23 minute read

Table 5-2 - Summary Implementation Cost Estimates by Project

# Project title Project Location Project sub-components Implementation agency and stakeholders Potential sources of financing/ funding and delivery mechanisms Total Estimated Costs (KES) Timescale

13 Increasing connections to Bungoma water supply Focus Area 1 - Bungoma Municipality › Last mile connections for 1000 households › Rolling loan fund to support the connection of 1000 low-income households › The main implementation agent and stakeholder would be the water company › Other stakeholders include the low-income households › IFI/Donor › The project would be funded through IFI or Water

Sector Trust fund

14 Supporting the sewer network expansion Focus Area 1 - Bungoma Municipality › Sewer connection of 500 households within low-income households › Rolling loan to support connection of 500 low-income households › Bungoma STW fence. › The implementation agent would be the NZOWASCO water company › Stakeholders include the NZOWASCO water company, low-income households connecting to the sewer system, local businesses and the Municipality/County government › IFI/Donor and Public sector › Funded through the public sector such as the NZOWASCO water company

15 Construction of recycling facilities County/ Municipalitywide - specific locations determined by a feasibility study. › Construction of a Materials

Recovery Facility › Support from NGOs, community groups › Private-Public Partnership (PPP) and/or private waste service provision › Revenue generating aspects: segregated materials will be a marketable product

16 Organic waste County/ Municipalitywide - specific locations determined by a feasibility study

17 Solid waste segregation, storage and collection County/ Municipality-wide › Purchase of bins/containers and collection vehicles › Running and maintenance of vehicles annually › Support from NGOs, community groups, waste pickers › Private Public Partnership (PPP) and/or private waste service

› Assessment of the waste arising based on adoption of door-to-door segregated waste collection › Development of AD plant › AD plant developer/operator to implement and maintain › Private-Public Partnership (PPP) and/or private waste service provision › Revenue generating aspects: biofuel is a marketable product KES 36,000,000 Short, medium and long-term

KES 57,000,000 Short, medium and long-term

KES 75,000,000 Short-term

KES 150,000,000 Short-term

KES 30,000,000 Short to medium-term

# Project title Project Location Project sub-components Implementation agency and stakeholders Potential sources of financing/ funding and delivery mechanisms Total Estimated Costs (KES) Timescale

18 Landfill rehabilitation County/ Municipality-wide - rehabilitation of the current Tuuti dumpsite › Construction of new engineered landfill cells › Construction of landfill gas collection and process system for biofuels › Support from NGOs, community groups › Private-Public Partnership (PPP) and/or private waste service provision › Revenue generating aspects: biofuel is a marketable product.

19 Catchment management in Mt Elgon water tower County/ Municipality wide › Trees and seedlings planting › The initiative should be coordinated by the County, with inputs during the design phase and implementation phase by governmental agencies (e.g. Kenya Water Towers Agency, KFS), the private sector, community groups, donors/IFI and climate funding bodies › IFI/Donor and Public sector › The financing option can be a cross-collaboration between the private sector, public sector,

County/Municipality budget,

Donors/IFI and Climate Funds Kes 479,000,000 Medium-term

KES 35,700,000 Short, medium and long-term

5.4 Scheduling

This section sets out the timeframe for the delivery of each climate-resilient infrastructure project for the respective sector action plans. The synergies for each sector action plan are also described in relation to the overall development framework.

The VC projects and climate-resilient infrastructure projects in the agriculture, livestock and agri-processing sector are mainly scheduled to be delivered in the short-term (0-3 years). As the main infrastructure for both the poultry farming and dairy VCs have already been developed over recent years within the County, the projects mostly focus on the management and organisation of services provided to support the VC activities, as well as capacity building, in order to create further value addition. Therefore, the initiatives proposed in sections 4.2.2 and 4.2.3 should be implemented in the short-term.

In order to support the dairy VC, the solar refrigeration (cold stores) climate-resilient infrastructure project should also be delivered in the short-term, this will reduce the levels of spoiled product and increase value addition as the shelf life of dairy products would be increased. The development of the Webuye Industrial Zone is suggested to begin in the short-term, with activities such as land acquisition and detailed design of the site occurring in the first few years. Running in parallel, the water, wastewater and drainage for the Industrial Zone climate-resilient infrastructure projects should be delivered soon after the acquisition of land and detailed design phase. This project should be in place in time for light industry to occupy the Industrial Zone in order to provide the businesses with adequate water, wastewater, and drainage services. After the completion of Phase 1 of the Industrial Zone, in the medium-term, expansion of the Industrial Zone should be considered in the long-term. It is however noted that this scheduling will also be driven by market demand, in terms of proponents and operators requiring serviced land for development of their respective industries. The anchor projects and climate-resilient infrastructure projects associated with the markets, trade and services sector are mainly scheduled to be delivered in the short to medium-term (0-3 and 4-9 years). In order to facilitate the redevelopment of the CBD main market and adjacent bus station, one of the anchor projects, the bus park should be relocated to the new site in the north of the Municipality in Kanduyi. This will unlock the land at the current bus park found in the CBD for development. In order to kick start the implementation of all the anchor projects, activities such as land acquisition and detailed design should occur in the short term, with construction of new buildings, facilities and public services beginning thereafter and continuing into the medium-term.

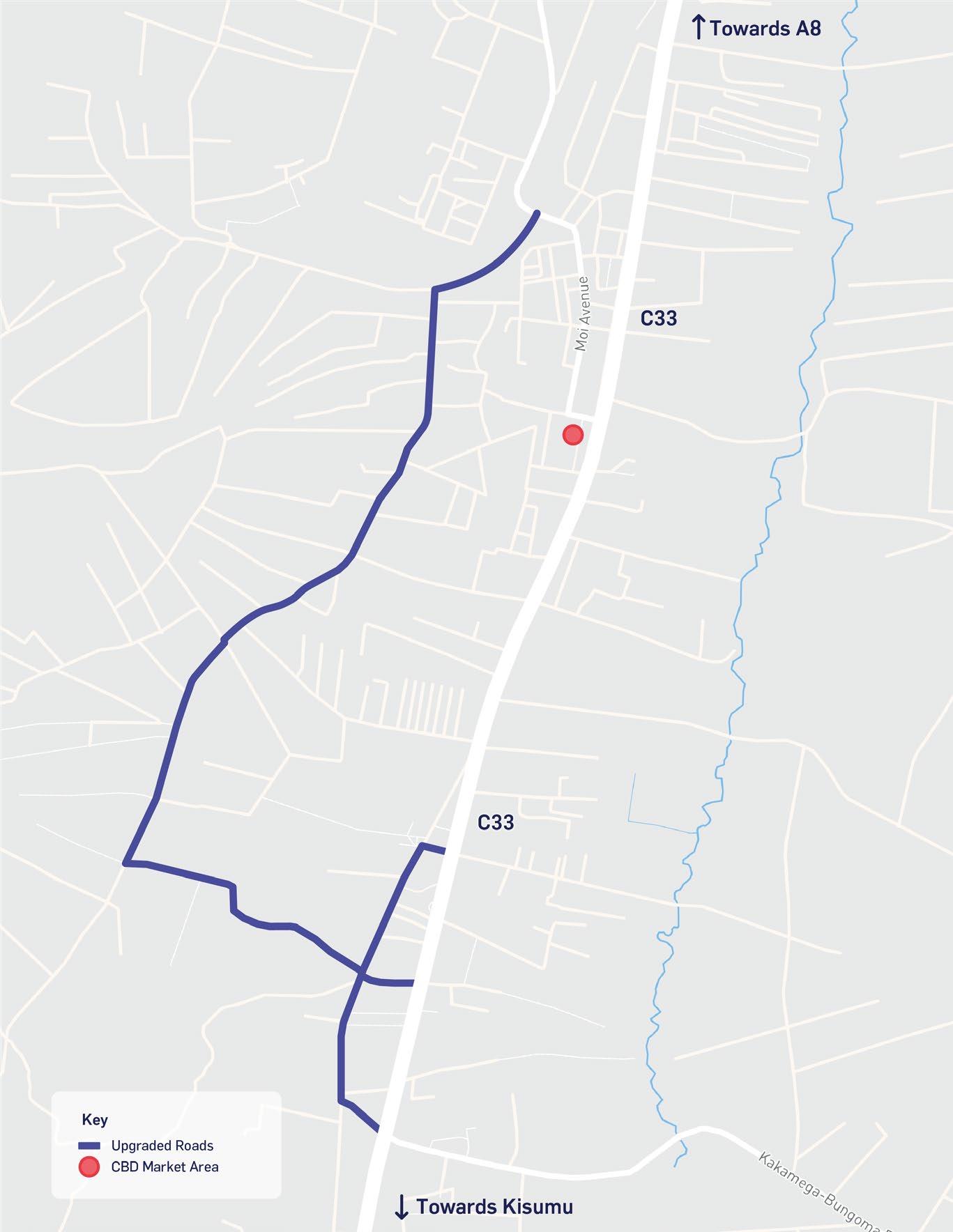

The anchor projects should also be supported by the implementation of the other climate-resilient infrastructure projects proposed in this sector. The accessible toilets and streetlights climate-resilient infrastructure projects will aid in increasing sanitation, public safety, and overall attractiveness of the public spaces around the anchor projects. Similarly, the upgrade of Town centre redundancy links, coupled with urban improvements along the C33, will help to improve road safety and the quality of public space by decongesting the CBD area of vehicles and encouraging NMT movement across the CBD and the other anchor projects.

Finally, the implementation of the truck parking facilities should begin in the short-term, with activities such as land acquisition and detailed design, with the infrastructure developed soon after and into the medium-term in order to accommodate vehicles stopping off along the A8 highway on their way to and from the Kenya-Uganda border.

The cross-sectoral/Bungoma-wide climate resilient infrastructure projects are mainly scheduled to be delivered in the short to medium-term (0-3 and 4-9 years). However, a number of the projects are expected to continue into the long-term to support the ongoing urban expansion of Bungoma and the services provided to its people.

The solar PV power generation and renewable energy/ energy efficiency project to support Matisi water treatment works climate-resilient infrastructure projects should both be implemented in the short-term in order to alleviate some of the current issues associated with high electricity prices across the Municipality and lack of water treatment. This would result in an increase in water supply to the reticulation network in Bungoma Town as higher volumes of water can be treated; furthermore, this will help to balance water demand and supply levels in the short-term before larger projects to improve water supply are implemented at a County and regional scale.

An ongoing loan scheme, starting in the short-term and continuing into the long-term, to increase the number of connections to the piped water network for low-income households, as part of the increasing connection to Bungoma water supply climate-resilient infrastructure project, will help to improve access to water to some of the most vulnerable people in the Municipality.

Similarly, the climate-resilient infrastructure project to support the sewer network expansion would begin in the short-term and continue into the long-term as the sewerage system expands to support urban growth of the Town over time. A series of climate-resilient infrastructure projects associated with solid waste management should be developed in the short to medium-term. The implementation of these projects will help to support the Industrial Zone and activities in Webuye as well as the anchor projects in Bungoma CBD by addressing the issues associated with the lack of adequate solid waste collection, sorting and disposal methods. Finally, the catchment management in Mt Elgon water tower climate-resilient infrastructure project will aid in rehabilitating and improving the local environment by planting around 65,000 trees in key locations starting in the short-term and continuing into the long-term.

Figure 5-1 demonstrates the full set of proposed VCs and climate-resilient infrastructure projects, showing when implementation would suitably begin and how they are linked:

Figure 5-1 – UEP Development Framework Project Schedule

Agricultural, livestock and agri-processing sector

Markets, trade and services sector

Cross-sectoral /Bungoma-wide infrastructure projects Short Term (0-3 Years)

VC - Poultry farming

VC - Dairy

Water, wastewater and drainage for industrial zone

Solar refrigeration (cold stores) Medium Term (4-9 Years)

Webuye Industrial Zone

Molasses to ethanol point

Bus park relocation

CBD market and bus station

Accessible public toilets

Streetlights CBD green link

Airstrip redevelopment

Town centre redundancy links

Urban improvement along C33 and road safety

Truck parking centre

Solar PV power generation

Energy effeciency project to support Matisi water treatment works

Construction of recycling facilities Supporting the sewer network expansion

Increasing connections to Bungoma water supply

Solid Waste Management

Organic waste

Solid waste segregation, storage and collection

Landfill rehabilitation

Catchment management in Mt Elgon water tower

Source: Atkins analysis, 2022

Long Term (10+ Years)

Anchor Projects

5.5 Funding

Investment attraction experts, as part of the SUED programme, will develop feasibility studies for the proposed projects which will include estimated capital expenditure and operating expenditure requirements. It will likely be necessary to combine a range of different sources of financial and non-financial support to meet the projects’ expenditure requirements. Careful consideration will have to be given to the differing eligibility criteria of the various sources in order to successfully structure blended finance arrangements.

Grant funding can help improve the financial viability of projects which have significant, upfront capital expenditures, improving the overall investment appeal of a project and attracting additional private investment as a result. The proportion of grant finance of the total project finance amount should be carefully justified, as simply seeking a maximised grant finance proportion can seed doubts in the private sector about the long-term financial sustainability of the project. Grant funding is also available to less commercially-viable projects with significant socio-economic or environmental benefits, particularly relating to climate change and resilience. They may also be focused on certain activities such as technical assistance in project preparation or capacity development.

Philanthropic and NGO grant funding could also be leveraged through initiatives such as businesses dedicating 1% of profits to corporate social responsibility (CSR) initiatives. The World Bank’s Kenya Urban Support Programme (KUSP) has also been identified as a source of potential funding support for some of the UEP projects, including public realm improvements and urban drainage solutions. Private sector finance for a range of sectors is available in East Africa from both local and international sources. Existing investors in the region include impact investors, venture capitalists and private equity funds who are able to provide relevant instruments for the value chain projects such as equity, quasi-equity (mezzanine finance) or concessionary debt. Access to private finance will be contingent on the concrete demonstration of viable business models and strong governance structures.

Projects will also benefit from blending in non-financial support in the form of social capital, such as volunteer efforts from the community. Actions to build social capital include mobilising community organisations and volunteers to be involved with the development and implementation of projects. The most successful mobilisation of human and social capital resources occurs in projects where there is a demonstrated, direct and visible relationship between the project and the future benefits for community and volunteer stakeholders. Examples of projects could include raising awareness campaigns for more efficient use of water and solid waste collection and management.

Climate-resilient infrastructure and VCs funding

It is now widely recognised that there is an urgent need to scale-up investment in climate change adaptation and low-carbon development in Africa, and the assessments carried out in the development of this UEP highlights that sustainable urban development can only occur if there is significant investment in climate resilience. There is an increasing focus on how to finance activities related to climate change adaptation and mitigation, with a range of specialised funds and financial instruments available. This includes a significant number of donor and IFI-led initiatives, but the field of private sector sustainable finance is also growing rapidly, and many investors are starting to look for investments which demonstrate clear environmental, social and climate benefits. The growing appetite to invest in projects which are aligned with low carbon and climate-resilient development outcomes provides a new potential source of finance to bring to bear to finance adaptation, resilience, and climate mitigation in East Africa.

Successfully accessing resources to support adaptation, and low-carbon development, depends on a good understanding of the investor’s perspective and procedures. The IFI and MDBs for example, have adopted the following principles for a project to be classified as contributing to adaptation:

> Include a statement of purpose or intent to address or improve climate resilience in order to differentiate between adaptation to current and future climate change and good development; > Set out a context of climate vulnerability (climate data, exposure and sensitivity), considering both the impacts from climate change as well as climate variability related risks; and > Link project activities to the context of climate vulnerability (e.g. socio-economic conditions and geographical location), reflecting only direct contributions to climate resilience.

Private sector financiers, on the other hand, are looking for clear metrics through which they can demonstrate the sustainability and impact of their investments. This is more closely aligned to existing impact investing and guidelines for demonstrating environmental, social and governance elements of an investment, or emerging criteria for sustainable finance, such as those outlined in the EU Taxonomy on Sustainable Finance. International climate funds have more stringent eligibility requirements, and so a comprehensive grasp of eligibility criteria, as well as the different financial mechanisms and the extent to which they can be combined is important.

The VCs and infrastructure projects have had climate change resilience actions embedded in their proposals, and further recommendations have been made, as per sections 4.2.2 and 4.2.3. This will aid the projects in accessing funding by demonstrating their significant contribution to climate change actions. The section below provides a brief overview of some of the main sources of funding available for projects, and to support low-carbon and climate-resilient development.

5.5.1 Climate action funds

Presented below is a snapshot of the available climate change funds that cover climate adaptation and mitigation, and the climate-resilient infrastructure projects in this UEP they could be applicable to. International climate funds generally deal in relatively large investments, and as such projects would need to be grouped and aggregated to provide investments that are large enough in scale. The following should be seen as indicative of the type of funding that might be able to be leveraged.

Green Climate Fund (GCF): The GCF seeks to promote a paradigm shift to low emission and climate-resilient development, taking into account the needs of nations that are particularly vulnerable to climate change impacts including African nations and Small Island Developing States (SIDs). The GCF aims to deliver equal amounts of funding to mitigation and adaptation measures. Its activities are aligned with the priorities of partner countries through the principle of country-led programmes and implementation. The financial delivery mechanism for the GCF is grants, loans, equity or guarantees. This fund could be a finance source for:

> Project 3: Solar refrigeration (cold stores) > Project 11: Solar PV Power Generation > Project 12: Renewable energy/energy efficiency project supporting Matisi water treatment works > Project 4: Molasses to ethanol plant In addition, two specific GCF investments provide further opportunities:

The ACUMEN Resilient Agriculture Fund (ARAF). The ARAF, which is currently operational, and is scheduled to end in 2031, provides finance to support innovative private sector businesses that enhance the resilience of smallholder farmers in Uganda, Kenya, Ghana and Nigeria. There is a specific focus on providing innovative MSMEs with the finance they need to adopt longer-term approaches to adapting to climate change, including increased use of digital approaches and climate-smart agriculture. Given the needs outlined through the UEP development process, there is a potential opportunity to attract finance for innovation, developing models and approaches that could then be replicated more widely.

The Global Sub-National Climate Fund (SnCF Global). The SnCF Global uses GCF backing to overcome the barriers to the financing of smaller-scale adaptation and mitigation projects at a sub-national level. The fund is managed by the International Union for the Conservation of Nature (IUCN) and was approved in November 2020. It will operate in Kenya, Rwanda, and Uganda, and will attract private finance to projects previously not deemed to be investible in, on a commercial finance basis. There is a focus in the fund on nature-based solutions, and it represents a possible avenue for investment in some of the project opportunities identified. This fund could be a finance source for:

> Project 19: Catchment management in Mt Elgon water tower

The National Treasury. This is the Kenyan National Designated Authority (NDA) for the GCF in Kenya. It has developed the Kenya National Green Climate Fund (GCF) Strategy,119 with a vision to channel investment from the GCF for a climate-resilient society and low-carbon economy. The Strategy identifies County governments as critical co-financiers who can take the role of executing entities and/or implementing entities of climate-resilient and low-carbon initiatives. The Strategy provides a roadmap for stakeholders in harnessing resources from the GCF. This fund could be a finance source for:

> Project 14: Supporting the sewer network expansion > Project 13: Increasing connections to Bungoma water supply > Project 2: Water, wastewater and drainage for Industrial Zone > Project 17: Solid waste segregation, storage and collection

A clear climate rationale would need to be developed for these projects, however, there is a case to be made that these investments serve to strengthen the overall resilience of the municipality, given increasing climate impacts. The Adaptation Fund (AF). The AF finances projects and programmes that help vulnerable communities in developing countries adapt to climate change. Initiatives are based on country needs, views and priorities. The financial instrument/ delivery mechanism used by the Adaptation Fund is grants. NEMA is the National Implementing Entity (NIE) for the Adaptation Fund in Kenya. The AF raised US$35.6 million at COP26, which will be used to continue supporting developing countries in their adaptation measures, as well as encouraging climate-resilient economic recovery from the COVID-19 pandemic121. This fund could be a finance source for:

> Project 14: Supporting the sewer network expansion > Project 13: Increasing connections to Bungoma water supply > Project 2: Water, wastewater and drainage for Industrial Zone > Project 19: Catchment management in Mt Elgon water tower

The Least-Developed Countries Fund (LDCF). The LDCF was established to meet the adaptation needs of least-developed countries (LDCs). Specifically, the LDCF has financed the preparation and implementation of National Adaptation Programs of Action (NAPAs) to identify priority adaptation actions for a country. The financial instrument/ delivery mechanism used by the LDCF is grants. The Global Environment Facility (GEF) administers the LDCF and Operational Focal Points (OFPs) are responsible for coordination in country. The Ministry of Environment and Forestry is Kenya’s GEF Operational Focal Point. The Special Climate Change Fund (SCCF). The SCCF was established to address the specific needs of developing countries to cover the incremental costs of interventions to address climate change relative to a development baseline. Adaptation to climate change is the top priority of the SCCF and in addition to this, it finances projects relating to technology transfer and capacity-building in the energy, transport, industry, agriculture, forestry, and waste management sectors. The SCCF is administered by the GEF and its financial instrument/delivery mechanism is grants. The Ministry of Environment and Forestry is Kenya’s GEF Operational Focal Point. This fund could be a finance source for:

> Project 3: Solar refrigeration (cold stores) > Project 11: Solar PV Power Generation > Project 12: Renewable energy/energy efficiency project supporting Matisi water treatment works > Project 4: Molasses to ethanol plant > Project 14: Supporting the sewer network expansion > Project 13: Increasing connections to Bungoma water supply > Project 2: Water, wastewater and drainage for Industrial Zone > Project 19: Catchment management in Mt Elgon water tower

121 Adaptat Fund, Adaptation Fund raises record US$ 36 million in new pledges at COP26 for its concrete actions to most vulnerable (2021), Available at: Adaptation Fund

Raises Record US$ 356 Million in New Pledges at COP26 for its Concrete Actions to

Most Vulnerable - Adaptation Fund (adaptation-fund.org), (Accessed:15/12/2021).

The Pilot Program for Climate Resilience (PPCR). The PPCR provides funding for climate change adaptation and resilience-building. It aims to demonstrate ways in which climate risk and resilience may be integrated into core development planning and implementation by providing incentives for scaled-up action and initiating transformational change. This may include technical assistance to integrate climate resilience into national development plans, or funding for public and private sectors when implementing climate resilience initiatives. It is a targeted program of the Strategic Climate Fund (SCF), which is one of two funds within the Climate Investment Funds (CIF) framework. The financial instrument/delivery mechanism for the PPCR is grants and loans. The CIF Secretariat is housed at the World Bank.

Following on from the PPCR the CIF is supporting four thematic programme areas aiming to support the transition to a low-carbon, climate-resilient economy. There may be particular opportunities to access funding under the Climate Smart Urbanisation programme, and the Nature, People and Climate Investment programme. Clean Technology Fund (CTF). A multi-donor fund and part of the Climate Investment Funds (CIF). The CTF promotes financing for the implementation of renewable energy technologies with potential to reduce emissions, with the aim of making these more attractive to public and private sector investors. The fund can be accessed via the African Development Bank, and uses a variety of financial instruments including grants, loans, equity and guarantees. This fund could be a finance source for:

> Project 3: Solar refrigeration (cold stores) > Project 11: Solar PV Power Generation > Project 12: Renewable energy/energy efficiency project supporting Matisi water treatment works > Project 4: Molasses to ethanol plant

The Africa Climate Change Fund (ACCF). This aims to support African countries’ transition to climate-resilient and low-carbon modes of development, as well as scaling-up their access to climate finance. The fund offers grants for projects related to the following themes: supporting small-scale or pilot adaptation initiatives to build resilience of vulnerable communities and supporting direct access to climate finance. The secretariat is housed at the African Development Bank. The Kenya County Climate Change Fund (CCCF) Mechanism. The expansion of the CCCF across the country is one of the priorities in the Kenya National Climate Change Action Plan (NAP), 2018-2022.

The CCCF improves a County’s readiness to access and distribute national and global climate finance to support community-prioritised investments to build climate resilience. The CCCFs are aligned with national priorities set out in the NAP and enable County governments to strengthen and reinforce national climate change policies while delivering on local adaptation priorities. Post COP26, the Kisumu County government has pledged to allocate 2% of its annual budget towards climate change mitigation measures, in line with Kenya’s commitments outlined in its NDC, with other counties set to make similar pledges.

African Financial Alliance on Climate Change (AFAC). AFAC was established with the aim of increasing financial sector participation to drive climate change initiatives across Africa. Bringing together key financial players, including private banks, multilaterals and sovereign funds, and the pan-African alliance will help to mobilise private capital investment towards a climate-resilient development path. AFAC’s main aim is to engage in knowledge-sharing and increase private sector participation in climate action, as well as attracting climate investment into national and regional climate projects122. This fund could be a finance source for:

> Project 14: Supporting the sewer network expansion > Project 13: Increasing connections to Bungoma water supply > Project 2: Water, wastewater, and drainage for Industrial Zone > Project 19: Catchment management in Mt Elgon water tower

122 African Development Bank, African Investment Forum 2018: African Financial

Alliance on Climate Change (AFAC) unveiled guiding principles (2018), Available at: Africa Investment Forum 2018: African Financial Alliance on Climate

Change (AFAC) unveils guiding principles | African Development Bank - Building today, a better Africa tomorrow (afdb.org), (Accessed: 15/12/2021).

Africa Adaptation Acceleration Program (AAAP). Endorsed by the African Union, the AAAP was established to raise US$25 billion for adaptation of the impacts of climate change123. The program focuses on four pillars: the creation of climate technologies to combat agricultural losses and food security, building resilient infrastructure, and empowering youth through green job creation. The fourth focus is on the mobilisation of funding for climate action, with consideration given to promoting green growth post-COVID-19. This fund could be a finance source for:

> Project 3: Solar refrigeration (cold stores) > Project 4: Molasses to ethanol plant

Sustainable Energy Fund for Africa (SEFA). This is a multi-donor fund managed by the African Development Bank. The fund was set up with the aim of contributing to the development of sustainable energy services across Africa. The fund supports initiatives through technical assistance grants, combined with concessional investment, via loans and equity instruments124. This fund could be a finance source for:

> Project 3: Solar refrigeration (cold stores) > Project 11: Solar PV Power Generation > Project 12: Renewable energy/energy efficiency project supporting Matisi water treatment works

> Project 4: Molasses to ethanol plant

5.6 Recommendations for Capacity Building

Several areas are recommended for capacity building for the UEP implementation, where the infrastructure provision for the VCs is mostly already there, capacity building is essential to the success of the VCs and the delivery of the SUED interventions. The following capacity building recommendations would support the effective and integrated approach to sustainable and inclusive economic sector development; infrastructure delivery, operation and maintenance; and climate resilience future-proofing development.

Project implementation

Capacity building in project preparation, project management and delivery and maintenance from the Municipality, and County, particularly when it comes to revenue-generating activities and how to ensure revenue is received and used, is recommended. Working with the private sector for the delivery of urban services and projects is increasing in importance and requires knowledge and skills to support effective implementation of market-driven solutions including the PPP mechanism. The UEP promotes an integrated approach to development and there is a need to ensure silo thinking is removed from planning and delivery. This enables an understanding of what needs to come first in the development process, and the wider dependencies and synergies. COVID-19 lessons

Strengthening preparedness and emergency response capacity is critical. This means better preparedness in terms of financing, service delivery and business continuity including budgeting for future crises, emergency operations centres, capacity building, drills, and human resources redeployment plans.

This capacity building is recommended for Bungoma Municipality and Bungoma County, where a cross-sector taskforce would be a recommended structure.

Data and digital tools

Effective data gathering and analysis will support the monitoring of strategic objectives for the Municipality, and County, including UEP project implementation, where capturing stakeholder information can be a key element of this. Data management of Municipality and County services, such as waste management, public transport service and open space and SuDS maintenance, will support the Municipality and County in responding to the resident and business needs as well as monitor impact of these services. The development of an integrated spatial development plan would be supported with registries on land use and ownership, infrastructure assets and service provision, to better plan and respond, both in normal times and during future shocks.

123 African Development Bank, Africa adaptation acceleration program, (2021), Available at: https://www.afdb.org/sites/default/files/2021/10/19/ africa_adaptation_acceleration_program.pdf, (Accessed: 15/12/2021). 124 African Development Bank, Sustainable Energy fund for Africa (2021), Available at: Sustainable Energy Fund for Africa | African Development Bank - Building today, a better Africa tomorrow (afdb.org), (Accessed: 15/12/2021).