HOME SALES CONTINUE TO FALL

June was slowest pace since January with near-historic low inventory for sale

Alex Veiga ASSOCIATED PRESSLOS ANGELES — Sales of previously occupied U.S. homes fell in June to the slowest pace since January, as a near-historic low number of homes for sale and rising mortgage rates kept many would-be homebuyers on the sidelines. The national median sales price fell on an annual basis for the fifth month in a row, though fierce competition led to about one-third of homes selling for more than their list price.

Existing home sales fell 3.3 percent last month from May to a seasonally adjusted annual rate of 4.16 million, the National Association of Realtors said Thursday. That’s slightly below what economists were expecting, according to FactSet, and marks the slowest sales pace since January.

Sales sank 18.9 percent compared with June last year. All told, sales are down 23 percent through the first half of this year.

The national median sales price fell 0.9 percent from June last year to $410,200. That’s the smallest annual decline since

March. While down from a year earlier, the median sales price rose from the previous month, reaching the second-highest level on records going back to January 1999.

“Perhaps home prices are beginning to firm up or at least certainly any downward pressure is ending,” said Lawrence Yun, the NAR’s chief economist.

The latest housing market figures are more evidence that even with prices

Average long-term U.S. mortgage rate falls to 6.78 percent

ASSOCIATED PRESS

LOS ANGELES — The average long-term U.S. mortgage rate slipped this week to the lowest level in four weeks, a boost for house hunters facing a market held back by persistently high prices and a near-historic low number of homes for sale.

Mortgage buyer Freddie Mac said Thursday that the average rate on the benchmark 30-year home loan fell to 6.78 percent from 6.96 percent last week. A year ago, the rate averaged 5.54 percent.

The latest move in rates brings the average slightly below the highest level since it surged 7.08 percent in early November. High rates can add hundreds of dollars a month in costs for borrowers, limiting how much they can afford in a market already unaffordable to many Americans.

The pullback in rates follows a modest easing in the 10-year Treasury yield, which climbed above 4 percent two weeks ago for the first time since early March. The yield, which lenders used to price rates on mortgages and other loans, was at 3.86 percent in midday trading Thursday. It has been mostly bouncing around 3.79 percent this week following mixed economic retail sales and labor market data.

Inflation has been on the way down since last summer, which has many on Wall Street expecting the Federal Reserve’s next hike to interest rates, expected next week, will the the last of this cycle.

“As inflation slows, mortgage rates decreased this week,” said Sam Khater, Freddie Mac’s chief economist.

easing back on an annual basis after rising for more than a decade many house hunters are being held back by a persistently low inventory of homes for sale.

Some 1.08 million homes remained on the market by the end of June, down 13.6 percent from a year earlier, the NAR said. That amounts to a 3.1-month supply at the current sales pace. In a more balanced market between buyers

and sellers, there is a 5- to 6-month supply. The shortage of homes for sale has kept the market competitive, driving bidding wars in many places, especially for the most affordable homes. About onethird of homes purchased last month sold for above their list price, and 76 percent of homes sold in June were on the market for less than a month.

“This is a tough market to be a buyer,” Yun said.

The combination of high borrowing costs and intense competition for the most affordable homes on the market is shutting out many first-time buyers. They accounted for 27 percent of home sales last month, down from 28 percent in May and 30 percent in June last year, the NAR said. In a normal housing market, that would be 40 percent.

The U.S. housing market has yet to emerge from a

slump that started a little more than a year ago, when the average rate on a 30year mortgage began to climb from ultra-low levels as the Federal Reserve began raising its short-term rate in its fight against inflation.

Global demand for U.S. Treasurys, which lenders use as a guide to pricing loans, investors’ expectations for future inflation and what the Fed does with interest rates influence rates on home loans.

The average rate on a 30year home loan is still more than double what it was two years ago, when the ultra-low rates spurred a wave of home sales and refinancing. Weekly average rates on a 30-year mortgage ranged between 6.67 percent and 6.79 percent in June, according to mortgage buyer Freddie Mac. This week, the average rate slipped to 6.78 percent, the lowest level in four weeks. A year ago, the rate averaged 5.54 percent.

Higher mortgage rates can add hundreds of dollars a month in costs for homebuyers on top of already high home prices. They also discourage homeowners who locked in those low rates two years ago from selling -- one reason the supply of homes for sale has been low even during the traditionally busy spring homebuying season.

* Graco Sprayers * Home Owner * * Maintenance * Commercial * Industrial *

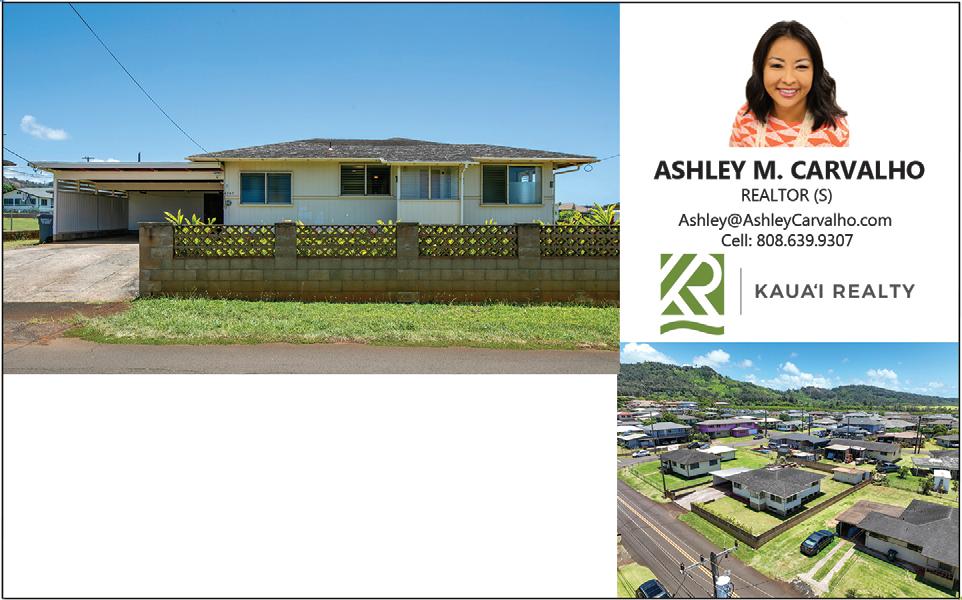

IN ESCROW

Land Area: 11,165 sf

Total Living Area: 2,376 sf

Bed/Bath: 3/3 & 2/1

Price: $1,250,000

MLS 702948

AROL C. CUMMINGS RB-14915 (RB) CRB, CRS, GRI, SFR 808-651-4766 kauairealty@gmail.com www.carolcummingskauai.com

LIHUE-2 HOUSES

PursuanttoHawaiiRevisedStatutes,Section342D7(i),theStateDepartmentofHealth(DOH)seeks writtencommentsfrominterestedperson(s)regarding thefollowing.GregoryYostandKennethBarkerhave appliedforavarianceforthemaximumoffive(5) yearsfromsection11-62-31.1(a)(1)(D)ofHawaii Administrative Rules, “Wastewater Systems.” Ms.SarahBroward,Designer,LoxHawaiiLLCis theauthorizedagenttoactfortheapplicant.The variancerequestisfortheconstructionofanew individualwastewatersystemtobeinstalledat406 PuaRoad,Kapaa,Hawaii,96746andTMK(4)4-1013:028.

Ifyouwouldliketoreviewthecomplete application,pleasevisitStateofHawaii,Wastewater Branch,2827WaimanoHomeRd,Rm207,PearlCity, Hawaii96782.Formoreinformationorifyouhave specialneedsininspectingand/orcommentingonthe publicnotice,pleasecontactMr.MarkTomomitsu, Supervisor,Planning&DesignSectionattheabove addressorcall(808)586-4294(voice)orSprintRelay HawaiiforTTY/TDDat1-711or1-877-447-5991at leastseven(7)calendardaysbeforethecomment perioddeadline.DOHwillconsiderallwritten commentsreceivedwithin30daysofthisnotice.If warranted,DOHmayholdapublichearingonthe applicationafterreceiptofrelateddocumentsand written comments, if any. KENNETH S. FINK, MD, MGA, MPH Director of Health (TGI1423967 7/21/23)

constructionbyLeonard Lyonsofthatcertain Installationofarestaurant inanexistingbuildingand anaddedoutsidepavilion structuresituatedat2555 AlaNamahanaParkway, Kilauea,Hawaii,TMK:5-2023-030,hasbeen completed. Kilauea Shops, LLC and Avalon Gastropub, LLC Owner(s) (TGI1422865 07/14, 07/21/23)

IN THE DISTRICT COURT OF THE FIFTH CIRCUIT STATE OF HAWAII SUMMONS STATE OF HAWAII

To: Defendant MARLYN M. STONER YOUAREHEREBYNOTIFIEDthatthePlaintiff GATHERFEDERALCREDITUNION,formerlyknownas KauaiCommunityFederalCreditUnion,afederally charteredcreditunion,filedaComplaint(AssumpsitMoneyOwed);Declaration;Exhibits1,2&3;and SummonsagainstyouinCivilNo.5DRC-23-265,in theDistrictCourtoftheFifthCircuit,StateofHawaii, prayingforjudgmentforsumsdueandowingfor nonpaymentofanautoloan,interest,latefees,costs and attorneys’ fees and for other proper relief. YOUAREHEREBYSUMMONEDtoappearinthe CourtroomofthePresidingJudgeoftheabove-entitled Court,Kauai,Hawaii,onMonday,the28THdayof AUGUST,2023,at8:00a.m.ofsaiddayortofilean answerorotherpleadingandserveitbeforesaidday uponSHERMANSHIRAISHI,Plaintiff’sattorney,whose addressis2403UluMaikaStreet,Lihue,Hawaii, 96766.Ifyoufailtodoso,judgmentbydefaultwillbe takenagainstyouforthereliefdemandedinthe Complaint.

DATED: Lihue, Hawaii, June 21, 2023.

/s/ DEBRA MANINI CLERK OF THE ABOVE-ENTITLED COURT (TGI1420963 7/7, 7/14, 7/21, 7/28/23)

SALES Account ExEcutivE

We are looking for the right candidate to call on new and current customers and market our numerous advertising solutions to grow our customer’s business. This person will prospect new business and grow the current account base. Comfort with cold-calling is a must. He/she will be able to represent numerous newspapers, magazines, website and digital products, be able to match those products to the customer’s needs and make sales presentations to key decision makers. A high school diploma is required. A Bachelor’s degree in marketing or business is preferred. An aptitude for understanding statistical information and basic computer skills are necessary. He/she also must possess excellent verbal and written communication skills and be able to successfully multi-task. If you want a career with a fast paced, top media company with excellent pay and benefits, we want to hear from you.

Our full-time employees enjoy a generous benefit package that includes: Medical, Dental, Company-Matched 401K as well as sick leave and paid vacation.