by Keith Giles

by Keith Giles

Consumer behaviors are difficult to predict, but psychologists and researchers have uncovered some fascinating details about why certain approaches succeed where others fail. Professor Eric Spangenberg of the UCI Paul Merage School of Business has studied consumer behavior for a long time now. In a recent article, he and his fellow researchers discovered how what they have labeled “The Incompleteness Effect” drives consumer choice, and why it’s very difficult for consumers to resist.

Understanding consumer behaviors inspired the research article that Spangenberg recently published with co-researchers Christoph Bauer of Simon-Kucher & Partners, Hamburg, Germany, Andreas Herrmann of the Institute for Mobility, University of St. Gallen, Switzerland, and his daughter, Katie Spangenberg of The Albers School of Business and Economics, Seattle University, Seattle, Washington. The results were published in the Journal of the Academy of Marketing Science (December, 2021) under the title, “Collect Them

All! Increasing Product Category Cross-Selling Using the Incompleteness Effect.”

Ironically, Eric Spangenberg can’t help himself when it comes to human behavior. He admits that he’s relentlessly curious about why humans act in certain ways—especially when deciding what and how much to purchase. “The inspiration for anything I work on is typically centered around consumer decision-making,” he says. “I am a consumer psychologist by training, so I’m always interested in why people make decisions and how we can influence them.”

Spangenberg identifies himself as somewhat of an “antimarketing marketer” preferring to inspire positive buying choices rather than using manipulative methods to merely increase consumer purchases. “Rather than just find new ways to sell people more rolls of paper towels, I’d prefer to find ways to encourage consumers to make smarter, healthier, and more societally conscious choices,” says Spangenberg.

“The inspiration for the study came from our co-author Christoph Bauer,” Spangenberg says. “It was taken directly from his doctoral dissertation completed at the University of St. Gallen where I served on his doctoral committee.”

One of the study’s underlying premises is that people often have an unconscious sense of unease about incomplete tasks. “Sometimes that unease can reach the conscious level if it becomes strong enough,” Spangenberg says. “But either way, that feeling of

unease drives people to complete a set or finish a task, and that drive is what we were most interested in exploring in our research.”

An experimental social psychologist by training, Spangenberg was fascinated with testing theories and hypotheses that are nearly a hundred years old. “Lewin’s Field Theory, for example, was first published in Germany in the 1920s,” he says. “Outside of our work, no one had looked at Lewin’s Field Theory in a cross-buying context, and to our knowledge, this is the first research to demonstrate how online product configurators can be used to trigger this impulse for consumers to complete a set. This effect is based on the state of tension people feel whenever there are unmet needs or desires, which increases the likelihood of cross-buying products.”

Their study showed that framing products and services as sets was effective, regardless of different presentations. “Using the incomplete set framework increased cross-selling of products, whether from a single purchase instance or over multiple interactions over a longer period of time,” Spangenberg says. Their study also examined the underlying drivers of the incompleteness effect and how online stores can visually group products. “When you arrange products as part of an interrelated set, you increase perceptions of incompleteness,” he says, “increasing the likelihood that consumers will buy more, or all products within the set created.”

While the benefits of this research for retailers appear quite obvious, there are benefits for consumers as well. “People may enjoy a more satisfying consumer experience, and certainly enjoy a more complete experience when given these options,” he says. “The

OPT-IN to read more from the Merage School.

whole premise of our work is based on the fact that people like complete sets better than incomplete sets.”

To illustrate this, Spangenberg suggests a scenario where someone has an upcoming dinner party, and they go online to purchase a nice wine for the occasion. “Under normal circumstances, that person would probably just buy one red and one white wine and be done,” he says. “But if you offered a complete dinner party experience, including a non-alcoholic cider, sparkling wine to serve with appetizers, red wine, white wine, and after dinner grappa, the incompleteness effect greatly increases the likelihood that consumers will choose to purchase the complete set.”

The perception that the experience would be incomplete without the entire collection of beverages is one that most consumers would not consciously (or subconsciously) prefer. The effect also comes in to play when you offer a customer an entire set and ask which options they’d like to eliminate. “A previous study we worked on with Audi found that customers who were shown a fully loaded vehicle and asked which features they wanted to eliminate ended up driving away with more features than those asked to build up a vehicle from a base model with few features,” he says. “The perception that the fully loaded vehicle would somehow be incomplete by removing features led people to not to eliminate those options.”

Of course, this model isn’t effective 100 percent of the time—many factors play into its success. “We have to

ask if the cost of completing a set is feasible or rational. In cases where the consumer feels that it’s both feasible and rational, we found that they are more likely to choose to complete the set that’s offered to them.”

On a personal note, Spangenberg was thrilled to work on this project with his daughter Katie Spangenberg. “This was the most fun I’ve had working on a paper because it meant we could work on it together,” he says. “A lot of the managerial and theoretical implications of the study came from her in addition to much of the statistical analyses. She’s a professor at Seattle University now, and not only did she have the most current methodological expertise, but as a younger scholar she was current in the literature.”

While their research doesn’t explain why hot dogs come in packs of ten and hot dog buns in eight, it offers guidance for how companies can improve customer experience and increase product cross-selling by incorporating these principles.

“What we found suggests that this methodology could be used across multiple settings,” Spangenberg says. “Whether you’re selling all the ingredients in a recipe, a complete line of cosmetics, home furnishings or spa services, it really doesn’t matter. No matter what you’re selling, if you frame things as a set, you’re more likely to find retail success and consumers are more likely to feel fulfilled as buyers.”

by Keith Giles

by Keith Giles

Organizations often want to encourage employees to report wrongdoing but don’t always know the best ways to foster open channels of communication. To understand how social relationships affect whistleblowing, Professor Patrick Bergemann of the UCI Paul Merage School of Business and his research partner, Brandy Aven of Carnegie Mellon University, recently completed a study, “Whistleblowing and Group Affiliation: The Role of Group Cohesion and the Locus of the Wrongdoer in Reporting Decisions,” that was recently published in the journal Organization Science.

Bergemann’s professional interests primarily revolve around understanding factors that drive people to report inappropriate behavior, specifically in its social context. “When you think about the act of reporting someone else, it’s oftentimes someone you know, someone in your social group,” he says, “and there are likely to be social reactions when people report their colleagues or peers. Someone might say, ‘Great job!’ or, ‘How dare you?’ so it’s a very social decision.”

Most research on whistleblowing focuses on the individual, the nature of the wrongdoing, or the organization, but Bergemann and Aven felt something crucial was missing. “The research we’ve seen focuses on how reporters make decisions as individuals,” says Bergemann. “But, so far, there’s been much less research on the social dimension of whistleblowing.” This oversight partially inspired Bergemann’s curiosity. “It seems like a big mistake to overlook the social aspects of whistleblowing. Not that no one else has ever looked at this side before,” he says. “But in the past, approaches have tended to be rather simplified: Your likelihood of reporting a friend versus a stranger is one angle that’s been explored, for example. In a complex organizational context, the broader social dynamics haven’t been explored as much.”

To get to the heart of how social groups affect whistleblowing, Bergemann and Aven took matters into their own hands, but it wasn’t easy. “Whistleblowing is a tough topic to study,” says

Bergemann. “As you might guess, these are relatively rare events, and often companies hesitate to share information on whistleblowing publicly. So, even if companies have an HR department that encourages whistleblowing, they don’t tend to like sharing that information outside the company.”

Fortunately, Bergemann and Aven identified whistleblowing data collected in the 2010 Merit Principles Survey, containing information on over 42,000 federal employees across 24 agencies. “This survey allowed us to test our theory in two ways,” Bergemann says. “First, by examining retrospective behaviors for the subset of respondents who had prior knowledge of wrongdoing. Second, by analyzing prospective whistleblowing intentions using the full sample of respondents. We also created an online experiment to replicate our findings and corroborate our results.”

Bergemann and Aven discovered that there was a distinction between whether the wrongdoer was a member of the whistleblower’s workgroup or someone outside of the group. “I think it’s fairly intuitive to most of us that we treat outsiders differently than insiders,” he says. “So, that was the first distinction we looked at. The second was how people felt about their workgroup. Did they view their group as cohesive, meaning that it had a

As Bergemann explains, some of the findings weren’t shocking: “If someone committed wrongdoing within a person’s workgroup, and if that workgroup was very cohesive, that person would be less likely to blow the whistle,” he says. “That wasn’t very surprising. People want to protect other members of a tight-knit group. On the opposite side, if you hate working with the people in your workgroup, you might see reporting one of them as an opportunity to strike back.”

spirit of teamwork and cooperation?”

“It seems like a big mistake to overlook the social aspects of whistleblowing.”

However, there were findings in their study that revealed some less intuitive results. “What I found more interesting is what happens outside of the groups,” Bergemann says. “This is where we see the opposite pattern emerge. If you have a cohesive workgroup and see someone commit wrongdoing outside of that group, you are more likely to report them. Put together with the other findings, the more cohesive your workgroup, the less likely you are to report wrongdoing inside of your workgroup, and the more likely you are to report wrongdoing outside of your workgroup.”

The latter behavior appears to be about self-preservation. “If you’re reporting someone outside your group, and you have a very strong, tight-knit group, then you’re probably less worried about retaliation because other group members have your back,” he says. “But if your group isn’t cohesive, you’re not as secure about protection from those within. The fear of retaliation is likely stronger for those in less cohesive workgroups than those in stronger workgroups.”

The bottom line in their research is that corporations cannot ignore the power of groups and social relationships when it comes to whistleblowing. “If we want to root out wrongdoing within organizations, then it’s not enough to set up an anonymous hotline,” Bergemann says. “We need to understand why groups protect certain wrongdoers but not others, and then account for these dynamics. Otherwise, we will continue to have organizational blind spots where individuals can get away with misconduct.”

One solution for corporations who want to improve whistleblowing might be to encourage cohesive groups to mix together more. “This integration might encourage people to report wrongdoing more often,” Bergemann says. “That’s just one suggestion. From our research, it’s clear that we need to think more broadly about these social dynamics. If we don’t, then we’ll continue to see employees who protect members within their groups and not report as often.”

Patrick Bergemann studies the reporting of wrongdoing, broadly conceived. Understanding when and why people report wrongdoing is fundamental to understanding how organizations and polities address problematic behavior, prevent malfeasance and function effectively. Reporting wrongdoing is also an essential way that individuals can deter and punish discrimination, harassment and victimization in the workplace. His research has been published Organization Science, Management Science, the American Journal of Sociology and the American Sociological Review. His book, Judge Thy Neighbor: Denunciations in the Spanish Inquisition, Romanov Russia, and Nazi Germany, was published by Columbia University Press.

by Alex D. Bennett

by Alex D. Bennett

Commission-free trading has become the norm among retail investment brokers. Although commissions are a thing of the past, transaction costs driven by the gap between buying and selling prices still get passed on to the investor. In a recent study, Professor Christopher Schwarz of the UCI Paul Merage School of Business and colleagues from UCI and other distinguished business schools discovered something surprising: transaction costs for simultaneous, identical market orders dramatically vary from broker to broker, ranging from -0.07% to -0.45%. The findings are causing a stir in the industry and beyond.

The results of the study are published in an article titled, “The ‘Actual Retail Price’ of Equity Trades,” authored by Professor Schwarz and his collaborators, Brad Barber of the University of California, Davis, Xing Huang of the Olin Business School at Washington University in St. Louis, Phillippe Jorion of the UCI Paul Merage School of Business, and Terrance Odean of the University of California, Berkeley Haas School of Business. Their paper can be downloaded at SSRN by clicking here.

Professor Schwarz and his colleagues uncovered the disparity between brokers while evaluating the strength of an academic algorithm designed to identify retail trades. “It was a Bob Ross happy accident,” he explains.

Professor Schwarz was using a personal brokerage account to make small intraday trades and, to improve the rigor of his experiment, decided to open another account at a different broker. In late December 2021, he simultaneously submitted identical, market order trades to both brokers.

“At the end of that first day, one account lost $150, while the other one made $12,” he says. “I was a bit confused how two brokerage accounts trading the same stocks at the same time could have such a huge execution difference. It made me want to know, is this type of execution difference typical? What’s actually driving the difference between brokers?”

To answer those questions, Professor Schwarz and his colleagues determined early on that they’d need to build their own dataset.

“As academics we rely on aggregate data that’s given to us,” Professor Schwarz says. “The NYSE’s Trades and Quotes Database has data on every trade that takes

place. There’s lots of limitations with that data. You don’t know the broker it came from, you don’t know the client type. For us the only way to get information broker-bybroker was to generate our own data.”

To get there, the team placed 85,417 market order trades between December 2021 and early June 2022. The trades, made for the same number of shares of the same stock, were made simultaneously at different brokers. Using broker disclosures and detailed trade reports, the team could compare results from broker to broker. “We don’t need to proxy anything, because we generated the data,” Professor Schwarz says.

Such a high volume of trades didn’t come without a cost, of course. “Sometimes you’ve got to get your hands dirty,” Professor Schwarz says. “It wasn’t cheap for us. We lost tens of thousands of dollars doing this. I’m sure many of our colleagues think we’re crazy. But I had to know, so I started trading.”

“We have a really cool data set,” he says. “It was just a little expensive.”

As they examined the data, the team identified three potential sources of the outcome discrepancy between brokers:

• Venue choice—Fee differences might be driven by the proportions of trades brokers send to various wholesalers.

• Stock routing—Brokers could send more trades

“I was a bit confused how two brokerage accounts trading the same stocks at the same time could have such a huge execution difference. It made me want to know, is this type of execution difference typical?”

to venues with worse-than-average execution for those particular securities.

• Broker execution—Venues could have different price execution for the exact same orders.

To everyone’s surprise, the third category—broker execution—turned out to be the source of the discrepancy.

To understand why this matters, one needs to understand how brokers make money in a zerocommission world. The industry’s move away from transaction-based commissions was made possible by an offsetting revenue stream from the securities wholesalers that serve as the trading venue for execution of orders.

The new revenue comes from “payments for order flow,” or PFOF, through which wholesalers pay most brokers a price, typically a fraction of a penny per share, to be selected as the venue for trades. For market orders, the fee works out well for the trading venues if they earn more than the PFOF amount on the spread between the bid and asking price of each transaction.

PFOF has been criticized for creating potential conflicts of interest, with brokers choosing between better outcomes for their clients and a higher revenue stream for themselves. The regulators have taken note. SEC regulations require broker-dealers to publish quarterly reports summarizing their routing practices, including details about their PFOF outlays. The regulations also give customers the option to request

details about how their trades are routed.

The problem, Professor Schwarz says, is that all these disclosures don’t reveal the significant execution differences between brokers. “If you use the PFOF disclosures, you’d expect execution across all the brokers to be the same. It’s a failure of disclosures that execution is not the same. I can’t think of any other consumer finance product where costs are different and it’s not disclosed.”

“Most people think that ‘zero commission’ means trading is free,” he says. “But that’s not the case.”

The big difference in outcomes between brokers has attracted a lot of attention in the short time the paper has been posted. Several brokers have reached out to Professor Schwarz to talk about the results, but that’s not all. Regulators, exchanges, and legislators have been in touch to learn more about the team’s findings.

We asked Professor Schwarz what retail investors should glean from his experiment. “The first takeaway is that nothing is free. Retail investors should be a little more cautious about what ‘zero commission’ means.” he says. “The other takeaway is that your price execution is going to depend on what broker you use for market orders.” The challenge, at least before Professor Schwarz and his team published their paper, is that no one knew what that difference was.

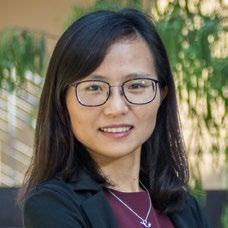

Christopher Schwarz is a professor of finance at the UCI Paul Merage School of Business. His research interests include the management, disclosure, and operational risk of the investment fund industry and the impact of manager incentives and structure on investment fund performance. His research has been published in such leading academic journals as the Journal of Finance, Journal of Financial Economics, Review of Financial Studies, and the Journal of Financial and Quantitative Analysis and included in testimony before the U.S. Congress House Financial Services Committee.

Professor Elizabeth Chuk

Title: “The Impact of Governmental Accounting Standards on Public-Sector Pension Funding”

Co-author: Divya Anantharaman

Accepted at: Review of Accounting Studies (Journal on Financial Times Top 50 list)

The funding policy for defined benefit pension plans covering government employees represents an important decision for governments sponsoring those plans. Many state and local government plans have become severely underfunded (e.g., New Jersey, Illinois, and Detroit), raising concerns about whether governments are contributing enough to their pensions. Governmental Accounting Standards Board Statements 67/68 ( “GASB 67/68”) fundamentally alter the financial reporting of pension liabilities, by (i) requiring pension liabilities to be estimated using a potentially lower discount rate (increasing estimated liabilities and any funding deficits), and (ii) mandating balance sheet recognition of funding deficits/ surpluses. Although GASB 67/68 only changes financial reporting and acknowledges specifically that funding is outside its scope, we find, for 100 large state-administered plans, that governments increase pension contributions significantly upon applying GASB 67/68. This funding response is stronger from governments likely to face greater political consequences once pension deficits are made prominent by GASB 67/68. Benefit cuts are also more likely post-GASB 67/68, but plans that increase funding are less likely to cut benefits – suggesting that these responses substitute for each other, and that pension funding is more of a fiscal priority in some states than others. Overall, our findings suggest that purely accounting changes can have “real” effects on governmental pension policy.

Professor Devin Shanthikumar

Title: “Bringing Innovation to Fruition: Insights From New Trademarks”

Co-author: Lucile Faurel, Qin Li (PhD alumnus), Siew Hong Teoh

Accepted at: Journal of Financial and Quantitative Analysis (Journal on Financial Times Top 50 list)

We build a novel comprehensive dataset of new product trademarks as an output measure of product development innovation. We show that risk-taking incentives in CEO compensation motivate this type of innovation and that this innovation improves firm performance. Using an exogenous shock to executive compensation, we find that reductions in stock option compensation cause reductions in new product development. We also find that firms undertaking new product development

OPT-IN to read more from the Merage School.

experience increases in future cash flow from operations and return on assets. These findings suggest the importance of product development innovation to firms and new trademarks as a novel innovation measure.

Professor Chenqi Zhu

Title: “Patent Publication and Innovation”

Co-authors: Deepak Hegde and Kyle Herkenhoff

Accepted at: Journal of Political Economy (Journal on Financial Times Top 50 list)

How does the publication of patents affect innovation? We answer this question by exploiting a large-scale natural experiment—the passage of the American Inventor’s Protection Act of 1999 (AIPA)—that accelerated the public disclosure of most U.S. patents by two years. We obtain causal estimates by comparing U.S. patents subject to the law change with “twin” European patents which were not. After AIPA’s enactment, U.S. patents receive more and faster follow-on citations, indicating an increase in technology diffusion. Technological overlap increases between distant but related patents and decreases between highly similar patents, and patent applications are less likely to be abandoned post-AIPA, suggesting a reduction in duplicative R&D. Firms exposed to one standard deviation longer patent grant delays increased their R&D investment by 4% after AIPA. These findings are consistent with our theoretical framework in which AIPA provisions news shocks about related technologies to followon inventors and thus alters their innovation decisions.

Professor Jinfei Sheng

Title: “Cheaper Is Not Better: On the ‘Superior’ Performance of High-Fee Mutual Funds”

Co-authors: Mikhail Simutin and Terry Zhang

Accepted at: Review of Asset Pricing Studies

In contrast with theoretical predictions, high-fee active equity funds generate worse net-of-expenses performance. We show that this fee-performance puzzle is driven by the preference of high-fee funds for stocks with low operating profitability and high investment rates, characteristics associated with low expected returns. After controlling for exposures to profitability and investment factors, high-fee funds significantly outperform low-fee funds before expenses and achieve similarly poor net-of-fees performance. In resolving the fee-performance puzzle, our findings provide support to the theoretical prediction that skilled managers extract rents by charging high fees, and challenge the common advice to prefer low-fee funds over high-fee counterparts.

Professor Yuhai Xuan

Title: “Director Job Security and Corporate Innovation”

Co-authors: Po-Hsuan Hsu, Yiqing Lü, and Hong Wu

Accepted at: Journal of Financial and Quantitative Analysis (Journal on Financial Times Top 50 list)

In this paper, we show that firms can become conservative in innovation when their directors face job insecurity. We find that after the staggered enactment of majority voting legislation that strengthens shareholders’ power in director elections, firms produce fewer patents, particularly exploratory patents, and fewer forward citations. This effect is stronger for directors facing higher dismissal costs or threats and for firms with greater needs for board expertise and is mitigated by institutional investors’ expertise in innovation. Overall, our results suggest that heightened job insecurity induces director myopia, which leads to a reduction in investment in risky, long-term innovation projects.

Professors Imran Currim and Sanjeev Dewanm

Title: “Validation of the information processing theory of consumer choice: Evidence from travel search engine clickstream data”

Co-author: Xiaoyi Sylvia Gao (PhD alumna)

Accepted at: European Journal of Marketing

We demonstrate how consumer clickstream data from a leading hotel search engine can be employed to validate two hidden information processing stages — first eliminate alternatives, then choose — proposed by the revered information processing theory of consumer choice. Most previous studies on validating the information processing theory of consumer choice have employed laboratory experiments, subjects, and information display boards comprising hypothetical product alternatives and attributes. Only a few studies employ observational data. In contrast, we uniquely employ point-of-purchase clickstream data on actual visitors at a leading hotel search engine, and test the theory based on real products, attributes, and diversity of the consideration set. We model the two hidden information processing stages as hidden states in a hidden Markov model, estimated on consumer search behavior, product attributes and diversity of alternatives in the consideration set. Our two main findings are as follows. First, the stage of information processing can be statistically

characterized in terms of consumer search covariates, including trip characteristics, use of search tools, and the diversity of the consideration set, operationalized in terms of: number of brands, and dispersion of price and dispersion of quality. Second, users are more sensitive to price and quality in the first rather than the second stage, which is closer to purchase. Our results suggest practical implications for how search engine managers can target consumers with appropriate marketing-mix actions, based on which information processing stage consumers might be in.

Professor Connie Pechmann

Title: “Understanding Hesitation to Use Nicotine Replacement Therapy: A Content Analysis of Posts in Online Tobacco-cessation Support Groups”

Co-authors: Connor Phillips, Douglas Calder, and Judith J. Prochaska

Accepted at: American Journal of Health Promotion

Free nicotine replacement therapy (NRT) is provided in smoking cessation programs to incentivize participation and improve abstinence; however, daily use of NRT typically wanes after a few weeks. This study sought to understand smokers’ hesitancy to use NRT. After providing free NRT to adult participants seeking to quit smoking through social media-based peer support groups, we related their posts about NRT to their NRT usage and smoking abstinence. Overall, 438 participants posted about NRT 1936 times, and we coded their posts to reflect their positive and negative perceptions. At one-month post-quit, most participants (N=339) reported their NRT usage in the past week and month. Nearly all participants (96.17%, 326/339) reported using NRT at least once but only 45.72% (155/339) reported using NRT daily for the entire month as recommended. Negative NRT posts comprised 65.34% (1265/1936) of NRT posts. Dislike and no longer needed posts related negatively to past-week NRT used at least once (B=-0.66, p=.005 and B=-0.37, p=.045), use occasions (B=-1.86, p=.018 and B=-1.10, p=.016) and used daily for the full month (B=-0.56, p=.044 and B=0.53, p=.009). Effectiveness posts related positively to past-week NRT used at least once (B=0.15, p=.023), used daily for the full month (B=0.25, p=.001), and smoking abstinence (B=0.27, p=.002). Our results indicate strategies are needed to address negative NRT perceptions and encourage positive ones, especially on social media where NRT posts may be amplified.

Professor Noah Askin

Title: “Recognition Killed the Radio Star? Recognition Orientations and Sustained Creativity after the Best New Artist Grammy Nomination”

Co-authors: Spencer Harrison and Lydia Hagtvedt

Accepted at: Administrative Science Quarterly (Journal on Financial Times Top 50 list)

Through an inductive study of the bands nominated for a Best New Artist Grammy , we develop a theory of reactions to early recognition in creative groups. Our multimethod analyses include oral histories from members of each band and quantitative data for triangulating the processes they describe. Our findings reveal that groups develop sets of emergent reactions and active adjustments to the recognition and its consequences, which we call “recognition orientations.” We identify three—Absorbing, Insulating, and Mixed—that reflect how groups interpret and integrate recognition into their creative processes going forward. Most groups struggled by “absorbing” recognition, which leads to internalizing expectations and opening their relationships to outsiders, ultimately inhibiting creativity. However, some groups begin “insulating” themselves from recognition by externalizing expectations and bounding relationships allowing them to sustainably produce creative output over time. Finally, other groups develop a Mixed orientation, initially experiencing the pitfalls of elevated recognitionseeking but ultimately attempts to insulate needs for external recognition by refocusing on their creative process. These findings reveal that recognition can upend the creative process and that groups that begin absorbing recognition are, ironically, less likely to earn it again in the future.

OPT-IN to read more from the Merage School.

Title: “Unlocking creative potential: Reappraising emotional events facilitates creativity for conventional thinkers”

Co-author: Lily Zhu (PhD alumna)

Accepted at: Organizational Behavior and Human Decision Processes (Journal on Financial Times Top 50 list)

We examine the cognitive processes that underpin emotion regulation strategies and their associations with creativity. Building on theories of emotion regulation and creative cognition, we theorize that cognitive reappraisal of emotion-eliciting events is positively associated with creativity because both involve considering new approaches or perspectives. We also predict that reappraisal experience boosts creativity for people prone to thinking conventionally. Three studies support our theory by demonstrating that reappraisal improves cognitive flexibility and enhances creativity for individuals low in openness to experience, independent from the effects of emotions on creativity. Therefore, reappraisal is an effective tool to foster creativity among conventional thinkers. More broadly, the results indicate that emotion regulation processes have downstream consequences on behavior, above and beyond their effects on emotions. Linked Here.

Title: “Getting Away with It (Or Not): The Social Control of Organizational Deviance”

Co-authors: Alessandro Piazza and Wesley Helms

Accepted at: Academy of Management Review (Journal on Financial Times Top 50 list)

The phenomenon of organizations breaking laws and norms in the pursuit of strategic advantage has received substantial attention in recent years. Such transgressions generally elicit the intervention of social control agents seeking to curb deviant behavior and defend the status quo. In some cases, their efforts result in the deviant behavior being suppressed; in other occasions, however, organizational deviance can persist and even be accepted into the very system of rules that was initially challenged. In this paper, we advance a structured view of this process by formulating a theory of the social control of organizational deviance. Building upon the sociological literature, we classify forms of social control based on their cooperativeness and formality; additionally, we shed light on the outcomes of social control by illustrating the conditions under which they are likely to be more or less accommodative of deviant behavior, as well as more or less permanent. In so doing, we contribute to the scholarly understanding of the role of social control in organizational fields, as well as of the advantageousness of deviant behavior as a strategic option for organizations.

Title: “Whistleblowing and Group Affiliation: The Role of Group Cohesion and the Locus of the Wrongdoer in Reporting Decisions”

Co-author: Brandy Aven

Accepted at: Organization Science (Journal on Financial Times Top 50 list)

Conventional accounts describe whistleblowing as prosocial behavior, where whistleblowers are largely driven by a desire to help or improve their organization. Yet individuals are not only members of their organization; they also belong to internal social groups that affect behavior and influence decision making. In this paper, we focus on these intraorganizational dynamics and theorize two ways in which group affiliations are likely to affect whistleblowing. When an individual observes wrongdoing committed by a person affiliated with the same group, higher group cohesion decreases the likelihood of blowing the whistle because of potential whistleblowers’ greater loyalties toward group members and a desire to protect the reputation of the group. When an individual observes wrongdoing committed by a person not affiliated with the same group, higher group cohesion increases the likelihood of blowing the whistle, as potential whistleblowers feel they have the support of fellow group members, lessening fears of retaliation. Using unique data on actual and hypothetical whistleblowing among U.S. federal employees in 24 departments and agencies coupled with a vignette experiment, we find support for our arguments. By showing how group affiliations inform whistleblowing decisions, we reveal how variation in social structure leads to heterogeneity in responses to wrongdoing. Together, these results reveal tradeoffs in the detection of misconduct and help explain why wrongdoing in organizations may be so difficult to eradicate.

OPT-IN to read more from the Merage School.

Professors John Joseph and Luke Rhee

Title: “Corporate Hierarchy and Organizational Learning: Member Turnover, Code Change, and Innovation in the Multiunit Firm”

Co-author: Alex Wilson

Accepted at: Organization Science (Journal on Financial Times Top 50 list)

This study examines how recombinant innovation is affected by member turnover and organizational learning within a corporate hierarchy. Prior work has overlooked the role of organizational structure in organizational learning, focusing instead on the knowledge provided by individual new hires or on the disruption caused by individual departures. We address this gap by applying March’s [March JG (1991) Exploration and exploitation in organizational learning. Organ. Sci. 2(1):71–87.] mutual learning model to a corporate hierarchy. In doing so, we theorize how the contributions of corporate staff to socializing new employees and to learning from the organizational code may differ from those of the organization’s subunit members. Empirically, we examine the learning effects of aggregate corporate and subunit arrivals and departures on novel recombinant innovation by subunits. Using 24 years of Motorola company directories, we construct membership turnover measures for corporate and subunit employees and exploit patent data to capture recombinant innovation. Our results suggest that, whereas the influx of new ideas through arrivals may be critical, breaking the pattern of inertial behavior through departures is more important for recombinant innovation. Corporate departures matter most for recombinant innovation, a result that reflects not only corporate staff’s slower individual learning from the organizational code but also its ability to update that code more quickly. In supplementary analyses, we find different effects for technical and nontechnical staff and internal and external arrivals, as well as demonstrate the mutual learning mechanism using internal corporate documents to capture code change. Our study has strong implications for theories of organizational learning, strategic human capital, organization design, and innovation.

Title: “Corporate Proximity and Product Market Reentry: The Role of Corporate Headquarters in Business Unit Response to Product Failure”

Co-author: Colleen Cunningham

Accepted at: Academy of Management Journal (Journal on Financial Times Top 50 list)

Understanding how organizations respond to failure is important to management research, yet prior studies have offered contrasting findings for whether, in a multiunit hierarchical organization, a corporate office improves business unit search following product failure. To better understand how a corporate office affects business unit search, we focus on the role of corporate proximity (hierarchical, geographic, and cognitive) between the corporate office and constituent units. We argue that corporate proximity improves a business unit’s local search process through two mechanisms—vertical linkages and corporate attention—that positively condition the likelihood of persisting, that is, re-entering a product market after having experienced a prior product failure in that market. We find support for our theory using data on reentry in the U.S. medical device industry following exit from the market due to product failure. We also explore how age of the product market and characteristics of the failure—cause and severity—further moderate corporate proximity’s role in business unit reentry. Overall, our study offers a better understanding of how complex organizations respond to failure, thereby contributing to literatures on search, corporate headquarters, and product entry.

Title: “Dear CEO and Board: How Activist Investors’ Confidence in Tone Influences Campaign Success”

Co-authors: Matthias Brauer and Philipp Binder

Accepted at: Organization Science (Journal on Financial Times Top 50 list)

Activist hedge funds represent the most potent form of financial activism. Yet we do not fully understand how these activist investors, despite holding only a small stake in target firms, are able to influence management and the board to acquiesce to their demands, especially given the large uncertainty that their demands will improve shareholder value. Building on impression management (IM) theory, we propose that activist investors who express their concerns and demands with high confidence in their letters to target firms are likely to be perceived as knowledgeable and competent by the firm’s other shareholders, thus influencing the response of the firm’s management and board. In support of this theoretical proposition, results of our empirical analysis of 475 U.S. activist campaigns against U.S. companies between 2007 and 2019 suggest that confidence in tone in an activist’s letter, as a form of self-promotion, is positively associated with campaign success.

OPT-IN to read more from the Merage School.

We also observe that the positive association between confidence in tone in activist letters and campaign success is less for activists with greater success in prior campaigns and in campaigns with multiple activists. Our paper contributes to financial activism research by showing that activists’ verbal impression management can serve as an effective influence tactic in their campaigns. Our study also contributes to the emerging research stream on verbal IM by introducing a language attribute, confidence in tone, that has not been studied in management research and is distinct from past constructs examined in verbal IM research.

Title: “Corporate Governance in Today’s World: Looking Back and An Agenda for the Future”

Co-author: Haeyoung Koo (PhD alumna)

Accepted at: Strategic Organization

Abstract: Corporate governance research has been driven by underlying assumptions and perspectives that are predominantly based on our understanding of US publicly listed companies and US capital market constituents with an emphasis on shareholder value maximization. Yet today, public companies face a changed governance landscape driven by the growth in passive funds, the dominance of the Big Three index funds, and the emergence of activist hedge funds. In addition, increasing investor emphasis on environmental, social, and governance matters has led to a shift away from shareholder primacy. While public companies face an altered governance context, scholars for the most part have not paid attention to the ramifications of these developments on corporate governance and strategic decision-making. We articulate the factors that have emerged and identify opportunities for future research that will lead to greater insight and a more comprehensive understanding of how the changed governance landscape is influencing managerial and board decision-making and firm outcomes.

Title: The Right Metrics for Marketing Mix Decisions

Co-authors: Ofer Mintz (PhD alumnus), Timothy Gilbride, and Peter Lenk

Accepted at: International Journal of Research in Marketing

Title: Manipulating Perceptions of Asset Specificity in Alliances: A Microfoundational Approach

Co-author: Russell Coff

Title:

Co-authors:

Accepted at: Decision Analysis

Professor Imran Currim 2021 Marketing Science Institute Robert D. Buzzell Best Paper Award Professor Libby Weber Best Paper Proceedings for the 2022 Academy of Management Conference Professor L. Robin Keller Valuing sequences of lives lost or saved over time: Preference for uniform sequences Jeffrey L. Guyse (PhD alumnus) and Candice Huynh (PhD alumna) Retired Faculty Robin Keller Professor Emerita New Faculty Michael Imerman Associate Professor of Finance Noah Askin Assistant Professor of Teaching