scale with a larger customer base.

High local manufacturing costs may discourage substantial investments in production facilities and equipment. Importing helps mitigate risks associated with significant capital outlay, allowing businesses to allocate resources to other critical areas like marketing, distribution, and customer service, enhancing overall efficiency and competitiveness.

The Food and Grocery Council is an industry association for grocery suppliers providing members networking, events, industry information and strong advocacy. Contact us for information on the benefits of membership: raewyn.bleakley@fgc.org.nz

• Networking • Industry Updates

• Conference and Events

• Education and Training

• Advocacy and Law Reform

In New Zealand’s current business landscape, high local manufacturing costs pose challenges for domestic businesses. However, this situation also creates opportunities for imported products to meet consumer demands. By exploring global markets and leveraging cost advantages, imported goods contribute to New Zealand’s economy. After a hiatus during COVID-19, food and beverage exhibitions worldwide are flourishing, with record attendance levels from various countries as attendees look for products to import. The networking opportunities, trend reports, new products and innovation coming through at these events are back as a must-visit.

The competitiveness of imported products is key to their success in our local market. Importing

from countries with lower manufacturing costs allows businesses to offer competitive prices, attracting priceconscious consumers. Imported products can also bring variety and innovation to the local market. Local manufacturers may have limitations in resources, technology, and expertise, hindering their ability to offer diverse products, or they may be hindered by being too small to compete when ranging in store is constrained.

Importing goods provides access to a wide range of options, including innovative and specialised products not available locally, expanding consumer choice and promoting market dynamism. Importing also grants businesses global market access. International suppliers have established distribution networks and economies of

Balancing support for local industries and capitalising on global opportunities is crucial for New Zealand’s economy. Local manufacturing contributes to job creation, economic growth, and selfsufficiency, and we need a collaborative approach that combines the strengths of both local and imported goods. A balancing act that needs experience at the helm.

www.fgc.org.nz

The NEW ZEALAND BEVERAGE COUNCIL is an industry association whose members cover all aspects of the non-alcoholic beverage market both in New Zealand and the export markets.

The Council members are spread throughout New Zealand and come together annually for a conference that covers industry issues and is addressed by international speakers. The organisation monitors product quality, sets standards for the industry and runs national competitions and awards.

PUBLISHER Tania Walters

GENERAL MANAGER Kieran Mitchell

EDITORIAL DIRECTOR Sarah Mitchell

EDITOR Caitlan Mitchell

EDITORIAL ASSOCIATE Annabel Maasdam, Sam Francks SENIOR DESIGNER Raymund Sarmiento

SENIOR DESIGNER Raymund Sarmiento

BusinessNZ has said that the Government’s Budget announcement provides a well-being boost for some, but is light on business investment.

Chief Executive Kirk Hope said most benefits for business are fringe in nature.

“Reduced public transport costs, scrapped prescription fees and increased ECE entitlements may have a benefit for some business owners and employees, but if we want real growth-promoting policy,

businesses will need more direct investment than that,” said Hope.

Hope said some positives from the announcement include investment in the gaming industry.

“Further investment in cyclone recovery and education are essential and welcome to get New Zealand back on track. Businesses were also hoping to see investment in infrastructure and immigration to assist in increasing productivity.” Read more here

Award-winning local brewers RedDot BrewHouse, Brewlander, Sunbird Brewing Company and Lion Brewery Co are among the headlining brands of Singapore-made craft beers at Beerfest Asia 2023, taking place from 22 to 25 June on new festival grounds at the Kallang Outdoor Arena, the open carpark space outside Leisure Park Kallang.

With over 600 varieties of beer from around the world, the 13th edition of Beerfest Asia will feature the most extensive line-up of exhibitors ever at the event, with over 100 booths offering top-selling brews, fresh new flavours and a unique curation of gourmet food over four days for beer

Foodstuffs North Island Merchandise Manager of Produce Brigit Corson, with Primor Head of Domestic Avocado Sales Regan Booth, explained what had happened to New Zealand Avocados.

As a favourite toast topper for Kiwis, many have noticed Avocados have become scarce from supermarket shelves lately. Foodstuffs North Island’s Produce Merchandise Manager Brigit Corson revealed a few things at play.

“The main reason we’re seeing fewer Avocados on supermarket shelves is because the Avocado season has run short,” Corson shared.

enthusiasts and festival-goers.

Highlights include top-rated Australian craft breweries Range, Mountain Culture, One Drop and Deeds, Vault City from Scotland, Sudden Death from Germany, Overtone, Tartarus and North Brewing from the United Kingdom, Jing A from Beijing and Young Master Ale from Hong Kong. Beerfest Asia also welcomes local breweries joining the festival for the first time, such as Rye and Pint, Ollie Hard Seltzer and Alive Brewing.

Attendees can expect a buzzing entertainment line-up with over 30 musical acts across four days.

Read more here

Primor’s Head of Domestic Avocado Sales Regan Booth, who supplies most of the Avocados for Foodstuffs North Island’s PAK’nSAVE, New World and Four Square supermarkets, added that New Zealand was currently sitting between two seasons.

“This hasn’t happened for a few years now. Normally we have our old season and our new season mash together, so we don’t run out of product, but this year it just hasn’t worked out,” said Booth.

Read more here

Foodstuffs North Island is pleased to announce the opening of the brand-new Four-Square Te Kowhai in rural Waikato. Featuring the latest designs and innovations, the store is operated by first-time owners Satnam and Randeep Kang. Designed to meet the needs of the Te Kowhai community, there’s a focus on convenience and ease with the new store offering a wide range of essentials, fresh foods, and self-checkouts, along with a great range of convenient meal solutions.

Read more here

The 2023 Grocery Charity ball has been announced, with tickets for the premier event now on sale. The event is one for the social calendar for all those in the grocery industry. Set to be held on the 14th of October 2023 at the Great Room in the Cordis, Auckland, the event has a black tie dress code.

Read more here

Economic activity remained finely balanced at the start of 2023, with a strong labour market, rising interest rates, and weather disruptions all significant influences on a cautious but still robust start to 2023. Infometrics’ March 2023 Quarterly Economic Monitor showed a 2.7 percent per annum rise in provisional economic activity in the March 2023 quarter, although several indicators signalled a more challenging economic outlook.

Read more here

As an established brand of paper towels, Tuffy recently saw an opportunity to energise sales by refreshing its branding and packaging.

the value of standing out,” said Grantham.

“One of the keys to that is packaging and, even with well-known and successful products, a packaging refresh can get immediate results- as well as long-lasting ones.”

Onfire moved away from the previous masculine look and aimed to appeal to a broader audience. Built around the line ‘Mess Happens. Get Tuff.’ the packaging was modernised with fun and colour not usually associated with paper towels.

In a generic and highly commoditised category at the Point of Sale, Onfire Design was tasked with giving Tuffy a modern edge to make it stand out from the competitors.

Led by Creative Director Matt

Grantham, Onfire challenged its client, Cottonsoft, to take a less conservative approach, reflect more contemporary values and capitalise on the value of the brand name ‘Tuffy.’

“Experienced brand owners that compete in crowded markets understand

As a result, new life has been breathed into the mature brand, and Tuffy has regained real presence on the shelf.

To complement the new packaging, Onfire has also developed a communication strategy for a national campaign featuring a new TV spot.

“We take all the values and features that make up an identity and translate

them into visual elements that customers love. It’s more than packaging. It’s all about communication and story-telling that can carry across any media,” shared founder Sam Allan.

To ignite your brand, get in touch with Sam and Onfire Design at 09 480 2036 or 021 608 204.

www.weareonfire.co.nz n

“It’s a region with some dynamic economies and powerful consumers, yet communities live under poverty and are the frontline of climate change impact. It’s a privilege for me to lead this movement designed to work at the intersection of such forces,” said Nathan.

Nathan worked with Fairtrade in India between 2015 to 2017, after which he worked with not-for-profits before returning to Fairtrade as CEO. Nathan revealed that working with the organisation had felt like a homecoming, as Fairtrade was the organisation where he began his career in the development sector.

Senthil Nathan CEO, FAIRTRADEThe new CEO of Fairtrade, Senthil Nathan, is excited about his new position, sharing that the idea of Fairtrade is well known now, more than ever, specifically in Oceania.

Having worked closely with smallholder communities in most of Asia and Oceania, across these countries, and as varied as they are, Nathan said that the aspirations of each smallholder community were the same.

“They need fair prices which will help them to lead a dignified life, improve their farming practices, and provide necessities for their families.”

When sharing why fair trade was important to him, Nathan said that when consumers walk into a supermarket and choose a product, they choose between paying the lowest price or choosing sustainable products. Nathan gave the example of whether a consumer should choose a product that alleges its sustainability or a product certified as fair trade.

“Fairtrade remains the best option by far. When a consumer buys a product with the Fairtrade mark, the value directly flows through to the producer communities as Minimum Price and Fairtrade Premium.”

When consumers choose a Fairtrade product, the choice compounds and has the power to transform the world. Furthermore, the Fairtrade mark is the world’s most ethical label.

Nathan elaborated Fairtrade’s practices are outlined by three key features, Fairtrade Minimum Price, Fairtrade Premium, Fairtrade Standards, and Ownership by Producers. Fairtrade Minimum Price for all commodities acts as a safety net for farmers and workers, protecting them from market fluctuations and helping them plan for the future. Secondly, Fairtrade Premium is an extra sum paid to a community fund where the product is produced. Then the community democratically decides how to spend it based on their environmental, social and economic needs.

Nathan commented that this funding could be for anything from health centres to new farming equipment and solar panels for electricity.

Thirdly, Fairtrade Standards, wherein producers and traders must meet standards or rules about conducting their business to be considered fair trade. This encapsulates environmental protection, fair pay, and gender equity.

To monitor these standards, an independent body conducts audits to make sure that the Standards are being met.

Finally, Ownership by Producers is a method of conducting business where Fairtrade is the only certification system co-owned by the producers, who have 50 percent of the votes in the organisation’s decision-making. Therefore, producers have the opportunity to help shape the Fairtrade Standards and prices so that they genuinely benefit.

Consumers globally have become more focused on the impacts of their purchasing decisions, with a global study revealing that 94 percent of those surveyed wanted to live a more sustainable life. In New Zealand specifically, research conducted through Kantar revealed that from 2000 New Zealanders surveyed, 90 percent were committed to taking action to live a more sustainable lifestyle, which has increased by 9 percent in 12 months.

Furthermore, Fairtrade is one of the most recognised ethical labels in New Zealand, with 55 percent of New Zealanders surveyed stating that they knew buying fair trade products was essential.

Consumers and businesses have grown more knowledgeable about the impact of Fairtrade, with ethical sourcing transitioning from a ‘fringe’ issue to a part of the mainstream. Nathan explained that this growing awareness and understanding has meant that ethical sourcing has become a manner of making good business decisions.

Nathan shared that Fairtrade has remained driven by addressing the inequities of the trading system. He offered the example of cocoa farmers worldwide, with approximately five to six million global cocoa farmers who possess mostly small farms in areas such as Cote d’Ivoire and Ghana, where 70 percent of the world’s cocoa is produced. The cocoa industry is dominated by nine global companies, from trading to processing and manufacturing.

“For every tonne of cocoa sold, farmers are estimated to receive less than 7 percent of the value of the final product, whereas

the manufacturers get 35 percent and the retailers get 44 percent. Pushing cocoa farmers into poverty and causing issues like child labour.”

By comparison, Fairtrade cocoa farmers are part of a cooperative or group to become Fairtrade certified, after which they have access to a market where they are paid a guaranteed minimum price for their cocoa, with their communities receiving an extra premium to spend on environmental, social and economic issues that they are facing.

“We also support them to address issues like gender equity and child labour. It’s not a perfect system, but it goes some way to redressing the balance.”

Nathan hopes that there will be more awareness around Fairtrade and that consumers and businesses will recognise Fairtrade certification as the gold standard.

However, consumers are increasingly demanding more regarding ethical practices from businesses, supported by their willingness to pay a premium for ‘green’ products. While businesses have begun moving towards sustainable business practices, Nathan warned temptation to cut corners where consumers couldn’t see was still present in some companies.

He emphasised the importance for the industry to maintain vigilance in ethical and sustainable practices being based in fact to avoid issues such as greenwashing.

When describing Fairtrade’s manufacturing processes and products, Nathan said that the organisation audits each of its products against its Fairtrade Standards, which means that with every purchase of Fairtrade coffee, for example, consumers can be confident in the knowledge that the farmer was paid

fairly, as well as the exporter, packers, and roasters. Achieving these assurances through the organisation’s globally recognised certification.

As the new CEO, Nathan focuses on building a better platform of understanding between consumers and businesses about the connection between paying people fairly for their work and sustainability. He explained that ensuring farmers can feed their families will ensure that they can take care of the environment through their farming practices, thus guaranteeing sustainability throughout the lifecycle of every product produced while also caring for the communities which farm some of the most significant ingredients in the market. n

time talking to counterparts around the world, particularly the Australian Food and Grocery Council, on how to achieve the best outcomes from the opportunities NZFGC has fought hard to achieve over the past decade. It became clear building a suite of support activities for members to equip them for operating under a Code would be critical, hence our partnership with NextGen and Matthews Law.

Sustainability remains another priority, and NZFGC has two important roles assigned by the Government in this area. First, as the co-design partner with The Packaging Forum of the Plastic Packaging Product Stewardship Scheme, and secondly in implementing the Australasian Recycling Label into New Zealand. These, along with other workstreams of our Sustainability Committee, enable us to be a key influencer and active player in what the future will look like.

The New Zealand food and grocery sector is in great shape, if the May Member Meeting and Annual General Meeting of the New Zealand Food and Grocery Council is any indication.

The around 200 delegates who attended not only heard some great speakers but also took full advantage of the opportunity to do some valuable networking that helps the sector perform well, stay connected and in good heart. It was fantastic to get a whole mix of people from across the sector –including, producers, manufacturers, supply chain experts, market analysts, salespeople, merchandisers, business advisers, food and legal experts, and recruitment specialists –in the same room chatting in an informal situation. It was hard to pull people away

from their conversations to be seated for the formal proceedings.

This was my first annual general meeting, and it was as fast-paced, interesting, and productive as has each of my first seven months as Chief Executive.

Having the Minister of Commerce, Dr Duncan Webb, update members on the legislation that will bring into being the Grocery Commissioner and the Grocery Supply Code was a coup. He was the first current Minister we have had at our AGM, and his update and clarification on the Government’s thinking on the Grocery Industry Competition Bill was invaluable.

Hearing also from NextGen, NZFGC’s partner along with Matthews Law on negotiating and informing members on the Code, would have assured members they will be in expert hands when that comes into being.

I told delegates in my annual report that getting out and about to meet as many of them as quickly as I could and building relationships with key government officials was my primary focus for my first year. Interacting with members and visiting their operations increases my understanding of the industry and the challenges members face in running their businesses, and I admit I thoroughly enjoy seeing their expertise and passion. I appreciate members being candid, and value the experiences and perspectives they share. These visits have been helpful to inform me about where to prioritise my efforts and what the work programme should look like.

The reform of the grocery industry to address the issues arising from a lack of competition as identified in the Commerce Commission’s Grocery Market Study in 2022 has been a big focus for NZFGC.

In preparation for the Code, I spent

NZFGC played a key role articulating the challenges members experienced as a result of the carbon dioxide shortage caused by the unplanned shutdown of the Kapuni plant due to health and safety concerns.

Significantly more impactful was the devastation caused by the three weather events in January and February. Though they were most significant for primary producers, some of our members experienced disruptions, and we’re all aware of their impact on food prices.

Unfortunately, such increases look like being an ongoing issue well into the current year, and even beyond, and this was something our Chair, Mike Pretty, of Heinz Wattie’s, mentioned in his annual report.

He pointed out that attempts by some to paint the big increases in food and grocery prices as solely down to suppliers showed those people did not – or deliberately chose not to – understand the many underlying issues involved.

He said that for a long time following the end of lockdowns, suppliers did a fantastic job of absorbing the cost increases, but they can do that for only so long – and that’s also true for unexpected events such unplanned outages and weather events.

Staff issues and cost pressures will most likely to be with us for some time to come, making it harder to manage and deliver affordable pricing.

But after talking to many members and visiting their operations you can rest assured suppliers are very aware of what’s going on and are working very hard to find efficiencies and hold price increases in a tough environment.

I look forward to working with the Board, which has some new members as a result of the elections at the AGM, over the coming year to support and be the voice of the members of the NZFGC in what will be a dynamic year ahead. n

With growing consciousness for food choices, consumers have also begun to reevaluate their drinking habits and the impacts of alcohol consumption on their health and well-being.

This growth in awareness and concern for personal health has driven market opportunity for non-alcoholic beverages that taste like and look like traditional alcoholic beverages. New Zealand’s social culture is underpinned by alcoholic consumption, with after-work drinks, a glass of wine with dinner, or a Sunday barbeque with beer being common occurrences.

However, with consumer behaviour transitioning to healthier lifestyles, supported by healthy food and beverage consumption, the demand for nonalcoholic alternatives has increased, allowing consumers to comfortably enjoy their favourite alcoholic beverages minus the alcohol without judgement or removing the sociability associated with drinking.

According to FMI, the non-alcoholic beer market is estimated to reach a value of USD 21.345 million in 2023, which is anticipated to increase to USD 45.0195 million by 2033 at a compound annual growth rate (CAGR) of eight percent.

Non-alcoholic beers can lower blood pressure, inflammation, and homocysteine levels. Hop beers, in particular, boost the action of the neurotransmitter gammaaminobutyric acid (GABA), which is a fundamental mechanism behind sleep. When GABA levels rise, neuronal activity decreases, resulting in a calming effect in the brain.

This positive effect on the well-being of

individuals, both physically and mentally, has further driven the non-alcoholic beer market.

In the United States, non-alcoholic beer accounted for 31.2 percent of the global market share in 2022. Comparatively, China is expected to command a significant proportion of the market share over the next decade. The accessibility of various flavours and low-alcohol content beers across supermarkets and online channels in China is anticipated to drive sales at an 8.3 percent CAGR over the forecast period.

Data has also revealed that in New Zealand, 2.1 million consumers are either open to or have bought non-alcoholic beverages in the three months leading up to January 2023, a category increase of 40 percent since February 2022.

This change is being led by younger generations, with Generation Z consuming up to 20 percent less alcoholic beverages than millennials, as the perception of alcohol for younger generations, regarding its impact on mental and physical welfare, differs from the socialisation aspect it is often associated with.

With this generational change in the perception of alcohol and the growing consciousness of consumers making food and beverage decisions based on health benefits, the market for non-alcoholic beverages will experience significant growth and innovation opportunity. n

0%* alcohol. 100% flavour.

Founder and director of Finery, Jane Allan, shared that she was a mother of two boys, aged 11 and 8 years old and had a background in management across development and construction, mainly regarding financial and project management.

Jane Allan Founder & Director, Finery

Jane Allan Founder & Director, Finery

panning back 20 odd years, a male-dominated industry with a heavy drinking culture. In the late ‘90s, I worked two jobs, by day in a developer’s office and by night at local bars and nightclubs,” said Allan.

In 2018, Allan’s sons were six and three, and while working full-time on high-end renovation projects, she had also taken on a training programme for a leaner, healthier lifestyle and body. As part of her training programme, Allan reduced her alcohol consumption to one alcoholic beverage per week.

After two weeks of no alcohol consumption and eating a raw, wholefood diet, Allan noticed a remarkable improvement in her mental and physical health. This led her to reevaluate her diet and lifestyle regarding beverages to improve her overall health.

Allan commented that Australia and New Zealand have a socially dominant drinking culture. When she wanted to maintain the sociability of going out with friends, Allan wanted not to be judged while having a drink minus the calories with little to no alcohol.

“Nothing on the menus told me ‘it’s ok you’re not drinking’. Everything was childlike or full of sugar.”

For Finery, creating a beverage for New Zealanders that affirmed that it was okay to drink or not drink alcohol was the primary goal. Secondly, it was for the beverages to look and taste the same, to remove the

question of why someone was not drinking. Furthermore, normalising ‘mixing it up’ underpinned Finery’s goals for future generations as the business aims to change New Zealand’s established drinking culture. Allan hopes that by the time her sons reach an appropriate drinking age, Finery has addressed New Zealand’s drinking culture and made a positive change towards helping New Zealanders build healthier relationships with alcohol, removing the binge drinking culture that has been prevalent since the ‘80s. By 2030 Finery, as part of the broader zero categories, intends to have reshaped New Zealand’s drinking culture by ensuring that better-for-you low and no-alcohol beverages are accessible and affordable throughout New Zealand.

Allan described the demand for the zeropercent beverage market as a reflection of consumers prioritising their health and wellbeing, elaborating that the pandemic was a turning point for many as time was allowed to slow down and New Zealanders were able to assess what habits they had in their personal and working lives that they did or did not like.

Over-consuming has become a common phrase for consumers who have reflected on incorporating zero-percent beverages into their weekly routines.

Allan noted that consumers are inclined to mixing their favourite everyday beverages with an in-between option, choosing lower calorie and carbohydrate options of their favourite flavours. Secondly, Allan shared

arage Project has introduced its Tiny Hazy IPA and Tiny XPA. The range is specially fermented, giving the juicy hop character and tropical aromatics Garage Project is renowned for, all without the alcohol. Full of big flavour without booze, these tiny but mighty beverages can be enjoyed anytime.

that consumers still enjoyed drinking. However, the push for zero-percent resulted from the desire to half alcohol consumption, with some choosing to leave drinking for special occasions only.

Growth within the better-for-you market centres on creating availability and accessibility to support consumers wanting to make healthier choices. This includes ensuring there are limited options with preservatives and artificial ingredients, which, if they are present, Allan advised should be clearly labelled to help consumers discern between their options.

“There is certainly room in this space for quality sparkling wine varietals, great tasting beer options and creative adult ready-todrink options.”

Allan revealed that Finery had exciting innovations and longer-term projects underway that have presented the company with opportunities to develop new beverage ranges using local ingredients ready for Spring to support consumers looking to moderate and choose a healthier alternative for their health and the environment.

However, the most significant challenges the zero beverage industry faces moving forward is shelf space and location in supermarkets. Allan shared that zero beverages needed to be in the correct location to help consumers buy fewer alcoholic beverages in favour of zero drinks. Therefore visibility and location are critical for consumers to avoid missing buying opportunities.

Furthermore, Allan shared that with the category’s growth, new brand offerings will enter the zero beverage space, making product development and innovation important to maintain a point of difference to avoid having copies of the same flavour or beverage with a price war between manufacturers.

Thirdly, Allan stated that working closely with category managers to inform them of new developments and innovations in the zero beverage space was vital in helping the category’s growth and giving consumers access to the best options.

Finery prides itself on its unique flavour combinations that are light and refreshing,

designed to be consumed daily as individuals would enjoy a glass of wine with dinner. The range has been crafted to replicate the brand’s low-alcohol recipe from 2019 from a seven-times distilled white spirit, with its overarching goal being to present consumers with a choice to drink or not drink alcohol without judgement.

“Our drinks look the same and taste the same with or without alcohol, leaving the social validation out of the question.”

Each Finery drink is crafted with health and well-being at the forefront, with little to no sugar, and no preservatives or sweeteners, using locally sourced ingredients where possible whilst maintaining flavour and affordable price points.

The packaging is light, recyclable and 100 percent home-compostable.

Allan’s personal favourite Finery beverage is the Giner Green Tea, Honey Mint and Lemon in either the zero or five percent.

“Is so mouthy, and we have just reformulated the recipe to give that extra Ginger spiciness. I love this tipped-over ice on its own or with a slice of lemon.” n

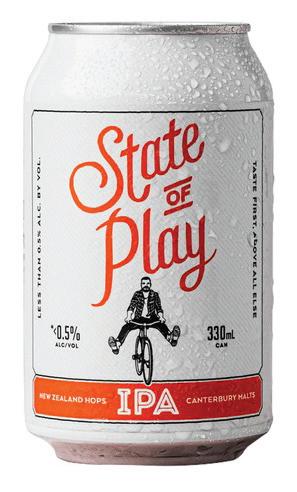

Founder and CEO of State of Play Brewing, Grant Caunter, shared that his first real job was at DB Breweries, which he started in December 1996, which was the start of a 25year career that has landed Caunter his dream job as the global director for a craft and variety at Heinkein based in Amsterdam. Here, Caunter oversaw an annual five billion euro global portfolio.

“Ihave always loved working in the beer industry, the people are a special breed, and I searched the world for great beers in amazing places wrapped up in very cool stories.”

Cauntershared that the beer quickly plays out in real-time with product innovation and marketing to mirror the social mood and trends. The CEO stated that New Zealand leads the way for craft beer, with retailers and hospitality in New Zealand quick to showcase the latest trends for a public interested in trying new and exciting things.

While Caunter was at Heineken HQ, he carried his experiences in crafts to the company’s most prominent beer markets, where he was tasked with expanding Lagunita into 45 different countries, forecasting growth in new-to-craft markets, and streamlining the craft model, balancing the demand for innovation, in conjunction

with developing core brands scalable into retail as well as on-premise.

Caunter shared that all was well until March 16th 2020, when he received an email explaining that due to COVID-19, he was in lockdown and would not be able to come into the office, or travel, with no people contact. He shared that he did not return to the office for the last 18 months of his employment with Heineken.

“Already 145 kgs, unfit with sleep apnea, and constant hangxiety, I was coping like a lot of other people with daily happy hour, that got earlier and earlier.”

Caunter shared that when outdoor bar terraces opened again, he felt that things were out of control with the number of times he went out to enjoy double IPAs. Therefore, on the 3rd of July 2020, Caunter and his wife Nicky stopped drinking alcohol to retake

control and commit to change, sharing that alcohol was at the centre of both of the couple’s bad habits.

The zero scene in Europe was already expansive, with 10 percent of the beer market being non-alcoholic. Within 45 weeks, he was 45 kilograms lighter, no longer using a sleep apnea machine and had a resting heart rate of 20 beats per minute less than before.

After finishing his assignment with Heineken, Caunter returned to New Zealand in September of 2021. After two weeks in MIQ and another lockdown, Caunter enjoyed a zero percent beer.

However, New Zealand had few zero options outside of imported products. With extensive experience, Caunter wanted to expand New Zealand’s zero-percent choices to include full flavour, naturally brewed, alcohol-free beer.

At the beginning of March 2022, Caunter began State Of Play Brewing, New Zealand’s only zero-alcohol brewery.

Caunter launched an IPA, followed by a dry-hopped Pale Ale in November, and later this month, he will launch a world-first fusion brew of Sunbreaker Ale with ginger, lime, and honey.

The latest supermarket data has revealed that State OF Play Brewing has had a significant year, its volume growth to the craft category in the past six months, placing the company as the 6th most considerable volume growth contributor of all craft brands. Nationwide, State Of Play Brewing has 30 percent distributions, and with the upcoming ‘dry-July’ month, State of Play Brewing's zero percent beers are well positioned.

The zero-alcohol category in New Zealand has exceeded two percent of total beer, with growth at 65 percent, with the market first propelled by major brands such as Heineken. The growth and popularisation of zeroalcohol beer have opened up opportunities for independent brand growth as consumers move away from alcohol-removed pilsners to new, fuller, flavourful brews.

“This is the shift from drinkers needing a zero (functional requirement) to wanting a zero (emotional and social benefit). It’s no longer shameful taking a craft zero to a BBQ.”

Caunter shared that the increased quality of zero-alcohol beers has directly caused a decline in mid-strength beers. The CEO predicted that in 18 months, the zero-alcohol market would get closer to a four percent market share. With consumers demanding high quality, Caunter stated that alcohol removal does not provide the same experience of the taste of an IPA or Hazy, which is where State oOf Play Brewing has decided to brew with a new yeast strain that ferments

New labelling regulations from New Zealand food safety have been outlined, with the enterprise reminding food businesses that from the 1st of August, 2023, a pregnancy warning label must be included on alcoholic drinks that contain more than 1.15 percent alcohol when they are for retail sale, with the exception for when the alcoholic drinks are packaged in the presence of the purchaser. Alcoholic beverages packaged and labelled before the 1st of August can be sold without a pregnancy warning label. Pregnancy warning labels on corrugated cardboard packaging used for multiple individual units of alcoholic drinks are permitted to be in a single colour on a contrasting background when a post-print process is used, which is a requirement applicable from the 2nd of February 2024. n

by converting only simple sugars, ensuring a flavour profile, with the hop highlights and experience consumers want, while being low in sugar with only 59 calories per can.

Furthermore, Caunter emphasised that zero beer is nutritionally healthier than sports drinks as its nanotonic, containing the precise amount of vitamins, minerals, and carbohydrates needed for refreshment. Caunter shared that alcohol is a depressant, with the body focussed on converting alcohol before addressing the food it was drunk with, incrementally adding weight to the scale, which low-carb beers do little to help with.

“The only way to enjoy a beer and kick off the weight is with a Zero alcohol brew.”

Caunter stated that New Zealand is leading the category with its taste with the ingredients list, including hops, malts, and natural adjuncts combined with speed to

market, which is good for New Zealand beer drinkers.

The CEO predicted that three groups would drive the zer alcohol market. Firstly, those like Caunter who love beer but want it without alcohol. The second includes what Caunter described as the moderators, consumers who consider alcohol-free a good choice for a mid-week drink or an inbetweener. The third group consists of the younger generation of 20 to 30-year-olds, who Caunter explained have a different relationship with alcohol, with him pointing

out that many choose to avoid alcohol altogether.

Caunter revealed that State of Play Brewing is brewed entirely at BStudio in Napiers, with the product containing 0.37 percent alcohol, which is less than orange juice or a ripe banana, and each beer is pasteurised once it is canned, making it stable and capable of maintaining flavour for longer.

Speaking of his favourite, Caunter revealed he loved an IPA after sport and State Of Play Brewing’s Nectatron with food as it complements anything spicy. n

Following the pandemic, health and wellness lifestyles and products have experienced significant growth, with the latest data suggesting that the category will grow to a value of USD 13,459,600 million by 2032 at a CAGR (compound annual growth rate) of 6.9 percent.

The COVID-19 outbreak prompted industry stakeholders to innovate and explore new revenue streams in health and wellness. However, the pandemic is only one aspect driving the health and wellness category growth, other aspects include the innovations of gadgets and cutting-edge fitness and healthtracking technology, cosmetic and anti-aging goods, the rise of health facilities, increased government spending on advanced healthcare facilities, as

well as the increased popularity of wellness tourism.

Currently, the health and wellness market has been dominated by the United States regarding generated revenue, of which there is an estimated continuation over the next decade.

However, the Asia Pacific is a close contender, with it expected to become the most opportunity-rich area for the health and wellness category as a result of its dense population, expanding urbanisation, innovation, and liberalisation of the market for foreign direct investment (FDI) according to Future Market Insights.

Health and wellness products encompass a spectrum of the food and beverage industry and businesses, including also the beauty and cosmetics industry, on a worldwide platform.

Data has suggested that younger generations in emerging regions are willing to pay a premium for health and wellness products in conjunction with the increasing sensitivity and trends towards physical fitness.

As people’s health awareness grows, producers are innovating

health and wellness products to cater to consumer demands for free-from, organic, lowcholesterol, sodium and saturated fat options.

Furthermore, the increased prevalence of chronic diseases and illnesses has propelled market growth for health and wellness products. The North American market currently holds a share of 33.6 percent. Conversely, Europe accounts for 39.9 percent of the global market for health and wellness products.

Organic foods currently dominate the health and wellness category at 31 percent, as they cater to consumer demand for clean, pure ingredients with better flavour, high antioxidant and mineral content, and numerous health and immunity benefits.

The popularity of the organic segment in health and wellness products has, consequently, created greater demand for organic fruits, vegetables, meats, dairy, nad baby foods as consumers have become more knowledgeable about the impacts of overly processed foods on their general welfare. n

The remarkable journey of AFT Pharmaceuticals, founded by Dr. Hartley Atkinson and his wife, Marree is a testament to the transformative power of passion, perseverance, and a commitment to improving people’s health.

effective pain relief.

From humble beginnings in a garage with a mere $50,000 in capital, AFT Pharmaceuticals has emerged as a local success story, generating over $150 million in annual global sales. However, Atkinson quickly acknowledged that the path to success had been challenging, and the company’s evolution remains an ongoing process.

At the core of AFT Pharmaceuticals is an unwavering ethos centred around selling products that genuinely enhance individuals’ health. Unlike many other pharmaceutical companies, Atkinson and his team have consistently prioritised patient well-being, believing that certain drugs like codeine or opioids should not be widely used. In pursuit of this vision, AFT developed and patented Maxigesic, an alternative analgesic that avoids these substances while providing

Innovation lies at the heart of AFT’s approach, addressing unmet needs that larger pharmaceutical companies often overlook due to the limited commercial potential. AFT’s dedication to tackling challenging conditions is exemplified by products like Pascomer, a cream for treating a rare disfiguring skin condition called facial angiofibromas in children, a topical treatment for strawberry birthmarks in newborns, and an antibiotic eye drop for combating superbug eye infections.AFT’s commitment to making these products available is evident in its decision to fund research from profits generated by existing products.

What sets AFT Pharmaceuticals apart is its emphasis on over-the-counter innovation. AFT continually develops products that address specific patient needs through independent global studies and collaborative relationships with doctors in Austin, Texas, and Barcelona, Spain. Dr Atkinson acknowledged the complexity of product development, especially when large-scale clinical trials are

involved. Yet, AFT has obtained approvals in more than 60 countries worldwide, including every European Union nation and the United States. The company takes pride in being the first New Zealand-based company to gain approval for a clinical trial-driven patented pharmaceutical in these regions.

A shining star in AFT’s portfolio is Maxigesic, a unique combination pain relief medication that has gained significant popularity since its introduction in New Zealand in 2010. Clinical trials conducted in the United States have demonstrated that Maxigesic provides 78 percent more effective pain relief than paracetamol alone and 36 percent more relief than ibuprofen when taken at the maximum dose. The effectiveness of Maxigesic against these two common pain relievers is undeniably clear.

Building on its success, AFT Pharmaceuticals recently launched into supermarkets and pharmacies nationwide for Maxigesic Cold & Flu Hot Drink. This world-first product has combined paracetamol and ibuprofen in a lemon-flavoured

beverage to effectively alleviate cold and flu symptoms. With the same patented formulation as Maxigesic tablets, the hot drink represents AFT’s commitment to delivering innovative solutions across various formats. Additionally, AFT has a range of Maxigesic extensions currently under regulatory approval, with others in the pipeline.

The COVID-19 pandemic has catalysed a heightened interest in personal health and wellness, leading consumers to take greater responsibility for their wellbeing. AFT Pharmaceuticals has observed this trend and experienced substantial growth in the over-the-counter medicines sector. AFT’s liposomal vitamin C product, Lipo-Sachets, has grown remarkably since the pandemic began.

Looking ahead, AFT Pharmaceuticals is poised for continued growth and innovation. With over 70 new products set to be launched in Australia and New Zealand in the next three years, including potential pre and probiotic offerings, the future holds great promise for this growing Kiwi success story. n

Professor Julia Rucklidge from the University of Canterbury has an online course about nutrition and wellness. Rucklidge trained as a clinical psychologist over 25 years ago in Canada.

Amid her PhD, her supervisor Bonnie Kaplan told Rucklidge about families in Southern Alberta, Canada, who were using nutrients, specifically vitamins and minerals in a pill form, to treat severe health disorders, including bipolar disorder and depression. Throughout her training, Rucklidge had been taught that nutrition was irrelevant to brain health.

“It was a bit of a disconnect with my education to hear about these stories. These families were claiming to be doing very, very well with additional nutrients to the point where some of them no longer needed medications,” said Rucklidge.

Rucklidge completed her post-doctoral training in Toronto and moved to New Zealand in 2000. However, she kept hearing of Kaplan’s research, which was publishing interesting preliminary findings regarding nutrients and brain health, which prompted Rucklidge to undertake to study it herself with the mindset that either her research would prove that they did not work, which would be of help to individuals investing in purchasing supplements, or it would prove that it did work, which would again be beneficial public knowledge.

Therefore, Rucklidge began clinical trials approximately 15 years ago. The publishing data made her realise that what she was taught in training was entirely incorrect, as her research (and that of others) showed that micronutrients were central to brain health.

Secondly, she learned that the vitamins and minerals used in her clinical trials, which have specific dosages, were making an incredible impact. Rucklidge emphasised that consumers checking the dosage on the label of the supplements they take was imperative, as products can be marketed based on the presence of an ingredient rather than whether its presence is sufficient to execute the benefits of the said vitamin or minerals.

With growing consumer consciousness on health and well-being, specifically, a drive to build healthier habits following the pandemic, Rucklidge warned that the percentage of ultra-processed foods which are marketed with terminologies associated as a health benefit, for example, ‘plantbased’, are foods consumers need to be wary of due to their micronutrient profiles and as Rucklidge cautiously stated, could be toxic to consumer health as research is showing that consumption of ultra-processed foods is a significant risk factor for poor mental health outcomes. Rucklidge quickly commented that there were plant-based products that were indeed healthy. However, the trained clinical psychologist and professor emphasised concern over the liberal use of specific labels and terms associated with health that are not accurate indicators of the health value of a product when the processing and actual nutrient levels were correctly assessed.

“It’s empty advertising.”

Furthermore, Rucklidge cited NZ research that showed that 42 percent of two-year-olds’ diet was made up of ultraprocessed food, increasing to 51 percent as children reach the age of five, which are critical years of development during children’s lives.

The concern Rucklidge shared over the labelling and actual nutrient value of foods was centred around her concern for New Zealander’s health and the chronic illnesses many New Zealanders face, an issue Rucklidge iterated should be a concern for all. Rucklidge revealed further that the average New Zealander consumes 37 teaspoons of sugar every day, posing the question of where this is coming from.

“The food industry could play an important role in reversing [chronic illness] by stopping selling these types of products to consumers and being concerned about the health value of their foods.”

Rucklidge revealed that processed foods dominate New Zealand supermarket shelves, estimating that 69 percent are over-processed. The research Rucklidge conducted has shown that vitamins and minerals in specific dosages for optimum efficiency for mental health improved psychological function and mood regulation, with decreases in stress with improvements in attention, which

suggested to Rucklidge that the foods people are eating are not nutritionally adequate.

Rucklidge further shared concern over the significant increases in food prices, with difficulty for those on low incomes to eat well, given the direct relationship between wellness and food consumed.

“How is it that 20 percent of New Zealanders are food insecure?”

The clinical psychologist shared that with New Zealand’s capacity to feed 40 million, that consideration into prioritising New Zealanders being fed must be addressed.

When advising consumers, Rucklidge shared that while ultra-processed foods don’t need to be wholly eliminated from diets, it would be best to only take up to 20 percent of consumers’ diets, encouraging consumers to prioritise the intake of whole foods, such as fruits, vegetables, legumes, seeds, fish for its essential fatty acids, and grass-fed beef to avoid creating deficiencies. Rucklidge discussed this was a risk when doing restrictive diets such as veganism or vegetarianism.

When discussing the intake of supplements, the key feature that Rucklidge emphasised consumers and manufacturers alike should prioritise is the dosage of the advertised ingredients. Using the example of fish oil, the EHA and DPA content of

fish oil supplements was imperative to investigate. One gram is the minimum requirement for the supplement to make any impact consumers desire based on their reason for purchasing it. Furthermore, specifically for fish oil, those older and seeking joint relief must consume more to feel the supplement’s benefits.

Rucklidge shared that she believed there should be regulation on the products. However, the issue was complex as supplements are technically food.

When advising manufacturers on the health of producing their products, she encouraged consideration of pesticides used for crops as these can have health consequences.

From her research, Rucklidge hopes that it could impact the population, government, and food producers to recognise and take responsibility for the effects of food on the health of New Zealanders. She pointed out that there were many ethically minded food producers. However, some still needed to address the implication and consequences of their products for consumers. Secondly, Rucklidge hoped the research would support broader knowledge and awareness of the connection between nutrition and psychological and physical health. n

Little Island, the New Zealand brand well known for its award-winning dairy alternative ice cream and ice blocks, yoghurt and milk, has taken a fresh look at the supermarket offering with the launch of its new blended milk range into stores this April. The range includes

Blends make for better-tasting and more balanced milk and deliver more functional health. All Little Island milk is unsweetened, providing 25 percent of daily calcium, D2

and B12, and is phosphate-free. These milks go well on their own or in smoothies, cereal, and breakfast bowls, and all four can be foamed and added to your daily coffee.

For more information, visit www. littleislandcreamery.co.nz or Email the team at orders@littleislandcreamery.com. n

The parent company of Keto Food Co, Conscious Foods, was founded by James Ehau, Tamati Norman, and Mikki Williden, who are passionate about healthy living and creating a positive impact in people’s lives through better nutrition.

The three founders met through a mutual interest in health, nutrition, and fitness. The trio quickly discovered they shared a common vision for creating ketofriendly products and promoting a healthier lifestyle.

Ehau’s journey into the keto world began after the passing of his father from type 2 diabetes in 2004. He learned that a keto or low-carb diet could have potentially reversed this condition, which sparked his

interest in promoting better nutrition.

As a personal trainer at Les Mills and an entrepreneur, he set up one of the first companies to sell keto products in the US in 2016. However, due to the Covid pandemic, he returned to New Zealand and wanted to help bring keto-friendly options back home.

Norman’s background was in food import and export to and from Papua New Guinea, which provided valuable experience

and insight into the food industry and Williden, who is a nutritionist with a PhD in nutrition, added her scientific expertise to ensure that Keto Food Co’s products were both delicious and nutritionally sound.

Mikki, a nutritionist with a PhD in nutrition, added her scientific expertise to the team, ensuring that the Keto Food Co’s products are delicious and nutritionally sound.

The Keto Food Co brand was launched in 2021. After

extensive supply chain and brand development, the company landed on supermarket shelves with Foodstuffs in May 2023.

Keto Food Co has aimed to make keto-friendly alternatives to traditional food products easily accessible and enjoyable for the more health-conscious consumer.

Crafting keto products combines a need for science, nutrition, and culinary expertise. The trio ensures that each area is fulfilled through extensive personal research into the ingredients used, the nutritional values, and the compatibility with the keto lifestyle.

However, this poses challenges as the current food service ingredients contain high sugars and starches. Therefore, the vetting process and lead times can be lengthy.

The Keto Food Co engages

with health professionals throughout their product development process, collaborating with nutritionists, doctors and other health experts to gather their insights and expertise to ensure the brand creates well-rounded products that cater to the needs of consumers while maintaining scientifically supported nutrition. Since the brand’s inception, it has consistently evolved to meet consumer demands.

“We have expanded our product range, fine-tuned our recipes, and strengthened relationships with our supply chain partners to serve our customers better,” shared Norman.

Norman shared that the three founders had noticed a significant shift in consumer behaviour towards healthier and more

sustainable food choices in recent years.

“People are becoming increasingly conscious of the ingredients in their food, the nutritional value of their meals, and the impact of their consumption habits on the environment.”

This has directly impacted the market, creating important growth opportunities for products to cater to consumers’ specific dietary needs, such as keto, paleo, and plant-based options. As a result, Keto Food Co has seen a steady increase in demand for its supplements, food products, and ready-made meals.

Keto Food Co’s products are all formulated to be low in carbohydrates to support those on keto and low-carb diets to maintain their desired macronutrient balance. Secondly, Norman shared that the brand’s products were nutrient-dense, with no added sugars or artificial sweeteners. Thirdly, the brand was proud to create convenient and accessible products, including ready-made meals for the busy consumer to easily stay on track for their desired diet, keto or otherwise while having guaranteed, flavourful food. While the brand’s range is geared toward low-carb, keto consumers, Keto Food Co has witnessed growing interest from non-keto consumers due to growing consciousness about health and well-being.

Norman shared that three founders expected the keto movement to continue gaining traction and popularity with consumers as people become more knowledgeable about its health benefits, particularly how it can support varying health conditions.

However, Norman shared that challenges moving forward included the risk of misinformation and misconception about the keto movement.

“There may be an influx of misinformation and misconceptions about the diet. Ensuring that consumers have access to accurate, science-based information will be crucial in maintaining the credibility of the keto lifestyle.”

To manage these challenges, the brand has committed to maintaining close relationships with health professionals and nutrition experts to provide reliable, evidence-based information on its products and the keto diet, including monitoring regulatory changes and continued innovation and product development to stay ahead of its competitors.

As consumer demand for health-based products has increased, Keto Food Co has committed to incorporating market research and customer feedback to create products aligned with consumer interests. Furthermore, the brand has noticed a trend towards natural, clean ingredients, functional ingredients, and global flavours, which Keto Food Co has stayed attuned to and implemented into its product development.

To manage the disruptions caused by the pandemic, Keto Food Co focused on diversifying its supplier to reduce the risk of relying on a single source for raw materials or components. Secondly, Keto Food Co prioritised the safety of stock and developed robust contingency plans to address varying potential supply chain disruptions.

Maintaining strong relationships with suppliers, monitoring global trends and making risk assessments whilst being flexible and adaptable were key features of Keto Food Co’s navigation throughout the pandemic.

“By implementing these measures, we strive to manage supply chain disruptions proactively and ensure the continuity of our business, even in the face of unforeseen challenges.”

For sustainability, Keto Food Co prioritises ethically-sourced, local, and fair-trade ingredients where possible, optimising manufacturing techniques and minimising packaging materials to reduce waste throughout the brand’s production process.

Norman shared that the company makes an effort to work with like-minded conscious companies who adopt and utilise energy-minimising practices. However, Norman also shared

that the brand focused on using eco-friendly and recyclable packaging materials, with a particular focus on soft plastic recycling.

Furthermore, the brand also encourages sustainable practices with its employees both in and out of work, committed to making a change on both personal and professional levels.

Technology also plays a significant role in Keto Food Co’s strategy as it supports streamlining its operations, enhances customer experiences, and reaches a wider audience.

Norman shared that the company leveraged technology through seven key points, an E-commerce platform, digital marketing, customer relationship management (CRM), data analytics, supply chain management, automation process optimisation, and collaboration and communication.

The brand’s E-commerce platform allows it to sell directly to consumers, and it utilises many different digital marketing challenge to generate greater activity, including social media, email campaigns, and online advertising.

Keto Food Co utilises CRM software to manage customer relationships and interactions, where the brand can give consumers personalised services and advice and gather valuable feedback. This feedback in reference to the brand’s data analytics, where it can gather insight on consumer preferences, shopping habits and upcoming market trends.

Furthermore, Keto Food Co leverages automation and process optimisation through digital tools and technologies to automate repetitive tasks and optimise processes throughout the organisation.

Lastly, digital technology allows the company to communicate with its team regardless of location.

“By leveraging digital technology in these ways, we aim to drive growth, improve our operations, and enhance the customer experience, ultimately positioning our business for longterm success.” n

With the growth of knowledge about health and wellbeing from consumers, in conjunction with the increased concern over environmentalism, consumers have become more vigilant about their purchasing decisions, taking into account the whether a product is organic, whether ingredients are locally sourced, as well as avoiding products containing long ingredients lists of including artificial flavours, colours, and any other nonorganic or natural additives.

Thus, the market for Clean Label products and ingredients has significantly grown. In 2022, the global market was valued at USD 38 billion. It was expected to continue robust growth over the next decade at a CAGR (compound annual growth rate) of 16 percent, according to FMI (Future Market Insights).

This increased demand for products cultivated using authentic, natural, and organic ingredients are driven by the consumer focus on health, with growing concerns over the impacts of products consumed on the body and mind.

The pandemic is one key feature that has driven the health-conscious consumer and the clean-label market. Furthermore, upcoming labelling changes, requiring manufacturers to specify allergens instead of using blanket terms, reflect this movement towards consumers’ desire to quickly identify ingredients, allergens, and the products’ true nutritional value.

Consumer demand for clarity and transparency of the contents of their products, including where ingredients are sourced and whether the manner they are sourced is both ethically and environmentally conscious, are key aspects propelling the growth and market opportunity for clean label products.

As consumers have become more knowledgeable and have begun scrutinising the ingredients of the products they consume more closely, this has led to significant changes for manufacturers, with many investing in research and development and innovation to cater to these consumer demands.

Furthermore, while consumers are more often basing purchasing decisions based on clean-label ingredients, they are not

willing to compromise on flavour and taste, pushing manufacturers to innovate solutions to cater to both the health benefits of clean-label products that consumers want while maintaining product flavour profiles.

Consumers’ behaviour and brand loyalty have also significantly shifted, with consumers more readily willing to switch the brands they usually buy from if another competitor has products more aligned with their values and tastes.

One of the main challenges of developing clean label products is the lengthy process as the innovation of traditional products to clean label includes the removal of highfunctioning, and established ingredients that have been long used for specific purposes, thus replacing these ingredients with clean, organic, and natural counterparts without compromising flavour or texture poses a challenge for manufacturers.

However, the popularisation of cleanlabel products and ingredients have created significant growth opportunity and has given those adhering to clean-label benefits has provided a key differential point to appeal to consumers. n

Demand for clean-label products has significantly increased as consumers have become more conscious of health and nutrition and seek transparency in their products. The head of Marketing at Tom & Luke, Rachel Morrison, revealed that the pandemic accelerated the consumer focus on better-for-you products that could be viewed as an opportunity to indulge or treat oneself.

hese trends are completed aligned with the Tom & Luke snack range, which are all based on real food with clean ingredients while also being a satisfying sweet treat, without the guilt,” said Morrison.

Tom & Luke’s snacks range is crafted from natural ingredients such as nuts, seeds and fruits, with no added sugar, sweeteners or sugar alcohols in the brand’s Snackaballs™ and no refined sugar in any of the brand’s chocolate coatings. Each product is glutenfree and non-GMO and Tom & Luke includes a range of certified vegan products.

As a Toitū-certified net carbon zero company, Tom & Luke’s packaging reflects its clean label ethos through its 100 percent recyclability through the soft plastics recycling scheme. However, the company is also part of Toitū’s carbon reduction programme, with Tom & Luke’s progressing towards becoming a certified B Corp company.

Morrison’s extensive corporate experience at the likes of Lion, Coca-Cola United Kingdom and Pernod Ricard, alongside her work with smaller, entrepreneurial New Zealand businesses such as Essano Limited and Tom & Luke, has given her the knowledge and skills to lead the development of Tom & Luke’s clean ingredient innovation pipeline, brand

strategy and marketing execution.

“I learned a lot from those companies, brands and colleagues. Since having a family, I’ve been doing more consultingtype work and have worked for smaller, entrepreneurial New Zealand businesses, which has also been amazing,” said Morrison.

Morrison shared that she’s had opportunities to create brands, develop and execute strategy and drive innovation which has taught her to be agile and creative, which the head of marketing enjoys.

However, Morrison shared that the pandemic posed challenges for the Tom & Luke brand as consumer snacking behaviour and the ability to unlock export opportunities drastically changed. Having overcome these challenges, the brand has shown continued growth in local markets. Morrison said the brand could deliver exciting growth opportunities in export markets, entering an exciting growth phase for the company.

Morrison shared that Tom & Luke’s had a custom-made manufacturing capability, which has resulted in the company operating at a unique scale concerning its Snackaball™ products.

Tom & Luke has also launched an exciting new product named ChocaDate Minis. The new snack is crafted with tiny pieces of date smothered in Tom & Luke’s signature refined sugar-free chocolate.

“We have two flavours, dark choc and white choc blueberry. I keep trying both to work out my favourite.”

When discussing her favourite snack from the Tom & Luke range, Morrison shared that she was a fan of the brand's softly textured reduced sugar range as an everyday option as it contains 50 percent less sugar than the rest of the Snackaball™ range.

“They are delicious and great in lunchboxes too. However, it’s also super hard to go past our choc coated Snackaballs…they are so good.” n

Established in 1990 as Garden City Coffee, then rebranded to Hummingbird

Coffee in 2000, Country Manager for New Zealand, Nick Cowper, shared that Hummingbird has become more than a brand.

“It was a way of doing business. That is why my family and I started roasting coffee in 2000,” Cowper said.

Cowper explained that for over 30 years, Hummingbird had been built on the principles of people committed to being involved through every step of the process, from crop to cup. This commitment has allowed the brand to cultivate relationships based on trust, sourcing beans from farmers

Hummingbird knows and supporting the communities of growers.

Known as a specialty coffee brand, Hummingbird is committed to delivering high-quality, distinctive coffees crafted to impact the communities the brand has relationships with positively.

In 2004, Hummingbird became an early champion of fair trade in New Zealand, being one of the first in partnership with Trade Aid to directly import fair trade, organic, and green coffee beans.

Hummingbird maintains relationships with coffee growers and pays a premium for fair trade organic coffee beans.

Since 2005, Hummingbird has donated over 10 million dollars in premiums to tens of thousands of growers and their respective families in 10 countries, reflecting the company’s ethos of sustainable coffee sourcing.

“The entire Hummingbird coffee range is 100 percent organic certified through our certification partner, AsureQuality. It is important to Hummingbird to work with farmers that grow coffee in a

way that makes the land they cultivate healthier, safer, and the coffee they produce is higher quality.”

The brand’s certification through AsureQuality has ensured that Hummingbird follows a stringent process to prevent non-organic chemicals from entering the source and production cycle of the brand’s product at any point.

Cowper described that before COVID-19, consumer behaviour had shifted towards buying organic and cleanlabel products, with consumer awareness around health and well-being incrementally growing, which was accelerated due to the pandemic.

Consumers are motivated to consume healthier products, including consideration and purchasing choices driven by how products are sourced and produced. This has prompted the demand for organic and clean-label products.

For the future of organic products, Cowper explained that the stabilisation of the economy following the pandemic, and the increase of consumer education around organic products, will result

in significant growth for the category as the health and environmental benefits of such products become more commonly understood.

Furthermore, Cowper predicts that more companies will move their entire range of products to 100 percent organic, rather than having only one or two organic certified products, making these practices standard rather than a specialty.

Hummingbird’s process for manufacturing is underpinned by a depth of understanding that coffee beans from different countries represent different characteristics that should be accounted for when roasted.

“We roast all our single-origin green coffee individually to get the unique flavours and characteristics of each origin.”

After the beans have been roasted, they are blended to create some of the brand’s most iconic coffee blends, including Oomph!, Nectar, and Crave.

Each coffee blend is packed within hours of roasting to ensure freshness.

In conjunction with the organic certified and fair trade sourcing of its coffee beans, Hummingbird ensures

sustainability and efficiency by investing in relationships with farmers who consciously care for the land crops are grown on. Secondly, Hummingbird invests in its equipment to keep its roasting operations up-todate and efficient. Thirdly, each product is directly delivered to stores and cafes to reduce freight time.

Finally, Hummingbird’s products are packaged in recyclable soft plastics to reduce waste going to landfills and environmental impacts, as the brand participates in New Zealand’s soft plastics recycling scheme. Customers can take their Hummingbird packs to their nearest supermarket with a soft plastics recycling bin or directly to the Hummingbird Experience Centre in Christchurch.

Cowper shared that while the uptake of organic clean-label products has been steady, it faces challenges based on knowledge around the benefits and impacts of organic products and lack of regulation around what can be labelled as organic. Companies currently can call a product organic without being certified. This can cause both confusion

and distrust within the industry and for consumers.

Another challenge for the category is its price point and accessibility.

However, Hummingbird remains proud that throughout the challenges of the pandemic, it has maintained an entirely 100 percent certified organic range, with the brand committed to continuing to deliver high-quality, fair trade organic products.

“As the market leader in fresh coffee, we must continuously educate our consumers about organic certification and lead the way of making specialty grade fair trade, certified organic coffee affordable and easily accessible.”

Cowper revealed that consumers should pay attention to the brand’s next singleorigin coffee from its Harvest range, as it will be sourced from the Marcala coffee region in Honduras.

The Country Manager iterated that the co-operative where the beans are sourced, Café Orgánico Marcala SA, was founded in 2001 by 69 farmers who set out to encourage quality and organic agriculture.

Over the years, the cooperative has cultivated over 1,200 members producing specialty-grade organic coffee, focusing on agricultural and social development. The cooperative has a school and operates organic education classes for farmers in various parts of the region and country.

“This next single origin has been developed to pair beautifully with oat, almond, and soy milk for a full, rounded mouth-feel. It has indulgent and bitter notes of dark chocolate with a hint of concentrated and sweet fruity notes of sultanas and vanilla.”

The new single origin will be available in most supermarkets in a 200g bag of coffee beans or plunger grind from the beginning of June.

Cowper shared that despite enjoying mixing up his coffee brew and blend, his personal favourite Hummingbird product was Oomph! for its versatility and fruit characteristics. n

The entire Hummingbird coffee range is 100 percent organic certified through our certification partner, AsureQuality.

Registered Nutritionist Sara Lake has worked in Quality Assurance and Operations. New labelling requirements will have more stringency around allergens, impacting manufacturing significantly.

Lake shared that while it has significant impacts, some manufacturers will be affected more than others.

“The impact on the industry will vary depending on the products made,” said Lake.

Lake explained that the critical factor affecting manufacturers would be the separation of allergens in storage, transport, and processing.

“Where previously, companies may have had one area of the warehouse dedicated to gluten-containing cereals or fish products, now they will have to separate products that contain wheat and keep their fish, crustaceans and molluscs separate.”

Consequently, this will create difficulties for dedicated equipment when handling a single defined allergen. Lake explained that while cleaning processes would minimise cross-contamination, the new labelling requirements may result in consumers noticing more the industry standard term, ‘it may contain traces of’ on product labels.

The increase of this statement on packaging will be the company’s method of guarding against the risk that traces of wheat have made their way into a cereal marketed as oat-based. Previously, these two products would have been under one identifiable label as a ‘gluten-containing cereal’, which would need to be specified separately with these changes.

Lake shared that Standard Operating Procedures around handling allergens and cleaning between products may need to change and be re-documented, requiring manufacturers to adjust operations to cater to these changes.

The Nutritionist revealed that the U.S.A. was a prime example of how manufacturers can embrace these labelling changes.

“I was very interested in what happened in the US with the new sesame labelling law. Rather than get sued for traces of sesame in products that didn’t have it on the label, companies are adding it into all their products and declaring it on the label.”

Lake shared that this approach was likely adopted because it is a more cost-effective solution than manufacturers completely re-inventing and changing their line cleaning processes.

Another impact that would have a costly effect is the need for design and reprinting of labelling across a multitude of brands and products which are not already compliant by the end of the transition phase in February 2026.

While there are technically no new allergens to be advised, allergens were previously under a single identifiable category. For example, gluten-cereal, fish, tree nuts and otherwise would be required to be specified either with more depth or made more evident on the label.

The Nutritionist revealed that while these may have significant impacts on manufacturers, the specifications for consumers of having allergen identified with more detail would be reassuring for those with allergies. For example, Lake shared that having ‘tree nuts’ means a product containing almonds or walnuts would help consumers make more informed purchasing decisions.

However, Lake shared that it may be surprising for non-allergic consumers to see more allergens emboldened on a product’s ingredients list. Furthermore, the specification requirements may also impact a brand or company’s ability to market their products to consumers, potentially limiting their opportunities to claim their products are free from specific allergens. n

The CEO of Ceres Organics, Alex Player, shared that he has always worked with the FMCG (fastmoving consumer goods) industry, starting in the United Kingdom before migrating to Australia and, finally, New Zealand. Player worked in various roles, including sales, marketing, human resources, and procurements.

“Iwas lucky enough to work for large multi-national companies such as PepsiCo and Lion, which had incredible internal development programs,” said Player.

Player elaborated that his roles in these companies were complemented by their significance in food service and distribution, allowing him an in-depth insight into the complex structures of multi-category companies and international trading.

When discussing what drew him to Cere Organics, the CEO was inspired by the company’s purpose to bring healing to the earth and humankind, as the company’s philosophy is rooted in the idea that business plays a significant role in addressing the social and environmental challenges that the world as a whole is facing.

Ceres Organics challenges itself on how it can conduct business better through informed, purpose lead decisions that balance financial sustainability with making environmentally conscious decisions that positively impact the community.

With Ceres Organics’ position as a clean, organic product company, Player has noticed a significant rise in conscious consumption, which the company calls a ‘groundswell’.