ShanAboo

KarolLeszczynski

NeilShonhard

DorotaSzcześniak

CarterHoffman

DuyguKarakuzu

KirtanaMahendran

DeepeshPatel

NigelTeoh

©TradeFinanceTalksisownedandproduced byTFGPublishingLtd(t/aTradeFinance Global) Copyright©2024 AllRightsReserved Nopartofthispublicationmaybereproduced inwholeorpartwithoutpermissionfrom thepublisher TheviewsexpressedinTrade FinanceTalksarethoseoftherespective contributorsandarenotnecessarilyshared byTradeFinanceGlobal

AlthoughTradeFinanceTalkshasmade everyefforttoensuretheaccuracyofthis publication,neitheritnoranycontributorcan acceptanylegalresponsibilitywhatsoeverfor theconsequencesthatmayarisefromany opinionsoradvicegiven Thispublicationis notasubstituteforanyprofessionaladvice

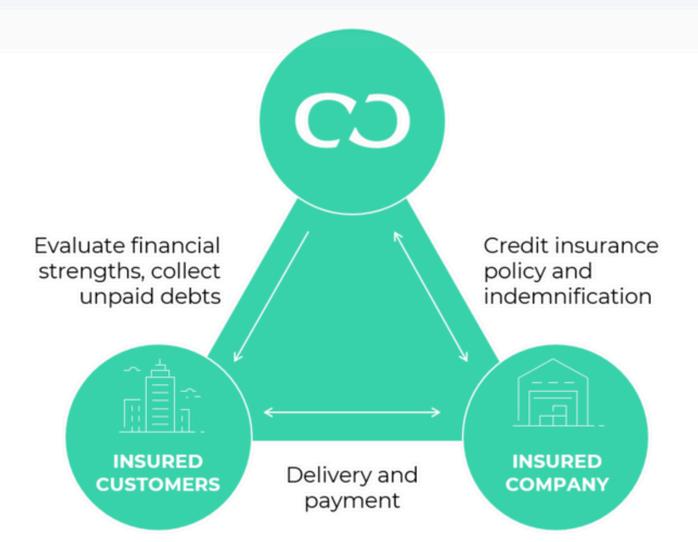

Creditinsuranceandfactoringarecrucialfinancialtools thatprovidebusinesseswiththestabilitytonavigateuncertain markets.Thesetoolshelpmitigaterisksandenhanceliquidity, especiallyininternationaltrade,wheremacroeconomic volatilityandcomplexenvironmentsarecommon.

AtFCI’s56thAnnualMeetinginSeoul,apanelofexperts discussedtheintricaterelationshipbetweencreditinsurance andfactoring.Thepanelincluded:

ChiefCommercialOfficer forAsiaPacific AllianzTrade

ChiefExecutiveOfficer MonetaGo

MemberofFCIExecutive CommitteeandSupplyChain FinanceCommittee SantanderFactoring

ProductManager Comarch

Creditinsuranceandfactoring aretwofinancialtoolsthatwork intandemtomitigaterisksand enhancebusinessliquidity.

Theirsymbioticrelationshipis crucialinprovidingbusinesses withthestabilityneededto navigatetheuncertaintiesof internationaltrade.

AccordingtoFCI,“International factoringistheprocessof purchasinganinvoicefrom anexporterinonecountry andcollectingitlaterfromtheir

buyer/importerlocated inanothercountry.The exporterreceivespayment upfrontfromthefactorby wayofadiscountagainst theinvoice,andthesource ofrepaymentcomesfrom theproceedspaidbythe buyer/importeratthe duedateoftheinvoice.”

Creditinsurance,on theotherhand,protects businessesagainsttherisk ofnon-paymentbybuyers.It coversthereceivables,ensuring thatevenifabuyerdefaults, thebusinesswillstillreceive payment,eitherpartiallyorfully

Thisinsuranceisparticularly valuableininternationaltrade, wheretheriskofdefaultcanbe higherduetovolatileeconomic conditions,politicalrisks,and otherfactors

Forbusinesses,credit insurancebothmitigatesrisk andenhancesliquidity.By convertingreceivablesinto immediatecash,companies canimprovetheircashflow andfinancialstability Thisis particularlyimportantfor businesseswithlimited paymentrecordsorthose operatingininternational markets

Creditinsurancegives prospectivetradersthe confidencetoengagewithnew buyersandenternewmarkets, knowingtheyareprotected againstpotentiallosses

Therelationshipbetweencreditinsuranceandfactoringissymbio becausetheycomplementeachotherinseveralways.Theseinclu

Riskmitigation:

Creditinsurancemitigatestheriskforfactorsby providingcoverageagainstnon-payment,making factoringmoresecureandattractivetobusinesses. Factorscanconfidentlypurchasereceivables, knowingtheyareprotectedagainstbuyerdefaults.

Enhancedliquidity:

Byconvertingreceivablesintoimmediatecash, factoringimprovesabusiness’scashflow Credit insurancefurtherenhancesthisbyproviding additionalsecurity,whichcanleadtohigher advanceratesfromfactors.

Marketexpansion:

Forbusinesseslookingtoenternewmarkets,credit insuranceprovidestheconfidenceneededtoengage withnewbuyers Itoffersprotectionagainstunfamiliar risks,encouragingbusinessestoexpandinternationally.

Dataandinsights:

Creditinsurershaveextensivedatabasesand analyticaltoolstoassessthecreditworthinessof buyers Thisinformationisvaluableforfactors,helping themmakeinformeddecisionsaboutpurchasing

Thepanellistshighlightedthese benefitsduringtheFCI’s56th AnnualMeetinginSeoul Aboo said,“Creditinsuranceprovides asafetynetbyprotecting companiesagainsttheriskof non-payment,makingthe factoringprocessmoresecure andappealing.”

Practical applications 1.3

Inpractice,therelationship betweenfactoringandcredit insuranceinvolvesclose cooperationbetweenfactors andinsurers Factorsrelyon insurers'dataandinsightsto assesstheriskofreceivables, andinsurers,inturn,benefit fromthebusinessgenerated throughfactoring.

InPoland,forexample,50% offactoringagreementsare coveredbycreditinsurance, thoughoverallpenetrationrate oftradecreditinsuranceis relativelylow.Szcześniaksaid, “Creditinsuranceisavery importantpartnerin ourbusiness,especiallyin internationalmarketswherewe havelimitedaccesstoforeign lawyersandfinancialdata.”

Despitetheclearbenefits,integratingcreditinsuranceandfactoring presentsseveralchallenges.Theseincludepoorinformationflow, cumbersomeonboardingprocesses,andhighpremiums.

Effectiveinformationflow isfundamentalforcredit insuranceandfactoring Creditinsurersneedaccurate andtimelydatatoassessthe creditworthinessofbuyerswhile factoringcompaniesrelyon thisinformationtomake

informeddecisionsabout purchasingreceivables

Oneofthesignificantissues facingthecurrentmarketisthe poorflowofinformation often usingantiquatedmethods betweeninsurersandfactors Shonhardsaid,“Cooperation betweeninsurancecompanies andfactoringcompanies usuallyinvolvesexchanging informationthroughemail, whichleadstodelays.”

Whenfactoringcompanies sendproposalstoinsurers forgrantinglimits,theyoften havetowaitseveraldays foraresponse.Inamodern businessenvironment,delays canbedetrimental,especially forbusinessesthatrequire quickaccesstofunds

Thedelayindecision-making isfurthercompoundedby thelackofreal-timedata exchangesystems.Without real-timeinformation,insurers andfactorscannotmakequick decisions,whicharecritical inmaintainingacompetitive edge Szcześniaknoted,"Our customersarenotpatient,and thecompetitionisaggressive. Thetimewedeliverthe decisionastothelimitisreally critical."

Thisimpatienceisnot unwarranted,asbusinesses needtimelyfinancialsupport tomanagetheiroperations, seizeopportunities,and mitigaterisks.

2.2

Cumbersome onboarding

Obtainingcreditinsurance canbecumbersomeand time-consuming,which,in someinstances,discourages businessesfrompursuing italtogether

Szcześniaksaid,“The onboardingprocessfor obtainingcreditinsurance isoftencumbersome,with businesseshavingtoprovide extensivedocumentation.”

Businessesandfactoring companiesmustfollow extensiveprocedures andprovidesignificant documentation,financial

information,credithistories, whichcreatesasubstantial administrativeburdenand slowsdowntheentireprocess

Smallerbusinesses,which mightnothavededicated teamstohandleintricate paperwork,oftenfind themselvesoverwhelmedby

thedemandsofthe onboardingprocess.

Thisextensivedocumentation andthoroughassessment requireconsiderabletimeand effortandcanstrainthelimited resourcesofsmallerfirms, makingtheprocessseem insurmountable.

Highcreditinsurance premiumsposeachallenge insomemarketsandforsome customers,creatingabarrier fornewentrants.

Inmanyemergingmarkets, economicinstabilityandhigher perceivedrisksleadinsurersto chargemoretocoverpotential losses Aboonoted,“Inmarkets likeIndia…thecostofcredit insurancecanbeprohibitive, limitingitsavailabilityin regionswhereitismost needed.”

Thismakesitdifficultfor businessesintheseareasto affordthenecessarycoverage, limitingtheirabilitytoengage ininternationaltradeand expandtheiroperations Shonhardadded,“Inemerging markets,theriskofeconomic instabilitymakesinsurers cautiousaboutextending coverage,whichlimitsthe availabilityofcreditinsurance.”

Regulatoryfactorsadd anotherlayerofcomplexity Insomeregions,stringent regulationsandtheneedfor comprehensivecompliance maydriveupthecostof offeringinsurance,whichis thenpassedontobusinesses throughhigherpremiums

Additionally,insufficient informationaboutbuyers' creditworthinessincreases insurers'risk.Whenthereis limitedaccesstoreliabledata, insurersmustaccountfor thisuncertaintybyraising premiumstoprotectagainst potentialdefaults Thiscan bedetrimentalforstartups orbusinessesthathave historicallyoperatedthrough theinformaleconomyand, therefore,lackformaldata trails

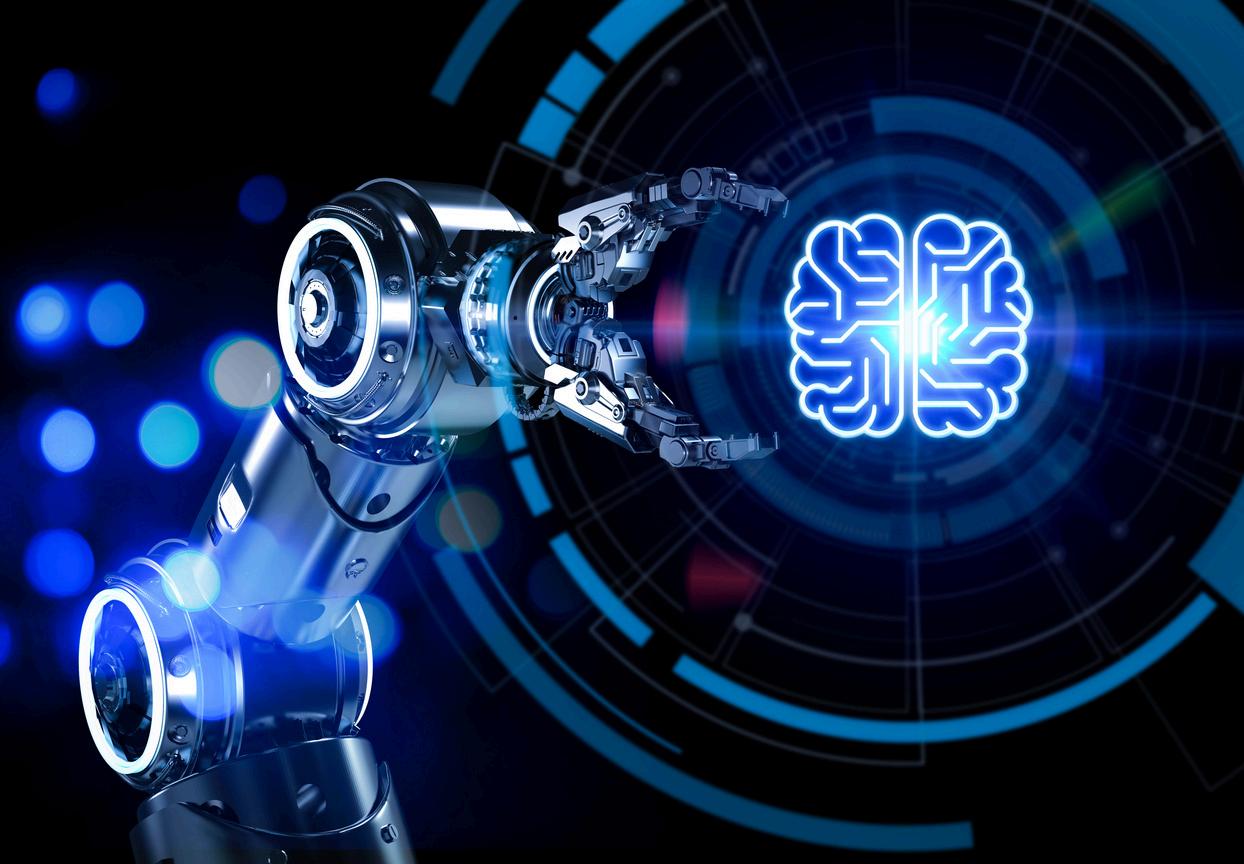

Technologicaladvancementsofferpromisingsolutionstomanychallenges thecreditinsuranceandfactoringindustriesface.Automationand digitisationcanenhanceefficiencyandstreamlineprocesses,while centraliseddatarepositoriescanhelpwithriskassessments.

Automationanddigitalisation willhaveamajorimpacton creditinsuranceandfactoring.

Byintegratingtechnologies suchasapplication programminginterfaces(APIs) andartificialintelligence(AI), theseindustriescanstreamline processes,reducedelays,and improvedecision-making.

exchangebetweeninsurersand factoringcompanies,leading toquickerandmoreaccurate decisions Thisreducesthe relianceonmanualprocesses andmitigatesthedelays associatedwithtraditional methodslikeemailexchanges.

Shonhardsaid,“AIand machinelearningcanenhance theunderwritingprocessby providingdeeperinsights intobuyerbehaviourand creditworthiness.”

Thesetechnologiescananalyse vastamountsofdataquickly andaccurately,identifying patternsandrisksthathuman analystsmightmiss.

Overall,automationand digitalisationcandrivegreater adoptionofcreditinsurance andfactoringbycreating amoretransparent,efficient, andinformedmarket environment.Aboosaid,“They cansignificantlyimprovethe efficiencyofcreditinsurance andfactoring”

Blockchaintechnologyisalso gainingtractionasatoolfor enhancingtransparency andsecurityintradefinance transactions Byprovidingan immutableanddecentralised ledgeroftransactions, blockchaincanhelpmeet regulatoryrequirementsfor transparencyandtraceability. Italsoreducestheriskoffraud anderrors,whicharecritical concernsforregulatorsand industryparticipants

Centraliseddatarepositories andcollateralregistriesare othermeansofimproving transparencyandtrustin themarket

Centraliseddatarepositories serveascomprehensive databasesthatconsolidate financialandcredit informationaboutbuyers. Theserepositoriesgatherdata fromvarioussources,including

banks,creditinsurers,andother financialinstitutions,tocreate aunifiedplatformofreliable andup-to-dateinformation

Collateralregistriesarepublic databasesthatrecordsecurity interestsinmovableassets, suchasreceivables,inventory, andequipment Once established,theycanprovide comprehensiveinformation aboutbuyers'credithistories andpaymentbehaviours, allowingforbetterrisk assessmentandmore informeddecisions

Thesecloselyrelatedtools areparticularlybeneficialin

emergingmarkets,where accesstoreliabledatais oftenlimited

Leszczynskisaid,“Centralised datarepositoriesandcollateral registriescanplayacrucial roleinimprovingtransparency andtrustinthemarket.”

Iffurthercollateralregistries canbedeveloped,especiallyin emergingmarkets,itcouldbea keysteptoenabletradecredit insurerstoengagefurtherin factoringandtradefinance.

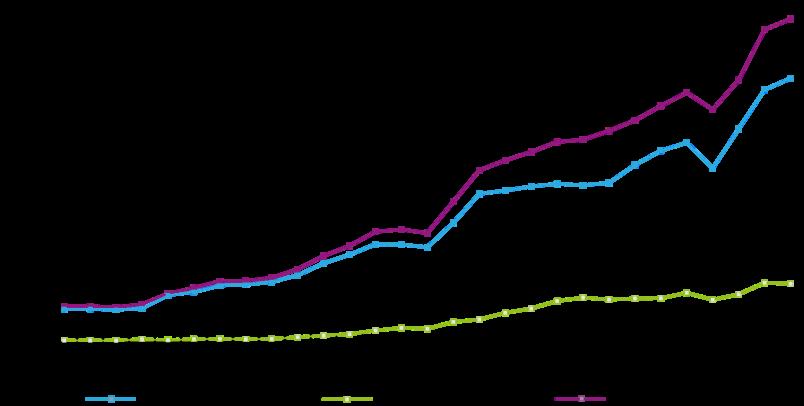

Germanyrepresentsamaturecooperationwithcreditinsuranceand factoring,with95%offactoringcoveredbyinsurance.Thewidespread useofthesefinancialtoolsinGermanyprovidesvaluableinsightsinto bestpracticesandsuccessfulintegrationstrategies.

InGermany,theintegrationof creditinsurancewithfactoring hasbeendrivenbyastrong focusonriskmanagement andfinancialstability German businesses,particularlylarge corporations,extensivelyuse creditinsurancetomitigate non-paymentriskand enhancetheirfinancialsecurity.

Afavourableregulatory environmentandthe availabilityoftailoredinsurance solutionshavealsosupported thehighpenetrationrateof creditinsuranceinGermany. Thesefactorshavemade iteasierforbusinessesto accesscreditinsurance andincorporateitintotheir factoringagreements.

Despitethehighpenetration rate,Germanbusinessesface challengesrelatedtothe complexityofmanaginglarge volumesofreceivablesand theneedforefficientdata exchange Toaddressthese challenges,Germanfinancial institutionshaveinvested heavilyintechnology.

Forexample,using centraliseddatarepositories andadvanceddataanalytics hasenabledGerman businessestomanagetheir receivablesmoreeffectively andmakeinformeddecisions. Thesetechnologieshavealso improvedtransparencyand trustinthemarket,making iteasierforbusinessesto engageininternationaltrade.

Educationandawareness:

TheexperiencesinGermany highlightseveralkeylessons fortheintegrationofcredit insuranceandfactoring:

Technologyadoption:

Increasingawarenessandunderstandingofthe benefitsofcreditinsuranceiscrucialforimproving adoptionrates Educationalcampaignsandoutreach programscanhelpbusinessesrecognisethevalueof thesefinancialtools Investingintechnologyisessentialforimprovingthe efficiencyandeffectivenessofcreditinsuranceand factoring.APIs,AI,andcentraliseddatarepositories canfacilitatereal-timedataexchangeandenhance decision-makingprocesses

Customisedsolutions:

Offeringtailoredinsurancesolutionsthataddressthe specificneedsofdifferentmarketscandrivegreater adoption.Insurersshouldconsidertheuniquerisksand requirementsofvarioussectorsandregionswhen developingtheirpolicies

Thefutureoffactoringandcreditinsuranceiscloselyintertwinedwith regulatorychangespoisedtochangetheindustry.Asthesefinancialtools becomemoreintegraltoglobaltradeandfinance,regulatoryframeworkswill continuetoevolve,impactinghowbusinessesandfinancialinstitutionsoperate.

5.1

Oneofthemostinfluential regulatorychangesaffecting factoringandcreditinsurance istheimplementation ofBaselIIIregulations. Theseinternationalbanking regulationsaimtostrengthen bankcapitalrequirements byincreasingliquidityand decreasingleverage For factoringandcreditinsurance, theseregulationsbringboth challengesandopportunities.

UnderBaselIIIandIV,banks mustholdmorecapital againsttheirassets,including receivablesandtradefinance instruments,whichhas implicationsfortheavailability andcostofcredit.Factoring companies,whichrelyon purchasingreceivables frombusinesses,willneed tonavigatethesestricter capitalrequirements

Creditinsurancecanplaya crucialroleherebymitigating

theperceivedrisk associatedwithreceivables, potentiallyallowingbanks andfactorstomaintainor evenincreasetheirfinancing levelsdespitehighercapital requirements.

Aboosaid,“Our[policy] wordingsneedtobe consistentlyadjustedasthe BaselIIIregulationschange tomakesurethatwekeep upfromaninternalcapital reliefpointofview.”

Regulatorychangesare alsodrivingenhancedrisk managementstandards. Financialinstitutionsare increasinglyrequiredtoadopt robustriskassessmentand mitigationstrategies For thefactoringindustry,this meansincorporatingmore comprehensiveduediligence processesandleveraging advancedanalyticaltoolsto assessthecreditworthiness ofclients

Creditinsurersaresimilarly affected.Tocomplywith regulatoryexpectations, theymustprovidemore detailedandtransparent riskassessments Thistrendis pushingtheindustrytowards greatertechnologyintegration, suchasAIandmachine learning,toenhancethe accuracyandefficiency ofriskevaluations

andopportunities Onone hand,thelackofstringent regulationscancreatea moreflexibleenvironmentfor innovationandgrowth.On theotherhand,theabsence ofrobustregulatoryoversight canleadtohigherrisksand lowerinvestorconfidence

developmentagenciescan helpgrowcreditinsurance andfactoringinemerging markets.”Theseorganisations canprovidethenecessary infrastructureandfinancial supporttoencourage adoption

Regulatorychangeswill haveapronouncedimpacton emergingmarkets,wherethe adoptionoffactoringandcredit insuranceisstillgrowing In manydevelopingeconomies, regulatoryframeworksareless mature,posingbothchallenges

Multilateralbanksand developmentagencies areworkingtoaddressthese challengesbyadvocatingfor regulatoryreformsthatsupport thegrowthoffactoringand creditinsurance.Shonhard said,“Leveragingthesupport ofmultilateralbanksand

Initiativessuchasestablishing collateralregistriesand paymentrepositoriesaimto enhancetransparencyand reducerisksinthesemarkets Theseeffortsarecrucialfor creatingastableand attractiveenvironmentfor factoringandcreditinsurance tothriveinemergingmarkets.

Integratingcreditinsuranceandfactoringcan enhancefinancialresilienceandstabilityinglobal trade.Thispartnershipmitigatesrisks,improves liquidity,andenablesbusinessestonavigate complexinternationalmarketsconfidently.

Todrivegreateradoptionofcreditinsuranceand factoring,stakeholdersmustimplementstrategic initiativesthatfostercooperation,education,and innovation.

Whilesignificantprogress hasbeenmadeindeveloping andadoptingnewtechnologies withinthefactoringandcredit insuranceindustries,more collaborationisneeded tocreateasuccessful environment.

Szcześniaksaid, “Bettercooperationand communicationbetween financialinstitutions,insurers, andtechnologyprovidersare essentialforimprovingmarket penetrationandefficiency.”

Byworkingtogether, stakeholderscandevelop integratedsolutionsthat streamlineprocessesand reducefrictioninthecustomer journey,creatingamore resilientanddynamicfinancial ecosystemthatsupports businessesineverycorner oftheworld

Ed 6.2

Education factoring willencou engagem financialt “Manybu oftheben insurance

Education outreach essential abouthow enhance andgrow

Enhanced adoption, managem smoother educating howcredi factoring theybring overcome buildtrust reach,esp markets

Integratingcreditinsuranceandfactoringismore financialstrategy;itisapathwaytobuildingares dynamicfinancialecosystem.

Byaddressingexistingchallenges,leveragingtec advancements,andimplementingstrategicinitia stakeholderscansupportbusinessesineverycor worldandpromoteeconomicstability.

Bysupportingbusinessesinmanagingrisksandi liquidity,thesefinancialtoolsarecrucialinpromo tradeandeconomicstability.Throughtheseeffor insuranceandfactoringwillenhancefinancialres contributetothebroadergoalofsustainableeco development.

Integratingcreditinsuranceandfactoringwillreq cooperation,education,andinnovation.Byembra elements,stakeholderscanunlockthefullpotent financialtoolsandcreateamorerobustandresil tradeenvironmentfordecadestocome.

FCIistheGlobalRepresentativeBodyforFactoringandFinancingofOpen AccountDomesticandInternationalTradeReceivables.Establishedin1968asa non-profitglobalassociation,FCInowhas400membercompaniesacrossmore than90countries,creatingauniquenetworkforcross-borderfactoring cooperation.Membertransactionsrepresentabout50%oftheworld’s internationalcorrespondentfactoringvolume.

FCIisanon-exclusiveorganisation,opentoanycompanyprovidingorplanning toprovideopenaccounttradefinanceservices,aswellasindustryservice providersAfter50years,FCIexpandedtoincludereversefactoringand IslamicInternationalFactoring

FCI'soriginsincludeastronglegalframework(FCIConstitution,Interfactor Agreement,GeneralRulesforInternationalFactoring-GRIF,Edifactoringcom Rules,SupplementalAgreementforIslamicInternationalFactoring,GeneralRules forFCIreverseandFCIRulesofArbitration),platformsforcross-border transactions(edifactoringcomandFCIreverse)andmorethan50years accumulatedknowledge(FCIAcademy)

FCI'sactivitiesaregroupedintothreeareas:

TradeFinanceGlobal(TFG)istheleadingB2Bfintechintradefinance.

TFG’sdata-ledoriginationplatformconnectscompanieswithinnovative tradeandreceivablesfinancesolutionsfromover300financialinstitutions.

Weassistspecialistcompaniestoscaletheirtradevolumes,bymatching themwithappropriatefinancingstructures–basedongeographies, products,sectorandtradecycles.Contactustofindoutmore.

TFGisaleadingproviderofeducationalresourcesoninternationaltrade andtradefinance-acrossapp,podcasts,videos,magazinesandresearch.

Attractingaround170kmonthlyreaders,ourpublications haveaglobalaudiencein187countries.

Ourspecialistcontenthubsprovidefreeguides,thoughtleadershiparticles andfeaturesonInternationalTrade,LettersofCredit,Shipping&Logistics, Risk&Insurance,Treasury&FX,Blockchain&DLT,Legal,Receivablesand ExportFinance.

TFGarestrategicmediapartnersfortradeconferenceproviders aroundtheworld.

TFGalsohoststheInternationalTradeProfessionalsProgrammewithLIBF, andfundstheAccelerateScholarship,agranttohelpstudentstopursue acareerintrade.OthersknowusthroughourAnnualInternationalTrade Awards,celebratingoutstandingplayersandcontributorsinthetrade ecosystem

Throughtheseactivities,TFGisdemocratisingtradefinance.