Giving our clients the confidence to grow sustainably in this rapidly changing market.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more. © 2022. For information, contact Deloitte Touche Tohmatsu Limited

When I look around me and I see businesses working hard to regain their place in our economy, not only do I feel proud, but also excited for what the future holds. If we as a nation can overcome the effects of a pandemic and the challenges that came with it, with its ripple effects still evident after two and a half years, we can overcome anything. What further provides peace of mind is that we also know we are not alone in this fight. The whole world has been fighting with us and will continue to do so. Based on this it was only fitting to choose a theme that can bring forth positivity, hope and motivation: ‘Reviving an economy’… Reviving OUR economy!

If we were to dissect the words of our theme, the word ‘economy’ is defined as the system according to which money, industries and trade is organised. To revive is to ‘regain life’, to ‘give new strength or energy to’. In our pursuit of reviving the economy, Namibians would have to take action by giving it new strength and energy to become active and successful again.

We need to challenge ourselves to think about how we are going to revive our industries, our interests, talks, fortunes and employee wellbeing. We see tourists returning to our beautiful country, we see creativity that Namibians birth daily to make a living, we see change all around us when it comes to leadership and employee wellness. We know that our workforce was highly impacted by the pandemic. The 2021 Deloitte Namibia Human Capital Covid-19 Flash Survey Report under the subheading ‘Unpacking the impact of Covid-19 on the employee experience’ illustrates how differently each Namibian organisation has

been impacted by the pandemic, but despite the unique nuances each organisation holds, the data suggested key similarities in the challenges we have to solve. Employee wellbeing and the needed support from leadership was highlighted. Leaders need to change how they think about, engage with and manage teams.

An article of 19 June 2020, by Jan Bellens, EY Global Banking & Capital Markets Sector Leader, and George Atalla, EY Global Government & Public Sector Leader, asks whether the road to recovery will lead to an economy that is revived or reimagined. According to the authors, the World Bank forecasted the global GDP to shrink by 5.2% in 2020 with recession in both advanced and emerging market economies. This would make the crisis following the pandemic the worst recession since the Great Depression and far worse than the Global Financial Crisis, which led to a 1.8% drop in global GDP in 2019. Countries around the world have responded to the immediate need to manage the Covid-19 crisis with extraordinary levels of effort and rising fiscal support.

We have to agree with the above article from EY, that “While every crisis is different, we can learn important lessons from how previous crises were managed. Governments, financial institutions and businesses have a strategic opportunity to shape the recovery and the future economy in a way that will reframe the future to deliver a more sustainable and more equitable revival.” We share these sentiments, and it is our passion at Namibia Trade Network and our hope for Namibia. We look forward to this journey.

In the PwC Namibia 25th Global CEO Survey of 17 January 2022 it states: “As we near the two-

year mark of the pandemic, the global economy has rebounded from the depths of mid-2020. The 4,446 CEOs from 89 countries and territories who responded to the 25th Annual Global CEO Survey display optimism about continued economic resilience.” In our continuous drive to build a stronger Namibian business sphere, we wish to encourage all businesses to share leadership articles, reports, podcasts, motivational talks and much more, which we can re-share during the coming year to contribute to ‘the optimism and continued economic resilience’ which would all contribute to REVIVING AN ECONOMY.

Follow us on social media platforms and refer to our website for up-to-date and relevant information on our comprehensive business network.

TEXT CONTRIBUTIONS

Willie Olivier Namibia Investment Promotion and Development Board (NIPDB)

IJG Securities

COVER PHOTOGRAPHS

Venture Media

PRINTERS

John Meinert Printing (Pty) Ltd Windhoek

CONTACT

+264 81 297 7634 daleen@venture.com.na www.namibiatradedirectory.com

We acknowledge that information, addresses and contact persons may change from time to timethe information provided is what the publisher had available at the time of going to print. We appreciate being advised of any changes, omissions, updates and improvements. Amendments for the purposes of the Namibia Trade Network can be forwarded to daleen@venture.com.na.

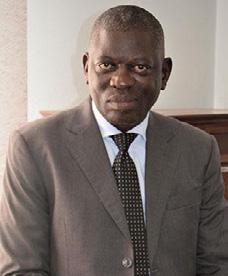

It is my distinct pleasure to present to you the 31st edition of the Namibia Trade Network (NTN) 2022/2023. This year’s theme, “Reviving an Economy”, is timely and relevant as it comes at a time when the country is making great strides towards economic recovery. It also signifies the role played by various stakeholders to realise the much-needed aggregate economic restoration and growth. It is therefore important to acknowledge the interventions made by the Namibian government to mitigate the impact of the Covid-19 pandemic on the economy through a combination of support measures as well as other assistance provided by various stakeholders. These actions largely cushioned the economy from the worst effects of the crisis.

The Namibian government recognises the importance of public and private sector engagements in responding to the various challenges facing our economy, including spearheading private sector development and shaping the country’s developmental agenda and aspirations. It is therefore worth noting that there are indicators which suggest that the economy is buoyant and recovery is taking place post the lifting of Covid-19 restrictions by the government, while being cognisant of the challenges posed by the Ukraine-Russia war with growing concerns about commodity shortages. Fuel prices, in particular, have underpinned the rise in inflation across countries, including Namibia, and the resulting rise in the prices of basic commodities has put pressure on households and businesses whose incomes have already been hit by a series of shocks.

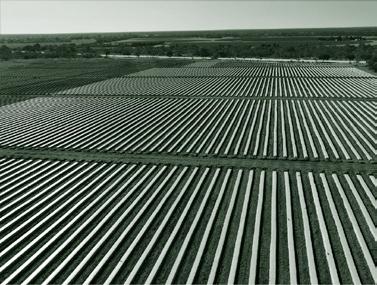

The recovery of key sectors, such as tourism, mining and agriculture, and the resumption of major trading activities with large multiplier effects on the rest of the economy are crucial in driving economic growth. Equally, new diversification initiatives such as green energy, manufacturing, logistics and services have a lot of potential, while ICT and digital transformation present new opportunities that must be exploited in the economic recovery process.

Our “Growth at Home” strategy emphasises the need for increased value addition to our locally available resources and inputs for greater socio-economic benefits at home where such resources originate. This is also crucial for self-sustenance and increased exports. The government has thus resolved to support commodity-based industrialisation by putting the right policies and regulatory framework in place, which can serve as a launching pad for long-term product diversification and competitiveness.

In this regard, the implementation of economic revival initiatives, including the diversification of economic activities such as exports opportunities, may lead to positive spillover effects. There is thus a need to support businesses, especially MSMEs, and ensure informal sector development. It is further vital to enhance targeted investment promotion from both domestic and foreign sources, as well as skills development in highly sought fields. The combined efforts of private and public sector stakeholders are critical for Namibia’s recovery. This will go a long way

toward instilling optimism and increasing investor confidence.

This year’s edition of the NTN provides vital information on the Namibian business landscape and I wish you a pleasant read as we are recovering as a country from the economic hard knocks.

Iipumbu, Minister of Industrialisation and Trade

Brand Namibia belongs to us all 28 Mapping Namibia’s post Covid-19 economic recovery 29

Thinking out of the box can contribute towards economic recovery 30 Using alternative building materials to revitalise growth in the construction sector 31

Penduka Social Enterprise: Playing their part in reviving the Namibian economy 32

Business and Intellectual Property Authority (BIPA) 50

Namibia Employers' Federation (NEF) 51

Susan Nel 51

Research@Tribefire 52

Dr Weder, Kauta & Hoveka Inc 53

Kalahari Holdings (Pty) Ltd 54 Francois Erasmus and Partners 56

Namibia University of Science and Technology (NUST) 60

University of Namibia (UNAM) 61

African Leadership Institute (ALI) 62 Learn on One 63

Bank of Namibia 66 Development Bank of Namibia (DBN) 69

Allan Gray Namibia 70 Alexander Forbes 72 NAM-MIC Holdings 73 Capricorn Group 74 M&G Investments 76 EY 78

FNB Namibia 80

Government Institutions Pension Fund (GIPF) 82

Königstein Capital 84 Nedbank CIB 86

Old Mutual Namibia 88 RMB 90 Standard Bank 92

Namibia Fish Consumption Promotion Trust (NFCPT) 96

Erongo Marine Enterprises 98 Gendev Fishing Group 98 Etosha Fishing 100 Hangana Seafood (Pty) Ltd 100

Renaissance Health Medical Aid Fund (RMA) 102

EMed Rescue 24 104

Namib Laboratories 106

Medipark Ongwediva 107

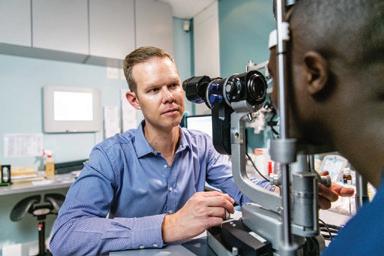

Windhoek Eye Centre 108

Medical Rescue Africa (MRA) 109 Olympia Eye & Laser Centre 110

The Communications Regulatory Authority of Namibia ( CRAN) 114 Green Enterprise Solutions (Pty) Ltd 116 MultiChoice Namibia 118 MTC 119 PowerCom (Pty) Ltd 120 Telecom Namibia 122

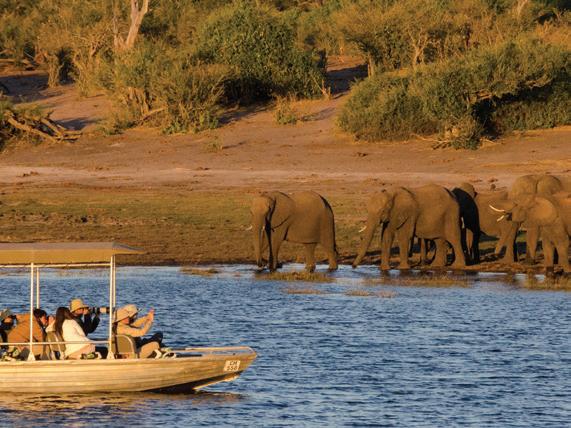

TOURISM

Vital Contacts 146

Ongava Game Reserve 147 Namibia Wildlife Resorts (NWR) 148 Journeys Namibia 149

Guans Packaging (Pty) Ltd 126 Neo Paints 128 Namib Mills (Pty) Ltd 129

Debmarine Namibia 132 NAMCOR 134

Dundee Precious Metals Tsumeb 135 NAMDEB 136

Namibia Power Corporation (NAMPOWER) 138

Oshakati Premier Electric (Pty) Ltd 142

FP du Toit Transport Group 152 Manica Group Namibia 153 MVA Fund 154

Namibian Ports Authority (NAMPORT) 156 FlyNamibia 157 The Logistics Company Namibia 159 Pupkewitz Motors 160 Walvis Bay Corridor Group 162 Westair Aviation 165

Namibia Investment Promotion and Development Board (NIPDB) 167 MSME Listing 170

Vital Contacts 171

Index 179 Omake Moments 181

Namibia is ranked amongst the world’s most politically stable countries. The Namibian government is committed to stimulating economic growth and employment through the attraction and retention of investments.

Namibia is strategically located on the southwestern coast of Africa and serves as a quintessential trade conduit with the rest of the world for landlocked neighbouring countries such as Botswana, Zambia, Zimbabwe and the Democratic Republic of Congo through the port of Walvis Bay. Compared to other ports in the region, the congestion-free port of Walvis Bay offers shipping lines time savings of up to five days to Europe and the Americas, and is a springboard into the Southern African Development Community (SADC) trade block, with a market access of 330 million people.

Namibia is endowed with natural wind and sun resources, and is considered to be amongst the most competitive (solar and wind energy) destinations in the world with the potential to become a producer and exporter of green hydrogen, reckoned to catalyse the decarbonisation of the planet.

Namibia’s primary infrastructure is well-developed and modern, with the road infrastructure quality ranked the best in Africa, an efficient communication system with global cellular networks and globally competitive broadband, as well as a sophisticated financial sector. The economy is mostly export-driven, with mining, tourism, fishing and agriculture being Namibia’s key sectors.

• African Continental Free Trade Area (AfCFTA)

• African Growth and Opportunity Act (AGOA)

• Namibia-Zimbabwe Preferential Trade Agreement

• Southern African Customs Union (SACU)

• Southern African Customs Union (SACU) - European

• Free Trade Association (EFTA)

• Southern African Customs Union (SACU) -

• Common Market of the South (MERCOSUR)

• SACU - Mozambique - United Kingdom (UK) Economic

• Partnership Agreement (EPA)

• Southern African Development Community (SADC)

• Southern African Development Community (SADC) - European Union (EU) Economic Partnership Agreement (EPA)

• World Trade Organisation (WTO)

The Namibia Investment Promotion and Development Board (NIPDB) serves as the first-point contact for potential investors and provides comprehensive services from the initial consulting stage to the operational stage. The NIPDB also provides general information and advice on investment opportunities, incentives and procedures.

The task of the NIPDB is to help investors reduce red tape by liaising with government departments and regulatory agencies, including obtaining work visas for foreign investors. The government of Namibia, therefore, welcomes and encourages foreign investment to help develop the national economy for the benefit of the people.

• 2nd in Africa, World Press Freedom Index – Reporters Without Borders (2022)

• 1st in Africa for the past five years, Quality and Connectivity of Road Infrastructure, Global Competitiveness Report – World Economic Forum (2019)

• 1st in Africa (6th globally), Global Gender Gap – World Economic Forum (2021)

• 6th in Africa, Corruption Perception Index – Transparency International (2021)

• 7th in Africa, Good Governance – Mo Ibrahim Foundation (2020)

• Top 10 in Africa, Investment Attractiveness Index, Annual Survey of Mining Companies – Fraser Institute (2021)

Fraser Institute Annual Survey of Mining Companies Ranking, 2021

WORLD

Policy perception 2 29 Political stability 1 20 Security indices 1 30 Geographical database 1 22

Namibia’s foreign investment policy is governed by the Foreign Investment Act No. (27 of 1990 - FIA). The aim of the Act is to address and stimulate foreign investment in Namibia. The Namibia Investment Promotion Act (NIPA) is currently under review and will replace the FIA.

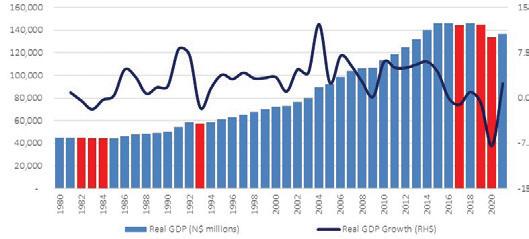

Since 2016, Namibia has been hit by a series of negative events, including a commodity price downturn, an extended sub-continental drought and, like the rest of the world, the Covid-19 pandemic. The combination of these negative trends has amplified the cyclical nature of Namibia’s economy.

As part of a high-level intervention to reduce the impact of these events, the government of Namibia engaged the Harvard Kennedy School’s Growth Lab in 2019 with the aim of creating a roadmap to more sustainable economic development and growth. A joint team of representatives from the Bank of Namibia (the country’s central bank), Ministry of Finance and Public Enterprises, the National Planning Commission, Ministry of Industrialisation and Trade, and the Harvard Growth Lab has been shepherding the process alongside other Namibian stakeholders.

The work Namibia has been doing with the Harvard Growth Lab predominantly focuses on:

• Diagnosing structural deficiencies in the economy

• Assessing and understanding the country’s economic complexity shortcomings

• Identifying specific strategies which could address the lack of economic depth

One of the major objectives that emerged from this research and analysis was the development of the Country Economic Diversification Strategy to address core issues impacting Namibia’s economy. The strategy is expected to:

• Reduce exposure to commodity price fluctuations and cycles

• Develop new sectors and products in the economy

• Focus on services and the economic value they create

• Increase economic complexity by facilitating the conversion of primary products from the commodities sector into secondary products

• Create new sectors and industries that will support the country’s energy transition ambitions, making Namibia a continental leader in the green economy

Economic

•

Tourism and hospitality have become synonymous with Namibia. The contribution of tourism to the national GDP was about N$7 billion, the third largest contributor after mining and agriculture. Conservation is a cornerstone of the Namibian experience, as Namibia was the first African country to incorporate protection of the environment into its constitution.

Natural resources, especially in the form of natural beauty, are abundantly available.

SERVICES (DIGITAL & GLOBAL BUSINESS)

Areas of investment opportunity

• Call centres, training centres, and business process outsourcing centres

Why invest?

• Advanced digital infrastructure

• Excellent national connectivity

• Linguistic prowess

• English as the only official language – many

• citizens also fluent in German, Portuguese,

• French, Spanish & Mandarin

Areas of investment opportunity

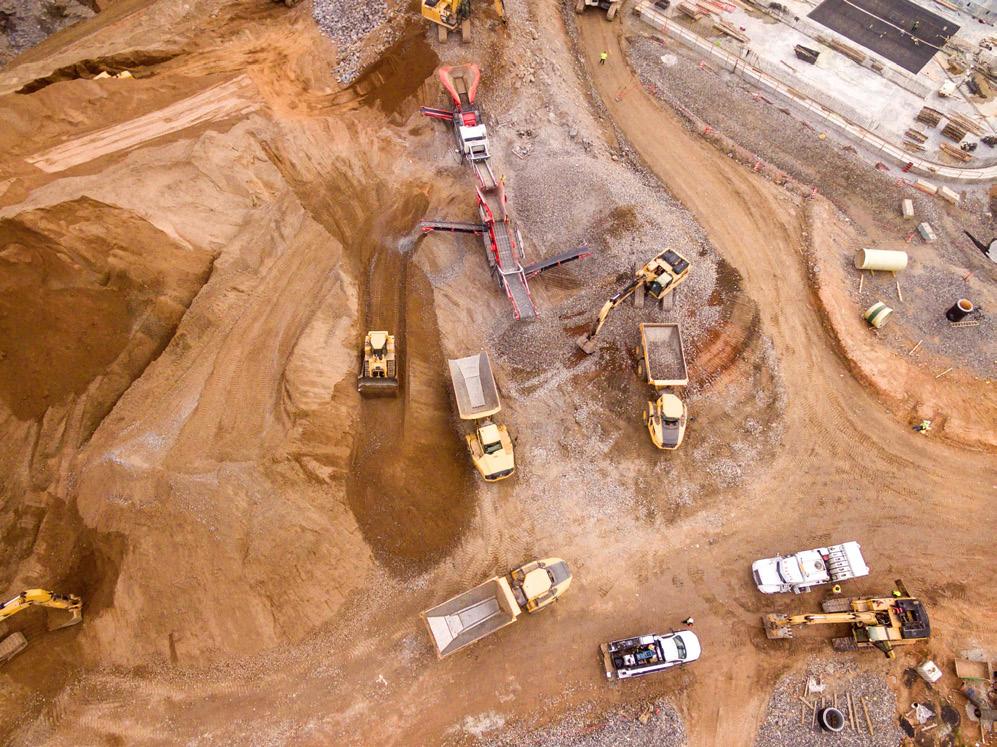

• Top 10 producer of diamonds

• Fourth largest exporter of non-fuel minerals in Africa and fourth largest producer of uranium oxide

• Significant natural resources

• Very well established local & regional mining industries

• Established salt & plastics industries

• Green hydrogen developments

• Oil & gas finds

• Diversification & quality employment

Areas of investment opportunity

The transportation and logistics industries have always been lucrative and are expected to grow exponentially as both the local and regional economies grow and become even more interconnected.

Why invest?

• Market access

• Logistical hub

• Available workforce

• Regional resources

• Diversification & quality employment

The Namibia Investment Promotion and Development Board (NIPDB) exists to unlock opportunities that enable a better quality of life for all Namibians. We do this by facilitating trust relationships to attract and retain sustainable investment for private sector-led and inclusive economic growth. As part of our statutory mandate, the Board also aims to improve Namibia’s competitiveness score, develop the required skills for sustainable investments that lead to job creation, and create an enabling ecosystem for MSME’s to thrive and scale.

The Namibia Investment Promotion and Development Board (“NIPDB”), is a Non-profit association incorporated under section 21 of the Companies Act, Act No. 28 of 2004 (“the Companies Act”). The Board was established as an autonomous entity in the Office of the President and is declared a Public Enterprise in accordance with section 2 of the Public Enterprise Governance Act, Act No 1 of 2019.

The Board commenced operations in January 2021, taking over the functions of its predecessor, the Namibia Investment Centre (under the Ministry of Industrialisation and Trade) to become the lead investment promotion agency for Namibia.

The NIPDB is mandated to promote and facilitate investment by foreign and Namibian investors, and coordinate MSME activities across all levers of the

economy, with the aim of contributing to economic development and job creation. In terms of investment promotion, the Board serves as the first point of call for potential investors wanting to do business in Namibia. Our aim is to make Namibia the investment destination of choice by improving the ease of doing business here and improving the country’s competitiveness. In the MSME space, the Board coordinates and implements programs and policies that will create an enabling ecosystem for MSMEs & Startups.

The NIPDB is mandated with the following functions, amongst other things:

• Promote and facilitate investment by foreign and Namibian investors and New Ventures that contributes to economic development and job creation;

• Implement Namibia Investment Policy and attendant Strategy;

• Review and propose policy reforms and measures to support trade and investment promotion, conducive labour market policies, improve the country’s Competitiveness and the Ease of Doing Business;

• Develop and implement branding interventions that promote Namibia as an attractive investment destination;

• Develop institutional mechanism and assume lead coordinating role across all levers for SME Development nationally;

• Implement the National MSME Policy of 2016;

• Promote regional Special Economic Zones that leverage the geographic comparative advantages of each region; and

• In collaboration with relevant stakeholders, facilitate collaborative roles between the Government and private sector to stimulate the growth, expansion and development of the Namibian economy.

Unlocking opportunities: enabling a better quality of life for all Namibians

Ms. Kauna Ndilula

Martin Shipanga Ms. Hilger Vendura Mr. Hans Gerdes Ms. Dagmar Honsbein

Mr. Vetumbuavi Mungunda Mr. James Mnyupe Mr. Stefan Hugo

Advisory Board

Ms. Nangula Uaandja Chairperson and Chief Executive Officer

Mr. Francois van Schalkwyk Executive Director: Investments and New Ventures

Mr. Dino Ballotti Executive Director: MSME Development, Innovation & Acceleration

Mr. Richwell Lukonga Chief Operating Officer

Ms. Jessica Hauuanga Head of Department: Investor Experience, Retention and Aftercare

Ms. Margareth Gustavo Executive Director: Strategy and Branding

Advisory Board

Ms. Nangula Uaandja Chairperson and Chief Executive Officer

Mr. Francois van Schalkwyk Executive Director: Investments and New Ventures

Mr. Dino Ballotti Executive Director: MSME Development, Innovation & Acceleration

Mr. Richwell Lukonga Chief Operating Officer

Ms. Jessica Hauuanga Head of Department: Investor Experience, Retention and Aftercare

Ms. Margareth Gustavo Executive Director: Strategy and Branding

The Namibia Trade Forum (NTF) is an agency of the Ministry of Industrialisation and Trade (MIT) whose main mandate is to institutionalise public-private dialogue and cooperation with emphasis on international and domestic trade and investment policies as stipulated by the National Development Plans.

The role of the NTF is to act as the main consultative body representing private sector views to the government. We drive smart dialogue between the public and private sector in order to influence trade policy, economic growth and a conducive business environment.

The NTF thus serves as the highest public-private dialogue institution on international and domestic trade and investment matters of government. It achieves this function through various means such as workshops, seminars, trade negotiations, meetings ,media releases etc.

+264 61 235 237 info@ntf.org.na www.ntf.org.na

A broad range of financial products, as well as financing for PPPs engaged in developing infrastructure, is provided by the Development Bank of Namibia (DBN) for priority development projects.

+ 264 61 290 800 info@dbn.com.na www.dbn.com.na

Expect more.

The NCCI’s brand promise is to be “A premier voice for business in Namibia.” Its core functions include: Outgoing and incoming business missions Certificates of Origin

The Chamber provides trade and investment facility related advisory services to its members and non-member institutions. The service is rendered through consultancy to individual business leaders and covers, amongst others:

• Business support by providing accurate and up to date information regarding export- import regulations, investment requirements, licensing requirements and more.

• Business matchmaking like B2B or B2G meetings

• Support in trade missions and exhibitions

• Industry representation in international trade negotiations or facilitation meetings

+264 61 228 809 info@ncci.org.na www.ncci.org.na

The Walvis Bay Corridor Group is a facilitation centre and one-stop shop coordinating trade along the four Walvis Bay Corridors linking Namibia and the ports of Walvis Bay and Lüderitz to the rest of the SADC countries.

+264 61 251 669 marketing@wbcg.com.na www.wbcg.com.na

One is too small a number to achieve greatness.

Preliminary National Accounts data from the Namibia Statistics Agency shows that Namibia recorded real GDP growth of 2.4% in 2021. While this is the quickest annual growth rate since 2015 it is lacklustre in the context of the low base set in the prior year. The NSA revised up real output for 2020 in the latest National Accounts release, bringing the contraction for the pandemic year to 7.9%, the deepest on record. The hard lockdown measures implemented in 2020 resulted in almost all sectors of the economy contracting, bar water supply (with the completion and inflows into Neckartal Dam), healthcare services and information and communication services. Output in 2021 benefitted from a less restrictive operating environment but was more severely impacted from a healthcare perspective. Supply chain challenges and reduced tourist numbers added to the drag on activity during the year.

from-home” trend as well as increased internet usage in general. Financial Intermediation contracted by 20.6% in 2021, with banks suffering from margin compression, while Insurance services posted growth of 11.6%. Real estate and business services growth was inline with that of the economy as a whole, a further symptom of the lacklustre business and consumer demand already noted.

Public Administration and Defence, or government output ex health and education, remained relatively flat in 2021, growing by just 0.5%. This mirrors guidance provided in the budget documents for the year. Fiscal consolidation remained in effect during the year and the freeze on hires and salaries remained in place. Education posted growth in line with the overall economy as well, while healthcare services expanded by 4.5%, with overall government expenditure on healthcare buoyed by the vaccination drive and increase in personnel needed to this regard. Finally, Taxes (less subsidies) posted a strong recovery, growing by 17.1%, off an admittedly very low base in 2020.

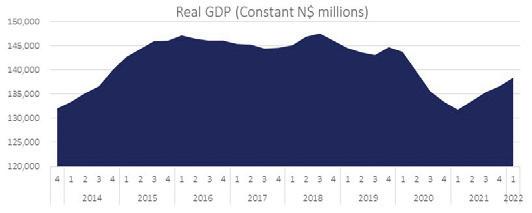

As is evident in the below figure, GDP remains below peak levels and may take some time to reach the high-water mark recorded in 2018 (which was only slightly above that of 2015). Present levels of output were last seen in 2014, illustrating the extent to which the extreme measures implemented to reduce the spread of Covid-19 impacted the economy.

Source: NSA, IJG SecuritiesMuch of the growth recorded in 2021 was as a result of growth in mining output as a recovery in global demand and supply chain disruptions pushed commodity prices to elevated levels. Within the sector growth came primarily from uranium, gold, lead, salt and marble production. Notably, uranium production almost reached 2018 levels, and the value of uranium exported surpassed 2018 levels as prices in both the spot and long-term market improved significantly. Agriculture, Forestry and Fishing was a slight drag on overall growth, with fishing and crop farming performance weighed down by a slight contraction in the livestock sector.

Secondary industries all recorded contractions with manufacturing output dropping by 6.2%, while electricity and water contracted by 5.7% and construction slumped 10.2%. The contraction in Manufacturing output was due to the beneficiation of basic non-ferrous metals coming to a halt as the Skorpion Zinc mine and smelter was put on care and maintenance. Bar this subsector manufacturing outperformed 2020 modestly. The construction sector has been particularly hard hit since the government embarked on its fiscal consolidation exercise, recording six years of consecutive contractions. In real terms the sector’s output in 2021 was only 30% of that of 2015.

Tertiary industries, although slow to recover, posted moderate growth in 2021. Importantly, wholesale and retail trade posted positive growth for the first time since 2016, indicating a potential floor in consumer sentiment was reached during the pandemic from which further recovery is likely. Output for the sub-sector was however still below 2013 levels, illustrating the depth of the contraction in consumer demand. The Hotels and Restaurants subsector recovered with an increase in tourist activity, although such recovery was still impacted by the prevalence of the Delta variant in Southern Africa. Information and Communication continued to benefit from the “work-

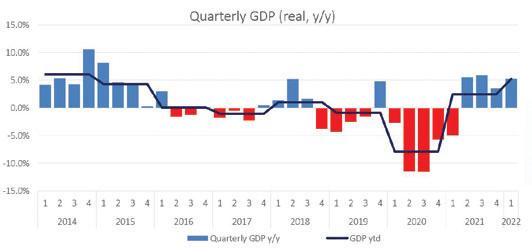

Source: NSA, IJG SecuritiesThis does however not mean that the Namibian economy has not posted a reasonable recovery in recent quarters. On the contrary, a closer analysis of the data shows that Namibia has recorded four consecutive quarters of growth on a year-on-year basis as at 1Q22, with three of these quarters posting growth of over 5.0%. Of concern rather is the fact that the Namibian recovery has lagged the rest of the world.

Source: NSA, IJG Securities

Source: NSA, IJG Securities

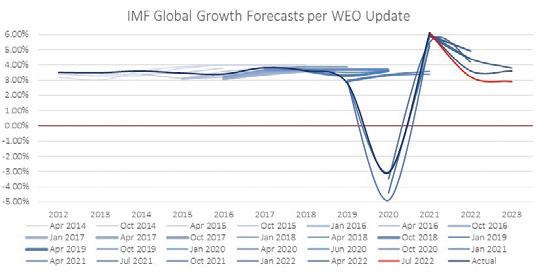

The IMF estimates global GDP growth of 6.1% in 2021, a significantly quicker pace of recovery than that experienced domestically. This was despite global supply chain challenges and some not insignificant restrictions on

movement. Part of the reason for the rapid recovery lies in the fact that many countries did not experience as deep a recession as Namibia did. Many countries, especially in the developed world, embarked on expansive fiscal policy, supporting businesses and individuals to a much greater extent than was possible in Namibia after years of tight fiscal conditions and low revenue growth. Similarly monetary policy was pushed to the extremes in many markets, with central banks emboldened by the relative success of such measures implemented during the decade following the global financial crisis. The lack of fiscal capacity in Namibia to deal with crises has long been warned about and the impact thereof is evident in the slow relative pace of recovery currently being experienced.

internally and lower production for export, both of which are expected to put further downward pressure on commodity prices. Exacerbating this outlook is a drop in global demand due to tighter monetary conditions brought about by unyielding inflation. Further concerns stem from risks that the continuation of lockdown measures and slowed growth in China pose on the Chinese property market. A full-blown property crisis in China would be felt across the globe.

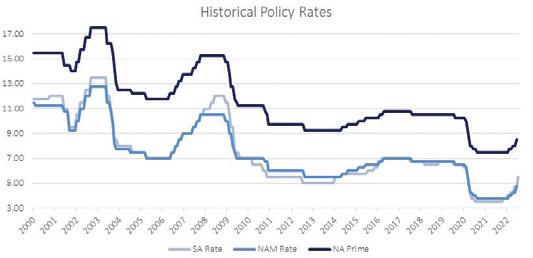

A third key theme in terms of the global macroeconomic outlook is inflation. The US, UK and Europe are all experiencing multi-decade high inflation at present and central banks are tightening monetary policy in response. The historically low interest rates applied to economies ravaged by governments’ reactions to the pandemic are now a thing of the past. At least in the short term. The US Federal Reserve has embarked on a rate hiking cycle, as has the Bank of England and the European Central Bank. Inflation, last year dismissed as transitory by these central banks, has remained and gained further steam. The implications of this are tighter monetary policy and higher interest rates globally, at least in the short term. The South African Reserve Bank (SARB) and Bank of Namibia (BoN) have already embarked on monetary tightening in order to prevent excessive currency depreciation and the cost push inflation it drives.

A few short months ago a more rapid Namibian recovery seemed imminent. Global demand was driving commodity prices ever higher and Namibia, already a beneficiary of much renewed interest in mineral exploration, was ideally positioned to take advantage of elevated zinc, tin, copper, gold and uranium prices. A new Debmarine diamond mining vessel further added to the mining sector outlook for the year. Agriculture was set to benefit from one of the better rainy seasons of the last decade. A rebound in manufacturing activity was taking place with various sub-sectors well placed to benefit from growth in primary sector activities. The outlook was decidedly rosier than had been the case for some time.

On the 24th of February that outlook turned uncertain when Russia invaded Ukraine. The consequences of this action were not immediately evident and commodity prices and financial markets did not initially overreact to the increased geopolitical tensions. Russia’s invasion was met with a host of economic sanctions by most western countries, but military intervention was largely limited to Ukraine’s own efforts supported by arms from the US and a host of European countries. Ukraine’s leadership successfully rallied much support from Western leaders and sentiment has thus far favoured increased Western action against Russia. Russia however held two trump cards up its sleeve, namely Europe’s dependence on Russian gas and the sympathies of a number of key non-Western countries that continue to support Russian trade, such as India and China. Thus, the conflict has become an economic headwind which may take some time to blow over. Thus far the impact has largely been negative for Europe where energy prices have skyrocketed. This in turn has negatively impacted consumer demand and business input costs and production. The immediate implication for Namibia is that commodity prices, especially copper, zinc and tin, have declined substantially from their recent highs.

Another key theme with regard to commodity prices has been the continuation of lockdowns and production halts in China on the back of Covid-19 outbreaks. These measures are expected to lead to a sharper decline in growth in China this year which means slower demand growth

Thus, the global macroeconomic environment has deteriorated since the start of 2022, and the global headwinds that plagued early 2021 have reemerged to give context to Namibia’s economic outlook. Interest rates are rising, commodity prices have retraced, recessionary concerns have emerged in the US and Europe, geopolitical tensions have escalated into conflict and the world’s second largest economy, China, is showing signs of instability. The global macroeconomic environment and growth outlook thus exhibits significant downside risks which inform the outlook for the domestic economy.

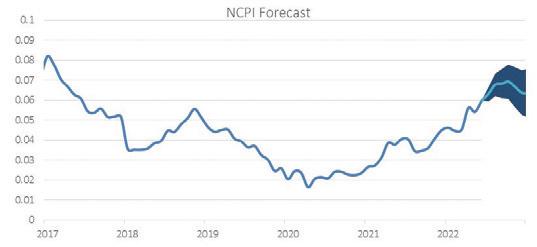

While global inflation has pushed up to multi-decade highs, Namibian Consumer Price Inflation (CPI) has remained within the SARB’s target band of 3.0% to 6.0% for the first six months of 2022. June CPI printed 6.0%, the highest rate of inflation since 2017 but by no means extraordinary for Namibia. For the most part “Food and non-alcoholic beverages” and “Transportation” have been the drivers of inflation during the year. Housing costs have tethered overall inflation somewhat as the largest CPI basket item only experienced price increases of 1.4% y/y. There is certainly more inflation to come though as higher transport costs filter through via second round effects on the prices of other goods and services, but runaway domestic inflation is unlikely. Elevated levels of inflation are detrimental to demand, especially when higher costs are driven by external factors, but current forecasts are tempered by a deterioration in the global outlook and as such should not act as a major drag on economic activity. We do expect inflation to reach 7.0%, or even higher, before the end of the year after which it is likely to taper if global economic headwinds remain.

Source: NSA, IJG Securities

Source: NSA, IJG Securities

Central banks globally are responding to high inflation by tightening monetary policy. The US Federal Reserve hiked rates for the first time in three years in March this year, while the Bank of England embarked on its rate hiking cycle in December last year. The European Central Bank has been slow to the party, hiking rates in June, the first hike in eleven years in the Eurozone. Developed market central banks are prioritising efforts to slow inflation over supporting growth. The implication of this is the spill-over of higher interest rates into emerging market economies in an effort to support currencies and negate supply side inflation.

The SARB hiked rates for the first time in this cycle in November 2021, and has subsequently hiked four more times bringing the repo rate to 5.5% in July from 3.5% in October last year. The SARB’s proactive rate hike in November caught many by surprise but has been supportive of the currency, with subsequent hikes of larger magnitude bringing benchmark rates closer to pre-pandemic levels. By historic standards benchmark rates in both South Africa and Namibia are still accommodative with Namibia’s repo rate set to rise in August to a level in-line with the bottom of the global financial crisis induced rate cutting cycle, previously the most accommodative interest rate levels seen since independence.

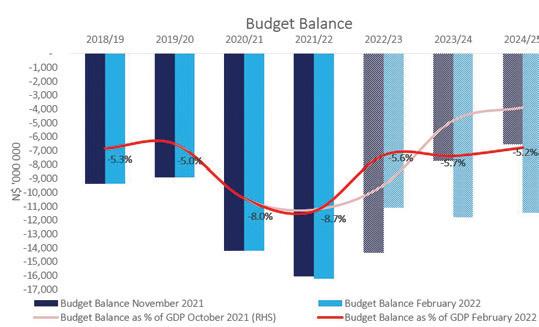

Fiscus and the Budget Government’s fiscal position for 2022/23 looks somewhat rosier than was the case in 2021/22. For the 2022/23 budget year the Ministry of Finance and Public Enterprises expects to receive N$59.68bn and spend N$70.77bn. Revenue expectations for the year starting April 2022 are up by 10.8% from the 2021/22 mid-year budget review, and 11.7% higher than in 2021/22. Expenditure is budgeted to grow by 3.8% versus prior expectations, or some 1.6% more than what was spent in 2021/22, this excludes the recently announced increase in the public sector wage bill, which is expected to amount to N$924m. The deficit for 2022/23 is thus expected to decline to N$11.09bn (N$12.4bn should the wage bill increase be funded through debt) or 5.6% of GDP, a significant improvement from the 7.3% deficit expected in last year’s mid-year review.

Source: BoN, SARB, IJG SecuritiesThus, while monetary policy is tightening domestically, interest rates remain accommodative and debt servicing costs cheap. Interest rates are expected to continue their upward trajectory over the short term, but are unlikely to put much pressure on Namibian economic activity unless the magnitude of hikes necessary to maintain the rand at reasonable levels pushes interest rates past pre-pandemic levels. This is unlikely in the context of slower global growth. And while some developed market central banks have been unexpectedly hawkish in favouring more rapid monetary tightening, this sentiment may shift quite quickly in the event that global GDP growth underperforms expectations.

Interest rates returning to pre-pandemic levels will also have a positive impact on bank margins in Namibia. Banks have been particularly cautious in the very low interest rate environment brought on by the pandemic, and some margin expansion may allow increased credit extension and a willingness to apply capital accumulated over recent years. Non-performing loans remain high and impairment charges may continue to be elevated when compared to historic measures, but moderately higher interest rates should still be positive for credit extension which would aid domestic investment as well as consumption.

On balance the interest rate environment is tilted ever so slightly to the negative as domestic monetary conditions tighten along with global monetary policy, but interest rates are unlikely to be a major drag on economic activity unless developed market central banks pursue more aggressive than expected policy in the face of growing uncertainty.

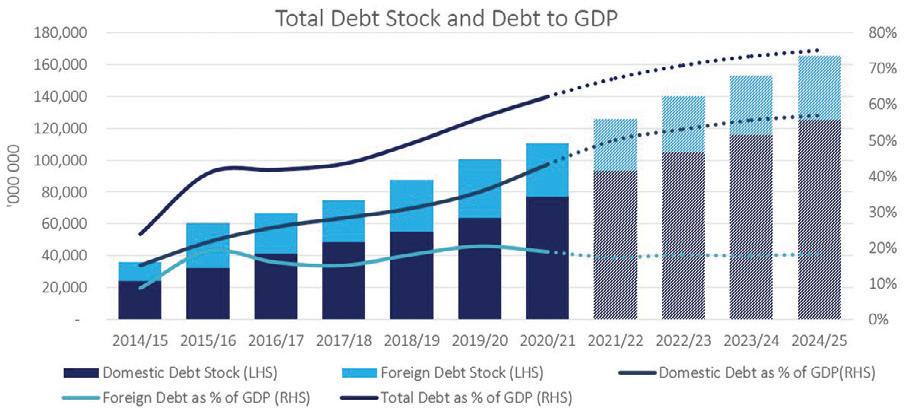

Source: MoF, IJG SecuritiesThe funding requirement for the current year is N$19.38bn, significantly lower than the N$30.40bn requirement in 2021/22, but still substantial. After debt rollovers are accounted for N$11.03bn in net debt is expected to be raised in the domestic market which will push up domestic debt stock to N$104.60bn. This is assuming that the recent wage increase will be accommodated within the current expenditure ceiling. Government debt is expected to reach N$140.19bn or 71.0% of GDP in 2022/23 after accounting for foreign debt. This is largely in line with prior expectations. The quantum of debt, however, continues to raise some difficult questions. Over N$100bn worth of debt has been raised in just eight years, and there are few productive assets to show for it.

Government’s budget ceiling has not expanded much over the years that fiscal consolidation was implemented. While described as pro-growth fiscal consolidation by the Ministry of Finance and Public Enterprises, the lack of growth in the expenditure ceiling has not contained growth in the operational portion of the budget but rather resulted in a decreased allocation to the development budget. Thus, while government was cautious to not act as a drag on economic activity, large deficits in combination with a shrinking allocation to productive expenditure has resulted in a large debt burden, growing debt costs and little increase in productive public assets as an enabler of economic activity. Yes, government has not put the brakes on the economy, but the fiscal consolidation exercise has resulted in a structurally less productive budget. As a result, government is not equipped to mitigate economic shocks. It is also unlikely to be a major driver of economic activity in the medium term despite reasonably strong revenue expectations for the current budget year.

Any evaluation of future economic activity would be amiss if not accounting for the recent offshore oil discoveries. In January, Shell announced encouraging early results from the Graff-1 exploration well, establishing the presence of a working petroleum system with light oil. Although no official estimates were provided on the size of the discovery, some researchers believe that the find could hold upward of 700 million barrels of oil equivalent.

A few weeks later, TotalEnergies announced that it too made a significant discovery of light oil with associated gas at the nearby Venus-1X prospect. Unofficial initial estimates suggested that the 2,700 sq. kilometre area could hold volumes of around 3 billion barrels, while others later claimed that recoverable reserves could exceed 10 billion barrels of oil equivalent. Appraisal drilling results are expected towards the end of the year and should provide a more accurate estimate of the actual reserves. Regardless of the exact size of the finds, the discoveries could have a profound effect on the size of the Namibian economy towards the latter part of the decade when extraction is expected to start.

In the near term however the discoveries are likely to impact government budget ceilings and allocations as certainty regarding the viability of exploiting the resource improves. Potential future windfall revenues remove some of the pressure on government to minimise debt issuance. Thus, as certainty improves around the viability of oil extraction it is likely that government could start playing an expansionary role in the economy once again. This should be prudently managed of course as the viability of oil production remains susceptible to production delays due to a complicated and expensive extraction process, macroeconomic shocks and future decarbonisation efforts.

It is unlikely that we will see the recent oil discoveries result in government playing such an expansionary role in 2022, but it is possibly a tailwind that might boost activity in subsequent years. The results of the planned appraisal processes at both discoveries could provide some implied guidance on government spending going forward and will be closely followed by both investors as well as creditors.

Economic growth for the year is forecast to come in at 3.3% in 2022, accelerating from the lacklustre growth of 2021. Much of the growth is expected to come from the primary sectors, with diamond mining providing for a substantial portion of the expansion. The new Debmarine vessel, the MV Benguela Gem, is projected to increase diamond production by roughly

500,000 carats per year. And while the outlook for commodities is less positive halfway through 2022, the increase in diamond production alone is enough to push the sector’s growth rate to over 10%.

Livestock production is also contributing meaningfully to growth in the current year, with the first half of the year already posting 20% growth in cattle marketed versus the prior year. The herd restocking exercise is yielding fruit and good rainfall has supported production, at least with regards to cattle. Smallstock is expected to be a drag on the sector with early reports indicating a marked contraction in the sub-sector. The improvements in number of cattle marketed should buoy the sector overall though.

Secondary industries, while expected to grow somewhat, are not expected to reach levels of output seen before the pandemic. Water and electricity production should grow modestly, and manufacturing continues to recover slowly while construction activity remains relatively stagnant.

Tertiary industries are exhibiting mixed performance with sectors such as tourism recovering from an extremely low base in prior years while wholesale and retail trade struggles to gain momentum as unemployment increases brought on by recession and the pandemic are slow to reverse. High inflation, primarily due to fuel prices and transport costs, is likely to temper demand in the second half of 2022, but despite this we expect a modest expansion in wholesale and retail trade and other consumer driven sectors. Real incomes in Namibia have been under pressure for more than half a decade now and consumption growth has languished as a result.

Headwinds to a more rapid expansion in the second half of 2022 and thereafter are, as mentioned before, global inflation and monetary tightening which threaten to close the taps on the accommodative post pandemic environment that was in place until early this year. The Russian invasion of Ukraine is likely to be a medium-term theme, adding to energy costs and creating uncertainty with regard to global food production. Namibia’s economy is often referred to as small and open and the potential for economic shocks has grown. The Namibian economic recovery remains under threat and the fiscus has few tools with which to protect against economic shocks. The outlook is uncertain and warrants prudent management by fiscal and monetary authorities in the near term. The longer-term outlook is likely to be significantly better if the recent oil discoveries translate to oil production.

Eric van Zyl | Managing Director Designate Danie van Wyk | Sales and ResearchGroup Chairman

Mathews Hamutenya Tel: +264 (61) 256 699

Managing Director Designate

Eric van Zyl

Tel: +264 (61) 383 530 eric@ijg.net

Equity & Fixed Income Dealing

Leon Maloney

Tel: +264 (61) 383 512 leon@ijg.net

Group Managing Director Mark Späth Tel: +264 (61) 383 510 mark@ijg.net

Group Financial Manager Helena Shikongo Tel: +264 (61) 383 528 helena@ijg.net

Financial Accountant

Tashiya Josua Tel: +264 (61) 383 511 tashiya@ijg.net

Financial Accountant

Gift Kafula Tel: +264 (61) 383 536 gift@ijg.net

Managing Director René Olivier Tel: +264 (61) 383 520 rene@ijg.net

Wealth Administration Lorein Kazombaruru Tel: +264 (61) 383 521 lorein@ijg.net

Managing Director

Jakob de Klerk Tel: +264 (61) 383 517 jakob@ijg.net

Managing Director Herbert Maier Tel: +264 (61) 383 522 herbert@ijg.net

Portfolio Manager Ross Rudd Tel: +264 (61) 383 523 ross@ijg.net

Wealth Administration Madeline Olivier Tel: +264 (61) 383 533 madeline@ijg.net

Business Analyst

Mirko Maier Tel: +264 (61) 383 531 mirko@ijg.net

Settlements & Administration

Maria Amutenya Tel: +264 (61) 383 515 maria@ijg.net

Sales and Research Dylan van Wyk Tel: +264 (61) 383 529 dylan@ijg.net

Group Compliance Officer Zanna Beukes Tel: +264 (61) 383 516 zanna@ijg.net

Sales and Research

Danie van Wyk Tel: +264 (61) 383 534 danie@ijg.net

Sales and Research

Josh Singer Tel: +264 (61) 383 514 josh@ijg.net

Money Market & Administration Emilia Uupindi Tel: +264 (61) 383 513 emilia ijg.net

Wealth Manager Wim Boshoff Tel: +264 (61) 383 537 wim@ijg.net

Wealth Manager

Andri Ntema Tel: +264 (61) 383 518 andri@ijg.net

Director Jolyon Irwin Tel: +264 (61) 383 500 jolyon@ijg.net

Broker

Ursula Gollwitzer Tel: +264 (61) 383 535 ursula@aldesnamibia.com

Broker

Richard Hoff Tel: +264 (61) 383 500 richard@aldesnamibia.com

Business Analyst Lavinia Thomas Tel: +264 (61) 383 532 lavinia@ijg.net

Value Add Analyst Fares Amunkete Tel: +264 (61) 383 527 fares@ijg.net

Photography credit: Namibian Presidency, Parliament of Namibia

H.E. PRESIDENT DR. HAGE GEINGOB

State House, 1 Engelberg Street, Auasblick Private Bag 13338, Windhoek +264 61 270 7878 www.op.gov.na

EXECUTIVE DIRECTOR

Amb. Claudia Grace Uushona +264 61 270 7787 / 7789

Grace.Uushona@op.gov.na / Laimi.Nembia@op.gov.na

Mr. Moses Pakote +264 61 270 7430 Moses.Pakote@op.gov.na

MINISTER IN THE PRESIDENCY

Hon. Christine //Hoebes

State House, 1 Engelberg Street, Auasblick Private Bag 13339, Windhoek +264 61 270 7829 / 245 989 Ivan.Chilinda@op.gov.na

Private Sector Interface

Mrs. Inge Zaamwani-Kamwi

+264 61 270 7783

Inge.Zaamwani@op.gov.na

Policy Implementation and Monitoring Vacant

+264 61 270 7808 Penny.Akwenye@op.gov.na

Press Secretary

Dr. Alfredo Hengari +264 61 270 7812 Alfredo.Hengari@op.gov.na

OFFICE OF THE FIRST LADY Madam Monica Geingos

1 Engelberg Street, Auasblick Private Bag 13339, Windhoek +264 61 270 7806 flon.admin@op.gov.na

PUBLIC RELATIONS OFFICER

Mr. Dennis Shikwambi +264 61 279 7431 +264 81 256 3526 dshikwambi@op.gov.n a

LIAISON OFFICER

Ms Yvonne Amukwaya +264 61 270 7544 +264 81 156 7801 Yvonne.Amukwaya@op.gov.n a

VICE PRESIDENT

H.E Dr Nangolo Mbumba

Old State House, Robert Mugabe Avenue Private Bag 13338 Windhoek +264 61 270 7202 Elina.kamalanga@op.gov.na

Youth Matters & Enterprise Development

Ms Daisry Mathias

+264 61 270 7811 Daisry.Mathias@op.gov.na

Community Co-ordination and Liaiso n

Vacant

+264 61 270 7918 Mavara.Shikongo@op.gov.na

Economic Adviser

Mr. James Mnyupe +264 61 270 7815 James.Mnyupe@op.gov.na

PRIME MINISTER

Rt. Hon. Dr. Saara

Kuugongelwa-Amadhila

Private Bag 13338

Robert Mugabe Avenue Parliament Gardens +264 61 287 9111 +264 61 287 2002 / 2082

Eveline.Shoongo@opm.gov.na / Salome.DuPlessis@opm.gov.na www.opm.gov.na

DEPUTY PRIME MINISTER

Hon. Netumbo Nandi-Ndaitwah

Robert Mugabe Avenue Green Office Park +264 61 282 2146

ppaulus@mirco.gov.na / tamkongo@mirco.gov.na

Mr I-Ben Natangwe Nashandi +264 61 287 2004

PS@opm.gov.na / Heidi.Isaac@opm.gov.na

MINISTER

Hon. Doreen Nampiye Sioka

Private Bag 13359, Windhoek Juvenis Building Independence Avenue +264 61 283 3206 / 3111 Doreen.Sioka@mgecw.gov.na / Emilie.Sivhute@mgecw.gov.na www.mgecw.gov.na

DEPUTY MINISTER

Hon Bernadette Maria Jagger +264 61 283 3208 David.Kulunga@mgecw.gov.na

EXECUTIVE DIRECTOR

Ms. Esther Lusepani +264 61 283 3122 Miyaze.Walubita@mpesw.gov.na

PRESIDENCY DISABILITY AFFAIRS

Deputy Minister

Hon. Alexia P.T. Manombe-Ncube +264 61 296 3112/3056 Wilma.Bruwer@mova.gov.na

MARGINALISED COMMUNITIES

Deputy Minister

Hon. Royal /Ui/o/oo +264 61 283 3272/3 Royal@mova.gov.na

MINISTER

Hon. Albert Kawana Private Bag 13338, Windhoek Cohen Building, Kasino Street +264 61 292 2051 / 2111 Minister.Pa@mha.gov.na

DEPUTY MINISTER Hon. Daniel V. Kashikola +264 61 292 2016 frieda.hamukoto@mha.gov.na

MINISTER

Hon. Frans Kapofi

Private Bag 13307, Windhoek Bastion 1, Sam Nujoma Drive Tel: +264 61 204 2005 / 9111 min@namdefence.org www.mod.gov.na

DEPUTY MINISTER

Hon. Hilma Ndinelago Nicanor

Tel: +264 61 296 3021 depmin@namdefence.org

EXECUTIVE DIRECTOR

Mr. Etienne Maritz Tel: +264 61 292 2017 executive.director@mha.gov.na

EXECUTIVE DIRECTOR

Commissioner (rtd) Trephine P Kamati Tel: +264 61 204 2055/6 ps@namdefence.org

MINISTER Hon. Iipumbu Shiimi Fiscus Building John Meinert Street Private Bag 13295, Windhoek +264 61 209 2930 / 9111 / 2931 secretary.minister@mof.gov.na www.mof.gov.na

DEPUTY MINISTER Hon. Maureen HindaMbuende +264 61 209 2933

EXECUTIVE DIRECTOR

Ms. Ericah B. Shafudah +264 61 209 2829 / 2929 erica.shafudah@mof.gov.na

MINISTER

Hon. Lucia Megano Iipumbu Private Bag 13338, Windhoek Block B, Brendan Simbwaye Square, Cnr of Dr David Kenneth Kaunda & Goethe Street Tel: +264 61 283 7334 / 9111 Lucia.Iipumbu@mit.gov.na www.mti.gov.na

DEPUTY MINISTER Hon. Verna Sinimbo +264 61 283 7329 Verna.Sinimbo@mit.gov.na

EXECUTIVE DIRECTOR

Mr. Sikongo Haihambo +264 61 283 7332

Sikongo.Haihambo@mit.gov.na

MINISTER Hon. Calle HG. Schlettwein Private Bag 13338 Government Office Park Luther Street +264 61 208 7111 www.mawf.gov.na

DEPUTY MINISTER Hon. Anna Ndahambelela Shiweda +264 61 208 7644 +264 61 208 7729

MINISTER Hon. Erastus Amutenya Uutoni Private Bag 13338, Windhoek Government Office Park, Block D Luther Street +264 61 297 5215 / 5111 pkayoko@murd.gov.na www.murd.gov.na

DEPUTY MINISTER Hon. Natalia /Goagoses +264 61 22 5712 deputyminister@murd.gov.na

EXECUTIVE DIRECTOR

Mr. Percy Misika +264 61 208 7648 ED@mawf.gov.na

MINISTER Hon. Dr Kalumbi Shangula Private Bag 13338, Windhoek Old State Hospital, Harvey Str Windhoek West +264 61 203 9111 / 2010 minister.secretary@mhss.gov.na www.mhss.gov.na

DEPUTY MINISTER Hon. Esther Utjiua Muinjangue +264 61 203 2010 d.minsterpa@mhss.gov.na

EXECUTIVE DIRECTOR

Mr. Nghidinua Daniel +264 61 297 5181 ndaniel@murd.gov.na akahamupembe@murd.gov.na

EXECUTIVE DIRECTOR

Mr. Benetus Nangombe +264 61 203 2019 Ben.Nangombe@mhss.gov.na

MINISTER

Hon. Anna Ester Nghipondoka

Private Bag 13186, Windhoek Government Office Park, Luther Street +264 61 293 3369 / 3111 / 3345 Sec.Minister@moe.gov.na www.moe.gov.na

DEPUTY MINISTER

Hon. Faustina Namutenya Caley +264 61 293 3307 Sec.DepMinister@moe.gov.na

EXECUTIVE DIRECTOR

Ms. Sanet L. Steenkamp +264 61 293 3524 ps.secretary@moe.gov.na Sanet.Steenkamp@moe.gov.na

MINISTER

Hon. Dr. Itha Kandjii-Murangi Private Bag 13338, Windhoek Government Office Park Luther Street +264 61 293 3111 / 435 6333 Secretary.Minister@mheti.gov.na

MINISTER

Hon. John Mutorwa Private Bag 13341, Windhoek 6719 Bell Str, Snyman Circle Rebother Road +264 61 208 8812 Maureen.Meyer@mwt.gov.na www.mwtc.gov.na

DEPUTY MINISTER

Hon. Veno Kauaria +264 61 435 6000 secretarydepminister@mheti.gov.na

EXECUTIVE DIRECTOR

Dr. Alfred Van Kent +264 61 435 6008/7

Anthea.Dewee@mheti.gov.na / Alfred.Vankent@mheti.gov.na

DEPUTY MINISTER Hon. Veikko Nekundi +264 61 208 8810

EXECUTIVE DIRECTOR

Ms. Esther Kaapanda +264 61 208 8822

Monica.Uupindi@mwt.gov.na

MINISTER Hon. Pohamba Shifeta Private Bag 13306, Windhoek Philip Troskie Building Dr. Kenneth Kaunda Street +264 61 284 2335 / 2111 privatesecretary.minister@met.gov.na www.met.gov.na

MINISTER

Hon. Tom K. Alweendo Private Bag 13338, Windhoek Mines & Energy Building 6 Aviation Road +264 61 284 8111 / 8318

Tom.Alweendo@mme.gov.na info@mme.gov.na www.mme.gov.na

DEPUTY MINISTER Hon. Heather Sibungo +264 61 202 3607

EXECUTIVE DIRECTOR

Mr. Teofilus Nghitila +264 61 284 2333 pa.ed@met.gov.na

DEPUTY MINISTER Hon. Kornelia Kashiimbindjola Shilunga +264 61 284 8314 Kornelia.Shilunga@mme.gov.na

EXECUTIVE DIRECTOR

Mr. Simeon N. Negumbo +264 61 284 8219

Simeon.Negumbo@mme.gov.na

MINISTER

Hon Derek Klazen

Private Bag 13355, Windhoek Brendan Simbwaye Square Cnr Kenneth Kaunda and Goethe Street +264 61 205 3101 / 3084 gregentia.shikongo@mfmr.gov.na

MINISTER

Hon. Yvonne Dausab

Private Bag 13248, Windhoek Justicia Building, Independence Ave Tel: +264 61 280 5262 / 281 9111 Minister@moj.gov.na www.moj.gov.na

DEPUTY MINISTER

Hon. Silvia Makgone +264 61 205 3104 Silvia.Makgone@mfmr.gov.na

EXECUTIVE DIRECTOR

Ms. Annely Haiphene +264 61 205 3007 / 2106

Annely.Haiphene@mfmr.gov.na

Ms. Felicity Owoses +264 61 280 5344 felicity.owoses@moj.gov.na

MINISTER Hon. Utoni Daniel Nujoma

Private Bag 19005, Windhoek 32 Mercedes Str, Khomasdal +264 61 206 6111 / 6321 / 6305 Anna.Salkeus@mol.gov.na annemarie.johannes@mol.gov.na www.mol.gov.na

DEPUTY MINISTER Hon. Hafeni Ludwigh Ndemula +264 61 206 6326 bernathe.situde@mol.gov.na

EXECUTIVE DIRECTOR

Mr. Bro-Matthew Shinguadja +264 61 206 6324

Bro.Matthew.Shinguadja@mol. gov.na

MINISTER Hon. Agnes Basilia Tjongarero Private Bag 13391, Windhoek NDC Building, 4 Goethe Str +264 61 270 6510 / 6111 minister.Secretary@msyns.gov.na www.msyns.gov.na

DEPUTY MINISTER Hon. Emma KantemaGaomas +264 61 270 6535 dmin.Secretary@msyns.gov.na

EXECUTIVE DIRECTOR

Dr. Audrin Mathe +264 61 270 6528 ps.secretary@msyns.gov.na ED.Secretary@msyns.gov.na

MINISTER

Hon. Dr. Peya Mushelenga

Private Bag 13355, Windhoek 2nd Floor, West Wing Government Offices, Love Street +264 61 283 2388 / 9111 Peya.Mushelenga@mict.gov.na www.mict.gov.na

DEPUTY MINISTER

Hon. Emma Theofelus

Tel: +264 61 283 2346 Emma.Theofelus@mict.gov.na

EXECUTIVE DIRECTOR

Mr. Mbeuta Ua-Ndjarakana +264 61 283 2387

Mbeuta.Ua-Ndjarakana@mict. gov.na

DEPUTY PRIME MINISTER & MINISTER

Hon. Netumbo NandiNdaitwah

Fourth Floor, West Wing Dr. Theo-Ben Gurirab Building Private Bag 13347, Windhoek +264 61 282 2146 / 9111 minister@mirco.gov.na www.mirco.gov.na

DEPUTY MINISTERS

Hon. Jennelly Matundu +264 61 282 2140 jmatundu@mirco.gov.na

EXECUTIVE DIRECTOR

Mr. Pendapala Naanda +264 61 282 2150/2 headquarters@mirco.gov.na

NATIONAL PLANNING COMMISSION

Ms. Annely Haiphene +264 61 2834225/195 AHaiphene@npc.gov.na CFrans@npc.gov.na

ANTI CORRUPTION COMMISSION

Hannu Shipena +264 61 435 4047 hshipena@accnamibia.org

OFFICE OF THE JUDICIARY

Ms. Rolanda van Wyk +264 61 435 3405 ps@jud.gov.na PA.PS@jud.gov.na

PRESS SECRETARY

Dr. Alfredo Tjiurimo Hengari +264 61 270 7812 Alfredo.Hengari@op.gov.na

OFFICE OF THE AUDITOR-GENERAL

Mr. Junias Etuna Kandjeke

123 Robert Mugabe Avenue. Windhoek Namibia P/Bag 13299, Windhoek +264-61-285 8000 info@oag.gov.na

NATIONAL ASSEMBLY

Ms. Lydia Kandetu +264 61 2882502/1/3 L.kandetu@parliament.na p.frederik@parliament.na

CHIEF ELECTORAL COMMISSION

Theo Mujoro +264 61 376 203 tmujoro@ecn.na

NATIONAL COUNCIL Adv. Tousy Namiseb +264 61 202 8014/5 tnamiseb@parliament.na m.walenga@parliament.na m.karongee@parliament.na

OFFICE OF THE FORMER PRESIDENT

54 Robert Mugabe Avenue Private Bag 13338, Windhoek 264 61 377 704

OFFICE OF THE FOUNDING PRESIDENT

54 Robert Mugabe Avenue Private Bag 13220, Windhoek +264 61 377 700

The Ministry of Industrialisation and Trade is charged with the responsibility to develop and manage Namibia’s economic regulatory framework, promote economic growth and development through the formulation and implementation of appropriate policies to attract investment, increase trade, develop and expand the country’s industrial base and enable equitable participation in the domestic and international markets.

To create an enabling environment for increased domestic and foreign direct investment (FDI), trade and industrial development, and to position and safeguard the interests of Namibia in the regional and global economy. The Ministry of Industrialisation and Trade is responsible for the development and management of Namibia’s economic regulatory regime, the basis on which the country’s domestic and external economic relations are conducted. It promotes growth and development of the economy through the formulation and implementation of appropriate policies to attract investment, trade, as well as develop and expand the country’s industrial base.

To be the leading ministry in the drive towards industrialisation, the realisation of an export-driven economy and making Namibia a preferred FDI destination to achieve increased and sustainable economic benefits and employment for Namibians and to be able to compete internationally.

Brendan Simbwaye Square, Block B

Cnr. Dr. Kenneth Kaunda & Goether Streets +264 61 2837223

Elijah.Mukubonda@mit.gov.na www.mit.gov.na

This segment seeks to advance inculcating service areas offered by the ministry to its stakeholders (internal and external). These include support services for micro, small and medium enterprises (MSMEs), such as liquor licencing, SME certification, business plan applications, feasibility studies, product development and testing, skills development, group training, mentorship, environmental impact assessments, market research, and the provision of information on trade and industrialisation statistics.

By extension, these services also embrace all programmes designed to assist MSMEs, including but not limited to:

(a) StartUp Survival Grant: Aimed at supporting various start-ups and small growing businesses to endure most of the Covid-19 pandemic.

(b) SDG Impact Facility: Providing mentorship grants and debt financing to women and youths in business, social enterprises and MSMEs, as well as addressing one of the key challenges faced by MSMEs, which is access to affordable finance.

(c) Empretec: The Government of the Republic of Namibia and United Nations Development Programme (UNDP) identified the need to support entrepreneurs in the country with the establishment of EMPRETEC Namibia for the development of entrepreneurship skills for enterprise expansion. The overall objective for EMPRETEC Namibia is to support entrepreneurship and enterprise development in the country using the EMPRETEC model’s best practice.

d) IUMP: A grant scheme designed to enhance productivity and competitiveness of selected firms, focusing on firmlevel diagnosis

The mandate of the NIPDB is quite extensive, she shares. However, according to her, two elements are critical, namely an increase in employment in the country as well as the improvement of Namibia’s trade account. ‘“And that, of course, comes with two (further) things: Number 1 is really to promote investment; to bring investment to Namibia; to promote local investment and to promote Namibia as a preferred investment destination.

“Number 2 is to support our start-ups, small and medium-sized enterprises (SMEs) and make sure that we coordinate SME activities in our country across all levers of the economy. There are a lot of supporting activities but in brief that is our mandate.”

She is a fervent believer in collaboration and cooperation. Therefore Uaandja believes that every Namibian has a role to play in fulfilling the NIPDB’s mandate. “I consider my team to be the entire Namibia. One of my favourite authors, John Maxwell, says: ‘One is too small a number to achieve greatness.’ If we want to achieve greatness, we need all Namibians on board to help make sure that we make this mandate a reality.”

Using the analogy of a bleeding patient arriving in a casualty ward, Uaandja says under those circumstances, there is no time to establish what had caused the bleeding: you just have to stop the bleeding.

She and the team have hit the ground running and are continuing to do so. “While we all want the luxury of time to first put in place policies, structures and frameworks, we don’t have that luxury.”

Uaandja attributes another analogy 'The Sand Box Concept' to the Governor of the Bank of Namibia (BoN), Johannes Gawaxab, which just means that we should be in a live experiment at present. “You do and as you do, you put the policies in place, and with that of, course, there is a number of mistakes that one can make, but you need to make sure that you learn from your mistakes and that you collaborate with other people so that they can support you.”

Nangula Nelulu Uaandja, the chief executive officer (CEO) at the Namibia Investment Promotion and Development Board (NIPDB), says someone recently captured the essence of the concept of resilience: the ability to bounce back fast after a setback.

Known for her direct and no-nonsense approach, the former managing partner of auditing giant PricewaterhouseCoopers (PwC) says resilience starts with policy agility. “One of the discussions that we are having in the economic sphere is how do our policies, how does our economy support the bouncing back of companies.”

As a case in point, she says, a closer look needs to be had at Namibia’s current insolvency and business rescue policies and legislation.

She acknowledges that there is room for improvement, especially as far as it relates to business rescue support. Given the high-level priority which this enjoys, the head of state, President Hage Geingob has recently established a committee that would be directly tasked with business rescue, Uaandja says.

Another critical component that capacitates business and economic resilience relates to the scope and magnitude of the country’s and the company’s reserves to help it withstand pressure and shocks. “Even the ants store food and our ability to bounce back depends on our reserves,” she says.

Testimony to her approach to her roles and responsibilities, Uaandja says resilience equally depends on one’s spirit. According to her, one’s personal push and one’s leadership approach are key in building resilience of spirit.

It is no secret that 2020 – as a result of the Covid-19 pandemic and resultant regulation to arrest its further spread – has had a devastating impact – not only on the local economy but on the global economy, Uaandja emphasises.

This has resulted in a decrease of approximately 11% in foreign direct investment (FDI) in subSaharan African countries, she says.

Before the advent of the pandemic, Namibia had already been struggling regarding FDI, she admits, especially since 2015. By 2019, Namibia’s FDI had recorded a negative figure, following a downward trajectory.

Since then, efforts to turn the situation around are slowly starting to bear fruit, Uaandja says. Notwithstanding the devastation given rise to by the Covid-19 pandemic, Namibia’s FDI has seen some improvement over the last year in particular, Uaandja says. According to her, positive FDI to the tune of N$250 million has been recorded during the last quarter of 2020.

Due to the restrictions in place to curb the further spread of the pandemic, having in-person conversations with prospective investors has without a doubt been a challenge, she states.

Fortunately, for her and her team, virtual engagements were already the order of the day by the time they hit the ground running at the start of 2021, Uaandja says. “So, yes, 2020 has been devastating to our economies, but as a people, we have definitely bounced back, and we are thinking of different ways on how to attract investment (to the country).”

Hope is on the horizon, though, she says. As matters stand at present, several potential investors have their eyes set on Namibia, according to her. During the times that they have been able and allowed to do so, regulations permitting, the Board has brought some of these potential investors to Namibia, shown them around in the country and engaged them in constructive conversation.

Part of their work also involves ironing out bureaucratic processes that could be dealt with more efficiently, the NIPDB CEO says. These have a direct impact on the country’s ability to secure FDI. “We have also been quite busy, working with various ministries and government departments, looking at some of the bottlenecks that investors might experience.”

These bottlenecks relate to but are not limited to delays with the issuing of permits, visas, or licences to enable the investors to operate businesses in the country. “We need to help them get those permits faster than they normally would.”

This would boost investment activities and support the growth of the economy, she says. “So, it has been quite an exciting journey, actually.”

Uaandja acknowledges that Namibia is not a perfect landscape. Challenges abound relating to unemployment, inequality and levels of poverty. For this purpose, we need all Namibians to alleviate the impact of these challenges and build the country’s economy, she pleads.

Building on her clarion call to every citizen in the Land of the Brave, Uaandja says Namibians who have a job or access to opportunities must give it their all and appreciate their privilege keeping in mind that one Namibian might have to go to bed hungry. She concluded: ‘I believe there is a lot of hope for Namibia. I believe that Namibia has a lot of potential, but that potential cannot be realised without the support of every one of us.”

On 22 February 2022, the Bank of Namibia hosted a seminar titled Mapping Namibia’s Post-Covid Economic Recovery, which advanced key strategies to address challenges impeding Namibia’s economic recovery. As a result, the seminar outlined specific evidence-based solutions for revitalising Namibia’s economy in the short to medium term. Covid-19 hit Namibia harder than South Africa and its peers because the country was already in a prolonged recession when Covid-19 struck. As a result, the entire economy experienced significant contraction and a slow recovery, particularly in tourism and manufacturing.

The seminar highlighted the barriers to structural economic transformation. These include a misaligned skills profile, and a relatively high tax burden for individuals and corporations compared to other countries. Other challenges identified include business-inhibiting regulations, access to capital, labour-market reforms, communal land reform, and the ease of doing business in Namibia.

The seminar emphasised the importance of Namibia optimising its natural resource stewardship, revamping the role of the public sector as an enabler for private sector-led growth, and creating opportunities that include Namibians in the growth process. Although not stimulating growth in the short run, the seminar noted that fiscal consolidation is required to restore fiscal stability.

Furthermore, the recovery of existing capacities, such as tourism postCOVID-19, and existing tradable activities with large multiplier effects on the rest of the economy, such as mineral resources and agriculture, must drive growth. Similarly, new diversification initiatives such as green energy, parts of manufacturing, logistics, and services have a lot of potential while the ICT and digital transformation are key enablers and represent new opportunities that must be exploited in the economic recovery process.

In this regard, Namibia’s recovery is dependent on how it implements the diversification plan of its economy currently being spearheaded by the government and the Harvard University Growth Lab. The seminar acknowledged that key products with export opportunities in food, metals, mining and adjacent industries, chemicals and basic materials, machinery and electronics, transportation and logistics identified through the diversification plan, can facilitate structural economic transformation.

The seminar identified access to financing and interventions aimed at preserving SMEs and putting them on a sustainable footing in order for them to thrive in a post-Covid-19 environment. Other recommendations include SME and informal sector development, targeted investment promotion from both domestic and foreign sources, as well as skills development.

Ensuring accountability in all government investments and achieving greater efficiency in government spending should be underscored. This can be accomplished through better prioritisation, which includes restructuring, liberalisation, and, if necessary, the closure of non-performing stateowned enterprises. The seminar also emphasised the importance of Namibian stakeholders cooperating and coordinating their efforts. This will foster a shared understanding of what needs to be done to address the challenges and aid in the recovery. The combined efforts of private and public sector stakeholders are critical for Namibia’s recovery. This will go a long way toward instilling optimism and increasing investor confidence.

The event brought together policymakers, business leaders, experts, representatives of civil society, professionals from local and international organisations, as well as academic institutions.

Ensuring accountability in all government investments and achieving greater efficiency in government spending should be underscored.Left: Dr. Postrick Mushendami, Mr. Rowland Brown, Dr. Emma Haiyambo, Mr. Sylvester Mbango, Ms. Leonie Dunn, Mr. Salomo Hei

Birgit Hoffmann is an internationally registered professional executive coach, as well as an industrial and organisational psychologist and a chartered public relations practitioner. Birgit combines over 20 years’ in-depth business knowledge with global training and accreditation as a professional certified coach (PCC) to bring her clients the benefits of fresh thinking and hands-on experience. It also brings a special quality and depth to her coaching.

As an ICF-credentialled coach, Birgit uses the integral coaching method. This compassionate way of coaching helps leaders through selftransformation while holding them accountable for their own development.

Birgit explains, “Fulfilment is a deeply felt experience that what we are doing, how we are living, and who we are becoming is meaningful and worthwhile. Steeped in wisdom from philosophy to neuropsychology to cognitive science and beyond, my way of working with clients is profoundly compassionate, grounded, and effective.”

The economic downturn and the Covid pandemic have led to a dramatic impact on health and psychological wellbeing overall and presents an unprecedented challenge to the world of work. The economic and social disruption caused is devastating.

To develop capacity in dealing with these challenges, coaching builds awareness, empowers choice and leads to change, in business and in life. Coaching is a key technique to consider when we might be looking for new direction. It gives individuals, companies and policymakers the permission to have a long, hard look at themselves and their way of doing things. Its non-judgemental approach and thoughtful two-way communication allow for out-ofthe-box thinking. Coaching is the ideal enabler of transformation and change, at individual, corporate or policy level.

An executive coach is a qualified professional that works with clients to help them gain selfawareness, clarify goals, unlock their potential, and act as a sounding board. The executive coach can be instrumental to the success of a company’s team since he or she will help concentrate a company’s development and improvement efforts. A coach with extensive knowledge and experience in organisational behaviour and rigorous psychological training will yield topmost results. When done well, executive coaching is a powerful and rewarding tool to improve the performance of executives and their organisations and will likely be well worth the investment.

Executive coaching is perhaps the most powerful approach to leadership development and transformation for senior leaders and high potentials who aspire to grow their careers. It is one of the most – if not the most – individually tailored practices in talent development as it involves a close and confidential relationship between the coach and the person being coached.

To understand what executive coaching is, it is helpful to look at the definition of coaching. According to the International Coach Federation (ICF), coaching is defined as “a partnership with clients in a thought-provoking and creative process that inspires them to maximise their personal and professional potential”. Key elements in this definition are partnering, thoughtprovoking, and maximising potential. These are the fundamentals that differentiate professional coaching from other forms of development. The value of a coach lies in his or her ability to serve as an insight-provoking partner, supporting the client to design his or her own actionable and sustainable strategies for success.

It is impactful in supporting people to develop skills that are effective in managing themselves in uncertainty, or a changing or challenging environment, by opening up new ways of thinking through self-reflection and collaborative dialogue. Through this, it brings new insights, growth and awareness, enabling an increase in the client’s reach, influence and impact.

In short, it helps the client focus on becoming a different observer, allowing him or her to take new and powerful action to take care of what matters most. When a country or organisation is under pressure, its players benefit from grounded, mindful reflection on its desired direction instead of continuing to do things in old, familiar ways.

Workplace coaching can be used in nearly any situation: to support organisational transformation, deal effectively with uncertainty and change, performance and career management, leadership development, personal wellbeing and effectiveness, strategic and policy dialogues, and deep reflection.

Executive coaching helps people find the resources within themselves to create sustainable transformation. Good coaches support delivering measurable bottom-line results at the same time. This makes it different to mentoring, consulting, or training. Leaders can transform their performance through working with a professional coach who offers both support and challenges.