ADVISER INDUSTRY STILL ATTRACTING RECRUITS

HOW TO PLAN YOUR MARKETING

RUNNING, READING, THE BIBLE AND MORTGAGE ADVICE

HOW TO PLAN YOUR MARKETING

RUNNING, READING, THE BIBLE AND MORTGAGE ADVICE

It was a tough situation. Doug and his wife had called it quits on the marriage. They agreed that selling up and settling up was the way to move on. The biggest impact was that it meant selling the family home.

Doug, as primary caregiver to a child, with a lifetime disability was trying to work out what next for where they could live. He badly wanted the stability of his own home. This time he was on his own as a home loan applicant. His situation was tricky, as an applicant with a

Government Assisted Income, he quickly discovered the banks weren’t interested in helping him with a mortgage – it was a flat no. Rentals were super expensive and he couldn’t find one anywhere near friends and family; it was a stressful time.

Luckily, he had a friend who knew a broker who knew Pepper Money.

The broker went to Pepper Money and set out Doug’s situation, putting what he had on the table: a small deposit and an unusual income. Pepper Money were able to look at Doug’s situation and make a preapproval offer, with a prime loan that allowed for up to 90% LVR and acceptance of the income source. The proposed repayments would be less than the rentals he had been

looking at. Armed with this offer he was able to go looking at properties and soon found a home he was really pleased with. A happy ending.

The moral of the story?

If the bank says no – give it the non-bank test with Pepper Money. It could turn a “No” into a “Yes!”

Case type: Low deposit. Unusual income.

The solution Pepper Essential. Alternative income. Up to 90% LVR.

Sourcing non-bank finance for your prime clients? If the rates are double digits, there may be a better fit.

Keen to know more? Contact the property lending specialists at Resimac.

Advisers are testing the new artificial intelligence tool ChatGPT to see how they can use it in their practices.

30

Partners Life gets behind advisers when they need it most

Regulation is an on-going theme of what we write about these days. We may not like it but we can’t escape it.

One of the things which regularly comes up in conversations these days is now that we are in this newly regulated world of advice – whether it is mortgages, insurance, investments, or KiwiSaver- businesses will change.

The face of the industry is changing too. TMM has been doing some work on how many new to industry advisers have come on board in the past two years. While this work is not complete a ballpark figure would be around 250 and many of these are younger advisers (under 35 years old).

At the other end we have seen mortgage advisers retiring or leaving the industry, but at lower rates than in the life insurance market.

A message which has been clear is that doing your level five papers and going through the registration process isn’t enough to survive in the future.

Advisers will have to change (and improve) their systems to be compliant when the regulator comes knocking.

In our Regulation feature this issue we have done the first of what will be a series looking at how you can remain compliant.

This is critical – in fact the survival of your business will rely on it.

The Financial Markets Authority now has a watchful eye on mortgage and insurance advice – two areas largely out of its remit earlier. A number of people have noted that the FMA has already started sending letters to advisers asking for information about their businesses and to expect a monitoring visit.

While we have not sighted the letter, everyone spoken to who had seen it said it will send the shivers down the spine of any adviser unfortunate

enough to be the recipient.

It’s not just a letter saying we are coming to visit, get out the coffee and biscuits.

It’s a detailed list of information which is required – and in a relatively short time frame.

The FMA is now under the leadership of its third chief executive and the current one looks likely to bring a much more hard nose approach to regulaton than her predecessor.

I wanted to wrap up this editorial by paying tribute to Geoff Bawden. As we report in news Geoff has sold his Q dealer group to The Advice Platform (TAP).

He remains working in the business but more in a role mentoring new advisers.

Geoff was one of the advisers I first met when we established TMM, then called The Mortgage Mag. Indeed, he was influential in helping us establish the magazine.

Way back then we had the NZ Mortgage Brokers Association (NZMBA) which Geoff led for many years. NZMBA was subsumed into the Professional Advisers Association (PAA) which was one of the founding bodies of Financial Advice NZ.

Geoff has been a big supporter of TMM over the years and championed the work we do. I wanted to acknowledge his support and the tremendous amount of work he did for advisers when the industry was in its fledging state.

Philip Macalister PublisherIn the current tough market, with record low dwelling sales and low business and consumer confidence, it's important to recognise the challenges we're facing. However, it's also crucial to look forward and identify the opportunities that will arise as $170 billion mortgages come off their fixed rates in the next 12 months.

While we can't control the market, we can focus on the controllable - our businesses and how we run them. Here are some things we should be doing now:

Go back to basics: Customer service has never been more important.

As it's becoming more complex to navigate obtaining finance and banks are pulling back from providing personalised advice, the need for qualified advisors has never been higher. Ensure your customer experience is exceptional and ask for referrals and recommendations from satisfied clients.

Use the quiet time to do your housekeeping: Make sure you're up to date with compliance requirements. With the expiry of the safe harbour for advisors to be qualified, we're now operating in a fully regulated environment where credibility to clients is recognised by a license. Maintaining professionalism backed up by qualifications and high-quality record-keeping is important.

Our industry is becoming a profession that is gaining credibility backed by qualifications and regulations. I’m a chartered accountant which is an industry where for many years credibility has been established with qualifications and professional advice. I think it’s great to see this come through to financial advisors.

The current market differs from previous high-rate environments

in terms of affordability. Driven by inflation, it's harder for people to take out a loan or refinance under the assessment criteria of CCCFA. While affordability is essential for accessing a loan, there needs to be some flexibility for commercial judgment in providing credit. We need an assessment guide rather than hard fast rules. The requirement for advisors to be qualified gives a new level of safety and comfort for borrowers, reducing the need to be governed by strict test criteria, and making now an appropriate time to reconsider how the CCCFA is applied in a practical sense. However, more than assisting New Zealanders to get their home loan, the role of a financial advisor is to coach their clients in financial management. Financial independence is really important and should be embedded from a young age, the results of which are powerful – it’s why I joined NZHL. There can be life-changing benefits for people who achieve financial freedom, not only mentally with the weight of their loan lifted off their shoulders but also in terms of wealth creation. Interest cost savings can be used to invest in income generators, lifestyle, or retirement savings, offering more financial freedom.

As we embrace market and industry changes and our responsibilities as qualified advisors, we should consider how we can assist in easing the pains of this economic climate for our clients

and guide them in creating a better financial future. While we continue to navigate operating our businesses in this extremely challenging environment, we should remember that this cycle won't last forever. There are undoubtedly more challenges to come, but as inflation and interest rates begin to ease, the housing market will start to unlock creating additional growth opportunities again.

NZHL is a passionately Kiwi, passionately local home loan and insurance network currently helping more than 50,000 New Zealanders collectively save millions of dollars in interest costs every year.

Part of Kiwi Group Capital Ltd (KGC) which are 100% Government owned, NZHL operates with an Independent Board and 70 local business owners nationwide. NZHL believes in helping Kiwis achieve financial freedom, faster and takes a structured, personalised approach to bring this to life. ✚

*Please note – Kip Hanna is the CEO at NZHL and has written this opinion piece based on his experience. This article is intended to be general in nature and should not replace personalised business or career advice.

‘WHILE WE CAN'T CONTROL THE MARKET, WE CAN FOCUS ON THE CONTROLLABLE: OUR BUSINESSES AND HOW WE RUN THEM’

Longtime adviser Geoff Bawden has sold his dealer group, Q Group, to The Adviser Platform (TAP).

This move accelerates TAP’s plans to work with mortgage advisers and has the potential to be the start of renewed competition amongst existing groups.

Adding to this will be the arrival of a well-established Australian group into the New Zealand market later this year.

TAP managing director Ryan Edwards says he has aggressive plans to expand and a “very clear value proposition.”

Under the TAP model advisers are encouraged and given the tools to run their own Financial Adviser Provider (FAP). This allows advisers to have responsibility for their own business and they can avoid “contagion” risk if they are part of another FAP which runs into trouble with one of its members.

Edwards says the Financial Markets

Authority has already started monitoring visits and these will show the value proposition offered by some groups just doesn’t stack up.

Bawden set up Q Group in 2015 after leaving another group Prosper. He is a veteran of the industry and headed the now defunct NZ Mortgage Brokers Association (NZMBA) for many years.

TAP and Q had been working together for some time, as previously reported by TMMOnline, and share similar values. Q has around 30 advisers.

"TAP and Q Group have had a strong partnership to date and with shared values and drive to make a difference for advisers, the acquisition aims to leverage the credibility of both businesses to create greater value for adviser members," Edwards says.

“For the past eight years, we’ve developed a market-leading proposition in the mortgage aggregation space," Bawden says.

Advisers have a new option for their professional indemnity insurance market with the arrival of a new player.

Quadrant PI is offering easy access to cover, nostrings-attached quotes, clarity and transparency around policy wording and fees, and premiums that last year were about 10%-15% lower than their competitors.

The new company is the brainchild of a small group of advisers who saw their annual PI premiums skyrocket in price about 18 months ago. Their risk profiles hadn’t changed, and there had been no adverse claims against them but their premiums had suddenly tripled.

At the small end of town this meant premiums for a single adviser/director soared from $2,500 per year to $4,000, while at the bigger end of the market premiums for a firm with five to six advisers rose from $10-11,000 to $30,000 annually.

Quadrant director Tony Vidler says the recent sudden rise in premiums was

covered off by insurance companies claiming advisers have moved into a riskier environment now they are regulated. “To be told they are in a riskier environment when the general consensus is the public is safer because of regulation, beggars belief,” he says.

Insurers also changed their model on assessing risk. “Now they assess a business overall and not individual advisers and say this means premiums had to rise.

“There was also the perennial excuse that they are under pressure from reinsurers,” he says.

“However, insurance companies never produce any data on how many PI claims they deal with in a year,

"But in an ever-changing industry, we need to evolve to keep up with demands and to continue adding value to advisers. TAP’s greater level of resourcing, capabilities, and exceptional technology platform will offer increased servicing to advisers," he says.

"The acquisition of Q Group is a testament to Geoff Bawden’s knowledge and expertise and will enable TAP to enhance and accelerate our growth plans in providing outstanding service, and an extremely competitive product to advisers”.

Under the new operations Bawden will transition to head of mortgage adviser distribution.

although advisers have to let their insurance company know if a claim could be made against them.”

While some PI providers require advisers to join an industry association and agree not to shop around among competitors before giving them a quote, Quadrant welcomes all comers who meet its criteria.

“We’ve made it easy for someone to get a quote, regardless of where they are, which most of the other schemes don’t allow,” Vidler says.

Advisers who want to check out Quadrant can see the policy wording before buying a policy – something which until recently was almost unheard, with most PI providers preferring to leave policyholders in the dark about the wording until they have bought cover. Even then, some providers will not give policy wording. “Many schemes flatly refuse to provide policy wording,” Vidler says. “Supposedly, it’s because they think that giving out the wording will somehow encourage more claims.”

Quadrant’s directors are Royden Shotter (chairman), Jason Kilworth, Kevin Smee and Tony Vidler. The Quadrant product is underwritten by QBE and accessible through broker Phil Mitchell of Hutchison Rodway. ✚

A cloud-based custom CRM for both Finance & Insurance.

Ongoing compliance and training.

Referral arrangements available for Fire & General and Risk Insurance.

Access to Astute’s professional indemnity insurance.

Access to the Astute FAP and supporting information.

Use your brand or the Astute brand.

Now’s the time to take your business to the next level!

We offer industry leading support for you and your business to grow.

Derek Mayne, a former mortgage adviser and banker says using bank UMI calculators when helping clients is not enough.

“Using a UMI calculator just tells an adviser what the client can borrow, it doesn’t take into account the client’s lifestyle and if there will possibly be any changes to it.”

He says when mortgage advisers sign hand-over sheets for the bank to finalise a loan, they are confirming that a client can afford the loan.

Mayne had a situation last year when he was told by an adviser it was wrong to take into account affordability.

Shortly after the adviser came back to him and confirmed that he needed to change his approach. “The adviser had put the client’s loan through the chosen bank’s UMI calculator, it showed the client could afford it, but

within three months the client came back and said he could not make the existing loan repayments.

“The adviser went to the bank and said his client was going to have to make changes. The bank immediately came back and said it was on the adviser because he had confirmed the client could afford the loan.”

Mayne says bank UMI calculators show what can possibly be borrowed. “Mortgage advisers really have to show how a client can afford the loan repayments.”

Mayne says many difficulties for advisers arise when clients want a house but don’t want to settle for second best. “They say they can afford it, a UMI calculator says they can, but realise after a while they can’t make the repayments and then want to make changes to the loan.”

He says what many mortgage holders

forget is they still have to live and the difficulty recently has been rising interest rates, higher utility and food costs.

“When advisers are handing over sheets to finalise a bank loan, I believe they should give information on client conversations and discussions on affordability. They should, if possible, include a note confirming that the new loan repayments fit with the client’s budget and will not create financial hardship.”

Mayne says it is important advisers do this because if there are any subsequent problems with payments it shows the discussion has been had and the client has acknowledged this.

“By this time, the client will not remember conversations of months ago, but there will be written notes of advice given and the client’s understanding.” ✚

At Avanti Finance, we’re in the business of opportunities. Our wide range of solutions cover prime, near prime and alternative solutions, helping all kinds of Kiwis find a path into home ownership.

Got a new appointment you would like to tell advisers about? Email details and a pic to editor@tarawera.co.nz

Former Liberty Finance business development manager Rose

Acton-Adams has joined Astute as its new sales manager.

For Acton-Smith it is a return to a former business. Before joining Liberty seven years ago she was at Mortgage Express, which is part of Astute.

Prior to that she was a mortgage adviser in her own right.

The sales manager role is newly created at Astute with a focus on helping its adviser members grow their businesses.

Currently Astute has around 130 mortgage advisers.

Head of sales, Nathan Kerr, who has been running the New Zealand

Home loan and insurance adviser network New Zealand Home Loans (NZHL) gets new general manager franchise, distribution and marketing.

Craig Wagstaff has been appointed as the group's new general manager franchise, distribution and marketing. He comes to NZHL from AIA where he was head of ASB Partnership. Wagstaff was an essential part of the integration team bringing Sovereign and AIA together.

Previously he held roles as head of new business operations at Sovereign and head of health operations at AIA.

NZHL chief executive Kip Hanna says NZHL is focused on scaling the business and Wagstaff was selected for his wealth of knowledge of the sector

and expertise.

This role will join NZHL's leadership team and be responsible for the growth of the core NZHL business, its franchise network, and how the group engages with its community.

“Ultimately, our goal is to help more New Zealanders reach financial freedom - working to pay off and reduce the long-term costs of their home loans while having adequate insurance protection.”

Hanna says NZHL’s priority is to continue to deliver competitive alternatives for Kiwis - particularly as homeowners are facing the cost-ofliving increases, much higher interest rates, and a changing property market.

“Craig is a highly regarded practitioner; we believe his depth and breadth of industry experience

business recently, says Acton-Adams will help members take the next step up with their businesses.

He says a lot of advisers in the group are looking to bring new members on board.

While lending volumes are down, advisers are still busy, he says, and many are looking to move to the next level.

Astute is looking to grow and add “like-minded” advisers. He says the business has a high focus on compliance.

Acton-Adams is well-known to many Astute members after her time with Mortgage Express and also Liberty.

“My passion is to help people grow,” she says.

will help drive NZHL forward strategically and support our local franchise offices.”

Wagstaff says, “NZHL is a purposedriven business with which I find myself aligned. I’m looking forward to working alongside the support office and franchise network in this exciting growth phase,” he says.

“With clients at the heart of the business, I’m excited to understand who our clients are, what financial freedom means to them and how I can contribute,” Wagstaff says. ✚

‘My passion is to help people grow.’

Regulation has doubled down on the need for business efficiency and transparency in record keeping.

With record keeping a fundamental duty of financial advisers, the Financial Markets Authority (FMA) stipulates that, ‘Amongst other things, you must create in a timely manner and maintain adequate records in relation to your financial advice service.’

‘Other things’, in record keeping, refers to all regulated financial advice given to clients, which must be kept safe and accessible for seven years - and available for inspection by the FMA at any time.

Logan Smythe Associates adviser Dean Logan spoke recently about how easy it is for advisers to omit some of these requirements inadvertently.

“We always have good intentions to upload our records to a CRM [customer relationship management platform]… but the road to hell is paved with good intentions.

“We get busy, we move on to our next business and these requirements may get buried.”

Logan says avoiding such omissions is worthwhile: keeping accurate records of financial advice helps ensure transparency and win trust from clients.

“The first thing to do is look at your current processes: are there any painpoints? Are there any problem areas?”

Once these are identified, systems should be put in place to avoid repeats.

Mortgages Online adviser Hamish Patel says the sheer volume of things that has to be done is a problem: with new regulations in force or coming, there are many things for advisers to remember.

He recommends using a recording device such as an old-fashioned

dictaphone, or simply speaking into the record function of a smartphone, immediately after a client meeting, to ensure a record exists of what the client wanted - before it can be forgotten or overtaken by other events.

“It’s like an airline pilot's checklist before taking off: a way of making sure that each

“Sometimes I am tired after a meeting and I don't want to do it, but I do it because it sets my mind at ease for the next day. I am always surprised at how much information I can put in there.”

Rupert Gough of Maurice Trapp Group focuses on another aspect of record keeping: the need to take notes during a fact-finding encounter with a client.

“This could be done with a laptop or a digital writing device,” he says.

“It does not matter what method is used, as long as the information ends up as high quality, searchable, retrievable notes, and ‘one source of truth’ such as a CRM.”

Gough also stresses the need for backup systems in case of a cyberattack such as ransomware, and upskilling aids to record keeping such as improving typing skills or other forms of technology.

The FMA has also reminded advisers of the consequences of failure to keep proper records, as in the case of an adviser at the centre of a Financial Advisers Disciplinary Committee (FADC) hearing in December 2020.

aspect of a client's wishes is ticked off,” says Patel.

“After your meeting [with a client], do a recording straight afterwards and send an email to yourself or an assistant straight away so you have a date stamp - and then the record is right there.

“I always [make these recordings] with two milestones: the initial meeting with the client but also at the delivery point.

The adviser, who has name suppression, was censured for breaches of two code standards – 12 and 15 of the Code of Professional Conduct for Authorised Financial Advisers – for having failed, in the case of three clients, to:

• record in writing adequate information about a personalised service provided to a retail client

• demonstrate adequate knowledge of the relevant legislative obligations which result from the term ‘personalised service’

The FADC maintained the breaches were ‘less serious’ than those of other

It’s all too easy to skip vital aspects of record keeping – but maintaining timely and accessible records will make your business run more smoothly.

‘It does not matter what method is used, as long as the information ends up as high quality, searchable, retrievable notes’

cases. There was no suggestion that the adviser improperly benefited at the cost of her client, no disadvantages to the client, and no former misconduct found prior to the adviser’s breach.

Afterwards, the adviser in the case ‘retired’ and wound down her practice.

Good Returns understands that she did not apply for a transitional licence to operate under the new licensing regime, which came into effect the following week.

The case has long been closed, but the FCSL (Financial Services Complaints Limited) disclosed that the complaint could have been decided differently under the new financial regime.

Under the new regime, advisers giving financial advice have more obligations: to not only keep adequate records, ensuring they have met obligations with clients, but also to make certain clients understand the advice given.

The FMA encourages advisers to maintain oversight of record keeping and ensure practices are suitable for the scale and nature of their organisation and advice offering.

While it seems only a small number of advisers may grapple with recent regulatory changes, it is important that full disclosure ensures transparency in the adviser-client relationship and serves to enhance the trust that clients place in advisers’ hands.

The more complex processes are, the easier it is to skip a few steps - so keep it simple.

Solid and consistent record keeping means your business will operate more easily, protecting clients’ best interests. ✚

In an earlier version of this story comments were attributed to Joshua Logan. These comments were made by Dean Logan from Logan Smythe Associates. We apologise for this error.

1 2 3 4

“After your meeting [with a client], do a recording straight afterwards and send an email to yourself or an assistant straight away so you have a date stamp - and then the record is right there.

“This could be done with a laptop or a digital writing device.”

in case of a cyber-attack such as ransomware.

Stay up do date with skills relating to record keeping such as improving typing skills or other forms of technology.

Debt-to-income levels will become reality for mortgage borrowers next March, says Kelvin Davidson, CoreLogic’s chief economist.

Although the Reserve Bank (RBNZ) hasn’t said it will introduce DTIs, it has indicated March next year is the date they will become a formal tool, along with LVRs, to restrict residential mortgage lending.

Davidson says the RBNZ will activate DTIs next year – not to curb lending in this housing cycle, but for subsequent cycles, so house prices never rise 40% over two years as they did during the Covid pandemic.

He says the RBNZ’s recent release about debt-to-income ratios didn’t say anything new.

“There was no indication of the limit, whether it would be five, six or seven

times income, exemptions for new builds, although it has to be assumed there will be, or speed limits.”

The release was to keep DTI restrictions in front of people, to remind them the RBNZ was still looking at it and could introduce it.

It won’t be an issue for mortgage holders and new borrowers even if they are activated in March, because risky lending has been reined in, he says.

“The system is not that stretched.”

Davidson says if DTIs are put in place it is likely they will not bind in this cycle.

“Recently interest rates have risen at such a rate, so borrowers can’t service as much mortgage debt, and house prices have come down, so they haven’t had to borrow as much,” says Davidson.

“That’s why DTIs activated next year

might not bind, because things have tightened up.”

He says introducing them is about keeping a lid on future property cycles, tying house prices to income and trying to limit house-price growth to 10% or less year-on-year.

“While it will not restrict growth immediately, it will in the long run. We won’t see outright house-price falls, but they won’t rise as quickly in future.”

Davidson says it’s anybody’s guess when the nitty-gritty of DTIs – the borrowing level against income – is laid out by the RBNZ.

“It could be in the bank’s six-monthly Financial Stability Reports, usually released about May and November, or it could sneakily announce it at any time, as it did with LVRs.”

A number of small, non-bank deposittakers have told Parliament’s Finance and Expenditure Committee they are worried the Deposit Takers Bill will mean a disproportionate and highly onerous level of regulation, which could lead to them going out of business.

In addition, the committee heard that the mere possibility of this level of regulation is already causing difficulties, by making it harder to raise capital to grow and provide financial services.

The Bill modernises the Reserve Bank’s framework for regulation and supervision of the deposit-taking sector and introduces an insurance scheme for depositors.

The insurance scheme will be funded by levies collected from deposit-takers, to be used to compensate depositors in the event of their deposit-taker collapsing.

Compensation will be capped at $100,000 per depositor, per institution.

Secondary legislation will be needed to get insurance scheme up and running by late 2024.

The Bill also includes modernising the licensing process, enabling a range of prudential standards to be applied to particular deposit-takers, or classes of deposit takers, and expanding the Reserve Bank’s supervisory and enforcement tools.

The committee has recommended a number of changes be made by the Government to the Bill, which brings banks and non-bank deposittakers (NBDTs) under a single regulatory regime.

A number of the changes are in response to concerns 13 non-bank NBDTs raised in a submission in November around the regime being too heavy-handed.

The committee says these concerns are in part a result of the approach taken to the design of the bill.

As originally introduced, the Bill would grant the Reserve Bank a significant degree of flexibility in how it discharges its prudential regulatory function, guided primarily by the objective of ensuring the financial system is stable.

“We appreciate the Reserve Bank needs flexibility to determine how best to achieve the overall objectives set for it, not least so that the prudential regulation regime continues to be fit for purpose, in the face of future developments that cannot necessarily be foreseen now,” the committee says.

“Nonetheless, we consider improvements can be made to the Bill that would balance the need for flexibility with our desire to maintain diversity.

The Government has had a third go at fixing the rules around the Credit Contracts and Consumer Finance Act (CCCFA).

The latest changes, announced just before the Easter weekend by the Minister of Commerce and Consumer Affairs, Dr Duncan Webb, include:

• explicitly excluding discretionary expenses from affordability testing

• providing more flexibility for lenders about how certain repayments are calculated

• extending exceptions from full income and expense assessments for refinancing of existing credit contracts

The changes mean affordability assessments are still needed for all loans.

Webb says the changes, which come into force on May 4, will improve safe access to credit for Kiwis.

“Whilst not departing from the original policy aim to ensure borrowers

can repay loans without hardship, this tidies up the December 2021 changes to the CCCFA and Credit Contracts and Consumer Finance regulations,” he says.

The CCCFA changes have been a thorn in the side for borrowers since they were introduced in December 2021.

Although they were aimed at unscrupulous lenders, banks have become embroiled in the changes - to the detriment of mortgage borrowers, who have had to supply a lot more detail.

Banks can be fined if they don’t elicit the extra details.

Once the changes came in, banks virtually stopped lending as they came to grips with what was required.

Many borrowers complained that banks would not give them a mortgage because of ‘excessive spending’, such as buying Christmas presents or Lotto tickets.

The Government decided some

tweaks were needed, which were applied in July last year. However, most of the existing changes in the December 2021 regulations were kept in place.

The Bankers Association said at the time the July tweaks wouldn’t make much of a difference to borrowers.

Webb says the current amendments made to the final regulations were informed by feedback from lenders, financial mentors and consumer advocates, after an MBIE exposure draft of the changes was released for consultation in September last year.

The housing market is still in the doldrums, with predictions values will fall further over the year - spurred by a floundering economy, high interest rates and banks’ reluctance to lend.

The latest Real Estate Institute data show the median house price across the country dropped 12.9% annually to $775,000 in March.

At the end of March, the total number of properties for sale was 29,284, up 3,625 properties (+14.1%) year-on-year.

The total number of properties sold was 5,877, up from 4,113 in February, and down 15.0% year-on-year.

The House Price Index showed an annual decline of 13.1%.

Home values have made the biggest first-quarter fall in more than 15 years, according to the latest QV data. Since the beginning of last year, average house values have dropped by more than $250,000 in Auckland and Wellington.

In many areas across the North Island, value declines are in six figures - signalling more is to come.

The latest QV House Price Index for March shows property values have dropped by an average of 3.9% since the start of the year – weakening further from the 2.7% three-monthly decline in February, and the 1.7% three-monthly decrease in January.

The average home value is now $907,737, which is 13.3% less than the same time last year.

It is a significantly bigger first-quarter decline than at the same time last year, when property values dropped by an average of 0.6% throughout the first three months of 2022.

The latest QV figures show the rolling three-monthly rate of reduction increased last month in all bar two of the country’s 16 largest urban areas, with the most significant quarterly home-value reductions occurring on average in Whangarei, down -6.6%, and Rotorua, down -5.7%.

Of the largest cities, Auckland (-5.2%), Hamilton (-5.2%), and Wellington (-4.8%) led the decline.

Christchurch (-1.2%) and Hastings (-2%) were the two exceptions – the former experiencing the smallest drop of the main centres.

Interest-rate hikes and tighter lending rules have triggered the biggest property-sales collapse since 1981.

Figures from CoreLogic NZ show 60,859 properties were sold in the year to February 2023 - the lowest 12-month total since October 1983.

For February alone, about 4,100 deals were done. That’s the lowest for that month since at least 1981.

CoreLogic NZ Chief Property Economist Kelvin Davidson says the figures are striking, showing just how quiet the market really is.

“Few vendors are in a hurry to sell, given that unemployment remains low.”

Other key highlights of the report include house sales in the 12 months to February 2023 are down a third (-32.7%) on last year; 16% more listings on the market than this time last year; property values were down 1% in February, -1.5% in the past three months, and -8.9% over the year; Wellington is the weakest of the main centres, with values down 19.7% from the peak, while Christchurch is only 4.7% down since then; cash buys by multiple-property owners (including investors) make up 15% of purchases, a record share for this type of buyer.

The latest Investor Survey by economist Tony Alexander and property management company Crockers shows One-year fixed preferred for those with debt.

Survey results show banks are seen as more willing to advance funds over the past two months; a relatively high 82% of investors intend raising their rents over the coming 12 months, up from just 70% in December; investors have become more concerned recently about rising insurance costs; concerns about reduced net migration are easing; and landlords report that good tenants are increasingly easy to find.

Alexander and Crockers’ survey shows that for the 21% of investors thinking about buying a property in the coming year, 56% will still buy an existing property, 28% will buy a new property, and 16% will undertake their own property development.

A major slowdown in the construction industry is fast approaching. Building consents have plunged 29% in the year to February, Stats NZ figures show.

There were 2,972 new homes consented in February, the fifth month in a row the number of new homes consented has been below the same month of the previous year.

NZ Stats construction and property statistics manager Michael Heslop says the drop in the number of homes consented last month is big when compared with February last year.

“[February 2022] had the highest number of homes consented for any February month on record,” he says.

On a yearly basis, the number of new consents reached 48,257, down 3.3% compared to the previous 12 months. It is the first time on an annual basis they have dropped since 2012.

The number of new homes consented in February fell 9% compared with January.

There were 27,872 multi-unit homes (townhouses, apartments, retirement village units and flats) consented in the year ended last month, up 15% compared with the previous year.

The number of stand-alone houses fell 20% to 20,385 over the same period.

Rents in some areas across the country appear to be dropping, the latest bond data show.

This is bad news - particularly for the Auckland CBD market, which is awash with apartment investors who are just starting to get on their feet again after international students fled when the pandemic hit.

Bond data from Tenancy Services shows median rent for a one-bedroom Auckland CBD apartment dropped by $30 a week from $430 in January to $400 in February.

For a two-bedroom apartment, the median rent also dropped $30 a week from $560 to $530.

The national median rent in February was $560 a week, down from $575 a week in January, but up by $10 week from last February. ✚

Eric Frykberg takes a closer look at who is entering the mortgage-advice business – and whether the number of newcomers points to industry growth or a revolving door.

The mortgage-advice industry is continuing to attract recruits – newcomers who are undaunted by taking a pay cut compared with their old jobs or facing a sluggish real-estate market.

The appeal of a career in mortgage advice remains independence, variety, the people-focused nature of the business, and the chance to build up a capital stake.

Providing an extra spur is a steady trend towards more adviser-arranged deals, as banks shut down branches to avoid paying high fixed costs for bricks and mortar.

This shift to the adviser channel, away from walk-ins at bank branches, is helping to smooth over the impact of a cyclical property market on its intermediaries.

It means there is more work to go around.

One recent arrival, at Loan Market, is 35-year-old Aaron Cooke of Auckland, whose early career was spent as a salesman.

His work ranged from selling advertising spots in the media to persuading people to buy training courses at Air New Zealand, often from outside the company.

He had long eyed a career as a mortgage adviser from afar, before making the leap to a business whose subject matter was in his blood already.

“I love finance; I love the concept of how finance works, how numbers work,” Cooke says.

“There are a lot of areas in New Zealand where financial literacy is lacking, so this job gives you a chance to help people's lives in that space.”

Jamie Maclennan, 31, is another recent recruit to Loan Market in Auckland.

‘I went from being employed, with a salary and commission, to basically earning zero’

Jamie Maclennan

He, too, came to the job as a salesman. His commodity was office equipment such as photocopiers, but selling mortgages held out a better chance of boosting his career.

“In my previous role, I was selling products for a large business, whereas now I can provide advice under my own business,” Maclennan says.

“I look at it as a salesperson's version of a trade. If you were a plumber or an electrician, you could set up your own business as a plumber or sparky.

“So I saw this as a chance to run my own business: to put the skills I had learned as a salesman into a business of my own.”

Looking on from the other side of the desk, as new advisers walk into the office, are people like Dan Bell, chief customer officer for Squirrel.

Like all managers, he wants the best new recruits he can find - and has a well-developed way of assessing their talents.

“Typically, we have targeted people who have a passion for property, and for helping people through the buying journey.

“We want people who have a natural curiosity about residential property.

“They have not necessarily come from a real-estate background; we’ve had more success hiring ex-retail-bankers.

“I don't think that’s been a new strategy; banks have been reducing their client-facing teams for years. We have picked up on some really good property lenders who have come out of that environment.”

Bell says these arrivals tend to be in their late 20s or early 30s and have had several different roles in a bank, before leaving for a job with a different structure and a greater focus on clients.

“If I were to break down the headcount that we’ve had of people coming into Squirrel in the past two-

and-a-half years, it has primarily been ex-bankers: people looking for an environment where they can be offering the best solutions to clients, instead of being focused on distributing just one product.”

Bruce Patten at Loan Market says many of his recruits have also come from banking, following the path from bank to brokerage that he himself set many years earlier.

The cost of switching

Switching to a new line of work can be costly. That was certainly the case for Jamie Maclennan.

“There was a significant pay cut. I went from being employed, with a salary and commission, to basically earning zero,” he says.

“I had to set aside six months of savings just to make sure I could do it.

“I actually ended up selling my house so I had some money in the bank, which meant that I could safely go to no-income for a few months while I started.

“I was kind of lucky when I began, because I got going pretty quickly; I started getting some settlements within a few months, so it wasn't too bad.”

Maclennan insists that going from salary to commission, even at the cost of selling his own home, was still worthwhile.

“I myself left banking because I got to the point where I didn't like the way the bank was going, and I felt that I could do more for my clients if I had a business where I could provide options for them.

“I was considered a bit of a maverick, because I was trying to get the bank to send deals to brokers. I thought that if the bank could not help clients, maybe a broker could place [a loan] somewhere else.”

Not everyone who went from bank to brokerage jumped of their own free will. Some were pushed.

These are the people who entered the mortgage-advice industry after a change of career was forced upon them.

“We had a big influx of people into the industry four or five years back,” says Patten.

“That was when one of the banks made a whole bunch of people redundant, and many of them came into mortgage broking.”

“It's a few years down the track now and I am loving it. It's a challenge every day, and that was what I was looking for. This job has definitely provided it.”

For Aaron Cooke, the process was a similar one. Did he take a pay cut? “Yes.” Significant? “Yes”

So how did he feel about that? “It's an investment.”

And did it pay off? “It's an ongoing journey. It certainly will pay off over time.

“There are two things: one is that you want to maximise the cash flow, and then [the loan book] will be an asset at the end as well.”

Will he stick at it? “One hundred percent.”

Is it the churn factor?

If Cooke and Maclennan are both relative newcomers, either the industry is growing in size or else there’s

‘People keep on talking about advisers leaving the industry and their loan books being put up for sale, but I’ve not seen the reality of it’

‘I’m getting CVs emailed to me all the time’ Jarrod Kirkland

The churn argument would appear to be supported by repeated suggestions that a lot of older people are quitting the profession, in protest - or despair - over the wave of regulations imposed on the industry in the past few years.

Proof of how real this trend is will emerge as final figures from the Financial Markets Authority (FMA) indicate how many advisers made the final deadline for full licensing and how many missed the boat or decided not to try to catch it.

But the size of adviser churn – or whether it is happening at all – is still up for debate.

Dan Bell of Squirrel says he has not seen many strong signs of churn taking place.

“People have been talking about that for a long time, but I’ve not really seen it,” he says.

“People keep on talking about advisers leaving the industry and their loan books being put up for sale, but I’ve not seen the reality of it. Maybe it is coming, but ultimately I think there are a lot of people in the industry who love what they do.

“They don't love all regulations and compliance, but they are still very connected with their clients.”

This raises another question: if new people are joining the industry and older people are not quitting, despite suggestions that they would, how is the mortgage-advice business getting enough work to go around? Especially when a real estate downturn is hitting both volumes and price.

Bell cites a fortunate trend to offset that impact.

“The share of the market going to mortgage brokers continues to grow,” he says.

“In New Zealand we’re on a trend towards similar levels to Australia, where 65% to 70% of all mortgages are written through mortgage brokers.

“That provides further upside to

our industry.”

According to this view, turnover in the mortgage business may be slipping, but advisers are getting a bigger share of it.

In other words, advisers are getting a larger slice of a smaller pie.

Bell points to another trend: newcomers going to a well-established firm rather than going it alone.

He says that’s partly because of the help a big company can provide in complying with the waves of regulation which have been imposed on the industry.

The standing of these companies is also appealing.

“I think brands are important for people. There’s that sense of security working for a well-known brand; people want to be aligned with a wellestablished brand that they respect and admire.”

The Mortgage Lab is another large company, one which recently became even larger by merging with insurance brokers Maurice Trapp.

National manager Jarrod Kirkland takes a different view from Bell, saying there are definitely signs of adviser churn in the mortgage-advice business.

“We are getting a lot of new-toindustry people who want to be advisers coming to us.

“But at the same time, there are older advisers who can't be bothered basically to keep up with regulation, and they are exiting the industry.

“We are in the position to be able to acquire their client bases, or their businesses in some cases. So we are experiencing [churn] from both ends.”

Short-term recruits

Kirkland also points to another layer of churn.

He says many people come into the industry thinking it is exactly what they want, only to find out that it does not suit them at all.

They then go back to their old jobs, or seek another one after six months or

a year.

Overall, this means that adviser personnel levels remain more or less constant - and Mortgage Lab is careful to keep it that way.

“We could double our adviser force tomorrow if we wanted to,” Kirkland says.

“I’m getting CVs emailed to me all the time.

“There are a lot of people wanting to get into becoming mortgage advisers. My job is to sit down and find out why they want to get into the industry.

“It's not for everyone. It's like the realestate industry: when times are great, everyone wants to get into it because all they see are big dollars and flash cars, but the reality is much harder than that.

“So we try to have that honest discussion with advisers and tell them, ‘Hey, it's not all glitz and glamour.’”

Unlike at Squirrel, Kirkland says his newcomers are not primarily departing employees of the banking industry.

“They come from all walks of life; they’re from a mixture of different professions.

“Maybe they have just become a bit disgruntled and thought, ‘I always wanted to get into financial services’, or maybe just, ‘I’ll give this broker gig a bit of a crack.’”

Of that mixture, sales staff make up quite a big chunk of the company's new arrivals.

This was especially true of people who had practised selling in retail or service-type roles such as telecommunications.

“They might have been selling mobile phones and thought, ‘I am quite good at selling, maybe I want to do something a bit more substantial’.

“It is more of a career focus for them. They say, ‘Hey, I’ve been in sales, but I’m looking for a long-term career, and brokering is something that I’ve picked up as having that potential.’” ✚

‘Turnover in the mortgage business may be slipping, but advisers are getting a bigger share of it’

Advice firms are already testing the chatbot sensation to see what it can do for them. Sally Lindsay finds out how the new artificial intelligence tool could help advisers.

Auckland-based financialadvice company National Capital has tested ChatGPT’s ability to generate financial information - and found it wanting.

Founder and director Clive Fernandes says while the chatbot is useful in limited circumstances, the main problem is it can’t distinguish between fact and fiction.

KiwiSaver advice is National Capital’s specialty, so Fernandes wanted to see how the AI stacked up against registered financial advisers.

ChatGPT was asked specific questions - and Fernandes says it came

as no surprise that it generated some incorrect answers.

To be fair, he says every financial statement made by the chatbot was followed by a reminder to seek professional advice.

Nonetheless, Fernandes says he can see a heightened risk of inaccurate information, despite its dangerously authoritative wording.

“Granted, it is great to summarise heavy content in plain English. [But] there is also a lack of quality depth in the answers generated by ChatGPT.”

He says where ChatGPT can currently be useful is for writing emails to clients.

Advisers can put in the points they want to make and an email will be generated in one minute - with correct spelling and grammar.

“It’s like having a professional writer alongside an adviser.”

Fernandes says once AI can provide accurate information, it will eventually free-up an enormous amount of time for advisers, which they can use to answer more complex client queries.

‘Eventually’ is the operative word. While the current iteration of ChatGPT is an impressive piece of AI, Fernandes is emphatic it cannot yet supply Kiwis

with relevant advice.

“It is not useful right now for providing client advice, because it can’t give 100% accurate information,” he says.

To fix this, National Capital is working on its own expert tool using ChatGPT’s base development.

In-house development of the product is underway and money will later be poured into testing on a regular basis to make sure it is totally accurate before it hits the market.

Fernandes is hoping it will become the leading tool for the country’s financial advisers.

On whether it will replace advisers,

Fernandes is adamant it won’t.

“At an Auckland University function it was summed up as, ‘AI is not going to replace jobs, people using AI will replace jobs’.”

He says a product launch is years away – not months.

Financial Advice NZ chief executive Katrina Shanks has spoken to other mortgage and insurance advice firms who have been testing ChatGPT by putting questions into it about their specific sectors: they, too, have been doubting what comes out.

Shanks believes ChatGPT will not be widely adopted in New Zealand any time soon by mortgage and insurance advisers, because it is too unreliable.

“What it produces is not necessarily based on facts.”

However, Shanks, who did not want to name the firms she has spoken to, says it could be useful as a base for published material advisers can use if they are short of ideas, as long as they supplement it with their own more advanced knowledge and shape it to suit their client base.

“Any adviser using ChatGPT has to thoroughly check the information they get from the AI tool.”

Financial Advice is a membershipbased organisation, and Shanks says the advanced AI has not been canvassed at meetings.

“Members have focused on business and making sure they are on the Financial Services Providers Register rather than worrying about new AI tools. It is not an issue of concern.”

Shanks says her the organisation itself will not be adopting ChatGPT, although it produces a lot of published material for its members.

“We want to stay authentic, so we mostly write the material we use ourselves.”

Resimac general manager Luke Jackson says while there has been

some play with ChatGPT socially, the company has not explored it for content - and certainly not for mortgage applications.

He says it is inevitable ChatGPT will become widely used, similar to the evolution of Google.

“But how much content do people want?

“While it will be able to generate regular content for mortgage advisers, they will need to ask who wants it and why do they want it?”

People are already overloaded with information, says Jackson, and if content comes from the same source regularly, it just ends up in their spam folder.

He says another question is this: how are companies going to pay to be involved in ChatGPT? Google launched Google Ads for this purpose.

“What will ChatGPT provide so nonbank lenders, for example, can get their name on it?”

As for mortgage applications, Jackson doubts they will ever be automated by a system such as ChatGPT.

“Advisers would be gone if that was the case.”

He says good mortgage applications are concise and disclose all relevant information.

“We do not need an extra three paragraphs for each part of the application added by ChatGPT.”

He says each loan application is different and adviser input is vital.

Paul Watkins, marketing adviser to the New Zealand financial services industry, says it clear ChatGPT’s immediate value is in the areas of enhancing marketing activity and messages.

He says clients will use the new service to search for information about mortgages, as ChatGPT can create personalised mortgage choices and suggestions based on client input, such

‘If this becomes widespread, it will free up advisers and their teams to be empathetic - more in tune with the emotions of clients’

Peter Vassilis

as their location, salary, house price and other factors affecting their credit rating.

“The downside here is that the value of using an adviser might become lost to some prospects, particularly Gen Z who are tech savvy,” Wilkins says.

On a positive note, he says chatbots backed by AI have the potential to provide well-informed answers to prospect and client questions, and would be available 24/7.

“This will enhance perceived levels of service, as the answers can often appear to be written by a human.”

Watkins says in his opinion mortgage advisers should embrace ChatGPT as a content aid for social media, blogs and newsletters.

The editor of Sydney-based The Adviser magazine, Annie Kane, says ChatGPT is a powerful tool which should be looked at closely.

“Having experimented with this tool for the past few months, I am convinced it can help many industries, including mortgage advisers –from setting up new businesses, prospecting, connecting and nurturing relationships, to generation of leads, right through to negotiating and successfully obtaining mortgages for clients.

“ChatGPT is a must-have tool in a mortgage adviser’s tool bag.”

Her advice is for mortgage advisers

to take the AI tool for a spin, but to tread carefully. Don’t accept the output automatically.

“Like many new tools there are some limitations and initial flaws. The possibilities, though, are encouraging.”

Peter Vassilis, managing director of Sydney-based Black and White Finance, says Chat GPT could free up mortgage advisers so they can spend more time with their customers.

He says the AI tool could help advisers with tasks such as content for websites or social media posts, and generating generic responses for new-to-industry customers, explaining offsets or redraws.

“Typing in what you think is a wellwritten response or content piece, pasting it into ChatGPT, and asking the software to make this text read in a much simpler form, can also help,” he says.

But he, too, says advisers should exercise caution when using the tools for content creation.

He warns there is still a lot of incorrect or dated information online, which ChatGPT is data-scraping to provide its response.

“It’s also known ChatGPT’s written text or content is likely to lack empathy or the human element, so it might be a good idea to blend its response with your own.”

Given that ChatGPT produces potentially lower-quality content than humans, Vassilis says it could lower an adviser company or individual’s organic Google ranking, which would be detrimental to businesses trying to rank online.

He says while it was likely to be business as usual for advisers for now, ChatGPT will eventually become more widely used, particularly because of the time it takes to create detailed responses to client questions or to create content.

“If this becomes widespread, it will free up advisers and their teams to be empathetic, more in tune with the emotions of clients feeling economic pressure, and to help make the experience even better when providing what’s in a borrower’s best interests.”

Vassilis says there is a layer of inperson relationship – on particular display in the mortgage-advice profession – which AI cannot replicate for now, and that the human connection is still an important element in building those strong customer relationships. ✚

ChatGPT represents a branch of artificial intelligence called generative AI.

Across the globe, AI is a rapidly developing field which is poised to revolutionise everything from healthcare to transportation, and entertainment to finance and mortgages.

At its core, AI is about using computer algorithms to mimic human intelligence. This can include everything from recognising patterns in data to making decisions based on that data.

ChatGPT, created by Microsoftbacked company OpenAI, has quickly amassed millions of users, garnering praise from business leaders, including billionaire Elon Musk, one of OpenAI’s original backers.

Musk tweeted, “ChatGPT is scary good. We are not far from dangerously strong AI”. While most of the excitement focuses on its ability to produce text, the major business impact comes from its ability to understand that text.

Michael D. Watkins, professor of leadership and organisational change at the International Institute for Management Development (IMD) says what separates ChatGPT from powerful search engines such as Google and knowledge repositories like Wikipedia is its capacity for knowledge synthesis: the ability to identify, appraise, and link information to distil and present arguments.

‘It is not useful right now for providing client advice, because it can’t give 100% accurate information’

Clive Fernandes

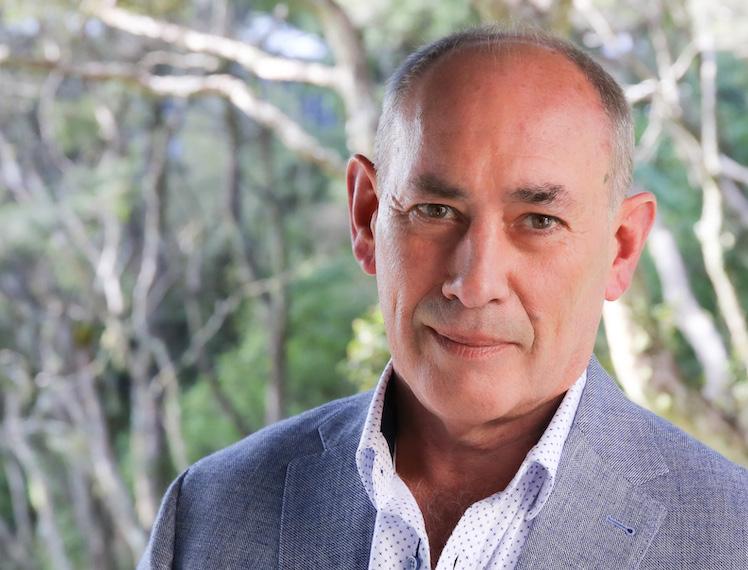

Wellingtonion Michael Anastasiadis talks to TMM about day-to-day life as a mortgage adviser: running, reading the Bible, and the need to pick up the phone whenever it rings.

BY ERIC FRYKBERG

BY ERIC FRYKBERG

Michael Anastasiadis is a 45-year-old mortgage adviser from Newlands, Wellington – and the latest subject in TMM’s series of adviser profiles.

He quit the IRD seven years ago to work for Wellington firm Bozinoff Mortgages, which is part of the New Zealand Financial Services Group (NZFSG).

Based in Kilbirnie, the 26-yearold business is primarily a mortgage company - but does have an insurance component.

How did you get into the mortgage advice business?

Peter Bozinoff, the owner of Bozinoff Mortgages, is a family friend, and I’ve known him all my life.

He has been in my ear since I was little, asking me to be a mortgage adviser, but it wasn't till seven years ago that I finally agreed to quit my safe job at the Inland Revenue Department, where I had been looking after a team of 30 project managers.

Peter had asked me at least half a dozen times over the years to join the company, and it had built up a lot of momentum, and I thought if I didn’t make the move now, I never would. So I thought, “Let's just do it.”

How did you feel about your new job when you started?

Look, I'll be honest, it was pretty overwhelming at the beginning in terms of learning something new, and in terms of handling the volume of work.

There’s a set process for handling each mortgage application, but each application is unique, and that is always a challenge.

Also, moving from a safe, salaried job and becoming commission-onlythat was the toughest part.

How do you feel about it now, six years on?

Up till now, I’ve not really had time to reflect on it, the job has just been so busy, but what I like most is helping people reach their goals.

The people I help are mostly firsthome buyers, people who want to get their own property.

What I enjoy is helping them along the way, because house buying can be a very lonely experience.

We live in a country of five million property experts, but that just means you get five million different opinions on what to do.

Helping them navigate their way through this challenge is the most satisfying thing about the business. What do you like least about the business?

It never stops.

What is a typical day like?

I work from home, I start most mornings at about 8am, and I finish each day when the work is done.

Today, for example, I am speaking to you at about 5pm on a Friday. I had been hoping to stop work at about 3, but after I hang up I’ll still be working for another few hours.

Tomorrow, Saturday, I’ll be working at least four or five hours.

I try to keep Sundays free, but I used to go to Open Homes to help real estate agents out. I stopped doing that because I need to take a break from

minutes.

I also try to pick them up a couple of times a week after school, and in the weekend, I try to take the kids to their sports activities. Sophia plays netball, Nikos plays soccer and my oldest plays golf.

Tell us about a favourite book, type of music, or TV show

I’m a spiritual person - a Christianand the only thing I read is the Bible, along with all the written compliance and mortgage updates that I have to keep up with for my job.

That’s enough to make anyone not want to read again!

And you attend church?

Yes, I attend the Church of God –Ministry of Jesus Christ International. It got its roots in Colombia, which is where my wife is from.

work at some stage and have some time with the family.

Still, the job can sometimes seem 24/7.

If you had your time over, would you do this job again?

Oh my gosh, what a question. Look, it’s risk and reward, this job: you work the hours to get the rewards.

I suppose I am a victim of my own philosophy because I am always trying to help people find a way [to get a home]. Whenever I take phone calls from people, I’m giving them advice - but I’m not necessarily going to get paid for it each time.

Sometimes, though, people have got no-one else to ring.

Like I said, if you ask five different people in the office, you get five different answers. And the bank doesn't really give you much tailormade advice.

So people ring me and I try to help them.

Would I do the job again? You’ve asked me at the end of a very long week; it’s a hard one to answer.

What is a typical leisure activity for you?

I try to go for a run first thing in the morning, and I try to get home to spend some time with the kids before they go to school - even if it’s just ten

What do you do to make the job work well for you?

I feel that it’s not a question of work-life balance: the thing to do is make your life work seamlessly.

For example, the phone rings on a Friday afternoon or a Sunday afternoon because someone has taken my name, and because I am a good mortgage adviser.

So I have to take the call, otherwise the momentum [of a potential business transaction] is lost.

I have to answer the call, but I don't know if the deal is going to work or not. Until I’ve answered the phone, and until I’ve seen if I can qualify someone, to help them through their mortgage process, I just don't know.

It’s a numbers game: out of every ten calls I get from people, I might only be able to help five of them.

But I don't know which five I’ll be able to help until I’ve worked through the ten.

That’s the frustrating part, but it has to work seamlessly.

You are helping people buy the biggest asset of their life. You’re helping them make the biggest financial commitment they will ever make.

It does take a lot of time, but you just have to do it. And you have to make it work seamlessly. ✚

‘It’s risk and reward, this job: you work the hours to get the rewards’

Rather than rushing to create marketing content, it’s far more effective to look first at ‘who, why, where and what’. Paul Watkins explains his ‘W4 One-Page Marketing Planning Tool’

What about billboards, do they work? Do I do more social media? LinkedIn?

I’ve heard TikTok is the big one now.

I saw a competitor advertise on the back of a bus, does that make the phone ring? Does the local free newspaper still have any impact?

Maybe I team up with a real estate agent or financial planner to get more referrals. I have a Facebook page, do I also need a website?

As existing clients are more valuable than new ones, should I offer more services, such as insurance or KiwiSaver?

These are all questions that I get asked and are all fair thoughts on how to get more clients.

The W4 one-page planning tool

The answer to these questions –effectively, how to grow - is to go right back to basics.

Go through a logical growthplanning process, which I call the “W4 One-Page Marketing Planning Tool”.

I developed it some time ago and it never fails, regardless of the industry or growth-challenges faced.

Here is how it works. The four W’s in order, represent WHO, WHY, WHERE and WHAT.

The first element of the W4 One Page Marketing Planning Tool is WHO. If you try to sell to everyone, you sell to nobody.

I often see such lines as, “Mortgage

broker: whether you’re looking for your first home, to move up, buy an investment property, or refix an existing loan, we do it all!” Translation: we are not experts in any of these. Who do you want more of? Look closely at your best 20 or so clients. Who are they? Into what age group do they fall?

Among other factors, what is the range of professions, family size, stage of life, income level? Where they are likely to live and what are their aspirations in the property market?

It’s the standard ‘bell curve’, with highly profitable and easy-to-dealwith block of clients in the centre, and various odd and sods towards the tails ends.

If you target the waste-of-time tailenders, then you will sadly get more of them!

Think of it this way: if you could get 50 new clients, describe the ones you really want. What would they look like?

For example, you may want more first-time buyers, or you may want more of the ones who struggled to get loans from the traditional sources.

In either case, draw me a picture. Describe them in detail.

This way, your promotional activity can be directed at the most desirable clients. If it’s more than one group you want more of, then run specific campaigns aimed at each one.

If you get this part right, the rest of the plan is relatively easy.

The second element of the W4 OnePage Marketing Planning Tool is WHY.

This refers to defining your ‘value proposition’, which is what value you can add in addressing the prospect’s pain-point.

Your value proposition should be based on your knowledge of the specific group you are targeting.

By defining a clear and compelling value proposition, specific to your chosen target group, you can differentiate yourself from your competitors, establish credibility and trust with your customers, and create a strong brand identity.

To do this, put yourself in the shoes of the desired client.

What are their concerns? Why would they go to you as a broker, rather than direct to the lending bank?

How can you save them time, worry, effort, or make the process easier for them?

Think of the last 20 clients you had of the type you want. Why did they call you? If you are not sure, phone them and ask.

It can take time to work this part out, but it’s time well invested.

WHERE do you find these people who you want more of?

Obviously, ‘where’ can mean geographically, but more important is knowing which channels you can reach them through.

Which media do your desired target group most watch, listen to or see?

There are various channels such as social media, email marketing, content marketing, search-engine optimisation and the various traditional media of radio, press and others.

To select the right channels, you need to consider your target audience's preferences, behaviour, and mediaconsumption habits.

How do you find that out? Ask them! It won’t be one; it will cover multiple media.

For example, if you are targeting 35-55-year-old couples, Facebook and YouTube are the dominant forces in that demographic, while for first-home buyers, say 25-35, TikTok, Instagram and YouTube reign. Find out.

If you are not communicating what’s of value to them, versus what’s valuable to you, you are irrelevant in

their world.

The fourth and final element of the W4 One-Page Marketing Planning Tool is WHAT.

This refers to creating compelling content which resonates with your target audience and promotes your value proposition.

Your content should be informative, engaging, and relevant to your audience's interests and needs.

Creating compelling content is much easier now that you understand your target audience's pain-points, challenges, and aspirations.

For example, if your target is 35-55 couples seeking to upsize their house, then the message right now could possibly be around how you can help them structure their loans to have realistic repayments in the face of rising interest rates.

That’s highly likely to be their painpoint. But this could well change over time.

And by the way, social media is still growing and dominating the media space - and the best content is video by a significant margin. When you get to

this point of the W4 plan, keep this in mind.

Don’t go straight to WHAT

In conclusion, the W4 OnePage Marketing Planning Tool is a framework which can help formulate a marketing-activity plan in a logical sequence.

It’s easy to go straight to the WHAT and not go through the necessary steps.

With new compliance rules, particularly in the advice space, maybe it’s time to rethink how you grow your client base and offer the required levels of client service to a clearly defined market.

Become an acknowledged expert to that group and your competitors will have less impact.

You can’t be all things to all people, so don’t try.

I take my clients through a halfday whiteboarding of this process, and without exception it refocuses promotional activity and makes making marketing decisions so much easier. ✚

‘If you try to sell to everyone, you sell to nobody’

‘Think of the last 20 clients you had of the type you want. Why did they call you?’

PAUL WATKINS

P a r t n e r s L i f e g e ts b e h i n d a d v i s e r s w h e n t h e y n ee d i t m o s t

Life insurance advisers spend their days helping clients put the right protection in place for when it’s needed most, including economic downturns. But who will advisers rely on when the going gets tough?

Now is the time to be talking about this. In January, the New Zealand Institute of Economic Research (NZIER) business confidence survey revealed that 75% of respondents believed the economy would worsen significantly over the course of this year

Life insurance is all about planning for the unforeseen. Partners Life places huge importance on always providing the right services, products and support for both advisers and clients.

As we saw during the pandemic, that includes making sure adviser businesses have all they need to support clients and to realise opportunities in challenging economic times.

With this is mind, let’s take a look at how Partners Life is positioned to support advisers and clients, through what will continue to be an economically turbulent year

To provide strong support, it helps to have solid foundations.

At the end of last year, and for the 12th year in a row, Partners Life led the way as the only risk insurer awarded a five-star rating in the annual Lewers Life Insurance Benchmark Study

In addition, it was the only insurer to have scored five stars since the study began in 2010 The results place Partners Life in the top spot for adviser satisfaction, with strong loyalty and patronage from adviser businesses who select the firm as their main provider of choice.

Gaining access to the right information at the right time is essential for success.

To help adviser businesses prepare for emerging issues, the Partners Life Masterclass series helps advisers plan their responses to those issues. The newest class in the series focuses on helping advisers prepare for a possible economic downturn later in 2023. Led by Partners Life managing director Naomi Ballantyne and her team of experts, it brings together decades of experience

to provide advisers with insights, analysis and informed opinion. They meticulously explore consumers’ attitudes when financial times are tough, and how advisers can prepare themselves to maximise the opportunities and minimise the negative impacts for themselves and their clients.

Partners Life is highly regarded for its top-rated health and life insurance product range. In the last few years, these versatile and popular products have been joined by a range of affordability solutions. Some of these were made available to clients over the past few years and certainly proved their value during the pandemic lockdowns. For clients who do become financially constrained due to the economy, Partners Life offers an expanded adviser toolbox of options for just this circumstance. As an example, clients may be able to retain the same amount of cover and adjust the comprehensiveness of their cover by utilising the new range of affordability solutions. This helps advisers retain the integrity of the advice they originally provided their client.

For new clients, affordability solutions can be mixed and matched with more comprehensive covers to deliver the best overall mix of coverage for price, enabling the most fulsome solution to be implemented irrespective of price constraints.

As advisers’ focus on their clients, they also face the major challenge of meeting regulatory requirements. In 2019, Partners Life launched an ‘Adviser Support Programme’ which provided comprehensive tools, templates, instructions and guidance to help advisers comply with the new licensing requirements. Over the years since the programme was launched, 238 advisers have completed the programme - while a further 505 are currently enrolled. The programme is confidential to the user, and free to adviser businesses who work with Partners Life.

Adviser feedback has been universally positive about the programme, citing a significant impact on business health and viability. In addition, the Partners Life Academy provides advisers with a range

of training programmes to help them meet their competence requirements under Code Standard 9 of the Code of Professional Conduct for Financial Advice Services.

These days, the life insurance industry places great emphasis on technical innovation and personalisation.

Partners Life advisers are benefiting from the firm’s unstinting commitment to developing technologies which put control in the hands of the people whose work Partners Life really appreciates: the advisers themselves. Over the years, Partners Life has created a range of innovative digital solutions to help ensure advisers have the best possible products, support and service to protect clients, achieve success and reach their own business goals.