themoonmag.com

Bought To You By

A note from Lisa…

Wow, it’s December already, and what have we done?

It’s been a massive 12 months for the Crypto and DeFi industries for ALL the wrong reasons... or was it?

‘Any publicity is good publicity.’ or ‘There’s no such thing as bad publicity.’

These phrases emphasise sentiment following Oscar Wilde’s famous quote; “The only thing worse than being talked about is not being talked about”.

A little bit of history of the origin of these famous quotes; both were first attributed in the 19th century to American showman and circus owner Phineas T.Barnum. The media often refer to Crypto as a circus, so possibily these quotes are fitting for the growth and development of the industry as a whole.

Is it ALL bad that the only information people know about Crypto is the Billions that have been wiped off the market cap over the 2022 year? Are the excellent stories of growth and development getting out? That is why the MOON MAG is here; please share the links with your crypto friends and, more importantly, your NON-COINER friends so they can understand that there is more to Crypto than the scams and bad actors and that there is ground-breaking technology and life-changing money... But we are here for the tech. right!

I wish you all a safe and happy Holiday Season! And all the best for an EPIC 2023 Crypto year! <3 Lisa

A note from Josh…

December again! It’s fair to say 2022 has been a wild ride in crypto! In this issue, we dive into some of the eventful moments of this year and upon reflection, you can see just how much growth this industry has had.

Yes, there have indeed been obstacles and fallouts along the way. Still, one could argue that that is a necessary component of development for the industry as a whole and, optimistically, paving the way for an exciting, adventurous and profitable 2023!

Wishing you all the best for the holidays. Season’s greetings! This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Editorial

Connecting The Metaverse 10 AptosLabs 22 12 Months Of Crypto 36 Hashmasks Where Are They Now? 65 TRADERS PERSPECTIVEThe Crypto Flywheel Effect 06 ZeroSwap 56 GEEQ 71

DISCLAIMER

All the content provided for you as part of the Moon Mag has been researched thoroughly and to the best of our ability however it is your choice, and your choice only, whether you wish to invest or participate in any of the projects. We cannot be held responsible for your decisions and the consequences of your actions. We do not provide financial advice. Please DYOR and above all, enjoy the content!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

CONTRIBUTORS

Aldrich Shillian

Aldrich (or Rhys to those in the Signals group!) has been HODL’ing since 2017 and is proud of surviving bear markets, rug pulls and still trading successfully enough to have paid off all debts. Recently, he’s jumped head-on into NFT projects - particularly ones that combine his love of gaming.

Kel Udeala

I’m a quantitative analyst and a mechanical engineer. I took an interest in crypto because my line of work led me down the financial trading and investment rabbit hole, and it’s only a matter of time before you reach crypto. I enjoy researching different crypto projects, and attempting to forecast their roles in the future financial and technology systems. I also find the volatility of the charts and the resulting crypto-Twitter posts very thrilling.

Daniel Jimenez

Mrinal B

Proud rugpull survivor since 2016; gem hunter; technophile; found asking ‘wen-moon, wen-lambo’ on Twitter; fundamentals driven asymmetric investor; making ends meet in an IT company.

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha Jimenez

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

written by Lisa N. Edwards

Daniel has been a blockchain technology evangelist since 2012 and is a faithful believer in the Crypto ecosystem. Daniel also writes for Coin Telegraph!

Samantha Jimenez

Freelance journalist dedicated to digital media, enthusiast of the crypto ecosystem and disruptive technologies. MDC writer since 2018, currently writer for CryptoTrendencia.

written by Lisa N. Edwards

TRADERS PERSPECTIVE THE CRYPTO FLYWHEEL EFFECT

First, we need to know how the FLYWHEEL EFFECT works,

Excerpts from Good to Great by Jim Collins

Picture a huge, heavy flywheel—a massive metal disk mounted horizontally on an axle, about 30 feet in diameter, 2 feet thick, and weighing about 5,000 pounds. Now imagine that your task is to get the flywheel rotating on the axle as fast and long as possible. Pushing with great effort, you get the flywheel to inch forward, moving almost imperceptibly at first. You keep pushing, and after two or three hours of persistent effort, you get the flywheel to complete one entire turn. You keep pushing, and the flywheel begins to move a bit faster, and with continued great effort, you move it around a second rotation. You keep pushing in a consistent direction. Three turns ... four ... five ... six ... the flywheel builds up speed ... seven ... eight ... you keep pushing ... nine ... ten ... it builds momentum ... eleven ... twelve ... moving faster with each turn ... twenty ... thirty ... fifty ... a hundred.

Then, at some point— breakthrough!

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

https://www.amazon.com/Good-Great-Some-Companies-Others/dp/0066620996

A company that has famously used the FLYWHEEL EFFECT is AMAZON. AMAZON’s growth can be attributed to Jeff Bezos’s first sketch of Amazon’s Flywheel, in what he called the “virtuous cycle’ like any entrepreneur, this was drawn on the only paper available at the time, a napkin.

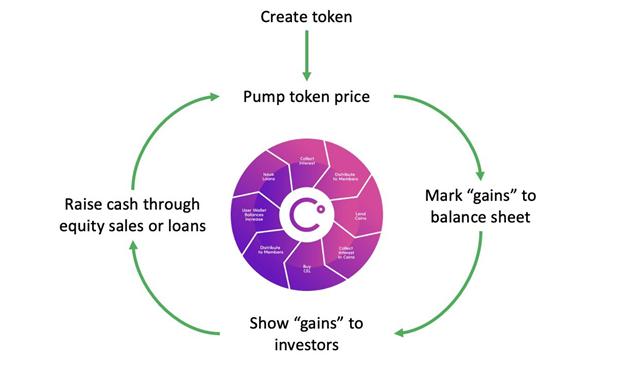

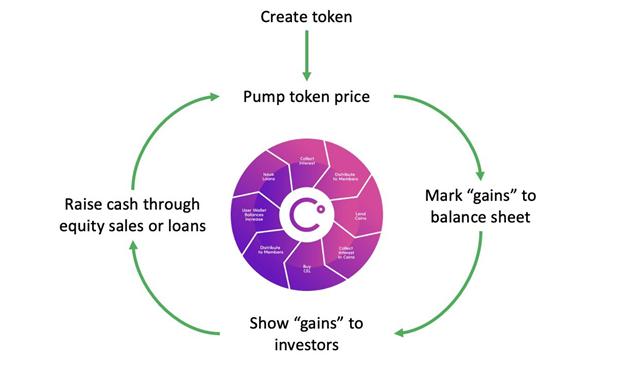

With the huge implosion of the crypto market from TERRA LUNA and now with FTX bankruptcy, this will go down in history as pivotal industry events; it’s time to look deeper into the driving forces of the entire crypto ecosystem.

Starting with - Was Do Kwon one of the smartest and simultaneously the dumbest man in crypto?

To explain this, Sir Isaac Newton’s Law of Gravity, What goes up, must come down. Do Kwon spun the flywheel so hard and fast from community hype that the cogs jammed from the resistance of those wanting control of crypto (the crypto space is not ready for competitor stablecoinsthat aren’t exactly stable). That flywheel is now uncontrollably moving in the reverse direction, undoing ten years of work for many in the industry and steamrolling everything it touched on the way up. The contagion from both direct and indirect contact has spiralled to the point of almost no return.

How TERRA LUNA and many crypto projects fund their company models is shown in the image below.

It’s also important to note that when the larger flywheel spins faster and faster, it needs more cogs to continue this momentum and growth. That is where we see new companies added to the ecosystems. This is not a bad thing; this is how this growth model works, but when we see one reckless action, this can cause this type of industry-wide contagion if not quickly contained.

Again to explain this, Sir Isaac Newton’s Third Law, Action & Reaction. His third law states that for every action (force) in nature, there is an equal and opposite reaction.

Math is the basis of any blockchain-based platform, so, therefore, you would assume an understanding of physics is necessary. Especially when you have a cryptocurrency in the spotlight like TERRA LUNA, with the FLYWHEEL spinning so fast that the only way to stop this was for someone to come in with greater power and spin the FLYWHEEL in the opposite direction.

Unfortunately, when these forces are applied in reverse, the contagion moves with a “CLEANING” or “DESTRUCTIVE” effect on the bad actors and innocent bystanders in the space. The innocent bystanders are always the investors (retail) and smaller crypto firms caught in the crossfire. In my opinion, education is so desperately needed within the financial system. Perhaps this is where going back to basics and teaching this early in the school curriculum urgently needs to be implemented with real-life examples. That is another post, though.

Now bring in FTX, and the arrogance and ignorance of the overnight billionaires, met with the destructive force of TERRA LUNA, was this the necessary evil and cleanse the crypto ecosystem desperately needed from this destructive momentum? I don’t believe FTX is the last of the unstable or financially unviable bad actors to fall, but part of the necessary cleanout.

The silver lining being big players in the cryptocurrency industry and now experiencing resistance from years of INERTIA (Sir Isaac Newton’s first law) to the current outdated monetary system.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

THE CRYPTO FLYWHEEL

Within each BEAR MARKET, we see failures and growth. When we look at the positives and the bigger picture, as the market grows, these events feel bigger as there are more people affected.

Remember, seeds are planted in the winter, and not all grow; some die for no apparent reason, while others flourish, but we always need to reap the rewards when they are available and remember, the flywheel spins both ways.

The investors and companies that will flourish from these events will be the shining stars of the next bull market, learning and growing as the market recovers, and it will as it has done many times before.

For those that do not know physics…

What are Newton’s Laws of Motion?

1. An object at rest remains at rest, and an object in motion remains in motion at a constant speed and in a straight line unless acted on by an unbalanced force.

2. The acceleration of an object depends on the mass of the object and the amount of force applied.

3. Whenever one object exerts a force on another object, the second object exerts an equal and opposite on the first.

EXCEPT FROM https://www1.grc.nasa.gov/beginners-guide-to-aeronautics/ newtons-laws-of-motion/#:~:text=Newton’s%20Third%20Law%3A%20 Action%20%26%20Reaction&text=His%20third%20law%20states%20 that,words%2C%20forces%20result%20from%20interactions.

CONNECTING THE METAVERSE

written by Daniel Jimenez

written by Daniel Jimenez

The Metaverse has arrived, no longer a utopia recreated in Second Life under Neal Stephenson’s futuristic inspiration in his 1992 novel Snow Crash, and is advancing to become part of our daily lives.

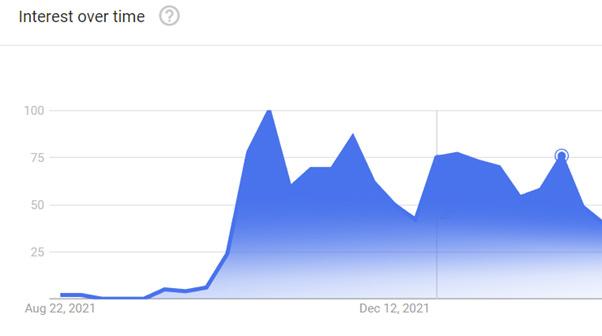

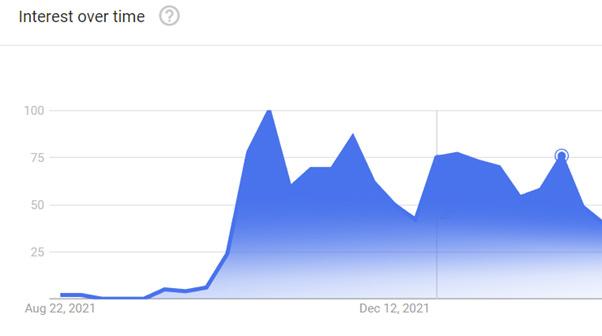

Since Mark Zuckerberg changed Facebook’s name to ‘Meta’ at the end of 2021, we have witnessed an inflection point for the Metaverse Industry. Things began to accelerate to the point of observing a search increase for the term ‘Metaverse’ that skyrocketed in the last quarter of 2021.

We know that the Metaverse will be orchestrated by multiple communities based on their technology stacks, which can vary and include everything from centralized HQs like Zuckerberg’s to decentralized and open options like Ethereum.

However, despite the technology giant’s huge venture capitalist interest in supporting projects focused on developing profits in the Metaverse, the reality is that we are still far from observing the true potential of linking the virtual and physical worlds.

And one of the main reasons is the lack of interoperability between the different virtual worlds currently developing in the industry, making it problematic to find options that allow moving assets between chains and provide the scalability needed for the widespread Metaverse adoption.

This isolation is similar to that observed in our physical galaxy, where each planet represents a specific platform with its rules, community, and culture, supported by unique architecture.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

While all these platforms together create a multichain universe, for now, it is very difficult to easily transport assets between different blockchain planets, resulting in the isolation of each Metaverse from the rest of the universe.

Moving avatars freely between interconnected virtual communities and transferring tokenized properties such as coins, NFTs, collectibles, and others from one place to another is the premise behind strong industry development in recent months, aiming to connect each isolated Metaverse mini economy with the rest of their peers.

After all, the Metaverse success will depend on being able to move freely anywhere without preconceptions or technical complexities as it should be in the real world.

Technology that empowers the Metaverse

Within this context, a strength-gaining sector is the facilities development, for both developers and companies/users to create and deploy their virtual worlds under the premise of an interconnected virtual economy without restrictions.

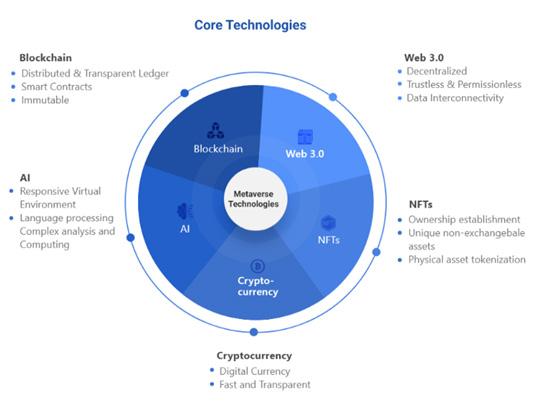

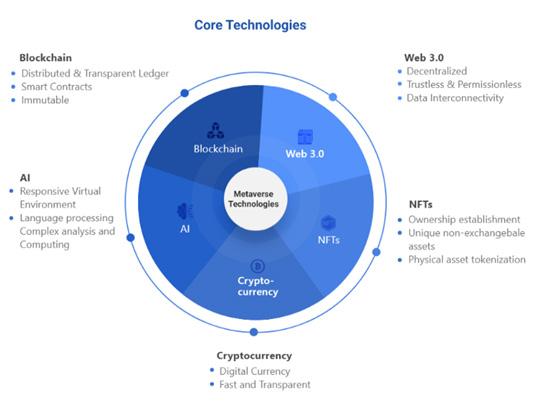

These facilities reside on the technologies that drive the Metaverse called Core Technologies: Blockchain, Web3, NFTs, Cryptocurrency, and AI, currently facilitating the enablers to lay the foundations for the Metaverse complex structure, which allows its economy to function.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

In this opportunity, we will analyze some of the options we can find in the industry that advance towards a premise of an interconnected and fully operable cross-chain future.

Arcade Network

ArcadeNetwork gives players actual ownership of their in-game purchases in any game they participate in. While for game developers, the platform offers the opportunity to develop theirMetaverse game con cepts much easier and faster. It solves the most concerning issue for those who want to live a Metaverse life, centralization.

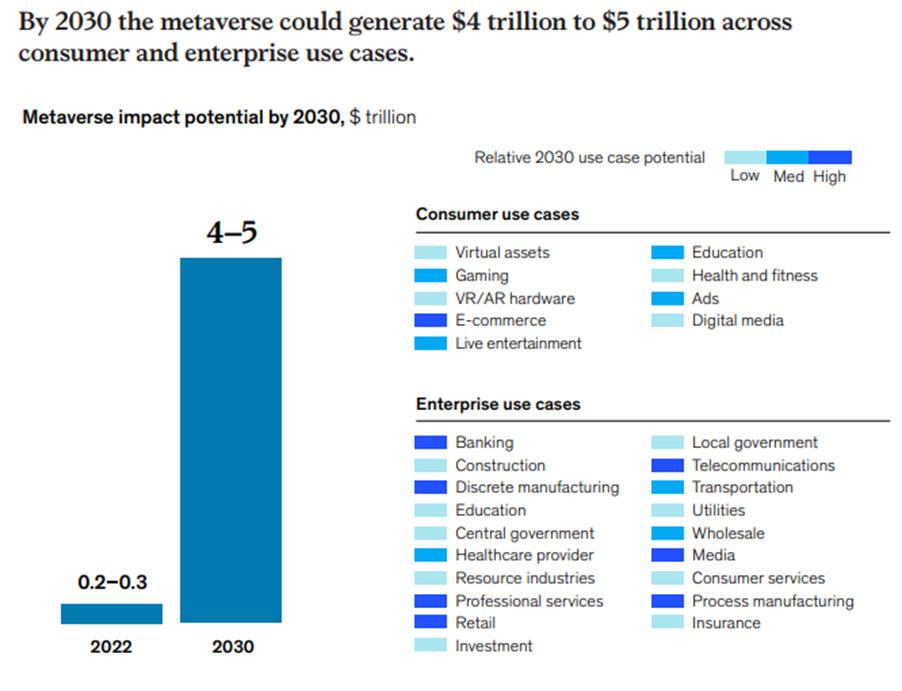

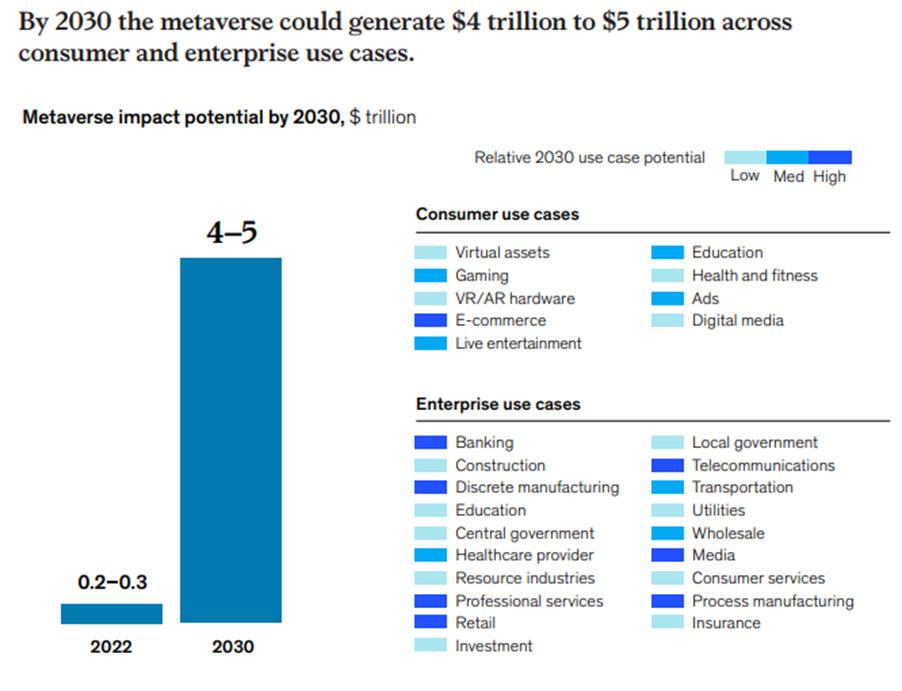

With around $4 trillion market value forecasted by McKinsey for 2030, the metaverse represents an op portunity for many use cases, including gaming.

Technology

Arcade is building a decentralized cross-metaverse bridge that will allow continuous asset movement between metaverses, allowing users who purchase NFT collectibles from one metaverse to export them to another.

The company’s base is to support blockchain games since they believe the blockchain industry’s future is in games and metaverses. They plan to connect metaverses through their cross-bridge to support all game types, including mobile games.

Its Arc Relayer Bridge solution is a complete, adaptable, and powerful set of APIs & SDKs to create interoperability between in-game assets while providing actual ownership to players.

In addition to moving game assets from one metaverse to another, users can also sell assets on any NFT marketplace or use them for staking on various partner platforms that provide this NFT Staking service.

In addition to Arc Relayer Bridge, Arcade has other core modules:

• Arc Notecase: a collectible cryptocurrencywallet (web and mobile) for storing $ARC, NFT, and other assets from ArcadeNetwork partner platforms. This technology solution has a simplified user interface that allows for easy deposits.

• ArcVerse: Game developers who want to launch and showcase their games or metaverses, but lack the investment and resources to develop, can use ArcVerse, which allows them to launch metaverses almost instantly without having their assets and graphics.

• ●Arc Minter: A module that allows free minting of game assets designed by players

• ●Arc Exchange Station: A decentralized NFT marketplace for the buying and selling of exclusive game assets

Unique advantages

ArcadeNetwork offers a completely new gaming metaverse experience for gamers and developers alike. The platform allows true ownership of ingame purchases, even if the game decides to close, which drives standards and security in the gaming ecosystem; all of this has been brought to life through a feature called ArcWrappers.

In addition, the platform’s ArcadeNetwork Bridge allows game developers to create metaverse platforms much easier and faster, without having to develop new assets for their metaverse game concepts, which is expected to be a game changer in this ever-growing market.

Token

The ARC token is the utility token in the protocol which can be used to purchase game assets, redeem game assets on the ARC token for exchange or flat redemption, or use it as an

interoperable token to purchase assets in different game environments.

The token is a fee settlement and loyalty token for the ArkadeNetwork platform and all its associated games. Among its functions we have:

• ●Staking upon registration

• ●game dev financing and loyalty payments

• get users attention and financing for game devs.

Byepix

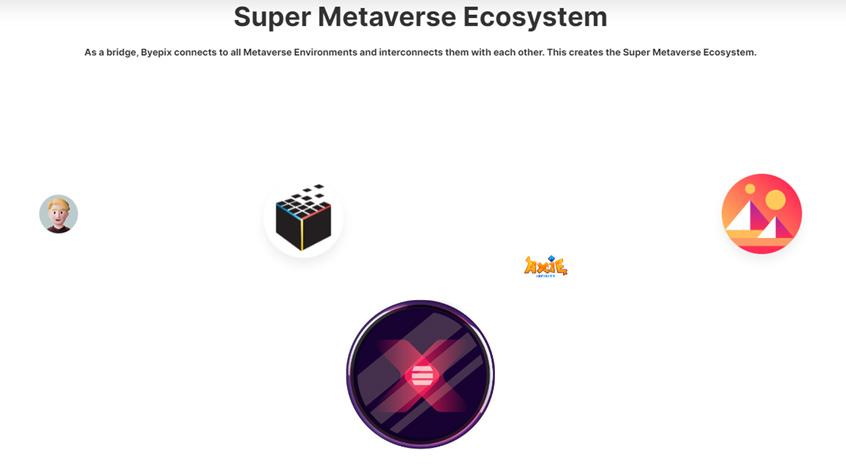

Byepix is a Multi-Faceted Web3-Based Technological Platform that Develops, Converts, Creates, and Provides.

In addition to developing The Most Exclusive Web3 Based All-In-One Super-Metaverse Platform, Byepix is also a Technological Laboratory working on its own Layer 2 Metaverse Blockchain to solve scaling, communication, boundary, and incompatibility problems between all Metaverse projects.

This Layer 2 Metaverse Blockchain solution is to be merged with its Byepix Super Metaverse Protocol, which will be integrated into the Byepix Super Metaverse Application with the goal of connecting all Metaverse Environments and their users.

Byepix Metaverse Layer 2’s focus will be on File Systems, NFTs, and most importantly, Byepix Metaverse Blockchain, which will be tasked with bringing together all metaverse projects in the Blockchain and IPFS ecosystem and providing interconnection exchanges between projects. Byepix Layer 2; On-Chain and Off-Chain functions will be configured for the Metaverse.

Its goal is to develop applications and protocols to expand the Web3 ecosystem for the benefit of the end user, creating a solutions that solve blockchain scalability issues to make the metaverse a secure, affordable, fast and more interconnected environment along with the use of other disruptive technologies such as VR, AR and Web XR systems.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Benefits

The Byepix Metaverse experience is available to all users, companies and organizational structures with development goals. Developers can enjoy Byepix universe’s unlimited production.

It builds on the Byepix Development Universe SDK (Software Development Kit) architecture. The BDU-S fabric will be able to communicate with Ethereum, Binance Smart Chain, and Polygon (MATIC) Testnet Networks and then connect to test branches.

Technological solutions

Byepix announced the Byepix Super-Metaverse Layer 2 Protocol to create a real-life environment that allows users to interact, do business, and stay in touch across multiple Metaverse.

Byepix Super Metaverse Technology advocates allowing multiple protocols to connect through a bridge and bringing them under one roof.

The Super-Metaverse provides an environment where all projects and users in these environments can interact by using the Super-Metaverse Protocol and Application infrastructure.

The Super Metaverse technology wishes to support all structures in the Metaverse environment providing flexible connection protocols, including the Blockchain Metaverse infrastructure to be developed by Meta.

• Super-Metaverse Application (SMA) develops through Byepix’s Metaverse Cross-Chain supported SMP Protocol, Allowing users to manage their NFTs and Lands in all metaverse environments, monitor their prices, measure their market caps, and sell them. SMA offers users and projects the ability to transact with Cross-Network Marketplaces.

• Super Metaverse Protocol (SMP): The Super Metaverse Pro tocol scans all DAPPS projects on Ethereum, Polygon, Bi nance Smart Chain, and IPFS Networks and includes projects from all assets for users and projects. SMP provides infrastruc ture support for Super Metaverse Application. Thus, users can transact in cross-blockchains and metaverse environments.

Features

• The project offers cooperation opportunities between the different ecosystem actors within the metaverse, providing infrastructure and interaction possibilities between several projects.

• The project is an independent NFT ecosystem that attracts users into the Blockchain space providing services that cover the NFT lifecycle, allowing anyone to create, publish, auction, and trade NFTs at low gas fees.

• It stands out with its intuitive algorithm that allows users to quickly find the NFTs they are looking for in the market and ensure smart earning models are used to stake NFTs.

• The Bypeix Super Metaverse has nine planets that conform the project’s ecosystem, where each planet is configured to offer unique solutions tailored to users’ needs: from P2E gaming to infrastructure for hosting interconnected assets.

• Byepix will allow users to create 2D/3D NFTs and transport them to planets in the Byepix star system.

• Byepix can host any NFT available in other markets that Byepix accepts and finds compatible with your blockchain structure.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

EPIX token is this platform’s core and the entire Virtual Reality-Metaverse.This token grants the following use cases for its holders:

•

●Governance designed so the EPIX token holders can vote on platform parameters to drive project economics and developments.

•

●Incentives: EPIX tokens used to reward user participation in future bounty hunting, referrals, and other programs. EPIX tokens are a requirement for NFT issuance, staking, auction, trading and more.

•

●System Tax: Users trading with EPIX tokens will contribute to a dividend pool.

Tokens can be obtained as a reward for playing P2E games, joining a referral program or performing specific tasks on the platform, among other ways.

Polkadot

Polkadot is a next-generation blockchain protocol that unites an entire purpose-built blockchain network, allowing them to operate seamlessly at any scale. This protocol allows any data to be sent between any blockchain, unlocking a wide range of real-world use cases.

One of the great use cases observed in Polkadot is precisely the development of gaming-focused platforms, metaverses, and NFT in general.

During the Polkadot Lisbon meetup at the beginning of November it was possible to observe how web3based projects were successfully deployed in Polkadot.

Thanks to its sharded blockchain architecture, the inherent properties to address scalability issues are approached successfully by this blockchain network.

Token

By bridging multiple specialized chains into one shared network, Polkadot allows multiple transactions to process in parallel. This system removes the bottlenecks observed on earlier networks that processed transactions one-by-one.

In addition, thanks to its relay chains, the number of shards to add to the network can increase, thus boosting network efficiency.

Polkadot unites a network of heterogeneous blockchain shards called parachains. These chains connect to and are secured by the Polkadot Relay Chain. They can also connect with external networks via bridges.

And it is precisely through the use of bridges in Polkadot that projects focused on connecting the metaverse use this network’s technology to communicate with external ones, like Ethereum or Bitcoin, allowing asset movement between different metaverse chains..

Thanks to Parity Tech Substrate and Polkadot, network asset ownership and governance are decentralized from the start and even after tokens are distributed evenly in the future for projects that make their home on this blockchain network.

A Polkadot deployed parachains example to use its technical capabilities to interconnect metaverses is Bit.Country and Enjin’s Efinity. Bit.Country is a Metaverse as a Service Platform - MaaS. Users can launch their metaverse project in 12 sec onds. Each metaverse has an NFT Marketplace, Map Engine, Land Economy, NFT Facilities, and Customizable 3D World Engine.

All this under the power of Polkadot’s blockchain technology.

Features

Polkadot design supports a vision for a fair, secure, decentralized, and resilient web where users are in control (coined “Web 3.0”), built on the following core principles:

• True interoperability

• Economic and transactional scalability

• Easy blockchain innovation

• Energy efficiency

• Security for everyone

• User-driven governance

Tools

Developers can use Substrate to develop specific use cases in Polkadot. Substrate is an extensible, modular, and open-source framework for building blockchains that provides all the core components needed to assemble a distributed blockchain network:

• Database

• Networking

• Transaction Queue

• Consensus

While these layers are extensible, Substrate mostly assumes the average blockchain developer should not care about the specific implementation details of these core components. Instead, Substrate’s core philosophy is to make a blockchain’s development state transition function as flexible and easy as possible. This layer is called the Substrate runtime.

Token

The DOT token is the main actor in the Polkadot ecosystem. This token serves three different purposes

• Governance over the network: Polkadot token holders have complete protocol control. All privileges, usually exclusive to miners, will be given to the Relay Chain participants (DOT holders), including managing exceptional events such as protocol upgrades and fixes.

• Staking: Game theory incentivizes token holders to behave honestly by rewarding good actors with this mechanism, while bad actors will lose their network stake, thus ensuring network security.

• Bonding: New bonding tokens added parachains. Outdated or non-useful parachains are removed by removing bonded tokens as proof of stake.

Other projects to consider

In addition to the previously mentioned projects with good Polkadot experience backup and use cases to connect blockchain metaverses, some interesting proposals also wish to implement facilities to achieve an interoperable and interconnected virtual world without limits. Let’s see who they are:

• MOODS: Moods is a social commerce platform that allows users to create immersive rooms for friends and strangers to explore.

• Vorlds: Vorlds is a creator-based Metaverse platform that supports users, NFTs, and other parts from blockchains across the Polkadot & Ethereum ecosystems.

• TeaDAO: TeaDAO is a Metaverse Reserve Currency, solving the illiquidity of NFTs and enabling sustainability and scalability for GameFi projects by offering a unique NFT-asBonding-Assets mechanism.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Aptos Labs Facebook’s Blockchain Legacies

written by Daniel Jimenez

written by Daniel Jimenez

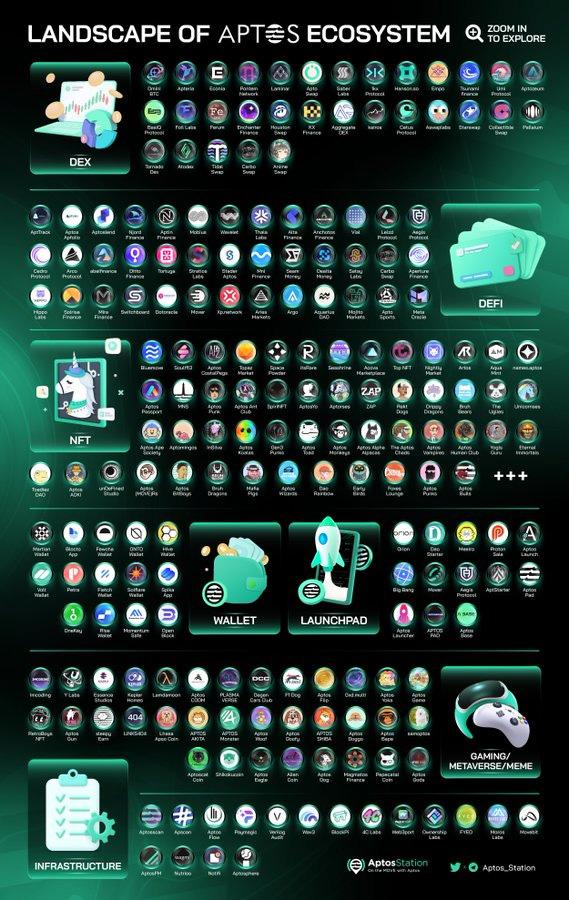

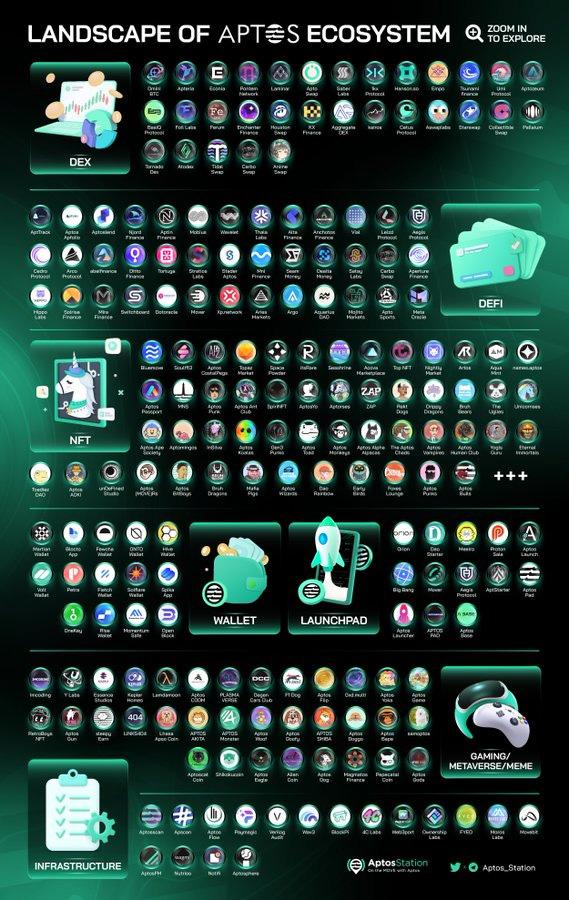

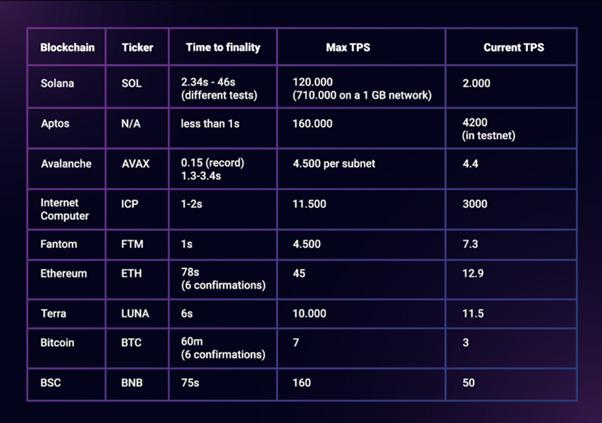

Developing a new L1 from scratch is extremely difficult. Although we will definitely see a multichain future, it is worth noting that there are few L1 solutions (paradoxical as it may seem) called to meet the current demand of applications that make life in the industry focused on all sectors: NFT, DeFi, Web3, etc.

On the one hand,we have the congestion in Ethereum until finally sharding is implemented in its architecture, which will happen in a couple of years possibly; on the other hand, BNB Chain is still a highly questioned network due to its centralization while Solana has not succeeded in convincing developers due to its performance issues.

In this context, two large L1 projects have emerged that have something in common: Aptos and Sui, natural heirs to the legacy of Diem, Facebook’s failed project for its Libra cryptocurrency. For now, we will only dissect Aptos and its potential within the blockchain ecosystem.

Aptos Blockchain: The genesis

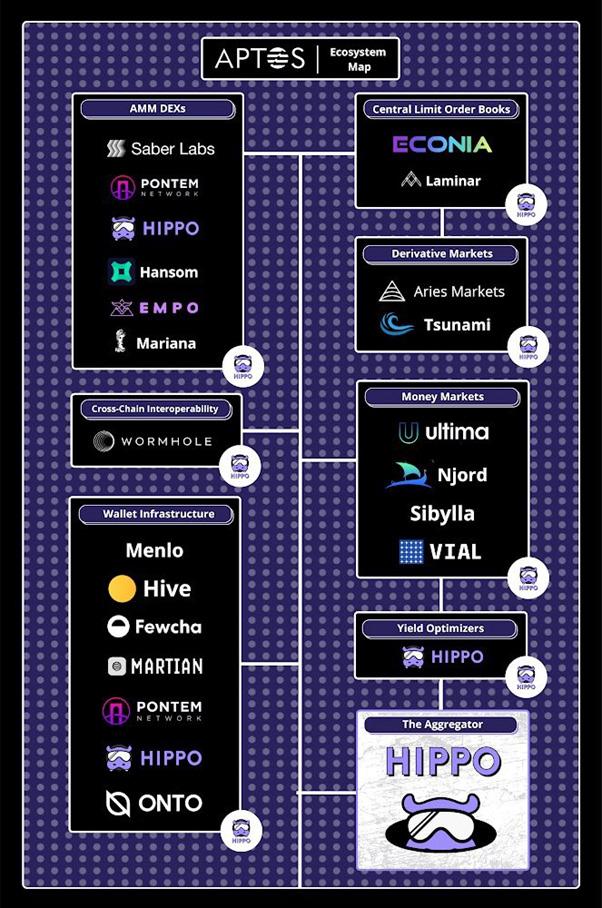

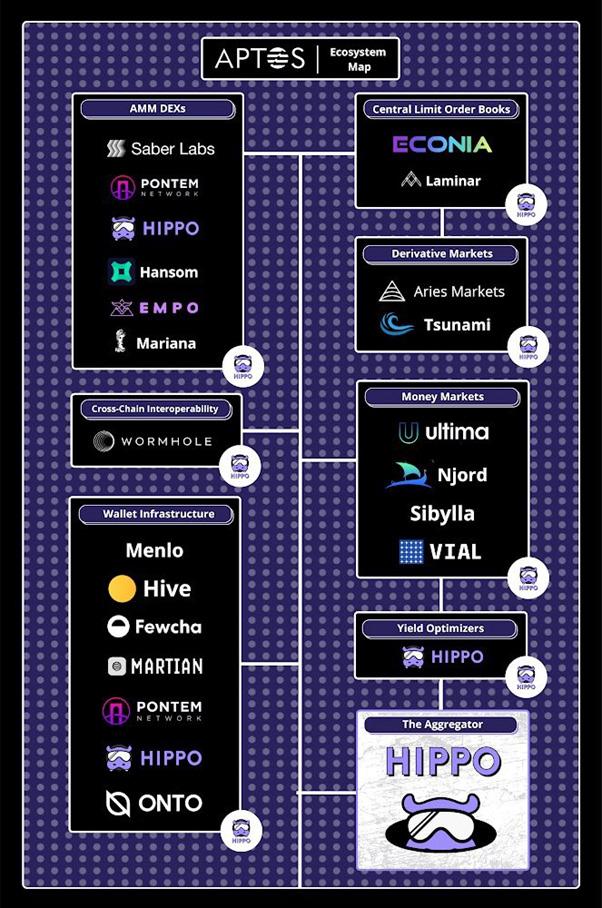

Aptos is a new L1 blockchain that has managed to attract so much interest prior to the launch of its mainnet in mid-October that in just seven months after its development was announced it already had more than 20,000 validation nodes on its test network, 10 times more than Solana has on its mainnet.

Its ecosystem has grown rapidly since then, boasting more than 300 decentralized applications (dApps) within days of the launch of its main network.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

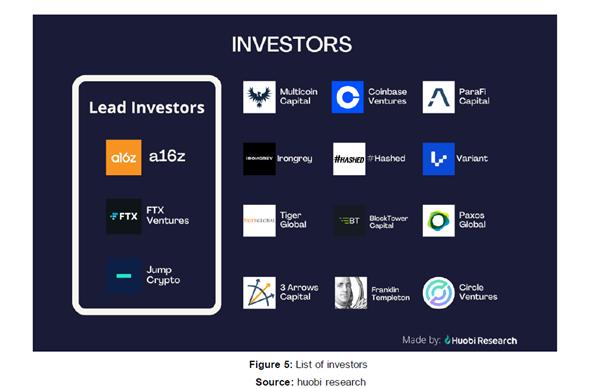

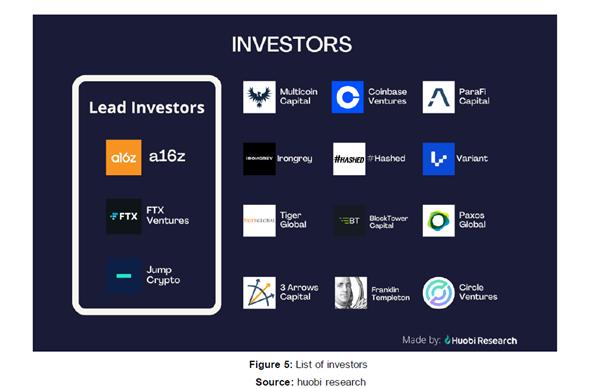

Its fundraising has also been a milestone in the industry, with over $350 million coming from prominent investors such as FTX Ventures, Binance Labs and Jump Crypto,just to name a few.

The Aptos vision is to deliver a blockchain that can bring mainstream adoption to Web3 and empower an ecosystem of decentralized applications to solve real-world user problems.

Interesting fact: the name ‘Aptos’ comes from the language of the Ohlone Indians and means ‘the people’. The Ohlone live in California, where Aptos is based.

Website

https://aptoslabs.com/

WhitePaper

https://aptos.dev/aptos-white-paper/aptos-white-pa per-index/ Twitter https://twitter.com/aptoslabs

Linkedin https://www.linkedin.com/company/aptoslabs/ Github https://github.com/aptos-labs

Medium

https://aptoslabs.medium.com/ Discord https://discord.com/invite/aptoslabs

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Who is behind this initiative?

As we pointed out, the team that makes up this platform is part of the Meta team (previously Facebook).

Aptos was co-founded by Mo Shaikh (CEO) and Avery Ching (CTO), both with years of experience as senior developers and engineers in the blockchain industry.

While @AptosFoundation will support and develop the Aptos network and ecosystem, Labs will develop tooling and products on the Aptos blockchain that redefine the Web3 user experience.

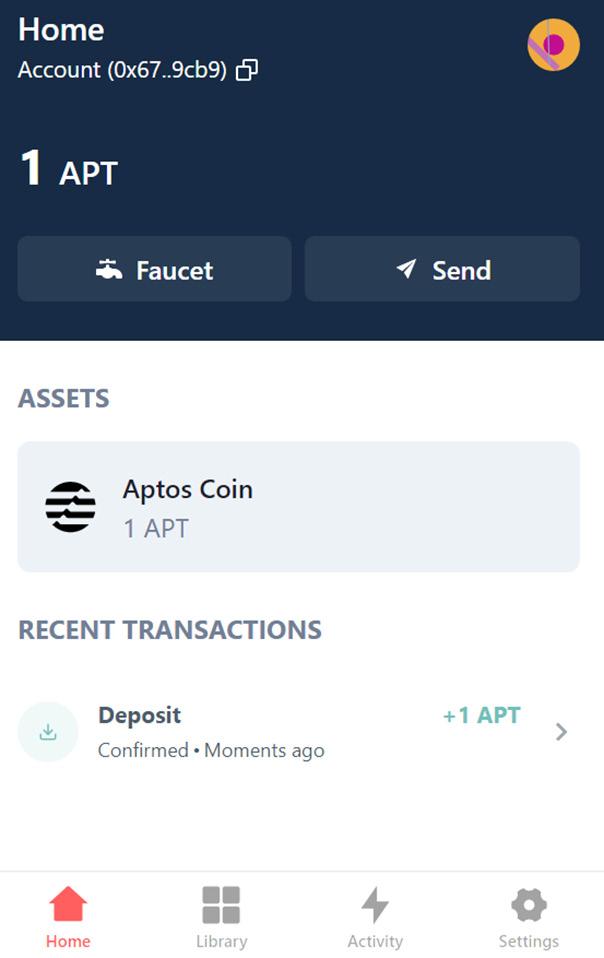

Its first products are Petra Wallet, Aptos Names and Aptos Explorer, which are fully available to both users and developers who want to build on top of Aptos Blockchain.

The two founded Aptos Labs based in Palo Alto, California to continue developing the technology they had originally developed for Diem. In addition, they added another industry leader to the team, Austin Virts, former head of marketing at Solana.

As a Web3-based project, Aptos Foundation is the entity dedicated to supporting the growth and development of the Aptos protocol, decentralized network and developer ecosystem.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

What’s all the hype about Aptos?

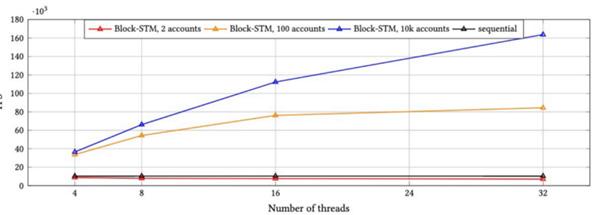

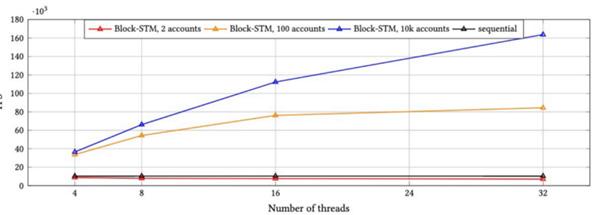

Its BLOCK-STM parallel execution engine is one of its great strengths that distinguishes this L1 blockchain network from the rest of its competitors.

Because the Aptos Labs team is highly experienced in developing scalable solutions inherited from the Diem project, they have managed to address common pain points in the blockchain by using horizontal scalability to keep gas rates low and processing capabilities high beyond traditional payment systems such as Visa and SWIFT.

“To maximize throughput, increase concurrency, and reduce engineering complexity, transaction processing on the Aptos blockchain is divided into separate stages. Each stage is completely independent and individually parallelizable, resembling modern, superscalar processor architectures. Not only does this provide significant performance benefits, but also enables the Aptos blockchain to offer new modes of validator-client interaction,” Aptos Labs describes perfectly in its whitepaper the special foundation of its blockchain network.

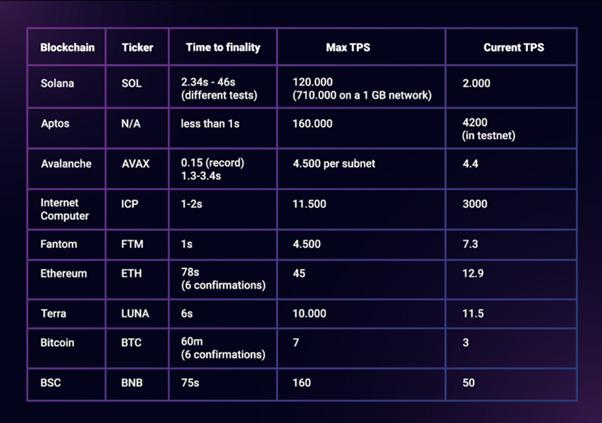

As a result, the Aptos design eliminates the requirement for global consensus on a list of transactions, achieving superior yields of up to 160,000 TPS in theoretical fields.

In simple terms, transactions are first executed by the nodes in parallel and only then validated. If there is a problem at this stage, the transaction can be canceled and re-executed or discarded.

Protocol highlights

• Scalability, immediate settlement

• A secure smart contract language that mainstream developers can use

• The ability to define rich and modular on-chain assets

• Improved Web3 app user experience

Architecture

When comparing Layer 1 networks, it is critical to understand their consensus mechanism and their advantages and disadvantages. Consensus mechanisms often trade off security, speed or decentralization.

The Aptos modular architecture design supports client flexibility and optimizes for frequent and instant upgrades. Moreover, to rapidly deploy new technology innovations and support new Web3 use cases, the Aptos blockchain provides embedded on-chain change management protocols.

Aptos is based on the proof-of-stake consensus mechanism with a consensus algorithm based on BFT (Byzantine Fault Tolerance), where parallelization is implemented through dynamic detection of dependencies and execution tasks using BlockSTM (an evolution of the seductively named HotStuff algorithm).

Block verification is performed through a reputation system that analyzes the state on the chain and automatically rotates leading nodes to adjust unresponsive validators.

Transaction execution is deterministic, tight and measured. According to Aptos, transaction execution is predictable and is based only on the information contained in the transaction and current state of the general ledger.

With AptosBFT, once all validators agree that a block is valid, it becomes final, a quick finalization that is a key advantage of Aptos over other blockchains such as BNB Chain or Solana where finalization takes 30 seconds or 6 seconds, respectively.

In addition Aptos is implementing account protection for users (including validators) who will be able to rotate their consensus private keys to mitigate theft. On the other hand, they are incorporating a key recovery method, something unique in blockchain.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Aptosi is scaling horizontally to meet the needs of applications. Network capacity grows in proportion to processing power as workers are added, resulting in low gas fees even during high network traffic. This scalability feature starkly contrasts with other blockchains that suffer from severe bottlenecks.

Move: The language that moves them

Aptos Labs was inclined to follow the legacy of Facebook’s Diem project; therefore, they use the original language conceived by this team, Move, a programming language with quite significant advantages for blockchain networks:

• Move is based on the Rust programming language, a high-level language that supports custom transactions.

• Any asset in Move can be represented or stored within resources

• Scarcity is applied by default, as structures cannot be duplicated, which eliminates the possibility of double spending

• Resource management in Move is inspired by the mathematical concept of linear logic. Resources have a high status in the Move code architecture, which prevents them from being accidentally copied or destroyed

• Gas costs can be minimized while maintaining a high level of safety

• Referenceable transparency for immutable references, making it easier to resolve bugs and vulnerabilities once smart contracts are implemented

• Move offers a formal ‘Move Prover’ tool that allows developers to quickly verify and test that their code is running as intended.

Overall, the advantages over Solidity are impressive: The early development experience with Move shows it has high capabilities to enable real intraoperative assets and smart contract composability.

In addition, the code that takes 3 weeks in Solidity requires only one day in Move.

Decentralization vs. reality

One of the great flagships of Aptos Labs since the conception of its blockchain platform in its Testnet phase was the great decentralization it offers. This is in large part because of the low barriers to entry for operating a full node compared with other L1 networks.

The above features have contributed to Aptos becoming the network with the second most active validators after Ethereum (1,000) and active nodes with over 20,000 (much more than Solana) in its Testnet.

However, this hype after the launch of its mainnet and the actual TPS achieved in the production phase, has caused the number of active validators to be considerably reduced to barely a hundred validators.

However, being a new project, as the Aptos Labs team succeeds in demonstrating the benefits of its protocol with the implementation of new tools for the Web3 experience, it is possible that decentralization will be able to emulate levels achieved in its testing phase.

Aptos Labs Products

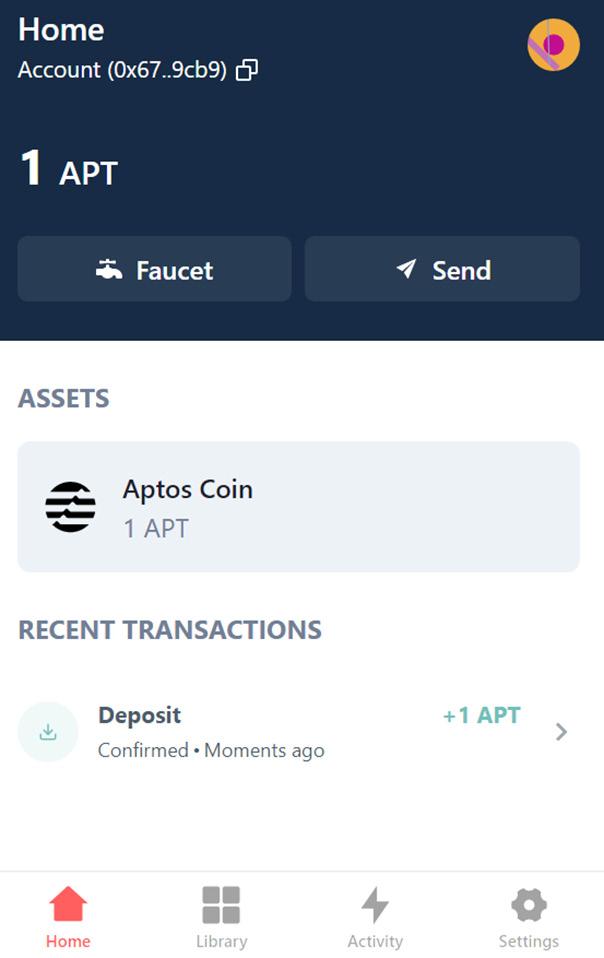

Petra Wallet

Petra Wallet: an interface to the Aptos blockchain. Petra Wallet is a free web application available as a Google Chrome extension that lets users store and transfer assets, create and view NFTs, and interact with decentralized applications (dApps), all on the Aptos blockchain.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

As mentioned above, the Aptos Labs team has so far managed to develop three products in less than a year:

Aptos Names Service (ANS)

Aptos Names Service (ANS): ANS allows all Aptos users to use a human-readable .apt name for their Aptos wallet address instead of their public key. ANS provides improved network tooling for all applications on Aptos’ blockchain and will offer numerous ecosystem integrations.

ANS supports names that are 3+ characters, and Latin characters, numbers and hyphens are supported. To start, ANS enables registering names for a 1-year rental period to ensure an equal opportunity for people to register for names and encourage active use by owners.

Aptos Names Service (ANS)

Aptos Explorer: A powerful and intuitive block explorer on the actual status of transactions executed by the user on the Aptos blockchain network. The explorer provides real-time performance of the Aptos mainnet.

It is important to remember that due to the large amount of financial

this L1 blockchain network has had, its ecosystem is quite broad with more than 300 decentralized applications covering different industry sectors such as NFTs, Web3, DeFi,

support

among others.

support

among others.

Tokenomics

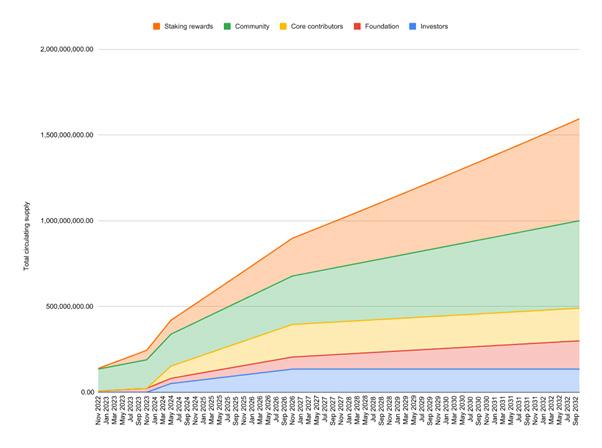

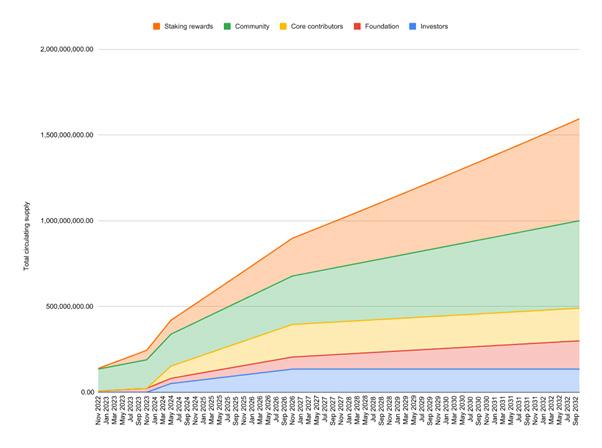

APT is the native token of the Aptos blockchain network that empowers its ecosystem. As with the other blockchains, APT is used for the management of all costs/rewards associated with network activity (in addition to other uses that may follow).

The Aptos Foundation announced last October 18 its tokenomics, due to community outrage after it launched its APT token a day earlier without first disclosing its full supply, which together with the poor performance recorded in the launch of its mainnet was the target of much criticism.

Aptos has an initial supply of one billion APT, with some 510 million distributed to community members, 190 million to core developers and the remainder to the Aptos Foundation and private investors.

Despite the generous airdrop to over 100,000 addresses, the move towards transparency was met with even more outrage after the community learned that the entire supply of tokens was allocated to early investors and the company.

That is, instead of giving the community 51% of the tokens supposedly allocated directly, either through airdrops, grants or participation rewards, Aptos allocated them to Aptos Labs and Aptos Foundation.

This amount of APT tokens in the hands of private investors was immediately a cause for criticism among some users in the community, as reported.

However, despite the dissatisfaction of some, the APT token is already available on some of the major exchanges in the market such as Binance, FTX, OKX and Huobi, among others.

According to the official token supply schedule, the inflation rate will start at 7% and decrease by 1.5% per year until reaching an annual supply rate of 3.25% (expected to last over 50 years). Transaction fees will be burned initially, although these mechanics may be revised through governance voting in the future.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Final Thoughts

There is a lot of interest from venture capital firms, developers and the community at large regarding the solutions that Aptos Labs can bring to the ecosystem as potential new hidden gems in the industry.

However, until all the dApps are fully deployed on your mainnet and the real litmus test begins to test the real capabilities of this L1 solution, it will not be possible to visualize a real added value to the industry from Aptos Labs.

The possibility of dethroning the skeptical narrative displayed on social media driven by the hype ‘planned’ by large VCs on Aptos, as happened with Solana, is still alive for this type of L1 blockchain solution. However, time will judge the results.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Advertise with us! Contact@themoonmag.com

written by Samantha Jimenez & Lisa N Edwards

12 Months Of Crypto

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The history of Bitcoin and the crypto market is full of events that left an evident mark on the community at large stone a benchmark for a new global currency and the crypto market’s recent history; Here at The Moon Mag, we breakdown the memorable events of 2022 in this “12 months of cryptocurrency”.

Bitcoin made history when it launched—setting a new benchmark for global currencies and the much-needed push into the 21st Century. A definitive line in the sand for the economy and financial technologies history. The underlying blockchain technology has brought numerous economic changes, including saving costs, improving efficiency, and transparency.

Beyond the events associated with its birth, the digital currency ecosystem pioneer went through different stages in its history that significantly affected its adoption and commercial evolution. Let’s jump straight to 2022!

Adoption of Bitcoin as legal tender in El Salvador

A significant market milestone was El Salvador’s adoption of Bitcoin as legal tender in the struggling country. Previously no government had dared to declare cryptocurrencies as legal tender before.

Flashback to Japan. One of the world’s most innovative countries committed to leading in advanced technology unveiled a legal reform

in 2017 that made bitcoin a payment alternative, widely interpreted as granting it legal tender status. However, a 2018 Central Bank of Japan report clarified that cryptocurrencies “are not legal tender and their use for payments depends on the willingness of the counterparty to accept them.”

In this sense, El Salvador would consequently be the first country in the world to make Bitcoin legal tender from September 7th 2021. Since then, different states have been closely studying this process to transfer several measures implemented in El Salvador to their reality.

However, despite this decree, local surveys suggested that Salvadorans needed more time to be ready to understand the technology. Plagued with fraudulent interactions, including identity theft, the rollout could have been smoother. International organisations such as the World Bank and the International Monetary Fund warned against its adoption. The main criticism of the project is undoubtedly the high volatility that characterises cryptocurrency.

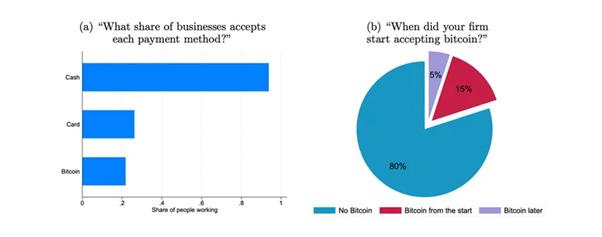

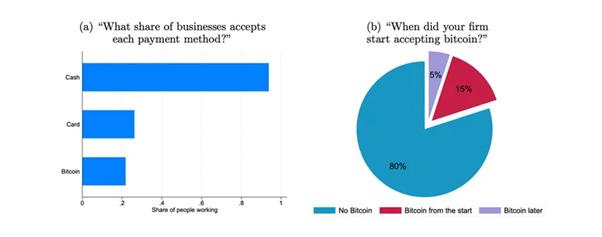

Received with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households conducted in February indicated that only 20% of the population used Chivo Wallet (the app to encourage Bitcoin transactions). More than twice that number downloaded the app, but only to claim the $30 incentive for using it…

Among respondents who identified themselves as business owners, only 20% said they accept bitcoins as payment. These are typically large among the top 10% of large businesses.

Source: Chamber of Commerce of El Salvador.

Source: Chamber of Commerce of El Salvador.

Had households HODLed their free Bitcoin, they are now 70% down, leaving approx $9 in their wallets.

It is imperative to highlight that, among the main advantages pointed out by the advocates of this initiative, thanks to bitcoin transactions, the population could save the intermediaries’ commissions in the remittances they receive from abroad, which can amount to up to 30% of the money sent, according to President Nayib Bukele.

Remittances are a vital lifeline of the Salvadoran economy, accounting for about 16% of its Gross Domestic Product (GDP). The president also highlighted that around 70% of the population does not have a bank account and works in the informal economy, meaning cryptocurrencies could improve financial inclusion.

Most research and economic reports agree that a country with advanced technological development has a better chance of eradicating backwardness. Digital technology such as blockchain and its mobile device use possibilities not only to reduce the transaction cost and create a higher level of payment settlement but also to allow access to international markets and guarantee transactions.

The question that must be asked was Bitcoin the right cryptocurrency to use.

Bitcoin City

But the adoption of Bitcoin as legal tender in El Salvador is not all. Bukele has also reportedly announced his intention to create the world’s first ‘Bitcoin City. A city that would be located in the coastal city of Conchagua and would initially be financed by Bitcoin-based funds.

The city’s location in Conchagua is no coincidence, as it is the site of a volcano. It is precisely this volcano that is intended to provide the energy for bitcoin mining. Last October, the Salvadoran country began mining bitcoin using volcanic energy. There is no coincidence, as the country has been producing a quarter of its electricity from geothermal energy for years.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

No property taxes

Among the fiscal benefits promised by the future city would be eliminating virtually all taxes except VAT. Some of those that would be at 0% is taxes on housing, income, capital, CO2 emissions and municipal taxes.

This new “Bitcoin City” would take the form of a currency and would include restaurants, shopping malls, residential areas, a central square in the shape of the Bitcoin symbol and even an airport.

The issue of taxation is undoubtedly the main complaint of this project.

The joke tells itself: China bans Bitcoin.

While some are betting on the legalisation of the leading cryptocurrency, as in the case of El Salvador, others are seeking to apply more and more restrictions. China, for example, is against cryptocurrencies and has considered them illegal since September 2021. Until then, the country was one of the largest cryptocurrency markets in the world.

Fluctuations there usually have caused the global price of this type of asset to fluctuate. Thus, following the announcement in September last year, the cost of bitcoin plummeted by more than $2,000. Since then, the country has been stepping up measures with up to 10 years of imprisonment.

Similarly, those who advertise through any medium to publicise prohibited activities are liable to be penalised. This essentially bans advertising for cryptocurrencies on the Internet, television, print media and messaging services, and other media.

But Bitcoin would not be the only thing the Asian giant would ban. The truth is that China has banned Facebook, Twitter, Google, Wikipedia, youtube, etc... and all the eggs without Chinese!

The paradoxically funny thing about this is that, after the bans, they launched a government platform for non-fungible tokens (NFT) in a centralised way, which gives the impression that the Chinese government is not totally against these technologies but that citizens can use them in a free and decentralised manner.

Somehow it was to be expected that communist sons of fruit would attack people’s economic freedom in this way.

The Merge

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Another one of the most anticipated events of the past cryptocurrency 12 months was the launch of Ethereum 2.0. Ethereum is one of the most relevant blockchain protocols in the crypto ecosystem. Its Ether cryptocurrency is the second largest in the world, both in market capitalisation and popularity, so any announcement related to its crypto or protocol itself keeps crypto enthusiasts on their toes.

In this line, Ethereum’s announcement was no exception, making a shocking turn with its update “The Merge,” moving from the Proof-ofWork protocol to Proof-of-Stake, bringing several benefits to users directly, such as security and indirectly, reducing 99% of electricity consumption. As a result, its environmental impact decreased.

Ethereum 2.0 presents itself as the end of mining. Users must “invest” or “stake” with at least 32 ETH to

The collapse of TERRA LUNA

get the new ETH tokens in this system. The model is based on the concept of incentives and rewards those who become validators of this system.

The advantages of PoS are significant in the efficiency of the system: moving away from mining will save an enormous amount of energy, as the current PoW is estimated to require 45,000 GWh per year - roughly the energy consumption of New Zealand - and PoS will reduce those needs by 99.9%.

Although Ethereum’ has not yet achieved its goal of becoming a deflationary network, these changes have considerably reduced the system emissions to be more scalable, secure, and sustainable without leaving aside its principal value: decentralisation, a change that, without a doubt, both current and future users will appreciate.

2022 brought increased scrutiny and negativity to the cryptocurrency market with events that shook the market. The collapse of Terra and Luna caused a death spiral and domino contagion effect in cryptocurrencies.

TerraUSD lost a third of its value during May, spooking cryptocurrency investors and partly contributing to Bitcoin falling below $30,000 for the first time in 10 months.

The token shot to fame earlier this year when Luna Foundation Guard, a non-profit affiliated with Terraform Labs, the company behind TerraUSD, pledged to accumulate $10 billion in bitcoins to back its parity with the dollar.

Unlike other stablecoins with traditional assets reserves, TerraUSD relies on an algorithm that moderates supply and demand in a complex process involving another balancing token, Luna.

Analysts have described it as a “death spiral” to the Luna crash at the same time as UST; investors rushed to liquidate their digital assets faster than the “algorithmic” stabiliser could kick in.

The price of the “sibling” token fell from around $86 to just 0.003 US cents during the same week. And investors suffered unprecedented losses when Luna’s market value plummeted from $40 billion to $500 million, triggering a massive sell-off and a crisis of confidence across the cryptocurrency market.

A significant factor in investor loss was token staking and the inability to ‘unlock’ tokens to protect capital. The preceding months saw huge APY offers, which looking back now, were unsustainable.

Recovering from the fall

Do Kwon, co-founder of the company behind the token, Terraform Labs, announced a “recovery plan” in a series of tweets, saying the company would seek additional external funding and “rebuild” TerraUSD to be collateralised. Sounds familiar, right? SBF of FTX.com craziness has just now done a similar thread. At the start of FTX’s demise, also quoted TWAP as a way to avoid liquidation, as did Du Kwon...

However, the Luna token plummeted by 99% and dragged down bitcoin and Ethereum. In fact, during those days, bitcoin reportedly lost 26% of its value and Ethereum 32%. Losses are even higher in other cryptocurrencies that were part of the ‘top 10 during that time as it was: Solana -50.7%, Cardano -46.2%, and Dogecoin by -41.3%.

Beyond the figure of Kwon and the distrust it generates, there was another important aspect: the new Luna 2.0 still had to demonstrate its value proposition.

Without the UST, there is no stable currency to support the new blockchain, so the future depends on the activity and projects it can attract in the decentralised application environment (DeFi).

July: Three Arrows Capital (3AC): They were not alone in feeling the chill of the cryptocurrency winter.

But, the collapse of LUNA has not only been a one-off event that has led to market losses this year. In the middle of the year, disastrous events accompanied LUNA’s fall.

For example, the collapse of Three Arrows Capital (3AC) was one. It is one of the world’s most significant crypto hedge funds that also felt the chill of the cryptocurrency winter. The fund is used to manage around US$10 billion in assets. However, with the collapse of cryptocurrencies, which reportedly plunged more than 54% in the market, the fund had to file for Chapter 15 bankruptcy protection in the Southern District of New York.

The collapse of cryptocurrencies and the TerraUSD stablecoin project wiped out Three Arrows Capital’s assets.

3AC, as the company is known, borrowed money from various investors and financial players in other industries and then invested the capital in other crypto projects. The company gained some prestige by being in business for around ten years.

3AC’s open crisis was triggered when one of its representatives, Zhu Su, one of its co-founders, admitted that the crypto investment fund was going through an internal problem. Su did not disclose any details at the time, which added more mystery to the matter, fuelling further fear of market sentiment.

However, Su Zhu and Kyle Davies attributed 3AC’s collapse to overexposure to Terra, staking Ethereum and Grayscale’s Bitcoin trust.

Tesla effect sold 75% of Bitcoin shares.

In addition to Three Arrows Capital’s collapse, July was also marked by another major event: Tesla liquidated around 75% of the Bitcoin it acquired in early 2021 (worth up to $1.5 billion). The electric vehicle company invested $1.5 billion in Bitcoin in February 2021 after changing its investment policy in January to allow it to hold digital assets. At the time, it was seen as a very bullish move. So much so that BTC reached what was then a new all-time high of $43,000.

Things would go further with the rise of cryptocurrency in the following months. Still, Musk, theoretically concerned about the energy consumption involved in bitcoin mining, announced in May 2021 that they would stop accepting car purchases with Bitcoin.

Predictably, shortly after Tesla’s news broke, the Bitcoin price retreated from its daily high of $24,280 to $22,900 before stabilising around $23,500. But this time, less pronounced.

Elon Musk’s love affair with cryptocurrencies has been bumpy. His influence on social networks such as Twitter has meant that his comments on this social network have boosted the price of bitcoin and Dogecoin on several occasions. Still, the cryptocurrency market has been plummeting for months.

From a technical point of view, Bitcoin was due for a pullback, and, despite the lower prices, the Bitcoin chart remained healthy.

Celcius collapse

But that was not all. Cryptocurrency platform Celsius followed in the footsteps of Three Arrows. They filed for bankruptcy protection under section 11 of US bankruptcy law virtually after a month blocking withdrawals from its users. The company argued that it could not pay them back due to a liquidity crisis.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Celsius would retain control over its operations, albeit under court supervision.

More than 100,000 investors were trapped on the platform. The firm avoided asking the judge to return its users’ deposits, and all indications were that use was to restructure all its liabilities. Investors then faced huge losses as the deposit guarantee did not protect them.

This caused the price of bitcoin and Ethereum, the two most significant virtual currencies by market value, to plummet, continuing a worrying downward trend.

In addition, Binance, the world’s largest cryptocurrency exchange platform, was also affected and had to “pause” bitcoin withdrawals for a few hours. Crypto investors on Twitter drew comparisons to the recent Terra collapse in question and the infamous Bitconnect cryptocurrency Ponzi scheme.

BlackRock launches Spot Bitcoin Private Trust in August.

A month after the bankruptcy disaster, amid global malaise, inflation and concerns about a looming recession, investors abandoned riskier assets, hurting the cryptocurrency industry.

However, in August, BlackRock made a pro-bitcoin move: the company’s partnership with Coinbase (COIN), one of the world’s largest cryptocurrency exchanges.

The new service offered by this partnership was exposure to bitcoin. Coinbase’s system would connect directly to BlackRock’s Aladdin investment management platform, allowing institutional clients to trade bitcoins seamlessly through the same platform used for various other asset classes.

The press release for this announcement stated in the question that clients were “increasingly interested in gaining exposure to digital asset markets and are focused on how to manage the operational lifecycle of these assets efficiently”.

Consequently, these events demonstrated how mainstream organisations, including pension funds, hedge funds and banks, have recently increased their investment in crypto assets, betting that the alternative asset class will continue to grow. This is even though the digital asset market has reportedly experienced a sharp decline.

However, this has an unfortunate downside: all bitcoins bought and sold by these users will not change hands but will remain in Coinbase’s cold storage and be secured by large amounts of fiat money. In other words, institutional investors using the Aladdin platform will not “own” these coins to be able to buy goods or services with them or move them to any form of safekeeping outside this internal system. However, it offers access to the world of cryptocurrencies, which makes it particularly interesting.

In this sense, in contrast to all the events that occurred regarding the market crash and the closure of operations of different platforms. MicroStrategy surprised the crypto market again by announcing the purchase of 480 bitcoins for around $10 million. Some advocates of digital assets seemed unconcerned by the recent longterm price decline and Saylor’s strategy.

Earlier this year, Michael Saylor stepped down as CEO and said he would focus more on Bitcoin after the enterprise software maker reported a loss of more than $1 billion related to the price drop in the second quarter.

While he acknowledged that it had been a “rollercoaster ride”, the famously bullish on bitcoin reckons bitcoin is 33% higher than when he started buying in 2020 and that MicroStrategy’s stock is “up 38% during that period”.

In fact, in November, he assured during an interview with CNBC that his shareholders are winning and that they will continue buying the main cryptocurrency because it has worked for them.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Opportunities amid crisis - Michael Saylor’s MicroStrategy bought USD 10 million in Bitcoin.

It’s almost the end of the year, and we couldn’t close this special edition without including FTT’s spectacular crash. Yes, we suddenly woke up one morning feeling frustrated looking at the disgusting price charts. Attempts to make a sound trading decision with a proper risk assessment are taking a back seat. The only real friend who accompanied us on this arduous journey was “Mr Loss”, even with stop losses in place. There was no avoiding his visitation to the market.

In the sheer hope of recouping the initial investment, many investors held on to their cryptocurrencies and were unwilling to exit their positions. If this is your story, you need not be discouraged. Stop thinking about your losses. To feel better, look at the case of Sam Bankman-Fried (SBF), as your situation is probably much better than his right now.

They say history repeats itself, but SBF seems to have created a story, the only one of its kind. On November 11th, Samuel Bankman-Fried resigned as CEO of FTX when his cryptocurrency exchange filed for Chapter 11 bankruptcy protection in the US.

According to the beleaguered crypto exchange statement, FTX, its affiliated cryptocurrency

exchange fund, Alameda Research, and 130 other companies have filed for voluntary Chapter 11 bankruptcy proceedings in Delaware.

Amid the market turmoil, Sam Bankman-Fried continued to be investigated by the Justice Department and the Securities and Exchange Commission (SEC) to determine whether any criminal activity or securities offences happened during FTX’s operation.

Just a few months ago, SBF was seen as a cryptocurrency white knight, reinstating beleaguered cryptocurrency companies that were shaky as prices fell. But things changed; according to Bloomberg’s net-worth calculations, BankmanFried was worth around $16 billion on Monday, November 7th, and his fortune completely disappeared by Friday, November 11th.

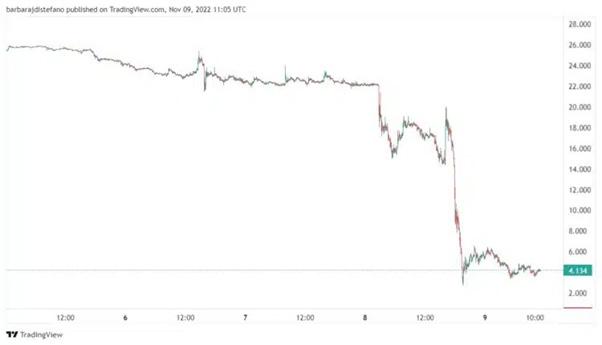

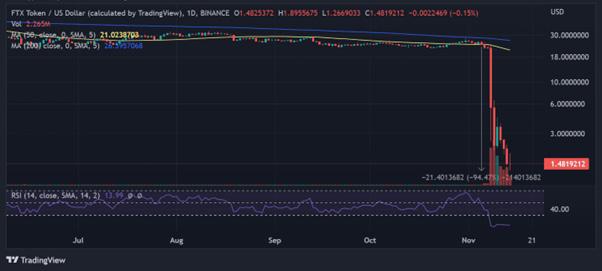

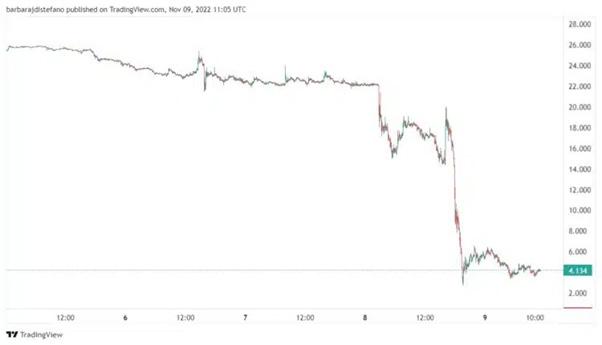

Predictably, the price of FTT, the FTX token, fell almost 90% from USD 25 to USD 2.7 in less than three days from Sunday, November 6th. And, after hitting a two-year low, it rose slightly to USD 4.3 on the morning of November 9th, according to TradingView data...

FTT plummets: FTX token lost 90% of its price

FTT plummets: FTX token lost 90% of its price

The price of FTT fell by almost USD 90% in three days. Source: TradingView.

With this three-day free fall, FTT lost 83% of its market capitalisation. According to CoinMarketCap data, it went from USD 3.29 billion to USD 419,269,514 at the time of this writing. Prices pushed down sharply in this short period.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

The price of FTT fell by almost USD 90% in three days. Source: TradingView.

Part of the fall in its market capitalisation was due to liquidations by some traders. Over the three days, losses on their leveraged positions amounted to around USD 35 million. Some USD 26 million, 74% of that amount, was liquidated in the last 24 hours of November 7th, according to Coinglass’ records.

According to records, FTT settlements were USD 26 million in the last 24 hours. Source: Coinglass.

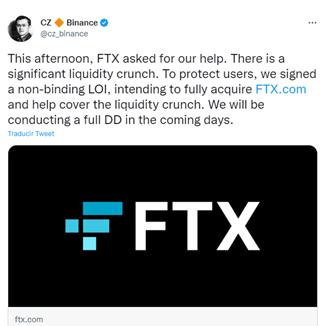

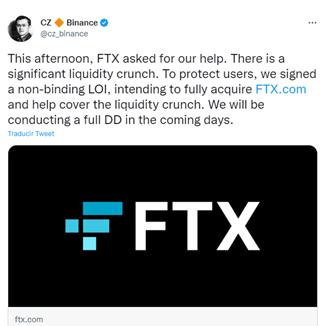

This situation came after Binance’s CEO announced that he would sell all his holdings in FTT due to rumours of FTX’s insolvency. And although the FTX CEO initially dismissed his comments, he later confirmed that they have a liquidity crisis, which is why he announced a potential deal with one of their main competitors.

On November 8th, both CEOs announced that Binance would acquire FTX after completing Due Diligence. However, Binance CEO Changpeng Zhao backed out less than 24 hours later due to an apparent hole in FTX’s financials.

Since then, it has come to light that FTX has USD 8 billion in liabilities.

The unforgettable aftermath

After the unpleasant events, the entire cryptocurrency market reeled under the effects of the FTX debacle. Some perceived it as worse than the LUNA turmoil, but was it caused by the LUNA contagion?

Analysing the situation from his perspective, Charles Hoskinson, a Colorado-based tech entrepreneur and mathematician, called the FTX debacle an “existential threat to the stability of the cryptocurrency ecosystem.”

According to him, in retrospect, there were huge red flags ranging from talent to company governance and fiscal strategy that underscored FTX’s faltering condition. In this regard, the Cardano founder stated: “This is what generally happens when you have regulated companies that are in a position of trust run by kids who are inexperienced.”

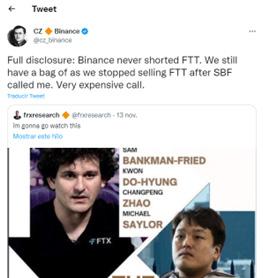

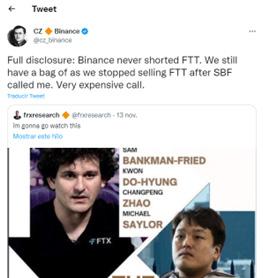

On the same note, taking a cue from FTX’s collapse, Binance CEO Changpeng Zhao (CZ) alerted cryptocurrency users on November 11th.

Do not forget that Binance and CZ inevitably became part of the FTX collapse saga. For its part, the DeFi market faced the heat of the FTX turmoil, with most tokens and projects posting negative statistics in recent days.

All other cryptocurrencies associated with FTX faced the wrath of the sell-off. Consider this: Solana, a top 10 cryptocurrency and one of Bankman-Fried’s most significant investments, lost 32% of its market capitalisation in the last few days.

The contagion continued, and the Bitcoin price momentarily fell below USD 16,000 last week when Sam Bankman-Fried’s FTX Group filed for bankruptcy. Likewise, deposits in cryptocurrency investment products rose sharply last week as institutional investors bought the dip amid the market-wide collapse triggered by FTX bankruptcy and Alameda Research.

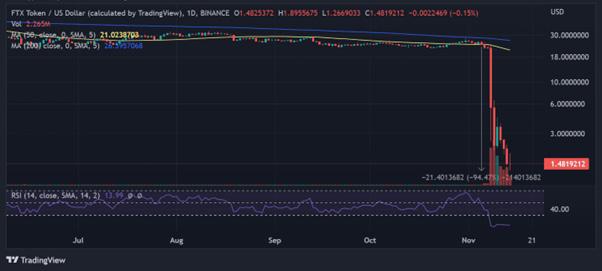

FTT’s slide continues with few gains

FTT lost almost 95% of its value since the news of FTX’s bankruptcy broke. According to an asset study on the daily time frame, the currency lost 75% percent of its value when the fall began on November 8th, according to the chart, with subsequent declines reaching double digits.

When writing this article, the token was trading at around $1.50, down from its initial value of more than $25.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Currently, cryptocurrency prices appear to have stabilised after last week’s fall and Bitcoin’s goal of USD 16,500, according to CoinMarketCap’s BTC price index. However, market sentiment could take months or even longer to recover.

The current market mood is tense. While the crypto community expects further development in the case of FTX, some speculate that it is just the beginning and the bottom is far ahead of us.

The FTX saga has been going on for the past week, and there seem to be daily new developments. Ev ery disruption surrounding the exchange raises the possibility of additional Pandora’s boxes opening, and the crypto community can only brace itself for the fallout. However, FTT holders can only be optimistic because there seems to be no end.

Crypto lender BlockFi plans to file for bankruptcy within days in FTX Fallout.

Just days after FTX filed for bankruptcy on November 11th 2022, cryptolender BlockFi has acknowledged in a statement that it is in a position where it is “no longer able to operate as usual”. The company had previously suspended withdrawals in the wake of the collapse of cryptocurrency exchange FTX a few days ago.

In June 2022, the cryptocurrency derivatives exchange FTX rescued BlockFi with a $250m injection and partnered with the cryptocurrency lender.

Source: TradingView

Source: TradingView

At the time, FTX CEO Sam Bankman-Fried revealed in a series of tweets that it had chosen to financially help BlockFi because it “has thoughtful risk management and great leadership”.

The most prudent decision’ is to pause activities. However, in the wake of the FTX fallout, BlockFi said the “most prudent decision” for all its customers was to “pause many of our platform activities”.

The crypto-lender also dismissed false rumours that most of BlockFi’s assets are held in custody on FTX.

Industry

However, BlockFi admitted that it had significant exposure to FTX and associated corporate entities that encompass obligations owed to them by Alameda Research, assets held at FTX.com and undrawn amounts from a line of credit with FTX.US.

The company also said it expected that obligations owed to them by FTX would now be delayed due to the Chapter 11 bankruptcy announcement. For now, withdrawals remain on hold, and BlockFi said it had asked customers not to send or deposit into the BlockFi wallet or interest-bearing accounts.

We take a breath of fresh air from the downturns and not-so-good times this year to look at how despite the sharp declines, the blockchain gaming industry and Metaverse have stood tall throughout the year and contributed to the cryptocurrency economy.

The Metaverse is 2022r’s trending concept, which repeats like a mantra among people in the technology industry. Not surprisingly, with the advent of blockchain came the creation of avatars with digital certificates of ownership, called “NFT” or “Non-Fungible Token,” which can trade, sell, rent, and manufacture digital assets from virtual worlds to externalise and monetise them in the real world.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

resilience amid the crypto winter: Metaverse and Blockchain Games evolution.

It’s becoming a tipping point, as digital work is being rewarded through cryptocurrencies, creating a digital economy that invites different professionals to provide services that can be highly lucrative.

Real estate has experienced a metaverse boom related to the commercialisation of digital land, with the cases of Decentraland and The SandBox standing out, sites where thousands of users already interact to offer or acquire different goods and services. As a result, the prices of the most central and crowded land have reached millions of dollars.

Another fast-growing technological phenomenon is NFT Gaming, where players can monetise their time through cryptocurrency earnings. The blockchain gaming industry landscape during September increased the daily average for unique active wallets (UAW) by 8% to 912K, accounting for 48% of blockchain activity, a very positive indicator for this category.

Source: Dappradar.

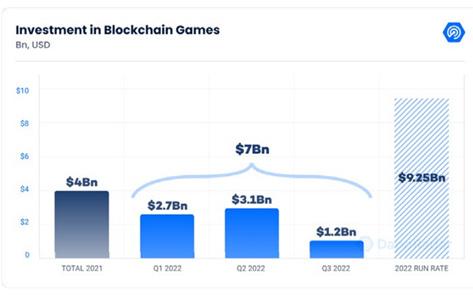

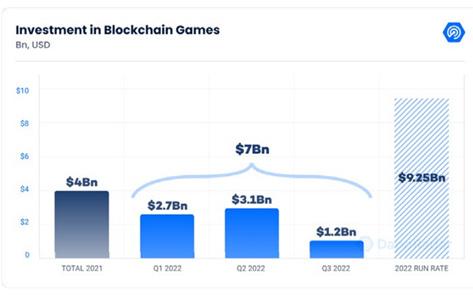

Also, during the third quarter, investors poured $1.3 billion into the blockchain gaming business, a 48% decline from the second quarter. However, although this quarter saw the lowest investment level, it showed that the sector continues to expand and that important new players are entering the market. It also suggests that, despite market conditions, Web3 gaming continues to be a driving force for the dapp industry.

Expectations for the total investments this year in this growing sector are down 8.8% to $9.25bn compared to last quarter’s forecast.

The amount of investments demonstrates that despite challenging and uncertain conditions in the digital asset markets, major investment entities remain bullish on the blockchain gaming industry.

Within the same ecosystem, we have seen that the next big trend in blockchain gaming focuses on moveto-earn applications. Not only in what has been this year but also in what will be in the coming months.

The aforementioned happens because they are becoming increasingly popular, with players from every imaginable background; thousands of people are captivated and motivated by exercise rewards among the big fitness app community enthusiasts worldwide.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Cryptocurrency market forecast for 2023

The bitcoin community is divided on whether the price of the coin will rise or crash in the coming year. What is a fact is that most analysts and technical indicators suggest it could bottom out between $12,000 and $16,000 in the coming months. This correlates with a volatile macroeconomic environment, stock prices, inflation, Fed data and (at least according to Elon Musk) a possible recession that could last until 2024.

On the other hand, influencers, BTC maximalists and a host of other fanatical “shills” argue that its price could soar to $80,000 and beyond. There is evidence to support both sides. One issue is that they may be looking at different time horizons. There is a solid case to be made that the price of BTC will likely continue to fall sharply in the coming months but could rise in mid to late 2023.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

Esports and Web3 gaming by 2023

On the other hand, the new esports & web3 gaming trends for 2023 show that the sector’s future looks more exciting than ever. The advancement of technology, together with the innovations coming to the market, is taking the gaming experience to a stage that once seemed like science fiction.

At this point, users increasingly have more sophisticated mobile devices and a better connection to the Internet. This means they spend more time on their mobiles, reducing their activity on game consoles or desktops.

Mobile esports is growing rapidly, and its reputation will continue to grow as technology moves forward. The popularity of streamed tournaments will also be a great ally. The community has received the first streamed competitions well.

World-renowned names have been slowly entering the gaming sector. There are more than a few who still need to see the advertising potential of this market.

For example, Coca-Cola, PepsiCo, Intel, BMW and Red Bull are significant corporations that have already sponsored or invested in esports tournaments.

And the unstoppable growth of the sector will continue to attract more companies in addition to a significant increase in investment in advertising and sponsorship of both teams and tournaments. In a few years, the money spent on virtual sports will be the same as that spent on traditional sports.

As we look to 2023, the esports & gaming trends show the sector will be tremendously important in the online market, and where we feel the real growth will occur.

written by Kelechi

written by Kelechi

ZeroSwap & ZEE Token

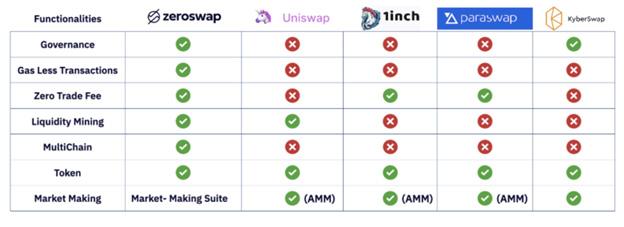

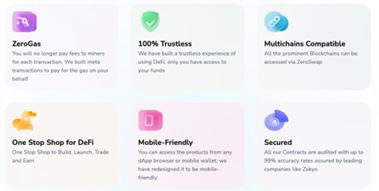

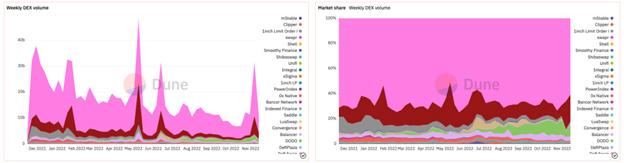

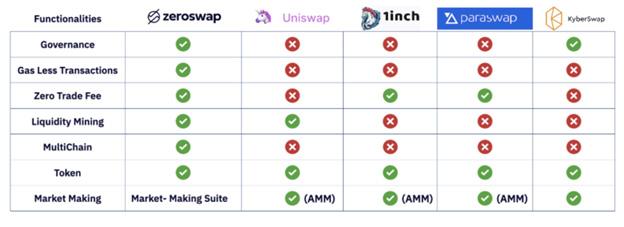

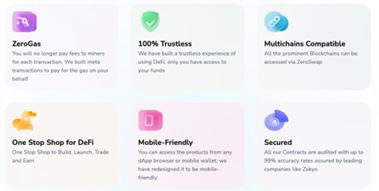

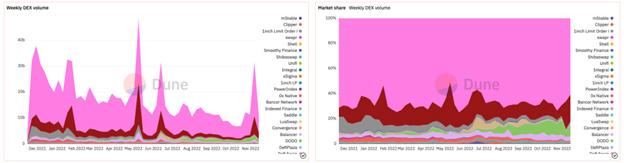

ZeroSwap is more than just a decentralised exchange (DEX); it is a multi-chain protocol with liquidity mining, DeFi offerings and exchange aggregation, giving users better pricing and liquidity both for smaller or less well-known tokens, as well as, well-known and ‘liquid’ tokens. Furthermore, transactions on ZeroSwap are gasless, with no trade fees and the protocol rewards users who provide liquidity and make on-chain trades.

The protocol aims to surmount the current hurdles DEXes face with fragmented liquidity, subpar UI/UX and inefficient market-making mechanisms.

Its core product design allows it to function in a gasless manner and aggregate liquidity from multiple chains like Ethereum, BSC, Polkadot, Celo, Polygon, Optimism, Fantom, Avalanche, and Elrond, and aims to add more blockchains in the future.

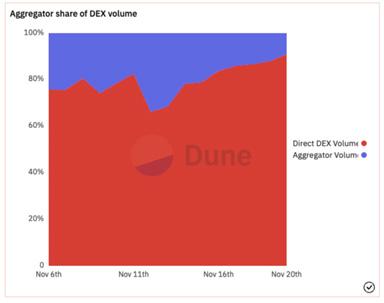

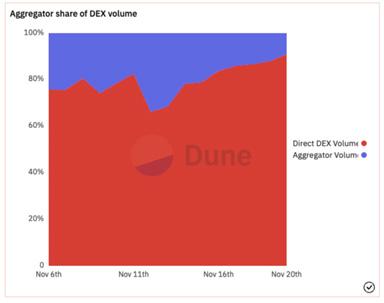

With the recent implosion of the FTX exchange and the ensuing contagion, decentralised and permissionless exchanges are drawing attention as traders, investors, and speculators exit centralised exchanges (CEXes) that may have inadequate reserves to weather a bank run or have lending or market-making exposure to the collapsed FTX exchange.

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else.

With increasing DEX volume, users may begin experiencing high gas fees. Even Layer 2 (L2) scaling solutions, while offering cheap transaction fees, often fragment liquidity. Hence, a gasless liquidity aggregator like ZeroSwap can provide a solution. ZeroSwap is gasless because it uses ‘Meta Transactions’, which can accept users’ transactions, fill them with gas by signing them, and then return the transactions to the users and relay them to the network via a ‘relayer’ or ‘relay hub’. From the user’s perspective, everything from selecting a relayer and the delivery of the transaction to the network is done transparently, autonomously and on time.

ZeroSwap’s utility token

the $ZEE, used to reward users

transaction

Data All Data Is Current at Time of Writing Circulating Supply: 71,172,487 Max Supply: 100,000,000 Total Supply: 100,000,000 Ethereum Network Contract Address: 0x2eDf094dB69d6Dcd487f1B3dB9febE2eeC0dd4c5 BNB Network Contract Address: 0x44754455564474a89358b2c2265883df993b12f0 Avalanche Network Contract Address: 0x44754455564474a89358b2c2265883df993b12f0 Polygon POS Network Contract Address: 0xfd4959c06fbcc02250952daebf8e0fb38cf9fd8c Token Allocation DEX Liquidity: 1% Seed & Private Sale: 35% Ecosystem Reserves: 17.5% Liquidity Mining: 14% Transaction Mining: 12.5% Marketing: 10% Team: 10%

is

for engaging with the protocol, for participation in launchpads on the protocol, governance and

fee mining.

Where to

ZEE Token

This magazine is sole property of themoonmag.com and is not to be redistributed in any form anywhere else. Website https://zeroswap.io/ Twitter https://twitter.com/ZeroSwapLabs Telegram https://t.me/zeroswap Medium https://medium.com/zeroswaplabs/introducing-zeroswap-d2d5556edb0e Discord https://discord.com/invite/nVW9sq9XSQ Reddit https://www.reddit.com/r/ZeroSwapLabs/

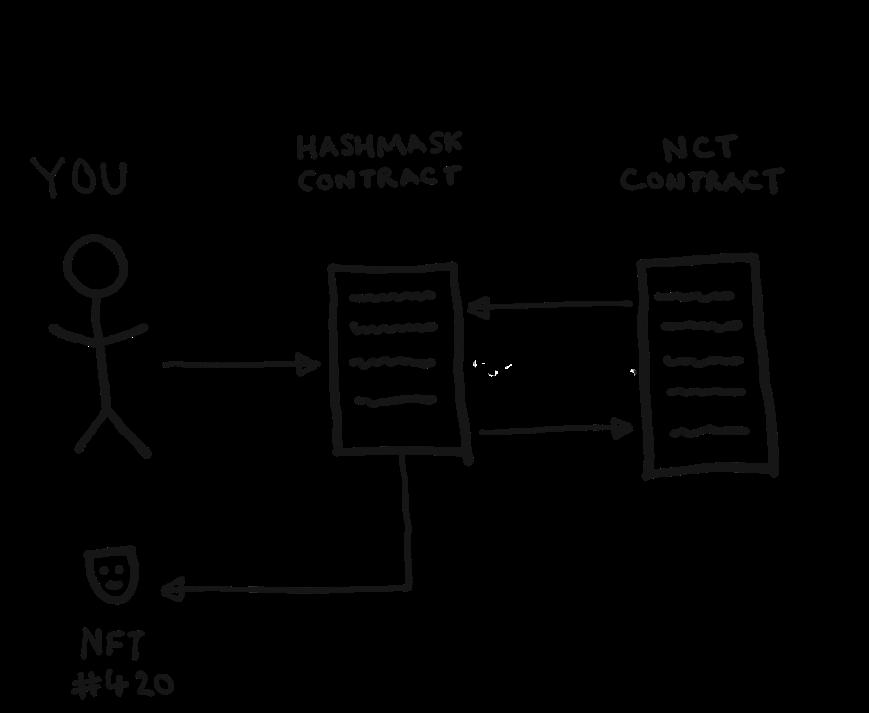

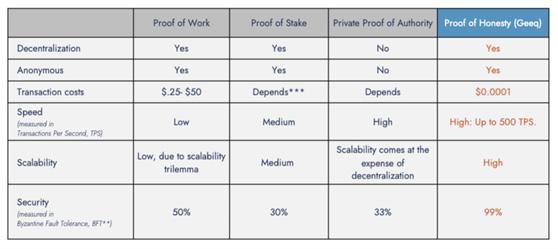

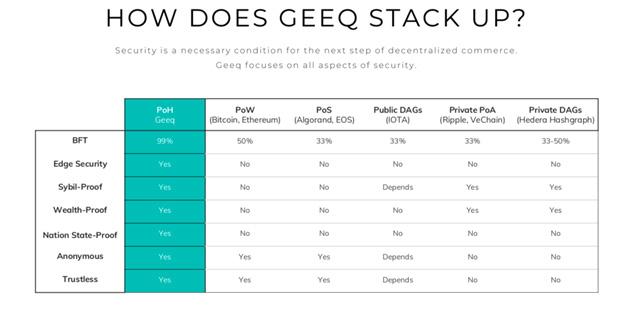

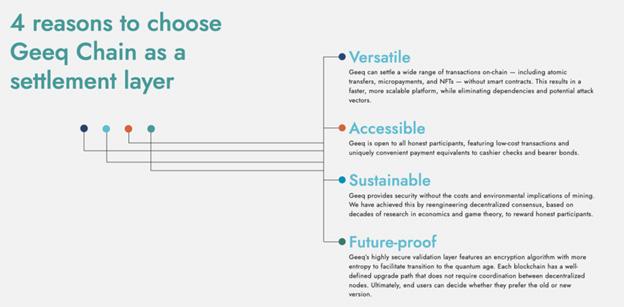

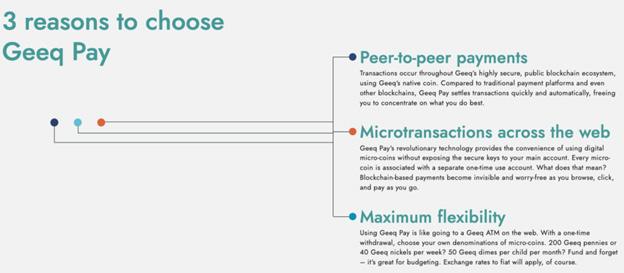

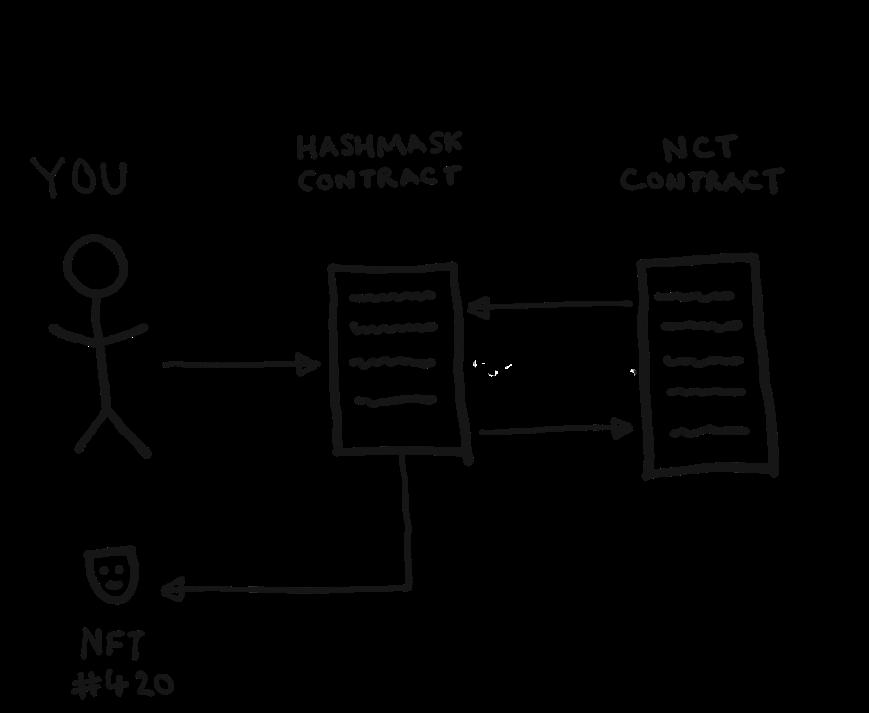

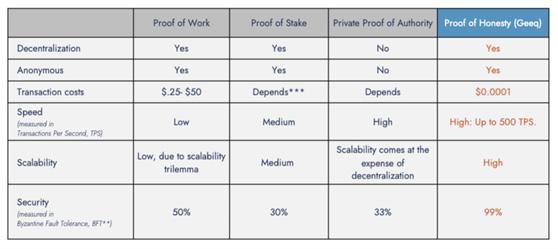

Purchase