Slim pickings for buyers amid record low homes for sale

Alex Veiga ASSOCIATED PRESSLOS ANGELES — Americans eager to buy a home this spring, beware: It’s slim pickings out there.

The number of U.S. homes on the market is at near-historic lows, which could dim would-be buyers’ prospects for finding a house or condo and fuel competition for the most affordable properties, economists say.

As of the end of February, just as the spring homebuying season got under way, some 980,000 homes were on the market nationally, according to the National Association of Realtors.

That’s an increase of 15.3 percent from February last year, when the number of homes for sale sank to an all-time low.

February’s tally of homes for sale translates into a 2.6-month supply at the current sales pace, according to NAR. In a more balanced market between buyers and sellers, there is a 5- to 6-month supply.

While homebuyers will have more properties to choose from now than last spring, the low supply and sharply higher mortgage rates set the stage for a higher overall price tag for homeownership.

“Buyers are facing a tough market,” said Hannah Jones, an economic data analyst at Realtor.com.

A big reason there are more homes for sale than a year ago: Properties are taking, on average, nearly twice as long to sell. New listings, meanwhile, were down about 16 percent in February from a year earlier, according to Realtor. com data.

Average long-term U.S. mortgage rate falls to 6.42 percent

ASSOCIATED PRESS

The average long-term U.S. mortgage fell for the second straight week which, combined with moderating home prices, could give house hunters a break and the housing market a boost as the spring buying season begins.

Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate fell to 6.42 percent from 6.6 percent last week. The average rate a year ago was 4.42 percent.

Even though financial markets remain jittery over recent bank collapses and the Fed raised its benchmark lending rate by another 25 basis points Wednesday, some economists think there may be light at the end of the tunnel for the downtrodden housing market.

Last year’s big rise in mortgage rates — which can add hundreds of dollars a month in costs for homebuyers — chilled the housing market. Before surging 14.5 percent in February, sales of existing homes had fallen for 12 straight months to the slowest pace in more than a dozen years.

In 2022, existing U.S. home sales fell 17.8 percent from 2021, the weakest year for home sales since 2014 and the biggest annual decline since the housing crisis began in 2008, the National Association of Realtors reported earlier this year.

But recently there has been some good news for those seeking to move: the national median home price slipped 0.2 percent from February last year to $363,000, marking the first annual decline in 13 years, according to the NAR.

The average long-term rate hit 7.08 percent in the fall as the Federal Reserve cranked up its key lending rate in a bid to cool the economy and stymie persistent, four-decade high inflation.

In their latest quarterly economic projections, the policymakers forecast that they expect to raise that key rate just once more — from its new level of about 4.9 percent to 5.1 percent, the same peak they had projected in December 2022.

HOW TO TELL IF YOU ARE ‘HOUSE POOR’

Steve Adcock WEALTH OF GEEKS“House poor” describes a house so expensive that it requires a significant percentage of your cash flow every month. It’s a position you want to avoid being in.

Generally, financial experts recommend spending at most about 30 percent of your monthly budget on your house, including your mortgage, utilities, and property taxes. If you spend more than 30 percent of your budget on your home, you might be house poor.

What’s wrong with being house poor?

The problem with being house poor is you lack financial flexibility, especially when times are tough. For instance, someone who spends 20 percent of their monthly budget on their house is in a far better position to endure a job loss or an unexpected expense than someone who spends 50 percent or more on their home.

Maybe your dream of owning a big beautiful home is catching up with you. Or, you didn’t account for the total cost of ownership before you bought the house. For instance, homeowners association fees, property taxes, utility costs, and maintenance all account for your home’s total cost of ownership. Lastly, maybe a change in your income has made you house poor.

Here is the bottom line: The more you spend on your home, the fewer options you have if you need extra cash. We need to be comfortable with our homes, but we also must avoid letting those homes reduce our

financial stability.

This means having an emergency fund ready to account for unexpected expenses is essential even if you aren’t house poor. I recommend saving at least three months’ worth of living expenses in a separate savings account. Separating your emergency fund makes it more challenging to accidentally spend that money while keeping it easy to access when needed.

How to stop being house poor

If you’re house poor, your first priority for the rest of 2023 should be improving your financial position. Here are four ways to keep your home from taking a substantial portion of your budget and reducing your financial stability.

Try to save more money by reducing your discretionary spend-

ing. For instance, cut back on restaurant meals, going to movies, or buying things on Amazon. To cut your spending, the first step is to track your spending. Use tools like Personal Capital, Mint, or You Need A Budget to help determine where your money is going. Then, take an active (and nonjudgmental) role in deciding where to trim your monthly expenses.

Refinance your mortgage

Depending on the financial climate, refinancing your mortgage could be an easy way to reduce your mortgage payments each month, bringing down the total cost of your home. Sometimes, mortgage lenders will cut you a check if you’re borrowing more than you owe on your current loan. This can be an excellent way to lower your monthly mortgage payments and put extra cash in

your pocket. Opt for a fixed interest rate mortgage to avoid getting caught off guard by unexpected interest rate hikes.

Boost your income with side hustles

Starting a side hustle is a great way to boost your income monthly by offering value. There are many ways to create a side hustle, including landscaping services, driving for Uber or Lyft, pet sitting, designing websites, teaching an online course, etc. If you don’t mind doing some driving, consider joining a grocery-delivery service, such as Instacart. Instacart says that the average driver gets paid about $17 per hour, including tips and the delivery charge.

Move to a lower cost-ofliving home/neighborhood

Sometimes, selling your current home and moving to a cheaper house in a more affordable area is the best way to cut your monthly home expenses. Of course, this is a drastic step and requires moving your family and furniture. However, it might be the best solution to improve your financial situation.

Being a house poor homeowner reduces your financial stability because your home takes a substantial amount of your monthly budget, leaving less money if times get tough. Are you house poor? If so, start by reigning in your spending habits to free up more money. Then, consider refinancing your mortgage, starting a side business to increase your income, or even moving to a lowercost-of-living area to bring your expenses down.

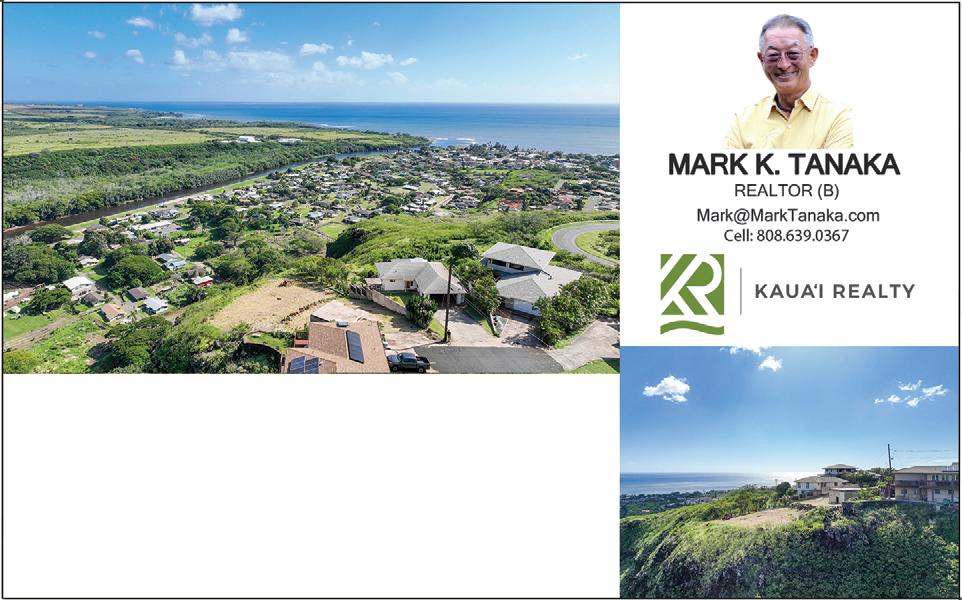

VILLAS AT PUALI

$825,000

3Bed/2Ba

Interior: 1,392 sqft MLS 667501

Newly refreshed 3 bedroom, 2.5 bath townhome in Villas at Puali community in Lihue. Convenient location close to major shopping, schools, business and eateries. New luxury vinyl plank flooring, lush upstairs carpeting and new paint throughout. Full kitchen appliances included. Enclosed 2-car garage.

A. Kukino, RB-15364 ckukino@kauairealty.net • 808-639-1490 Jordan Kukino, RS-81289 jordankukino@kauairealty.net • 808-634-5032 Kaylin Kukino, RS-84730 kaylin@kauairealty.net • 808-635-2822

CIRCUIT COURT NOTICE OF PROBATE AND NOTICE TO CREDITORS

P. No. 5CLP-23-24 Estate of JERRY ERIC LAGAZO, JR., Deceased FILED,PetitionforAdjudicationofIntestacy andAppointmentofPersonalRepresentative,showing propertywithinthejurisdictionofthisCourtandasking thatDELCYNNLAGAZO,whoseaddressisc/oMichael D.Scarbo,4442HardySt.,Ste.201,Lihue,HI96766 be appointed Personal Representative of said estate.

ThatTuesday,May2,2023,at1:00p.m. beforethepresidingJudgeinProbateatwhoshallbe sittinginprobateinhis/hercourtroomat3970 Ka‘anaStreet,Lihu‘e,Hawai‘i,96766bethe appointeddate,timeandplaceforhearingsaid petition and all interested persons.

Allcreditorsoftheabove-namedestateare herebynotifiedtopresenttheirclaimswithproper vouchersordulyauthenticatedcopiesthereof,evenif theclaimissecuredbyamortgageuponrealestate,to saidnomineeattheaddressshownabovewithinfour monthsfromthedateofthefirstpublicationofthis notice or they will be forever barred.

Dated: Lihue, Hawaii, March 21, 2023.

Christine J. Martinez Clerk of the Above-Entitled Court Michael D. Scarbo 4442 Hardy St., Ste. 201 Lihue, HI 96766 Attorney for Personal Representative

Notice of Public Comment: Annual State Application under Part B of the IDEA InaccordancewiththeprovisionsoftheGeneral EducationProvisionsAct,theHawaiiStateDepartment ofEducation’s(HIDOE)applicationforFederalFiscal Year2023fundsunderPartBoftheIndividualswith DisabilitiesEducationImprovementActwillbe availableforreviewfrom March20,2023, through May 20, 2023, on the following website: https://bit.ly/HIDOE-PartBapp2023 TheHIDOE,ExceptionalSupportBranchwillaccept publiccommentsregardingtheapplicationfrom April4,2023toMay4,2023,at4:00p.m.Please include the following information:

Name: Contact phone number: Email address: School/Office: Comments: Submit this information to emmitt.ford@k12.hi.us. Comments may also be mailed to: Mr. Emmitt Ford, Institutional Analyst Exceptional Support Branch 475 22nd Avenue Honolulu, HI 96816 Ifthereareanyquestionsorclarificationsneeded, please contact Mr. Ford, at (808) 305-9806.

NOTE:Commentsmustbereceivedby4:00p.m., Thursday, May 4, 2023. (TGI14097113/22,3/23,3/24,3/25,3/27,3/28, 3/29,3/30,3/31,4/01,4/03,4/04,4/05,4/06, 4/07/23)

P. NO. 5CLP-23-0000019

ESTATEOFFRANKJOSEPHMATTIA,alsoknownas

FRANK J. MATTIA and FRANK MATTIA, Deceased, FILED,anApplicationbyDEBORAANNHERZOG allegingintestacyofsaiddecedent,showingproperty withinthejurisdictionofthisCourt,andaskingthat DEBORAANNHERZOG,c/oClayIwamuraPulice& Nervell,700BishopSt,Ste2100,Honolulu,HI 96813,beappointedPersonalRepresentativeofthe estate.

Ifanyinterestedpersonhasobjectiontothe informaladministration,heorshemayfileapetition forformalproceedingswithinthirty(30)daysafterthe dateofthefirstpublicationofthisnotice;ifany interestedpersondesiresfurthernoticeconcerningthe estate,heorshemustfileaDemandforNotice pursuant to HRS Section 560:3-204.

Allcreditorsoftheabove-namedestatearehereby notifiedtopresenttheirclaimswithpropervouchersor dulyauthenticatedcopiesthereof,eveniftheclaimis securedbyamortgageuponrealestate,tosaid nomineesattheaddressshownabove,withinfour(4) monthsfromthedateofthefirstpublicationofthis notice, or they will be forever barred.

DATED: Lihue, Hawaii, March 7, 2023.

C. Martinez Clerk Edward

3/17, 3/24, 3/31/23)

IN THE FAMILY COURT OF THE FIFTH CIRCUIT STATE OF HAWAl’I

Tina Marie A. Parraga-Alejandro ) CASE NO. 5FDV-22-0000188 ) ) ORDER ON EX PARTE MOTION FOR Plaintiff, ) SERVICE BY PUBLICATION ) (and Mailing of Notice) vs. ) )

Greg Alejandro ) )

Defendant.__________ )

ORDER ON EX PARTE MOTION FOR SERVICE BY PUBLICATION (and Mailing of Notice)

Itappearingtothesatisfactionoftheundersignedthatservicebypublicationis appropriate and reasonable.

ITISHEREBYORDEREDthatthiscausebesetforhearingonTUESDAY,MAY2, 2023,at8:00a.m.ofsaiddayintheFamilyCourt,FifthCircuit,CourtroomNo. _____, 3970 Ka’ana Street, Lihu’e, Kaua’i, Hawai’i.

ITISHEREBYFURTHERORDEREDthatnoticeofthependencyofthiscauseand oftheaboveorderedtimeandplaceofhearingthereofbegiventotheDefendant abovenamedbypublicationofsuchnoticeinTheGardenIsland,anewspaper suitablefortheadvertisementofnoticesofjudicialproceedings,publishedinthis State,whichpublicationshallbeatleastonceineachofthree(3)successive weeks,thelastpublicationtobenotlessthantwenty(20)dayspriortothetime above set for hearing; and

ITISHEREBYFURTHERORDEREDthatsuchnoticeincludethestatementthat intheeventtheDefendantfailstoappearanddefendasrequired,furtheraction maybetakeninthiscauseincludingjudgmentforthereliefdemandedinthe complaint without further notice to the Defendant.

ITISHEREBYFURTHERORDEREDthatnoticeshallbemailedtoDefendantat his/her last known address by regular mail.

Thereshallbefiledinthisproceedingpriortothetimeofhearingofthe Complaint,anaffidavitofpublication,pursuanttothisorderwhichshallconstitute proof of service under the provisions of this order.

DATED: Lihu’e,

(TGI1407095