THANKSTO

AkinkunmiAbolade

InwangAkpan

YoussefAhouzi

KhalilAlHarthy

NassourouAminou

RaviAmin

SilviaAndreoletti

RobertBessling

FedericoAvellanBorgmeyer

SeanBowey

TodBurwell

AndréCasterman

AbdelrahmanEl-Beltagy

AlexGray

MariyaGeorge

DoaaHafez

NealHarm

MohammedKabbaj

MichaelMatossian

JohnMiller

PeterMilne

VikramNair

SindisoNdlovu

AneelSabir

NeilShonhard

ShonaTatchell

RichardWulff

TFGEDITORIALTEAM

DeepeshPatel

BrianCanup

CarterHoffman

DuyguKarakuzu

KirtanaMahendran

SilviaAndreoletti

LAYOUTDESIGN

MariyaGeorge Co-founder&CEO Cleareye.ai

KhalilAlHarthy CEO

CreditOman

NigelTeoh

SindisoNdlovu

Website www.tradefinanceglobal.com

MagazineandAdvertising talks@tradefinanceglobal.com

EditorialandPublishing

©TradeFinanceTalksisownedandproduced byTFGPublishingLtd(t/aTradeFinance Global).Copyright©2024.AllRightsReserved. Nopartofthispublicationmaybereproduced inwholeorpartwithoutpermissionfromthe publisher TheviewsexpressedinTrade FinanceTalksarethoseoftherespective contributorsandarenotnecessarilyshared byTradeFinanceGlobal

AlthoughTradeFinanceTalkshasmade everyefforttoensuretheaccuracyofthis publication,neitheritnoranycontributorcan acceptanylegalresponsibilitywhatsoeverfor theconsequencesthatmayarisefromany opinionsoradvicegiven Thispublicationis notasubstituteforanyprofessionaladvice

Foreword-EmbracingthefutureoftradefinanceinAfricaandtheMiddleEast

Usingdeep-tiersupplychainfinancing’spotentialtounlockcapital

Thefutureoftradefinance:Leveragingtechnologytoovercome industrychallenges

Deepdive:ICISA’s2023industryresultsexplained

Navigatingsanctions:TheroleoftransshipmenthubsinWestern-made componentstoRussia

Riskmanagementintradefinance:HowaCITRcertificationcanhelp

TL;DR:FCIannualreporthighlightsstablegrowthandtechinnovationin2023

TheBaselEndgame:ImplicationsforUScreditinsurance

Q&A:ReducingrisksandboostinggrowthinSaudiArabiaandtheGCC

TDMeconomicinsight:CantheMiddleEastsavefreetrade?

efcom:Turbochargingthegrowthoffactoringandsupplychainfinancein MENAandIndia

TheroleofinnovativetechnologiesintransformingMoroccantrade

Navigatingtrade-basedfinancialcrime:ImpactofUCP600andISBP821Earticles

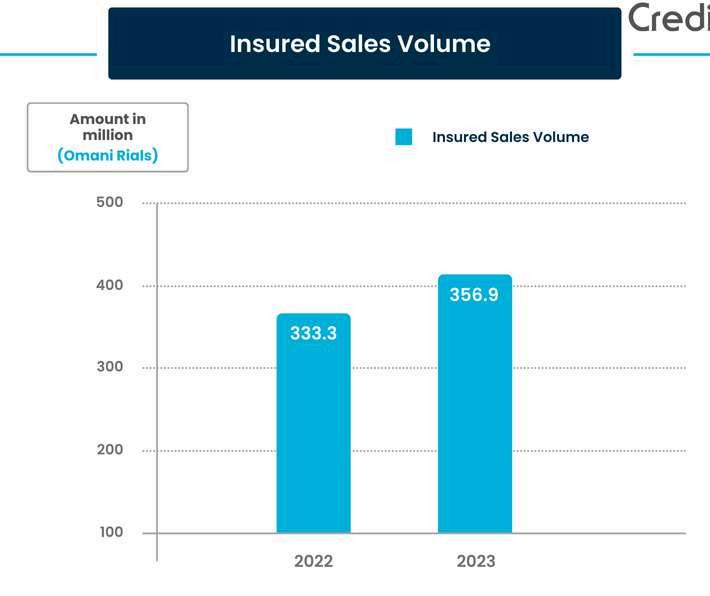

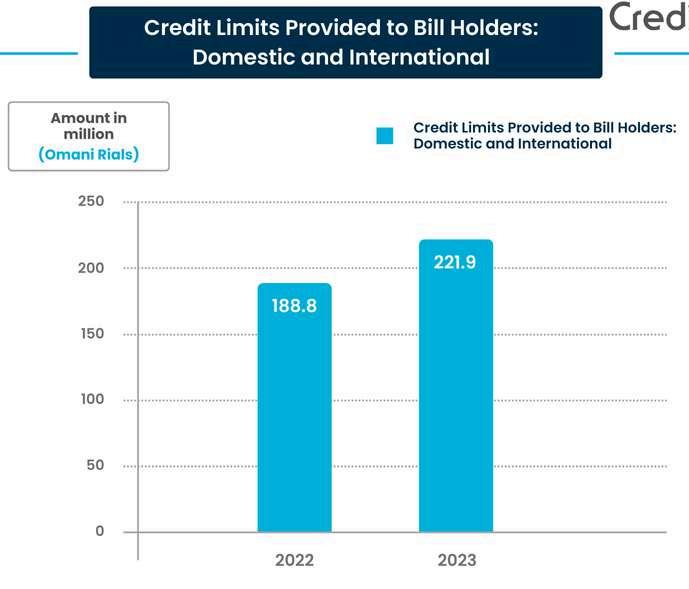

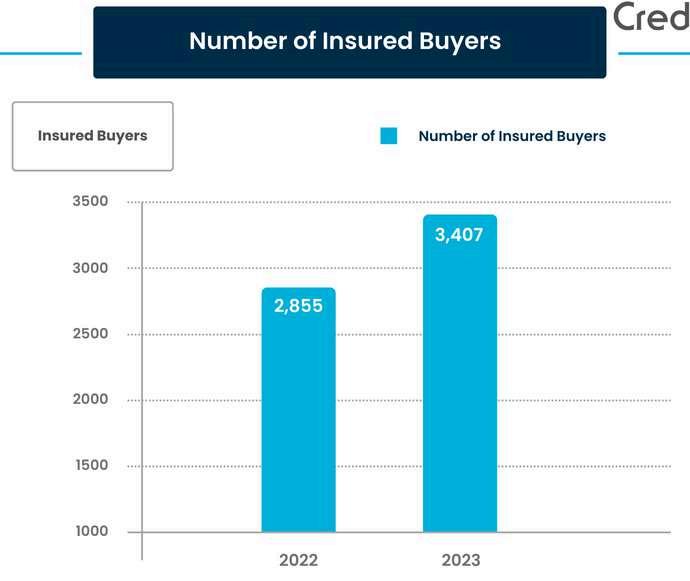

CreditOman:AdvancingOman’sglobaltradepresence

Tradetransactions:Removethepaper-keeptheprocess

UnderstandingLettersofCredit&TheUCP600RulesinNigeria

Levellingtheplayingfieldforfactoringaroundtheworld,wherewillfuture growthcomefrom?

BreakingdownthegrowthoffactoringandcollateralregistriesinAfrica Nigeria,Ghana,andSouthAfrica:Challengesandopportunitiesfor theSub-Saharangiants

Embracingthefutureof tradefinanceinAfricaand theMiddleEast

CarterHoffman ResearchAssociate TradeFinanceGlobal(TFG)

hepotentialofthisrichlydiverseregionisvast, andasrecentdevelopmentsshow,this potentialisbeingadeptlyfulfilled.Asthisedition willdemonstrate,itiscrucialtomonitortrade financedevelopmentsinAfricaandtheMiddle East,astheywilllikelyinformtheindustry’s trajectoryacrosstheworld

It magazinearoundthethemeof AfricaandtheMiddleEast. Encompassingaround2billion people-25%oftheworld’s population-thesegmentation thatwe’vechosenforthis editioncoversareaswith enormousnatural,cultural, political,andeconomic differences.

resources-includingminerals, metals,andagricultural products-whiletheMiddleEast ispredominantlyknownforits oilandnaturalgasreserves Africaishometothousandsof ethnicgroupswithdiverse languages,traditions,and religions,whiletheMiddleEast, althoughculturallyrich,has

fewerethnicandlinguistic groups,withapredominant culturalinfluenceofArab traditionsandIslam.

Africancountriesoftenhave variedpoliticalsystems, includingemerging democraciesandsome authoritarianregimes,whereas theMiddleEastfeaturesamix ofmonarchies,theocracies, andauthoritariangovernments

Fromatradeperspective, Africaisheavilyinfluenced byitscolonialhistoryand primarilyexportsrawmaterials, whiletheMiddleEast’strade isdominatedbyoilexports, withsignificantgeopolitical implicationsforglobal energymarkets

Aswediveintothisedition, ouraimistoprovidea comprehensiveunderstanding ofthecurrenttrendsandfuture prospectsfortradefinancein AfricaandtheMiddleEast From cutting-edgeinnovationsto shiftsinriskmanagement,we explorethekeytrendsthatare revolutionisingtheindustry

Unlockingpotential throughinnovation

The16thcenturyspicetrade puttheAMEAregioninthe centeroftheglobaleconomy Today,lettersofcreditarethe newclovesandcardamom,as AfricaandtheMiddleEasthave becomecriticalplayerswithin globaltradefinance.

Oneofthemostsignificant innovationsreshapingthe regionisthedigitalisationof tradefinanceprocesses,with traditionalmethodsbeing replacedbycutting-edge technologiessuchas blockchain,artificialintelligence (AI),andmachinelearning

Fintechsacrosstheregion arespearheadingthedrive towardsfinancialinclusion. Byofferinginnovativesolutions tailoredtotheuniqueneedsof localbusinesses,thesefirms canenableSMEstoaccess creditandotherfinancial servicesmoreeasily.Thisis particularlyvitalinaregion where,accordingtotheIMF,

MSMEscompriseupwardsof 90%ofthebusinessesbutoften facechallengesinsecuring traditionalfinancing.

Inmanyinstances,innovative approachestoage-old methodsaregainingtraction Deep-tierfinancing,which extendscredittosuppliers atmultiplelevelsofthesupply chain,improvesliquidity forsmallersuppliersand strengthenstheentiresupply chain,makingitmoreresilient todisruptions.AI-driven analyticsinsupplychain financecanalsohelpprovide real-timeinsightsintocash flowanddemandpatterns, enablingbusinessestomake moreinformeddecisions

It'snotjusttheprivatesector pushingtheinnovation agenda;governmentsand public-privatepartnerships areemergingaspowerful catalystsforchange,driving thedevelopmentand implementationofinnovative tradefinancesolutions.

InitiativessuchasSaudi Arabia'sVision2030and theUAE'sNationalInnovation Strategyarecreatinga conduciveenvironmentfor technologicaladvancements, aimingtodiversifyeconomies andreducedependenceon oilrevenues InAfrica,Mobile Moneytechnologycontinues togrowrapidly,reaching$14 trillionintransactionvalue in2023,a14%year-on-year increase.

Collectively,these advancementsarehelping topositionAfricaandthe MiddleEastasglobalhubs forinnovationandtrade.

Spotlightonrisk management

Effectiveriskmanagement remainsacornerstoneof successfultradefinance operations

AcrossAfrica,geopoliticalrisks -includingongoingconflicts andpoliticalinstability-impact thetradeandinvestment climates InJulyandAugust, youth-ledprotestsinKenya, Nigeria,andUgandaaboutthe costofliving,unemployment, andgovernmentcorruption haveledtowidespreadunrest andevenrealpolicychanges, withKenyanPresidentRuto retractinganunpopulartaxbill andreplacinghiscabinetasa result.

EconomicrisksintheMiddle Eastareparticularlytiedtooil pricevolatilityandsignificantly impactoil-dependent economies,suchasSaudi ArabiaandtheUAE.Sharp changesinoilpricescanhave reverberatingimplicationsfor governmentrevenuesand economicprospectsinthese nations

Despiteglobaldisruptionsand geopoliticalconflicts,African andMiddleEasterntrade

remainsresilient.Theregion's strategiclocationandgrowing consumptioninemerging marketspositionitasafuture globaltradehub.

TheICCTradeRegisterreport showsarobustcreditriskprofile fortradefinanceintheMENA region,butchallengessuch asinflation,interestrates,and supplychainvulnerabilities continuetoimpactthe businessenvironment.

Africa'sevolving tradelandscape

InAfrica,theriseofmobile bankingandfintechsolutions isenhancingcreditaccess andmanagement,particularly forMSMEs.

Governmentinitiativessuch astheAfricanContinentalFree TradeAgreement(AfCFTA) areexpectedtocreategreater opportunitiesforregionaltrade.

AfCFTA,whichcommencedin January2021,createdasingle marketof13billionpeoplewith acombinedGDPof$34trillion andisexpectedtoboost intra-Africantradebyupwards of50%byeliminatingtariffs onmostgoods.

opment estingin chasroads, mmunications, rade bankalso elopmentof reementsand uralreforms ecurityand alareas. vancements, n Trade non-tariff adequate ntinueto tradeacross ditionally, tiesbetween riskto and nomiesare estrongUS raisesthe nominated andimports, ancountries algoodsand cerbates uresand serves, tomanage ntain y hedollar financial mportcosts, tsustainability, neededrelief miesfacing

Aswepresentthisedition, ourgoalistoprovideyouwith adeeperunderstandingof thecurrenttrendsandfuture prospectsintradefinance, withaparticularfocuson AfricaandtheMiddleEast

Whiletheseregionscertainly havetheirdifferences,we hopethattheinsightsand analysesprovidedthroughout thesepagesbyourmany contributorswillhelpequipyou withanedgewhennavigating thiscomplicatedlandscape.

Wehopeyoufindthisedition bothinformativeandinspiring aswecontinuetoexplorethe possibilitiesoftradefinance inAfrica,theMiddleEast, andbeyond.

DeepeshPatel

EditorialDirector TradeFinanceGlobal(TFG)

Todiscussthepaperandbetterunderstand howDTSCFcanpromotefinancialstability,risk management,andsustainability,TradeFinance Global(TFG)spokewithTodBurwell,President andCEOofBAFT.

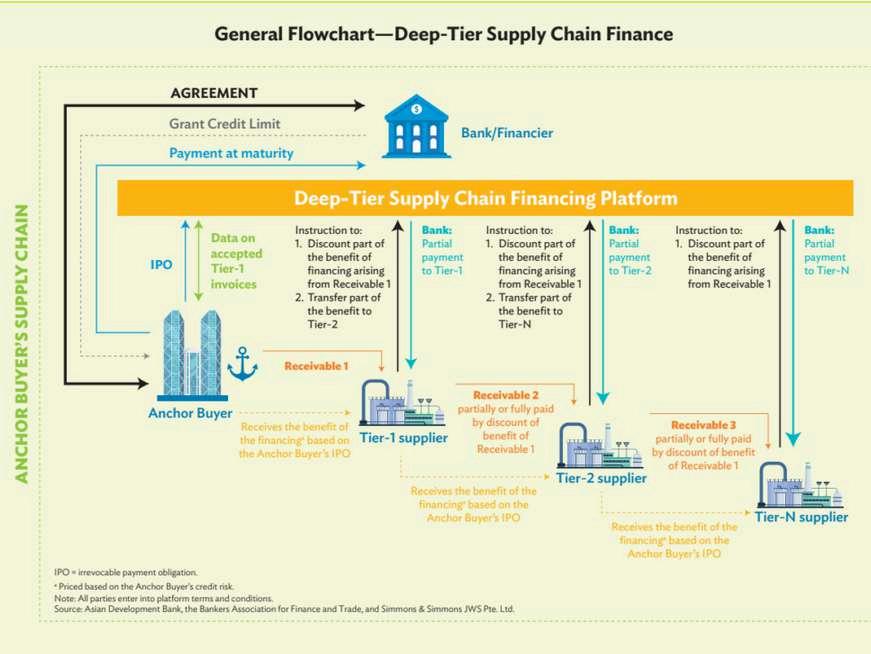

Deep-tiersupplychainfinance (DTSCF)isaninnovative financialsolutionwiththe potentialtounlockfinancingfor smallersuppliersdeepintoa supplychainbyleveragingthe creditriskoftheanchorbuyer.

Thelatestwhitepaperfrom BAFT(BankersAssociation forFinanceandTrade)and theAsianDevelopmentBank (ADB),“Deep-TierSupply ChainFinance:Unlockingthe Potential”,exploressomeof themoreopaqueaspects ofdeep-tiersupplychains.

Todiscussthepaperand betterunderstandhow DTSCFcanpromotefinancial stability,riskmanagement, andsustainability,Trade FinanceGlobal(TFG)spoke withTodBurwell,President andCEOofBAFT.

BAFTisamemberofthe GlobalSupplyChainFinance Forum(GSCFF),anorganisation establishedin2014todevelop, publish,andchampionaset ofcommonlyagreedstandard marketdefinitionsforsupply chainfinance(SCF).

TodBurwell

partiallyorfullypaid bydiscountofbenefit ofReceivable1

Receivesthebenefitof thefinancing*basedon theAnchorBuyer’sIPO

IPO=irrevocablepaymentobligation

*PricedbasedontheAnchorBuyer’screditrisk

Note:Allpartiesenterintoplatformtermsandconditions

Source:AsianDevelopmentBank,theBankersAssociationforFinanceandTrade,andSimmons&SimmonsJWSPte Ltd

DTSCFandits differencesfrom traditionalsupply chainfinance

DTSCF,avariationofthe traditionalformsofSCF,hasthe potentialtoreachmicro,small, andmedium-sizedenterprises (MSMEs)deepwithinsupply chainsbyallowingthemto financetheirpayablesbased onthecreditriskprofileofthe anchorbuyer

AccordingtotheBAFTandADB whitepaper,aprogrammust haveseveralcoreelementsto beconsideredDTSCF.

Forexample,itmustbe relatedtotradefinance, drivenbytheanchorbuyer’s supplychain,occurpostshipment,andbepredicated onanirrevocablepayment obligation

Burwellsaid,“DTSCFallows anoriginalreceivableto bediscountedinpartsat multiplelevels,withthebenefits transferringdownthechain”

Itisadistinctformof payablesfinanceastier1 suppliersaretypicallythe mainbeneficiariesofa payablesfinancestructure.

Tier-2 Supplier

Receivesthebenefitof thefinancingbasedon theAnchorBuyer’sIPO

Supplier

Fromabuyerstandpoint,DTSCF createsgreaterresilienceand transparencyinthesupply chainbycreatingvaluefor lower-levelsuppliersthrough reducedcostsandfraudrisks

Burwellsaid,“Inadeeptier structure,yourtier2supplier whohaspresentedaninvoice toyourtier1supplieralsogets theabilitytodiscountthat invoice,andthetier3supplier thathaspresentedaninvoice tothetier2supplier,andso forthdowntheline”

Fromafinancier’sperspective, withmanycurrentlynot financingMSMEs,thispresents awaytogrownaturalclient basesduetotheincreased visibilityofdeeper-tier suppliers

Thereisalsoanopportunityto linkESGreportingoncedeeper levelsofthesupplychainare connected.

Burwellsaid,“DTSCFcreates moreefficientoperations, whichcanhelplowercosts. AsweseemoreESGcreeping intothestructureofsupply chains,itenablesthese lower-tiersupplierstoachieve complianceandreporting requirementsinthecontext ofthatsupplychain.”

Coreimplementation challenges

DTSCFbuildsonseveralofthe coreelementsoftraditional SCF.Unfortunately,inadequate securedfinancinginfrastructure haspreventedthewidespread adoptionofSCFinmany markets Withoutthatfoundation, manymarketsarenotprepared foradeep-tieralternative.

Currencyimpediments arealsofactors Whiletier1 suppliersoftendealinmajor tradablecurrencies,suppliers furtherdownstreamarelikely toworkwithlocalcurrencies thatcanbesubjecttotight FXcontrolregimes

Burwellsaid,“Onebig challengeishavingwilling participants.Youaredependent oneveryoneinthesupplychain tobeopentobeingtransparent witheveryoneelse.

Youstartwiththeanchor buyer,butifyouarethetier1 supplier,youneedtobewilling toopenupaboutyourown supplychaintoyourbuyer”

Accordingtothewhitepaper, complexandonerous onboardingprocedures alsohinderthescalabilityof supplier-ledfinancingofferings Thecostandeffortrequiredto onboardsuppliers,particularly MSMEs,canbeprohibitivefor lenders,makingitdifficultto extendfinancingtothedeeper tiersofthesupplychain.

Despitethechallenges,there arecasestudiesofsuccessfully implementedDTSCFprograms

Successful implementation casestudies

OneoperationinChina hadreached9levelsdown thesupplychain,reaching$70 billionoverseveralyears,with theaverageinvoicetotalling $77,000

Burwellsaid,“Thesmallest invoicewecameacrossinthis programwas$15.Traditionally, thiswouldbeunthinkable becausemanyfinanciersare notinterestedinadealifthe ticketsizesarethatsmall.But thepointofthisistoprovide valueattheMSMElevel,where youwillhavesmallerand smallerticketsizes.Ifitcan workfora$15invoice,itcan workforanything.”

Anotherexampleisabank withabout1000supplierson ablockchain-basedplatform thatreducedonboardingtime by75%.Giventhatmany considerthesupplier onboardingprocessalone responsibleforholdingback SCFscaling,thisiscritical.

Burwellsaid,“Havingtheright technologyandthestructure whereeachofthetiersare onboardingtheirownsupplier networks;ifyoucanreduce onboardingtimeby75%,you havesomething”

Nextstepstoscale andfullyrealise opportunities

TocontinueadvancingDTSCF, thetwomostimportantnext stepsareeducationand developingconsistentlegal frameworks

Ontheeducationside,the industrymustcontinueto engagewithandcommunicate DTSCFstructuresandbenefits

Themoreorganisationsknow aboutautility,themoretheyuse it,andthemoreinnovationwill beaddedtoexistingstructures.

Onthelegalside,itwillbe importanttocreateconsistent legalframeworkstoenable DTSCFonacross-borderbasis Whilesomestructuresare basedoncontractrights withirrevocablepayment undertakings,othersarebased onnegotiableinstruments.

Burwellsaid,“Theheavylifting forusisgoingtobelooking atthelegalframeworksand howwecanbetterenable cross-borderlegalframeworks tostandardisetheclient agreementsandonboarding processestoachievescale.”

MariyaGeorge Co-founder&CEO Cleareyeai

Tradefinanceisatacriticaljuncture.Withan ever-growing$2.5trilliontradefinancegapand over4billionpiecesofpapercirculatinginthe globaltradeecosystem,theindustryisripefor digitaltransformation.

Tradefinanceisatacritical juncture.Withanever-growing $2.5trilliontradefinancegap andover4billionpiecesof papercirculatingintheglobal tradeecosystem,theindustry isripefordigitaltransformation

Financialinstitutionsand corporatesalikemustadopt technologicaladvancements toremaincompetitiveand compliant Thoughtherehas beenadmirableprogressin recentyears,theindustryneeds tocontinuetoinnovateandnot idlywaitforsomeoneelseto taketheinitiative.

ClearTrade®: Highlightingthe imperativefordigital transformationin tradefinance

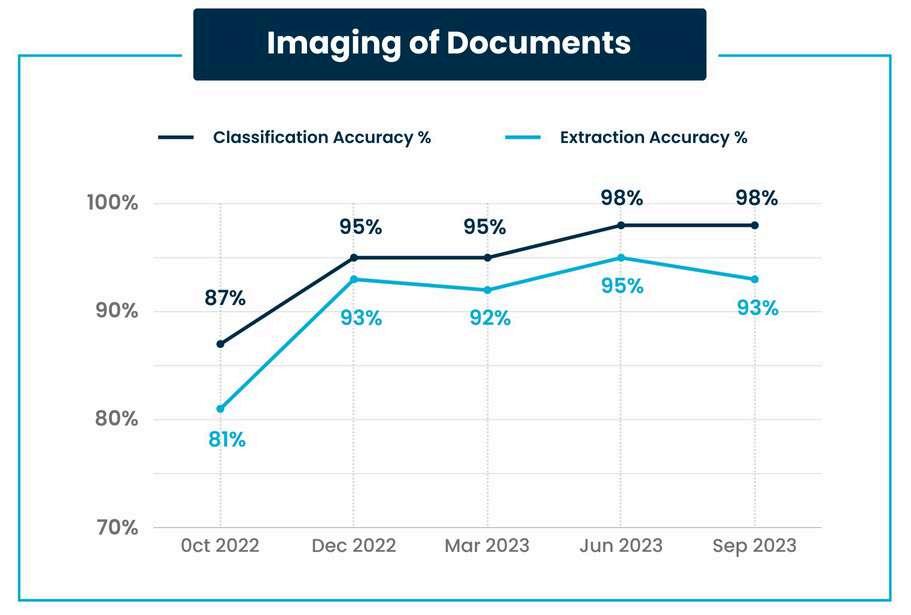

Cleareye’splatform, ClearTrade®,isdesigned totransformtradefinance operationsbyaddressingkey challengesandproviding comprehensivesolutions

Theplatform’sdigitisation moduleisatitscore,converting unstructuredtradedocuments

intostructureddatasetsusing advancedOpticalCharacter Recognition(OCR),Machine Learning(ML),andNatural LanguageProcessing(NLP) algorithms.

Thisprocessnotonlyboosts operationalefficiencybutalso significantlyreducestherisk ofhumanerror.

Thedigitisationoftrade documentsiscrucialforseveral reasons Firstly,itstreamlines processessuchassanctions screening,TradeBased MoneyLaundering(TBML) assessments,workability checks,anddocument examination.

Thesedatasetscanbe seamlesslyintegratedinto tradeback-officesystems, enhancingoperational efficiency ClearTrade®’s classificationandextraction accuraciesexceed93%and 88%,respectively,setting newstandardsintheindustry

Furthermore,thesanctions screeningmodulewithin ClearTraderefinestheprocess bycategorisingnounsintrade documentsintocorporate entities,vessels,locations, andindividuals

Thisrefinementreduces falsepositivesbyupto70%, optimisingproductivityand efficiency.Thecompliance andTBMLmoduleintegrates avarietyofchecks,including maritimeassessments andhigh-risktransaction evaluations,aligningwith regulatoryguidelinesto ensurecomprehensiverisk management.

Addressingoperational challenges,compliance andESG

Tradefinanceisamanually intensiveindustry,burdened bypaperandlacking standardisation Banksface significantoperational challenges,includingpotential lossesfromhumanerrorand ashrinking,highlyspecialised workforce

Additionally,theincreasing complexityofregulatory landscapesdemands heightenedvigilanceand auditability,makingmanual compliancescreening impracticalandcostly

Cleareye’ssolutionsare designedtoalleviatethese painpoints TheClearTrade® platformautomatescritical complianceprocesses,from redflagchecksandvessel trackingtoBillofLading validation

Thisautomationreduces theoperationalburdenon staff,decreasestherequired headcountformaintaining compliance,anddelivers substantialcostsavings.

Inadditiontooperational efficiencyandcompliance, thereisaclearneedto addressESGcompliance intradefinance

WhileESGhasbeenanareaof focusinrecentyears,thereare betterandmoreefficientways toapproachit

ClearTrade®’sESGmodule enablesbankstoassess transactionsfromanESG perspective,trackcustomer trends,andintegrateESG principlesintotheiroperations

Thispioneeringapproachsets thestageforenhanced ESGcompliance,fostering responsiblebusinesspractices forbothcorporatesandbanks.

Theplatformevaluates transactionsbasedon parameterssuchasbuyer, seller,distribution,anduseof proceeds.Thisenablesbanks toassesstransactionsfrom anESGperspectiveandtrack customertrendseffectively

ByintegratingESGprinciples intotheiroperations,financial institutionscanensurethey areconductingESG-compliant businessintradefinance.

Cleareye’sinnovativeapproach toESGcomplianceintrade financedemonstratesits commitmenttopromoting sustainableandresponsible businesspractices

Thepathforward: Collaborationand innovation

SinceitsalliancewithJ.P. MorganinSeptember2022, Cleareyehasdeepenedits integrationwithinthetrade financeindustry. Collaborationswithtrade back-officeproviderslike FinastraandSurecomp, andcloudproviderssuchas IBMandMicrosoft,havehelped shapeindustrystandardsand shareknowledge

Workingwithothercloudand technologyproviders,and majorglobalbanks,ensures thatmultipleindustriesand perspectivesallowsforthe mostcomprehensive collaborationtooccur.

Thisstrategicapproach involvesthoroughmarket researchanddirect engagementwithTrade OperationsandCompliance teamsacrossdifferentclients

Forexample,byunderstanding thespecificrequirementsof financialinstitutions,Cleareye candevelopsolutionsthatnot onlyaddresscriticalcustomer needsbutalsomaximise efficiencygainsandmitigate compliancerisks

CaseStudy: Cleareye’sintegration withglobalbanks

Theseinnovationsarenot hypotheticaleither,therehave beenmultipleconcrete examplesofClearTrade®’s impactwithinmajorglobal banks

Specifically,ClearTrade®was usedtoenhancedigitisation, compliance,andautomated documentexamination moduleswithinthebank

Theresultsweretransformative andhighlightedthereal-life efficacyofCleareye’ssolutions inaddressingtheindustry’s challenges

Detailsofthecase studyarebelow:

DigitisationModule

TheDigitisationModuleof ClearTrade®ingeststrade documentimagestoextract relevantdata,eliminating manualentryandrekeying Additionally,digitisation includesnounextractionfrom documentsandde-duplication, enablingeffectivesanctions screeningforrestrictedparties, vessels,andhigh-risklocations.

Benefits:

Enhancedprocessingpower: Thebankfuture-proofed itstradeoperationswith advancedautomation technology,enhancing processingpowerata fractionalcostcompared tolegacysystemsor hiringadditionalresources

Competitiveadvantage: Leveragingtheplatform’s machinelearningcapabilities, trainedonalargevolume oflettersofcredit(LCs)and documents,resultedin reducedfalsepositivesand alowerriskofhumanerror.

Highconfidencedata extraction:Achieveddocument classificationandextraction ratesof98%and93%, respectively,comparedtothe averageof65%observedin thelegacysystem,ensuring reliabledataextractionat highconfidencelevels.

Costsavings: Realised$1millioninsavings oninternaltechexpensesfor dataextractionand$300,000 savingsforsanctionsscreening efficiencyviareductionoftraffic toexistingenterprisesanctions screeningsoftware.

Costavoidance: Avoided$1millionincosts forinternalcompliancebuild

TheClearTrade®Compliance Moduleutilisesthedata extractedfromtheDigitisation Moduleandemploysaseriesof redflagchecks,vesseltracking, BillofLadingvalidation,and otherriskcontrolmeasuresto ensureregulatorycompliance foreachtransaction

Benefits:

Operationalefficiency:Enabled a70%decreaseintherequired headcountforupholdingglobal marketstandardsinthebank’s tradeoperationsfunction. Compliance&TBML Module

Annualsavings:Achieved annualsavingsof$13million oninfrastructure,maintenance, andenhancementsfor complianceandauto documentexamination,plus $1millioninoperationalsavings forcomplianceandauto documentexamination

Tradefinanceisatacrossroads, withdigitaltransformation offeringapathwaytoenhanced efficiency,compliance,and sustainability.TheClearTrade® platformexemplifieshow advancedtechnologycan addresstheindustry’smost pressingchallenges,from digitisingtradedocuments toautomatingcompliance processesandintegrating ESGprinciples.

Themessageisclear:the timetofuture-prooftrade financeisnow

TheClearTrade®AutoDoc ExamModuleleverages advancedtechnologies tointerpretrulesand conditions,validatingthem againstLCpresentation documentstooptimise tradeoperations.Itcomes preconfiguredwithtrade financerulessuchasthe UCP,ISBP,andURC,offering flexibilitytocustomise therules.

Financialinstitutionsmust embracetechnological advancementstostay competitive,compliant, andpreparedforthefuture

Byleveragingadvanced technologiesandfostering industrycollaborations, Cleareyeisnotonlysimplifying tradefinancebutalsosetting newstandardsforefficiency, compliance,andsustainability.

TradeFinanceGlobal(TFG)

2.3

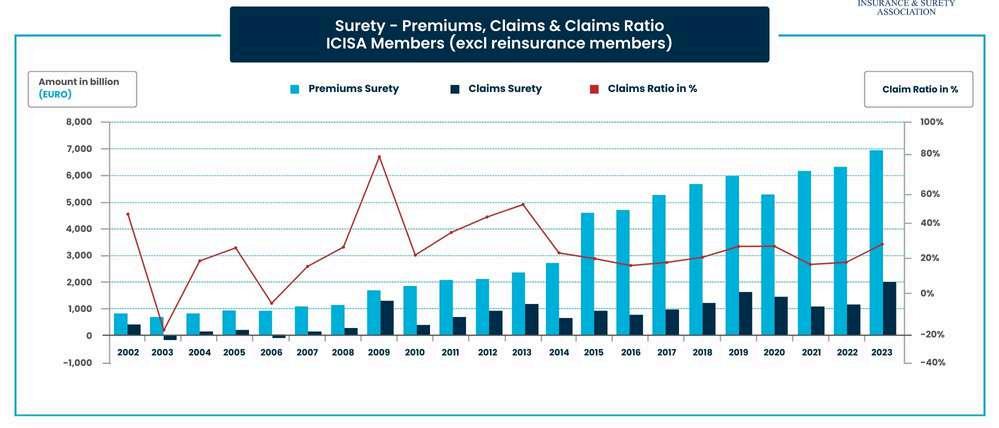

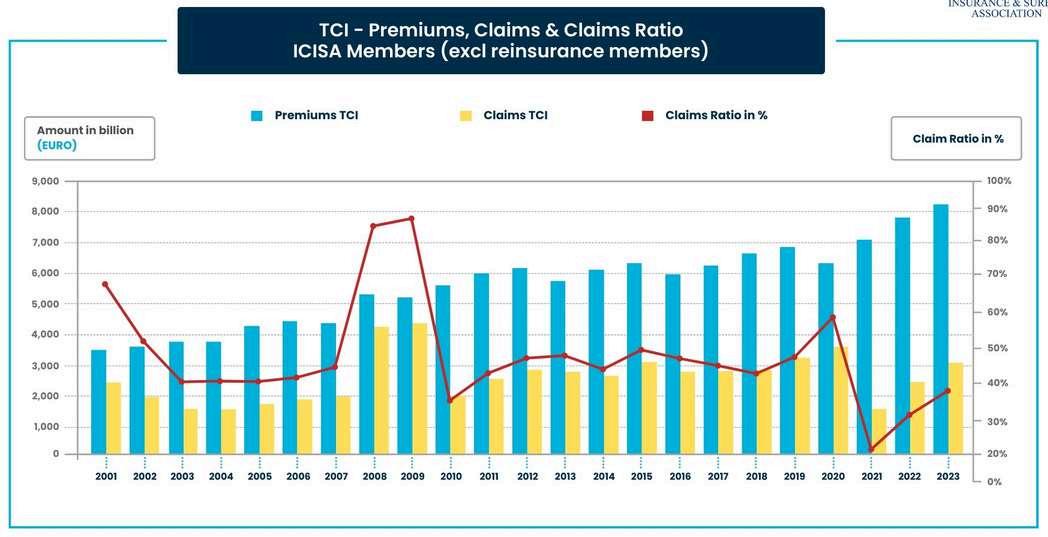

Deepdive: ICISA’s2023industry resultsexplained

TradeFinanceGlobaldivesintothereport’s findingsandfeaturesinsights,speaking exclusivelytoRichardWulff,ExecutiveDirector ofICISA.

heInternationalCreditInsurance &SuretyAssociation(ICISA)has releasedits2023industryresults, highlightingkeytrendsand developmentsinthetradecredit insuranceandsuretybond markets

ICISArepresents95%ofthe world’sprivatecreditinsurance business,withnearly€32trillion intradereceivablesinsured andbillionsininfrastructure guaranteed.

TradeFinanceGlobaldives intothereport’sfindingsand featuresinsights,speaking exclusivelytoRichardWulff, ExecutiveDirectorofICISA

ICISAplaysacrucialrole insupportingglobaltrade andeconomicdevelopment.

Bybringingtogether theworld’sleading creditinsuranceandsurety companies,ICISAensures theprotectionoftrade receivablesandguarantees constructionandservice projectsglobally.

Theassociationservesas asafeharbourfortrade andinvestment,providing securityandstabilityamid economicuncertainties.

RichardWulff

Keyfindingsfromthe 2023industryresults

The2023industryresultsreveal severalimportanttrends:

SuretyHighlights:

Insuredexposureincreased by7.7%,reaching€1.4trillion.

Premiumswrittenroseby 89%to€69billion

Claimspaidsurgedby 68.5%,totalling€2billion.

Theriseinpremiumswritten reflectsincreaseddemand forsuretybonds,which provideguaranteesforthe completionofconstruction andinfrastructureprojects. Thegrowthininsured exposureindicatesa broadermarketacceptance andrelianceonsurety productstomitigaterisks inthesesectors(ICISA).

TradeCreditInsurance Highlights:

Insuredexposuregrewby 45%,totalling€32trillion

Premiumswrittenincreased by5%,amountingto€8.2 billion.

Claimspaidroseby114%, reaching€32billion

Theincreaseintradecredit insuranceexposureand premiumshighlightsthe criticalroleofthese productsinprotecting businessesfromtheriskof non-payment,ensuring liquidityandfinancial stability(ICISA)

Suretybondsplayacritical roleinguaranteeingproject completionandprotecting againstcontractordefault.

Theincreaseinsuretyclaims paid,whichsurgedby685% to€2billion,highlightsthe difficulteconomicconditions contractorsandother principalsfacetoday.Equally, ithighlightsthevaluethat suretiesprovidetothe economybymitigatinglosses whendefaultsoccur

Similarly,thetradecredit insurancesectorhasseen substantialgrowthreflecting thedemandfrombusinesses forprotectioninuncertain times

Tradecreditinsuranceprotects businessesfromtheriskof buyernon-payment,ensuring thatsuppliersreceivepayment evenifthebuyerdefaults

Thisinsuranceiscrucialfor maintainingcashflowand

allowingbusinessestoextend morefavourablecreditterms totheircustomers.

Increasesinbothinsured exposureandclaimsforboth TCIandsuretymarketsclearly demonstratethechallenging economicenvironmentwe facewheredefaultsaremore frequent.Stronglycapitalised andstableTCIandsurety marketsareessentialfor economicresilienceinsuch periods(ICISA)

Impactof macroeconomicfactors

Theglobaleconomic landscape,markedbyhigh interestrates,risingcosts, theenergytransition,and geopoliticaltensions,has significantlyinfluencedthe tradecreditinsurance marketin2023

Wulffsaid,“Thereisnodoubt thattheriskawarenessof clientshasincreased.Therisk ofinsolvencyhasincreased notablyoverthepastcouple ofyears,leadingtoasteep increaseinbusinessfailures withintheOECDarea.Thishas manycausessuchasinterest rateincreasesandsupplychain disruptionsduetopolitical events(exportsfromUkraine, theIsrael-Hamasconflict impactingRedSearoutesetc) Thishasputthespotlight onourindustryandthe professionalisminunderwriting riskforthebenefitofitsclients.”

Technological innovationsintrade creditinsurance

Theriseof‘Insurtech’, includingAIanddigital platforms,hastransformed thetradecreditinsurance sectorbyimprovingrisk assessmentandoperational efficiency.

Wulffsaid,“Wesee theimpactonboththe product/distributionsideas wellasforinternalprocesses.

Initiativesofinsuring businesstransacted onB2Bplatformsfitinto thefirstcategory

IntegratingAIintounderwriting andclaimsprocessesfits intothesecond.Thesector willcontinuetodevelopinline withtheavailabilityofnew technologiestooptimizecover andspeedtoservecustomers inthebestpossibleway”

EnvironmentalandSocial Governance(ESG) initiatives

ICISAmembersareincreasingly integratingESGprinciplesinto theiroperations,reflecting agrowingawarenessof sustainabilityinfinancial services.

Wulffsaid,“Sustainability principlesareincorporated anddeeplyrootedintoour members’business From underwritingguidelines(which sectorstopromote,whichto avoid)toinvestmentpractices. Anditisnotsimplyamatter ofenvironmentalimpact ICISA membersareconsciousofthe needtomonitorhumanrights, governanceandsocialissues withinthevaluechainthey areinvolvedin.

Itisnottobeunderestimated thatactingresponsiblyalsohas animpactontheattractiveness ofoursectortonewtalent

Challengesinthe suretymarket

Thesuretymarketfaces challengessuchasregulatory hurdlesandmarketdemand fluctuations ICISAmembers areactivelyaddressingthese issuestomaintainmarket stability.

Onthecurrentchallenges facingthesuretymarket,Wulff said,“Theinflationarypressures thatwehaveseenhavehada majorimpactontheexpense baseofcontractors,amajor cohortofclientsofoursurety members.”Thishasimpacted thepricesofbuildingmaterials aswellaswagesandlabour availabilitygenerally

“Thishasweakenedmany contractors’balancesheets, makingthemmorevulnerable tonegativesituationswhere theycannolongerfulfilbonded contracts Ourmembers haveworkedtirelesslytofind solutionsthatarepalatable forthebeneficiaryofthebond (whowantsthecontracted workdone).

Onalonger-termhorizon, andespeciallyinEurope, amultitudeofregulatory, politicalandeconomicfactors limitopportunitiestostart newconstructionprojects Thisistothedetrimentofthe constructionsectoraswell astothepublicatlarge,for instanceforpeoplelookingfor anaffordableplacetolive.”

Futureoutlookfor tradecreditinsurance

Lookingahead,thetradecredit insurancemarketispoisedfor growth,drivenbyemerging marketsandtechnological advancements However, potentialrisksremain,requiring continuousinnovationand adaptation.

Wulffsaid,“Wearevery optimisticforthefuture. Ourmembershaveshown themselvestoberesilient andtobeabletoservetheir clientsinafast-changing environment.Riskswillremain andpopupfromtime-to-time, butthisiswhatwedobest.

Thisisourreasonforexistence –tomitigateriskandtohelp clientsrebuildafterloss events.”

ICISAhaslaunchedthe Women’sSuretyNetworkand theWomeninCreditInsurance initiatives,reflectinga commitmenttodiversity andinclusionintheindustry.

Theseprogrammesaimto supportandpromotewomen inthefield,fosteringamore inclusiveindustryenvironment

Howwillindustryinitiatives actuallyimpactgender diversity?Wulffsaid,“Attracting andretainingtalentto ourindustryisvitalforits developmentandtheability todelivermaximumvalueto customersandshareholders alike Uniformityintalentleads tosuboptimaloutcomes. Genderdiversityinitiativeslike WICIandWSNaddresspart ofthis Weseeourmembers hiringdiversetalent,andthese initiativessupportthem”

ICISAwelcomedthreenew members:Export-ImportBank ofThailand,Interamerican,and RenaissanceRe.

Theseadditionsstrengthen ICISA’snetworkandenhanceits capacitytosupportglobal tradeandinvestment:

Export-ImportBankof Thailand:Playsakeyrolein drivingThailand’stradeand investmentstrategies.

Interamerican:Aleading insurancecompanyin Greece,enrichingour networkwithexperienceof Greekandneighbouring suretymarkets

RenaissanceRe:Basedin Bermuda,addstothe expertisewithinICISAwith aninnovativefocusonrisk managementandfinancial solutions(ICISA)(ICISA)

Supportingthe globaleconomy

Despiteeconomicchallenges, ICISAmemberscontinueto provideessentialsupport totheglobaleconomy.

Theincreaseintradecredit insuranceexposureandsurety claimspaidreflectsthe industry’sresilienceandits criticalroleinmitigatingrisks,

ensuringliquidity,andfostering economicstability.

The2023ICISAindustryresults underscorethepivotalroleof creditinsuranceandsurety bondsinfacilitatingglobal trade

Astheindustrynavigates economicchallengesand embracestechnological innovations,ICISAmembers remaincommittedto supportingeconomic developmentworldwide.

RaviAmin

TradeComplianceSubject MatterExpert

S&PGlobalMarketIntelligence

DeepeshPatel

EditorialDirector

TradeFinanceGlobal(TFG)

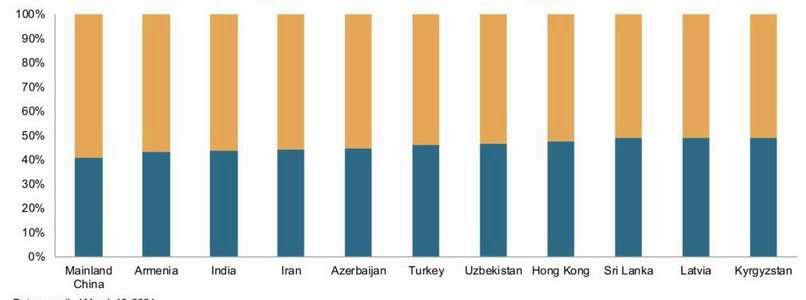

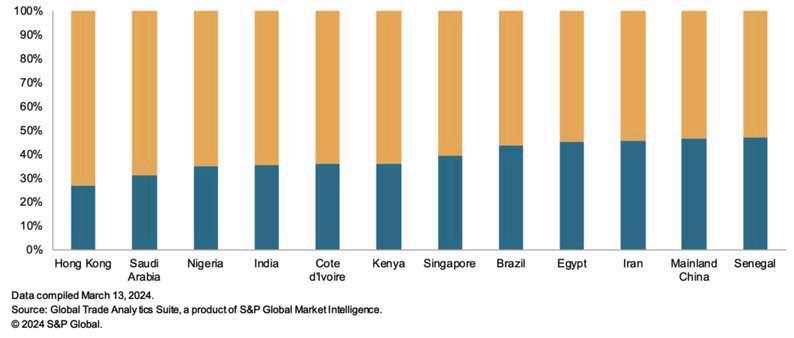

Navigatingsanctions: Theroleoftransshipment hubsinWestern-made componentstoRussia

TodiscussS&PGlobalMarketIntelligence’s whitepaper,“Aretransshipmenthubs facilitatingthemovementofWestern-made componentstoRussia?”TradeFinanceGlobal’s DeepeshPatelspokewithRaviAmin,Trade ComplianceSubjectMatterExpertatS&PGlobal MarketIntelligence.

Sanctionsandfrosty traderelationshavebeen aconsistentthemeof internationaltradeinthepast half-decade,butevenmore soaftertheRussianinvasion ofUkraineon24February 2022.

Sincethen,Western governmentshave attemptedtocurtaildirect andindirecttradewithRussia, bothtoimposeeconomic punishmentanddiminish Russia’sabilitytoproduce militaryequipment.

However,theworldof internationaltradeisoften quiteopaque,andwhile governmentscanintroduce sanctions,theireffectiveness isnotguaranteed

TodiscussS&PGlobalMarket Intelligence’swhitepaper, “Aretransshipmenthubs facilitatingthemovementof Western-madecomponentsto Russia?”TradeFinanceGlobal’s DeepeshPatelspokewithRavi Amin,TradeCompliance SubjectMatterExpert,atS&P GlobalMarketIntelligence.

Effectivenessandevasion ofsanctionsonRussia

Sinceearly2022,Western governmentshaveimposed numerousroundsofsanctions onRussianeconomicactivity.

AsofJune2024,theEUalone hasimplemented14roundsof sanctionsagainstRussiasince theirinvasionofUkraine

Aminsaid,“Theideaistorestrict Russia’seconomy,stopthem fromexportinggoodsand makingmoney,andthenstop theimportofgoodsintoRussia tostoptheperforationoftheir warefforts”

Initially,thefocuswason itemsdirectlysupporting Russia’smilitary,suchas semiconductorsandelectronics, buteventuallyexpandedto includecivilianluxurygoods.

Theitemsweredividedinto differenttiers,rangingfrom 1-4b,whichessentiallywasan augmentationof50HScodes HSCodes,“HarmonizedSystem codes”,arethesix-digit numbersusedinternationally toclassifygoodsforcustoms purposes

AdministeredbytheWorld CustomsOrganization(WCO), theycover98%ofgoodsin internationaltradeandover 5,000commodities.

CustomsauthoritiesuseHS codestoapplytariffsandtaxes togoodsandkeeptrackof importsandexports.

Despitetheseextensive measurestosanctionmaterials basedontheirHScodesand differenttiers,Russiahasbeen abletoworkaroundsomeof

Market Intelligence

Tier1:IntegratedCircuts,HSCode854231

Tier2:Wirelesscommunicationsandsatelliteradio navigation,HSCode851762

Tier3A:Discreteelectroniccomponents, HSCode850440

Tier3B:Bearings,opticalandnavigationequipment, HSCode848220andHSCode880730

Tier4A:Electronicmanufacturingequipment, HSCode9030andHSCode9030

Tier4B:Computernumericalcontrolmachinetools, HSCode84581

thesanctions,maintaininga relativelystabletradeprofile.

Aminsaid,“They’veredirected theirexportstocountriesinAsia andareimportinggoodsfrom neighbouringcountriesthat haven’timposedsanctions.

Overall,thetradeprofile isrelativelyconsistentpreinvasionversuspost-invasion; they’vejustuseddifferent countriestoacquireorsell thosegoods.”

Neighbouringcountries particularlythosewithin theCommonwealthof IndependentStates(CIS), suchasKazakhstan,Armenia, andUzbekistan have significantlyincreasedtheir tradewithRussia.

Thesecountriesarenotonly relyingongoodsfromthe UnitedStateseither,though asignificantamountofthe importsdostemfromthere

Countriesthathaveincreased tradewithRussiasincethe invasionhavealsobeen increasingtheirimportsfrom theEU

Aminsaid,“Russia’strading partnersarepotentially importingmaterialsfromother countriesaswellwithinEurope. ”

Thisunderscoresacritical challenge:whilesanctions disruptdirecttradechannels, theyoftenfailtoeliminate economicinteractionsentirely andmerelydisplacetradeflows tootherwillingpartners.

ThedatafromS&PGlobalMarketIntelligencecorroboratesthisadaptivebehaviour

Figure1:ExportstoRussia,2022vs.2023,%change($value)

DatacompiledMarch13,2024

Source:GlobalTradeAnalyticsSuite,aproductofS&PGlobalMarketIntelligence ©2024S&PGlobal

Figure2:ImportsfromRussia,2022vs.2023,%change($value)

DatacompiledMarch13,2024

Source:GlobalTradeAnalyticsSuite,aproductofS&PGlobalMarketIntelligence ©2024S&PGlobal

ItshowsthatcountrieswithoutsanctionsonRussiahaveseenincreasedimportsofgoodsthatcould berepurposedformilitaryuse.Thistrendisparticularlynotableintheelectronicsandmanufacturing sectors,wheregoodsinitiallyintendedforcivilianuseinintermediarycountriesaresubsequently funnelledintoRussia.

Roleoffinancial institutionsandthe supplychainin compliance

Theresponsibilityforenforcing sanctionsextendsbeyond governmentagencies,deeply involvingfinancialinstitutions andthebroadersupplychain

Aminsaid,“Therehasbeen alotoffocusonfinancial institutionsfrommultiple regulatorsaroundtheworldin thepast Primarily,theonushas onthemtostoptheflowof sanctionedgoods,andthey wouldhavehadtoadapttheir complianceproceduresto incorporateanychanges.” Thisinvolvesacomprehensive reviewoftradeembargoes, exportcontrols,andtracking goodsthatmayhavemilitary applications.

Forinstance,banksmust performenhanceddue diligenceifatradetransaction involvesacountryidentifiedas atrans-shipmenthubfor Russiangoods.

Aminsaid,“Ifthereisatrade thatisgoingfrom,say,theUS to,say,Kazakhstan,for example,younowknowthat thereiselevatedriskbasedon theproximityofKazakhstanto Russia,basedonthedatathat we’vejustshown.Eventhough Kazakhstanisnotasanctioned country,whyisthatcompany nowwantingtotradewith Kazakhstanwherepreviously theymightnothave?Doesthe trademakeeconomicsense?”

UnderUSAExecutiveOrder14114, thescopeofthesesanctions

isnolongerlimitedtofinancial institutionsintheUnitedStates. Theorder,signedbyUS PresidentJoeBidenin December2023,expandsthe abilitytoimposesanctionson foreignfinancialinstitutions engagingintransactions involvingRussia’smilitaryindustrialbase.

Whiletheburdenhas traditionallysatwithfinancial institutions,entitiesacrossthe entiresupplychainnowhave anincreasingroletoplayin maintainingcompliance.

TheUSAhasalsoimposeda Quint-SealNotice,which mandatesthatallparties involvedinthetradeprocess fromfinancierstoshippers mustensurethatthegoods beingtradeddonotcontravene internationalsanctions.

Aminsaid,“It’snolongerjust thefinancialinstitutionthat’s responsible,it’severybody”

Futureprojections andstrictersanctions

Lookingahead,thelandscape ofsanctionsagainstRussiais poisedtobecomeevenmore stringent

Aminsaid,“Aslongasthe conflictcontinues,sanctions willcontinue Whatwillend uphappeningisthey’llstart targetingnewsectorsofthe Russianeconomy They’ve alreadydoneagriculturetoa degree,sanctioningfertilisers, timber,andthelike They’ve alreadytargetedtransport They’vealreadytargeted defence They’llfindnewways, newitemstosanctionRussia withuntiltheconflictends”

Inearly2024,theUnitedStates announcedanewroundof over500sanctions,targeting cardpaymentsystems,military institutionsandfinancial institutions Afterthisround, theUnitedStateshas sanctionedover4,000entities connectedwithRussiasince thestartoftheinvasion.

Additionally,the14thround ofsanctionsbytheEUtargets sectorslikeliquefiednatural gas(LNG)andimposesstricter controlsonvesselshistorically linkedtoRussianports.

Theinternationalcommunity remainssteadfastinitsefforts tocurtailRussia’seconomic andmilitarycapabilities throughincreasingly sophisticatedandtargeted measures.

Whilethesemeasureshave undoubtedlydisrupteddirect tradechannels,Russia’s strategicredirectionoftrade highlightsthechallengesof enforcingacomprehensive sanctionsregime.Assanctions becomemorestringent andexpansive,theneedfor coordinatedeffortsacross alllevelsoftradeandfinance becomesparamount.

Consultant

AlexGray

PeterMilne DirectorofTradeand

TransactionBanking

LondonInstituteofBanking andFinance(LIBF)

TheICCestimatesthatifeven1%ofthe$5 trillionglobaltradefinancingmarketis susceptibletofraud–andassumingonly10%of thosetransactionswillleadtolosses–thisstill meanstherewillbeanestimatedannualcost ofaround$5billionintotalbusinessdisruption.

Internationaltrademakes theworldgoround

Theextremevastnessofthis industryispreciselywhat makesitsofascinatingand, atthesametime,sorisky Itis easytoseehowvariousrisks canarisealongthe internationaltradeprocess. Rangingfromphysical commoditytradingtoshipping, storage,distribution,andthe finalsale,theprocesscango wronginmanyways

AccordingtoaPWCstudy across53countries,over51% ofcompanieshaveexperienced somesortoffraud

TheICCestimatesthatifeven 1%ofthe$5trillionglobaltrade financingmarketissusceptible tofraud–andassumingonly 10%ofthosetransactionswill leadtolosses–thisstillmeans therewillbeanestimatedan annualcostofaround$5billion intotalbusinessdisruption

Thatiswhyunderstandingrisk and,moreimportantly,learning tomitigatethatriskaresomeof themostimportantaspectsof workingininternationaltrade.

Tolearnmoreaboutrisks andriskmanagement,Trade FinanceGlobal(TFG)spoke withPeterMilneandAlexGray, DirectorofTradeand TransactionBankingatthe LondonInstituteofBanking andFinance(LIBF).

Internationaltradebrings manyinherentrisks

Theindustry’scomplexity meansrisksarealwayslurking aroundthecorner Eachstep intheintricatetradeprocess–fromphysicalcommodity tradingtoshipping,storage, distribution,andthefinalsale–holdspotentialpitfallsthatcan jeopardisetransactions.

Understandingtheserisks andhavingplansinplace toaddressthemshould theyarise,canmakealarge difference.

Graysaid,“COVID-19 differentiatedbanksthat werepreparedforcertain risksfromthosethatweren’t Thebanksthathadthose continuousemergency plansinplacewereable toadaptquickly. ”

Traditionalrisks,such ascreditrisk(where acounterpartydefaultson payment),performancerisk (whereacounterpartyfails tofulfilitscontractual obligations),and sovereignrisk(involving acountry’spoliticaland economicinstability),remain ever-presentdangers,but newerrisksarealsoemerging.

Contemporaryissueslikecyber riskhavegainedprominence intheindustry Cybersecurity breachescancompromise sensitivetradedataand disruptoperations,posing severethreatstoallparties involved

Additionally,theincreasing emphasisonESGfactors introducesnewdimensions ofriskthatmustbe navigatedcarefully.

Graysaid,“Morepeople–even thosenotintheindustry–are becomingmoreawareofthose risksthantheywouldhave beeninthepast.It’sbecoming alotclearerthattherisksin tradeaffectpeopleeveryday”

Giventheindustry’sevolving risknature,theLIBFhas releaseditslatestcertification, theCertificateinInternational TradeRisk(CITR).

TheCITRfortrade financeprofessionals

TheCITRisaLevel4certificate designedtoequiplearners withspecialistexpertisein internationaltraderisk.

Theprogramoffersa comprehensiveframeworkfor professionalsseekingtomaster theintricaciesoftraderisk managementandequips participantswiththeskills toidentify,understand,and mitigatetheseriskseffectively

TheCITRprogramcoversboth traditionalandcontemporary risksandistailoredtomeetthe needsofprofessionalsat differentstagesoftheircareers

Graysaid,“Theaudience,for mostofourqualifications,is splitintotwogroups.There arethepeoplewhohavethe knowledgealreadyandneed

awaytodisplayit,andthere arethepeoplewhowant tolearnaboutit”

Forthosefamiliarwithtrade risk,theCITRformallyrecognises theirexpertise,enhancingtheir credentialsanddemonstrating theirproficiencytoemployers andpeers Fornewcomers,it providesasolidfoundation, equippingthemwiththetools andunderstandingneededto dealwithtraderisks.

Notably,theCITRprogram focusesonpractical applications,emphasising real-worldscenariosand casestudies,andallowing participantstoapplytheoretical conceptstoactualtrade situations

Thispracticalemphasisensures thattheknowledgegainedis comprehensiveanddirectly applicabletoday-to-day professionalactivities.

Adaptabilityand internationalscope oftheCITRprogram

Theriskspresentin internationaltradearealways changing,whichmeansthat astrongtraderiskeducation offeringmustbeableto changejustasfast

Technologicaladvancements likeblockchainandartificial intelligence(AI)are transformingtradefinanceand introducingnewrisksthatmust bemanaged

TheCITRprogramisdesigned tokeeppacewiththese developments,incorporating thelatesttrendsandemerging risksacrossarangeofglobal marketsthroughitsupdatable onlinedeliveryformat.

Milnesaid,“Thebeauty aboutthisprogramisthatit isbrokendownintosections andmodules,andtheycan beadapted,ornewmodules includedsothatthosecoming todothequalificationwillbe gettingthelatestinputonwhat thecurrenttrendsare. ”

Developedwithcontributions fromexpertsworldwide,the CITRprogramoffersaglobal perspectiveontraderisk, allowingittoreflectthe latestchangesandregional differences,makingit applicabletoprofessionals

operatinginvariousmarkets

Itsholisticapproach,practical emphasis,andadaptability makeitaninvaluableresource forthoseseekingtobetter understandandmanagethe risksassociatedwith internationaltradefinance

TheCITRcoursewillbeavailabletostudy from24June2024.Ifthissoundslikethe certificationyouhavebeenlookingfor, youcanlearnmoreaboutithere:

TradeFinanceGlobal(TFG)

TL;DR:FCIannualreport highlightsstablegrowth andtechinnovationin2023

Thereportshowsaglobalfactoringgrowth of3.6%,markingthethirdconsecutiveyear ofexpansion.

BrianCanup

AssistantEditor

TradeFinanceGlobal(TFG)

TheFCIAnnualReviewfor 2023confirmsareturnto pre-pandemicstabilityin theglobalfactoringmarket.

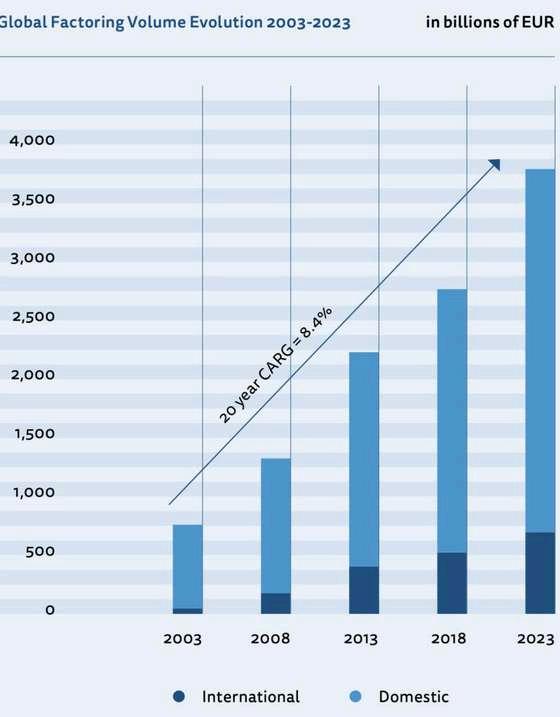

Thereportshowsaglobal growthof36%,markingthe thirdconsecutiveyear ofexpansion.

NealHarm,FCISecretary General,said,“Aswas predictedinlastyear’sreport, 2023volumesslowedfrom thepriortwoyears However, theworldfactoringstatistics indicatethatthe2023volumes infactoringandreceivables

financewitnesseda continuedgrowthtrajectory, increasingby+3.6%,which comesofftheheelsoftwo consecutivesolidgrowth yearsin2021-2022”

Thisgrowthisbasedon anestimatedvolumeof €3,791billion,upfrom €3,659billionin2022.

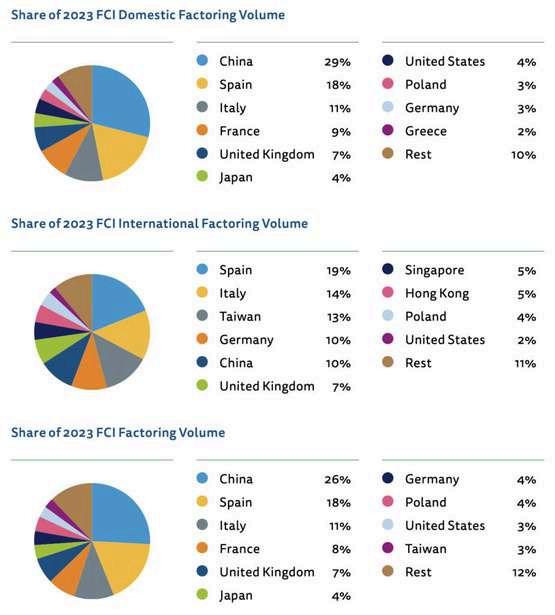

Domesticfactoring continuestodominate, comprising78%ofthetotal volume,whileinternational factoringaccountsfor theremaining22%.

Globalfactoringvolumeevolution2003-2023 Source:FCIAnnualReview2024

HongKong’smarketshrank byover20%,whileJapan experiencedmodestgrowth andTaiwansawa14%decline.

Thisrepresentsasignificant dropintheTwo-Factor Systeminternational factoring,whichdecreased from€58billionin2022to €51billionin2023

AlbertoWyderka,FCIRegional DirectorfortheAmericas,said, “Challengesareaconstant, muchlikepoliticalchanges anduncertainties.However, theoutlookfortheaccounts receivablefinancingindustry remainspositiveand promising.”

TheEuropeanUnion sawmodestgrowthof2%, reachingatotalturnover of€2,443billion

Theregionremainsthe largestfactoringmarket globally,representing66% oftheworldmarket.

DespitetheEUGDPdropping to04%from35%in2022,the penetrationrateoffactoring overEuropeanGDPwas stableat12%.

“TheECB’sseverepolicyto curbinflationledtorapid increasesinlendingrates, coupledwithconflicts betweenRussiaandUkraine andIsraelandPalestine

TheAsia-Pacificregion remainsasignificantdriverof growth.Chinaledwitha10% increaseinfactoringvolume, demonstratingresilience despiteeconomicchallenges

North-EastAsiasawanoverall growthof7%,withmainland Chinacontributing81%ofthe region’smarket.However, AsiaPacific

IntheAmericas,thefactoring volumegrewby4.3%inSouth andCentralAmerica,while NorthAmericasawa107% decline

Thetotaldomesticfactoring volumeintheregionreached €222billion,withinternational factoringexceeding€11billion.

Despitethis,theEuropean factoringmarketremains themostimportantglobally, representing66%ofthe worldmarket”said FaustoGalmarini, ChairofEUF

FCIFactoringVolumes.Source:FCIAnnualReport2024

MiddleEastandAfrica

TheMiddleEastshowed growthdrivenbyfavourable commoditypricesand diversificationintonewsectors

Theregion’sfactoringmarket isexpectedtogrowby2.3%in 2024.Africa,representing1.3% oftheglobalfactoringvolume, sawasignificantgrowthrate of13.5%in2023

SouthAfrica,thelargestmarket onthecontinent,witnessed a14%increaseinvolume. SouthAfrica,thelargestmarket accountingforover80%ofthe

entirevolumeonthecontinent, witnessedanincreaseof14%. Countriesthatledthisgrowth includedMauritius,Egypt, Tunisia,andothersfor158%

“ThisindicatesthattheAfrican marketcontinuesitsstrong growthtrajectoryintothe foreseeablefuture”said NassourouAminou,FCI RegionalManagerforAfrica

TheFCIhasalsoevolvedasan association,growingfromover 100members20yearsago tonearly400today.

Technology,education andpartnershipdrive globalfactoringadoption

Thisgrowthisdrivenbya significantincreasein membershipfromemerging markets,whichnowaccount forover70%ofnewmembers.

In2023,FCIadded31 newmembers,while26 membershipswereterminated Thistrendhighlightsthe growingglobalinterestin factoringandthevalue providedbyFCI

Technologicaladvancements haveplayedacrucialrole inFCI’sevolution.

Thelaunchoftheedifactoring 2.0platformin2022represents asignificantinvestmentin technology FCIhasalso implementedaninternally controlledbookkeepingsystem andanautomatedinvoice approvalsystem,enhancing operationalefficiencyand financialcontrol.

Buttechnologyisonly oneaspectofFCI’sholistic approach Educational initiativeshavebeenafocusfor FCI,withvariousprogrammes aimedatenhancingindustry knowledgeandskills

Craftinganeffectiveeducation programmetakestime, resources,andpartnershipsto properlyeducateregionsabout thepotentialoffactoring.Thisis whytheAfricanDevelopment Bank(AfDB)special-purpose grantisvitalinthisprocess

Thegranthelpsprovide consultancyservicestohelp supportnewandexisting

factoringfirmsacrossAfrica, creatingsustainaiblegrowth fortheindustrythroughout thecontinent.

“Weworktowardspromoting andeducatingpeopleon factoringandsupplychain finance.Ourcollaborations bringtogetherindustryleaders, banks,financialinstitutions, legalprofessionals,factoring companies,andgovernments tocoverawiderangeoftopics” emphasisedÇagatayBaydar, FCIChairman.

However,forfactoringtobe increasinglysuccessful,there needstoberiskmitigation beforewidespreadadoption

Thisiswhycreditinsurance playedavitalroleinmitigating riskswithinthefactoring industryin2023.Itprovided additionalsecurityforfactors, especiallyinvolatilemarkets, ensuringstabilityand confidence

Thefutureoffactoring

Lookingahead,FCIisoptimistic aboutthefutureofthefactoring industry.Withcontinuousgrowth inmembership,technological advancements,andeducational initiatives,theassociationis well-positionedtosupport theglobalfactoringmarket

Thefocusremainsonproviding valuetomembersthrough advocacy,education,and arobustglobalnetwork.

“Wearepoisedtoleadthe factoringindustryintoanew eraofgrowthandinnovation” , saidHarm

DOWNLOAD THE REPORT HERE

MembersthatuseCreditInsurance CoverageforBuyers2023

DeepeshPatel

EditorialDirector

TradeFinanceGlobal(TFG)

TheBaselEndgame: ImplicationsforUScredit insurance 2.7

UnderstandingtheimpactofBaselIIIonbanks: learnabouttheglobalregulatoryshiftand increasedcapitalrequirements.

TheBaselIIIproposalssignifya globalregulatoryshiftforbanks, focusingonincreasedcapital requirementsandrefinedrisk weightcalculations

IntheUS,thisimplementationis calledthe‘Baselendgame,’ whiletheUKreferstoitasBasel 3.1andtheEUcallsitFinalised BaselIII.

Thistermhasdrawnsignificant attentionfromUSfederal bankingagenciesundera ‘NoticeofProposedRulemaking’ (NPR).

Theregulatorshaveinvited publiccomments,andthe creditinsuranceindustryhas engagedactivelytoadvocate formeaningfulRisk-Weighted Assets(RWA)relief.

TradeFinanceGlobal(TFG) spoketoindustryleadersSian Aspinall,MarilynBlattner-Hoyle, TodBurwell,NealHarm,Scott Ettien,TomaschKubiak,Azi Larsen,HarpreetMann,Jean Maurice-Elkouby,HernanMayol, MarcusMiller,RichardWulff,

lookingattheimplicationsof BaselIIIimplementationinthe US,andwhatthismeansfor thetradefinanceandcredit insurancesector

Thehistorycontext ofBaselregulations

TheBaselCommitteeon BankingSupervisionestablished Baselregulationsinresponse tofinancialturmoilinthe late1970s.

BaselI(1988)focusedoncredit risk,BaselII(2004)included operationalandmarketrisks, andBaselIII(post-2008crisis) aimedtostrengthenbank capitalrequirementsand improveriskmanagement

The2008financialcrisis revealedsignificant shortcomingsinBaselII,leading toBaselIII,whichintroduced morestringentcapital requirements,newriskweight calculations,andarevised leverageratioframework

BaselIII’snuanced implementation

EachmarkettailorstheBaselIII implementationtoitsspecific regulatoryenvironment. TheUScallsitthe‘Basel endgame,’theUKreferstoit asBasel31,andtheEUcalls itFinalisedBaselIII

Implementationhasbeen pushedbackto1January2025 fortheEU,and1July2025for theUKandUS.Canadaand Australiahavealreadyadopted BaselIII

TheBaselendgamefocuses onincreasingcapitalagainst credit,market,andoperational risks,significantlyimpacting lendingcostsandavailability.

WhiletheStandardised approachdoesnotallow modelling,AdvancedInternal Ratings-Based(A-IRB)banks previouslymodelled probabilitiesandlossgiven defaults(LGDs)

BaselIIIremovesthisflexibility bysettinginputfloors(LGDsat 40%forcorporatesand45%for financialinstitutions)and anoutputfloor(capital requirementscannotbeless than725%oftheStandardised equivalent)

BaselIII–ThecurrentUSvsEUregulatorycomparisons(likeforlike)

Aspect

CapitalRequirements

RiskWeightCalculations

CreditConversionFactors

RecognitionofCreditInsurance

LeverageRatio

Keyregulatorychanges andwhatthismeans fortheUS

TheBaselIIIendgameincreases capitalrequirementsagainst credit,market,andoperational risksintheUS

Itintroducesadualstructure forthecalculationof Risk-WeightedAssets(RWAs) forbankingorganisationswith totalassetsof$100billionor more,includingthelegacy standardisedapproachand anewexpandedrisk-based approach.

UnliketheEUandUK,theUS approachtorecognising creditinsuranceforcreditrisk mitigationhasledtovarying interpretationsandoversight

Creditinsurancecanmeet theoperationalrequirements setoutinRegulationQfor eligibleguarantees

USregulations (Baselendgame)

Higher,strictleverageratios

Stringent,detailed standardisedapproach

50%forperformance guarantees,higher

Limitedrecognition, non-favourabletreatment

Non-risk-based,actsasa backstop

However,thevaguenessof RegulationQhasresultedin differentinterpretationsby banksandinsurers,leadingto variedpracticesinthemarket

Thisambiguityhasbeena focalpointinadvocacyefforts, emphasisingtheneedfor clearerpolicyguidelinesto ensurecreditinsuranceis appropriatelyrecognisedand utilisedasariskmitigationtool

Industryreaction

Industryreactionsare variedUSbanksarguethat increasedcapitalrequirements areimpactingtheir competitivenesscomparedto EUbanks,asitcoststhemmore, whichisnottheintentofBasel.

Insurersseethisasan opportunitytoprovidegreater supporttoUSbanks,similarto whattheyofferintheUKandEU, helpingtodiversifycarriers’ portfolios

EUregulations(BaselIII)

Moreflexible,lowercapital charges

Moreflexible,lessstringent

20%forperformance guarantees,lower

Recognisedasa riskmitigationtool

Flexible,notbinding

Thereiscurrentlyalackof clearrecognitionofcredit insuranceforcreditrisk mitigationintheUS,partly becausemostinsurance companiesprovidingcredit insurancedonotqualifyas eligibleguarantors

Thiscouldpresentan opportunityforUSregulators toleveltheplayingfieldby recognisingcreditinsurance, potentiallyencouraging itsgreateruseasarisk mitigationtool.

Advocacyeffortshave highlightedhowcredit insuranceworks,thetransfer ofriskfrombankstoinsurers, andthebenefitsofspreading riskacrossinsurersand reinsurers

Thisdiversificationofriskis akeyadvantage,providing amorestableandresilient financialsystem

Manyhaveassociations advocatedUSregulators throughassociationslike BAFT(BankersAssociation forFinanceandTrade),the InternationalTrade& ForfaitingAssociation(ITFA), InternationalAssociationof CreditPortfolioManagers (IACPM),andReinsurance AssociationofAmerica(RAA).

MarshMcLennancompanies (MMC),includingMarsh, OliverWyman,andGuy Carpenter,havealso independentlyadvocated forregulatorychanges.

Theybelievecreditinsurance shouldqualifyasaneligible guaranteeandinsurance companiesaseligible guarantors.MMCisseeking clarificationsthatwouldallow insurancecompanieswithout debtsecuritiestoqualify basedontheirparent companies’status

Additionally,theyrequest confirmationthatcredit insurancepoliciesbe classifiedascorporate exposureswitha65%risk weight,insteadofthecurrent 100%

BAFT(BankersAssociation forFinanceandTrade)has raisedconcernsabout increasedcapital requirementsdrivingupthe costoftradefinanceand reducingitsavailability.

Theyarguethattheproposed 50%creditconversionfactor forperformanceguarantees andstandbylettersofcredit overestimatestherisk comparedtotheEU’s20%, disadvantagingUSbanks.

TheInternationalChamber ofCommerce(ICC)hasalso advocatedforthe20%CCFin theEU,supportedbydata fromtheICC-GCD2022study, whichshowedevenlowerCCF requirementsforperformance guarantees

Theproposedguidelinesunder theBaselIIIendgamesuggest a50%CreditConversion Factor(CCF)forperformance guaranteesandstandbyletters ofcredit(SBLCs),whileindustry associationsareadvocatingfor areductionto20%,aligningwith EUstandards.

Theguidelinesalsopropose alowerriskweightof20%for trade-relatedexposureswith maturitiesofthreemonths orless,comparedto recommendationsinother jurisdictionsfortenorsof sixmonthsorless.

AssociationslikeITFAandIACPM areadvocatingforinsurance companiestobetreatedas banks,potentiallyattracting lowerriskweightsforselfliquidatingtradefinance instruments

RichardWulff,Executive DirectorofICISAsaid,“Ata timeofeconomicdifficulty, unlockingbankfinancingto therealeconomyisan importantpolicyquestion governmentsmustaddress Recognisingtheprotection thathighly-capitalisedand well-regulatedinsurersdeliver tobanksforpreciselythis purposecouldbeaneasywin, benefitingbusinessesaround theworldinthelongrun”

MarilynBlattner-Hoyle,Global HeadofTradeFinance,Trade Credit&WorkingCapital SolutionsatSwissRe CorporateSolutions,and ViceChairoftheICCBanking Commission,said, “USregulatorshaveawin-win opportunityheretofurther theBaselfinancialstability aimswithaprovenecosystem –theinsuranceandbank partnershipinthecredit space Thisecosystemhas thepotentialtocreatetrade andhelpcompanies Weare convincedthattheinsurance industrywillcontinueto beasafeanddiversifying riskpartner”

Theyarguethattherulesfail toacknowledgethevaluable protectioncreditinsurance providestobanksinreducing anddiversifyingtheircreditrisk

Thesilenceonthissubjectin theBaselstandardsisinpart duetothisrelationshipbetween banksandinsurersdeveloping asmarketpracticeinthe periodsincethestandards firstemerged

IntheEUandUKregulators arealsoexaminingtheuse ofcreditinsuranceinthisway andassessinghowbestto incorporateeligibilityofthis kindofprotectioninthe versionsoftheBaselstandards

Thiswouldincludeboththe criteriaforutilisingcredit insuranceinthisway,aswell askeymetricssuchasthe loss-givendefaulttoapply toaninsurancepolicyused inthisway

AssumingtheEUandUK adoptanapproachthat enablesbankstocontinue

tobenefitfromcreditinsurance post-Baselimplementation, theUScouldmissoutbynot adoptingasimilarapproach.

Infact,astheproductisnot aswellestablishedonthatside oftheAtlantic,thereishuge potentialforbankstobegin usingcreditinsuranceand otherunfundedcreditrisk transfersolutionstoboost bankfinancingbygivingproper recognitionintheregulation

Thecreditinsurancemarket providesvariouscreditrisk transferproductstailoredto differentassetclasses, allmeetingregulatory eligibilitycriteria

KeyproductsincludeNonPaymentInsurance(NPI)for lendingbooks,TradeCredit Insurance(TCI)forreceivables andsupplychainfinance,and SuretyMasterRiskParticipation Agreements(MRPAs)for unfundedguaranteebusiness

TheITFA-IACPMwhitepaper providesacomprehensive analysisofcreditinsurance asariskmitigationtool

Creditinsuranceprotects policyholdersfrom non-paymentordelayed paymentbydebtors,dueto individualfinancialissuesor externaleventslikepolitical incidents,catastrophes,or macroeconomicproblems.

Historically,creditinsurance wasnotexplicitlyrecognised asacreditriskmitigantin Baselregulations

However,Article506, introducedinOctober2022, marksabreakthroughby recognisingitasadistinct riskmitigantintheEU.

TheUKhadalreadytaken similarstepswithapolicy statementin2018,explicitly recognisingtheroleof creditinsurance.

Creditinsuranceas ariskmitigationtool

Theprivatecreditinsurance markethasgrownsignificantly overthepast20years,with around60insurersholding investment-graderatings

Banksusecreditinsuranceas aportfoliomanagementtool, withoverahundredbillion dollarsofcoverageglobally.

A2020surveybyITFAand IACPMfoundthat$135billion ofcreditinsurancecoverage facilitated$346billionin loanstotherealeconomy.

Forexample,thewhitepaper notesthatcreditinsurancecan significantlyreducebanks’risk exposure,allowingthemto lendmoreconfidentlyand atlowerrates

Thisisparticularlyimportantin sectorswithhigherdefaultrisks, wheretraditionallendingmight beprohibitivelyexpensive Thepaperincludesdata demonstratingthereliability ofcreditinsurancepolicies.

Between2007and2020, 9773%ofthevalueofallclaims waspaidinfull,showingthe robustnessofthesepolicies evenduringfinancialcrises Onewhitepaperanecdote illustratestheseregulatory differences’practicalimpact.

AmajorUSbank,unableto leveragecreditinsurancedue toregulatoryrestrictions, facedhighercapitalcharges andreducedlendingcapacity. Incontrast,aEuropean competitor,benefitingfrom moreflexibleregulations, managedtosecurea significanttradefinancedeal byusingcreditinsuranceto mitigateriskandlowercosts.

InalettertothethreeUSfederal bankingagencieson16January 2024,HernanMayol,Board Member,ITFA,andSom-lok Leung,ExecutiveDirector, IACPMsaid,“Theproposed implementationoftheBasel Accordsshouldrecognisethe suitabilityofcreditinsurance asaneligibleriskmitigant underthecapitalrules This willnotonlyadvancethegoals oftheBaselAccords,butalso placeUSbanksonequal footingwithnon-USbanks. ”

Comparativeanalysis: USvsNon-USbanks

Theregulatorydifferences betweenUSandnon-US banksunderBaselIIIcreate competitivedynamics

TheCollinsAmendmentlimits USbanks’abilitytogaincapital reliefcomparedtonon-US banks.EUbanksbenefitfrom moreflexiblerisk-weighting rulesandleverageratios TheTargetedReviewofInternal Models(TRIM)intheEUadds capitaladd-onsforEuropean banks,mitigatingtheBaselIII endgame’simpact.

IntheUS,theFederalReserve’s assessmentsandstresstests serveasequivalents,but withoutsimilaradd-ons, USbanksfacestricter requirements.

Differencesinregulatory frameworksbetweenthe USandEUmayintroduce opportunitiesforregulatory arbitrage,benefitingbanksthat navigatethesediscrepancies.

TheBaselIIIendgamepresents anopportunityfortheUStrade financeandcreditinsurance sector

Advocacyeffortshave focusedoneducationaround howcreditinsurancebenefits realeconomicgrowthand tradefinance

Allgoingwell,thetransferof suchriskfrombankstoinsurers andreinsurersequatesto$250 billion,accordingtotheIACPM andITFA,potentiallyoccurring withinthefirstthreeyears

Thishigh-caliber,low-losslevelbusinesscouldenhance thestabilityofinsurers’ portfolios.

However,addressingissues suchasthenuclearexclusion clause,whichtypicallyexcludes coverageforlossesdueto nuclearincidents,remains achallenge.

Whilesomeflexibilityhas beenachieved,insurers’ currentcapacitytofully waivethisclauseislimited, potentiallyhinderingthefull implementationofRWArelief.

NeilShonhard

ChiefExecutiveOfficer MonetaGo

SeanBowey

HeadofProduct,GlobalTrade andReceivablesFinance SAB

BrianCanup

AssistantEditor TradeFinanceGlobal(TFG)

TheMiddleEastisembarkingonadigital transformation,withpioneeringdevelopments inSaudiArabiaacrossbanking,supplychain financing,andriskmitigation.Regulationand private-publicpartnershipsmustkeeppaceas thesechangesaccelerate.

Theglobaleconomyhas alwaysundergonechanges Fromtheagrarian-based economyinthe18thcentury totheadventoftheIndustrial Revolution,fromsailboatsto steamships,therehasalways beenashiftineconomy, industry,and,ultimatelythe dynamicsofacountry

In2024,weareinthemidst ofyetanothertransformative eraaswetransitionthe internationaltradeindustry toamoredigitalstate.

Todiscusssomeofthedigital developmentoccurringinSaudi Arabia,TFG’sBrianCanup(BC) spokewith:

SeanBowey(SB),Headof Product,GlobalTradeand ReceivablesFinance,SAB

NeilShonhard(NS),Chief ExecutiveOfficer,MonetaGo

BC:Tostart,couldyougiveus yourbroadperspectiveonthe mainareastofocusonto promotecontinuedgrowth acrosstheMiddleEast?

SB:Startingwiththebigpicture, SaudiArabia’sVision2030is concentratedonthegrowth ofthenon-oileconomy.

Coupledwiththat,there'sa significantpushtowards becomingafullydigital bankingenvironment.Thisis crucialbecausearobustdigital publicinfrastructure,paired withayoung,technologically adeptpopulation,beginsto removemuchofthefriction traditionallyassociatedwith trade.

Thereisalsogrowing entrepreneurship,whichis supportedbyenhancingSME growththroughvarious governmentschemesand funds,suchasguarantee schemes,butalsobycreating adigitalpublicinfrastructure thatsimplifiesovercoming traditionalchallengesinthis space

Thedigitalidentityandthe infrastructuretosupportitare verystrong.We’realsoseeing astrengtheninginfrastructure tosupportinvoicevalidation, whichisn'tjustforitsownsake

Thissetupallowsus,asbanks, toinjectmoreliquidityintothe spacebecausethetraditional roadblocksareremoved KYC becomesaloteasieraswe getfeedsdirectlyfrom thegovernment’sdigital infrastructure

Thefraudriskintermsoftrade andinvoicefinancingisalso reducedbecausewecantap intothird-partyvalidation throughtrustedplatforms, suchasVATtaxplatforms andinvoicefinancevalidation throughplatforms.

These,Ithink,areoften overlookedfactorsinterms ofeconomicgrowth,butyou havetocreatethatunderlying infrastructure,thoseunderlying conditionsforthatgrowthto happen.

BC:Movingtotechnology, howdotechproviderslike MonetaGoslotinand supportremovingrisk?

NS:FocusingonSaudiArabia here,weknowthatjust5%of lendinginKSAistotheSME sector Thatneedstobe drasticallyimproved Froma MonetaGoperspective,having toolslikeourscanhelpcreate safer,moretrustedfinancing ecosystems,whichiswhat SaudiArabiaisafter.

Withinnovativesolutions,banks canhaveincreasedconfidence inextendingtheirbooksof business,whichiskeyto increasingtradegrowth.Crossborderinteroperabilitywithinthe GCCisalsokey,bothforSaudi Arabiaandthewiderregion

We’reengagedinexpanding ourinteroperableandscalable solutionthroughtheGCC.

Manyofthebanksthat we’vespokentointheregion haveremitstoextendtheir supplychainfinancebooks Havingtheabilityto validatetransactiondatain SaudiArabiaisobviouslykey, buthavinginteroperability acrosscountriesorregionally isalsokey

BC:Sean,couldyouexpandon themarketforsupplychain financeandhowit's developingintheregion?

SB:It'sstillarelativelynascent marketforthisformoffinance It'sexperiencedgrowthstarting intheUS,withAsiaandEurope followingsuit.However,this marketisstillrelatively immaturefromaproduct perspectiveandfrom corporateacceptanceof theproduct,althoughitis developingquicklyandthere's interestintheproduct.

Itisalsoaneasiermeansfor thebankstodemonstratethat they'resupportingtheSME sector This,ofcourse,isthe easiestwaytodoitbecause you 'retakingthatcorporate balancesheetandthat

corporateriskandusingthat toinjectliquidityintotheSME sector

BC:Whatarethechallenges withexpandingfurtherintothe SMEworkingcapitalcycle?

SB:TherealtrickforSABishow dowegetfurtherintothe workingcapitalcycleofthe SME?Obviously,traditional payablesfinanceisonlyafter theacceptanceoftheinvoice.

Wewanttobeabletofinda waytosupportthepreacceptance,thepre-shipment, andthebuildphaseofthe workingcapitalcycleforthose SMEs,whichiswherethey reallyneedthatadditional support.

Whydon’twetypicallydothis? ItcomesbacktoNeil'spoints It'sthefraudriskandthecredit riskinthatspace

BC:Sohowdoesemerging technologyplayintothis de-riskingagenda?

NS:It'scrucialforbankslike SAB,whichoperateregionally, tohaveaninterconnected andinteroperabletechnology infrastructure This infrastructurenotonly validatestransactiondatafor fraudpreventionlocallybut alsodoessoonaregional scale.

Connectiontothingslike theSauditaxregistryZATCA, orconnectiontodata aggregatorslikeLloydsList IntelligenceandS&PGlobal forpricevalidation,both domesticallyandregionally, enhancestheutilityofthis infrastructure.Itnotonly fosterswideradoptionbut also simplifiestheuser experienceforbanks.

SB:That'sexactlyit ForSAB,it's aslightlydifferentsituationas alocal,domesticbankinSaudi. Cross-borderfinancingis limitedbybankingregulations However,weleveragetheHSBC networktoachievethatglobal andregionalbankeffect

Thenecessarytechnologies areinplacetoestablishan infrastructurethatprovides third-partyvalidationforthe elementsfundamentalto financing Soasabank,I'm lookingforadigitaltriggerfor financing,takingoutasmuch ofthefraudriskaspossible fromtheequation.

Intheregion,practiceslike doublefinancingofinvoices

andforwardthinkingand receptivetoinputinterms ofregulation.

Broadlyspeaking,thelegal regulatoryframeworkfor bankinghaskeptpaceandis movingintherightdirection

Ithinktheonewherewewould seethebenefit,intermsof Saudibecomingatradehub, istheadoptionofMLETRcompliantlegislationlocally, especiallyaftertheUKhas adoptedETDA,andFranceand theUSaremakingstrides.

SoifSaudiwantstobecome aregionaltradehub,Ithinkit woulddowelltoaccelerate adoptionandIknowthatwork

andcircularfinancing,where relatedpartiescirculateand financethesameinvoices amongthemselves,arequite prevalent However,current technologiesareeffectively reducingtheseissues,enabling bankstoinjectliquiditywith greaterconfidence.

BC:Whataretheregulatory challengesinkeepingupwith digitalevolution?

SB:Regulationusuallylagsabit behinddigitalevolution;that's thenatureofit.Regulatorsin thisregiontendtobeengaged

isunderwayconsidering thatregulation

There'sadigitalplatform,the NafithPlatform,forpromissory notes,forexample,which underpinsalotofthe financinginSaudiArabia

There'sadigitalplatform aspartofthedigitalpublic infrastructurerunbythe MinistryofJusticethatcreates promissorynotes,whichif theycomethroughthat platform,areguaranteed tobeenforceable.

BC:DoyouseeSaudiactingas acatalystforothercountries intheregiontoenhancetheir tradeandregulatory frameworks?

NS:Vision2030setatrend Othercountriesfollowedwith differentvisionstatements. SaudiArabiahasaknackfor settingfashionorthepace, andonewouldhopethat othercountriesintheregion arewillingandabletoadopt innovativetechnologiesfor thebenefitoftrade,risk prevention,riskmitigation, anddigitalisation.

SB:AndIthinkintermsof adoptionofspecificlegislation, IknowthattheIFCrecently adoptedwhattheydeemedto beMLETR-compliantlegislation. BahrainandtheAbuDhabi GlobalMarkethavealready adoptedlegislation Sosome jurisdictionsareabitahead, butithasn'treallygained tractionyet

Whereas,IthinkifSaudi adoptedlegislationandstarted doingtransactions,Ithinkit wouldhaveasnowballeffect withintheregion

BC:Returningtothetopicof fraudprevention,whattypeof economicchangescouldbe expectediftheseprogramsand technologiesareimplemented morewidely?

NS:UsingMonetaGo’s experienceinIndiaasacase study,we'veobserved exponentialgrowthfrom creatingsaferfinancing environments Thefocuson previouslyneglectedsectors liketheSMEandMSMEsectors hasmultiplebenefits.

Morefinancingtranslatesinto moreeconomicgrowth;more goodsproduced,andmore taxesgenerated Additionally, increasingconfidenceincredit insurance,whichmighthave beenreluctanttounderwritein certainmarketspreviously, catalysesevenmorelending.

Thisresultsinadominoeffect governmentscollectmore revenue,businessesthrive,and banksprofit.Ultimately,leading towidespreadsocio-economic benefitsbothnationallyand regionally

BC:Couldyououtlinekeynext stepstoadvancethe technologyandfraud preventionindustries?

NS:Fromthefintech perspective,agilityiskey Governmentscansometimes beslowertoact,whichiswhere partnershipsbetweenpublic andprivatesectorsbecome essentialtoacceleratethetime tomarketandsubsequent benefitsofthesesolutions

AnexampleisSwift;realising theyweren’tagileenoughto deploynecessaryvalue-added services,theyinitiatedapartner program,whichledtoour

partnershipwiththemcreating aglobalstandardforprevention

Thisstandardhasexpedited ourcollaborationswithcentral banksandotherpublicentities, enhancingourimpactacross theGCCandglobally.Such partnershipsarecrucialfor thrivingbusinessandfinancing ecosystems

SB:Absolutely,Neil’spoint aboutthesynergybetween agilefintechsandthemore methodicalgovernmental approachiscrucial Saudi Arabiaandothergovernments intheregionarequiteforwardthinkingandplanstrategically toincorporatethese advancements

Thedriveoftenstemsfrom practicalusecasesprovided bycorporatesandfintechs Asa bank,wemaynotalwaysbeas nimble,butwearecommitted tosupportinganydevelopment thatfacilitatesouroperations moredigitaltriggerpointsand controlsmeanasmoother processintradefinance

We’reverykeenonanything thatbolstersthisenvironment, asitultimatelysimplifiesour workandenhancesthe serviceswecanprovide

JohnMiller ChiefEconomicAnalyst

AstheU.S.andtheEuropeanUniongradually slideintoaquasi-permanentprotectionist mindset,includingtit-for-tattradewarswith China,whathappenstofreetradeinother regionsoftheworld,includingtheMiddleEast, willbecomemoreimportant.

MiddleEast: Thebigpicture

Therearefewregionsas pivotaltoglobaltradeasthe MiddleEast Thepetroleumrichareaisthesourceof roughlyone-thirdofthe world’soilproduction.When geopoliticaltensionsinthe MiddleEastforceupoil prices,thewholeworld catchesacold

TheSuezCanalisone oftheworld’sessential transshipmentpoints. And,becauseofstrategically significantnationssuchas Israel,EgyptandSaudiArabia, theMiddleEastpunches faraboveitsweightin internationalpolitics

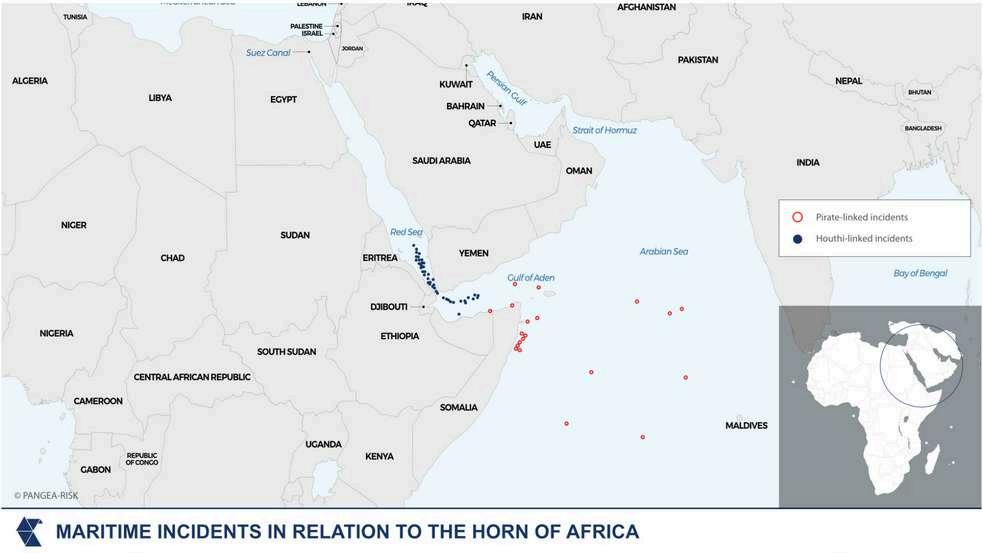

In2024,theregionhasbeen hitbyconflict,piracy,and thevagariesofsupplychains andtheoilmarket

Thespectreofprotectionism appearsthreatening,especially betweencountriesinconflict witheachother

AstheUS andtheEuropean Uniongraduallyslideintoa quasi-permanentprotectionist mindset,includingtit-for-tat tradewarswithChina,what happenstofreetradeinother regionsoftheworld,including theMiddleEast,willbecome moreimportant

Tobesure,thebigpictureisnot asbleakastheheadlinesmight suggest.Economistsforecast exportgrowthataround4% fortheregionin2024

Andsomeoftheeffortsat diversification,thebiggest challengeforoil-reliantMiddle Easterneconomicpower, aresucceeding Non-oilfrom SaudiArabia,forexample, rose43%to$122billion, whileimportsincreased55% to$34.6billioninthefirsttwo monthsof2024,according toTradeDataMonitor.

ThewarinIsraelandGaza hasdisruptedtheeconomies ofbothnations Consumers inIsraelarelessconfident spendingmoneyduringatime ofhighriskandconflict.Israeli importsofcarsandtrucksfell 37%year-on-yearto$1billion inthefirstquarterof2024, accordingtoTDM

Importsofbusses,however, rose10.6%to$104.3million. Israeliexportsfellin10ofits 12topmarkets.Shipmentsrose toChinaandtheU.S.,butfell toGermany,Turkey,Italy, France,Russia,India,South Korea,Spain,theUK,and theNetherlands.

ThewarhasmadeIsrael increasinglyreliantonitstrade relationshipwiththeUS Total Israeliexportsincreasedby 12%to$169billion Shipments totheUS rose9%to$48 billion.Exportsofelectronic integratedcircuitssoared 416.4%to$478.2billion.

Protectionistcasestudy: Israel-Turkey

Theyearhasbeenastudy ofthevolatilityoftradeinthe region.InMay,oneofthe MiddleEast’smostsuccessful tradingpartnerships unravelledamidtensionover thewarinGaza.

AfterTurkishPresident TayyipErdogansaidhis countrywouldhaltexportsto Israel,TelAvivretaliatedby nixingafreetradeagreement withTurkeyandpromisingto imposea100%importtariffson goodsfromthecountry.

Earlierthismonth,Turkeysaid “itwasstoppingexportsto Israelduringthedurationof theIsrael-Hamaswar,citing a“worseninghumanitarian tragedy”inthePalestinian territories.

However,theTurkish TradeMinistryhassaidthat companieshavethreemonths tofulfilexistingordersviathird countries

WarinIsrael-Palestine

Already,tradebetweenthe twocountrieshastakenahit. TurkishimportsfromIsraelfell 21.5%year-on-yearto$429 millioninthefirstquarterof 2024,whileexportsdropped 217%to$12billion,according toTDM

That’snotwhattheregion needsifitscountriesareto diversifytheireconomiesand buildstablemiddleclasses

Accordingtoarecentreport bytheInternationalMonetary Fund,MiddleEasterncountries couldincreasetradebyupto 17%by“reducingnontarifftrade barriers,boostinginfrastructure investment,andenhancing regulatoryquality”

CountriesintheMiddleEast andNorthAfrica“canmitigate ongoingshippingdisruptions byimprovingtheirsupplychain management,securingnew suppliersinthemostaffected sectors,seekingalternate shippingroutes,and assessingairfreightcapacity needs,”theIMFsaid.

TheRedSeacountries Egypt, Jordan,SaudiArabia,Sudan, andYemen–risklosingaround 1%oftheirgrossdomestic productiftheattackscontinue.

Cargovolumesaredown inkeyregionalportssuchas Jeddah,SaudiArabiaand AlAqaba,Jordan Egyptian importsfell254%year-on-year to$5.5billioninJanuary,the latestmonthforwhichdatais available,accordingtoTrade DataMonitor Egyptianexports fell164%to$35billionover thattime

China

Protectionismisn’ttheonly problemtheregionfaces. Attacksonmerchantshipsin theRedSeahaveheightened insuranceratesandfearsof riskamongmanufacturers andshippinglines

TransitsthroughtheSuezCanal havefallenover50%sincethe Israel-Palestinewarstarted inOctober.

Likeotherpartsoftheworld, Chinareliesheavilyonoiland gasimportsfromtheMiddle East.Withoutpetroleumand naturalgassuppliedbySaudi Arabia,Qatarandothers,the Chineseeconomywould takeamajorhit,evenasit replacessomeofitsenergy mixwithfreshsuppliesofgas andoilcomingfromRussia. Iftheconflictdrivesupenergy prices,thatwillincrease manufacturingcostsinChina China,ofcourse,isalsoa market,butliketheUS and EU,MiddleEasterncountries struggletopenetrateit.When countrieslikeSaudiArabialook

athowthey’regoingtodiversify theireconomies,oneoftheir mainmarkets,inevitably, mustbeChina.Afterall,China istheleadingtradingpartner forover100countries.Itremains achallenge.Inthefirsttwo monthsof2024,Saudinon-oil exportstoChinafell155% to$9448million

GulfcountriesincludingSaudi Arabia,Kuwait,Omanand Bahrainhavebeennegotiating anewtradeagreementwith China,butSaudiArabiahas stalledtalksoverChina’s reluctancetolimitexportsto theoilpower.Saudiofficials wantsomeprotectionfortheir ownmanufacturingsectorto develop TheArabblocdidsign afreetradedealwithSouth Korealatelastyear

Intimesofrisk,tradeingold andpreciousstonesoftenrises asinvestorsseeksafetyintimehonouredgoods.Inthefirst quarterof2024,Israelidiamond exportsrose14%to$1.8billion. SaudiArabiaboostedgold importsawhopping144% year-on-yearto$24billion inthefirsttwomonthsof2024, accordingtoTDM.

JohnW.Millerischiefeconomic analystforTradeDataMonitor.

Preciousstones

AbdelrahmanEl-Beltagy

FedericoAvellan Borgmeyer IslamicFactoringSpecialist efcom ChiefPartnerOfficer efcom