Welcome to the July issue of National Liquor News, another issue that’s packed with business advice and product information, reflecting the very dynamic nature of the current drinks retail market.

In many ways, we’re experiencing a golden age in terms of liquor here in Australia. New product development is occurring on an unprecedented scale, both globally and with a new wave of local producers. It’s unlocking new categories and revolutionising more traditional ones.

Consumers have never had it so good. No matter what your preferences, budget or occasion, there’s something to drink for everyone.

But that abundance of choice brings with it new challenges for retailers. They have their own choices to make – about what to stock and how to sell it. For decades, National Liquor News has been helping retailers overcome their challenges and in today’s climate we have a more important role than ever: identifying the trends that will make a real commercial difference, providing the latest advice on product ranging and highlighting the best ways to market and promote your store and the products within it.

This month, for example, we take a deep dive into the US whiskey category, an important sector for Australian retailers given that Australia has the highest per capita consumption of American whiskey in the world.

The Intermedia Group takes its Corporate and Social Responsibilities (CSR) seriously and is committed to reducing its impact on the environment.

We continuously strive to improve our environmental performance and to initiate additional CSR based

Traditionally, this category has been dominated by (1) Jack Daniel’s and (2) Kentucky bourbon, but the fact is US whiskey is enjoying a rich period of innovation and increasing diversity in terms of style and provenance. If you want to know what you should be stocking, both for the more and the less adventurous consumer, we have you covered.

Elsewhere, we explore the fast-evolving premium mixers sector, get our fingers sticky with liqueurs and taste some terrific red blends in our wine tasting.

If you’ve looked at the picture above this column, you’ll have noticed that Brydie Allen isn’t writing this piece as she normally would. Brydie has left to pursue other opportunities and I’d like to take a moment to thank her for the great contribution she’s made to NLN over the last few years.

While we’re sad to say farewell to Brydie, I’m pleased to announce that our previous editor Deb Jackson is returning to pick up the NLN reins once more. Many of you will know Deb; she’s an experienced journalist and knows this sector well. We’re thrilled to be working with her again.

In fact, by the time you read this, Deb will already be in the hot seat. I hope you’ll join me in welcoming her back.

Have a great July!

Paul Wootton Publisherprojects and activities.

As part of our company policy we ensure that the products and services used in the manufacture of this magazine are sourced from environmentally responsible suppliers.

This magazine has been printed on paper produced

from sustainably sourced wood and pulp fibre and is accredited under PEFC chain of custody.

certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests.

Get the facts DrinkWise.org.au

PUBLISHED BY:

Food and Beverage Media Pty Ltd

A division of The Intermedia Group 41 Bridge Road GLEBE NSW Australia 2037 Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Managing Editor: Deb Jackson djackson@intermedia.com.au

Journalist: Caoimhe Hanrahan-Lawrence chanrahanlawrence@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Thorburn kthorburn@intermedia.com.au

Prepress: Tony Willson tony@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc GST)

2yrs (22 issues)for $112.00 (inc GST)

– Saving 20% 3yrs (33 issues) for $147.00 (inc GST)

– Saving 30%

To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au

Disclaimer

This publication is published by Food and Beverage Media Pty Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials. The mention of a product or service, person or company in this publication does not indicate the Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information. All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication.

Copyright © 2023 - Food and Beverage Media Pty Ltd

Crafted with the highest quality ingredients from around the world. Fever-Tree’s range of delicious mixers for dark spirits such as Whiskies, Bourbons and Rums, make the Ultimate Mixed Drink.

0%* alcohol. 100% flavour.

The Australian premium fortified wine category is an important one to McWilliam’s Wines, being a core part of the brand’s identity. Over half a century ago, McWilliam’s was at the forefront of the category, and now, thanks to investment in its new look master brand and fortified range, McWilliam’s is on track to reclaim this leadership.

McWilliam’s Hanwood Estate is an iconic purveyor of fortified wines. The range includes Tawny (available in Five, 10 ‘Grand’, 20 and 30 Year Old editions, with special gift packaging for the older expressions); Muscat Five and 20 Year Olds; Apera Five Year Old; and Topaque 20 Year Old.

Russell Cody, Senior Winemaker and Fortified Custodian at McWilliam’s Wines, explains the allure behind this range.

“Our selection of Aged Tawny is an exciting opportunity to experience this shift in style across multiple generations, with the Rare and Very Rare wines showing the big, full-flavoured Australian style while the Classic and Grand wines demonstrate a more modern, savoury style,” Cody said.

“These are magnificent, old winescrafted to last. They will be a fantastic gift for someone to savour and enjoy a glass of Australian wine history.”

Ahead of winter and with Father’s Day just around the corner, McWilliam’s is redoubling its marketing efforts to engage

consumers and retailers with the awardwinning Hanwood Estate offering.

Carrah Lymer, McWilliam’s Brand Manager at Calabria Family Wine Group, said: “McWilliam’s Hanwood Estate premium fortified range is especially enjoyable during the cooler months, there’s nothing like sitting by a fire and sipping on a McWilliam’s Tawny. The support of the McWilliam’s national advertising campaign will ensure fortified is front of mind this winter.”

The new campaign will hark back to the golden era of Australian advertising in the 1950s and 1960s, when McWilliam’s dominated the landscape with activations in print, TV and on iconic landmarks like Sydney’s Central train station. While it won’t exactly copy its past, McWilliam’s will reconnect with some of its old touch points, including via the platforms at Central, and also refresh the strategy with a national instore promotion from mid-July.

This new campaign will also build on the recent success of McWilliam’s Hanwood Estate since being rebranded last year, a change that has been embraced in the market by consumers and trade alike.

“The Hanwood Estate brand was fully refreshed, with a proprietary bottle featuring the McWilliam’s logo and rich, black, elegant design features,” Lymer explained.

“The wines (from Grand up) are housed in beautifully designed outer packaging -

which become more ornate as the wines increase in age,” she continues.

The season and upcoming gifting occasion mean the time is perfect to hero McWilliam’s Hanwood Estate in-store, especially given that it’s also a landmark year for the brand. 2023 marks 110 years since JJ McWilliam first planted vine cuttings in the Riverina, carting in 50,000 vines to establish the region as a producer of wine. For Hanwood Estate, this year is also the 50th anniversary of the opening of the vineyard’s famous ‘Big Barrel’ cellar door, with a newly renovated version due to reopen to the public later this year. ■

Pay rebates only on selected Core Ranged products?

Force you to take product allocations?

Charge you a shrink wrap fee?

Have their call centre or accounts department located offshore?

Make you pay monthly fees?

Include discounts, point of sale and advertising spend in their rebate calculations?

Make you pay for promotional point of sale and signage?

Have agreed terms with all Suppliers?

Have full control of their logistics?

Restrict you from having greater flexibility to retail and market to your local community?

ILG is Australia’s largest member-owned Liquor Co-operative with over $50 million in assets

ILG means ownership in two and soon to be three distribution centres in NSW & QLD

ILG has six strong banner groups providing choice and flexibility to suit your business needs.

ILG has 1500 members/customers strong in three states.

ILG offers competitive rebates on all package liquor purchases with no exclusions.

ILG offers freight rebates of $1.10 per case inc gst

ILG has NO forced product allocations

ILG offers strong signage to improve street presence free of charge

ILG has a dedicated sales team and member services team to help with day to day needs.

ILG has NO shrink wrap fees

ILG offers a marketing and e-commerce platform free of charge including a complete fortnightly printed promotional kit

Two iconic family drinks businesses has welcomed a new generation into their companies in recent months.

Coopers has now welcomed the third member of its sixth generation, with Iain Cooper joining his cousin and sister at the company to become Technical Brewer. Cooper brings international experience to the role after spending the past three and a half years with Carlsberg in Copenhagen.

“Any family member keen to join the brewery is strongly encouraged to first earn their stripes outside the business. So, I headed overseas to do just that,” Cooper explained.

Cooper remembers the brewery being a key part of his life as long as he can remember, but wasn’t sure he would join the family business, initially pursuing a degree in media and economics. However he later turned to his passion for brewing, traveling to Edinburgh to work in local breweries and complete a Master of Science in brewing and distilling. He now looks forward to contributing to his family’s world-class brewery.

Meanwhile, Calabria Family Wines welcomed the first of its fourth generation, with Sophie Calabria joining the company’s marketing department. Sophie is the eldest grandchild of second generation custodians Lena and Bill Calabria, and is thrilled to be working alongside her dad and family to learn more about the wine industry.

Bill is especially proud of Sophie joining, and said: “As a family-owned business, we are proud to have been producing award-winning wines for over 75 years. We believe that our success is due to our commitment to quality, sustainability, and family values. With Sophie joining the marketing team, we are excited to continue this legacy and to pass on our passion to the next generation.”

Hairydog Group has announced the acquisition of Boozebud, noting the “unique opportunity” for both parties. The acquisition brings together Boozebud’s existing e-commerce infrastructure and Hairydog’s experienced and knowledgeable team to maximise the combined potential of the two brands.

“Through this acquisition, we’re not just expanding our business footprint, we’re strategically aligning the strengths of BoozeBud’s advanced e-commerce capabilities with Hairydog’s proven retail expertise” said Ryan Agar, Head of E-commerce for Hairydog Group.

“This merger of two brands creates a powerhouse that is set to transform the online liquor retail space to provide better drinks and experiences to our customers.”

Hairydog said this latest acquisition will boost the group’s annual revenue beyond $75m threshold, driving incremental profitability and reinforcing its position as a dominant player in the online liquor retail industry.

Boozebud had previously announced it was going into voluntary administration, and ceased online orders. Now, the site has been relaunched, with Damien Smith, former Chief Technology Officer at BoozeBud, becoming part of the Hairydog team to help ensure a smooth transition.

“To celebrate the return of BoozeBud and its new beginning, we have lined up a series of compelling promotions that we believe will thrill our customers and provide them with an unmatched shopping experience,” added Agar.

For suppliers interested in learning more about the acquisition or the relaunch, please get in touch with your Hairydog point of contact or email cheers@hairydog.com.au

Crime Stoppers NT has announced a new campaign to target sly grogging across the Territory, joining forces with NT Police and retailers.

Through online advertising and prominent campaign posters displayed at key locations, the new campaign reminds people about legal regulations, discouraging the sale or supply of alcohol from unauthorised individuals or unlicensed stores, and asks for community support to catch ‘grog runners’.

Chair of Crime Stoppers NT, Catherine Phillips, explained the issue around sly grogging and said: “There are some individuals who buy alcohol on behalf of their banned drinker relatives and friends, bypassing the intended restrictions.

“We want everyone to understand that when they do that, they risk being placed on the Banned Drinking Register and receiving significant penalties.

“Our campaign also takes aim at criminals who transport alcohol across local or jurisdiction boundaries to sell it in the black market within restricted areas. We know that despite current measures, a significant quantity of alcohol continues to enter our communities without being lawfully sold through licensed outlets.”

Retail Drinks CEO, Michael Waters, said the association and its members were pleased to be supporting the campaign.

“Our support for this campaign is part of our commitment to help address issues related to supply of alcohol to minors, including our long-standing industry responsibility initiatives, including ‘Don’t Buy It For Them’,” Waters said.

“Don’t Buy It For Them is an initiative designed to discourage secondary supply and to educate the community on their shared responsibility not to supply to minors – or vulnerable people – and highlights the penalties for doing so. It also reinforces staff awareness and confidence to refuse service when in doubt, with back-up point-of-sale material.”

After announcing plans for the expansion and strengthening of the Banned Drinkers Register (BDR) earlier this year, the Western Australian Government has now confirmed the trial has rolled out into the Carnarvon and Gascoyne Junction region.

Racing and Gaming Minister, Reece Whitby, said the latest move was another targeted response to problem drinking.

“Alcohol-related harm is a long-standing, complex issue. There is no easy fix. The Banned Drinkers Register will not be a cure all but I’m confident it will help address alcohol-related violence and anti-social behaviour in Carnarvon,” he said.

The liquor industry has long been a supporter of the BDR initiative trial, and has again supported the decision to expand the trial into a new area of need.

Retail Drinks CEO, Michael Waters, said: “Retail Drinks has long supported the use of a Banned Drinker Register (BDR) as a targeted, localised policy measure to help minimise levels of alcohol-related harm and problem drinking.”

Liquor Stores Association of WA CEO, Peter Peck, said this expansion was a positive for liquor retailers, as it gave them the opportunity to demonstrate that issues of alcohol-related harm in the Carnarvon region were stemming from other forces.

“We are extremely happy with this news, because now we are going to be generating data for the Government through the BDR system, which will prove that the alcohol-related dysfunction in the town isn’t coming from off-premise retailers,” Peck said.

“Hopefully that will mean there will be a greater focus on sly grogging. And also, with this spotlight on Carnarvon, it will not only look at liquor retailers but put a greater focus on other Government departments, like child protection, which can better step up to the mark [to address issues in the area].”

Leading Japanese whisky distillery Suntory celebrated its 100th anniversary with four super premium releases.

By Caoimhe Hanrahan-Lawrence.This year marks a century since Shinjiro Torii established Suntory’s Yamazaki distillery, Japan’s first commercial whisky distillery, and fifty years since the opening of the Hakushu distillery. Suntory whisky celebrated the milestone with guests in Sydney at the newly opened Oborozuki restaurant in Circular Quay. Guests sampled a range of Suntory whiskies, including limited release whiskies blended especially for the anniversary celebrations.

To mark the brand’s 100th anniversary, Suntory has released four super premium limited-edition bottlings of its renowned Yamazaki and Hakushu ranges.

Opened in 1923, the Yamazaki distillery was founded with Torii’s dream to “create an original Japanese whisky blessed with the riches of Japanese nature and craftsmanship”.

Fifty years later, in 1973, the secondgeneration master blender, Keizo Saji founded the Hakushu distillery in Mt. Kaikomagatake, a location chosen because of the exceptional granite-filtered mountain water. Fifth generation chief blender Shinji Fukuyo spoke to the importance of the Hakushu and Yamazaki whiskies to Suntory.

“Hakushu and Yamazaki whiskies are gifts from our past handed down by generations. It is fitting to release limited editions as part of this incredible milestone, as they represent our relentless pursuit of quality and symbolize our promise to carry

our philosophy on for the next one hundred years and beyond,” Fukuyo said.

The Yamazaki 18 Year Old Mizunara is exclusively aged in mizunara casks, a native Japanese oak, and offers rich and elegant notes of dark cherry and ripe peach on the nose, with a subtly spiced palate.

“Yamazaki 18 Year Old Mizunara was blended for our 100 year anniversary and features a rich texture created from a long aging process. This expresses the delicate and meticulous attention to detail that went into its craftsmanship,” Fukuyu described.

The Hakushu 18 Year Old Peated Malt is a daring exploration into peated whisky for the distillery, with a subtly smokey flavour mellowed by the delicate Hakushu whisky, creating a herbaceous palate with notes of smoke, honey, and green apple.

“Blending is at the heart of everything we do at the House of Suntory, and we hold each of our whiskies to the highest standards throughout the process. I am proud to share the release of Hakushu 18 Year Old Peated Malt and special edition packaging of our Hakushu

12 Year Old with the world,” Fukuyu said.

The Yamazaki 12 Year Old and Hakushu

12 Year Old have received limited edition anniversary packaging, which reflect the concept of “monozuruki”, a style of Japanese craftsmanship integral to the Suntory distilling process.

Guests at the Sydney event were witness to the Australian premier of Academy Award-winning director Sofia Coppola’s short film, the Suntory Anniversary Tribute. The Coppola family have a storied past with Suntory, beginning in 1980 when Francis Ford Coppola starred in a Suntory advert directed by legendary Japanese director Akira Kurosawa. This advert inspired the inclusion of Suntory in Sofia Coppola’s 2003 film Lost in Translation, which originated the famous “Suntory Time” slogan. The new Suntory Anniversary Tribute advert, starring renowned actor Keanu Reeves, is an energetic collage exploring the history of the Suntory brand and the true meaning of Suntory time.

Later in the year, Suntory will release The Nature and Spirit of Japan, a series of documentary shorts starring Reeves and directed by Sofia Coppola’s brother Roman Coppola. The shorts will delve into Japanese whisky culture, with shorts inspired by “Wa”, (harmony with nature), “Monozukuri” (Japanese craftsmanship), and “Omotenashi” (mindful hospitality). Reeves requested to be a part of the anniversary celebration due to his love for Suntory whisky, especially his preferred Hibiki.

“I’m honoured to partner with Suntory Whisky again thirty years after our Suntory Reserve campaign. I’m a huge fan of Suntory Whisky, so it’s very special to collaborate

in honour of this milestone anniversary. My admiration for the whisky goes beyond tasting the whisky. It is the elevated Japanese craftsmanship and attention to every detail that makes Suntory Whisky so special. As an actor honing and perfecting my own craft, sharing this process in a docuseries is a thrill,” Reeves enthused.

Jon Potter, managing director of House of Suntory, expressed his pride at the milestone.

“As the pioneer of Japanese whisky, the House of Suntory played a significant role in shaping culture and leading craftsmanship in Japan over the last century. To mark this historic milestone, partnering with Sofia and Keanu, who are Suntory Whisky fans, makes perfect sense. From our fifth generation chief blender Shinji Fukuyo’s striking blends to Sofia and Keanu’s unique cinematic creations, this commemoration has surpassed all expectations to celebrate our iconic Japanese whiskies,” Potter concluded. ■

Earlier this year, Fever-Tree announced it would transition to a new operating model in the Australian market, bringing its distribution, sales and marketing operations in-house. This new direction enables the brand to build on the solid platform it has built in Australia, fuelling further growth opportunities for Fever-Tree and its trade partners.

Andy Gaunt, Managing Director for Fever-Tree Australia/New Zealand, said: “Ultimately, we won’t be changing anything for our customers and consumers - we will continue driving brand strategy and perspective. Our main objective is to give people the option of a better tasting drink, and that will always remain important.”

In recent months, Fever-Tree has built out its new and diverse team of industry professionals, with the help of dedicated drinks recruiter BrightSide.

“The fresh new team brings passion and dedication and enables additional support to be given to our current partners who have worked with us to write the Fever-Tree story thus far. This gives FeverTree the ability to build and maintain richer, deeper, collaborative partnerships with a team solely focused on the premiumisation of mixers and adult drinks,” said Gaunt.

“The new team members bring different experiences from all over the drinks industry and collectively share the vision of Fever-Tree to create better tasting drinks. They are able to understand and translate this message through a collaborative environment.

“Australia is a unique market, given mixers are traditionally shopped through grocery channels that don’t stock alcohol. Our structure has been built to provide experts focused on the liquor channel through the on-premise and off-premise, with a sales function supported by shopper and sales, and including logistics and supply.”

Fever-Tree’s new direction also includes a commercial partnership

with Remedy Drinks. Gaunt called this a “perfect pairing”, melding Remedy’s capabilities and expertise in the grocery channel with Fever-Tree’s leadership in the liquor industry. The partnership is set to unlock mutual growth for the companies as they focus on delivering premium mixer options for their similar sets of shoppers.

All of this comes at a key moment in the Australian market right now. The overall premium mixer segment is an important one locally right now, as consumers keep learning how to embrace more discerning mixed drink choices. With its new direction, Fever-Tree is set to continue its key role as a category leader that drives this journey.

“Premium mixers are still emerging within a category dominated by mainstream international soft drink companies and home brands. But they are experiencing growth even in challenging times, especially as we see more consumption across mixed drinks, so we see an incredibly exciting future to provide choices in mixers across all variations - from carbonated sodas and tonics to non-carbonated mixers with cocktail ‘ready to mix’ options,” Gaunt said.

Consumption trends support this future potential - long and refreshing, easy to make cocktails are seeing strong growth amongst consumers both in venues and at home.

“As we emerge out of three years of the pandemic, we’re excited about the opportunities to partner in the on-premise and off-premise to support the consumer demand to drink better quality mixed drinks,” Gaunt said.

“Our role at Fever-Tree as the number one pioneering mixer company globally, will look to lead the development and premiumisation of mixers within Australia.”

For any questions or enquiries about Fever-Tree and its new direction, please contact Trade Marketing Manager, Steve Carr, at Steve.Carr@fever-tree.com ■

A strong alignment of strategy with a focus on loyalty and brand was the deciding factor behind Harvest Hotel’s decision to choose and partner with ALM and IBA. Harvest Group will shift all venues across both South Australia and New South Wales, retail and on-premise, to ALM under the IBA banner group of Thirsty Camel. The transition date into Thirsty Camel has begun in South Australia with New South Wales venues to follow over the next few months.

Australian Liquor Marketers (ALM) are proud to share they are the newly chosen wholesaler and retailer of the Harvest Hotels Group. Harvest is committed to creating iconic regional pub and retail experiences and their decision is a result of a mutual vision for partnership, growth and innovation.

Chris Cornforth, Director and Founder of the Harvest Hotel Group said, “Harvest recognises the importance of partnering with a National Banner to support our growing portfolio of retail venues. Thirsty Camel provides us with the structure and expertise to support our growth ambitions, through their key retail program which is built on data, insights and retail excellence”.

The continual and consistent focus of the ALM strategy of being frictionless in their core processes and sticky of value creation has meant they are creating famous brands in the market and it is proving to be successful in attracting large groups to join the network.

Chris Baddock, CEO of ALM, said, “I am excited to be working with the Harvest Hotel Group. During all our discussions, we agreed partnership was central to both The Harvest Group and IBA. A partnership with retailing, wholesaling and suppliers is essential to meeting consumer needs every day.”

Having been exposed to Thirsty Camel in South Australia, the Group holds a strong affinity for the brand which exudes great energy and promotes shopper experience; characteristics they know will resonate well with consumers everywhere from Adelaide to Regional NSW.

ALM’s network of the future has a clear focus on loyalty, with demand from retailers to join the loyalty program growing across all banners. Chris Cornforth added, “Loyalty is an important offering and Thirsty Camel’s Camel Card and Hump Club will work with our Harvest Gold loyalty program.”

The ALM purpose of Championing Successful Independents has never been stronger, with another large group joining the network to offer the support in becoming the best store in your town. ■

Giesen Group’s range of non-alcoholic wines under the Ara Zero label have been making a splash, taking out a huge amount of awards in the past year.

The range initially launched with the Ara Zero Sauvignon Blanc, showcasing all the great things about Marlborough Sauvignon Blanc, without the alcohol. The wine has been a high point scorer across the globe, receiving 95 points at the International Wine & Spirit Competition, and has also won big at notable international awards, taking up multiple medals and trophies.

The most recent launch from the range is the Ara Zero Rosé, a dry, delicious and refreshing wine that delivers everything consumers have come to love about Marlborough rosé, just without the alcohol. Ara Zero Rosé is expertly crafted as a full-strength wine by Senior Winemaker Jeremy Tod, who delicately removes the alcohol using advanced spinning cone technology. The remaining wine features balanced notes of strawberry, lime and guava with crisp citrus, a subtle sweetness and a fresh and moreish finish.

This latest release from Ara Zero follows the brand’s highly awarded nature, stacking up to full strength rosé wines at the Royal Hobart Wine Show to become a bronze medal winner. But that’s not all to love about Ara Zero Rosé and Sauvignon Blanc – they are also lower in calories, with only 23 calories per 125ml serve, and certified vegan friendly with Vegetarian Society UK.

Ara Zero is a serious contender in the non-alcoholic wine market of Australia, distributed locally by Oatley Fine Wine Merchants.

Diageo Australia has announced that it will be taking over the distribution of Mr Black Coffee Liqueur from 1 July 2023.

“We are looking forward to working with our new Diageo family to build on Mr Black’s success to date. It’s been a genuine pleasure working with SouthTrade over the last four years, and we’re grateful for their dedication to Mr Black and Aussie craft spirits generally,” said Tom Baker, Founder of Mr Black.

“Aussies love coffee - it’s a part of our national identity. High quality coffee liqueurs are really just an expression of that, but during cocktail hour. Outside of Bailey’s, I don’t think other categories of liqueurs have the same deep consumer obsession.”

Mr Black was launched in 2013 by designer Tom Baker and award-winning distiller Philip Moore, with the vision of bringing Australian coffee culture to the world of spirits and cocktails. Over the last five years, Mr Black has been the fastest growing brand in the global coffee liqueur category. The brand was acquired by Diageo in 2022.

William Grant & Sons Australia is delighted to announce that The Balvenie Caribbean Cask 14-year-old is back in stock and available for order.

If you are not yet familiar with this whisky connoisseur’s favourite, The Balvenie Caribbean Cask 14-year-old single malt whisky is a testament of how cask finishing has elevated single malt whisky. It is part of the most popular Balvenie collection, Cask Finishes, alongside the classic and iconic whisky, The Balvenie Double Wood 12-year-old.

As hinted by its name, The Balvenie Caribbean Cask 14-year-old single malt whisky has been matured in traditional oak whisky casks for 14 years before being ‘finished’ in casks that formerly held Caribbean rum. And not any ex-rum casks… To create the ideal finish Malt Master David C. Stewart MBE filled American oak casks with his own blend of select Caribbean rums. When he judged the casks to be ready, the rum was replaced with the 14-year-old whisky and the wood was put to work adding the final touches.

The result is an exceptional single malt whisky with the traditional smooth, honeyed character of The Balvenie married with notes of toffee and a hint of fruit, with a warm, lingering finish. It is best enjoyed neat and paired with an aged cheddar or dark chocolate with orange.

The Balvenie Caribbean Cask 14-year-old is now available at $165 RRP per 700ml bottle, alongside The Balvenie Double Wood 12-year-old at $125 RRP per 700ml bottle.

Tulchan Gin has launched in Australia, bringing its proud Scottish roots to our shores in the form of a super-premium gin from one of the world’s distilling capitals, Speyside.

Tulchan Gin hails from the Tulchan Estate, 22,000 acres of lochs and glen with eight miles of the River Spey, located in the heart of Speyside. It is a gin that has been crafted with whisky drinkers and gin lovers in mind and really draws on its Scottish identity through the botanicals in the gin and an outstandingly Scottish bottle.

Brand Lead, Kara Anderson, said: “Tulchan is made in Speyside and I think that’s a real differentiator, it really separates us. Speyside is for me, and many others, the epitome of distilling heritage. There’s been nearly 200 years of making all kinds of spirits in Speyside, not just whisky, but they do make some of the best Scotch whiskies in the world. It’s just perfect real estate to make spirits and in particular whisky and gin.”

Tulchan is a London Dry-style gin, so it’s juniper-forward with lots of citrus notes, but there are 14 other botanicals in the spirit as well. It comes in at 45 per cent ABV, in a brilliantly Scottish bottle which is blue to reflect the River Spey, with bespoke Tulchan tartan on the side and proper cork stopper complete with thistle and a grouse piper on the label. Available now through Amber Beverages.

Stone & Wood’s winter seasonal beer has returned for 2023, and this year is a dark winter porter. The beer was crafted using an ancient brewing technique of lowering wood fired stones into the kettle, which gave the beer its name.

This year’s brew utilised choice Australian and German malts and is infused with aromas and flavours of coffee, rich dark chocolate, and hints of subtle smoked barley. Stone Beer 2023 is near-black in colour and finishes with a rich smooth malt character and firm bitterness. It pairs well with beautifully with grilled meat, hard cheeses, and excellent with anything containing chocolate.

Stone & Wood has also released the 2023 Barrel Aged Stone Beer – a jet black porter that has been aged for 12 months in whiskey barrels. It offers a strong malt profile of chocolate and coffee flavours, with added notes of whiskey and oak. Rich, smooth and full bodied, it has a medium bitterness and low hop profile that balances the roasted malt flavours. It is best paired with rich, dark chocolate dessert.

Little Drippa was a well-kept secret in the bartending world but is now available for all to purchase. The Melbourne-made cold extracted coffee makes for an effortless espresso martini, providing a classic coffee taste without the fuss of a coffee machine.

Not to be confused with coffee liqueur, Little Drippa is an alcohol-free cold drip extracted coffee that was created with consistency in mind, so every tipple tastes the same as the last. With no added sugar and a 24-month self life, it is a welcome addition to any home bar.

Dylan Alexander, CEO of Little Drippa is looking forward to sharing Little Drippa with the nation.

“We are so excited that Aussies can finally get their hands on Little Drippa. We are extremely proud of this product, and for so long it has been every bartender’s little secret; we thought it was time to share it with the world,” Alexander said.

“The idea for Little Drippa was simple, we love espresso martinis and wanted to create a product that cut down on hassle and ensuring consistency in flavour, Little Drippa is a guaranteed delicious coffee cocktail - every time.”

Melbourne-based bottled cocktail company The Everleigh Bottling Co. has joined the distribution portfolio of independent spirits company, Proof & Company.

The Everleigh Bottling Co. was founded by longstanding hospitality professionals Michael and Zara Madrusan, and produces bottled cocktails inspired by old-world elegance.

Damian Kaehler, General Manager of Proof & Company, said: “We are honoured to be partnering with The Everleigh Bottling Co. and warmly welcome them into our portfolio for distribution. Michael and Zara are passionate individuals and have made significant impact in our industry. They have successfully curated an extraordinary suite of brands that brings the bar to your home. Their story has deep synergies with Proof and Company; we’re of the same DNA and look forward to what’s to come from this partnership.”

The current range of classic cocktails, sparkling cocktails and non-alcoholic sparkling cocktails will be available through Proof & Company, alongside a new release in the non-alcoholic sparkling cocktail range.

The Sierra Antiguo range has launched in Australia, bringing a new 100 per cent blue weber agave tequila to the market. Sierra Antiguo is produced by a family-run distillery in Destilerías Sierra Unidas in the highlands of Guadalajara. Because of the distillery’s sunny, low-rainfall climate, the agaves grown for Sierra Antiguo are free from artificial fertilisers and industrial irrigation.

The range is comprised of two tequilas - Sierra Antiguo Plata and Sierra Antiguo Añejo. Sierra Antiguo Plata is a smooth tequila with a fresh aroma, fruity sweetness, and notes of citrus and clear agave notes. The more full-bodied option is Sierra Antiguo Añejo, which has a warm, deep golden colour and a full-bodied yet fine taste. Flavours include vanilla, oranges, cloves and pepper with a fruity finish.

Mario Kappes, Global Advocacy & Education Manager for Sierra Tequila, is excited about the release.

“We’re thrilled to expand the Sierra brand into the Australian market with the launch of Sierra Antiguo, our 10 per cent Agave range. Our biggest intention with our brand is to be able to provide all our tequila lovers with a 100 per cent agave tequila with the best mixability for margaritas and other tequila drinks. 100 per cent agave, 100 per cent creatividad!” Kappes enthused.

“Many Australians have been fans of Sierra Silver Tequila for a long time, and now we’re upping the game with a more premium offering. We believe that the better the ingredients, the greater the indulgence – this range brings just that.”

Proof Drinks Australia has partnered with Cavu Distilling to distribute Nil Desperandum Rum and Sunshine & Sons Gin nationwide.

The announcement comes as Nil Desperandum ‘Special’ is released, a two year old rum that has been certified as organic.

Managing Director at Proof Drinks Australia, Drew Doty, said: “Proof Drinks Australia is thrilled about partnering with Cavu Distilling. Proof is dedicated to delivering what we believe to be the finest premium brands to both Australian and international consumers.

“The addition of Nil Desperandum and Sunshine & Sons to our portfolio aligns seamlessly with our business objectives, and the promising potential for our organisations to flourish together is truly invigorating.”

Matt Hobson, Co-founder of Cavu, added: “Since the launch of Sunshine & Sons Original Dry Gin in March 2020 the two Cavu brands have achieved meteoric success and we are super excited to continue our journey with the incredible team at Proof Drinks Australia.

“Proof Drinks Australia are passionately committed to exciting, quality spirits with compelling points of difference to consumers that have national scale and international reach. We look forward to working closely with the Proof Drinks Australia team and meeting and exceeding the needs and expectations of the on and off premise trade across Australia and internationally.”

Winesmiths has released a limited edition set of 2 litre wine packs featuring designs by South Australian artist Billie Justice Thomson.

Thomson is known for her nostalgic depictions of iconic food and drinks, and she has turned her focus to Australia’s native flora and the native honeybee for the limited edition Winesmiths packs. These striking designs will draw attention to wine shelves and raise funds for the Wheen Bee Foundation.

Thomson drew much of her inspiration from vineyards.

“Bees and native plants play an important role in the biodiversity of vineyards and ultimately in the wine itself. I’ve always been attached to natives, they’re so uniquely Australian. They’re so rugged and often a little bit strange,” she said.

“Just like an artist, our vineyards require as much love and attention to drive a healthy eco-system, delivering beautiful natural flavour and yield. We don’t compromise on quality in any way,” explained Winesmiths’ Senior Brand Manager Lisa Antoney.

Fiona Chambers, Wheen Bee Foundation CEO, expressed her gratitude at the initiative.

“As a charity we value Winesmiths’ generous support, which enables the Wheen Bee Foundation to continue important projects to support bees and bee research,” she said.

The limited edition designs appear on packs of Sauvignon Blanc, Semillon Sauvignon Blanc, Pinot Grigio, Shiraz, Cabernet Sauvignon and Dry Rosé, with part proceeds from the Shiraz and Pinot Grigio going to the Wheen Bee Foundation for research.

The Winesmiths x Billie Justice Thomson Limited Edition packs will be in stores from August.

De Bortoli has added a new wine to the portfolio, releasing Handcrafted Heathcote Shiraz. The wine is handcrafted by Chief Winemaker, Steve Webber, using meticulously and purposefully chosen small parcels of Shiraz grapes.

The Heathcote region is well known for its intense and full bodied Shiraz wines that feature distinct structure and fruit-driven characteristics. Webber notes that Handcrafted Heathcote Shiraz exhibits these qualities while also being quite ‘supple, relaxed, ethereal and compelling.’ This allows the unique characteristics of the region and the carefully chosen grapes to shine in the glass, with a noticeable difference to other Heathcote Shiraz wines on the market.

“Heathcote has a long history of growing Shiraz of extraordinary quality. The ancient Cambrian red soils of the region give flavours of dark berry fruits and violets combined with lovely texture and feel,” said Webber.

On the nose of the Handcrafted Heathcote Shiraz, you can expect haunting, deeply scented forest aromas, while the palate follows with dense, mouth filling flavours with dark fruits and earth.

BOOK TICKETS NOW FOR THE

Friday 18 August 2023

Lunch 12.30pm

Grand Ballroom Hyatt Regency

Sydney

$195 (WCA members)

$225 (non-members)

Full table $1941 (table of 10)

Retail Drinks advocates on behalf of liquor retailers to ensure our industry’s needs and interests are considered and represented in government decision-making.

We aim to ensure policy outcomes are based on credible evidence and reliable data, as opposed to unproven concepts or assertions pushed by other stakeholders. When an evidence-based approach is taken towards policymaking, and is supported by robust data, it is far more likely that optimal policy outcomes are achieved.

Unproven concepts like liquor licence density and alcohol-related harm being incorporated into regulatory policy decision making is concerning. For example, the South Australian Government is proposing to include licence density as a criterion against which future applications for liquor licences are assessed, as part of their draft Community Impact Assessment Guidelines – a myopic view which ignores a lack of any credible evidence or reliable data establishing a causal nexus between licence density and alcohol-related harm.

The SA Government has also recently implemented restrictions on takeaway alcohol sales in the Adelaide CBD in response to instances of anti-social behaviour. In engaging with government on this issue, Retail Drinks emphasised the need for such restrictions to be underpinned by robust data rather than relying on anecdotal reports from stakeholders. Any continuation of these restrictions should involve a thorough consultation process with industry.

We’ve also seen renewed calls from some advocates for Minimum Unit Pricing (MUP) to be rolled out into jurisdictions beyond the Northern Territory, without any robust evidence proving that the MUP scheme was successful. We recently published a letter to the editor in the NT News, highlighting the flaws in a recent research article on MUP supporting this policy. Our letter called out several facts, including that the ‘selective’ study was misleading as it specifically excluded cask wine drinkers – the very cohort the measure impacted the most.

Even though alcohol consumption in the NT had been in steady decline for years prior to MUP commencing, with adult abstainers doubling to one in five between 2010 and 2019 and the rate of risky drinking dropping, its introduction has had the opposite effect.

The regulatory environment continues to present challenges as governments react to community issues with policy changes ‘on the run’ which provide significant costs and inconvenience to consumers and retailers, often without a credible evidence base and stimulated by anti-alcohol advocacy, and unfortunately without solving the issue in question.

Retail Drinks continues to search for opportunities to work together with governments, regulators, and community stakeholders on evidence-based and targeted policies that nurture a stable political, social, and commercial environment in which the entire retail liquor industry may grow sustainably. ■

Retail Drinks CEO, Michael Waters, discusses how the organisation is advocating for regulation that is effective in addressing industry issues.

Retail Drinks CEO, Michael Waters, discusses how the organisation is advocating for regulation that is effective in addressing industry issues.

Michael Waters CEO Retail Drinks

“When an evidence-based approach is taken towards policymaking, and is supported by robust data, it is far more likely that optimal policy outcomes are achieved.”

Simon Strahan, CEO of DrinkWise, discusses the launch of a new initiative to address harmful drinking in Queensland.

The latest Australian Government statistics confirm that Australians are continuing to make healthier and safer decisions with respect to their alcohol consumption. Over the past 15 years we have seen drinking habits change substantially, with the overwhelming majority of people who choose to consume alcohol drinking in moderation and within the government guidelines. However, there are still some who are drinking at risky levels, engaging in antisocial behaviour or turning to alcohol as a coping strategy.

DrinkWise research revealed Queenslanders (34 per cent) are significantly more likely to be drinking alcohol at risky levels when compared with the nation’s average (28 per cent).

To continue to help address this, DrinkWise and the Queensland Hotels Association (QHA) have partnered on a campaign to remind regional Queenslanders who choose to purchase and drink alcohol about the importance of moderating their alcohol consumption and always being respectful towards others.

The new initiative has been supported by Queensland Police, Member for Cairns and Assistant Minister for Tourism Industry Development Mr Michael Healy, Mayor of Cairns Cr Bob Manning OAM, Clubs Queensland and the North Queensland Cowboys – all wanting to ensure that safe and respectful environments in our communities.

To ensure a whole of community approach was taken, we also worked with support services including, Lives Lived Well, ReachOut, 13YARN, 1800RESPECT, DVConnect and Men’s Referral Service. This important element of the campaign helps ensure people who might be having trouble managing their alcohol consumption or their behaviour know that support services are available and that asking for help and advice is okay.

Moderation, respect and responsibility themed posters, coasters, and digital assets are being rolled out to over 115 pus, bars and bottle shops throughout Cairns, Townsville and Mount Isa, with Clubs Queensland also supporting the initiative in their venues across the state. Geo-location targeted moderation, mental health and support service social media messaging is also being implemented to help embed these important health messages.

QHA Chief Executive, Bernie Hogan, said: “QHA is proud to support this initiative to remind patrons that having a great experience at licensed venues means respecting those around you

and consuming in moderation if drinking alcohol. It is important that QHA are helping promote messages that encourage conversations about mental health, with pubs integral to our regional Queensland communities. We want to ensure that as our customers come together at licensed venues, to socialise, have a meal, catch up with friends and family, that they have a great time and they also use these opportunities to talk about local issues and support each other.” ■

DrinkWise was recently recognised for the impactful and effective parental supply campaign It’s okay to say nay, with a win at the Melbourne Advertising Design Creativity awards and a highly commended at the Mumbrella CommsCon Awards. While our focus is on delivering programs that help enable a safer and healthier drinking culture in Australia, it is nice that these awards recognise the innovative approach DrinkWise takes to alcohol education initiatives and the impact they have on the attitudes and behaviours of Australians who choose to drink alcohol.

Chardonnay has long been the most planted white winegrape variety in Australia and second overall to Shiraz. The Chardonnay crush in Australia grew from 1,000 tonnes in 1979 to 28,000 tonnes in 1989 and reached a peak of 428,000 tonnes in 2008. In 2022, just under 360,000 tonnes of Chardonnay was crushed across Australia, accounting for 46 per cent of the national white crush – almost four times the share of Sauvignon Blanc.

Chardonnay is grown in all states in 57 of Australia’s 65 GI regions, from the Granite Belt in the north to Tasmania in the south, and from Margaret River in the west to Hastings River in the east.

The average price paid for Chardonnay grapes has been rising. After reaching a low of $304 per tonne in 2014, the price paid for Chardonnay has steadily risen, peaking at $532 per tonne in 2021, before dropping back slightly to $517 per tonne in 2022.

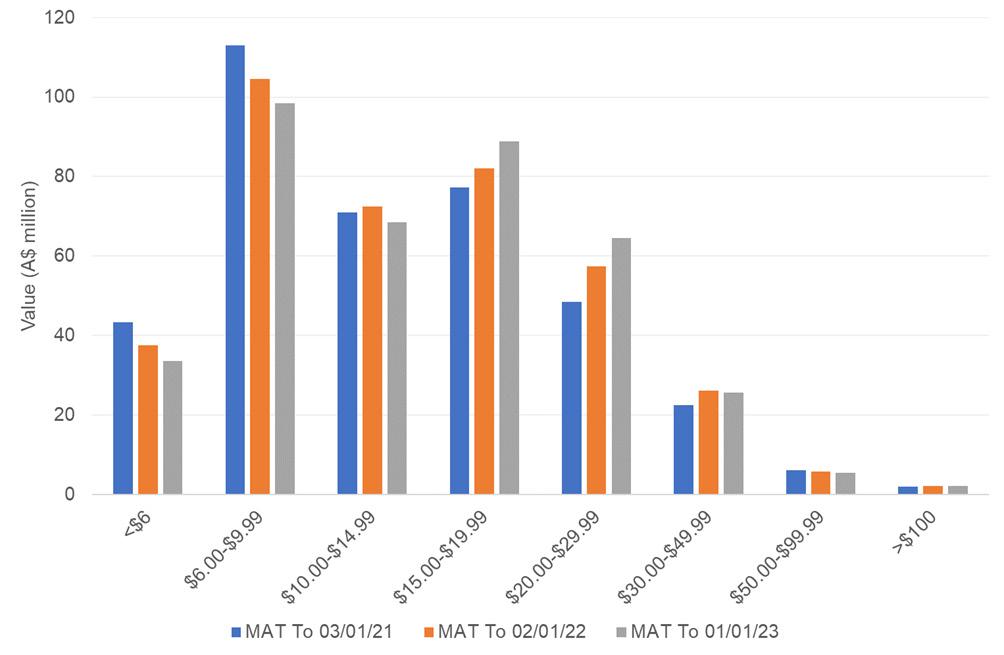

The rise in the price paid for Chardonnay grapes has been assisted by the growing demand for premium Australian Chardonnay wines in the domestic market. Data from IRI MarketEdge shows that while the value of Chardonnay sales in the domestic off-trade market fell by 0.3 per cent in the 12 months ended 1 January 2023, there were varying performances by price segment. Chardonnay sales declined below $15 per bottle but have seen growth above $15.

A quarter of Chardonnay sales were at $6.00 to $9.99 per bottle but sales value fell by six per cent. Conversely, sales at $15.00 to $19.99 grew by eight per cent and at $20.00 to $29.99 by 13 per cent. At $20.00 to $29.99 per bottle, Chardonnay outsells Sauvignon Blanc by $16 million.

There has also been growth in Australia’s exports of Chardonnay. In the 12 months ended March 2023, exports of wines labelled as Chardonnay increased by three per cent in value to $327 million and in volume by nine per cent to 176 million litres compared to the

same period in 2022. By volume, Chardonnay is now the number one variety exported ahead of Shiraz.

Most of the growth in the past 12 months has come at below $2.50 per litre, up 19 per cent to $148 million. There was also strong growth at $10 or more per litre, albeit off a lower base, up 22 per cent to $25 million. ■

Average purchase price of Chardonnay in Australia ($ per tonne). Source: Wine Australia.

Value of Chardonnay sales in the domestic off-trade market. Source: IRI MarketEdge.

Average purchase price of Chardonnay in Australia ($ per tonne). Source: Wine Australia.

Value of Chardonnay sales in the domestic off-trade market. Source: IRI MarketEdge.

This year’s Vinexpo Asia was the first time that the trade show had been held in Singapore and the first Vinexpo Asia since the pandemic. The event attracted exhibitors from more than 30 different nations, while nearly 10,000 trade professionals visited the show from 64 countries.

Singapore is a centre of international trade and a gateway to Asia for the wine trade. As such, there was significant representation from producing nations from around the world, and key industry trends on show.

Preferences in the Asia-Pacific region are likely to have ramifications in Australia (and for domestic retailers) too, so it was intriguing to see what Australian exhibitors reported.

“Australia definitely has a purity and flavour profile that I think resonates. Quite fruit-driven, soft, easy-drinking wines are good,” said Andrew Calabria, Sales & Marketing Manager at Calabria Family Wines.

Paul Turale, Marketing General Manager for Wine Australia, believes that similar

food preferences in Australia and Asia offer an opportunity for the nation’s wines.

“We are in a space where most of the cuisine in Australia is highly representative of what we’re seeing through the south east Asian market – those flavours and spices – and a lot of the wines that are being produced to match what we’re eating and drinking in Australia are absolutely geared towards the various markets here,” he said.

Fresh styles of label seem to be gaining traction too. As Rupert Steenberg, Sales & Marketing Director at Joval Family Wines, explained, this reflects ongoing trends in Australia.

“I was in Korea… The green shoots that I saw were younger, smaller, artisanal winemaking is getting going, and a lot of them had really visual labels,” he said.

“For a young demographic, very heavily on social media, very trend-focused, they’re into new alternative varieties, and I saw that from New Zealand and Australia.”

Wine and Spirits representing American producer Ironstone Vineyards, stated it plainly: “Asia in general is, as most people would say, predominantly a red market. People like red wines.

“You’re probably looking at around a 70:30 split for the majority of the region –Japan, South Korea maybe skew a little bit more even, but it’s still predominantly red.”

And this provides significant advantages for certain producing nations, America among them.

“We’ve always had a strong focus on Zinfandel… And personally, I think that this style matches a lot of the Asian region – not as many tannins, a little more acidity, perhaps making it a little bit more food friendly with a variety of dishes. I’ve noticed more and more countries are receptive to Zinfandel,” McCheane continued.

French wine group, Barton & Guestier (which also has a strong presence in Australia), had a large stall at Vinexpo Asia.

Seamus May attended the event in May, learning about key wine trends that will likely impact Australia in the near future. Photography by Richard Koh and Seamus May.Guillaume Bladocha, Export Director for Barton & Guestier in the Asia Pacific, gave his impressions from the show.

“I have noticed a constant increase in the demand for sparkling wines. Sparkling has been (and is still currently) the most dynamic wine category overall in Asia,” he said.

“We have seen a strong increase in our volumes exported in the whole APAC region, but also in the requests received for brand distribution.”

Like other exhibitors, Bladocha found that buyers were largely sticking to the classics, but were still driving the premiumisation movement.

“In this difficult economical context, we see that the consumers (and, therefore, the buyers) are less adventurous when it comes to purchasing wine and stick to the brands they know [and] they trust,” he said.

“In terms of product profile, we noticed that a much higher proportion of buyers were looking for higher quality wines (premium appellations from Bordeaux, Burgundy). End consumers drink less, but better.”

For Stephen Jones, an importer based in Hong Kong at Discover Wines Asia, it was Australia’s embrace of ‘alternative varietals’ that stood out as a key current trend.

“Particularly in Australia, we’ve seen a few producers that are using some grape varieties from Italy and Portugal that can handle extreme weather,” Jones said.

“All over the world, climate change [is] causing an issue in winemaking. So you’re seeing new trends of more hardy grape varieties that can deal with the heat.”

Jones also shared what he thought the Asian wine customer and seller was by and large looking for.

“The Asian consumer is obviously more of a novice in wine - so they look at packaging, easy to recognise labels,” he noted.

“Other than that, they’re looking for the big brands, the ones that have big points – easier for them to sell.”

One standout stall was When In Rome, an Anglo-Italian business selling Italian wines in more environmentally friendly packaging.

CEO Rob Malin explained the brand’s position and said: “Our business is founded on the premise that 40 per cent of the wine industry’s carbon footprint comes from single use glass bottles.

“We are about trying to educate the consumer both by example… We calculate and display our carbon footprint on the wine labelling.”

Malin said interest in the brand’s packaging had been “really, really strong” at Vinexpo Asia, showing the sustainable angle is a key element that drinks businesses are thinking of in today’s market. ■

Circana discusses how retailers can go beyond face value and dig into what really matters to their customers in the current cost-of-living crisis.

The record high cost of doing business is passing on price increases to value-craving Australians, which is hitting households hard as we grapple with the soaring cost of living.

The CommBank Household Spending Intentions retail spending index fell by 21.3 per cent in January and buy now, pay later platform debt is at its highest. Reeling from a 10th consecutive interest rate hike, three-quarters of us are concerned about paying general household bills (72 per cent), food and groceries (77 per cent), while half are worried about the cost of petrol (54 per cent) and rent or mortgage payments (46 per cent).

Aussies are also more focused on what we fill our trolleys with at the supermarket – and when. Average supermarket retail trips per shopper was down -3.7 per cent in January but we are starting to see an increase. Importantly, dollar sales are up +4.7 per cent, but more recent trading hints at an inflationary-led acceleration in sales growth while the +4.2 per cent uplift in dollars per trip is being driven by higher prices helping to compensate for the smaller baskets.

Our latest research reveals that three-quarters of shoppers now always compare prices, and seven in 10 are likely to make unplanned purchases after seeing promotions and discounts. These customers are brand switching for new and appealing features or benefits.

Two-thirds tell us that retailer/own-label products are a good alternative and three in five now make a shopping list and stick to it, making product purchase decisions when in the store. But almost seven in 10 are also shopping online the same or more than a year ago too.

It’s important to understand generational values and nuances of Aussie shoppers as sustainability (younger Aussies) and personal choice (older people) are also behind brand switching tendencies. Millennials are set to overtake Baby Boomers as the largest

generational group in Australia and are already the biggest-spending consumers in both bricks and mortar stores and online. Millennials and Gen Z together are a rising force in retail shopping, currently accounting for 36 per cent of total retail spending in Australia and forecast to account for 48 per cent by 2030. Gen Z in particular presents tremendous opportunities for brands and retailers, but these digitally native, fiercely independent consumers approach shopping with very different expectations than prior generations. Gen Z expects brands to be authentic and understand them as unique individuals to earn their dollars.

We are cautiously optimistic for 2023 but expect value-based shopping behaviours to continue to define the year. Successful brands and retailers must differentiate their customer types and quantify their sales contribution to prioritise initiatives.

Clearly, there are many headwinds, so now, more than ever, you need to know how people feel and how they’ll shop in the moment. It’s all about the experience they have and how it relates to their new values – both on and offline. Australians are open to ordering directly from you and sharing their data if it will result in a better shopping experience or reward.

Shopper data will also help you manage the social impact of inflation by differentiating and communicating what’s right from profit gain, and supporting your customers by delivering and communicating price, value and experience. You need to show your customers that you’re going through this cost-of-living crisis with them. Honesty and transparency underpin a solid relationship, especially during disruptive times. Getting your data and your omni-channel customer experience synchronised is critical for an integrated lens on how the same shopper uniquely uses each channel on their disruptive path to purchase. ■

Just because the temperature is dropping and our entertaining has moved out of the sunshine to indoors, it doesn’t mean consumers are going to say goodbye to their favourite premium mixers. Producers big and small shared their thoughts about the current trends for premium mixers and what can be done to strengthen the market.

One dominant trend is that many consumers are looking to reduce their overall alcohol intake, or to simply improve the quality of what’s in their glass. The trend is evident in the beer and wine categories but also in spirits and, by extension, in mixed drinks.

“People are taking a more conscious approach to drinking. Whereas in spirits, people are drinking less but better; with mixers the approach is flavour first, not so much zero sugar and ‘good for you’ but more ‘I like a good time and I’d like to drink something that’s better for me,’” stated Strangelove Beverage Co. Brand manager, Caitlin Lockie.

The desire to source low- or no-alcohol drinks options has also entered this realm, coupled with lower levels of sugar, according to Capi Sales and Marketing Director, Kate Solly.

“On the back of the moderation and abstinence trends, we are also seeing customers drinking mixers as a nonalcoholic alternative over ice and with a garnish,” said Solly.

A consumer focus on sourcing products made from natural, unprocessed ingredients has been matched by producers, said Mr Consistent Chief Brand Officer, Kahrissa Bell.

“The cocktail mixer category has expanded significantly since Mr. Consistent launched - when there were predominately products on the market that weren’t made with real fruit ingredients. We have seen this demand for premium mixers with a focus on true flavour profiles made from real fruit ingredients expand dramatically since launch, and don’t think this will change in the future as people become more intentional about what they consume,” said Bell.

The premium mixers category is undergoing significant change, writes Brendan Black

There can be many factors at play in regards to what influences a consumer to purchase one premium mixer over another, with a big focus on matching flavours to the alcohol in your glass, as well as the quality of the ingredients, while price may not be such a deciding factor, stated Fever-Tree Trade Marketing Manager, Steve Carr.

“Based on a recent study conducted by Fever-Tree (May 23), we know that the two most important factors to Australians when selecting a mixer brand are taste and available flavours. Australians also look for mixers that are made with high-quality, natural ingredients. Meanwhile being the cheapest price is ranked no.15 in the list of factors that are important to consumers when selecting a mixer. The mixer category has undergone significant premiumisation over the past 3 years, with premium share of mixers growing from 5% to 20% (2019-22), as they deliver on the qualities that Australians are looking for in a mixer,” stated Carr

Attitude can also be an important element, with many people simply wanting a high-quality product and being prepared to pay for it, claimed Strangelove’s Caitlin Lockie.

“Brand-conscious individuals [can be] passionate about what exactly goes into their drinks, where it’s made, what produce is used, and most importantly, want to look interesting because they turned up to a dinner party with some pretty little bottles featuring an 8 ball on the label,” stated Lockie.

The higher cost of living has made a dent in people’s level of disposable income, yet from all reports, premium-mixer producers have not experienced (yet) any hits to their bottom lines, affirmed Fever-Tree’s Steve Carr.

Steve Carr Trade Marketing Manager Fever-Tree

“Both premium spirits and premium mixers continue to grow ahead of mainstream and value products, despite cost of living pressures. While Australians are trading down in everyday items and cutting back on big ticket discretionary spend, Australians continue to seek opportunities to trade-up in ‘little luxuries’ and experiences that make them feel good. This is what premium mixed drinks and cocktails can deliver. Some Australians are choosing to visit on-premise less often than usual due to cost of living pressures and these Australians are looking to recreate bar experiences and make bar-quality drinks at home. This has given rise to what we call the ‘home premise’. Use of premium mixers in the home premise is popular as it allows Australians to make simple, great tasting mixed drinks and cocktails with few ingredients,” said Carr.

The ability to make a high-quality product at home with premium ingredients but at an affordable price is still possible, claimed Mr Consistent’s Kahrissa Bell.

“If anything, this proves the existence of the premium cocktail mixer market is even more necessary! When you can make a perfectly balanced and delicious cocktail or mocktail for $3 a serve, you can still feel as though you are having a boujie night, but on a (cheaper than) beer budget!” stated Bell.

Convenience is a key factor when it comes to competition, and the ease of buying mixers from a supermarket means liquor retailers need to make it easier for consumers to buy “what they want, where they want it,” noted Capi’s Kate Solly.

“I would encourage liquor retailers (space permitting) to merchandise complementary mixers within spirit bays and have mixers merchandised closed to counter for the last-minute impulse purchase; there is nothing more frustrating than getting home or to a party with no mixers available,” stated Solly.

Where a product is situated within a store obviously has much

“Driving visibility of mixers at point of purchase will result in higher basket spend.”

impact on its visibility and therefore if a consumer is more likely to purchase it, stated Fever-Tree’s Steve Carr.

“There is still the element of impulse buy for immediate consumption. Bundle deals work well along with product positioning in store on gondola ends paired with matching spirits. Placement of product near the counter results in a significant sales uplift for the liquor retailers. Driving visibility of mixers at point of purchase will result in higher basket spend. Consumers will generally pay more for a mixer when purchasing alcohol from bottle shops,” said Carr.

In the cooler months, many people will opt for red wine over white, or possibly spirits over beer, and mixers may also become less popular as a go-to drink, yet much can be done by retailers to turn this around, believes Fever-Tree’s Steve Carr.

“Focus on warming flavours and positioning autumnal coloured spirits and mixers together for ease of purchase. As humans, our palates change seasonally; in the cooler months we naturally gravitate towards bolder flavours, perhaps we perceive them to be more nutrient rich. We also gravitate more towards carotenoid/caramel colours in the cooler months, just thinking of a whisky & ginger, pumpkin soup or a sticky date pudding makes me warm and fuzzy!” stated Carr.

This view is echoed by Strangelove’s Caitlin Lockie. “Look to warmer flavours and recipe inspiration. Think Hot Ginger Beer and whiskey, Shiraz gin and Bitter Lemon tonic, Lime and Jalapeno. Inspiration is key here.”

The desire for warmth in winter (from our heaters and drinks) offers retailers a chance to focus on different flavours, stated Mr Consistent’s Kahrissa Bell.

“Whilst we know cocktails and summer are synonymous, at Mr. Consistent we have been working with retailers to embrace winter, rather than escape it! Choose your darker spirits, and match them with some amazing cocktail mixers such as sours - and you have a winning combination!” said Bell.

There are many ways in which producers can increase the appeal of their premium mixers to the public, claimed Strangelove’s Caitlin Lockie.

“Keep experimenting. Keep things interesting. Keep pushing flavour boundaries. Take risks. Not everyone will like what you do, but at least you aren’t boring,” stated Lockie.

Education, collaboration and accessibility are three main ways for the appeal of premium mixers to be heightened, believes Capi’s Kate Solly.

“Educate consumers about the value and versatility of premium mixers through social media and a content-rich website, including recipes and perfect pairings.

Collaborate with established spirit partners to reach a wider audience and leverage their existing customer base. Make premium mixers accessible through various retail channels, including online platforms, to expand reach and convenience for consumers,” said Solly. ■

SALTED GRAPEFRUIT MIXER. WHY?

BECAUSE TEQUILA.

ZESTY WHITE GRAPEFRUITS FROM MILDURA. MURRY RIVER PINK FLAKE SALT. SIMPLY ADD ANY PREMIUM TEQUILA AND YOU HAVE YOURSELF A ONE WAY TICKET TO PALOMA TOWN.

Australians have long appreciated American whiskey, and Caoimhe Hanrahan-Lawrence sets out to investigate why.

It’s no secret that Australians have a large appetite for American whiskey. According to market research by GlobalData, the US is second only to Scotland in terms of market share of whiskey sold in Australia. The category has seen impressive growth, with the IWSR reporting 11 per cent CAGR growth over the last three years.

Additionally, the Australian market is an incredibly important one for American producers, with the Distilled Spirits Council of the United States (DISCUS) identifying Australia as the third largest export market for American whiskey, worth US$85 million. The numbers are even more impressive on a per capita basis, with the IWSR indicating that Australia is the nation with the highest per capita consumption of US whiskey in the world. The Australian appeal of American whiskey is even more pronounced when it comes to bourbon, as Australia is the second largest export market by value – an impressive feat for a country with a relatively small population.

Alexandra Clough, spokesperson for

Westward Whiskey, said that Australian interest in American whiskey has strengthened and developed.

“Australia is – and always has been – an incredible market for whiskey. Australian consumers have long been fans of the more traditional categories within American whiskey – namely bourbon and rye, and in recent years, we continue to see Australians reaching for more premium whiskies and dynamic craft brands,” Clough remarked.

Over the past few years, there has been a trend

towards Australians seeking out local labels in the bottle shop, which may be concerning for the international beverage sector. However, John Weifert, founder of Orrsum Spirits, still expects the American whiskey segment to remain popular, due in part to the relative youth of Australian whiskey production.

“A lot of Australian distilleries are putting out some young products right now, but of course will improve with time. With small scale production, it will be hard to compete at similar price points [to US whiskey], but some brands such as Starward and Archie Rose are on a good track!” Weifert commented.

When compared to other popular market sectors such as Scotch and Japanese whisky, the American whiskey sphere is quite distinct, with many describing it as innovative and modern. Though American whiskey is certainly governed by regulations concerning provenance and production, the regulations are less strict than those in Scotland, which allows for more experimentation among American producers.

“We’ve seen an increasing interest in smaller batch, more specialty American whiskies.”

Eric Thomson Global Marketing Director Pernod Ricard

“American whiskey is to me the most exciting whiskey category. Yes, they have the tradition, but they also have brands pushing the boundaries with experimental grains, cask finishes, etcetera,” said Weifert.

When it comes to Japanese whisky, even though the category has seen incredible popularity internationally, America has more than a century of experience in whiskey-making over Japan, with more defined regional styles and a distinct difference in flavour profiles. Rather than squeezing the market, Eric Thomson, Global Marketing Director for PernodRicard noted that the popularity of Scotch and Japanese whisky is beneficial to American whiskey, as these other categories are leading new consumers to the American whiskey category.

“There’s a generationally new consumer, Gen Zs and millennials coming through and being introduced in the category, but I think we’re seeing whiskey consumers in general coming across American whiskey as they move through things like Scotch whisky and Japanese whisky,” Thomson said.

As with many beverage sectors, American whiskey is seeing a trend towards premiumisation, with consumers spending more per bottle on average. Rachel Pullicino, marketing manager at Brown-Forman says that this may result in more brand curiosity.

“Mindful consumption is also playing a key role in the way in which consumers interact with brands. Premiumisation has been a significant macro trend for

the category in recent years across all liquor segments. In American whiskey we see this play into greater experimentation across brands, trading up to more premium offers, but doing so on fewer occasions as part of managing overall consumption,” Pullicino explained.

However, even though value mainstream and super premium are both in decline, Pullicino expects there will be some customers turning to old favourites due to economic pressures and the rising cost of living.

Within the premium sector, O’Neill predicts that more ultra-small batch and collectible American whiskies will be made available on the Australian market.

“In this super premium space, we’re seeing increased allocations of rare and premium bourbon to help meet the demand of Aussie consumers,” O’Neill explained. Thomson agreed with this prediction, saying that the Australian interest in this section of the market is on the rise.

“Over the course of the last few years, we’ve seen an increasing interest in smaller batch, more specialty

American whiskey is a broad and growing category that can appeal to a wide range of customers, from the most discerning Scotch drinker to the category newcomer. Due to the category’s diversity, it is often insufficient to organise products by style or state. While shelf separation can be useful for consumers looking for new or preferred products, it is also vital that staff are educated on the differences and similarities between products in store, so as to properly direct customers to the products that best suit their personal tastes.

American whiskies. I think we’re seeing an evolution of the category from that perspective, more diversity from style as well as an increase in the average price point that consumers are looking for,” Thomson commented.

In particular, premium bourbon has experienced a boost in sales, as it is a popular addition to many consumers’ home bar set up.

“Bourbon, being such a big bold spirit, pairs so well with cocktails. Especially during COVID, we saw a big bump in the premium sector, mostly from people stepping up their cocktail game at home,” said Weifert.

Though bourbon is not the only style of whiskey the US has to offer, it is certainly the most popular in Australia. DISCUS data indicates that Australians drink 19 million glasses of US whiskey per month, 2.5 times more than is drunk in America. While many whisky drinkers are familiar with the different regions of Scottish whisky, the bourbon category can be seen as monolithic. However, there are actually a number of regional differences within the category.

“We are seeing a diversity. Whether it’s Kentucky, Tennessee, Texas, Virginia, [they] are all starting to carve out their own little niche,” said Thomson.