Ebenezer Onyeagwu Emerges Best Banking CEO in Africa in International Banker Awards

Oluchi Chibuzor

The Group Managing Director/ Chief Executive Officer of Zenith Bank Plc, Dr. Ebenezer Onyeagwu has been named ‘Best Banking

CEO of the Year in Africa’ in the International Banker 2023 Banking Awards. The award, published in the Spring 2023 Issue of the International Banker Magazine,

saw Onyeagwu honoured alongside other individuals and banks from the Middle East and Africa. Expressing gratitude over the recognition, Onyeagwu, in

a statement yesterday, commended Publishers of the International Banker for considering him a fitting recipient of the ‘Best Banking CEO of the Year in Africa’ award.

www.thisdaylive.com

high ethical standards, which have become integral to our overall strategy as an institution.” He dedicated the award to

He stated, “This award reflects the bank’s position as a leading financial institution in Nigeria and the African continent. It also attests to our commitment to principles of sustainability and Continued on page 5

Bandits Kill Scores in Sokoto over Refusal to Pay Imposed Levy...

NNPC Ends Crude Swap Contracts with Foreign Refiners

Says private marketers may resume petrol importation this month

IPMAN: For subsidy removal to make sense, FG must break national oil company’s monopoly on importation

Continued on page 5

NLC Absent as FG, TUC Agree on Wage Increase to Cushion Effects of Subsidy Removal

Trade union centre presents list of demands to govt FG: Demands not impracticable, to set up tripartite committee

Parties to reconvene tomorrow to finalise discussion NNPC lacks power to fix petrol price, NLC insists

Maintains there's appropriation for subsidy till end of June

Declares no division among its members ahead of strike

Electricity, judiciary workers mobilise for planned nationwide strike PDP urges Tinubu to engage labour, blames FG for lack of adequate consultation Apologise to Jonathan, Okonjo-Iweala, Obi, Atedo Peterside tells Tinubu, others

Deji Elumoye, Chuks Okocha, Onyebuchi Ezigbo, Sunday Aborisade in Abuja, Raheem Akingbolu and Peter Uzoho in Lagos

Nigeria Labour Congress (NLC) was absent yesterday at the reconvened meeting between the federal government and representatives of the organised labour centre at the State House, Abuja.

The first meeting held last Wednesday to discuss the contentious issue of withdrawal of fuel subsidy by the federal government was attended by representatives of both NLC and Trade Union Congress (TUC). But at the reconvened meeting yesterday, representatives of NLC did not turn up, just as TUC presented its demands to government, with minimum wage review topping the list.

President of NLC, Joe Ajaero, while speaking in an interview on ARISE News Channel, yesterday,

Continued on page 5

yesterday

TRUTH & REASON

Page 11 Monday 5 June, 2023 Vol 28. No 10281. Price: N250

GODWIN OMOIGUI

Page

R-L: Senator-elect, Edo-North senatorial district, Adams Oshiomhole; CBN Governor, Godwin Emefiele; a former Commissioner of Information in Lagos State, Mr. Dele Alake; newly appointed Secretary to the Government of the Federation, George Akume, and GCEO of NNPCL, Mele Kyari during FG /TUC meeting on the removal of fuel subsidy held at the Presidential Villa, Abuja...

PwC: Why Local Refining Won’t Crash Fuel Prices...

10

Chief Executive Officer of Nigerian National Petroleum Company (NNPC) Limited, Mallam Mele Kyari, says the company has terminated its crude-for-petrol swap deal, otherwise called Direct Sale Direct Purchase (DSDP) contracts, with foreign refiners and consortia of traders. Kyari spoke at the weekend during an interview with Reuters. He said NNPC would now pay cash for petrol imports. He also revealed that

Emmanuel Addeh in Abuja APeter Uzoho in Lagos Group

MONDAY JUNE 5, 2023 • THISDAY 2

MONDAY JUNE 5, 2023 • THISDAY 3

MONDAY JUNE 5, 2023 • THISDAY 4

IATA: Foreign Airlines’ Trapped Funds in Nigeria Have Risen to $812m

Optimistic new govt will resolve issue

Chinedu Eze in Istanbul

The International Air Transport Association (IATA) has confirmed that foreign airlines’ revenue not yet repatriated from Nigeria has risen to $812.2 million.

This was disclosed by the IATA’s Regional Vice-President, Africa and Middle East, Kamil Al- Awadhi, at the on-going 79th AGM and World Air Transport Summit in Istanbul, Turkey. He warned that rapidly rising levels of blocked funds were a threat to airlines’ connectivity in

the affected markets, disclosing that the global industry’s blocked funds increased by 47 per cent to $2.27 billion in April 2023, from $1.55 billion in April 2022.

IATA said the top five countries accounted for 68 per cent of blocked funds. These included Nigeria ($812.2 million), Bangladesh ($214.1 million), Algeria ($196.3 million), Pakistan ($188.2 million), Lebanon ($141.2 million) and Ethiopia ($126 million).

Al- Awadhi explained that the countries with the trapped funds were unable to pay the airlines

for different reasons, stating that Nigeria had been responsive in helping the airlines repatriate their revenues, but may have delayed due to the transition to a new government from the Muhammadu Buhari administration.

He expressed hope that before the end of one month, the President Bola Tinubu’s administration would facilitate airlines to repatriate 50 per cent of the trapped revenue and in the next six months complete the repatriation of all the funds.

Al- Awadhi lamented that after the COVID-19 airlines came out

with little cash so, “they are in dire need of operational funds; therefore, holding down their revenue is pulling them down.” The world body urged governments to abide by international agreements and treaties to enable airlines repatriate funds arising from the sale of tickets, cargo space, and other activities.

Also reacting to the trapped funds, IATA’s Director General, Willie Walsh said, “Airlines cannot continue to offer services in markets where they are unable

to repatriate the revenues arising from their commercial activities in those markets. “Governments need to work with industry to resolve this situation so airlines can continue to provide the connectivity that is vital to driving economic activity and job creation.”

Appraising airlines’ performance in Africa and Middle East, AlAwadhi said there have been improvement in air transport in Africa and Middle East, especially in the Middle East and disclosed that IATA has prioritised

NLC ABSENT AS FG, TUC AGREE ON WAGE INCREASE TO CUSHION EFFECTS OF SUBSIDY REMOVAL

accused the federal government of foul play, insincerity and insensitivity on the subsidy matter. NLC insisted that the federal government lied in its declaration that there was no appropriation for subsidy beyond May 2023.

The NLC also stated that all its branches and affiliates across the country were united in the struggle to reverse the unilateral increase in pump price of petrol.

However, following the directive by the National Union of Electricity Employees (NUEE) to its members to withdraw their services nationwide from Wednesday, and join the planned strike called by NLC, some industry

analysts warned workers against downing tools, saying it portends national security risk. They stressed that the law clearly stated that it was an offence for anyone or group to prevent or obstructs the transmission of electricity through any electricity or main transmission line.

Similarly, Judiciary Staff Union of Nigeria (JUSUN), in a letter dated June3, 2023, started mobilising all its chapters and members for the nationwide action and withdrawal of service from Wednesday.

“This followed a decision of the NEC of the NLC at her meeting on June 2, 2023, over the increase in the pump price of PMS by the federal

government,” the letter signed by JUSUN General Secretary, M.J. Akwashiki, read.

“All zonal presidents are to coordinate their zones by ensuring that branch and chapter chairmen mobilise their members for total compliance,” the letter added.

Weighing in on the subsidy matter, Peoples Democratic Party (PDP), yesterday, called on the federal government to engage the organised labour to find solution to the raging dispute.

Lagos State Governor, Mr. Babajide Sanwo-Olu, and former leader of the Senate, Mohammed Ali Ndume, yesterday, appealed to the national

NNPC ENDS CRUDE SWAP CONTRACTS WITH FOREIGN REFINERS

private oil marketing companies in Nigeria could begin importing petrol as early as this month.

However, as the fuel subsidy removal continued to generate angry debate nationwide, Independent Petroleum Marketers Association of Nigeria (lPMAN) called on President Bola Tinubu to walk his talk on the total deregulation of the downstream petroleum sector.

Kyari said, according to Reuters, “In the last four months we practically terminated all DSDP contracts. And we now have an arm's-length process where we can pay cash for the imports.

"This is the first time NNPC has said it is terminating crude swap contracts. By importing less petrol, as private companies import the bulk, NNPC will be able to pay for its purchases in cash.”

The move was part of Tinubu's plans to deregulate the petrol market and reduce the burden of subsidy payment on government finances.

NNPC had been importing petrol from consortiums of foreign and local trading firms and repaying them with crude oil through the DSDP contracts since 2016, as it did not have enough money to import on a cash-and-carry basis.

Nigeria is Africa's biggest crude producer, but it imports most of its refined products after running down its refineries.

A significant drop in oil production last year, coupled with high global fuel prices due to the war in Ukraine, pushed NNPC's debt to traders higher.

It owed the consortiums about $2 billion, Reuters quoted a September 2022 NNPC report to the Federation Account Allocation Committee as revealing.

Reuters quoted an in industry source with direct knowledge of the matter as saying that NNPC was still allocating crude for fuel swaps for July loading, though less than in previous months.

In its report detailing March crude

oil loadings, NNPC allocated crude to the swap contracts held by the consortiums, the report said.

Kyari said NNPC's monopoly on petrol supplies was ending and private firms could start importing as early as this month. He added that Nigeria's total crude and condensate output was at 1.56 million barrels a day (bpd) as of Friday.

Nigeria has struggled to meet its Organisation of Petroleum Exporting Countries (OPEC) oil quota of 1.742 million bpd due to grand oil theft and illegal refining. That has raised doubts on whether Nigeria could meet supplies for the 650,000 bpd newly-inaugurated Dangote Refinery. NNPC has a contract to supply 300,000 bpd to the refinery.

NNPC had last week adjusted the pump price of petrol by nearly 200 per cent, from N195 per litre to between N488 and N557 nationwide.

The development followed the announcement by Tinubu during his inaugural address on Monday

EBENEZER ONYEAGWU EMERGES BEST BANKING CEO IN AFRICA IN INTERNATIONAL BANKER AWARDS

the Founder and Chairman, Jim Ovia, CFR, for his guidance and mentorship; the bank’s management team and staff, for being the shoulder upon which his achievements and success as CEO rests; and the bank's customers for making Zenith Bank their bank of choice.

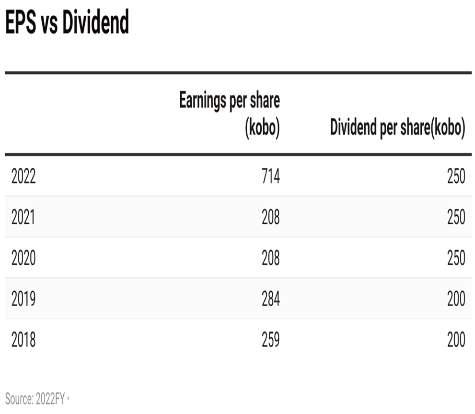

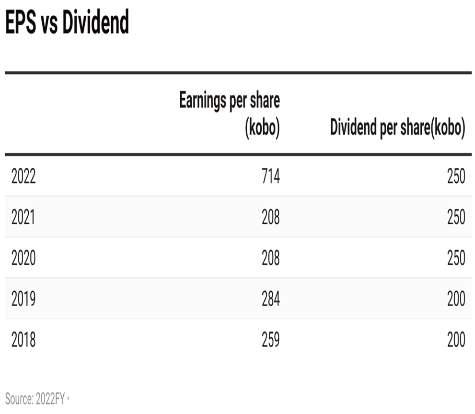

Onyeagwu’s outstanding career has led to him receiving multiple awards, including Bank CEO of the Year (2019) by Champion Newspaper, Bank CEO of the Year (2020, 2021 & 2022) by BusinessDay Newspaper, CEO of the Year (2020 and 2021) – SERAS Awards, and CEO of the Year (2022) – Leadership Newspaper.

As Group Managing Director/ CEO, Onyeagwu has led Zenith Bank to achieve tremendous feats and milestones in financial performance (including 47 per cent growth in the bank’s market capitalisation in four years), financial inclusion, corporate governance and sustainability.

These efforts have culminated in several local and international awards and recognitions including being recognised as Number

One Bank in Nigeria by Tier-1 Capital, for the 13th consecutive year, in the 2022 Top 1000 World Banks Ranking published by The Banker Magazine; Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards 2020 and 2022; Best Bank in Nigeria, for three consecutive years from 2020 to 2022, in the Global Finance World’s Best Banks Awards; Best Commercial Bank, Nigeria 2021 and 2022 in the World Finance Banking Awards; Best Corporate Governance Bank, Nigeria in the World Finance Corporate Governance Awards 2022; ‘Best in Corporate Governance’ Financial Services’ Africa, for four consecutive years from 2020 to 2023, by the Ethical Boardroom; and the Most Responsible Organisation in Africa 2021 by SERAS Awards.

On March 25, 2023, he was conferred with a Doctorate Degree in Business Administration by the University of Nigeria, Nsukka, Nigeria's first indigenous University, in recognition of his immense achievements as Group Managing Director/CEO of Zenith

Bank as well as his contributions to the growth of the financial services sector in Nigeria and across the African continent. The award was given during the 50th convocation ceremony of the University.

Published by Finance Publishing Limited, the International Banker is a leading global source of authoritative analysis and opinion on banking, finance and world affairs. Its influence, integrity, accuracy and objective opinion have earned it global recognition.

The International Banker Awards strive to recognise worthy financial institutions around the world - those not just doing their jobs well but exceptionally wellthose operating at the industry’s cutting edge and setting new performance levels to which others will aspire.

The 2023 Banking Awards focused on various criteria, including the provision of much-needed capital for economic growth, cutting-edge innovation to enhance security and efficiency, and intelligent investing to maximise profits and shareholder value.

leadership of NLC not to embark on its proposed nationwide strike, saying Tinubu means well for the country. But founder of Stanbic IBTC Bank Plc. and Anap Foundation, Atedo Peterside, yesterday, called on Tinubu and others in the present government, who had in 2012 opposed the removal of fuel subsidy by the administration of then President Goodluck Jonathan, to tender an unreserved apology to the former president as well as Nigerians. In a tweet on his handle, Atedo pointed out that following the decision of Tinubu to end the fuel subsidy regime, the president and some members of his party, who vehemently protested against subsidy removal

that fuel subsidy was “gone”. Tinubu promised to re-channel the expected savings to education, health and other sectors.

But the development did not go down well the Nigeria Labour Congress (NLC), which described the new pricing template as vexatious. Nigeria Labour Congress (NLC) had expressed displeasure over the, describing it. NLC has announced plan to commence a nationwide strike from Wednesday.

IPMAN: For Subsidy Removal to Make Sense, FG Must Break NNPC's Monopoly on Importation

IPMAN called on Tinubu to walk his talk on the total deregulation of the downstream of the petroleum sector.

In a statement signed by IPMAN’s President and National Secretary, Debo Ahmed and Chief John Kekeocha, respectively, the association stated that having taken a decisive position on the removal of subsidy on fuel, Tinubu must proceed to ensure that the sole right of the national oil company to import petrol was broken.

That came on the heels of divergent opinions on the new price increase by the sole importer of the product, NNPC. NNPC’s four refineries with 445,000 barrels per day combined refining capacity had not been functioning at optimal capacity, while the Dangote refinery recently commissioned with 650, 000 barrels per day refining capacity was yet to commence operation.

But IPMAN urged Tinubu to ensure that other downstream sector players, aside NNPC, were allowed to partake in the importation of petrol into Nigeria.

IPMAN stated, "The primary essence of removing subsidy is to free the market and make it competitive." it explained that allowing other interested parties into the petroleum supply network, either through local refining or importation, will guarantee adequate production and supply and ultimately crash prices.

"This will precipitate reasonable reductions in the high price that is being witnessed at this initial take off," IPMAN stated.

areas it would help to boost air transportation in the continent.

IATA said it would help airlines in Africa improve their operational safety through a data-driven collaborative programme to reduce safety incidents and accidents, in the air and on ground.

It said it would facilitate the growth of efficient, secure and cost-effective aviation infrastructure.

In the area of connectivity, IATA said it would promote the liberalisation of intra-African market access through the Single African Air Transport Market (SAATM).

by Jonathan, ought to apologise to Jonathan, Ngozi Okonjo-Iweala, Peter Obi, and other members of the 2012 Economic Team.

Peterside wrote, “The petrol subsidy removal is complicated by the fact some liars who held sway in 2012 are now singing a different tune in 2023. They should apologise to @ GEJonathan @PeterObi @NOIweala & others in the 2012 Economic Team and beg Nigerians for forgiveness so we can move forward.”

NNPC had last week adjusted the pump price of petrol by nearly 200 per cent, from N195 per litre to between N488 and N557 nationwide. The development followed the

The statement also enjoined the federal government to ensure that Nigerians at the receiving end of the subsidy removal felt the dividends in the areas of infrastructure development, health sector, as well as well as education and basic social amenities.

The statement said, "As the NNPC continues to justify its price template for Premium Motor Spirit (PMS), IPMAN wishes to lend its voice in support of the current removal of the long awaited petroleum subsidy, which had lingered for more than 20 years.

“It goes a long way to demonstrate the very strong will and dexterity that President Bola Ahmed Tinubu has in his promise to liberate Nigerians from perpetual indebtedness and easy borrowing, which has jeopardised all efforts for reasonable progress in the country.

"It is our belief and hope that the NNPC will ensure that the product is made available for Nigerians and that the NMDPRA ensures adequate monitoring and distribution, making sure that the policy takes place seamlessly.

“However, it's important to state here that the primary essence of removing subsidy is to free the market and make it competitive. This is by allowing other interested parties into the petroleum supply network.

“This is either by engaging in importation or local refining. It's the duty of government to ensure that all bottlenecks and frustrations in this regard are removed so that adequate productions and supplies will eventually precipitate reasonable reductions in the high price that is being witnessed at this initial take off.”

IPMAN stated that while many Nigerians welcomed the policy “with a pinch of salt”, it believed that the constraining sacrifices of the people in “swallowing this bitter pill” will be compensated with obvious and empirical proofs of how the dividends of the subsidy removal positively impacted their lives.

The group promised to align with the present administration in the “social contract” by playing according to the rules and believing that the policy will be a milestone in repositioning Nigeria’s ailing economy.

announcement by Tinubu in his inaugural speech on Monday that fuel subsidy was “gone.”

Tinubu promised to re-channel the expected savings to education, health and other sectors.

But the development did not go down well with NLC, which has announced plan to commence a nationwide strike from Wednesday.

NLC Absent as FG, TUC Agree on Wage Increase to Cushion Effect of Fuel Subsidy Removal

Speaking with newsmen after the meeting between the TUC leaders and federal government’s representatives, held at the conference room of the Chief of Staff's office, both sides disclosed that negotiations would continue from tomorrow, when the federal government would be taking labour’s demands to President Bola Tinubu. The meeting lasted about two and a half hours.

The government was expected to come with answers to labour's demands.

Apart from the demand for a review of the minimum wage, TUC demanded a tax break for Nigerian workers. It said it would leave the remaining items on the list undisclosed until the government representatives must have relayed the list to the president and come back with positions.

Spokesman of the government’s side, Mr. Dele Alake, expressed satisfaction with the proceedings. Alake hinted that the demands by TUC were not impracticable. But he noted that the president must be allowed time to consider them.

According to Alake, government would look into the issue of minimum wage, since the removal of subsidy has the immediate consequence of reducing the purchasing power of the people. He added that government would be putting a tripartite committee together to study all dynamics relating to the subsidy.

Alake said, "Well, as you all know, we had this reconvened meeting today as we promised you few days ago when we had the initial meeting with the labour movement. We said we were going to reconvene today to keep the engagement on, in order to diffuse the tension in the land as a result of the withdrawal of subsidy, which is a reality. Now, we are very happy to announce to Nigerians that this engagement has been very productive.

"The TUC that attended today’s meeting presented a list of demands and those demands we have studied and we are going to present to Mr. President for his consideration. But those demands, we can announce to Nigerians that a lot of the items on the list are not impracticable.

“What we need to do is to study the numbers very well, then we have asked the TUC to also give us a leeway to consult very exhaustively and reconvene on Tuesday to actually look at the numbers’ viability, practicability of all the items that have been presented to us.

THISDAY • MONDAY, JUNE 5, 2023 PAGE FIVE

5 Continued on page 43

WASHINGTON DINNER FOR OMFIF LEADERS…

Nigeria Agrees to Cut Oil Production to Stabilise Crude Supply Market

Emmanuel Addeh in Abuja

Nigeria has agreed to cut its Organisation of Petroleum Organisation (OPEC) crude production, to ensure global oil market stability, a statement by the country’s delegation to the meeting in Vienna, said yesterday.

Alongside other African countries which have struggled in the last few years to meet their production quota, the delegation stressed that the country’s output will now be hinged on its highest volume in the last six months which is 1.38 million barrels per day.

“Nigeria alongside other OPEC and Non-OPEC members at the Joint Ministerial Monitoring Committee (JMMC) meeting agreed to cut production volumes in order to ensure global oil market stability.

“Furthermore, Nigeria, Congo and Angola have agreed that the highest production volumes of the last six months (November 2022 – April 2023) be used as the basis for the determination of their 2024 production quota,” the statement added.

The country has recently blamed massive oil theft as well as years of underinvestment for the development, but has since August last year moved to end the menace by ramping up security in the Niger Delta.

“ Nigeria’s highest production of crude oil only of 1383KBD was achieved in February 2023. OPEC has also agreed to allow these countries to continue to produce maximally to their OPEC quota of 2023.

“This implies that Nigeria can ramp up its production up to its current quota of 1742KBD and

subsequently be capped at 10 per cent less as its quota for 2024 subject to verification by independent secondary sources,” it stated.

Besides , the Nigerian delegation said it was confident that the ongoing security intervention under the leadership of President Bola Tinubu will enable the restoration of the country’s production to the tune of 1580KBD crude oil.

“This will be complemented by condensate of about 400KBD. This will ultimately enable Nigeria’s crude oil and condensate production of about 2 million barrels per day in 2024,” the delegation said.

Meanwhile, Nigeria's state oil firm, the Nigerian National Petroleum Company Limited (NNPC), is winding down crude swap contracts with traders and will pay cash for petrol imports, its Chief Executive, Mallam Mele Kyari, told Reuters.

Adding that private companies could begin importing petrol as soon as this month, the firm stated that the move was part of new Nigeria’s President Bola Tinubu's plans to deregulate the gasoline market and reduce the burden on government finances.

Tinubu has already scrapped a costly fuel subsidy, effective from last Tuesday, a decision which tripled petrol prices, angering labour unions who have called for a strike starting on Wednesday if the decision is not reversed.

NNPC has been importing gasoline from consortiums of foreign and local trading firms and repaying them with crude oil via what are known as Direct Sale Direct Purchase (DSDP) contracts since 2016 because it does not have enough cash to pay for the purchases, data and

trading sources said. "In the last four months we practically terminated all DSDP contracts. And we now have an arm's-length process where we can pay cash for the imports," Kyari told Reuters in an interview late on Saturday.

This is the first time NNPC has said it is terminating crude swap contracts. By importing less petrol as private companies import the bulk, NNPC will be able to pay for its purchases in cash, Kyari said.

Nigeria is Africa's biggest crude producer but imports most of its refined products after running down its refineries.

A significant drop in oil production last year coupled with high global fuel prices due to the

war in Ukraine pushed NNPC's debt to traders higher. It owed the consortiums about $2 billion, a September 2022 NNPC report to the Federation Account Allocation Committee (FAAC) showed.

An industry source with direct knowledge of the matter told Reuters that NNPC was still allocating crude for fuel swaps for July loading, though less than in previous months. In its report detailing March crude oil loadings, NNPC also allocated crude to the swap contracts held by the consortiums.

Kyari said NNPC's monopoly on gasoline supplies was ending and private firms could start importing as early as this month.

Kyari added that Nigeria's total

crude and condensate output was at 1.56 million barrels a day as of Friday. Nigeria has struggled to meet its OPEC oil quota of 1.742 million bpd due to grand oil theft and illegal refining.

That has raised doubts on whether Nigeria can meet supplies for the 650,000 bpd newly commissioned Dangote Refinery. NNPC has a contract to supply 300,000 bpd to the refinery.

In the same vein, Nigeria’s daily crude oil production has surged to about 1.6 million barrels per day, and it’s expected to hit 1.8 million barrels per day, according to the Chief Upstream Investment Officer of the NNPC Upstream Investment Management Services, Bala Wunti. Wunti made the disclosure on

Saturday at the 186th meeting of the Organisation of Petroleum Exporting Countries (OPEC).

The NUIMS boss was also confident that with the technology deployed, Nigeria’s oil production will hit 1.8 million barrels by July or early August.

“It is what we are harvesting already, and the result of the security collaboration is what actually reversed the trend of our declining production.

“That we are back to about 1.6 million barrels today is a result of the collaboration. Everybody is working, the security agencies are working in synergy with the industry, the regulators are working and the communities,” he said.

One Year after His Abduction, College of Medicine Provost, Iweha Still Not Found

The whereabouts of the Provost College of Medicine, Gregory University Amachara, Abia State, Prof. Uwadinachi Iweha has remained a mystery 12 months after he was abducted by assailants. Iweha, who had served as the Chief Medical Director(CMD) of Abia State University Teaching Hospital(ABSUTH), Aba and CMD Abia State Specialist Hospital Amachara, was whisked away on June 5, 2022, at his home in Umuajameze Umuopara, Umuahia South Local Government of Abia State.

Though an undisclosed sum was eventually paid as ransoms to his abductors, the family of the missing medical doctor told journalists at a press conference weekend that nothing has been heard about their father.

The first son of the Professor of medicine, Engr. Chukwudi Iweha, who spoke on behalf of the family, said the family, "is still in shock and distress," due to absence of any concrete information about what has become of their father since his abduction.

"As a family, we cannot discern the motive behind this evil act or even point any accusing finger at anybody; we have our trust in God

that he will return and be reunited with us," he said.

Iweha lamented the, "unnecessary delays" in police investigations to unlock the mystery behind his father's ordeal and pinpoint the main sponsor(s) of the abduction.

He stated that having recovered the handset of Iweha from a suspect which led the police to arrest four others, it was expected the security agencies should have solved the case 52 weeks on.

Iweha, disclosed that the family has learnt that the police had already arraigned two of the suspects in court but the matter got stalled due to the ongoing strike by judicial workers which led to closure of

courts in Abia.

However, he reasoned that having arrested some of the suspects and even has even gone to the extent of charging two of them to court, the police should have by now been in a position to tell the Iweha family where exactly the abductors said they kept him.

The Iweha family spokesman took a swipe at people spreading insidious rumours that Iweha had been freed and flown abroad for medical attention, saying that nothing could be further from the truth.

"This (unfounded rumours) adds to our pains. We are still looking for our father," Chukwudi said in anguish-laden voice.

Recurrent Leadership Change in PAP Impacts Policy Implementation, Says N’Delta Youth Leaders

A development expert and a Niger Delta youth leader, Dr. Matthew Ayibakuro, has expressed concern that frequent change of heads of public institutions and interventionist agencies distort their plans, policies and programmes of such organisations.

He cited the current Interim Administrator of the Presidential Amnesty Programme (PAP), Major General Barry Ndiomu (rtd), saying

it would be unfair to assess his performance in office because he had spent only few months.

Ayibakuro, said in Yenagoa the Bayelsa State capital that frequent leadership changes make it impossible to assess them whenever the leadership is removed from office, saying the period they spent would have been grossly insufficient to make any real or meaningful impact.

He stressed that some good

intentions and well-thought out plans of heads of such agencies of government are easily truncated when they abruptly leave office, leading to avoidable waste of public funds.

He, however, lauded Ndiomu’s effort to create sustainable partnerships between PAP and other public as well as private institutions, noting that, if he succeeds, it would be for the benefit of ex-agitators in

the Niger Delta.

In Ayibakuro’s words: “I think it’s a bit early to form any strong perspective of him (Ndiomu), I think that six months is a very short time in a programme like PAP to do that.

“I’ve seen him try to form partnerships, I don’t think that six months is a good enough time if anybody is being objective to say he has been effective or he’s not been effective.

“You have to give people the benefit of the doubt. But then that takes me back to the point: are we going to have him for two years so that we can actually assess what he has achieved?

“If it’s a training programme, if he came in you don’t expect that he’s going to start new training programmes on his own, there were training programmes already existing.

“So six months is a short time within training circles for you to be able to say the person in office has been successful or not successful.”

Another youth leader and chairman of the Ondo State Chapter of the Niger Delta Amnesty Delegates Network, Ominidougha Richard, also opined that it was too early to assess the performance of Ndiomu “given that it is barely a year”.

6 THISDAY • MONDAY, JUNE 5, 2023 NEWS Group News Editor: Goddy Egene Email: Goddy.egene@thisdaylive.com, 0803 350 6821, 08074010580

Emmanuel Ugwu-Nwogo in Umuahia

NNPC begins winding down crude swap contracts NUIMS eyes 1.8m bpd production output

L-R: Chief Representative of the Bank for International Settlements (BIS) for Asia and the Pacific and former Director of the Strategy and Policy Department of the International Monetary Fund, Siddharth Tiwari; US Chairman of OMFIF and former Assistant Secretary of the Treasury for International Monetary and Financial Policy, Mark Sobel; Member, Advisory Council of OMFIF and former Deputy Governor of the Central Bank of Nigeria, Kingsley Moghalu, and Chairman of OMFIF, David Marsh, at a dinner of OMFIF leaders at the Metropolitan Club in Washington DC… recently. OMFIF, headquartered in London, is an independent network of asset management firms, hedge funds, sovereign and pension funds and central banks with a combined $43 trillion dollars in investable assets

MONDAY JUNE 5, 2023 • THISDAY 7

SANWO-OLU'S SECOND TERM INAUGURATION THANKSGIVING SERVICE…

L-R: Lagos State Deputy Governor, Dr. Obafemi Hamzat; his wife, Mrs. Oluremi; wife of the Governor, Dr. Ibijoke Sanwo-Olu; Governor Babajide Sanwo-Olu and CAN chairman, Lagos state chapter, Most Rev Stephen Adegbite, during the second term inauguration thanksgiving Service of Sanwo-Olu and Hamzat, at the Cathedral Church of Christ, Marina ... yesterday

Why Double-Digit GDP Growth Eludes Nigeria, by Kale, Nevin, Yusuf, Others

Dike Onwuamaeze

Economic experts have identified governments’ willful implementation of bad decision, disinterest in strategic economic planning, over-reliance on crude oil, stifling taxation and insecurity as among factors that have hindered Nigeria from optimising its resources to attain double digit economic growth.

They also expressed the view that the only areas where Nigerians have excelled globally were those outside the control and influence of Nigeria’s government.

These views were shared by former Statistician General of Nigeria Bureau of Statistics of Nigeria, Dr. Yemi Kale, who is currently partner and chief economist of KPMG Nigeria; the Financial Service Leader and Chief Economist of PwC West Africa, Dr. Andrew Nevin; an Economist and Founder of Centre for the Promotion of Private Enterprises (CPPE), Dr. Muda Yusuf.

Others were Chief Economist and Head, Economic Research/ Intelligence, Coronation Merchant Bank, Ms. Chinwe Egwim and CoFounder/Chief Executive Officer, Cowrywise, Mr. Razaq Ahmed.

The experts shared these views during the Nairametrics Economic Outlook with the theme: “Fostering Economic Resilience: Harnessing Opportunities for Development,” which was held virtually.

Chief Analyst, Nairametrics, Mr. Ugo Obi-Chukwu, attributed Nigeria’s fiscal challenges to shortfall in public revenue.

Speaking further, Kale stated that, “almost every economic activity in Nigeria is underperforming and that is why we have not been able to grow anywhere close to our real potentials growth, which is double digit,” in spite of Nigeria’s advantageous entrepreneurial youthful population, diverse natural resources and geographical location that arguably no other African country possessed in greater quantity than Nigeria.

He added: “We are moving from start, stop and reset and that has limited Nigeria’s ability to realise that huge potential. Secondly is what I may like to call unforced errors because they the things that we did to ourselves like very bad policies, very bad strategies and when the government is told that these strategies are not working it intend to just continue doing them.

“The most obvious of all is over dependence on oil. Associated to these are our disinterest in proper planning, which is a major difference between Nigeria and many of the (Asians) countries that we are either better than or at the same level in the 1960s who has long left us behind.

“The main difference is that they kept faith with proper strategic planning and continued to be doing

so while we abandoned it and relied on agenda decision making and relying on oil production that we kept consuming rather than building with our oil wealth.

“Currently there is a very weak link between data and policy design and implementation. That focus on oil earning for consuming and the presence of inadequate planning over the years has now lead to other issues that is making realising that vast potentials a challenge.

“We also failed by relying on subsistence farming and anything that we cannot grow by subsistence agriculture we just decided to use our oil revenue to import them.

“We will also take into consideration the refusal of the government over the years to move solid minerals from the exclusive list to concurrent legislative list and develop a proper mining framework that can unlock investments into developing solid minerals from supply chain to heavy industries.

‘But they are all tied to these three main issues of over dependence on oil, unforced errors and nonadherence to proper planning. These are the things that I think have prevented us from taking advantage of our huge potentials.”

He added that the first quarter of 2023 was, “the first time agriculture has contracted since 1982 but it is tied to the Naira redesign policy and the dominance of subsistence

farming.”

According to Nervin, the sectors where Nigeria has been doing well on the global scale are sectors that government has not been involved in.

He said: “Let me list the things that we (Nigerians) are successful in: Nollywood is a success, Nigerian music is a success all over the world, financial services that are spread across Africa is a commendable success.

“The biggest global export that Nigeria ever had are Nigerians in diaspora that include soccer super stars, digital franchise, basketball, premier league. Nigerians already have large things that we are doing at the global stage that we are very successful at.

“And one thing that is very interesting is that the government has nothing to do with them. The sectors that have been doing well on the global scale are sectors that government has not been involved in.

“There is no large scale mining, no world class mining in Nigeria in spite of all these world class mineral deposits. Where Nigeria has succeeded in the world stage is where there is no government presence. Where we struggle is where the government brought complexities.”

In his own contribution, Yusuf, who was the immediate past director general of the Lagos Chamber of Commerce, noted that fighting

Resident Doctors Urge FG to Invest Proceeds of Subsidy Removal in Health, Education

Opts for more time to resolve dispute with FG

Onyebuchi Ezigbo in Abuja

Nigerian doctors under the aegis of the National Association of Resident Doctors (NARD) has advised the federal government to ensure that monies saved from the removal of fuel subsidy are judiciously used.

They said such saved funds should be put into meaningful investments that would better the lives of all Nigerians, especially in health and education sectors.

NARD said they have resolved to give the new government some time to quickly resolve the issue which was at the root of the current spate of massive brain drain in the sector.

In a communique issued at the end of its Ordinary General

Meeting (OGM) held in Lagos, NARD urged the government of President Bola Ahmed Tinubu, to as a matter of urgency put measures in place to cushion the effect of subsidy removal on poor Nigerians.

"We advise the government to ensure that monies saved from the removal of subsidy are judiciously used and put into meaningful investments that would better the lives of all Nigerians. In this case, health and education should be prioritised," he said.

The association urged Tinubu to as a matter of urgency declare state of emergency in the Nigerian health sector, stressing that the era of paying lip service to the monster of Brain Drain should be over.

It urged the federal government to set up a high-powered panel to review and harmonise reports from the former President Obasanjo Health Agenda for Nigeria committee and the former vice President Osinbajo-led health sector reform committee, in order to generate a plan of action in the health sector for the Tinubu-led Administration.

However, the doctors said they were insisting on their demand for at least 200 per cent increment in the CONMESS salary structure and, “the associated allowances as contained in our letter to the government dated 7th July 2022.”

"We have resolved to give the new government some time to quickly resolve this issue which is at the root of the current spate of

massive brain drain in the sector.

"We call on Governors Adedapo Abiodun of Ogun State, Alex Otti of Abia state, Siminalayi Fubara of Rivers state, Seyi Makinde of Oyo state, Abdurahman Abdulrasaq of Kwara state and the FCTA Administration to urgently look into the situation in the health sector in their states as mentioned in the observations above since these are capable of breaking down the industrial peace in their states," they added.

In addition, NARD urged the management of LASUTH and the Lagos State Governor to discontinue the demand for bench fees as this contravenes the decision of the National Council on Establishment to abolish the fees.

insecurity would impact positively on Nigeria’s economic growth because the risk of investment is correlated to the risk that you have in the environment.

He said: “Insecurity has affected some major segments of the economy, including agriculture that accounts for 23 per cent of our GDP.

“We know the impact of insecurity on the agricultural sector that virtually crippled it. We know the implication for that on food inflation and the implications of inflation on poverty.

“Again, on the perception of the country as an investment destination, the news headlines about number of people killed by bandits and insurgents is enough to scare away any person watching Nigeria from afar.

“We have investors that have extremely high risk evasion appetite but those with average risk appetite

will just run away. That is why we mostly have Asian investors whose risk appetite are extremely very high.

“If we have much better environment as far as security is concerned, we will be able to attract more investment from the West. It is good to have a very good defence budget but again we have deprived a number of sectors of very valuable resources.”

Egwuim, in her contribution, observed that Nigeria has not exploited its demographic dividend maximally and highlighted the need to keep the strengthening of the country’s educational system at all levels, including vocational training at the front burner.

Speaking on the same vein, Ahmed harped on the need to boost Nigeria’s human capital development, adding that emigration is draining the country’s pool of skill labour force.

Group Seeks Appointment of More Women in Tinubu's Govt

President's daughter rallies support for her father's administration

Kingsley Nwezeh in Abuja

A women group, Evolving Women in Politics (EWIP) at the weekend called on President Bola Tinubu to priortise the appointment of more women in government.

The group also hosted the president's daughter, Mrs. Folashade Tinubu-Ojo, who is a grand patron of the association, for her contributions in mobilising women for politics.

This was just as Tinubu-Ojo sought the understanding and support of Nigerians for her father in his quest to make Nigeria a better place.

Speaking at the event organised to celebrate Tinubu’s victory at the election and his inauguration as the president, National President of the Association, Fatimah Bello, urged Tinubu to deliver on his promise to involve more women in government.

"As women we multitask, we take care of the home and so excellently well. The president promised to bring more women into his cabinet and we trust that he will deliver.

For women, this is our time and we call on women to join EWIP", she said.

In his remarks, Former Managing Director of Nigerian Communications Satellite, Ahmed Rufai, who is also a patron of the association, urged the president to raise the bar in the appointment of women to his government by moving away from

the 30 per cent Beijing Declaration to 50 per cent.

"Tinubu should make a departure from the 30 per cent Beijing Affirmative action to 50 per cent in terms of assigning responsibilities to women," he said.

Rufai, who is also a member of Tinubu-Shettima Vanguard, said Nigerians were desirous of a secure and safe society.

"We want a Nigeria where doctors treat our patients, where our educational system works, where our engineers build our roads. A Nigeria where people live above poverty line, where we can sleep with our two eyes closed, where we can travel freely", he said.

Meanwhile, Tinubu-Ojo sought the understanding and support of Nigerians for her father in his quest to make Nigeria a better place.

"I seek fellow Nigerians’ understanding and support for our President to succeed. I also want to appreciate Nigerian women. This is our turn; our hope is renewed. I must appreciate the commitment of this group, EWIP, for what we have done, the love is overwhelming.

“All that you have committed to this cause, may God return it to you in a million fold. What you have done for someone else, may your children enjoy it while you are alive. Thank you for the show of patriotism," she said.

NEWS

8 THISDAY • MONDAY, JUNE 5, 2023

MONDAY JUNE 5, 2023 • THISDAY 9

WITH LOVE FROM BRITAIN…

L-R: Director of Marketing, Charterhouse Lagos,

Trade Envoy to Nigeria and

PwC: Why Local Refining Won’t Crash Fuel Prices

Says current subsidy structure not benefitting Nigeria’s poorest Advocates evidence-based palliatives to cushion impact

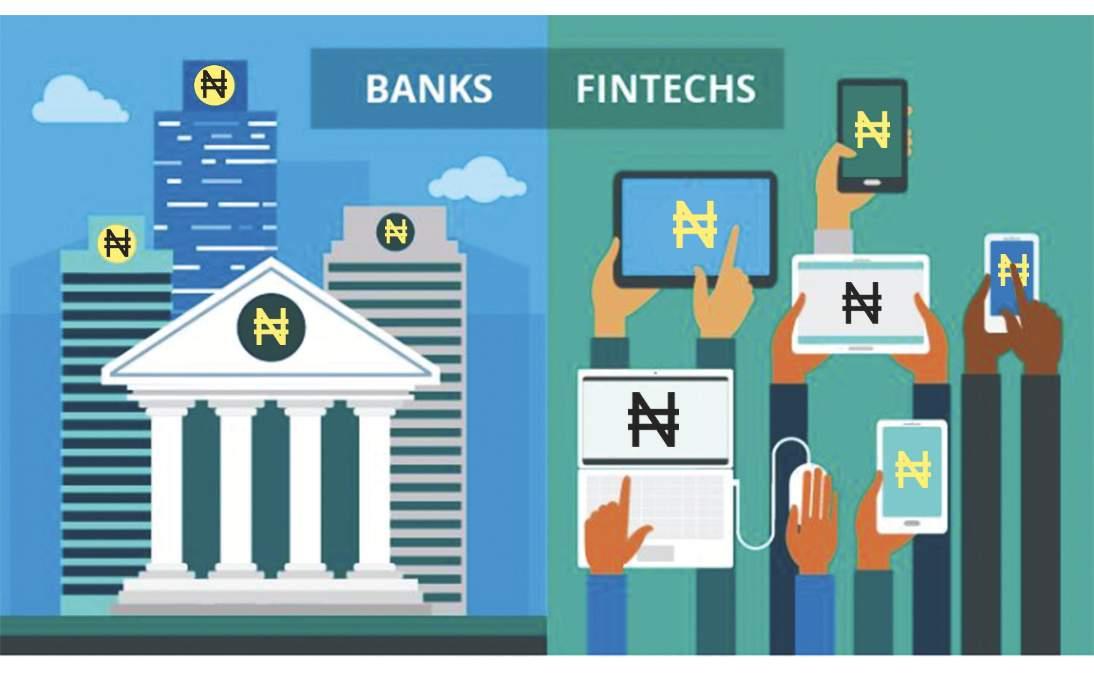

Price Waterhouse Coopers (PwC) has argued that in-country crude oil refining may not significantly reduce petrol prices because the costs of haulage, insurance and associated cost of importation do not constitute the most significant component of cost across the value chain.

In a report released by the global organisation which offers clients various professional business services, including accounting, auditing, human

resources consulting, and strategy management, it picked holes in the general belief that local refining of crude oil could potentially eliminate the need for petrol subsidies altogether or make the market price affordable.

It argued that unless the international price of crude oil falls below a certain level, while local refining will provide a price cushion, it is not a silver bullet that would magically solve the subsidy problem.

While noting that currently, Nigeria imports its refined

PIA: Delta Community Suspend Protests against Chevron, Gives SPDC June 9 Deadline for Engagement

Sylvester Idowu in Warri

Relief has come the way of Chevron Nigeria Limited (CNL) as the people of oil rich Ugborodo in Warri South West Local Government area of Delta State have suspended their siege to the company in protest against it's non implementation of the Petroleum Industry Act ( PIA) in the community.

The indigenes of Ugborodo Federated Communities had since May 20, been protesting at the Chevron terminal over failure of the oil company to engage them in the implementation of the PIA as enshrined in the act.

A prominent leader in the community, Mr. Alex Eyengho, who addressed journalists at the end of a general meeting held at the community town hall at Ode-Ugborodo, over the weekend, said the people of the community have suspended further protests against Chevron to give room for further negotiations.

According to him, the community had held several meetings with Chevron management since the commencement of the protests and had to suspend their action for more engagements towards finding peaceful resolutions to their demands.

Eyengho, also said there had been a tripartite meeting between Ugborodo Community, Chevron and the Nigeria Upstream Regulatory Commission over the matter adding "Chevron is showing some commitment as it concerns the Petroleum Industry Act, PIA." For peace to reign and make the environment conducive for business operations of Chevron, the community leader disclosed that

Ugborodo Community demanded a "Trust" different from others in Itsekiri land.

He said indigenes of Ugborodo community resolved as an autonomous Community that its Trust should now be known as "Ekpere Host Communities Development Trust".

He stressed that the action was not a disrespect to anyone but in compliance to what the PIA stipulates.

Eyengho also disclosed that the oil-rich community had issued Shell Petroleum Development Company (SPDC), which also operates in its domain a seven-day notice to come and negotiate with them directly the way CNL is currently is doing.

"The PIA is clear. It's host community based. Follow the law to the latter," he said, warning that should SPDC fail to heed to its demands, Ugborodo Community would do what's right within the ambit of the law in a peaceful protest against the oil company.

"CNL is doing the right thing. We have served SPDC seven-day notice to comply with the extant law guiding the PIA", he added.

The Personal Assistant to the Eghare-Aja of Ugborodo community, Joseph Uwawah, corroborated the claims of Mr. Alex Eyengho, insisting that PIA, " is purely community based" and expressed hope that the ongoing discussions between Ugborodo and Chevron Nigeria Limited, results in fruitful conclusion.

He maintained that people of Ugborodo, would continually stand against any company operating in their land and dealing with people whose tenure have elapsed, describing such people as fifth columnists and impostors.

petroleum products due to limited or no domestic refining, it explained that this makes the country’s fuel price not only dependent on global oil prices and exchange rates, but also importation and handling charges.

“However, other than the costs of haulage, insurance and associated cost of importation, (these) materials do not constitute the most significant components of cost across the value chain.

“This implies that the pump price without subsidy would still be higher than the regulated price unless the international price of crude oil falls below a certain level.

“While local refining will provide a price cushion, it is not a silver bullet that would magically solve the subsidy problem,” the organisation stated.

PwC added that fuel subsidy in Nigeria had been fraught with issues of corruption and inefficiency while palliatives had been suggested by some as a possible way to alleviate the suffering of those that will be most affected by subsidy removal.

But it said that while palliatives may help to mitigate the immediate impact of rising prices such as cash transfers, provision of buses to the Labour Union or other forms of assistance, the effectiveness of palliatives depends on several factors.

For one, PwC argued that it is difficult to identify and sufficiently cover the vulnerable population that will be most impacted, especially given the lack of reliable demographic data.

According to the firm, in reality, palliatives can be expensive yet ineffective in addition to their being

prone to corruption.

However, it suggested that a multifaceted approach that involves evidence-based identification of the most vulnerable population, and a robust palliative administration with in-built controls would provide a more sustainable and long-term solution.

Writing on the unsustainable financial cost of subsidy, it said that according to the World Bank, Nigeria's total revenue in 2000 was $10.8 billion, explaining that by 2010, this amount increased to $67.9 billion, yet the Nigerian government had spent over $30 billion on fuel subsidies over the past 18 years.

In addition, PwC noted that this has had a significant impact on funds available for critical infrastructure and other essential sectors such as education, health, and defence.

It maintained that fuel subsidy payments have also distorted the economy, stressing that according to a report, households in the bottom 40 per cent of the income distribution account for less than 3 per cent of all fuel purchases.

Furthermore, it is pointed out that that three-quarters of all fuel sold in Nigeria is consumed by private firms, public transportation services, government agencies, and other businesses.

Most vehicles used for carrying large numbers of people (such as molue) and goods, it said, are diesel-powered, a product that is already deregulated.

Also, it said that household kerosene which is mostly used by the poor is no longer subsidised, meaning that the poor are already

to a large extent paying market prices for their fuel.

“This effectively means that the government is subsidising mostly those who can afford fuel (PMS) at market rates and not the poorest of the poor who need subsidy.

“This is one of the major problems with the way fuel subsidy is being implemented in Nigeria. For the benefit of subsidy to reach its intended recipients, the current structure will need to be reviewed and creatively restructured,” it argued.

Besides, the global company said that the porous borders between Nigeria and neighbouring countries have created an enterprise for smugglers who purchase large volumes of petrol at a subsidised rate in Nigeria and sell at market prices in neighbouring countries.

It quoted a report published by Chapel Hill Denham, as estimating that 15.64 million litres of petrol are smuggled out of Nigeria daily as the retail price of Nigerian petroleum products on average is 3.7 times cheaper than those of its neighbours, which has given smugglers undue opportunities for arbitrage.

It posited that since the subsidy point for fuel is importation (or supply) rather than at the pump for eligible users only, subsidy in the current form encourages arbitrage and other forms of corruption.

It said that subsidy has also scared investors in the downstream sector of the oil and gas industry, leading its having the least foreign direct investment compared to the midstream and upstream sectors.

“ The reason for this is not far-fetched. The current subsidy regime and the legal framework

of the downstream sector generally discourages investments.

“The downstream sector needs full deregulation if it would attract more private investors, and one of the impediments that will need to be removed upon full implementation of the Petroleum Industry Act (PIA) is fuel subsidy,” it asserted.

It added that the federal government’s COP26 commitment in Glasgow, Scotland in 2021, was a contradiction for the country to subsidise consumption of fossil fuel while at the same time seeking to reduce the country’s carbon footprint. “Rather than subsidising fossil fuel, the country should encourage green and renewable energy,” PwC said.

On the relationship between petrol price increases, inflation and cost of living, it said that while petrol price deregulation can contribute to higher costs of living and inflation, the impact can be moderated if complemented with effective policies and well-thought out implementation strategy.

It also opined that the argument that Nigeria, being an oil producing country should be able to sell petrol at the regulated price without incurring significant subsidy costs is not supported by evidence.

Subsidy removal, it said will lead to creation of jobs, enhance the country's energy security and reduce dependence on imported petroleum and increase investment flow to the downstream sector as well as reduce government borrowing.

It therefore backed a fully deregulated downstream sector and complete remove petrol subsidy as well as provision of credible, evidence-based palliatives.

End Cycle of Corruption Now, Kaigama Urges New Leaders

Onyebuchi Ezigbo in Abuja

The Catholic Archbishop of the Abuja Metropolitan Archdiocese, Most Rev. Ignatius Kaigama has admonished leaders of government at the national and state levels to put a stop to the network of corruption and reduce the high cost of governance which according to him are mainly responsible for poverty and lack of infrastructure in the country.

Kaigama, who made the call yesterday, during his Homily at Our Lady Queen of Nigeria Pro-Cathedral, Parish in Abuja, also urged the new leaders to also end the reckless borrowing of huge sums of monies.

"We call on our leaders to

restore security, break the network of corruption and reduce the high cost of governance which are mainly responsible for the poor infrastructure and people rationalising acts of corruption.

"We hope that there will be an end henceforth to borrowing huge sums of money (piling humongous debts) and not putting them to productive use.

“Nigeria is unable to construct excellent hospitals and schools and our leaders with the means are often seen patronising these institutions abroad where things are working normally, instead of replicating the same facilities at home. We hope decency will be enthroned again from top to bottom," he said.

Kaigama gave a personal

experience of the consequences of corruption in the country's affairs saying: "On Friday evening when we arrived from abroad and while waiting at the airport for our luggage, the light went off and the conveyor belt stopped. Many chorused: “Welcome back to Nigeria.”

He further said: "After finishing with my passport, the official said, “na only blessing remain” (not spiritual blessing of course). Another official said, “Daddy welcome, anything for us?” We beg the government to give workers their proper entitlements to do away with these shameful and embarrassing begging attitudes."

Kaigama said his work as a priest was to pray and preach and

urged all to grow in the true love of God, love of one another and to be truly companions along this life’s journey to eternity.

While explaining the meaning and essence of celebration of the Holy Trinity Sunday, Kaigama said the Blessed Trinity, “is a model of community life and love.”

"What today we celebrate is the central mystery of our faith and the essence of God. The Catechism of the Catholic Church teaches: “The Trinity is One. We do not confess three Gods, but one God in three persons….” (cf. nos. 253-255). We cannot rationally or scientifically explain God. He is a mystery, a reality that is to be believed and lived through the eyes of faith," he said.

Emmanuel Addeh in Abuja

NEWS 10 THISDAY • MONDAY, JUNE 5, 2023

Damilola Olatunbosun; Chief Operating Officer, Charterhouse Lagos, Angela Hencher; British Deputy High Commissioner, Ben Llewellyn-Jones OBE; UK Prime Minister's

Special Envoy on Girls' Education, Helen Grant MP; and Head, Charterhouse Lagos, John Todd, during the visit of the British Deputy High Commissioner to Charterhouse Lagos...recently.

OSINBAJO, OLD IGBOBI STUDENTS PAY CONDOLENCE VISIT TO BALOGUN FAMILY…

Bandits Kill Scores in Sokoto over Refusal to Pay Imposed Levy

Police confirm attack as PDP condoles victims’ families

Onuminya Innocent in Sokoto

No fewer than 50 persons were reportedly killed in Gwadabawa and Tangaza Local Government Areas of Sokoto State by bandits last weekend after locals refused

to pay illegal levies imposed on them.

Sokoto Police Command PPRO, ASP Ahmad Rufa’i, who confirmed the attacks, yesterday, assured the people that the command was on top

of the situation and promised to give update on the attacks.

Hours after the attack on three communities in Tangaza council, corpses of 37 persons were yet to be buried. The communities attacked were Raka, Raka Dutse,

UN Observance Days Require More Actions, Says Asije

International Society of Diplomats (ISD) Special Emissary on Media to Nigeria, Mr. Victor Asije, has said the United Nations (UN) Observance Days urgently requires more follow-up actions globally to achieve their desired objectives.

Asije said in Lagos, “that UN Days, with the emerging national and global challenges needed less parties, speeches, branded T-shirts, caps, jeans, hugs, group pictures, backslapping and exchange of contacts.”

A statement at the weekend, quoted him to have said national governments, international organisations, communities, private organisations, NGOs, the media, must know that the essence of these special days was beyond just the international dates.

"These Observance Days, which the UN observes globally on certain days, weeks and years, are meant to promote awareness and action to match strides with emerging environmental and other national and global challenges.

"But more prominence has over the decades been given to awareness creation than an all-out follow-up actions to make our silo-bunkered speeches, suggestions, recommendations and expertise yield the desired results.

"We need to reduce to the barest minimum, the huge amount of money we budget and spend on renting attractive hotels, halls, preparing banners, T-shirts, caps, jeans , snacks and drinks," he said.

Asije observed that there was usually a disconnect and inaction between the observance day in one year and the next, a situation he described as "sleeping on duty."

He said during the gap between one the celebration of a day in a year and the next, challenges that were supposed to had reduced had always increased.

"We must know that as we embark on creating awareness in these beautifully decorated halls, through the media and other means, with experts and other speakers taking turns to offer possible solutions to our environmental challenges, what is most needed now and going forward, is our all-out actions at making our suggestions and recommendations here a reality.

"Because the environmental challenges and other earthly emerging challenges are out there to affect us all, then, we all must humble ourselves, irrespective of our positions and social status, roll up our sleeves, and daily, actively keep pressure on what these observance days are meant to achieve," he said.

Asije, who said that the World Environment Day(WED) and other UN special days should not be seen as annual routine for making speeches, noted that, for instance, that trees planted in Nigeria, African and other developing countries were either usually destroyed by flood, human and vehicular movements or poorly nurtured.

He, thereof, called on governments and other relevant stakeholders and organisations to rededicate themselves and resources to afforestation programmes as a means to mitigating the effects of climate change.

The Special Emissary said it was imperative for governments, international organisations, communities, private organisations

and NGOs to prepare for more uncertainties in the years ahead.

Asije expressed the International Society of Diplomats (ISD) readiness to partner, through its team of experts on environmental sustainability, with governments, embassies, Consulates-General, High Commissions, United Nations agencies, research institutions, foreign academies, educational institutions and Ministries of the Environment, in achieving sustainable environment globally.

and Filin Gawa.

The immediate chairman of Tangazaa, Bshar Kalenjeni, also confirmed the attacks, saying,18 persons were killed at Raka, 17 at Filin Gawa and two at Raka Dutse.

In his narration, Kalenjeni said, “The bandits sometimes impose levies on the communities to be paid within a stipulated time and also want to be dictating to the residents on what to do. The offence of the villagers was their refusal to pay the levies imposed on their communities and succumb to the bandits threat.

“Angered by the villagers bold face, the bandits struck Saturday evening, killing 37 persons while several others with various degrees of gunshot injuries are currently receiving treatment at General Hospital, Gwadabawa.

“We wanted to bury those

killed in the night but the bandits came back and dispersed us. As at this morning, the deceased are still there, yet to be buried. As this moment I am talking to you, we are waiting for security operatives to lead us to the villages in order to bury the dead ones and comb the surrounding areas in search of those missing.”

A source in Gwadabawa said, “Some of the bandits were already in the town unknown to residents of the affected communities before others arrived in the evening to strike. The operation started after evening prayer, where they attacked the two most populous villages of Sakamaru and Bilingawa, simultaneously.

“In Bilingawa, not less than 18 people were killed with Sakamaru being the worst, where scores of people were slaughtered and others shot dead. After killing them, they set their corpses and

that of their animals on fire by ensuring that most of them were burnt beyond recognition,” he said.

The Sokoto State Chapter of the Peoples Democratic Party (PDP) has, however, expressed sadness over the attacks.

Chairman of the party in the state, Alhaji Muhammadu Bello Aliyu Goronyo, condemned and described it as callous and dastardly.

Speaking through the party's Publicity Secretary, Hassan Sahabi Sanyinnawal, he expressed dismay over the death of the helpless citizens during the attack.

The party also condoled families of the victims as well as the people of Gwadabawa and the state in general over the unfortunate incident.

The PDP also extended similar condolences to the people of Kware Local Government and Raka in Tangaza.

NDLEA Destroys Three Tons of Skunk in Edo Forest, Seizes 76.9kg Loud from Canada

Michael Olugbode in Abuja

Operatives of the National Drug Law Enforcement Agency (NDLEA) in an invasion of Edo State forest, destroyed a large warehouse of skunk, used to store 231 jumbo bags of the psychotropic substance weighing 3,003 kilograms (over 3 tons).

A statement yesterday, by the spokesman of the anti-narcotics agency, Femi Babafemi, stated that the operatives stormed Iwe forest in Iwe community, Owan West local government area of Edo state, where they located a large warehouse of skunk, used to store 231 jumbo bags of the psychotropic substance weighing 3,003 kilograms (over 3 tons), which was set ablaze. Babafemi, disclosed that the operation involving hundreds of well-armed NDLEA operatives in the early hours of last

Tuesday, which followed intelligence that a wanted drug kingpin had stored tons of the illicit substance in the forest ready for distribution to other parts of the country.

“In other clampdowns across the country, not less than 76.9 kilogrammes of Canadian Loud, a synthetic strain of cannabis were recovered from four used vehicles in a container marked MSDU6686346 from Canada at the Port Harcourt Ports Complex, Onne, Rivers State between last Thursday and Friday during a joint inspection of the shipment with men of the Nigeria Customs Service,” it added.

Babafemi stated that the request for 100 percent examination of the shipment followed earlier intelligence received by the agency on the container.

“In Kano state, two suspects:

Ma'aruf Rabiu and Abubakar

Mustapha were arrested last Tuesday along Zaria-Kano road with 260 blocks of cannabis weighing 139.4 kilogrammes, while Auwal Ibrahim was nabbed with 38 kilogrammes of the same substance the following day Wednesday along Kaduna-Abuja road, also same day 35-year-old female suspect, Bilkisu Isiya, was arrested at Birnin Yero, Kaduna in possession of 5.6 kilogrammes cannabis.

“In Borno state, two suspects: Abubakar Usman (aka Alhaji Mai Kero) and Adamu Yusuf were arrested at Bargu village, Shani local government area last Saturday with 165 blocks of skunk weighing 140.7 kilogrammes. Their arrest was effected deep inside a fluid insurgents’ environment with military support.

“A female suspect, Hauwa

Ibrahim, 25, was also nabbed in the same village with 6.4 kilogrammes of the psychoactive substance, while another suspect Alhaji Abubakar, 27, was arrested at Njimtilo checkpoint with 4,200 ampoules of pentazocine injection and different quantities of D5 and exol-5 tablets.

“A 30-year-old suspect, Iroko Wasiu was arrested at a drug joint at Sabo AbaOwolowo along Oyo-Ogbomoso expressway last Tuesday and 31.2 kilogrammes of cannabis recovered from him, while two suspects: Deji Adelabu, 35, and Mutiu Salau, 37, were nabbed the following day on Wednesday in Sabo area along Oyo- Ogbomoso road and Awuro Dada area in Orire local government area of Oyo state with a total of 8 kilogrammes cannabis recovered from them,” the statement revealed.

NEWS 11 THISDAY • MONDAY, JUNE 5, 2023

The immediate Past Vice President, Prof. Yemi Osinbajo SAN in a group photograph with the family of Otunba Subomi Balogun and the Old Igbobi Boys Students during a condolence visit to the family of Late Subomi Balogun at the Balogun Residence in Lagos State... Yesterday TOLANI ALLI

NCC’S TALK-TO-THE-REGULATOR STAKEHOLDERS CONSULTATIVE FORUM…

L-R: Executive Director, Obasi and Sceptre International Ltd,

End to Sit-at-Home: Bishops, Enugu Town Unions Back Mbah

Reiterate call for Kanu’s release

Gideon Arinze in Enugu

The Catholic Bishop of Nsukka Diocese, Most Rev. Godfrey Onah, the Anglican Archbishop of Enugu Ecclesiastical Province, Most Rev. Emmanuel Chukwuma, and the Enugu State Association of PresidentsGeneral of Town Unions, have thrown their weights behind efforts of the Government of Enugu State to end the

sit-at-home in the state starting from today, saying it was long overdue.

They equally expressed support for the call for the release of Mazi Nnamdi Kanu, from detention, saying it was the right path to national healing and stability in the south-east region.

A statement quoted them to have said this after leading a prayer session for a smooth end to sit-at-home in Enugu State and the entire south-east at

the Chapel of Redemption, University of Nigeria, Enugu Campus (UNEC), yesterday.

Most Rev. Chukwuma, who also doubles as the Anglican Bishop of Enugu Diocese, appealed to the people to support the government’s move through compliance.

“Government has given directive. My advice and appeal is that they should comply so we can save the

economy of Southeast.

“Now the Governor has said it is safe to come out; therefore, people should come out to do their business, and be free and set ourselves free from this bondage. It is a bondage, and we must be set free from it”, he concluded.

Also, in his homily at the St. Theresa’s Cathedral Nsukka, Bishop Onah, while commending Mbah’s

More Senators Deserting Akpabio’s Camp for Yari’s, Says Group

EFCC presents overwhelming evidence to Tinubu

Wale Igbintade

The National Coordinator of Think Nigeria Initiative, Mr. Omogbolahan L. Babawale, has disclosed that a majority of the senators-elect had begun to desert Senator Godswill Akpabio and shifting their support to the former governor of Zamfara State, Senator Abdul-Aziz Yari. Reacting to a statement credited to the Director General of Akpabio campaign group, Senator Ali Ndume, that Yari’s only claim to the Senate presidency was money, Babawale said there was palpable panic mood in Akpabio's camp.

The group also noted that, a senator in Akpabio's camp had stated that no one in Nigeria had more money to spend in politics than the former governor of Akwa Ibom State.

But, speaking in Abuja yesterday, Babawale explained that the "careless outburst has further brightened the chances of Yari to clinch the presidency of the Senate.”

According to him, “Ndume might have read the handwriting on the wall, that majority of the senators are deserting Akpabio and shifting their support to our good-natured candidate, Yari, and is therefore in a panic mood, which brought about that preposterous statement.”

There were strong indications that the Presidency had been influenced by the Economic and Financial Crimes Commission (EFCC), to withdraw its approval from Akpabio’s aspiration.

“So far, the camp of a former Governor of Akwa Ibom State, Senator Godswill Akpabio is in

a panic mood as the President, Asiwaju Bola Ahmed Tinubu, is withdrawing his support for him following overwhelming evidence from the EFCC.

“He is said to have multiple questions to answer before the EFCC agency and fears that such a personality would be more of a liability than an asset to the Tinubu presidency.

"Chairman of EFCC, Mr. Abdulrasheed Bawa, had reportedly compounded the woes of Akpabio," Babawale added, adding that the EFCC chair had opened a can of worms on the series of financial crimes allegations being investigated and which necessitated the commission to invite Akpabio twice, but on both occasions, he failed to honour the invitations.

Competent security sources that

the EFCC Chairman was upbeat on Akpabio’s criminal cases, when he discussed them with his crack team in their office.

The source, who declined to give details of the directives given to the crack team on the matter, hinted that Akpabio might again be invited to the EFCC again.

“The EFCC boss was in the villa, ostensibly to brief the president on the rumpus between the commission and the DSS, which led to the storming of the Ikoyi EFCC office, where he also briefed the president on Akpabio and his inordinate ambition to lead the Senate. But Akpabio is no respecter of institutions. He showed the same disdain to the Senate many times, when it invited him to discuss certain urgent issues rearing their ugly heads at the NDDC where

Senate Presidency: Tension as Senators-elect Double-deal

Sunday Aborisade in Abuja

The stakes appear high for the office of the Senate President as the same set of senators-elect had been the ones holding meetings with major aspirants in different camps for the position of the Senate President and the development had begun to cause tension in the nation's apex legislative institution.

Investigations by THISDAY revealed that as some senatorselect were hobnobbing with the Senator Godswill Akpabio/Barau Jibrin Stability Group, the same set of prospective lawmakers were

also doing same with the Senators Abdul-Aziz Yari, Osita Izunaso, Orji Uzor Kalu 's Senate Democratic Caucus (SDC)

A member of the Osita Izunaso's Campaign Office told THISDAY under the condition of anonymity that no fewer than 77 senators out of the 109 elected on various political parties’ platforms had already signed on for the SDC. He claimed that "as of Sunday afternoon, the Yari/Izunaso-led camp swelled from 73 to 77 senators-elect between Thursday and Sunday morning."

The source said, "This is based on

the statistics taken at the last outings of the two camps held simultaneously at the Transcorp Hilton Hotel and The Destination Hotel respectively.

"Barely 21 Senators-elect attended the Stability group of Akpabio while 57 physically attended the Yari-led group meeting with concrete apologies from 16 other senators-elect, who could not attend in person.

"However, as of Sunday morning, at least four of the senators-elect that attended the Akpabio meeting had shifted camp and alliance to the SDC. The four senators are from South-south and South-West.

"With this, the Yari/Izunaso-led

group made up of senators-elect from the six geopolitical zones of the country now has 77 senators-elect in their camp, a clear majority in the 109-member Senate.

"Even with the 57 senatorselect that physically attended the meeting at Senator Izunaso-owned Destination Hotel, the group has already secured more than the 55 votes required to produce the senate president."

The source maintained that the simultaneous meetings of the two camps had confirmed the actual strength of the competing tendencies.

initiative to end the sit-at-home syndrome, noted that the suffering in the land was too much.

He, however, begged the people to give the new governors of the South East the benefit of doubt.

Bishop Onah traced the insecurity and restiveness in the region to the continuous detention of Kanu, and appealed to Tinubu to heed Mbah’s call for Kanu’s release.

"The suffering is too much. But, please, everybody should have mercy. Those that are angry should calm down. Many of us are angry, but we have to be careful how we express our anger or we may cause more problems.

"It's in this spirit that I understand the initiative by some state governments in the South East, especially the newly inaugurated government in Enugu state, to try to restore normalcy in the South East.

"But I want to believe and I want to affirm that this initiative must of necessity include an increase in the effort to secure the release of Mazi Nnamdi Kanu from detention".

On their part, the Presidents-General (PGs) of Enugu State Town Unions wondered why Enugu State should continue to be on lockdown every Monday whereas “both private and pubic offices in the capitals of other states of the South East region had since resumed businesses, wondering why Enugu’s case should be different”.