikes more accessible by offering excellent value without compromising on quality. In many European countries, we’re seeing eBikes starting at €3,000€4,000, which is a significant investment. Our goal is to make eBikes accessible to everyone while providing riders with a great experience through high-quality motors, displays, and more.”

The message, coming as the industry argues back and forth over bike costs, is timely.

bob-elliot.co.uk

bob-elliot.co.uk/twitter

bob-elliot.co.uk/facebook

bobelliot-online

“HOLDING A SIGNIFICANT PORTFOLIO OF INVENTION PATENTS WE CAN GUARANTEE HIGH QUALITY PRODUCTS.”

Quality & support

It’s likely that the roll call of bike brand names working with Ananda will go some way to assure the market of Ananda’s credentials and expertise, and the firm is eager to highlight the point: “We have a good quality product. We do a lot of testing in our production units through to final quality control. That’s really what we focus on in our factories. No product gets out there before being finally checked out by the QC department. Holding a significant portfolio of invention patents we can guarantee high quality products. We work with renowned bicycle brands, helping to

develop product together with their R&D departments.”

The increased presence in the Netherlands, including call centre staff and other service personnel, comes as Ananda’s service point network (as listed above) is set to expand, not only in the UK…

“In 2025 we are planning to have more service points in Germany, Norway, Poland an Brazil. At Ananda, we prioritize providing the best service possible to our partners and customers through our support network. For instance, if an issue arises with a motor, dealers can rely on nearby service stations, reduc-

ing the need for long-distance shipping to a factory. In the Netherlands, for example, motors can be sent to our local service center for quick processing. While our service stations are designed for efficient dealer support, including stocking essential components, motor repairs or replacements are carried out at our facility in Hungary, which is central to the European market. This setup ensures that we can offer quick and reliable support to our partners, with a focus on efficiency, convenience, and sustainability.”

Open platform USP

Ananda is exploring opportunities in the US eBike market. Ruben explains:

“The US market is still developing in terms of eBikes, and we are preparing to strengthen our presence there in the coming year. While it may not be as established as some European markets, we see it as an interesting opportunity to engage with local brands, consumers and expand our footprint.”

Ananda’s wide array of eBike drives and accompanying products is flexible, while battery production is handled by its close partners. Ananda’s openness of system is a winning factor for some companies seeking an eDrive supplier, as Ruben points out: “Often a specific bike brand wants to work with their own battery supplier.

Because we work with an open system, we can easily integrate everything. For example, if a brand wants to work with their own smart system, or with a key lock system, or whatever it is, we have an open platform, and we also have that engineering knowledge, so we can make everything work. That’s what makes us quite special, also in comparison with our competitors, some of

whom operate quite closed systems.”

When some of our partners want to use their own display, app, specific hardware or software customisation, Ananda can accommodate these needs. Ananda’s experience and R&D expertise provide significant advantages”. Ruben adds, “We can really help brands, and this gives us a competitive edge. In a

“We can really help brands and this gives us a competitive edge”

market with many players, it can be challenging for some brands to stand out, so it’s a major plus that Ananda can support them in different ways to help them compete. We’ve been doing this for a long time. Our expertise in integrating systems sets us apart.”

www.ananda-drive.com

2We’ve spent four years taking stock of the here and now, but what about the future? Industry analyst Mark Sutton takes the crystal ball view at some potential tailwinds and some new headwinds that may affect planning in the next decade. This time, the climate is the topic…

024 has been the year of writing about things I’d much prefer not to. Having endured six months of fairly non-stop rain to begin the year, boy did I hope that the second half of 2024 would be more productive. In many ways it was, but when the press slings its muck all too often it sticks and as such the industry has spent much of the year fighting fires. Not ones it caused, mind.

In case you missed it, this series started with an analysis of how misinformation has posed what I deem to be a quite uniquely severe threat to the profitable end of the bike business of late; that’s electric bikes and all things to do with expanded mobility.

For those that have yet to read its contents, well, the gist is that misinformation is causing a landslide of consequences for the eBike shop and workshop, none more threatening than having insurance support pulled, or in some cases tripled in cost yearon-year. Having insurance pulled is, coincidentally, a theme that carries through this column too.

So, the plan was to talk about something far more positive in the next instalment of this series, which is loosely pitched as an assessment of the tailwinds and headwinds that will come to pass in the post-Covid trading era. Within each the goal is to make expert references and be able to offer

solutions where negatives apply. Sadly this is a headwinds bit; a big one, but with some hopeful ideas all the same. I promise tailwinds will follow this column, but events of late have rather pushed this subject to the forefront.

That subject is the climate crisis. And that’s the thing about the climate emergency, we tend to assume it’s a future problem. Images taken on phones of those in far-flung places... Probably just a fluke. And then it gets closer. It gets more regular. It gets more intense. Often it repeats, just a little closer together than the last interval. Then before you know it your overseas contacts have personal stories, the footage is on their phones. They have losses, whether personal or in business. It’s closer to home. Then, finally, it’s on your doorstep too. Perhaps it’s not devastating, but it’s not normal either. It’s recorded on your phone for the first time and there’s good odds it won’t be the last time either. Forgive me if that seems like scaremongering, but I see it more realistically as trend spotting.

Some of you may remember that around two years ago I signed off my time as Editor of this title with an article talking about how the bike business possibly stood to gain from the shortening of low-elevation ski resorts in Europe. The research I was able to dig out showed a one-way trend of

shorter more unpredictable snow seasons and faster melt, as well as seasonal peaks shifting. Some lowelevation resorts at around 2,000 metres above sea level were seriously considering their future. More were just adapting, extending the mountain bike season to offset some of the empty chairlifts. Over a short cycle you win some seasons, you lose others. Zoom out and there is only one accelerating trend.

At Eurobike this year, on the back of that rainy first half in England, I sat with international colleagues at a dinner. Distributors and dealers from Italy, Austria, Germany. Each had something to say on the weather this year in particular. Flash floods the most common theme. It’s the first time I’ve heard the subject of climate brought up with sincerity outside of reporting on the industry’s innovators work in the space to lessen their impact. This was not that conversation, these were real stories told straight-faced, with not much of that look on the brightside spin we tend to put on adverse trends in the industry. We are, if nothing else, resilient in the face of challenges. We’re generally here because we care about our sport, or improving people’s routines, or mobility. Some of us are here simply because we love the outdoors and the freedom bikes bring.

“WE KNOW THAT THE FIRST HALF OF THE YEAR WAS WET. REALLY WET. BUT MORE CONSISTENTLY THAN BARRAGES THAT CAME AND WENT.”

Three months on from that dinner it feels as though the chickens are roosting in ever greater number on our doorstep.

Let me explain the trigger for going early with this column (and I ask that you excuse my omission of the personal side of some of the tragedies in order to stay on brief).

Earlier this year I began to read Ed Conway’s Material World. Only a chapter or so in there is heavy focus on one unique destination globally that has the right consistency of sand to make the silicone that goes on to become the most important ingredient in semiconductors. Semiconductors, as we know, were briefly a flash point of the global supply chain crisis during Covid and I distinctly remember a shortage of these microscopic components being an issue for the production of parts to finish electric bikes.

That location, where this unique ingredient is mined? Asheville, North Carolina in the USA, now known to be the destination of the USA’s worst flooding in recorded history and with a roughly $160 billion damage bill.

You could easily have missed in our media cycle that it was this mountainous region, over 300 miles inland and 2,000 metres above sea level, that saw

some of the very worst impacts of the category 4 Hurricane Helene that made landfall in Florida’s Panhandle in September and maintained its strength as it moved inland. US trade portal BicycleRetailer.com reported that on its path of destruction, it took out numerous bike businesses and forced countless others to shutter.

Now, truth be told, I don’t know for certain that these specific semiconductors make it into electric bikes, but many of course do. There are very few semiconductor giants globally, it’s an extremely skilled, secretive business. So, supply and demand stressors would now dictate, with the mega facility now closed for many months on the back of a rare ‘force majure’ notice being issued that lowered supply means higher prices. Perhaps not eye-wateringly so, but as anyone who traded through Covid knows, one week it’s shipping prices rising, the next it’s raw materials. That’s fine in Black Swan events. This hurricane would fairly be considered one. Except it’s not anymore; Not ten days later and another potential category 5 is set to slice through the middle of Florida, presumably with even higher costs on its current path. The ocean between Florida and Mexico is currently one of the

warmest bodies of water globally, but it’s not unique, a record number of bodies of water are now above 30degrees. Needless to say, that’s hurricane fuel.

At the time of Helene, over on the other coast of the North America, Acapulco, Mexico was simultaneously being levelled by the second major hurricane in two years. No one in their right mind will rebuild there now, you’d think. Even if they did, just try getting insurance. This theme, it seems, is going to become a headache for any businesses operating in high-risk areas, but actually premiums are rising generally for anyone near water, be that ocean or river. Dense populations tend to cluster around such things.

I’m conscious that talking about faraway places will lose your attention and as yet I’ve not said enough about bikes, so let’s take a look at this year in England. We know that the first half of the year was wet. Really wet. But more consistently than barrages that came and went. Sub prime conditions for moving bikes, all the same. Now fast forward to September, where the monthly rainfall was 300% above average, 330%+ in localised places like Oxfordshire. Bizarrely, Scotland’s rainfall was generally below normal levels.

THE NEXT 10 YEARS | PART 2

For every one-degree of warming the atmosphere holds on average 7% extra moisture, but at the upper end of the scale the water retention calculations have gone as high as 28%. Now that the latest El Nino cycle has been accounted for, it seems generally accepted that we are now beyond 1.5 degrees above the pre-industrial baseline and the broadly accepted ‘target’ zone for warming. The 2020 reduction of sulphur levels in shipping fuels that, when spent, reflected the sun’s rays, it seems, had been masking the true warming effects. The result is abrupt and unaccountedfor warming and a spike in abnormal weather events.

Rather than changing course, we’re still accelerating warming. The conditions for cycling are already inclement, to say the least. Personal anecdotes don’t matter much here, but 2024 was the year I bought a full-body waterproof suit. I simply would not have kept up our reviews schedule on CyclingElectric.com without it. A tangible effect on my work and no doubt yours in tandem.

We have, of course, always sold waterproofs and pointed out that people do still cycle in the rain; London proves it as much as Amsterdam at this stage. However, that may suit existing cyclists, but it’s not great optics for marketing to new clients.

Don’t just take my word for it, only two years ago, you (well, 46% of bike shops) told Cycling Industry News’ annual market research that the weather was the fifth greatest obstacle to selling bikes. If you’re curious, the top four were safety concerns and lack of infrastructure (72%), cycling’s press image (59%), the perception of theft risk and lack of parking (54%) and Government policy messing with cycling appeal (51%). I’d love to take that survey again now to see if anything has changed.

On the freak weather since, cycling industry advocacy leader Adam Tranter flagged: “Making the UK’s existing transport infrastructure more resilient is going to be urgent, difficult and costly. And we can’t afford not to.”

He’s right. In the UK, 26% of all of our emissions come from transport, so we have a massive opportunity for cycling to make a huge contribution to the national reduction effort. In fact, emerging in the midst of the new Government’s carbon capture

“PERSONAL ANECDOTES DON’T MATTER MUCH HERE, BUT 2024 WAS THE YEAR I BOUGHT A FULL-BODY WATERPROOF SUIT.”

announcement came an IPCC graph that showed a deep cost-to-benefit analysis of all the tools at our disposal to make a difference. What is immediately evident is that carbon capture is about as poor an investment as you can make on account not only of its cost, but also its readiness to be deployed at scale. It was, in fact, the worst of all solutions in the energy category.

Scroll down a touch to the settlements and infrastructure section and shaded in blue, which represents a cost so small it doesn’t register on the ‘USD spent to co2 saved’ scale, is public transport and bicycling. The impact of cycling, it is determined, could be as impactful as moving entirely to energy-efficient lighting and appliances and more so than making efficiencies in shipping and aviation.

And guess what: Our industry’s product has far greater potential to reduce carbon emissions than the Government’s costly flagship scheme! Not only is the cost substantially lower, but our technology is already deployed and successful at scale. All we need is a few cycle paths and a little subsidy to drive uptake, as proved successful in France, and cycling could be the silver bullet not only for climate, but also for health and congestion.

It’s crazy that the Government missed this fact, isn’t it? Make sure you remind your MP at every opportunity.

A few facts from recent research of mine into the subject of raw materials and carbon cost of our industry’s products, comparable to neighbouring products.

Pound for pound of material, the Tern Quickhaul at 22.9kg carries more load (150kg) than a Tesla Cybertruck, which takes 998kg for its 3,009kg weight. Often they carry the same loads, albeit miles apart in cost to the user and broader society.

A smaller electric car battery layout typically uses about 66 times the Cobalt and 100 times more lithium. Boost the size to a truck or SUV and the gap widens drastically still; the aforementioned Cybertruck using around 246 times the resources of a 500Wh eBike battery.

The Bloomberg New Economics Foundation has found that electric two-wheelers (inclusive of escooters and e-motorbikes) are delivering 60% of the world’s transport emissions reductions. They only use 4% of the battery materials that large EVs do.

The manufacturing emissions attributable to an electric bike are 109 times lower than than of a Range Rover (Source – How Bad are Bananas, Mike Berners-Lee)

Unleash your potential, break boundaries, and go full-send with the all new HiDrop Helmet.

ABUS HiDrop – Reach your goals.

The fit frontier: Ensuring bikes, gear and rider contact points are optimal is an absolute essential for the market, ensuring regular (and would-be regular) riders enjoy their time in the saddle. Fit-focused fizik is among the brands focused on new tech and dealer collaboration to keep riders comfortable in the saddle…

Sizing matters and one of the key advantages bricks and mortar stores hold is the ability to make sure their customers end up with kit that is correctly sized for them.

No less important are the rider and bike contact points – which can be offputtingly uncomfortable to riders when they’re not done right – though arguably these have not seen as much focus from the industry in the past. fizik is one of the brands that has been working to put that right through its product ranges. Fit is embedded in the nature of fizik – its own logo stems from the phonetic spelling of physique – and it’s been the focus right from the start.

Broadly speaking

The plain fact that not all of us have the same frame, build, size and attributes makes it more of a challenge to ensure the right gear makes its way to consumers, not least for manufacturers, but it also plays into the advantages of face-to-face retail.

fizik’s brand message is all about choosing the right saddle for a rider’s needs – both biological and discipline.

“FIT-FOCUSED FIZIK NOW HAS A LARGER RANGE OF WIDE FIT SHOES THAN EVER BEFORE. WHILE THE BRAND’S STANDARD FIT IS NOT NARROW, THE WIDE FIT IS NOTICEABLY WIDER.”

This includes the overall shape, pressure relief/support, length, and width. There is a fizik saddle guide that is designed to help guide customers on selecting the correct saddle.

Refreshingly for a market that has seen plenty of turmoil of late, the fizik and Extra UK distributor relationship is reassuringly long lived, having started way back in 2002. Both have a bricks and mortar store focus which plays to the strengths of the brand and dealers alike.

For example, spring 2024 saw fizik launch One-To-One custom saddle printing, produced in collaboration with select stores globally. Each saddle, manufactured in Italy, is uniquely (3D) printed based on instore pressure mapping with a bike fitter, offering a personalised fit.

It should be noted that for those looking for a less custom option the Adaptive saddle range offers the multidensity construction benefits of 3D printing across a range of models, giving pressure relief and support where riders need it most.

Dealer feedback has also been taken

on board by the brand, not least in the decision to bring in a 30-day comfort guarantee on saddles for UK brick-andmortar stores, a unique policy outside the USA. Consumers can (via their local store) swap out their saddle for a different one if they’re not comfortable. fizik says it’s a clear indication of its dedication to supporting the IBD network and ensuring customer satisfaction.

Fit-focused fizik now has a larger range of wide fit shoes than ever before. While the brand’s standard fit is not narrow, the wide fit is noticeably wider – place the shoes next to one another and this becomes quite obvious. Perhaps more importantly, fizik’s wide fit shoes are not simply adapted versions of standard fit shoes: Wide fit has a completely different outsole, upper and a different toebox shape, with an average of 5mm difference across the widest part of the shoe (this is average as it’s different across different sizes). Wide fit is currently available across key sellers within fizik’s road range, with more options due to be added in 2025.

Ensuring kit and contact points aren’t ill

fitting doesn’t just scupper enjoyment in the saddle, but it also undermines a rider’s performance which, for many, is a crucial part of their riding experience. Advances in shoe and saddle tech have made challenging riding more possible and – well, fun.

fizik supports two dedicated Retail Specialists in the UK, who focus on aiding the IBD network through staff training, instore merchandising and participation in local and national events. Their other role is to gather market feedback, understand dealers’ needs and wants and provide feedback to the brand and influence product range adjustments like expanding the wide fit shoe range and perfecting the fit.

All this combined allows fizik to stay at the forefront of contact point development, using the latest technologies to improve rider comfort for the best user experience, but also to stay ahead of the changing needs of contemporary cycling and ever-evolving disciplines. Shops can rest assured that their customers will have the best possible experience, both in-store, and on their bikes.

www.extrauk.co.uk

“FIZIK’S BRAND MESSAGE IS ALL ABOUT CHOOSING THE RIGHT SADDLE FOR A RIDER’S NEEDS – BOTH BIOLOGICAL AND DISCIPLINE.”

“CUSTOMERS ARE MORE LIKELY TO BUY WHEN THEIR DOPAMINE LEVEL INCREASES, THEREFORE YOUR JOB IS TO MAKE CUSTOMERS FEEL INSTANTLY RELAXED, WELCOMED AND COMFORTABLE, AND AS A RESULT TO BUILD GOOD RELATIONSHIPS WITH THEM.”

Have you ever visited a store that looked great, but despite all the effort that someone put into that store’s appearance, you wanted to leave it quicker than you had originally planned, or never wanted to return to that store? Perhaps you felt ignored? Maybe some member of staff appeared to be rude, and made you feel like you are disturbing them? Or maybe no one was available to assist you when you needed help, so you walked around the store to find someone that you could talk to but there was no one available? Maybe you even felt like you are invisible, and no one even noticed you are actually there?

Perhaps you left that store feeling frustrated, annoyed and ignored, and at the same time empty handed as well?

Did you know that being ignored or mistreated by a member of staff in a store is one of the few but very important reasons customers are not satisfied with their shopping experience, the reason they might give your store a negative review and that they would be less likely to buy from that store or return for more purchases?

You probably realised by now that you absolutely need to make sure your customers feel comfor table, relaxed and happy at your store, as that makes a huge impact on whether they buy from you or if they will ever be willing to return to your store. One of the very important tools that can help you achieve this goal is to properly greet and treat your customers. This is very powerful, low-cost improvement to make sure you have satisfied customers, which would be followed by great results for your revenue.

If you are wondering what the best practices are to greet and to treat your customers at your bicycle store, what you should never say to your customers and what you should say, to leave the long-lasting positive impression on them, make them more likely to buy and return to your store later... then keep reading.

The first and most important thing to remember is that customers need to feel welcome and surrounded by friendly, helpful and kind people when shopping. Especially in speciality stores such as a bicycle shop, they need to receive relevant, elaborate information about product too.

At present, you might feel awkward

greeting customers that are walking into your store, or you perhaps follow standard, typical salesperson responses as this is what you think you should be doing. Unfortunately with that type of approach, customers very often feel jumped at by a salesperson that walks right to their face, without giving them time to transition from the outside world to the inside of your store, and to sell them something they do not need, or want. Instead of feeling relaxed and comfor table, customers then start to feel tense, pushed and defensive… and ready to leave. The naked truth is that no one likes salespeople, which unfortunately comes from bad experience with aggressive, standard sales methods that most of us had experienced before at least once.

Customers are more likely to buy when their dopamine level increases, therefore your job is to make customers feel instantly relaxed, welcomed and comfortable, and as a result to build good relationships with them.

You probably wondered by now, how do you do that?

Start with your staff appearance by providing them with proper outfits, that are always neat and groomed. It could be as simple as unified, clean tshirts with the store logo, name tag and probably with the function of each member of staff too. Ask members of your team to come to work with clean, tied up hair, clean hands and nails as well as make sure they breath smells pleasantly. All of this will make customer feel respected and will show them that you do care.

Another important thing is body language. Make sure members of your staff stand tall, they make eye contact, keep their arms at their sides with hands open, or mimicking whatever customer is doing with their posture and hands when they are having conversation together. They should smile and say hi. A warm greeting can make customers feel valued.

Your customers do need time to transfer themselves from outside world to your store’s environment. Give them a minimum 15 seconds before you

acknowledge them so they do not feel overwhelmed, but at the same time make sure you do it not later than 30 seconds after they enter as then the customer might feel ignored. That’s right! You only have a 15 second slot to do it in the correct way.

If you are with another customer when a new customer comes in, make sure you acknowledge them. Maintain eye contact, look at them, smile and say ‘hello, welcome, I am glad you here’ or something similar. You can also ask the customer you are with for permission to leave them for a minute to greet the other one, so they know you will be with them shortly.

Greet them and let them browse.

It would make your returning customers feel great and recognisable if you make sure you remember their names, but do not worry if you don’t as there are ways to greet returning customer without that and they will still feel recognised. For example, you can say ‘Hi, it’s good to see you again’. Do try also to remember facts about them, so you have an opportunity to greet them with something even more personal or relate to it later when you talk to them. That will also make them feel very comfortable at your store.

After you let your customer browse for a while, and sink into your store’s beautiful environment, I recommend going nearby them first, start maybe tidying up the display, so you are close enough to them. Now all you need to do is start conversation. You should not worry about sales, you are here to build a relationship with them. Your true success lies in building relationships with customers, not as just one of transaction. If you think about all of this from a building relationships perspective, instead of a sales perspective, this immediately leads to everyone be more relaxed, relieves the pressure and makes everyone much more comfortable.

So, having in mind a building relationship goal, approach customers in a friendly, kind manner, by perhaps complimenting them on something that might lead to the conversation,

then that is the moment you can start asking open ended questions.

By open questions I mean the questions that cannot be answered with a simple, short ‘yes‘ or ‘no’. These are the type of questions that customers must give you an answer in full to. Asking open questions will give you the opportunity to build your relationship with a customer, make them feel more relaxed, and would make them talk, so you can get to know them better, it will uncover stories and insights. It will help you to find out what your customer is looking for today, it will give opportunity to explore a topic, and in general it opens the door to further conversation.

After starting conversation with a compliment as mentioned above, the first open question should be not sales related at all, for example if it is beginning of the week, you could ask your customer, for example ‘where were you riding your bike over the weekend?’ or if it is before the weekend you might ask ‘where you will be riding this weekend?’ After the conversation starts to slow down this is best moment to ask a more sales related question, but that still should be an open ended question. You can ask something like ‘what brought you

“CUSTOMERS NEED TO FEEL WELCOME AND SURROUNDED BY FRIENDLY, HELPFUL AND KIND PEOPLE WHEN SHOPPING.”

today to our store today?’, ‘what are you looking for to find in our store today?’. This would invite the customer to share their ideas with you, so you can show them the available product that meet their needs.

Remember that when you talk to a customer make sure you look interested. Focus on the conversation and what your customer is saying. Listen carefully, make eye contact, as long as the customer is willing to continue the conversation keep asking open questions. Make them feel like no one else exists by giving them your undivided attention. Unless there is another customer walking in, and you need to greet them quickly as mentioned before.

Make sure you know the product you are selling very well, so you can answer questions customers might have, or you will be able to offer recommendations, and if you do not know the answer straight away, apologise and inform your customer that you will go and find out and get back to them as soon as possible to give them information they had requested.

Make sure one member of staff is available to answer customer needs. There is nothing worse than your customer wandering alone around the store and unable to find any assistance regarding your bikes or other products you might have in the store. That will put them off and will be recorded as bad service.

We already covered the customer who is willing to talk, but not every customer needs help or will be happy to talk to you. If they indicate that they just want to walk around and browse by themselves, do give them space to do so, just make sure you are available on the shop floor, nearby in case they need you. Do not go standing behind the counter as that immediately builds barrier between you and your customer as they will now perceive you as that widely disliked salesperson. If that customer picks up any item, you can then approach them again and ask politely their permission to talk to them more about an item they have in their hand or basket. They might still say they would not like to hear it, which is fine, so then politely smile and walk away, but still be around on the sales floor, or they might

bob-elliot.co.uk

bob-elliot.co.uk/twitter

bob-elliot.co.uk/facebook

bobelliot-online

“PROPERLY HANDLED FRONT-OF-HOUSE GREETINGS AND KIND, KNOWLEDGEABLE STAFF WOULD BE A LOW-COST INVESTMENT THAT WILL BRING BACK CUSTOMERS AND MAKE THEM MORE LIKELY TO TALK POSITIVELY ABOUT YOUR STORE.”

welcome you to listen what you’d like to tell them. Your job is to be perceptive and make sure you notice when they look lost, or their face says ‘I need someone to help me now’.

The other type of customer is the ‘person on the mission’ to buy quickly something specific. They walk in the store fast, seem like they are in rush and have no time to waste on unnecessary browsing. You can then approach them straight away acknowledging that you see they are on the mission and asking how you can assist them to make their shopping fast and efficient. You can say something like ‘hi, I can see you are here on the mission to buy something fast; how can I help you to find quickly what you are looking for today?’ Most likely they will welcome your help and confirm that they only have a certain amount of time to find something they need. You still must start asking them open ended questions and talk to them as if they were your best friends and you would like to help.

Make sure every member of your staff receives proper training about how to greet customers and how to talk to them, so your shop is well known for having the best customer service in town. Practice with members of your team, do lots of role plays so they really find a natural and comfortable way

of talking to customers later in real life, to open sales talk and to build relationships with your customers.

Above greeting customers and knowing how to build good lasting relationship with them, you can go the extra mile. For example, instead of giving instructions to the customer where they can find product they asked you for, walk them to that product and inform them about the product benefits. Demonstrate to the customer how product works or let them try it. Open the door to the customer that walks in or out with their own bicycle, pushchair or the product they just bought, especially when their hands are full. You might also offer to help to take their new bicycle to their car or walk out from behind the till point to pass their bag with what they just had purchased to them, instead of handing it over the till counter. Do things above and beyond. Think about the other ways that your store can be better with customer satisfaction ratio then other retailers.

Try not to ask every customer the same question, instead be creative and make it as personal as possible. Do not ask your customers such questions as ‘How can I help you today?’ or do not say ‘If you need anything I will be right there’.

Do not assume anything. Even some customers might appear rude to you, do not be rude to them, instead be politely assertive and try to calm them down. Above all, remember that you must find the perfect balance between making sure customers feel acknowledged and well looked after and overwhelming them with your presence, so they do not feel they’re being watched by you or a member of your team, as that would make them feel very uncomfortable and as if you were suspecting them of stealing from you.

To sum it up, properly handled frontof-house greetings and kind, knowledgeable staff would be a low-cost investment into your staff training that will bring back customers, will make them more likely to shop at your store, or talk about your store and how great they had been treated there whilst they had shopped around, as they would feel welcomed and comfortable in its environment. What automatically comes with that is more profit.

If you would like to discuss the subject further or talk about any other design or retail psychology subjects, please contact Gosia Adamska via email on: gadamska@whichinteriors.com

Existing and future bike store owners can come talk to Gosia and get a free consultation in person during The National Cycling Show, at stand C40 (22-23 March 2025).

Weldtite is spending plenty of time out on the road visiting shops to gather feedback and insights into prevailing market trends, then funnelling those into its ranges. Ed Smith, UK & Ireland Accounts Manager, talks mechanics, margins and workshop mess with CIN

Workshop, workshop, workshop. CIN hasn’t yet polled retailers to glean whether their workshops have provided a larger percentage of their turnover over the tail end of 2024, but it seems a betting certainty that workshop revenue is more important than ever to the trade right now as consumers are largely reluctant to open their wallets to spend on new cycle gear.

Therefore, naturally, shops are keeping a keen eye on their workshop profit centres, not least for the products and services that are working, but also their mechanics. Weldtite UK & Ireland Accounts Manager Ed Smith explains: “Workshop managers are paying closer attention to the care of their staff. They’re giving much more consideration to what they are using on bikes on a daily basis. If we can create products which are less harmful and still perform well, while being convenient to use and save or make them money, then we all win.”

That insight, gleaned from time out on the road, has fed into the development of some of Weldtite’s latest products, Ed adds: “I think that the Thunder Foam Degreaser and Snow Foam Cleaner for me is a gamechanger. They are both easy to apply, with almost zero overspray. They do not melt, so even if you’ve applied them and you are inter-

rupted by a phone call or customer, you can return even minutes later and continue where you left off.

“Far more economical than other liquid sprays and are significantly less

messy and fumy to work with. Workshops are often in confined spaces, so being able to work quickly, cleanly and in a healthy environment, is influencing what they choose to buy and use.”

Our exciting new range of KX Wheels are produced right here at Bob Elliot HQ Utilising our specialist machinery, we prepare the hubs using reliable, economical, high quality componentry and lace the wheels before finishing them to precise tolerances with the use of a robot which are then quality checked to deliver the perfect wheel every time. Competitively priced replacement wheels offering a wide selection for 700C and all MTB disciplines.

Built here at Bob Elliot HQ IN THE UK

All wheels FInished to exacting tolerances Comprehensive range, PRICED competitively

Quality componentry from all around the World

Over 50 years combined wheel building experience

Next day delivery available

Chemical bonds

2023 was a transitional year for Weldtite, losing several key UK distrib utors and retailers during the course of that challenging year. Happily, 2024 has brought growth for the firm. Ed picks up the story: “We have been very pleased with how our partners have responded and most of them have picked up new accounts as a result. Coupled with the excellent work which has been done here in terms of both product development and on the marketing side, it’s setting Weldtite up to become a key supplier to the mainte nance sector.”

As you’ll have gleaned by now, getting out on the road and visiting dealers is something Weldtite remains a keen advo cate of, using first-hand feedback to help guide product development. It also uses in-house experience in helping shape range evolution – much of the small, close-knit team ride bikes in all weathers and disciplines, giving them a firm grasp of what riders and mechanics want and need from workshop-related products.

Weldtite’s manufacturing is aided by an experienced in-house chemist, with a strong track record in production and manufacturing, CIN is told: “It enables

“WE HAVE BEEN VERY PLEASED WITH HOW OUR PARTNERS HAVE RESPONDED AND MOST OF THEM HAVE PICKED UP NEW ACCOUNTS AS A RESULT.”

us to turn out quality products which perform well and give excellent value.”

Ed Smith is among the Weldtite staff that regularly get out on the road, accompanying reps and agents where he helps demo products and listens to shop reaction: “It drives what we do in terms of product development. We focus on at what we can improve, e.g. the performance, environmental impact, versatility and convenience.”

The investment in skilled in-house technicians and bodies in the field is good news for Weldtite’s distribution partners too, he adds: “They can see first-hand how we present the products to the shops, and it assists the shop in how to merchandise and talk about the features and benefits to their customers – and if necessary to overcome any objections.”

Crucially, the products provide strong margins and stable RRPs, says Weldtite, both of which remain crucial considerations – now even more so.

Weldtite’s new 500ml Snow Foam and Thunder Foam Degreaser are available from all Weldtite distribution partners.

www.weldtite.cc

The frustrating ‘green washing’ phenomenon, where a token nod to sustainability is made in lieue of a substantial effort, has a diversity equivalent where companies make a token hire, for example, ensure it is well publicised, but don’t necessarily give that person a higher role or power. Experienced cycling marketing exec Katya Gasenko, founder of Marketing 4Cycling, provides a no holds barred opinion on the topic…

Since a couple of years we have seen lots of women in cycling brands’ ads, social media, magazines, etc. Everyone is trying to show their support and welcoming approach to “the fair sex”. The truth is, in most companies it is only a nice wrapping made to make the market happy by showing they support the newest trends. But does the shit covered in silver foil become chocolate?

Yes, this article is an expression of anger. But of course, when a man uses strong words and speaks frankly, he’s called brave and deserving of a standing ovation. When a woman does the same, she’s hysterical. Am I right or am I right?

I “love” how companies show off their new female employees and say how proud they are to have them on board, blah-blah-blah. What they’re actually saying is: “Look, we did what you expect us to do, now we will show her everywhere as a proof, so stop all this equality/diversity bullshit!”

If you look closer, most of those new employees are put into low positions or middle at best. Very few companies actually treat women equally and are ready to not only give them lowresponsibility jobs and orders, but listen to what they have to say and take their advice.

I already see your disgusted faces and hear you say: “You’re wrong, it’s not true, look at Kalkhoff and Specialized Australia, they have women for Managing Directors!”. And? How many more cycling industry companies that weren’t founded by women are run by them? How many women are at the top managerial positions? Some 5% overall? This tiny-tiny number of female representatives in the cycling industry is made solely of women, who kept

“I “LOVE” HOW COMPANIES SHOW OFF THEIR NEW FEMALE EMPLOYEES AND SAY HOW PROUD THEY ARE TO HAVE THEM ON BOARD, BLAH-BLAH-BLAH.”

“I SPEAK PROFESSIONAL LANGUAGE, POINT OUT THE PROBLEMS, OFFER SOLUTIONS AND ALL MEN SEE IS THIS CUTE BLOND, WHO WOULD BE A NICE SECRETARY OR INFLUENCER.”

hitting the wall until they broke it. How many more gave up? And how many men had the same difficulties?

I’ll tell you a personal anecdote. Some years ago I was going through a recruiting process with one of the bike manufacturers. When I came to the main office with my presentation, one of its points proposed to engage in supporting women to increase their share in purchases, I was asked: “What is it with this fuss around women? Why should we support them? There are some female cyclists, we don’t see any problem with that.” The job was filled by a guy (and by the way, the company has zero women in managerial positions), who, funnily enough, contacted me to offer collaboration. I was good in the role of influencer, but I couldn’t possibly be Head of Marketing.

I’m not the only one with such “equal-treatment” stories. One of the women I deeply admire told me that before she stepped into her managerial role in a tech department, the team needed to be gently introduced to the

idea of having a female boss and given time for this thought to soak in. Really? When a man gets any head position in any kind of company, in absolutely any branch, including cosmetics and fashion, does anyone ease the team in? No, because it is only natural for a man to lead, think, make decisions and orders.

I have more stories like those, but I guess the above is enough to show the absurd treatment and absolute lack of equality and even readiness for it.

I decided to share my observations with you because I am absolutely sick of being forced to constantly prove I’m a camel. I speak professional language, point out the problems, offer solutions and all men see is this cute blond, who would be a nice secretary or influencer. I wasn’t entrusted USD $1 million to develop and oversee a national campaign for being cute! I didn’t increase sales by 200% by being nice, I didn’t build brand awareness because I look good in a skirt. As a matter of fact I didn’t get my top maths grades in school

for that either and I was accused of that in those exact words by an envious classmate. I told him, I’d be glad to lend him my skirt if it helps him with his grades. I thought the school was long left behind, but it seems like we’re still at the same playground.

I often feel like I’m hitting a wall laid with “You’re a woman, you can’t know what men know and if you claim to know even more, you’re a witch and we need to burn you!” bricks. And no one cares about my experience, tremendous knowledge, analytical mind, long-term strategic thinking, exceptional ability to understand and learn things, solve the “unsolvable” problems, calmly manage critical situations when everyone else is running around like headless chickens, take educated risks, optimise, ride MTB, get up smiling after hitting the ground face first, etc. Nothing matters as long as I’m a woman.

katya@marketing4cycling.com marketing4cycling.com

BOB ELLIOT | KX WHEELS

Continuing the story of distributor Bob Elliot’s diversification into manufacturing, this time we pick things up with KX Wheels, the firm’s first foray into production. Purchasing and Customer Support exec Rob Dando talks wheel sizes, staff skills, container issues and gradual evolution…

KX Wheels was the first time that distributor Bob Elliot stepped into the world of manufacturing proper. The move wasn’t purely to diversify –though it was part of the appeal to get a piece of that business – but in fact KX Wheels was partly created to help fill gaps in the range where suppliers weren’t quite producing the kind of product Bob Elliot wanted to offer its bike shop customers. Nevertheless, it felt like a big deal when the company decided to make the move.

Rob Dando tells CIN: “We’d never done it before as a business, but I had production training at college as well as a background in production, so I knew that side of things well.”

Any scepticism in-house about the move was short lived, with the team swiftly buying into the concept and – of course – the disrupted supply chains related to Covid just around the corner proving it to have been a well-timed move.

As the brand was setting up, Bob Elliot was in the fortunate position of having considerable wheel building skills inhouse already, which it has retained over time. Rob explains: “We’ve had a core group of wheel builders, but of course you have to get more people in. Obviously the wheel builders have got to train other people, and we’ve got people who’re interested in doing that sort of thing. It’s defi-

nitely a skill set, Chris is the main person who sees everything and makes sure everything is as it should be.”

Like Bob Elliot’s other house brand, KranX, the IBD has played a large part in the development of the brand, playing a guiding hand and providing feedback along the way that has been funneled back into the range. “The IBDs were the priority, they knew what they wanted and we supplied what they wanted, essentially.”

Wearing a manufacturer’s hat, as opposed to a distributor’s, it’s a different kind of challenge when keeping up with wheel trends. Rob says: “We have our tubeless range in now, and obviously people still ride 26-inch wheels, others ride 29-inch wheels… there’s always someone who wants something different, including wheels that we don’t do now. We get calls asking us ‘can you do this?’ It’s not always possible but we try to have as many SKUs as possible to please everyone.”

Packaging is probably the less exciting side of new product development, but nonetheless a hugely important part of getting products into the hands of retailers and then consumers, while also adhering to ecological ambitions and evolving legislation. “We’ve been working on improvements and are currently sourcing axle/hub protectors during transportation and delivery. This, alongside our wheel hang tags for our wheels, we hope will help to stand out from others and be unique.”

KX Wheels came to market around 2019, but given inflation and disruption since then, ensuring that prices are in the sweet spot of appealing to customers and still ensuring shops (and the manufacturer) gets some margin has got more challenging. Rob adds: “When you’re getting product and materials from the Far East you’ve obviously got prices and currency to deal with. There have been problems with the Red Sea, but we are hopefully on the other side of these issues now and we are over the worst of this after responding quickly to the delays in spring 2024.

“We now have a few containers lined up for the start of 2025. We have added nearly 200% more availability to our shelf in the last eight weeks and we have plans to maximise the quieter trading season on builds.”

Aside from supply, Bob Elliot has been making sizeable investments in its facilities too, doubling floor space: “We are putting things in place for not only improving but expansion too.” For Bob Elliot, that helps facilitate the gradual evolution it has planned for KX Wheels over the coming years, with more tweaks and range extensions arriving gradually. Something that promises not to change, however, is the refreshingly

BOB ELLIOT | KX WHEELS

simple focal point for KX Wheels: “I’d like us to produce more, but it’s all about making sure the products are right and that we’re getting a good quality wheel at the end of it”.

www.bob-elliot.co.uk

“There’s always someone who wants something different in

www.cambriantyresb2b.co.uk

www.lyonequipment.com

goodyearbike

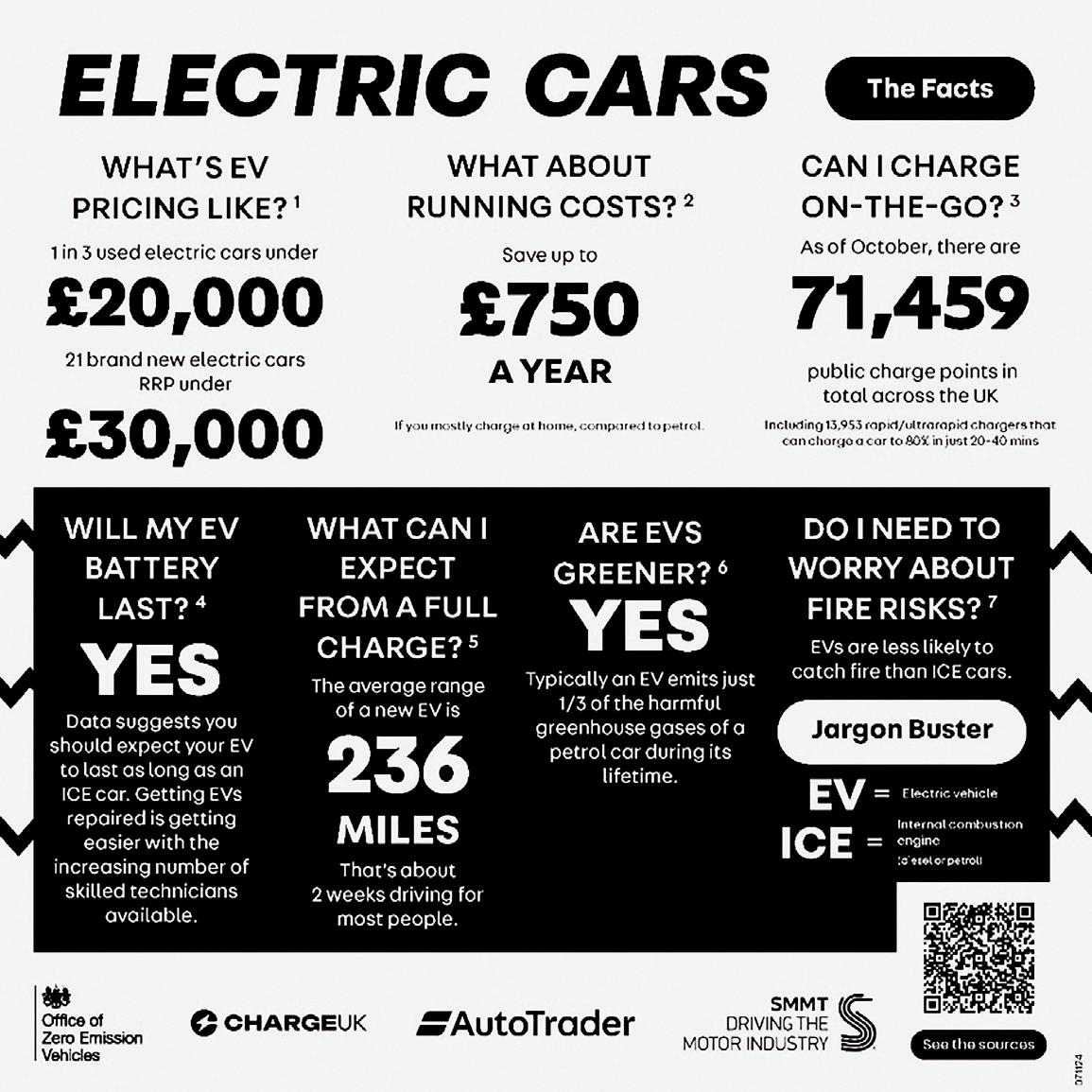

The industry is uniting to fight misinformation and fear about electric powered vehicle… For once, that challenge is not about eBikes, but electric cars and EVs, another market that is battling misconceptions and misplaced fears…

The advent of electric powered bicycles and cars have united the two markets in a key challenge: Misinformation.

As the bicycle industry battles misleading headlines and perceptions – how many bike retailers have had customers enter their shop and ask about eBike battery fires? – the automotive sector is fighting a similar battle and has launched a new initiative to combat it. Auto Trader, ChargeUK and the Society of Motor Manufacturers and Traders (SMMT) have committed to promote a set of user-friendly facts about electric cars, endorsed by the Department for Transport.

The move has been sparked by research that has shown that a significant proportion of consumers believe myths such as “electric vehicles are more likely to catch fire” and “electric cars are not cheaper to run than petrol driven cars”.

That research, conducted by Auto Trader earlier this year, showed that “mistruths repeated in various media sources were impacting consumer confidence in electric cars”. 72% of consumers were aware of the “electric cars catch fire” narrative and 44% incorrectly believed it’s true – which has made them less likely to go electric. Similarly, 70% had heard that “EVs are not cheaper to run” with 33% agreeing that they believe this to be true, and that this has made them less likely to buy an electric car.

Car retailer sentiment shows a significant lack of confidence in stocking and selling EVs, with the share of retailers stocking electric cars on Auto Trader stalling at around 35% in both 2023 and 2024, contrasting a previous significant

year-on-year jump (57%) in 2022. Separate research from the publication shows that 46% of retailers believe a lack of consumer confidence in the technology is a significant barrier to adoption.

The SMMT said that “There’s a clear disconnect between perception and reality as, despite consumer and retailer nervousness, 83% of current electric car owners said they would buy electric again.”

The call to action

This automotive collaboration have created a collection of user-friendly, simplified facts that offers a more balanced and data-backed view of the reality of owning and driving electric cars. These facts clarify points such as how electric cars are greener than petrol-driven cars, are no more likely to catch fire than an ‘ICE’ car, and that the electric range and charging point availability is better than some might think. The group has confirmed that the data points will be regularly reviewed and updated, with new versions issued when required. This information is endorsed by the Department for Transport.

Despite the misinformation challenge, the situations facing the automotive and cycling markets have marked differences. The EV battle is in part to convince consumers that BEVs are a viable option to convert to, when trading in their ‘ICE’ car, with the market pursuing a governmentimposed targets to increase reduce ICE cars in favour of BEVS. There are no such governmental targets forcing the cycling industry to promote eBikes and non-pedal assist bicycles are pretty environmentally sound already compared with ICE cars (the supply

chain is another story). Instead, consumers have proved pretty keen on converting to eBikes or have perhaps been lured into the cycling industry enticed by pedal assisted bikes. Nevertheless, eBikes have taken an ever larger slice of the traditional cycle market (see inset). How the impact of misinformation about the dangers of eBike fires or range issues have affected the rate of eBike uptake is difficult to assess in lieue of the kind of stats available in the automotive market.

We’ve seen some of the ways the automotive market is responding to the challenge of misinformation on EVs. So how is the cycling industry responding to the challenge of misinformation on eBikes?

In October, the Association of Cycle Traders (ACT) launched a campaign for fair and accurate reporting of eBike-related news whilst publicising good news about eBikes. Jonathan Harrison, director of the ACT, said:

“We’ve observed a concerning trend in some media outlets where the term ‘eBike’ is being used inappropriately or sensationally, particularly in accident reports. This not only misrepresents the nature of eBikes but also risks

Battery electric vehicles (BEVs) have a 20.7% share of the UK market. There are now more than 125 BEV models for consumers to choose from, up 38% in 2024. EVs in Europe have a market share of 14%, down from a 21% peak in 2023 (stats via ACEA).

The eBike share of the market is 9% of volume and 31% of value (according to Bicycle Association of Great Britain 2023 stats). That’s significantly less than the European average of 27% of total bicycle volume (in 2022), but a noticeable uptick from pre-Covid levels.

damaging public perception of what is an increasingly popular and sustainable mode of transport.”

Harrison added: “In my opinion, the main cause of eBike and battery fears is the increasing coverage – both in the media and online social channels – of fires linked to unsafe eBike batteries and chargers, which has the overall effect of damaging the reputation of all eBikes.”

More broadly, the Electric Bike Alliance E-Bike Positive campaign was launched, with the backing of the ACT, the Bicycle Association of Great Britain, Cycling UK and Bosch eBike Systems.

The E-Bike Positive campaign aims to clear up any confusion around eBikes, including where they can be ridden,

that riders don’t need to be taxed, insured or have formal training, and the mental and physical health benefits.

E-Bike Positive has advice for those retailing and repairing eBikes, including the legalities involved.

We’ll finish with some words from the automotive market that, if you squint a bit, work for eBikes too:

Future of Roads Minister Lilian Greenwood said: “Ensuring consumers have clear, accurate information when deciding what [kind of car] to buy is essential. This work by industry is absolutely vital to boosting confidence in zero emission vehicles.

www.ebikepositive.co.uk

With 100 years’ experience in locks and decades in bike helmets, ABUS is innovating with products, tech and its commercial set-up, with a business that now extends into software and OE. CIN joined the firm across several of its German sites, starting with where it all began…

Visitors to the facilities of ABUS in Germany will likely take home many findings with them: Unusually, the HQ has its own volleyball court on its vast campus. Heritage is important (the firm this year celebrates its 100th anniversary). So is innovation. It’s not just about bike helmets and locks (ABUS also majors in home security, marine security with offshoots into industrial security and even the equestrian market).

Probably one of the main ‘take homes’ is scale. ABUS is really really big. And getting bigger. From its huge HQ in

Wetter to its three other German locations, the Italian helmet factory, sites in North America and its steady present in the Far East since the 1970s.

It maybe a cliché but it really is quite the change from ABUS’ humble beginnings in 1924. Founded by August Bremicker in Volmarstein, a town where 29 other lock manufacturers were once based (now there’s two, including ABUS), the business was set on a hill with a punishingly steep gradient (in days of yonder, customers asking for a discount would be challenged to ride it faster than ABUS’

100 years: One century on, the ABUS investment programme is in rude health, from continual improvements at facilities like its HQ in Germany, to product and R&D

well practiced climbing champ. Spoiler: discounts weren’t forthcoming). By 1928, the firm employed 30 staff. Now ABUS employs north of 3,000 internationally. In an entrepreneurial stroke of genius, ABUS was considering the export market almost from the start, with its first product given an internationally-minded name (more on that later).

Over the years, the ABUS business expanded into different sectors beyond its home security/lock origins, most pertinently into the cycle business in the 1990s. Recent strides saw ABUS acquire Italian helmet label Maxi Studios in 2021(having worked with the firm since 2016) and close by in Italy, near Vicenza, ABUS is developing plans for a new and more modern manufacturing plant close to its existing Italian factories (coincidentally close to some other prestige Italian manufacturers like Campagnolo, Alpinestars and Selle Royal).

And if you’re a returning visitor to ABUS HQ, like this bike trade hack, it’s still a worthwhile endeavour to use up some shoe leather and take the trip because there’s a good chance the innovative company will have built another production hall by the time you come back. Most recently in Germany, ABUS added a huge 5,800m2 (62,430 ft2) manufacturing hall to its plant near Frankfurt. Axel Roesler, Director of Sales and Marketing at ABUS Mobile, surprises CIN when he admits there might be a need for another production hall in 2-3 years thanks to recent growth.

In fact, some of ABUS’ steepest growth trajectories have come in recent decades. When Roesler began at the company, 25 years ago, there were circa 175 staffers at its main Germany production plant. That number has now expanded to 650 (peaking at 800 during Covid to keep up with demand). There’s no little automation either, with some very high-end tech including robots and cobots in the production halls, making manufacture more efficient but seemingly not at the cost of employee numbers.

And the workforce are certainly no afterthought. This year has been chock full of events to mark the people who’ve made ABUS successful over its first century, with staff firmly at the centre. Retention of the workforce is something the company is proud of, not least for keeping knowledge in-house. ABUS also makes a point of extending many of the advantages European staff enjoy to ABUS’ sizeable workforce in Asia, which sadly isn’t always the case with other companies. Cleverly, Germany’s production staff work in different sections and on different products day-to-day, reducing the potential for boredom, keeping staff multi-skilled and also meaning the company can change up production quickly, depending on market need – another point of pride for the manufacturer.

ABUS retains a lot of control over its business thanks to making its own tooling. We’re reliably informed that the tool storage room is the most expensive in the house, and the CNC machines that help create them look fairly dear too. Owning its own tooling provides control and – once again – flexibility to optimise and evolve its production and ranges.