In Loving Memory of Our Precious Daughter, and Sister, Sammi Kane Kraft

www.SNN.Network Follow us: @StockNewsNow

SNN Inc.

Published Since 2006

www.SNN.Network

Follow us: @StockNewsNow

4055 Redwood Ave. Suite 133 Los Angeles, CA 90066 www.SNN.network

PUBLISHER

SNN inc. 4055 Redwood Ave. Suite 133 Los Angeles, CA 90066

www.SNN.network

Robert K. Kraft, MBA SNN Chief Executive Officer, Executive Editor & Director rkraft@snnwire.com

pUBLiSHEr

Robert K. Kraft, MBA

SNN Chief Executive Officer, Executive Editor & Director rkraft@snnwire.com

Shelly Kraft SNN Founder, Publisher Emeritus skraft@snnwire.com

Shelly Kraft SNN Founder, Publisher Emeritus skraft@snnwire.com

Lynda Lou “Lulu” Kraft SNN President & Director lkkraft@snnwire.com

We welcome our new subscribers and welcome back our subscribers and readers. Thank you all for your support. Since 2006 we continue to provide access to “all things microcap” with content related to our community and the ecosystem including articles from influencers, experts in their fields, opinions from industry leaders and coverage of up-to-date events affecting our investment strategies, best practices, rule changes and new insights. Issuers, please take notice in this issue the service provider ads which are intended to provide a resource for issuer’s seeking microcap friendly sources.

As we get bombarded with market information and intel in the news, social media, newsletters, TV ads, YouTube etc. we have to keep our own perspective in mind, which is, how does what’s happening in the stock market affect microcap stocks? How do we manage the holdings in our portfolio? How do we make our decisions of whether we should buy, sell or hold? As investors we do need to decipher pertinent details from the noise of those trying to sell us their ideas. Picking up morsels of truth is still relevant to our decision making which brings me to the point of staying in our lane, picking sources we trust with a history of accuracy, doing this will do more to protect our self-made directives while resisting a constant repetitive barrage of attempted paid influences.

ASIAN PACIFIC CORRESPONDENT

Leslie Richardson

Lynda Lou “Lulu” Kraft SNN President & Director lkkraft@snnwire.com

We have assembled articles about ETFs, the nuances of microcap public relations and investor relations strategies, sponsored research analysis, market making in microcaps, the cannabis report, platinum the most misunderstood metal, carbon credits, EOS, legal updates, Hong Kong market update, Drew Bernstein’s ASIA report, and IPO vs Reverse Mergers vs SPACs. This issue has something of interest and importance to everyone.

SNN COmPLIANCE AND DUE DILIgENCE ADmINISTRATION

aSiaN paciFic corrESpoNDENT Leslie Richardson

Jack Leslie

SNN coMpLiaNcE aND

CHAIRmAN OF SNN ADvISORy BOARD

DUE DiLigENcE aDMiNiSTraTioN

Jack Leslie

Dr. Leonard Makowka

Pundits in the microcap world often preach doing your homework, believe in your own methods, stick to your plan, learn from your mistakes, and build your sensibility to maintain focus. I believe for the most part they are correct. However, it’s quite difficult to locate non-biased information during our searching for it and even harder to interpret incoming information when it finds you.

This issue precedes our 9th annual investor conference Planet MicroCap Showcase held April 25-27, 2023, at the Horseshoe Hotel & Casino (formerly Bally’s).

ADvERTISINg and SALES info@snnwire.com

gRAPHIC PRODUCTION

cHairMaN oF SNN aDviSory BoarD Dr. Leonard Makowka aDvErTiSiNg and SaLES info@snnwire.com

Unitron Media Corp info@unitronmedia.com

SNN CONFERENCES info@snnwire.com

grapHic proDUcTioN Unitron Media Corp info@unitronmedia.com

SNN coNFErENcES info@snnwire.com

Microcap Review

Inc.

Investors are invited to attend and participate no charge and we hope you take advantage of this opportunity to meet and network with the C level management teams, investment bankers, fund managers. Many of the contributing writers included on these pages will be featured speakers or panel participants. The networking opportunities make the travel all worthwhile. —Shelly Kraft

Published Since 2006

Although I am a market traditionalist and since I historically lean on using my own common sense, this method may be costly since it also embeds learning from one’s own mistakes. For example, for generations investors relied on their stockbroker or wealth advisor to “trust” their advice, timing, ideas, guidance and performance. For better or for worse this marriage could have been a very successful marriage, oh by the way, the Internet, social media, relentless advertising, and regulatory intervention changed everything. The advent of discount brokering, and millennial DIY activity gave investors the power of making decisions but added the need for discipline, research, and trial & error. As far as I’m concerned and in my opinion, I would rather fail or succeed because of my own decisions rather than being led to slaughter and placing blame elsewhere.

www.SNN.Network

In the last issue of the magazine, I stated how Q3 2022 (and all of 2022 up that point last year) has been a tough year for MicroCap investors. Well, 2022 called and said “hold my beer”, it can get worse. The Planet MicroCap Index was down 39.38%

Follow us: @StockNewsNow

SNN inc. 4055 Redwood Ave. Suite 133 Los Angeles, CA 90066 www.SNN.network

pUBLiSHEr Robert K. Kraft, MBA

SNN Chief Executive Officer, Executive Editor & Director rkraft@snnwire.com

Shelly Kraft

SNN Founder, Publisher Emeritus skraft@snnwire.com

Lynda Lou “Lulu” Kraft SNN President & Director lkkraft@snnwire.com

aSiaN paciFic corrESpoNDENT

Leslie Richardson

SNN coMpLiaNcE aND

DUE DiLigENcE aDMiNiSTraTioN

Jack Leslie

This publication and its contents are not to be construed, under any circumstances, as an offer to sell or a solicitation to buy or effect transactions in any securities. No investment advice is provided or should be construed to be provided herein. Planet Microcap Review Magazine and its owners, employees and affiliates are not, nor do any of them claim to be, registered broker-dealers or registered investment advisors. This publication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements of or concerning the companies mentioned herein are subject to numerous uncertainties and risk factors, including uncertainties and risk factors that may not be set forth herein, which could cause actual results to differ materially from those stated herein. Accordingly, readers are cautioned not to place undue reliance on such forward-looking statements. This publication undertakes no obligation to update any forward-looking statements that may be contained herein. Planet Microcap Review Magazine, its owners, employees, affiliates and their families may have investments in companies featured in this publication, may purchase securities of companies featured in this publication and may sell securities of companies featured in this publication, at any time and from time to time. However, it is the general policy of this publication that such persons will refrain from engaging in any pre-publication transactions in securities of companies featured in this publication until two trading days following the publication date. This publication may contain company advertisements/advertorials indicated as such. Information about a company contained in an advertisement/advertorial has been furnished by the company, the publisher has not made any independent investigation of the accuracy of any such information and no warranty of the accuracy of any such information is provided by this publication, its owners, employees and affiliates. Pursuant to Section 17(b) of the Securities Act of 1933, as amended, in situations where the publisher has received consideration for the advertisement/advertorial of a company or security, the amount and nature of such consideration will be disclosed in print. Readers should always conduct their own due diligence before making any investment decision regarding the companies and securities mentioned in this publication. Investment in securities generally, and many of the companies and securities mentioned in this publication from time to time, are speculative and carry a high degree of risk. The disclaimers set forth at Planetmicropcap.com or SNN.Network - disclaimer are incorporated herein by this reference.

Like everything in the Stock Market, MicroCaps are down. As of EOD on June 17, 2022, the MicroCap Review (MCRI), our proprietary MicroCap index tracking

As we get bombarded with market information and intel in the news, social media, newsletters, TV ads, YouTube etc. we have to keep our own perspective in mind, which is, how does what’s happening in the stock market affect microcap stocks? How do we manage the holdings in our portfolio? How do we make our decisions of whether we should buy, sell or hold? As investors we do need to decipher pertinent details from the noise of those trying to sell us their ideas. Picking up morsels of truth is still relevant to our decision making which brings me to the point of staying in our lane, picking sources we trust with a history of accuracy, doing this will do more to protect our self-made directives while resisting a constant repetitive barrage of attempted paid influences.

Pundits in the microcap world often preach doing your homework, believe in your own methods, stick to your plan, learn from your mistakes, and build your sensibility to maintain focus. I believe for the most part they are correct. However, it’s quite difficult to locate non-biased information during our searching for it and even harder to interpret incoming information when it finds you.

cHairMaN oF SNN aDviSory BoarD

Dr. Leonard Makowka

©Copyright 2022 by MicroCap Review Magazine Inc. All Rights Reserved. Reproduction without permission of the Publisher is prohibited. The publishers and editors are not responsible for unsolicited materials. Every effort has been made to assure that all Information presented in this issue is accurate and neither MicroCap Review Magazine or any of its staff or authors is responsible for omissions or information that is inaccurate or misrepresented to the magazine. MicroCap Review Magazine is owned and operated by SNN Inc. This publication and its contents are not to be construed, under any circumstances, as an offer to sell or a solicitation to buy or effect transactions in any securities. No investment advice is provided or should be construed to be provided herein. MicroCap Review Magazine and its owners, employees and affiliates are not, nor do any of them claim to be, registered broker-dealers or registered investment advisors. This publication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements of or concerning the companies mentioned herein are subject to numerous uncertainties and risk factors, including uncertainties and risk factors that may not be set forth herein, which could cause actual results to differ materially from those stated herein. Accordingly, readers are cautioned not to place undue reliance on such forward-looking statements. This publication undertakes no obligation to update any forward-looking statements that may be contained herein. MicroCap Review Magazine, its owners, employees, affiliates and their families may have investments in companies featured in this publication, may purchase securities of companies featured in this publication and may sell securities of companies featured in this publication, at any time and from time to time. However, it is the general policy of this publication that such persons will refrain from engaging in any pre-publication transactions in securities of companies featured in this publication until two trading days following the publication date. This publication may contain company advertisements/advertorials indicated as such. Information about a company contained in an advertisement/advertorial has been furnished by the company, the publisher has not made any independent investigation of the accuracy of any such information and no warranty of the accuracy of any such information is provided by this publication, its owners, employees and affiliates. Pursuant to Section 17(b) of the Securities Act of 1933, as amended, in situations where the publisher has received consideration for the advertisement/advertorial of a company or security, the amount and nature of such consideration will be disclosed in print. Readers should always conduct their own due diligence before making any investment decision regarding the companies and securities mentioned in this publication. Investment in securities generally, and many of the companies and securities mentioned in this publication from time to time, are speculative and carry a high degree of risk. The disclaimers set forth at http://www.microcapreview.com/disclaimer/ - disclaimer are incorporated herein by this reference.

aDvErTiSiNg and SaLES info@snnwire.com grapHic

MicroCaps, but overall markets, is when I’m reflecting on how I want to deploy cash that will set me up for financial independence in the next 10-15-20 years. We don’t have all the answers, however, by reading this issue of the magazine, I hope that you’re able to walk away with a few nuggets that can help you on your path to financial independence.

Although I am a market traditionalist and since I historically lean on using my own common sense, this method may be costly since it also embeds learning from one’s own mistakes. For example, for generations investors relied on their stockbroker or wealth advisor to “trust” their advice, timing, ideas, guidance

and the iShares Micro-Cap ETF was down 23.49% for all of 2022.

But there is hope! Despite the continued nuclear winter for many growth sectors (Crypto, Cannabis, Psychedelics, and more) and the Silicon Valley Bank collapse, (as of March 24, 2023), the Planet MicroCap Index is up 3.99% so far in 2023.

My main question that I asked the Profiled Companies in this issue was: what does executing mean for you? I asked this question because throughout 2022, a lot of management teams spoke about how 2023 was the “year of execution”, a declaration that, to me, implies the company has been very clear about the goals they want to accomplish and that 2023 was the year those goals will materialize, or not. What I’ve found is the answer to that question is quite subjective. Experienced MicroCap investors are painfully aware of this.

This is important for this issue of the magazine and I think for MicroCaps moving forward in 2023. Based on earnings so far this year, companies are being rewarded for performance. Sure, management will always blame an outside force for underperformance, a time-honored tradition in public markets, and sure, current macro conditions are difficult to navigate. BUT, investors want to see perseverance, they want to see creativity, they want to see companies survey the landscape and start to figure out how they are going to generate alpha for their constituents.

In my Q&A with Joe Koster, we discuss how there’s a shift towards “real economy” businesses and current profits, where he states, “I think, in general, there was more of a focus on technology in the last decade, and now people are beginning to understand the importance of the infrastructure, raw materials, and supply chains that go into making the economy operate.” I want to take this a step further, MicroCap investors want to see growth companies take that next step, go to market with an MVP, establish a market need for their product or service. And guess what, those growth companies in some cases NEED to take that next step in order to survive.

This is one of the greatest times of my lifetime to be a MicroCap investor; there’s almost too many ideas to do research and due diligence on right now. With basically all MicroCaps taking a haircut across the board and the need for management teams to get creative, as a reader, you have to keep turning over every rock. As my father said in the first part of this editorial, we have our conference coming up in Las Vegas, which a great opportunity to get direct feedback from issuers. Please visit: www.PlanetMicroCapShowcase.com to learn more.

Thank you all for your continued support, please enjoy the Spring 2023 issue of the Planet MicroCap Review and look forward to seeing you all in Las Vegas. —Bobby Kraft

8 Navigating the Biotech Bear Market and Biotech’s 4 Hottest Trends for 2023

Q&A with David Sable, Portfolio Manager for the Special Situations Life Sciences Fund & Life Sciences Innovation Venture Capital Funds

12 Market Maker Corner: Why is it So Difficult? by Eric Flesche, Glendale Securities

byJoseph M. Lucosky Esq., Lucosky Brookman

15 Your Sustainable Supply Chain: It’s Time for MicroCaps to Report on ESG

by Seth Forman, Socialsuite

30 Value Investing in 2023

Q&A with Joe Koster, Sorfis Investments

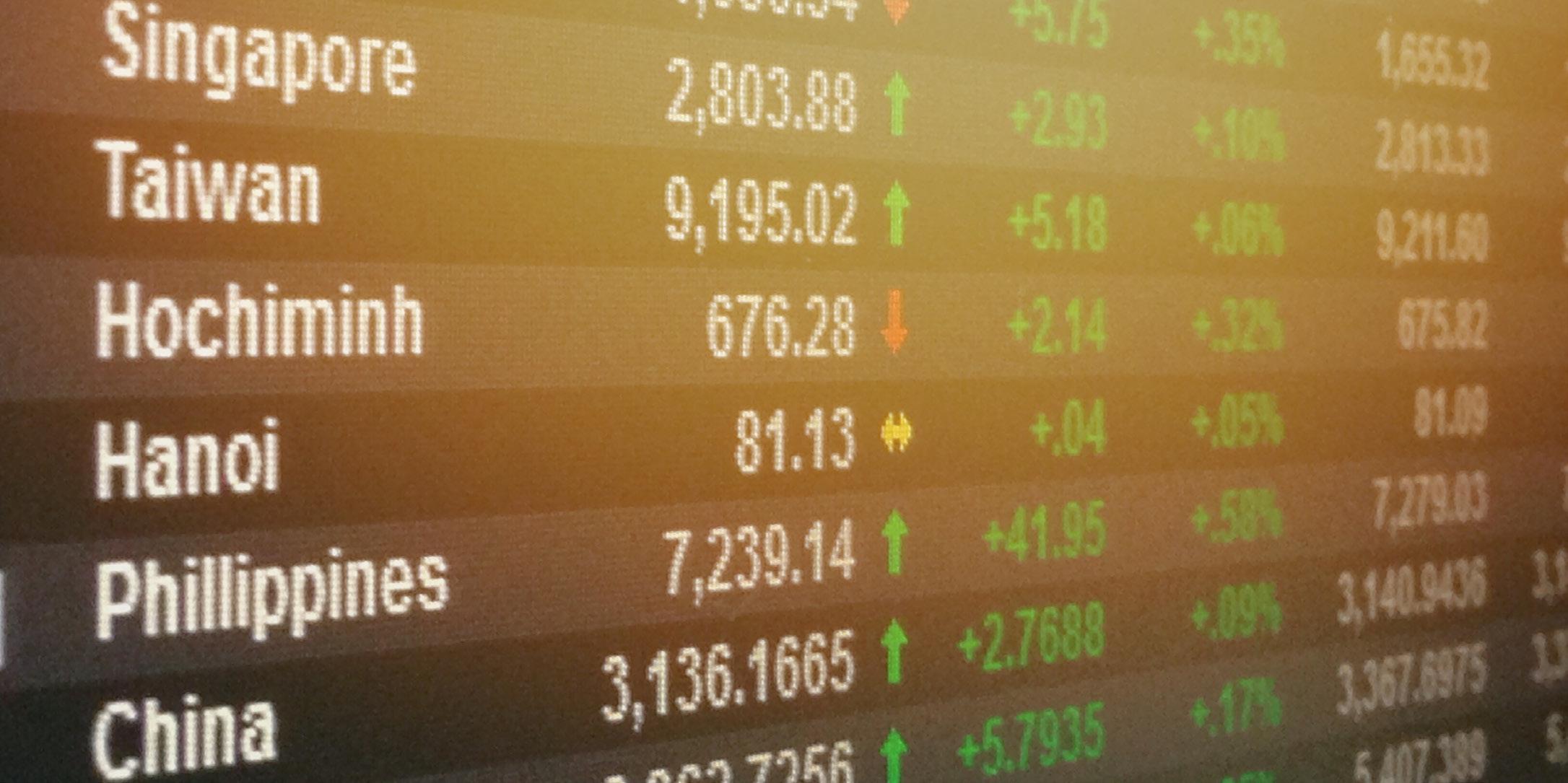

38 Will Investor Optimism Return to Asia in 2023? Q&A with Michael Fritzell, Asian Century Stocks

90 Asia Corner: End of Pandemic Restrictions

Fuel revival in Hong Kong’s IPO Market by Leslie Richardson, Elite IR

94 Ask Mr. Wallstreet: “Play Ball Stock

Picking” by Shelly Kraft, Founder, SNN Incorporated

by Gustave Passanante, Esq., The Basile Law Firm

96 MicroCap Investing in 2023 by Roger Pondel, PondelWilkinson

100 50 Years of Seasoned IR Advice

by Mike Porter, Porter, LeVay & Rose

102 To DTC or Not to DTC, That is the Question?

by Richard Revelins, Peregrine Corporate Limited

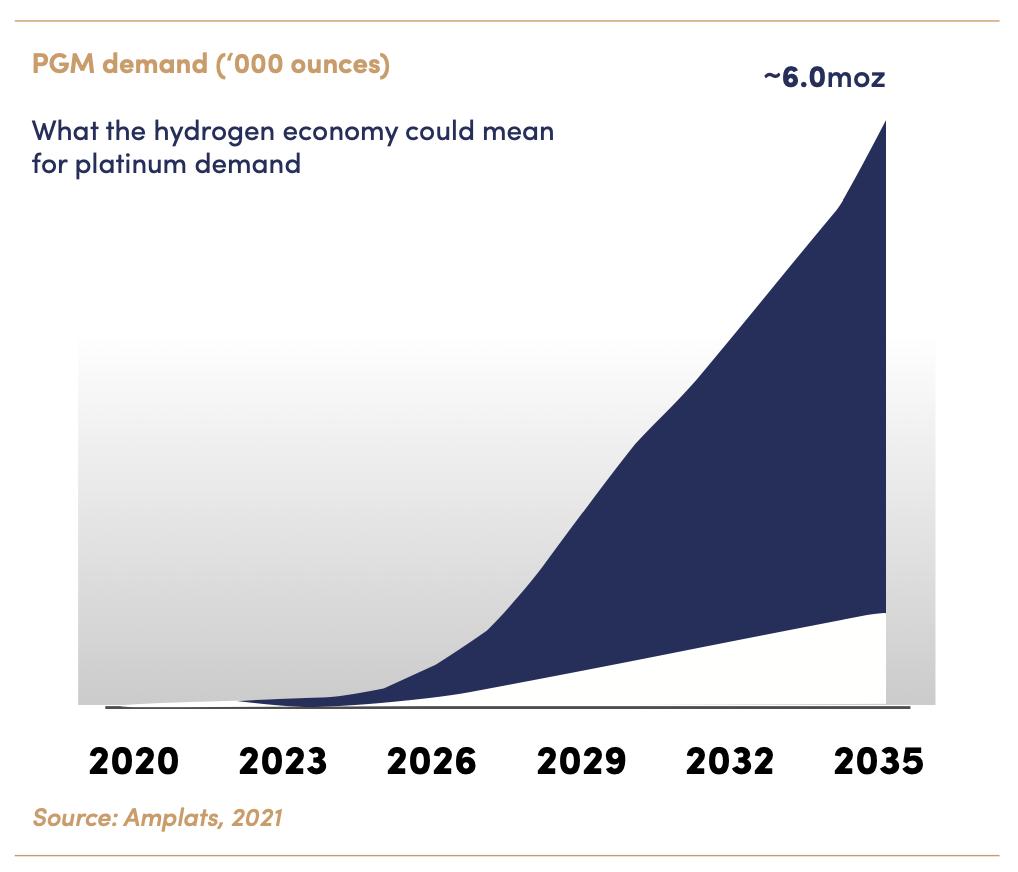

104 Platinum Risk in South Africa

by David Morgan and Ryan Blanchette, The Morgan Report

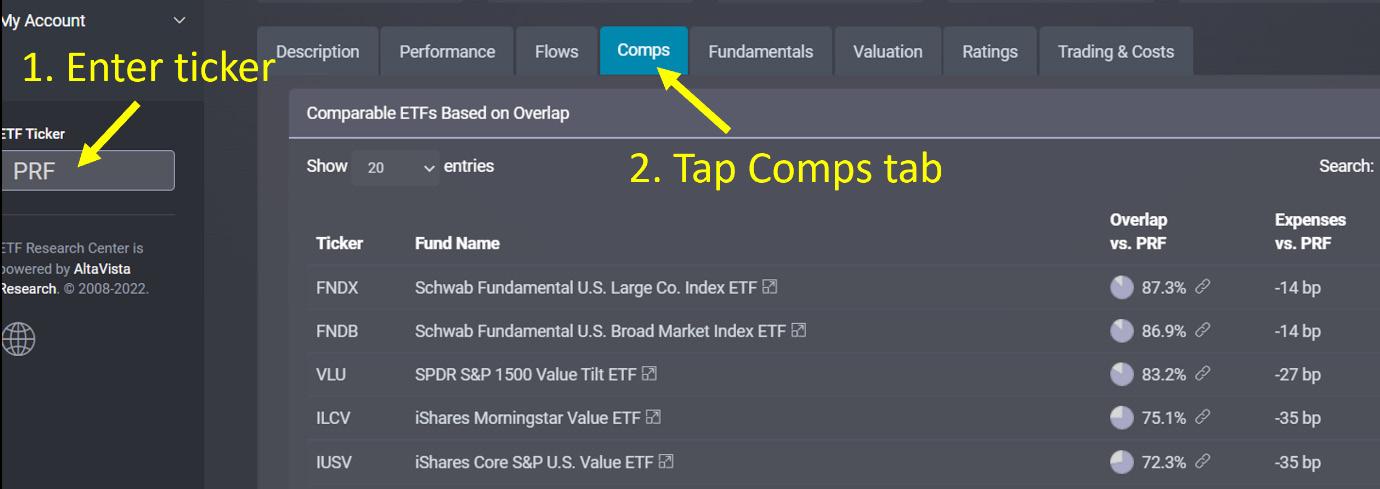

112 ETF Corner: There’s An ETF for That by Michael Krause, AltaVista Research

by Andrea

Esq., Mitchell Silberberg & Knupp LLP (MSK)

72 The Luckiest City State on Earth by Drew Bernstein, CPA, MarcumAsia

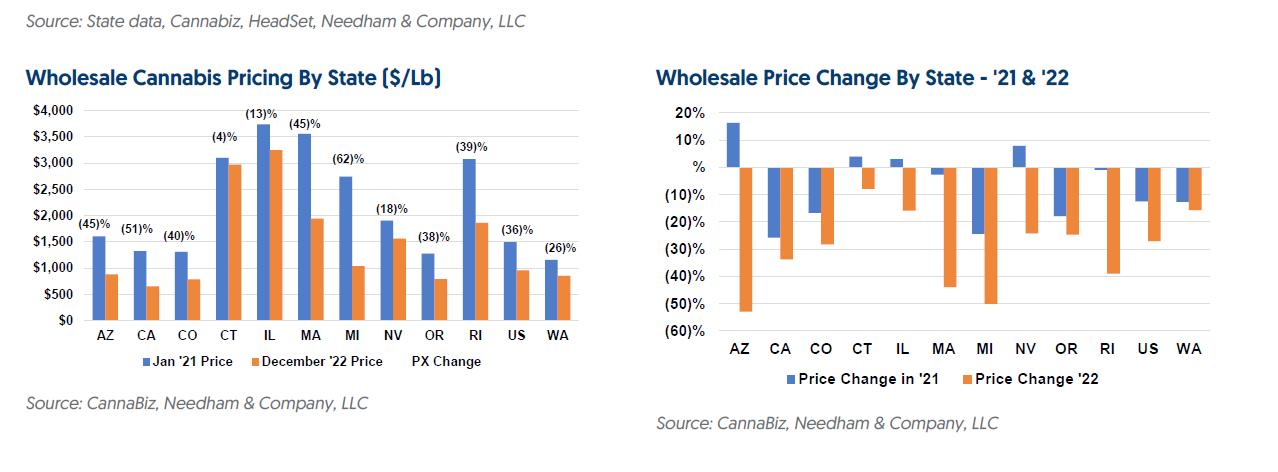

80 Cannabis Corner: Cannabis Year End 2022 by Seth Yakatan, Katan Associates

83 How is Carbon Footprinting Transforming Banking? by Julie Lindenberg, APAC Region at Cogo

86 Legal Corner: Pushing Back: Navigating the Rise in SEC Enforcement Actions

by Jon Uretsky, Esq., PULLP

48 Overview of the Planet MicroCap Index P

20 DATA Communications Management Corp. (TSX: DCM) (OTCQX: DCMDF)

34 QuoteMedia, Inc. (OTCQB: QMCI)

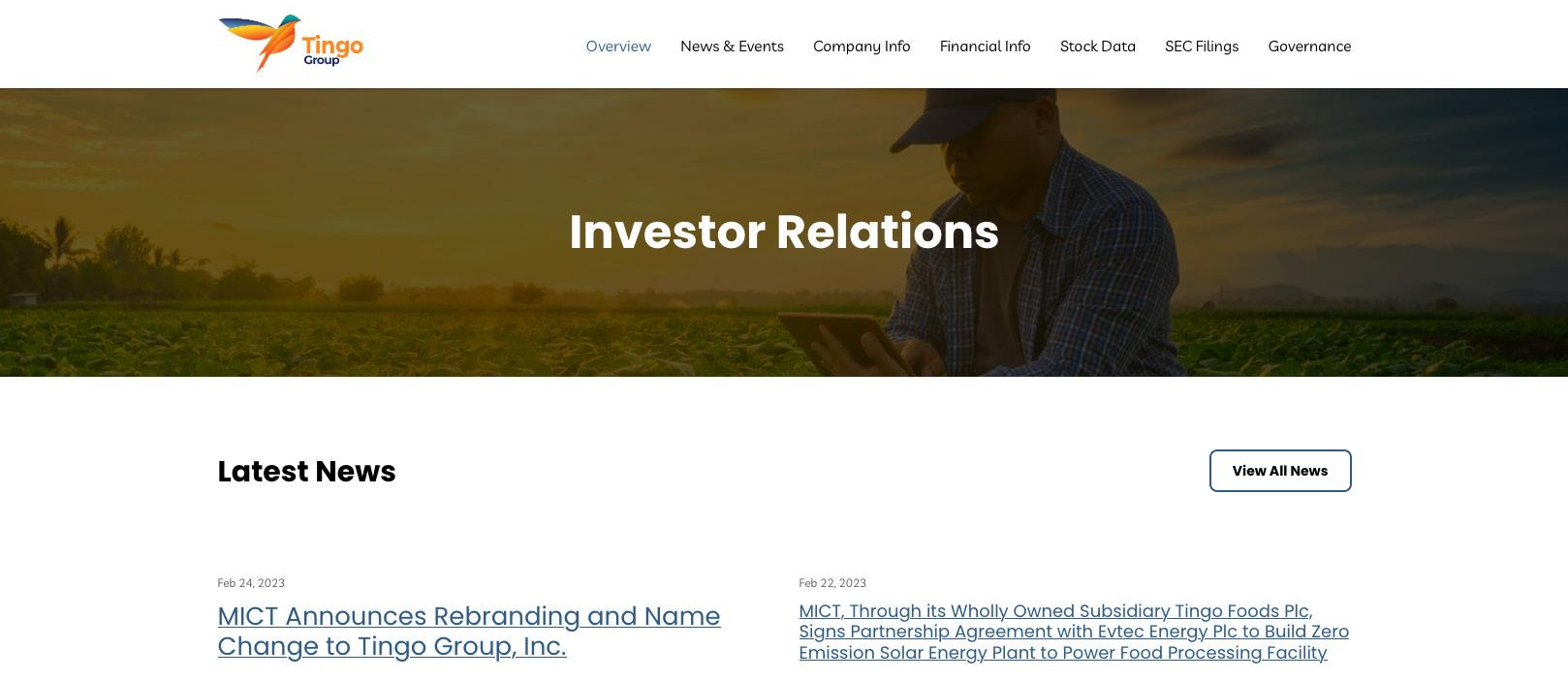

60 Tingo Group, Inc. (NASDAQ: TIO)

76 Data I/O Corporation (NASDAQ: DAIO)

50-59 MCRI Q1 2023 Constituent List

Q&a wiTh david SaBlE, PORTFOliO MaNagER FOR ThE SPECial

SiTuaTiONS liFE SCiENCES FuNd aNd liFE SCiENCES iNNOvaTiON

vENTuRE CaPiTal FuNdS

THE BIOTECH INDUSTRy HAS BEEN IN A TwOyEAR BEAR mARkET. ACCORDINg TO THE S&P BIOTECHNOLOgy SELECT INDUSTRy INDEx, THE SECTOR HAS BEEN DOwN ~45-50%. wHy HAS THIS BEEN THE CASE? AND, HOw COmE 2022 DIDN’T FARE mUCH BETTER THAN 2021 FOR THE BIOTECH INDUSTRy?

I think there are three factors that, combined, can explain a lot of the biotechnology market performance over the past couple of years. The first is that the 2021-2022 underperformance followed an exuberant 2018-2020, when the number of companies going public in biotechnology hit a record high, and the amounts of capital invested and the valuations relative to the development stage of the assets were unprecedented. Those of us in the industry knew that this was unsustainable, and early in 2021, just as some of these companies were approaching the need to go back to the market and sell equity again, the public market appetite for these assets had been satisfied. Demand disappeared pretty quickly.

The second factor relates to the type of biotech company that was going public. Historically, new biotech companies are development stage and pre-revenue, so we replace the usual financial metrics, hard numbers like earnings, revenue and cash flow, with less precisely defined value inflections, like clinical trial results and regulatory approvals. These create

a schedule by which experienced biotech investors can gauge the progress of a company and place a valuation in the absence of financial data. The classes of 2019 and 2020 were filled with companies with earlier stage drug development projects, assets which are more difficult to time and handicap, as well as some platform companies in areas like gene editing and synthetic biology — even earlier stage in product development — great science projects that were much more difficult to financially model, and for those without deep scientific expertise, stocks that are tough to understand. Logically, valuations for companies like these are imprecise, and subject to cycles of optimism and pessimism — even when the fundamentals remain constant. In 2021 that cycle turned pessimistic. A fundamental factor, the slower than hoped-for progress in some of these early stage assets, progress completely in-line with how basic science works but not at a pace that matched the expectations from the IPO roadshows, exacerbated this turn in sentiment.

Finally, the macroeconomy affected the sector in a big way. Since drug development and scientific platform maturation are long processes, ten or more years from idea to viable product, businesses in these areas face a decade or more of cash burn and are extremely sensitive to the cost of capital. Years of near zero interest rates made risk capital, whether at the seed, venture, crossover or public

level, readily available. Inflation is a real headwind for cash burning companies like biotech, and sector performance the past two years correlates with interest rates and fears of inflation.

AT THE SAmE TImE, IN 2023, ALSO ACCORDINg TO THE S&P BIOTECHNOLOgy SELECT INDUSTRy INDEx, THE SECTOR IS UP ABOUT 4-5% ALREADy ON THE yEAR (AS OF JANUARy 20, 2023); wHy DO yOU THINk THAT IS AND IS THIS A SIgNAL FOR CHANgE IN SENTImENT?

Two weeks is much too short an interval from which to infer sector moves; this could merely be a manifestation of the new year, and the sudden absence of tax loss selling.

HOw wOULD yOU SAy mACROECONOmIC EvENTS ARE AFFECTINg INSTITUTIONAL PERSPECTIvE TOwARDS THE BIOTECH INDUSTRy? SOmE CONTExT, ALL BIOTECHS HAvE A mUCH LONgER RUNwAy TO ACTUALIzE mORE vALUE FOR THEIR BUSINESSES, wHICH SOmE FOLkS PERCEIvE TO BE A HEDgE AgAINST SHORT TERm FACTORS, LIkE, IF THE US gOES INTO A RECESSION - wHAT DO yOU THINk?

Biotech is one of the poster sectors for “risk-on.” It’s imprecise to model, outcomes and value inflections are hard to handicap, even for those with maximal fundamental expertise, and there are a lot of participants in the equity marketplace who really don’t understand what they are buying and selling. When times are heady, traders’ risk tolerance

increases, and retail investors perceive the high risk - high reward biotech sector differently than when times are uncertain. And, as we saw earlier, the fundamental relationship between interest rates and costs of capital for cash burning businesses like biotech, equates to these companies having higher barriers to success in a down economy, even if they do everything right, if every laboratory experiment and clinical trial works and the FDA grants approvals every time an approval is sought.

yOU wERE JUST AT THE JP mORgAN HEALTHCARE CONFERENCE IN SAN FRANCISCO, wHICH IS THE SEmINAL HEALTHCARE INDUSTRy EvENT OF THE yEAR THAT HAPPENS IN EARLy JANUARy - wHAT wERE SOmE OF yOUR TAkEAwAyS FROm THE EvENT IN TERmS OF: wHAT AREAS OF HEALTHCARE ARE HOT, wHAT’S NOT, mOST INNOvATION HAPPENINg - LOvE TO HEAR yOUR NOTES HERE.

In biotech there are four types of hot.

There’s hot science, and that arises organically when things like CRISPR gene editing are developed and announced.

There are hot companies and sub-sectors when a new drug category opens up a market to suddenly help people with previously unmet needs like. Alzheimer’s Disease is a good example.

There are hot markets when the market is hungry for IPO’s and secondaries, as we discussed before.

And finally, there are hot M&A markets, when big Pharma’s need for new drugs to manufacture and sell in order to replace existing drugs that lose patent protection produces a critical mass of a lot of deals in a short period of time.

Of course these factors are not independent, and scientific advances fuel faster drug development, which can heat up M&A, which can raise public market valuations and fuel banking activity.

If I had to judge this years’ sentiment, I would predict the market heat will come from M&A. With public valuations down sharply, with approximately two hundred negative enterprise value biotech companies (cash in the bank greater than the market cap of the company) and lots of basic science maturing into

real world use, the scenario is right for those with the greatest expertise coupled with acute business need to go shopping for discounted assets.

TO CLOSE US OUT, IF yOU HAD TO mAkE ONE PREDICTION REgARDINg THE BIOTECH INDUSTRy FOR 2023, wHAT wOULD THAT BE?

I’ll give two. The first is: lots of big companies buying small companies, in a marketplace where the big companies are dealing from strength and the small companies’ sometimes desperate financial conditions give them little leverage to negotiate. This will translate into modest deal premiums. The few blockbuster deals will come from truly unique bestin-class solutions for large markets.

The second is that the biggest, most important market moving event will likely be something that none of us were smart enough to predict.

For more information about Special Situations Fund, please visit: www.ssfund.com

David Sable MD directs healthcare and life science investing for the Special Situations Funds and is portfolio manager for the Special Situations Life Sciences Fund and Life Sciences Innovation Venture Capital funds.

After graduating from the Wharton School and the University of Pennsylvania School of Medicine, he trained in obstetrics and gynecology at New York Hospital - Cornell Medical Center, and in reproductive endocrinology at the Brigham and Women’s Hospital. He co-founded and served as director of the Institute for Reproductive Medicine and Science at Saint Barnabas Medical Center in New Jersey, was founder of Assisted Reproductive Medical Technologies, which was acquired by Saint Barnabas in 1999, and cofounder of Reprogenetics, acquired by Cooper Surgical in 2015. After leaving clinical medicine, Dr. Sable managed a proprietary healthcare portfolio at Deutsche Bank before joining the Special Situations Funds.

Dr. Sable is an adjunct in the department of biology at Columbia University, and teaches “Entrepreneurship in Biotechnology” at Columbia’s Graduate School of Arts and Sciences. He serves on the boards of directors for Hamilton Thorne Ltd, and Celmatix Inc, is a clincal advisory board member and board observer for TMRW Life Sciences and a member of the medical advisory board for Conceivable. He previously served as a board member for Ohana Biosciences, Genenews Inc, for the nonprofit advocacy organization RESOLVE, on the medical advisory board for Progyny Inc and on the scientific advisory board of Ovascience Inc. In addition to his academic publications, he has written for the Newark Star-Ledger, Yoga Journal, Xconomy, Genetic Engineering and Biotechnology News, the Timmerman Report, Wharton Magazine, and Forbes.

This article is not an attempt to provide investment advice. The content is purely the author’s personal opinions and should not be considered advice of any kind. Investors are advised to conduct their own research or seek the advice of a registered investment professional.

Assurtrak Insurance Brokers

www.assurtrak.com

Charlotte, NC | Atlanta, GA | Chicago, IL

info@assurtrak.com

WOne answer comes in the form of good intentions by regulatory agencies and unintended consequences from those good intentions.

e are often asked why we don’t offer commission free trading like some of the online retail brokerage firms offer. Wait, how can a broker dealer offer commission free trading? The answer to that question requires a discussion on the practice of payment of order flow, and a clarification on when payment for order flow

Fraud occurs in corporations across all market capitalizations, including large, mid, small and micro-

cap. Remember Enron, WorldCom, HealthSouth? Fraud comes in many forms including but not limited to FCPA violations, market manipulation, and accounting fraud. In 2022, names like Honeywell International Inc, Oracle Corporation, and Stericycle Inc all paid fines for FCPA violations. Did your

send your order to an exchange or ATS, but those often charge the broker on a net basis for execution. They can execute the order internally as a market maker, but that requires staff, technology, and risk capital that may be too cost prohibitive. Another option is to send customer orders to a wholesale market maker who pays the brokerage firm for its

At Glendale

Inc., we mainly

securities for our customers. We charge our customers a commission for execution and use our market making capabilities to facilitate customer executions.

brokerage firm turn off trading in these securities? Probably not.

While large cap fraud cases may get the big headlines, many believe that fraud is more prevalent in the microcap space. Microcaps are usually lower priced, have fewer shareholders, and have lower trading volumes, all of which could make them more susceptible to market manipulation. Microcaps that trade on the OTC and do not trade on an exchange like Nasdaq or the NYSE do not benefit from the extra regulatory scrutiny provided by these exchanges. Rather, the extra regulatory review falls in part to the brokerage firms trading these securities on the OTC. Regulatory agencies frequently publish guidance to securities professionals regarding red flags to look out for when trading microcap securities. Compliance departments at these brokerage firms are then faced with a business decision. Do they take the time to implement the additional reviews necessary to comply with the guidance or do they just turn off microcap trading to focus on trading large cap stocks like Oracle and Honeywell? Wholesale market makers that pay brokerage firms for order flow do not pay for OTC orders. If a brokerage firm offers $0 commission because it is relying on payment for order flow, the decision to turn off OTC microcap trading is easy, since there is no money in it. If the compliance department is willing to look past profitability, they are then forced to come up with reasonable rules to comply with the securities laws and guidance published by regulatory agencies regarding these laws. Many brokerage firms opt out of microcap trading or at minimum opt out of deposits to avoid the regulatory burden.

There are a few brokerage firms left that are willing to do the work. Glendale Securities, Inc. accepts OTC, OTCQB, and OTCQX securities for deposit along with exchange traded microcap securities, subject to compliance review. Glendale Securities, Inc. makes markets and can apply for DTC Eligibility for issuers. Contact us today to learn more at 818-907-1505 option 2.

After I wrote this article, I asked chatgpt the following question to see if maybe the machine knew better:

is there more fraud in microcap securities than in large cap securities?

Microcap securities are generally considered riskier investments than large cap securities due to their smaller market capitalization and typically less established companies. However, it is difficult to make a blanket statement about fraud being more prevalent in microcap securities compared to large cap securities, as fraud can occur in any type of security or market.

That being said, there are some factors that may contribute to fraud being more prevalent in microcap securities. For example, microcap companies may have less scrutiny from analysts and institutional investors, making it easier for fraudulent activity to go undetected. Microcap companies may also be more vulnerable to manipulation by insiders or other market participants due to their smaller size and lower trading volume.

Furthermore, microcap securities are often sold through less regulated channels, such as penny stockbrokers or unregistered broker-dealers, which can increase the risk of fraudulent activity. These channels may also attract unsophisticated investors who are more susceptible to fraud.

Overall, while it is difficult to say whether fraud is more prevalent in microcap securities compared to large cap securities, it is important for investors to exercise caution and conduct thorough due diligence before investing in any security, particularly those that are more speculative or less well-known.

I think chatgpt provided a mostly well-balanced answer to a complicated question.

Eric Flesche is the CFO/CCO of Glendale Securities, Inc. a market maker in OTC securities since 2006.

GlendaleSecurities.com

MEMBER FINRA/SIPC

Note: ChatGPT is an AI chatbot that uses natural language processing to create humanlike conversational dialogue. The language model can respond to questions and compose various written content, including articles, social media posts, essays, code and emails.

With the start of a new year, comes a fresh list of priorities for microcap organizations. But what does caring for your customer mean in 2023?

Climate change is on everyone’s radar. The gamechanging US climate Bill (the Inflation Reduction Act) of 2022, underscores that every investor, company and member of the public has direct exposure to

As the old saying goes, “If you are not taking care of your customer, your competitor will.”

climate change, and that we need unambiguous information about how organizations are contributing to greenhouse gas emissions. As for Environmental, Social & Governance (ESG)? It’s the mega-trend of the decade.

Reporting on non-financial activities is no longer just for large corporations. The urgency for microcaps to address their impact on our planet, and our society, is here. As for your stakeholders? They’re going to continue to put the pressure on a commitment to transparency.

In this article, we’ll focus-in on ESG driven supplychain pressures that if your microcap isn’t already experiencing, you’re likely to in the months ahead.

Action on ESG is essential for companies seeking investor dollars, regulatory approvals, and the social license to operate. As companies, large and small, face increasing demands from their stakeholders, ESG disclosure is officially no longer a ‘nice to have’. Under growing pressure from government regulators, investors, customers and employees, leaders of listed companies understand the economic realities of ESG – and its impact on people, planet and prosperity.

As demand for action intensifies, it will be increasingly important for companies to share comprehensive information on tangible metrics and goals, and how they plan to achieve them. More than 90% of S&P 500 companies now publish ESG reports in some form, and the US Securities and Exchange Commission (SEC) is considering requirements for detailed disclosure of climate-related risks and emissions.

Today’s investors are deploying over $30T in capital based ESG factors, and are influencing companies to adopt ESG best practices. What’s more, 82% of retail investors have reported an interest in backing companies that are socially and environmentally responsible, and 9/10 institutional investors are now using ESG factors to make their decisions.

Investors value transparency and clear communication about ESG initiatives and their potential impact on performance and enterprise value. Many com-

panies already have important ESG-related policies, mechanisms and data in place. Yet measuring and reporting on ESG seems to fall into the ‘too hard basket’, even for listed companies. Avetta states: “Given the lack of transparency, many investors are wary of the hidden ESG risks stemming from complex supply chains of portfolio companies. To manage exposure to supply chain risks, investors are asking portfolio companies to integrate ESG considerations into supply chain due diligence, risk assessment, and compliance”.

Regulators around the world, including in the United States, Australia, Canada and Europe, have passed or proposed a variety of ESG requirements making compliance a top of mind priority.

While regulatory requirements and enforcements vary around the world, it is universally expected that mandatory disclosures will become increasingly prevalent. That’s why it’s important to start benchmarking performance now – ideally against a globally recognized framework like the World Economic Forum’s Stakeholder Capitalism Metrics. Being an early adopter can protect your company’s market position while local regulations continue to evolve – and will also give you a robust model for mitigating compliance risks.

Society expects companies to change, and consumers are looking for visible action on ESG goals.

Forrester research suggests companies with a sustainability focus will generate revenue growth from new opportunities, as well as improved employee retention.

What’s more, the 2023 Edelman Trust Index revealed that society expects businesses to leverage their comparative advantage to inform debate and deliver solutions on climate, with 82% looking for CEO’s to act on climate change. Meanwhile, Forbes reports the likes of Shell, Starbucks and IBM all linking CEO salaries to ESG metrics.

ESG reporting shows you are walking the talk. And by sharing incremental progress with tangible impact,

it avoids being seen as ‘greenwashing’. Greenwashing is used to describe companies who publish misleading and deceptive communications surrounding their commitments to climate change -- or a lack of ESG progress after a big and bold statement. In November 2022, for example, the SEC fined Goldman Sachs Asset Management $4M for not following its ESG investments policies.

As ESG implementation continues to rise, consumers, alongside funders and regulators, are looking to organizations to commit to genuine, actionable, and visible positive change.

With global investors, consumers and regulatory bodies setting greater expectations of corporate social responsibility, measuring and reporting ESG information is becoming common-place. Multinational organizations are taking action by implementing frameworks such as The Task Force on Climate Related Financial Disclosures (TCFD), which asks companies to report on their Scope 1, 2, and 3 emissions. Scope 3 emissions include all indirect emissions that occur in a company’s value chain. Even though these emissions are out of the control of the reporting company, they can represent the largest portion of its greenhouse gas emissions inventory.

As a result, organizations must set a plan, organize and push down to their suppliers requesting for various sets of ESG related information. What does this mean for microcaps who rely heavily on large corporations in their buying and selling practices? The time to start ESG reporting is now.

ESG is mission critical for global supply chains. Executives and supply chain leaders are meeting the world’s net-zero challenge head-on. It’s about commiting today, or getting left behind.

In 2022, General Motors launched a company-wide initiative to drive its entire supply chain to report on ESG driven criteria. Eventually, this will likely become a requirement in doing business with the auto manufacturer giant.

Also in 2022, Apple, one of the largest companies in

the world, enacted a plan to drive its supply chain to address climate change, report on ESG criteria and other actions.

A 2021 McKinsey report found that two-thirds of an organization’s ESG commitments lie with its suppliers. Choosing the right supplier partners and managing them well is perhaps the most impactful decision a company can make when it comes to sustainability - and one that shouldn’t be overlooked.

Given the ever increasing demands for businesses to prioritize sustainability, ESG driven supply-chain pressures are growing. The stakes are high with ESG transparency becoming a condition of doing business with many multinational organizations. By starting their ESG journey today, microcaps can unlock useful partnerships with these major players while also leveraging their ESG position as a competitive advantage.

The small and micro cap companies that get ahead of ESG trends and start their journey sooner rather than later will be in a better position to capitalize on establishing closer relations with their large customers and win more business.

As we work towards a more sustainable future, the world will continue to expect more from microcaps. My recommendation for microcaps across the globe is to future-proof your operations by starting your ESG journey today.

Seth Forman President ofSocialsuite helps companies to get started with Environmental, Social & Governance (ESG) disclosure by offering an easy-to-use reporting software that operationalizes popular ESG frameworks, including the World Economic Forum’s globally recognized Stakeholder Capitalism Metrics ESG framework. With support from best-in-class ESG coaches, this approach allows small/mid cap companies that lack large ESG teams to quickly commence ESG reporting and demonstrate ongoing progress. Over 90 companies across the ASX, NASDAQ, NYSE, and OTC Markets trust Socialsuite to track and disclose the changes they are making to the world. Socialsuite has offices in Austin, Texas, Melbourne, Australia, and Vancouver, Canada.

Learn more about our Socialsuite ESG: https://www.socialsuitehq.com/

Lucosky Brookman is a corporate law firm directly serving the small and middle markets. With offices in New York, New Jersey and Philadelphia, we represent domestic and international clients in a variety of sophisticated corporate and securities transactions, mergers and acquisitions, secured and unsecured lending transactions, PIPEs, SPACs, commercial and securities litigation, intellectual property, insurance coverage and defense, real estate and general corporate matters.

•NYSE, NASDAQ and NYSE Amex Listings

• Uplistings

•Public Offerings

•Private Placements / PIPEs

•Recapitalizations (Reverse / Forward Splits)

•Rule 144 Matters

•Joint Ventures

•SEC Compliance Matters

• SPACs and De-SPACs

• Mergers & Acquisitions

•General Corporate Matters & Governance

• Term and Revolving Lending transactions

•Asset-based Lending transactions

•Revolving Lines of Credit

•Bridge Loans

•Registration Statements (S-1, S-3, S-8, Form 10)

•Commercial Litigation and Arbitration

•Regulatory Investigations (SEC / FINRA)

DCM is one of Canada’s largest marketing and communications providers, currently serving 70 of the top 100 corporations in Canada as well as 3 of the top 5 government agencies. Supporting multiple verticals such as financial services, retail, healthcare, and other regulated industries, DCM is well positioned as a leader in the Canadian market. Known primarily as a legacy print communications provider, DCM uncovered a number of digital capabilities within their print offering that has led to the evolution of DCM as a tech-enabled marketing workflow and digital asset management provider. The focus on digital has created a more comprehensive service offering for its 2,500+ clients, as well as increased the potential growth for DCM as technology has been a key catalyst in landing new customers. DCM has made great strides over the past few years in transitioning enterprise clients to using its online platform (called DCM Flex) for design, review, regulatory compliance, and ordering that integrates with a wide variety of ERP, CRM and marketing technology software platforms. The DCM Flex solution now drives about 30% of revenues, has helped to improve gross margins, and has been responsible for several major client wins.

While DCM currently only generates a modest ($6 million/ year) of digital-related revenues, they have over 40 years of experience in handling clients’ digital assets (graphic files, content scripts, letterhead, website content) that are used for print and digital marketing and client communications programs. This has led to DCM moving upstream and launching subscription-based cloud services to make marketing workflows easier to handle. Not surprisingly, the first offering is a high- margin subscription-based digital asset management (DAM) solution called ASMBL that enterprise clients use to store and share their corporate media content.

Under the experienced leadership of President and CEO Richard Kellam, and CFO James Lorimer, DCM has been driving, and executing on an aggressive 5-year growth strategy. The company is well positioned for digital acceleration due to its impressive, and sizeable list of enterprise clients, strong capabilities, and consistent Cash flow conversion rate supporting the business. Over the last two years DCM has invested in building a better business and is now in a strong position to build a bigger business that incorporates both conventional print solutions and a growing stack of tech-enabled workflow and asset management solutions.

Reflecting on 2022, how would you describe the company’s performance in the previous year? Did the company reach the milestones and goals that you set for the company?

While the company is yet to release the Q4 results, it is fair to say that 2022 was a strong year of growth for DCM on both the financial and organizational sides the business. On the financial side, DCM posted record results, achieving growth across the board YTD through September 30, 2022, vs. 2021 as Revenue up 15.1%, Gross Profit up 17.1%, Net income up 201% and EBITDA up +34.2%. From an organizational side DCM has achieved this growth with zero restructuring costs and DCM continued to pay down the higher cost fixed-term debt, which is now at $25.1 million, down from $34.1 million at the end of 2021. DCM remains focused on executing their strategy of helping clients simplify their marketing and communication workflows while delivering more value against their market competitors. As a result, DCM has an extremely high retention rate and believes there is an opportunity for expanded wallet share with existing clients as they continue to bring more digital capabilities to the table. As reflected in 2022, the financial results show management’s focus

on building a better business than the years prior, and as DCM continues to evolve its technological capabilities, we believe that there are substantial growth opportunities to build a bigger business. On that note, a milestone in 2022 was to focus on its digital capabilities, and YTD the company has generated over $30M in new business, all tech-enabled.

ARE THERE ANy INDUSTRy TAILwINDS TO PUSH FORwARD SOmE OF THE COmPANy’S gOALS AND OBJECTIvES?

DCM’s five-year strategy focuses on key areas such as digital transformation, revenue and EBITDA growth, debt reduction, client revenue expansion, customer growth, leadership development, and employee satisfaction. The company has seen revenue and EBITDA momentum in 2022 as it recovered from the impacts of the COVID-19 pandemic, however due to supply-side issues in the industry, DCM has continued to maintain a higher inventory level than normal to ensure that it could meet client demands. DCM continues to expect working capital improvements as the raw material market normalizes and inventories are reduced to more traditional levels. Additionally, while more of an opportunity than an industry tailwind, only 1/10 companies in currently are using a Digital Asset Management solution. As more companies evolve to meet the growing demands of the digital world, DCM should experience increased tailwinds on its DAM sales amongst its 2,500+ customers.

IN A NUmBER OF INTERvIEwS IN 2022, A LOT OF mANAgEmENT TEAmS SPOkE ABOUT HOw 2023 wAS THE “yEAR OF ExECUTION” - RANgINg FROm ExECUTINg THE BUSINESS mODEL TO SURPASSINg INTERNALLy DERIvED gROwTH gOALS; wHAT DOES “ExECUTINg” mEAN FOR yOU?

DCM remains focused on executing against their strategy of helping clients simplify their marketing and communication workflows while delivering a better and bigger business. If 2022 can be looked at as a year of building a better business, 2023 can be seen as a year of building a bigger business. By expanding our service offering amongst existing

clients, while also adding new clients via their techenabled solutions, DCM feels confident in their ability to grow the business in 2023. The company has released 5-year objectives of: +5-10 Revenue CAGR, 35-40% Gross Margin, 18-20% SG&A, Adjusted EBITDA 18-25% and Debt <1.0x. Executing on these objectives in 2023 would be a sign of success for the company and something that the company feels is within range given their recent success.

DCM is a cash positive business with significant growth ahead in 2023. Building off a record 2022 year, the company continues to drive hard on building a bigger business and should be able to continue growing its tech-enabled/digital revenue in 2023. The company’s objective to grow digital revenue to drive higher margins and cash flow.

However, the true value catalyst for DCM in 2023, is people recognizing the attractive valuation it trades at today. Despite its impressive Clients, Capabilities and Cashflow – the company has a fully diluted market capitalization of roughly $70M on $34.2M in TTM Adjusted EBITDA. When compared to the sector averages of Conventional Print Solutions (EV/ Revenue of 1.0x), DAM (EV/Revenue of 3.5x), and Tech-Enabled Marketing Workflow (EV/Revenue of 1.9x), DCM is trading well below market comps.

In accordance with some of the value catalysts for 2023, we just announced on February 23, 2023, has entered into a share purchase agreement to acquire the Canadian operations of R.R. Donnelley & Sons for a total cash purchase price of CDN $123 million.

As the company continues to grow the top line and drive margins up, there is a significant opportunity for investors to get in before the true value of the company is realized in the market.

For more information about DATA Communications Management Corp., please visit: www.datacm.com

DISCLAImER AND FORwARD-LOOkINg STATEmENTS NOTICE: This article is provided as a service of SNN inc. or an affiliate thereof (collectively “SNN”), and all information presented is for commercial and informational purposes only, is not investment advice, and should not be relied upon for any investment decisions. we are not recommending any securities, nor is this an offer or sale of any security. Neither SNN nor its representatives are licensed brokers, broker-dealers, market makers, investment bankers, investment advisers, analysts, or underwriters registered with the Securities and Exchange Commission (“SEC”) or with any state securities regulatory authority

SNN provides no assurances as to the accuracy or completeness of the information presented, including information regarding any specific company’s plans, or its ability to effectuate any plan, and possess no actual knowledge of any specific company’s operations, capabilities, intent, resources, or experience. any opinions expressed in this article are solely attributed to each individual asserting the same and do not reflect the opinion of SNN. information contained in this presentation may contain “forward-looking statements” as defined under Section 27a of the Securities act of 1933 and Section 21B of the Securities Exchange act of 1934. Forward-looking statements are based upon expectations, estimates, and projections at the time the statements are made and involve risks and uncertainties that could cause actual events to differ materially from those anticipated. Therefore, readers are cautioned against placing any undue reliance upon any forwardlooking statement that may be found in this article.

SNN does not receive compensation for, nor engage in, providing advice, making recommendations, issuing reports, or furnishing analyses on any of the companies, securities, strategies, or information presented in this article. SNN recommends you consult a licensed investment adviser, broker, or legal counsel before purchasing or selling any securities referenced in this article. Furthermore, it is encouraged that you invest carefully and consult investment related information available on the websites of the SEC at http://www.sec. gov and the Financial industry Regulatory authority (FiNRa) at http://finra.org.

Note: This article is not an attempt to provide investment advice. The content is purely the author’s personal opinions and should not be considered advice of any kind. Investors are advised to conduct their own research or seek the advice of a registered investment professional.

The process, however, is complex and challenging, requiring a deep understanding of regulatory requirements, knowledge of marketplace dynamics, and strategic planning. Lucosky Brookman LLP, a leading securities law firm in the United States, has become the premier uplisting law firm, successfully guiding companies quoted on the OTC Markets into the national marketplace.

Recognizing that the uplisting process is not onesize-fits-all, Lucosky Brookman’s tailored approach addresses each company’s unique needs and challenges. They work closely with management teams to identify goals and develop a customized plan for uplisting. This personalized approach ensures a smooth transition to a senior exchange while meeting the management team’s objectives.

exchange

the

(NYSE) or Nasdaq is a significant milestone for any company aiming to increase exposure, gain credibility, and attract investors.

Lucosky Brookman has successfully completed dozens of uplistings for the benefit of its clients. The firm’s expertise spans a wide range of industries. Working with companies of varying sizes and spanning various market sectors allows them to better understand the nuances of each industry, providing tailored advice that caters to the specific needs of their clients.

In addition to their uplisting expertise, Lucosky Brookman has a proven track record of raising millions of dollars in firm commitment underwritten financings during the uplisting process. These financings enable companies to raise capital, which is crucial for growth and continued success in the national marketplace.

Lucosky Brookman has developed a practical, business-oriented approach to legal work that enables clients to achieve their uplisting goals while minimizing costs and maximizing value. This approach focuses on understanding the client’s business objectives and aligning the uplisting process with these goals. By doing so, the firm ensures that clients gain the most value from the uplisting process, including increased exposure, enhanced liquidity, and the ability to raise capital.

The firm’s extensive knowledge of regulatory requirements, combined with its deep understanding of the marketplace dynamics, makes them an essential partner for companies seeking to uplist. Their team of experienced attorneys provides comprehensive and coordinated guidance throughout the uplisting process, ensuring that companies navigate the complexities of regulations and market conditions successfully.

One of the significant advantages of working with Lucosky Brookman LLP is the firm’s ability to provide innovative solutions to complex problems. They understand that each company has unique needs and challenges, and their creative problem-solving skills enable them to address these issues effectively.

Joseph Lucosky, Managing Partner and Head of the Securities Practice Group at Lucosky Brookman LLP, is widely recognized as an expert in uplisting. His experience and expertise extend to all aspects of the uplisting process. He has a deep understanding of the regulatory landscape, which is essential to the success of the uplisting process. He is familiar with the various rules and regulations governing national

stock exchanges and can help companies navigate these complexities with ease. Joseph Lucosky has developed strong relationships with key stakeholders, such as investment banks and market makers, which can be crucial for a successful uplisting. His strategic thinking and ability to find creative solutions to complex challenges have helped many companies overcome obstacles and achieve their uplisting goals.

Uplisting to a senior exchange like the NYSE or Nasdaq can offer companies significant benefits, such as increased exposure, enhanced liquidity, and the ability to raise capital. However, navigating the complex process requires a deep understanding of regulatory requirements, knowledge of marketplace dynamics, and strategic planning. Companies looking to uplist should engage Lucosky Brookman LLP to ensure a successful transition.

By partnering with Lucosky Brookman LLP, companies can confidently navigate the uplisting process and achieve their goals of enhanced exposure, credibility, and investor attraction, setting the stage for future growth and success in the national marketplace.

With their tailored approach, extensive industry expertise, and innovative problem-solving capabilities, Lucosky Brookman LLP has established itself as the premier uplisting law firm in the United States. Their monthly publications, including the Uplisting Report, the Microcap IPO Report, and the Microcap SPAC Report, further demonstrate their commitment to providing cutting-edge insights and guidance to companies seeking to uplist and unlock their full potential. For further information on the firm, companies should see their website at www.lucbro.com and review their various monthly publications at https://www.lucbro. com/our-firm/uplisting-report; https://www.lucbro. com/our-firm/micro-cap-ipo; and https://www.lucbro. com/our-firm/micro-cap-spac-report.

Joseph M. Lucosky is the founding and managing partner of Lucosky Brookman LLP and oversees both the transactional and litigation departments. Mr. Lucosky has a broad multidisciplinary practice that includes extensive experience in litigation and dispute resolution, regulatory investigations (including FINRA and SEC matters), negotiated mergers and acquisitions; domestic and cross-border investments/joint ventures; the representation of private equity; venture capital and other private investment funds, placement agents and underwriters; securities offerings; private and public financings (including secured and unsecured lending); bankruptcy transactions; real estate matters; and various other types of commercial transactions. In addition, he counsels corporate boards, board committees (including special committees) as well as being a personal adviser to many entrepreneurs, business leaders and corporate executives. He has counseled clients on significant litigation, regulatory and transactional matters across a number of industry sectors.

A Special Purpose Acquisition Company (“SPAC”) is a publicly traded company that has no formal commercial operations. A SPAC usually has a lifespan of about 2 years and is formed with the sole purpose of effecting a merger with another company.

Since the 1990’s, Special Purpose Acquisition Companies have been successful in raising hundreds of billions of dollars. The money raised in its IPO is deposited into an interest-bearing trust account that cannot be disbursed except to consummate a business combination. To start, a SPAC must supply its own capital when issuing its IPO. This is ultimately provided by the SPAC’s sponsors. The sponsors receive founder shares in return for providing capital to the company for its operations. This includes the SPAC’s professional fees and due diligence it undertakes when identifying and acquiring a target company. After the SPAC successfully completes its IPO, the sponsor begins searching for a target company to merge with. SPACs have a specified time to complete its special purpose, generally around 2 years, or it must return the capital raised in its IPO to investors.

In short, a SPAC is a freely trading public company that’s seeking a company to merge with to continue its existence. Since a SPAC itself is a publicly traded company that’s subject to strict federal securities laws and exchange listing requirements, SPAC sponsors take into consideration the target’s ability to abide by these requirements since their goal is to ensure they deliver as much value as possible to the SPAC and its shareholders.

A publicly traded company makes for a powerful SPAC acquisition candidate. Typically, a SPAC will target a private company. A conventional IPO process could take the target company more than a year, while the route to public offering using a SPAC may take a mere few months. Traditionally, the target company is a third party, such as a start-up firm.

There are a few key factors the SPAC will often look at when evaluating a target company: A strong management team, financial systems and reporting in place, corporate governance familiarity and alignment, a mature company lifecycle, and growth opportunities.

A strong management team and prior company experience will be more attractive SPAC targets. A strong, experienced CFO is necessary to implement and meet the financial and reporting requirements of a publicly traded company. A mature company lifecycle is reflected in a company’s history of healthy

In short, a SPAC is a freely trading public company that’s seeking a company to merge with to continue its existence.

growth coupled with plans for a sustainable future. Ultimately and arguably the most important factor, is the potential growth of the target company. The success of a SPAC transaction will depend on the growth of the acquired company.

Lastly, one of the biggest hurdles when consummating a merger for any public company is the registration statement that needs to be filed with the SEC which is called Form S-4. Form S-4 is required to disclose material information with respect to a merger or acquisition upon the registration of a company’s securities. It consists of information regarding the terms of the transaction, risk factors, ratios, pro-forma financial information, and material contracts with the company being acquired. Most importantly, in order to file Form S-4 both companies need 2 years’ worth of audited financials. This poses a problem

for private companies targeted by SPACs because they need to undergo the audit process and incur additional expenses. This could make the transaction timelier and more expensive. Thus, if a company is audited, it significantly enhances the likelihood of the completion of the transaction because it decreases time and costs.

With these key factors in mind, what kind of company seems like a perfect fit? That’s right, a publicly traded company.

Of course, a public company can always become the target of a SPAC through the traditional due diligence process where the sponsors take a liking to a company, the sponsors target the company, they

begin due diligence and, eventually, close the deal. Of course, the chances of this are rather slim simply because the number of OTC companies far outweigh the number of SPACs looking for targets. Luckily, this isn’t the only way an OTC company can get targeted and eventually merge with a SPAC.

Another route for a company to merge with a SPAC is by a company stepping into the shoes of the sponsor where it will appoint independent leadership for the SPAC. The SPAC then targets the OTC company for a business combination.

While a merger with a SPAC may cost more than an uplist, it’ll likely be quicker and decrease the chances of a company getting delisted for failing to meet certain exchange requirements. The entire process can take a mere few months, risk is minimized, and the potential benefits that come with becoming listed on a national exchange are tenfold. With a typical reverse merger, a lot of due diligence is required to combat potential liabilities.

It ends with an OTC company landing itself on NASDAQ. Since the sponsor-and-target company has already had experience being on the OTC markets, management will be prepared to handle the demanding regulatory and compliance requirements that go along with being a public company.

OTC companies are commonly smaller companies which makes it difficult to meet the listing requirements of national exchanges. Investors face greater risk when investing in more speculative OTC securi-

ties. Further, stocks trading on OTC markets are, generally, not known for their large volume of trades, therefore the OTC marketplace is an alternative for small companies or those who would have trouble listing national exchanges due to their financial capabilities. It’s incredibly possible to outgrow the OTC. The quicker the process, the better. For example, on the other hand, stocks listed on NASDAQ experience less volatility, tighter spreads, and more depth. Tighter spreads and more depth at the inside quote decrease costs to investors. In addition to tighter spreads making it cheaper to trade, this also makes it easier for investors to get larger trades done.

The familiar risks associated with SPAC mergers and the obvious inexperience of a private target company seemingly melt away when the sponsor-and-target is an established, publicly traded company. This method provides microcap companies another option to grow. The popularity and use of SPACs will continue to find success as faster merger speeds benefit companies involved in this seamless transaction.

Gustave (“Gus”) Passanante is a partner at the Basile Law Firm, P.C. He specializes in corporate restructuring, complex commercial litigation, and mergers and acquisitions to achieve practical outcomes for clients. Gus is recognized for his work as an entrepreneur, advisor, and litigator to best counsel companies at all stages.

The Basile Law Firm, P.C. provides a range of legal services for their OTC clients including debt remediation, restructuring, corporate finance litigation, shareholder derivative actions, corporate dispute resolution, and mergers and acquisitions. Founded by Mark Basile, former CEO of several OTC companies, the Basile Law Firm, P.C. offers clients a unique legal perspective and thorough understanding of how to achieve their goals.

Contact: Thebasilelawfirm.com gus@thebasilelawfirm.com 516-455-1500

While a merger with a SPAC may cost more than an uplist, it’ll likely be quicker and decrease the chances of a company getting delisted for failing to meet certain exchange requirements.

LET’S START By REFLECTINg ON 2022 - yOU RUN A NEwSLETTER CALLED vALUE INvESTINg wORLD, IN COvERINg THE vALUE INvESTINg UNIvERSE, wHAT wE’RE SOmE kEy TRENDS AND STORyLINES THAT CAUgHT yOUR ATTENTION IN yOUR COvERAgE?

For me, one of the most interesting storylines of 2022 was the divergence of the value vs. growth factors. Most of us consider growth a component of value, so don’t blindly buy things at low multiples like the factor ETFs, but those factor ETFs saw just slight declines, or even gains, while the growth and broad markets saw more significant losses. And Berkshire Hathaway, run by the world’s most famous value investor, Warren Buffett, was also up on the year.

So from a broad market perspective—while 2022 seemed volatile and maybe a little stressful for some investors—if you had entered the year leaning heavily toward value, it seemed fairly normal and uneventful, at least from an investment return point of view.

AS THINgS STARTED TO TAkE A TURN FOR THE wORSE IN 2022, EvERy FINANCIAL NEwS PUNDIT STARTINg ESPOUSINg THE IDEA THAT wE NEED TO “RETURN TO FUNDAmENTALS” - wHy IS IT THAT THIS PHRASE SOmETImES gETS CONFUSED OR LINkED TO “vALUE INvESTINg”? IF SO, wOULD yOU SAy THAT’S A gOOD OR A BAD THINg?

I don’t think it’s a bad thing. Value investing is simply the process of acquiring more than you are paying

for. And to attempt to do that, you need to focus on valuation.

Now, valuation is imprecise and often tricky, but company fundamentals are the north star that guides the process. If people start paying more attention to things like profit margins and cash flows, we may get at least a little less speculation in the financial world, and maybe those of us that have stayed disciplined to the value process will get noticed a little more as well.

THE INvESTINg UNIvERSE IS HUgE, BUT IT SEEmS HARDER AND HARDER TO FIND vALUE; mORE AND mORE ROCkS NEED TO BE TURNED OvER, AND EvEN THEN, FOLkS SmARTER THAN I HAvE PROBABLy ALREADy FOUND THE ASymmETRIC OPPORTUNITy AND ARE POUNCINg. wHAT DO yOU THINk?

I think that’s true. The internet and information age have made it easy to find things and have made it easier for more people to learn about investing and how lucrative it can be to find a good company early in its life cycle, buy it, hold it, and let compounding do the work for you. And the professionalization of the investment industry has created new job categories and institutional investment dollars trying to find the next great investment or next great investment manager.

But there’s always value out there somewhere, and the difficulty of finding value can change in a hurry. The popularization of investing and ease of buying

stocks has also made it more likely that, when fear and panic enter the market, as they do from time to time, great companies will get sold too—and reach great valuations. You may have to act more quickly than in the past, so having a list of companies ready to buy ahead of time in case they reach your desired buy prices is important. As Charlie Munger has said, “Really good investment opportunities aren’t going to come along too often and won’t last too long, so you’ve got to be ready to act. Have a prepared mind.”

LOOkINg AHEAD TO 2023, wHAT ARE SOmE TRENDS yOU’RE LOOkINg AT mORE CLOSELy IN THE vALUE INvESTINg wORLD?

We’re seeing more of a shift to ‘real economy’ businesses. I think, in general, there was more of a focus on technology in the last decade, and now people are beginning to understand the importance of the infrastructure, raw materials, and supply chains that go into making the economy operate. And people are trying to uncover the big, competitiveadvantaged players in those areas, as well as the small niche players in those industries.

I also think people are putting more emphasis on current profits, and less emphasis on a future story that has yet to be proven. A good story can make any investment seem like a value investment when it’s told. Over the last several years, many investors have been willing to forego proof of current profits and pay up for future cash flows.

This is a perfectly valid strategy that got taken too far. The role of competition and difficulty of business in general were underestimated, and in many cases, the future cash flows either never materialized or have little hope of materializing.

And so I think that trend is changing—not completely, but there seems to be much more emphasis on profits and the validity of a company’s business model than there has been in recent years.

where you are, even if you can’t know precisely where you’re going. Knowing where you are in a cycle and what that implies for the future is very different from predicting the timing, extent and shape of the next cyclical move.”

I lead with that Marks wisdom because my prediction is based on my analysis of where we currently are in the business and economic cycle, but I have no idea how the shape of things will play out.

And so, the prediction is that what worked in 2022 is likely work throughout 2023 as well. Passive value investing will be a better place to be than the S&P 500, which is still significantly overvalued compared to its history, and the opportunity for active value investing is even greater. There are values to be found in all industries, and some of the big winners over the next few years are likely to be found in beaten-down, small-company technology stocks that got sold along with the route in overall technology stocks in 2022.

I think we’ll see plenty of volatility in the economy, inflation, and markets. And that volatility will create opportunities for active value investing. The 1970s saw similar volatility, and one of the biggest winners of the 1970s was Warren Buffett, as he made some of his best investments of all-time during that period. So, if you can keep your head when things get volatile, there will be some great opportunities to invest in things where you can buy right and sit tight for a long period of time.

For more information about Sorfis Investments, please visit: www.sorfis.com, and you can subscribe the Value Investing World Newsletter on Substack here: www.valueinvestingworld.substack.com

LASTLy,

One of my favorite Howard Marks memos was one he wrote in 2001 titled “You Can’t Predict. You Can Prepare.” In that memo, Marks wrote: “In my opinion, the key to dealing with the future lies in knowing

Joe Koster bio: Joe started his career as a financial analyst and has been a Portfolio Manager or Co-Portfolio Manager since January 2007. He founded Sorfis Investments, LLC, which began its life as a Registered Investment Adviser in January 2019, and serves as the firm’s Managing Member and Portfolio Manager for individual client accounts. Joe earned a Bachelor of Science Degree in Business Administration with a concentration in Finance from Coastal Carolina University, where he is currently a member of the Wall Fellows Program Board of Directors as well as a member of the Finance and Economics Advisory Board at the Wall College of Business Administration.

Navigating the microcap space has been a career endeavor for me. As I look back and reflect on how the heck did I get here, I noticed that there were a couple of driving forces behind why I found my home as a microcap executive and ultimately board member. I am sharing my insights to help others to consider, why not microcap? As you contemplate what your career trajectory looks like, I hope my insights can help you find your path.

First, I don’t think anyone starts their career thinking – Microcap – that is where I want to be. I think it is the love of the entrepreneur and work with companies to be successful. Microcap is its own unique animal. You find everyone from the idea person to the perpetual executive trying to “make it”. One thing continues to shine bright, everyone has an idea/company that they are looking to grow and need capital to get there. They may have tried other avenues, but were not successful, or were really looking to get into the public markets for the liquidity.

I started my career in public accounting and ended up at a Fortune 100 company, which is where I really learned about public company and public markets. In addition, we were acquisition happy and acquired 50-100 companies a year. What a fun time that was, seeing a vision come together and putting all of the pieces into organized chaos. This is where I really learned about entrepreneurs, how they thought about their “baby” and the pride they had in their business. In addition, I realized how hard it was for them to “give up” their business and now be an employee to another company. This was not an easy transition and some were not very successful in the transition.

Working with these entrepreneurs, I realized that they were nimbler in their thinking and were able to make the changes and pivots in their businesses without the committee approval. In addition, their ability to efficiently allocate capital, both human and

monetary was amazing. I also realized that there was a significant lack of truly understanding how a CFO can be a partner to these entrepreneurs. The majority of the CEO’s didn’t view the CFO as necessary. This was due in part to their ability to understand and manage the cash of the business very efficiently. They just did not see how a CFO brought value. In addition, a lot of the CFO’s in this market segment were really controllers and perpetuated the idea that they were not a true partner. I quickly realized that I could help these entrepreneurs bring the financial acumen to their business. Shareholders and investors were clamoring for the CFO that could talk to the street, understand the business and help drive the business forward.

I knew that I could be that person and thus began my search for a company I could help achieve their goals and bring the financial discipline lacking in a lot of the microcap companies. In addition, knowing there was a growth opportunity was key to working with a company.

I landed in an alternative energy company and started my journey into the microcap space. There were very few women in the market. I took this as a challenge to see how I could bring awareness that yes, we did make great executives. I dove into the company, learned everything there was to learn, put together the much-needed financial controls and started the process of uplisting to a national exchange.