Committed to responsible water stewardship and strategic partnerships to ensure long-term water security.

Thanks to some extraordinary local engineering prowess, the lives of 246 zama zamas – trapped at the Stilfontein Mine

were rescued.

With the challenges facing SA’s mines, localisation and building a resilient and competitive SA supplier base has emerged as a key strategy to address these

So starters are invaluable in a wide range of mining and industrial applications, in protecting motors and motordriven equipment. We consider the options.

On-site or

ering encompassing

VIEW OUR 2025 CALENDAR

https://issuu.com/sundaytimesza/docs/2024_calendar_a2

www.linkedin.com/company/samining/

businessmediamags.co.za/mining/sa-mining/subscribe/ www.samining.co.za or www.businessmediamags.co.za

www.facebook.com/businessmediaMAGS/company/samining/ twitter.com/BMMagazines

www.instagram.com/business_media_mags/

South Africa’s ability to localise some industries and develop others offers enormous potential from a socioeconomic and job creation point of view.

Rodney Weidemann

nemployment remains one of South Africa’s biggest challenges, which is why the concept of localising industries that have previously been the remit of foreign countries is so crucial.

In fact, with the challenges facing SA’s mining sector, localisation, and building a resilient and competitive local supplier base, has emerged as a key strategy to address this issue.

A er all, relying on international suppliers can make mining operations susceptible to challenges like logistical delays, currency volatility, and geopolitical uncertainties. Meanwhile, strong local supply chains help minimise these risks, by reducing dependence on external sources.

Local suppliers also better understand local mining conditions, and can tailor solutions more e ectively than international providers, enhancing productivity and operational performance.

to create a regional minerals processing hub, with all the job creation and economic benefits this o ers.

With the appropriate policies, transport networks and partnerships in place, the country can attract investments and jobs and turn around the long-term decline in its mining sector.

The recent Stilfontein mine tragedy, which cost 78 zama zamas their lives, underscores the complexities of illegal mining in South Africa. However, despite the tragedy, the rescue of 246 individuals from the same perilous sha , thanks to Tech Edge and its mobile mine rescue winder, demonstrated the country’s extraordinary engineering prowess.

EDITOR

Rodney Weidemann

Tel: 062 447 7803

Email: rodneyw@samining.co.za

ONLINE EDITOR

Stacey Visser

Email: vissers@businessmediamags.co.za

ART DIRECTOR

Shailendra Bhagwandin

Tel: 011 280 5946

Email: bhagwandinsh@arena.africa

ADVERTISING CONSULTANTS

Ilonka Moolman

Tel: 011 280 3120

Email: moolmani@samining.co.za

Tshepo Monyamane

Tel: 011 280 3110

Email: tshepom@samining.co.za

PRODUCTION COORDINATOR

To achieve such localisation in the materials handling sector, it is imperative to foster strong collaboration between mines, government, industry, and local suppliers in order to align goals and provide the necessary support for capacity building.

Similarly, the projected shortage of critical minerals over the next decade could significantly benefit South Africa, which has a large share of these minerals. It sets the stage for the country

In an increasingly climate-conscious world, industries that have a negative impact on the environment are facing greater levels of scrutiny from end-users. For the modern mine, this means focusing on sustainability from the initial mining plan, through aligning corporate goals with environmental imperatives, to the a er-mine rehabilitation and the long-term impacts on the surrounding communities.

Moving from green mining to digital mining, we consider how the e ective harnessing of data allows mines to leverage artificial intelligence and automation to a far greater extent. This will help to catapult the mining industry to the frontiers of technological advancement and enable it to futureproof operations by mining “smarter”.

In other stories, we take a look at the key issues raised at the Investing in African Mining Indaba 2025, which focused on inclusivity, sustainability, and strategic collaboration, with the goal of futureproofing Africa’s mining industry.

We also take a look at how invaluable so starters are in a wide range of mining and industrial applications, helping users to protect motors and motor-driven equipment. We look at why these are such important components in many industrial systems, and the benefits mines can obtain from using this equipment.

Finally, in our cover story, Phillips Global, with its ability to draw upon the resources of a worldwide network of companies, has built its reputation on cra ing engineering quality and precision into every product and service the company provides. This full service o ering, encompassing rebuild, repair and remanufacture, is aimed at keeping customers’ operations – and profits –running at full speed.

Neesha Klaaste

Tel: 011 280 5063

Email: neeshak@sahomeowner.co.za

SUB-EDITOR

Andrea Bryce

BUSINESS MANAGER

Lodewyk van der Walt

Email: lodewykv@picasso.co.za

GENERAL MANAGER MAGAZINES

Jocelyne Bayer

SWITCHBOARD

Tel: 011 280 3000

SUBSCRIPTIONS

Neesha Klaaste

Tel: 011 280 5063

Email: neeshak@sahomeowner.co.za

PRINTING

CTP Printers, Cape Town

PUBLISHER

Arena Holdings (Pty) Ltd, PO Box 1746, Saxonwold, 2132

Motor Engineering (Deutz, Perkins, Detroit & all other engine types)

Parts | Engine Remanufacture

Car, LDV, Truck, Bus & Heavy Duty Vehicle Service & Repairs

Diesel Fuel Injections Services (Bosch Accredited)

Field Services (Mining & other Onsite Services)

Barrick Gold Corporation has injected over $4.24-billion into the Tanzanian economy since establishing the Twiga joint venture with the government in 2019, contributing $888-million in 2024 alone. Twiga comprises the North Mara and Bulyanhulu gold mines.

Barrick president and chief executive Mark Bristow says the Twiga partnership remains a leader in Tanzania’s extractive industry, creating thousands of jobs, supporting local businesses and funding critical community projects.

“We spent $573m on national suppliers and service providers last year, representing about 83% of our total spend in-country. Additionally, 75% of all our payments to suppliers and service providers went to indigenous companies, exceeding our target of 61%,” says Bristow.

Thanks to Barrick’s policy of local employment and advancement, 96% of its 6 185-strong workforce are nationals, with 53% coming from the communities neighbouring the mines.

Barrick also invested over $5m during the year in potable water, healthcare and education, taking the total investment in community projects to $15.8m since Barrick formed the Twiga partnership with the government and assumed operational control of the Tanzanian mines in 2019. “Barrick’s work in Tanzania is a model for sustainable mining that balances economic, environmental, and social responsibility,” he says.

SRK Consulting has emphasised the nurturing of skills as a vital foundation for building inclusion and long-term resilience in the continent’s mining ecosystem.

This is particularly true in West Africa, where gold production was estimated to have reached almost 12 million ounces in 2024. The region is also home to other minerals that are critical to the global energy transition, further fuelling Africa’s industrialisation through downstream processing and manufacturing.

“We need to be building on the depth of mining expertise that exists in West Africa, which has been developed over more than a century of mining in countries like Ghana,” says Ivan Doku, partner and Ghana country manager for SRK Consulting. “The region must foster local skill sets in response to changing standards and requirements both from government and clients.

“The global shortage in critical tailings-related skills, for example, does make it di icult for the mining sector at the moment, but at the same time presents great opportunities for young professionals in our region. With the growing focus on local content in mining services and products, there is an urgent need to develop these skills locally.”

This also aligns well with mining’s future-proofing imperative, adds Doku, by upskilling local young generations to contribute meaningfully to mining’s growth – and to embrace emerging technologies to develop cutting-edge solutions.

Just four years a er commencing operations, the Tshiamiso Trust has achieved a significant milestone, disbursing over R2-billion to ex-gold mineworkers and their families who met the criteria for silicosis and work-related tuberculosis (TB) compensation.

This groundbreaking achievement represents a positive impact on more than 21 200 families, and marks the largest payout ever made by a compensation organisation in this sector.

“This milestone is a collective victory. It is through the remarkable collaboration of all our stakeholders that we have accomplished something unprecedented. Together, we are making a real di erence in the lives of those who have su ered due to the working conditions they endured,” says Dr Munyadziwa Kwinda, CEO of the Tshiamiso Trust.

The geographical distribution of claims highlights the trust’s impact across the region, with Lesotho seeing the highest concentration of payments at 40%, followed by the Eastern Cape in South Africa at 27%. To date, 8 799 Lesotho claims have been paid out, amounting to R799-million, and 5 559 Eastern Cape claims have been compensated, valued at R531m.

State-of-the-art global haulage company Railveyor has appointed Deebar as its o icial sales representative in South Africa. This partnership is a pivotal step in Railveyor’s global expansion, enhancing its capabilities in this dynamic and resource-rich region, according to Tas Mohamed, CEO of Railveyor.

As a leading supplier of innovative mining solutions, Deebar led the installation of an earlier Railveyor system at Phakisa Mine, a Harmony Gold-owned operation in SA. This project exemplified the power of combining Deebar’s local expertise with the advanced technology of the Railveyor system – to deliver an e icient and sustainable materials handling solution.

Through the strategic agreement, Railveyor and Deebar will collaborate on new opportunities across the country, o ering clients state-of-the-art material haulage systems that prioritise e iciency, sustainability, and safety. The partnership underscores Railveyor’s dedication to forging meaningful relationships that drive progress in the mining industry.

The Railveyor system’s exclusive combination of fully electric, autonomous operation and scalability has proven to be a game-changer in mining logistics, o ering significant reductions in operational costs and environmental impact. This partnership aims to bring these benefits to more clients in the Southern African Development Community, a region renowned for its mining heritage and potential.

Impala Platinum Holdings (Implats) has signed a five-year power purchase agreement (PPA) with Discovery Green, to supply wheeled renewable energy to its Impala Refineries operation, which is based in Springs, east of Johannesburg.

The strategic renewable electricity contract will significantly reduce Impala Refineries’ Scope 2 greenhouse gas (GHG) emissions – by more than 852 000 tonnes CO2e over the initial five-year period of the PPA – and yield cost savings.

Implats’s energy strategy seeks to strengthen the security of electricity supply in South Africa, reduce GHG emissions and long-term input costs, by integrating renewable electricity into its electricity supply options.

One of its initiatives involves procuring renewable solar and wind electricity from energy aggregators via the South African national grid – the concept known as “wheeling”.

This PPA represents the first phase of Implats’s aggregator wheeling programme and will supply 90% of Impala Refineries’ electricity needs from 2026 – starting with the delivery of over 130 000MWh of wheeled energy per year.

The record low number of fatalities and advances in health on South African mines in 2024 are a result of the collaboration between all stakeholders who share the vision of zero harm, and who support the interventions and programmes developed by the Minerals Council South Africa (MCSA) in partnerships with its members.

The MCSA, an advocacy body whose members account for 90% of annual mined production by value, notes that the 42 fatalities reported for 2024 is a new all-time low for the industry, and continues the encouraging overall downward trend in deaths on mines.

In 2022, the industry reported 49 fatalities, which was then a record low, but there was a regression to 55 fatalities the following year. There was a 24% year-on-year decline in fatalities in 2024.

Injuries declined by 16% year-on-year to 1 841 in 2024 from 2 181 the year before, while occupational diseases declined by 17% to 1 864 cases in 2024, from 2 233 the year before.

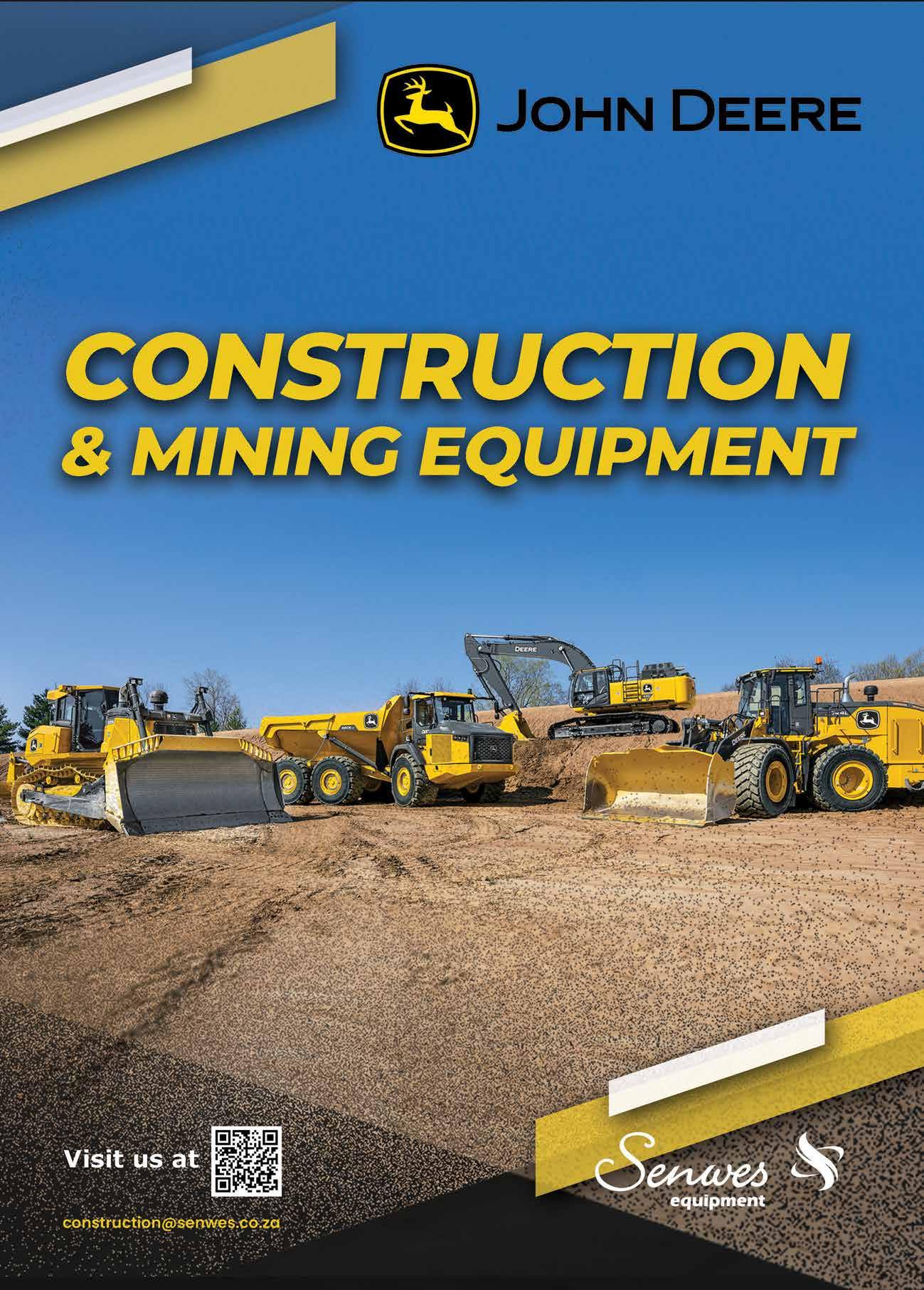

Phillips Global delivers a full service offering encompassing rebuild, repair and remanufacture, aimed at keeping customers’ operations –and profi ts – running at full speed.

With the ability to draw on the resources of a worldwide network of companies,

Phillips Global has built its reputation on cra ing engineering quality and precision into every product and service the company provides.

This has led to Phillips Global becoming one of the largest full service companies in the world. According to South Africa MD John Pinheiro, this full service consists of a range of equipment and services that are designed to meet all their clients’ requirements.

“Our full service o ering encompasses original equipment manufacturer (OEM) solutions designed for customers that have specific requirements involving either purchasing such equipment new, or replacing existing equipment within their operations,” he says.

“It further includes refurbishments done to customers’ existing equipment that has reached the end of its expected life cycle. Such renovations mean the customer can

repeat the cycle with the same, refurbished, equipment.”

He says the service also ensures regular repairs to customer equipment, in order to increase its reliability and reduce their downtime, while custom modifications can be made to client equipment, which will cater for their specific conditions and mining needs.

“Finally, we also supply a ermarket parts to customer operations, providing ongoing support for their equipment, along with 24/7 support provided by the organisation’s Field Service unit, which is always on call to assist when required.”

“Apart from standard repairs, Phillips Global is also able to assist clients with the rebuilding of used and damaged equipment, while in extreme cases, we can help restore used equipment to a like-new status.”

Pinheiro notes that from a repair

perspective, the work covers everything from fixing individual parts to the repair of an entire machine, should it require such an intervention before it reaches the end of its life cycle.

“When we rebuild equipment, this is usually in instances where the customer has equipment that is incomplete, abused or damaged – and thus requires missing parts and repairs to get the unit up and running,” he says.

“Remanufacturing, on the other hand, is the process of restoring used equipment to like-new condition. Essentially, this involves stripping the machine completely, a er which it is properly cleaned, repaired, the relevant parts are replaced, and it is tested to ensure it meets OEM specifications. Only a er all of this is completed is the machine returned to the customer.”

What Phillips Global is doing here, continues Pinheiro, is rewriting the script as an OEM – going beyond equipment, in order to take the business to the next level.

Apart from standard repairs, Phillips Global is also able to assist clients with the rebuilding of used and damaged equipment. – Pinheiro “ “

Among the core equipment supplied by Phillips Global are:

■ OEM shuttle cars and battery scoops

■ Refurbishment of shuttle cars and battery scoops

■ Refurbishment of continuous miners

■ Repair of continuous miner fabrications

■ Repair and lacing of cutter drums

■ Manufacture, wiring and repair of flameproof enclosures

■ Supply and refurbishment of underground batteries and chargers

“As an enterprise, we rely on the vast experience of our people in order to deliver a truly full service operation that o ers all the capabilities described above. The experience we have gained over the past half century now enables us to be a solutions provider, helping customers with problems and delivering the requisite engineered solution.

“In order to be a quality solutions provider of this nature, we focus closely on listening to our customers, while also understanding their particular situation and requirements. In this way, we are able to achieve the required results.”

He says by listening closely to its customers, the business is able to gain a better understanding of their daily frustrations and issues. This knowledge then enables it to either provide a solution, or improve on the current application.

“By understanding its customers, Phillips Global has adopted a ‘continuous improvement’ approach that has, in turn, made its equipment and parts more reliable, while also reducing its customers’ running costs,” he says.

“Most crucially, we understand that ultimately, ‘people buy from people’, which is why we place so much focus on our team. By concentrating on ourselves – as opposed to focusing on our competition – we are able to ensure we do what we do, to the best of our ability.”

Phillips Global, which is part of the Baughan Group of companies, recently announced a new acquisition of its own, in the form of WB Fabricators. Pinheiro explains that with this acquisition, Phillips Global will be able to increase its ability to deliver complete machine builds.

“Our organisation is renowned throughout the industry for its continuous miner refurbishments and cutter drum lacing and repairs. The new acquisition has significantly added to the experience of our team, making us a leader in this field,” he says.

“This will now also provide us with the capability to provide quality products on both our OEM and refurbished miners, which fits with our dedication to protecting the continuous miner by providing a balanced and smooth cutting machine.”

It is important to recognise that Phillips Global has had two philosophies since its inception in 1976, notes Pinheiro. These are to get customers back in production as soon as possible, no matter what it takes, and thus enable them to achieve the second philosophy, which is to mine more, haul more, and make more.

“It has always been our goal to ensure customers can do more, in order to assist them to make more profit. To achieve

this, we need to have simple, easy to fix and reliable equipment, as this is what translates into more profitability for our customers’ operations.

“In the longer run, our commitment is to the industries we serve, by consistently providing products of the highest quality, along with exceptional customer support.

“Phillips Global therefore remains committed to innovative design, manufacturing, procurement and superior service, concentrating on – and innovating within – the specialised niches that the company understands best,” he says.

The importance of sustainability runs through the life-of-mine – from initial fi nancing, through aligning corporate goals with environmental imperatives, to the legacy of the communities left behind.

By Rodney Weidemann

In an increasingly climate-conscious world, industries that have a negative impact on the environment are facing greater levels of scrutiny from end-users.

For the modern mine, this means focusing on sustainability from the initial mining plan, to the a er-mine rehabilitation.

According to Cathy Nader, principal: Mining and Resources at Nedbank Corporate Investment Bank, a focus on sustainability and environmental awareness is no longer just a nice-to-have, but is in fact essential. The trick is to take sustainability to a new level, while not impacting profitability.

“It should be remembered that virtually any focus on sustainability will help to reduce costs, thereby boosting profitability. Furthermore, a sincere focus on sustainability will be attractive to banks and other investors, potentially leading to the mine accessing cheaper funding,” she says.

“On the other hand, an insu icient focus on environmental, social and governance (ESG) goals will a ect access to debt funding from banks, make investors more wary and maybe even impact access to mining licences.”

She says a failure to focus on remediation and rehabilitation from the outset can also lead to massive and unexpected costs when it comes time for mine closure. A lack of ESG focus can also lead to potential community and labour disruptions.

“This is why companies should implement sustainability practices into the mine plan from day one. For example, utilising renewable energy and practising

good water management from day one allows the mine to optimise e iciencies, leverage new technologies, and really get its ESG principles in tune with its operations.”

Natasha Pather, partner at Webber Wentzel, notes that a holistic approach to ESG-linked funding can unlock additional funding benefits for businesses.

“In the SA market, there are usually two types of ESG-linked funding made available to corporate borrowers – sustainable financing and use of proceeds financing, sometimes known as green or social loans,” she explains.

“Sustainable financing is a type of funding that allows borrowers to measure their performance against a set of predetermined key performance indicators. If these are met, there is a financial benefit, such as a margin reduction or access to additional funding. This financing is typically a better fit for larger corporates, which already have their own corporate social responsibility programmes.”

Use of proceeds financing, continues Pather, focuses on the purpose against which the proceeds are applied. This funding arrangement can be either a loan or a security, such as bonds, notes or other commercial paper.

“This type of funding is appropriate where it is possible to link the purpose to which the funding will be applied to an ESG-linked cause. A benefit of this type of funding is that it can be more accessible for a broader range

of borrowers or issuers, who are looking to fund an ESG-linked purpose,” she says.

From a sustainable power perspective, it must be understood that the shi to greener energy sources comes with substantial financial investment. Fortunately, suggests Johan Pretorius, MMM segment lead: Anglophone Africa at Schneider Electric, there are also attainable financing models which allow mines, particularly junior miners, to realise their green projects.

“Foremost are partnerships with independent power producers (IPPs) and energy companies, which o er flexible financing and infrastructure development options. One example is power purchase agreements (PPAs), where mines partner with renewable energy companies to secure long-term, stable energy supply contracts,” he says.

“Under a PPA, the renewable energy company finances, builds, and operates the renewable infrastructure – such as solar or wind farms – and the mine agrees to purchase the generated power at a predetermined rate over a fixed period.”

This model, says Pretorius, is particularly advantageous for mines that want to reduce upfront capital expenditure, while ensuring a reliable and clean energy source.

“Another option is build-own-operate (BOO) models, preferred by larger, financially secure mining groups. These o er greater control over energy production, reducing reliance on external power sources and

– Nader “ “

A sincere focus on sustainability will be attractive to banks and other investors, potentially leading to the mine accessing cheaper funding.

According to NSDV Law, South Africa’s legal framework provides mechanisms to regulate the environmental impact of mining preventing unacceptable damage while avoiding stifling sustainable development. Compliance with these regulations, along with innovations in greener mining technologies and waste management, is critical to striking a balance between economic growth and environmental protection.

In addition to legal compliance, advancements in mining technology – such as the use of renewable energy in operations and innovative waste management practices – are becoming crucial to reducing the environmental impact of CRM extraction. These innovations help mining companies meet global sustainability goals while minimising their carbon footprints.

minimising long-term operational costs.”

BOO models are for more established clients, he notes, who want to have more say over how their energy mix is being used. For junior miners, on the other hand, there is growing interest from development finance institutions (DFIs) and international organisations in funding green energy projects in Africa’s mining sector.

“Ultimately, reliability of power is the key issue in most of Africa, so increasing green investments here not only help to improve ESG standards, but it should also upli the surrounding communities, as it will enable the mine to create a sustainable ecosystem around it,” he says.

According to Pooja Dela, partner at Webber Wentzel, it is imperative that mines ask the question: What does sustainable development mean for the communities we leave behind?

“The global shi towards embedding business and human rights (BHR) principles in corporate decision-making has reshaped expectations of the mining industry. Companies are now seen not only as extractors of resources, but also as custodians of community wellbeing and as influencers of good practice in their supply chains,” she says.

“For mining companies to e ectively future-proof their legacies, sustainable development requires a shi towards genuine, transparent, meaningful and continuous engagement with communities,

throughout the mining lifecycle.”

Companies must always listen to community voices, she says, ensuring their needs and priorities shape the development agenda. This includes moving away from one-size-fits-all solutions, and tailoring projects to the unique cultural, heritage, environmental, economic, and social contexts of each community.

“Mines must invest in initiatives that promote economic diversification, such as supporting agriculture, entrepreneurship, or manufacturing. These investments foster resilience, and are a catalyst to creating sustainable livelihoods and development beyond the life-of-mine. Clearly, these should be considered upfront.

“Social and labour plans o en include training and education components. However, the scope should expand to include skills development and skills transfer, to prepare communities for a post-mining economy. Collaborating with academic institutions and NGOs can enhance the quality and relevance of these programmes.”

While mining operations o en bring significant infrastructure investments, such as roads, schools, and clinics, continues Dela, ensuring the long-term sustainability of these assets requires proper planning and handover processes, including partnerships with local governments.

The environmental impact of mining can persist for decades. Companies must prioritise rigorous rehabilitation programmes that create opportunities for sustainable post-closure land uses and economic

transition. This, she says, could include ecological tourism, agriculture, or renewable energy projects, in line with regional spatial development priorities.

“In South Africa, the legacy of mining is inextricably tied to the country’s socioeconomic development. As the sector navigates these changing dynamics, it must embrace a forward-looking approach that prioritises long-term community well-being and resilience. This means thinking not just about the present, but also about the generations to come, as the construct of sustainable development envisages.

“The communities we leave behind are not just a reflection of the mining industry’s commitment to transformation, they are a testament to its humanity. By embracing their role as partners in development, mining organisations have an opportunity to redefine their legacy – not as extractors of resources, but rather as builders of resilient, thriving communities,” says Dela.

A DFS is the foundation for a successful mining project. However, even the most technically sound DFS risks effective execution, without a funding strategy.

RISK ALLOCATION IS KEY.

Mining projects are as much about vision as execution, and all too o en projects fail – not because of what’s beneath the ground but because of what’s missing in the plans. A definitive feasibility study (DFS) should map the route from concept to execution.

Stressing this aspect, Tshepo Pitse, principal of Mining and Resources at Nedbank Corporate and Investment Banking (CIB), notes that without a proper funding strategy woven in, a DFS risks leaving projects stranded. It’s like a mine sha with no exit – a promising start, but going nowhere.

A DFS is not just technical; it’s strategic, he says. Banks look to fund projects with clear competitive advantages, such as highquality shallow resources with good grades, a long mine life, and first or second quartile unit costs in stable jurisdictions, with good management teams. These factors reduce uncertainty and improve viability. However, even the best technical cases require strong financial structures to turn potential into progress.

“Risk allocation is key. Mining is inherently uncertain, shaped by fluctuating commodity prices, operational risks, and shi ing regulations. Successful projects involve precise risk allocation among various stakeholders that are best equipped to manage those risks, thereby enhancing the project’s attractiveness to funders and investors,” he notes.

Exploring alternative funding pools during the DFS is critical, says Pitse. Streaming and royalty finance o er liquidity with less equity

dilution. While faster to implement than traditional loans, one must carefully consider the long-term impacts these mechanisms may have on cash flow and profitability. Each decision must align with the broader economic resilience of the project.

“The front-end engineering design phase also presents an opportunity to unlock liquidity. Capital goods and services sourced from countries with export credit agencies and equipment suppliers o ering asset-based finance provide valuable liquidity pools.”

“Execution is as important as financing. Construction phases are sensitive to delays and cost overruns, requiring contingencies and strong project management to stay on track. Lenders focus on developers’ experience and ability to deliver on time and within budget, with guarantees from engineering, procurement, and construction management firms or sponsors support, which provides further reassurance.”

Sustainability has become a defining feature of project viability, and banks insist on environmental, social and governance (ESG) principles being integrated into a company’s strategy as a core principle – not just as a boxticking exercise, he says.

“Aligning with the net-zero transition is also non-negotiable. Banks have started measuring financed emissions and have pledged reductions in scope 1, 2 and 3 emissions, requiring mining projects to demonstrate clear plans for decarbonisation.”

Lenders are increasingly focused on projects with real environmental benefits and robust financial returns, he says. “Those

Mining is inherently uncertain, shaped by fluctuating commodity prices, operational risks, and shi ing regulations.

that integrate renewable energy and sustainability-linked loans gain competitive advantages, enhancing both funding certainty and reputational value. Stakeholder engagement is equally critical, as a DFS that overlooks the communities and governments impacted by mining, risks its social licence and long-term success.”

The global energy transition has positioned mining as a cornerstone of sustainability, with critical minerals reshaping the industry. This opportunity comes with increased scrutiny, and projects are judged as much on their social and environmental credentials as their technical merits. The future of mining will thus be shaped by those who combine technical expertise with long-term strategic vision.

“Nedbank CIB stands at the forefront of this evolution, o ering unparalleled insights and solutions in mining finance. Our commitment to integrating ESG principles, innovative funding strategies, and stakeholder engagement ensures that we not only enable projects, but also align them with global sustainability goals,” he says.

Our mining sector team understands that mining is one of the largest contributors to the green energy transition. To explore every possibility to create sustainable mining solutions and help future-proof African mining, partner with the leader in sustainable mining finance.

When you see unexpected connections, you see sustainable growth.

cib.nedbank.co.za

The

effective harnessing of data allows mines to leverage AI and automation to a far greater extent, enabling them to future-proof operations by mining “smarter”.

By Rodney Weidemann

Over the past decade, global mining companies have adopted autonomous operations, applying the technology to one area at a time – like haulage or drilling, or drones and remotely operated vehicles (ROVs).

Remote operations centres provide the analytics and human intelligence required for safe monitoring and operation of these assets. But traditional mine automation has continued to rely on fixed-function robotics that are unable to self-adapt to the dynamic and evolving nature of mining environments.

According to Seema Mehra, business head for Energy, Resources, Utilities, EPC, LifeSciences and Healthcare at TCS Asia Pacific, Middle East and Africa, artificial intelligence (AI) techniques – like computer vision and deep learning, combined with AI compute at the edge – have finally brought in intelligent, flexible, and adaptable modes for automation.

“AI-led automation has the potential to enhance adoption, making it, in most use cases, wider, faster, and easier – at least for the miners who have managed their data well,” she says.

“The advent of digitalisation and internet of things (IoT), blended with AI, has helped to

catapult the mining industry to the frontiers of technological advancement. So, greater value can come from integration of data across these siloed functions, and mines can start linking the value chain together with the deep analytical capabilities of generative AI (GenAI) enabled by advances like chain of thought reasoning.”

In the emerging world of Industry 5.0, notes Mehra, mining 5.0 is rapidly assessing the adoption of AI and related technologies in human-cyber-physical systems (HCPS).

“The advanced techniques are being used in digital simulations for ROV route and load optimisation; ultra-accurate analysis of geophysical and geo-chemical engineering data using quantum computing; AI in augmented or virtual reality (AR/VR)-based drilling; for early warning in mining safety and hazard prevention; combining IoT with environment 4.0 for mining territory restoration; and commodity market trigger sensing for smart contracts in ore sales.”

Jody Conrad, CEO of Krux Analytics, explains that real-time analytics helps mining companies catch issues before they snowball into major setbacks. By providing immediate insights into operations, companies

can detect ine iciencies early, and take corrective action before they a ect long-term profitability.

“Having real-time data in a normalised format ensures consistency, allowing for accurate comparisons across operations –an apples-to-apples view of performance. This visibility highlights the true impact of ine iciencies, prompting timely decisions to resolve delays, optimise workflows, and ensure drilling programmes stay on track,” she says.

“For example, real-time data may highlight that a drill rig is experiencing excessive standby time, due to ine icient shi changes. By catching this early, operators can adjust schedules, keeping rigs drilling instead of sitting idle. Small ine iciencies like these, when addressed proactively, can have a significant impact on overall productivity and profitability.”

Conrad indicates that beyond optimising operations, real-time analytics plays a crucial role in financial sustainability, by providing deeper insights into drilling costs and e iciencies. The data collected during the drilling stage significantly enhances budgeting accuracy, and helps companies plan future programmes with confidence.

Seema Mehra from TCS suggests that there are disruptive possibilities with using AI for mining concepts the industry has been researching for a long time, including:

■ AI-augmented analysis of ore samples during exploration accelerates characterisation of ore bodies and improves accuracy.

Having real-time data in a normalised format ensures consistency, allowing for accurate comparisons across operations – an apples-toapples view of performance. – Conrad

“By ensuring that every dollar spent achieves the maximum metres drilled, mining companies gain greater clarity and confidence in their resource estimates. This not only improves decision-making but also extends mine life by optimising resource extraction and long-term planning.

“For example, by analysing drilling energy consumption, companies can identify ine icient rigs, optimise fuel usage, and reduce operational costs. Tracking water usage through real-time data also helps mines optimise consumption, reducing waste and improving cost e iciency.”

In essence, notes Conrad, leveraging realtime data not only ensures e icient resource utilisation today, but also strengthens the long-term economic viability of a mine –maximising returns over its entire lifespan.

By leveraging and learning from the data collected today, she continues, we are actively shaping the future of mining. As we uncover the true value of di erent data sources, we can expand data collection frequency and quality, leading to continuous improvement.

“This evolution enables greater optimisation and automation, allowing

mining operations to become more e icient, cost-e ective, and sustainable. The more we refine our data-driven approach, the more we unlock opportunities to streamline workflows, reduce waste, and enhance decision-making.

“Mining companies that fail to harness their data risk being outpaced by competitors who are leveraging real-time insights for smarter, faster decision-making. The future belongs to those who invest in data today.

“In an industry where margins and resources are critical, data is not just an advantage – it’s the foundation for long-term success,” says Conrad.

Mehra points out that AI has already helped make mining operations resilient, through the predictive monitoring of asset failure, thereby ensuring zero downtime. AI improves worker safety and accelerates automation too, making mining operations more e icient, cost e ective, and scalable –and therefore there are zero boundaries or constraints to mining operations.

“AI enables mining organisations in their net-zero journey and beyond, through decarbonisation, minimisation of waste avoidance, and energy consumption. AI further assists in bio-conservation, to protect

■ At the operations stage, leading miners are applying AI to geology and mine planning data, to transform drilling and blasting by custom designing each blast. Careful positioning of drill holes and automated, high-precision delivery of micro-controlled explosives help achieve optimal blasting in real life. It results in safer blasts that also produce better fragmentation of the ore.

■ Beyond that, AI could make it possible to redesign mine operations for modular, flexible processes where capacity can be scaled up or down in small increments. It could reshape the mining industry by eliminating the boom-to-bust cycle driven by the traditional capital-intensive approach of large capacity additions.

■ AI can optimise the entire pit-toport value chain in a seamless, integrated and intelligent way.

the ecological footprint of the region, as well as restoration of end-of-life mines. We believe AI models will help optimise the entire pit-to-port operations in a truly seamless, integrated and intelligent way.

“Moreover, the symbiosis of human and machine intelligence makes it possible to redesign mine operations for modular, flexible processes, where capacity can be scaled up or down in small increments. This can future-proof mining from a financial perspective, freeing it from the boom-to-bust cycles of large capex and capacity additions. In fact, in just a few years, it may be di icult to find a facet of mining that remains untouched by AI,” she says.

Following a long evolution, SA is on the cusp of having a robust, investor-friendly wind energy sector – which will benefit employment, manufacturing, and industrial growth.

South Africa is on the brink of a renewable energy revolution, with wind power positioned at the heart of this transformation. As the country progresses with power sector reforms and pivotal policy shi s, wind energy is no longer seen merely as an alternative; it is now integral to the country’s energy future.

Reflecting on 2024, SA has made remarkable strides in transformative policy and regulatory developments. These achievements are the result of collaborative e orts that have been a hallmark of the country’s electricity sector in recent years.

A key driver of this transformation has been policy advocacy and industry collaboration, with the SA Wind Energy Association (SAWEA) playing a central role in influencing legislative advancements. Notable among these are the Electricity Regulation Amendment Act (ERAA) and the upcoming iteration of the Integrated Resource Plan (IRP 2024).

These reforms lay the groundwork for a robust, investor-friendly wind energy sector that will generate employment, boost local manufacturing, and foster industrial growth.

As momentum builds, now is the time to unlock the full potential of wind energy – not just to power homes and industries, but to drive economic growth, promote social equity, and ensure long-term sustainability.

By Wangari Muchiri

Africa

Director

at the Global Wind Energy Council and Niveshen Govender CEO of the SA Wind Energy Association

Building on past successes, such as the launch of the first IRP in 2010 and the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), strengthening policy and regulatory frameworks will unlock further investment in wind energy.

A major advancement in SA’s power sector reform was the passing of the ERAA. Signed into law in August 2024 and e ective from January 2025, the ERAA establishes a competitive wholesale electricity market platform and an independent transmission system operator (TSO).

This is expected to transform power production, trade, and grid operations, while also accelerating licensing and regulatory approvals and fostering investment in grid expansion – key to developing and connecting wind farms.

The restructuring of Eskom, as envisioned in the 1998 Energy Policy White Paper, also made significant progress in 2024. The establishment of the National Transmission Company of South Africa (NTCSA) is a crucial step in Eskom’s transformation. The NTCSA will handle key functions of the TSO during the transition to a wholesale electricity market.

Moreover, the introduction of Independent Transmission Projects (ITPs) is a positive move towards encouraging private sector participation in transmission development under the newly cra ed Transmission Development Plan (TDP 2025-2037).

Wind energy continues to lead SA’s transition to a lowcarbon, renewable energy future. With over 3.5GW of installed capacity from 37 wind power plants, contributing over 46 480GWh annually, wind energy plays a vital role in the country’s energy security.

The government’s updated IRP 2024 status has also improved the contribution by wind. In fact, wind energy is slated to contribute between 69GW and 76GW of new capacity by 2050. This presents significant opportunities for investment, industrialisation, and job creation.

Beyond energy security, wind power is a catalyst for economic growth, industrial development, and job creation. Investments in wind energy stimulate domestic industries, with the establishment of local wind turbine manufacturing facilities fostering technological advancement and reducing reliance on imports.

The South African Renewable Energy Masterplan outlines a strategic framework to drive industrialisation, expand employment, and localise manufacturing within the renewable energy sector. By focusing on technology transfer, skills development, and workforce training, the country can strengthen its wind energy industry and ensure long-term sustainability.

The wind industry’s social impact is evident, with over R898-million invested in socioeconomic development initiatives by 2022. SAWEA’s 2023 Community Engagement Handbook has further strengthened collaboration between developers and local communities, ensuring transparency and shared benefits from wind energy projects.

SA’s vast wind resources, both onshore and o shore, present significant opportunities for growth. While onshore wind farms dominate, the potential for o shore wind is also substantial.

A 2022 Council for Scientific and Industrial Research feasibility report estimated that the country could generate up to 44.52TWh annually from shallow-water wind farms, and an astonishing 2 387.08TWh from deep-water installations – equivalent to eight times the country’s total electricity demand.

O shore wind remains a long-term prospect, but has attracted growing investor interest. For example Hexicon AB, in partnership with Genesis Eco-Energy Developments, is planning an 800MW o shore wind farm o the coast of Richards Bay, marking a significant milestone in the nation’s energy transition.

As South Africa enters its second decade of wind energy development, the progress made in 2024 serves as a clear indicator of the sector’s transformative potential.

Through continued policy advocacy, industry collaboration, and strategic investments, South Africa is poised to lead the continent’s transition to a renewable energy future, ultimately driving economic growth, energy security, and sustainability.

The views expressed are the author’s own and do not necessarily reflect SA Mining’s editorial policy.

Recognising the challenges facing the nation’s mining sector, the Southern African Institute of Mining and Metallurgy has issued a call for collaboration, innovation, and skills development.

By Dr Elias Matinde, President of SAIMM

As we enter a new year, the mining sector in South Africa is at a critical juncture. Faced with new challenges, a rapidly changing global economy, and an increasing need for sustainability and innovation, the industry must adapt and collaborate in ways that will shape its future success.

As the president of the Southern African Institute of Mining and Metallurgy (SAIMM), I feel a deep responsibility to address these challenges head-on, focusing on three key areas that I believe are essential for the sector’s growth. These are collaboration between industry, academia, and research institutions; skills development at the higher research level; and the revitalisation of South Africa’s research capacity in mining.

Historically, SA has been a global leader in mining, known for its technical expertise and cutting-edge operations. However, one area where we’ve fallen behind is research. The mining industry in the country has struggled to keep pace with international technological advancements, and as a result, much of the innovation today comes from external sources.

Local companies o en buy o -theshelf technologies from abroad, relying on

external experts for maintenance and repair, rather than developing these capabilities locally. This disconnect between local industry needs and global research solutions has hindered our ability to adapt to emerging challenges.

To regain our competitive edge, we must foster greater collaboration between the mining industry, research councils, and academic institutions. When we look at some of the world’s leading mining nations, it is clear that a collaborative approach between these sectors has been key to their continued success.

SA’s research councils, such as Mintek and the Mandela Mining Precinct, along with universities and industry stakeholders, must come together to ensure that we are solving local problems with locally generated knowledge.

Through multi-disciplinary collaborations, we can build research capacity and create practical solutions to the challenges that are unique to our mining sector. This will require an ecosystem where knowledge flows freely between academia, research institutions, and industry – fostering innovation that benefits not only mining operations, but also broader societal and economic growth.

ABOUT DR ELIAS MATINDE

Zimbabwean-born Dr Elias Matinde holds a PhD in Metallurgical Engineering from Tohoku University in Japan, a Master of Business Administration and a BSc (Hons) Metallurgical Engineering (cum laude) from the University of Zimbabwe, and a Postgraduate Diploma in Higher Education from the University of the Witwatersrand. He is a professional engineer, a Fellow of SAIMM, and a Past Fellow (2017-2018) of the Africa Science Leadership Programme.

AN OPPORTUNITY WE CANNOT IGNORE

One of the main areas of focus during my tenure as president is to rejuvenate South Africa’s lost research capacity in mining.

“ “

Through multi-disciplinary collaborations, we can build research capacity and create practical solutions to the challenges that are unique to our mining sector.

For years, the industry has faced critical challenges – particularly when it comes to new and emerging issues that demand innovative, cutting-edge solutions. Experience alone cannot solve these problems, as they are o en unprecedented. This is why research is essential.

I believe our nation can reignite its research potential by embracing the idea of industry-driven PhDs. By encouraging professionals already working in the industry to pursue advanced research, we can create a powerful pool of knowledge that is tailored to our sector’s specific needs. These industry PhDs would not only solve practical problems, but also ensure that the country is at the forefront of developing new technologies, solutions, and methodologies that will allow us to tackle future challenges head-on.

Moreover, investing in research and development will help SA regain the technological autonomy it has lost over the past decades. We cannot continue relying on imported technologies indefinitely. Local researchers, engineers, and scientists must lead the way in developing solutions that are tailored to our own unique conditions. In my view, one of the greatest challenges facing the mining sector in

SA today is the lack of high-level skills. While we have a strong pool of graduates entering the industry with undergraduate degrees, there is a clear shortage of professionals with advanced research skills – such as master’s degrees or PhDs. In an era of rapid technological change, these higher-level qualifications are essential.

To address this issue, we must encourage young professionals to continue their education beyond their undergraduate degrees. Industry and academia must work together to create pathways that allow professionals to pursue advanced qualifications, while still being employed in the industry. Not only does this ensure the sector is constantly refreshed with new knowledge, but it also boosts job security and creates greater mobility within the global job market.

Moreover, companies that invest in the training and development of their employees will be better positioned to weather industry fluctuations, including economic downturns and commodity price volatility. In today’s competitive market, companies cannot a ord to ignore the value of investing in their talent pool through continuous education.

It’s clear that for the country’s mining sector to thrive, we must prioritise collaboration, innovation, and skills development. As I reflect on the opportunities that lie ahead, I am reminded that while the challenges we face may seem daunting, they are also an opportunity to reshape our industry for the future.

By fostering partnerships between industry, academia, and research institutions, we can solve the problems of today, while preparing for the challenges of tomorrow. Collaboration is the key to unlocking SA’s potential as a leader in mining once again.

It’s time to reconnect the dots, bridging the gap between knowledge generation and practical application. By doing so, we will not only improve the competitiveness of our industry, but also ensure that it remains a source of sustainable economic growth and development for generations to come.

I encourage industry professionals to work together, as one mining community, to embrace research, upskill our workforce, and collaborate in ways that will shape the future of mining in South Africa. Together, we can forge a path forward; one that is rooted in collaboration, knowledge sharing, and the relentless pursuit of excellence.

This year’s Mining Indaba focused on inclusivity, sustainability, and strategic collaboration, with the goal of futureproofi ng Africa’s mining industry.

The 9-12 February 2025 Investing in African Mining Indaba was unique in that it placed indigenous peoples and local communities at the forefront of the discussions, acknowledging their vital role in shaping the industry’s future.

For the first time, representatives from these groups actively participated in key sessions, o ering their perspectives on sustainable and equitable mining practices. The 2025 Indaba was all about a commitment to inclusivity, sustainability, and strategic collaboration, with the goal of positioning Africa’s mining industry for a resilient and prosperous future.

One of the key focuses at the event was around how to maximise Africa’s critical mineral endowment, and how the critical minerals needed for a global clean energy future – which are plentiful in Africa – give the continent a strategic edge, moving forward.

With its strong focus on communities, understanding how to strengthen social cohesion and sustainable partnerships between traditional communities and the mining sector in SA was a core aim.

Indaba also considered the importance of looking beyond extraction, and understanding how important it is to build infrastructure, skills, and value in the African mining sector.

Similarly, the need for local beneficiation was discussed, as delegates considered what it would take to increase investment in midstream and downstream manufacturing facilities.

GOVERNMENT AND SUSTAINABILITY PERSPECTIVES

In the Indaba’s “intergovernmental stream”, much was made of the need to transform

governments’ permitting processes, by understanding what countries with fast permitting processes do well. Naturally, the role of cadastral systems, and the need for greater upgrade investments, were also discussed, alongside potential permitting processes for artisanal and small-scale miners.

Delegates also looked at ways to transform tailings with innovative water solutions and how organisations could reclaim brownfields and rehabilitate mine sites, which dovetailed nicely with the launch of the Global Tailings Management Institute.

From an environmental, social and governance (ESG) perspective, the question was asked as to how short-term profit pressures a ect mining companies’ willingness to invest in circularity, as well as whether mining companies are being honest in reporting their ESG and sustainability impacts.

From a financing point of view, key discussions were held around the subject of whether intra-African financing options can plug the gap le by concerned and risk-wary foreign entities.

Delegates discussed a range of potential solutions to the energy crisis – including new power-generation technologies – and the role mining has to play in Africa’s energy transition.

Technology is playing an increasing role in the mining sector, so it is no surprise that key questions, such as whether mining is being disruptive enough with technology, were asked.

Technology trends across various industries were examined, as was the

issue of employees’ resistance to change, along with strategies for e ective research commercialisation in mining.

Obviously, artificial intelligence (AI) was high on the technology agenda, and how leveraging it can unlock performance excellence in mining operations. Delegates considered the potential return on investment from data-driven initiatives – such as improved operational e iciency, predictive maintenance, expedited mineral discovery, and improved drilling confidence, as well as the hurdles to be faced when implementing data standards in the mining industry.

Technological advancements that can facilitate reduced carbon emissions across various parts of the supply chain were also looked at. As were the adoption of bespoke innovations to help unlock the full potential of Africa’s critical mineral endowment – covering the areas of exploration, extraction, sustainability, and global competitiveness, among others.

Ultimately, the Investing in African Mining Indaba 2025 succeeded in helping to position Africa as the world’s mineral partner of choice. Significant progress was made in understanding what should be done to ensure the continent becomes the global mineral leader, and is able to future-proof its industry.

Most critically, all of this was done in the context of understanding and learning from stakeholders’ respective perspectives, experiences, and expertise, in order to leverage this knowledge to chart pathways for growing the industry while also future-proofing communities beyond mining.

Despite the global aim to transition from coal, it remains a signifi cant mining commodity. Collieries like Khanye therefore remain major contributors to local employment and to the economy as a whole.

Although countries are facing a lot of pressure to transition away from coal rapidly, the shi will happen gradually due to infrastructure constraints, energy security concerns, and economic considerations. While some countries in Europe are moving away from coal, the opposite is happening in Asia. China is making massive investments towards building new coal mines and coal-fired power stations.

According to the Global Energy Monitor, China is developing more than 1.2 billion tonnes of coal mining capacity, accounting for over half the projects across the globe. To support its large population and rapidly growing economy, India is also not backing away from coal. India is, in fact, importing a lot of thermal coal from South Africa, making operations like the Khanye Colliery – which produces washed coal predominantly for the export market – quite significant.

Closer to home, suggests Dawid Venter, mine manager at the Khanye Colliery, coal continues to be the backbone of the energy sector in South Africa. According to the Minerals Council South Africa’s Facts and Figures 2024, coal is the country’s most significant mining commodity by production

volume with an output of 235 million tonnes.

The sector also employs 98 425 direct employees, he notes, reflecting the importance of having coal operations such as Khanye, which contribute to the economy and provide much-needed employment.

“Khanye, which has a remaining life-of-mine of seven years and employs more than 622 people – including local contractors – is an opencast mine located in Bronkhorstspruit, Gauteng. Opencast mining commenced in January 2018, and today, the mine produces around 200 000t/m of run-of-mine coal through its 400 tonnes per hour (tph) Larcodem plant for beneficiation, which was commissioned in March 2019. At this plant, the coal is washed and is predominantly used for the export market,” he says.

“The mine remains important and relevant for various reasons. For one, the demand for coal remains strong not only locally, but globally as well, due to the high energy demand. The International Energy Association (IEA) has forecast that global electricity demand will grow at a faster pace in the coming three years, due to an improved economic outlook for both developed and emerging economies. With such growth expected, countries will need

reliable and a ordable resources to generate enough baseload power.”

Venter points out that Khanye has a range of environmental, social and governance initiatives in place to ensure that mining practices are conducted sustainably and responsibly. These include proactive measures, such as having robust environmental management practices and ongoing rehabilitation e orts, to e ectively address environmental concerns.

“As a colliery, Khanye places great value on its relationship with the Bronkhorstspruit community and is dedicated to fostering positive relationships. The mine actively engages in community outreach programmes and maintains transparent communication through established community forums.”

Furthermore, he says, Khanye is committed to employing locally as part of its social labour plan and HR policies – contributing to the stimulation and enhancement of Bronkhorstspruit’s community and residents’ lives. Khanye also gives preference to local suppliers, with regard to the procurement of locally sourced goods and services.

In addition, the colliery supports

As a colliery, Khanye places great value on its relationship with the Bronkhorstspruit community and is dedicated to fostering positive relationships. – Venter “ “

sustainable development projects through its local economic development projects, like the Mkhambi Primary School, where the organisation has conducted upgrades and renovations. Khanye also o ers bursaries for studies in electrical engineering, mechanical engineering, civil engineering, mining engineering, environmental science, and safety management.

“These bursaries aim to support the education and development of individuals interested in pursuing careers in these fields, contributing to the growth of skilled professionals within the mining industry,” says Venter.

“Furthermore, Khanye Colliery provides learnerships in the engineering department, o ering valuable hands-on experience and training opportunities for aspiring engineers.”

He says the colliery has also committed to providing articulated dump truck training to 32 individuals from the local community. The aim is to enhance their skills and employability in the mining sector, which has in the past proved a great success and benefit for both the community and the local mines.

These initiatives, he says, reflect Khanye’s dedication to nurturing talent,

promoting education, and creating meaningful employment opportunities within the community.

“Khanye has a 400tph large coal dense medium separator (Larcodems) plant for beneficiation. This plant is capable of producing a single 0-50mm product while maintaining the optionality to produce sized products, depending on the demand.”

In addition, he explains, the plant is equipped with a filter press, which mechanically dewaters the ultrafine coal material using special filter mediums to exert pressure on it, thereby separating the filter cake from the clean water. The water attained from the fine coal is reused in the plant.

“Khanye works closely with its suppliers, and the mine supports companies owned and operated by residents of its host communities. Additionally, we provide business opportunities through integration into our supply chain,” says Venter.

“The mine is also committed to recognising and mitigating the potential impacts of opencast coal mining, through proactive measures. The colliery is currently engaged in concurrent rehab activities such

The colliery is currently engaged in concurrent rehab activities such as seeding 25 hectares of topsoil to support land rehabilitation, in alignment with its approved environmental management plan.

as seeding 25 hectares of topsoil to support land rehabilitation, in alignment with its approved environmental management plan.”

He says the colliery plans to initiate a hydro-seeding process, which is e ective for hard-to-reach or steep areas.

“Hydro-seeding is helpful for areas like stockpiles, berms, around bridges or culverts, and small areas where construction has occurred. It entails spraying a mix of seeds, fertiliser, and binders – in liquid form – from a bowser with a pipe and nozzle. This can reach distances of 60m to 100m from the point of spraying.

“In so doing, Khanye not only mitigates the potential impact of mining activities on surrounding communities, but just as crucially, demonstrates its commitment to responsible mining practices.”

Implats recognises that responsible water stewardship is a strategic priority, which is why its water stewardship framework is aligned with global frameworks.

Southern Africa faces significant water stress due to a combination of low annual rainfall, uneven distribution of water resources and increasing demand from population growth and economic activities. The region’s average annual rainfall is well below the global average.

Responding to the water stress faced in the regions surrounding its South African and Zimbabwean operations, Impala Platinum Holding’s (Implats) water stewardship e orts focus on maximising water recycling/reuse at operations, and reducing freshwater withdrawals, to increase resilience against water scarcity at each operation and the surrounding communities.

Responsible water stewardship is a strategic priority. Implats’s water stewardship framework consists of six pillars, which are aligned with global frameworks and provide guidance on managing water-related risks and associated capital allocation decisions.

In most parts of Southern Africa, El Niño events are associated with prolonged dry spells, reduced rainfall and increased temperatures. These conditions o en lead to droughts, water shortages and crop failures, posing significant challenges to health, agriculture and food security, and worsen existing water shortages and socioeconomic vulnerabilities.

El Niño events – and the increasingly unpredictable and extreme weather conditions brought about by climate change – foretell future water-related risks for Implats operations and its host communities, which are reliant on rain-fed agriculture. As such, each operation has fit-for-context plans in place to build resilience, including social performance initiatives, to help communities access water and improve their food security.

Several projects are being implemented to achieve these goals – which include achieving 60% water recycling/reuse by 2030 – and mitigate water-related risks.

Implats’s

operation’s southern sha s, once completed.

“ “

water stewardship framework consists of six pillars, which are aligned with global frameworks and provide guidance on managing water-related risks and associated capital allocation decisions.

At Impala Rustenburg, a stormwater catchment dam will be built to improve stormwater storage and ensure greater resilience to extreme weather events, such as floods and drought. In addition, to mitigate water supply disruptions and water quality deterioration, Impala Rustenburg has committed to installing two potable water reservoirs.

Phase 1 was completed in August 2023 and commissioned in March 2024, at a cost of R130-million, and involved constructing a reservoir, pump station and water treatment plant, which provides potable water bu er capacity to the operation’s northern sha s and minerals processing facility. Phase 2 will see the construction of a second reservoir, pump station and water treatment plant, which will o er similar bu er capacity for the

Impala Bafokeng will upgrade the Maseve pump station to improve reticulation and water-use e iciency. Meanwhile, Impala Refineries has committed to an e luent treatment plant and a nickel wash water optimisation project to improve water recycling and reuse capacity, and reduce freshwater intake, while the installation of flow metering on the tailings thickener will improve water accounting at the operation.

Zimplats is implementing process improvement initiatives to reduce freshwater consumption at its mining and mineral processing activities. In FY2024, it achieved a 35% reduction in freshwater consumption at the Selous Metallurgical Complex (SMC) concentrator plant, a er it commissioned its new mills lubrication system cooling towers.

Recycling and reusing treated sewage e luent to suppress dust and water lawns and flower gardens is being actively promoted at both the mining and processing divisions. The volume of treated e luent recycled increased by 60% year-on-year.

A turf and SMC sewage recycling study will be initiated to further improve the security of water supply and reduce freshwater intake. In addition, in the first quarter of 2024, the 3.3km extension of the water pipeline from Chitsuwa Dam to the Ngezi Weir was commissioned, which will prevent unauthorised abstraction and evaporative losses along the Ngezi River tributary.

In conclusion, Zimplats is an active participant in the two catchment councils within which the operations are located. Water conservation awareness sessions are conducted regularly and employees are encouraged to carry water-saving principles and initiatives to their respective homes and communities.

Mines that adopt a circular economy approach will position themselves to adopt sustainable production practices, reduce waste generation, and invest in recycling infrastructure.

The concept of the circular economy has gaimed significant traction in recent years, as a sustainable alternative to the traditional linear economy, which follows a “take-makedispose” model.

In the mining industry, adopting circular economy principles can lead to more e icient use of resources, reduced environmental impact, and enhanced economic resilience – in a time where environmental, social and governance (ESG) principles have come to take on a new and farreaching meaning.

The mining sector is critical to the global economy, providing essential raw materials for various industries, including construction, manufacturing, and technology. However, the traditional linear approach to mining has significant drawbacks, such as resource depletion, environmental degradation, and high waste generation. A shi to a circular economy addresses these issues by promoting resource e iciency, recycling, and sustainable practices.

While the benefits of a circular economy in mining are clear, it also has its fair share of challenges. Implementing circular economy practices can at times require advanced technologies for e icient resource recovery, waste processing, and recycling. Depending on the level of complexity, these technologies can be costly and may require investment in research and development should it be a one-o solution. Moreover, the economic feasibility of circular economy practices may be seen as a barrier, particularly for the junior mining industry, which may have only limited access to capital.

By Dr Andries van der Linde (PhD UH, UK), Technical Director at Blue Tree World

In a circular economy, the focus is on maximising the value of resources, by using them more e iciently. This involves optimising extraction processes to reduce waste, using advanced technologies to increase recovery rates, and improving resource management throughout the supply chain.

Recycling and reuse are fundamental principles of the circular economy. In mining, this can involve the recovery of valuable metals from waste materials, such as tailings and slag, and the repurposing of mining by-products for other industrial applications. For example, slag can be used in high-performance concretes, some types of tailings can be used in road construction, while plastic waste and tyres can be converted into fuels to provide energy.

Extending the life cycles of products derived from mining can also contribute to a circular economy. This can be achieved through better design, maintenance, and repair, as well as through innovative business models such as leasing and product-as-a-service, which would encourage manufacturers to design for longevity and recyclability.

Implementing circular economy principles in mining o ers numerous benefits. A circular economy reduces the environmental footprint of mining operations by minimising waste, reducing emissions, and conserving natural resources. By promoting recycling and reuse, it extends the life of mines, which in turn reduces habitat destruction, water consumption, and energy use.

Adopting a circular economy approach can enhance the economic viability of mining operations by reducing costs associated with waste management and resource extraction. It can also open new revenue streams, through the sale of recycled materials and by-products.

A circular economy in mining can improve community relations and social licence to operate, by demonstrating commitment to sustainability and responsible resource management. It can also contribute to local economic development by creating job opportunities and fostering innovation.

Investments in circular practices may not always provide immediate returns, making it challenging for companies to justify the costs. However, a move towards a circular economy is no longer a choice – it is fast becoming a mining imperative – and fortunately such expenditure can be o set or even turned into a financial benefit, should the business case for such capital expenditure be well structured and supported by solid engineering.

Regulatory frameworks and policies play a crucial role in enabling the transition to a circular economy. In terms of the National Environmental Management: Waste Act, 2008, waste recycling legislation has become an essential component of environmental management and sustainable development.

Recognising the urgent need to address waste generation and its environmental impacts, the SA government established a comprehensive legal framework aimed at promoting recycling and waste minimisation.

Adopting a circular economy requires a shi in mindset and organisational culture. This can be challenging, because it involves changing established practices and overcoming resistance to new ways of thinking and operating – especially considering the opportunities at hand. Advances in recycling technology and innovative waste management solutions present opportunities for improving recycling rates and e iciency.

Collaboration between the finance sector and the mining industry can foster investment in recycling infrastructure and create new economic opportunities. Education and advocacy can raise public awareness and drive behavioural changes towards sustainable waste management practices.

The transition to a circular economy in the mining sector o ers a promising pathway to sustainable resource management, environmental protection, and economic resilience. While there are challenges to overcome, the benefits of reduced waste, lower environmental impact, and enhanced economic opportunities make it a worthy endeavour.

By embracing circular economy principles, the mining industry can play a crucial role in building a more sustainable and resilient future. The mining industry can be seen as an essential partner in the successful implementation of waste recycling legislation, and as such, be encouraged to adopt sustainable production practices, reduce waste generation, and invest in recycling infrastructure.

The views expressed are the author’s own and do not necessarily reflect SA Mining’s editorial policy.

Mining is one of the toughest professions on the planet and requires safety gear that stands up to the most punishing conditions. Lemaitre’s Maxeco Pro meets these needs

For decades, South Africa’s mining industry has been the backbone of the nation’s economy, built on the resilience and sheer determination of its workforce. Every miner who descends into the depths of the Earth, operates heavy machinery, or works tirelessly in a processing plant, knows the importance of durable safety footwear.

When every step matters, choosing the right boot is not just about comfort, it’s about protection, comfort, and trust.

To this end, BBF Safety has introduced the Maxeco Pro, Lemaitre’s flagship safety boot that builds upon the trusted legacy of the original Maxeco, now enhanced to meet the evolving demands of modern mining. Designed with insights from workers in some of the country’s most hazardous environments, the Maxeco Pro delivers superior durability, all-day comfort, and advanced safety features that empower miners to perform at their best.

MEETING THE DEMANDS OF MINING

Mining is one of the toughest professions on the planet, requiring safety gear that stands up to the most punishing conditions. From underground tunnels, to open-pit operations, workers face constant struggles against unstable terrain, falling debris, extreme temperatures, and

long shi s on their feet. The Maxeco Pro is designed to ensure miners have the protection and support they need to get the job done safely and e iciently.