Human Dynamics specializes in providing trained human resources for the management of your warehouse

Human Dynamics specializes in providing trained human resources for the management of your warehouse

The magazine you are holding, as readers around the world, is not just another issue of the Greek Supply Chain & Logistics magazine. In the diligence of the team of journalists of the Greek Supply Chain & Logistics magazine, we created a special issue for readers from all corners of the world, to be able, in a few pages, to obtain a full picture of the course of the Greek economy – the fastest growing economy in Europe in the past 5 years- and, in particular, the logistics service provision market.

An essential introduction to meet us: O.MIND CREATIVES is the publishing company of the best known and accepted by the Β2Β market magazine on Supply Chain, Logistics, Freight Transport and Professional Vehicle, while it is also organizing company of the ‘Supply Chain & Logistics’ trade fair, unique of its kind, which has been organized continuously in Athens since 2007. In 2024 we launched a new trade fair, ‘Logistics & Transport Thessaloniki Expo’, that involves the entire Balkan peninsula and the countries of SE Europe, and that will be held on 11-13 April 2024 at Thessaloniki (you can find information in this issue).

Supply Chain & Logistics magazine, distinguished for its reliability, publishes a special issue in English annually, bringing together articles, information, market sizes, infographics, opinions and research conclusions. This special edition aims at enabling you to understand, quickly and in-depth, the course of the Greek Logistics market, as well as the degree of investment maturity of the country.

At the pages of the issue you are holding, you can find the personal approach of the Greek minister of Infrastructure & Transports, who places emphasis on the development of interconnected infrastructures of the Balkans, you can see the studies of EY, the Federation of Industries of Greece, the Hellenic Logistics Association, on the course of the economy, Freight Centres, City Logistics, while you will find articles on Logistics future trends, the assessment of 6 consultants on the Greek market in 2024, our Research data on e-commerce & last mile orchestration, as well as information about your participation on both the Thessaloniki trade fair ‘Logistics & Transport Thessaloniki Expo’ in April 2024, and the Athens trade fair ‘Supply Chain & Logistics’, in fall 2025.

Enjoy your reading with a comprehensive panorama of Greek Logistics, wherever you may be reading us!

Theodoros Dimitriadis CEO OMIND CREATIVES & Publisher of ‘SC&L’ Magazine-Greek

Subscriptions: syndromes@omind.gr www.supply-chain.gr • info@supply-chain.gr

PUBLISHER - CEO

Theodoros Dimitriadis

COMMERCIAL DIRECTOR

Antonis Moschonidis

CHIEF EDITOR

Mary Efthymiatou editor@supply-chain.gr

ADVERTISING

Manos Georgoulakis

Sofia Katsardi

George Glynos

ART DIRECTOR & GRAPHIC DESIGNER

Yiannis Ntrigios

Charis Papageorgiou

PRODUCTION EXECUTIVE OFFICER

Aggelos Anastasopoulos

SUBSCRIPTION

Eleni Vagionaki

MEDIA & MARKETING ASSISTANT

Alex Dagres

EVENTS CLIENT SERVICE

Anastasia Kolovou

ACCOUNT OFFICE

Katerina Kosiva

SECRETARY Maria Michalochrista

TRANSLATION Intertranslations A.E.

Owned by:

Dimitriadis Th. & Co PC

187, A. Syngrou Avenue 17121

Nea Smyrni Athens Greece

Τ. +30 210-9010040

F. +30 210-9010041

www.omind.gr • info@omind.gr

Follow us on...

Tightly connected network of correspondents all across Europe - daily connections

Private warehouse facilities in Attica and Thessaloniki area

High quality performance for more than 50 years

Custom-made

24/7, our biggest asset

I• BY MARY EFTHYMIATOU, CHIEF EDITOR OF SC&L MAGAZINE

I• BY MARY EFTHYMIATOU, CHIEF EDITOR OF SC&L MAGAZINE

n a market accustomed to operating with disruptions, 2024 has commenced with a terrible crisis that affects supply chains at a global scale, the prices of goods (also at a global scale) as well as their delivery times with no imminent end in sight...

We are referring, of course, to the crisis that erupted during the Christmas season of 2023 in the Red Sea, with the attacks of the Huthi insurgents against merchant ships that cross the straits in order to enter the Mediterranean Sea through the Suez Canal.

The impact of the crisis on Piraeus port and product prices

Already during the past one month and a half of this crisis, the shipping cost has skyrocketed for a whole range of products imported to Greece from Asia due to tensions in the Red Sea, since container ships now have to detour round Africa. Based on data from the Piraeus Chamber of Commerce and Industry, container import volumes at the port of Piraeus have fallen by 45% in the first fortnight of January.

By mid January, around 200,000 container ships have been detouring round Africa, since 67% of the vessels avoid crossing from Suez due to another, additional issue: insurance companies do not insure ships should they decide to cross the Suez Canal. As such, products arrive at Piraeus with a two-week delay at the very least - whatever this may entail for ‘fresh’ products and their final cost - whereas, in many cases, container ships unload their cargo in other ports, e.g. in Spain, and the recipient company is forced to pay extra freight costs in order for smaller ships to transit the goods to Piraeus.

The cost has tripled

Today (end of January), the shipping costs from Asia to South Europe (Piraeus) have more than tripled. Transporting a 40’ft container used to cost USD 1,875 before the crisis whereas, currently, it costs USD 6,150. The first delays in the arrival of raw materials from Asia to Greek craft enterprises have already been

noticed, with market actors talking about new extra costs, perhaps in excess of 10%, for dozens of products.

A huge issue is the sharp increase in insurance premiums for the ships crossing the Red Sea, which sometimes reaches a ten-fold rise. One way to address extensive delays in product delivery times on account of ships detouring round Africa, is for ships to cut down on stops at some of the scheduled ports of anchorage.

Can the Chinese ‘One Belt – One Road’ initiative offer a solution?

A Foreign Policy document (which came to light in mid January 2024) reports that a solution to this chain chaos may come from China which, in the past years, has been promoting the revival of the ancient Silk Road through the One Belt – One Road initiative; this initiative links its ports with respective major European ports through land crossings and railway networks that travel through Asia and reach Central and Northern Europe.

Of course, many analysts claim that the BRI initiative is the ultimate excuse for a new Cold War based on trade. However, the truth is that, since 2013, funds amounting to approximately 1 trillion US dollars have flowed to BRI states for construction projects and non-financial investments.

Especially for developing countries, the development of road and railway infrastructure is a prerequisite in order for them to meet domestic demands, having domino effects and leading to connectivity with global economy. The regional European states such as Hungary and Serbia also benefited from the BRI initiative.

It should be noted that long before the crisis that ensued in the Red Sea, the United States had applauded during the previous G20 Summit an alternative India - Middle East - Europe corridor as a counterweight to China’s ‘One Belt – One Road’ initiative.

What the future holds for global supply chains remains unknown and it may be too early to make predictions. What is certain is that the Red Sea crisis in the early days of 2024 has opened a can of worms that is bound to lead to enormous changes.

Every day, approximately 5,000 ships transport 5-6 million containers. The cost for transporting a 40ft (12.19m) container from China and East Asia to Northern Europe has skyrocketed above 6,000 US dollars. According to the logistics Freightos platform, the cost has tripled since 22 December 2023 and has increased manyfold since last autumn

Detouring round Africa extends one-way transport between Europe and Asia up to 15 days

Greece’s potential in terms of the growth of the freight transport sector is enormous. Our country’s geographical location and the pivotal role of Greek merchant shipping in maritime transport, create significant competitive advantages.

The Government has been working towards this direction for the past 4.5 years. It is not just a theory but something that can be proved in practice. According to the World Bank classification, the Greek supply chain sector moved all the way up to the 19th position from the 42nd in 2018.

Freight transport contributes 1/10 of the country’s GDP. Investment in logistics infrastructures and services is a strategic priority for the Ministry of Infrastructure and Transport, despite the existing adversities and challenges.

The damages caused to the railway network by the devastating floods last September, resulted in disruptions to the movement of goods, at a considerable cost for the national economy.

Working together with the Hellenic Railways Organization (OSE), tremendous efforts were made to restore the railway line without delay and the first trains to travel transported the goods that had been accumulated, mostly in the ports of Piraeus and Thessaloniki.

In the course of 2024, we will proceed with permanent repairs using resources from the Recovery and Resilience Facility.

Over and above the restoration and modernisation of the existing railway network, we are promoting long-term planning, which includes the connection of the domestic railway network to ports and Industrial Zones, to ensure seamless cargo transportation.

In the current programming period, we have included the connection with ports of Northern Greece (Thessaloniki, Kavala, Alexandroupoli), together with the connection to the new cargo port of Patra and the extension of the suburban railway in Attica all the way to the ports of Lavrio and Rafina.

In addition, we are submitting a proposal of financing from the Connecting Europe Facility-2 (CEF-2) for the following projects:

• Upgrade of Acharnes Railway Centre - Oinoi section.

• Upgrade of Liossia - Corinth section.

• Upgrade ofThessaloniki - Promachonas line.

• Implementation of Alexandroupoli - Ormenio project.

• Implementation of Rio - Patra project.

At the same time, aiming to extroversion, the Greek government has undertaken an initiative for new, European railway freight corridors, promoting at an EU level a project pertaining to the development of the “Thessaloniki - Kavala - AlexandroupoliBurgas - Varna - Ruse” railway connection.

The new connections will give domestic freight activities considerable momentum

At the same time, we have proceeded with upgrading the services of supply chain operations, based on our National Supply Chain Strategy which focuses on the following axes:

• Infrastructures’ upgrade, with the creation of new freight transport centres, such as Thriassio I and II, the largest logistics hub of Southeast Europe in Fyli, and the Gonou ex-military camp in Thessaloniki.

• Digital transformation, based on initiatives such as the participation of the Ministry of Infrastructure and Transport in the co-funded FENIX project, which is a pan-European digital information network for transportation and logistics.

• Sustainable and Green Logistics, aiming to reduce the sector’s environmental footprint.

• Improvement of professionals’ training level in the sector.

At the forefront of this effort, we find the digital transformation of procedures enhancing the resilience of the supply chain, as it was in fact proven during the pandemic.

The continuous flow of digital information in the supply chain has contributed to the strengthening of e-commerce, by making it easier for companies to develop innovative methods for the movement of goods, resulting in operating cost reduction and new customer services.

Tools, such as the pilot platform for the “Hellenic Transportation & Logistics Watch” connecting digitally the Greek with the European logistics market, provide useful qualitative and quantitative data, with a view to developing a strategy and making business decisions.

The Ministry of Infrastructure and Transport remains focused to its strategy. We make multi-faceted investments in the supply chain, aiming to make Greece the main freight gateway to Europe.

Through planning, methodical approach and fruitful cooperation with all the public, private and scientific stakeholders involved in the Greek market of freight transport and logistics, I am confident that we can succeed.

The attractiveness of Greece as an investment destination continues to strengthen.

The EY Attractiveness Survey Greece 2023 shows foreign direct investment (FDI) projects in Greece grew by 57% in 2022, at a time when investment in Europe increased by a mere 1%. The improvement in the qualitative composition of investments, is continuing, with a marked shift toward knowledge-based activities with relatively high added value. Investors’ perception of the country’s attractiveness remains positive with several key indicators further improving. Forty percent of respondents say they intend to invest or expand their operations in the country; the highest figure since the launch of the survey in 2019, now in its fifth year.

For the second consecutive year, FDI in Europe has continued to recover at modest rates, following a 13% decrease during the COVID-19 pandemic in 2020. The number of FDI in Europe increased by 5% in 2021 and a mere 1% in 2022.

According to data from the European Investment Monitor (EIM), Greece attracted 47 FDI projects in 2022, marking a 57% increase compared to 2021.

Number of FDI projects in Greece increases by 00% one of the highest growth rates recorded in Europe this year.

This is one of the highest growth rates recorded in Europe for the year, positioning Greece in the 19th place among European countries for 2022. It amounts to Greece’s strongest performance

since 2000, when the European report was launched. This trend confirms the upward trajectory observed in recent years. The number of FDI projects recorded for Greece over the last three years, accounted for one-third (35%) of the total investments in the period from 2000 to 2022.

Greece’s share of total FDI projects in Europe stands at 0.79%. It is clear that, in order for Greece to secure its rightful place on the European investment map and cover the investment gap of the past two decades, the current growth rate needs to be maintained and even intensified for many more years.

The report also reveals a continuous improvement in the qualitative composition of investments, with greater diversification into a wider range of activities. A significant share of investments is now directed toward knowledge-based activities with relatively high-added value, such as software and information technology services, which can play a significant role in transforming the country’s productive model.

According to the survey, conducted by FT Longitude, the specialist research and content marketing division of the Financial Times Group, between 3 July and 26 July 2023, with the participation of 250 executives from foreign companies worldwide, two out of five companies (40%) plan to establish or expand their operations in Greece over the next year. This percentage has steadily increased over the past three years, from 28% in 2020 to 34% in 2021 and 37% in 2022.

As with the rest of Europe, the most significant economic risks that have impacted plans to invest in Greece were inflation and its impact on consumer demand (50%), as well as the rising interest rates and tightening financial conditions (43%).

When asked about the sectors where they expect to increase their current investment footprint over the next three years,

companies already established in the country selected business services (61%) and logistics (58%) as their top two choices. In contrast, only one in three companies intends to increase its footprint in Greece in the critical area of research and development (R&D33%), compared to 64% for the whole of Europe, while 25% stated they expect to reduce it.

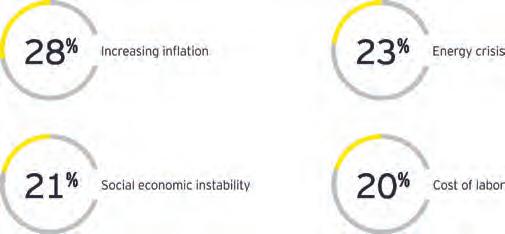

Regarding the most significant risks that could threaten Greece’s overall attractiveness as an investment destination, survey participants mentioned increasing inflation (28%), the energy crisis (23%), social and economic instability (21%), and cost of labor (20%).

Three out of five respodents have seen an improvement in the country’s attractiveness in the past year ...

According to the survey, 60% of respondents state that their perception of Greece as a location where their company might establish or develop activities has improved over the last year, with 8% stating that it has significantly improved. The overall percentage of those reporting improvement has increased compared to 2022 (58%) and is the highest since the launch of the survey, with the exception of 2021, when it had reached 62%.

... while optimism remains high for the improvement of the country’s attractiveness in the next three years

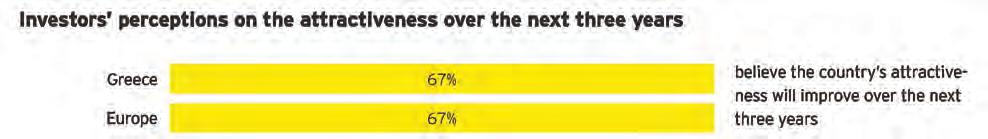

Two out of three participants (67%) believe that Greece’s attractiveness will further improve over the next three years, with 5% anticipating significant improvement, while 9% of respondents expect a slight decline, and 2% a significant decline. This outlook is in line with that for the whole of Europe (67% expecting improvement and 8% expecting a deterioration).

Greece’s attractiveness policy seen as effective, with room for further improvement

Three out of four respondents (76%) consider the country’s policies for attracting investors to be “very” (16%) or “somewhat” (60%) effective. However, the high percentage of respondents describing Greece’s attractiveness policies as “somewhat” effective, suggests that there is room for further improvement.

Among specific attractiveness policies, companies appear more impressed by policies for attracting companies (76%), innovative activities (68%), and human talent (64%), followed by policies to attract business headquarters (58%) and establishing global centers for competitiveness/world-class clusters (54%).

Participants were also asked to assess Greece’s performance compared to other countries, based on a series of criteria related to three critical factors influencing investment decisions today: sustainability, technology, and talent.

In all these areas, the majority of respondents stated that Greece is performing as well as other countries. The most positive perception for the country emerges with regard to sustainability, where, for five out of six individual criteria, those that feel that Greece is performing better than other countries outnumber those stating the opposite. However, with regard to criteria related to technology and talent, the picture that emerges is more mixed, with participants almost equally split between those who say that the country is performing better and those who say it is performing worse than other countries, indicating some key areas where further progress will be needed in the coming years.

Greece outperformed others in handling the 2022 energy crisis, according to respondents. Two out of five respondents expressed positive opinions, with 36% stating that Greece managed the crisis “slightly better” and 7% “significantly better” than other countries, while 22% believed that the management of the crisis was comparatively worse.

Regarding the areas the country should focus on to maintain its competitive position in the global economy, respondents continue to prioritize three key areas: developing education and skills (31%), reducing taxation (28%), and supporting high-tech industries and innovation, such as cleantech (26%).

The EY Attractiveness Survey Greece 2023 shows foreign direct investment (FDI) projects in Greece significantly grew in 2022, shifting toward knowledge-based activities with relatively high-added value. At the same time, investors’ appetite to invest in the country reached its highest ever level and perception of the country’s attractiveness remains positive with several key indicators further improving. To maintain this momentum and further expand its footprint on the global investment map, Greece will need to continue improving on key areas such as human skills, taxation, and innovation.

Georgios Papadimitriou is Country Managing Partner of EY Greece. EY Central, Eastern and Southeastern Europe & Central Asia (CESA) Markets and Accounts Leader. THE ARTICLE WAS FIRST PUBLISHED at EY’s CORPORATE SITE.

Synergy

Value

Greece's sign in the international investor satisfaction indicators is positive. Direct foreign investments have multiplied over the last 4-year period and projections remain positive

In 2022 the direct foreing Investments in Greece recorded at 47 Projects

40% intends to invest more

21,1% is the growth rate the IMF foresees for the greek economy during 2024

67% of foreign investors claim that the economy’s attractiveness is going to ameiliorate more

(source: IMF)

From 2015 to 2022, the Central State's investments in upgrading Infrastructure and Transport Networks have quadrupled compared to the past (annual Public Investments Programme data). The intensification of concessions through HRADF, and the completion of the Major Road Projects has improved the confidence of businessmen & investors towards the country. The Plan is upgraded for 2024

16 projects planned for 2024

79 new project acts with a total budget of 2,229 bill euros

In the two-year period of 2024-2025

the new projects will evolve:

• Rail – Road Network

• Electromobility network

• Smart bridge

(sources: Information from Hellenic Ministry of Infrastructure, Transport and Networks, Hellenic Ministry of Development)Business 4.0 is a reality, elements of which became a daily routine for businesses, perhaps a bit violently, with the emergence of covid-19 pandemic in 2020, as they were required to implement digitalisation solutions which had only existed on paper until then. The surveys which have seen the light of day (and the corresponding surveys that have been carried out by O.MIND CREATIVES in collaboration with Optilog Advisory Services) have indicated that in the following 3–5-years more than 75% of enterprises intend to invest in Innovation – Digitalisation

80%

42%

59%

GEN AI is evaluated to have a 5,5% total impact to the Greek economy up to 2030

8 to 10 businesses intent to use GEN AI apps and focus on Data Analytics

of those already talk about Internet of Things and AI applications

of active businesses state that they will invest in Cloud services

25.000 – 83.000 new jobs are going to be implemented

(sources: Eurostat)

452 companies were measured at the end of 2023, with total revenues more than 1 m euros

The 15th bigger companies has more than 26.1% the revenues, which is more than 2,49 million euros

19th place at the LPI world rate

(source: Eurostat)

A new exhibition event for the logistics and transport sector is inaugurated in Thessaloniki in April 2024. The new exhibition, named "LOGISTICS & TRANSPORTS THESSALONIKI EXPO," will take place in the heart of the city at the Thessaloniki International Exhibition Centre (TIF-HELEXPO) from April 11th to 13th, attracting professionals from Greece and the Balkan countries.

The organisers, aiming to bring together neighbouring countries which regularly collaborate with each other as well as with the Northen and the rest of Greece in terms of export trade and logistics, are planning an exhibition and conference event focusing on connecting and fostering partnerships among these countries, with Thessaloniki at the centre. This initiative offers additional collaboration opportunities for companies based in Greece.

The exhibition will cover sectors such as transportation and logistics companies, ports and forwarding companies, railway and road transportation, warehouse equipment, lifting machinery, shelves and automation, information technology, as well as professional vehicles.

A significant number of businesses from Greece and the Balkan countries, chambers of commerce, professional organizations and the government have expressed interest in this new event and intend to participate, strengthening this important event to be held in Thessaloniki. The exhibition will also be complemented by the conference event LOGI.C (Logistics Conferences), established, and recognized in the market for over a decade.

120 Exhibitors

4.500 Visitors

500 International Visitors

8 Conference Themes (LOGI.C)

Simultaneously, the exhibition for international trade in fruits and vegetables, "Freskon," organized by HELEXPO, will take place on the same dates, presenting the following statistics:

220 Exhibitors

4.300 Greek & International Visitors

250 hosted buyers

The LOGISTICS & TRANSPORTS

THESSALONIKI EXPO provides a unique opportunity for companies offering transportation and logistics services and technologies to connect with thousands of businesses from Greece and abroad. The new era that Greece, and especially Thessaloniki, has entered with the new prospects created by infrastructure development, increased trade and exports, the strategic position of our country in Southeastern Europe, and the growing interest of investors, creates opportunities for all businesses in the industry.

By participating in the exhibition, you partake in the events of our country, you affirm your presence at a leading event in Northern Greece, engage in meetings with entrepreneurs and investors from Greece, the Balkans, and Europe in general, and strengthen your corporate presence.

The role of the supply chain and the logistics industry has been continuously improving, over the last 8 years, in our country. The sectoral participation in the formation of the GDP approaches 11-13% with increasing trends, while the high quality of services provided by Greek logistics companies, combined with the completion of significant infrastructure projects in the country, port development and the great investment interest, have placed Greece in the top 20 countries with developed logistics worldwide, in World Bank's Global Logistics Performance Index (LPI no 19), in contrast to its 49th place just three years ago.

In this context, it is evident that the economy of Northern Greece plays a significant role in the Balkans and Southeastern Europe, with Thessaloniki gradually assuming its deserved role as a Transport and Logistics Hub for the broader region. The investment initiatives for the development of ThPA, in combination with the existence of a robust supportive network (Igoumenitsa, Volos, Kavala, Alexandroupoli), and the railway and intermodal cooperation with neighbouring Balkan countries, outline a bright future for the region and the industry as a whole.

The International Exhibition Centre of Thessaloniki is located in the centre of the city, with direct connections to "Macedonia" International Airport, the road axis to the Balkans and the entire railway network of the country. It covers a total area of 180,000 sq.m., 62,000 of which constitute the covered exhibition space distributed across a complex of 17 pavilions. With free parking for exhibitors and visitors, indoor and outdoor restaurants, ATMs, and hotels nearby to facilitate easy access to the fairground, it ensures the best possible hospitality, entertainment and accommodation services for exhibitors and visitors alike.

THE 5TH BALKANS & BLACK SEA FORUM WAS HELD IN PIRAEUS “TRADING ARTERIES & GLOBAL SUPPLY CHAINS

The 5th Balkans & Black Sea Forum (BBSF) entitled "Trading Arteries & Global Supply Chains at Stake", was successfully held on February 15, 2024, at the headquarters of the Piraeus Port Authority.

The BBSF2024 was organized in cooperation with the Embassy of the People's Republic of China and the Piraeus Port Authority; it brought together 170 high-level executives & representatives from international organizations, government, diplomatic missions, businesses, media, and it included two keynote sessions on "Geopolitics, Regional Cooperation and Ports Hubs in the Mediterranean" the first, and "New order & trends in regional connectivity " the second.

The Forum took place amidst the grave disruptions in global transports, shipping routes and supply chains due to the spiraling conflict in the Middle East region and the ongoing war against Ukraine, the combination of which raise profound concerns over the sustainability of global trade and supply routes. Thus, the Balkans & Black Sea Forum 2024, provided the opportunity to experts and stakeholders to investigate means and ways to address the complex crisis affecting not only key trade routes but also the overall economies of many countries in the wider region.

The Alternate Minister of National Economy and Finance, Mr. Nikos Papathanasis, underlined that Greece, amidst the international and regional turmoil, remains a pilar of stability in the wider region of the

first best port in the Mediterranean Sea, can play a catalytic role. I believe that investors can use Greece's advantages to increase their turnover, concluded Minister Papathanasis.

Speakers that honored the BBSF2024: in representation of the Prime Minister Mr. K. Mitsotakis the Alternate Minister of Economy & Finance Mr. Nikos Papathanasis, the Ambassador of China Mr. XIAO Junzheng, the Executive Chairman of the Piraeus Port Authority Mr. YU Zenggang, the General Secretary of the International Transport Forum (ITF/OECD) and the Director General of the International Union of Railways (UIC), Mr. Young Tae Kim and Mr. François Davenne, respectively, the Counsellor of the Secretariat of China-CEEC Cooperation of MFA of China Ms. XIA Xiaoxi, the President of the Foreign Policy Research Institute from the MFA of Kazakhstan Ambassador Nurgaliyev, the Director General of the Fudan Institute for Belt & Road and Global Governance Dr. HUANG Renwei, the Vice President of the China Foreign Affairs University Ms. SUN Jisheng, the Head of Investment Strategy of Piraeus Bank Mr. Lekkos, the Dpt. Secretary General of the BSEC-Permis Ambassador a.h. Mr. Rallis, the Project Manager of the OECD SE Europe, Mr. Bosshammer, the CEO of the Port of Kavala S.A. Mr. Vlachos, etc.

The Balkans & Black Sea Forum is a flagship economic platform and key summit for leading business- & policy-makers committed to enhancing stability, growth, and cooperation across the Balkans, Black Sea and Eurasia. Experts, diplomats, policymakers, heads of

Special Spatial Planning Frameworks (SSPF) have been, since the late 2000s, the basic planning tools for the organisation and spatial development of basic production sectors of national significance in Greece. Today, studies are under way for the revision of the current (since 2009) SSPF for industrial activities (SSPF-Ind.), which is expected to include, due to their complementary nature, provisions and guidelines for the spatial development of the logistics sector.

• BY GIANNIS LAINAS

For the Hellenic Federation of Enterprises, the SSPF-Ind. contributes especially to promoting sustainable spatial development while advocating for legal certainty in connection with industrial activities. Through this Plan:

• some fundamental constitutional requirements have been met, especially for pre-defined areas that will be hosting industrial-craft land uses (national standards for spatial organisation, areas for intensification, expansion, etc.);

• it has been determined that there should be a restructuring of the system of organised receptors (industrial zones, industrial and business zones, etc.). This provision was implemented through the new legislation for Business Parks;

• it was introduced provisions for the urban regeneration and upgrading of informal industrial concentrations as well special procedures for the establishment of investments with major importance to the national economy (later institution of Special Urban Plans and Special Plans for the Spatial Development of Strategic Investments);

• the modernisation of the classification of industrial activities has been promoted in terms of degrees of nuisance. Today there are new environmental classifications for industrial activities, that have restructured into a new single system with (A1 environmental category-high nuisance, A2-medium nuisance and B-low nuisance);

• provisions have been made for increasing the building coefficients for organised receptors, with such increase being implemented by virtue of Law 4759/2022.

Despite the institutional and planning innovations introduced by the 2009 SSPF-Ind., in the years that followed there were delays in the legal procedures for monitoring and evaluation of the Plan (the legislation requires such procedures every five years). This has resulted in the accumulation of crucial issues that are now pending and must be addressed by the current revision study which, as stated, will include the Logistics sector.

In particular, it is assessed that planning must incorporate crucial new aspects regarding, among others:

(a) timely resilience and adaptation to climate change (for industrial-logistics areas as well as infrastructures): planning must take into account the climate crisis aspect, with targeted measures and provisions for the effective resilience of industryrelated areas and infrastructures;

(b) smooth spatial implementation of green and digital transition: spatial and organisational incentives for the smooth implementation of green and digital transition need to be provided, in accordance with European planning guidelines (e.g. acceleration areas, netzero industry valleys);

(c) promotion of industrial ecosystems & sectors that are a priority for the EU: further promotion and support, through targeted spatial and organisational incentives, of the industrial ecosystems and strategic sectors which the EU is dependent upon, within the framework of the new European industrial strategy and the EU strategic autonomy (with specific spatial planning guidelines for expansion, reindustrialisation or creation of European industrial clusters);

(d) adequacy of hard infrastructures and networks at the proper places: strengthening and supplementing the infrastructures and networks which contribute to the competitiveness and support of the industrial activity, including export aspects (e.g. industrial ports, multimodal transport networks, energy networks, waste management facilities etc.);

(e) further protection of the environment and natural resources: enhancing the protection of natural environment, soil and water by promoting industrial symbiosis and circular economy at organised receptors as well streamlining the framework for the installation of environmental technologies and related infrastructures;

(f) completion of actions that have been initiated but are still pending, such as: streamlining the manufacturing licensing process in the Attica region, organising the Informal Industrial

Areas, launching special projects to promote organised receptors and restructuring the list of land uses used in urban plans.

The role and contribution of the Hellenic Federation of Enterprises (SEV) and responsible entrepreneurship in promoting sustainable spatial planning and development, is crucial. Through participation in public consultations, law-making committees, institutional boards such as the National Board for Spatial Planning as well as expert groups, SEV contributes to the social dialogue with integrated policy proposals, studies and memos, in order to promote sustainable industrial development.

It is, therefore, necessary, during the current planning process, to strengthen the consultation procedures, through a meaningful and continuous institutional discussion that will provide a timely and successful response to the multiple challenges that lie ahead (among others, spatial, environmental and development challenges).

Rational space organization has always been a factor directly linked to economic growth. Business create value and improve their position versus the competition when, among others, they utilise in the best way possible the space in which they have their registered office and base of operations. In the past decades, rational spatial planning has been directly associated with environmental protection. It imposes rules of capacity and operation on businesses and their infrastructures and, as a result, it averts any arbitrary actions with a negative impact on the environment. By contrast, in areas outside urban planning zones as well as in the wider urban and peri-urban space, activities that are environmentally harmful take place more frequently.

The idea of Business Parks is based precisely on the aforestated data: pre-defined and urban-planned spaces with specific compatible uses prescribed in spatial plans are granted an ad hoc development authorization and meet many of the licensing requirements. These spaces are intended to house industries, craft enterprises, logistics firms and other uses of the primary and tertiary sectors. This way, businesses operate in a regulated framework which respects the environment and, at the same time, they are free from any compliance concerns, since compliance rules are already adhered to as a whole in the Business Park hosting them. Hence, they are able to dedicate their time without hindrances - therefore, more productively - to their activity, at a reasonable ‘external’ administrative cost. It is an advantageous solution for all parties involved - the State, society and enterprisesthat is applied on a large scale in many European countries.

In Greece, however, Business Parks are often underused and, as a whole, they host very few businesses. Why is this happening?

A new study published by non-profit organization diaNEOSis, conducted by a research team of the consulting firm Re.DePlan AE Consultants and scientifically supported and edited by Athina Giannakou, Professor, School of Spatial Planning and Development, A.U.Th, aims to showcase the value of Business Parks ‘’as tools of competitiveness and environmental protection’’. The study, outlines the background of the regulatory framework on land uses in Greece, and includes extensive commentary on

past attempts to establish Business Parks or, as widely called, “organized receptors”, thus underlining the factors associated with the current situation. Finally, it showcases the usefulness of a “National Action Plan for the development of organized receptors of entrepreneurship” and, in fact, the authors submit a specific proposal for such a Plan as they attempt a quantitative assessment of its impact on economy.

In the course of 2010-2020, a period of considerable disinvestment in Greece, the contribution of manufacturing continued to be steady for the most part, contrary to the European average. Therefore, offering incentives is necessary so that the sector can record further growth. As afore-stated, the operation of Business Parks encourages investments since the parks reduce the cost for businesses and, at the same time, with the proper planning and implementation, it benefits both the society and the environment.

However, the Business Parks (organized receptors) which currently operate fully in Greece are few - only 26 - according to the authors’ estimates. In addition to their limited number, they are unevenly distributed if one matches them against the manufacturing needs in the country. For example, approximately 44% of the manufacturing activity in Greece takes place in the regions of Attica and Viotia (due to the large concentration of industries in the area of Oinofyta). However, only 4 Business Parks, namely just 2.86%

of the total number, operate in the territory of these two regions. In fact, the operation of these four receptors is also uneven: the first receptor (Thisvi) belongs as a whole to one business, the second one (Schisto) presents high occupancy rates, the third one (Ano Liossia) ’’faces major operational issues’’ and the forth one (Keratea) is located in Eastern Attica, which, according to the researchers,"is not an area preferred by businesses". The authors further point out that this mismatch between Business Parks and industrial needsis not limited just in Attica and Viotia regions, but it is a general phenomenon.

The Business Parks that operate fully in Greece, today, are few - only 26 - according to the authors’ estimates. In addition to their limited number, they are unevenly distributed if one matches them against the manufacturing needs in the country.

However, given that Greek businesses do not operate in Business Parks, where do they actually operate? The term which describes areas with a large concentration of industries but lacking central planning is “Informal Industrial Concentrations’’. These are ‘’industrial areas’’ which have never been designed as such but, for a variety of reasons, attracted businesses there and were, thus, transformed ‘’from the bottom up’’ into areas that host business activities. However, there are so many problems in these areas that the term ‘’Informal Industrial Concentration’’ often results in being regarded as a euphemism.

According to the authors,‘’Hundreds of Informal Industrial Concentrations developed in areas without access and environmental management networks and infrastructuresand continue to host industries, logistics firms, small and medium sized craft enterprises in various areas in Greece, rendering roadside construction along provincial and national motorways the predominant model of spatial organization for business facilities". The authors further note: "When the development perspectives of an area are planned without the particularities of the area being seriously considered [...], but, instead, the focus is only on the ways in which the growth of several economic aggregates can be achieved, this results in setting aside the main (and longterm) growth objective which can be no other than the continuous improvement of living standards for the residents of a specific region and of a country, in general".

However, apart from the wider social or environmental consequences of this unregulated landscape described by the authors, there are consequences on the growth of the manufacturing sector itself and, eventually, on the economy as a whole. The deficient planning of Business Parks where these exist and the lack of Business Parks where they should exist, allows for such (environmental, spatial planning, financial, etc.) issues that will inevitably arise to be regulated with provisions that are occasional in nature. These regulations, specifically with regard to construction in regions without specified land use, create, in turn, conditions of uncertainty (since, e.g., these regulations can be annulled at any time by the Council of the State), which is, eventually, detrimental to the investments which such regulatory framework is, in fact, supposed to make easier. “For the past 35 years, the country has been making efforts to acquire some spatial organization”, according to the authors who continue stating that ‘’Only about 20% of the areas of the country’s municipal units have statutory land uses, which, inter alia, is the main factor of uncertainty with serious consequences on investment planning’’.

The study comprises an interesting chronicle of the spatial planning legislation in Greece. The authors make reference to the laws that set the foundation of spatial planning in the country: from Article 24 of the 1975 Constitution which formally conferred to the State the responsibility of protecting the environment to Law 947/1979 which introduced the term “land uses” but was not implemented and Law 1337/1983 which has been the basis of spatial and urban planning legislation to date and has introduced Urban Control Zones. The most recent legislation, namely, Law 4685/2020 and Law 4759/2020, as well as Presidential Decree 59/2018, are the latest additions to this series of statutes, extending the general and specific categories of land uses and introducing new ones related to economic activity.

Although Business Parks have never been the rule as the location of businesses, in the past 50-60 years, some parks do operate in Greece. Within which institutional framework? How have they evolved through time and what rules apply to them?

The first reference, by a Greek statute, to what is currently

known as an Industrial Zone, is made in Law 4458/1965. One year later, a bank of that time known as ETVA established a limited company for the exploitation of Industrial Zones. More than a decade later, Law 742/1977established the first 25 Industrial Zones of the country based on geographical criteria. However, the zones were institutionalised, according to the researchers, ‘’on the basis of priorities that, as it turned out in retrospect, could not be identified with nor serve adequately the needs of the industry and of the wider entrepreneurship, both in terms of space and sustainability’’. In the meantime, by the late 1990’s, Greece underwent rapid urbanization. As a result, the State stepped up the process of institutionalising land uses and decided to grant the right to develop organized receptors to private stakeholders as well, with or without the State’s participation, by virtue of Law 2545/1997. This law establishes Industrial and Business Zones, an “umbrella” term that includes Industrial Zones, Industrial Parks, Craft Enterprise Parks and Technopolies. With both these laws, the law of 1965 and the law of 1997, 50 organized receptors were institutionalised whereas 5 more were institutionalised with the more recent Law 3982/2011 (which establishes the term “Business Parks”) and are to date in various stages of implementation.

What can be done today, however? Maybe the most significant contribution of the study is the authors’ effort to highlight the need for a National Action Plan concerning Business Parks. Before they give their own opinion, they present two other recent studies concerning Business Parks and their best possible development. The first study was commissioned by the General Secretariat for the Industry, was delivered in 2018 and revised in 2021. This study records the Informal Industrial Concentrations throughout the Greek territory and, in addition, underlines the needs for the development of Business Parks per type - anyhow, it was based on this study that the legislation related to Business Parks was shaped.

The second related study was commissioned by the Union of Hellenic Chambers of Commerce in 2018, also representing an attempt to prepare a National Action Plan on Business Parks. Local

Chambers-members of the Union indicated the Informal Industrial Concentrations in their territories as well as the most appropriate locations for the development of new Business Parks.

The authors’ group utilised the results of the Union’s study in order to prepare its own recommendation for a National Action Plan and even went a step further. In May 2020 and June 2021, the researchers addressed, through targeted questionnaires, the municipalities in the territories of which the development of new Business Parks was suggested in the study commissioned by the Union of Hellenic Chambers of Commerce. Based on this methodology, the authors collected and processed the data and attempted to submit a very specific proposal for the next 20 years. Their proposal pertains to the development of Business Parks in 73 areas, of a total area of approximately 10,000 hectares throughout Greece, with a total budget of €1.14 billion (40% financed by the State, namely, about €23 million per annum for 20 years).

In addition to proposing a National Action Plan, researchers also attempted to assess the benefits to be had by a hypothetical implementation of this Plan for the Greek economy - of course, such assessments are always subject to considerable limitations. Therefore, based on the assumption that 73 Business Parks will be created, of a total area of 10,000 hectares, comprising approximately 2,530 hectares of business buildings, the authors estimated that the parks can contribute to economic growth with approximately €13.8 billion or 7.7% of the GDP (in 2018 terms).

They also attempted to estimate the number of jobs that the development of these 73 parks and, eventually, the activities therein, could generate. The benefit from the development of said infrastructure projects was estimated to 13,414 jobs whereas from the development of the new building facilities to 152,840 jobs. Finally, they also estimated that the number of permanent jobs for the operation of businesses would range from 46,475 (if the total number of businesses to be hosted in the Business Parks under the National Plan are capital-intensive (usually the most productive ones), to 139,425, if the businesses to be hosted there are only labour-intensive.

In conclusion, the development of Business Parks is an internationally established practice, which, if properly executed, offers considerable benefits for all the parties involved: businesses, the State and, in general, the society as a whole. Greece, despite the progress that has been made, has not yet managed to exploit this particular business opportunity. Organized receptors in the country are not often matched properly with areas of major industrial production. Conversely, businesses are located in Informal Industrial Concentrations, e.g. in areas adjacent to national freeways, and often operate in a context of uncertainty based on a multitude of small-scale provisions of occasional nature, which may hinder major investments.

On the occasion of the annual English special edition of the magazine, we had the pleasure to speak with the head of the European community for smart cities ERTICO – ITS Europe, Dr. Amditis (you can find his full bio titles below). In the interview he granted us, he enumerates the benefits of each of the new technologies that are already positively affecting management and operations in global supply chains, pointing out that overall the impact of new technologies on logistics will resemble a revolution that will be unique.

INTERVIEW TO MARY EFTHYMIATOU

SC&L MAG: Dr. Amditis, please talk to us about ICCS institute in Greece. What kind of programs it undertakes and which are the main focus areas for the Institute of Communication & Computers Systems of NTUA?

Dr Amditis_ One of the largest academic Research Institute in Greece and in Europe, the Institute of Communication and Computer Systems (ICCS) of the National Technical University of Athens (NTUA) has a mission to promote applied research, to advance digitalization and to boost innovation in research areas such as AI, Robotics Smart Systems, Hardware and Software, Computer networks, Mobile Communications, Control and Automation, Power production, transport and distribution, Energy, Smart Transport and Logistics, Climate, Biomedical and Biomechanics, Information Systems, Management and Decision Support, Photonics, Networks and IoT.

Today, ICCS stands among the top 3 Research Institutions in Greece (first together with NTUA) and it is ranked among the top 20 European Organisations in terms of research funding. It counts more than 40 research units, 800 highly qualified researchers and has participated and coordinated thousands of national and European R&D projects in the respective areas. Throughout the years, ICCS developed an extensive network of international partners in the research, a global reputation

These technologies have already a great impact in global logistics landscape, reshaping how goods are transported, stored, and delivered. And this transformation is going to be unique

of scientific excellence, and delivered a number of success stories where research results contributed to innovation at the national and global level.

Today and in the light of accelerating technological advancements, translating this intense research activity into tangible results and real value for the Greek society, becomes a priority for our community and a challenge guided by our vision towards a smart society, green, safe and resilient. In this respect ICCS invests in implementation of its research results and knowledge through Spin Offs, and many exploitation activities.

SC&L MAG: With many research projects completed, even more success stories integrated, what would you call ‘trends’ for 2024 in Greece and Worldwide?

Dr Amditis_ A complex net of scientific breakthroughs, innovative research, regulatory changes, economic conditions and societal needs are shaping the technological trends ahead us, and many of them have already started to give us an idea of their transformative nature and high impact on society and global economy.

Much like automation, the proliferation of artificial intelligence will continue to make its way into every part of business and life. Much of what was pure science fiction until recently is possible today thanks to AI. Continued progress in AI and Machine learning technologies, with applications across various industries such as healthcare, finance, and autonomous vehicles will bring major changes in the interaction between human beings and machines in the next few years. The progress made in the sector is so enormous that holds the power to revolutionize existing systems, business models and practices.

In parallel, advancements on the Internet of Things (IoT) continue to evolve with several key tendencies shaping the field such as edge computing integration, evolution of 5G networks, the exploration of beyond 5G technologies like 6G, AI integration. Efforts to establish common IoT standards and protocols and improve energy efficiency reducing environmental impact are currently in the focus of research. IoT underpins the digital transformation of manufacturing and enables the

realization of Industry 4.0 principles and beyond. Connectivity and digitization, networked devices, sensors and robotics will continue to transform industrial production beyond recognition bringing structural changes and giving rise to the smart factory of the future.

Blockchain technology has now emerged into various organizations and industries and is becoming more and more popular with advancements in scalability solutions, interoperability protocols, and decentralized applications.

Big data continues to be highly relevant and impactful technological trend. As we follow advancements in data storage and processing, data analytics tools and platforms, Big data can serve as a catalyst for innovation across various industries, including healthcare, finance, retail, manufacturing, and transportation. At the same time, data security remains a constant concern and protecting such data becomes increasingly important.

Technology platforms and cloud computing will play a bigger role in digital transformation. Specialized AI development platforms, MaaS and SaaS based platforms will continue to gain ground. Everything as a Service, a well know technology trend is expected to manifest in fresh and unexpected ways in the next years. Also, we will witness further integration of AR, VR and XR technologies into various sectors, advancements in autonomous driving technology and smart transportation systems leading to an explosion of services in the mobility and logistics sectors.

SC&L MAG: The adoption of new technologies, automation and AI are factors that will shape the business future. How much opportunity do you foresee for logistics and supply chain?

Dr Amditis_ In the close future, Automation, and robotics, IoT, AI, and blockchain, when combined together, will open newer and innovative possibilities that will benefit industries in a powerful manner, bringing extraordinary opportunities but also considerable challenges. When it comes to logistics each technology has to deliver numerous benefits including improved efficiency, transparency in the procedures, environmental friendly

Only by working together effectively will the logistics sector be able to capitalize on opportunities and achieve mutual success in this ever changing environment

practices, cost savings and security and overall digitalization of the sector and the economy overall.

IoT sensors attached to containers, goods, assets, vehicles etc allow tracking in real time throughout the supply chain, enabling companies to optimize routes, monitor and improve asset utilization and minimize delays. IoT enabled inventory management systems can monitor the quality of procedures in warehouses and distribution centers, and predictive maintenance algorythms have the power to identify potential issues in the infrastructure performance and reduce maintenance costs.

AI technologies when deployed in logistics will also improve operational efficiency streamlining manual tasks such as order processing, invocing and documentation. As AI algorithms will be able to analyze big data, traffic patterns, weather forecasts etc, they will guide decisions for reduced fuel consumption, transporation costs while maximizing vehicle capacity and

warehouse efficiency. AI driven demand forecasting models and intelligent automation can help logistics companies optimize inventory levels, allocate resources effectively, and respond quickly to changes in demand.

A key technology with the potential to revolutionize the logistics sector and overcome all the challenges posed by traditional delivery solutions -such as last mile delivery-, is drone technology. Speed and efficiency, cost efficiency, easy access to remote areas, low environmental impact is only some of the benefits that this technology has to offer. Beyond delivery, in the near future we might witness UAV technology in a wide range of innovative applications, including warehouse management, inspection of infrastructures and even autonomous transportation between distribution centers.

At last, blockchain technologies have already started to transform the sector, offering supply chain visibility , enhancing

trust and transparency in all transactions and supply chain procedures, preventing counterfeiting and ensuring product authenticity.

These technologies have already a great impact in global logistics landscape, reshaping how goods are transported, stored, and delivered. And this transformation is going to be unique as it will be the first time in modern history that three transformational technologies have appeared within the same generation.

However, apart from technologies, there are other factors that will define our ability to benefit from these opportunities as a society and as an economy. In the following years, we will witness a rise in regulatory activity as governments around the word are implementing regulations and standards to enhance safety, security and compliance, adopt sustainable practices and reduce their carbon footprint. Also, the emergence of industry 4.0 has already led to a growing demand for new skills, digital literacy and continuing professional education. Ongoing learning, training and skill development of the workforce will be a perquisite for success.

In this complex and dynamic environment, companies will need to collaborate, innovate and adapt to stay competitive. Collaboration becomes the new normal and we need to see further strategic partnerships and alliances with the research sector, information and data sharing among supply chain partners, further integration of interoperable systems, cross-docking and consolidation centers, collaborative transportation initiatives, and above all a commitment to continuous improvement by incorporating innovation and ongoing skills training in the workforce. Only by working together effectively will the logistics sector be able to capitalize on opportunities and achieve mutual success in this ever changing environment.

• Research & Development Director, ICCS of the National Technical University of Athens (NTUA)

• Chairman of ERTICO - ITS Europe

• Vice President of ITS Hellas (Former President and Founder)

• Μember of the ALICE Executive Group (Board), Alliance for Logistics Innovation through Collaboration (ALICE)

• Member of ILME Board of Directors, Hellenic Institute for Logistics Management (ILME)

• Eretous President and member of the Board of EuroXR (former President and founder)

• Former Chairman of OASA

• Former member of the Board, EYDAP

ity logistics is a developing sector that has become increasingly important. Organising it in the best way possible is a tough challenge that requires balance between social, environmental, financial and energy factors. Nonetheless, enhancing the field of logistics makes our cities “smarter“ and “greener “. The new policy document published by diaNEOsis non-profit organisation is signed by Dr. Vassilis Zeibekis, President, among others, of the Board of EEL, the Hellenic Logistics Association, and maps the global trends on city logistics, gives a description of the current situation in Greece and outlines directions and steps towards a substantial and beneficial reform.

• By 2050, more than 8 out of 10 Europeans are expected to live in cities

• E-commerce is developing rapidly, changing consumer expectations

• The vehicles used for logistical tasks generate approximately of the total CO2 emissions and 30%-50% of the pollutants in Europe

• City logistics have a wider impact on city life: on congestion, noise pollution or road safety

Factors that affect the manner in which merchandize is transported within the cities:

• Dwell time

• Distance from distribution centres

• Vehicle maintenance cost

• City characteristics such as their size or population density

Ideas and strategies for the transportation of goods that have come up in the past decades:

• Night deliveries In some cases they increase costs but reduce daily traffic congestion

• Development of Zero or Low Emission Zones where only vehicles with a low or zero carbon footprint are allowed

• More efficient use of the roads with multiple-use lanes and deliveries based on schedule

• Urban Consolidation Centres, namely, facilities where merchandize is entered and stored temporarily for a few hours, is then consolidated per area of delivery and sent on the same day to the inner city

• Retail stores which exist exclusively for a more efficient delivery of e-orders (“dark stores”)

• Electric bikes with a dedicated compartment for the transportation of packages (“cargo bikes”) are quite efficient in the “last mile” (meaning the last stage of delivery) whereas, at the same time, they generate zero emissions

• Use of autonomous robots and automated fleet routing and management systems

How are logistics regulated, directly or indirectly, in Athens today? There are four basic policies or rules related to the circulation of vehicles used in logistics:

They vary from one municipality to another, also depending on the characteristics of each vehicle:

• In December 2022, the Municipality of Athens prohibited the delivery of goods by trucks over 2 tons from 9 am to 9 pm

• In the hours in between, goods can be distributed and delivered only by smaller-size vehicles

• In other neighbouring municipalities (e.g. Zografou or Ilioupoli), different restrictions apply

The new delivery hours brought about several challenges:

• Limited time for deliveries since many stores do not have staff or infrastructures available for taking delivery of goods in night hours

• Increased congestion from 7 am to 9 am, namely, in the twohour slot outside of quite hours

• Complex delivery hours that vary per municipality make it difficult to coordinate the delivery of goods

It has been in force since 1982 and determines which vehicles are permitted to enter and circulate in a geographically defined area in the centre of Athens, depending on the last number of their licence plates. Trucks over 2.2 tons may not enter and, as for lighter-weight trucks, these must follow the rules applicable to all other vehicles. After 2012, further environmental restrictions were added: trucks and buses that were already in circulation before 1st January 2000 may not enter the Inner Ring. This does not apply to roads leading outside the city, such as Kifissou Avenue or Athens-Lamia National Road.

In the areas between the ‘apexes’ of the Commercial Triangle, heavier trucks may circulate in narrow streets in hours that are prohibited elsewhere.

• Blue Zone

• In specific streets downtown, all trucks can move freely between 2.30 pm - 5 pm and 9 pm - 7 am

• In the morning hours (from 7 am to 11 am), only the circulation of trucks up to 4 tons is permitted

• Urban Consolidation Centres at the edges of the city centre. It is recommended that the issue of a joint ministerial decision (KYA) specifying the respective Law 4302/2014 and regulating the UCC operation and spatial planning be expedited.

• Creating Low Emission Zones

• Using cargo bikes for deliveries in the historic centres of the cities

• Creating multiple-use traffic lanes while using an app at the same time for booking a loading/unloading spot

Steps for the implementation of a roadmap

• Recording the current situation

• Identifying the stakeholders involved and establishing a working group

• Hammering out scenarios with a view to achieving sustainable urban transport

• Determining the vision and the objectives of the actions that will be selected

• Determining pilot actions

• Setting Key Performance Indicators for the evaluation of the pilot operation

• Final selection of smart and sustainable urban logistics for implementation

• Adoption and implementation of actions by stakeholders

THE FINDINGS OF THE FIRST SURVEY ON “E-COMMERCE LOGISTICS & LAST MILE ORCHESTRATION” IN DETAIL

The window of opportunity for cooperation between e-shops and 3PLs, which is still at low level, is highlighted by the first survey entitled “e-commerce logistics & last mile orchestration”, which was conducted by O.MIND CREATIVES and OPTILOG ADVISORY SERVICES in the form of a questionnaire, lasted for approximately 3 months, gathered more than 300 complete replies and was publicly presented for the first time in the multi-conferences LOGI.C 2023, within the context of the ‘’Supply Chain & Logistics’’ exhibition on 1st October 2023.

The main findings

It is pointed out that the sample of the study (306 complete replies) is representative of the components that constitute the Greek ecommerce ecosystem. 55% of the sample represent commercial enterprises with e-shops, 37% comprise Logistics service providers and 8% represent IT system and equipment providers. So, what arises from their replies?

1_ The majority of the e-shops (59%) opt for in-house storage whereas 27% of the e-shops of the sample collaborative with 3PLs, mostly due to lack of space (with the 3PLs operating as buffer areas). According to the replies in the relative question, the basic reasons behind a non-full cooperation with 3PLs pertain to the number of orders, which is relatively small to be outsourcec, lack of flexibility, poor customer service and significant cost. (CHARTS below)

2_ With regard to their operation, currently, the average number of order lines executed daily reaches 200 in the majority (64%) of the e-shops taking part in the study. 71% of those have 1-7 order lines per order and 65% about 1-5 pieces per order (with a large share having 1 piece per order).

3_ Return reasons vary and include: refusal to take delivery (42%) as well as logistics matters, e.g. product destroyed during transport: 32%, wrong SKU: 32%. However, what is extremely positive is the fact that the rate of returns is at satisfactory levels (65% of the e-shops stated that their return rate is only 1%). CHARTS next page

4_76% of the e-shops report that the cost for processing an order (in house logistics) amounts to 2 euros whereas the majority of the e-shops do not charge return fees (69%), aiming to attract a larger customer base without, however, having considered the logistical cost of returns.

5_ A large part of the e-shops that took part in the study choose

Indeed, the survey showed that a large share of e-commerce companies do not wish to partner with 3PLs, with the exception of some cases where 3PLs are used as a space for storing overflow stock.

to cooperate with more than 2 courier companies, aiming to flexibility and better customer experience. House delivery is still predominant, but the use of lockers is increasing. Deliveries usually take place in 1-2 days (65%) whereas the delivery slot of 48-72 hours remains at high levels (56%).

The companies which participated in the study anticipate a significant

increase in e-commerce, which looks like it may result in a generalised investment strategy towards equipment purchases, new recruitments of specialised employees and new warehouse premises.

It is worth pointing out that the majority of the companies that took part in the study reported that they expected significant increases in all themes related to project performance/e-commerce logistics.

In addition to reporting the findings of the study, we asked the science officer responsible for the project, Dr. Vassilios Zeibekis, for his opinion on the survey and its findings.

SC&L_ Dr. Vassilios Zeibekis, what do you consider to be the most hopeful findings of the survey you developed on e-commerce logistics orchestration - a pioneering study in terms of its subject matter?

V.Z._ Said study, which depicts the ecosystem of e-commerce logistics in Greece for the first time, provides us with a series of hopeful findings. The first one is the fact that companies/e-shops acknowledge the vital role of logistics in providing a high-quality customer experience. In addition, companies that took part in the study estimate that the e-commerce sector will grow considerably in the following years; as a result, the use of IT systems will increase

respectively with a positive impact on sales and profitability. As such, in order for companies (e-shops and/or logistics service providers) to be able to meet the increasing customer demands, they must:

(a) acquire a digital culture, (b) restructure their processes, (c) train their personnel and attract executives with expertise, and (d) invest in automation and clever systems.

SC&L_ In your opinion, can we conclude, based on the study, that e-commerce companies hesitate to rely on 3PLs due to the latter’s ignorance in terms of the services provided or due to their lack of specialization?

V.Z._ Indeed, the study showed that a large share of e-commerce companies do not wish to partner with 3PLs, with the exception of some cases where 3PLs are used as a space for storing overflow stock. This means that they serve as buffer areas, feeding e-shop warehouses. The basic reasons behind the reluctance of e-shops to

Only if the flexibility requested, combined with competitive prices, is offered to e-shops, will we witness increased partnerships and outsourcing. This has already been achieved abroad, so I believe that we can achieve it in Greece as well.

outsource their warehousing activities are the following: (a) they do not have a sufficient number of orders so that they can cooperate with 3PLs, (b) they believe that, through 3PLs, they will not be flexible and customer-oriented enough, (c) the cost of 3PL services is high, (d) 3PL companies do not offer high-quality customer service, and (e) through 3PLs, there is no end-to-end visibility of the orders sent.

SC&L_ What is the golden mean so that 3PLs and e-shops can work together more harmoniously in the future within the context of providing better service to consumers? What is the role of the increasingly higher consumer demands in all this?

V.Z._The fact is that, in the next few years, consumer demands will increase even more, with consumers seeking even faster delivery, end-to-end visibility and multiple ways of multi-channel delivery. In my opinion, 3PLs, must listen to e-shop needs and organise themselves in such a way, in terms of warehouse equipment, automation, IT systems and processes, so that they can offer added value and high-quality services. It is my belief that only if the flexibility requested, combined with competitive prices, is offered to e-shops, will we witness increased partnerships and outsourcing. This has already been achieved abroad, so I believe that we can achieve it in Greece as well. The applicability of synergies and win-win situations are the two elements necessary for a fruitful cooperation between 3PLs and e-shops.

Already before the dawn of 2024, global conditions foreshadowed a strange year, with global supply chains having been accustomed to withstanding multiple disruptions and overcoming daily and successfully any bottlenecks, whilst new conditions are continuously being formed against any type of regularity.

Is the Greek market, however, aligned with major global trends in the supply chain or is it that the situation here in Greece is somewhat different? We asked 6 well-known business consultants (specialised in the wider sector of supply chain and logistics) to give us their answers about which they regard as the top 3 challenges for the Greek

market and to what extent these are aligned with the respective international challenges... We present you with their answers and wish you a happy 2024!

NOTE: the answers follow a random order according to the layout needs of the magazine

Trend 1 – E-commerce, digital transformation & city logistics

E-commerce growth combined with increased urbanisation has resulted in a significant increase in the merchandize being transported within the cities (city logistics). This practically means that in order for high-quality customer experience and end-to-end visibility to be achieved, companies must organize properly and digitize/automate their storage facilities (placing emphasis on the creation of microhubs & darkstores) and orchestrate the last mile smartly.

Trend 2 – Risk management and resilience

In an increasingly unstable and unpredictable environment, supply chains are in constant danger of disruptions. The aim of

the businesses should continue to be the strengthening of flexible supply chains (at supplier, partner and customer levels), risk management and resilience. The anticipation of potential disruptions and scheduled risk mitigation contribute to the creation of flexible and robust supply chains.

Trend 3 – Circular economy & sustainability in the supply chain

The adoption of sustainable supply chains with an emphasis on green buildings (e.g. according to the LEED standard), environmentally friendly trucks and waste management will become more and more necessary. In addition, for production companies, the operation of a circular supply chain through the reuse of products and by-products as well as the development of Industrial Symbiosis platforms will become the new trend.

I think it is important to clarify that it is not necessary for a year’s global trends to be adapted per force, without any change, in a domestic market. From my experience and interaction with several Greek businesses in need of Logistics consultants, they realize that, in 2024, our major concerns will be the following themes (not necessarily in that order):

Α_ Upgrading Small and Medium-Size enterprises:

Many of the small companies fervently want to increase the quality of services in their warehouses, realising that with proper organisation, IT systems and rational distribution, they will manage to stay on top and not disappear because of the competition. As a result, consultation services are sought - much more so than in previous years - for the purpose of organising Logistics and a warehouse operating model.

Β_ Great momentum in ERP-WMS projects: The companies of all sizes are not yet ready for full automation or,

even, for the incredible AI-based plans. Companies that, up to this moment, used to work only with Excel, now realize that - for a start - their systems need to be able to ‘’interact’’ with each other. In this context, a trend is created whereby small IT companies are trying to make up for the lost time in the past 20 years by entering the field of WMS solutions - with doubtful results, however. Many of the already installed warehouse management systems (WMS) have very poor functionality and, often, one and only barcode scan on entry and exit. I also notice a more acute problem in the field of WMS due to the lack of know-how on the part of IT consultants as regards warehouse operation. This is a bet that remains to be won.

C_ Lack of workforce: This is a wider issue, yet we can narrow it down by focusing on the lack of specialised executives in the warehouse and of basic workforce. This applies to such an extent that even workforce rental companies cannot meet the demand. This is why companies turn to inhouse personnel and invest to employees they can train and retain.

1. Advanced technologies change what we knew in the Supply Chain field. With rapidly evolving capabilities such as AI, Data Analytics, ML, IoT, Blockchain, etc., the “smart” Supply Chain is definitely one of the three trends in 2024 that will gradually become the new normality. The future ‘’promises’’ stand-alone machines which will be teaching themselves how to manage properly, depending on the occasion, the end-to-end operation of the Supply Chain whereas, in the course of 2024, we will see digital transformation technological tools changing Supply Chains and making them more agile, sustainable and fast.

2. The second trend that ‘’threatens’’ the sector is the global (very intense in our country, in the past years) lack of workforce. We have said it many times in our conferences that the lack of