#INSPIR #INSPIREINCLUSION #INSPIREINCLUSION ISSUE21 TRADEFINANCEGLOBAL.COM BELONGING ALLYSHIP TOGETHER HOPE

NehaNoronha

TFGEDITORIALTEAM

DeepeshPatel

BrianCanup

CarterHoffman

DuyguKarakuzu

KirtanaMahendran

LAYOUTDESIGN

NigelTeoh

PHOTOGRAPHSAND ILLUSTRATIONS

FreepikCompanyS.L. Canva Unsplash

JohannaHill DeputyDirectorGeneral WorldTradeOrganization(WTO)

MichelleKnowles HeadofTradeandWorking CapitalProducts Absa

DeepaSinha VPPayments&FinancialCrimes BAFT

www.tradefinanceglobal.com 2

©TradeFinanceTalksisownedandproducedby TFGPublishingLtd(t/aTradeFinanceGlobal). Copyright©2024.AllRightsReserved.Nopartof thispublicationmaybereproducedinwholeor partwithoutpermissionfromthepublisher.The viewsexpressedinTradeFinanceTalksarethoseof therespectivecontributorsandarenotnecessarily sharedbyTradeFinanceGlobal. AlthoughTradeFinanceTalkshasmadeevery efforttoensuretheaccuracyofthispublication, neitheritnoranycontributorcanacceptanylegal responsibilitywhatsoeverfortheconsequences thatmayarisefromanyopinionsoradvicegiven. Thispublicationisnotasubstituteforany professionaladvice. Website www.tradefinanceglobal.com MagazineandAdvertising talks@tradefinanceglobal.com EditorialandPublishing media@tradefinanceglobal.com Telephone +44(0)2038653705 3 www.tradefinanceglobal.com

Empoweringchange:Womentransformingtheworldoftrade, treasury&payments

LloydsBanktradeinsights:Theneweraofworkingcapitalmanagement, atreasurer’sview

Understandingrulesoforigin:Gettingthedetailsright

InternationalStandbyPractices(ISP98):25yearslater

A2024guidetocustomscomplianceandcross-bordertrade

FCI’sNealHarmonkickingoffinclusivegrowthinthefactoringindustry

WomeninTrade,Treasury&Payments2024–Fromclassroomtoboardroom: Educatingforgenderequityintrade,treasury,andpayments

Africafocus:Afreximbankonempoweringwomenintrade,treasury,andpayments

Progressionthrougheffortandrisktaking:Absa’sMichelleKnowles discussesbeingawomanintheworkplace

DDGHill:Empoweringwomenthroughglobaltrade

Empowermentthroughinclusion:ADB’smissionforequitabletrade

InternationalWomen’sDay2024:Breathinginclusion

2 3 1 38 8 6 12 14 40 18 44 20 48 24 52 30 56 34 60 64 Featured Drivingprogress:Womenleadingintrade,treasury&payments Foreword 1.1 2.1 3.1 2.2 3.2 2.3 3.3 2.4 3.4 2.5 3.5 2.6 3.6 3.7

WomeninTrade,Treasury&Payments2024–Policytopractice: Addressinggenderdisparityinfinancialaccess Navigatingthenew“new”intheSupplyChainFinanceindustry

CONTENTS 4 www.tradefinanceglobal.com

Keepingpacewithpayments:Lessonslearnedfromadynamiclandscape

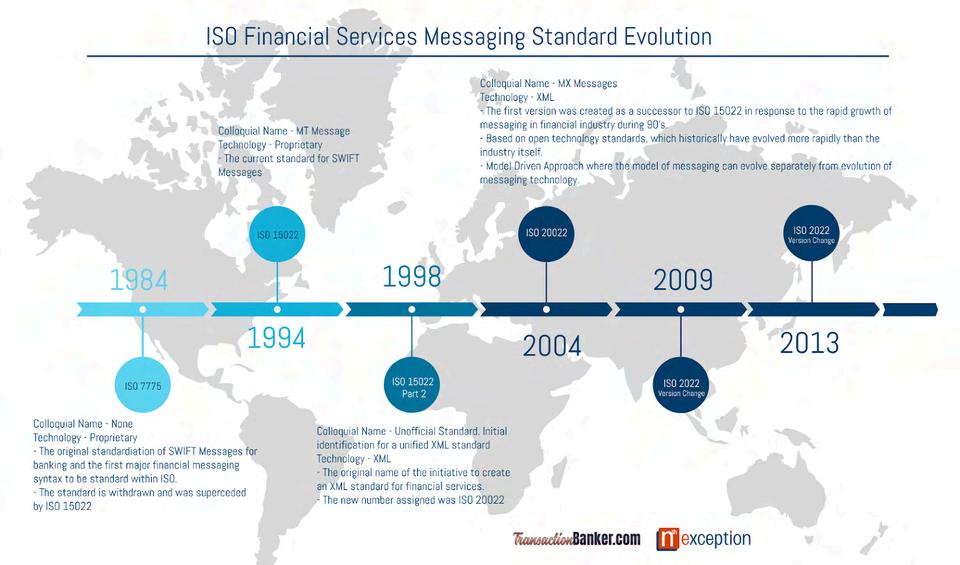

ThefutureprospectsoftheRTP®network,easingtheISO20022transition

EU’sLatePaymentRegulation:Exposingtheneedforbetterpublicdiscourse

Thegreatbalancingact:Makingtradeandpaymentsfaster,cheaper, andeasierin2024

FederalReserve:Monetarypolicyupdate,makingpayments

5 6 106 110 114 118 122 Sustainabilityandtrade:Howtomakethetwomatch PartnerEvents 3.1 3.2 3.3 3.4 3.5 TheESGchallengeforAfricancreditinsurers Newsustainabilityapproachesinshipping:Strategiesfordecarbonising theindustry SustainabilityinMENA

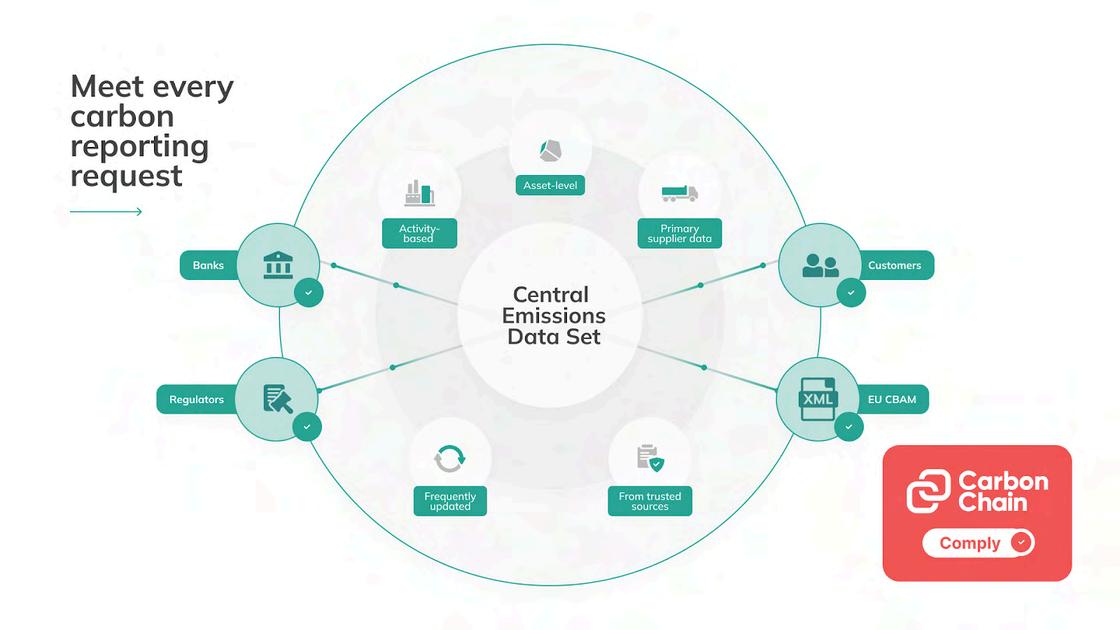

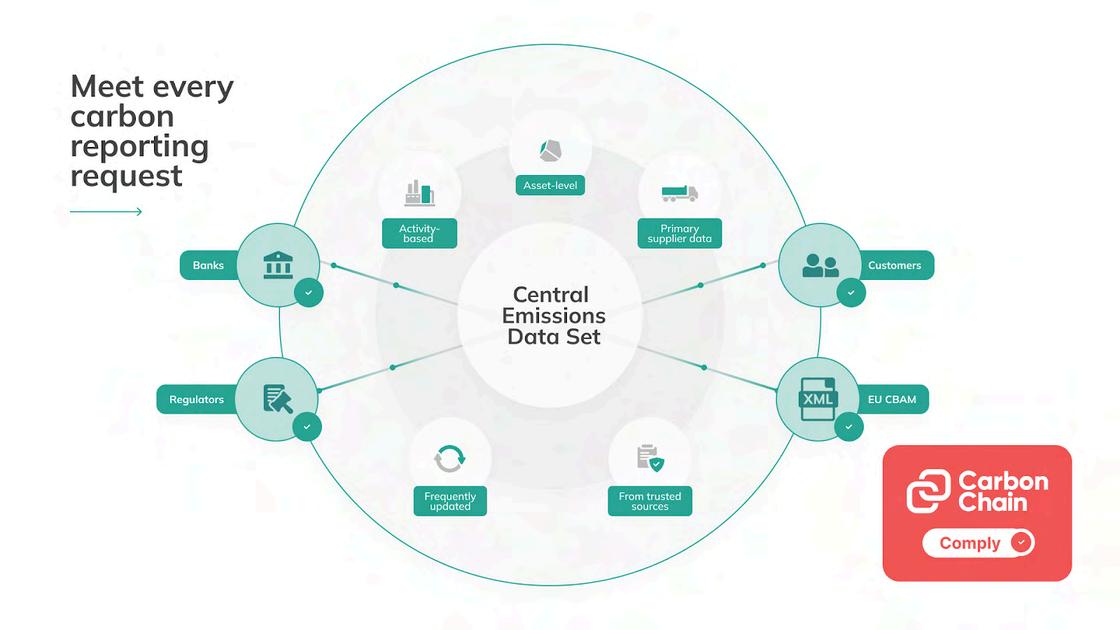

FirstAbuDhabiBank’sapproachtosustainable tradefinance Howcantheshippingindustryhelpsustainablerentalservicesgrow? Corporateaccountabilityinawarmingworld:CarbonChain’srolein effectivecarbonreporting 4 70 76 80 84 88 94 98 102 Achangingpaymentslandscapein2024 4.1 4.2 4.3 4.4 4.5 4.6 4.7 4.8 The

banking

:

impactsofISO20022ontransaction

Mexicoamendslegislation,enableselectronicfinancialdocuments Demystifyingpaymentmodernisation:Separatingfactfromfiction 5 www.tradefinanceglobal.com Content 68 104 126

instantandfaster, overviewoftheFedNowService®

FOREWORD

www.tradefinanceglobal.com 4

TradeFinanceTalks

www.tradefinanceglobal.com 5 Foreword

DeepeshPatel EditorialDirector TradeFinanceGlobal(TFG)

DeepeshPatel EditorialDirector TradeFinanceGlobal(TFG)

Empoweringchange: Womentransformingthe worldoftrade,treasury& payments

AswecelebrateInternationalWomen’sDayand thenumerousachievementsofwomenintrade financeallyear,beyond8March,wemustalso lookforwardtothefuture.

BrianCanup AssistantEditor TradeFinanceGlobal(TFG)

BrianCanup AssistantEditor TradeFinanceGlobal(TFG)

AttherecentIFCGlobalTrade PartnersMeetinginBarcelona, TFGmoderatedaroundtable onWomeninTrade.

Weaskedtheparticipants afewpollquestions,butone responsetoaquestion specificallystoodout.“Does yourcurrentclientbase compriseofmorethan50% ofwomen?”

Onepersonraisedtheirhand.

Whileitistruethatthetrade, treasury&paymentsindustries havemadeimpressivestrides ingenderinclusion,moments liketheseshowthatwehave alongwaytogo.

Butthisiswhyroundtable eventslikethisareimportant, andwhyTFGhostedourannual WomeninTrade,Treasury& PaymentseventinLondon,at thehistoricLansdowneClub inLondon.

www.tradefinanceglobal.com

TradeFinanceTalks 8 1.1

Ifyoulookaround,thereare remarkablestoriestobetold aboutinclusion,perseverance, andsuccess.Wejustneedto tellthem.

Itwasaman’sworld, butnotanymore: Theroleofwomen intradefinance

Tradefinancehastraditionally beenamale-dominatedfield, infact,accordingtotheWEF GlobalGenderGapreport,it willtake131yearstoreachfull genderparity.

Butthisnarrativeischanging, slowlybutsurely.

Womenarenowleadingkey initiatives,drivinginnovation, andbringingdiverse perspectivestothetable. Theirparticipationiscrucial forfosteringaninclusive environmentthatpromotes sustainablegrowthand equitableopportunities.

LeaderslikeGwenMwaba, Afreximbank,JohannaHill,WTO, MichelleKnowles,Absa,Neha Noronha,ADBandDeepaSinha, BAFT,arenotableexamplesof howtheindustryischanging. Additionally,newinitiativeslike BAFT’sWomeninTransaction BankingandIFC’sWomen’s Tradenetworkareexamples ofhowtheindustrycancreate spacestocollaborateand sharebestpracticestofurther theadvancementofwomenin theTTPindustry.

Asmorewomenare empoweredwithinthe industryandworktheirway toleadershippositions,itcan helpchangethenarrative.

Byelevatingmorewomento C-Suitepositions,theycan helpsolvesomeofthelongstandingissuesfacedby womenwhotrade.

Butitisnotjustabouthelping promotewomentoexecutive jobs,it’sabouthelpingwomen onaday-to-daybasis.Asof 2021,therewereapproximately 740millionwomenwholack accesstobanking.

AccordingtoIFC’snewest whitepaper,“Bankingon WomenWhoTradeAcross Borders”,inAfrica,90%of tradefinanceapplicationsfor femalesarerejectedbecause ofalackofcollateral.

Aswediscussinthisissue,there aremanydifferentreasonsfor thesestats,andthereareno easy,one-size-fits-allsolutions.

However,therearenew programmes,policiesand initiativesthatarestartingto addressthesechallenges.One personwon’tsolveallthese

problems,butasanindustry, thecollectiveelevationof femaleleadersisagreatplace tostart.

Digitaltransformation andaccesstofinance

Thedigitalrevolutionisa powerfulcatalystforgender inclusionintrade.Digital platformsandtechnologies offerunprecedented opportunitiesforwomento accessglobalmarkets,secure financing,andenhancetheir businessoperations.

InitiativesliketheAfricaTrade Gateway(ATG)byAfreximbank providewomenentrepreneurs withaccesstocriticaltrade information,helpingthemmake informeddecisionsandexpand theirbusinesses.

Moreover,digitaltradehas proventobeparticularly beneficialforwomen.Itbreaks downtraditionalbarrierssuch asgeographicallimitationsand

www.tradefinanceglobal.com 9 Foreword

providesflexibleworking conditions,whichareessential forbalancingprofessionaland personalresponsibilities.

Aswecontinuetoembrace digitalisation,itisimperative thatweensurethese advancementsareaccessible toall,fosteringanenvironment wherewomencanthrive.

Whocanyoulookupto?

Rolemodelscanmakea difference

Mentorshipplaysavitalrole inempoweringthenext generationoffemaleleaders. Bysharingtheirexperiences andknowledge,established womenprofessionalscanguide andinspireyoungerwomento pursuecareersintradefinance.

Programmesfocusedon mentorshipandrolemodelling areessentialforbuilding confidenceandprovidingthe supportneededforwomen toexcelintheircareers.

Theconceptofreverse mentoring,whereyoungeror lessexperiencedindividuals mentorseniorleaders,isalso gainingtraction.Thisapproach canfosteracultureof inclusivityandcontinuous learning,allowingorganisations tobenefitfromdifferent perspectivesandinnovative ideas.

Despitetheprogressmade, significantchallengesremainin achievinggenderparityintrade finance.Societalpressures,lack ofrolemodels,and organisationalbiasesoften hinderwomen'scareer advancement.

Toaddresstheseissues,a multifacetedapproachis required,encompassingpolicy reforms,corporateinitiatives, andculturalshifts.

Policiespromotinggender equalityandfinancialinclusion arecrucialfordismantling barriersthatwomenface. Companiesmustalsotake proactivestepstocreate

inclusiveworkenvironments wherewomencanadvance basedontheirskillsandmerits.

Thisinvolvesimplementing flexibleworkarrangements, providingequalopportunities forcareerdevelopment,and activelycombatinggender biaseswithintheorganisation.

TheTimesTheyAre A-Changin'

Thestoriesofsuccessful womenintradefinancearenot justinspiringbutalsoserveas powerfulexamplesofwhatcan

beachievedwith determinationandsupport.

AttheIFCevent,weasked afewmorequestions.

“Whenyoufirststartedyour jobsoryourcareersintrade, pleaseputyourhandsupifyou thoughtyouhadfemalefigures inseniorpositionsinyour organisationsthatyoufeltthat youcouldlookupto.”

Only10%oftheroomraised theirhand.Butwewantedto knowabouttheenvironment now.

“Putyourhandsuporkeepyour handsupifyoufeelthatthis haschanged.Sotoday,looking atyourorganisation,doyoufeel thatyouhaveafemalesenior orfemalerolemodelthatyou canpickupto?”

Over2/3rdsofthe roomraisedtheirhand.

Andover90%oftheroomsaid theyarementoringayounger femaleintheindustry.

www.tradefinanceglobal.com 10 TradeFinanceTalks

Theseareimportantchanges tohighlight.Itremindsusthat beyondthenegatives,things arechangingforthebetter. Thepoliciesandinitiatives, whilenotperfect,areworking, andweneedtocontinueto moveaheadwiththem.

OverthefiveyearsthatTFG hasrunourWomeninTrade, Treasury&Payments campaign,wehavecelebrated 57femalesin132organisations across72countries.Thisis incredible,butweknowthere areendlesssuccessstories thatweallcouldhighlight. Butit’sastart.

What’snextfor WomeninTrade?

AswecelebrateInternational Women’sDayandthe numerousachievementsof womenintradefinanceallyear, beyond8March,wemustalso lookforwardtothefuture.

Thejourneytowardsgender parityisongoing,anditrequires thecollectiveeffortsof individuals,organisations, andpolicymakers.

Byfosteringaninclusiveand supportiveenvironment,wecan ensurethatwomencontinueto driveprogressandinnovation intradefinance.

Wehopethatthiseditionof TradeFinanceTalksservesasa talkingpointforyou,tothinkof howyouandyourorganisation cancontinuetoelevatewomen acrosstrade,treasury& payments.

Inothernews

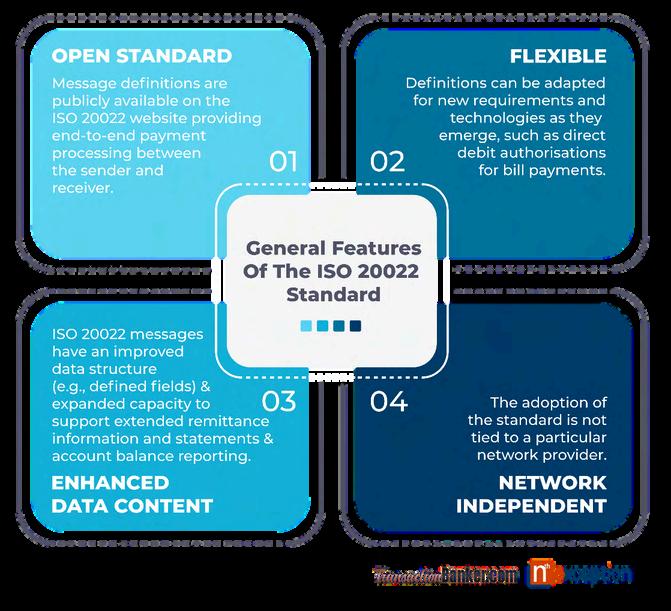

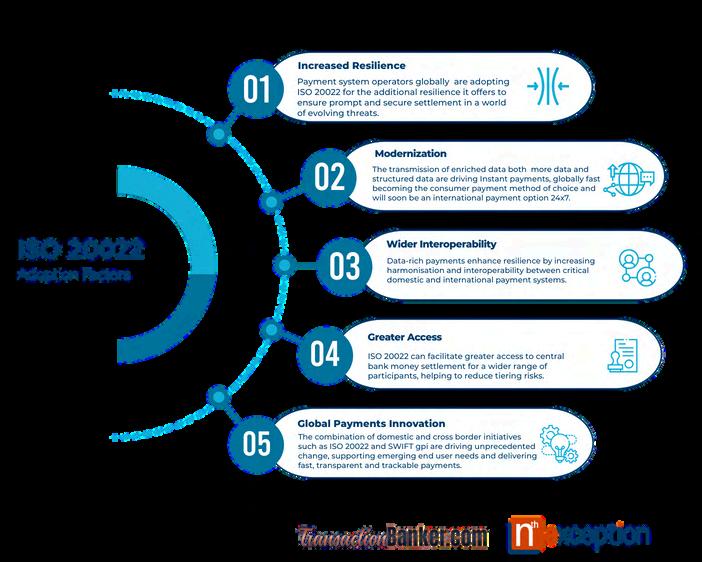

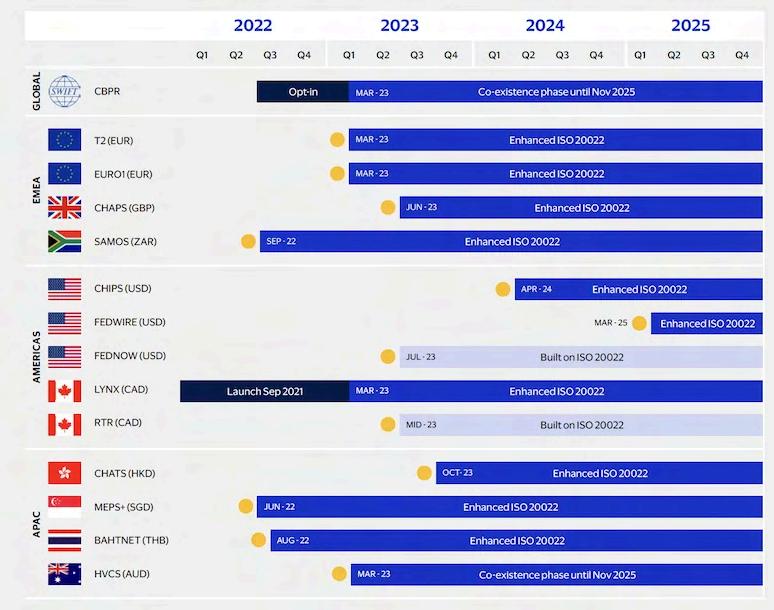

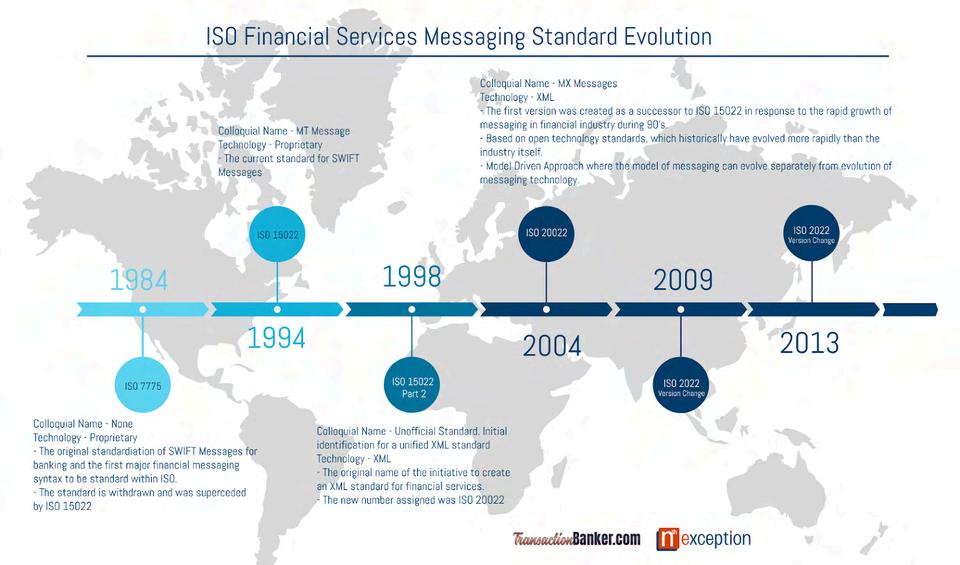

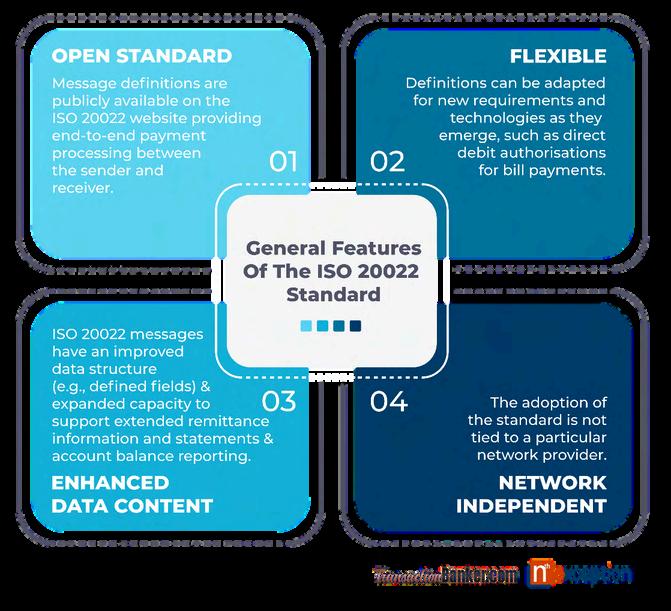

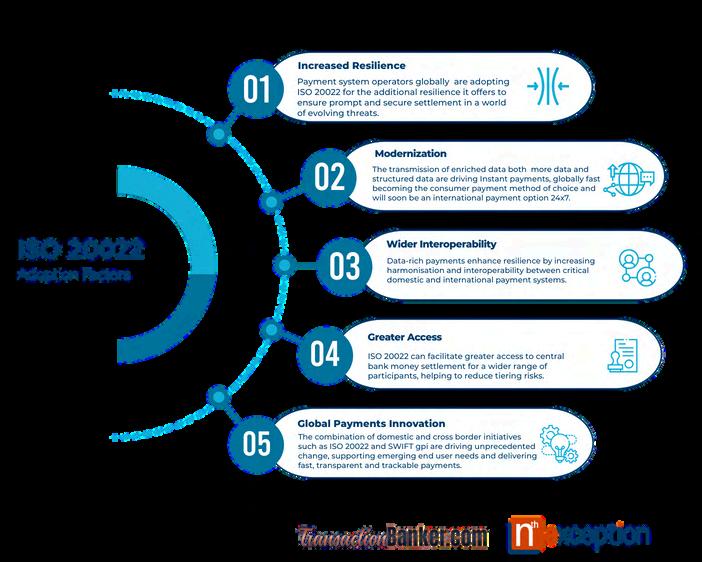

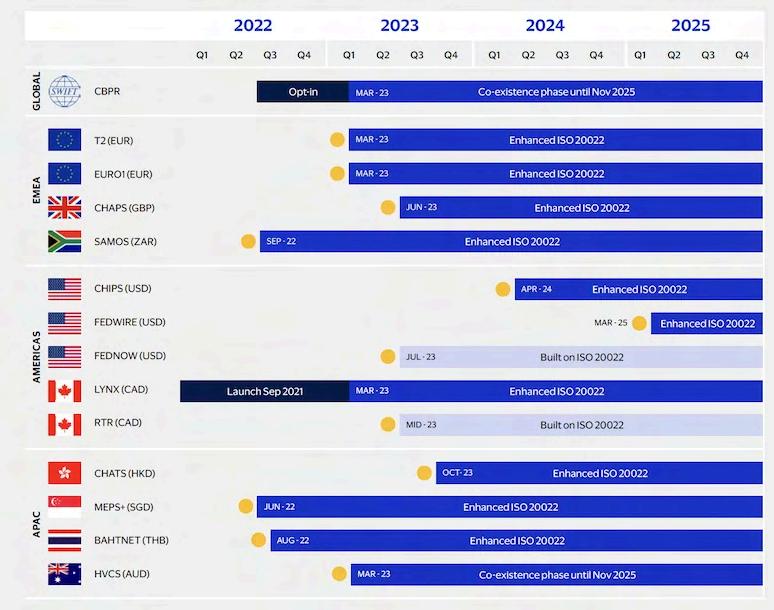

Thepaymentsindustry hasexperiencedsignificant transformationsin2024 drivenbytechnological advancements,regulatory changes,andevolving consumerpreferences.Key technologieslikeISO20022,

cloudsolutions,instant payments,andAPIsare redefiningbankingsystems andenhancingtheefficiency, transparency,andspeedof financialtransactionsglobally.

Real-timepayments(RTP)are becomingcrucial,drivenby thedemandforimmediate transactionsacrossvarious sectors,includingfinancial services,fintechwallets,thegig economy,insurance,andonline betting.Thisshifttowardsfaster paymentsisessentialfor competitivenecessity, reflectingthemarket's emphasisonspeedand operationalefficiency.

Thismightjustbeoneedition, butTFGwillcontinueourwork indiversityandinclusion throughouttheyear.Keep aneyeoutformorenews!

Asalways,thankyoutoour sponsorsandpartners,andall ofourcontributorsacrossthe globe!

www.tradefinanceglobal.com 11 Foreword

12 TradeFinanceTalks www.tradefinanceglobal.com

Featured 13 www.tradefinanceglobal.com

CarterHoffman ResearchAssociate TradeFinanceGlobal(TFG)

CarterHoffman ResearchAssociate TradeFinanceGlobal(TFG)

LloydsBanktradeinsights: Theneweraofworking capitalmanagement, atreasurer’sview

TheLloydsBankTradeInsightreportfocuseson thesechangingeconomicconditionsandtheir implicationsonworkingcapitalfromatreasury perspective.

Businessestodayarefacing alandscapedefinedby uncertainty.

Thefactthatmorethanhalf oftheglobalpopulationis settogotothepollsin2024, addsadegreeoflegislative uncertaintytothealready starkgeopoliticaltensions andenvironmentalchanges thatourworldisfacing.

Geopoliticaltensionscan disrupttraditionaltraderoutes asweareseeingwiththe eventsintheRedSea,while

electionsinkeymarketsmay resultinpolicyshiftsthat promptrapidadjustments ininternationaloperations.

Climatechangefurther compoundsthesechallenges. WatershortagesinCentral Americaareimpactingthe PanamaCanal’soperational capacitycausingsome shippersintheregionto turnmoretowardsrail transportationtogetgoods totheirfinaldestination.

www.tradefinanceglobal.com 14 2.1

TradeFinanceTalks

Inresponsetothesechallenges, aparadigmshiftisoccurring inhowbusinessesapproach theiroperations.Itisnolonger feasibleforbusinessesto operateunderthesame assumptionsandmental modelsthattheydideven fiveyearsago.

Inthisdecade,resilienceiskey.

On8April,LloydsBankreleased itslatestreportexploringsupply chainresiliencyacrossthe globalmarket.

Theshiftinsupplychains –JustinTime

Inlightoftheseconditions,the LloydsBankBusinessBarometer anchorsconfidenceatnear recenthighs(Figure1),even thoughsupplychainscontinue tofacechange.

Thisapproach,whileprudent, requiredfirmstoholdadditional inventory,tyingupfundsthat couldotherwisebedeployed towardsgrowthorinnovation. Thisintroducescomplexitiesin managingworkingcapitalfor smallandlargefirmsalike.

Businessesmustlearnhowto balancetheneedforadditional

inventorywiththeneedfor workingcapital,ensuringthey havesufficientstocktoweather supplychaindisruptions withoutcompromisingtheir financialhealth.

Alongsidethesechanging supplychainconditionsand driveforresiliencecomes

changingdemandsforworking capitalmanagement,atask thathasrisentotheforefrontof corporatestrategydiscussions. Thisiswherethework oftreasuryprofessionals becomescritical.

Butnotjustanytreasury professional.

Featured

40% 42% 28% 60 40 20 0 -20 -40 2010 2012 2014 2016 2018 2020 2022 2024 Start End LTaverage www.tradefinanceglobal.com

15

Figure1:LloydsBankBusinessBarometer 10(March2024),BVABDRC

www.tradefinanceglobal.com 16 TradeFinanceTalks

alsoprovinginstrumental instrengtheningsupplier relationships,mitigatingrisks, andenhancingliquidity.

Thesetoolsnotonlyfacilitate smootheroperationsbutalso fosteramorecollaborative ecosystembetween businessesandtheirsuppliers.

Forexample,underasupply chainfinancescheme,a smallersuppliercanleverage thestrongerfinancialstanding ofitslargerbuyertosecure financingatamorefavourable ratethanitwouldbeabletoon itsown.

Thishasthepowerto enhancetheoverallstability

andresilienceofthesupply chain,providingabuffer againsttheshocksof unforeseenevents.

Aninsideperspective: LloydsBankTradeInsight

TheLloydsBankTrade Insightreportfocusesonthese changingeconomicconditions andtheirimplicationson workingcapitalfroma treasuryperspective.

Thereportsharesinsights onmanagingworkingcapital fromAbelMartins-Alexandre, managingdirectorandhead ofinfrastructure,energy,and industrialsatLloydsBank.

Itisessentialforthe treasurertobepartof strategicconversations withallareasofabusiness sothatworkingcapitalis optimised,processesare improved,sustainability objectivesareaddressed, andsupplychainresilience isbuilt.

Thereportalsoincludes anoverviewofLloydsBank’s tradeandsupplychainfinance offeringsthatcanbusinesses andtreasurerstacklethe challengestheyfaceamidthe uncertaineconomiclandscape.

Forthoseinterestedinlearning more,thefullreportisavailable here

Featured www.tradefinanceglobal.com 17

AshishKohli ExecutiveDirector,Supply ChainFinance,GlobalProduct StandardCharteredBank

AshishKohli ExecutiveDirector,Supply ChainFinance,GlobalProduct StandardCharteredBank

Navigatingthenew“new” intheSupplyChainFinance industry 2.2

Uncoverthevulnerabilitiesofglobalsupply chainsandthecrucialroleoffinancein ensuringcontinuousproductionforSME suppliers.

Supplychainshave becomeglobalandincreasing complexitieshavemadethem brittleanddependent,rather thanrobustandresilient; Covid-19isaprimeexample ofthis.

OneblowintheJITinventory approachmaydisrupt distributioneasily.

ForSMEsuppliers,having accesstofinancetoprepare forthenextorderandmaintain continuousproductionis crucial.

Theimpactofdisruptions causedduetoCOVID,geopoliticaltensions,highinterest andinflationrateshasfurther exposedtheresiliencegapsin thealreadycomplexandglobal supplychains.

TheSupplyChainFinance(SCF) industryhasevolvedoverthe lasttwodecadesontheback ofevolvingglobalsupplychains andtechnologyimprovements withfintechsdisruptingthe industry.

However,theindustryis currentlyexperiencinga“first”. Inapreviousera,thelanded costofborrowingtosuppliers underSCFprogrammeswas lessthan2%,whilethecurrent rateisatleast5%.

Smallsuppliersmustdecide betweendiscountingtheir receivablesearlytofundtheir nextproductioncycleor slowingdownsalestowait forthefundstocomein.

www.tradefinanceglobal.com 18

TradeFinanceTalks

Shiftingsupplychains createnewchallenges

Multi-shoringandnear-shoring forWesterncorporatesare donewiththehopeofmore resilience,butultimatelywill comewithhighercosts.

ShiftingfromChinatoChina+1 isevident,butthetransitionwill begradualandslow.Ittook Chinaovertwodecadesto becomethe“World’sfactory” andthemoveoutwardwilltake timetoo.

Thespeedatwhichmarkets likeIndia,ThailandandVietnam developtherightskillsetsto makemanufacturingeasierwill haveakeyroletoplayaswell.

TheSCFIndustrywillalsoevolve withthisgradualshift.Foreign banks,localbanksandfintechs willfighttoothandnailtograb thisnewsupplierbase.

Supportingsupplierswiththeir regulatorycompliances, providinglocalcurrency

funding(includingpreshipmentfinance)andefficient supplieronboardingwouldbe akeyaspecttoconsider.

Regulatorsareplaying abalancingactbetween corporatebuyers, investorsandsuppliers

Theintroductionofstricter disclosuremandatesand paymentregulationsincertain marketswillleadtohighercosts ofcomplianceandincreased purchasingcostsforbuyers.

Thediscussionisn’tfocusedon thepurposeoftheregulations butratherontheirpotential shortandmedium-termeffects ontheSCFindustry.Banksand financialinstitutionswillhave tocollaboratewithbuyersto adjusttheirsupplychain programmestomeetthese newstandards,whichmight necessitateadditional investmentsfrombothbanks andbuyers.

Technologywillcontinueto democratisetheproposition Leveragingtechnologyfor supplieronboardingandlegal documentationisessentialfor theindustry’sexpansionand playsacrucialroleinoffering financingtountappedsuppliers inemergingmarkets.

willplayakeyroleinthisarea, howeverabalancebetween regulatoryrequirementsand easeofonboardingsuppliers iscritical.

Anyregulatoryorlegal arbitragemaycreate additionalriskintheindustry

Further,whiletheeffortsare ontobringin“digitalmoney/ tokens”tosupportdeeptier financing,theregulatoryand legallandscapeneedtoevolve furthertomakethisareality onacross-borderbasis.

ToconcludewhiletheSCF industryiscontributingto closingthefinancinggap forsmallandmedium-sized suppliers,itissimultaneously navigatingmacroeconomic challenges,shiftsinsupply chains,theentryofnew participants,andregulatory adjustmentsforthefirsttime.

Howtheindustryrespondsto thisneedstobeseen,butall theseeffortsarewellinthe directionofachievingthe objectiveofprovidingaccess tofinancetotheoneswhoneed itthemost!

*Theviewsexpressedbytheauthor inthearticlearepersonal

www.tradefinanceglobal.com 19 Featured

LucindaO’Reilly Founder

TheInternationalTrade Consultancy

LucindaO’Reilly Founder

TheInternationalTrade Consultancy

Understandingrules oforigin: Gettingthedetailsright 2.3

RulesofOriginaretherulesthatdetermine whereagoodwasobtainedormanufactured (itseconomicnationality).

FollowingtheUK’sexitfromthe EU,therewasconcernamongst internationaltradeexpertsthat UKexportersweren’taware thatfrom1stJanuary2022, theywouldberequiredto demonstratecompliancewith theUK-EUrulesoforiginlaidout intheTradeandCooperation Agreement(TCA).

Thisconcernwasrealisedinthe followingyears,asnumerous manufacturershavecontinued todeclarepreferentialorigin ontheirexportcommercial invoiceswithoutchecking whethertheirproducts actuallycomply.

Whilsttheissuewashighlighted byBrexit,RulesofOriginare animportantelementof internationaltradethatall importersandexportersneed tounderstandregardlessof thecustomsterritorytheyare dealingwith.

Tohelpclarifythistopic,Iwill giveanoverviewofwhatrules oforiginare,whytheymatter, thedifferencebetween preferentialandnonpreferentialrulesandabrief explanationofeachrule.

www.tradefinanceglobal.com 20

TradeFinanceTalks

Forsimplicity’ssake,thisarticle iswritteninthecontextofthe UK/EUTradeandCooperation Agreement,althoughthebroad principlesapplytoalltrade.

Whatarerulesoforigin?

Theoriginofgoodsisan importantconcept,asitis centraltodeterminingthe customsdutiesandtaxes relatedtoaspecificgood. Italsoisimportanttosome traderestrictionssuchas quotasorlabelling.

RulesofOriginaretherulesthat determinewhereagoodwas obtainedormanufactured (itseconomicnationality).

Whydotheymatter?

Productsthatmeettherules oforigincanbesoldtariff-free betweentheUKandEUunder thetermsoftheTCA,meaning thatanygoodsthatfailtomeet thecriteriawillcostmorethan similaritemsthatdocomply.

Duringtheone-yeargrace periodgrantedin2021,itwas clearthatmanycompanies werestatingthattheirproducts compliedwiththerulesoforigin withoutchecking.

Afrequentinstanceinvolves goodsimportedfromChina, repackaged,andthenexported totheEUasUK-originproducts. Repackagingdoesnotalterthe originofthegoods,meaning theEUcustomershouldpay importdutyasthoughthe goodsweredirectlyimported fromChina.

Non-Preferentialor Preferential?

Non-preferentialrulesoforigin arethosewhichapplyinthe absenceofanytrade preference—thatis,when tradeisconductedonaWTO ormost-favoured-nationbasis. Notallcountriesapplyspecific legislationrelatedtononpreferentialrulesoforigin.

However,sometradepolicy measuressuchasquotas, anti-dumpingdutiesor “madein”labelsmayrequire adeterminationoforiginand, therefore,theapplicationof non-preferentialrules.Inthis eraofsanctionsandescalating tradetensionsbetweentheUS andChina,andChinaandthe EU,non-preferentialrulesof originwillbeofincreasing importance.Thenonpreferentialrulesoforigin areWhollyObtainedandLast SubstantialTransformation.

ThepurposeofPreferential Originistoprovideduty benefitsthroughFreeTrade Agreements.Rulesoforigin ensurethatthebenefitsof anagreementareonlygiven tothoseproductswhich “originate”inoneofthe partiestotheagreement. Thepreferentialrulesoforigin aretheTariffShiftRule,the ValuePercentageRuleand theSpecificProcessRule.

www.tradefinanceglobal.com 21 Featured

Non-Preferential: WhollyObtained

Whollyobtainedisfairly straightforward,itcovers thecasesinwhichagoodis entirelyobtained,extracted ormanufacturedinasingle countrywithoutusingparts importedfromothercountries, forexample,naturalproducts extracted,harvested,hunted orcaughtinacountryorany goodproducedinacountry exclusivelyfromotherwholly obtainedgoodsfromthat country.

BeermadeintheUKcouldbe anexampleofthisasallofthe ingredientscanbegrownor obtainedintheUK.

Non-Preferential: LastSubstantial Transformation

Substantiallytransformed goodsarethosewhichare producedfromorwithimported materials,orthosewhich requireprocessingindifferent countries.

Attributingtheoriginofagood toasinglecountrycanbea complexexerciseinthesecases becauseseveralmaterials, parts,processesoralarge numberofcountriesmaybe involved.

Thepurposeoftheruleoforigin thereforeistoclearlyidentify whenexactlyatransformation occurs,thatis,whenthefinal productresultingfroma processissufficientlydifferent

fromtheinputsused tomanufactureit.

Substantiallytransformed goodsarethosewhichare producedfromorwithimported materials,orthosewhich requireprocessingindifferent countries.

Attributingtheoriginofagood toasinglecountrycanbea complexexerciseinthesecases becauseseveralmaterials, parts,processesoralarge numberofcountriesmaybe involved.

Thepurposeoftheruleoforigin thereforeistoclearlyidentify whenexactlyatransformation occurs,thatis,whenthefinal productresultingfroma processissufficientlydifferent fromtheinputsusedto manufactureit.

Ingeneral,thecriteriaofthelast substantialtransformationare expressedinthreeways:

Byarulerequiring achangeoftariff subheadinginthe HarmonisedSystem nomenclature;

Byavalue-addedrule, wheretheincreaseof valueduetoassembly operationsand incorporationoforiginating materialsrepresents aspecifiedlevelofthe ex-workspriceofthe product.

Byalistofmanufacturing orprocessingoperations whichmeettheoriginrules forthegoods;

www.tradefinanceglobal.com 22

TradeFinanceTalks

Preferential: Tariffshiftrule

Thetariffshiftruleisfairly straightforward.Theexact termswillvaryfromtrade agreementtotradeagreement.

Still,anexamplewouldbethat allmaterial(inputs)usedto manufacturesomethingmust beclassifiedinatariffheading (thefirst4digitsoftheHScode) differentfromthefinalproduct.

Leather(4104)+ eg. Buckle(8308)+ Zip(9607)= Handbag(4202)

Preferential:Value percentagerule

Thevaluepercentagerule specifieswhatpercentagein valuetherawmaterialscostis allowedtobeofthefinalselling

priceofaproduct.Itwillvary foreachcommoditycode andtradeagreement,so it’simportanttorefertothe termsoftheFTArelevanttothe correspondingtradingcountry.

Anexamplemightbechemical fertilisers,whicharelargely madeof3elements: ammoniumnitrate,potassium chlorideandammonium phosphate.AUKmanufacturer mightimporttherawmaterials andexportthefinalproduct totheEU.

Preferential:

SpecificProcessRule

EachFTAwillhaveanannex wherethespecificprocesses thatchangetheoriginofan importedproduct(asidentified bytheHScode)arelisted. Again,thesewillvaryfrom agreementtoagreementand willbeinfluencedbythemost highlyprizedindustrial

processesineachterritory. Therewillalsobealist ofoperationsthatarenot consideredsufficientto changeorigine.g.repackaging.

AstheUKseekstoreach£1 trillionofexportsby2030,an understandingoftherelevant rulesoforigincanprovide significantbenefitsinreduced tariffsorexploitationofquotas.

However,theconstantly evolvinglandscapeof sanctions,anti-dumpingand countervailingdutiesimposed bythemajoreconomieson eachother’sgoodsmeans non-compliancewithrules oforigincanentailserious financialpenaltiesoreven jailtime.

Therehasneverbeenamore importanttimetounderstand rulesoforigin.

www.tradefinanceglobal.com 23 Featured

PavelAndrle TradeFinanceTrainer andConsultant TradeFinanceConsulting

PavelAndrle TradeFinanceTrainer andConsultant TradeFinanceConsulting

InternationalStandby Practices(ISP98):25years later 2.4

Thisarticlewasoriginallypublishedin DocumentaryCreditWorld(DCW),published bytheInstituteofInternationalBanking Law&Practice.

Thisyearrepresentsa remarkablemilestoneinthe lifetimeoftheinternational rulesforstandbylettersof credit:ISP98.AlthoughIcome fromEasternEurope,aregion wheretheuseofstandby lettersofcredit(SBLC)islimited, Idealwithrelevantissues relatedtostandbyrulesand practicesveryoftenasan internationaltradefinance trainerandconsultant.

Iseeexpandingtheuseof standbysnowadaysandalso increasingrelianceonISP98 asthesetofgoverningrules forSBLCsissuedoutsideits maindomain,theUS.

Useofstandby lettersofcredit

Itisawell-knownfactthat standbylettersofcredit instrumentoriginatedintheUS whereitisusedverywidelyin situationswhereweEuropeans wouldutiliseademand guarantee.

Thereisalsoauniquetypeof standby,called“directpay”(i.e., payablewhentheunderlying paymentobligationisdue withoutregardtoadefault) whichdoesnothavean equivalentindemand guaranteepractice.

www.tradefinanceglobal.com 24

TradeFinanceTalks

Ingeneral,intheUS,usershave achoicetomakestandbys governedbyISP98orUCP600 Demandguaranteesarerarely usedintheUS;iftheyare,itis mostlyinthecontextof internationaltransactions.

Inmyregion,wemaychoose betweenademandguarantee andanSBLC.Understandably, thefirstchoicewouldbea demandguarantee,often subjecttoURDG758,orsilentas togoverningrulesandsubject toapplicablelawalone.

AnSBLCcouldbeusedif sorequestedbytheclient. Standbysareoftenusedto securethepaymentobligation ofabuyerinrelationtoits overseasopenaccounttradeor similarpaymentobligations. Suchrelativelysimplestandbys arefrequentlymadesubjectto UCP600.

BanksinCentralandEastern Europealsoissueandreceive other,morecomplicated standbys,directandcounterstandbys.Thisisusuallythe casewhentheunderlying transactionrelatestothe Americas.Mostofthese standbyswouldbesubjectto ISP98.

Asaninternationaltrainer activeinmanyregionsof Europe,Asia,andAfrica,Isee increasinginterestinISP98, aboveallintheMiddleEastover thepastfiveyears.Userswant toknowaboutthedifferences amongtheavailablerules,what practicalimpactthechosen ruleshave(ormighthave)on therelevantinstrumentand howitisprocessed.

Consequently,manyofmy coursesfocusondifferences amongURDG758,UCP600,

andISP98andprovidedetailed practicalanalysisand comparison.Inthisarticle,Ionly intendtodiscussthemain aspectstoconsiderwhen choosinggoverningrulesand someobservationsaboutISP98.

Useofstandby lettersofcredit

UCP600istheleastsuitableset ofrulesforasecurityinstrument suchasademandguarantee orstandbyletterofcredit. Firstly,theUCPrulesarenot designedtodealwithanyof therelevantissuessuchas indirectschemes(issuance ofalocalundertakingbacked byanincomingcounterundertaking),extendorpay demands,extensions,or reductions.

Inmanyothercases,the UCPrulescoversituations inadequately,suchastransfers. Nevertheless,somestilloptfor UCP600forstandbys!Itismost commonlyforaquitesimple commercialstandby(Also referredtoasa“payment standby“asitsecuresa paymentobligationofthe buyertopayfordelivered goodsorservices).

Forsuchstandbys,whichare usuallyissuedforshortperiods oftimeandonlycallfora demandwithastatementof paymentdefault(andpossibly acopyofanunpaidinvoice, sometimesalsoacopyof atransportdocument),the deficienciesofUCP600are wellknownandcanbeeasily remediedinthewordingof thestandby.

www.tradefinanceglobal.com 25 Featured

Itistruethatthereareseveral ICCOfficialOpinionswhichdeal withUCP500andUCP600 mattersinrelationtotheiruse withstandbys,somanyofthe problemsareknownandcan beavoided.

However,formorecomplex securityundertakingsand counter-undertakings,theuse ofUCP600presentsproblems andshouldbecompletelyruled out.

Consequently,thechoiceis betweenademandguarantee subjecttoURDG758ora standbyletterofcreditsubject toISP98.Whatarethemain concernsforuserswhen consideringthesegoverning rules?

Anotherthingtoconsideristhe culturalandhistoricalaspects, whichcouldbereasonsto chooseoneinstrumentandrule type.Settingthisaside,letus focusonmoretechnical features.

Theoverallbackingofthe rulesisveryimportantand playsasignificantroleinthe perceivedsuitabilityofthe rules.Itisessentialfortherules themselvestobeclearand easytounderstand.

However,whatifthereisa dispute,whowillprovidethe answer?

Whowillguideusersandwhere cantheylearnabouttherules sotheycanbecome comfortableusingthem?

UDRG758arerulescreatedby theICCandthusaresupported bythemwithitsvast infrastructureofpublications suchasISDGP,andvarious expertbooks,inadditiontothe

ICCOfficialOpinionsand DOCDEXcases.

TheICCnationalcommittees providemanytrainingson URDG758;andmanybooks, articles,andstudiesprovide informationabouttherules. Educationisakeytothe successofanyrule.

DoesISP98enjoy suchasupportive infrastructure?

Iseethatthereisconfusion abouttheISP98.Theywere createdbytheInstituteof InternationalBankingLaw& Practice,Inc.(IIBLP)whichholds thecopyrighttoISP98,however, theywerealsoapprovedbythe ICCBankingCommissionand publishedasICCPublication No.590.

ButtheyarenotICCrules. Consequently,ICCisnot mandatedtopublishany ICCOpinionsonISP98-related issues,however,IIBLPis.

IIBLPproduced“TheOfficial CommentaryonISP98”and otherverydetailedpublications dealingwithstandbysand otherundertakingssuchas demandguarantees.

Additionally,thestandby industrybenefittedgreatlyfrom theexcellentpracticaltoolwith explanatoryendnotes–the freelyavailablecollectionof ISP98ModelForms.

Theyprovideanyuserwith comprehensiveknow-how relatedtothemostcommon typesofstandbysandclauses.

www.tradefinanceglobal.com 26

TradeFinanceTalks

BankersAssociationfor FinanceandTrade(BAFT) hasitsownStandbyLettersof Credit/GuaranteesCommittee whichservesasanother valuableresource.

ICC’sDOCDEXsystemisalso availabletostandbyletters ofcreditsubjecttoISP98 (oranyothertradefinance transaction)ifsochosenby partiesforsettlingdisputes. Leadingqualificationson documentarycredits(CDCS), demandguarantees(CDGS), andstandbyLCs(CSGP) includequestionsonISP98 andtrainingmaterial.

Asitdoesforotherpractice rulesets,ICCAcademyhasa courseonISP98.Manylocal andinternationalinstitutions (includingmanyICCnational committees)conducttraining

onstandbysanddemand guaranteeswhichinclude sessionsonISP98,

Therefore,inmyview,thereis astrongbasesupportingISP98 andanyonewhowantstolearn abouttherulescandoso.

ISP98:Presentday andthefuture

1

IsISP98up-to-date?

Interestingly,peoplerecently seemtobeconcernedwhether ISP98isstillamodernsetof rulessuitablefortoday´s practice.Itistruethattherules werecreatedin1998andthere hasbeennorevisionofthem.

Atthattime,UCP500andURDG 458wereinplaceandbothUCP andURDGsubsequentlywent throughsignificantoverhaul. Sothequestioniscertainly relevanttoaskbut,itseems thatISP98hasnotbeenrevised astherewasnoneedtodoso.

Thereareonlyafewcourt caseswhichwouldrelatetothe ISP98rulesthemselves.When IaskmyUScolleaguesabout courtcasesorissuesrelatedto

SBLCs,theyalwaysleadmeto UCPcasesorwhenthestandby wasnotissuedsubjecttoany setofpracticerules.Itseems therearenonoticeableissues withISP98.

Nevertheless,Ithinkthata profoundlookattherulesmight bestillbeneficial.WhileIalso donotthinkthereareany provisionswhichneedtobe fixed,ISP98doesusesome phrasesandconceptswhich havebeenre-addressedin UCPandURDG.

Therefore,nowadays,whenwe makeacomparisonbetween therulesthismightcausesome degreeofconfusion.

Forinstance,ISP98Rule5.01 (TimelyNoticeofDishonour) refersto“unreasonable”time. ThisreflectsUCP500Article13 “areasonabletimenotto exceedsevenbankingdays” andURDG458Article10(a) “reasonabletimewithinwhich toexamineademand”.

BothUCP600andURDG758 abandonedthe“reasonable time”conceptandfixedthe periodtobeinanycaseupto “fivebanking(business)days.

Featured www.tradefinanceglobal.com 27

replaceditwith“noconflict”. UnderbothUCP600andURDG 758“inconsistency”indatais allowed;only“conflict”isnot.

ISP98Rule4.03states: “Anissuerornominated personisrequiredtoexamine documentsforinconsistency witheachotheronlytothe extentprovidedinthestandby.” Consequently,inmyview, inthecontextofISP98, theword“inconsistency”is interchangeablewith“conflict”.

Sotheruleeffectivelysays: “Anissuerornominated personisrequiredtoexamine documentsforinconsistency (orconflict)witheachother onlytotheextentprovidedin thestandby”.(addedbythe author).

IsISP98widely recognisedbyjudges toensureaccurate judgements?

Ihaveheardconcernsabout theproperinterpretationof ISP98bycourtsinjurisdictions otherthantheUS.Evidently, outsidetheUS,itispresumed thereisalowerknowledge baseaboutISP98.Inany event,incaseofadispute, itisincumbentontheparties involvedtobringrelevant interpretativeauthorities tothetable.

Mostcertainly,aknowledgeable courtwitness,anexpertonthe matter,wouldbeemployed. Courtsregularlydecideon

andsanctionswheretherules themselvesplayaminorrole, ifany.

Ifthereisadisputeabouta technicalaspectofanSBLCor ademandguaranteeitisoften duetobadissuance,wrong orambiguouswordingofthe instrument,soagain,therules themselvesarenottheroot cause.

Whatarethemain challengesforISP98 users? 3

Incountriesoutsidethe Americas,wheretheSBLCis widespread,thepreeminent challengeisthelackof knowledgeandpractice.

www.tradefinanceglobal.com 28

2

TradeFinanceTalks

financeproduct.Inthepast, standbylettersofcreditwere processedbydocumentary creditpersonnelinmanybanks.

However,withtherecent changesinrelevantSwift messages,namely,the remakeofMT760tocover bothstandbysanddemand guarantees,manybanks shiftedstandbystotheir guaranteedepartments.

Iseethatmanyofthese guaranteepersonnelstruggle withsomewell-established SBLCconcepts.Forinstance, theconceptof“confirmation”, “nomination”andtheroleof the“nominatedbank”, “automaticevergreenextension clauses”,reimbursing nominated(confirming)bank, placeofpresentationbeing

withthenominatedbanknot necessarilyonlyatmycounters, etc.

Consequently,onemustfirst fullygrasptheseLCaspects ofstandbys,whicharestrange eventoaguarantee practitioner.Thoseimpacted needtoplungethemselves deeperintotherules.

DeepknowledgeofURDG758 (andUCP600)iscertainly anadvantage.

Somedifferencesbetween therulesarewellknown(e.g. differenttreatmentof“force majeure”or“noconflict indata”);othersareless evident(e.g.ISP98Rule3.06(b) allowspresentationviaSWIFT (ie.electronicforminthis format)ifonlyademandis presentedandthebeneficiary isaSWIFTparticipantorabank. InthecaseofaURDG758 guarantee,suchapresentation wouldhavetobeexpressly allowed.

TherearesomeSBLCpractices whichmightcauseproblems, ifnotproperlythoughtthrough andthendrafted.Irecallsome intensivediscussionsabout confirmation,evergreen extensionclausesincaseofa confirmedstandby,extension clausesincasesofacounterstandbyandthelocalstandby. Requeststoissueademand guaranteeagainstacounterstandbyortheotherway aroundareparticularly challenging.

Oneshouldalsorealisethat ISP98treatsacounter-standby andalocalstandby(orany otherundertakingissuedas instructed)ascompletely separateandindependent fromeachother.

UDRG758setsthesamerule initsArticle5butthenmodifies therulebyArticle21(Currency ofpayment)andArticle26 (Forcemajeure)(Seealsothe provisionofISDGPParagraph 108).

Inmyview,thebiggest challengeisthelackofpractice, experience,andtheresulting lackofconfidence.Thisis understandableandtruewith allotherinstrumentsandrules whichwedonotdealwithon adailybasis.

Mygeneraladvicewouldbe:

Centraliseyourdemand guarantee/standbyletterof creditoperations;

Findaninternalchampion (orchampions)foreach product,rules,etc.toaccrue therelevantexpertiseand shareitwithothers;

Collectyourcases,create internaltools,andbuildup yourknow-howbase;

Useyourcorrespondent banknetworkwisely;

Spendoneducationwith practicalfocus.

ThemoreIlearnaboutISP98, themoreIadmirethemand themastermindbehindthem, ProfessorJamesE.Byrne.They areindeedamasterpieceof rulemakingandremainfully relevantafter25yearssince theircreation.Iwishthemthe verybestinthecoming25 years!

Thisarticlewasoriginallypublished inDocumentaryCreditWorld(DCW), publishedbytheInstituteof InternationalBankingLaw&Practice.

www.tradefinanceglobal.com 29 Featured

HollyPiggott

Director AlineaCustoms

HollyPiggott

Director AlineaCustoms

A2024guidetocustoms complianceandcrossbordertrade

Customscomplianceobligationshavetobe metwhenimportingandexportinggoodsto ensurethatthedocumentationrelatedtothe accompanyinggoodsisgeneratedin adherencewiththelegislationoftheimporting

obligationshavetobe metwhenimportingand exportinggoodstoensurethat thedocumentationrelatedto theaccompanyinggoodsis generatedinadherencewith thelegislationoftheimporting andexportingcountries.

TheWorldTradeOrganisation and164membernations, andtheWorldCustoms Organisationwith184member

multilateraltreaties,suchas TheGeneralAgreementfor TariffsandTrade,andthe RevisedKyotoConvention, governingareasincluding customsvaluation,customs classification,andrulesof origin.

Thisensuresthatcustoms obligationsformerchantsare forthemostpartharmonised.

www.tradefinanceglobal.com 30

2.5

TradeFinanceTalks

Customsclassification

Theharmonisedschedule(HS) determinesthefirst6digits ofacommoditycode,thisis knownastosub-headinglevel. Dependingontheimporting territory,digitsfollowingtheHS codemayvaryonaregional basis.

andincertaincases, exciseduty,anti-dumping duty,safeguardingduty, countervailingduty,and quotaswillbemandated.

TheEuropeanUnionandthe UnitedKingdomclassify goodstoanational10-digit nomenclatureforimports,and onthebasisof:classification, thecountryofeconomic originofthegoods, andexportingcountry, compliancemeasures relatedtoprohibitions andrestrictions, licensingandcertification, sanctions,andthe applicationofcustomsduty, andincertaincases,excise duty,anti-dumpingduty, safeguardingduty, countervailingduty,and quotaswillbemandated.

Traderswhoareimporting orexportinggoodsfromthe UnitedKingdomcanreview theirobligationsusingHMRC’s CheckHowtoImportand ExportGoodstool.TheUnited Kingdom’s(CDS)removal ofthe999Lwaivercodefor importssince31January2024 hasobligatedincreased scrutinyofthecomposition ofimportedgoods.

Rulesoforigin

Rulesoforigingoverntrade agreements,enablingaccess topreferentialtariffs.The criteriawillbeassessedon whetherthegoodsarewholly sourced,sufficientlyprocessed orcumulatedtoapermitted percentage,asdeterminedby theaccompanyingfreetrade agreement’sproduct-specific rules.

Inordertobenefitfromthe enhancedmarketaccess, exportersmayhavetoapply theappropriatelywordedtext ofthestatementoforiginonan accompanyingdocumentsuch asthecommercialinvoiceand mayalsohavetoapplyto theirnationalauthoritiesfor approved/registeredexporter (REX)statusifthevalueof thegoodsisabove£5,500. Alternatively,theymaychoose topresentacertificateoforigin, EUR-1orEUR-MedCertificate, wherepermitted.

InadditiontoFTAs,thereare 65countriesinthedeveloping countriestradingscheme (DCTS)thatcanbenefitfrom preferentialtariffsforexports. Incircumstanceswherethe goodstradeddonotmeetthe rulesoforigincriteriaorare exportedfromacountrywhich doesnothaveatradedealin placewiththeimportingnation, goodswillbetradedundera “mostfavourednation”(MFN) basis,ensuringequivalentduty rates.

www.tradefinanceglobal.com 31 Featured

‘GateofTears’twenty-mile straitsadjacenttoYemen, andthroughtheSuezCanal, whereitconnectstothe MediterraneanSea.

USDper40ftcontainer.The delayedarrivalofgoodshas particularlyaffected‘just-intime’manufacturers,whomay beassessingtheirpositionin on19October2023.Atthetime ofwriting,themajorityof shipmentswhichwerein progresspriortothecrisiswill havetakenplace.

www.tradefinanceglobal.com 32

TradeFinanceTalks

highlightingtocarriersthat theRedSeacrisiscannotbe consideredaforcemajeure incident,whichcanonlybe declaredwhenacontractual provisionisimpossibleto

bydelay,eventhoughthedelay becausedbyariskinsured against”andat6.1doesnot “warcivilwarrevolution rebellioninsurrection,orcivil strifearisingtherefrom,orany hostileactbyoragainsta belligerentpower.”

Whethertheunderlyingsale agreementisgovernedby Englishlaw,andtheSaleof GoodsAct1979,theUnited NationsConventionforthe InternationalSaleofGoods (CISG)ortheUniform CommercialCode(UCC) mayalsohaveanyimpacton theassessmentofdamages causedbythelatearrival ofgoods,ifatall,andany obligationstomitigatethe circumstances.

www.tradefinanceglobal.com 33 Featured

NealHarm

SecretaryGeneral FCI

NealHarm

SecretaryGeneral FCI

DeepeshPatel

DeepeshPatel

FCI’sNealHarmonkicking offinclusivegrowthinthe factoringindustry

Tobetterunderstandtheprinciplesoffinancial inclusion,equitableregulation,andsustainable growthinthefactoringindustry,TradeFinance Global’s(TFG)DeepeshPatelspokewithnew FCISecretaryGeneral,NealHarm.

EditorialDirector TradeFinanceGlobal(TFG)

EditorialDirector TradeFinanceGlobal(TFG)

InApril2021,theworldof footballwasrockedbythe announcementoftheEuropean SuperLeague(ESL),aproposed elitecompetitionthatsought topermanentlyplaceEurope’s topfootballclubsinaclosed league.

Theplan–metwithwidespread criticism–wasseenasamove thatprioritisedfinancialgain oversportingmerit,threatening theinclusivenatureofthesport bypotentiallyleavingsmaller clubsandtheirfansbehind.

Thisincidentservesasa parallelintheworldoffinance, particularlywithinthefactoring industry,raisingpertinent questionsaboutensuring growth,resilience,and inclusivity.Asthefactoring sectorcontinuestoexpand, significantlyimpactingglobal tradeandeconomic development,itfacesthe challengeofevolvingwithout creatingdisparitiesreminiscent oftheESLdebacle.

www.tradefinanceglobal.com 34

2.6

TradeFinanceTalks

Tobetterunderstandthe principlesoffinancialinclusion, equitableregulation,and sustainablegrowthinthe factoringindustry,Trade FinanceGlobal’s(TFG) DeepeshPatelspokewithnew FCISecretaryGeneral,Neal Harm.

Understandingfactoring: Acatalystforglobaltrade

Factoringisafinancialservice thatprofoundlyimpactsglobal tradeandeconomic development.

newopportunitieswithout beingconstrainedbycash flowissues.

Secondly,factoringis particularlybeneficialin financingopenaccount tradereceivables,acommon practiceininternationaltrade wheregoodsareshippedand deliveredbeforepaymentis due.

Thisalignswithglobaltrade needs,whereextended paymenttermsarestandard andcanposesignificantrisks andliquiditychallengesfor exporters.

Thefactoringindustrycan tapthesebenefitsforglobal marketsbyincreasing awarenessandunderstanding offactoringandbyfostering partnershipswithfinancial institutionsandregulators.

www.tradefinanceglobal.com 34

Featured

Harmsaid,“What’sinteresting–andit’shistoryrepeatingitself –ishowwe’reenteringthose emergingmarketstoday.It’s nodifferentthan56yearsago. It’slearningaboutthemarket, advocatingfortheproduct, andeducatingthemembers onwhatthisproductisand whatitisn’t.Thenit’swatching itgrow.”

Byfollowingthisproven approach,theindustrycan openupnewmarketsand supporttradefinanceinregions whereaccesstotraditional bankingandfinancialservices islimited,helpingtoliftnations outofpovertyandfacilitating theirintegrationintotheglobal economy.

Expandinghorizons: Factoring’sgrowthin emergingmarkets

Factoringhassignificantgrowth andpotentialinemerging markets,underliningitsvital roleinenhancingeconomic developmentandfacilitating trade.

Harmsaid,“Ifyouthink abouttheAfricanregion theSouthernAsianregion, particularly opportunityforgrowthasthey maturewithopenaccount finance.”

Thisopportunitylendsitself totheevolvingunderstanding andadoptionoffactoringas acrucialfinancialservice thatsupportsbusinessesin managingcashflowand accessingworkingcapital efficiently.

Akeyaspectistheexponential growthpotentialoffactoring inthesemarkets,propelled byincreasingtradevolumes andtheneedforalternative financingsolutionsthat complementtraditional bankingservices.

Thegrowthoffactoringin developingregionsisnotjust afunctionoftheexpanding globaltradebutalsoaresult ofdeliberateeffortstowards education,advocacy,andthe establishmentofsupportive regulatoryframeworksthat recogniseinvoicesas investableassets.

Harmsaid,“It’scomplexandit requirescoordinationbetween banks,financialinstitutions,and regulatoryagencies.Withallof thosegroupsworkingtogether, wecanfigureoutthebestway tomakeaninvoiceintoan investableasset–the regulationsweneedtoput aroundit,howwesecureit, andhowwebringliquidity intothemarkettosupportit.”

Moreover,thestrategic partnershipsbetweenglobal institutionslikeFCIandother localstakeholderscanhelpto fosteradeeperunderstanding offactoringandarecrucialin

www.tradefinanceglobal.com 36

TradeFinanceTalks

creatinganecosystem whereitcanthrivebyaligning businesses,financiers,and policymakers.

Visionandchallenges ahead:InsightfromFCI’s newsecretarygeneral

TheFCI’smissionistoensure theresilient,sustainable inclusivegrowthoffactoring onaglobalscale.Centraltothis objectiveistherecognitionof factoringasafinancialtooland avitalcomponentoftheglobal tradeecosystemthatcandrive economicdevelopmentand alleviatepoverty.

Harmsaid,“Itcomesdownto awareness,advocacy,and education.That’swhatFCIis therefor.Forustobeawareof what’sgoingoninthe market,advocatingaswesee somethinghappening,and theneducatingasfastaswe can,tobringpeopleupto speed.”

Recognisingthechallengesand opportunitiesofregulatory changesandeconomictrends, FCIpositionsitselfasavoicefor thefactoring,openaccount andtradefinanceindustries, engagingwithpolicymakers andstakeholderstoadvocate forregulationsandpoliciesthat supportthegrowthofthese markets.

Throughtheseefforts,the organisationaimstoaddress potentialchallengeshead-on, suchasthosearisingfrom Europeanlatepayment regulations,bypromoting awarenessandeducation, whichcanleadtomore informedandconstructive policy-making.

AttheheartofFCI’svisionisthe desiretoseefactoringand openaccountreceivables recognisedasacriticalelement oftheglobaltradefinance landscape,capableofdriving significanteconomicbenefits.

Harmsaid,“IwantFCItobe threelettersthatcome immediatelytopofmindwhen someoneisthinkingaboutopen account.Ifwe’retalkingabouta receivable,thetransaction,the financing,whetheryou’rea bank,whetheryou’rea regulator,we’repartofthat conversation.”

Thisvisionisnotonlyabout fosteringgrowthinthevolume offactoredreceivablesbutalso aboutensuringthatthe benefitsoffactoringarewidely andequitablydistributed, supportingbusinessesin developedandemerging marketsalike.

Justasthefootballworldunited againsttheexclusivityofthe ESL,thefactoringindustrymust embraceinclusivity,ensuring nosmallplayerisleftbehindin thepursuitofglobaleconomic progress.

Puttingtheideaintopractice, FCIishostingtheir56thAnnual MeetinginSeoul,SouthKorea from9-13June,bringing togetherallglobalprofessionals tofurtherthediscussioninto factoringandreceivables finance.

ForHarm,thiseventoffersthe opportunitytogrowthe industry.Hesaid,“Abigpartof theeventofawareness, advocacy,andeducation…It’s tohavetimewitheachother, learnhowtodobusinessand howtomakemoneytogether. Andagain,totakethatfriction outofthetransactionasitgoes cross-border.”

www.tradefinanceglobal.com 37

Featured

38 TradeFinanceTalks www.tradefinanceglobal.com

Drivingprogress:Womenleadingintrade,treasury&payments

DeepeshPatel EditorialDirector TradeFinanceGlobal(TFG)

DeepeshPatel EditorialDirector TradeFinanceGlobal(TFG)

WomeninTrade,Treasury &Payments2024–Policy topractice:Addressing genderdisparityin financialaccess

BrianCanup AssistantEditor TradeFinanceGlobal(TFG)

BrianCanup AssistantEditor TradeFinanceGlobal(TFG)

TradeFinanceGlobalhostedanin-person roundtabletocelebrateWomeninTrade, Treasury&Payments2024.Learnmoreabout theevent!

TocommemorateInternational Women’sDayandcelebrate themanyremarkablewomen acrosstheindustry,Trade FinanceGlobal(TFG)held itsannualWomeninTrade, Treasury,&Paymentseventat theLansdowneClubinLondon.

Roundtablediscussionsat theevent,heldunderChatham Houserules,haveilluminated thestaggeringnumberof womenworldwidewhoremain unbankedandlackequal economicrights.

Thiscomplexissue, exacerbatedbycultural influencesandlongstanding traditions,callsfortargeted interventionstoimprove financialeducationandaccess, highlightingthenecessityof aconcertedeffortacrossall sectorsofsocietytoaddress thesedisparitieseffectively.

3.1 www.tradefinanceglobal.com 40

TradeFinanceTalks

Addressingcultural andsocietalinfluences onwomen’sfinancial literacyandaccess

Thegenderdisparityinfinancial accessisacomplexissue deeplyrootedinsocietalnorms andculturalexpectationsthat caninfluencefinancialliteracy amongwomen.

Still,anextremelylarge numberofwomenaroundthe worldremainunbanked,with approximately740million womengloballylackingaccess tobankingservicesasof2021.

Thisgapinfinancialaccessis furtherexacerbatedbythefact thatwomen,onaverage,enjoy fewereconomicrightsthan men,highlightingasignificant barriertoachievinggender equalityineconomic participation.

Butthesedifferencesarefar fromuniversal.

Culturalandsocietalinfluences playapivotalroleinshaping women’sfinancialliteracyand overalleconomicparticipation, oftenstemmingfrom longstandingnormsand culturalexpectationsthat dictateexpectedgender rolesinacommunity.

Suchculturalnormscandeter womenfromseekingfinancial knowledgeorparticipatingin financialdecisions,further wideningthefinancialliteracy gap.

Breakingdownthesenormsis fareasiersaidthandone,with oneparticipantnotingthat“in somecountries,you’rebreaking centuriesoftraditions.”

Thisunderscorestheneedfor targetedinterventionsto improveaccesstofinancial

educationandchallengethe culturalnormsandsocietal expectationsthathave historicallyplacedwomenat adisadvantageinthefinancial sphere.

Strengtheningpolicyand regulationtoempower femaleentrepreneurs andleaders

Policyandregulationplay crucialrolesinpromoting genderequality,offeringa frameworkwithinwhichbarriers tofemaleentrepreneurship andleadershipcanbe systematicallyaddressed anddismantled.

AreportfromtheWorldBank highlightsthat,globally,on paper,womenenjoyonly aroundtwo-thirdsofmen’s rights.

www.tradefinanceglobal.com 41 Drivingprogress:Womenleadingintrade,treasury&payments

However,despitetheexistence oflawsaimingtoensure genderequality,the implementationand enforcementoftheselaws remainchallengingandon average,countrieshave establishedlessthan40% ofthesystemsneededto implementthem.

Thegapbetweenpolicyand practiceshowstheimportance ofmorecomprehensiveand enforcedregulationsto equaliserightsonpaperand ineverydayreality.

Thispolicyrealityhas widespreadimpactsonmany areas,notablyfemale entrepreneurship.

Oneofthecriticalbarriersto femaleentrepreneurshipand leadershipisthelackofequal opportunities,whichispartially attributedtoinsufficient regulatoryframeworks.

Forexample,despitedecadesoldlawssuchastheUK’sEqual PayAct(passedinthe1970s), thegenderpaygapspersist, suggestingthatlegislation aloneisinsufficient.Whatis requiredisacombinationof policyinnovationandcultural shift,whereregulationsare supportedbysocietalchange thatvaluesandpractices genderequality.

Fosteringanenvironment encouragingfemaleleadership andentrepreneurshipalso meansaddressingcultural biasesandstereotypeslimiting women’srolesand contributions.

Policiesthatencourage educationandtrainingin leadershipandfinancialliteracy forwomen,aswellasinitiatives

thatshowcasesuccessful femaleleadersasrolemodels, arecrucial.

Suchmeasurescanhelpshift culturalperceptionsandinspire futuregenerationsofwomen toaspiretoleadershiproles.

Theseefforts,however,need tobematchedwithgroundlevelimplementationand enforcementmechanismsthat ensurethepolicieseffectively translateintoreal-world changes.

Policyandregulationare indispensabletoolsin promotinggenderequality, particularlyinfacilitating

femaleentrepreneurshipand leadership,butstepscanalso betakenatthecorporatelevel tofurthercatalysechange.

Strengtheningpolicyand regulationtoempower femaleentrepreneurs andleaders

Corporateinitiatives,such asthoseaimingtodemystify financialterms,create transparenthiringpractices, andensureequal representationonpanelsand leadershiproles,arecrucialto fosteringanenvironmentwhere womencanthriveequally alongsidemen.

Theseinitiativesprovidethe structuralsupportnecessary forwomentoadvanceintheir careersandaddressthe systemicbiasesthatoften hindertheirprogress.For instance,thesecorporate initiativescanhelpcombatthe perceptionthatwomenare

www.tradefinanceglobal.com 42

TradeFinanceTalks

chosenforrolessolelybased ontheirgenderratherthantheir qualificationsandabilities.

Bycreatingmoreinclusive andequitableworkplaces, corporationscanleadby example,showcasingthe benefitsofdiversityand equalitynotjustwithintheir wallsbutacrossthebroader businesscommunity.

Therapidlygrowingdigital economyalsooffersaunique platformforpromotinggender inclusionandequalityby providingaccesstomarkets, finance,andopportunities thatmightotherwisebe inaccessible.

Digitalplatformscanserveas equalisers,allowingwomen entrepreneurstobypass traditionalbarrierstoentry

intothebusinessworld.Therise offintech,forexample,canhelp addressthegapinfinancial accessbyofferingservices tailoredtowomen’sneeds andcircumstances,potentially transformingtheireconomic participationand empowerment.

Newanddigitalbusinessescan bemoremeritocraticandless boundbytraditionalgender rolesandbiases,providing afreshlandscapewhere women’scontributionscanbe valuedbasedontheirskillsand innovations.

Whilecorporateinitiatives canreshapetheworkplace environmentandculturetobe moreinclusiveandequitable, thedigitaleconomyprovides newopportunitiesand platformsforwomen’s economicempowerment andparticipation.

Together,theseforcescan significantlycontributeto breakingdownbarriersto genderequalityandfostering amoreinclusiveandequitable globaleconomy.

Reiteratetheimportanceof amultifacetedapproachto addressinggenderdisparitiesin financialliteracyandeconomic participation.

policyinnovation,andcultural shiftstoachievegender equalityintheeconomy.

Theroundtablediscussionsat TFG’sWomeninTrade,Treasury, andPaymentseventfurther highlightedwomen’s challengesintheglobal economy.However,through conversation,theparticipants proposedsolutions encompassingpolicyreform, corporateinitiatives,andthe burgeoningdigitaleconomy.

Tobridgethegapsoffinancial inclusionandgenderequality, acohesiveeffortbetween legislation,corporate responsibility,and technologicalinnovationis essential.Aswemoveforward, letthesediscussionsinspire actionablechange,fuelling effortsacrosstheglobeto createamoreequitable economiclandscape.

Thejourneytowardsgender parityinfinanceislongand fraughtwithobstacles,yetwith continueddialogue,innovation, andcommitment,it’sajourney thatcanandmustbe undertakentoimprovethe worldforeveryone.

www.tradefinanceglobal.com 43

Drivingprogress:Womenleadingintrade,treasury&payments

DeepeshPatel EditorialDirector

DeepeshPatel EditorialDirector

TradeFinanceGlobal(TFG)

WomeninTrade,Treasury &Payments2024–From classroomtoboardroom: Educatingforgenderequity intrade,treasury,and payments

LearnmoreaboutTradeFinanceGlobal’s WomeninTrade,Treasury&Payments roundtablesandeventheldinLondon!

TradeFinanceGlobal(TFG)held itsannualWomeninTrade, Treasury,andPaymentsevent

Inaseriesofroundtable discussionsattheevent,held underChathamHouserules,

BrianCanup Assistant

Editor

TradeFinanceGlobal(TFG)

www.tradefinanceglobal.com 44

3.2

TradeFinanceTalks

trade,treasury,andpayments aninclusiveindustryfor everyone.

Promotinggender equalityintheworkplace startswithearly education

Promotinggenderequality fundamentallybeginswithearly education.Itplaysacriticalrole inshapingperceptionsand breakingdowngender stereotypes.

Onespeakersaid,“Iwasraised inafamilywheretherewasno differenceingender.Myfather alwaystoldmetherewas nothingIcouldnotdoor achievebecauseIwasagirl.” Anotheradded,“Education startswhenyouareveryyoung inyourfamily,withyourparents saying,okay,youareagirl,but youcanspeakup.”

Byincorporatinggender equalityattheseearlieststages

oflife,childrencanbetaught toappreciateandunderstand theimportanceofequality betweenmenandwomen.This willaddressstereotypesand instilconfidenceinyounggirls, empoweringthemtopursue theirinterestsandambitions withouttheconstraintsof traditionalgenderroles.

Thisconfidenceiscrucial fortheircontinuedsuccess andparticipationinareas traditionallydominatedby men,suchasSTEMfieldsor leadershippositions.

Ultimately,asoneparticipant said,“Educationstartsinthe family,thenintheschool,then inuniversity,andtheninthe industry.”

Oneofthepowerfulaspectsof educationintheindustryisthat itcancomefrominfluential mentorsandrolemodels.

Mentorshipandrole modeling

Mentorshipandrolemodelling canhaveatransformative impactinshapingthenext generationoffemaleleaders. Mentorshipiscrucialfor knowledgesharing,skill development,andconfidence buildingamongwomen navigatingtheircareersin thesesectors.

However,it’snotjustmentoring inthetraditionalsensethat canplayaroleinpromoting equalityintheindustry;there isalsoaconceptofreverse mentoringthatsome organisationsareexploring.

Reversementoringinvolvesa processwherethetraditional mentoringrolesareinverted, meaningthatyoungerorless experiencedindividualsmentor

www.tradefinanceglobal.com 45 Drivingprogress:Womenleadingintrade,treasury&payments

staff.Forinstance,younger employeesmightshareinsights aboutnewtechnologies,social media,orcurrenttrendswith theirmoreexperienced counterparts.

Reversementoringcanalso taketheformofjunior membersfromhistorically marginalisedgroupsmentoring seniorleadersabouttheir experiencesandwaysof working.Thismethodcanfoster aninclusiveculturethatvalues differentperspectivesandskills, regardlessofthetraditional seniority-basedmentoring paradigms.

Whetherconductedinthe traditionalsenseorunderan invertedapproach,mentoring intheworkplacecanbea powerfultooltopromote equalityinthetrade,treasury, andpaymentsspace.

Inclusiveleadership anddecision-making

Closelyrelatedtomentoring, ensuringanorganisationhas aninclusiveleadershipteam canhelpinspireemerging leaders,regardlessoftheir demographicbackground.

Seeingwomeninleadership positionsnotonlychallenges theprevailingstereotypes andbiasesaboutgenderroles withintheindustrybutalso demonstratesthepossibilities forcareerprogressionand success.Whenwomensee themselvesreflectedin leadershippositions,itfosters asenseofpossibilityand belongingthatcancatalyse ambitionanddrive.

However,leadershiprolesand decision-makingprocesses remainheavilymaledominatedinmanyindustries.

companyis43%women,but notattheleadershiplevel.IfI lookatthecompanystats,it’s good,butit’snotgoodenough formebecauseI’mtheonly womanintheboardroom. Everysingletime,I’mtheonly oneintheboardroom.”

Itistimetodobetter.

Byactivelyinvolvingwomenin strategicdiscussionsandpolicy formulations,organisations canensureamorebalanced representationthatreflectsthe diversityoftheirworkforceand customerbase.

Theemphasisoninclusive leadershipisgroundedinthe understandingthatdiverse teams,ledbyindividualswho valuedifferentviewpointsand experiences,arebetteradept atnavigatingthecomplexities oftheglobalmarket.

www.tradefinanceglobal.com 46

TradeFinanceTalks

Consequently,thecommitment toinclusiveleadershipand decision-makingstrengthens anorganisation’scompetitive edgebyharnessinghuman creativityandintelligence.

Anotherwaytomaximise employeepotentialisby buildingacorporateculture thatembracesandencourages flexibleworkingarrangements.

Flexiblework arrangements

Ensuringflexiblework arrangementsisastrategyfor promotinggenderequalityin theworkplace,astheyallowfor amoreinclusiveenvironment thataccommodatesthe diverseneedsofevery employee,notjustparents.

Oneparticipantsaid,“The benefitofflexibleworkoptions isthatwhenyougivethemto women,yougivethemto everyone.Itdoesn’thavetobe thatsinceI’mamum,Ineed thatflexibility.Someonemay needtheflexibilitytolookafter ageingparents,andifthat’s somethingoffered institutionally,itcanbenefit everyone.”

Byofferingoptionssuchas remotework,flexiblehours,and part-timepositions,employers cansupportwomenandmenin achievingahealthywork-life balance,enablingeveryoneto thriveprofessionallyand personally.

Thisapproachhelpsretain talentedfemaleprofessionals andensurestheydonothave

tochoosebetweencareer advancementandtheirroles outsideofwork.

TradeFinanceGlobalwants tothankallofourpartnersfor helpingmakethisWomenin Trade,Treasury&Payments campaignpossible.

Additionally,wewanttothank alloftheroundtable,evening eventanddigitalcampaign participantsforhighlightingthe amazingworkthatallwomen aredoinginthetrade,treasury &paymentsindustry.

Wewanttoensurethatthe lessonswealltookawayfrom thiseveningarenotforgotten, andwecontinuetobuildonthis knowledgeeveryday.From acknowledgingdifferent culturesandhowtheydealwith genderissuestoeducatingthe nextgeneration,thereare endlesswaysthatwecan continuethismomentumand makeourindustrymore inclusive.

Wewanttochallengeyou, whatcanyoudotohelp inspireinclusion?

BeonthelookoutforTFGto continuetofeatureallofthe amazingwomenintrade, treasury&payments throughouttheyear!

www.tradefinanceglobal.com 47

#InspireInclusion

Drivingprogress:Womenleadingintrade,treasury&payments

GwenMwaba Director&GlobalHead ofTradeFinance Afreximbank

GwenMwaba Director&GlobalHead ofTradeFinance Afreximbank

Africafocus:Afreximbank onempoweringwomenin trade,treasury,and payments

Tolearnmoreaboutthechallengesthatwomen faceinthetrade,treasury,andpaymentsspace acrosstheAfricancontinent,andsomeof theprogrammesinplacetohelpbalancethe scales,TFGspokewithGwenMwaba,Director andGlobalHeadofTradeFinanceat Afreximbank.

DeepeshPatel EditorialDirector TradeFinanceGlobal(TFG)

DeepeshPatel EditorialDirector TradeFinanceGlobal(TFG)

TradeFinanceGlobal’s(TFG) annualWomeninTrade, Treasury,andPayments campaignin2024focusedon InspiringInclusionaroundthe globe.Differentregionsface differentchallengeswhenit comestogenderinclusion, anditisvitaltounderstand perspectivesfromacrossthe globe.

Tolearnmoreaboutthe challengesthatwomenface inthetrade,treasury,and paymentsspaceacrossthe Africancontinent,andsome oftheprogrammesinplace tohelpbalancethescales, TFGspokewithGwenMwaba, DirectorandGlobalHeadof TradeFinanceatAfreximbank.

www.tradefinanceglobal.com 48

3.3

TradeFinanceTalks

Afreximbank’srolein addressinggender equality

WomeninAfricaaimingto acceleratetheircareersin trade,treasury,andpayments faceseveralsignificant challenges,includingsocietal pressures,whichsometimes dictatewomen’srolesand affecttheircareeropportunities.

Additionally,womencan encounterobstaclesincareer advancementduetoperiods ofmaternityleave,whichcan putthembehindtheirmale counterparts.Manywomenalso lacksufficientrolemodelsin leadershippositionswithintheir fields.

Mwabasaid,“Therealityisthat tradeisnotgenderbalanced, particularlyacrossdeveloping andemergingmarkets.”

Thisissomethingthat Afreximbankfocusseson addressinginordertosupport, include,andempowerwomen acrossthecontinent.

Thebankhasimplemented variousinitiativestoprovide mentorshipandtraining programmestoupskillfemale employeesandattractmore womenintotheindustry.These effortsarepartofabroader strategytobuildcapacityand offersupportsystemsthat enablewomentonavigate theircareersmoreeffectively, includingovercoming organisationalchallenges.

Beyondinternalinitiatives, Afreximbankextendsits supporttoAfricanfemale entrepreneurs,offeringtargeted

programmestofacilitate theirinvolvementintradeand accesstoessentialinformation andfinancialresources.

Throughthesecomprehensive measures,thebankis makingsignificantstridesin empoweringwomeninAfrica, helpingtoovercomethe generationsofembedded challenges.

Impactof Afreximbank’swork

Afreximbank’sTrade InformationPortalisone initiativethathashelpedto democratiseaccesstotrade informationandishelpingto leveltheplayingfieldfor womenintrade.

TheTradeInformationportal, whichisavailableunder theAfreximbank’sdigital ecosystemtheAfricaTrade Gateway(ATG),offersa subscription-basedservice

whereentrepreneurs,atno initialcostforthefreelimited accessversion,canaccess informationaboutmarket needsandopportunitiesin neighbouringcountries. Thisinformationiscrucialfor womenlookingtoexportgoods andservices,empoweringthem tomakeinformeddecisions andidentifyviablemarkets fortheirproducts.

Thebank’sroleinpromoting successfulfemale-led enterprisesfurtherhighlights itsimpact.

Mwabasaid,“Wehaveavery successfulclientinthecocoa industryinGhana.Shestarted asacocoabeantrader,but weencouragedhertosetup amanufacturingplant,which Afreximbankfinanced.Now,the companyissemi-processing cocoabeansintococoacake, cocoaliquor,andcocoabutter forexporttomanufacturersof finishedproductsoutsideof Africa.

www.tradefinanceglobal.com 49

Drivingprogress:Womenleadingintrade,treasury&payments

“Whatisexcitingaboutthis businessisthatitisownedbya womanwhoisalsotheCEO,her CFOisawoman,herentire seniormanagementteamare women,andthepeopleonthe shopfloorarewomen.

“That’sjustoneexampleof Afreximbank’sinitiativesto supportwomenentrepreneurs.”

However,supporting entrepreneursintoday’s technology-driveneconomy alsorequiresadedicated digitalapproach.

Howcandigital educationhelpwomen?

Afreximbankisstrategically positionedtoenhanceand promotedigitaleducation amongAfricanfemale entrepreneurs,enablingthem toparticipatemorefullyin digitaltrade.

Thebank’sapproachtodigital education–whichisnolonger justanadvantagebuta necessityforstaying competitiveintheglobal market–involvesproviding digitalsolutionsandtrainingto ensureuserscanfullyleverage thesetechnologies.

Onedigitalinitiativewhichcan alsobeaccessedonATGisthe MansaDigitalPlatform,aKYC repositorythatsimplifiesthe verificationprocessfor corporatesandbanks.This platformisinstrumentalin helpingentrepreneursgain quickeraccesstofinancial servicesbystreamliningthe duediligenceprocessfor potentiallenders.

bankstoprovideyouwith solutions.Withinthat ecosystem(ATG),wehavealso developedadigitalsolution calledtheAfricaTrade Exchange(ATEX),whichisa digitalexchangeforbuyingand sellingallmannerof commodities.”

TofurthersupportATEX, Afreximbankisthepayment bankandwilllinkATEXto thepaymentplatform,the PanAfricanPaymentand SettlementSystem(PAPSS) whichfacilitatestransactionsin localcurrencies.

receiveKenyanshillingsfor goodsthattheyselltoabuyer inRwanda,whopaysin RwandanFrancs.Thissystem significantlyreducesthe relianceonforeigncurrencies, makingtrademoreaccessible andcost-effectiveforAfrican entrepreneurs.

ForAfreximbank,however,the digitaljourneyisaboutmore thanjustprovidingaccessto thesetechnologyplatforms. Itisalsoabouttrainingand education.

46 www.tradefinanceglobal.com 50

TradeFinanceTalks

comprehensivetraining, empoweringthemwiththeskills neededtonavigateand maximisethebenefitsthe digitalsolutionsprovide.

Mwabasaid,“ThroughourHR departmentweoffer Afreximbankacademy AFRACAD,whichhasanumber ofdigitalandnon-digital coursesaccessibletopeople whowanttoupskillthemselves inanythingtodowithbanking andtrade.”

Thiseffortenableswomento trademoreeffectivelyinthe digitalrealmandcontributes

tradesector.Afreximbankplans tocontinuethismomentumby rollingoutnewinitiativesinthe yearstocome.

Lookingtoan inclusivefuture

Oneoftheinitiativesthebank isdrivingistheestablishment ofExportTradingCompanies (ETCs),whichseekto overcomeoneofthe significantchallengesfemale entrepreneursface:theinability toexportduetothesmall sizeoftheiroperations.

Mwabasaid,“Thismodelentails aggregatinggoodsfrom differentmarketstocreate scale.Forexample,youhave manysesameseedproducers who,ontheirown,aretoosmall tobeabletoexport.

“ThisETCinitiativewould aggregatesesameseedsinto onelocationwiththehighest comparativeadvantage, packageandbrandthem underonelabeland,usingthat volume,exportthemoutside Africa.”

Additionally,Afreximbankis spearheadingthedevelopment ofindustrialparksfocusedon lightmanufacturingacross Africa.Theseindustrialparks wouldprovideaconducive environmentforentrepreneurs whoengageinlight manufacturing,suchas producingsmallelectrical componentsorgarments,and arewellsuitedtowomendueto theirscalabilityandpotential forjobcreation.

Throughtheseandother programmes,thebank continuestopavetheway foramoreequitableand prosperousfutureforwomen intradeacrossthecontinent. Afuturethatwillinspire inclusionforall.Mwabasaid, “Tome,InspireInclusionmeans youcan’tbeallthingstoall people.Justbethebest versionofyourselfcanbe.”

www.tradefinanceglobal.com 51

Drivingprogress:Womenleadingintrade,treasury&payments

MichelleKnowles HeadofTradeandWorking CapitalProducts

MichelleKnowles HeadofTradeandWorking CapitalProducts

Progressionthrough effortandrisktaking: Absa’sMichelleKnowles discussesbeingawoman intheworkplace

TokickoffTFG’sWomeninTrade,Treasury& Payments2024campaign,TFGspoketoAbsa’s MichelleKnowlesaboutherexperiencesinthe industry.

BrianCanup AssistantEditor TradeFinanceGlobal(TFG)

BrianCanup AssistantEditor TradeFinanceGlobal(TFG)

InternationalWomen’sDay on8March,2024israpidly approaching,andTrade FinanceGlobalispreparingto hostourownWomeninTrade, Treasury&Payments campaign.WhileTFG’s campaignisdesignedto highlighttheworkthatall womenaredoingintheTTP industry,wethinkit’simportant tohearfromsomeofthe leadersoftheindustry.

Personalstoriesandjourneys areanimportantpartof pushingtheindustryinthe rightdirection.Withthisinmind, TradeFinanceGlobal’sBrian Canup(BC)spokewithMichelle Knowles(MK),HeadofTrade andWorkingCapitalProducts atAbsa.

BC:Lookingatyourcareer journey,howdoyoufeel likeyouwereinspired and/orincludedbyothers inyourindustry?

MK:AsIcontemplatemycareer journey,Irealisehowfortunate Ihavebeentohavethesupport andinfluenceofseveralrole models.Eachoneofthem playedaroleinmyjourney, someformallyandothers informally.

Asaself-motivatedindividual, Ithriveonnewanddiverse experiences.Fortunately, IfoundacareerthatIfind engaging,particularlythe complexityanddiversitythat comeswithinternationaltrade.

46 www.tradefinanceglobal.com 52

1

3.4

Absa

TradeFinanceTalks

communityisveryfulfilling forme.

Mypurposeinlifeistomake adifference,andmycareer alignswiththispurposegiven thevitalrolethattradeplays ineconomicgrowthand development.Workingin anemergingmarket,where issueslikeunemploymentare constantlyinfocus,Ifindit meaningfultobepartof developinganddelivering solutionsthatfacilitateand enablegrowth.Iamequally highlymotivatedbynew challenges,andIenjoymeeting andengagingwithnewpeople andcultures,aswellasbeing motivatedbynew opportunities.

Ialsobelieveinproviding supporttoemergingleaders anddrivingchangewithinthe organisation.Iamalways curiousandenjoytakingon newchallenges.Earlyinmy career,Igotinvolvedinindustry initiativesthattookmeoutof mycomfortzone,allowingme togrowandinfluence.

someindustrygiants,from whomIlearnedalot.Although manyofthemhaveretired ormovedontodifferent industries,Iamstillincontact withmany.Thisprocessopened otheropportunitiesthatfurther expandedmyhorizons, includingbeingappointed tosomeindustrypositions.

Iamgratefultothemany leaderswhohaveinfluenced andsupportedmethroughout myjourney.Theyencouraged metotakeonnew opportunities,pushedmeout ofmycomfortzoneconstantly, andguidedme.Althoughmy journeyhasnotbeen straightforward,thechallenges Ifacedhavemademethe personIamtoday,andeach partofmyjourneyhastaught menewskills.Thishasgivenme agilityandresilience,andIlook forwardtothenextpartofmy journey.

Toallthosecontemplating thenextstepsintheirjourneys, Iencourageyoutotake ownershipofyourcareerand

Mostimportantly,surround yourselfwithpeoplewhowill supportandguideyou.

2 BC:HowisAbsaactively inspiringinclusionfor others?

MK:Creatingadiverseand inclusiveworkplaceiscrucialfor acompany’slongevity,notjust intermsofattractingtalent, butalsoforbusinessefficiency, success,andprofitability. However,achievingadiverse andinclusiveorganisation canbechallenging,andsome initiativesaimedatpromoting diversitycanendupexcluding certainindividuals,causing negativereactionsandfear. Therefore,everyoneshould beapartofthejourney.

Absa,likemostcompanies, hasbeenfocusingoncreating aninclusiveanddiverse environmentoverthepast fewyears.Severalinitiatives areunderway,andmany peoplearesteppingupto supportthem.

www.tradefinanceglobal.com 53

Drivingprogress:Womenleadingintrade,treasury&payments

Theorganisationhasspecific workinggroupsacrossthe groupthataimtocreate adiverseandinclusive environmentandensurethat thevoicesofallcolleagues areheard.

Asaleader,Ihavebeen involvedinmanyinitiativesover thepastfewyears,especially asIhaveprogressedinmy career.

Ibelieveinthesayingby BonangMohale“liftasyourise,” whichmeansthatweshould activelysupportyoungleaders intheirjourneysandnot“kick theladderdown”oncewehave achievedcertainmilestonesin ourcareers.

Imentorseveralyoung leadersacrossdifferent countries,providingasounding boardforthemandsharing myjourneyandhowIapproach certaindecisionsandstagesin mycareer.Ihavelearnedalot fromthoseImentor,andI encourageallleaderstoget involvedinmentoringprograms bothwithinandbeyondtheir organisations.

Ihavealsobeenactively involvedinforumswithin theorganisation,suchasthe CorporateandInvestmentBank BankingonWomeninitiative, wherewefocusontopics suchasthegenderpaygap, representation,andbuilding anetworkforwomenwithin thebusiness.

Iwaspartofinitiatingthe CorporateTransactional BankingPanAfricawomen’s forumlastyearwiththehelpof someamazingleadersinthe business.

Althoughthisisawomen’s forum,weareactively engagingmenacrossthe organisationtogettheirviews andinputintotheprocessand ensuretheyfeelpartofthe changewearelookingto achieve.Alliesareanimportant partofprogress.

Considerableprogresshas beenmadearoundthegender paygap,increasing representation,gender-based violence,andaddressingthe unconsciousbiasweallhave. However,thereisstillalotof worktobedone,andweneed morepeopletogetinvolved.

3 BC:Weallliketostrive forinclusivityinour companiesandindustries, butwhatmakesitso difficulttobetruly inclusive?Howdowe accountforthedifferent obstaclesandbarriers thatmanyindividuals face?

MK:Theindustryismaking satisfactoryprogressbutthere isstillawaytogotoachieve diversity,particularlyatsenior levels.Whilewomenmakeup morethanhalfoftheworkforce, theyaretypicallyconcentrated injuniorandmiddle management.

46 www.tradefinanceglobal.com 54

TradeFinanceTalks

Representationatexecutive levelsremainslowandmany organisationsarenotdoing enoughtounderstandthedata aroundthedevelopmentand progressionoffemale leadership.Thismeansthat manycompaniesarestillnot creatingenvironments conducivetodevelopingand retainingstrongfemaleleaders.

Researchindicatesthatwithout specificinitiativestoaddress thedisparityinorganisations, thetrendisunlikelytoimprove. Acceleratinggenderparity initiativestoensurethebanking industrycanrealiseitsoptimum businessbenefitswillrequire decisiveactionatan organisationallevel. Furthermore,strong commitmentandongoing sponsorshipandsupportby executiveleadershipare imperative.