A note from Lisa…

This month’s MOON MAG is all about REAL ESTATE... but not what you think, VIRTUAL REAL ESTATE. In my opinion we are on the precipice of an avalanche of projects that are about to enter or are entering the market now. While crypto is still in its infancy compared to traditional markets, it’s important to know and understand what projects or types of projects you should be researching and investing in for the long term. At the time of writing this, there are 12,266 Cryptos in circulation and more created daily, so it is our job to fnd the gems and help you weed out the scams, duds and ultimate shitcoins. Once you read through you will understand why we’ve chosen the projects featured. Happy Reading

A note from Josh…

An amazing launch of the Moon Mag last month caught the attention of many readers and the feedback Lisa and I have received is astonishing! Already, some of the projects from the frst issue, such as Hashmasks, have increased in value so if you delved into that project and purchased a Hashmask, you should now be looking at a neat proft! Here’s issue 2, full to the brim of more projects and hopefully, they’ll be bringing you nice returns. As always, do your own research and remember, you make the decision to invest as it’s your money. Enjoy! This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Editorial

DeRace Murat Pak GameFi AFEN HoDooi Metaverses

CON TRI BU T O R S

Aldrich Shillian

Aldrich (or Rhys to those in the Signals group!) has been HODL’ing since 2017 and is proud of surviving bear markets, rug pulls and still trading successfully enough to have paid of all debts. Recently, he’s jumped head-on into NFT projects - particularly ones that combine his love of gaming.

Shaun

Also know as XRPChillDaddy, Shaun loves researching cryptocurrencies from a technical and business strategy perspective. He spends his free time either reading, working on his business, or talking about blockchain like it’s a religion!

Daniel Jimenez

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

written by Daniel

written by Daniel

Will GameFi be the future of decentralized finance? Will GameFi be the

of decentralized finance?

OPI NION

future

A new but widely used concept in the crypto world has begun to emerge on social networks: GameFi.

Although many still have not fully assimilated the meaning of the term DeFi (especially those outside the crypto world), the truth is that since July of this year the price of assets in the NFT gaming sector has skyrocketed, drawing attention to this new concept GameFi.

But what does GameFi mean?

GameFi, derived from the combination of two high growth sectors within the blockchain industry DeFi and Games, was introduced in September 2020 by “Father DeFi” Andre Cronje (Yearn.Finance).

According to Cronje, GameFi is the intersection between blockchain-based games (cryptogames) and decentralized fnancial instruments (DeFi) in all their forms.

Thus, the union of both sectors in a single platform gives rise to a decentralized fnance video game in its simplest essence; where smart contracts are involved and their operations are recorded on the blockchain.

In addition, GameFi adds many popular DeFi activities such as yield farming, liquidity mining, and staking, among others.

Even more interesting is the fact that many GameFi platforms incorporate another key element within the DeFi sector, NFTs. In Q3 2021, the popularity of games and collectibles represented by nonfungible tokens surpassed that of sports and the arts.

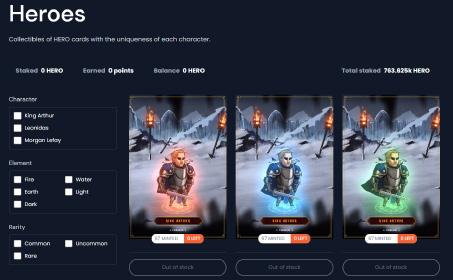

These types of gaming platforms use a native utility token in most cases to reward players while also allowing them to use it to exchange items within the platform with other players.

Users can use the platform’s native token to purchase character upgrades in NFT format that they can then sell on a decentralized marketplace as they appreciate in price in the market.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

What is GameFi’ driving growth in DeFi ?

With GameFi, the elements of decentralized fnance are more interactive and user-friendly. Users do not have to worry about understanding the technicality of DeFi protocols to increase their income in a dynamic interface loaded with fun elements typical of games (battles, challenges, missions, etc).

This new trend lowers the threshold for most newbies who eschew the complexity of the technical terminologies of fnance applied to DeFi protocols, in exchange for a fun way to apply these same principles to monetize their time and efort spent within a platform.

In GameFi protocols, retail investors have more access to decentralized fnance, increasing opportunities to earn more money as interest in this sector grows among investors of all sizes.

Thus, the model of turning mining projects into “games”, for example, creates more income possibilities for small investors.

Through gamifcation, the blockchain industry is seeking to engage the masses through elements of games, a technique that is already beginning to bear fruit if we look at the successful case of Axie Infnity, for example.

Growth prospects

The gaming industry is currently valued at more than $159 billion and is expected to grow to $295 billion worldwide in the next fve years, according to the latest reports from the prestigious Newzoo frm.

Add to this a high interest in decentralized fnancial platforms, which have seen a vertiginous increase in transactions in recent months, reaching a TVL greater than $ 170 billion, according to fgures from DeFi Llama.

If we combine both sectors, the capacity of this sector within the gaming industry is enormous, since the limits are imposed by the players themselves as these GameFi platforms become popular.

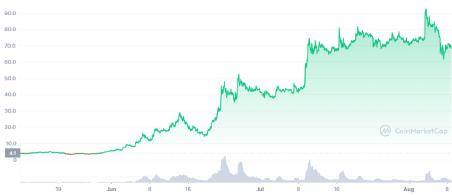

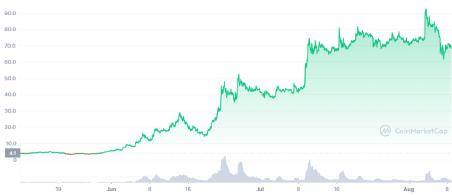

To mention an exemplary case within the sector, Axie Infnity’s native token exceeded a staggering growth rate of more than 1,138% in less than a month, while other similar assets representative of the sector also experienced triple-digit growth.

GameFi has brought a great revolution to crypto fnance, since it has redefned the rules of DeFi in the way of games, for example, increasing revenues using NFT items on its platforms, the inclusion of combat mode, etc. Compared to conventional yield farming projects, GameFi projects are more interactive and entertaining.

Therefore, GameFi has been key in the adoption of blockchain technology and the crypto ecosystem in general, to the point of attracting more users than the DeFi sector.

NFT: A Key element in GameFi

Since 2020 NFTs, have been an emerging trend in decentralized fnance that has created its own branch of business in the blockchain industry.

Currently, projects promoting cross-industry DeFi applications combined with NFTs have unleashed enormous potential. Experts consider that NFTs introduce diferentiated assets based on rarities to the DeFi sector, while DeFi, in turn, gives commercial value to NFTs through fnance.

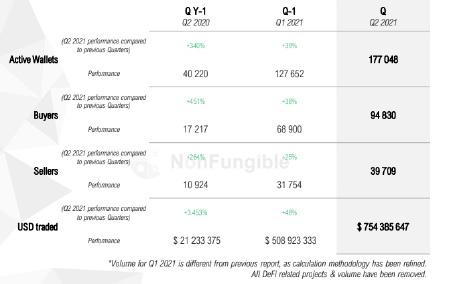

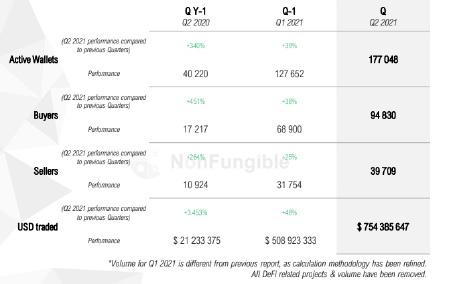

As a result, NFT trading volume has grown exponentially during the second quarter of 2021, reaching $750 million, an increase of more than 48% than in the previous year, according to data from nonfungible.com.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

This growth is now supported by the growing value of game NFTs which are incorporated into more GameFi platforms while combining with the game itself in a fun way through the attractive design of characters, equipment, mascots, etc.

Integrating NFTs and DeFi into games provides an open platform of revenue-generating possibilities that combine a unique and new way to build a healthier initial market for GameFi projects.

Thus we can see how NFT mining, NFT farming pools and NFT markets are now “common” practices within GameFi platforms, resulting in millions of dollars a day in transaction volume related to these projects.

How to locate these projects?

It is important to note that there are two types of GameFi solutions: one where the central business model of the project is gamifcation instruments in DeFi; and another that includes bringing specifc DeFi concepts to the sphere of decentralized games, which generally correspond to NFTs.

Due to its nascent adoption, some analysts and blockchain enthusiasts difer on which protocols and solutions should be classifed as GameFi. However, DeFi protocols powered by gamifcation tools are considered GameFi.

Similarly, when blockchain-based gaming assets are used in DeFi-like solutions it is also possible to classify them as GameFi.

Based on the above, there are several platforms worth your time exploring in the exciting GameFi world. DappRadar, which analyzes GameFi games, has placed CryptoBlades, Mobox, X World Games, CryptoBay and Step Hero in the top 5 dApps in the sector by number of users.

What do I need to get started in the GameFi sector?

Whether you are an average investor or a gamer fond of cryptocurrencies and blockchain technology, you only need to have your noncustodial wallet ready to link your wallet address with each of these platforms ofering assets in games ranging from collectibles including improved NFT formats to the utility tokens of each platform.

Examples of GameFi platforms

Axie Infnity

Axie Infnity is a game based on non-fungible tokens of the “play-to-earn” genre using Ethereum’s blockchain technology. Users can create personalized characters that can be improved (axies) to become more formidable fghters against other players (PvP) in battles or against the artifcial intelligence of the game.

By winning these battles, the user gets rewards in the form of the native ERC-20 Small Love Portion (SLP) token. In addition, the user also receives rewards for their participation in the game in the form of the ERC-20 Axie Infnity Shard (AXS) token.

With AXS, users can stake, participate in decentralized governance of the game and support the community treasury — activities unique to the decentralized fnance system (DeFi).

On the other hand, with the SLP token, users can “breed” their Axies, the pets necessary to start the game, or improve their existing characters, which they can later trade on the marketplace for cryptocurrencies.

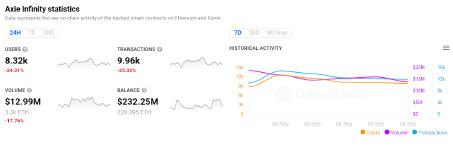

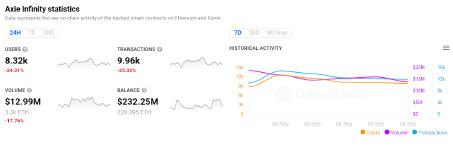

Axie Infnity is currently the most popular GameFi platform in the ecosystem, with daily volumes estimated at around $12.99M according to data from DappRadar.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

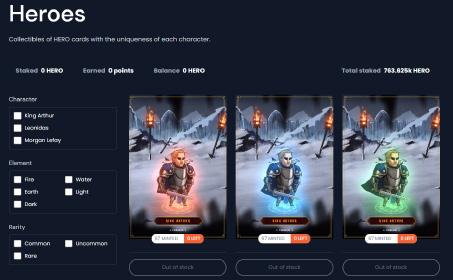

Mobox: NFT Farmer

MOBOX Platform is a blockchain gaming platform built on Binance Smart Chain (BSC), which combines both DeFi and NFT features creating another unique “free to play, play to earn” ecosystem.

The game’s economic system revolves around the platform’s unique NFT MOMO, which ofers GameFi to players and merchants the opportunity to win these unique MOMO NFTs.

The GameFi dynamics introduced by the platform consists of providing liquidity to the pool of the $MBOX token, the game’s DAO token and other BSC tokens established in VAULTS, to generate $KEY BEP 20 tokens that are essential to unlock unique NFTs (MOMO NFT).

The game undoubtedly ofers the best graphic representation of what decentralized fnance gamifcation is. Players, in addition to “playing to earn,” have various options from the DeFi sector to earn higher profts from the game’s assets.

NFT Farmer is currently the second platform by daily volume according to DappRadar, with$2.39 million in trading volume.

Step Hero

Step Hero is an NFT ecosystem comprising fantasy RPG on Binance Smart Chain and Polygon, as well as a highly liquid marketplace with world-class collectibles and a vibrant growing community.

The objective of the platform is to promote the expansion of the BSC and Polygon ecosystems by combining NFT and DeFi games, allowing users to have fun and earn profts simultaneously.

Users are tasked with fghting villains in battles while improving their energy by collecting game items, earning money in the native STEP currency, and upgrading their characters.

The DeFi elements appear focused around the characters in NFT format: Farming, LP Farm and Staking.

In addition to the decentralized exchange, players can exchange game elements in exchange for cryptocurrencies in decentralized marketplaces.

According to Dapp.com, Step Hero is the second platform by daily volume with just over $440 thousand dollars in volume over the last 24 hours.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

“GameFi will be the next big thing that will make DeFi, NFTs and the largest crypto space easy to understand and engage,”

Justin Sun Tron Foundation founder said.

Will GameFi be the future of decentralized fnance?

What to expect from GameFi?

An epic future for this sector is undeniable. Blockchain developers have understood the message sent by Axie Infnity fans: decentralized fnance should be easier, simpler, and more fun to use while monetizing your time.

The NFT summer of 2021 was dominated by the GameFi scene and it is expected that over the next 2-3 years this emerging trend will be one of the dominant ones in the crypto ecosystem.

For this reason in recent months, we have seen news related to strong investments in the sector, such as the announcement by the Tron Foundation together with APENFT and

WINKLink to launch the Tron Arcade fund of $300 million in support of GameFi projects over the next three years. “GameFi will be the next big thing that will make DeFi, NFTs and the largest crypto space easy to understand and engage,” Justin Sun Tron Foundation founder said.

By now, these gaming economy platforms are starting to outpace many real world economies, so the compelling question becomes: Will GameFi be the future of decentralized fnance?

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

written by Rhys

written by Rhys

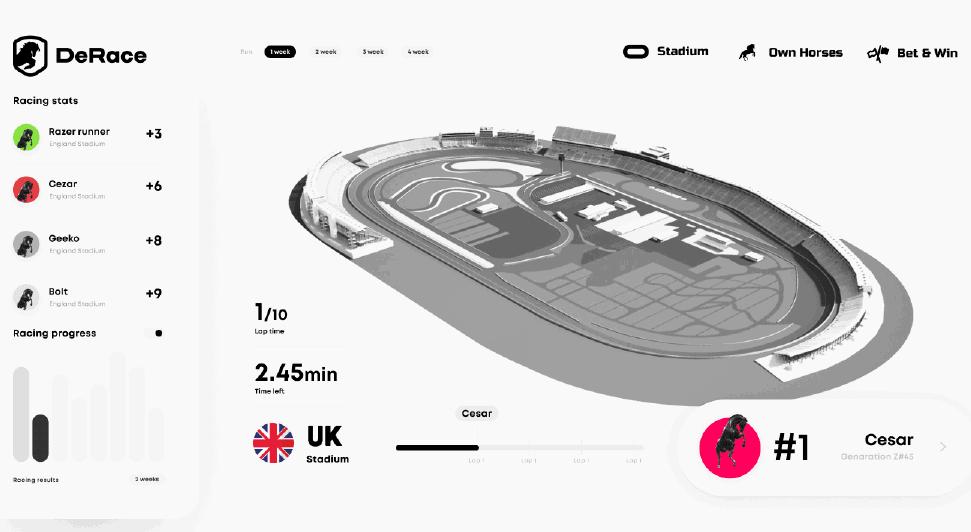

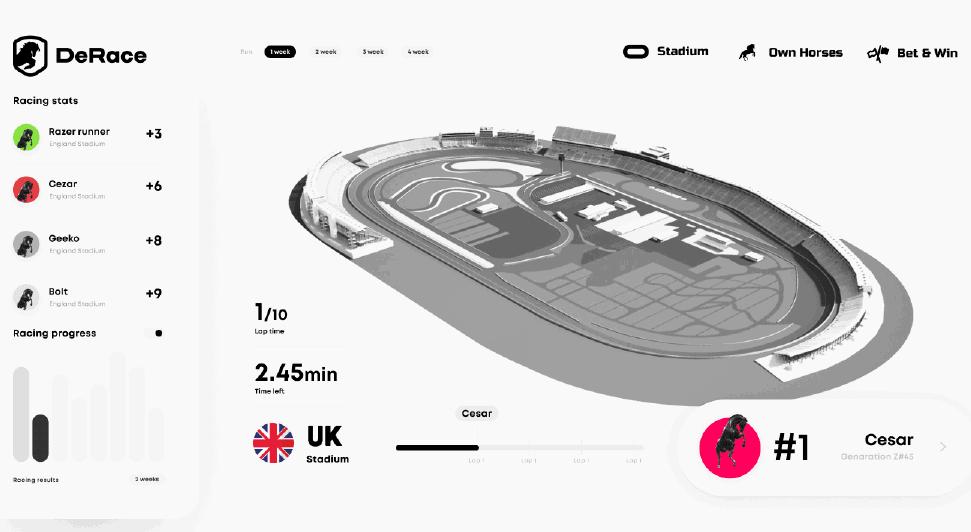

DeRace is an upcoming NFT horse-racing playto-earn game, with their native token $DERC available on Ethereum and Binance Smart Chain, with the game itself running on Polygon.

The idea sounds familiar to those who’ve seen Zed Run beforebut the combined potential of the token being available on BSC to trade (lower gas!), availability on major exchanges (Crypto. com, Binance’s frst-ever Initial Game Ofering for the horse NFTs) and having a native token rather than buying horses in ETH give it the potential to go big - and possibly even surpass Zed Run’s trading volume!

DeRace will allow you to buy NFT horses and set up your own racing stables, breed horses to race or sell, earn winnings through racing, and even build your racing empire up with hippodromes so you can earn fees from bets and races. They’ll also ofer products like ETFs (like a package of horses) where you could earn a portion of their winnings just by holding the ETF. Lots of potential options, broadening the appeal base to diferent styles of investors!

I can’t not cover the recent DAO Maker hack and the price dip which you might spot on the charts, if interested. At time of writing, the price has recovered from the hack –which took place on DAO Maker’s platform rather than anything to do with DeRace itself – as the team have been incredibly fast at addressing the issue and getting the project better protected from future problems by locking liquidity up with Unicrypt.

DeRace

DeRace

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Normally hacks are obviously bad news - but the DeRace project itself hasn’t done anything to cause the issue – and by locking liquidity up elsewhere instead, securing tokens from future problems, this can be seen as a positive development. Active, responsive team and a strong community, with some of the usual crypto issues shaken out? Yes please.

It’s hard to write about DeRace without frst going over ZedRun – the established horse racing NFT game - how that works and then showing how DeRace intends to build and improve on that basic formula. So that’s exactly what we’re going to do!

ZedRun

Zed Run is a popular play-to-earn horse racing game built on Ethereum. The basics boil down to buying a decent horse and racing them to earn winnings for fnishing in the top 3. Clearly this means having a good horse is key – and these can be pretty pricey nowadays – but there’s other opportunities to earn, including stud farming or having your own horse breeding set up (with limitations such as fllies only being able to breed once a month, while male horses are limited to 3 per month. This means you can’t just pump tons of ETH into the game and fll up the market with your horses).

Zed Run (as you might expect from an early blockchain game) runs into a number of the problems that ETH-based projects do. With the value of horses and races being pegged to ETH itself, the value of your horses and breeding activity can fuctuate wildly with the market price of ETH. While this is also true of other projects with native tokens of course, those other projects tend to charge relatively lower fees in dollar value in that native currency than you would expect over time from ZedRun.

Additionally, as a more mature project now, the barrier to entry is higher now – although horses can be had for a small amount of ETH, with gas fees on top this can run to a few hundred dollars for even the cheapest horses, and realistically are likely to not be competitive for racing, or desirable for breeding at this time. That being said, there’s clearly a brisk market for NFT horses with hundreds of NFTs changing hands every day. This market could be even bigger with less gas fees where smaller transactions are easier to make.

What DeRace does diferently

DeRace is – from the outset – making their NFT game a business, and a universe where you can get involved in many diferent aspects of the racing world depending on your willingness to play and invest. Their horses –on paper – seem more complex than those of Zed Run. The additional opportunities with shorter breeding cooldown times and potential full automation for race setups could mean less “downtime” on your assets. The fip side of this may mean lower NFT prices initially as the market could fll up with horse NFTs rapidly with a faster breeding cycle compared to Zed Run (although if you are a later adopter, this would be useful for you to get on board!)

ZedRun is a pure horse-racing game for now - the options really are to buy more horses and perhaps some skins to pretty them up. Although they have recently announced an expansion into other aspects of the horse-racing world, like owning stables or tracks. This is always trickier to do in retrospect than from the get-go. Don’t get me wrong - I love Zed Run too - but DeRace is aiming to provide some of these things from the get-go, which gives it something of a second-mover advantage.

This will be ofset by the use of their native token - $DERC if you want to buy anything in DeRace, you will need some $DERC. The ambition of the platform (running on Polygon) is to make transactions simple - a key factor in onboarding new players.

This will include ofering straight-up fat purchases.

DeRace

DeRace

magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

This

These fat purchases will go on to automatically buy DERC tokens from holders/sellers, which will help maintain the price as new users come into the space, or even drive the token value higher. An NFT marketplace for the horses combining these aspects should allow the $DERC token to ofset any theoretical horse marketplace saturation - as transactions are settled in $DERC, even if your horse becomes less valuable in $DERC terms, it could break even or even increase in dollar value through this.

The secondary advantage of using a native token is the ability to draw more eyes to the project simply by existing. $DERC already features on sites like PancakeSwap and Crypto.com, with more partnerships arriving regularly. Curious traders and investors are exposed to the token, and by proxy, the game. This provides a key advantage for building a user base – and so far, it seems to be working.

DeRaceDeRace

On a very low-level, you can compare the Twitter and Telegram accounts against competitors such as Zed Run and look at the sheer diference in follower numbers, and engagement with posts. DeRace has much greater engagement even before releasing fully, and with Binance taking DeRace for it’s frst-ever Initial Game Ofering on their Binance NFT platform September 23rd (IGO), they’re increasingly likely to get more and more eyes on the game.

This is a double-edged sword of course – getting in when a project is hyped to this degree is challenging as you might be battling thousands of people for your NFT horse – but it’s also a promising sign of demand that can be soaked up and interested buyers who can sold when the game gets underway properly. Indeed, even getting in now on a secondary market sale of a horse might set you up with a good start to your stable to then sell on to new users at full game implementation when the most eyes will probably come to the project.

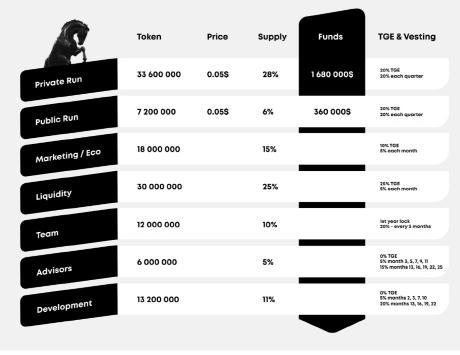

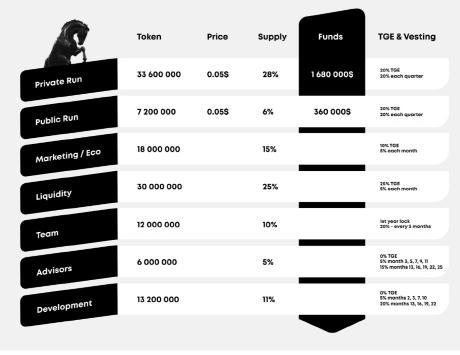

Tokenomics

Max supply: 120,000,000 Circulating supply: 20,520,000 (project-reported)

Volume: $12m/day (average of last month at time of writing)

More tokens will be issued per quarter up to Month 24 (August 2023) when $DERC stops being generated. Short-to-mid term, this makes $DERC infationary. But for long-term holders, or players getting in and playing the game, this could stack up to great rewards when the last tokens are issued.

Website: https://www.derace.com/ Coingecko: https://www.coingecko.com/en/coins/ derace

Whitepaper: https://derace.gitbook.io/derace/ Tokenomics: https://www.derace.com/wp-content/ uploads/2021/06/DeRace-Tokenmetrics.pdf

Telegram: https://t.me/DeRaceNFT

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

What else is setting DeRace apart?

DeRace’s road map is very exciting. While the NFTs are imminent, other features like the hippodrome and ETFs are going to be spaced out over the next few quarters and even years. Right now, getting your frst horse represents a foot on the ladder of a long journey with huge potential added values - and just generally a fun way to pass the time too.

The thing that’s gotten me most excited from the roadmap is a mobile app. Mobile gaming is a huge business – particularly in some markets where mobile is now the major gaming platform – and to tap that in even a small way could be extremely bullish for DeRace.

Additionally, with a native token, DeRace is free to build partnerships around the token itselfwhich in turn drives value to the project and its holders. This could be things as big as allowing other projects to use the token for transactions, or to create similar games based on existing mechanisms - perhaps other racing games. This could appeal to other audiences and increase the value and volume of $DERC transactions.

Finally, the idea of NFT upgrades and additional assets for performance like horseshoes, saddles etc could further the depth of the game and potential investments for big-time players. Will it be better to get a great NFT horse from the of, or will it be more economical to get something a bit weaker and upgrade it with equipment? Time will tell!

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Conclusion

I really love how ambitious DeRace is, and that they’ve really thought about not just the racing aspect, but the whole horse racing ecosystem. There seems to be so many ways to make some money through the platform if you’ve invested, and to have fun as a player. As a token holder, you could proft purely by selling your coins late-on to those wishing to place bets or buy their own horse/hippodrome. As a horse owner, you could race to your hearts’ content and set up your own stables –and sort it all out on your mobile rather than having to sit on a computer one day!

If DeRace can deliver a mobile app – with a seamless fat conversion experience – there’s incredible potential there for gamblers and investors alike.

I truly believe this could be huge and see DeRace as a strong short, mid and long-term project.

DeRaceConclusion

written by Shaun

HoDooi and

Hodooi is a newly built marketplace for NFT’s that has some serious use case built into their designs.NFT’s are a rapidly emerging market that have gained some serious traction this year (2021) while also making investors some serious gains. Hodooi is a multichain platform that is not limited to a particular blockchain such as Ethereum like other platforms that kicked of without scope in mind. Being built initially on the Binance Smart Chain (BSC) they enable their users to experience the low gas fees that come from the network while providing membership loyalty programs to those who utilize Hodooi.

Ultimately Hodooi is providing a community platform that brings multiple services to the forefront that are otherwise not being done elsewhere for NFT marketplaces.

• Reward System

• Multi-Chain Eforts (Currently supporting BSC and FLOW Blockchain), working towards Ethereum

• Cross Platform perpetual royalties

• Verifed creator and seller capability, further creating security behind your NFT’s

• Tokenizing Non-Fungible Physical Items (More on this soon)

While they intend to integrate Ethereum into their platform, Hodooi enables all users with the same level of service and benefts relative to the membership tier level they have unlocked, regardless of the chain they are using. They are truly bringing a customer frst mentality to the NFT market that is sorely needed. Not only do they have diferent levels of verifcation for user accounts that provide security to buyers and sellers, Hodooi will be bringing payment plans to market for NFT’s allowing users to access items that conventionally would have been out of reach for them.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Data All Data Is At Time Of Writing Max Supply: 1,000,000,000 Total Supply: 1,000,000,000 Circulating Supply: Unknown Binance Smart Chain Contract Address: 0x19A4866a85c652EB4a2ED44c42e4CB2863a62D51

Token

HOD

distribution

tokens?

Token Allocation

Public: 0.5% of Tokens are unlocked at 0.045 to the general public.

Private: 15% of the tokens are owned privately and 25% are unlocked at time of release with 75% unlocking over a 24 month period

Team: 10% of Tokens go to the team and will have a 1 year lock up period, tokens vest 20% Quarterly after 12 months.

Reserves: 10% of Tokens are in the reserve stash and is unlocked by proposal only Company Treasury: 40%of tokens are held in the treasury with a 10% quarterly lock up condition.

Staking: 12% of tokens are allocated to staking for the public.

Liquidity Fund: 12.5% of tokens are allocated to the liquidity fund and are unlocked.

Website https://app.hodooi.com/en White Paper (Waiting)

CoinMarketCap https://coinmarketcap.com/currencies/hodooi/ CoinGecko https://www.coingecko.com/en/coins/hodooi-com

Twitter https://twitter.com/hodooicom Join their Twitter to keep up to date on news and activity!

Telegram https://t.me/hodooi

LinkedIn https://www.linkedin.com/company/hodooi/

Investors

What’s the

breakdown of the total 1,000,000,000 generated

Where To Purchase HOD Token

Currently there are 4 ways to purchase HOD Token which will involve signing up with an exchange or using a wallet that can connect to PancakeSwap such as MetaMask. I have sorted them by volume from greatest to least for your liquidity easement (This means there is more buy/sell movement on that exchange or swap site making it easier to get in/out).

• Gate.io (Exchange) - Paired in HOD/USDT

• ●MEXC Global (Exchange Site) - Paired in HOD/ USDT

• ●BitMart (Exchange) - HOD/USDT

• PancakeSwap (Swap Site) - HOD/WBNB

On Swap sites, you will have to have a trusted wallet on your phone or computer with the currency needed to make the swap. For example, if using PancakeSwap, you would need to have a PancakeSwap approved wallet such as Metamask to connect with the Swap Site, and you would need Wrapped BNB in your Metamask wallet. BNB can be purchased through most exchanges but is native to Binance.

Generally when using a swap site there will be a Gas fee involved that will fund the exchange from one token to another due to people providing liquidity. BNB usually has extremely low fees and is why most projects that are kicking of choose to run on BSC rather than ETH. Either way if you are paying a fee to get in before the token goes mainstream, the upside will be worth it long term.

Glossary

Non-Fungible Token (NFT)

Non-fungible tokens (NFTs) are provably scarce / unique, digital items with blockchainmanaged ownership. Some examples include collectibles (e.g. CryptoKitties), game items, digital art, event tickets, domain names, virtual real estate (e.g. Decentraland) and even ownership records for physical assets.

Decentralized Autonomous Organization (DAO)

A Decentralised Autonomous Organisation is a method of governance where rules are encoded as a computer program that is transparent, controlled through votes of a distributed group of organization members rather than a single entity.

InterPlanetary File System (IPFS)

IPFS is a distributed system for storing and accessing fles, websites, applications, and data.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Core Team

Profle Data pulled directly from Whitepaper*

In 2017, Matt founded Travala.com (the world-leading crypto-friendly travel booking marketplace) at twenty-two years old, built it into a globally recognised brand & business with over $1.5M in growing monthly revenue. Powered by its native token AVA, the Travala. com platform ofers over 3,000,0000 travel products from accommodation, fights and activities in 230 countries and territories.

https://www.linkedin.com/in/ matthewluczynski/

He has managed, supervised and worked in cross-cultural teams and fulflled various high-profle contracts surpassing values of $1B. Bryson is responsible for managing HoDooi.com’s day-to-day business operations. As Chief of Operations, Bryson manages HoDooi.com’s operational activity, committing to providing an outstanding customer experience whilst ensuring all operational and fnancial requirements are ready to go.

https://www.linkedin.com/in/ brysonwarsap/

Matt Luczynski CEO/Co-founder

Bryson Warsap COO/Co-founder

William Nguyen CTO/Co-founder

Matt Luczynski CEO/Co-founder

Bryson Warsap COO/Co-founder

William Nguyen CTO/Co-founder

William Nguyen is one of the Co-founders of Sota Tek a software development company and formerly CTO of VCC Cryptocurrency Exchange Vietnam. William has proven to be excellent at fnancial leadership in both internal management and global investments.

Dominic Tunstall CCO

Dominic Tunstall CCO

Dominic is a senior full-stack creative entrepreneur pushing the boundaries across branding, advertising, and digital products. Dominic has 8 years experience working at some of Australia’s leading brand, design, and advertising agencies, including M&C Saatchi. Dominic’s work for Samsung, Sydney Airport, Nickelodeon and other internationally recognized brands has won numerous awards. Acting as our CCO, Dominic will be combining culture, commerce, and creativity to propel Hodooi.com into the cryptocurrency space.

https://www.linkedin.com/in/domtunstall/

Anndy Lian CSO

Anndy is an all-rounded business strategist with more than 15 years of experience in Asia. He has provided advisory across a variety of industries for local, international & public listed companies. Anndy played a pivotal role in not-for-proft and quasi government linked organizations. An avid supporter for incubating start-ups, Anndy has investments in a few health-related companies. He believes that what he is doing for blockchain technology currently will revolutionize and redefne traditional businesses.

https://www.linkedin.com/in/anndylian/

Steph Gemson CFO

Steph Gemson CFO

Steph is a well experienced accountant and Chartered tax advisor with a wealth of experience. Steph started her career in the entrepreneurial services department at EY, one of the world’s big 4 accountancy frms and has since formed the fnancial backbone around many successful startups, including travala.com. Steph’s breadth of knowledge has also led her to work with other high profle corporations such as Manchester United Football club. Her wealth of experience and knowledge forms the fnancial background of our business, and she is a great leader to our growing fnance team.

https://www.linkedin.com/in/stephgemson-99159368/

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Markets

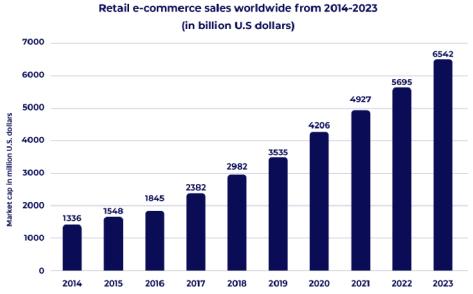

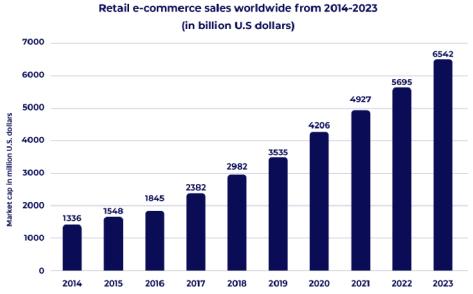

Hodooi operates in the NFT Ecommerce industry with plans on integrating physical objects into the marketplace. From 2021 to 2023 the market cap is projected to increase by 33% meaning they are in the perfect position to secure a position in the upside of this market growth. By having a platform that has pristine useability for users looking to mint/buy/sell NFTs with low gas fees they are creating a global hub for this money to funnel through, further incentivising users with fat purchasing capability.

Hodooi Platform

Their platform is extremely user friendly and allows for sellers to to advertise to their respective niche markets within the platform. Currently the desktop version is the only platform that is usable but they have aspirations to bring a mobile friendly application to market soon.

NFT specifcation is done through a private key conforming to the ERC 1155 protocol meaning users can identify NFTs minted on Hodooi.

ERC-1155:

The issue with ERC-20 is the need for a new contract to be issued for every token or NFT (The reason tokens all have diferent contract addresses), ERC-721 brings NFT’s into the equation. 1155 combines it all together into a bundle allowing the separate contracts to be stored together on the same contract with cheaper fees and less data used to store these items. ERC-1155 tokens have immense security and allow for a very secure network.

Competitive Advantage

The NFT market has recently picked up a lot of steam. I have mentioned this before in other articles that NFTs are here to stay and will be the virtual standard for private ownership, any project being stood up with NFTs built into the foundation will have immense value over time. DeFi currently has over 70 million wallets, hitting a total of $50B in funds that are in those wallets.

Having multiple chains in one place brings easement to the market that doesn’t exist at the moment. Having HOD token capable of being used to buy NFT pieces of multiple chains keep users from having to migrate tokens between wallets and other platforms, reducing the need for the gas fees to move those tokens. By being able to market your NFT pieces with HOD, you get more visibility which only helps emerging artists to get noticed. On top of the incentives to use the platform, such as referral bonuses and staking features, users can treat Hodooi as the Hub of the NFT marketplace for their NFT pieces.

Buyers will be able to pay a fair price for the products they purchase and because the users are verifed there are securities in place with the reviews of content.

Due to the hash being stored on-chain, the platform is able to identify if a duplicate item is submitted for minting to the network. The platform enables users to report fraudulent content that will be audited, if found to be stolen property it will be deleted from the network permanently. This is a remarkable feature that we currently don’t see in the market much and it stems from having an active team that can review materials in times when ownership is in question.

InterPlanetary File System (IPFS)

IPFS is a distributed system for storing and accessing fles, websites, applications, and data. The IPFS allows for a host of benefts that bring security, speed and reliability to the internet. By having an IFPS built into the network, NFTs are capable of being stored and managed on the platform with content addressing in place, allowing the metadata to be stored as a JavaScript Object Notation (JSON) File or text based fle on the storage system while the hash of this fle is stored on the blockchain.

Content addressing is no diferent than searching for an item by certain criteria such as name, size, location, alphabetical only with a CID in place, or Content Identifer. These CID’s are the hash that is referenced in the blockchain that identifes not only the location of the object but also how they can be linked together with other objects. By using smart contracts users can query the location of any object on the IPFS which only adds credibility and reliability to the Hodooi platform.

The team has mentioned that right now they are storing fles on the IPFS cluster, they may have intentions of utilizing partners such as FileCoin, Pinata, IceTea, Docuguard, etc.

What Does HOD Do For Investors and Users?

HOD Token can directly be used for purchasing goods on the platform, resulting in lower fees that are used when buying or selling goods due to being on the BEP-20 protocol on BSC. Fees will be further reduced by the membership

program, the more you hold, the higher tier you have unlocked. HOD tokens will be governed by smart contracts that will move to web 3.0 when the time comes. Users will also have the option to stake their tokens on a decreasing percentage scale.

Membership Tiers and Rewards

Tier 1 Membership

• Fee Reduction of 20%

• Staking Reward

• T1 Exclusive NFT Rewards

Tier 2 Membership

• Fee Reduction of 40%

• Staking Reward

• T2 Exclusive NFT Rewards

Tier 3 Membership

• Fee Reduction of 80%

• Staking Reward

• T3 Exclusive NFT Rewards

Tier 3 Membership

• Fee Reduction of 100%

• Staking Reward

• T4 Exclusive NFT Rewards

Non-Fungible Physical Items

The Hodooi team intends to bring physical items to the NFT space, by “digitizing” a physical asset they will merely assign a digital token that represents the full value of the physical item. They plan to partner with businesses to create ecosystems from scratch that hold value.

There is real value here, by being able to have a digital representation of a physical item, you can turn physical items into a more liquid item where the value can appreciate beyond normal parameters and ownership can change hands just as fast. We are already seeing other use cases for this in the real estate market, by applying this to

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Copyright Protection

everyday items the team will be bringing markets of resale to the table that will only increase the value of HOD token. Because the asset will be tokenized, its value can be fractionalized.

Imagine if an artwork that was worth millions could be split between owners, it would bring price appreciation to the asset that allows buyers of all entry levels to join the market. While this feature is currently in R&D, I fully expect this to be a catalyst to the token and platform as various markets will have the capability to migrate and merge into the crypto industry.

Marketing

Currently the team plans to continue their development of the blockchain integrations they have planned to promote the platform as their leading competitive advantage. That being said, they will mainly utilize partnerships in the industry with intent to promote the platform and token.

Having E-Commerce and Cryptocurrencies merged together, there is ample opportunity to bring partners into the fray. Liquidity will be another core marketing strategy, as the token is listed on exchanges Hodooi will gain more attention to the public as it becomes increasingly more obtainable to investors. Other marketing strategies to be used will be brand ambassadors and “Grow Hacking” where they will incentivize users to create content while promoting giveaways.

The RoadMap

Hodooi intends to capture a majority of the NFT marketplace through their multi-chain eforts. While being a relatively new project, founding in 2021, this year they have been primarily focused on token economics and platform creation. So far they have a very successful platform available to the public to buy and sell NFT’s and are working on their marketing eforts for the following years to come. The platform has been launched with full integration into Binance Smart Chain with integration into Ethereum coming soon. They have already kicked of staking features to earn tokens passively by lending to Hodooi.

Q4 has the team striving to increase their R&D eforts into mobile applications, this research will become a catalyst for them as mobile connectivity is becoming a predominant feature in the crypto space. They have intentions of beta testing iOS and Android apps next year. In the future they will have a Decentralized Autonomous Organization (DAO) in place where users who hold HOD token can vote on proposals for the future of the platform and protocols instated.

Additionally, there are intentions to incorporate FIAT capability to buy/sell NFTs with, creating a truly scalable marketplace bringing the NFT market to FIAT currencies. One of their unique objectives is that of the “Non-Fungible Physical” capabilities which apply NFT principles to physical objects as mentioned previously in the article. A successful launch of this feature will bring markets outside of crypto to the Hodooi space, which is bullish for HOD tokens entirely.

Conclusion

Hodooi has a stacked team with arraying experiences that boost their chances of success. They bring stability to the NFT market that is needed, by creating a global hub for NFTs they reduce the fees overall that users need to spend in order to migrate assets around the various platforms that exist. They have created reward and loyalty programs to incentivise users to utilize Hodooi and have brought advertising to the market for emerging content creators.

The project is still fairly new and yet they already have a working platform that is seamless for the users. Here soon in Q4 I anticipate a lot of features to be added that will boost the value of HOD token. Currently we see NFT markets sticking to their respective chains, with add-on tokens being in their founding tokens chain. Having the ability to operate on BSC and soon ETH, captures a portion of the market share that other marketplaces are failing to compete with at the moment. Users will fock to this platform as soon as marketing eforts expand and HOD token investors will beneft from these eforts simultaneously. I am excited to see what this project is able to accomplish in the next 5 years.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Afen Group and AFEN Token

written by Shaun

AFEN is an acronym for Arts Finance & Education Network

Afen Group is aiming to become the central hub in Africa for the blockchain marketplace. They have a very ambitious goal of bringing together industries that are otherwise separated to the forefront for their users. Specializing in Decentralized Finance, they intend to create a marketplace where education, real estate and art can merge, for one centrally located marketplace to represent all of Africa. Aiming to bring legitimacy to blockchain in Africa, they are working closely with government bodies of various countries to ensure products listed on Afen Marketplace are viable to the public for ownership.

Along with bringing revenue to the early investors of AFEN Token, Afen aims to inspire content creators and collaborators. One of the aspects of this project that is surely noticeable is their goal to bring educational content to the space that is immutable, “History books will no longer be subject to change.”. AFEN would be a decentralized fle share platform that allows users to store certifcations, diplomas, transcripts and really anything that requires a notary, on the blockchain. All of this will be advanced in Q4 of this year, as they not only have their marketplace for NFT’s and real estate, but are creating an education platform that can be used with a simple Metamask Wallet on the Binance Chain.

This project has nothing but utility to spare, bringing real world value to the asset for investors and users alike. Afen Group is a budding project that is at the ground foor, and they have already made signifcant progress since launching in Q2 of 2021.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

All Data Is At Time Of Writing

Total Supply:

Circulating

Smart Chain Contract

What’s the distribution breakdown of the total 850,000,000 generated tokens? Token Allocation Public: Private: Team: Reserves: Product Marketing: Dex Liquidity: Advisory Board: Strategic Investor & Partnership: Community Incentives & Rewards: 5% 2% 15% 23% 12% 5% 3% 11% 24%

Data

Max Supply: 850,000,000

850,000,000

Supply: 135,713,858 Binance

Address: 0xd0840d5f67206f865aee7cce075bd4484cd3cc81

Website https://www.afengroup.com/ White Paper https://www.afengroup.com/white-paper CoinMarketCap https://coinmarketcap.com/currencies/afenblockchain/ CoinGecko https://www.coingecko.com/en/coins/afenblockchain Twitter https://twitter.com/afenblockchain Join their Twitter to keep up to date on news and activity! Telegram https://t.me/afenblockchain Marketplace https://afenmarketplace.com/

Where To Purchase AFEN Token

Currently there are 3 ways to purchase AFEN Token which will involve signing up with an exchange or using a wallet that can connect to PancakeSwap such as MetaMask. I have sorted them by volume from greatest to least for your liquidity easement (This means there is more buy/sell movement on that exchange or swap site making it easier to get in/out).

PancakeSwap (Swap Site) - AFEN/WBNB

MEXC Global (Exchange Site)Paired in AFEN/USDT

BitMart (Exchange) - AFEN/USDT

On Swap sites, you will have to have a trusted wallet on your phone or computer with the currency needed to make the swap. For example, if using PancakeSwap, you would need to have a PancakeSwap approved wallet such as Metamask to connect with the Swap Site, and you would need Wrapped BNB in your Metamask wallet. BNB can be purchased through most exchanges but is native to Binance.

Glossary

Non-Fungible Token (NFT)

Non-fungible tokens (NFTs) are provably scarce / unique, digital items with blockchain-managed ownership. Some examples include collectibles (e.g. CryptoKitties), game items, digital art, event tickets, domain names, virtual real estate (e.g. Decentraland) and even ownership records for physical assets.

Decentralized Finance (DeFi)

Decentralized fnance is a blockchain-based form of fnance that does not rely on central fnancial intermediaries such as brokerages, exchanges, or banks to ofer traditional fnancial instruments, and instead utilizes smart contracts on blockchains, the most common being Ethereum.

Binance Smart Chain (BSC)

Binance Smart Chain (BSC) is an Ethereumcompatible blockchain that ofers the same smart contract capabilities at much cheaper transaction fees.

Know Your Customer (KYC)

KYC standards are designed to protect fnancial institutions against fraud, corruption, money laundering and terrorist fnancing.

Core Team

Profle Data pulled directly from Whitepaper*

Deborah Ojengbede CEO Keith Mali Chung Chairman Advisory Board

Deborah Ojengbede is a seasoned banker with over 5 years of working experience in the industry and has thrived in roles ranging from Business Analytics, Strategy and Project Management to culminate in leadership roles in Women Empowerment and Banking. By virtue of her experience, both within and outside the Bank, she has also garnered experience in building, scaling and impacting various businesses in the entertainment sector.

https://twitter.com/binancefreak?s=21

Keith Mali Chung is a pro-blockchain technology enthusiast widely informed in the world of cryptocurrency. He has pioneered the development of several blockchain products such as a decentralized social media with Swirge, and is on board AFEN as the Chairman of the Advisory board. Keith brings with him a wealth of knowledge and expertise.

https://twitter.com/bitcoinkeith?s=21

Ibidoyin Aina

Legal Adviser/Company Secretary

Doyin Aina is the head of our legal team. Her practice focuses on Sports and Entertainment Law, ICT Law, Real Estate Law and general commercial practice. She is also a crypto-enthusiast. Doyin handles the administrative and legal secretarial aspects of our company. Her knowledge of the crypto business and her practice experience helps bring a new favor to our Company. Doyin is an alumnus of Afe Babalola University, Ado-Ekiti, Ekiti State. She is also a football enthusiast and is best described by her passion for sports and for the development of Female Football in Nigeria. She has also written a number of published articles on Sports Law. She is also a member of the Chartered Institute of Arbitrators, UK..

https://www.linkedin.com/in/ibidoyin-aina-9450a8120

Rugi Kavamahanga Chief Marketing Ofcer

Rugi Kavamahanga is a Blockchain marketing professional with experience in community engagement and strategic messaging development. He has been working in Crypto since 2017 and has had an MBA from Penn State University.

https://www.linkedin.com/in/rugi-kavamahanga-0870ba5/

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Avinash Sengar Chief Technology Ofcer Bukola Akinpelu Lead Product Designer

Avinash Sengar is a blockchain enthusiast & tech evangelist with over 11 years industry experience. He has worked on various projects in Blockchain technology such as DeFi/NFTs, SSI, Banking & Healthcare sector. He is currently fulflling his goal of helping startups build decentralized applications targeted at solving real time problems.

https://www.linkedin.com/in/avinash-sengar

Bukola is an industry recognized expert in product design, data analysis and blockchain startup marketing. She has over 3 years of working experience in various felds in computer science. She combines UI/UX design experience from building blockchain products, website development with product marketing to ofer an invaluable mix of service.

https://twitter.com/cryptobea

Saba David is a professional graphic designer with over 4 years of working experience in various design applications. He is focused on creating and developing meaningful human-centred experiences, through visual designs and branding. As a result, he has secured special knowledge in Brand management, Social media management and Content Creation.

https://twitter.com/king__dayvee

Oliva-Nwoko Excel Bienose Team Lead Corporate Communications and Strategy

Excel Oliva is an enigmatic and enthusiastic communication expert vast in Public relations, content creation, crypto marketing, blockchain technology, and several forms of writing. He has a wealth of experience working in the Real estate industry as well as the blockchain industry, and is a great addition to the team.

https://twitter.com/thequietex?s=09

David Saba

Lead Product Designer

David Saba

Lead Product Designer

Markets

AFEN operates in the NFT Ecommerce industry with plans on integrating real estate, art, and education onto their marketplace. “The global blockchain market size is expected to grow from USD 3.0 billion in 2020 to USD 39.7 billion by 2025, at an impressive Compound Annual Growth Rate (CAGR) of 67.3% during 2020–2025.” This leaves ample room to bring in the niche markets of education, real estate and arts to capture a portion of this market share.

Africa and Asia currently are in need of educators as the world needs to expand and add 1.5 million teachers a year to be able to continue educational eforts for children and young adults. According to Afen group the next decade will see an additional 350 million post-secondary graduates and nearly 800 million more K12 graduates than present day statistics. Afen aims to drive blockchainbased educational content for users to learn from, helping to lower the strain on educators. Lastly, NFTs are all the rage this year and have seen magnifcent increases in attention from the public. AFEN intends to capture a percentage of the market share in the NFT space by working with artists local to their communities.

AFEN Platform

Their platform is relatively simple to use and cost efective, being integrated with Binance Smart Chain. Choosing BSC as the chain to utilize AFEN on allows for cheaper fees than what we currently see on chains such as Etherium.

They have an array of services they intend to create moving forward and have already acted upon the NFT Marketplace.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Education

• Open source platform where users can create course content

• Creators will be paid in AFEN token for completed courses

• Would start with blockchain education and promote content creators to branch into math, fnance and other various topics.

•

•

•

Real Estate

• Allows peer to peer sale of real estate, cutting brokerage fees down from 10% to 1% facilitation fee.

• Taxes will be paid from the transaction on behalf of the buyer by Afen Group

• Fractional ownership in properties

• Easement of international investment in African countries

will be minted and verifed

Pieces

forms of listings:

Art Art

as African Art

Three

Government Partnerships Government Backed

Individual Artist Listings

Individual

Artist Listings

African

AFEN Platform

What Does AFEN Do For Investors and Users?

AFEN Token can directly be used for purchasing goods on the platform, resulting in lower fees that are used when buying or selling goods due to being on the BEP-20 protocol on BSC.

Staking

Interest rewarding pool that users can lock up for a period of time to earn token rewards, acting more like a certifcate of deposit.

Cash Back on Transactions

By using AFEN tokens on the marketplace and partnered platforms, users earn cash back percentage at the end of a tracking period

Art Marketplace| Discounted Transaction Fees

Buying Art on the marketplace also triggers the cash back reward efectively discounting transaction fees on the marketplace

AFEN Education Payments

Educators are paid in AFEN for every course completion their course holds.

AFEN Real Estate Payments

Users get cash back rewards for purchasing property on the marketplace, money is escrowed upon sale & taxes are paid to the government, ownership transferred to buyer after requirements are met.

Referral Tokens|Transaction Fee Share

Referring members nets you a percentage of their fees from using the platform.

The RoadMap

Afen Group is relatively new to the industry but that hasn’t stopped them from showing up and standing out as industry leaders in their hub. Kicking of this year by collaborating immediately with African artists to have a service ofering ready to go from the start on their marketplace. They have been steadily networking with government bodies to bring legitimacy to their eforts and have been successful. This last quarter, being Q3, they have been hard at work launching the frst phase of AFEN NFT Marketplace while onboarding a host of African countries to their network. Afen is currently working on their educational platform that will be collaborated with educators in various countries that will be launched in the next quarter.

Afen Group, by the end of 2021, intends to have their educational platform launched, their real estate architecture in development and a royalty program fushed out for their users. They have their work cut out for them, with government backing on their side they will no doubt have all the resources they need to scale the platform to meet these goals.

Conclusion

AFEN has a very ambitious team flled with vision and the technical know-how to enact their goals. This is a relatively new project, and given they have only had 2 quarters this year to operate, I believe they have hit some milestones that other projects have taken years to achieve. They have a host of governments in Africa working with them and have a genuine intention of bringing communities together in a manner that not only brings value, but quality of life improvements.

Their aim to create an education platform is one that can be celebrated. Bringing education into the blockchain has been a goal for a few projects in the space, AFEN intends to incentivize creators to share knowledge.

I look at the team and see they are full of energy with a desire to create a one stop shop for Africa, I would not be surprised if they fnd a way to bring more quality of life improvements to the economy as we move forward. The wonderful aspect is that as early investors, we are able to share in the rewards and purchases of NFTs and beta test the acquisition of real property once the beta tests are complete. Having AFEN tokens seems like a strong way for early investors to pivot over to real estate fairly quickly without ever having to leave the crypto market. I am defnitely excited for what’s to come from Afen Group!

There’s no doubt that crypto - in particular, the NFT space - is becoming a place where big money changes hands rapidly for all sorts of things we don’t quite understand. Whether it’s the investor who buys their frst Bitcoin without knowing how a blockchain works, or those picking up their frst NFTs without understanding the projects behind them or how to value them… Money talks.

https://lostpoets.xyz/

Murat Pak

written by Rhys

[The NFT world in particular is drawing more and more parallels with the art world. Pieces of work changing hands for thousands or millions of dollars, people raising eyebrows about the “quality” of the artwork on display, questions about “what is art” and how do we value it... All seen in both the physical and digital art spaces. As major art auctioneers start getting involved selling work by creators like Beeple, eyes are drawn from the physical space into the digital - and the very nature of NFTs ofers digital artists a unique opportunity to capitalise on the work that they create, or to even expand on what they make in creative and interesting ways. One such artist pushing the boundaries of NFTs as art is Murat Pak..

What is digital art?

Digital art is quite a literal term - it’s any artwork that has been created digitally using a computer or digital technology. This makes it a fairly broad term that can encapsulate a large range of works. 3D sculpting, digital painting, visual collages, photography, interactive media… This can even stretch to digital installations in physical spaces.

Ironically, one of the biggest issues that digital artists face is digital itself. With the internet being what it is, as soon as an artist shares a piece of work online, it can be downloaded, edited, printed, and get very quickly away from its original intended use or purpose - often with no money changing hands for the uses, either. After all, why would someone buy an image when they can download it for free? If you wanted a print, why get one from the artist directly when you can just make your own cheaper? The issue of how to protect and monetise digital art and images is a growing issue as social media has enabled sharing of content at a far faster rate than ever before.

[How can NFTs help?

By their nature, NFTs provide a chain of ownership that can be traced back to the original issuer, as well as a record of all the owners in between. Whether this be a project owner/team on a new game issuing NFT assets, or artworks like we’re covering here, the blockchain allows us to track a token’s journey from creation to our wallet. In doing so, it’s similar to a certifcate of authenticity to the underlying work; while others may make prints or copies of the art, you can show that you “own” that piece. Indeed, sometimes the journey might make it even more valuable - buying the frst NFT a major NFL player owned, for example, might enhance the value of that NFT far above others in the same collection. This idea has already helped a variety of people monetise their pictures and things derived from them, such as the subjects of memes getting paid for the rampant use of their original image and likeness.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

Murat Pak

Who is Murat Pak?

Murat Pak (Pak for short) is a pseudonymous artist who has been working in digital art and design for over 20 years. They’re also pretty well-known for the Archillect Twitter account - an AI image curator with over 2.6 million followers created by Pak. If you haven’t heard of Pak, you might’ve seen Archillect pop up on your feed from time to time.

The images Pak creates skew towards the modern, the minimalist, clean lines and curves. Indeed, their own website features only a single circular button linking to an email address. Their social media is their calling card, their portfolio, and their playground all at once; a gateway into their past works (frequently retweeted back to us), but also the bubbling cauldron of their current projects. They write in riddles, in half-poems, and challenge those looking on to defne art, value, and our place in the world in equal measure.

[So what do they have to do with crypto?

Burn art to get ashes to get art to burn art.

Well, since 2020, Pak has created several NFT projects and a cryptocurrency – the two of which interact together in a special way. Each NFT project has been experimental – some of which are covered below – as well as the $ASH token where you can “burn” Ethereum NFTs for $ASH – the value of which is derived by scarcity and the community willing to put up liquidity for exchange. $ASH has already had additional utility in granting early access to Pak’s latest project - which drives those who might want that early foot in the door next time to buy more $ASH. As their site says - Burn art to get ashes to get art to burn art.

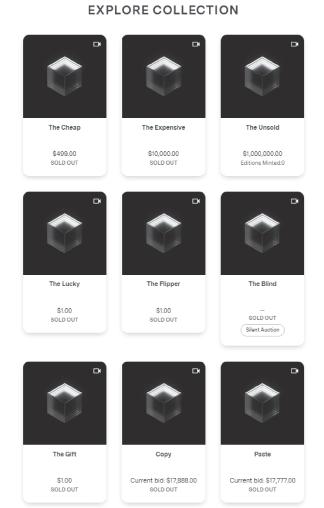

Pak’s previous work

While it’s not essential to see previous work to understand or buy Pak’s more recent – or even next – projects, we will look at both the collection itself as well as how their value has increased since their initial sale.

While Pak has issued several of their own collections – as well as a few collaborative projects – here we focus on two collections in particular: The Title (9 identical NFTs that difered purely on the name) and The Fungible (a collaboration with major art auctioneer Sotheby’s). Both demonstrate Pak’s commitment to making the most of the NFT/crypto format that they are working with by creating not just NFTs, but games and layers within the sale itself.

Pak’s work feels as if it’s building towards something else, a performance piece in the digital space, with the fnal fourishes yet to be revealed. Their projects have started to overlap and build in tandem with each other - particularly with Pak NFTs being worth more $ASH than standard NFTs. And their most recent project – Lost Poets – backs up that thinking, with the fnal stage of the project being presented in a years’ time – a similar approach to the Hashmasks project covered in the last issue with its name-lock mechanism.

Pak’s The Title sold through Nifty Gateway, selling the same image under nine diferent titles:

and is

This magazine is sole property of gettingstartedincrypto.com

not to be redistributed in any form anywhere else. [

Murat Pak

Pak sets out that this work is a play with value, as the titles - combined with the variable quantities and sale types (including auctions) - are the playground toys. All these NFTs – on the blockchain - point to the same IPFS fle. They seek to make a point - if the image, even the very fle, is the same, then what are we paying for? Is it scarcity? Is it to be part of the moment, the performance itself? Part of the market later on? Or is it just to say you own a Murat Pak NFT? And what even is ownership concerning the image displayed, and the fle underlying it? Does the person who’s paid more have more “ownership”, or a more valuable piece over time? What about secondary sales?

These are not questions I’m seeking to answer, but the questions that Pak poses. In a way, the collection as a whole is the work – as is common with much of Pak’s projects, blending that performative aspect with the NFT itself – and owning one of the tokens gives you a piece of the whole. What value you attribute to that piece is up to you.

This is what makes Pak’s projects interesting - they’re not just selling you an image, or an NFT, but involving you in an event, played out on the blockchain and on social media. It’s these aspects that elevate a Pak project over a standard art NFT ofering.

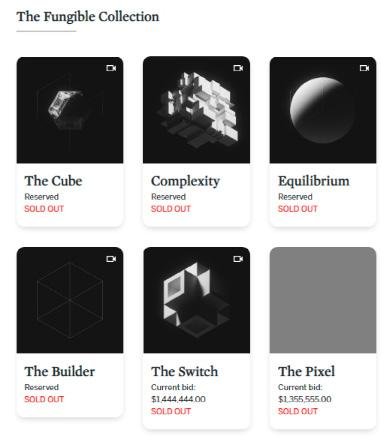

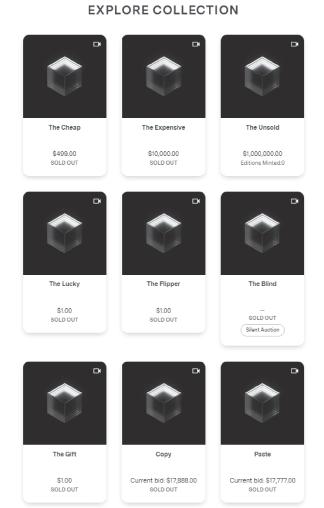

Their next collection – The Fungible – is the biggie. This is the one that bridged that gap between our little corner of the cryptosphere with a mainstream auction house.

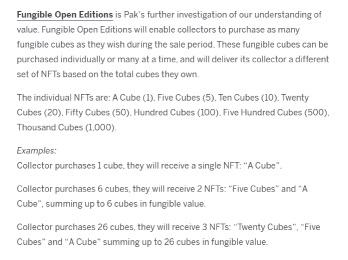

Supported by Sotheby’s, the project was split into two parts – the Open Edition, and the Fungible Collection. The Open Edition was relatively simple; you could buy cubes – NFT cubes – as many as you wanted. While the cubes were sold in batches (1, 5, 10, 20, 50, etc), you could order any number and you’d be delivered a number of NFTs based on your purchase. For example, buying 8 cubes would get you 3x Cube NFTs and 1 Five Cubes NFT. As taken from the Sotheby’s website:

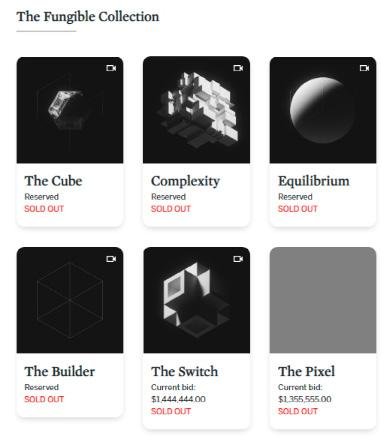

The Fungible Collection – the more unique part of the auction –had six groups of NFTs available that were each delivered based on diferent outcomes. For example, The Cube NFT was delivered to the owner of the most Open Edition NFTs at the end of the 3-day auction period (each period ran for only 15 minutes each day). The Equilibrium was granted to 4 users – for solving a puzzle, reaching the biggest audience, etc. The other requirements can be seen by clicking each item here. With these mechanisms, Pak created scarcity, hype, metagaming, reasons to buy more Cubes, and more – all in a three-day auction period, with tiny purchasing windows. The sale raised a total of $16.8m.

[

So now we’ve got a favour of what Pak is about, and what they create. They create images, sure. But to look at these NFTs as just images would be missing the point. You’re also owning part of the performance in some ways. But the big question you’re probably asking now is how do we value these? And how have their values changed since their original sale?

THE FUNGIBLE COLLECTION

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

[

Well, a quick glance at Opensea and Nifty Gateway shows these fipping already for huge mark-ups. The Title NFTs have been changing hands for nearly 10x or more above their original listing, even just 9 months after release - and even with the cheapest NFTs of the sale. The Fungible pieces – even the basic Open Editions – are selling for well over 5x and growing fast. With opportunities on OpenSea and through Nifty Gateway, there’s even a very limited arbitrage opportunity here for those with time and money on their hands. This takes a good sense of what a good price is – and the ability to hold out for a better sale value where needed – but hey. If you’re reading this, hopefully, you’ve been learning these skills from Lisa anyway!

So where does $ASH ft into this?

It’s complicated, but the existence of $ASH both acts as a mechanism to drive scarcity in the NFTs and a mechanism to set a foor price on Pak NFTs. $ASH is a cryptocurrency that is minted by burning NFTs through Pak’s BURN site - burn NFT, get $ASH. Simple enough. The kicker is that burning a Pak NFT generates a whole ton more $ASH than any basic NFT; a standard NFT burn started at generating 2 $ASH per burn, while a Pak NFT generated 1,000 $ASH. Less $ASH is issued as the token becomes more ubiquitous (read more here), so although it’s not going to be quite 1,000 to burn a Pak NFT now, it’ll still be much, much more than another NFT. And at the time of writing, if you’d bought say one Cube NFT for $500, even at 900 $ASH you could be sitting pretty on nearly $14,000 of easily tradable funds right now if you were struggling to get the right price on the market like Opensea, or just needed to liquidate quickly.

That’s a huge mark-up on the sale price. And while those NFTs burn, the others become more scarce, driving up the value of those remaining. So does a Pak NFT become more valuable over time as he continues to create interesting work and collections? Will $ASH be a part of something bigger? Only time will tell, but with relatively low foor prices on Pak NFTs at initial point of sale, they’re certainly an interesting artist to get pieces from early. With future Pak NFTs also likely to be part of the $ASH minting process, even if you do nothing else than buy at entry price and burn when able, it seems like you’d be able to make a bit of money very quickly... Although perhaps not as much as if you’re happy to hold on and resell down the line. And given that $ASH has become a gateway into future Pak projects, if you’re keen on their work, holding on to that $ASH could give you opportunities to repeat that cycle a few times over and possibly expand your collection and/or wallet.

LOSTPOETS

What are they up to now?

Pak’s latest project – Lost Poets –shouldn’t surprise you in being out there, given the context above. They’ve sold 65536 “pages”, which are tokens that allow you to unlock Poet NFTs, for 0.32 ETH each, and there are LAYERS to this project.

Each Page is exchangeable for a Poet, which can be named and – 365 days after the project start – can be burnt in the high-tier $ASH band as mentioned above.

[

[

So for 0.32 ETH – and a bunch of hodling – you’ll have a pretty valuable NFT in $ASH terms. But in the meantime, there’s a secret roadmap as the game goes afoot – with extra-special Origin NFTs being dropped randomly to Page/Poet NFT holders at a rate of 2 per day being dropped to wallets across the pool of Page holders – so the more pages you hold, the more likely you are to get one of these much rarer NFTs. Being a Pak project, there are surprises in store for holders –some of which have already been teased – and pages themselves are already trading on OpenSea for 0.65ETH upwards – in just two weeks from release. That means they’ve doubled in value in that time - with a long time still to run on the project which might adjust their value even further (although clearly it could be to make them less valuable too!)

As noted above, $ASH holders were granted early access to the ability to buy Pages, with even small holders being able to buy at least one Page if they had at least 25 $ASH. This is great to see as it might be a sign of future direction for Pak projects – if you burn some NFTs now or buy some $ASH, you’ll be on the ground foor of possible lucrative or exciting NFT projects in the near future. There’s already mythos and curiosity abound with this project, as with all things Pak, and I’m sure this will grow over time. Buying Pages now – even if just to burn in a year – seems like a ticket to a fascinating journey which will end who-knows-where – with some additional crypto opportunities at the end. Who knows? Maybe your Poet NFT will be worth a huge markup from your entry price anyway when the fnal twists arrive!

One to watch

Lost Poets might not be for you. You can certainly say that Pak is an artist at the cutting-edge of NFT fne art - not just tokenising images and giving them a traceable provenance and scarcity, but also embracing the opportunities granted by smart contracts, gamifcation, and the passionate community that surrounds all things NFT and crypto. Pak pushes the boundaries and as a leader in the space, generates a mythos around them that leaves you wondering what they’ll be involved in next. It also lights the touchpaper under other wacky and wonderful groups and projects - like Shadowpak - whose reputed sole purpose is to buy Pak NFTs to burn.

Digital art is certainly a challenging sell to people – as is performance art of the type that Pak indulges in their work. But the consistent marriage of the two in these creative, challenging formats has clearly been efective in building hype and intrigue around them – and I for one cannot wait to jump on to what Pak gets up to next.

This magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

How Blockchain Metaverses Are Powering the New Virtual Real Estate Industry

written by Daniel

written by Daniel

OPI NI ON

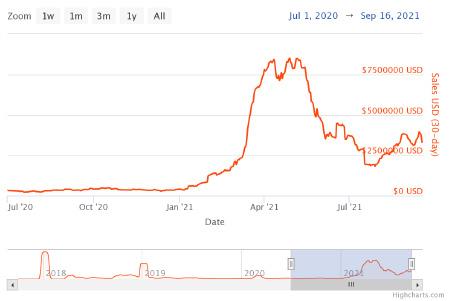

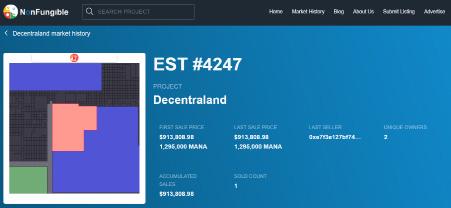

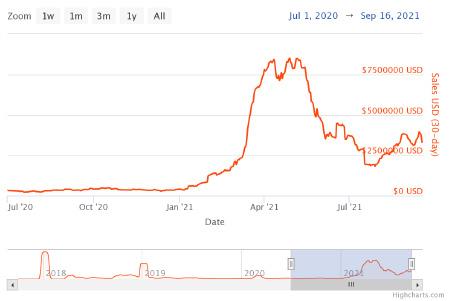

Empty hotels and ofce spaces available in bulk have become a common scenario over the last two years due to the COVID-19 pandemic. Such high vacancies do not inspire confdence among investors. However, in virtual terrestrial worlds like Decentraland and Cryptovoxels, the sales of spaces in these metaverses are soaring, with the prices of the properties available far removed from the economic realities of the time.

Somnium Space NFT Marketplace News en Twitter: “The biggest estate in @SomniumSpace sold, with an @Indiegogo teleporter & #NFT kayak for 280 #ETH or $504,000 USD. Meanwhile, total weekly volume reached $2,000,000 USD on @opensea. #VirtualReality is THE place for #NFTs.�#VR https://t.co/YRoFeErbP2 https://t.co/ A0uvxKWSEm https://t.co/NeqXIo5J4O” / Twitter

The buyers in metaverses like The Sandbox range from celebrities to high net worth individuals, demonstrating huge interest in online parcels of land that are changing hands more quickly with each auction.

The above demand shows that the emerging NFT economy is revolutionizing many spaces of daily life, and the digital replica of the real estate industry is rapidly rising, alongside the interest of large companies inside and outside the blockchain space in investing in this virtual property.

Such interest has been highlighted by the media such as Bloomberg, which reported in March on the interest of recognized real estate investors in acquiring properties in Genesis City, the city created in 2017 in the Decentraland metaverse.

Although metaverses are not something new — early virtual lands include Maze Wars (1974), Second Life (2003), and Roblox (2006) — the introduction of Blockchain technology and cryptocurrencies in these virtual spaces for social interaction has generated a series of unique properties that has allowed this new economy to be generated around these metaverses.

magazine is sole property of gettingstartedincrypto.com and is not to be redistributed in any form anywhere else.

This

This

ON

“Real estate in the real world is very uncertain right now,” Janine Yorio, director of Republic Real Estate told Bloomberg on the occasion of creating an investment fund to acquire digital parcels in metaverses.

Blockchain improves digital ownership

NFTs, metaverses and virtual real estate have something in common, Blockchain technology. With the use of this technology, users of these virtual worlds called metaverses can now create unique and unreplicable elements for which the blockchain is the faithful witness of their authenticity.

Thus a user can create a house or building, then convert it into a non-fungible token (NFT) and sell it on various decentralized markets. Then, it will be bought by another user, and they will place it in their virtual space where they can use other NFT objects to customize it.

All of the above is possible under the power of blockchain technology, thus guaranteeing legitimacy and ensuring buyers are “ the real owners of their own avatar, store, land, building, house, etc”. The key here is the word “property.”

and

This magazine is sole property of gettingstartedincrypto.com

In this way, metaverses — shared virtual spaces where anyone can fulfll any fantasy and generate social interactions (parties, walks, concerts, festivals, dinners, etc.) — help to promote and develop the new economy: the NFT economy.

Why Invest in Virtual Real Estate?

Blockchain technology and NFTs in particular give a realistic sense of digital real estate belonging to each user. This space belongs to the owner and no one else.

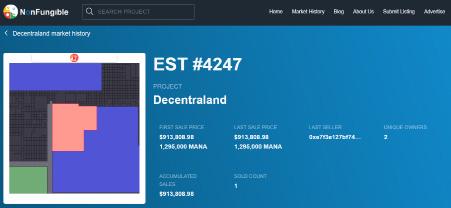

Many wonder why they should invest in virtual real estate. First, the price of virtual real estate continues to grow; some land has been priced at more than half a million dollars.