www.SNN.Network Follow us: @StockNewsNow

SNN Inc.

4055 Redwood Ave. Suite 133 Los Angeles, CA 90066 www.SNN.network

PUBLISHER

Robert K. Kraft, MBA SNN Chief Executive Officer, Executive Editor & Director rkraft@snnwire.com

www.SNN.Network Follow us: @StockNewsNow

SNN Inc.

4055 Redwood Ave. Suite 133 Los Angeles, CA 90066 www.SNN.network

PUBLISHER

Robert K. Kraft, MBA SNN Chief Executive Officer, Executive Editor & Director rkraft@snnwire.com

www.SNN.Network

Follow

SNN inc. 4055 Redwood Ave. Suite 133 Los Angeles, CA 90066 www.SNN.network

pUBLiSHEr Robert K. Kraft, MBA

SNN Chief Executive Officer, Executive Editor & Director rkraft@snnwire.com

Shelly Kraft SNN Founder, Publisher Emeritus skraft@snnwire.com

Shelly Kraft SNN Founder, Publisher Emeritus skraft@snnwire.com

Lynda Lou “Lulu” Kraft SNN President & Director lkkraft@snnwire.com

ASIAN PACIFIC CORRESPONDENT

Leslie Richardson

You know the phrase, “sell in May, and go away” - it’s a popular phrase in the investing world. In MicroCaps, this has been especially true, but it’s been more like “sell in November 2021, and never come back” - at least it’s felt as much. Despite every pundit being wrong (so far) regarding the U.S. going into a recession and almost every economic indicator signaling the strength of the U.S. economy, the negative sentiment in MicroCap (and even Small Cap) has now extended from 12 months to 18 months to 20-22 months with no real end in sight.

In all my conversations with quality buy-side, family offices and high-net worth retail, two key points we all agree on:

1. We have no idea when sentiment will turn, and

As we get bombarded with market information and intel in the news, social media, newsletters, TV ads, YouTube etc. we have to keep our own perspective in mind, which is, how does what’s happening in the stock market affect microcap stocks? How do we manage the holdings in our portfolio? How do we make our decisions of whether we should buy, sell or hold? As investors we do need to decipher pertinent details from the noise of those trying to sell us their ideas. Picking up morsels of truth is still relevant to our decision making which brings me to the point of staying in our lane, picking sources we trust with a history of accuracy, doing this will do more to protect our self-made directives while resisting a constant repetitive barrage of attempted paid influences.

Lynda Lou “Lulu” Kraft SNN President & Director lkkraft@snnwire.com

SNN COmPLIANCE AND DUE DILIgENCE ADmINISTRATION

Jack Leslie

2. We went from having a dearth of quality ideas in November 2021, to an environment where there’s almost too many!

aSiaN paciFic corrESpoNDENT Leslie Richardson

SNN coMpLiaNcE aND

CHAIRmAN OF SNN ADvISORy BOARD

DUE DiLigENcE aDMiNiSTraTioN

Dr. Leonard Makowka

Jack Leslie

ADvERTISINg and SALES info@snnwire.com

cHairMaN oF SNN aDviSory BoarD Dr. Leonard Makowka

gRAPHIC PRODUCTION

aDvErTiSiNg and SaLES info@snnwire.com

Unitron Media Corp info@unitronmedia.com

SNN CONFERENCES info@snnwire.com

grapHic proDUcTioN Unitron Media Corp info@unitronmedia.com

SNN coNFErENcES info@snnwire.com

Pundits in the microcap world often preach doing your homework, believe in your own methods, stick to your plan, learn from your mistakes, and build your sensibility to maintain focus. I believe for the most part they are correct. However, it’s quite difficult to locate non-biased information during our searching for it and even harder to interpret incoming information when it finds you.

Inc.

This publication and its contents are not to be construed, under any circumstances, as an offer to sell or a solicitation to buy or effect transactions in any securities. No investment advice is provided or should be construed to be provided herein. Planet Microcap Review Magazine and its owners, employees and affiliates are not, nor do any of them claim to be, registered broker-dealers or registered investment advisors. This publication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements of or concerning the companies mentioned herein are subject to numerous uncertainties and risk factors, including uncertainties and risk factors that may not be set forth herein, which could cause actual results to differ materially from those stated herein. Accordingly, readers are cautioned not to place undue reliance on such forward-looking statements. This publication undertakes no obligation to update any forward-looking statements that may be contained herein. Planet Microcap Review Magazine, its owners, employees, affiliates and their families may have investments in companies featured in this publication, may purchase securities of companies featured in this publication and may sell securities of companies featured in this publication, at any time and from time to time. However, it is the general policy of this publication that such persons will refrain from engaging in any pre-publication transactions in securities of companies featured in this publication until two trading days following the publication date. This publication may contain company advertisements/advertorials indicated as such. Information about a company contained in an advertisement/advertorial has been furnished by the company, the publisher has not made any independent investigation of the accuracy of any such information and no warranty of the accuracy of any such information is provided by this publication, its owners, employees and affiliates. Pursuant to Section 17(b) of the Securities Act of 1933, as amended, in situations where the publisher has received consideration for the advertisement/advertorial of a company or security, the amount and nature of such consideration will be disclosed in print. Readers should always conduct their own due diligence before making any investment decision regarding the companies and securities mentioned in this publication. Investment in securities generally, and many of the companies and securities mentioned in this publication from time to time, are speculative and carry a high degree of risk. The disclaimers set forth at Planetmicropcap.com or SNN.Network - disclaimer are incorporated herein by this reference.

©Copyright 2022 by MicroCap Review Magazine Inc. All Rights Reserved. Reproduction without permission of the Publisher is prohibited. The publishers and editors are not responsible for unsolicited materials. Every effort has been made to assure that all Information presented in this issue is accurate and neither MicroCap Review Magazine or any of its staff or authors is responsible for omissions or information that is inaccurate or misrepresented to the magazine. MicroCap Review Magazine is owned and operated by SNN Inc.

This publication and its contents are not to be construed, under any circumstances, as an offer to sell or a solicitation to buy or effect transactions in any securities. No investment advice is provided or should be construed to be provided herein. MicroCap Review Magazine and its owners, employees and affiliates are not, nor do any of them claim to be, registered broker-dealers or registered investment advisors. This publication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements of or concerning the companies mentioned herein are subject to numerous uncertainties and risk factors, including uncertainties and risk factors that may not be set forth herein, which could cause actual results to differ materially from those stated herein. Accordingly, readers are cautioned not to place undue reliance on such forward-looking statements. This publication undertakes no obligation to update any forward-looking statements that may be contained herein. MicroCap Review Magazine, its owners, employees, affiliates and their families may have investments in companies featured in this publication, may purchase securities of companies featured in this publication and may sell securities of companies featured in this publication, at any time and from time to time. However, it is the general policy of this publication that such persons will refrain from engaging in any pre-publication transactions in securities of companies featured in this publication until two trading days following the publication date. This publication may contain company advertisements/advertorials indicated as such. Information about a company contained in an advertisement/advertorial has been furnished by the company, the publisher has not made any independent investigation of the accuracy of any such information and no warranty of the accuracy of any such information is provided by this publication, its owners, employees and affiliates. Pursuant to Section 17(b) of the Securities Act of 1933, as amended, in situations where the publisher has received consideration for the advertisement/advertorial of a company or security, the amount and nature of such consideration will be disclosed in print. Readers should always conduct their own due diligence before making any investment decision regarding the companies and securities mentioned in this publication. Investment in securities generally, and many of the companies and securities mentioned in this publication from time to time, are speculative and carry

I want to focus on the second point because your guess is as good as mine regarding when sentiment will return. Anecdotally, I’ve interviewed or had conversations with hundreds of management teams over the last 5-6 months (since our last issue), and I would argue that 80-90% have reported one or more of the following: growth in earnings, newly profitable, highly accretive acquisition, multi-year contract with a Fortune 500 company, almost completing a new manufacturing facility, fully financed for growth initiatives - all catalysts for what one would assume would result in share price appreciation. That’s what one would think, and that’s what every CEO would hope and confused/frustrated as to why it hasn’t.

Although I am a market traditionalist and since I historically lean on using my own common sense, this method may be costly since it also embeds learning from one’s own mistakes. For example, for generations investors relied on their stockbroker or wealth advisor to “trust” their advice, timing, ideas, guidance and performance. For better or for worse this marriage could have been a very successful marriage, oh by the way, the Internet, social media, relentless advertising, and regulatory intervention changed everything. The advent of dis count brokering, and millennial DIY activity gave investors the power of making decisions but added the need for discipline, research, and trial & error. As far as I’m concerned and in my opinion, I would rather fail or succeed because of my own decisions rather than being led to slaughter and placing blame elsewhere.

WaiTiNg oN EDiToriaLAnd thus, for this reason, investors and funds with a MicroCap strategy or rather, any MicroCap investor with dry powder feel like they are kids in a candy store. Companies that were liked are now loved with haircuts in stock prices across the board. I’ve been trying to interview as many of these

Like everything in the Stock Market, MicroCaps are down. As of EOD on June 17, 2022, the MicroCap Review (MCRI), our proprietary MicroCap index tracking MicroCap performance, is down 26.73% YTD; the only index we track that is doing worse is NASDAQ, which is down 31.36% YTD. I don’t want to spend time in this editorial discussing why; I highly recommend tuning into Planet MicroCap Podcast to hear what my guests have to say about the matter. The real question is, well, now what? The summer is an opportune time to start reflecting on what your financial goals are for the near and long term using some of the data enclosed in this issue of the magazine, as well as macro data/indicators. Few things we are certain of right now: liquidity has dried up, interest rates have gone up (and probably will continue to) in order to rein in inflation, high flying growth names have taken it on the chin. There’s actually a bunch of things that we’re now certain of, but at the end of the day, despite rising inflation, this may sound otherworldly these days, but CASH IS STILL CASH. Having cash to deploy in times like these is where the greats have made names for themselves. At least for me, especially if we are going to continue to see declines, not just MicroCaps, but overall markets, is when I’m reflecting on how I want to deploy cash that will set me up for financial independence in the next 10-15-20 years. We don’t have all the answers, however, by reading this issue of the magazine, I hope that you’re able to walk away with a few nuggets that can help you on your path to financial independence.

companies as possible for my podcast and feature in the magazine because it confounds me. If you’re reading the Planet MicroCap Review, surely you are aware of the sentiment in this asset class - it’s no surprise. I’m only here to validate that if you even opened the magazine this far, you’re walking the path of every legendary contrarian. Hopefully, you’ll find some actionable information in here and I wish you all the best traveling down the rabbit hole(s) of your choosing.

Thank you for joining us on this journey, and please enjoy the Planet MicroCap Review Summer 2023 Issue (ideally reading this on a beach somewhere with a nice cold one). Cheers!

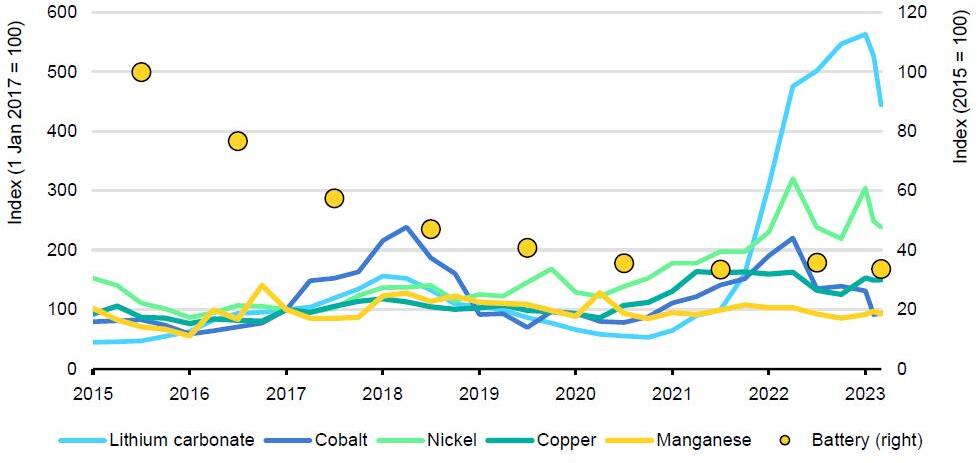

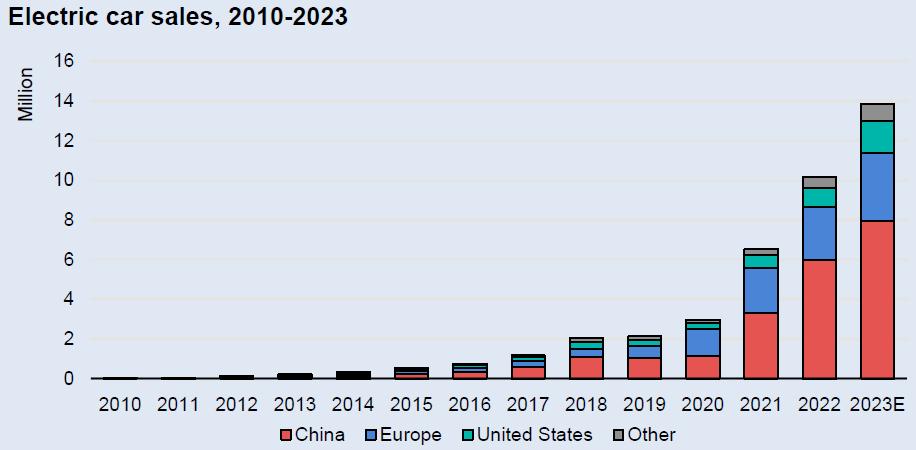

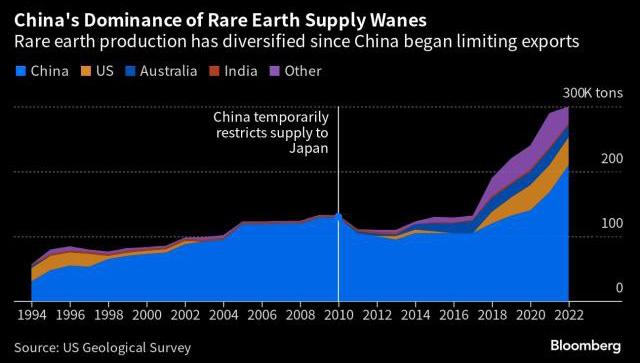

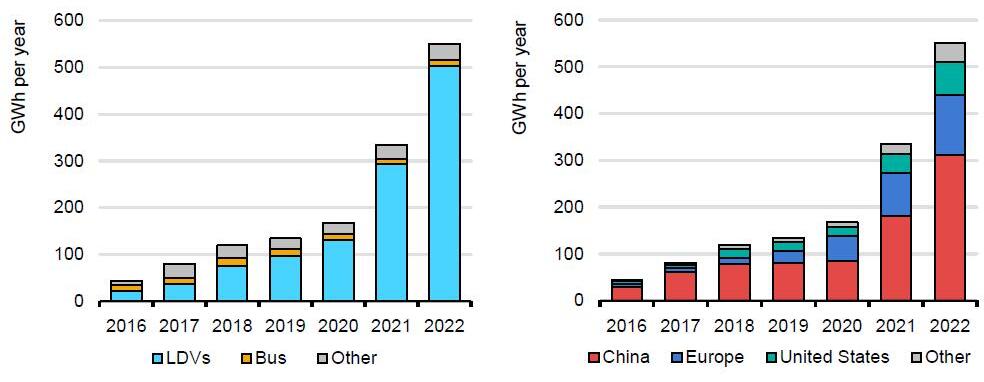

—Robert Kraft, Host & CEO Planet MicroCapanalysis of the sector and answered my questioned with a resounding yes, that battery metal stocks have transitioned from a fad to fashion.

• Where can investors find Hidden Gems in the numerous listings and noise/news in the market. Yale Bock’s article “Finding hidden gems” answered many of the questions with thought provoking insights.

• Regardless of market conditions, what do professionals do to successfully navigate through headwinds, rough waters and promotions picking stocks? Find it in: …..Other notable articles and Q&A’s cover topics such as updates on SPACs by Doug Ellenoff, and the latest on ESG and sustainability today is covered by Socialsuite’s Seth Forman.

As storytellers ourselves, we comb through the micro & smallcap spectrum of information, social media, press releases and even our own podcasts, magazine inserts, Index and financial conferences in our attempt to provide the most poignant articles, thought leaders opinions, and suggestive reasoning for you our readers.

When choosing content for this issue we asked ourselves a variety of questions such as:

get bombarded with market information intel in the news, social media, newsletters, ads, YouTube etc. we have to keep our perspective in mind, which is, how does what’s the stock market affect microcap stocks? How do we manage the our portfolio? How do we make our decisions of whether we should hold? As investors we do need to decipher pertinent details from those trying to sell us their ideas. Picking up morsels of truth is still our decision making which brings me to the point of staying in our sources we trust with a history of accuracy, doing this will do more self-made directives while resisting a constant repetitive barrage paid influences.

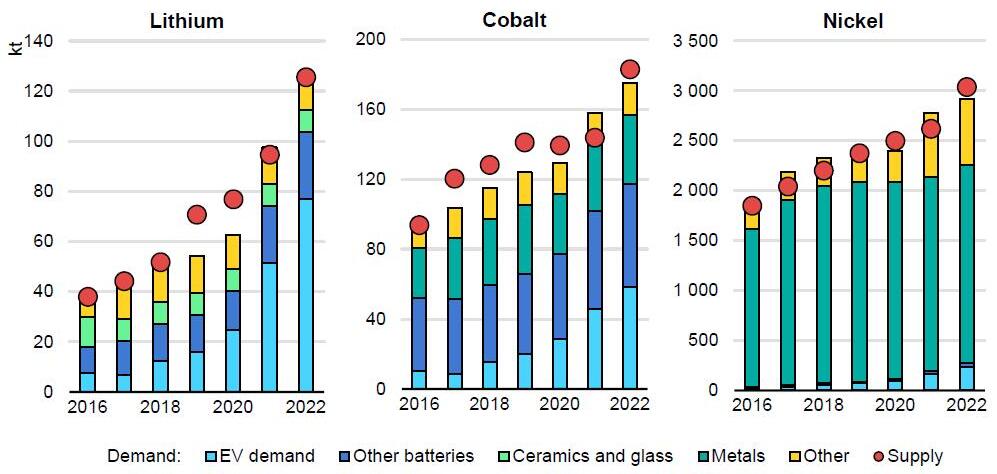

• Are battery metal stocks fad or fashion? Thankfully Gavin Wendt went the extra mile with his

microcap world often preach doing your homework, believe in methods, stick to your plan, learn from your mistakes, and build your maintain focus. I believe for the most part they are correct. Howdifficult to locate non-biased information during our searching for harder to interpret incoming information when it finds you.

• Several features answer pertinent questions on topics we all are pondering such as: Is AI a threat or a financial bonanza?

There’s insight in every article and we’d like to thank all our contributors and advertisers for their support and sharing their views. We look forward to seeing you in person at either of our upcoming events, Planet MicroCap Showcase: VANCOUVER on September 6-7, 2023 or the Planet MicroCap Showcase: VEGAS on April 30 - May 2, 2024.

a market traditionalist and since I historically lean on using my sense, this method may be costly since it also embeds learning own mistakes. For example, for generations investors relied on their or wealth advisor to “trust” their advice, timing, ideas, guidance performance. For better or for worse this marriage could have been a successful marriage, oh by the way, the Internet, social media, relentless and regulatory intervention changed everything. The advent of disbrokering, and millennial DIY activity gave investors the power of making added the need for discipline, research, and trial & error. As far as concerned and in my opinion, I would rather fail or succeed because of my decisions rather than being led to slaughter and placing blame elsewhere.

everything in the Stock Market, MicroCaps are down. As of EOD on June MicroCap Review (MCRI), our proprietary MicroCap index tracking

24 Why

Q&A with Chris Wood, Chief Investment Officer at RiskHedge

30 Survival is Most Important in MicroCaps

Q&A with Ian Cassel, Founder of MicroCapClub

90 Asia Corner: Hong Kong Hopeful to Breakout of IPO Slump

byLeslie Richardson, Elite IR

94 Making The IP Capital Model The Model Of The Future by Robert Cote, Esq., Cote Capital

96 Finding Hidden Gems in MicroCap Stocks by Yale Bock, CFA, Y H & C Investments

100 Awesome Aussies-Rarified Air by Richard Revelins, Peregrine Corporate Limited

102 ESG Investing 101 with ESGFIRE

by Filip Erhardt

106 Adding Public Relations to the IR Mix

by Roger Pondel, PondelWilkinson

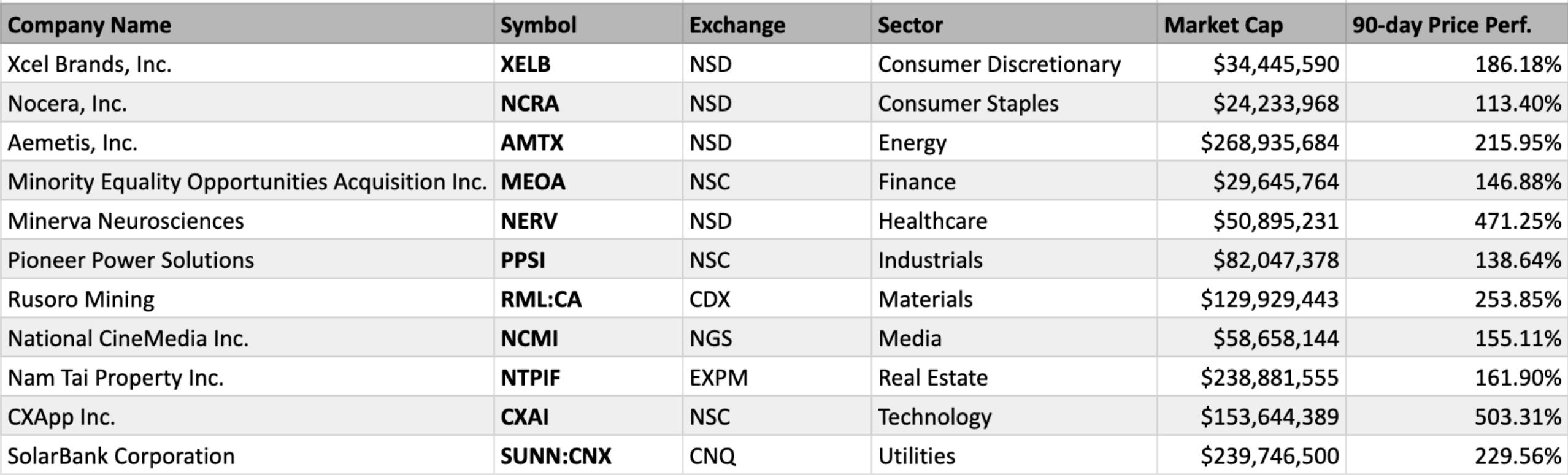

48 Overview of the Planet MicroCap Index

P ROFILED C O m PANIES

22 Immuron Limited (NASDAQ: IMRN) / (ASX: IMC)

40 VirTra, Inc. (NASDAQ: VTSI)

68 Xcel Brands, Inc. (NASDAQ: XELB)

86 Pioneer Power Solutions, Inc. (NASDAQ: PPSI)

50-59 Planet MicroCap Index Q3 2023 Constituent List

seeing emerging trends and trends that were in place accelerating in all things related to AI.

The investment landscape was heavily influenced by macro events in what was a volatile first half of 2023. January started off on a strong note; a bit of a relief rally from a challenging 2022 across many sectors. However, the strength was concentrated in stocks that had underperformed meaningfully in the prior year and those with the highest BETAs. January’s market dynamics had all the hallmarks of a classic momentum crash. In fact, by our calculation, January was the 10th worst month going back to the late 1920’s for the momentum factor in US equities and the 17th worst in Non-US equities since the early 1990’s.

Despite the volatility, we have still been able to find meaningful trends. One of the more surprising sources of momentum in the US has been homebuilders and building supply companies - not an area that you would necessarily expect to be strong given higher interest rates and the banking crisis in March. Nevertheless, we are seeing better than expected performance and some green shoots of recovery in those industries. We have also seen momentum in biotech within US micro cap, especially those related to breakthroughs in oncology and liver disease. Of course, more recently we are

No matter what might be happening in the world economically, we have found over the years that there are always companies doing well somewhere. Our systematic application of momentum investing allows us to find them, unbiased to the source of strength.

2. CAN yOU HIgHLIgHT POTENTIAL OPPORTUNITIES, RISkS, AND kEy FACTORS TO CONSIDER wHEN INvESTINg IN mICROCAP STOCkS IN 2023 THUS FAR?

Micro cap is always full of opportunity….and risk. Overall, we think it might be a good time to invest in micro cap overall given its recent historic underperformance relative to larger market caps and tough sledding overall. We believe there could be a good snap-back rally in both absolute and relative terms in an equity market recovery scenario. From a stock specific perspective, we believe there will be massive opportunities for micro cap companies globally to pivot towards the strength in AI. We look at the opportunities from AI in three buckets:

1) enablers – those companies that can provide the building blocks that enable these giant AI workloads from a technology infrastructure perspective and supply innovation to larger companies,

2) integrators – those companies that can integrate the power of AI into their products/services to gain market share

going forward, and 3) harnessers – those companies that can implement the power of AI to unlock massive productivity gains and earnings power in their own businesses. We believe micro cap companies globally can play in all three of these areas as it relates to AI.

Lastly, we believe there is opportunity in micro cap globally as supply chains move closer to home. Micro cap companies tend to be more levered to their local economies, so they should disproportionately benefit from manufacturing and consumption originating with a more domestic orientation.

3. HOw HAS mACRO NEwS INFLUENCED yOUR CURRENT PORTFOLIO CONSTRUCTION AND wHEN ASSESSINg NEw IDEAS?

From a portfolio construction standpoint, we haven’t changed anything given the macro backdrop. Given micro cap’s general volatility, we have always believed that you need a disciplined approach to risk management and a sufficiently diversified portfolio no matter the market conditions. When assessing new ideas in a volatile, macro-driven market, it is even more important to focus on true alpha signals through the noise. Systematically, our investment process captures those companies with positive

momentum in their business and their stock prices. From there, we focus our research on those that have clear rationale for that momentum. We only invest in those companies with clear reasons as to why that momentum may persist long enough to earn value-added returns. We have found that in overly macro-influenced markets, you tend to have a higher proportion of false positives, which is why the combination of momentum and rationale is extremely important.

4. FOR THE REST OF 2023, wHAT ARE SOmE kEy CRITERIA, mACRO EvENTS, mICROCAP EvENTS, ETC... THAT yOU ARE wATCHINg AND wHAT ACTIONS wILL yOU TAkE IF THOSE POTENTIAL OCCURRENCES HAPPEN?

Our investment approach will stay the same no matter what may happen. We perpetually move our portfolios to strength and away from weakness, to new trends and away from old trends that are breaking down. However, for micro cap in general, we believe the macro economic cycle/path of interest rates will be most important to watch. Historically speaking, micro cap stocks are most sensitive to changes in investor sentiment and economic cycles. Micro cap tends to lead into the downdrafts and lead out in the recoveries. Given the amount of money on the sidelines and the relative lack of liquidity in micro cap versus larger market caps, we think the eventual rally in micro cap may be explosive in a recovery scenario. As we like to say, come to micro cap for the BETA in recoveries, but stay long term for the alpha opportunities.

For more information about Travis Prentice and EAM Investors, please visit: www.eaminvestors.com

Given micro cap’s general volatility, we have always believed that you need a disciplined approach to risk management and a sufficiently diversified portfolio no matter the market conditions.

1. CAN yOU PROvIDE A qUICk OvERvIEw OF ACUITAS’ mULTImANAgER STRATEgy?

Acuitas is a boutique multi-manager investment firm based in Seattle, WA. The firm is focused on small and microcap markets. We believe this exclusive focus on the inefficient corners of the market offers the greatest opportunity for absolute and excess returns. Aggressive idea generation and deep manager research are hallmarks of our investment process and we aim to find and evaluate investment managers before they hit the institutional radar. We then draw from this pool of high confidence investment managers to build portfolios where we seek to maximize excess returns. In the end we try to utilize our highest conviction managers and pair them in complementary ways to build custom portfolios for our clients.

2. wHAT mAkES A gREAT mICROCAP INvESTOR?

I think that great microcap investors employ a disciplined process and combine that with an exceptional focus on investing within a high-performance team. We are looking for investment managers that can win through stock selection and we don’t believe it is as simple as “knowing the names”. Acuitas formally evaluates dozens of aspects of an investment manager’s process from portfolio construction to sell discipline and in the end, it is important the investment manager can articulate the keys to the success of the investment process. If there is one characteristic that is common from the investment managers that we employ it is a passion for investing that manifests within a disciplined process. This

passion or competitive fire is really key to generating powerful returns over time. That said, it isn’t enough on its own. It has to exist within the proper framework. Idea generation is important to us so we are always looking to find great microcap investors and we look to form a view on them over time based on many conversations and a deep review of analytics.

3. wE’RE ABOUT HALF-wAy THROUgH 2023, I’vE HAD mULTIPLE CONvERSATIONS wITH BUy-SIDE mANAgERS THAT HAvE BEEN FACINg REDEmPTION ISSUES FROm THEIR INvESTORS. IN yOUR OPINION, wHy IS THIS A REAL CONCERN FOR BUy-SIDE mANAgERS? ESPECIALLy, wHEN CONSIDERINg I CHAT wITH OTHER INvESTORS wHO HAvE A TON OF DRy POwDER AND TOO mANy qUALITy mICROCAP IDEAS TO LOOk AT.

Active investment managers who focus on small and microcap stocks have come through a very challenging period. Prior to the pandemic, from 2009 to 2020, steadily rising markets made it easy for plan sponsors and individual investors to favor passive products. Just gaining market exposure seemed like enough for many. The characteristics of leadership also didn’t help. Large and growthy stocks led the market. While the smallest stocks showed a return advantage over the very long-term, it was easy for investors to ride the wave of mega cap dominance. The pandemic brought a wave of volatility to the market which brought some investors back to appreciating active management. This volatility can mean opportunity for stock pickers and we have seen a better overall active environment recently. Rising

interest rates put a degree of pause on the growthiest non-earners and brought back an environment where valuation and quality mattered. This has been good for long-only active managers. Finally, equity microcap investors have had to face headwinds from the rush toward private investments. We believe at some point there are challenges for the private equity/venture capital space due to higher rates, increased competition and tempered returns from these strategies. In the end, many investors chase returns and rush toward what has worked. That said there are always informed allocators that appreciate the valuation opportunity present within the small and microcap space. While stock opportunities may be abundant for fund managers, it may take a shift toward small cap leadership for plan sponsors to appreciate broader opportunity in microcap and allocate directly to the space.

The combination of large cap leadership and the perceived success of private investments has clearly affected the ability of small investment managers to raise capital. There always seems to be a headline highlighting the latest offshoot from a giant hedge

fund, but raising capital is hard work. Of course raising assets is also only one part of building an outstanding investment organization, but it is a necessary one. Larger allocators often have hurdles before allocating to small managers such as a five-year track record or wanting a critical mass of assets. They may want long tenure from a product or firm as well before they allocate. Of course it results in a chicken and an egg problem for the investment managers. That said, there are allocators like Acuitas. We pride ourselves on being early adopters and are willing to evaluate strategies at the

“If there is one characteristic that is common from the investment managers that we employ it is a passion for investing that manifests within a disciplined process.”

beginning of their life-cycle. In fact, we believe that there is a tangible positive impact to investing early with managers that have a smaller asset base and are best able to implement their strategy.

It is no secret that investors buy brand so I would encourage any buy-side manager to carefully build their brand by working hard to generate strong returns, networking and learning to communicate effectively about the strategy they employ. Historically we have seen some of the most lucrative environments for active management come after extremely challenging periods and it takes diligent and sustained outreach to find allocators willing to take advantage of valuation opportunities and market dislocations like we are seeing today.

funds for microcap managers. Our firm is unique in that we seek out early-stage, low asset base products that we feel have the potential to generate excess returns for our clients. Our process is lengthy, and it is a high bar to reach funded status, but we are proud of our investment results and we continue to believe that deep fundamental research on this inefficient corner of the market has the potential to benefit clients. Our multi-manager offering creates an efficiency for large plan sponsors and a source of capital for smaller investment managers. We believe that there is currently a unique opportunity for the asset class as microcap remains cheap relative to other cap tiers, most notably large cap. These types of dislocations often provide lucrative opportunities for strong active microcap managers and we are always looking to identify the next generation of great investors.

Acuitas can help by acting as a potential source of

For more information about Acuitas Investments, please visit: www.acuitasinvestments.com

FOuR

“Most retail investors believe ESG investments will perform as well as or better than the market as a whole” (Mottola, et al.). Whether it’s physical impacts, decarbonization incentives, or systemic risk to portfolio returns, investors are not taking the topic of climate change lightly; business will correlate to climate concerns.

For starters, their main goal is to provide returns to their clients, and climate change can impact their ability to do so. Professor David Larcker, of Stanford’s Graduate School of Business, told The Wall Street Journal that “fund managers need to acknowledge that there is likely to be some trade-off between ESG and financial returns, and that tradeoff may matter to individual investors” (Ward).

Although there is risk involved with climate change, there is also a lot of opportunity for investors. It is never too early for early action. Investors must manage risk while also exploring opportunities.

Perhaps the most important from a capital standpoint is that the younger generation of retail investors have an increased focus on climate change and ESG issues. An IR Magazine survey from February 2023 found that “45% of retail investors find ESG important” (Distefano). Evidence shows that businesses can attract and retain the best talent if they are making an effort to be sustainable and are trans-

parent about starting their ESG journey. Additionally, the younger generation is more likely to invest in a company that cares about the environment.

“For most retail investors, ESG investing is a natural fit. A recent survey from the Finra Foundation found that 57% of retail investors desire to align their finances with their values and view investing as an opportunity to make a positive change in the world” (Barbosa Vargas).

The Wall Street Journal survey, “How Investors Feel About ESG Initiatives,” details each age group’s willingness to invest in environmental, social, and governance issues. Evidence finds that young investors (18-41) feel positively about ESG, whereas investors 58+ years old were the least likely to support ESG objectives (Ward).

As climate change becomes an increasingly critical global crisis, the trend of young retail investors holding ESG investments will continue to grow.

It can be extremely difficult and overwhelming to start focusing on climate change within a business. Companies are encouraged to have high ambitions in this area. Tim Siegenbeek van Heukelom, Chief Impact Officer at Socialsuite, and Duncan Paterson, Director of Investor Practice at Investor Group on Climate Change, outline four steps as a good place to start focusing on in their July 2023 webinar “Why Investors Care About Climate Change.”

Step One: Develop a statement, policy, or position on climate change for the company. This can be as simple as having a page on the website. It’s important to acknowledge the climate risks the companies’ management will have to deal with, so make a statement that they can build off of.

Step Two: Introduce practices for managing climate risk. You can’t manage what you can’t measure. Try

to find quantitative data that reports can be generated from. Once a baseline has been established, implement changes and evaluate efficiencies. For example, a company could measure their electricity bills month over month to see where to cut usage and ultimately cut costs.

Step Three: Transparency and reporting. The company must identify who the key stakeholders are that they want to report out to. This could be investors, employees, shareholders, the board, or society at large.

Step Four: Generating outcomes. Share outcomes with key stakeholders. For the most part, this feels largely investor driven.

It is understood that climate-related regulation and/ or ESG regulation is on the horizon. Hopefully, there will be a global, unified framework but for now, we must be on the forefront of standardized data. A company who is transparent about starting their ESG journey may be more likely to attract investors, whether that’s institutional investors or Millennials and Gen Z retail investors.

Every company’s ESG journey is going to look different. Each company may disclose different information or gear it toward different stakeholders, but as time progresses we expect there will be standardized regulations.

Creating the company’s first ESG report can be daunting. Where is the data coming from? What framework should we follow? How much is this going to cost? How long will it take? Utilizing a platform like Socialsuite can help with all of the unknowns that comes with ESG reporting.

Socialsuite is an ESG reporting platform geared toward companies who are just beginning their ESG journey. A designated ESG Coach guides you through the process and ultimately creates the company’s initial baseline report.

ESG Disclosures are a great way to communicate to your key stakeholders– the Board of Directors, investors, employees, society at large– that your organization is dedicated to creating a positive impact.

Barbosa Vergas, Erica. “If You Care about Your Investment Bottom Line, You Care about ESG.” Nasdaq, 18 Apr. 2023, www.nasdaq.com/articles/ if-you-care-about-your-investment-bottom-line-youcare-about-esg.

Distefano, Noemi. “How Much Do Retail Investors Care about ESG Ratings?” IR Magazine, 10 Feb. 2023, www.irmagazine.com/case-studies/how-muchdo-retail-investors-care-about-esg-ratings.

Mottola, Gary, et al. Investors Say They Can Change the World, If They Only Knew How: Six Things to Know about ESG and Retail Investors, https://www. finrafoundation.org/sites/finrafoundation/files/ Consumer-Insights-Money-and-Investing.pdf.

Rosenfield, Josh, and Bruce Usher. “Author Talks: An Investor’s Guide to the Net-Zero Transition.” McKinsey & Company, 23 Nov. 2022, www.mckinsey.com/ featured-insights/mckinsey-on-books/author-talksan-investors-guide-to-the-net-zero-transition.

Ward, Lisa. “How Investors Feel about ESG Initiatives.” The Wall Street Journal, 2 Nov. 2022, www. wsj.com/articles/esg-initiatives-investors-survey11666975292?reflink=integratedwebview_share.

Socialsuite is an ESG reporting platform geared toward companies who are just beginning their ESG journey. A designated ESG Coach guides you through the process and ultimately creates the company’s initial baseline report.

Lucosky Brookman is the industry leader in micro-cap IPOs and in uplisting domestic or foreign quoted OTC companies and foreign exchange listed companies to the Nasdaq or NYSE.

Each month, Lucosky Brookman publishes The Uplisting Report and The Micro-Cap IPO Report - the most comprehensive resources dedicated to the Uplist, cross-list and micro-cap IPO marketplaces. The reports bring powerful and in-depth market data and analytics to help issuers, management teams, boards of directors, consultants and others involved in the IPO, uplisting and cross-listing processes make better decisions

Placing a particular emphasis on issuers operating in the micro-cap space (issuers with up to $300 million market cap), the following is a synopsis of our Uplisting and Micro-IPO Reports for the First Half of 2023 (H1) To view current monthly and archived Reports, please visit: https://www.lucbro.com/our-firm/uplisting-monthly, and https://www.lucbro.com/our-firm/micro-cap-ipo

Please contact us at uplist@lucbro.com if you would like to discuss your company ' s IPO, uplisting or cross-listing prospects, if you would like to better understand the IPO, uplisting and cross-listing marketplace, or if you would like to receive a comprehensive 7-8 page listing Analysis of your company

Lucosky Brookman LLP

www.lucbro.com

L i k e t h e l a r g e r c a p i t a l m a r k e t s , t h e m i c r o - c a p m a r k e t p l a c e c o n t i n u e d t o b e s e l e c t i v e i n t h e f i r s t h a l f o f 2 0 2 3 ( H 1 ) M i c r o - c a p u p l i s t e d a n d c r o s s - l i s t e d c o m p a n i e s r a i s e d a p p r o x i m a t e l y $ 5 6 . 7 m i l l i o n i n H 1 , w h i l e c o m p a n i e s c o m p l e t i n g m i c r o - c a p I P O s r a i s e d a p p r o x i m a t e l y $ 4 4 1 m i l l i o n

M I C R O - C A P I P O s

A t o t a l o f 3 9 m i c r o - c a p i s s u e r s , o p e r a t i n g i n 1 5 d i f f e r e n t s e c t o r s c o m p l e t e d t h e i r I P O s i n H 1 , w i t h o f f e r i n g s r a n g i n g f r o m a p p r o x i m a t e l y $ 4 , 0 0 0 , 0 0 0 t o $ 4 3 , 0 0 0 , 0 0 0 . T w e n t yt h r e e ( 2 3 ) m i c r o - c a p f o r e i g n p r i v a t e i s s u e r s ( F P I s ) f r o m 8 d i f f e r e n t j u r i s d i c t i o n s c o m p l e t e d t h e i r I P O s i n t h e U S d u r i n g H 1

U P L I S T I N G / C R O S S - L I S T I N G

A t o t a l o f 9 m i c r o - c a p c o m p a n i e s w h i c h o p e r a t e i n 5 d i f f e r e n t s e c t o r s m a d e u p t h e 2 0 2 3 H 1 c l a s s o f u p l i s t e d a n d c r o s s - l i s t e d c o m p a n i e s F i v e o f t h e n e w l y e x c h a n g e t r a d e d c o m p a n i e s w e r e l i s t e d o r g a n i c a l l y , m e a n i n g t h e y d i d n o t r e q u i r e a s i m u l t a n e o u s u n d e r w r i t t e n p u b l i c o f f e r i n g i n o r d e r t o c o n s u m m a t e t h e u p l i s t i n g o r c r o s s - l i s t i n g t o a S e n i o r U . S . E x c h a n g e . F o u r o f t h e u p l i s t s a n d c r o s s - l i s t s i n c l u d e d s i m u l t a n e o u s u n d e r w r i t t e n p u b l i c o f f e r i n g s , r a n g i n g f r o m a p p r o x i m a t e l y $ 3 , 9

While the number of micro-cap IPOs remained steady in H1, deal sizes and valuations were significantly down. In H1, the median capital raise and the average public offering price were $8.1 million, and $5.32, respectively, down 42% and 12% respectively, when compared to the same period in 2022

In a bid to meet Nasdaq's and NYSE's $15 million "Public Float" requirement in such a selective market, issuers began registering selling stockholders in their micro-cap IPOs, with 12 such issuers in H1, an increase of 11 issuers (1100%) from the same period in 2022

Our key takeaway from H1 is that less is more Smaller deal sizes not only appear to be getting over the goal line, but are also helpful in avoiding increased dilution at lower valuations. The strategy of registering legacy shareholders in the IPO compliments this approach to the challenges of today's market

The market for Uplist/Cross-list is at its most selective point in years During H1, 9 micro-cap uplisting and cross-listing issuers listed on a Senior U.S. Exchange, a decrease of 21 issuers when compared to the same period in 2022 A total of 5 issuers listed organically during H1, a decrease of 7 issuers

A total of 4 offerings were completed by micro-cap uplisting and cross-listing issuers in H1 (down 71%), raising a combined $56.7 million. This represented a significant decrease of $158.3 million from the combined $215 million raised in a total of 18 offerings during the same period in 2022 The average offering size in H1 was $14 million, however, 3 of the 4 offerings raised a combined $12 4 million ($4 1 million on average), with one offering raising a whopping $44 million. Similarly to the micro-cap IPO market, with smaller deals issuers are relying more and more on legacy shareholders to meet the "Public Float" requirement In addition, certain other Nasdaq rules related to reverse splits and simultaneous listing days are having a drag on the process.

Immuron Limited is commercializing and developing a novel class of specifically targeted polyclonal antibodies which are delivered within the gastrointestinal tract and do not cross into the bloodstream.

Products in clinical development have the potential to transform standard of care for moderate to severe Campylobacteriosis, Clostridioides difficile infections, Enterotoxigenic Escherichia coli (ETEC) infections and Traveler’s Diarrhea. Immuron markets Travelan® in Australia, Canada and the U.S. In Australia, Travelan® is indicated to reduce the risk of travelers’ diarrhea and to reduce the risk of minor gastro-intestinal disorders. In Canada, Travelan® is indicated to reduce the risk of travelers’ diarrhea. In the U.S, Travelan® is a dietary supplement for digestive tract protection.

Immuron’s clinical programs for IMM-124E and IMM529 are the first steps in the pathway towards FDA (US Food and Drug Administration) approval in the BLA process (Biologic License Applications).

Lumanity a leading lifescience consulting company conducted an opportunity assessment of IMM-529. Infectious disease experts reacted favourably to the IMM-529 mechanism of action, and its unique ability to target three elements of the CDI infection – the spores, vegetative cells, and Toxin B. Base case yearly revenue in USA for IMM-529 was estimated at US$92M for the target patient population (limited to second recurrence and later). Positioning IMM-529

earlier than second recurrence could lead to higher uptake.

C. difficile infection (CDI) can cause life-threatening diarrhoea and is the leading healthcare-related gastrointestinal infection in the world.1 The global CDI market was estimated to increase to $1.7B by 2026, according to a report by GlobalData.2

1. Australian Commission on Safety and Quality in Health Care

2. GlobalData via Pharmaceutical Technology

wE’RE ABOUT HALF-wAy THROUgH 2023, wHAT ARE SOmE HIgHLIgHTS FOR THE COmPANy FOR THE FIRST HALF OF 2023?

• Global FY23 sales increased by 136% on FY22 to A$1.8 million

• Two FDA approved INDs: Travelan (IMM-124E) and CampETEC

º Phase 2 clinical programs for each to commence in collaboration with the Department of Defense

• Travelan randomized placebo controlled field trial being conducted by Uniformed Services University (USU) in active military personnel more than 35% recruited of a targeted 868 participants

ARE THERE ANy INDUSTRy TAILwINDS TO PUSH FORwARD SOmE OF THE COmPANy’S gOALS AND OBJECTIvES FOR 2023?

• International travel continues to rebound following removal of pandemic travel restrictions

º 2022 travel to Caribbean, Asia, South America, Central America, Africa, Mexico was 83% of the peak 2019 US outbound travel

º During the March quarter, US outbound travel to these regions was up 6% on 2019

º In Australia, Australian resident short term departures in April 2023 were 82% of those in April 2019

• Pandemic restrictions impacted our ability to conduct clinical trials, especially for traveler’s diarrhoea

º We anticipate strong recruitment for our Phase 2 trials (Travelan, CampETEC) and USU’s field trial

FROm wHAT yOU CAN TELL US, wHAT ARE SOmE OF THE COmPANy’S vALUE CATALySTS FOR THE REST OF 2023?

• We anticipate completion of recruitment for

Travelan Phase 2 clinical study

• We anticipate ethics approval and initiation for one of the CampETEC Phase 2 clinical studies (two Phase 2 studies are planned; one in Campylobacter, another in ETEC)

• We anticipate completion of recruitment for one of the CampETEC Phase 2 clinical studies

• We anticipate cGMP manufacture of IMM-529 clinical product; IMM-529 has been developed to prevent and treat clostridioides difficile (CDI)

• We anticipate pre-IND (Investigational New Drug) application to the FDA (US Food and Drug Administration) for IMM-529

• We anticipate continued strong sales growth for Travelan® in both Australia and USA

º Currently penetration in USA is low; based on US annual travel numbers and a penetration rate of 15%, USA market potential is estimated at $83m

For more information about Immuron Limited, please visit: www.immuron.com

DISCLAImER AND FORwARD-LOOkINg STATEmENTS NOTICE: This article is provided as a service of SNN inc. or an affiliate thereof (collectively “SNN”), and all information presented is for commercial and informational purposes only, is not investment advice, and should not be relied upon for any investment decisions. we are not recommending any securities, nor is this an offer or sale of any security. Neither SNN nor its representatives are licensed brokers, broker-dealers, market makers, investment bankers, investment advisers, analysts, or underwriters registered with the Securities and Exchange Commission (“SEC”) or with any state securities regulatory authority

SNN provides no assurances as to the accuracy or completeness of the information presented, including information regarding any specific company’s plans, or its ability to effectuate any plan, and possess no actual knowledge of any specific company’s operations, capabilities, intent, resources, or experience. any opinions expressed in this article are solely attributed to each individual asserting the same and do not reflect the opinion of SNN. information contained in this presentation may contain “forward-looking statements” as defined under Section 27a of the Securities act of 1933 and Section 21b of the Securities Exchange act of 1934. Forward-looking statements are based upon expectations, estimates, and projections at the time the statements are made and involve risks and uncertainties that could cause actual events to differ materially from those anticipated. Therefore, readers are cautioned against placing any undue reliance upon any forwardlooking statement that may be found in this article.

The company profiled has paid consideration to SNN or its affiliates for this article. SNN does not engage in providing advice, making recommendations, issuing reports, or furnishing analyses on any of the companies, securities, strategies, or information presented in this article. SNN recommends you consult a licensed investment adviser, broker, or legal counsel before purchasing or selling any securities referenced in this article. Furthermore, it is encouraged that you invest carefully and consult investment related information available on the websites of the SEC at http://www.sec.gov and the Financial industry Regulatory authority (FiNRa) at http://finra.org.

Note: This article is not an attempt to provide investment advice. The content is purely the author’s personal opinions and should not be considered advice of any kind. Investors are advised to conduct their own research or seek the advice of a registered investment professional.

1. I THINk IT’S SAFE TO SAy THAT THE SECTOR/TREND THAT By ALmOST EvERy mETRIC HAD THE mOST COvERAgE, mOmENTUm, yOU NAmE IT....wAS ARTIFICIAL INTELLIgENCE “AI”: wHy DO yOU THINk 2023 HAS BEEN THE yEAR OF AI?

I couldn’t agree more. It’s certainly safe to say that.

And it’s really been a long time coming.

As you know, the term “artificial intelligence” has been around since the mid-1950s. And businesses have been taking advantage of AI for years.

I wrote newsletters back in 2014 about how AI was already changing the world in countless ways. But every single application was for businesses.

What’s changed is that we’re now seeing consumerfacing AI applications for the first time.

So regular folks are recognizing how AI can affect their everyday lives. That’s driven a lot of hype in the space.

And it’s thanks to the new generative AIs like ChatGPT and DALL-E.

As you know these kinds of AIs can create unique content in the form of text, images, audio, and even

video from a text prompt. So you don’t need to be able to write code to take advantage of them.

Like you can tell ChatGPT to write a poem about shrimp po-boys in the style of Robert Frost.

Or you could tell DALL-E to create a picture of the New York City skyline in the style of Pablo Picasso.

Pretty cool stuff.

The “transformer” neural network architecture first introduced by Google in 2017 allowed these consumer-facing applications to materialize.

2. wE’vE SEEN mANy ExCITINg NEw INDUSTRIES/SECTORS/TRENDS IN THE LAST 10 yEARS (CANNABIS, PSyCHEDELICS, CRyPTO), wHAT mAkES AI DIFFERENT FROm OTHER “gROwTH-y” TRENDS?

Yeah, the main difference I see is that AI is a true general purpose technology… like the personal computer or the internet. But even more profound in terms of the productivity gains that are possible.

It’s these sorts of general purpose technologies that really make a difference in the world by spreading throughout all sectors of the economy and accelerating the march of economic progress.

When a breakthrough general purpose technology

gets to the point where mass adoption is possible, the growth that comes with it is mind blowing.

And that’s what we’ve seen with AI this year.

3. FROm A RESEARCH PROCESS PERSPECTIvE, CAN yOU LEvERAgE AI AS PART OF THE DUE DILIgENCE PROCESS? wHAT AI TOOLS OUT THERE HAvE yOU USED?

Absolutely.

Now, you should always check the accuracy of what these things spit out because of the “hallucination” issue. That’s when a large language model (LLM), like what ChatGPT is built upon, essentially makes up information.

In late June, for example, two New York lawyers were sanctioned for submitting a legal brief that included six fake case citations that were generated by ChatGPT.

So you must be careful. It’s best to treat these things like a junior analyst that you need to check. But as long as you take the hallucination issue into account, these AIs can definitely help with the research process.

Personally, I was using OpenAI’s ChatGPT Plus Browse with Bing beta feature. It was superior to regular ChatGPT because it used the most capable model (GPT-4) and was essentially stitched onto the

Bing search engine, which allowed you to get up to date information beyond ChatGPT’s last “knowledge update” in September 2021.

Unfortunately, OpenAI disabled the plug-in on July 3 because it “can occasionally display content in ways we don’t want. For example, if a user specifically asks for a URL’s full text, it might inadvertently fulfill this request.”

OpenAI says it’s working to bring back this feature “as quickly as possible.”

Another option for now that works well is Bing Chat, which is built into the Microsoft Edge browser’s sidebar. It lets you choose the tone, the format, and the length of what you want it to write about. I recommend playing around with it to see how it could help you.

4. FROm AN INvESTINg PERSPECTIvE, mANy COmPANIES ARE TRyINg TO CAPITALIZE ON THE AI TREND AND COmINg OUT wITH THEIR “AI” TOOL - wHAT ARE yOUR CRITERIA FOR SEPARATINg THE TRUE AI CONTENDERS FROm THE PRETENDERS?

As a general rule, I tend to avoid stocks with AI in their names…

There is one tiny company with AI in its name that I recently recommended to my subscribers and I invested in personally. But this was a special case.

In general, I’d say stay away from the stocks with AI in their names.

It’s like what we saw with blockchain craze when stocks that added the word blockchain to their names or business descriptions saw their stocks pop. Then reality set in and they fell hard.

Remember in January when BuzzFeed said it was going to use AI to create content and the stock jumped more than 300% virtually overnight. It’s fallen 85% since then.

If you want to go back a little further it’s very similar to the stocks that put “dot com” in their names in the late 1990s… most of which fell apart.

I think a better way to look at the AI space is to start with industries and companies that make sense independent of AI.

You know find fast growing cash generating companies solving problems in big markets…

And then see how they’re taking advantage of AI to grow revenue and improve efficiency and profitability.

So think of how Google used AI to provide the best search results and beat out the competition way back when.

Or how Amazon used AI to provide the best product recommendations and essentially develop a new way to shop.

I also think it’s smart to look for companies riding the AI wave across all sectors of the economy. These are companies that provide something fundamental that all AI needs. Picks and shovels type things.

You know like how regardless of the electric vehicle company, they all need batteries. So if you find the best EV battery company it’s probably a solid investment.

So this would entail looking at the hardware and infrastructure layers of AI rather than the application layer.

A company like NVIDIA would fit the bill here.

As you know NVIDIA’s GPUs power most AI projects.

It’s important to be aware of the amazing run that NVIDIA’s stock has been on… and the fact that it’s not an AI pure play. But I don’t see demand for its AI chips declining anytime soon… quite the opposite in fact.

5. wILL 2023 CONTINUE TO BE THE yEAR OF AI? wHy/wHy NOT? AND, HOw SHOULD wE THINk ABOUT AI’S EvOLUTION FOR THE NExT 3-5 yEARS?

Well, we could definitely see a pullback in the well-known AI pure plays like C3.ai (AI), BigBear.ai Holdings (BBAI), and SoundHound AI (SOUN).

In fact, we’ve already seen that with BigBear.ai. It’s fallen more than 65% from its February highs.

But AI itself is not just here to stay, it’s arguably the biggest disruption in history. And it will continue chugging along for decades to come.

There’s an important thing to keep in mind here: This is the WORST AI is ever going to be. It’s only going to get better from here. And it’s already quite impressive.

I’m not smart enough to be able to predict how AI will evolve over the next 3 to 5 years… or even the next six months really. And I’m okay with that. I mean how many folks could have predicted how the internet and world wide web would evolve?

That’s what makes human beings exceptional… our ability to create previously unimaginable products and services once these kinds of general purpose technologies are unleashed.

But I am smart enough to know that if you’re not paying attention to AI and doing all you can to learn about it and leverage it, then you’re going to be left behind… whether you’re an individual or a business.

For more information about Chris wood and RiskHedge, please visit: www.riskhedge.com

Since 1927 value stocks have outperformed growth stocks and smallcap stocks have outperformed largecap stocks. It shouldn’t be surprising that smallcap value stocks were the best performing segment. In fact, since 1927 smallcap value has outperformed the S&P by 14x. MicroCapClub member Mark Vonderwell mentioned on our forum that during this ~100-year period, smallcap value suffered long periods of mediocre perfor-

mance or even under performance. The longest period of mediocre performance lasted 19 years. The periods of outperformance can be explosive, and they normally last 5-7 years. We are currently in a 16-year period of underperformance. The EV/EBIT value spread which represents valuations of the cheapest 10% of the market has historically never been cheaper. Smallcap value is cheaper than it was during the DOT COM bubble and the global financial crisis. This is all to say smallcap value is staged to have a few good years. Perhaps even phenomenal years. In Q2 2023 we are starting to see signs of smallcap value

downtrend.

2. CAN yOU HIgHLIgHT POTENTIAL OPPORTUNITIES, RISkS, AND kEy FACTORS TO CONSIDER wHEN INvESTINg IN mICROCAP STOCkS IN 2023 THUS FAR?

Smallcap value stocks are a good opportunity, but the risks in microcap stocks don’t change year to year. Microcap is for stock pickers. The key is finding the ones that can both grow and survive. Some investors only focus on growth (growth investors). Some investors only focus on survival (value investors). I like to find both attributes in a business. Growth is rather easy to identify. The hard part of growth is finding a business that can sustain growth over a 5–10-year period. Does the business have the leadership, people, processes, culture that can scale? These are the growth questions you need to answer.

Survival is more important. As microcap investors, our biggest risk is dilution. It’s hard for a company to create shareholder value when they need to consistently sell equity to survive. It’s hard for management to make long-term decisions when they must constantly worry about their short-term stock price. In general, being an unprofitable microcap company is a big disadvantage. If you do invest in unprofitable companies, you must have confidence in their ability to hit short-term milestones and catalysts and also you are hoping/praying the market will reward the company with a higher stock price.

A much easier way to win is to focus on the 18% of microcap companies that operate profitable businesses or have large cash positions that can get them to profitability.

3. HOw HAS mACRO NEwS INFLUENCED yOUR CURRENT PORTFOLIO CONSTRUCTION AND wHEN ASSESSINg NEw IDEAS?

I can’t control the macro situation. The best macro strategists in the world are right 50% of the time. We are all better off flipping coins if we want to predict the future. The way I handle the macro is the handle the micro. Focus on what you have control over, finding and holding great investments. My primary hurdles for new investments:

• A business that can grow through a recession.

• A balance sheet that can weather a storm and act with occasional boldness.

• A leadership team and organization that show signs of intelligent fanaticism ie Find management teams that deserve to be running much larger companies.

• A valuation that can conservatively double in three years.

Are there many companies that fit these four qualifications? No. It screens out 99% of the microcap investment universe. This is fine. I’m a stock picker. I can be selective. If I’m successful in finding businesses that fit these four parameters, I don’t have to worry about the macro.

4. FOR THE REST OF 2023, wHAT ARE SOmE kEy CRITERIA, mACRO EvENTS, mICROCAP EvENTS, ETC... THAT yOU ARE wATCHINg AND wHAT ACTIONS wILL yOU TAkE IF THOSE POTENTIAL OCCURRENCES HAPPEN?

I’m 100% focused on the micro. Are the businesses I own executing or am I making excuses for them not executing? The businesses that are executing make it look easy. I don’t stress over the stocks that move up and grow into big pieces of my portfolio. They’ve earned that right. I stress over the small ones I’ve been holding and justifying “let’s wait another quarter”. It’s those “wait another quarter” stocks that are like death by a thousand cuts. Holding losers is easier than holding winners. Why? Because losers always look cheap.

If you invest in microcaps you will have turnover. You must have turnover. 20% of what you own today will likely deserve to be owned 5 years from today. This means that 80% of what you own today will deserve to be sold. My intention with every purchase is to hold forever but very few will earn that right.

In a recent article I wrote titled, “Conviction Investing,” I mentioned that successful stock picking isn’t just picking winners. It also means picking out the losers in your portfolio. Warren Buffett wasn’t a coffee can investor. Most of the stock pickers you admire are conviction investors. They focus on finding the best opportunities, knowing them better than most, holding the ones that are worth holding, and selling mediocrity.

For more information about MicroCapClub, please visit: www.MicroCapClub.com

As they sweep up the broken glass, market participants are asking what comes next. Will SPACs return to being a niche alternative approach to going public? Or could new approaches to structuring deals reignite excitement among quality private companies and public market investors?

To rewind a bit, SPACs first caught the attention of average investors and the media back in 2020. While SPACs had existed for several decades, they surged in popularity during the pandemic lockdown as ample liquidity and couch-bound speculators fueled an explosion in deals. That year, 248 SPAC IPOs raised over $83 billion in proceeds, exceeding the number of traditional IPOs. The largest investment banks embraced the format, and many established private equity funds and hedge funds rushed to launch their own vehicles. In 2021, the market doubled as 613 new SPAC IPOs raised over $162 billion.

SPACs are, in essence, public shell companies that load up with cash and go out searching for a private target company to merge with. In those heady days, many deals soared above their $10 offer price as soon as a target was announced. As competition for targets increased, SPAC managers began to embrace earlier-stage companies with visionary promises of flying taxis and space tourism. Aspirational valuations were supported by heroic financial forecasts stretching many years into the future. In addition to the shareholder money held in the SPACs trust fund, many deals lined their war chests with significant PIPE investments by institutional investors.

Unfortunately, not all these management teams were able to deliver the hockey stick forecasts contained in the SPAC merger slide presentations. Shareholders were reminded that venture-stage companies do not always gain market traction on a predictable timetable. And some never gain it at all.

For two years, the SPAC market threw an epic party. Now it’s wrestling with an awful hangover.

As interest rates began to rise and the prospect of a recession appeared on the horizon, investors began to lose their taste for more speculative SPAC mergers. Rather than receive shares in the new company when the deal closed, investors increasingly elected to receive their share of the cash held in trust instead. Companies that missed their forecasts saw market caps wither. SPACs went from white hot to stone cold.

What is the state of the SPAC market in 2023?

Just 19 new SPAC IPOs have gone public thus far in 2023, raising $2.3 billion. That said, SPACs have accounted for half of the total IPOs in what has been an anemic market for new issues.

Over that same period, 131 SPACs have liquidated, returning the cash they raised to shareholders. For the SPAC sponsors, liquidation means losing millions of dollars in risk capital spent to pay fees to investment bankers, lawyers, auditors, and other costs of being a public company and conducting due diligence. While SPAC sponsors are often portrayed as profiting at the expense of retail investors, these deal makers have collectively lost billions of dollars, while public shareholders are made whole when a SPAC dissolves.

44 SPACs have completed a business combination with a private company so far this year. However, investor redemptions on those deals have run at an average of 96 percent, meaning the new public company is left with only a tiny fraction of the anticipated capital raise to fund expansion. In many cases, the accumulated professional fees are higher than the amount of cash left in the SPAC to pay them.

Today 210 SPACs are still searching for deals. But given the inherent uncertainty about how much capital will be injected at the end of the process, luring private companies to embrace the SPAC format has grown more challenging. Many SPACs have reached the end of their allotted time to complete a deal and now must pay additional fees each month to extend their lives.

By the end of the year, the population of SPACs seeking to complete mergers could be winnowed

What does the future hold for the SPAC market?

In the near term, SPAC IPOs will likely be smaller and fewer than during the boom. In 2023, most new SPAC IPOs have been under $100 million, down from over $300 million in 2020. Smaller, specialized investment banks are underwriting these deals. And to entice investors, sponsors are offering a higher guaranteed rate of return by overfunding the trust account or adding on additional warrants or rights to sweeten the deal.

These features make SPACs more attractive to credit-oriented investors and arbitrage funds. But unfortunately, they also increase the probability that shareholders will redeem, and the trust fund will be depleted at closing. Sponsors end up paying a high cost to keep the money in trust while searching for a target and navigating the SEC registration process. But then, when they and the target company really need the money, it disappears.

Restoring a fundamentally healthy SPAC market would require a few significant changes. Investors need to see they can make more money by holding their shares in the merged company rather than redeeming them for cash. Companies need to have a higher degree of confidence that they can raise the capital they require to execute their growth plans. And sponsors need to be rewarded for the effort and capital they put into sourcing great companies and guiding them to be successful in the public markets.

Achieving those goals requires changing how SPACs approach valuations, incentives, and public company readiness.

To entice investors to keep their money in the deal, the SPAC and the target must provide a valuation that offers a reasonable upside to public investors based on achievable financial targets. In the heat of negotiations to persuade a private company to pursue a SPAC merger, sponsors and advisors may be tempted to dangle an inflated valuation to close a deal. Company management must be educated that it is far better to have most of the cash remain in the company and have the stock trade up than to

briefly obtain an inflated valuation and end up with a threadbare balance sheet.

In a difficult financing market, SPACs with some form of captive financing are likely to have a competitive advantage in sourcing quality deals and the credibility to negotiate favorable terms for all investors. One solution could be a hybrid structure combining committed private financing with the contingent capital offered by the SPAC.

The incentives for SPAC sponsors should be aligned away from “get rich quick” towards “build wealth over time.” This might involve rebalancing their equity ownership from shares to warrants that pay off once the stock trades above the cost basis of public investors.

Investment banking compensation could be adjusted to reflect the amount of cash on the balance sheet at the closing of the SPAC merger and not simply the amount raised at IPO. This would create incentives to advise on positioning deals to be attractive to equity investors beyond the “SPAC mafia” of credit and arbitrage funds.

network Iridium Communications (NASDAQ: IRDM), digital sports gaming platform DraftKings (NASDAQ: DKNG), and salty snacks brand Utz Brands (NYSE: UTZ) have created value for shareholders and accelerated their growth via this method.

Given their flexibility, SPACs are likely to be a permanent part of the corporate finance landscape for the foreseeable future. Now that the champagne has gone flat and the bills have come due, it is the right time to look in the mirror and contemplate what changes are required to make the SPAC a valuable tool for discovering and launching great companies.

Drew Bernstein, Co-Managing Partner Marcum Bernstein & Pinchuk (MBP)a leader in SEC audit accounting and consulting services to Chinese companies seeking access to capital markets.

In 1983, Drew Bernstein co-founded Bernstein & Pinchuk. Additionally, he co-founded MarcumBP, which is a member of the Marcum Group and an affiliate of Marcum LLP. a leading U.S. accounting and advisory firm. Both firms have multiple offices within the United States and Asia.

Bernstein is a distinguished expert with deep knowledge of the China and U.S. financial ecosystem with experience extending across Asia. Europe and Africa. Industry experience encompasses technology. retai l. manufacturing, hospitality, pharmaceutical and real estate. Bernstein directs a global team, featuring highly trained PCAOB and SEC accounting experts and financial consultants working in New York as well as Beijing. Tianjin. Shanghai. Shenzhen. Hangzhou. and Guangzhou.

Finally, SPAC managers will need to pay greater attention to selecting targets that have the potential to be successful as public companies. This requires not just an investment story that resonates with public shareholders but the ability to set targets and deliver results in a reasonably predictable fashion. Building a robust financial reporting and forecasting function is essential to earning investors’ confidence and remaining current with reporting obligations.

One of the great potential advantages of a SPAC merger over a traditional IPO is that the target company can draw upon the expertise and guidance of executives with extensive experience in public company management and the capital markets. Ideally, a strong SPAC management team would remain closely involved for several years after the transaction closes, providing a bridge to becoming a thriving public company.

When it works well, a SPAC merger provides a path for companies with solid fundamentals that are slightly outside the mainstream to access the public markets. Companies as diverse as satellite

Additionally, Bernstein is considered a valuable thought leader and news commentator. He has published articles for Forbes.com and China Daily and is a frequently called upon source by prominent media such as China Global Television Network. CNBC. Bloomberg TV. The Financial Times. The South Chino Morning Post. The Wall Street Journal. Yahoo! Finance. and more regarding Chinese IPOs. China’S economic growth. investment appetite, innovation trends, corporate governance, SEC regulations and more.

Bernstein graduated from the University of Maryland with a B.S. in Accounting. Currently, he resides in New York City with his wife and children.

About MBP

Marcum Bernstein & Pinchuk LLP (MBP) offers specialized audit and advisory services to support SPAC sponsors and SPAC targets in Asia. MBP and its parent company, Marcum LLP. have been involved in more SPAC transactions than any other audit firm. MBP is the only audit firm to have a dedicated SPAC team for Asia. MBP performs all audits for Marcum in Greater China. and MBP is a top-five auditor for Chinese companies listed in the United States.

The dedicated SPAC team has worked with SPAC sponsors, underwriters, and targets. MBP draws on wide-ranging experience with the initial publiC offerings and subsequent business transactions forged by such companies. MBP has designed its audit platform to deliver the technical expertise. efficiency. and urgency required by SPAC IPOs. This includes high-quality. PCAOB-compliant audits for private Asian companies that are contemplating entering a SPAC merger.

Website: U.S.: https://www.marcumbp.com:

China: https://cn.marcumbp.com

Note: This article is not an attempt to provide investment advice. The content is purely the author’s personal opinions and should not be considered advice of any kind. Investors are advised to conduct their own research or seek the advice of a registered investment professional. The author does not own shares in any of the companies mentioned in the article.

Sports create purpose and fuels dreams. That’s why the Challenged Athletes Foundation is committed to providing athletes with permanent physical disabilities access to life-changing sports equipment, coaching, and competition expenses.

CAF is ready to deliver more impact, create more invaluable opportunities for mentorship, and strengthen our adaptive athlete community.

Learn how your organization can be part of the movement that’s breaking barriers, igniting futures, and changing lives. challengedathletes.org/partner

It’s hard to believe that 2023 is half over. It has been an interesting year in the markets.

Capital is still available, but harder to come by, IPO’s are slowing down, although there is some upward momentum. SPAC’s continue to have the microscope on them. The redemption rate remains high for SPAC transactions. In March alone we saw almost a 95% redemption rate on trust capital for the March deals. This leaves the SPAC underfunded and investors quickly lose interest in the deals. Companies can’t rely on the funding and have to look to raise capital to meet their plans.

On the executive talent front, 2023 is definitely a transition year. There are very qualified executives available in the market looking for their next opportunity. For companies looking to expand or upgrade their teams, it’s an opportunistic time to bring in some exceptional talent. Many of the available executives are the victims of M&A. Companies are slowing their hiring decision process, many companies are just not adding to the headcount and instead asking the existing team to do the work of two executives. While asking more for less keeps cash burn down, companies that don’t build out their executive team, run the risk of not executing their business plans and not meeting their goals. For companies that are looking to grow, I expect to see hiring growth as we near the end of the year.

On the human capital front, companies are starting to realize that they need employees in the office at least on a hybrid basis. There are studies now stating what many of us knew, remote work is not as productive nor innovative. The pace of innovation has slowed considerably in a remote environment. Employees are still pushing back on retuning the office and are enjoying their work from home situations. Companies need to weigh the productivity and innovation with the happiness quotient of employees. Companies that can educate the workforce and create the culture that incorporates the importance of on-site work for career development will see long term success. In addition, the ability to show employees that collaboration at the office is a vital component of that growth, both personal and corporate will reap the rewards of employee development. Employees who embrace the culture will see a more rapid career growth. Companies that can successfully develop a hybrid culture will be more successful.

Microcap companies are constantly faced with staffing challenges. Competing with larger companies on experience, pay, benefits, etc. that larger companies can use to attract and retain talent. Historically, microcap companies have succeeded as they are nimble and can make decisions faster and more

efficient. In a microcap company there is access to the decision-makers and routinely the executives are working alongside the team, thus creating a sense of ownership and collaboration at a level employees would not experience in a large firm. As larger tech firms are laying off employees, opportunities exist for microcap firms to grab these tech-savvy employees from larger firms. This will create the innovation needed for a microcap company to accelerate development, growth and build their success. Companies that can take advantage of hiring employees will have an advantage in innovation and growth.